- 1School of Foreign Languages, Neijiang Normal University, Neijiang, China

- 2Department of International Trade and Logistics, Mokwon University, Daejeon, South Korea

- 3Department of International Business, Chungbuk National University, Cheongju, South Korea

This research explores the dynamic capabilities required for firms to implement environmental, social, and governance (ESG) strategies, and investigates sustainable management performance that can be created based on them. By using dynamic capabilities theory, we integrate sustainable management and the ESG literature to suggest a research model and identify the factors that act as the catalysts achieving sustainability. The data used for the analysis were collected from 78 firms listed on the Korea Exchange (KRX) with assets totaling more than 2 trillion Korean won. In this study, the partial least squares structural equation model (PLS-SEM) is applied. We found that absorptive capability and adaptive capability significantly affect sustainable management performance through implementation of the ESG strategy as a mediating variable. In particular, a firm’s implementation of an ESG strategy is a significant determinant that impacts sustainable management performance. We also believe our model contributes to the current knowledge by filling several research gaps, and our findings offer valuable and practical implications not only for achieving sustainable growth but also for creation of competitive advantage.

Introduction

We often witness the rise and fall of firms due to various environmental changes (technological evolution, pandemics, etc.). In other words, firms that appropriately respond to changes in the business environment get an opportunity to maintain their business activities or prosper, while those that fail to adapt can lose their competitive advantage and face expulsion from the market. In particular, the COVID-19 pandemic further increases uncertainties in the business environment, triggering innovations for firms to survive. In this situation, firms seek solutions by establishing and implementing various strategies, such as changing business models or restructuring to enhance their sustainability in order to survive.

Discussions have steadily taken place in academia on ways to increase corporate sustainability. This stream of research assumes the resource heterogeneity and stability of the strategic resources over time. Some researchers, including Barney (1991), argued that the relationship between a firm’s resources and sustained competitive advantage is possible if the resources are valuable, rare, inimitable, non-sustainable, and organized (Pisano, 1994; Grant, 1996; Eisenhardt and Martin, 2000; Bhandari et al., 2020). The resource-based view (RBV) focuses on the internal strengths and weaknesses of the firm, as opposed to the external environmental model of competitive advantage, which emphasizes on opportunities and threats (Bhandari et al., 2022). On the other hand, climate science enthusiasts and environmental economists have emphasized that firms need to address the imbalance between demand and natural supply if they want to be sustainable and achieve the United Nations’ Sustainable Development Goals (SDGs; Dasgupta, 2021). Therefore, scholars have been raising the need for stakeholder governance (Barney, 2018; Amis et al., 2020; Barney et al., 2021) to correct the supply–demand imbalance of resource depletion. They point out that attention should be paid to reducing their demand for environmental, social, and governance-related (ESG) footprints and helping to sustain their supply capacity.

Recent studies on these discussions emphasize the harmonious development of the economy, society, and the environment to achieve corporate sustainability (Dey et al., 2020; Henderson, 2021; Alkaraan et al., 2022). Previously, the literature mainly focused on economic (or financial) performance when predicting a firm’s sustainability. Lately, however, there has been consensus on the argument that sustainability can be improved when firms coexist with society (Ben-Amar et al., 2017; Holden et al., 2017). These discussions initially developed around international organizations (e.g., the UN, the OECD, and the World Bank), but have now expanded to include the private sector. Meanwhile, a number of studies examining this have shown that firms can benefit financially when they address environmental or societal concerns, but dismiss situations in which environmental and social aspects cannot be aligned with financial performances (Hahn et al., 2015). Accordingly, there is an increasing need for firms to understand their impact on society and the environment through non-financial performance (Schaltegger and Hörisch, 2017). When evaluating this non-financial performance, the environmental, social, and governance (ESG) framework is the one most commonly used and has emerged as a new measure for predicting corporate sustainability. Note that the ESG framework was initially used as an indicator to measure non-financial performance when investors (or asset management institutions) make investment decisions.

However, the ESG concept has recently been recognized as an essential management strategy for the survival of firms. There is a growing trend worldwide for firms to voluntarily disclose ESG information using standards and frameworks presented by the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB). As such, ESG activities have become a trend for sustainable growth, but it is also true that many firms are unable to respond to these changes. For example, in South Korea (hereafter, Korea), the government encourages firms to engage in ESG activities, but only some corporations respond systematically to these changes, and most firms are not even discussing it. In addition, in order to achieve the lofty goal of sustained competitive advantage, the majority of Korean firms have profit maximization as their objective at the cost of ESG degradation. Therefore, for many Korean firms to continue to achieve competitive advantage without falling behind in the global market, it is necessary to identify the strategic approach that allow firms to respond quickly to environmental changes and seek effective management strategies for sustainability.

Achieving a competitive advantage is a strategic approach that is being pursued by all competitors in parallel. When a firm has a sustained competitive advantage, the strategic approach is to create value that belongs only to that firm, where imitation is not possible (Barney, 1991, 2001; Bhandari et al., 2020; Barney et al., 2021). With the rapidly changing business environment, there is an increasing interest in how to create unique value. The dynamic capabilities (DCs) perspective is actively used as a theoretical framework in this vein. Therefore, the focus of our research is on the firm’s DCs and how they create sustained competitive advantage.

The DCs perspective explains that a firm can achieve a sustainable competitive advantage by reconfiguring various resources and capabilities according to the changing environment (Teece et al., 1997). Previous studies have shown that a firm develops DCs through three standard features and processes that directly or indirectly affect its competitive advantage. The first factor is absorptive capability, which recognizes new-value external information, assimilates it, and applies it to commercial ends (Cohen and Levinthal, 1990). The second factor is adaptive capability, which is defined as a firm’s ability to identify and capitalize on new market opportunities (Miles et al., 1978; Chakravarthy, 1982; Hooley et al., 1992). The third factor is innovative capability, which refers to a firm’s ability to develop new products and/or markets by aligning an innovative, strategic orientation with innovative behaviors and processes (Wang and Ahmed, 2004, 2007).

Meanwhile, all these studies focus on creating financial value in achieving a competitive advantage based on DCs. However, a severe problem still resides in the fact that all three of these approaches (i.e., DCs) are experiencing a lack of sustainable social value that modern society is recently aiming for. In other words, although a firm’s competitive advantage desperately needs the creation of sustainable social value, the extant literature tends to shed light only on economic value, such as corporate growth and increases in sales. In particular, firms should be aware of the value of social responsibility and should meet the ethical demands of stakeholders because they are strategically crucial to improving a firm’s long-term performance. In this vein, no one can guarantee that a firm will be a long-lived organization if it does not appropriately assess the importance of sustainable social value, which indicates the necessity for a study dealing with cementing the gap between extant theoretical discussions and reality.

Based on the series of discussions above, we suggest several research objectives. First, we would like to provide a foundation for understanding the capabilities and structures to achieve competitive advantage by creating sustainable management performance (SMP) using ESG strategies. The DCs-related studies mentioned above have developed around a firm’s financial performance, making it somewhat challenging to understand the management trends that have been changing due to recent social and environmental value considerations. In other words, as these values emerge as a critical factor influencing corporate sustainability, the activities to find capabilities to create them are accelerating around various firms. In particular, we argue that it is necessary to discuss the implementation of an ESG strategy as a mediating variable for achieving SMP based on social and environmental values as well as financial values. Second, to the best of our knowledge, we have not seen an empirical analysis successful exploring how to improve a firm’s SMP by setting an ESG framework as a strategic process. Porter and Kramer (2019) confront the firm’s sustainability and ESG literature at the firm level through the concept of “shared value.” However, attempts to measure the “shared value” have not been very successful, even after Porter et al.’s (2011) contribution in this direction. Extant research has applied survey data or archival proxies in strategic management in general terms, with the latter predominating in highly cited contributions. We will design a research model suitable for measuring ESG and we will prove it through empirical analysis for firms that are pursuing a strategic approach for actual ESG implementation.

The potential expected effects of this study and the subsequent contributions are as follows. First, we propose an integrated framework to realize sustainable values or address social and environmental problems, such as development- and pollution-caused polarization, as well as economic value from the sustainable management perspective. Such a framework will help minimize the gap between extant theoretical discussions and reality and will set a direction to improve corporate sustainability. Second, we present the DCs and the ESG strategy needed for firms eager to achieve sustainable development, significantly providing the direction and foundation necessary to implement the ESG strategy.

Theoretical Background and Hypothesis Development

The theoretical basis of our analysis is DCs perspective. DCs theory provides the understanding of the critical role of firm’s capabilities and their changes in shaping organizational behavior and performance (Teece et al., 1997; Teece, 2007; Wang et al., 2015). The core idea of this DCs theory is that in order to develop core competencies for competitive advantage in a rapidly changing business environment, firms should integrate, nurture, and reorganize internal and external resources in response to environmental changes (Teece et al., 1997). DCs theorists, including Teece et al. (1997), argue that through this framework, firms can understand the importance of innovation and achieve long-term surviving. This theory aims to examine sustainable growth methods based on firm’s capabilities and excellent strategies, while also containing innovation rather than just accepting the status quo of business environment. According to this perspective, firm’s decision-making process, behavior, and strategic response are primarily shaped by the rationale for achieving competitive advantage and restructuring the business environment. Competitive advantage is ensured for long-term competitiveness by generating sustainable management performance (SMP) in a constantly changing business environment (Barney et al., 2021; Bhandari et al., 2022). To achieve competitive advantage, firms typically strive to reduce uncertainty and improve performance through their strategies to meet the expectations of their stakeholders (Freeman et al., 2021). In the same vein, Gueler and Schneider (2021) posited that firms can achieve SMP by constantly supplementing and changing capabilities according to the needs of stakeholders. From this perspective, we argue that competitive advantage can be achieved by developing and fostering the DCs for firms to respond to changing environments. Specifically, the recent business environment requires a paradigm shift to coexist with stakeholders rather than prioritizing shareholder interests (Henderson, 2021). For this reason, many firms are expected to attempt to integrate and coordinate internal and external resources to acquire their DCs to meet the expectations of stakeholders. In particular, the movement to redefine the core values, strategies, and structures of firms is spreading as the social demand for a shift to stakeholder capitalism increases. In addition, firms will strive to improve SMP in a changing business environment by establishing strategies that are considered socially and institutionally appropriate based on these DCs. Therefore, unlike previous studies that primarily considered exploring the relationship between a firm’s own resources and its financial performance, we are interested in examining the DCs and ESG strategy of firms to achieve significant SMP to enhance their competitive advantage.

Dynamic Capabilities and Sustainable Management Performance

Recently, competition between firms has intensified with the deepening uncertainty in the business environment. Accordingly, it not easy to guarantee a firm’s survival with existing strategic thinking that only seeks solutions based on its core resources and assets. Many scholars, including Teece et al. (1997), argued that DCs are needed for a firm’s survival and prosperity in a rapidly changing environment, through which the CEO can gain an innovative perspective to secure long-term competitiveness (Eisenhardt and Martin, 2000; Rindova and Kotha, 2001; Zollo and Winter, 2002; Teece, 2007).

