- 1Xipu Technological Entrepreneurship Development (Suzhou) Co., Ltd., Suzhou, Jiangsu, China

- 2Cardiff Business School, Cardiff University, Cardiff, United Kingdom

- 3International Business School Suzhou, Xi'an Jiaotong Liverpool University, Suzhou, Jiangsu, China

Introduction: Does an entrepreneur's prior experience affect the early-stage performance of new ventures? This study further explores the mediating effect of the entrepreneurial mindset, indicated by the quality of business plans, between entrepreneurs' prior experience and the early-stage performance of their new ventures.

Methods: The sample consists of 157 valid formal business plan documents from the “2021 Gusu Science and Technology Angel Program.” The study employs an evaluation system developed to measure the quality of these business plans and assess the entrepreneurial mindset levels.

Results: The results reveal the mechanism through which prior experience influences early-stage performance. It indicates that entrepreneurs aiming for high long-term new venture performance should focus on learning and acquiring diverse experiences.

Discussion: The opportunity to write and evaluate their business plans can serve as a self-assessment tool for their entrepreneurial mindset using the evaluation system developed in this study. This approach can significantly enhance their performance and contribute to entrepreneurial success. Moreover, by employing this evaluation system, educators and educational institutions can better understand the entrepreneurial mindset levels of trainees (entrepreneurs) and tailor their courses more effectively.

1 Introduction

It has been widely acknowledged that entrepreneurs tap into the knowledge, experience, and skills gleaned from their prior ventures to formulate and execute their plans in new ventures (Cooper et al., 1994; Unger et al., 2011). In the context of a VUCA (Volatility, Uncertainty, Complexity, and Ambiguity) world and the ongoing digital revolution, conducting business is becoming increasingly complex because entrepreneurship embodies a journey filled with dynamic fluctuations. However, entrepreneurs' personal attitudes, such as demographic characteristics, cognitive ability, behavior, and educational background, are also vital for their management decisions, thereby influencing their firm performance (He et al., 2019; Joseph et al., 2022). Recently, the ability to predict which firms will succeed has become essential for investors and researchers seeking to characterize what makes a successful entrepreneur (McKenzie and Sansone, 2019). The rapid development of technologies has accelerated disruption, innovation, and the implementation of business models (Nowiński and Kozma, 2017; Soltanifar et al., 2021).

Since the 1990s, the process-oriented view of entrepreneurship has focused on understanding entrepreneurship as a continuous learning process. This perspective does not regard entrepreneurship as a stable trait or characteristic, but rather as an ability that is gradually built up over time during the professional lives of enterprising individuals (Politis, 2005). Donbesuur et al. (2020) and Lamont (1972) suggests that entrepreneurs' prior experiences play a critical role in corporate performance. Among other things, the shift in focus highlights the role of entrepreneurs' prior experiences in developing their ability to handle the entrepreneurial process from opportunity recognition to exploitation (Politis, 2008). Specifically, an emerging area of research in strategic management emphasizes the role of business planning, which describes the current state and presupposed future of an organization. It can be considered one of the most widely recognized indications of embedding entrepreneurs' prior experience in start-up planning and managing a new venture (Botella-Carrubi et al., 2024; Honig and Karlsson, 2004).

Skills, preferences, and attitudes shape the entrepreneurial mindset, that enables entrepreneurs to navigate novel and ambiguous business concepts during the creation of new ventures, fostering sustainable growth for their enterprises (Oyeyemi et al., 2024). Business plans are considered highly practical tools that force entrepreneurs to transform their entrepreneurial mindsets into structured documents (Ferreras-Garcia et al., 2019; Kraus and Schwarz, 2007). Moreover, the positive effect of an entrepreneurial mindset (business plan quality) on new venture survival and growth has been confirmed (Lussier and Pfeifer, 2001; Lussier and Halabi, 2010). Nevertheless, the impact of entrepreneurs' prior experiences on their entrepreneurial mindset (indicated by their business plan quality) and, thus, the early-stage performance of their new ventures remain unknown, although entrepreneurs typically convert their prior experience into specific plans and actions for their new ventures.

Therefore, this study explored this mechanism, with the aims to investigate the mechanisms underlying entrepreneurial cognition, with a particular emphasis on entrepreneur's cognition reflected by their business plan. It seeks to update existing findings regarding the influence of entrepreneurs' past experiences on the early performance of new ventures and to integrate these insights into the framework of business plan cognition. Ultimately, the goal is to contribute new empirical insights to the field. Hence. based on a sample of 157 entrepreneurs' business plans and new ventures from the “2021 Gusu Science and Technology Angel Program” in China, we discover that in addition to the direct effect of the entrepreneurs' prior experiences (including formal education background, entrepreneurial experience, managerial experience, and industrial experience) on their new ventures' performance, their entrepreneurial mindset level (indicated by their business plan quality) plays a significant mediating role.

This study seeks to address an important and unresolved issue in the entrepreneurial literature by exploring entrepreneurs' cognition reflected in their business plans as an intermediary process and mechanism that explains the relationship between their prior experience and entrepreneurial performance, highlighting two key implications: first, it reveals how an entrepreneurial mindset, shaped by prior experience, significantly influences the early-stage performance of new ventures by transforming those experiences into actionable plans; second, it suggests a potential approach for assessing entrepreneurial mindset levels through the measurement of formal business plan quality.

2 Theoretical background and hypothesis development

Jemal (2020) argue that the notion of “potential opportunities” and the fit between this and entrepreneurs' mindset facets are pivotal to the identification of profitable markets and affects positively and significantly the performance of new ventures. Baron (2006) holds that the entrepreneurial social cognitive perspective can explain why certain entrepreneurs, but not others, recognize profitable opportunities. Social cognitive theory can be used to investigate how perceived opportunities are determined by key factors, including knowledge of the market and the entrepreneurs' alertness (Chen and Pan, 2019; Donbesuur et al., 2020). Kimjeon and Davidsson (2022) propose that entrepreneurs can cultivate a unique cognitive framework that enhances their ability to identify viable entrepreneurial opportunities by leveraging various resources, prior knowledge, and sustained alertness. The identification of such opportunities, both before and after launching a new venture, is critical to entrepreneurial success when combined with the actions the entrepreneur takes in response to these perceptions. Existing studies have largely focused on identifying new entrepreneurial business ventures and how they can be turned into profit-making opportunities (Mitchell et al., 2007). However, it remains unknown how entrepreneurs' prior experiences, including relevant knowledge and skills, facilitate their planning and actions before and after launching new ventures.

Based on MacMillan et al. (1986) and Power and Lundmark (2004), most scholars argue that entrepreneurs' prior experience is internalized by potential knowledge and skills accumulated via education, entrepreneurship, work, and industrial experience (Dimov, 2010; Toft-Kehler et al., 2014). Several studies, including those by Baron and Ensley (2006), Gompers et al. (2006), and Bignotti and Le Roux (2020) have focused on the performance of new ventures and suggested that the financial success of such ventures relies partly on the application of the skills, knowledge, and expertise acquired from previous business experience. According to Delmar and Shane (2004) and Toft-Kehler et al. (2014), prior experience can predict new venture performance. Eesley and Roberts (2012) claim that entrepreneurs develop expertise incrementally with each business venture, arguing that this represents a mechanism that leads to subsequent performance improvement. However, the empirical evidence is inconclusive. For example, Dencker et al. (2009) and Oe and Mitsuhashi (2013) find no effects; Delmar and Shane (2004) and Eesley and Roberts (2012) report non-linear effects, whereas Alsos and Carter (2006) and Tornikoski and Newbert (2007) identify a negative effect. Given these inconsistent findings, we argue that the relationship between entrepreneurs' prior experience and the performance of new ventures at an early stage may be indirect.

2.1 Business planning and new venture performance

Hopp et al. (2018) argue that writing a business plan involves collecting and analyzing relevant information about the business sector as well as identifying risks and opportunities, which in turn enables the entrepreneur to develop viable contingent plans for future actions. In the business planning literature, some studies (e.g., Gruber, 2007; Welter et al., 2021; Schwenk and Shrader, 1993) have focused on the effect of business planning on the performance of new ventures. Honig and Karlsson (2004) definition of a business plan describes the current state and presupposed future of an organization, while recently George et al. (2019) and Mtau and Rahul (2024) reveal that formal plans can improve performance when aligned with organizational goals, as this alignment ensures that performance measurements are directly linked to the organization's mission and vision, thus promoting consistency in decision making and resource allocation.

Moreover, several scholars (e.g., Hechavarría et al., 2017; McCann and Vroom, 2015) suggest that business plans can help entrepreneurs address further problems and that a structured business plan can facilitate higher financial performance. Although one meta-analysis presents evidence of the positive but small impact of business planning on performance (Brinckmann et al., 2010), scholars tend to question the theoretical premise of the efficacy of business plans for higher business performance.

Business planning may help entrepreneurs make decisions and turn abstract goals into actions, reducing risk diffusion and accelerating product development (Delmar and Shane, 2003). Specifically, entrepreneurs who develop their business plans at an early stage may help reduce the impact of environmental uncertainty, send a message of legitimacy to investors, and provide effective guidance for subsequent entrepreneurial activities (Ansoff, 1991; Liao and Gartner, 2009). Essentially, the process of creating a new venture and developing a plan in written form can encourage entrepreneurs to learn and think because entrepreneurial planning and learning coexist, and the adaptive nature of entrepreneurial planning is the dynamic process of entrepreneurial learning. Thus, a business plan can substantially indicate the learning outcome, namely, the status quo of the entrepreneurial mindset of an entrepreneur for their business (e.g., Mansoori and Lackéus, 2020; Wei et al., 2018). Entrepreneurial success is multifaceted (Wach et al., 2016) and is based on the process of achieving valued outcomes (Alstete, 2008; Dej, 2010; Kurczewska et al., 2020). Hence, an entrepreneurial mindset, indicated by a business plan's quality, can affect and improve a new venture's income and shorten the time between its launch and attaining its first income.

Therefore, we hypothesize:

H1: The entrepreneurial mindset (indicated by business plan quality) significantly impacts new venture performance at an early stage.

H1a: The entrepreneurial mindset (indicated by business plan quality) significantly impacts new venture performance at an early stage, such that the better the entrepreneurial mindset, the higher the income of the new venture.

H1b: The entrepreneurial mindset (indicated by business plan quality) significantly impacts new venture performance at an early stage, such that the better the entrepreneurial mindset, the shorter the time before the new venture's first income.

