- 1College of Economics and Management, Beijing University of Technology, Beijing, China

- 2LinKong School of Economics and Management, Beijing Institute of Economics and Management, Beijing, China

- 3School of Management, Jiangsu University, Zhenjiang, China

- 4Riphah School of Leadership, Faculty of Management Sciences, Riphah International University, Islamabad, Pakistan

- 5Faculty of Management, University of Agriculture, Peshawar, Pakistan

Introduction: A recent increase in interest rates has raised doubts about the stability of micro-finance institutions (MFI) A recent increase in interest rates has raised doubts about the stability of MFI in many countries. This has compelled governments to consider some MFI practices unethical.

Methods: This paper studies the MFI interest rates by using a dynamic panel method to identify the determining factors of the viability, financial, and social execution of microfinance firms. The research shows that the long-term interest rate evolution depends on the anticipation of loan loss rates (LLR), profit, or macroeconomic factors like inflation and the short-term current interest rate. The Study used database of 897 microfinance institutions in 106 countries and six geographic regions with a representative sample size of 5,075 observations between 2008 and 2020. The external factors considered are the market structure (Competition), economics (inflation), cultural and technological political conditions, and banking regulations in effect (regulation). Financial costs, operational costs, the write-off rate, and the average size of the loan are the most important determinant factors in MFI interest rate fluctuations.

Results: The research find that other factors like gender, legal status, and regulations also contribute to the MFI interest rate variation. The research also discovered that there is a threshold effect in the relationship between women borrowers (WB) and the interest rate. Another important finding of this study is that MFIs do not anticipate inflation in the definition of the interest rate.

Discussion: From an institutional point of view, it is necessary to promote competition, as the study shows that well-regulated competition helps to keep interest rates at a reasonable level.

Introduction

Micro-finance institutions (MFI) interest rates have fluctuated significantly in recent years. Most MFI data specifies that financial and operational costs must be offset by the increase in interest rates. Most microfinance institutions have succeeded to develop and create sustainable activities by applying interest rates that cover their overall operating costs (Rosenberg et al., 2009; Gupta and Mirchandani, 2019). The interest rate variation comes out of several factors that are less manageable by micro-credits (Nwachukwu et al., 2018). There are also micro-credits whose activities are only motivated by profit-seeking. The recent increase in interest rates has raised some questions about the stability of MFIs in many countries. This has compelled some governments to consider some MFI practices as unethical and against the best interest of borrowers, hence the capped rate of interest in some countries to fight against distortion practices is overviewed (Helms and Reille, 2004; Al-Azzam, 2016; Chikalipah, 2017). Measures have been taken in some countries, like Nicaragua, where President Ortega encouraged borrowers to default on loans (Jiang et al., 2019).

This MFI interest rate increase has been observed in most countries over the past decade and has motivated field research (Rosenberg et al., 2009; Dorfleitner et al., 2013; Gupta and Mirchandani, 2019). The primary motivation behind this research is to identify the determining factors of the viability, financial, and social execution of microfinance firms. Previous researchers failed to understand the interest rate fluctuations that stem from the anticipation of some variables like loan loss rates (LLR), profit, or macroeconomic factors like inflation. They were constructed on the estimations of static econometric models. These authors assume that the interest rate evolution observed at the (t-1) period is identical to that observed at the (t) period. However, these static analyses do not provide sufficient explications for present and future interest rates of MFI fluctuations because adjustments to changes in the financial environment are never instantaneous (Chao et al., 2019; Jiang et al., 2019).

In addition to these limitations, these works have not highlighted the MFI legal status effects and the impact of female borrowers on interest rate fluctuations (Nwachukwu et al., 2018). This article removes these ambiguities by using the Fisher hypothesis test and by showing the threshold at which the share of women in microfinance institutions has a fluctuating impact on the rate of interest.

Our study considers a different analysis of the above-mentioned literature. By using a dynamic approach, the main question that we ask in this paper is whether the increase in interest rates is bound to the anticipation phenomena. That is a system that is not spot dependent on its properties but rather depends upon the progression over time. It is important to distinguish between the current and long-term effects of explanatory variables on MFI interest rate changes (Hashemkhani Zolfani and Bahrami, 2014; Chao et al., 2019).

Firstly, the study uses the effect of the dynamics of short- and long-term by combining lagged and spot variables to show whether the value of the interest rate in periods depends on the anticipation of its value in (t-1) and the evolution trend of other independent variables. The coefficients associated with the lagged variables represent the anticipation coefficients. If the coefficient is positive and significant, this means that the trend will continue and that the MFI anticipates an interest rate increase; otherwise, it anticipates an interest rate decrease. If it is equal to zero, the MFIs anticipate that the interest rate evolution at the (t-1) period will be identical to that observed at the (t) period, which refers to the static models. Secondly, it shows that using a dynamic analysis method provides more and better information on MFI interest rate fluctuations.

Finally, the research confirms the difference between acclaimed specificities as per the legal status of microfinance establishments and their outcomes as depicted by the observation that NGOs and rural banks do not often meet expectations of solidarity practices.

The study used a representative sample of 897 MFIs over 12 years period (2008–2020). The results showed the determination of interest rates according to short and long periods.

The remaining article is structured in four sections. In section “Literature Review,” researchers present the literature review, and section “Data Description and Methodology” discusses the methodological approach. The balanced panel data results are presented in section “Results and Findings” by employing the GMM method and finally, the conclusion with the research perspectives is presented in section “Findings.”

Literature review

Recent theoretical developments have shown that the interest rate of MFIs depends on several characteristics. These include market structure, type of clients, MFI legal status, internal, and external factors, and macroeconomic factors.

However, as with classic banks, the relationship between these factors and the MFI’s interest rate has been embryonically discussed in the literature (Dorfleitner et al., 2013; Catalán-Herrera et al., 2019). This literature focused mainly on determinants explaining the profitability of microfinance firms without considering the interest rate evolution (Cuéllar-Fernández et al., 2016) examined the determinants of MFI financial viability by using a MIX database (Microfinance Information Exchange) for the year between 1992 and 2002. Researchers identified that rates of interest and refinancing prices impact the financial viability of microfinance firms. Their results might be reconsidered, as these authors do not justify how the interest rate affects MFI’s financial performance. Gonzalez and McAleer (2011) and Rosenberg et al. (2013) argue that while MFIs have higher yield rates than classic banks, rent-seeking is not a determinant element of these interest rates (Gonzalez and McAleer, 2011; Rosenberg et al., 2013; Mimouni, 2017). Despite the resonance of their discussion, these researchers could not test their results due to the lack of evidence of the explanatory variables and the econometric method (Jiang et al., 2019).

Another empirical study uses data on subsidies D’Espallier et al. (2017) to explain the interest rate evolution. The uncertainty of subsidies makes the MFI objectives difficult to reach and causes the drifting of their social mission, and consequently interest rate adjustment increases (Hashemkhani Zolfani and Bahrami, 2014; Chikalipah, 2017; D’Espallier et al., 2017).

Relating to the MFI objectives, some authors argue that micro-finance is unable to generate high profits because they still support high costs by generating low incomes (Mersland and Strøm, 2012; Mimouni, 2017).

Furthermore, Ahlin et al. (2011) highlight the national context effect, especially macroeconomic and macro-institutional characteristics to explain the MFI’s financial performance. They showed that the interest rate, and the operating costs, could be reduced by the competition. Cotler and Almazan (2013) distinguish a positive connection between monetary expenses and the microcredit loan fee and a negative connection between the proficiency level of MFIs and financing cost (Cotler and Almazan, 2013; Janda et al., 2014; Mimouni, 2017).

Despite this extensive literature, some of these results are weak and the question of the MFI interest rate anticipation setting remains unanswered. In other words, anticipation phenomena have never been studied in the microfinance literature. Another contribution of this article is the evidence regarding the existence of a threshold effect between women borrowers and interest rates. Most of the authors who studied the effect of female borrowers on interest rates estimated that an MFI female clientele increases because interest rates increase (Dorfleitner et al., 2013). Our study showed that this relationship is not linear and from a certain threshold, about 68% of the positive impact of women on the interest rate becomes negative (Kou et al., 2019).

Data description and methodology

To further this research on the microfinance interest rate determinants, the study used a database from the MIX (microfinance information exchange) to collect all information on microfinance institutions across the world to better ease exchange between the different MFIs. Created in 2007, the MIX aims to foster a microfinance market, allow a comparison between MFIs, and provide performance monitoring tools and data collection services. It allows to easily access to monetary and social execution data for more than 2,000 microfinance institutions worldwide, that cover 0.092 billion borrowers. MIX is earmarked for financial inclusion and transparency in the microfinance sector.

Sampling method

For this study used a database containing 897 microfinance institutions over 12 years (2008–2020). This allowed us to take into account all the factors that can influence the interest rate economically, socially, historically, or geographically. The implementation of this sample results from a multi-step adjustment. In the first sampling phase, considering that MIX distinguishes the social and financial performance based on diamond classification on a scale of 1–5, we only used MFIs that had reached 3 diamonds. This is to have complete external reporting (financial audit).

In the second phase, the researchers removed from the sample those MFIs with portfolio values negative or less than USD 20,000 and those with operating costs greater than 350%. In the final phase, MFIs that have recorded missing data or have not reported their data for those periods have also been removed from the sample.

Dependent variable

The research used the real interest rate (TX REAL) as a dependent variable at the expense of the real yield rate to explain the interest rate evolution. MIX does not explicitly provide this interest rate for various reasons, more than often related to confidentiality, to ensure transparency between borrowers and microcredit providers. It is also bound to the high diversity of applied interest rates and fixed banking fees. This makes it difficult to assign a uniform interest rate for each MFI. In this way, the interest rate considered in this paper derives from the nominal interest rate.

