- 1CAES Energy Policy Institute, Boise State University, Boise, ID, United States

- 2School of Public Service, Boise State University, Boise, ID, United States

Highly technical rules for regional electricity markets shape opportunities for new technologies and the pace of transition to a cleaner and more distributed power system. We compare three case studies of regional transmission organizations and identify common mechanisms that describe the relationship between institutional design and administrative policy decisions. We compare industry actors, old and new, across these case studies to better understand structural power and institutional stability through four mechanisms drawn from the literature: (1) self-reinforcing interests, (2) participation in and position of groups, (3) influence over communication and information, and (4) control over problem framing and pace of decisions. A focus on the mechanisms that operate within RTO governance provides insight into needed RTO governance reform.

Introduction

Ongoing efforts to promote more sustainable, resilient, and equitable energy systems are disrupting economic, political, and institutional relationships (Lockwood et al., 2017; Loorbach et al., 2017). Correspondingly, issues of power and politics are now central themes in sustainability transition research (Breetz et al., 2018; Roberts et al., 2018; Brisbois, 2019). This body of literature recognizes that sustainability transitions are highly contested, involving political-economy challenges of power, resistance, and redistribution. Moreover, energy transitions research has begun to examine these concepts in particular institutional settings (Stokes and Breetz, 2018; Brisbois et al., 2019; Lockwood et al., 2019). Recent attention has focused on the political dynamics within administrative agencies, as well as the potentially transformative capacity associated with the implementation of existing laws (Garmestani et al., 2019; MacLean, 2020).

Wholesale electricity trading has long been viewed as a depoliticized technical task, but regional electricity transmission and market debates are often contentious. Recent conflicts over capacity market design, interstate transmission, state clean energy policy implementation, and responses to climate extremes highlight the political, financial, and social stakes involved with these administrative decisions (Chen, 2019; Peskoe, 2020; St. John, 2020a; Spiegel, 2021; Watson M., 2021). Over the past three decades, the electric power sector in the United States has been restructured to introduce more competition. At the same time, public policy and technological innovation have promoted a cleaner and more decentralized electricity grid. These changes have introduced participatory approaches to electricity system governance and new institutional arrangements for regulation (Dworkin et al., 2013; Baldwin, 2018; Lenhart and Fox, 2021). A large literature examines the economic and legal aspects of restructuring the electricity sector (Hogan, 2002; Cramton, 2003; Blumsack, 2007; Walawalkar et al., 2008; Borenstein and Bushnell, 2015; Eisen, 2016; Rossi, 2016; Peskoe, 2021; Welton S., 2021). However, the political dynamics and exercise of structural power within these new institutional arrangements have received less attention, as has the interplay of market rules and state clean energy policy (Lenhart et al., 2016; Stafford and Wilson, 2016; Konschnik, 2019; Baldwin and Tang, 2021).

In regions of the United States with competitive multi-lateral wholesale markets, electricity system governance occurs through interactions among industry actors, state and federal regulators, policymakers, and civil society representatives working to develop administrative policy that is ultimately formalized through tariffs, rules, and practices. Highly technical rules formed through stakeholder processes within regional transmission organizations and independent system operators (hereafter RTOs) have substantial impacts on consumer electricity prices, air quality, carbon emissions, the value of energy investments, and the pace of transition to a cleaner and more distributed system (Paine et al., 2014; Yoo and Blumsack, 2018). Yet, the opportunities for meaningful participation, the influence of differently positioned stakeholders, and variations in institutional arrangements across RTOs are not well understood.

This paper examines case studies of the mechanisms that link RTO decision-making processes and the market rules for one set of new grid technologies: energy storage resources. We focus on the evolution of storage market rules in three RTO regions: the California Independent System Operator (CAISO), the Southwest Power Pool (SPP), and the Independent System Operator New England (ISO-NE). These cases reflect diversity in the origins of the RTO, the extent of market restructuring, major market design elements, state clean energy policies, and energy generation mix. For each of these RTOs, we trace how the interests of stakeholders, the institutional design of stakeholder processes, and state actions influenced the design of storage market rules.

Our analysis makes both empirical and theoretical contributions to the literature on energy system governance. The institutional design and dynamics of RTO decision-making are not well documented in the literature, let alone the details of how market rules are affecting energy storage. Our original case studies offer a significant contribution by illuminating how RTO decisions occur in practice and the procedural opportunities and challenges for new market entrants to meaningfully participate in RTO decision-making practices. Our analysis also contributes to the understanding of power dynamics in sustainability transitions and the opportunities and limits of transformative capacity within institutional arrangements for administrative policymaking. By comparing change across these case studies, we provide further evidence supporting research arguing that the exercise of power depends on variations in interests, institutional design, and ideas (Kern, 2011; Scott, 2014; Lockwood et al., 2019). Additionally, we identify patterns in the decision-making dynamics across our cases, suggesting common institutional design challenges associated with complex institutional arrangements for regulation.

In our case studies of storage market rule development, we find evidence of structural power and institutional stability associated with mechanisms drawn from the literature. These cases expand the understanding of how these mechanisms operate in different contexts by highlighting the influence of regulatory arrangements at multiple levels and across different functions. The cases also illuminate how governance design affects political dynamics among stakeholders and how structures and processes often limit the influence of new business models or new technologies in administrative policy decisions. We conclude RTO stakeholder engagement practices could be strengthened, and we provide several specific recommendations for stakeholders and regulators to consider.

The next section provides background on wholesale multilateral electricity markets and energy storage. The Theoretical Framework: Structural Power and Stability in Energy System. The Governance section outlines our theoretical framework and The Methods section describes our research methods. The last three sections present our findings, discussion, and conclusions.

