- 1College of Economics and Management, Fujian Agriculture and Forestry University, Fuzhou, China

- 2College of Business Administration, Fujian Business University, Fuzhou, China

- 3Department of Hospitality Management, Chung Hwa University of Medical Technology, Tainan, Taiwan

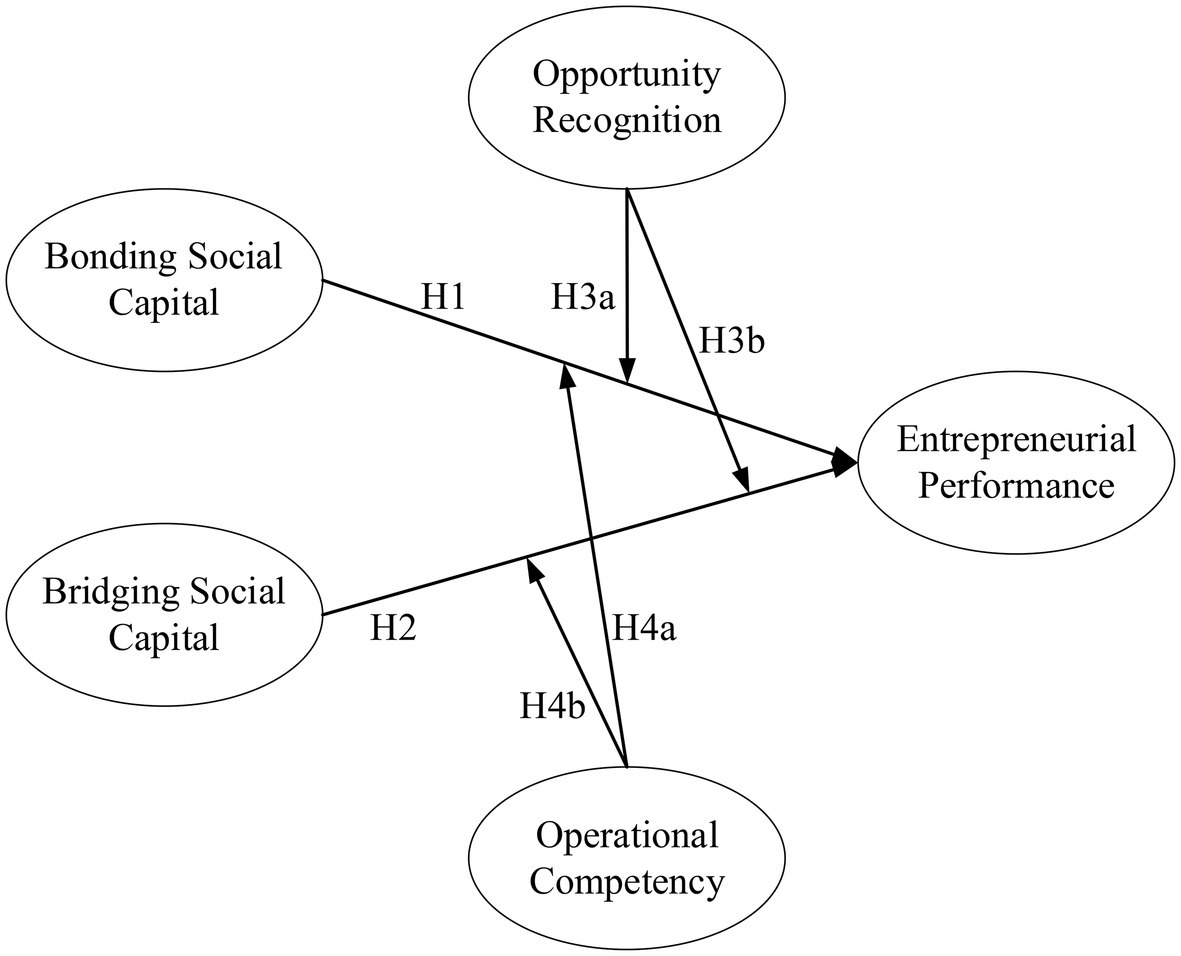

Social capital, which is derived from psychological research, has an important value in the construction of network relationships in enterprises. It influences the direction and tendency of network connections in start-up enterprises and has gradually become an important factor in the study of entrepreneurship by scholars. However, the relationship between this and the effectiveness of innovation is unclear. In this study, the social capital is divided into bonding social capital and bridging social capital, and specific data of agricultural entrepreneurs are collected through questionnaire surveys. The results show that both bonding and bridging social capital have a significant positive effect on agricultural entrepreneurship performance. The entrepreneurial capacity of agricultural entrepreneurs regulates the relationship between social capital and creative performance. In the relationship between integrated social capital and creative performance, operational competency plays a positive role and opportunity recognition plays a negative role. On the other hand, in the relationship between bridging social capital and creative performance, the opportunity recognition plays a positive role and the operational competency plays a negative role. Finally, based on the above findings, this study proposes theoretical and practical implications and suggestions for follow-up research.

Introduction

Social networking is important for the growth and development of both established and start-up companies, as it is an important channel for individuals, teams, and organizations to access information and resources from outside. New ventures are often born with “new entry defects” and “small size defects” because they are “new” and “small,” and thus face serious resource constraints (Siu and Bao, 2008). In implementing entrepreneurship, entrepreneurs often build and leverage social networks to access valuable information and resources, identify and develop valuable opportunities, and cultivate core competencies to create a competitive advantage and continuously ensure the sustainability of the new venture. The tendency or attitude to use the Internet to solve entrepreneurial practice problems is called as network orientation (Sorenson et al., 2008). As mentioned earlier, new ventures in China’s transitional economy face a number of constraints, a lack of resources, and a lack of credit to access the necessary resources (Long et al., 2016). As a result, they seek network relationships to solve these problems, i.e., new businesses are more network-oriented.

Watson (2007) argues that businesses are embedded in certain social relationships and their development is inevitably influenced by social relationships. When entrepreneurs or new businesses actively build network relationships and develop them for commercial behavior, they exhibit a strong network orientation, which satisfies the basis for building and maintaining a competitive advantage (Strobl and Kronenberg, 2016; Mu et al., 2017). Adler and Kwon (2002) suggest that the social capital theory refers to the existence of social networks in which individuals establish special social relationships through their interactions with others, and the resources or information that actors obtain through these interactions. Through close social interaction, the efficiency, depth, and breadth of knowledge exchange between individuals is increased (Lane and Lubatkin, 1998). According to Sorenson and Stuart (2008), the ability of new enterprises to face changes in the industry environment and grasp business opportunities in the process of operation is a test of whether they can improve the quality and quantity of information they obtain in an open environment and have good thinking, innovation, and responsiveness. If companies can quickly recognize changes in the market and react and act quickly in their operation management, the competitive advantage they build will be enhanced and sustained (Chen, 2019). Therefore, if we can grasp the advantageous structural capital of networking, together with the common cognitive network and the shared trust relationship, we can not only stimulate each other’s all-round learning but also increase the knowledge exchange frequency, so the willingness and ability of organization members to share knowledge could be enhanced. In addition, the social capital of reciprocal interest combination has the effect of stimulating the connection and exchange of resources in the organization, which can accelerate the expansion and circulation of knowledge.