The inclusion of loan Lost springs from the fact that when the customers stop repaying their debt, the nominal yield (real interest paid) is on a slightly downward trend compared to the facial interest rate (the total interest he would have paid if he continued to repay his debt).

The real interest rate can be calculated in two different ways:

In this paper, the study use the second method which provides more information on the real interest rate.

Description and variables operationalization

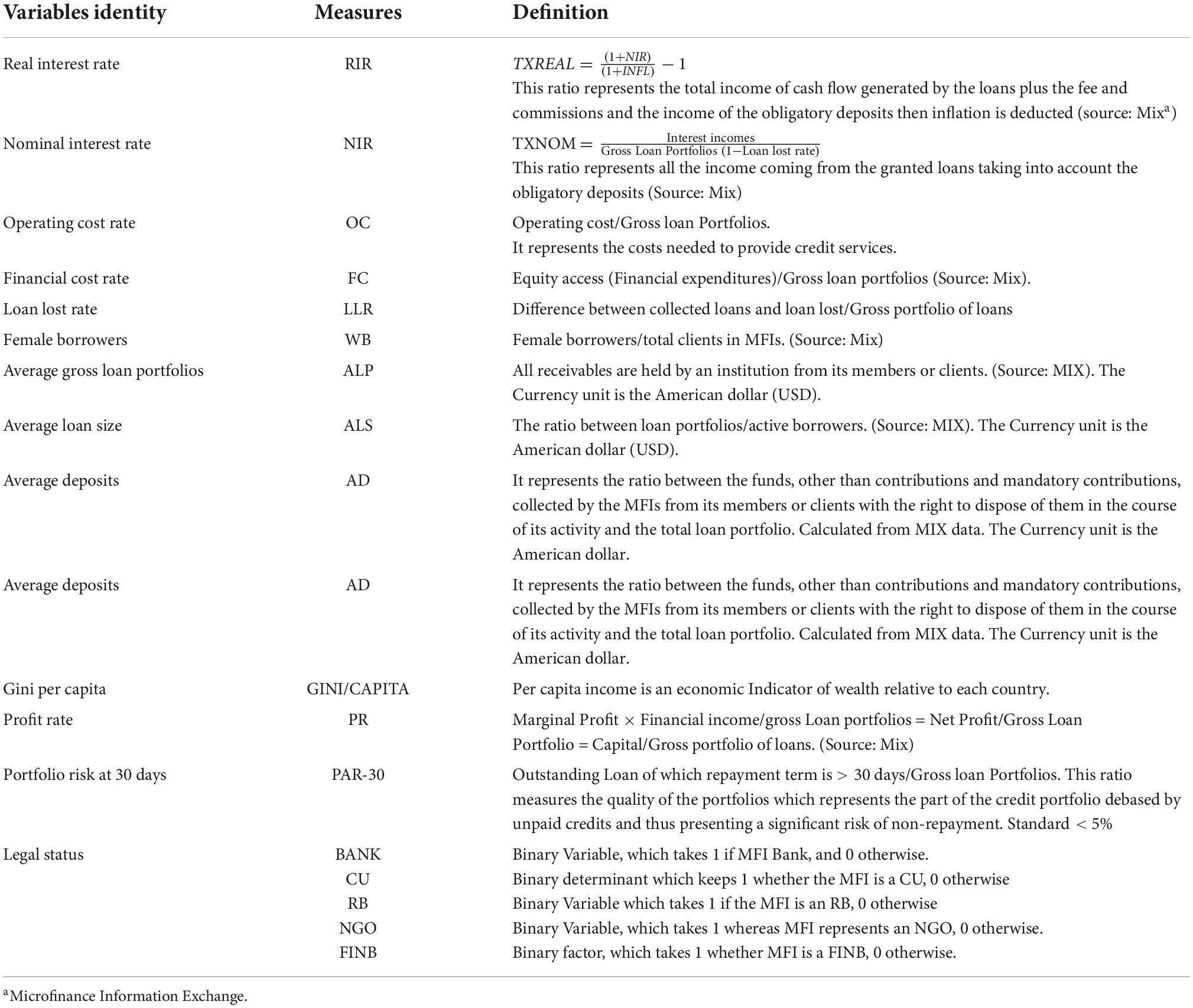

For this study, we have selected a set of variables considered essential. Some of these variables have been highlighted by other authors like Rosenberg et al. (2013) but adopting a different methodology from ours. The definition of variables is explained in Table 1.

The first independent variable represents the overhead costs measured in terms of the ratio approached by MIX as the operating costs (OC). This variable allows us to understand the impact of administrative costs, personnel costs, and depreciation costs on MFI interest rates. According to a study conducted by Rosenberg et al. (2013), overhead costs fluctuate between 10 and 25% and represent the most decisive element in the interest rate setting (62%). The second independent variable represents the loan lost rates (LLR) measured as losses on loans that have been recorded after each accounting balance sheet. he third variable represents the financial costs (FC) or refinancing costs from donors, banks, or other MFIs.

In recent years, financial costs have continued to increase due to microfinance institutions’ growth and a decrease in potential borrowers. This has led the MFIs to turn to commercial lenders that apply higher interest rates. furthermore, another variable influencing the interest rate is the percentage of women using MFIs. Women borrowers (WB) are a very active part of the microcredit market and are therefore an appropriate target for MFIs. It is estimated that 70% of the poor and 85% of the poorest clients receiving microfinance services are women, which represents a significant and growing potential of the informal economy. Commercially, many types of research have demonstrated that the loan recovery rate observed in the female borrower population is higher than other borrowers. in this study we also control for the legal environment (whether the MFI is regulated or not), the legal status of NGO, non-banking financial institutions (NBFI), credit associations banks, and cooperatives, or whether it is a for-profit MFI or not.

Model specification

We examine the importance of all the above-mentioned factors using a dynamic panel regression analysis. We recall that all available studies on the determinants of MFI interest rates are too often limited to a static approach, as is the case with the work of Dorfleitner et al. (2013). The studies, so far recalled, allow the correction of heteroscedasticity (method of generalized least squares) and/or serial autocorrelation of residues. These studies do not consider the intertemporal variations of the interest rates. The purpose of this paper is to correct the shortcomings noted in the static model by using a dynamic model. This latter represents a model in which one or more lags of the independent variables. This results in the paper that the interest rate in the “t” period depends on the one in the (t-1) period and the other explanatory variables that compose it.

The estimation method

Our model is based on the one developed by Bond (2002):

Equation (1) is a dynamic model characterized by the presence of one or more lags of the endogenous variable, which appear as an explanatory variable. To simplify the model, the variable Yit is studied with only one lag.

The i and t indexes respectively denote the time dimension cross-sectional panel data.

Yit is the interest rate (presented in the form of MFI i proportion) in t period; Yit-1, the interest rate at t-1 period; X1it is the internal factors matrix while X2it is the external factors matrix. μi, is the specific effect of i on MFI; time effect, and the error term. All the statistics relating to the error term are standardized forms and are distributed according to the descriptive statistics (having zero mean and variance equal to).

The statistical assumptions of equation are as follows (Greene, 2010). The foremost assumption is that the model is linear in parameters. The second assumption is E (εit| xi1, xi2, …, xiT) = 0 ∀ i. The third assumption is var(εit| xi1, xi2, …, xiT) = σε 2. The fourth assumption is cov(εit| xi1, xi2, …, xiT) = 0 given that i ≠ j or t ≠ s and the last assumption is X is a (NT × K) full column rank matrix.

It ranges widely of specification errors. Mostly, these effects are caught by the existence of individual and temporal effects, but some are only caught by the standard error term or idiosyncratic error.

If all the explanatory variables (internal and external factors) other than Yit-1 are grouped in only vector that will be noted “X,” Equation (1) can be rewritten as:

error term and lagged endogenous factor correlated with each other, or the potential correlation between the Xit and past events, the estimation of this Equation (2) by ordinary least squares or the fixed effect (within) give biased results. The main motivations for applying the GMM methodology can be found in Blundell and Bond’s (2000) or Arellano and Honoré’s (2001) research which generalizes this method by applying it to the investment rate of firms and the production function. According to this, we will retain two types of estimates based on GMMs (Generalized method of the moment):

Arellano and Bond (1991) built up a model to estimate the consistency in differentiating the econometric model and instrumenting term by the set of lagged values. It takes into account a possible bias of omitted variables from the specific effects (Arellano and Bond, 1991). Thus Equation (2) becomes:

Δ represents the first difference operator.

This method affords the advantage of assessing the autocorrelation errors caused by the first differentiation and removes the variations among the countries. It is convergent when the number of observations tends to infinity and the period is fixed. However, the properties of this estimator are weak when variables are highly persistent and error terms are correlated with the dependent lagged variable: :

This implies that the lagged variables in level are weakly correlated with the first difference equations (weak instruments). When explanatory variables and the dependent variable are highly persistent, Bond (2002) presented to employing the estimator of the “GMM in Difference” is weak and that this estimator is not appropriate (Bond, 2002).

This model fills the gap detected in the “GMM in Difference” (weak instruments). This method combines the first difference Equation (3) and the level Equation (1). These authors found that GMM estimated efficiency.

The latter provides biased results in limited examples when the instruments have less capacity to measure. Two tests are associated with the dynamic panel GMM estimator: the Sargan/Hansen over identifying test allows us to test the legitimacy of the instruments, which tests where the null hypothesis is no correlation of the error of differential equation.