Background: Energy Markets and Energy Storage

The electric power sector has a long history of voluntary coordination among utilities to achieve operational and planning efficiencies (Peskoe, 2021). Investor-owned utilities (IOUs) built interconnected transmission networks and coordinated operations through what are often referred to as regional power pools. These voluntary industry agreements were used to share reserve capacity, exchange excess low-cost electricity, and in some cases, to implement joint dispatch of generation resources. By the late 1990s, the United States had 17 large multi-plant utilities with central dispatch, five power pools, and several other “loose” power pools with less formal coordination1 (Cramer and Tschirhart, 1983; U.S. Energy Information Administration, 1998).

This coordination benefited consumers through efficiencies and improved reliability but also created barriers for the growing independent generation market (Peskoe, 2021). To promote competition in power generation and retail service, the electricity sector was restructured (Borenstein and Bushnell, 2015). The power pools and large utilities with central dispatch became central actors in the formation of independent organizations to operate the system (Hogan et al., 1996; Joskow, 1996). Today, seven RTOs are regulated by FERC as they manage approximately 70% of U.S. electricity sales through transmission planning, operations, and administration of multilateral wholesale electricity markets (U.S. Energy Information Administration, 2013). Of these seven RTOs, six emerged from existing agreements among IOUs to coordinate operations through central dispatch (Boulden, 2016).

RTO governance is shaped by these historical institutional relationships and concepts established in three FERC rulemakings. Order 888 provides a foundation for the voluntary formation of RTOs and requires fair and non-discriminatory rules of governance (Federal Energy Regulatory Commission, 1997). Order 2000 requires each RTO to maintain a decision-making process that is independent of control by any class of market participants. Order 719 requires RTOs to ensure ongoing responsiveness to customers and other stakeholders (Federal Energy Regulatory Commission, 2000, 2008). The resulting RTO governance designs vary across regions with differences in participation, communication and information sharing, and collective decision-making practices.

These RTO governance structures that developed to support restructuring and a growing independent power producer market segment are now confronting the complexity of integrating innovative technical capabilities, novel business models, and increasingly diverse stakeholders. RTO stakeholder engagement processes, market participation models, and market rules were originally designed to accommodate centralized generation, long-distance transmission, and transmission-dependent distribution utilities. Stakeholders are typically grouped into sectors according to the services provided, for example, transmission, generation, or distribution, or according to traditional business models, such as investor-owned utilities or electric cooperatives. Within this structure, some services such as generation, are fully traded in markets, whereas, other services such as transmission, are based on cost-of-service rates and other services such as primary frequency response are, for the most part, uncompensated (Sioshansi et al., 2012). As a resource that provides multiple services at different points in time, energy storage presents unique challenges to these institutional designs.

In the United States, energy storage is a $1.5 billion annual market and is projected to grow from 1.2 GW to 7 GW between 2020 and 2025 (Wood Mackenzie Power and Renewables/Energy Storage Association, 2020). Eight states have targets for energy storage deployment and ten states have grants, rebates, tax incentives, or other programs to encourage storage deployment (North Carolina Clean Energy Technology Center, 2021). Much of this deployment is anticipated to earn a substantial share of its revenue through markets designed and operated by RTOs. Storage can be used to shift power production from periods with low prices to periods with higher prices (i.e., energy arbitrage), supply power at times of peak load, provide fast ramping to complement rapid increases and decreases in variable renewable generation, improve transmission efficiency, avoid or defer transmission investments through targeted local power supply that relieves congestion, and provide ancillary services that support grid stability (Victor et al., 2019; Denholm et al., 2020). In practice, most legacy pumped-storage plants are deployed and operated based on a single value stream. However, new technologies, such as batteries or flywheels, can rapidly alternate between generation and charging but have lower overall capacity and shorter discharge times. Storage optimization studies find that “stacking benefits” across multiple value streams, including energy, capacity, and ancillary services can significantly increase revenue relative to a single value stream (Chang et al., 2014; Hledik et al., 2017). Because storage can provide many different grid services, can interconnect to the transmission or distribution system, and can be deployed at a wide range of scales with different power capacities and discharge durations, it crosses asset classes and has different operational capabilities and limitations than other resources (Akhil et al., 2013; Albertus et al., 2020).

In recent years, FERC has taken steps to open opportunities for storage to participate in restructured markets (see Orders 890, 719, 755, 764, 792, 825, 845, and 2222), with the most explicit action being Order 841: Electric Storage Participation in Markets Operated by Regional Transmission Organizations and Independent System Operators. This rulemaking was initiated by FERC, under Section 206 of the Federal Power Act (FPA), based on its finding that then-existing RTO market rules were “unjust and unreasonable in light of barriers that they present to the participation of electric storage resources in the RTO/ISO markets” (Federal Energy Regulatory Commission, 2018, p. 1). Specifically, FERC found that market participation rules designed for traditional resources limit the range of services that emerging technologies can provide. For example, in several of the RTO markets, storage was limited to a single market service such as frequency regulation. This final rule has been described as a “landmark” order and an “enormous step” for energy storage with the potential to create major new opportunities by opening access to energy, capacity, and ancillary services markets (Energy Storage Association, 2019; St. John, 2020b). RTOs implementing this administrative policy are required to negotiate diverse interests and develop novel market designs with important implications for the sustainability, affordability, and resilience of regional electricity grids. These implementation processes provide rich case studies for examining the relationship between RTO governance design, stakeholder participation, and market rule outcomes.

Theoretical Framework: Structural Power and Stability in Energy System Governance

The decision-making processes and dynamics of regional wholesale market design have received less research attention than the economic and legal aspects of electricity sector restructuring. The need for a better understanding of RTO governance is highlighted by studies identifying concerns regarding RTO institutional structures and public interest accountability (Dworkin and Goldwasser, 2007; Kavulla, 2019; Simeone, 2021), the balance of decision-making power between state and federal regulators (Dennis et al., 2016; Chen and Murnan, 2019), and the ability to further state clean energy policy goals (Cullenward and Welton, 2018; Welton S., 2021). Responding to this need, we examine RTO governance through the lens of institutional design and power to shed light on the politics of sustainability transitions.