Specifically, Tallman (1991) and Luo (2002) highlighted DCs as a source that enables MNCs to achieve a sustainable competitive advantage in the global market. According to Uhlenbruck et al. (2003) and Cepeda and Vera (2007), DCs develop strategies necessary to maintain a long-term competitive advantage in a highly uncertain and changing environment, enabling them to cope with crises occurring in a business environment. It has been widely agreed that there is a direct and positive relationship between DCs and a firm’s performance (Wang and Ahmed, 2007; Wilden et al., 2013; Wilhelm et al., 2015; Girod and Whittington, 2017). Meanwhile, some studies showed that DCs do not guarantee successful results for firms (Eisenhardt and Martin, 2000; Zahra et al., 2006). However, the existing literature has focused on the financial aspects of corporate performance due to DCs and does not deal with how it can affect the sustainable (including social and environmental) performance recently required by society (see Appendix 1).

As we all know, firms’ business environments have more volatility, complexity, uncertainty, and ambiguity than before (Teece, 2018). In particular, advances in technology (e.g., the Fourth Industrial Revolution) and the COVID-19 pandemic are accelerating these changes in the business environment. As uncertainty in corporate management grows, a firm’s competitive advantage is focused on sustainability rather than economic (or financial) growth. In this vein, many firms have recently shifted their operational objectives to a direction that increases sustainability. For example, firms such as Apple, Amazon, and GM are revising their strategies to meet the needs of stakeholders and secure capabilities to achieve a competitive advantage, breaking away from the existing strategic framework that strives to maximize shareholder profits.1

Focusing on this stakeholder capitalism perspective, scholars are increasingly discussing how firms should cover not only financial performance but also social and environmental value creation in order to improve sustainability (Henderson, 2021). Hussain et al. (2018) highlighted how a firm’s social responsibility activities could eventually improve shareholder profits. Kanashiro and Rivera (2019) explained that firms should shift their management policies from economic performance oriented to sustainable management that emphasizes environmental management and social responsibility at the same time. Therefore, it is essential for firms to secure DCs that help improve sustainability in order to effectively and innovatively change existing lagging operational systems according to volatile business trends.

In a similar vein, Cohen and Levinthal (1990) and Zahra and George (2002) pointed out that the more dynamic the business environment, the more critical the absorptive capability to improve sustainability. Absorption capacity refers to an organization’s ability to acquire, absorb, and use new information and knowledge (Cohen and Levinthal, 1990; Reinhardt, 1998). An absorptive capability provides a platform for generating sustainability-oriented learning, which in turn encourages organizations to adopt the necessary behaviors in response to sustainability situations and opportunities (Todorova and Durisin, 2007). Therefore, Lichtenthaler (2009) highlighted the importance of absorbing market knowledge for a firm’s sustainable growth. Moreover, Bhupendra and Sangle (2017) showed that an absorptive capability helps build a strong reputation, and gives legitimacy to the firm’s activities through sustainable strategies and knowledge management, which creates differential advantages and improves performance in the market. That is, deeper learning and dynamic awareness of stakeholder preferences through absorption capabilities can help a firm create solid growth in a future market.

Meanwhile, Oktemgil and Greenley (1997) argued that firms should be based on adaptive capabilities to achieve sustainable performance. In particular, an adaptive capacity is increasingly recognized as a critical attribute of environmental management. Tuominen et al. (2004) found that firms with an adaptive capacity create innovations that benefit not only financial performance but also social equity and conservation of the environment. Wong (2013) pointed out that the adaptive capabilities of firms in environmental management are critical organizational capabilities that are valuable to sustainable performance. In particular, as interest in environmental issues such as climate change has grown recently, strengthening an adaptive capability to environmental transformation is emerging as a very important competency for corporate sustainability.

As such, the literature reveals that absorptive and adaptive capabilities lead to sustainable performance improvement. In order to create SMP, including for society and the environment, the presence or absence of DCs to adapt and lead changing management trends can be a crucial factor. Based on the previous arguments, we propose the following hypotheses.

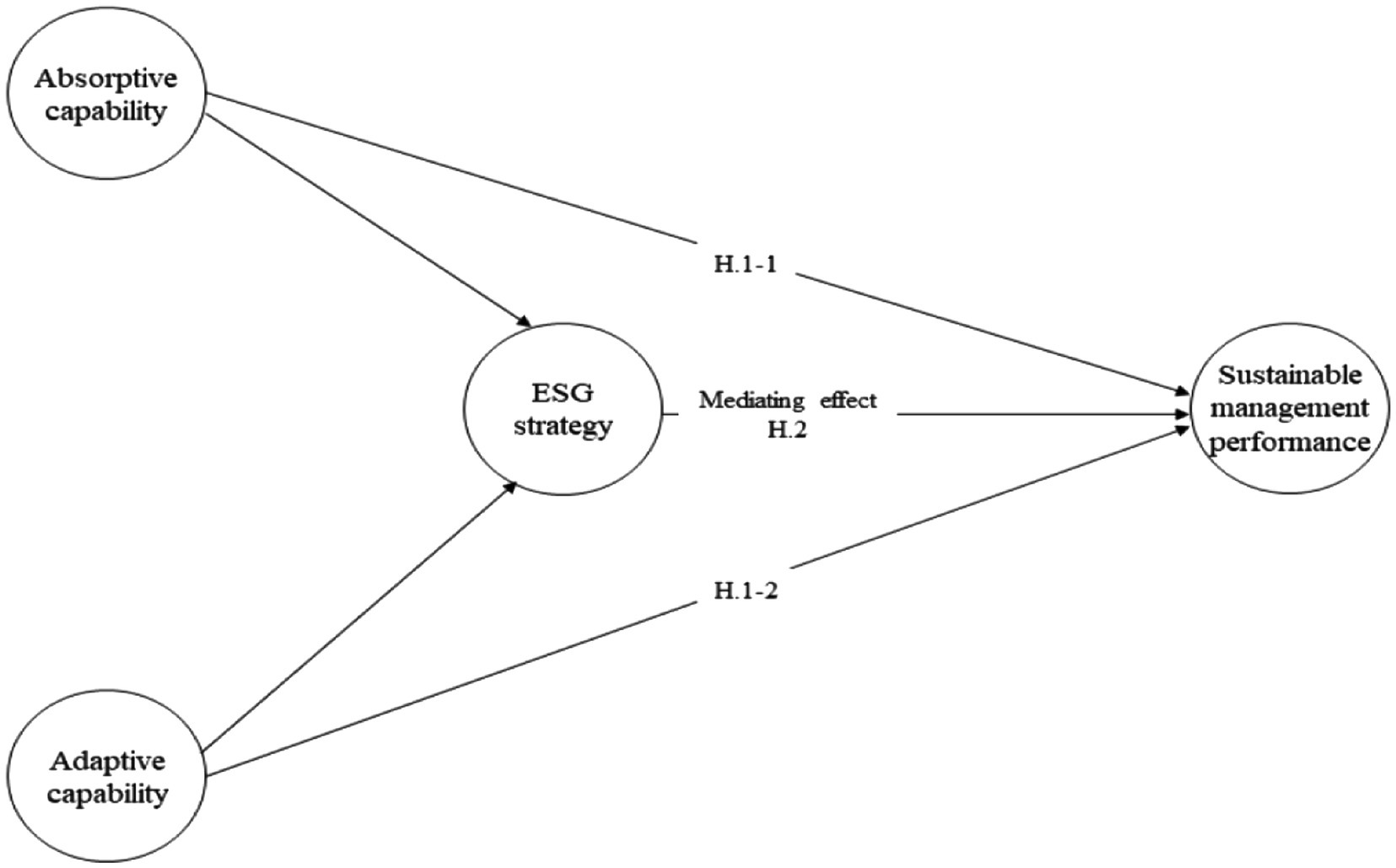

H.1-1 An absorptive capability will positively affect the creation of sustainable management performance.

H.1-2 An adaptive capability will positively affect the creation of sustainable management performance.

The Mediating Effect of an ESG Strategy

No one will object to the argument that strategy is a key factor influencing the sustainable growth of a firm. That is because a successful strategy guarantees a firm’s prosperity, but a failed strategy can bring disaster. In this vein, Teece (2007, 2012) explained that firms could seek effective strategies to respond to environmental changes based on DCs linked to the development of competitive advantage. Ringov (2017) emphasized that firms create value if they develop and implement a suitable strategy based on their resources and capabilities (i.e., operational and dynamic capabilities). As such, firms can achieve superior performance if DCs underpin their strategies.

In this research, an ESG strategy, as one of the critical determinants of sustainable growth, was chosen in order to examine its mediating effect on the link between DCs and a firm’s SMP, because more firms are seeking strategies in terms of ESG to improve sustainability. According to the changing business environment, firms are considering their roles and responsibilities in order to secure sustainability beyond simply pursuing profits, and there is a movement to redesign the existing management systems based on an ESG strategy (Van Duuren et al., 2016). For example, Microsoft established a strategy to achieve a carbon-negative footprint by 2030 (i.e., carbon absorption is to be higher than carbon emissions) and is actively participating in solving climate problems. Netflix set inclusion as a corporate cultural value in 2017, revealed the gender and racial proportions of its employees, and is increasing recruitment of Hispanic and Latino talent. SK has increased the board of directors’ independence, and strengthened management monitoring and check functions by separating the roles of CEO and chairman of the board of directors to enhance the trust of stakeholders. As such, numerous firms are looking for ways to effectively allocate their resources on ESG, checking whether firms are realizing social functions and moving away from existing management strategies focused on profits maximization.

Meanwhile, to establish a successful overall strategy for a firm, it is necessary to focus core competencies on the ESG strategy. In particular, in any strategic management process, DCs should be taken into consideration to enable businesses to achieve their ESG goals. Amit and Schoemaker (1993) argued that DCs enable firms to develop strategies necessary to maintain long-term competitive advantages in highly uncertain and changing environments, and such strategies enable firms to respond well to crises occurring in competitive environments. Therefore, we argue that DCs create sustainable value if they positively contribute to the development and support of an ESG strategy.

The literature shows there is no doubt about the positive contribution of an ESG strategy to value creation (Wang and Ahmed, 2007; Parnell, 2011). Indeed, firms develop ESG strategies to create value for their stakeholders. However, different empirical studies postulate various relationships among firms’ strategies, DCs, and performance or value (Parnell et al., 2015; Yi et al., 2015; Rashidirad et al., 2017). We propose that sustainable value creation may not be perfectly accessible if DCs do not foster the firm’s ESG strategy. For instance, one of the primary sources of value in an ESG strategy is to develop long-term relationships with stakeholders for coexistence and co-prosperity.

We posit that such goals can be achieved if a firm develops a strategy to improve a shareholder capitalism system that is fostered by their DCs. Thus, ESG strategies will assist firms in deploying DCs that achieve SMP (see Figure 1).