2.2 Role of entrepreneurs' prior experience

Generally, the more relevant the knowledge entrepreneurs have, the more chances they have to successfully complete the entrepreneurial process. According to Baron (2006), entrepreneurship is the process of identifying, acquiring, and accumulating resources to seize perceived opportunities. Stuart and Abetti (1990), Quan (2012), Li and Dutta (2018) as well as Moritz et al. (2022) highlight the various factors that influence each entrepreneur's or entrepreneurial team's experience and expertise, including the number of new ventures they previously founded and the managerial roles they played within those ventures, as well as other aspects such as age, education, years of business, and technical experience. Haber and Reichel (2007) argue that the entrepreneurial process begins with an idea and business concept, followed by the accumulation of resources, the establishment of the venture, and finally its operation.

Prior research indicates that entrepreneurs' prior experience in business growth comprises four dimensions: industrial, entrepreneurial, managerial, and education (Blackwood and Mowl, 2000; Deakins and Freel, 1998; Soriano and Castrogiovanni, 2012; Toft-Kehler et al., 2014). Industrial experience can largely help the entrepreneur predict trends in the business environment and relevant technologies (Kor et al., 2007); entrepreneurial experience can empower the entrepreneur to transform opportunity identification into substantial actions (Ucbasaran et al., 2003); managerial experience can facilitate addressing the internal and external challenges of business management (Balsmeier and Czarnitzki, 2014); and education can provide a broader horizon for the entrepreneur to develop strategies and plans (Halberstadt et al., 2019).

Although entrepreneurs' prior experience has often been considered a critical factor in predicting venture success, research has yielded mixed findings. Kim et al. (2023) and Toft-Kehler et al. (2014) argued that these mixed findings were due to a lack of attention paid to how experience influences performance. Typically, entrepreneurs use their acquired prior experience to perceive connections between seemingly unrelated events or trends in markets and thus identify opportunities (Baron, 2006). Experienced entrepreneurs are likely to develop a substantial reservoir of knowledge to draw on, which provides them with hints and clues of greater quality and quantity for their decisions (Yang and Hahn, 2015). This allows them to pursue more feasible and desirable ideas and, thus, potentially better business performance (Baron and Ensley, 2006; Hmieleski and Baron, 2009). Hence, intermediate processes and mechanisms exist between prior experience and entrepreneurial success (Unger et al., 2011). For instance, experienced entrepreneurs identify opportunities more effectively than nascent entrepreneurs, as they use intuition and conduct in-depth analyses based on their experience and knowledge to avoid intuitive misleading judgments (Baldacchino et al., 2015; Chen and Pan, 2019).

Moreover, the response to uncertainties related to opportunities, as well as the expectation of costs and benefits, concurrently drives entrepreneurs to make business plans (Bhide, 2003). The improvement of business plan quality with the continuous growth of experience is essentially a learning process for entrepreneurs (Brinckmann and Kim, 2015). The knowledge and skills obtained during this process can help entrepreneurs better interpret the opportunities around them, thus affecting their entrepreneurial mindsets (Shane, 2000). Entrepreneurs' systematic mindsets regarding new opportunities and subsequent activities can be explicitly indicated by the quality of their business plans (Brinckmann et al., 2010; Burke et al., 2010; Schenkel and Garrison, 2009).

Therefore, we hypothesize:

H2: Entrepreneurs' prior experience significantly impacts their entrepreneurial mindset (as indicated by their business plan quality).

H2a: Entrepreneurs' industrial experience significantly impacts their entrepreneurial mindset (as indicated by their business plan quality).

H2b: Entrepreneurs' managerial experience significantly impacts their entrepreneurial mindset (as indicated by business plan quality).

H2c: Entrepreneurs' entrepreneurial experience significantly impact their entrepreneurial mindset (as indicated by business plan quality).

H2d: Entrepreneurs' educational backgrounds significantly impacts their entrepreneurial mindsets (as indicated by their business plan quality).

The venturing process is an entrepreneurial learning process that involves a transformation process that is effective in recognizing and acting on entrepreneurial opportunities and coping with the liabilities of newness (Smith and De Silva, 2022). Gustafsson (2009) and Zollo et al. (2021) indicate that if entrepreneurs have both linear and nonlinear thinking focuses, they tend to make rational decisions in highly dynamic and uncertain entrepreneurial situations.

Jones and Butler (1992) conclude that entrepreneurs' experiences of uncertainty may result in short-term rewards, allowing them to achieve higher performance. Entrepreneurs typically use their acquired cognitive frameworks and experiences to identify opportunities and perceive connections between seemingly unrelated events or market trends (Baron, 2006). Thus, an entrepreneurial mindset developed from prior experience can substantially empower the performance of new ventures, influencing both their initial revenue and sustainability. In this case, their mindset can be a critical mediator between their knowledge base (stemming from their prior experience and educational level) and their new venture's performance. Hence, intermediate processes and mechanisms exist between prior experience and entrepreneurial success, which must be explored (Unger et al., 2011).

Therefore, we hypothesize:

H3: The entrepreneurial mindset (indicated by business plan quality) mediates the significant relationship between entrepreneurs' prior experience and new venture performance at an early stage.

H3a: The entrepreneurial mindset (indicated by business plan quality) mediates the significant relationship between industrial experience and new venture income.

H3b: The entrepreneurial mindset (indicated by business plan quality) mediates the significant relationship between managerial experience and new venture income.

H3c: The entrepreneurial mindset (indicated by business plan quality) mediates the significant relationship between entrepreneurial experience and new venture income.

H3d: The entrepreneurial mindset (indicated by business plan quality) mediates the significant relationship between educational background and new venture income.

H3e: The entrepreneurial mindset (indicated by business plan quality) mediates the significant relationship between industrial experience and time before the new venture's first income.

H3f: The entrepreneurial mindset (indicated by business plan quality) mediates the significant relationship between managerial experience and time before the new venture's first income.

H3g: The entrepreneurial mindset (indicated by business plan quality) mediates the significant relationship between entrepreneurial experience and the length of time before the new venture's first income.

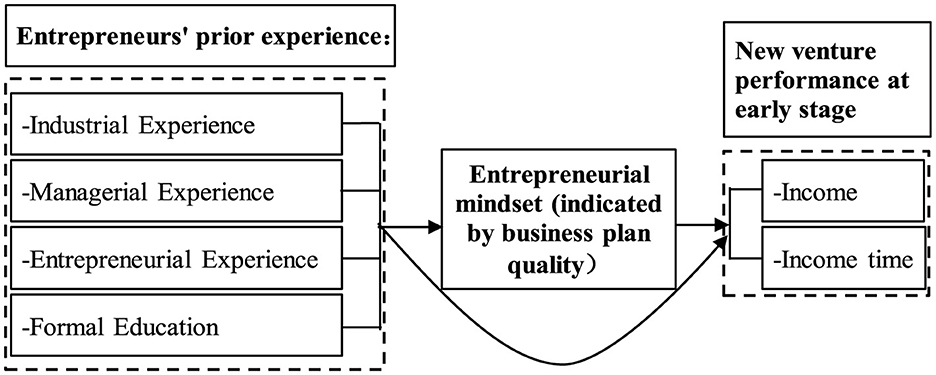

H3h: The entrepreneurial mindset (indicated by business plan quality) mediates the significant relationship between educational background and the length of time before the new venture's first income. The conceptual model of this article is illustrated in Figure 1.

Figure 1. The full conceptual framework of the relationship between the entrepreneurs' prior experience and new venture performance at early stage, mediated by entrepreneurial mindset level (indicated by business plan quality).

3 Data and measures

3.1 Participants

The data were collected from the applications for Suzhou's “2021 Gusu Science and Technology Angel Program,” which is driven by social honors and policy grants and has a competitive nature. Our research focused on the business plans of Chinese technological entrepreneurs. Our sample consisted of new technological ventures in Suzhou. Suzhou has become a hub of commerce and entrepreneurship in Southeastern China, where an inclusive business culture has been nurtured that strongly supports start-ups (Hemmert et al., 2019). Valid samples were selected based on two key criteria: first, new ventures were founded for no <42 months, and second, new ventures generated patents (including patents in the application process). This research was supported by the Suzhou Science and Technology Bureau, which provided the data and required all applicants to submit business plans that followed the same proposed format, allowing for the viability of this study.

We randomly selected 160 applications (business plans) from the “2021 Gusu Science and Technology Angel Program.” Of these, 157 met the quality criteria as detailed and formal written plans. These plans ranged from 3,163 to 14,206 words and included the main project information about societal, industrial, and technological backgrounds; project purpose and meaning; product technological features and their key innovation indicators; economic and social benefits; market, promotional, pricing, and competition strategies; risks and corresponding countermeasures; financial goals and the financial situation; further growth and development plans; and expected business operations over the following 3 years. Overall, the plans covered several high-tech industries, such as new energy, biomedicine, new materials, intelligent manufacturing, and big data.

3.2 Measures

The measures used for the variables in this study are listed below:

3.2.1 Entrepreneurs' prior experience

Prior experience was measured using four variables consistent with those used in the studies discussed in the literature review. Because the subjects of our research were technical entrepreneurs, we believe that their academic degrees are an important part of their prior experience in the analysis. The participants were asked to indicate their answers to the following questions:

Industrial experience refers to whether entrepreneurs have industrial research or management experience before beginning a new business: no (coded as 0) or supported (coded as 1).

Managerial experience refers to whether the entrepreneurs had management experience before beginning a new business: no managerial experience (coded as 0), managerial experience below the department manager level (coded as 1), experience as a department manager (coded as 2), director (coded as 3), or senior executive, that is, vice president or above (coded as 4).

Entrepreneurial experience refers to whether entrepreneurs are nascent (coded as 0) or serial (coded as 1).

Formal education refers to an educational background. Considering technological entrepreneurs as our sample, we divided their educational background into doctoral degree (coded as 2) and master's degree or lower (coded as 1).