At present, many national policies encourage the development of agricultural and rural innovation and entrepreneurship to promote the revitalization of rural areas. Social capital is a special and important asset for agricultural entrepreneurs and has a positive effect on entrepreneurial activities in rural areas and has been widely studied in studies of agricultural entrepreneurship performance. Scholars have explored the impact of differential social capital, such as geographic, kinship, and karma social capital, on entrepreneurship (Lans et al., 2015). With the development of technology and changes in the economic structure of rural societies, social capital for agricultural entrepreneurs has also changed, with more sources and a wider variety (Rezaei-Moghaddam and Izadi, 2019). These social capitals can be divided into bonding social capital, which exhibits strong ties, and bridging social capital, which exhibits weak ties (Leonard, 2004; Newell et al., 2004; Agnitsch et al., 2006; Coffé and Geys, 2007; Jensen and Jetten, 2015). However, there is a lack of research on these two types of social capital of entrepreneurs and their relationship with entrepreneurial performance in the field of agricultural entrepreneurship. Therefore, this study focuses on the impact of bonding and bridging social capital on agricultural entrepreneurial performance with agricultural entrepreneurs as the research object and uses two different types of entrepreneurial abilities, namely, opportunity recognition and operational competency, as moderating variables to further analyze the role of resources and entrepreneurial factors on agricultural entrepreneurial performance.

Literature Review

Social Capital and Entrepreneurial Performance

Social capital was first introduced by sociologists to explain the use of general interpersonal embedded relationships, such as community, friends, colleagues, and family relationships, to help to create social capital and wealth for individuals (Burt, 1997). Jacobs (2016) defines social capital as an interpersonal relationship that is cultivated over time and that provides a good foundation for group trust, cooperation, and collective action. The social capital theory focuses on how interpersonal relationships cultivated over time can provide a valuable resource for the members of a network.

Social capital is a collection of the most important resources for entrepreneurs including social capital at the individual and social levels. This study focuses on the social capital of entrepreneurs at the individual level. Social capital was first described by Bourdieu (1977), who defined it as “the sum of actual or potential resources associated with an enduring network of more or less institutionalized relationships of mutual understanding and recognition. From a functional perspective, social resources are social capital (Coleman, 1988). Lin (2001) divides social resources into personal resources and social resources. In his view, social resources are embedded in a network of personal relationships and originate from an individual’s interpersonal relationships, and only when an individual interacts with other members of society, social resources are generated. Based on this, he proposed the social capital theory, defining social capital as “the social resources that exist in social network relationships and can bring returns”. This study draws on the research by Lin (2001) to define the social capital of entrepreneurs as the various networks of relationships and the resulting social resources of entrepreneurs in the process of starting a business.

Two sources consist of social capital for entrepreneurs: internal networks and the resources they bring with them, which have strong relational characteristics, called as bonding social capital; and external networks and relationships, and the resources embedded in them, which have weak relational characteristics, called as bridging social capital (Sajuria et al., 2015; Ceci et al., 2019). The former provides emotional support through internal interactions, shares information, and promotes trust among internal members; the latter facilitates entrepreneurs to obtain information from outside the organization, identify opportunities, and gain decision-making advantages.

This paper draws on Putnam (2000) and Phua et al. (2017) to classify social capital in social media contexts into bonding social capital and bridging social capital. Among them, bonded social capital refers to the scope of interaction, frequency of interaction, degree of trust, and reciprocity formed by the network of communication and interaction between entrepreneurs and their familiar friends and relatives as well as within the entrepreneurial team through social media. Bridging social capital refers to the social capital formed by entrepreneurs with the help of social media and different relationship networks of suppliers, customers, the public, government departments, service organizations, media, and intermediaries in the external environment, including the breadth of relationships, the depth of relationships, the degree of trust in relationships, and the degree of reciprocity between relationships.

Organizational behavior scholars believe that entrepreneurial performance, or entrepreneurial organizational performance, is a measure of how well an entrepreneurial organization accomplishes its goals and is often used to measure the outcomes and effectiveness of entrepreneurship (Lumpkin and Dess, 2001; Hmieleski and Corbett, 2008; Renko et al., 2015). Morgan et al. (2010) argue that the performance and benefits of farmers’ farming-related entrepreneurship can be measured by comparing the performance of farmers before and after starting a business or by comparing the benefits of similar entrepreneurs. The definition of entrepreneurial performance in this study is the results obtained and the extent to which the entrepreneurs has achieved his or her goals after starting a farm-related business.

The Impact of Social Capital on the Performance of Entrepreneurship

Scholars have studied the relationship between social capital and entrepreneurship and found that the social capital of entrepreneurs facilitates the adoption of entrepreneurial behaviors by entrepreneurs (Wang et al., 2019). For example, Li et al. (2021) empirically showed that social capital not only directly promotes farmers’ e-commerce adoption but also plays a part in the positive relationship between “prior entrepreneurial experience-farmers’ e-commerce adoption behavior” and “prior training experience-farmers’ e-commerce adoption behavior.” An empirical study by Kobayashi et al. (2006) found that in the e-commerce environment, rural residents gained a heterogeneous and broader social network, reduced affective trust dependence, adapted to market social norms, and developed new and richer social capital, which ultimately facilitated entrepreneurial activities. Therefore, social capital for entrepreneurs is conducive to the innovation and growth of entrepreneurial enterprises and ultimately to the improvement of entrepreneurial performance. The relationship between integrated social capital and bridging social capital and entrepreneurial performance is addressed.

Empirical research has found that bonding social capital can provide information on value creation capabilities (Herrero, 2018). Family, relatives, or friends with whom the entrepreneur interacts regularly provide information on raw materials, capital, pipelines, and internal production management (Wernerfelt, 1984; Davidsson and Honig, 2003). The bonding social capital formed among familiar members can facilitate the entrepreneurial activities of entrepreneurs in terms of resource provision, emotional support, and psychological enhancement. First, acquaintances or family members provide a source of capital to start a business and make up for the lack of entrepreneurial labor. The start-up capital for small and micro-agricultural entrepreneurial activities in China comes from family members or family capital, and the labor force at the early stage of entrepreneurship is mainly family members, and some micro-entrepreneurs even have only their own people involved. Secondly, the entrepreneurial process is full of hardships and the understanding of family members, relatives, and friends as well as the entrepreneurial team members often serves as a spiritual pillar for the entrepreneur during difficult times, strengthening the entrepreneur’s resilience and making him less likely to give up. In summary, it is concluded that

Hypothesis 1: The bonding social capital of entrepreneurs has a significant positive effect on the performance of entrepreneurship.

Previous research has shown that bridging social capital has a positive effect on entrepreneurial performance, specifically in terms of entrepreneurial heterogeneity in resource acquisition, identification and acquisition of entrepreneurial opportunities, and innovative business ideas (Stam et al., 2014; Lee et al., 2019). Bridging social capital can provide entrepreneurs with heterogeneous information about the market (Stam et al., 2014). Entrepreneurs receive entrepreneurial guidance through various channels, informal relationships with people inside and outside the industry, and participation in professional discussions can facilitate the recognition of entrepreneurial opportunities (Spigel, 2017).

In agricultural entrepreneurship, entrepreneurial projects are mostly scattered in large areas of the countryside, and some entrepreneurial activities are carried out in remote rural areas. As a micro and small business start-up, agricultural entrepreneurs themselves often have to personally participate in agricultural production and operation activities and cannot spend too much time and energy to carry out social capital operations. Therefore, in the old closed rural environment, the social capital of farmers was mainly the traditional social capital based on blood, kinship, and locality, and such social capital had few opportunities to obtain heterogeneous resources because they were familiar with each other. In this context, those who have access to more favorable heterogeneous resources in traditional rural societies are often agricultural entrepreneurs whose family members are civil servants in government departments, and they have better entrepreneurial performance because of the heterogeneity of government and business relationship resources. In summary, the second research hypothesis of this study was derived.