H2. An ESG strategy mediates the positive effect of dynamic capabilities (absorptive and adaptive capabilities) on a firm’s sustainable management performance.

Methodology

Sample and Data Collection

The population for this study was firms with total assets of 2 trillion Korean won or more and that were listed on the Korea Exchange (KRX) as of December 2020. In order to promote ESG activities, the Korean government has made it mandatory for ESG activities (e.g., environmental information, sustainability, and firm governance) to be disclosed by firms with total assets of more than 2 trillion won as of 2021. The standard for disclosure is total assets, and the Korean government plans to reduce the standard amount every year to expand the number of firms subject to disclosure. For example, governance of disclosure will expand to firms with total assets of more than 1 trillion won in 2022, dropping to assets totaling more than 500 billion won in 2024, and governance will apply to all KRX-listed firms from 2026 on. For 2021, 215 firms were subject to disclosure, and this study surveyed them to collect data.

For the survey, each firm’s website was visited and checked for the email address of the ESG manager. However, one problem revealed at this time was that many firms did not disclose email addresses and contact names of ESG managers on the website. For this reason, helped by PhD students, there was no choice but to call as many firms as possible to inquire about the email address of the ESG manager, and firms that did not provide that email address were asked for the contact information of an investor relations (IR) representative. We selected senior managers who responsible of ESG, such as chief executive, vice president, senior director, and general managers in each firm to serve as key informant. The survey was assigned one person per firm, who have a wide knowledge of firm’s capabilities and ESG strategy. In particular, several firms were piloted to have representation of the firm. As a result of such pilot tests, some validity was obtained for these processes.

Building on the previous literature (Wang and Ahmed, 2007; Abdul-Rashid et al., 2017; Dey et al., 2020), we used Korean questionnaires to collect data for this research. The questionnaire was modified and written appropriately for this study based on items used in a previous study. Once the draft questionnaire was developed, we got feedback from several academic and managerial experts. Feedback from these experts was then taken and integrated into the final questionnaire. Several Korean professors and managers were invited to check whether the questionnaire was precise. A few minor changes were applied to increase clarity based on their feedback.

Before conducting the survey, a pilot test was undertaken to check the appropriateness of each question. Five ESG managers from SK and POSCO, and professors studying ESG strategies of Korean firms participated in the preliminary investigation. They confirmed that most of the questions were easily understood, but they also advised us to replace some words with better terms. Their suggestions were reflected in the final version. The finalized questionnaire was emailed to the firm’s ESG managers and investor relations representatives; emails sent to IR managers included a request to deliver the questionnaire to ESG-related departments and managers.

The survey was conducted over the 2 months from November to December 2021. At the end of that time, 80 questionnaires were finally collected, of which 78 were used for the final analysis because two were missing too much information (a response rate of 36.27%).

Variable Measurement

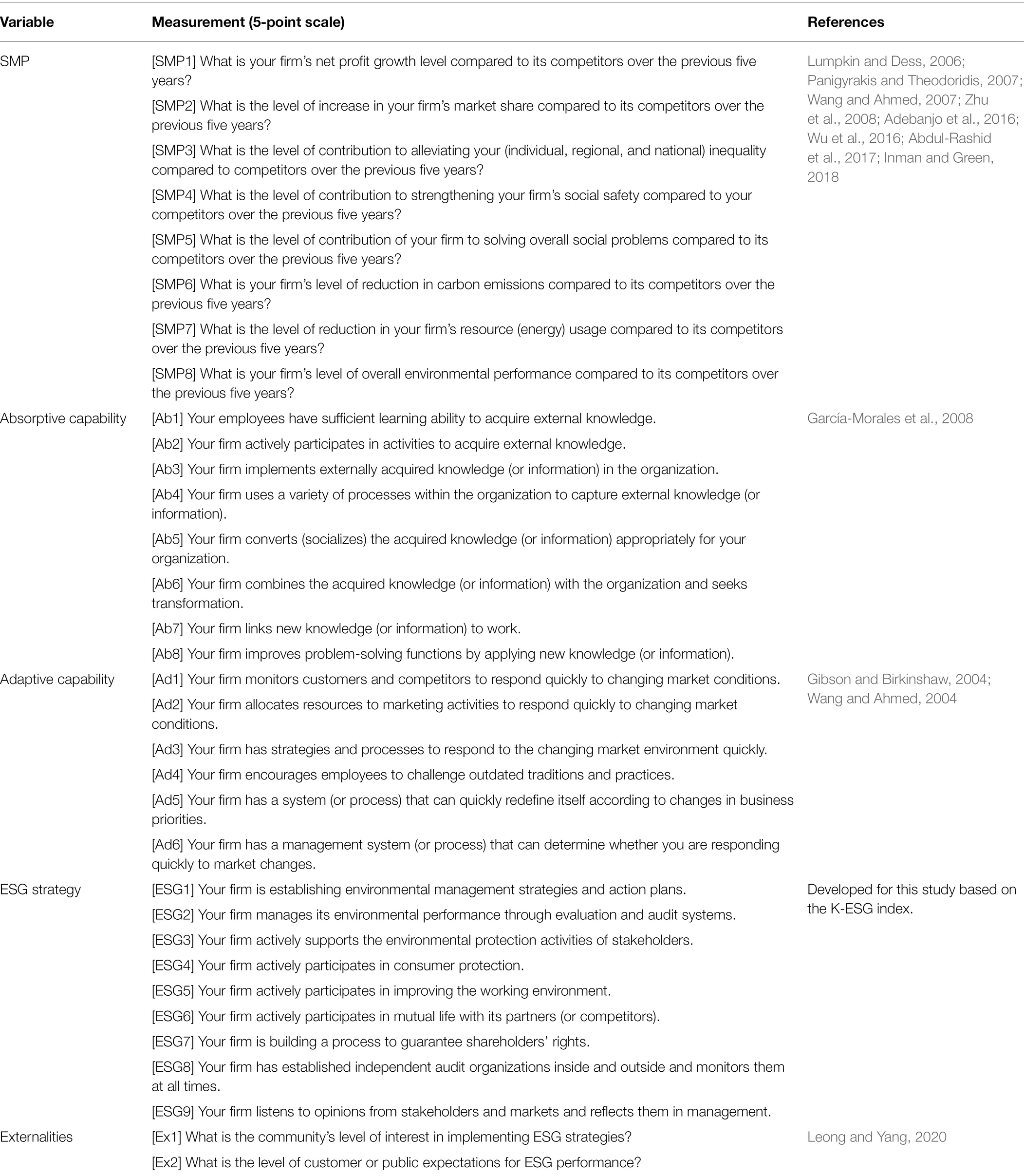

The dependent variable in this study was the firm’s SMP combining economic, environmental, and social performance (Abdul-Rashid et al., 2017). To measure this, we inquired about (1) financial and market-based performance, (2) social performance, and (3) environmental performance. A firm’s financial and market-based performance was evaluated by modifying the measurement factors recommended by Panigyrakis and Theodoridis (2007). Specifically, we included three items: growth in sales, growth in profitability (He and Wong, 2004; Lumpkin and Dess, 2006), and growth in market share (Wang and Ahmed, 2007). The firm’s social and environmental performances were evaluated by referring to measurement factors used in Dey et al. (2020), including three additional items in each. A firm’s social performance alleviates inequality, strengthens social safety, and solves social problems. The firm’s environmental performance reduces carbon emissions, reduces resource usage, and improves the environment. These items were designed based on Zhu et al. (2008), Adebanjo et al. (2016), Abdul-Rashid et al. (2017), and Inman and Green (2018). Each item was rated on a five-point Likert scale ranging from 1 (much worse) to 5 (much better) by comparing the firm’s performance to its competitors over the previous 5 years.

The independent variable in this study was DCs. This study adopted the item scale of García-Morales et al. (2008), which was based on the definition of absorptive capability by Cohen and Levinthal (1990). Moreover, this study referred to items used to measure adaptive capability as defined by Gibson and Birkinshaw (2004) and Wang and Ahmed (2004). Each item was rated on a five-point Likert scale ranging from 1 (strongly disagree) to 5 (strongly agree; see Appendix 2 for details).

The mediation variable in this study was ESG strategy. This study included questions based on the K-ESG index developed by the Ministry of Trade, Industry, and Energy in 2021. Specifically, it requested four items for each strategy implementation. It asked about the establishment of environmental management strategies and action plans, management of environmental business performance, and support for stakeholders’ environmental protection activities. The social strategy asked about consumer protection, improvement of the working environment, and win-win activities with partner firms (or competitors). Regarding governance strategy, the survey asked about process design to guarantee shareholder rights, continuous monitoring through an independent audit team, and reflecting stakeholders’ opinions. Each item was rated on a five-point Likert scale ranging from 1 (strongly disagree) to 5 (strongly agree).

This study used three control variables: firm size, industry type, and externalities. It measured firm size as a natural log of the firm’s total assets (in millions of Korean won) for 2020. This study controlled for size because larger firms have access to more or better capabilities than smaller firms, while smaller firms may have more flexibility and the ability to develop DCs more quickly. It measured the industry type based on data submitted by firms to the KRX. This study assigned a dummy variable to each firm based on dominant industry types: processing and manufacturing (MFG), which included 32 firms; sales and service (SVC), which included 34 firms; and 12 firms in other industries such as utilities, energy, chemicals, and transportation (Khanna and Rivkin, 2001; Kriauciunas and Kale, 2006). We used measures for the other industries as control variables with regard to manufacturing and industry, sales, and service. This study also included externalities in the models as a separate measure for control purposes because social concern may influence firm performance (Leong and Yang, 2020).

Common Method Bias

In this study, the dependent and independent variables were subjectively measured by the same person at the same time. In this case, the answer itself might contain the respondent’s bias, which implies the possibility or risk of common method bias. Therefore, we verified whether standard method bias applied or not by performing one-factor analysis before conducting a full-scale statistical analysis.

According to Podsakoff et al. (2003), “One of the most widely used techniques that have been used by researchers to address the issue of common method bias is what has come to be called Harman’s one-factor (or single-factor) test” (p. 889). We entered all variables measured subjectively by the respondents into this testing method. The results showed that four factors were divided, and the largest factor was 43.34%, which suggests that common method bias was not a concern in this study. According to Podsakoff et al. (2003), the presence of a substantial number of common methods should be suspected in cases where (1) a single factor emerges from the factor analysis or (2) one largest factor accounts for the majority of the covariance among the measures (i.e., more than 50%).