A growing body of research recognizes sustainable energy transitions as highly contested involving political power and policy influence (Avelino, 2017; Köhrsen, 2018; Stokes and Breetz, 2018; Brisbois et al., 2019; Hess, 2019). Drawing on institutional theory, transitions research seeks to understand and accelerate system change by examining the structures that influence collective action, such as rules, norms, values, or practices and the degree to which these structures are institutionalized (Geels and Shot, 2010; Geels, 2011; Fuenfschilling and Truffer, 2014). A strategic action field perspective extends this work by focusing attention on the differences in the power among collective actors and the contribution of ongoing contentions and strategic actions to processes of change and stability (Fligstein and McAdam, 2011, 2012; Kungl and Hess, 2021).

Within this theoretical framework for institutions and power, researchers seeking to understand how politics and policy influence can acceleration energy transitions have begun to focus on the mechanisms that explain how effects are produced in contested institutional processes (Roberts et al., 2018). These underlying mechanisms are often conceptualized as an interplay of interests, collective identity, and shared ideas (Kern, 2011; Scott, 2014; Lockwood et al., 2019). Interests and incentives create path dependence through positive feedback. Collective identity forms through social entanglements and commitments created and reinforced by institutional structures such as rules, procedures, and norms. Shared ideas create taken-for-granted assumptions that shape debates and behaviors (Scott, 2014). These mechanisms can create positive feedback effects and institutional stability, particularly when processes are complex and opaque making it difficult to determine whether or not the institutional processes are performing as intended (Pierson, 1993; Lockwood et al., 2015). Integrating research on energy transitions and politics, Brisbois (2019) aligns these general mechanisms with conceptualizations of power and identifies a finer-grain set of mechanisms through which power dynamics can operate in energy policy processes. This research highlights that structural power associated with institutional design and collective commitments can manifest through the dynamics of how actor groups are positioned, influence on the relevant knowledge and information used in processes, and influence on problem framing and agenda setting (Brisbois, 2019).

Applying these concepts, our study aims to understand the dynamics of interorganizational governance in the implementation of a particular highly technical program intervention to integrate storage technologies into RTO markets. RTOs can be considered hybrid organizations that mix institutional logics and practices to allow translation of ideas across boundaries in a diverse field of interdependent organizations (Scott, 2014; Nelson-Marsh, 2017). RTOs operate in organizational fields encompassing legacy electricity sector actors, new market entrants, and increasingly diverse consumer interests while also being situated at an intersection of state and federal regulation and policy. While in some cases RTOs are participating in implementing state clean energy policies (Stafford and Wilson, 2016), in others, the interface with state policy is less clear and a source of contestation (Cullenward and Welton, 2018).

Given our interest in understanding the political implication of observed variations in RTO governance, we seek to identify the mechanisms that describe the relationship between institutional design and outcome in terms of market rules for storage. To support this empirical work, we examine the political and economic characteristics that establish institutional relationships within the field and the institutional logic for each RTO in our study including organizational form/ownership, extent of regulatory restructuring, existing generation mix, and identity. Additionally, we examine how actors are positioned (or excluded) within and across groups, the venues for incorporating relevant new knowledge and information, and the actors and processes that control problem framing, agenda setting, and pace of decision making. The overall aim is to assess whether there is evidence that institutional design allows legacy electricity sector actors to exercise structural power and whether positive feedback is acting as a source of institutional stability and preventing change needed to accelerate sustainability transitions.

Methods

Because we are interested in how institutional design influences stakeholder participation and market outcomes, this paper examines cases of RTOs with diverse institutional designs implementing similar market reforms over the same time period. Specifically, we trace decision-making for storage market participation rules through the stakeholder engagement processes of three RTOs with different political and economic characteristics and different governance structures.

Case Selection

Our research relies on case studies to understand the dynamics of administrative policy change in RTOs as they unfold in practice (Stake, 2005). We use our theoretical framework to focus on the causal mechanisms within particular cases and use process tracing to investigate specific propositions about evidence that contribute to our understanding of the relationships between structures, actors, and outcomes (Beach and Brun, 2019). In this study, we are specifically focused on theory-testing. Drawing on the theoretical discussion in Theoretical Framework: Structural Power and Stability in Energy System Governance section, we conceptualize the mechanisms that contribute to structural power and institutional stability and develop propositions about evidence for our research. Specifically, we are interested in RTO market stakeholders and state actors and the activities of constructing economic and political interests, forming sectors and coalitions, sharing of relevant knowledge and information, and controlling problem framings and pace of decisions.