Hypothesis 2: The bridging social capital of entrepreneurs has a significant positive impact on the performance of entrepreneurship.

Entrepreneurial Ability and Its Moderating Effect

Entrepreneurial Ability

As an important quality for entrepreneurs, entrepreneurial ability has received widespread attention from academics. In the past, scholars considered as entrepreneurial competencies as qualities and skills necessary for entrepreneurs to carry out the whole process of entrepreneurial activities (Pyysiäinen et al., 2006; Chell, 2013). McElwee and Bosworth (2010) defined family farmer entrepreneurial competencies as those that family farmers should possess to identify and develop family farm entrepreneurial opportunities, obtain the resources needed to start a farm, and implement entrepreneurial activities. In summary, this study considers that the entrepreneurial capacity of agricultural entrepreneurs refers to the various qualities and abilities of agricultural entrepreneurs to give full play to their initiative, identify and develop opportunities for agriculture-related entrepreneurship, and carry out decision-making, resource utilization, and organizational management for the normal operation and management of agricultural projects.

In this study, the entrepreneurial ability of entrepreneurs is divided into two dimensions: opportunity recognition and operational competency. Gatewood et al. (2002) suggest that new firms should identify and develop opportunities and use them to build organizational capabilities to achieve business growth defined as opportunity recognitions. In this study, opportunity recognition refers to the ability of entrepreneurs to identify, through effective information obtained in the process of entrepreneurship, development opportunities that are favorable to their own operations, such as new products and markets with development prospects, and to put these opportunities into practice in entrepreneurship.

Regarding operations management capability, Burke et al. (2002) argue that it is the ability to build and grow an organization and is a timely response that reflects the effectiveness of an organization’s operations management process. Alsos et al. (2003) identified operational management capability as part of entrepreneurial capability and the ability of farmers to coordinate and integrate entrepreneurial resources after implementing entrepreneurial activities, to make the best use of existing conditions to operate and manage new ventures, and to strive to improve entrepreneurial performance. It specifically refers to the ability of entrepreneurs to integrate various resources in their entrepreneurial activities, manage the production and services of entrepreneurial activities internally, motivate the leadership of the team, develop social networks externally, communicate and link up, continuously solve various problems that arise in the process of entrepreneurship, and ultimately achieve the expected results of entrepreneurship.

Moderating Effect of Entrepreneurial Ability

Past research has validated the moderating role of entrepreneurial capacity (Huang, 2016). Opportunity recognition can mediate the relationship between network orientation and the competitive advantage of new businesses. The effect of network concern and openness on competitive advantage is more pronounced for new firms with strong opportunity recognition, while the effect of network cooperativeness on competitive advantage is suppressed (Reed et al., 2012). Past empirical studies have found that the relationship between business models of start-ups and organizational performance is positively influenced by entrepreneurial capabilities (Cucculelli and Bettinelli, 2015). In addition, it has been shown that this positive moderating effect of entrepreneurial competencies also occurs between entrepreneurial relationship network construction and organizational performance relationships (Zahra and Garvis, 2000; Stam et al., 2014).

In entrepreneurial activities, consumer demand for products and services changes rapidly, requiring entrepreneurs to have the ability to dynamically grasp entrepreneurial opportunities, i.e., to both identify opportunities and make full use of them. With the improvement of opportunity recognition, the more entrepreneurs can discover favorable business opportunities through different social capital, including new products popular in the market, innovative business services, and occupy the market at favorable times, thus obtaining better financial performance, innovation performance, and customer satisfaction. Summarizing the above analysis, it is concluded that

Hypothesis 3a: The opportunity recognition of entrepreneurs significantly and positively moderates the positive effect of bonding social capital on entrepreneurial performance.

Hypothesis 3b: The opportunity recognition of entrepreneurs significantly and positively moderates the positive effect of bridging social capital on entrepreneurial performance.

In addition to the opportunity recognition, the operations ability to effectively integrate and organize various resources is also important (Camisón and Villar-López, 2014). A strong operational competency enables the allocation of existing resources to products and services that will enable customers’ needs to be more fully met or will enable the business to meet customers’ needs at a lower price. In business, the combination of social capital and bridging social capital by entrepreneurs brings rich entrepreneurial resources to the business activities of projects. Once operational competency are in place, these social capital will enable entrepreneurial ventures to be more responsive and flexible in terms of improving quality, reducing costs, and innovating operations (Coltman and Devinney, 2013). With the improvement of operational competency, the positive impact of social capital on the entrepreneurial performance will become stronger and stronger. In summary, the above studies have resulted in

Hypothesis 4a: The operational competency of entrepreneurs significantly and positively moderates the positive effect of bonding social capital on the entrepreneurial performance.

Hypothesis 4b: The operational competency of entrepreneurs significantly and positively moderates the positive effect of bridging social capital on the entrepreneurial performance.

Based on the literature review and the hypothesis proposed, this study proposes the following research model for Figure 1.

Research Methods

In this study, the social capital of entrepreneurs was classified into bonding social capital and bridging social capital, and the questionnaire was referred to the scales of Subramaniam and Youndt (2005) and Han and Hovav (2013). The measure of entrepreneurial performance was subjective and was based on the scale of Su et al. (2015). We employed the following steps to select scale items. First, the scale items from the prior literature were translated into Chinese. Second, three professors familiar with social capital and agricultural contexts issues in China were asked to examine the Chinese wording of each measurement item and suggest on its content validity. These suggestions were adapted to add, remove, or reword inappropriate scales. Third, the pilot test was conducted prior to the formal investigation to enhance the readability and clarity of all the measurement items. The questionnaire in this study was scored on a 7-point Likert scale. The target of this paper is startup enterprises, but there is no consensus among scholars on the criteria for new enterprises. According to Zahra and Bogner (2000), firms that have been in existence for less than 8 years are start-up enterprisers. Second, in this study, 180 respondents were distributed for pre-test, 166 were returned, and 120 valid questionnaires remained after questionnaire screening. The reliability of the data was examined by internal consistency reliability analysis. The data were subjected to internal consistency reliability analysis for reliability check, and the Cronbach’s α values for each dimension ranged from 0.74 to 0.82, which were higher than the reliability standard of 0.7, indicating that the questionnaire was reliable. The measurement items of social capital scale, the entrepreneurial performance scale, and the entrepreneurial ability scale have KMO values greater than 0.7, the Bartlett sphericity test significance is less than 0.05, and the factor loading of all measured questions is greater than 0.6, which meets the default criteria. Therefore, the scale of this study has good construct validity.