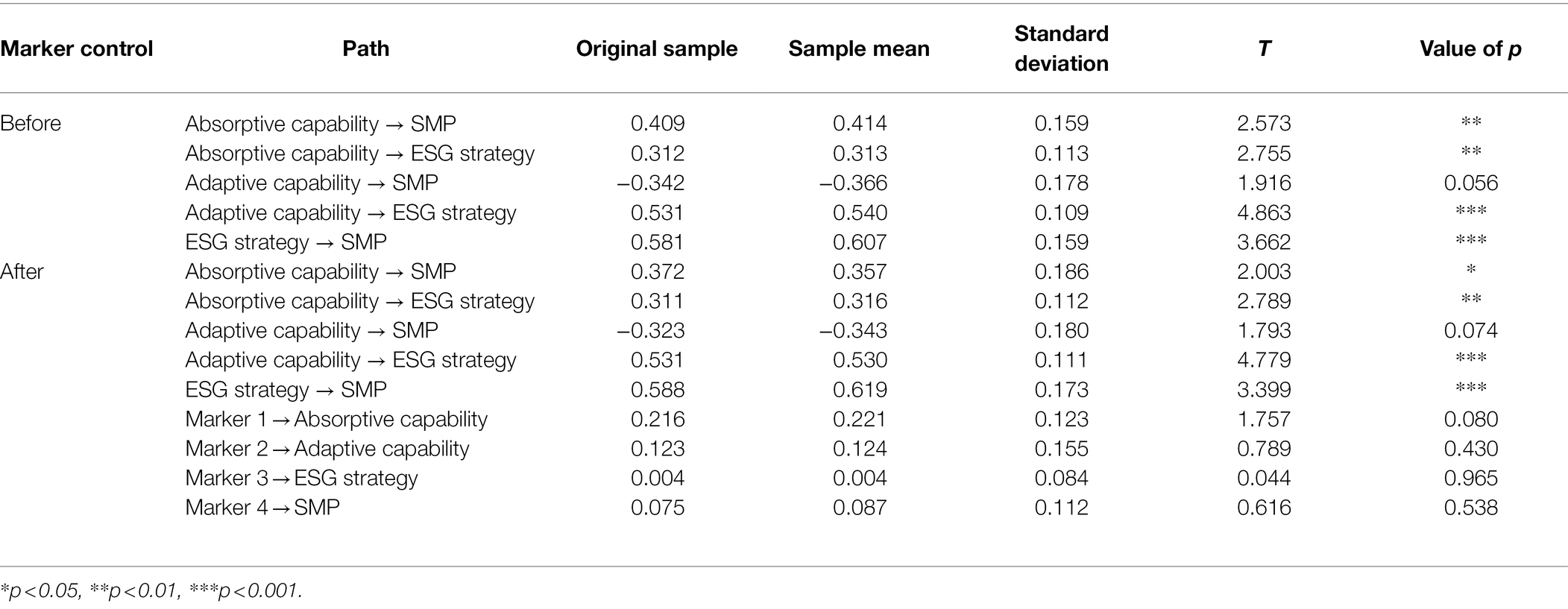

We used externalities as a marker variable. Bootstrapping for the path coefficient and significance verification confirmed that a marker variable was not significant with all variables. In addition, it was proven that the path coefficient is greater before a marker variable is controlled for (see Table 1). This result indicates that common method bias is not a major problem in our data.

Analyses and Results

Analysis Method

We applied the partial least squares structural equation model (PLS-SEM), which is considered suitable for complex path models, and it has the advantage of being relatively free from strict and unrealistic assumptions (e.g., multivariate normality) and sample size (Hair et al., 2017). In general, the PLS-SEM focuses on predictive and exploratory analysis, compared to the covariance base SEM (Hair et al., 2018).

This study discusses the ESG strategy and DCs to achieve a firm’s SMP. There were relatively few prior studies that were not systematized; therefore, a strong attribute of the research is selection and analysis of measurement items. In particular, to consider sustainable management, analysis should be conducted from an integrated perspective that connects the firm’s capabilities and ESG strategy. For this reason, we decided that using PLS-SEM is more effective for stably estimating parameters and examining integrated causal relationships.

Construct Validity

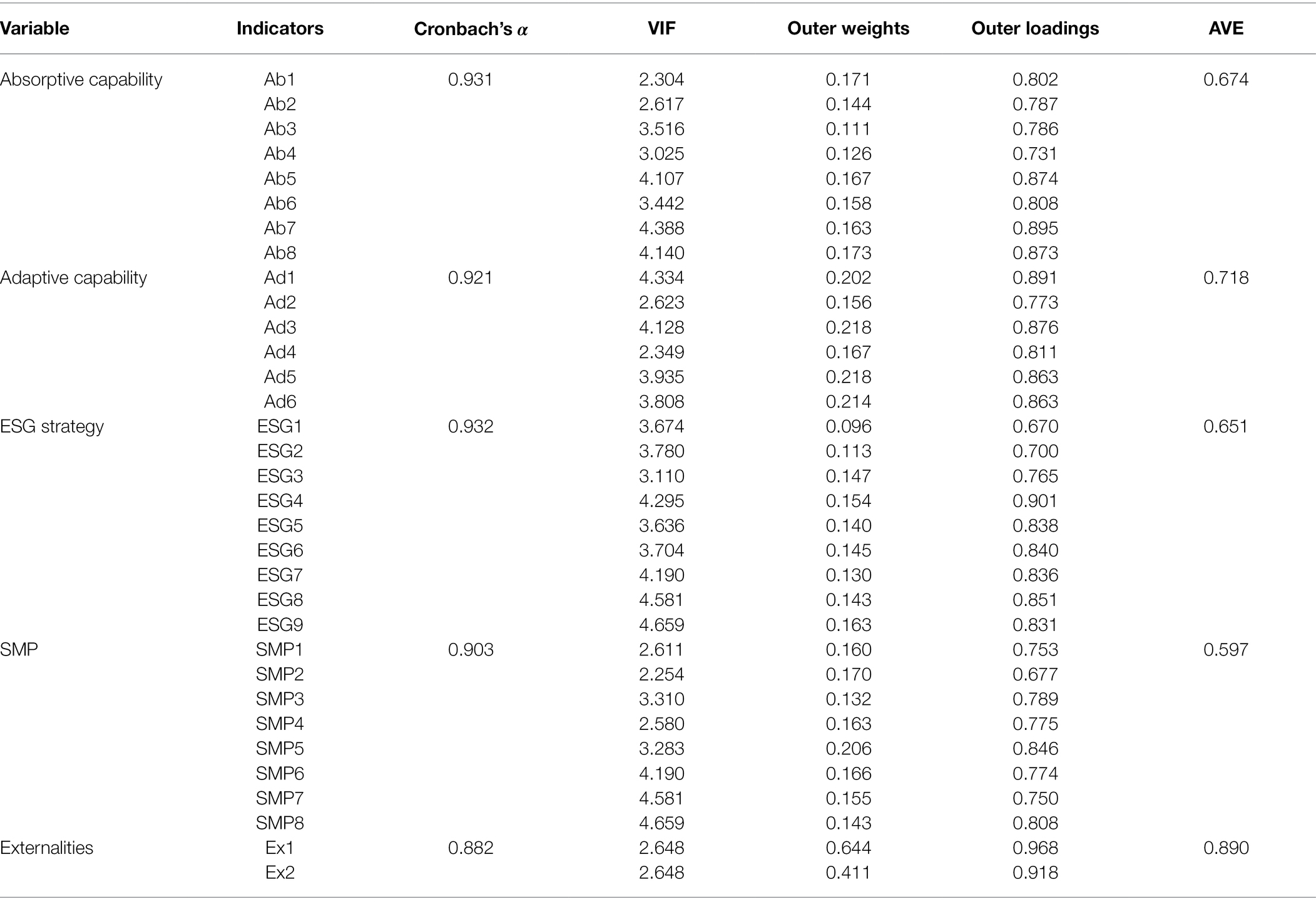

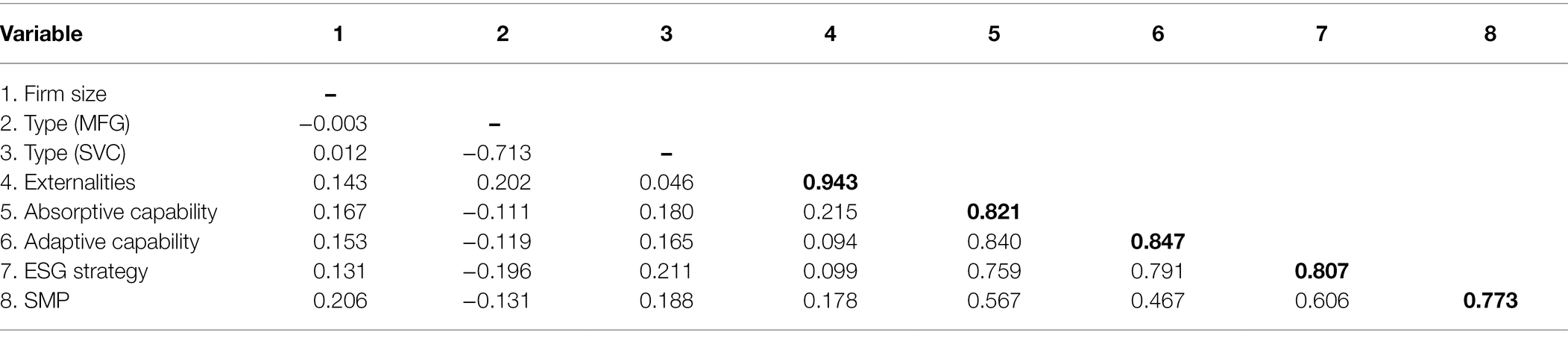

The validity was verified by analyzing the measurement model and the structural model. Measurement model analysis was verified in the following order: Cronbach’s alpha, multicollinearity, convergent validity, and discriminant validity. Cronbach’s alpha coefficient of all constituent concepts was 0.70 or higher (0.882 < all alpha coefficients <0.932). Multicollinearity is evaluated by the variance inflation factor (VIF), and in this study, the VIF values of all measured variables were less than 5 (2.254 < all VIF values <4.659), which confirmed there was no problem with multicollinearity. Convergent validity uses factor weights, outer loads, and average variance extracted (AVE). As shown in Table 2, the factor weights and factor loadings of all variables were significant, and the AVE values were greater than 0.50 for all constructs (0.597 < all AVE values <0.890), which provides strong evidence of convergent validity. Discriminant validity was evaluated by comparing the AVE estimates for each construct with the square of the parameter estimates between two constructs. According to Fornell and Larcker (1981), discriminant validity is achieved if the AVE of each construct exceeds the square of the standardized correlations between the two constructs. All AVE estimates were greater than the squared correlations between all constructs. Thus, multicollinearity, convergent validity, and discriminant validity were established (see Tables 2 and 3).