3.2.2 Entrepreneurial mindset (indicated by their business plan quality)

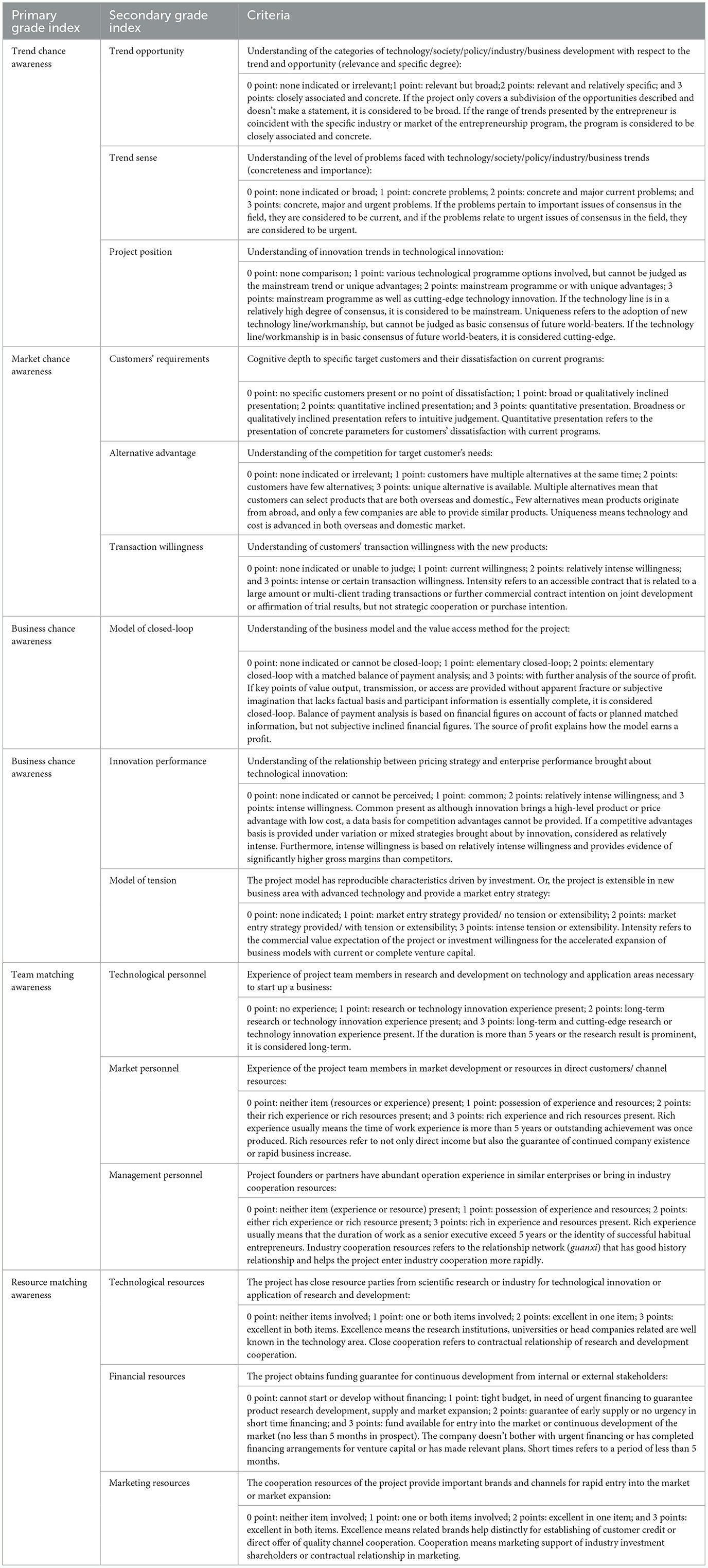

There is no existing scale for measuring entrepreneurial mindset levels (or business plan quality). Based on Timmons' (1999) model of the entrepreneurial process and the further exploration of entrepreneurial models by Bruyat and Julien (2001) and Shane (2003), we developed the measurement scale presented in Table 1. We adopted five primary dimensions and 15 secondary indicators. The average value was used to represent the mindset level (indicated by business plan quality). The 4-point Likert scale was used to evaluate each item.

3.2.3 Business performance

Unger et al. (2011) regard profitability, growth, and size as criteria for assessing entrepreneurial success. As it is difficult for start-ups to make a profit in a short period, we focus on two dependent variables: income (if no income, coded as 0; otherwise, coded as 1) and the length of time before the first income was generated (0–6 months, coded as 1; 7–12 months, coded as 2; and 13–18 months, coded as 3).

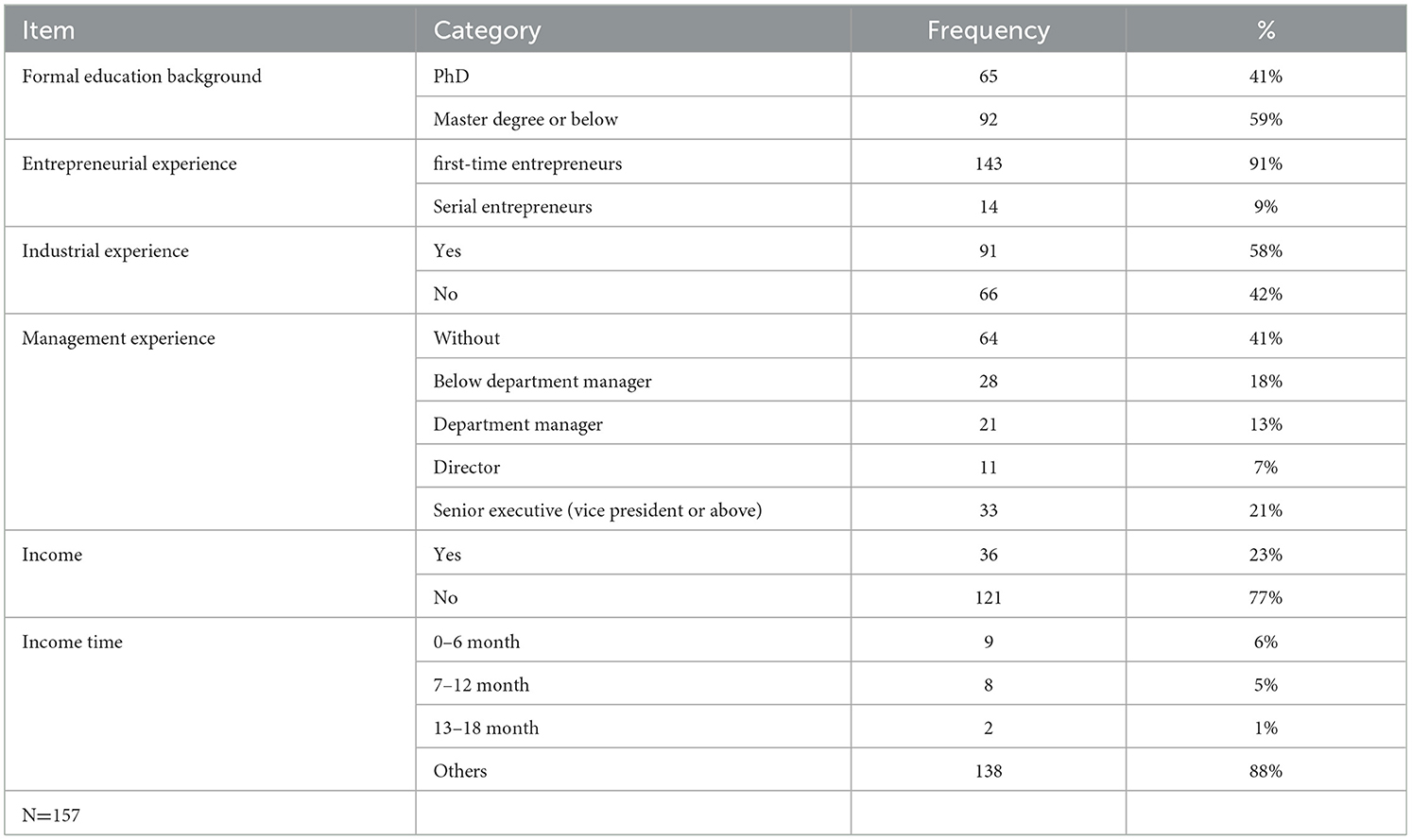

The demographics of those technological entrepreneurs are presented in Table 2.

3.3 Procedures for data analysis

We invited four specialists (with rich entrepreneurial knowledge and a minimum of 3 years of corporate counseling and consulting experience) to independently grade three identical samples. The results indicated a high degree of consistency, and the grading experience was discussed and reviewed. They graded the same six samples individually, and the results were highly consistent. The remaining 148 samples were evenly distributed among the specialists. Four members completed sample allocation and grading. Finally, the data were summarized, and further statistical analyses were conducted using SPSS 25, AMOS 24, and Mplus 7.