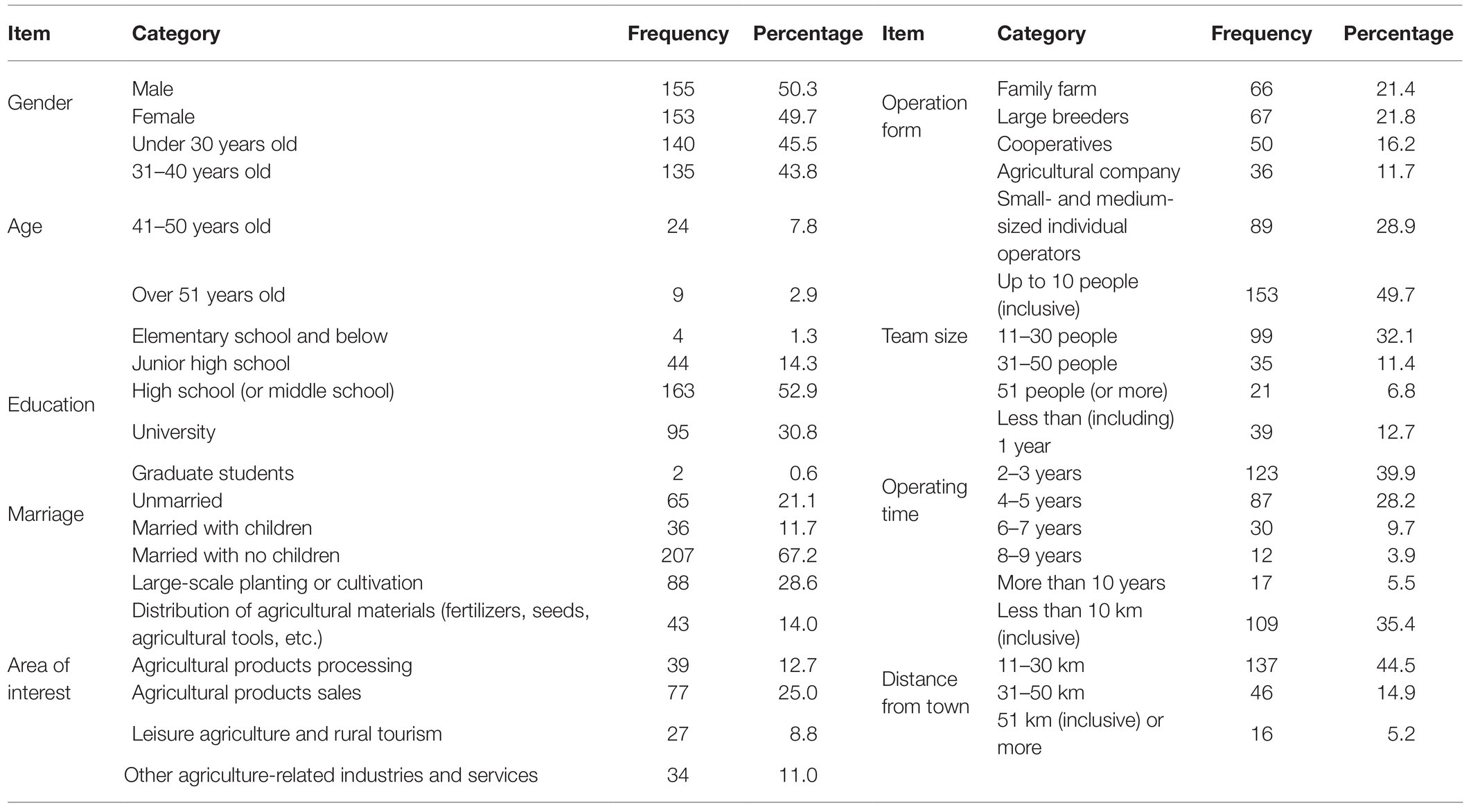

The formal survey of this study, which began in July 2018 and continued through March 2019, was conducted on agricultural entrepreneurs in China and new vocational farmer training classes at agricultural vocational and technical colleges. A total of 326 paper and electronic questionnaires were distributed in this study, and 308 valid questionnaires were analyzed using SPSS and AMOS software after excluding invalid questionnaires. As can be seen from Table 1, among the agricultural entrepreneurs in this survey, there are 155 men, accounting for 50.3%, mainly under the age of 40 (89.3%), educated mainly in high school (or secondary school; 52.9%), nearly 80% of the entrepreneurs are married, and the number of those engaged in large-scale agricultural farming or breeding is the highest, reaching 28.6%. The majority of entrepreneurs operate as small and medium-sized individual households, family farms, and large agricultural households, and the team size is generally small, with 59.7% up to 10 people, and 80.8% of the entrepreneurial projects have been operating for less than 5 years.