To choose between these two estimators, Bond (2002) proposes to estimate a first-order autoregression model for each variable to measure its “persistence.” If for some variables the autoregression coefficient is close to one, the Blundell and Bond (2000)’s GMM system estimator is better, otherwise, the GMM difference estimator is adopted (Bond, 2002).

In this paper, we use the “GMM system” (Sys-GMM) which has the advantage of taking into account both the difference in inter-countries and intra-microcredits characteristics.

Results and findings

In this section, we present the different estimates to analyze whether the explanatory variables have a significant impact on the MFI’s interest rate fluctuations or whether these interest rates in defined according to the anticipations of some variables. This requires a development of the work of Dorfleitner et al. (2013) and Rosenberg et al. (2013) on the variables they had used and to extend the study in a general framework taking into account the inter-temporal variabilities of some variables. We also highlight the stationarity and cointegration tests between variables.

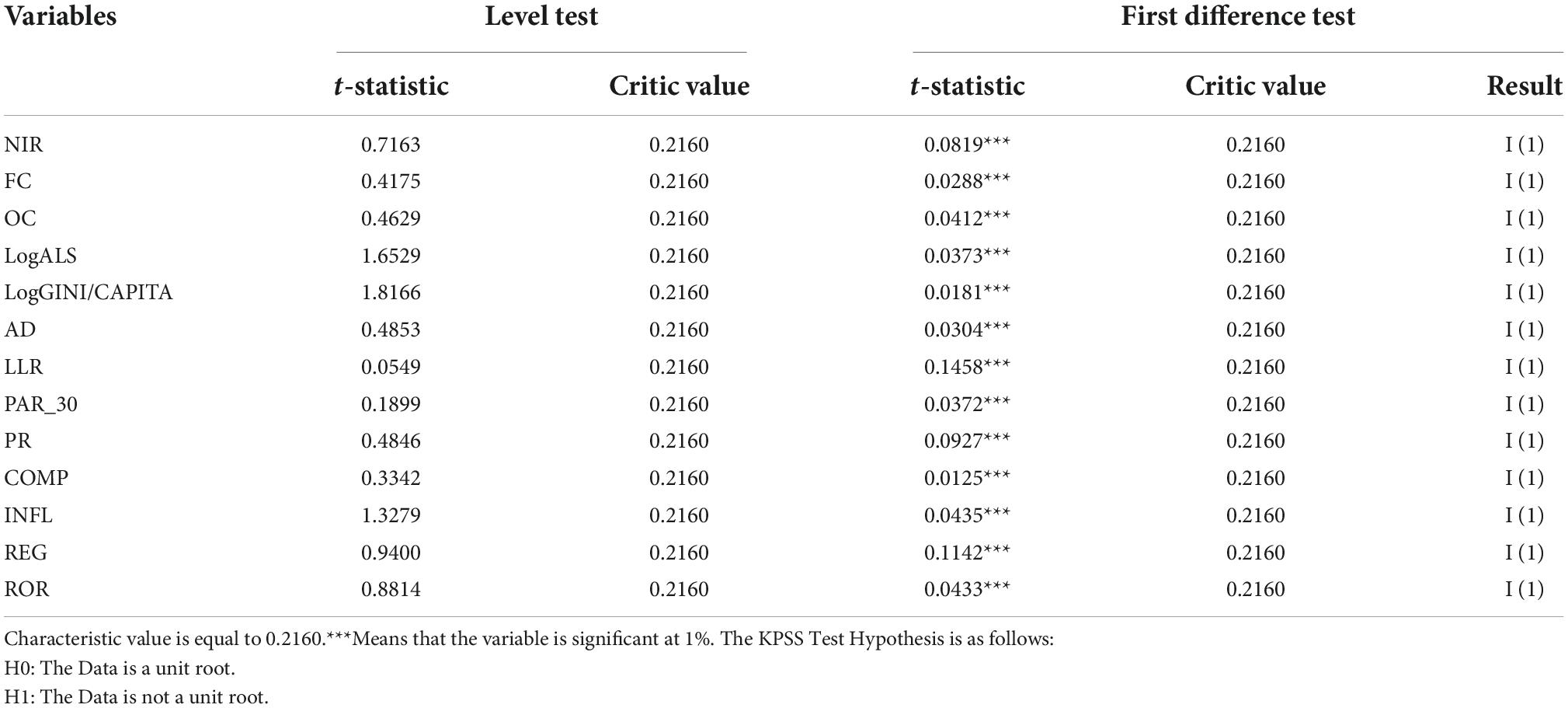

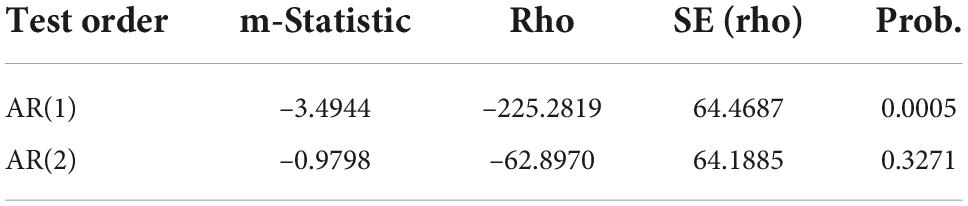

Unit root test (KPSS test)

Table 2 presents the unit root test obtained with KPSS. In this test, under the null hypothesis, the variables in level are stationary or integrated with zero-order [I (0)]. This is done by including the constant and the trend. The results of the level test show that the t-statistics of all variables are above the critical values at the 1% threshold. This involves rejecting the null Ho hypothesis which assumes that data is a unit root. However, by expressing the variables as the first difference, we remark that they are all significant at 1%. Therefore, the results show that the data is stationary.