4 Analysis and results

4.1 Scale reliability and validity

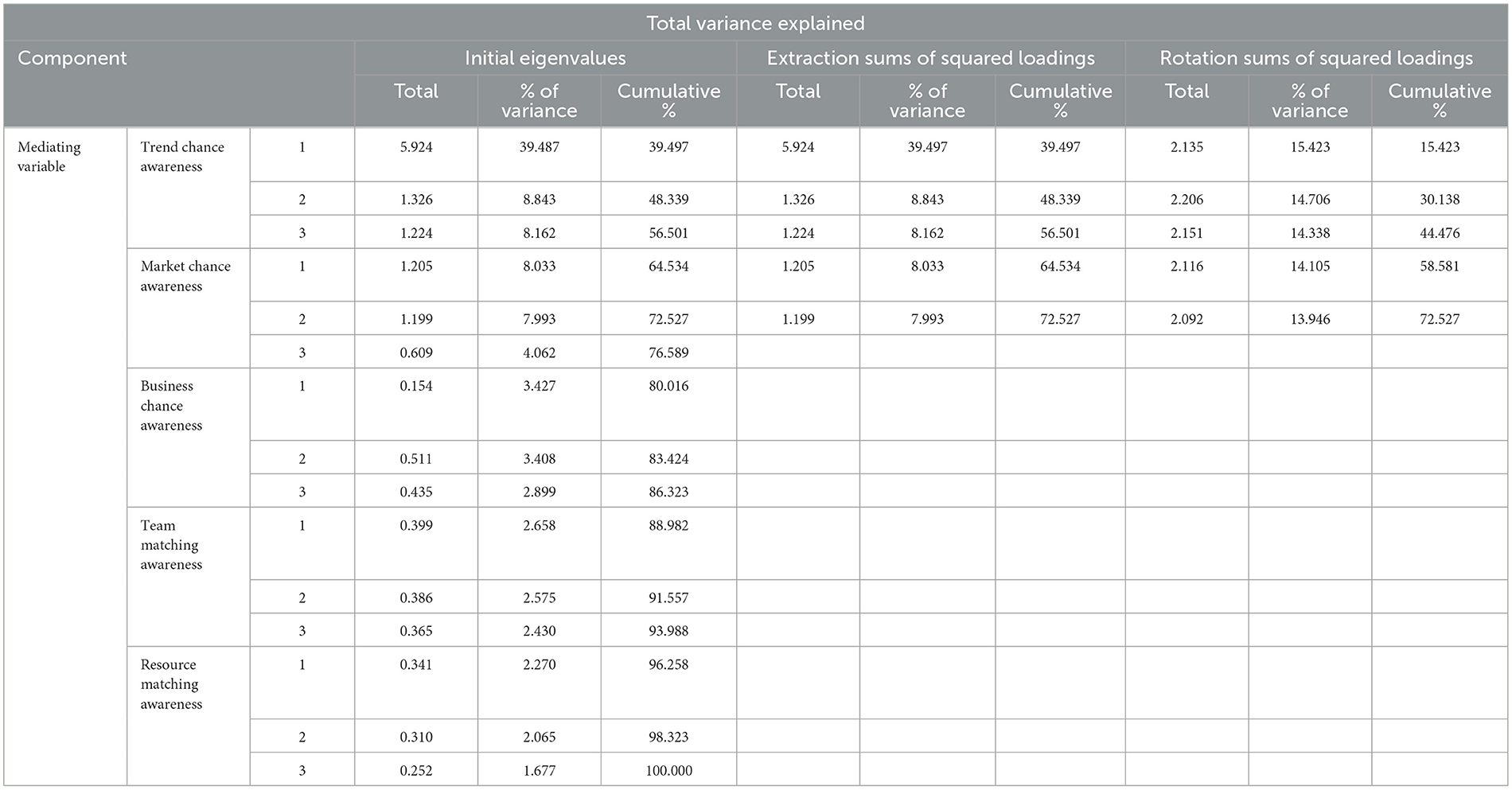

Our novelty measures of entrepreneurial mindset demonstrated internal consistency (reliability) with Cronbach's α values between 0.763 and 0.860 (for each subdimension: trend chance awareness: 0.860; market chance awareness: 0.799; business chance awareness: 0.778; team matching awareness: 0.787; resources matching awareness: 0.781). Given that our research adopted the 4-point Likert scale to measure the variables, Cronbach's α values are all above 0.7, which is an acceptable level of reliability to indicate high reliability (Hair et al., 2010). Therefore, we used KMO and Bartlett's tests to check the entrepreneurial mindset variable ratios for the analysis, and the results were positive for data analysis (Kaiser–Meyer–Olkin Measure of Sampling Adequacy = 0.979; Approx. Chi-squared = 2,009.346; df = 105.000; p = 0.000) as shown in Table 3.

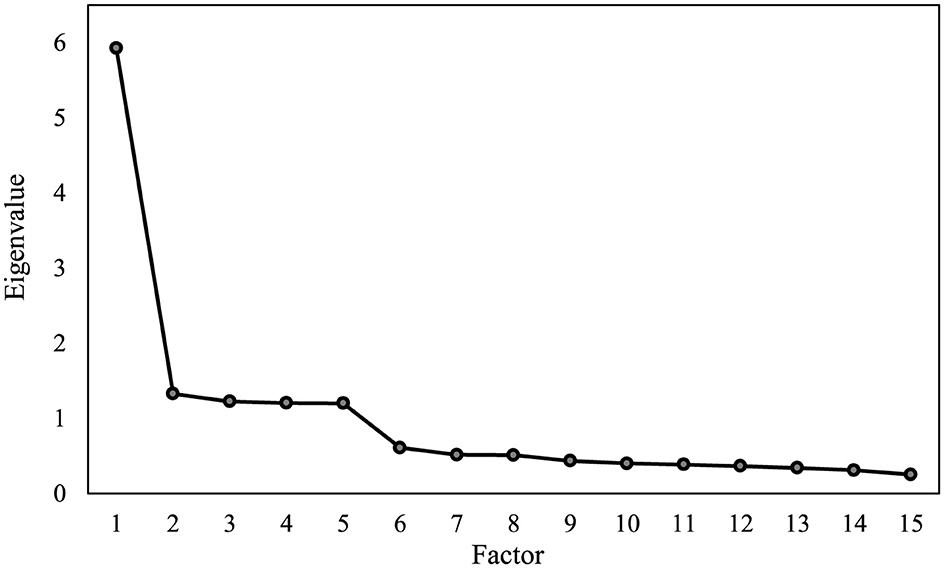

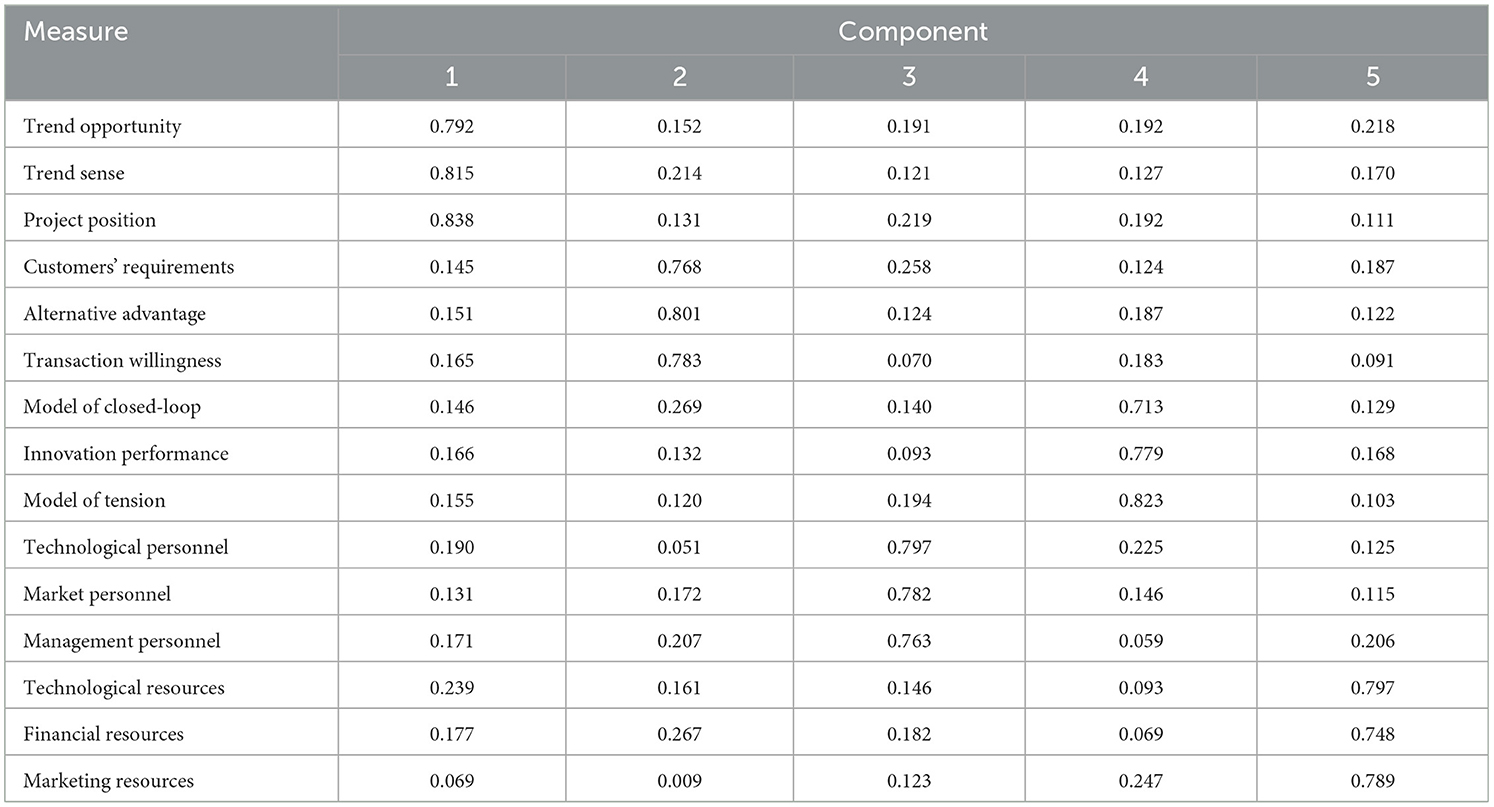

Moreover, to reduce the number of variables needed to explain and interpret the results, we further adopted an exploratory factor analysis (EFA) for our entrepreneurial mindset variable to discover the factor structure of the measure and to examine its internal reliability. The results indicated that there were five factors with eigenvalues >1, and the total explained variance was 72.527%. Furthermore, the scree plot (Figure 2) tended to be flat starting from the sixth factor, indicating that five factors (6–1 = 5) should be extracted. After extracting the five measurement factors, the maximum variance method was used for the rotation (Table 4). The results showed that the entrepreneurs' mindset level (business plan quality) measure scale, which was used in this study, had good structural validity.

