- 1School of Business, Anhui Xinhua University, Hefei, China

- 2School of International Education, Anhui Xinhua University, Hefei, China

- 3School of Foreign Studies, Anhui Jianzhu University, Hefei, China

When manufacturers construct a dual-channel distribution system, which includes online and offline sales channels, they need to solve the inventory management problem to ensure supply and reduce inventory costs of the supply chain system. The dual-channel supply chain is the research object, and the inventory decision model is designed to achieve optimal profit when market demand is divided into online and offline demands. The results of the numerical analysis and simulations, conducted using MATLAB, indicate that both the manufacturer and the retailer increase their inventories and that their profits decrease when demand uncertainty increases. Besides, the increase in the online demand ratio causes the increase in the manufacturer’s inventory and reduces the profits of the retailer and the entire supply chain.

Introduction

Rapid development in electronic commerce, based on advanced Internet technologies and logistics systems, has led physical economy enterprises to increasingly develop online sales channels when they develop offline sales channels. This challenges the traditional business relationship between manufacturers and retailers, adding competition to the cooperation relationship between the upstream and the downstream in the supply chain. In other words, it creates a channel conflict problem [1]. The supply chain operation strategy and coordination mechanism under the dual-channel structure have been studied by many scholars. R. H. Niu et al. consider joint pricing and inventory and production decision problems for members in a monopoly two-stage dual-channel retailer supply chain. For a dual-channel retailer, pricing in one channel will affect the demand in the other channel. This subsequently affects the retailer’s replenishment ordering decisions, which has an impact on the producer’s inventory and production plans and the wholesale price decisions. They analyze joint pricing, inventory, and production problems under three scenarios by incorporating intra-product line price interaction in the economic order quantity model and present a unique equilibrium under certain realistic conditions [2]. Chiang studies the inventory competition and coordination of the dual-channel supply chain in the case of permit stockout. The author designs a coordination contract of revenue sharing and cost sharing of inventory holding to achieve the coordination of the dual-channel supply chain [3]. Cai et al. [4] study the impact of price discount contracts on dual-channel profit under consistent or inconsistent prices and find that the dual-channel pricing agreement or the implementation of price discount contracts can ease the channel conflict. Xu et al. [5] use the mean–variance method to measure risk in the risk-averse dual-channel supply chain. They design the revenue sharing contract of both sides to realize the coordination of the dual-channel supply chain. Mahdi Shafieezadeh et al. propose an integrated inventory management model within a multi-item multi-echelon supply chain. Three inventory models are developed because of different layers of the supply chain in an integrated manner to optimize the total cost of the entire supply chain. They design an evolution algorithm to cope with the computational complexity caused by the nonlinear structure of the proposed model [6]. Yan et al. calculate the maximum profit of the supply chain system under centralized decision-making and evaluate the impact of both sales service and retailer loyalty on the member enterprises’ decision and profit. In the situation of decentralized decision-making, they analyze each member’s performance level and profit behavior under four different cases, namely, wholesale price, buyback, revenue sharing, and advanced purchase discount contract. Numerical results reveal that the advanced purchase discount contract can maximize the integrated profit of the supply chain system because it can fairly diversify the inventory risk between the manufacturer and the retailer [7]. The articles [8, 9] study the problems of pricing and coordination of dual channel. Rhee and Park [10] discuss the relationship between service level and channel selection. Dumrongsiri et al. [11] highlight that product price and service are important factors in attracting consumers to dual channel. However, the logistics conflict that exists in the dual channel has been studied rarely. Furthermore, logistics conflict in the dual-channel supply chain focuses on the inventory problem of online sales and traditional retail. Because the demand uncertainty and channel selection have an impact on the inventory and profits of manufacturers and retailers, how to adjust their inventory levels is especially important for them. This study examines the inventory optimization strategy of the dual-channel supply chain and reveals the change in trends of inventory levels and profits of the dual-channel supply chain and its node enterprises.