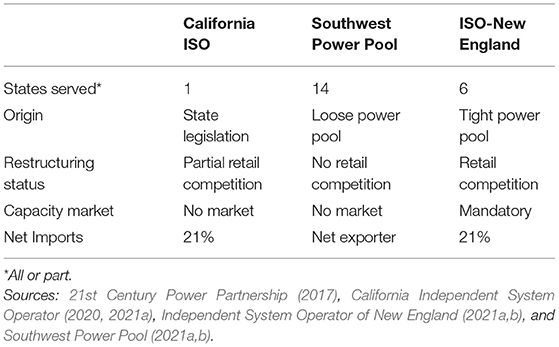

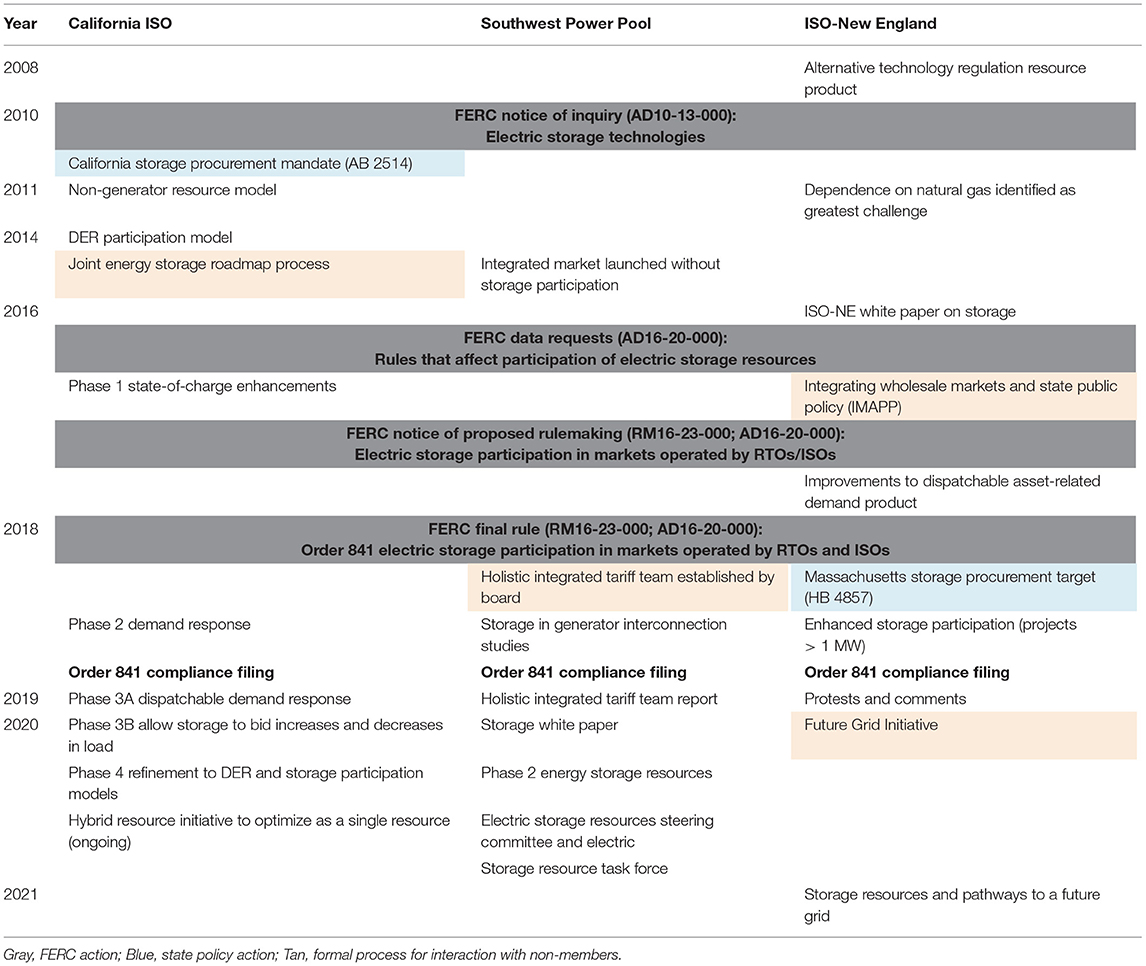

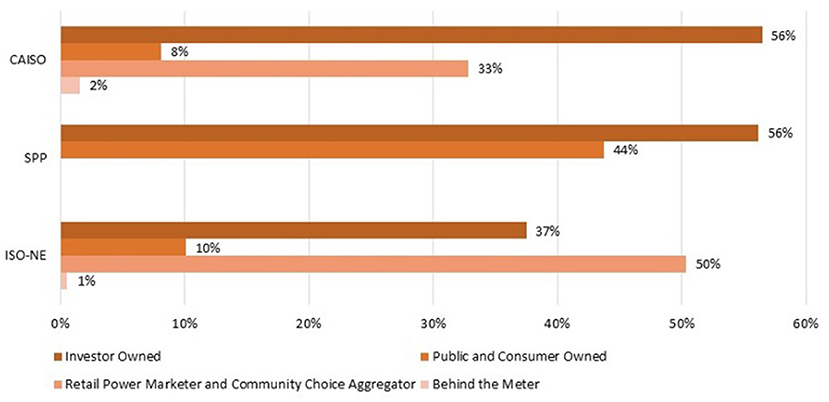

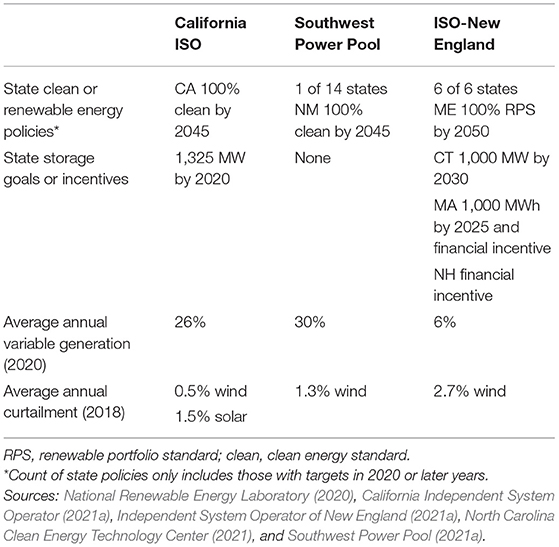

To trace these dynamics, we develop longitudinal case studies over approximately a decade for three RTOs: CAISO, SPP, and ISO-NE. The cases briefly present the history of market rule development related to storage technologies before, during, and after issuance of FERC Order 841 with a focus on specific institutional design elements. The RTOs in our study differ across regulatory and market dimensions (Table 1; Figure 1), generation resources and policy contexts (Table 2; Figure 2), and governance structures (explained within our case study findings).

Figure 1. Share of annual megawatthours of sales by ownership type for selected regional transmission organizations. Source: U.S. Energy Information Administration (2020a).

Table 2. State energy policies, variable renewable generation, and curtailment across selected regional transmission organizations.