Descriptive analysis of the statistical data

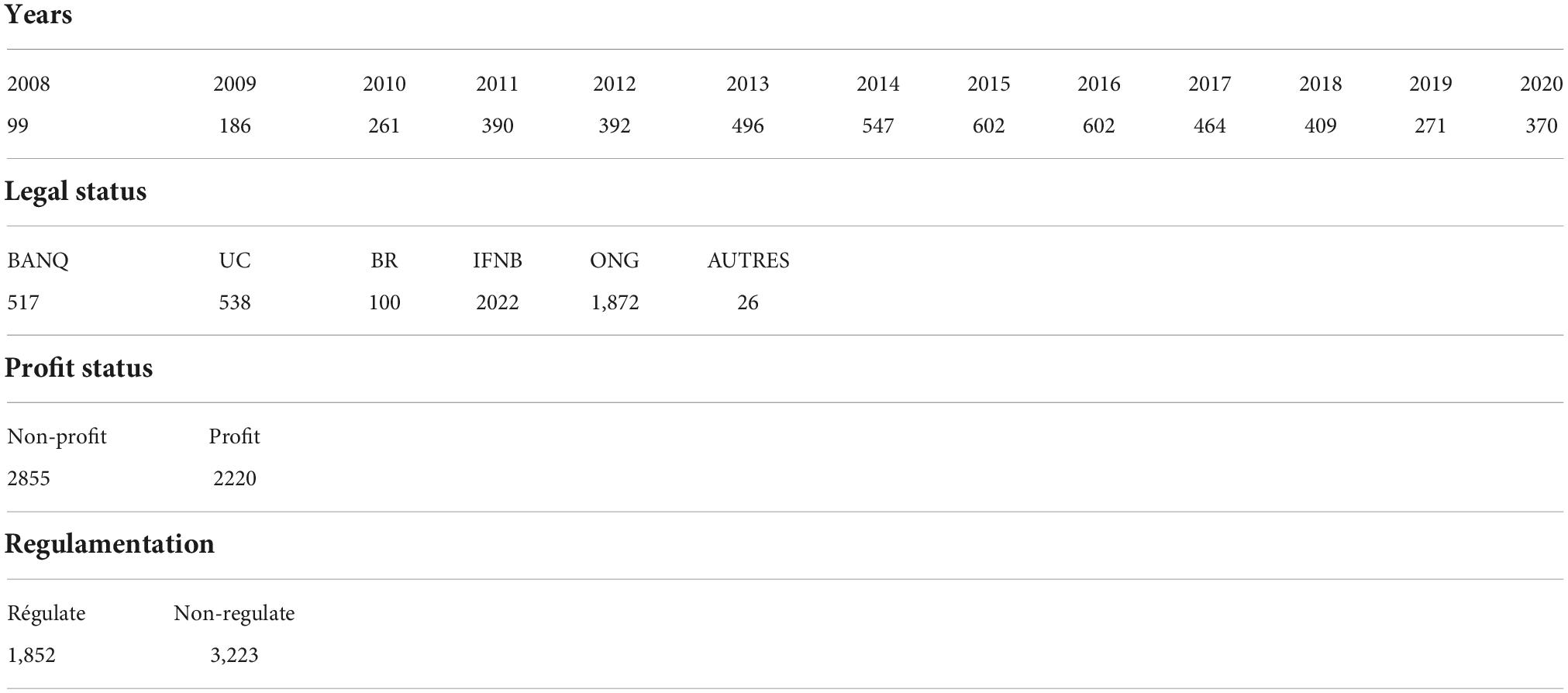

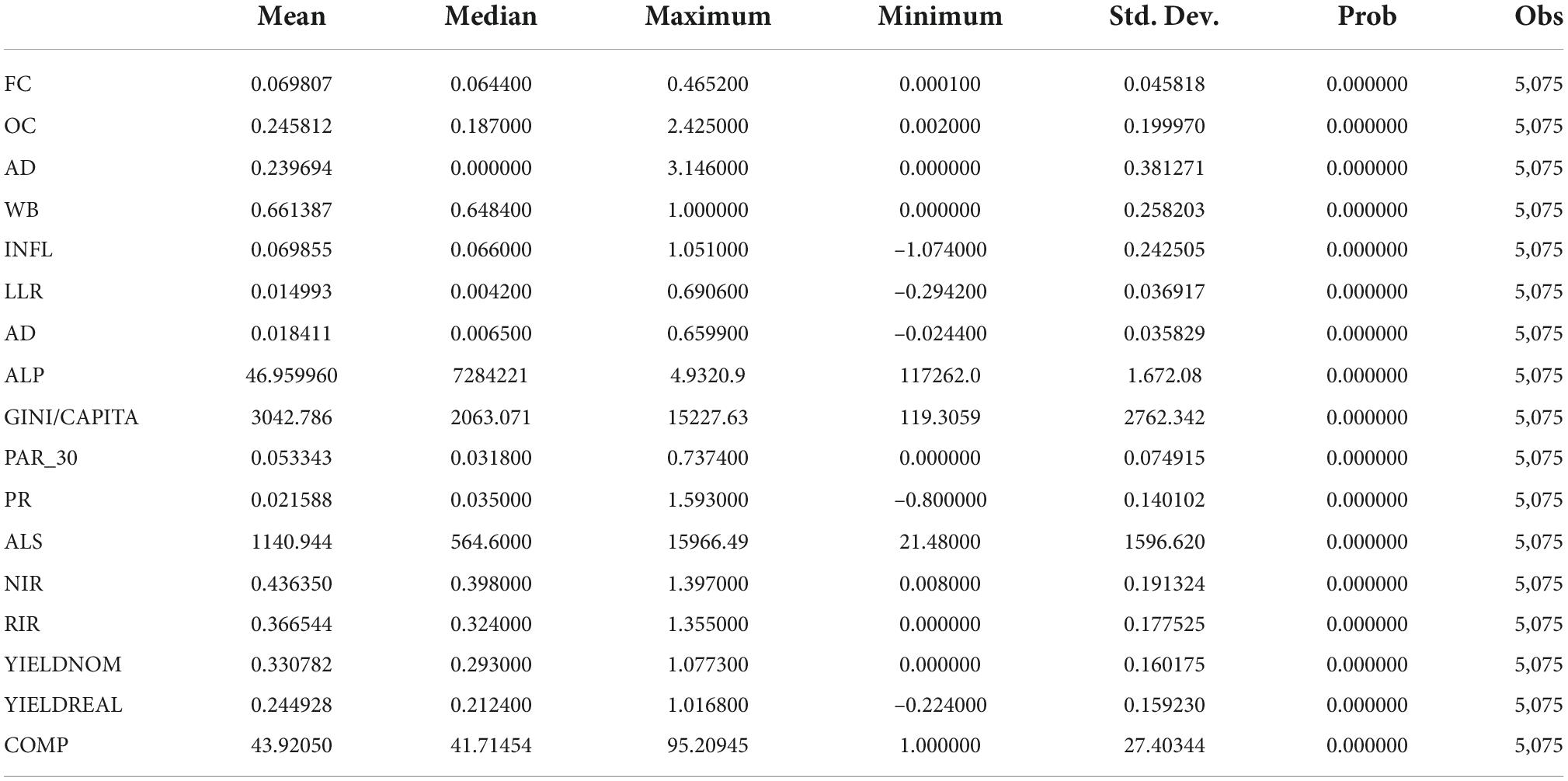

Regarding the developed theory, data was collected, and different variables have been highlighted. The descriptive statistics of this study are summarized in Tables 3, 4.

The real interest rate applied by the MFIs in the world is estimated at 36.6%. The standard deviation which reflects the dispersion around the mean was estimated at 17.75%. This result shows that the data used for the real interest rate variable are weakly dispersed. Operating costs (OC) represent the variable with the most weight on MFI costs with an average of 24.58%. Thus, MFI’s share of financial costs (FC) averaged over 7% of total costs. The results of this study also confirm that women are essential actors in microfinance. They represent a 66.13% average among borrowers. This approximation is similar to that found in the models developed by Dorfleitner et al. (2013).

The MFIs in our sample are mainly composed of non-financial institutions, NGOs are mostly non-profit (2,855) and not regulated. The average risk portfolio quality (PAR_30) is 5%, which is above the 1% threshold. Before we further this issue, it is necessary to focus on the correlation between the different quantitative variables implemented in our sample to recognize the causal connection between the factors.

Correlation analysis test

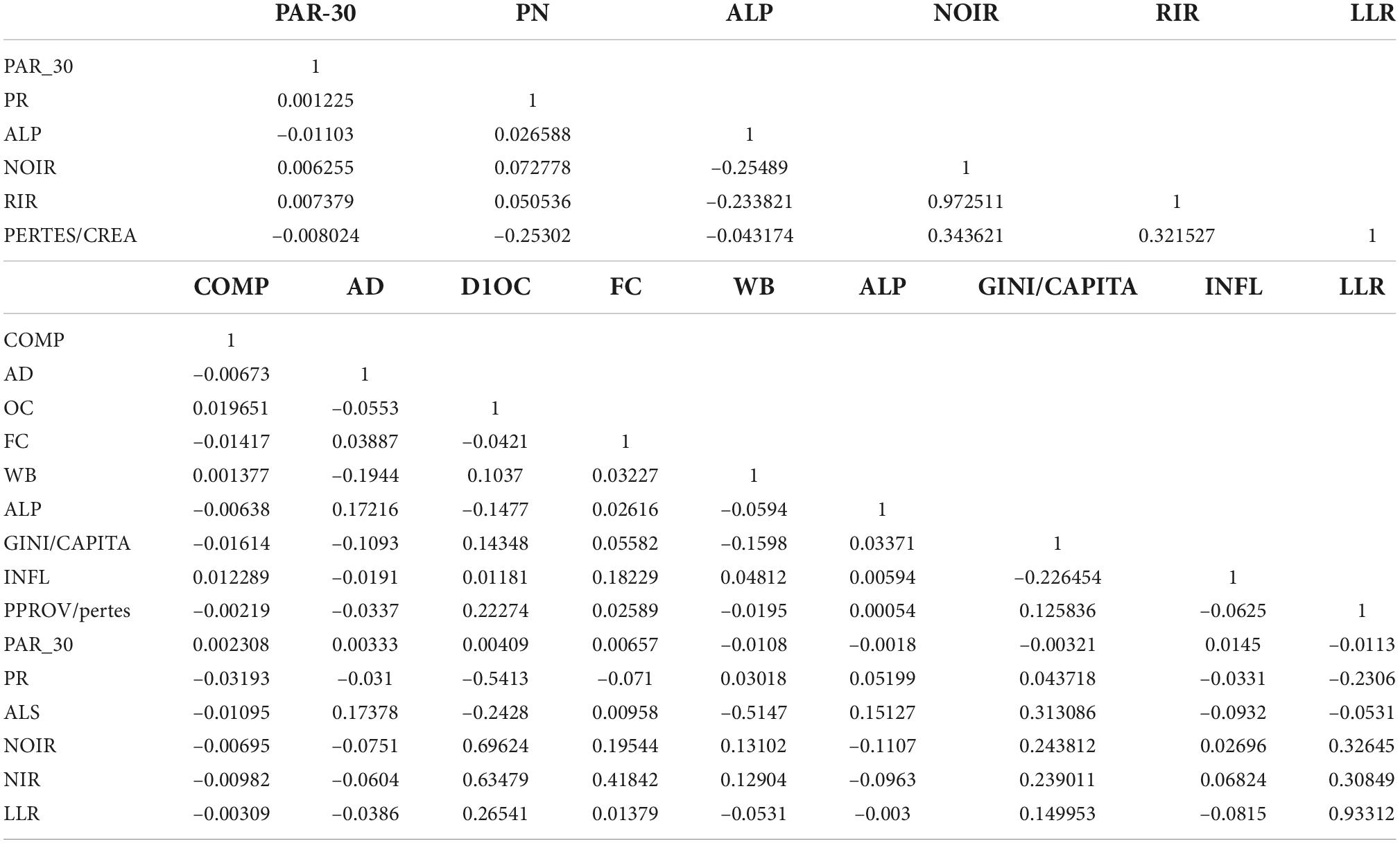

According to Mersland and Strøm (2010), only the correlated variables of 0.8 level can bias the estimation results by generating a multi-collinearity effect (Mersland and Strøm, 2010). Thus, highlighting in the same model of LLR and provisions can bias the results because these two variables are considerably correlated at a 93% level. Interest rates (real and nominal) are also correlated with yields (real and nominal) with correlation coefficients above 80%.

According to the correlation (Table 5), NIR and DIOC is a highly optimistic relationship with each other. Interest rates are negatively correlated with competition level (COMP), average deposits (AD), average loans portfolios (ALP), and average loan size (ALS) with respective coefficients of –10%, –0.9%, –6%, 9%, –24%. It shows that there is no problem with multicollinearity.