The research on inventory control of the dual-channel supply chain has achieved several research results. Zhao and Cao provide an insight into the impact of two-cycle inventory strategies of the dual-channel supply chain on pricing and profit. Their research indicates that the commodity price of the network retailer with zero stock is lower than that of the retailer with a certain stock and that the price gap decreases with rapid market expansion over time [12]. Chiang and Monahan study a hybrid dual channel comprising a retailer with a traditional retail channel and a manufacturer with an online channel. The manufacturer and the retailer manage their inventory separately. When customer demand cannot be satisfied by the stock in one channel, the customers will turn to another channel in a certain proportion. Using a numerical example, they find that the mixed structure of dual channel is more dominant than the single-channel structure [13]. Boyaci studies the distribution system in dual channel, assuming the products as substitutes and price as an exogenous variable. He analyzes the decision-making problem on the order quantity of the dual channel and the impact of the product substitution rate on channel efficiency [14]. Geng and Mallik discuss the inventory competition and distribution problems of the dual channel and separately design the game equilibrium on the limited and unlimited production capacity of the manufacturer. They find that the manufacturer is likely to reject the retailer’s orders even if the production capacity is not limited [15]. Xu et al. [16] construct a two-tier dual-channel supply chain model considering the manufacturer’s shortage cost and present a coordination mechanism for decentralized inventory management in which the optimal system can be obtained only when a small amount of global information can be shared between the manufacturer and the retailer. Wang et al. study the decision-making problem on the optimal pricing of the network channel in the dual-channel supply chain and the optimal inventory of the hybrid channel in the case of the market demand being random and affected by the price. Their research indicates that the existence of the dual-channel model improves the expected returns of retailers, manufacturers, and the whole supply chain when the change in market demand distribution is within a reasonable range in the two channels [17].

The existing research is based on the assumption that the inventory is under centralized management. This is not entirely consistent with reality where both manufacturers and retailers often manage their own inventories, and the impact of the change in the demand ratio from online and offline channels on the inventory and profit of the supply chain is not a concern. Therefore, our study begins by analyzing the inventory and profit of the manufacturer and the retailer based on the existing literature, constructs the inventory model under the dual-channel environment, investigates the dual-channel optimal inventory decision-making under decentralized management, and analyzes—through numerical experiments—the impacts of the fluctuation in demand distribution on the optimal inventory levels and profits of the manufacturer and the retailer, respectively.

Construction of the Inventory Model of the Dual-Channel Supply Chain

Inventory Operation Model of the Dual-Channel Supply Chain

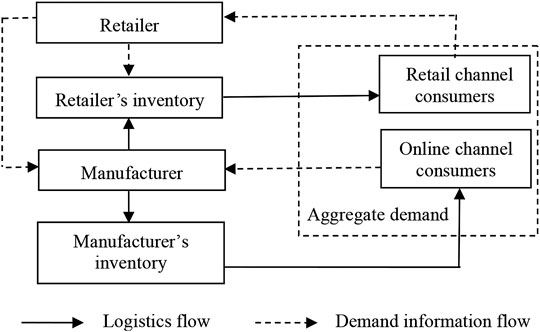

We assume that there are two types of channels in the dual-channel supply chain system, namely, the retailer’s traditional product sales channel and the manufacturer’s online sales channel. Under this assumption, the consumers consider not only the price of the product but also other factors, such as the purchase convenience and time and travel costs. Accordingly, there are two different channel choices—offline channel and online channel; the consumer demands for which are assumed to be mutually exclusive random variables. Both the manufacturer and retailer keep inventories. The manufacturer’s inventory is used to meet the needs of the online sales channel’s consumers, and the retailer’s inventory is used to meet the needs of the retailer’s consumers. Demand information come from retail channel and online channel and flow to the upstream and finally to the manufacturer. The operational model is illustrated in Figure 1.

Construction of the Model

Because this study focuses on the inventory strategy of manufacturers and retailers, the model treats the wholesale and retail prices of the product as exogenous variables. The manufacturer and the retailer decide the optimal inventory strategy after comprehensively considering revenues and costs. A manufacturer’s revenue includes sales revenue from the online channel, wholesale revenue from retailers, and residual value of the inventory. The manufacturer’s cost includes the production cost, stockholding cost, distribution cost of products sold through the online channel, and shortage cost of the online sales channel. A retailer’s revenue includes sales revenue from the retail channel and the residual value of inventory. The retailer’s cost includes the retailer’s ordering cost, stockholding cost, and shortage cost of the retail channel. The symbols used in this model and their meanings are presented below:

It is assumed that a linear relationship exists between the stockholding cost and the inventory level in the model.