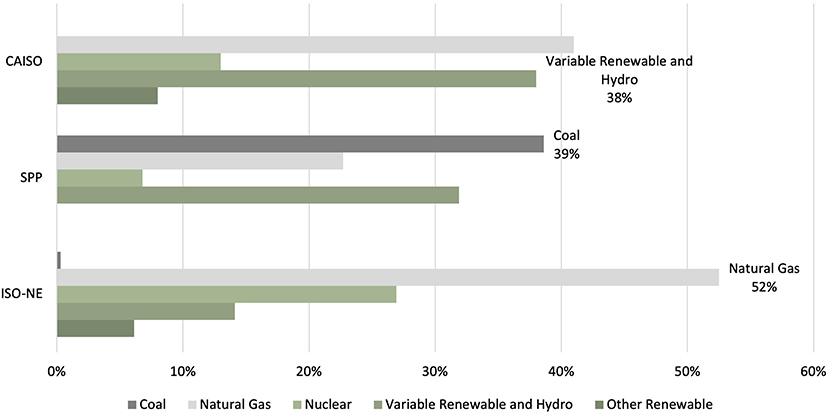

Figure 2. Share of energy generation by resource for selected regional transmission organizations. Sources: California Independent System Operator (2021a); Independent System Operator of New England (2021b); Southwest Power Pool (2021a).

Of the three study sites, CAISO operates within the most coherent regulatory and policy context. CAISO serves a single state and is established in state statute (California AB 1890). The California market is partially restructured allowing market competition for industrial and commercial customers and community choice aggregation (Figure 1). Planning for resource adequacy is done through bilateral contracts, rather than a centralized capacity market. California has been a leader in setting aggressive clean energy policy goals with a current target of 100% clean energy by 2045 and a storage capacity target of 1,325 MW by 2020. Variable renewables comprise ~ 26% of average annual energy production and curtailment rates for wind and solar are 0.5 and 1.5%, respectively (Table 2). Overall, the dominant energy resources in CAISO are renewables balanced with natural gas (Figure 2).

SPP operates in a multi-state context with limited electricity market restructuring and few clean energy policy goals. It serves all or part of 14 states and a relatively large share of public and electric cooperative utilities that fall outside the purview of state rate regulation. The states served by SPP do not offer retail power choice and they have retained authority over resource adequacy planning. SPP retail sales are managed by vertically integrated and consumer-owned public or cooperative utilities and SPP does not operate a capacity market (Figure 1). The SPP market is new relative to other RTOs. It began operating as an energy imbalance market in 2007 and added day-ahead energy and operating reserve markets in 2014. Following this expansion of services, the SPP footprint almost doubled with the addition of three public power utilities (Sawyer, 2016). Of the 14 states served by SPP, New Mexico is the only one with an active clean or renewable electricity policy. None of the states within the SPP footprint have implemented storage policy goals (Table 2). Although coal represents the largest energy generation source within the SPP market, wind accounts for nearly 30% of generation and now exceeds its use of natural gas (Figure 2).

Of the three study sites, ISO-NE operates with the greatest degree of market restructuring. It has almost fully transitioned to independent power producers for generation and five of the six states allow competitive retail power marketing, with Vermont being the exception (Figure 1). ISO-NE was created by the New England Power Pool (NEPOOL), and it is one of three RTOs with a mandatory capacity market (Independent System Operator of New England, 2019). This highly restructured regulatory context operates alongside a range of state energy policy goals. All six states served by ISO-NE have active renewable portfolio standards (RPS). Moreover, Massachusetts has a target of 1,000 MWh of installed energy storage by 2025 and Connecticut has a target of 1,000 MW of energy storage by 2030. Despite these policy goals, variable renewable resources only comprise 6% of the average annual energy generation managed ISO-NE and the ISO has a 2.7% curtailment rate for wind resources (Table 2). Overall, the generation mix is heavily reliant on natural gas (Figure 2).

Data Collection and Analysis

The timelines and mechanisms for each case study were developed from primary sources and documents including market rule proposals, stakeholder comments, and white papers in RTO archives; filings in FERC proceedings; and semi-structured interviews with RTO staff and stakeholders. To evaluate institutional design differences and the impact on storage market rules, we reconstruct actions, recommendations, and decisions, with a focus on identifying the sequence of events occurring contemporaneously in parallel RTO actions. We then examine evidence of why and how an RTO as a collective actor made decisions about storage market rules and we identified the temporal and procedural aspects of the policy design process.

From March 2020 through May 2021, we conducted 41 interviews with practitioners engaged with CAISO (14 interviewees), SPP (14 interviewees), and ISO-NE (13 interviewees) (see Supplementary Appendix 1). The recruitment strategy targeted experts involved in RTO processes; purposeful sampling was conducted to ensure distribution across stakeholder sectors. Interviews were conducted via video and/or audio calls and typically lasted between 30 mins to 1 h. The interviews were guided by 10 primary questions that allowed us to ask practitioners about access to decision-making processes, representation, whether engagement opportunities are meaningful, the ability for different participants to influence decision-making, and recommendations for process changes (see Supplementary Appendix 1).

Data analysis for the interviews used an iterative coding process (Saldana, 2009). We began coding guided by our research interest in institutional logic, breadth of participation, information sharing, approach to communication and collective decisions, procedural design and fairness, and organizational adaptive capacity. Subsequent cycles of coding reorganized the codes to create seven categories that support our themes (see Supplementary Appendix 1).