4.2 Confirmatory factor analysis

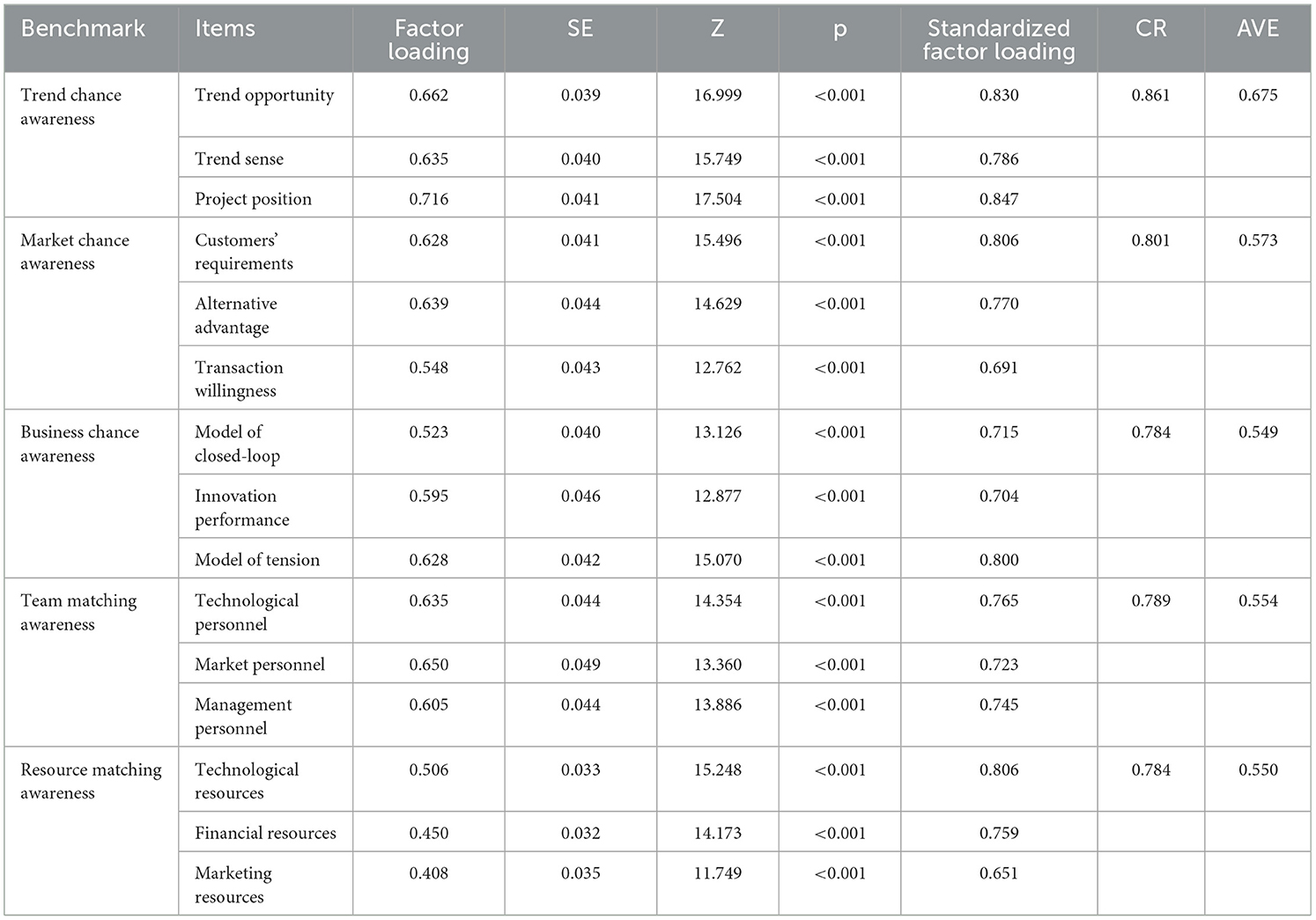

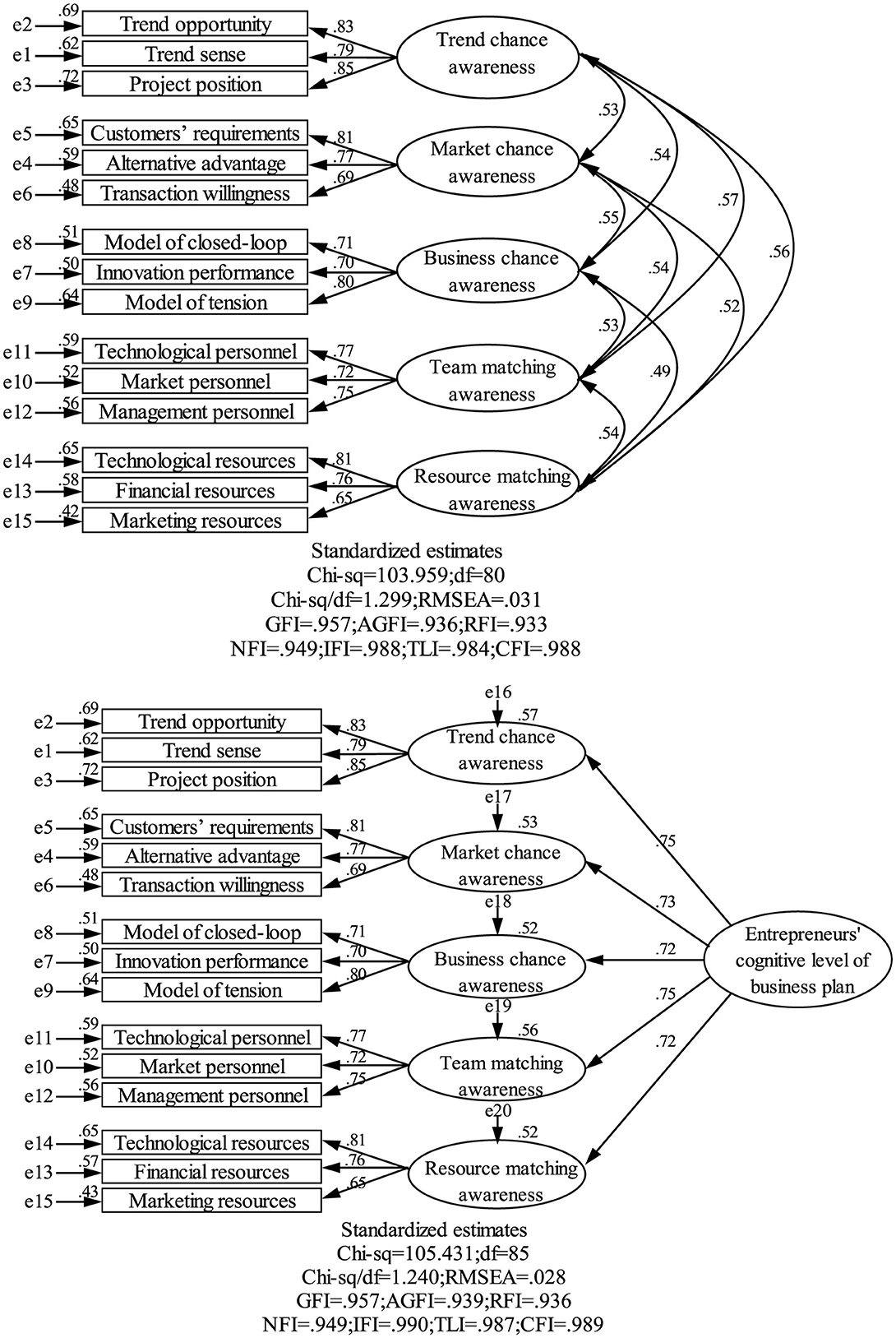

Furthermore, confirmatory factor analysis (CFA) was conducted to assess the reliability and validity of the measurement model for the entrepreneurial mindset variable. To do so, according to Ho's (2006) recommendations, scale fit indices and factor loadings must be checked. Incremental, absolute, and badness-of-fit indices were used. The result indicated that χ2 = 103.959, df = 80,χ2/df = 1.299, p < 0.001, GFI = 0.957, AGFI = 0.936, CFI = 0, 0.998, RFI = 0.933, TLI = 0.988, NFI = 0.949, and RESMA = 0.031. We further examined the factor loading of each item, and the results are shown in Table 5, demonstrating that each load was between 0.651 and 0.847, reaching the significance level (P < 0.001). The CR values for each dimension ranged from 0.784 to 0.861, all of which exceeded 0.7. The AVE values ranged from 0.549 to 0.675, all of which exceeded 0.5. Therefore, all indicators meet the corresponding standards, and the convergent validity of the measurement dimension was acceptable.

Based on the first-order confirmatory factor analysis, the second-order confirmatory factor analysis test showed that the second-order confirmatory factor analysis model χ2 = 105.431, DF = 85, χ2/DF = 1.240, RMSEA = 0.028, GFI = 0.957, AGFI = 0.939, RFI = 0.936, NFI = 0.949, IFI = 0.990, TLI = 0.987, CFI = 0.989, which is shown in Figure 3. Therefore, it also has a good model fit, indicating that latent variable analysis can be used later or that first-order variables can be packaged.

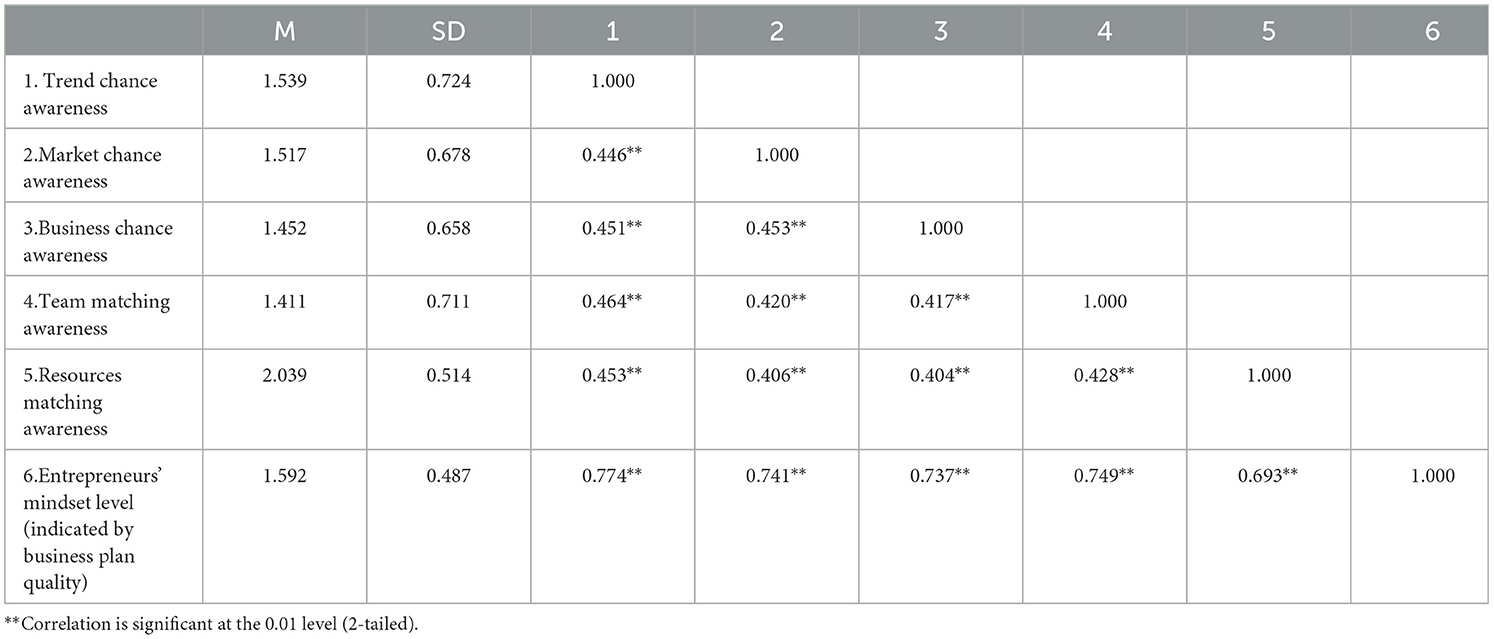

4.3 Correlation analysis

Descriptive statistics and correlations for the study variables are shown in Table 6. We calculated the average score of the dimension items of the business plan cognitive level and implemented descriptive statistics and correlation analysis for each dimension variable. The results show that a significant positive correlation existed between the sub-dimensions of the business plan (PS <0.05), with a correlation coefficient between 0.404 and 0.464. A significant positive correlation was also observed between the sub-dimensions and the entire business plan (PS <0.05), with correlation coefficients between 0.693 and 0.774.