Multicollinearity test

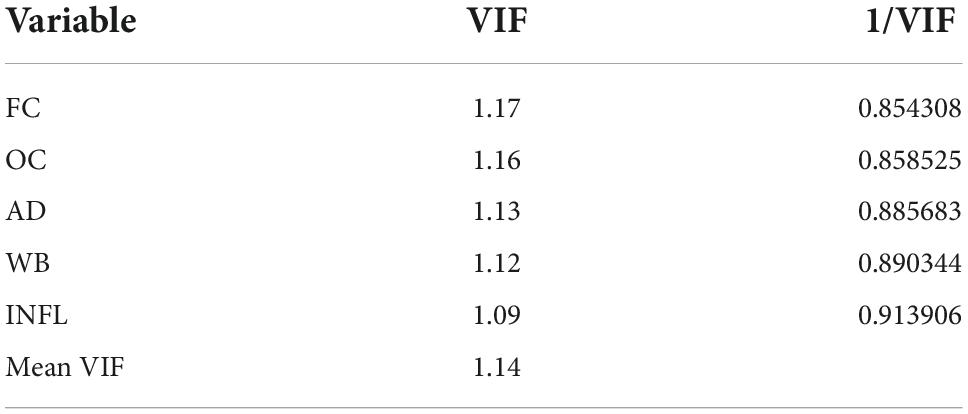

The multicollinearity test is calculated by the Variance Inflation Factor (VIF) test that is given below in Table 5. In this analysis, the ratio is calculated for each explanatory variable. A high VIF value indicates the sign of multicollinearity in the model, normally the value is greater than 5. Table 6 shows that VIF values of independent variables are less than 5. So, there is no multicollinearity in the model.

Heteroscedasticity test

The Heteroskedasticity test is calculated by the Bruesch Pagan LM test which is given below in Table 7. The null hypothesis is the constant variance that is not rejected because the p-value is greater than 5%. So variance is constant and there is no heteroskedasticity in the model.

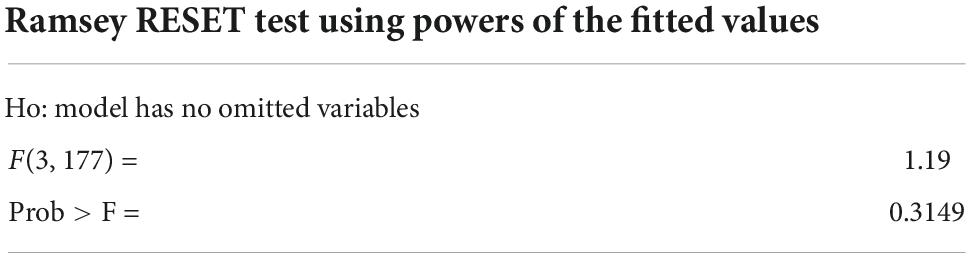

Ramsey RESET test

The Ramsey RESET test is used to check model misspecification. It is given below in Table 8. The null hypothesis is model has no omitted variables that are not rejected because the p-value is greater than 5%. So the model has no omitted variables and there is no misspecification in the model.

This test identified the overidentifying restrictions in the model.

H0: overidentifying restrictions are valid.

The results indicate that overidentifying restrictions are not valid in the model.

Findings

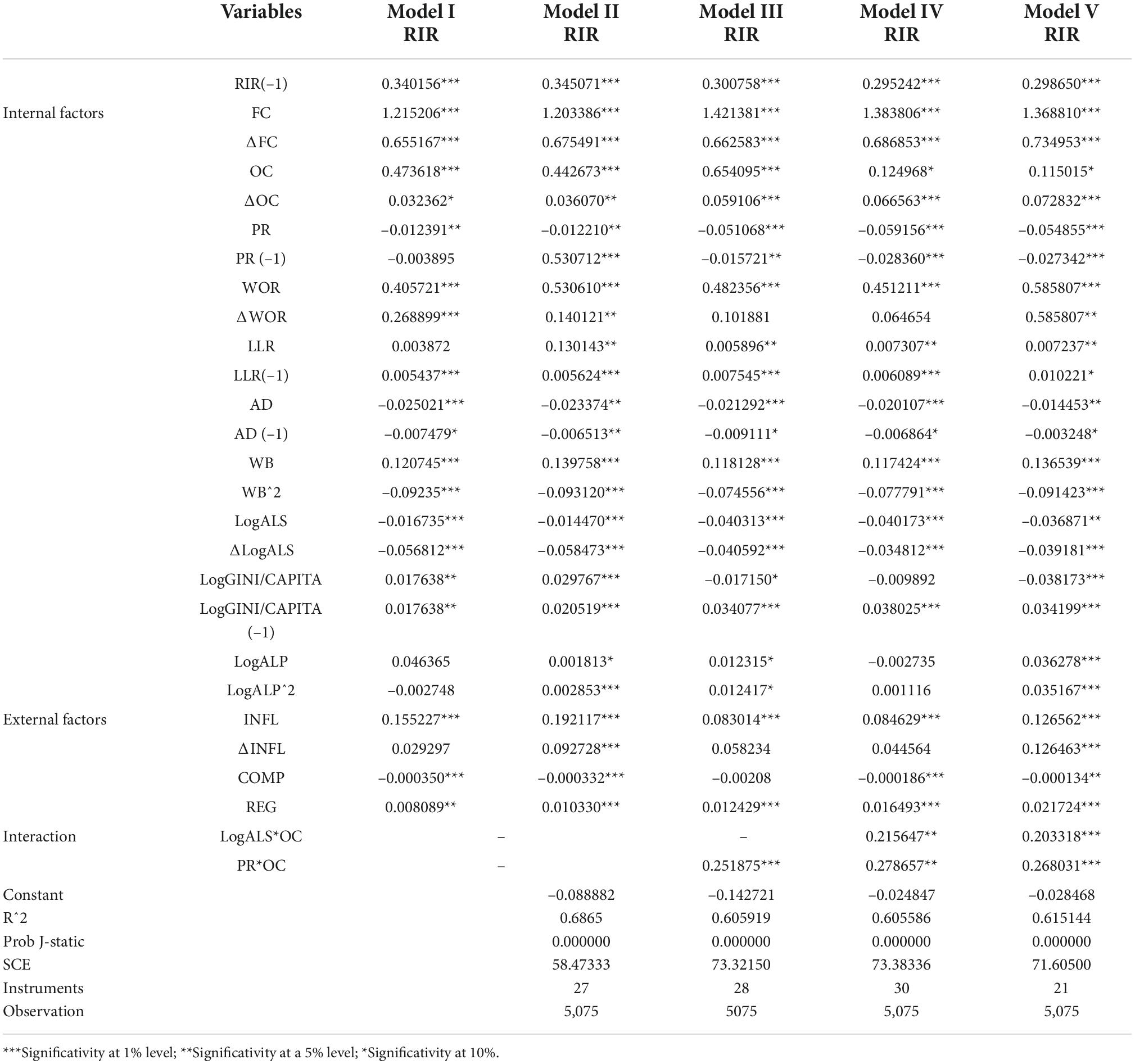

In Table 9, we have pointed out five estimation models that combine the lagged of the explanatory variable, some level variables, and the differential factors in order 1. The first model represents the reference model, which considers all variables except interactions. The objective is to analyze the individual impact of each variable on the interest rate change.

In the second model, all non-significant variables were removed from the model. In the third model, we have integrated in addition to significant variables, the interaction between operating costs and profit. This is to observe if the impact of this latter on the interest rate can be better explained by the operating costs, all other things being equal. The fourth model incorporates the second level of interaction between the ALS and operational costs (OC). The last model considers only significant variables and different interactions.

Interpretation of internal factor results

The estimation results from the different models show that the coefficients associated with the lagged real interest rate have a significantly positive relationship at 1%. This shows that MFIs’ interest rate rises can be persistent over time and that the anticipation phenomenon of these interest rates remains a reality in the microfinance sector. The money that remains capitalized for a longer time in an uncertain future, and the lower risk level in the short term, can explain this result.

Taking account of the anticipations allows MFIs to adjust the yield/risk relationship, in comparing the existing risk portfolios and the various assets. The consequence is that a short-term rise in interest rates affects long-term rates more quickly and more often. The consistency of results is due to the interest level at t period which depends on the interest level in t-1 past period.

In Table 10, we remark also that the coefficients of operational costs (OC) and that associated with the absolute variance of this variable are statistically significant. On this basis, it can be said that a short-term change in operational costs led to an increase in the MFI interest rate. In setting the interest rate, MFIs take into account current operating costs and changes in those costs between two periods. From this point of view Cuéllar-Fernández et al. (2016), specify that operational costs (OC) result in higher interest rates (Cuéllar-Fernández et al., 2016). They also argue that excluding this variable in the estimates may cause a considerable reduction in the global significatively of the model (i.e., generating a 31.6% decrease in R squared). Multiple reasons justify this operational cost impact on the interest rate. MFIs are common on the significant influence of some factors, which affect operational costs such as the loan amount, the geographical location, the density of the customers, and the loan types. The MFIs development generates operating costs that absorb almost all the incomes of the microcredit portfolios. For this reason, operating costs are a determining factor in interest rate fluctuations.

Except for the operating costs, in the study, have the financial costs (FC) as an influential variable in the MFI interest rate. It is noted that a significant part of the MFI portfolio is funded by the financial debts on which MFIs pay interest. These resource costs represent the interest paid on the incurred financial debts and the interest paid on the deposits. The estimation results of the different models (I to V) show positive and significant (at the 1% level) coefficients associated with the variable FC and ΔFC. In other words, an increase in the current financial cost value, and a variation of this over time generates an interest rate increase.

MFIs anticipate, among other things, the increase in financial costs to determine their interest rate. The positive impact of the current financial cost value is confirmed in Cotler and Almazan (2013) studies, which have shown that this variable is a fundamental element in the definition of MFI yields. This phenomenon may be explained by MFIs development, which means that potential lenders tend to reduce their loan parts. Fact due to this, MFIs will increasingly turn to almost commercial borrowers at expensive lending rates on national or international financial markets. this is adding to the regulation effect, which makes lenders tend to turn to regulated MFIs.