Findings

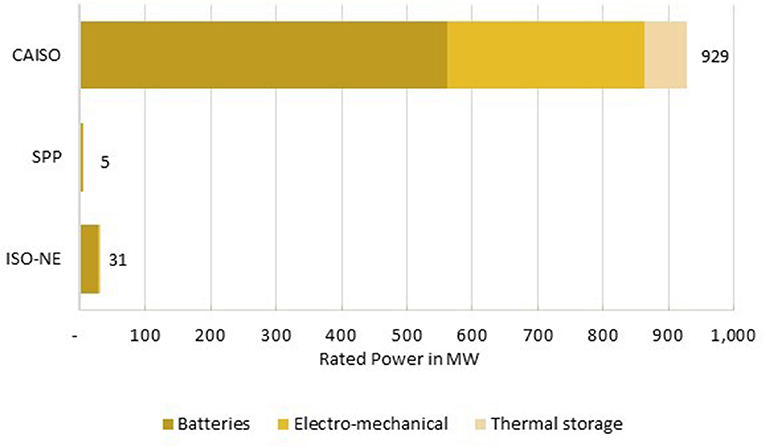

In the United States, the expansion of grid-connected storage has been uneven across the country. Pumped-storage hydroelectric power is the most common form of energy storage. Currently, 42 pumped storage projects provide 22,800 MW of capacity, representing ~ 90% of the existing U.S. storage capacity (National Technology & Engineering Sciences of Sandia, LLC, 2020; U.S. Energy Information Administration, 2020a,b). Most of these plants were developed in the 1970s and 1980s and are concentrated in five states. In our case study sites, three pumped storage projects provide 1,719 MW of capacity in the CAISO region with several other projects announced or commissioned and two pumped storage projects providing 2,312 MW of capacity in ISO-NE with one additional small project commissioned. The SPP region has one 260 MW non-dispatchable pumped-storage project. The more recent expansion of batteries, electro-mechanical storage (e.g., flywheels and compressed air), and thermal storage is also unevenly distributed. In our case study sites, the capacity from storage resources, excluding pumped storage, ranges from 5 MW in SPP to more than 900 MW in CAISO (Figure 3).

Figure 3. Rated power of energy storage projects by regional transmission organizations in 2020 (MW)*. *Excludes pumped-storage hydroelectric projects. Sources: National Technology & Engineering Sciences of Sandia, LLC, 2020.

The integration of storage into RTO markets has also evolved in different ways. Typically, a defined participation model, associated technical requirements, and other market rules determine how a resource can engage in an RTO market. However, each RTO develops these rules through its own institutional processes and is building off a different foundation of market and governance design as it responds to market demands, stakeholder interests, and regulatory requirements.

In 2010, FERC opened a notice of inquiry seeking comments on storage uses and issues. This was followed by a 2016 data request regarding storage treatment within existing market rules and later in the same year a notice of proposed rulemaking (NOPR) on electric storage market participation. FERC found that while storage resources are already providing energy and ancillary services in some markets, they do so through participation models designed for other technologies or models that limit the full range of services that storage can provide. Based on these barriers, FERC found that the existing rules discriminated against energy storage resources and it took action under Section 206 of the FPA requiring RTOs to enable storage resources located on the interstate transmission system, on a distribution system, or behind-the-meter to participate to the full extent of each storage technology's capabilities (Federal Energy Regulatory Commission, 2018). Unlike market rule proposals initiated through RTO processes under Section 205 authority, the action taken by FERC under Section 206 includes specific minimum requirements that each RTO is required to meet, to achieve “just and reasonable” and “not unduly discriminatory” market rules.

Concurrent with and following these FERC actions, RTOs were responding to staff and stakeholder concerns and developing proposals through their governance structures. Table 3 highlights FERC actions, state energy storage policy initiatives, RTO engagement in efforts with outside actors, and RTO communication and decision-making actions, with a focus on identifying the sequence of events. The following sections build on this timeline to present our case studies of why and how each RTO made particular decisions about storage market rules.

California Independent System Operator

CAISO describes itself as “helping lead the electricity industry's transformation to a cleaner and more reliable grid” (California Independent System Operator, 2020). In our data collection, CAISO governance was characterized as responsive to state policy direction, interactive with stakeholders, resource-intensive, driven by management and staff, and “on the cutting edge” of introducing new technologies into the grid. CAISO has been at the forefront of addressing certain RTO design issues, like transmission planning for renewable resources and storage market participation, with FERC subsequently integrating CAISO approaches into industry-wide rulemakings.

CAISO serves a single state where electricity service is dominated by three large IOUs that own transmission, provide retail services, and own some generation. The RTO Board is appointed by the Governor of California and the RTO has interdependent working relationships with California energy agencies, including the California Public Utilities Commission (CPUC) and the California Energy Commission (CEC). For example, the state's resource adequacy processes involve all three agencies.

Efforts to integrate storage resources into the CAISO market have evolved along with a series of California clean energy statutes. California energy policies include RPS targets that have escalated between 2002 and 2018, a mandate to reduce greenhouse gas emissions, and a target for 100% carbon-free energy by 2045 (SB1078, SB350, AB32, SB100). California's storage mandate for 1,325 MW of new storage by 2024 was allocated across the three major IOUs in the CAISO market. At the time, CAISO lacked market rules to efficiently value storage products.

Between 2011 and 2014, CAISO established a non-generator resource participation model, reviewed storage interconnection requirements, and developed rules to allow small storage resource aggregation. In 2014, CAISO and two state energy agencies (i.e., the CPUC, and the CEC) developed a joint Energy Storage Roadmap to facilitate storage deployment in support of California's energy and environmental policy goals. The roadmap process included outreach to solicit input from any interested stakeholder through an online survey, emails, and interviews of selected stakeholders. The roadmap generated a high level of interest with 400–500 stakeholders participating in the initial workshop, 131 survey respondents, and 36 different entities submitting background information and written comments. These ideas were used in an iterative process of developing summary reports and draft documents, facilitating workshop discussions, and soliciting written stakeholder comments. The roadmap was used to identify issues to be taken up in standard decision-making venues. In 2015, CAISO furthered the work of the Energy Storage Roadmap through a stakeholder initiative. In explaining this initiative CAISO states, “These resources represent an increasingly important part of the future resource mix and will help lower carbon emissions and provide operational benefits,” (California Independent System Operator, 2021b). The initiative is now in Phase 4 with ongoing work to refine the CAISO storage and distributed energy resource participation models.

CAISO stakeholder engagement processes are ad-hoc, open to any interested organization or individual, and subject to California open meeting and open record statutes. Agendas, minutes, written stakeholder comments, and often responses and meeting recordings are available to the public. CAISO staff support the stakeholder process and move the discussion through an iterative progression of straw proposals, comments, and revisions. Stakeholders comment but do not cast a vote on proposals; ultimately the Board files proposed market rule and other tariff changes with FERC (California Independent System Operator, 2015). Market participants, CPUC staff, and for selected topics, civil society and environmental organizations are regular participants in the meetings.