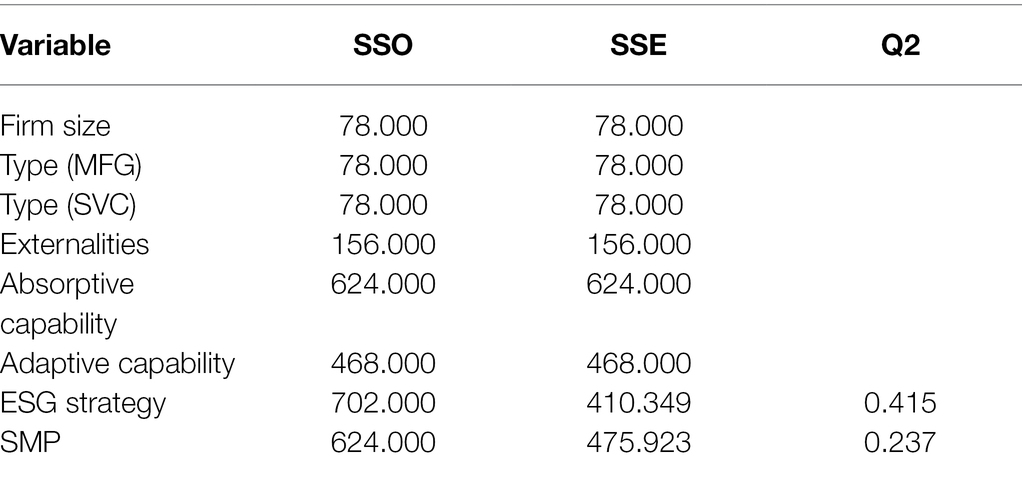

The PLS-SEM can evaluate the structural model with the coefficient of determination (R2) and predictive relevance (Q2). The coefficient of determination from building an ESG strategy was 0.656, and SMP was 0.436. Moreover, blindfolding was performed to examine the predictive relevance of endogenous reflection indicators and single-item scales. Q2 was obtained from the sum of squares of observations (SSO) for SMP and the sum of squares for predictive error (SSE). Looking at the analysis results, the Q2 of SMP was 0.237 with a value of 0 or higher, and hence, the Q2 of the structural model for endogenous potential variables exists (Sarstedt et al., 2016, see Table 4).

Hypothesis Testing

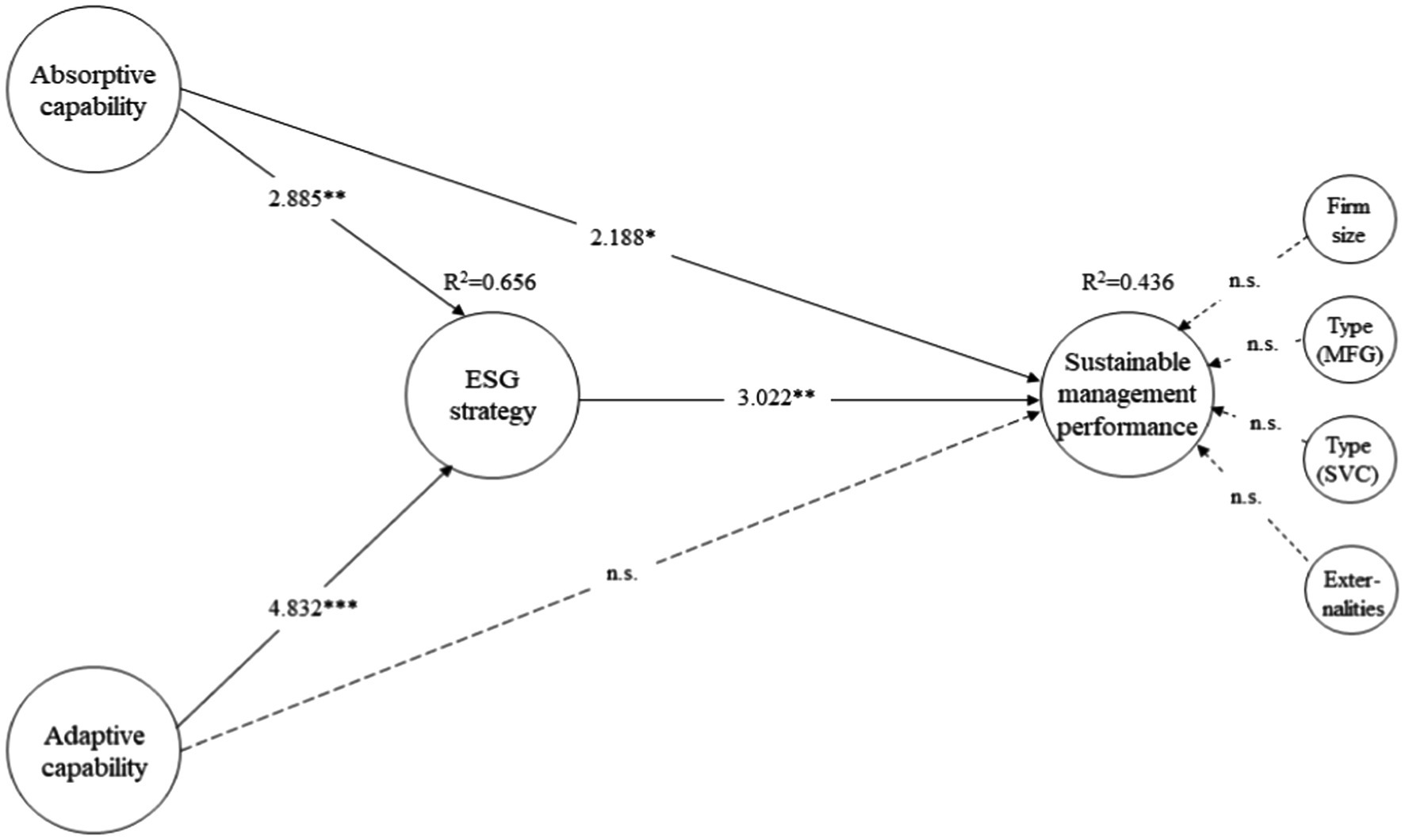

Figure 2 presents the results of the structural equation model. The results show that the absorptive capability (β = 2.188, p < 0.05) had a positive relationship with SMP. However, the adaptive capability (β = 1.606, p = 0.109) had no significant relationship with SMP. These results support Hypothesis 1–1, but not Hypothesis 1–2. Furthermore, we examined the mediating effects of the ESG strategy between the DCs (absorption and adaptation capabilities) and SMP. As a result of bootstrapping, absorptive capability (β = 2.885, p < 0.01) and adaptive capability (β = 4.832, p < 0.001) were analyzed as having a positive effect on the ESG strategy. The path from the ESG strategy to SMP was also positive and significant (β = 3.022, p < 0.01). In addition, the indirect path (DCs → ESG strategy → SMP) was also analyzed as significant, and it is possible to determine whether there is partial mediation. More importantly, when the mediating variable (i.e., the ESG strategy) was included in the model, the R2 of SMP further increased from 0.372 to 0.436. Overall, these results demonstrate that ESG strategy implementation plays an important role in mediating between DCs and SMP. Thereby Hypotheses 2 is supported. Meanwhile, investigating whether control variables such as firm size, firm type, and externalities affected SMP did not show statistically valid results.

Figure 2. Estimated results of a structural equation analysis. Non-significant paths are shown with a dotted line; n.s. = not significant. *p < 0.05, **p < 0.01, ***p < 0.001.

Discussion and Conclusion

In this study, we theorized and addressed two central research questions: (1) What capabilities and structures are required to achieve a firm’s SMP? (2) How does the ESG strategy improve this performance? We developed a series of hypotheses by adopting a DCs perspective to explore the capabilities and strategies needed to create a firm’s SMP. According to previous studies, DCs is generally a key factor that closely affects achieving a competitive advantage by improving a firm’s performance. In particular, we argued that SMP can be achieved when implementing an ESG strategy based on DCs. Given the recent changes and uncertainties surrounding the business environment, we suggested that implementing strategies that meet social trends, such as having an ESG strategy, can serve as an essential mechanism for a firm’s economic (or financial) performance as well as social and environmental performance.

The DCs perspective has long highlighted that a firm’s competitive advantage is driven by the capabilities built into the process of responding to environmental changes. Building upon this analytical and theoretical underpinning, we linked two types of capabilities (absorptive capability and adaptive capability) to respond to the rapidly changing business environment, and business performance is important to a firm’s sustainability. Moreover, we argued that firms should implement ESG strategies in order to achieve the sustainable value required by modern society. An empirical test on a sample of firms that implemented an ESG strategy in Korea supports some of our hypotheses. We obtained partially significant statistical effectiveness from the hypothesis that DCs (i.e., absorption and adaptation capabilities) respond to a changing environment and directly or indirectly affect SMP. In addition, we found that if the firms implemented an ESG strategy through DCs, they were more likely to achieve SMP. This evidence suggests that a firm’s ESG strategy implementation has a vital role in promoting competitive advantage based on DCs. Our empirical findings demonstrate that firms’ ESG implementation efforts can help strengthen their competitive position in terms of sustainability. Meanwhile, The Korean government is enacting various norms from an institutional perspective to facilitate ESG implementation in firms. This can act as regulatory pressure on firms, leading to an increase in the cost of regulatory compliance. Our research results can suggest a direction for firms to redefine their capabilities and develop ESG strategies in terms of preemptive response.

Our study offers important theoretical contributions to DCs research. First, our study contributes to the literature on a firm’s sustainable competitive advantage creation. Specifically, we adopted a DCs perspective to show the importance of a firm’s capabilities and its strategy in affecting SMP. More importantly, this study contributes to the competitive advantage literature by providing new insights into the role of an ESG strategy in creating SMP. We expand corporate sustainable development research through strategic frameworks based on two types of DCs. These two DCs seem important in encouraging firms to implement ESG strategies. In addition, we contribute to the literature theoretically by identifying and capturing the social and environmental performance required for firms to improve sustainability. Despite great efforts by prior scholars on this issue, they generally focused on achieving results in terms of finance and innovation, ignoring the possibility that competitive advantage may influence social and environmental performance. We thus advance the understanding of the literature on sustainability and DCs by linking capabilities with sustainability, and by capturing and measuring effects at the firm level. By integrating ESG literature with the DCs perspective, we highlighted ESG strategy implementation based on DCs in achieving sustainable performance. To the best of our knowledge, our study is one of the first to examine how the various types of DCs shape an ESG strategy and the benefits such an ESG strategy provides to a firm’s SMP.

Our study also provides important implications for a practical audience. This study shows that ESG strategy implementation can positively contribute to enhancing a firm’s SMP. Undoubtedly, firms can benefit from implementing ESG activities when operating their businesses. Our study particularly suggests that firms can improve their SMP in terms of social and environmental performance as well as financial performance by actively responding to changing environments through implementation of ESG strategies based on DCs. Furthermore, managers of firms should be aware that DCs might not directly contribute to SMP. Therefore, most importantly, firms should recognize the importance of effectively implementing ESG strategies through DCs.