Result

Reliability and Validity Analysis

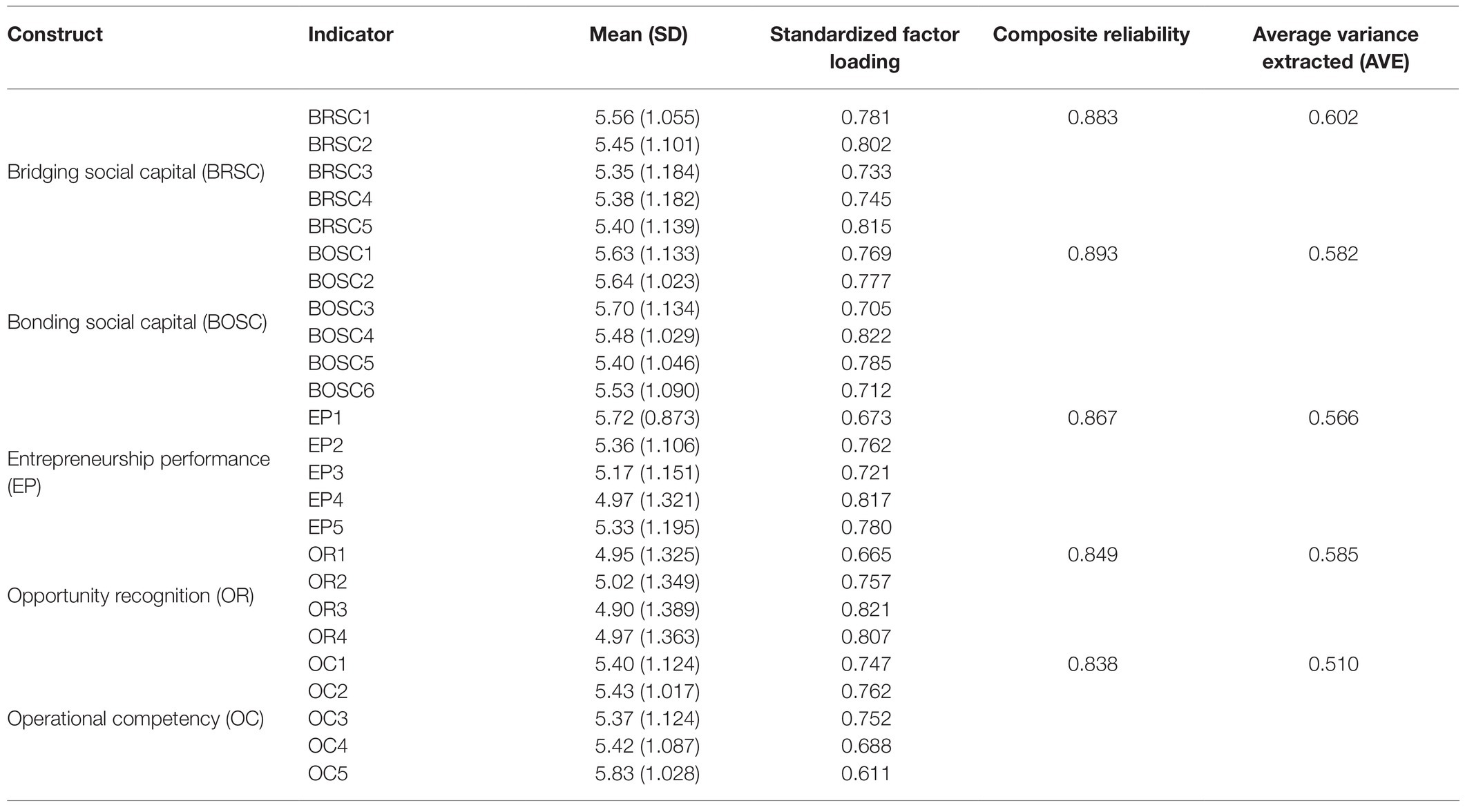

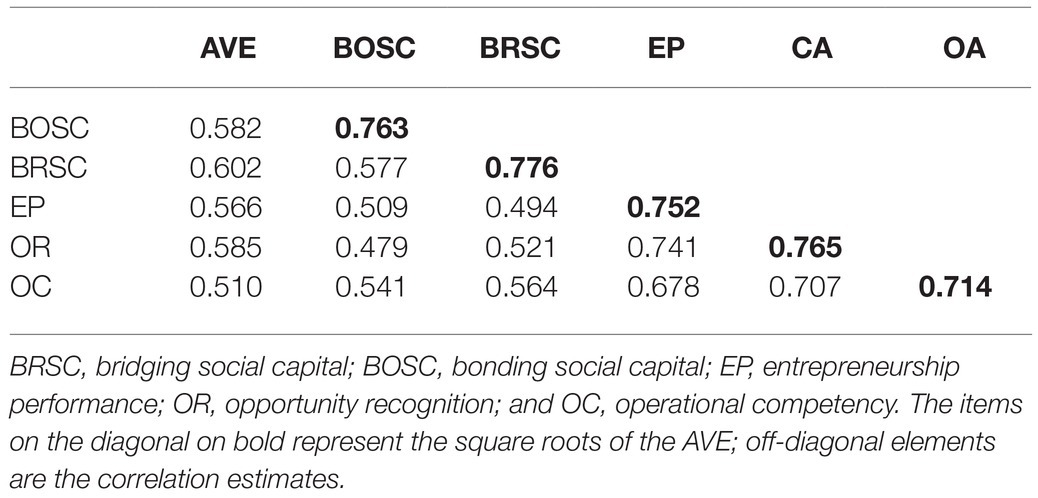

This study evaluates and revises the CFA measurement model based on the two-stage model. The results of the analysis of the measurement model using the extreme likelihood estimation method are shown in Table 2. The standardized factor negative loadings ranged from 0.611 to 0.822, all of which met the range, indicating that each question had question reliability; the synthetic reliability of the study constructs ranged from 0.838 to 0.893, all of which exceeded 0.7, all of which met the criteria suggested by scholars, indicating that each construct had good internal consistency; finally, the mean variance extractions ranged from 0.510 to 0.602, all of which were above 0.5, indicating that each construct had good internal consistency. Finally, the mean variance extracted ranged from 0.510 to 0.602, all above 0.5, all of which met the criteria of (Hair et al., 2017). The average variance extracted (AVE) comparison method was used to examine the discriminant validity of the measurement model. The square root of AVE for each variable is greater than the correlation coefficient between the variables, which meets the criteria of Fornell and Larcker, indicating a good discriminant validity between the variables.

Comparing the square root of the AVE of a given construct with the correlations between the construct and the other constructs is the discriminant validity (Fornell and Larcker, 1981). The indicators are more closely related to the construct than the others if the square root of the AVE of a construct is greater than the off-diagonal elements in the corresponding rows and columns.

As shown in Table 3, the bold numbers in the diagonal direction represent the square roots of AVEs. Because the square roots of AVEs in the diagonal direction are all greater than the off-diagonal numbers, discriminant validity is satisfactory for all constructs.

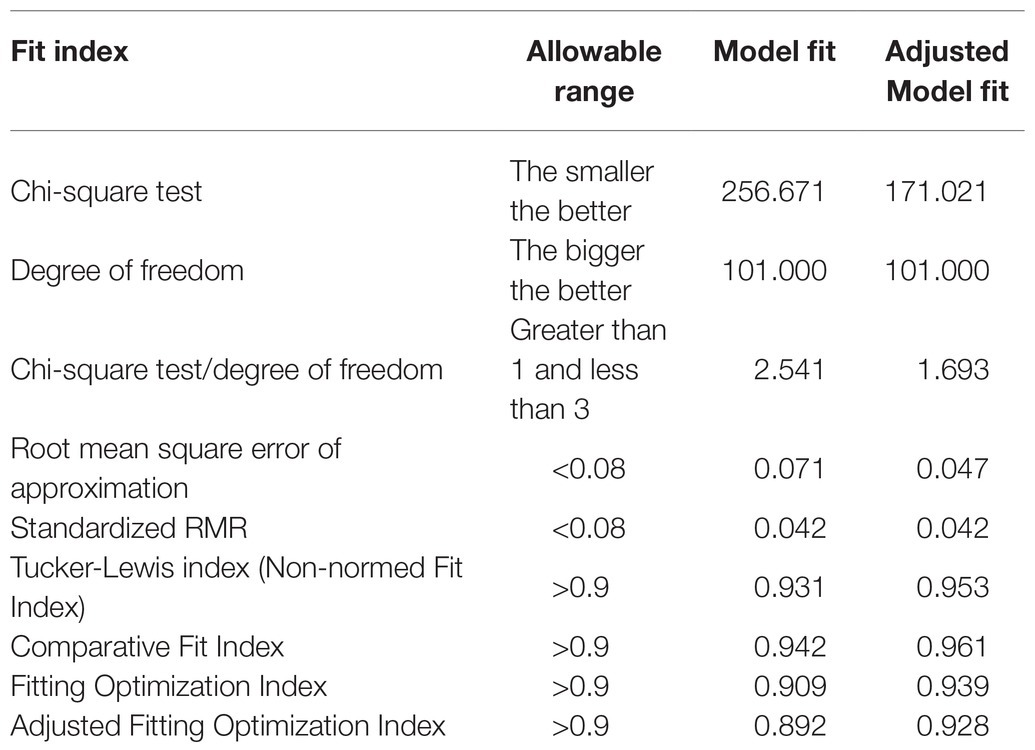

The measurement model analysis was performed by the maximum likelihood estimation method. After the correction of the cardinality heteroskedasticity, all the fitted indicators improved significantly and the model fit was adequate as shown in Table 4. The goodness-of-fits of the model shows the model meets the criteria, indicating that the model has good fit indices.

Structural Model Analysis

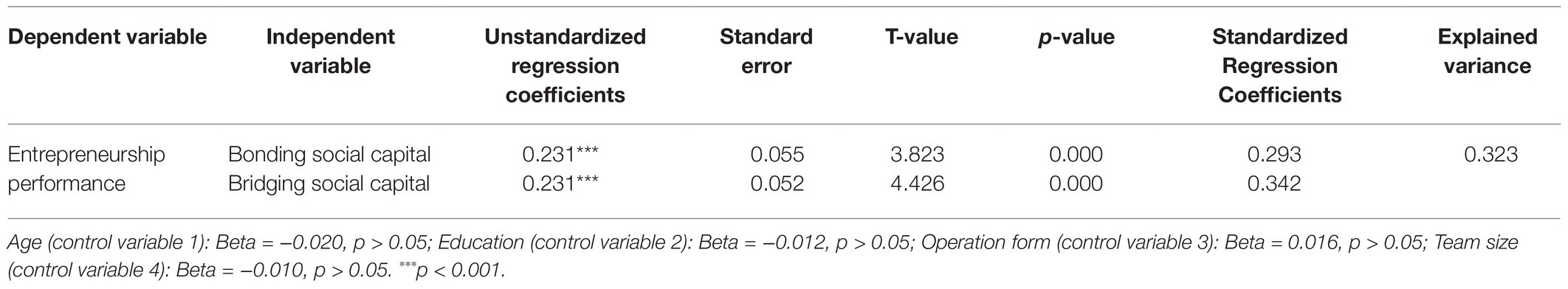

From the results of the path coefficient in Table 5, bridging social capital (b = 0.214, p < 0.001) and bonding social capital (b = 0.228, p < 0.001) significantly affect entrepreneurial performance, and research Hypothesis 1 and research Hypothesis 2 hold, and the explanatory power of bridging social capital and bonding social capital in explaining entrepreneurial performance is 32.0%. It can be seen that social capital, which is rich in social relationships and social resources, has a significant and important impact on entrepreneurial performance for agricultural entrepreneurs.