Communication and information exchange in these meetings flows largely from CAISO staff to stakeholders, with limited dialogue among stakeholders during formal meetings. In our data collection, respondents explained that while they found the process to be fair, priorities are developed based on consideration of political influence, stakeholder expertise, FERC regulatory constraints, data and technology capabilities, and having “skin in the game.” Stakeholders also explain that these initiatives are not rigorous legal proceedings with associated due process, rather having conversations with CAISO staff and management outside of the stakeholder meetings and having conversations with other stakeholders is an important part of the overall process and essential for explaining unique positions and operating practices. While some stakeholders that compete with the dominant actors do not feel heard in the process (Respondent 315), other stakeholders prefer the open opportunity to share information. As an NGO stakeholder stated:

“I… have much more influence comparatively speaking at CAISO than I have at an [RTO like SPP], where I'm sort of looped into a very bureaucratic convoluted membership structure, and kind of placed at the bottom of the barrel” (Respondent 342).

When FERC issued the NOPR for electric storage participation, CAISO had already developed storage and distributed energy resources participation models (California Independent System Operator, 2017). CAISO's Order 841 compliance filing reduced the minimum size requirement for storage participation, but otherwise included few changes. Despite these efforts, the full integration of storage into the CASIO market, planning, and operations requires more work:

“With the potential of hybridization that includes storage, you now have the ability to create what some people call perfect resources… But the rules and the incentives right now are not right for them. It's too complicated.” (Respondent 301)

Barriers to storage participation continue to persist in the CAISO market. For example, further refinements are needed to allow owners to manage the operation of hybrid energy resources that pair storage with generation. Moreover, the division of responsibilities across California agencies creates uncertainty for storage developers and storage has yet to be fully considered in the resource adequacy regime or transmission planning. These new challenges require diverse stakeholder engagement. As one industry representative explained: “We are starting to run into issues that no one has run into before and that requires a lot of engagement” (Respondent 192). These issues extend beyond traditional RTO stakeholders and require more explicit consideration of the relationship between FERC and state regulators. Some stakeholders argue that questions around coordination and communication are not being discussed broadly enough. Instead, each utility is figuring out its future, which is suboptimal and fails to consider reform of the decision-making process itself (Respondent 301).

Southwest Power Pool

SPP is often referred to as an RTO that listens to its members. It places a high value on the “power of relationships” many of which have been in place since the power pool was formed 80 years ago (Sawyer, 2016). In our data collection, SPP governance is characterized as responsive to members, slow to implement change, and seeking unity in decisions. Success is often measured by avoiding conflict at FERC. It operates with an accessible board, open interactions with state regulators, limited use of sector representation, and authority vested in membership. Members can participate in all meetings, take on a wide range of leadership responsibilities, and vote on market rule changes. In contrast, non-members can participate in most meetings, but cannot initiate rule revisions, nor can they chair committees, participate in workgroups, or vote. Furthermore, Board deference to members limits the influence of such non-member participation.

SPP serves a region that has not restructured retail markets but instead relies on state regulation of retail rates and regional coordination of resource adequacy (21st Century Power Partnership, 2017). In this regulatory setting, the “turf” utilities are trying to protect is broader and more directly influenced by state regulators than in some other regional markets. The SPP Regional States Committee (RSC) provides collective input from 11 state regulatory bodies. It is supported by SPP staff and participates in board meetings, committees, and workgroups. SPP bylaws grant the RSC authority over cost allocation, financial transmission rights, planning for remote resources, and regional resource adequacy. RSC policy determinations on these issues are filed by SPP, and if warranted, SPP may file a competing proposal (Southwest Power Pool, 2019a). The RSC considers state policy as it develops proposals. For example, in 2009 it considered state RPS requirements in the development of a wind cost allocation methodology (Hinton, 2019).

FERC's storage rulemaking largely preceded SPP efforts to align market design with storage capabilities. In the mid-2010s, the only storage in the SPP market was a 260 MW pumped-storage hydroelectric plant that was not dispatched (National Technology & Engineering Sciences of Sandia, LLC, 2020). Moreover, although wind resource participation in the market was growing rapidly, the region was just beginning to explore how storage could help balance this shift in the generation mix.

SPP began working on a storage participation model following the FERC NOPR on storage (Southwest Power Pool, 2016). The SPP Market Working Group, a standing group of between 8 and 18 members with a balance between transmission-owning and transmission-using members, led this initiative. Between August and December of 2018, the workgroup organized a stakeholder education session and developed rule revisions. The proposed rule changes were reviewed and approved by three other standing workgroups before proceeding to the Markets and Operations Policy Committee. This high-level committee includes a representative for each SPP member and uses super-majority voting across transmission-owning and transmission-using sectors. Following approval by the members, final approval for filing with FERC was granted by the Board in a joint meeting with the Members Committee, which is comprised of representation across 10 sector designations. In contrast to a typical SPP stakeholder process with members determining priorities and pace of decision-making, stakeholders described the process for Order 841 compliance as heavily driven by staff and going further than what stakeholders wanted to implement within the available timeframe. Additionally, the timing of implementation was delayed in part due to needed software changes.