Like all research, this study has limitations. First, our sample only consists of firms in Korea, which may raise concerns about generalizing on the effectiveness of ESG strategies. Future research can verify the generalization of our frameworks and empirical results by expanding our study with samples of firms operating in other countries that promote ESG implementation. Second, we acknowledge that this study incorporated only a limited set of DCs and outcome variables into the analysis. Additional variables and conditions should be considered when exploring the forces to form a firm’s ESG strategy and its implications. Previous research has emphasized the importance of a firm’s various dynamic capabilities in forming suitable strategic choices (e.g., Wang and Ahmed, 2004, 2007; Agarwal and Selen, 2013; Ringov, 2017). Therefore, future research is recommended to investigate whether and how firms’ various DCs can form ESG strategies differently and how these firms can achieve successful SMP by using ESG strategies. In the same line, the detailed process (e.g., sensing, integrating, and reconfiguration) of constituting DCs can be considered. Third, although we argue that the issue of reverse causality is of less concern in our study, we acknowledge that the problem may still be found in this type of cross-sectional research. As well, data constraints do not adopt longitudinal data or experimental methods to guard against the possibility of having a reverse-causality effect that biases the results. Moreover, due to data unavailability, we cannot capture in this study the possible dynamic nature of ESG strategy forces. Future research can further capture the dynamic effect of ESG strategies using longitudinal data. Studies can also explore how various DCs respond to environmental changes during implementation, and how ESG strategies contribute to a firm’s strategic response and various types of performance. This is another potential future research avenue. Finally, as in a recent study by Bhandari et al. (2022), empirical analysis using ESG disclosure data emerged. This study used secondary data through a survey, which can be limiting in terms of ensuring the legitimacy of the data.

Meanwhile, using ESG disclosure could have been even better because this information is publicly out with some evidence at least (Christensen et al., 2013; Winkler et al., 2020). Using ESG disclosure data is useful to ensure the legitimacy of the methodology. For reference, in Korea, each firm discloses an ESG implementation report annually. However, these reports have no standards, and there are limitations in using them as analysis data because the contents are different for each firm. Of course, the Korean government is gradually promoting the disclosure of such ESG-related information, which is expected to be supplemented in future research issue.

In conclusion, our study offers a nuanced understanding of how a firm’s DCs may influence its ESG strategy, and how they can be used to achieve sustainable performance in Korean context (institutional and social). We believe our findings provide valuable insights for improving a firm’s sustainability by enabling scholars and practitioners to deepen their understanding of the importance of ESG strategic management.

Data Availability Statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author/s.

Author Contributions

YL and ML contributed to the conceptualization, methodology, investigation and writing – original draft. ML and JJ performed research model, data collection, data curation and formal analysis. YL, ML, and JJ participated in the manuscript revision, review, editing and validation. All authors have read and approved the final manuscript.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1. ^The CEO of the U.S. Business Roundtable deleted the phrase “maximizing shareholder value” from the firm’s purpose, and argued that firms should also invest in employees and provide value to customers (New York Times, 2019.8.19).

References

Abdul-Rashid, S. H., Sakundarini, N., Raja Ghazilla, R. A., and Thurasamy, R. (2017). The impact of sustainable manufacturing practices on sustainability performance: empirical evidence from Malaysia. Int. J. Oper. Prod. Manag. 37, 182–204. doi: 10.1108/IJOPM-04-2015-0223

Adebanjo, D., Teh, P. L., and Ahmed, P. K. (2016). The impact of external pressure and sustainable management practices on manufacturing performance and environmental outcomes. Int. J. Oper. Prod. Manag. 36, 995–1013. doi: 10.1108/IJOPM-11-2014-0543

Agarwal, R., and Selen, W. (2013). The incremental and cumulative effects of dynamic capability building on service innovation in collaborative service organizations. J. Manag. Organ. 19, 521–543. doi: 10.1017/jmo.2014.5

Alkaraan, F., Albitar, K., Hussainey, K., and Venkatesh, V. G. (2022). Corporate transformation toward industry 4.0 and financial performance: the influence of environmental, social, and governance (ESG). Technol. Forecast. Soc. Chang. 175:121423. doi: 10.1016/j.techfore.2021.121423

Amis, J., Barney, J., Mahoney, J. T., and Wang, H. (2020). From the editors – why we need a theory of stakeholder governance – and why this is a hard problem. Acad. Manag. Rev. 45, 499–503. doi: 10.5465/amr.2020.0181

Amit, R., and Schoemaker, P. (1993). Strategic assets and organizational rent. Strateg. Manag. J. 14, 33–46. doi: 10.1002/smj.4250140105

Barney, J. B. (1991). Firm resources and sustained competitive advantage. J. Manag. 17, 99–120. doi: 10.1177/014920639101700108

Barney, J. B. (2001). Resource-based theories of competitive advantage: a ten-year retrospective on the resource-based view. J. Manag. 27, 643–650. doi: 10.1177/014920630102700602

Barney, J. B. (2018). Why resource-based theory’s model of profit appropriation must incorporate a stakeholder perspective. Strateg. Manag. J. 39, 3305–3325. doi: 10.1002/smj.2949

Barney, J. B., Ketchen, D. J. Jr., and Wright, M. (2021). Bold voices and new opportunities: an expanded research agenda for the resource-based view. J. Manag. 47, 1677–1683. doi: 10.1177/01492063211014276

Battisti, M., and Deakins, D. (2017). The relationship between dynamic capabilities, the firm’s resource base and performance in a post-disaster environment. Int. Small Bus. J. 35, 78–98. doi: 10.1177/0266242615611471

Ben-Amar, W., Chang, M., and McIlkenny, P. (2017). Board gender diversity and corporate response to sustainability initiatives: evidence from the carbon disclosure project. J. Bus. Ethics 142, 369–383. doi: 10.1007/s10551-015-2759-1

Bhandari, K. R., Rana, S., Paul, J., and Salo, J. (2020). Relative exploration and firm performance: why resource-theory alone is not sufficient? J. Bus. Res. 118, 363–377. doi: 10.1016/j.jbusres.2020.07.001

Bhandari, K. R., Ranta, M., and Salo, J. (2022). The resource-based view, stakeholder capitalism, ESG, and sustainable competitive advantage: The firm’s embeddedness into ecology, society, and governance. Bus. Strateg. Environ. 31, 1525–1537. doi: 10.1002/bse.2967

Bhupendra, K. V., and Sangle, S. (2017). What drives successful implementation of product stewardship strategy? The role of absorptive capability. Corp. Soc. Responsib. Environ. Manag. 24, 186–198. doi: 10.1002/csr.1394

Blome, C., Schoenherr, T., and Rexhausen, D. (2013). Antecedents and enablers of supply chain agility and its effect on performance: a dynamic capabilities perspective. Int. J. Prod. Res. 51, 1295–1318. doi: 10.1080/00207543.2012.728011

Cai, L., Hughes, M., and Yin, M. (2014). The relationship between resource acquisition methods and firm performance in Chinese new ventures: the intermediate effect of learning capability. J. Small Bus. Manag. 52, 365–389. doi: 10.1111/jsbm.12039

Cepeda, G., and Vera, D. (2007). Dynamic capabilities and operational capabilities: a knowledge management perspective. J. Bus. Res. 60, 426–437. doi: 10.1016/j.jbusres.2007.01.013

Chakravarthy, B. S. (1982). Adaptation: a promising metaphor for strategic management. Acad. Manag. Rev. 7, 35–44. doi: 10.2307/257246

Chen, Y. S., and Chang, C. H. (2013). The determinants of green product development performance: green dynamic capabilities, green transformational leadership, and green creativity. J. Bus. Ethics 116, 107–119. doi: 10.1007/s10551-012-1452-x

Cheng, J., Chen, M., and Huang, C. (2014). Assessing inter-organizational innovation performance through relational governance and dynamic capabilities in supply chains. Supply Chain Manag. 19, 173–186. doi: 10.1108/SCM-05-2013-0162

Chien, S. Y., and Tsai, C. H. (2012). Dynamic capability, knowledge, learning, and firm performance. J. Organ. Chang. Manag. 25, 434–444. doi: 10.1108/09534811211228148

Chiu, W. H., Chi, H. R., Chang, Y. C., and Chen, M. H. (2016). Dynamic capabilities and radical innovation performance in established firms: a structural model. Tech. Anal. Strat. Manag. 28, 965–978. doi: 10.1080/09537325.2016.1181735

Christensen, L. T., Morsing, M., and Thyssen, O. (2013). CSR as aspirational talk. Organization 20, 372–393. doi: 10.1177/1350508413478310

Cohen, W. M., and Levinthal, D. A. (1990). Absorptive capacity: a new perspective on learning and innovation. Adm. Sci. Q. 35, 128–152. doi: 10.2307/2393553

Dey, P. K., Malesios, C., De, D., Chowdhury, S., and Abdelaziz, F. B. (2020). The impact of lean management practices and sustainably-oriented innovation on sustainability performance of small and medium-sized enterprises: empirical evidence from the UK. Br. J. Manag. 31, 141–161. doi: 10.1111/1467-8551.12388

Drnevich, P. L., and Kriauciunas, A. P. (2011). Clarifying the conditions and limits of the contributions of ordinary and dynamic capabilities to relative firm performance. Strateg. Manag. J. 32, 254–279. doi: 10.1002/smj.882

Eisenhardt, K. M., and Martin, J. A. (2000). Dynamic capabilities: what are they? Strateg. Manag. J. 21, 1105–1121. doi: 10.1002/1097-0266(200010/11)21:10/11<1105::AID-SMJ133>3.0.CO;2-E

Fainshmidt, S., Nair, A., and Mallon, M. R. (2017). MNE performance during a crisis: an evolutionary perspective on the role of dynamic managerial capabilities and industry context. Int. Bus. Rev. 26, 1088–1099. doi: 10.1016/j.ibusrev.2017.04.002

Falasca, M., Zhang, J., Conchar, M., and Li, L. (2017). The impact of customer knowledge and marketing dynamic capability on innovation performance: an empirical analysis. J. Bus. Ind. Mark. 32, 901–912. doi: 10.1108/JBIM-12-2016-0289

Ferreira, J., Coelho, A., and Moutinho, L. (2020). Dynamic capabilities, creativity and innovation capability and their impact on competitive advantage and firm performance: the moderating role of entrepreneurial orientation. Technovation 92-93:102061. doi: 10.1016/j.technovation.2018.11.004

Fornell, C., and Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 18, 39–50. doi: 10.1177/002224378101800104

Freeman, R. E., Dmytriyev, S. D., and Phillips, R. A. (2021). Stakeholder theory and the resource-based view of the firm. J. Manag. 47, 1757–1770. doi: 10.1177/0149206321993576

García-Morales, V. J., Lloréns-Montes, F. J., and Verdú-Jover, A. J. (2008). The effects of transformational leadership on organizational performance through knowledge and innovation. Br. J. Manag. 19, 299–319. doi: 10.1111/j.1467-8551.2007.00547.x

Gelhard, C., von Delft, S., and Gudergan, S. P. (2016). Heterogeneity in dynamic capability configurations: equifinality and strategic performance. J. Bus. Res. 69, 5272–5279. doi: 10.1016/j.jbusres.2016.04.124

Gibson, C. B., and Birkinshaw, J. (2004). The antecedents, consequences, and mediating role of organizational ambidexterity. Acad. Manag. J. 47, 209–226.