The study also highlighted in these models the loan lost rate (LLR) as well as its lagged value. They represent bad debts or credits, which have delays against their deadline. Most of the time they are considered loans in default or restructured credits. This variable provides information on MFI interest rate fluctuations. Through the different models, we identify the coefficients associated with the current value of (LLR) variable and the lagged (LLR (–1) variables that have positive relationships. The interest rate increase is considered boosted by the loan lost rate (LLR) anticipation and its current value.

The sensitivity of this variable to MFI portfolios and the quality of risk portfolios may explain this impact. If this risk level is high, the MFIs should constitute reserves and therefore increase their interest rate to keep the MFI financial equilibrium.

Regarding female borrowers (FEMEMP), we note that it represents a determinant element in the interest rate MFI variation due to their reactivity and their repayment capacity. It is, therefore, a target for most MFIs operating in rural areas. MFIs bill them significant interest rates to offset loan lost credit they may incur with other borrowers. Our results show that an increase in female borrowers to the 67% threshold is accompanied by a real interest rate increase.

This threshold represents the ratio between the marginal effects of the two variables (β (for the woman)/2 ×β (for Woman^2). If the range of female borrowers is between 0 and 67% levels, the interest rate tends to increase by about 0.11 points (Model III, IV). Beyond this 67% threshold, the effect of this variable on the interest rate is decreasing. In other words, when women borrowers exceed this threshold, MFIs lower their interest rates. Other authors consider that the MFIs that serve a high female borrowers section are more likely to lower their real interest rate because women are more likely to repay (Pitt and Khandker, 1998). Brau and Woller (2004) conclude that there is an ambiguous relationship between women borrowers and interest rates (Brau and Woller, 2004). Net profit (PR) is also an important factor for MFIs. It allows them to be financially independent, to be developed without subvention granted, to access financial resources, and to reinvest. The results from the various estimates show a significant but negative association between the interest rate and the current profit (K) values. It is also noted that when the interaction between operational costs (OC) and the net profit rate (PR) is being taken into account in the estimations models, MFIs anticipate an increase in profit, explained by the operational costs decrease, which will reduce the interest rate. This shows that the anticipation phenomenon of the profit impact on the interest rate is better explained by the variety of operational costs. This result is different from other field studies whose perspective is that MFIs should not practice social missions if this comes as a disadvantage to their activity. Other authors argue that generating profits will only consolidate innovation in the sector.

Another variable that requires particular attention is customer deposits (AD). Our results show that the higher the deposits then the lower the MFI interest rates. The regression outcomes displayed coefficients associated with the current deposits which are negative and significant at a 1% level, as the anticipated deposit values are also significant. This phenomenon can be expressed through competition in the opening of bank accounts, which are almost free in the microfinance sector compared to those offered by conventional banks, which motivates most customers to turn to MFIs.

Customer deposits also provide MFI managers with a perspective situation of the lending portfolio at a specific time. In the short term, the deposit variation (AD) generates anticipation of MFI interest rates decreasing.

The results also showed that the ALS is a determinant factor in the fluctuations of MFI interest rates. The coefficients associated with the current variable (LogALS) and its absolute value changing (ΔLogALS) are significantly negative at 1% in all the estimated models (I–IV). An increase in this variable as well as a variation in this latter in the short-term causes an MFI interest rate to decrease. This means, that the IMF is very active. The outcomes have consistency with the results of Dorfleitner et al. (2013). This variable also reflects the MFI’s financial sustainability and performance level.

The interaction effect between the ALS (locals) and operational costs shows statistically significant outcomes. The negative impact of the ALS on the interest rate is partly explained by the operational costs, all other things being equal.

Interpretation of the result of the external factors

External factors represent those variations that may have an indirect, positive, or negative impact on MFI interest rate variations and on which the MFI does not necessarily have the power to control. The external factors considered in this study are the market structure (Competition), economics (inflation), cultural and technological political conditions, and banking regulations in effect (regulation).

Inflation is an important external factor influencing MFIs. In the context of inflation rising, MFIs are often faced with an arbitration problem between a negative real interest rate that would negatively affect their loan portfolio quality as customers, save less, or negatively affect a nominal interest rate that covers inflation. In the first case, the objective of the IMF is to lower inflation, which will, therefore, boost the decreased purchasing power of households and thus their income. Whereas in the second case, the increase in the interest rate aims to contain inflation at a reasonable level, this would mechanically increase the household purchasing power by emphasizing the income increase.

This could encourage household savings with MFIs. The results express the significant positive relationship at the 1% level between current inflation and the interest rate level. In other words, an increase in inflation can cause an increase in the MFI interest rate. However, this relationship between interest rates and the absolute value changing in inflation is not significant but always positive. These results show that MFIs do not anticipate inflation in setting their interest rates.

Regulation (REG) is also an important factor in the microfinance sector for different reasons: it limits the MFI’s power over clients and minimizes the risk level of clients.

Thus, through the results provided in Table 5, the coefficient of variables is significantly positive at the level of 5%. This shows that regulation does not necessarily provide an interest rate decrease even if a regulated MFI is more likely to decrease its interest rate. This impact of the regulation on MFI interest rates may result from the restraint measures introduced by the government such as the interest rate ceiling, supervision or control, the requirement for minimum reserves, and restriction on some financial services that require additional costs for the MFI.

Regulation can also cause a changeover from a non-lucrative MFI to a lucrative MFI. As was the case in Bolivia in the 1990s, where the legislation introduced allowed a reduction of the financial activities of NGOs by obligating them to transform themselves into a joint-stock company to own a license. Facing a growing MFIdiversity, some believe that regulations should not be applied to all MFI types (CGAP, 2000)1. Therefore, our results are contradictory to those found by Dorfleitner et al. (2013) and Kacem and Zouari (2013) who have shown that regulation causes low rates of interest (Dorfleitner et al., 2013; Kacem and Zouari, 2013).

Competition (COMP) is an important instrument for innovation. Based on our results (Table 5) an increase of one unit in the competition leads to a significant decrease in the real interest rate (Model I to Model V). All coefficients associated with this variable are significantly negative. Thus, this phenomenon can be justified by the necessity for MFIs to provide quality services through advertising, and procedures for change in lending to get closer to and retain their target group.

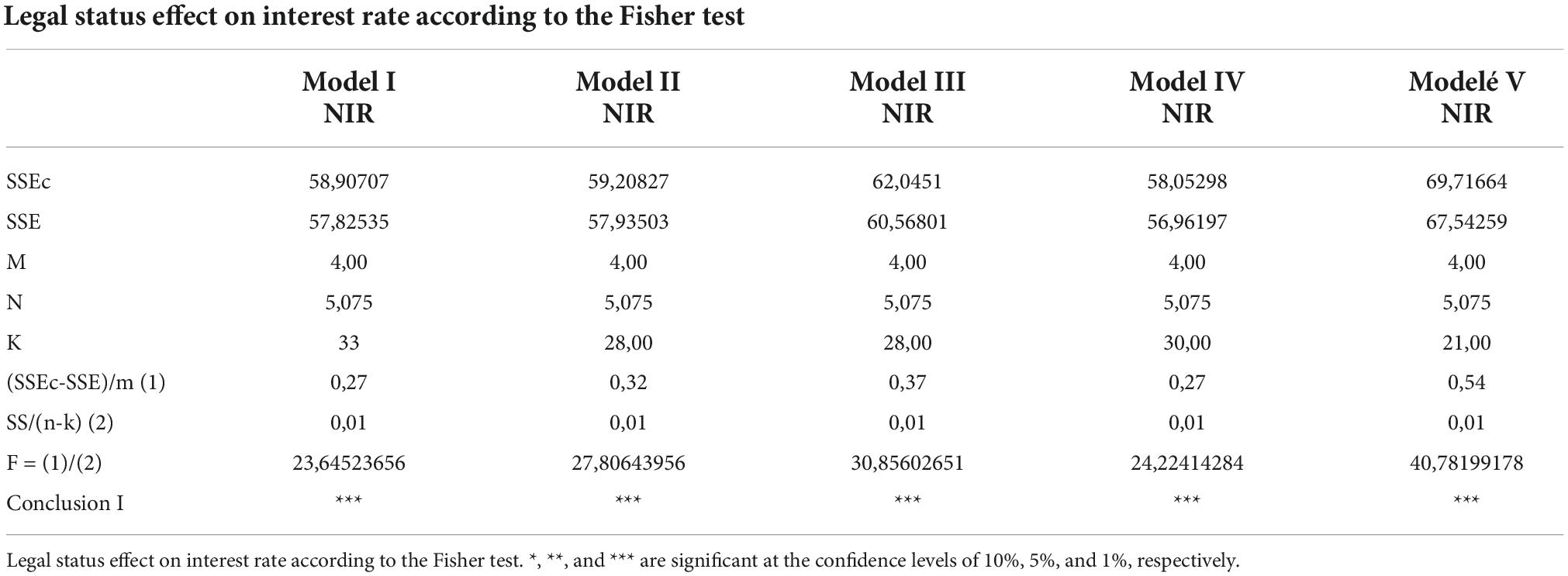

Analysis of the legal status effect

The legal status represents the legal entity of the microfinance institution, which allows for the management of all the rules structuring the institution’s activities. The different results obtained (Table 5) show how the different factors that are taken into account affect the MFI interest rate. Nevertheless, despite the relevance of these results, they do not specifically prove how these variables affect the interest rates defined within each legal status (NGO, NFIB, Rural Bank, Credit Union, Bank). In the existing literature, some authors (Dorfleitner et al., 2013) have developed the influence of legal status on interest rate evolution. Most of the research focuses on the relationship between financial health and legal status (Tchakoute-Tchuigoua, 2010).