4.4 Structural equation model and mediation effect testing

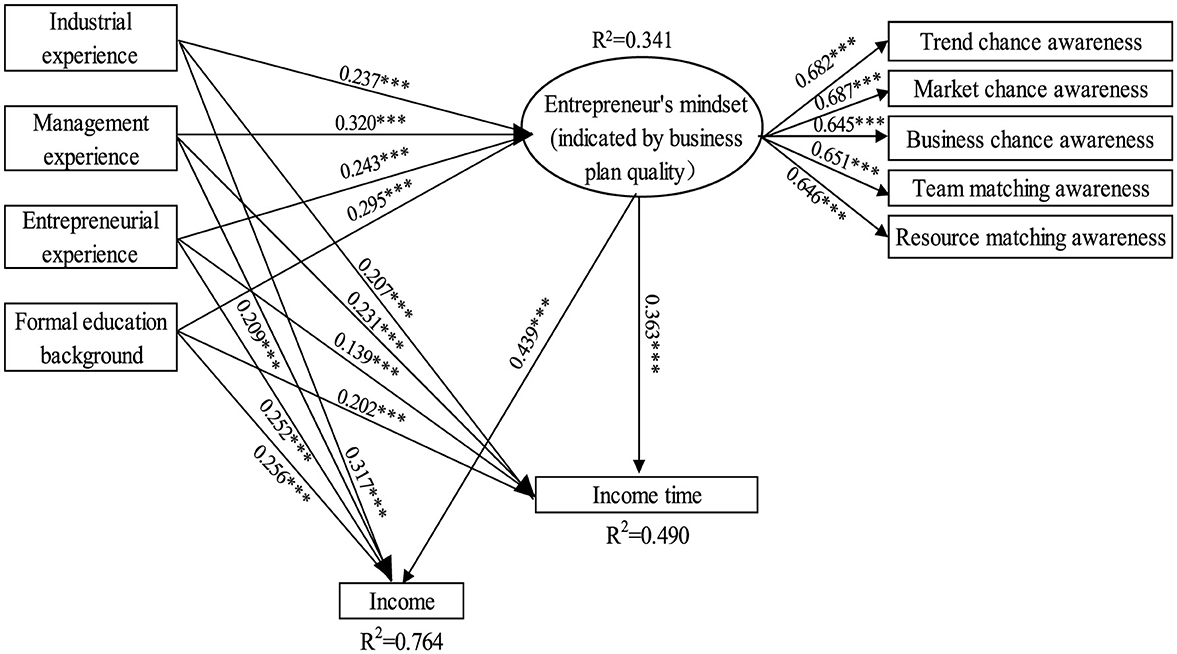

Furthermore, we used Mplus 7 to establish a structural equation model with industrial experience, managerial experience, entrepreneurial experience, and educational background as mediating variables; entrepreneurial mindset (business plan quality) as mediating variables; and income and income time as dependent variables. As Kishton and Widaman (1994) and Yang and Hahn (2015) suggested, all five sub-benchmarks were subject-packed to reduce the difficulty in estimating the model. In addition, because the affected variables of dichotomies were involved in the model, the weighted least squares with mean and variance method was used for robust estimation. The result is shown in Figure 4, indicating that the model has a good fit (χ2 = 27.170, df = 29, χ2/df = 0.937, RMSEA = 0.000 (90%CI = [0.000, 0.040]), CFI = 1.000, TLI = 1.000, SRMR = 0.027).

Figure 4. The structure equation model (standardized). ***Correlation is significant at the 0.001 level (2-tailed).

Industrial experience has a significant positive effect on entrepreneurial mindset (B = 0.237, SE = 0.059, Z = 4.03, P < 0.001, β = 0.237), thus H2a is supported. Managerial experience has a significant positive effect on entrepreneurial mindset (B = 0.105, SE = 0.019, Z = 5.368, P < 0.001, β = 0.32), thus H2b is supported. Entrepreneurial experience has a significant positive effect on entrepreneurial mindset (B = 0.242, SE = 0.055, Z = 4.424, P < 0.001, β = 0.243), thus H2c is supported. Educational background has a significant positive influence on entrepreneurial mindset (B = 0.296, SE = 0.056, Z = 5.263, P < 0.001, β = 0.295), thus H2d is supported. Therefore, H2 was supported. Entrepreneurial mindset has a significant positive effect on income (B = 1.476, SE = 0.243, Z = 6.078, P < 0.001, β = 0.439), thus H1a is supported. Entrepreneurial mindset has a significant positive effect on income time (B = 0.723, SE = 0.123, Z = 5.887, P < 0.001, β = 0.363), thus H1b is supported. Accordingly, H1 is supported. Table 7 presents the results.

Finally, regarding the mediation effect of H3, according to Hayes (2009), the bootstrapping procedure in AMOS was adopted and performed with 5,000 resamples to analyze the confidence intervals (CIs) for each specific mediation path. The results indicated in Table 8 show that the 95% CI of each specific mediation path were all above zero, implying that the hypotheses for the mediating effects were supported.

5 Discussion and conclusion

This study highlights the mediating role of entrepreneurs' mindsets, specifically reflected in the quality of their business plans, and provides empirical evidence on how previous experiences influence new venture performance during early stages. The research was conducted using a sample of technical entrepreneurs participating in a formal business plan competition. Parameters such as industrial, managerial, and entrepreneurial experience were analyzed. The findings suggest that entrepreneurs' cognitive understanding of the role of business planning is strongly influenced by their prior experiences. This distinction in experience and business planning levels serves as a clear indicator of their capacity to achieve success.

As anticipated, the direct relationship between entrepreneurs' cognitive levels concerning business plans and early-stage venture performance (H2) was confirmed. The research validates that entrepreneurs with a higher cognitive awareness demonstrated enhanced creativity and the ability to clearly articulate and predict valuable entrepreneurial activities. This capability allows them to assemble teams with complementary skills and identify potential opportunities aligned with customer needs, ultimately improving venture performance (de Mol et al., 2015). Moreover, prior entrepreneurial experiences significantly contributed to their success, as predicted in H3, corroborating earlier studies (Lamont, 1972; Lee and Tsang, 2001; Stuart and Abetti, 1990). The results of H1 validate our measurement model, confirming that business plan quality is a strong predictor of early-stage new venture performance.

The theoretical framework built upon cognitive and entrepreneurial mindset theories reveals that prior experiences: whether entrepreneurial, industrial, managerial, or educational—positively influence an entrepreneur's cognitive level regarding business planning. This cognitive capacity, in turn, enhances early-stage venture performance and acts as a critical mediator. The study introduces a conceptual model linking prior experiences to both cognitive levels of business planning and early-stage venture performance, alongside a measurement model for cognitive level assessment. Based on these findings, we conclude that evaluating the quality of written business plans remains paramount, as it is a reliable predictors of entrepreneurial success across various contexts.

5.1 Theoretical implications

Our research has important theoretical implications for entrepreneurship studies. The findings align with the mainstream perspective that an entrepreneur's prior experience strongly influences early-stage new venture performance (Baron and Ensley, 2006; Politis, 2008; Shepherd et al., 2009; Toft-Kehler et al., 2014). Additionally, our study reveals that the cognitive level of an entrepreneur's business plan mediates the relationship between previous experience and early-stage venture performance. This is a significant finding, as it provides empirical support for prior research (Delmar and Shane, 2004; Eesley and Roberts, 2012) that suggests a non-linear relationship. Our research demonstrates that the cognitive level of business planning serves as a critical intermediate mechanism. The discrepancies in previous results regarding the impact of entrepreneurial experience on new venture performance may be attributed to the overlooked interaction effect of this experience (Van Gelderen et al., 2011).

Furthermore, by incorporating social cognitive theory, our study addresses a gap in understanding the pre-factors influencing business plan development. By integrating goal-setting theory into the analytical framework of entrepreneurs' cognitive levels, our research rectifies the shortcomings of prior studies that primarily focused on experience and opportunity recognition. Additionally, we propose an evaluation system to measure entrepreneurs' cognitive levels regarding business planning, which we believe will significantly influence future entrepreneurship research. Our findings suggest that while prior experience plays a role in venture performance, its explanatory power is limited without considering the mediating role of cognitive business planning.

These findings highlight the distinct advantages of experienced entrepreneurs and the complexities of the entrepreneurial process. We have filled a crucial research gap by empirically demonstrating that the cognitive level of business planning is the intermediary between prior experience and early-stage venture success. Beyond contributing to entrepreneurship theory and practice, we recommend using the 15 dimensions from our evaluation system for further entrepreneurship research to assess business planning levels, with room for further refinement.

5.2 Practical implications

Based on these findings, the research indicates that entrepreneurs seeking high levels of long-term new venture performance should engage in continuous learning and diverse experiences. This approach enhances their knowledge and equips them with essential resources and skills for entrepreneurial activities. By writing and evaluating their business plans, entrepreneurs can conduct a self-assessment of their entrepreneurial mindset using the developed evaluation system, significantly improving their performance and success.

Additionally, this evaluation system allows educators and training agencies to gain insights into the entrepreneurial mindset levels of their trainees, enabling them to customize courses and programs to better meet the needs of aspiring entrepreneurs. Targeted workshops can address key areas identified through evaluations, ensuring entrepreneurs are well-prepared to navigate the complexities of the VUCA era. By fostering effective business planning and mindset development, we can create a stronger entrepreneurial ecosystem that supports sustainable growth and success in new ventures.

5.3 Limitations

Although this research provides better knowledge and understanding of the mediation effect of entrepreneurs' mindset level of business plan on the relationship between their previous experience and new venture performance at an early stage, it also has several limitations. Despite the high reliability and validity of the evaluation criterion of entrepreneurs' mindset level (business plan quality), the research may not capture all the capabilities and skills required to establish a new venture and needs further improvement. In addition, this study relied on evaluations by third-party experts; therefore, there is a chance that judgments will be influenced by personal bias (Langfeldt, 2004). Thus, we recommend that further studies test the hypothesized conceptual model using data from different regions. Another potential limitation of this study is related to the time span and measurement model that we used to measure new venture performance; therefore, further research is needed for future studies to replicate the findings of the study using longitudinal analysis. Finally, we recommend further research to improve our proposed conceptual model by including additional samples and controlled variables (e.g., geographic origins of entrepreneurs and family background).

Data availability statement

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

Ethics statement

Ethical review and approval was not required for the study on human participants in accordance with the local legislation and institutional requirements. Written informed consent from the participants was not required to participate in this study in accordance with the national legislation and the institutional requirements.

Author contributions

SC: Data curation, Formal analysis, Project administration, Writing – original draft, Writing – review & editing. LZ: Data curation, Software, Writing – original draft, Writing – review & editing. XW: Data curation, Formal analysis, Methodology, Project administration, Resources, Supervision, Validation, Writing – original draft. BC: Data curation, Formal analysis, Investigation, Resources, Software, Writing – original draft.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Acknowledgments

We would like to express our deep gratitude to the three experts who participated in this business plan evaluation, their rigorous attitude and critical thinking are touching. We also like to thank for the continuous help from relevant government departments in Suzhou for their support in the data collection process.

Conflict of interest

SC and BC were employed by Xipu Technological Entrepreneurship Development (Suzhou) Co., Ltd.