Analysis of Moderation Effect

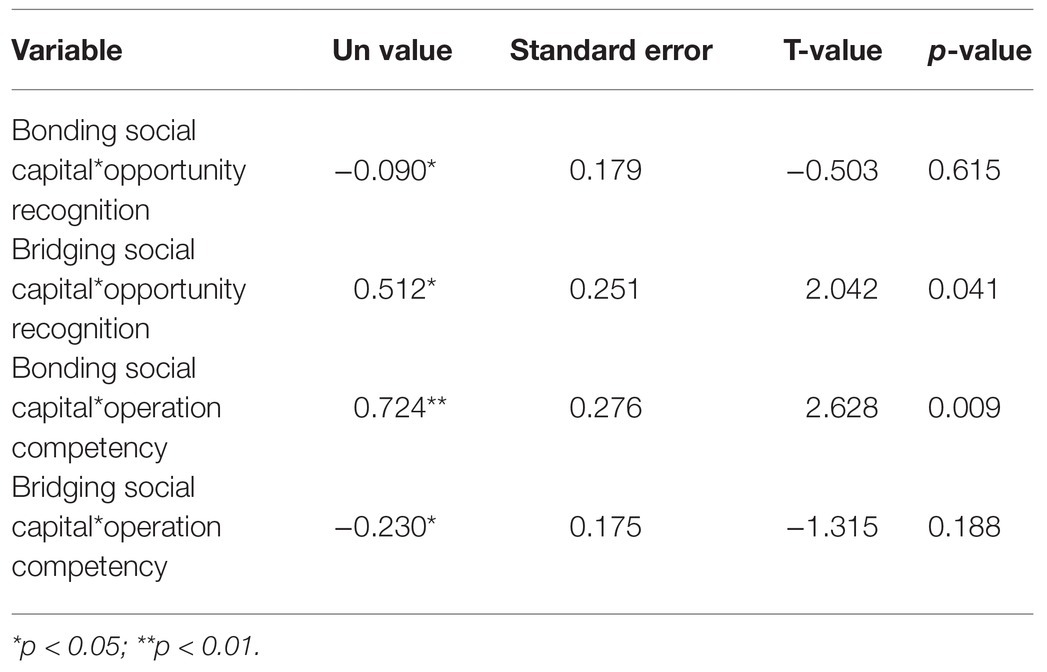

In this study model, opportunity recognition and operational competency are the moderators. As shown in Table 6, in terms of opportunity capacity, the moderation effect of bonding social capital*opportunity capacity on entrepreneurial performance is −0.090 (t = |−0.503| < 1.96, p = 0.615 > 0.05), which means that the moderation effect does not exists. The research Hypothesis 3a is not supported. The moderating effect of bridging social capital*opportunity capacity on entrepreneurial performance is 0.512 (t = |2.042| > 1.96, p = 0.041 < 0.05), indicating that the moderating effect exists and that the slope of bridging social capital on entrepreneurial performance increases by 0.512 units for each unit increase in the moderating variable opportunity capacity, and research Hypothesis 3b is supported. This may be because bridging social capital is the sum of social network relationships based on weak ties and the heterogeneous resources they can bring, which can bring more differentiated resources and means more opportunities. Therefore, the stronger the ability of agricultural entrepreneurs to identify and utilize opportunities, the more they tend to look for better entrepreneurial and innovative development opportunities from weak ties rich in bridging social capital, thus bringing better creative performance to agricultural business activities.

In terms of operating capacity, the moderation effect of bonding social capital*operation competency on entrepreneurial performance is 0.724 (t = |2.628| > 1.96, p = 0.009 < 0.05), indicating the existence of a moderation effect, representing that for every unit increase in the moderation variable operating capacity, the slope of bonding social capital on entrepreneurial performance increases by 0.724 units, and research Hypothesis 4a is supported. The moderation effect of bridging social capital*operation competency on entrepreneurial performance is −0.230 (t = |−1.315| < 1.96, p = 0.188 > 0.05), indicating that the moderation effect does not exist significantly, and research Hypothesis 4b is not supported. This is probably because the operational competency is more a reflection of the entrepreneur’s ability to internally coordinate and manage the business project. The stronger the operational competency of agricultural entrepreneurs, the more they will pay attention to the development of strong relationships for agricultural business projects and will focus on existing network relationships and resources to improve the survival and development of agricultural business projects through their integrated operations.

Conclusion

New enterprises often have inherent new entry defects and small-scale defects because they are new and small, and thus face serious resource constraints. Therefore, social capital is important for the growth and development of both established and new businesses, as it is an important channel for individuals, teams, and organizations to obtain information and resources from outside sources (Zhou et al., 2020). In the process of implementing entrepreneurship, entrepreneurs typically build and leverage social capital to acquire valuable information and resources, identify and develop valuable opportunities, and cultivate core competencies to create a competitive advantage and continuously ensure the sustainability of the new venture.

The following conclusions were drawn from an empirical study of 308 agricultural entrepreneurs: (1) both bonding social capital and bridging social capital significantly and positively affect the performance of agricultural entrepreneurship and (2) there are differences in the way agricultural entrepreneurs with different abilities use social capital to start entrepreneurial activities and their effectiveness. The use of bridging social capital by entrepreneurs with strong opportunity capabilities will significantly contribute to the improvement of entrepreneurial performance, while entrepreneurs with strong operational competency will achieve better results by using bonding social capital to start agricultural entrepreneurship.

In response to the above findings, the following recommendations were proposed. First, entrepreneurship should win the support of relatives and stakeholders obtain more bonding social capital; on the other hand, it should also obtain heterogeneous resources and accumulate bridging social capital to eventually promote the smooth development of entrepreneurial activities. Second, entrepreneurs objectively understand the differences in their own abilities and make full use of their strengths to carry out entrepreneurial activities. The members of the entrepreneurial team can reasonably divide the work and form complementary capabilities in terms of opportunity capabilities and operational competency, thus promoting the overall improvement of organizational performance.

This study enriches the study of factors influencing the entrepreneurial performance of agricultural entrepreneurs, provides a new idea for the study of social capital of agricultural entrepreneurs, and once again verifies the important role of entrepreneurial ability of entrepreneurs at the individual level in regulating entrepreneurial performance. Social capital is only one of the factors influencing entrepreneurship performance. Future research can combine other factors to conduct a comprehensive analysis of the impact on entrepreneurship performance or to consider the mediating factors of social capital of agricultural entrepreneurs on entrepreneurship performance and reveal the specific path of its role.