The decision goal of the retailer and the manufacturer is to maximize their respective profits. The decision variables of the model include

In the equation,

Equation 1 illustrates the structure of the revenue and the cost of the retailer.

If

The first integral part of Eq. 2 indicates the revenue of the retailer when the market demand from the retail channel is less than or equal to the inventory level of the retailer

In the same way, the formula of the manufacturer’s profit can be expressed as follows:

In the equation,

Eq. 3 illustrates the structure of the revenue and the cost of the manufacturer. Similarly, if

The first integral part of the Eq. 4 indicates the revenue of the manufacturer when the market demand from the online channel is less than or equal to the inventory level of the manufacturers (

Suppose

Proof: According to Eqs 2 and 4, it is known that the optimal inventory of the retailer and manufacturer should satisfy the condition that the first derivative is zero:

Because

therefore,

Furthermore,

Proving by the same method:

Proof finished.

Equation 5 shows that the optimal inventory of the retail channel is affected by the retail channel price, shortage cost, purchase price, and residual value of the surplus inventory. Equation 6 demonstrates that the optimal inventory of online channels is affected by the online channel price, shortage cost, distribution cost, residual value of the surplus inventory, variable inventory holding cost, and production cost.

Numerical Analysis

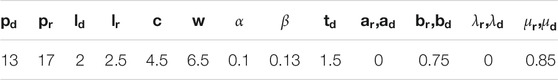

Because the expression of the optimal inventory is an implicit function, it becomes difficult to observe the impact of the changes in various parameters on the adjustment of the inventory strategy of the manufacturer and retailer. Thus, this section assigns values to the parameters of the model. The specific values are presented in Table 1 to illustrate the fluctuation of the optimal inventory level and profit of the manufacturer and retailer under uncertain demand, and the impact of the change in the online demand ratio on the inventory strategy and profit of the manufacturer and retailer in the supply chain.

Impact of Demand Uncertainty on Inventory

The total demand of the dual channel follows the normal distribution with a mean value of 300. Assume the following conditions:

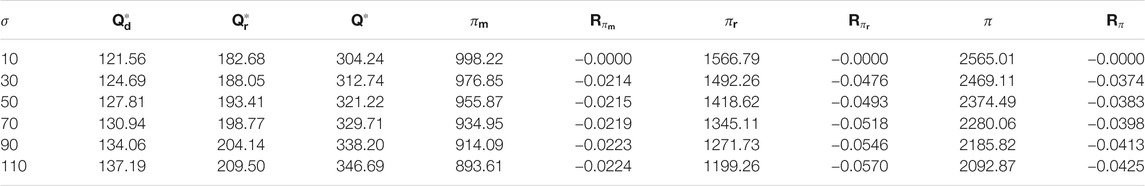

The results of the numerical analysis demonstrate the following:

(1) With the increase in demand uncertainty, the manufacturer and retailer tend to increase inventory, inventory changes are more obvious, and the manufacturer’s inventory increases at the same speed as that of the retailer. It means that the manufacturer and retailer need to make an accurate forecast of the market demand when they decide their inventory levels. The retailer has to make great efforts on the collection and research of market demand information, as well as product sales because of the channel price gap. The manufacturer also needs to make an accurate forecast of the entire market demand, the cost of which is relatively high because of the logistics expense.

(2) As the demand uncertainty increases, the profits of the manufacturer, the retailer, and the entire supply chain decrease, which is aligned with reality. The increase in the inventory level will inevitably lead to an increase in inventory costs. The changes in decrease rates of the optimal profits

(3) The online demand ratio

Impact of Online Demand Ratio on Inventory

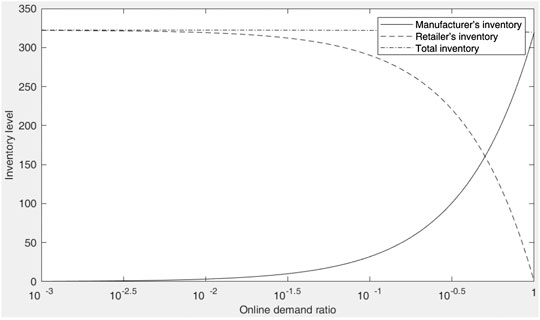

It is assumed that the total demand of the dual channel follows the normal distribution with a mean value of 300 and a standard deviation of 50, that is,