To address this issue, the study presents an economic model considering the dynamic panel dimension by using the Fisher F-test which provides more correct results for such qualitative variables. The procedure is as follows:

Firstly, the unconstrained models are estimated. The sum of the squares errors noted (SE) is calculated.

The object is to test the hypothesis that legal status does not influence interest rate fluctuations, this hypothesis is written as:

Secondly, under the null hypothesis H0 the models become constrained models, these models are estimated without the cooperative union (CU), Bank (BANQ), NGO, and rural banks (RB). We calculate the sum of the Error Sum of Scales (SSE).

The following statistic is used:

m shows constraints here, N is the total observations, while k is the coefficients of regression. This statistic follows Fisher’s law at m and n-k degrees of freedom.

The summary of outcomes (constrained and non-constrained models) are shown in the following table:

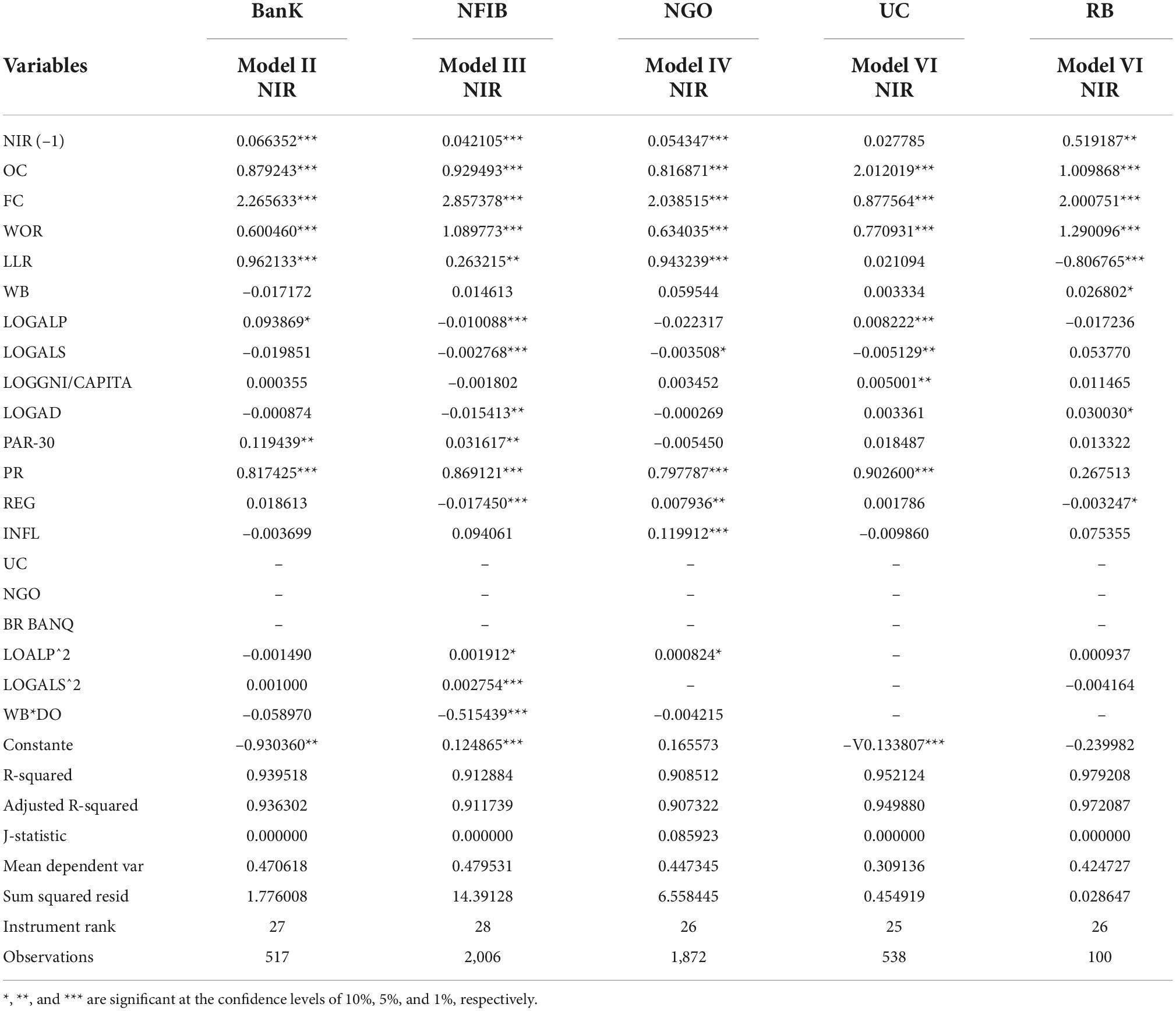

Table 11 shows Fisher’s and different statistics on legal status. Their calculation is based on the constrained and non-constrained models set out in the appendices. We notice that the different statistics generated are statistically significant. The coefficients associated with the different variables (CU, BANQ, RB, NGO) are significantly different from zero. Therefore, legal status provides a crucial role in the MFI interest rate fluctuations. To improve comprehension of the effect of legal status on the interest rate, we have studied in Table 12 how the explanatory variables affect the interest rates set by each legal status. This allows an evaluation of the MFI characteristics and vision of the similarities and differences between the MFI types to detect those that apply higher interest rates.

Microfinance institutions can differentiate themselves according to their size, age, legal status, etc. In Table 7, the study highlights the variables to prove how this interest rate is defined according to the legal status chosen by the IMF. From this table and for each MFI type, we remark that the interest rate in the t-year is defined according to that for the t–1 year. The different coefficients associated with this variable and according to each legal status, except the credit unions (CU), are positive and significant at the 1% level. Otherwise, NGOs, NBFI, rural banks (RB), and banks (BANQ) generally anticipate an interest rate increase. This phenomenon of anticipation is more important in rural banks.

The results provided in this table demonstrate that the effect of financial costs (FC) on the interest rate determination is positive for all legal statuses. In other words, this variable causes a rise in interest. It is more important for NBFI and BANQ with significant coefficients at the 1% level (2.857378***, 2.26***, respectively). As for operational cost (OC), their impact on the interest rate increase is more important for credit unions (CU) and rural banks (RB) with a significantly positive at the level of 1%.

This can be explained by the small loans focused on by these MFI types. Based on these observations, we support that the applied interest rate by credit unions (CU) is lower than other MFI types and those applied by NBFI are higher. This is in line with Fernandes et al. (2016) who argue that the CU makes group loans, a solution that boosts cost minimization.

Analysis of other variables like women borrowers (WB), regulation (REG), and ALS provides different results depending on legal status. If we take into account the regulation, we notice a significant but negative impact on the rate of interest change for NBFI. This result proves the variance in interest rates between regulated and non-regulated NBFI. For the other legal statutes, except NGO, the various coefficients associated with regulated MFIs are positive and not significant.

According to these results, it can be said that there is a variance in interest rates between regulated and non-regulated NGOs. For women borrowers, the positive expected signs of the coefficients are obtained for all MFI types except the banks (BANQ). However, they remain non-significant for most, except for rural banks (BR) where a 1% increase in female borrowers generates a positive and significant interest rate fluctuation. The same pattern is noted for LLR and provisions where the coefficients are positive and significant for all MFI types except for rural banks (BR). The impact of LLRs on the interest rate is higher for BANQ and NGOs with a considerable increase in the LLR (Brihaye et al., 2019). As for provisions, they are more significant for the NBFI and the RB with respective coefficients of 1.08*** and 1.29***. The coefficients associated with PAR_30 for various legal statuses are positively significant for banks (BANQ) and financial institutions (NBFI). Indeed, a 1% increase in PAR_30 causes a 12% increase in bank interest rates and 3% for NBFI.

In summary, the general pattern provided by the estimates in Table 7 proves that the NBFI applies higher interest rates given that all the tested variables are significant for this legal status.

These different conclusions, extracted from the legal status effects on the determination of the interest rates, allow validation of the hypothesis that the interest rates of microfinance institutions also depend on the IMF’s legal status.

Conclusion

The main objective of this paper was to study the determinant factors of the rate of interest fluctuations of microfinance enterprises based on the study limitations of Dorfleitner et al. (2013) and Rosenberg et al.’s (2013) research. For this purpose, we have used a dynamic panel analysis to understand the behavior of MFIs in interest rate settings.

MFIs anticipate these interest rate changes because the latter represent sensitive data to the slightest economic variations. Financial costs, operational costs, the write-off rate, and the average size of the loan are the most important determinant factors in MFI interest rate fluctuations. The outcomes of this research also show that MFIs set their interest rates above the parameters taking into account the Rosenberg et al. (2013) formula.

The study find that other factors like gender (number of female borrowers), legal status, and regulations also contribute to the MFI interest rate variation. We have also discovered that there is a threshold effect in the relationship between women borrowers (WB) and the interest rate. In other words, women pay higher interest rates if their number in the institution is below 68% and low-interest rates if the percentage of women borrowers in the MFI exceeds this threshold. According to the legal status of the institution, we have demonstrated that NBFI clients bear higher interest rates compared to other MFIs. Another important finding of this study is that MFIs do not anticipate inflation in the definition of the interest rate. Rather, they incorporate current inflation to define the interest rate, which is a recurring phenomenon in developing countries.