The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/forgp.2024.1435134/full#supplementary-material

References

Alsos, G. A., and Carter, S. (2006). Multiple business ownership in the Norwegian farm sector: Resource transfer and performance consequences. J. Rural Stud. 22, 313–322. doi: 10.1016/j.jrurstud.2005.09.003

Alstete, J. W. (2008). Aspects of entrepreneurial success. J. Small Busin. Enterprise Dev. 15, 584–594. doi: 10.1108/14626000810892364

Ansoff, H. I. (1991). Critique of Henry Mintzberg's ‘The design school: reconsidering the basic premises of strategic management'. Strat. Manage. J. 12, 449–461. doi: 10.1002/smj.4250120605

Baldacchino, L., Ucbasaran, D., Cabantous, L., and Lockett, A. (2015). Entrepreneurship research on intuition: a critical analysis and research agenda. Int. J. Manag. Rev. 17, 212–231. doi: 10.1111/ijmr.12056

Balsmeier, B., and Czarnitzki, D. (2014). How Important Is Industry-Specific Managerial Experience for Innovative Firm Performance? KU Leuven; Fac. of Economics and Business.

Baron, R. A. (2006). Opportunity recognition as pattern recognition: how entrepreneurs “connect the dots” to identify new business opportunities. Acad. Manage. Persp. 20, 104–119. doi: 10.5465/amp.2006.19873412

Baron, R. A., and Ensley, M. D. (2006). Opportunity recognition as the detection of meaningful patterns: evidence from comparisons of novice and experienced entrepreneurs. Manage. Sci. 52, 1331–1344. doi: 10.1287/mnsc.1060.0538

Bignotti, A., and Le Roux, I. (2020). Which types of experience matter? The role of prior start-up experiences and work experience in fostering youth entrepreneurial intentions. Int. J. Entrep. Behav. Res. 26, 1181–1198. doi: 10.1108/IJEBR-10-2019-0577

Blackwood, T., and Mowl, G. (2000). Expatriate-owned small businesses: Measuring and accounting for success. Int. Small Busin. J. 18, 60–73. doi: 10.1177/0266242600183004

Botella-Carrubi, D., Ribeiro-Navarrete, S., Ulrich, K., and Blanco González-Tejero, C. (2024). The role of entrepreneurial skills as a vehicle for business growth: a study in Spanish start-ups. Managem. Deci. 62, 2364–2387. doi: 10.1108/MD-02-2022-0161

Brinckmann, J., Grichnik, D., and Kapsa, D. (2010). Should entrepreneurs plan or just storm the castle? A meta-analysis on contextual factors impacting the business planning–performance relationship in small firms. J. Business Vent. 25, 24–40. doi: 10.1016/j.jbusvent.2008.10.007

Brinckmann, J. A. N., and Kim, S. M. (2015). Why we plan: The impact of nascent entrepreneurs' cognitive characteristics and human capital on business planning. Strat. Entrep. J. 9, 153–166. doi: 10.1002/sej.1197

Bruyat, C., and Julien, P. A. (2001). Defining the field of research in entrepreneurship. J. Busin. Ventur. 16, 165–180. doi: 10.1016/S0883-9026(99)00043-9

Burke, A., Fraser, S., and Greene, F. J. (2010). The multiple effects of business planning on new venture performance. J. Manage. Stud. 47, 391–415. doi: 10.1111/j.1467-6486.2009.00857.x

Chen, Y., and Pan, J. (2019). Do entrepreneurs' developmental job challenges enhance venture performance in emerging industries? A mediated moderation model of entrepreneurial action learning and entrepreneurial experience. Front. Psychol. 10:1371. doi: 10.3389/fpsyg.2019.01371

Cooper, A. C., Gimeno-Gascon, F. J., and Woo, C. Y. (1994). Initial human and financial capital as predictors of new venture performance. J. Busin. Ventur. 9, 371–395. doi: 10.1016/0883-9026(94)90013-2

de Mol, E., Khapova, S. N., and Elfring, T. (2015). Entrepreneurial team cognition: a review. Int. J. Manage. Rev. 17, 232–255. doi: 10.1111/ijmr.12055

Deakins, D., and Freel, M. (1998). Entrepreneurial learning and the growth process in SMEs. Learn. Organiz. 5, 144–155. doi: 10.1108/09696479810223428

Dej, D. (2010). “Defining and measuring entrepreneurial success,” in Entrepreneurship: A Psychological Approach (Prague: Oeconomica), 89–102.

Delmar, F., and Shane, S. (2003). Does business planning facilitate the development of new ventures?. Strat. Manage. J. 24, 1165–1185. doi: 10.1002/smj.349

Delmar, F., and Shane, S. (2004). Legitimating first: Organizing activities and the survival of new ventures. J. Busin. Ventur. 19, 385–410. doi: 10.1016/S0883-9026(03)00037-5

Dencker, J. C., Gruber, M., and Shah, S. K. (2009). Pre-entry knowledge, learning, and the survival of new firms. Organiz. Sci. 20, 516–537. doi: 10.1287/orsc.1080.0387

Dimov, D. (2010). Nascent entrepreneurs and venture emergence: Opportunity confidence, human capital, and early planning. J. Manage. Stud. 47, 1123–1153. doi: 10.1111/j.1467-6486.2009.00874.x

Donbesuur, F., Boso, N., and Hultman, M. (2020). The effect of entrepreneurial orientation on new venture performance: contingency roles of entrepreneurial actions. J. Bus. Res. 118, 150–161. doi: 10.1016/j.jbusres.2020.06.042

Eesley, C. E., and Roberts, E. B. (2012). Are you experienced or are you talented?: When does innate talent versus experience explain entrepreneurial performance?. Strategic Entrepreneurship Journal 6, 207–219. doi: 10.1002/sej.1141

Ferreras-Garcia, R., Hernández-Lara, A. B., and Serradell-López, E. (2019). Entrepreneurial competences in a higher education business plan course. Educ. Training. 61, 850–869. doi: 10.1108/ET-04-2018-0090

George, B., Walker, R. M., and Monster, J. (2019). Does strategic planning improve organizational performance? A meta-analysis. Public Administrat. Rev. 79, 810–819. doi: 10.1111/puar.13104

Gompers, P., Kovner, A., Lerner, J., and Scharfstein, D. S. (2006). “Skill vs. luck in entrepreneurship and venture capital: Evidence from serial entrepreneurs,” in National Bureau of Economic Research.

Gruber, M. (2007). Uncovering the value of planning in new venture creation: a process and contingency perspective. J. Busin. Ventur. 22, 782–807. doi: 10.1016/j.jbusvent.2006.07.001

Gustafsson, V. (2009). “Entrepreneurial decision-making: thinking under uncertainty,” in Understanding the entrepreneurial mind: Opening the black box (New York, NY: Springer New York), 285–304.

Haber, S., and Reichel, A. (2007). The cumulative nature of the entrepreneurial process: The contribution of human capital, planning and environment resources to small venture performance. J. Busin. Vent. 22, 119–145. doi: 10.1016/j.jbusvent.2005.09.005

Hair, J. F., Black, W. C., Babin, B. J., and Anderson, R. E. (2010). Multivariate Data Analysis. Upper Saddle River, NJ: Pearson Prentice Hall.

Halberstadt, J., Timm, J. M., Kraus, S., and Gundolf, K. (2019). Skills and knowledge management in higher education: how service learning can contribute to social entrepreneurial competence development. J. Knowl. Manage. 23, 1925–1948. doi: 10.1108/JKM-12-2018-0744

Hayes, A. F. (2009). Beyond Baron and Henny: statistical mediation analysis in the new millennium. Commun. Monogr. 76, 408–420. doi: 10.1080/03637750903310360

He, C., Lu, J., and Qian, H. (2019). Entrepreneurship in China. Small Bus. Econ. 52, 563–572. doi: 10.1007/s11187-017-9972-5

Hechavarría, D. M., Li, T., and Reynolds, P. D. (2017). To Plan or Not to Plan: The Effects of Business Planning on Start-up Speed and Outcomes. Available at: https://www.researchgate.net/publication/320685359_To_Plan_or_Not_To_Plan_The_Effects_of_Business_Planning_on_Start-up_Speed_and_Outcomes (accessed November 02, 2024).

Hemmert, M., Cross, A. R., Cheng, Y., Kim, J. J., Kohlbacher, F., Kotosaka, M., et al. (2019). The distinctiveness and diversity of entrepreneurial ecosystems in China, Japan, and South Korea: an exploratory analysis. Asian Busin. Manage. 18, 211–247. doi: 10.1057/s41291-019-00070-6

Hmieleski, K. M., and Baron, R. A. (2009). Entrepreneurs' optimism and new venture performance: A social cognitive perspective. Acad. Manage. J. 52, 473–488. doi: 10.5465/amj.2009.41330755

Ho, R. (2006). Handbook of Univariate and Multivariate Data Analysis and Interpretation with SPSS. Boca Raton, FL: Chapman and Hall.

Honig, B., and Karlsson, T. (2004). Institutional forces and the written business plan. J. Manage. 30, 29–48. doi: 10.1016/j.jm.2002.11.002

Hopp, C., Greene, F. J., Honig, B., Karlsson, T., and Samuelsson, M. (2018). Revisiting the influence of institutional forces on the written business plan: a replication study. Managem. Rev. Quart. 68, 361–398. doi: 10.1007/s11301-018-0143-9

Jemal, S. (2020). Effect of entrepreneurial mindset and entrepreneurial competence on performance of small and medium enterprise, evidence from litrature review. Int. J. Manage. Entrep. Res. 2, 476–491. doi: 10.51594/ijmer.v2i7.197

Jones, G. R., and Butler, J. E. (1992). Managing internal corporate entrepreneurship: an agency theory perspective. J. Manage. 18, 733–749. doi: 10.1177/014920639201800408

Joseph, C., Norizan, S., Enggong, T. S., Rahmat, M., and Nyet, C. A. (2022). Realizing sustainable development goals via entrepreneurial digital mindset: resource-based view perspective. Int. J. Account. Finance Busin. 7:42. doi: 10.55573/IJAFB.074201

Kim, J., Kim, H., and Geum, Y. (2023). How to succeed in the market? predicting startup success using a machine learning approach. Technol. Forecast. Soc. Change 193:122614. doi: 10.1016/j.techfore.2023.122614

Kimjeon, J., and Davidsson, P. (2022). External enablers of entrepreneurship: a review and agenda for accumulation of strategically actionable knowledge. Entrep. Theory Pract. 46, 643–687. doi: 10.1177/10422587211010673

Kishton, J. M., and Widaman, K. F. (1994). Unidimensional versus domain representative parceling of questionnaire items: an empirical example. Educ. Psychol. Meas. 54, 757–765. doi: 10.1177/0013164494054003022

Kor, Y. Y., Mahoney, J. T., and Michael, S. C. (2007). Resources, capabilities and entrepreneurial perceptions. J. Manage. Stud. 44, 1187–1212. doi: 10.1111/j.1467-6486.2007.00727.x

Kraus, S., and Schwarz, E. (2007). The role of pre-start-up planning in new small business. Int. J. Manage. Enterprise Dev. 4, 1–17. doi: 10.1504/IJMED.2007.011452

Kurczewska, A., Dory,ń, W., and Wawrzyniak, D. (2020). An everlasting battle between theoretical knowledge and practical skills? The joint impact of education and professional experience on entrepreneurial success. Entrep. Busin. Econ. Rev. 8, 219–237. doi: 10.15678/EBER.2020.080212

Langfeldt, L. (2004). Expert panels evaluating research: decision-making and sources of bias. Res. Eval. 13, 51–62. doi: 10.3152/147154404781776536

Lee, D. Y., and Tsang, E. W. (2001). The effects of entrepreneurial personality, background and network activities on venture growth. J. Manage. Stud. 38, 583–602. doi: 10.1111/1467-6486.00250

Li, J., and Dutta, D. K. (2018). Founding team experience, industry context, and new venture creation. N. Engl. J. Entrep.21, 2–21. doi: 10.1108/NEJE-04-2018-0008

Liao, J., and Gartner, W. B. (2009). Are Planners Doers?: Pre-venture Planning and the Start-up Behaviors of Entrepreneurs. Washington, DC: SBA Office of Advocacy.