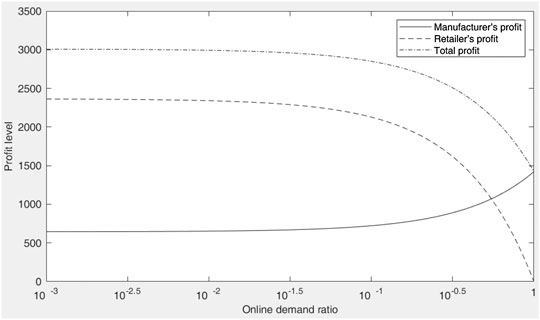

The following conclusions can be drawn from the numerical analysis:

(1) With the increase in the online demand ratio

(2) With the increase in the online demand ratio

(3) With the increase in the online demand ratio

Conclusion

In this article, we discuss the inventory strategy of products under the dual-channel supply chain. The manufacturer sells its products through both the retail and online direct sales channels. The consumers in the market are divided into two types according to the channel type. We construct the optimal inventory strategy model for the manufacturer and retailer. We then create a numerical experiment to analyze the impact of demand uncertainty on the optimal inventory level and profits of the manufacturer and retailer. We find that both the manufacturer and retailer need to increase their inventory and their profits decline, with the retailer’s profit declining faster than the manufacturer’s. The reason for this phenomenon is the existence of the channel price gap and distribution cost. We also discuss the impact of the online demand ratio on the optimal inventory and profits of the manufacturer and retailer. The results of the numerical analysis show that increasing the online demand ratio leads to an increase in the manufacturer’s inventory and the loss of the retailer’s profit and that of the entire supply chain. The reason is that the cost of the retailer will not decrease linearly in the case of fewer consumers, and the hidden benefit produced by the retailer is freely transferred to the manufacturer. How to establish a mutually beneficial mechanism between the manufacturer and the retailer on the allocation of the profit from the online channel is a future research direction. Furthermore, we can study the impact of competition between online and offline sales on inventory in dual-channel supply chain from the perspective of the game theory [21–23].

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author Contributions

NX, JC, and ZC contributed the conception and design of the study. JC organized the literature. ZC performed the design of figures. NX wrote the first draft of the manuscript. All authors contributed to the manuscript revision, read, and approved the submitted version.

Funding

This work was supported by the Key Project of Humanities and Social Sciences of Anhui Xinhua University (Grant No. 2018rw002), Anhui Provincial Quality Project in Colleges and Universities (Grant No. 2018ylzy074), and Research Funds for High Level Talents of Anhui Xinhua University (Grant No. 2018kyqd01).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Acknowledgments

The authors would like to express their sincere gratitude to the reviewers and the editors for their careful reviews and constructive recommendations and like to thank Editage (www.editage.com) for English language editing.

References

1. Webb KL. Managing channels of distribution in the age of electronic commerce. Ind Market Manag. (2002). 31(2):95–102. doi:10.1016/s0019-8501(01)00181-x

2. Niu RH, Zhao X, Castillo I, Joro T. Pricing and inventory strategies for a two-stage dual-channel supply chain. Asia Pac J Oper Res. (2012). 29(1):1240004. doi:10.1142/s0217595912400040

3. Chiang W-yK. Product availability in competitive and cooperative dual-channel distribution with stock-out based substitution. Eur J Oper Res. (2010). 200(1):111–26. doi:10.1016/j.ejor.2008.12.021

4. Cai G, Zhang ZG, Zhang M. Game theoretical perspectives on dual-channel supply chain competition with price discounts and pricing schemes. Int J Prod Econ. (2009). 117(1):80–96. doi:10.1016/j.ijpe.2008.08.053

5. Xu G, Dan B, Zhang X, Liu C. Coordinating a dual-channel supply chain with risk-averse under a two-way revenue sharing contract. Int J Prod Econ. (2014). 147:171–9. doi:10.1016/j.ijpe.2013.09.012

6. Mahdi S, Ahmad S. Developing an integrated inventory management model for multi-item multi-echelon supply chain. Int J Adv Manuf Technol. (2014). 72:1099–119. doi:10.1007/s00170-014-5684-z