Finally, this study has three main research limitations and future research directions. First, since this study focuses on cross-sectional analysis, it cannot be interpreted for a specific period of time. In the future, we may use time series or longitudinal analysis to investigate the relationship between social capital, entrepreneurial performance, and national competitiveness over time with comparing the results of this study. Second, this article uses structural equation modeling as the main statistical analysis method. Structural equation modeling is a statistical methodology of parametric estimation, which aims to use the characteristics of the sample inference matrix. To avoid bias in statistical inference, the data collection must conform to the assumptions of sampling principles. For example, the structural equation model is estimated with the assumption of simple random sampling, i.e., any sampling unit in the parent has an equal chance of being selected as a sample. Due to the difficulty of obtaining a sample list for this study, intentional sampling was adopted for data collection. Therefore, the statistical inferences obtained from the theoretical model can only be generalized to matrices that are similar with the observed samples in this study, but not to general matrices. Third, the selection of relevant factors in this study did not compare the differences in social culture, religion, economic income, and geographical location. In other words, future studies may adopt different analytical frameworks, including Western and Eastern cultures, high-income and low-income countries, advanced countries and developing countries, etc., and use different frameworks as control variables to investigate the differences in social capital among different groups and their effects on entrepreneurial performance and national competitiveness.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Ethics Statement

Ethical review and approval was not required for the study on human participants in accordance with the local legislation and institutional requirements. Written informed consent for participation was not required for this study in accordance with the national legislation and the institutional requirements.

Author Contributions

G-hX and L-pW: conceptualization. G-hX: methodology investigation, data curation, and writing – original draft preparation. G-hX, L-pW, and B-fL: validation. B-fL: formal analysis and writing – review and editing. L-pW: supervision and funding acquisition. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Education Department of Fujian Province through Grant No. JAS20225 and the Fujian Business University through Grant No. 2019sysk08.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

References

Adler, P. S., and Kwon, S. W. (2002). Social capital: prospects for a new concept. Acad. Manag. Rev. 27, 17–40. doi: 10.5465/amr.2002.5922314

Agnitsch, K., Flora, J., and Ryan, V. (2006). Bonding and bridging social capital: the interactive effects on community action. Community Dev. 37, 36–51. doi: 10.1080/15575330609490153

Alsos, G. A., Ljunggren, E., and Pettersen, L. T. (2003). Farm-based entrepreneurs: what triggers the start-up of new business activities? J. Small Bus. Enterp. Dev. 10, 435–443. doi: 10.1108/14626000310504747

Burke, A. E., Fitzroy, F. R., and Nolan, M. A. (2002). Self-employment wealth and job creation: the roles of gender, non-pecuniary motivation and entrepreneurial ability. Small Bus. Econ. 19, 255–270. doi: 10.1023/A:1019698607772

Burt, R. S. (1997). The contingent value of social capital. Adm. Sci. Q. 42, 339–365. doi: 10.2307/2393923

Camisón, C., and Villar-López, A. (2014). Organizational innovation as an enabler of technological innovation capabilities and firm performance. J. Bus. Res. 67, 2891–2902. doi: 10.1016/j.jbusres.2012.06.004

Ceci, F., Masciarelli, F., and Poledrini, S. (2019). How social capital affects innovation in a cultural network: exploring the role of bonding and bridging social capital. Eur. J. Innov. Manag. 23, 895–918. doi: 10.1108/EJIM-06-2018-0114

Chell, E. (2013). Review of skill and the entrepreneurial process. Int. J. Entrep. Behav. Res. 19, 6–31. doi: 10.1108/13552551311299233

Chen, C. J. (2019). Developing a model for supply chain agility and innovativeness to enhance firms’ competitive advantage. Manag. Decis. 57, 1511–1534. doi: 10.1108/MD-12-2017-1236

Coffé, H., and Geys, B. (2007). Toward an empirical characterization of bridging and bonding social capital. Nonprofit Volunt. Sect. Q. 36, 121–139. doi: 10.1177/0899764006293181

Coleman, J. S. (1988). Social capital in the creation of human capital. Am. J. Sociol. 94, S95–S120. doi: 10.1086/228943

Coltman, T., and Devinney, T. M. (2013). Modeling the operational capabilities for customized and commoditized services. J. Oper. Manag. 31, 555–566. doi: 10.1016/j.jom.2013.09.002

Cucculelli, M., and Bettinelli, C. (2015). Business models, intangibles and firm performance: evidence on corporate entrepreneurship from Italian manufacturing SMEs. Small Bus. Econ. 45, 329–350. doi: 10.1007/s11187-015-9631-7

Davidsson, P., and Honig, B. (2003). The role of social and human capital among nascent entrepreneurs. J. Bus. Ventur. 18, 301–331. doi: 10.1016/S0883-9026(02)00097-6

Fornell, C., and Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 18, 39–50. doi: 10.1177/002224378101800104

Gatewood, E. J., Shaver, K. G., Powers, J. B., and Gartner, W. B. (2002). Entrepreneurial expectancy, task effort, and performance. Entrep. Theory Pract. 27, 187–206. doi: 10.1111/1540-8520.00006

Hair, J. F. Jr., Sarstedt, M., Ringle, C. M., and Gudergan, S. P. (2017). Advanced Issues in Partial Least Squares Structural Equation Modeling. Sage publications.

Han, J., and Hovav, A. (2013). To bridge or to bond? Diverse social connections in an IS project team. Int. J. Proj. Manag. 31, 378–390. doi: 10.1016/j.ijproman.2012.09.001

Herrero, I. (2018). How familial is family social capital? Analyzing bonding social capital in family and nonfamily firms. Fam. Bus. Rev. 31, 441–459. doi: 10.1177/0894486518784475

Hmieleski, K. M., and Corbett, A. C. (2008). The contrasting interaction effects of improvisational behavior with entrepreneurial self-efficacy on new venture performance and entrepreneur work satisfaction. J. Bus. Ventur. 23, 482–496. doi: 10.1016/j.jbusvent.2007.04.002

Huang, H. C. (2016). Entrepreneurial resources and speed of entrepreneurial success in an emerging market: the moderating effect of entrepreneurship. Int. Entrepreneurship Manag. J. 12, 1–26. doi: 10.1007/s11365-014-0321-8

Jensen, D. H., and Jetten, J. (2015). Bridging and bonding interactions in higher education: social capital and students’ academic and professional identity formation. Front. Psychol. 6:126. doi: 10.3389/fpsyg.2015.00126

Kobayashi, T., Ikeda, K. I., and Miyata, K. (2006). Social capital online: collective use of the Internet and reciprocity as lubricants of democracy. Inf. Commun. Soc. 9, 582–611. doi: 10.1080/13691180600965575

Lane, P. J., and Lubatkin, M. (1998). Relative absorptive capacity and interorganizational learning. Strateg. Manag. J. 19, 461–477. doi: 10.1002/(SICI)1097-0266(199805)19:5<461::AID-SMJ953>3.0.CO;2-L

Lans, T., Blok, V., and Gulikers, J. (2015). Show me your network and I'll tell you who you are: social competence and social capital of early-stage entrepreneurs. Entrep. Reg. Dev. 27, 458–473. doi: 10.1080/08985626.2015.1070537

Lee, R., Tuselmann, H., Jayawarna, D., and Rouse, J. (2019). Effects of structural, relational and cognitive social capital on resource acquisition: a study of entrepreneurs residing in multiply deprived areas. Entrep. Reg. Dev. 31, 534–554. doi: 10.1080/08985626.2018.1545873

Leonard, M. (2004). Bonding and bridging social capital: reflections from Belfast. Sociology 38, 927–944. doi: 10.1177/0038038504047176

Li, X., Guo, H., Jin, S., Ma, W., and Zeng, Y. (2021). Do farmers gain internet dividends from E-commerce adoption? Evidence from China. Food Policy 102024. doi: 10.22004/ag.econ.266298

Lin, N. (2001). “Building a network theory of social capital,” in Social Capital: Theory and Research. ed. B. Ron (New York: Aldine de Gruyter Inc.).