Lussier, R. N., and Halabi, C. E. (2010). A three-country comparison of the business success versus failure prediction model. J. Small Bus. Manag. 48, 360–377. doi: 10.1111/j.1540-627X.2010.00298.x

Lussier, R. N., and Pfeifer, S. (2001). A crossnational prediction model for business success. J. Small Bus. Manag. 39, 228–239. doi: 10.1111/0447-2778.00021

MacMillan, I. C., Block, Z., and Narasimha, P. S. (1986). Corporate venturing: Alternatives, obstacles encountered, and experience effects. J. Bus. Ventur. 1, 177–191. doi: 10.1016/0883-9026(86)90013-3

Mansoori, Y., and Lackéus, M. (2020). Comparing effectuation to discovery-driven planning, prescriptive entrepreneurship, business planning, lean startup, and design thinking. Small Bus. Econ. 54, 791–818. doi: 10.1007/s11187-019-00153-w

McCann, B. T., and Vroom, G. (2015). Opportunity evaluation and changing beliefs during the nascent entrepreneurial process. Int. Small Busin. J. 33, 612–637. doi: 10.1177/0266242614544198

McKenzie, D., and Sansone, D. (2019). Predicting entrepreneurial success is hard: Evidence from a business plan competition in Nigeria. J. Dev. Econ. 141:102369. doi: 10.1016/j.jdeveco.2019.07.002

Mitchell, R. K., Busenitz, L. W., Bird, B., Gaglio, C. M., McMullen, J. S., Morse, E. A., et al. (2007). The central question in entrepreneurial cognition research. Entrepr. Theor. Pract. 31, 1–27. doi: 10.1111/j.1540-6520.2007.00161.x

Moritz, A., Diegel, W., Block, J., and Fisch, C. (2022). VC investors' venture screening: the role of the decision maker's education and experience. J. Busin. Econ. 92, 27–63. doi: 10.1007/s11573-021-01042-z

Mtau, T. T., and Rahul, N. A. (2024). Optimizing business performance through KPI alignment: a comprehensive analysis of key performance indicators and strategic objectives. Am. J. Indust. Busin. Manag. 14, 66–82. doi: 10.4236/ajibm.2024.141003

Nowiński, W., and Kozma, M. (2017). How can blockchain technology disrupt the existing business models? Entrep. Busin. Econ. Rev. 5, 173–188. doi: 10.15678/EBER.2017.050309

Oe, A., and Mitsuhashi, H. (2013). Founders' experiences for startups' fast break-even. J. Bus. Res. 66, 2193–2201. doi: 10.1016/j.jbusres.2012.01.011

Oyeyemi, O. P., Kess-Momoh, A. J., Omotoye, G. B., Bello, B. G., Tula, S. T., and Daraojimba, A. I. (2024). Entrepreneurship in the digital age: a comprehensive review of start-up success factors and technological impact. Int. J. Sci. Res. Arch. 11, 182–191. doi: 10.30574/ijsra.2024.11.1.0030

Politis, D. (2005). The process of entrepreneurial learning: a conceptual framework. Entrep. Theory Pract. 29, 399–424. doi: 10.1111/j.1540-6520.2005.00091.x

Politis, D. (2008). Does prior start-up experience matter for entrepreneurs' learning? A comparison between novice and habitual entrepreneurs. J. Small Busin. Enterprise Dev. 15, 472–489. doi: 10.1108/14626000810892292

Power, D., and Lundmark, M. (2004). Working through knowledge pools: labour market dynamics, the transference of knowledge and ideas, and industrial clusters. Urban Stud. 41, 1025–1044. doi: 10.1080/00420980410001675850

Quan, X. (2012). Prior experience, social network, and levels of entrepreneurial intentions. Managem. Res. Rev. 35, 945–957. doi: 10.1108/01409171211272679

Schenkel, M. T., and Garrison, G. (2009). Exploring the roles of social capital and team-efficacy in virtual entrepreneurial team performance. Manage. Res. News 32, 525–538. doi: 10.1108/01409170910962966

Schwenk, C. R., and Shrader, C. B. (1993). Effects of formal strategic planning on financial performance in small firms: a meta-analysis. Entrep. Theory Pract. 17, 53–64. doi: 10.1177/104225879301700304

Shane, S. (2000). Prior knowledge and the discovery of entrepreneurial opportunities. Organiz. Sci. 11, 448–469. doi: 10.1287/orsc.11.4.448.14602

Shane, S. A. (2003). A General Theory of Entrepreneurship: The Individual-Opportunity Nexus. London: Edward Elgar Publishing.

Shepherd, D. A., Wiklund, J., and Haynie, J. M. (2009). Moving forward: Balancing the financial and emotional costs of business failure. J. Bus. Ventur. 24, 134–148. doi: 10.1016/j.jbusvent.2007.10.002

Smith, H. L., and De Silva, M. L. (2022). “Future entrepreneurs: exploring paradigms in the entrepreneurial learning experience,” in Strategies for the Creation and Maintenance of Entrepreneurial Universities (Hershey: IGI Global), 168–193.

Soltanifar, M., Hughes, M., and Göcke, L. (2021). Digital Entrepreneurship: Impact on Business and Society (Cham: Springer Nature), 327.

Soriano, D. R., and Castrogiovanni, G. J. (2012). The impact of education, experience and inner circle advisors on SME performance: insights from a study of public development centers. Small Bus. Econ. 38, 333–349. doi: 10.1007/s11187-010-9278-3

Stuart, R. W., and Abetti, P. A. (1990). Impact of entrepreneurial and management experience on early performance. J. Bus. Ventur. 5, 151–162. doi: 10.1016/0883-9026(90)90029-S

Timmons, J. A. (1999). New Venture Creation: Entrepreneurship in the 21st Century. New York, NY: Irwin Mc-Graw-Hill.

Toft-Kehler, R., Wennberg, K., and Kim, P. H. (2014). Practice makes perfect: Entrepreneurial-experience curves and venture performance. J. Bus. Ventur. 29, 453–470. doi: 10.1016/j.jbusvent.2013.07.001

Tornikoski, E. T., and Newbert, S. L. (2007). Exploring the determinants of organizational emergence: a legitimacy perspective. J. Bus. Ventur. 22, 311–335. doi: 10.1016/j.jbusvent.2005.12.003

Ucbasaran, D., Wright, M., Westhead, P., and Busenitz, L. W. (2003). “The impact of entrepreneurial experience on opportunity identification and exploitation: habitual and novice entrepreneurs,” in Cognitive Approaches to Entrepreneurship Research (Leeds: Emerald Group Publishing Limited), 231–263.

Unger, J. M., Rauch, A., Frese, M., and Rosenbusch, N. (2011). Human capital and entrepreneurial success: A meta-analytical review. J. Bus. Ventur. 26, 341–358. doi: 10.1016/j.jbusvent.2009.09.004

Van Gelderen, M., Thurik, R., and Patel, P. (2011). Encountered problems and outcome status in nascent entrepreneurship. J. Small Bus. Manag. 49, 71–91. doi: 10.1111/j.1540-627X.2010.00315.x

Wach, D., Stephan, U., and Gorgievski, M. (2016). More than money: Developing an integrative multi-factorial measure of entrepreneurial success. Int. Small Busin. J. 34, 1098–1121. doi: 10.1177/0266242615608469

Wei, Y. L., Long, D., Li, Y. K., and Cheng, X. S. (2018). Is business planning useful for the new venture emergence? Moderated by the innovativeness of products. Chin. Manag. Stud. 12, 847–870. doi: 10.1108/CMS-10-2017-0315

Welter, C., Scrimpshire, A., Tolonen, D., and Obrimah, E. (2021). The road to entrepreneurial success: business plans, lean startup, or both?. N. Engl. J. Entrep.24, 21–42. doi: 10.1108/NEJE-08-2020-0031

Yang, L., and Hahn, J. (2015). “Learning from prior experience: an empirical study of serial entrepreneurs in IT-enabled crowdfunding,” in Thirty Sixth International Conference on Information Systems, Fort Worth. Available at: https://aisel.aisnet.org/icis2015/proceedings/HumanBehaviorIS/21 (accessed November 02, 2024).

Keywords: entrepreneurs' prior experience, entrepreneurial mindset level, new venture, early stage performance, business plan

Citation: Chen S, Zhong L, Wang X and Chen B (2024) Impact of entrepreneurs' prior experience on their new ventures' early-stage performance: the mediation effect of entrepreneurial mindset level. Front. Organ. Psychol. 2:1435134. doi: 10.3389/forgp.2024.1435134

Received: 20 May 2024; Accepted: 25 October 2024;

Published: 15 November 2024.

Edited by:

Yashar Salamzadeh, University of Sunderland, United KingdomReviewed by:

Ricardo Martinez Cañas, University of Castilla-La Mancha, SpainAyşe Günsel, Kocaeli University, Türkiye

Copyright © 2024 Chen, Zhong, Wang and Chen. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xiao Wang, eGlhby53YW5nQHhqdGx1LmVkdS5jbg==

Sihui Chen1

Sihui Chen1 Lichen Zhong

Lichen Zhong Xiao Wang

Xiao Wang