Based on our study, a few key propositions emerge that, if applied, would likely keep the MFI interest rate at a reasonable and fair level. It is important to find ways to streamline operational and financial costs. Financial alphabetization must also be promoted to enable consumers to understand the MFI organization. From an institutional point of view, it is necessary to promote competition, as the study shows that well-regulated competition helps to keep interest rates at a reasonable level.

This study has a substantial field contribution and the relevance of the results is widespread to all MFIs in the world with a representative sample size (5075 observations) and relevant variables.

The methodological approach through the dynamic method used in this paper is novel and is not used in the microfinance institution literature before this study. Nevertheless, despite these important conclusions, some limits are worth noting. This paper can better be explained by distinguishing regulated and unregulated MFIs in the course of the research. Research can be also expanded on the borrowers to have a double facet of the MFI interest rate as they have a role in MFI interest rate determination and because they change their attitude against interest rate variation.

Data availability statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found in the article/supplementary material.

Ethics statement

Ethical review and approval was not required for the study on human participants in accordance with the local legislation and institutional requirements. Written informed consent from the participants’ legal guardian/next of kin was not required to participate in this study in accordance with the national legislation and the institutional requirements.

Author contributions

FR and WW: conceptualization and data curation. WW: methodology and supervision. FR: software, formal analysis, investigation resources, and visualization. FR, WW, LJ, SR, SQ, and KN: validation, writing—original draft preparation, and review and editing. FR and LJ: project administration. All authors have read and agreed to the published version of the manuscript.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

- ^ CGAP is a donor coordinator in microfinance and a disseminator of microfinance best practices to policymakers and practitioners (see www.cgap.org).

References

Ahlin, C., Lin, J., and Maio, M. (2011). Where does microfinance flourish? Microfinance institution performance in macroeconomic context. J. Dev. Econ. 95, 105–120.

Al-Azzam, M. D (2016). Corruption and microcredit interest rates: Does regulation help? Bull. Econ. Res. 68, 182–202. doi: 10.1111/boer.12080

Arellano, M., and Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev. Econ. Stud. 58, 277–297. doi: 10.2307/2297968

Arellano, M., and Honoré, B. (2001). “Panel data models: Some recent developments,” in Handbook of econometrics, Vol. 5, eds J. J. Heckman and E. Leamer (Amsterdam: Elsevier), 3229–3296.

Blundell, R., and Bond, S. (2000). GMM estimation with persistent panel data: An application to production functions. Econom. Rev. 19, 321–340.

Bond, S. R. (2002). Dynamic panel data models: A guide to micro data methods and practice. Port. Econ. J. 1, 141–162. doi: 10.1007/s10258-002-0009-9

Brau, J. C., and Woller, G. M. (2004). Microfinance: A comprehensive review of the existing literature. J. Entrepreneurial Finance 9, 1–28. doi: 10.57229/2373-1761.1074

Brihaye, T., Pril, J. D., Labie, M., and Périlleux, A. (2019). Positive versus negative incentives for loan repayment in microfinance: A game theory approach. Rev. Dev. Econ. 23, 577–597.

Catalán-Herrera, J., Arriaza, J. C., and Alvarado, R. (2019). Is the financial accelerator story, empirically relevant for the determinants of the interest rate spread? Q. Rev. Econ. Finance 71, 37–47.

Chao, X., Kou, G., Peng, Y., and Alsaadi, F. E. (2019). Behavior monitoring methods for trade-based money laundering integrating macro and micro prudential regulation: A case from China. Technol. Econ. Dev. Econ. 25, 1081–1096. doi: 10.3846/tede.2019.9383

Chikalipah, S. (2017). The nexus between microcredit nominal interest rates and inflation in sub-Saharan Africa: Evidence from panel vector autoregression analysis. Enterp. Dev. Microfinance 28, 355–370. doi: 10.3362/1755-1986.00038

Cotler, P., and Almazan, D. (2013). The lending interest rates in the microfinance sector: Searching for its determinants. J. Cent. Cathedra 6, 69–81. doi: 10.7835/jcc-berj-2013-0082

Cuéllar-Fernández, B., Fuertes-Callén, Y., Serrano-Cinca, C., and Gutiérrez-Nieto, B. (2016). Determinants of margin in microfinance institutions. Appl. Econ. 48, 300–311. doi: 10.1080/00036846.2015.1078447

D’Espallier, B., Hudon, M., and Szafarz, A. (2017). Aid volatility and social performance in microfinance. Nonprofit Volunt. Sect. Q. 46, 116–140. doi: 10.1177/0899764016639670

Dorfleitner, G., Leidl, M., Priberny, C., and von Mosch, J. (2013). What determines microcredit interest rates? Appl. Financial Econ. 23, 1579–1597. doi: 10.1080/09603107.2013.839860

Fernandes, C., Ferreira, M., and Moura, F. (2016). PPPs—True financial costs and hidden returns. Transport Rev. 36, 207–227.

Gonzalez, L., and McAleer, K. (2011). Determinants of success in online social lending: A peak at US prosper and UK Zopa. Rochester, NY: SSRN. Available online at: https://ssrn.com/abstract=2442442

Gupta, N., and Mirchandani, A. (2019). Corporate governance and performance of microfinance institutions: Recent global evidences. J. Manag. Gov. 24, 307–326. doi: 10.1007/s10997-018-9446-4

Hashemkhani Zolfani, S., and Bahrami, M. (2014). Investment prioritizing in high tech industries based on SWARA-COPRAS approach. Technol. Econ. Dev. Econ. 20, 534–553. doi: 10.3846/20294913.2014.881435

Helms, B., and Reille, X. (2004). Interest Rate Ceilings and Microfinance: The Story so Far. Washington, D.C: The World Bank.

Janda, K., Rausser, G., and Svárovská, B. (2014). Can investment in microfinance funds improve risk-return characteristics of a portfolio? Technol. Econ. Dev. Econ. 20, 673–695. doi: 10.3846/20294913.2014.869514

Jiang, W., Martek, I., Hosseini, M. R., Tamošaitienë, J., and Chen, C. (2019). Foreign infrastructure investment in developing countries: A dynamic panel data model of political risk impacts. Technol. Econ. Dev. Econ. 25, 134–167. doi: 10.3846/tede.2019.7632

Kacem, S. B. A., and Zouari, S. G. (2013). The determinants of access to financial services for micro-credit associations: Application on Tunisian case. J. Bus. Econ. Manag. 4, 031–046.

Kou, G., Chao, X., Peng, Y., Alsaadi, F. E., and Herrera-Viedma, E. (2019). Machine learning methods for systemic risk analysis in financial sectors. Technol. Econ. Dev. Econ. 25, 716–742. doi: 10.3846/tede.2019.8740

Mersland, R., and Strøm, R. Ø. (2010). Microfinance mission drift? World Dev. 38, 28–36. doi: 10.1016/j.worlddev.2009.05.006

Mersland, R., and Strøm, R. Ø. (2012). “Microfinance: Costs, lending rates, and profitability,” in Handbook of Key Global Financial Markets, Institutions, Infrastructure, ed. G. Caprio (Amsterdam: Elsevier), 489–499. doi: 10.1016/B978-0-12-397873-8.00046-3

Mimouni, K. (2017). Currency risk and microcredit interest rates. Emerg. Mark. Rev. 31, 80–95. doi: 10.1016/j.ememar.2017.03.001

Nwachukwu, J. C., Aziz, A., Tony-Okeke, U., and Asongu, S. A. (2018). The determinants of interest rates in microfinance: Age, scale and organizational charter. Rev. Dev. Econ. 22, e135–e159. doi: 10.1111/rode.12402

Pitt, M. M., and Khandker, S. R. (1998). The impact of group-based credit programs on poor households in Bangladesh: Does the gender of participants matter? J. Political Econ. 106, 958–996. doi: 10.1086/250037

Rosenberg, R., Gaul, S., Ford, W., and Tomilova, O. (2013). “Microcredit interest rates and their determinants: 2004–2011,” in Microfinance 3.0, ed. D. Köhn (Berlin: Springer), 69–104. doi: 10.1007/978-3-642-41704-7_4

Rosenberg, R., Gonzalez, A., and Narain, S. (2009). “The new moneylenders: Are the poor being exploited by high microcredit interest rates?,” in Moving Beyond Storytelling: Emerging Research in Microfinance, eds T. A. Watkins and K. Hicks (Bingley: Emerald Group Publishing Limited), 145–181. doi: 10.1108/S1569-3759(2009)0000092008

Keywords: interest rate (E43), microfinance, GMM, dynamic analysis, macro and micro

Citation: Rauf F, Wanqiu W, Jing L, Qadri SU, Naveed K and Rahman SU (2022) Dynamic analysis of the determinants of long-term microfinance interest rates: Macro and micro factors. Front. Psychol. 13:1008002. doi: 10.3389/fpsyg.2022.1008002

Received: 31 July 2022; Accepted: 14 November 2022;

Published: 30 November 2022.

Edited by:

Muhammad Kaleem Khan, Liaoning University, ChinaReviewed by:

Mohamed R. Abonazel, Cairo University, EgyptShahzad Hussain, Rawalpindi Women University, Pakistan

Irfan Ullah, Dalian University, China

Copyright © 2022 Rauf, Wanqiu, Jing, Qadri, Naveed and Rahman. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Wang Wanqiu, d2FuZy13YW5xdWlAcXEuY29t; Li Jing, MTY3MzYwMDhAcXEuY29t

Fawad Rauf

Fawad Rauf Wang Wanqiu1*

Wang Wanqiu1* Khwaja Naveed

Khwaja Naveed