Long, H., Tu, S., Ge, D., Li, T., and Liu, Y. (2016). The allocation and management of critical resources in rural China under restructuring: problems and prospects. J. Rural. Stud. 47, 392–412. doi: 10.1016/j.jrurstud.2016.03.011

Lumpkin, G. T., and Dess, G. G. (2001). Linking two dimensions of entrepreneurial orientation to firm performance: the moderating role of environment and industry life cycle. J. Bus. Ventur. 16, 429–451. doi: 10.1016/S0883-9026(00)00048-3

McElwee, G., and Bosworth, G. (2010). Exploring the strategic skills of farmers across a typology of farm diversification approaches. J. Farm Manag. 13, 819–838.

Morgan, S. L., Marsden, T., Miele, M., and Morley, A. (2010). Agricultural multifunctionality and farmers’ entrepreneurial skills: a study of Tuscan and Welsh farmers. J. Rural. Stud. 26, 116–129. doi: 10.1016/j.jrurstud.2009.09.002

Mu, J., Thomas, E., Peng, G., and Di Benedetto, A. (2017). Strategic orientation and new product development performance: the role of networking capability and networking ability. Ind. Mark. Manag. 64, 187–201. doi: 10.1016/j.indmarman.2016.09.007

Newell, S., Tansley, C., and Huang, J. (2004). Social capital and knowledge integration in an ERP project team: the importance of bridging and bonding. Br. J. Manag. 15, 43–57. doi: 10.1111/j.1467-8551.2004.00405.x

Phua, J., Jin, S. V., and Kim, J. J. (2017). Uses and gratifications of social networking sites for bridging and bonding social capital: a comparison of Facebook, Twitter, Instagram, and Snapchat. Comput. Hum. Behav. 72, 115–122. doi: 10.1016/j.chb.2017.02.041

Putnam, R. D. (2000). Bowling Alone: The Collapse and Revival of American Community. New York: Simon and Schuster.

Pyysiäinen, J., Anderson, A., McElwee, G., and Vesala, K. (2006). Developing the entrepreneurial skills of farmers: some myths explored. Int. J. Entrep. Behav. Res. 12, 21–39. doi: 10.1108/13552550610644463

Reed, R., Storrud-Barnes, S., and Jessup, L. (2012). How open innovation affects the drivers of competitive advantage: trading the benefits of IP creation and ownership for free invention. Manag. Decis. 50, 58–73. doi: 10.1108/00251741211194877

Renko, M., El Tarabishy, A., Carsrud, A. L., and Brännback, M. (2015). Understanding and measuring entrepreneurial leadership style. J. Small Bus. Manag. 53, 54–74. doi: 10.1111/jsbm.12086

Rezaei-Moghaddam, K., and Izadi, H. (2019). Entrepreneurship in small agricultural quick-impact enterprises in Iran: development of an index, effective factors and obstacles. J. Glob. Entrep. Res. 9, 1–21. doi: 10.1186/s40497-018-0133-3

Sajuria, J., vanHeerde-Hudson, J., Hudson, D., Dasandi, N., and Theocharis, Y. (2015). Tweeting alone? An analysis of bridging and bonding social capital in online networks. Am. Politics Res. 43, 708–738. doi: 10.1177/1532673X14557942

Siu, W. S., and Bao, Q. (2008). Network strategies of small Chinese high-technology firms: a qualitative study. J. Prod. Innov. Manag. 25, 79–102. doi: 10.1111/j.1540-5885.2007.00284.x

Sorenson, R. L., Folker, C. A., and Brigham, K. H. (2008). The collaborative network orientation: achieving business success through collaborative relationships. Entrep. Theory Pract. 32, 615–634. doi: 10.1111/j.1540-6520.2008.00245.x

Sorenson, O., and Stuart, T. E. (2008). Bringing the context back in: settings and the search for syndicate partners in venture capital investment networks. Adm. Sci. Q. 53, 266–294. doi: 10.2189/asqu.53.2.266

Spigel, B. (2017). The relational organization of entrepreneurial ecosystems. Entrep. Theory Pract. 41, 49–72. doi: 10.1111/etap.12167

Stam, W., Arzlanian, S., and Elfring, T. (2014). Social capital of entrepreneurs and small firm performance: a meta-analysis of contextual and methodological moderators. J. Bus. Ventur. 29, 152–173. doi: 10.1016/j.jbusvent.2013.01.002

Strobl, A., and Kronenberg, C. (2016). Entrepreneurial networks across the business life cycle: the case of Alpine hospitality entrepreneurs. Int. J. Contemp. Hosp. Manag. 28, 1177–1203. doi: 10.1108/IJCHM-03-2014-0147

Su, Z., Xie, E., and Wang, D. (2015). Entrepreneurial orientation, managerial networking, and new venture performance in China. J. Small Bus. Manag. 53, 228–248. doi: 10.1111/jsbm.12069

Subramaniam, M., and Youndt, M. A. (2005). The influence of intellectual capital on the types of innovative capabilities. Acad. Manag. J. 48, 450–463. doi: 10.5465/amj.2005.17407911

Wang, W., Tang, Y., Liu, Y., Zheng, T., Liu, J., and Liu, H. (2019). Can sense of opportunity identification efficacy play a mediating role? Relationship between network embeddedness and social entrepreneurial intention of university students. Front. Psychol. 10:1342. doi: 10.3389/fpsyg.2019.01342

Watson, J. (2007). Modeling the relationship between networking and firm performance. J. Bus. Ventur. 22, 852–874. doi: 10.1016/j.jbusvent.2006.08.001

Wernerfelt, B. (1984). A resource-based view of the firm. Strateg. Manag. J. 5, 171–180. doi: 10.1002/smj.4250050207

Zahra, S. A., and Bogner, W. C. (2000). Technology strategy and software new ventures’ performance: exploring the moderating effect of the competitive environment. J. Bus. Ventur. 15, 135–173. doi: 10.1016/S0883-9026(98)00009-3

Zahra, S. A., and Garvis, D. M. (2000). International corporate entrepreneurship and firm performance: the moderating effect of international environmental hostility. J. Bus. Ventur. 15, 469–492. doi: 10.1016/S0883-9026(99)00036-1

Zhou, L., Peng, M. Y. P., Shao, L., Yen, H. Y., Lin, K. H., and Anser, M. K. (2020). Ambidexterity in social capital, dynamic capability, and SMEs’ performance: quadratic effect of dynamic capability and moderating role of market orientation. Front. Psychol. 11:584969. doi: 10.3389/fpsyg.2020.584969

Keywords: entrepreneurship performance, social capital, bonding social capital, bridging social capital, entrepreneurial ability, opportunity recognition, operational competency

Citation: Xie G-h, Wang L-p and Lee B-f (2021) Understanding the Impact of Social Capital on Entrepreneurship Performance: The Moderation Effects of Opportunity Recognition and Operational Competency. Front. Psychol. 12:687205. doi: 10.3389/fpsyg.2021.687205

Edited by:

Fu-Sheng Tsai, Cheng Shiu University, TaiwanReviewed by:

Shih-Chih Chen, National Kaohsiung University of Science and Technology, TaiwanLi Xin Guo, Huaiyin Institute of Technology, China

Copyright © 2021 Xie, Wang and Lee. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Lin-ping Wang, MzUzODY1MDUzM0BxcS5jb20=; Bey-fen Lee, bWljaGVsbGVAbWFpbC5od2FpLmVkdS50dw==

Gui-hua Xie1,2

Gui-hua Xie1,2 Bey-fen Lee

Bey-fen Lee