Girod, S. J., and Whittington, R. (2017). Reconfiguration, restructuring and firm performance: dynamic capabilities and environmental dynamism. Strateg. Manag. J. 38, 1121–1133. doi: 10.1002/smj.2543

Grant, R. M. (1996). Prospering in dynamically-competitive environments: organizational capability as knowledge integration. Organ. Sci. 7, 375–387. doi: 10.1287/orsc.7.4.375

Gueler, M. S., and Schneider, S. (2021). The resource-based view in business ecosystems: a perspective on the determinants of a valuable resource and capability. J. Bus. Res. 133, 158–169. doi: 10.1016/j.jbusres.2021.04.061

Hahn, T., Pinkse, J., Preuss, L., and Figge, F. (2015). Tensions in corporate sustainability: towards an integrative framework. J. Bus. Ethics 127, 297–316. doi: 10.1007/s10551-014-2047-5

Hair, J. F., Hult, G. T. M., Ringle, C. M., Sarstedt, M., and Thiele, K. O. (2017). Mirror, mirror on the wall: a comparative evaluation of composite-based structural equation modeling methods. J. Acad. Mark. Sci. 45, 616–632. doi: 10.1007/s11747-017-0517-x

Hair, J. F., Sarstedt, M., Ringle, C. M., and Gudergan, S. P. (2018). Advanced Issues in Partial Least Squares Structural Equation Modeling (PLS-SEM). Thousand Oaks: Sage.

Han, Y., and Li, D. (2015). Effects of intellectual capital on innovative performance: the role of knowledge-based dynamic capability. Manag. Decis. 53, 40–56. doi: 10.1108/MD-08-2013-0411

He, Z. L., and Wong, P. K. (2004). Exploration vs. exploitation: an empirical test of the ambidexterity hypothesis. Organ. Sci. 15, 481–494. doi: 10.1287/orsc.1040.0078

Henderson, R. M. (2021). Changing the purpose of the corporation to rebalance capitalism. Oxf. Rev. Econ. Policy 37, 838–850. doi: 10.1093/oxrep/grab034

Hermano, V., and Martín-Cruz, N. (2016). The role of top management involvement in firms performing projects: a dynamic capabilities approach. J. Bus. Res. 69, 3447–3458. doi: 10.1016/j.jbusres.2016.01.041

Holden, E., Linnerud, K., Banister, D., Schwanitz, V.J., and Wierling, A. (2017). The Imperatives of Sustainable Development: Needs, Justice, Limits. New York: Routledge.

Hooley, G. J., Lynch, J. E., and Jobber, D. (1992). Generic marketing strategies. Int. J. Res. Mark. 9, 75–89. doi: 10.1016/0167-8116(92)90030-O

Hsu, L. C., and Wang, C. H. (2012). Clarifying the effect of intellectual capital on performance: the mediating role of dynamic capability. Br. J. Manag. 23, 179–205. doi: 10.1111/j.1467-8551.2010.00718.x

Hung, R. Y. Y., Yang, B., Lien, B. Y. H., McLean, G. N., and Kuo, Y. M. (2010). Dynamic capability: impact of process alignment and organizational learning culture on performance. J. World Bus. 45, 285–294. doi: 10.1016/j.jwb.2009.09.003

Hussain, N., Rigoni, U., and Orij, R. P. (2018). Corporate governance and sustainability performance: analysis of triple bottom line performance. J. Bus. Ethics 149, 411–432. doi: 10.1007/s10551-016-3099-5

Inman, R. A., and Green, K. W. (2018). Lean and green combine to impact environmental and operational performance. Int. J. Prod. Res. 56, 4802–4818. doi: 10.1080/00207543.2018.1447705

Jiang, W., Mavondo, F. T., and Matanda, M. J. (2015). Integrative capability for successful partnering: a critical dynamic capability. Manag. Decis. 53, 1184–1202. doi: 10.1108/MD-04-2014-0178

Ju, K.-J., Park, B., and Kim, T. (2016). Causal relationship between supply chain dynamic capabilities, technological innovation, and operational performance. Manage. Prod. Eng. Rev. 7, 6–15. doi: 10.1515/mper-2016-0031

Kanashiro, P., and Rivera, J. (2019). Do chief sustainability officers make companies greener? The moderating role of regulatory pressures. J. Bus. Ethics 155, 687–701. doi: 10.1007/s10551-017-3461-2

Karimi, J., and Walter, Z. (2015). The role of dynamic capabilities in responding to digital disruption: a factor-based study of the newspaper industry. J. Manag. Inf. Syst. 32, 39–81. doi: 10.1080/07421222.2015.1029380

Khanna, T., and Rivkin, J. W. (2001). Estimating the performance effects of business groups in emerging markets. Strateg. Manag. J. 22, 45–74. doi: 10.1002/1097-0266(200101)22:1<45::AID-SMJ147>3.0.CO;2-F

Ko, W. W., and Liu, G. (2017). Environmental strategy and competitive advantage: The role of small-and medium-sized enterprises’ dynamic capabilities. Bus. Strateg. Environ. 26, 584–596. doi: 10.1002/bse.1938

Konwar, Z., Papageorgiadis, N., Ahammad, M. F., Tian, Y., McDonald, F., and Wang, C. (2017). Dynamic marketing capabilities, foreign ownership modes, sub-national locations and the performance of foreign affiliates in developing economies. Int. Mark. Rev. 34, 674–704. doi: 10.1108/IMR-01-2016-0004

Kriauciunas, A., and Kale, P. (2006). The impact of socialist imprinting and search on resource change: a study of firms in Lithuania. Strateg. Manag. J. 27, 659–679. doi: 10.1002/smj.537

Kumar, G., Subramanian, N., and Arputham, R. M. (2018). Missing link between sustainability collaborative strategy and supply chain performance: role of dynamic capability. Int. J. Prod. Econ. 203, 96–109. doi: 10.1016/j.ijpe.2018.05.031

Lee, S. M., and Rha, J. S. (2016). Ambidextrous supply chain as a dynamic capability: building a resilient supply chain. Manag. Decis. 54, 2–23. doi: 10.1108/MD-12-2014-0674

Leong, C. K., and Yang, Y. C. (2020). Market competition and firms’ social performance. Econ. Model. 91, 601–612. doi: 10.1016/j.econmod.2019.12.002

Li, D. Y., and Liu, J. (2014). Dynamic capabilities, environmental dynamism, and competitive advantage: evidence from China. J. Bus. Res. 67, 2793–2799. doi: 10.1016/j.jbusres.2012.08.007

Lichtenthaler, U. (2009). Absorptive capacity, environmental turbulence, and the complementarity of organizational learning processes. Acad. Manag. J. 52, 822–846. doi: 10.5465/amj.2009.43670902

Lin, Y., and Chen, Y. S. (2017). Determinants of green competitive advantage: the roles of green knowledge sharing, green dynamic capabilities, and green service innovation. Qual. Quant. 51, 1663–1685. doi: 10.1007/s11135-016-0358-6

Lin, Y., and Wu, L. Y. (2014). Exploring the role of dynamic capabilities in firm performance under the resource-based view framework. J. Bus. Res. 67, 407–413. doi: 10.1016/j.jbusres.2012.12.019

Liu, H. Y., and Hsu, C. W. (2011). Antecedents and consequences of corporate diversification: a dynamic capabilities perspective. Manag. Decis. 49, 1510–1534. doi: 10.1108/00251741111173961

Lumpkin, G. T., and Dess, G. G. (2006). The effect of ‘simplicity’ on the strategy–performance relationship: a note. J. Manag. Stud. 43, 1583–1604. doi: 10.1111/j.1467-6486.2006.00652.x

Luo, Y. (2002). Capability exploitation and building in a foreign market: implications for multinational enterprises. Organ. Sci. 13, 48–63. doi: 10.1287/orsc.13.1.48.538

Mikalef, P., and Pateli, A. (2017). Information technology-enabled dynamic capabilities and their indirect effect on competitive performance: findings from PLS-SEM and fsQCA. J. Bus. Res. 70, 1–16. doi: 10.1016/j.jbusres.2016.09.004

Miles, R. E., Snow, C. C., Meyer, A. D., and Coleman, H. J. (1978). Organizational strategy, structure, and process. Acad. Manag. Rev. 3, 546–562. doi: 10.2307/257544

Mitrega, M., and Pfajfar, G. (2015). Business relationship process management as company dynamic capability improving relationship portfolio. Ind. Mark. Manag. 46, 193–203. doi: 10.1016/j.indmarman.2015.02.029

Monferrer, D., Blesa, A., and Ripollés, M. (2015). Born globals trough knowledge-based dynamic capabilities and network market orientation. BRQ Bus. Res. Q. 18, 18–36. doi: 10.1016/j.brq.2014.04.001

Monteiro, A. P., Soares, A. M., and Rua, O. L. (2019). Linking intangible resources and entrepreneurial orientation to export performance: the mediating effect of dynamic capabilities. J. Innov. Knowl. 4, 179–187. doi: 10.1016/j.jik.2019.04.001

Mu, J. (2017). Dynamic capability and firm performance: the role of marketing capability and operations capability. IEEE Trans. Eng. Manag. 64, 554–565. doi: 10.1109/TEM.2017.2712099

Oktemgil, M., and Greenley, G. (1997). Consequences of high and low adaptive capability in UK companies. Eur. J. Mark. 31, 445–466. doi: 10.1108/03090569710176619

Panigyrakis, G. G., and Theodoridis, P. K. (2007). Market orientation and performance: an empirical investigation in the retail industry in Greece. J. Retail. Consum. Serv. 14, 137–149. doi: 10.1016/j.jretconser.2006.05.003

Parnell, J. A. (2011). Strategic capabilities, competitive strategy, and performance among retailers in Argentina, Peru and the United States. Manag. Decis. 49, 139–155. doi: 10.1108/00251741111094482

Parnell, J. A., Long, Z., and Lester, E. (2015). Competitive strategy, capabilities and uncertainty in small and medium sized enterprises (SMEs) in China and the United States. Manag. Decis. 53, 402–431. doi: 10.1108/MD-04-2014-0222

Peng, J. C., and Lin, J. (2017). Mediators of ethical leadership and group performance outcomes. J. Manag. Psychol. 32, 484–496. doi: 10.1108/JMP-10-2015-0370

Piening, E. P., and Salge, T. O. (2015). Understanding the antecedents, contingencies, and performance implications of process innovation: A dynamic capabilities perspective. J. Prod. Innov. Manag. 32, 80–97. doi: 10.1111/jpim.12225

Pinho, J. C., and Prange, C. (2016). The effect of social networks and dynamic internationalization capabilities on international performance. J. World Bus. 51, 391–403. doi: 10.1016/j.jwb.2015.08.001

Pisano, G. P. (1994). Knowledge, integration, and the locus of learning: An empirical analysis of process development. Strateg. Manag. J. 15, 85–100. doi: 10.1002/smj.4250150907

Podsakoff, P. M., MacKenzie, S. B., Lee, J. Y., and Podsakoff, N. P. (2003). Common method biases in behavioral research: a critical review of the literature and recommended remedies. J. Appl. Psychol. 88, 879–903. doi: 10.1037/0021-9010.88.5.879

Porter, M. E., Hills, G., Pfitzer, M., Patscheke, S., and Hawkins, E. (2011). Measuring Shared Value. How to Unlock Value by Linking Social and Business Results (Boston: FSG), 1–20.