7. Yan RF, Wu JJ. Inventory decisions and contracts analyses in a dual-channel supply chain with sale services. In: Proceedings of 20th international conference on industrial engineering and engineering managemen. Baotou, China. Berlin Heidelberg:Springer doi:10.1007/978-3-642-40063-6__111

8. Yao D, Liu J. Competitive pricing of mixed retail and e-tail distribution channels. Omega. (2005). 33(3):235–47. doi:10.1016/j.omega.2004.04.007

9. Chiang WK, Chhajed D. Multi-channel supply chain design in B2C electronic commerce. In: J Geunes, and PM Pardalos, editors Supply chain optimization. Boston, MA: Springer (2005). p 145–68.

10. Rhee BD, Park SY. Online stores as a new direct channel and emerging hybrid channel system. Hong Kong: The school of business and management of Hong Kong University and Technology (2000).

11. Dumrongsiri A, Fan M, Jain A, Moinzadeh K. A Supply chain model with direct and retail channels. Eur J Oper Res. (2008). 187(3):691–718. doi:10.1016/j.ejor.2006.05.044

12. Zhao H, Cao Y. The role of e-tailer inventory policy on e-tailer pricing and profitability. J Retailing. (2004). 80(3):207–19. doi:10.1016/j.jretai.2003.11.001

13. Chiang W, Monahan GE. Managing inventories in a two-echelon dual-channel supply chain. Eur J Oper Res. (2005). 162(3):325–41. doi:j.ejor.2003.08.062

14. Boyaci T. Competitive stocking and coordination in a multiple-channel distribution system. IIE Trans. (2005). 37(5):407–27. doi:10.1080/07408170590885594

15. Geng Q, Mallik S. Inventory competition and allocation in a multi-channel distribution system. Eur J Oper Res. (2007). 182(3):704–29. doi:10.1016/j.ejor.2006.08.041

16. Xu CY, Liang L, Gou QL. Optimization and coordination of inventory system in a two-echelon dual channel supply chain. Forecasting. (2009). 28(4):66–70. doi:10.1016/S1874-8651(10)60088-9

17. Wang H, Zhou J, Sun YL. Integrated pricing and inventory analysis in dual channel supply chain. Ind Eng J. (2011). 14(4):58–62.

18. Hadley TG, Whitin M. Analysis of inventory system. Englewood Cliffs, NJ: Prentice Hall (1963). p 29–34.

19. Ruey HY, Chen MY, Li CY. Optimal periodic replacement policy for repairable products under free-repair warranty. Eur J Oper Res. (2007). 176(3):1678–86. doi:j.ejor.2005.10.047

20. Xiong YH, Sheng HC, Xing GB. The influence of normal hypothesis of demand characteristics on inventory system. J Ind Econ. (2006). 25(6):78–80. doi:10.1037/h0081900

21. Li H-J, Bu Z, Wang Z, Cao J. Dynamical clustering in electronic commerce systems via optimization and leadership expansion. IEEE Trans. Ind. Inf. (2020). 16(8):5327–34. doi:10.1109/tii.2019.2960835

22. Li H-J, Wang Z, Pei J, Cao J, Shi Y. Optimal estimation of low-rank factors via feature level data fusion of multiplex signal systems. IEEE Trans Knowl Data Eng. (2020). 1. doi:10.1109/TKDE.2020.3015914

Keywords: dual channel, inventory optimization, demand distribution, supply chain, online demand ratio

Citation: Xu N-R, Cheng J and Cai Z-Q (2021) Investigating Inventory Strategy Under Demand Distribution Fluctuation in Dual-Channel Supply Chain. Front. Phys. 8:579652. doi: 10.3389/fphy.2020.579652

Received: 21 July 2020; Accepted: 28 October 2020;

Published: 11 January 2021.

Edited by:

Hui-Jia Li, Beijing University of Posts and Telecommunications (BUPT), ChinaReviewed by:

Ke Hu, Xiangtan University, ChinaWen-Xuan Wang, Beijing University of Posts and Telecommunications (BUPT), China

Copyright © 2021 Xu, Cheng and Cai. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jie Cheng, NDM5MzE4NDBAcXEuY29t

Nai-Ru Xu

Nai-Ru Xu Jie Cheng

Jie Cheng Zheng-Qun Cai

Zheng-Qun Cai