Porter, M. E., and Kramer, M. R. (2019). “Creating shared value. How to reinvent capitalism and unleash a wave of innovation and growth,” in Managing Sustainable Business. eds. G. Lenssen and N. Smith (Dordrecht: Springer), 323–346.

Rashidirad, M., Salimian, H., Soltani, E., and Fazeli, Z. (2017). Competitive strategy, dynamic capability, and value creation: some empirical evidence from UK telecommunications firms. Strateg. Chang. 26, 333–342. doi: 10.1002/jsc.2135

Reinhardt, F. L. (1998). Environmental product differentiation: implications for corporate strategy. Calif. Manag. Rev. 40, 43–73. doi: 10.2307/41165964

Rindova, V., and Kotha, S. (2001). Continuous morphing: competing through dynamic capabilities, form, and function. Acad. Manag. J. 44, 1263–1280.

Ringov, D. (2017). Dynamic capabilities and firm performance. Long Range Plan. 50, 653–664. doi: 10.1016/j.lrp.2017.02.005

Sarkar, S., Coelho, D. M., and Maroco, J. (2016). Strategic orientations, dynamic capabilities, and firm performance: an analysis for knowledge intensive business services. J. Knowl. Econ. 7, 1000–1020. doi: 10.1007/s13132-016-0415-3

Sarstedt, M., Hair, J. F., Ringle, C. M., Thiele, K. O., and Gudergan, S. P. (2016). Estimation issues with PLS and CBSEM: where the bias lies! J. Bus. Res. 69, 3998–4010. doi: 10.1016/j.jbusres.2016.06.007

Schaltegger, S., and Hörisch, J. (2017). In search of the dominant rationale in sustainability management: legitimacy-or profit-seeking? J. Bus. Ethics 145, 259–276. doi: 10.1007/s10551-015-2854-3

Schilke, O. (2014). On the contingent value of dynamic capabilities for competitive advantage: the nonlinear moderating effect of environmental dynamism. Strateg. Manag. J. 35, 179–203. doi: 10.1002/smj.2099

Swoboda, B., and Olejnik, E. (2016). Linking processes and dynamic capabilities of international SMEs: the mediating effect of international entrepreneurial orientation. J. Small Bus. Manag. 54, 139–161. doi: 10.1111/jsbm.12135

Tallman, S. B. (1991). Strategic management models and resource-based strategies among MNEs in a host market. Strateg. Manag. J. 12, 69–82. doi: 10.1002/smj.4250120907

Teece, D. J. (2007). Explicating dynamic capabilities: the nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 28, 1319–1350. doi: 10.1002/smj.640

Teece, D. J. (2012). Dynamic capabilities: routines versus entrepreneurial action. J. Manag. Stud. 49, 1395–1401. doi: 10.1111/j.1467-6486.2012.01080.x

Teece, D. J. (2018). Profiting from innovation in the digital economy: enabling technologies, standards, and licensing models in the wireless world. Res. Policy 47, 1367–1387. doi: 10.1016/j.respol.2017.01.015

Teece, D. J., Pisano, G., and Shuen, A. (1997). Dynamic capabilities and strategic management. Strateg. Manag. J. 18, 509–533. doi: 10.1002/(SICI)1097-0266(199708)18:7<509::AID-SMJ882>3.0.CO;2-Z

Todorova, G., and Durisin, B. (2007). Absorptive capacity: valuing a reconceptualization. Acad. Manag. Rev. 32, 774–786. doi: 10.5465/amr.2007.25275513

Tuominen, M., Rajala, A., and Möller, K. (2004). How does adaptability drive firm innovativeness? J. Bus. Res. 57, 495–506. doi: 10.1016/S0148-2963(02)00316-8

Uhlenbruck, K., Meyer, K. E., and Hitt, M. A. (2003). Organizational transformation in transition economies: resource-based and organizational learning perspectives. J. Manag. Stud. 40, 257–282. doi: 10.1111/1467-6486.00340

Van Duuren, E., Plantinga, A., and Scholtens, B. (2016). ESG integration and the investment management process: fundamental investing reinvented. J. Bus. Ethics 138, 525–533. doi: 10.1007/s10551-015-2610-8

Vanpoucke, E., Vereecke, A., and Wetzels, M. (2014). Developing supplier integration capabilities for sustainable competitive advantage: a dynamic capabilities approach. J. Oper. Manag. 32, 446–461. doi: 10.1016/j.jom.2014.09.004

Vickery, S. K., Koufteros, X., and Droge, C. (2013). Does product platform strategy mediate the effects of supply chain integration on performance? A dynamic capabilities perspective. IEEE Trans. Eng. Manag. 60, 750–762. doi: 10.1109/TEM.2013.2266301

Villar, C., Alegre, J., and Pla-Barber, J. (2014). Exploring the role of knowledge management practices on exports: a dynamic capabilities view. Int. Bus. Rev. 23, 38–44. doi: 10.1016/j.ibusrev.2013.08.008

Wamba, S. F., Gunasekaran, A., Akter, S., Ren, S. J. F., Dubey, R., and Childe, S. J. (2017). Big data analytics and firm performance: effects of dynamic capabilities. J. Bus. Res. 70, 356–365. doi: 10.1016/j.jbusres.2016.08.009

Wang, C. L., and Ahmed, P. K. (2004). The development and validation of the organizational innovativeness construct using confirmatory factor analysis. Eur. J. Innov. Manag. 7, 303–313. doi: 10.1108/14601060410565056

Wang, C. L., and Ahmed, P. K. (2007). Dynamic capabilities: a review and research agenda. Int. J. Manag. Rev. 9, 31–51. doi: 10.1111/j.1468-2370.2007.00201.x

Wang, C. L., Senaratne, C., and Rafiq, M. (2015). Success traps, dynamic capabilities and firm performance. Br. J. Manag. 26, 26–44. doi: 10.1111/1467-8551.12066

Wilden, R., and Gudergan, S. P. (2015). The impact of dynamic capabilities on operational marketing and technological capabilities: investigating the role of environmental turbulence. J. Acad. Mark. Sci. 43, 181–199. doi: 10.1007/s11747-014-0380-y

Wilden, R., and Gudergan, S. P. (2017). Service-dominant orientation, dynamic capabilities and firm performance. J. Serv. Theory Pract. 27, 808–832. doi: 10.1108/JSTP-04-2016-0077

Wilden, R., Gudergan, S. P., Nielsen, B. B., and Lings, I. (2013). Dynamic capabilities and performance: strategy, structure and environment. Long Range Plan. 46, 72–96. doi: 10.1016/j.lrp.2012.12.001

Wilhelm, H., Schlömer, M., and Maurer, I. (2015). How dynamic capabilities affect the effectiveness and efficiency of operating routines under high and low levels of environmental dynamism. Br. J. Manag. 26, 327–345. doi: 10.1111/1467-8551.12085

Winkler, P., Etter, M., and Castelló, I. (2020). Vicious and virtuous circles of aspirational talk: From self-persuasive to agonistic CSR rhetoric. Bus. Soc. 59, 98–128. doi: 10.1177/0007650319825758

Wong, C. W. (2013). Leveraging environmental information integration to enable environmental management capability and performance. J. Supply Chain Manag. 49, 114–136. doi: 10.1111/jscm.12005

Wu, L. Y. (2007). Entrepreneurial resources, dynamic capabilities and start-up performance of Taiwan’s high-tech firms. J. Bus. Res. 60, 549–555. doi: 10.1016/j.jbusres.2007.01.007

Wu, L. Y. (2010). Applicability of the resource-based and dynamic-capability views under environmental volatility. J. Bus. Res. 63, 27–31. doi: 10.1016/j.jbusres.2009.01.007

Wu, H., Chen, J., and Jiao, H. (2016). Dynamic capabilities as a mediator linking international diversification and innovation performance of firms in an emerging economy. J. Bus. Res. 69, 2678–2686. doi: 10.1016/j.jbusres.2015.11.003

Yi, Y., He, X., Ndofor, H., and Wei, Z. (2015). Dynamic capabilities and the speed of strategic change: evidence from China. IEEE Trans. Eng. Manag. 62, 18–28. doi: 10.1109/TEM.2014.2365524

Zahra, S. A., and George, G. (2002). Absorptive capacity: a review, reconceptualization, and extension. Acad. Manag. Rev. 27, 185–203. doi: 10.2307/4134351

Zahra, S. A., Sapienza, H. J., and Davidson, P. (2006). Entrepreneurship and dynamic capabilities: a review, model and research agenda. J. Manag. Stud. 43, 917–955. doi: 10.1111/j.1467-6486.2006.00616.x

Zhang, J., and Wu, W. (2017). Leveraging internal resources and external business networks for new product success: A dynamic capabilities perspective. Ind. Mark. Manag. 61, 170–181. doi: 10.1016/j.indmarman.2016.06.001

Zheng, S., Zhang, W., Wu, X., and Du, J. (2011). Knowledge-based dynamic capabilities and innovation in networked environments. J. Knowl. Manag. 15, 1035–1051. doi: 10.1108/13673271111179352

Zhu, Q., Sarkis, J., and Lai, K. H. (2008). Confirmation of a measurement model for green supply chain management practices implementation. Int. J. Prod. Econ. 111, 261–273. doi: 10.1016/j.ijpe.2006.11.029

Zollo, M., and Winter, S. G. (2002). Deliberate learning and the evolution of dynamic capabilities. Organ. Sci. 13, 339–351. doi: 10.1287/orsc.13.3.339.2780

Appendix 1 Previous Literature on Dynamic Capabilities

Appendix 2 Variables and Measures

Keywords: dynamic capabilities, absorptive capability, adaptive capability, ESG strategy, sustainable management performance

Citation: Liang Y, Lee MJ and Jung JS (2022) Dynamic Capabilities and an ESG Strategy for Sustainable Management Performance. Front. Psychol. 13:887776. doi: 10.3389/fpsyg.2022.887776

Edited by:

Taewoo Roh, Soonchunhyang University, South KoreaReviewed by:

Hee Sun Kim, Korea SMEs and Startups Institute, South KoreaSoo Hee Lee, University of Kent, United Kingdom

Copyright © 2022 Liang, Lee and Jung. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jin Sup Jung, anNqdW5nQGNibnUuYWMua3I=

†These authors have contributed equally to this work and share first authorship

Yi Liang1†

Yi Liang1† Min Jae Lee

Min Jae Lee Jin Sup Jung

Jin Sup Jung