Communication and information exchange in these meetings involves deliberation among participants, with questions, responses, and “room to compromise or reach a totally different solution” (Respondent 240). The Board is relatively open and accessible. It holds joint meetings with members and state regulatory representatives and board members regularly attend committee meetings. Yet, some interests, particularly consumer, energy efficiency, and clean energy interests, have not been at the table. In our data collection, some stakeholders suggested that there are “wide gaps between those who have lots of influence and those who have much less influence” (Respondent 248) and that initiatives are driven by large utilities (Respondent 244). Moreover, some stakeholders expressed concern that market changes and a greater diversity of interests are making it more difficult to reach consensus. These changes are perceived to be contributing to a larger role for staff and more conflicts in FERC proceedings. In our data collection, stakeholders had opposing views on these challenges. One perspective is that the governance structure needs to give more voting weight to those who “bring the most to the table—generation, transmission, and load,” whereas, the other perspective is that broader representation, more independence from transmission utilities, or more assertive action by the Board is needed to adapt to changing conditions and emerging technologies. As one non-member new market entrant noted:

“You do actually substantially need market participants to comment on, lead and share their experience, not only from their own personal competitive positions for their business but they're also often bringing solutions.” (Respondent 503)

Alongside Order 841 implementation, the Board established a Holistic Integrated Tariff Team (HITT) to address the challenges of a shifting generation mix, new technologies, state policy, and economic development opportunities. An important driving factor for this initiative was that wind as a share of annual energy generation increased from 6 to 18% between 2011 and 2018 (Southwest Power Pool Market Monitoring Unit, 2012). The HITT included 15 members representing the Board, the RSC, membership, and senior staff, and it was charged with developing high-level recommendations. This was a departure from typical member-driven practices in that the Board “took the reins” (Respondent 405). Stakeholders were allowed to listen to HITT meetings, but participation was only by invitation. For the HITT members, this structure provided opportunities for information sharing, communication, and deliberation on a broad range of issues. However, the departure from open discussions raised concerns among other SPP members and non-members.

The final HITT report identified storage as a priority. A few of the recommendations are specific to storage, such as evaluating the use of storage to alleviate transmission constraints. However, many of the recommendations are technology-neutral approaches to improve reliability, market design, planning, and cost-allocation in a context with new technologies, resources, and goals (Southwest Power Pool, 2019b). These improvements will further enable storage to participate in the market and are an important step in the right direction from the perspective of some technology developers. For example, SPP is currently developing ancillary services and ramping products to help address the difficulty of balancing wind with old inflexible coal plants. Moreover, following the initial set of HITT recommendations, SPP has taken several steps directed specifically at integrating storage. In 2020, SPP released a storage white paper and launched an energy storage roadmap. This was quickly followed by the creation of an Electric Storage Resources Steering Committee and an Electric Storages Resources Task Force.

Independent System Operator of New England

ISO-NE describes itself as “responsible for keeping electricity flowing across the six New England states and ensuring that the region has reliable, competitively priced wholesale electricity today and into the future” (Independent System Operator of New England, 2021b). In our data collection, ISO-NE was characterized as focused on reliability, an efficient competitive market, and precise price formation. Governance was described as a collegial “insider's game,” conservative, strongly influenced by incumbents, and requiring consistent participation to be effective. Participants know each other's positions, exchange information, and engage in bargaining and negotiation to develop market rules.

ISO-NE serves one of the most fully restructured regions in the country, comprised of six states that have been coordinating outages, system planning, and dispatch since the early 1970s through the New England Power Pool (NEPOOL). When the region restructured the electricity sector, NEPOOL created the ISO and NEPOOL continues to serve as the stakeholder advisory group. This organizational separation contributes to a reliance on FERC as a backstop authority. For example, although ISO-NE staff are heavily involved in running the stakeholder process, producing information, and drafting tariff changes, NEPOOL has its own staff and legal counsel giving it the capacity for independent review of issues and development of competing tariff changes that are filed with FERC if they receive approval through NEPOOL sector-weighted voting.

ISO-NE has largely approached storage market participation as a modification to existing practice. Two large pumped-storage hydroelectric facilities have operated in the region since the 1970s and market rules designed around this early technology allow storage to participate as either generation or load, with a single facility able to participate through both models (Independent System Operator of New England, 2016). However, these rules don't consider the capabilities of battery storage, next-generation pumped-storage hydroelectric technology, or other advanced storage technologies.

The future of storage resources in ISO-NE is intertwined with two issues that have dominated recent attention in ISO-NE market design: natural gas dependence and public policy resources. In ISO-NE, the share of annual average energy generation from natural gas increased from 6% to more than 50% between 1990 and 2012, with the current share at 53% (Independent System Operator of New England, 2021a). Alongside this shift toward natural gas, all six of the New England states adopted clean energy policies. By 2015, the region was in a contentious dialogue around the market integration challenges of “public policy resources” that receive state economic support or incentives (Chairman's Opening Remarks NEPOOL IMAPP Initiative, 2016). By 2018 when FERC finalized Order 841, each of the six states in New England also had specific incentives for energy storage.

When FERC moved forward with the storage rulemaking, ISO-NE sought to maintain its conventional view of market participation as either generation or demand. It commented that:

“ISO-NE is deeply concerned that the Commission's emphasis on ‘participation models' and market participant types is inconsistent with ISO-NE's core market design objective to focus on products rather than participant types” (Independent System Operator of New England, 2016, p. 12; 2).

Despite these concerns, as the implementation of Order 841 moved forward, ISO-NE created an Enhanced Storage Participation model. NEPOOL used its standard processes to engaged members in two storage initiatives between April and October of 2018, one to create a storage participation model and another to address remaining compliance issues delayed due to data system constraints. The initiatives were first reviewed and amended by standing technical committees—markets, reliability, and transmission—composed of representatives from each membership sector. The initiatives were then considered by the Participants Committee, a plenary committee of all NEPOOL voting members. The Committee serves in an advisory role to ISO-NE and uses weighted voting across six sectors (Independent System Operator of New England, 2007, 2017).

The Participants Committee approved the enhanced storage participation rules through a consent agenda and the Order 841 compliance rules with one vote in opposition and two abstentions. Sector representatives that voted to support, oppose, and abstain all noted concerns with provisions that would automatically redeclare storage resource operating limits. This filing resulted in protests at FERC and subsequent rule revisions.

Communication and information exchange in these meetings is managed by ISO-NE and NEPOOL staff who control which topics are on the agenda for discussion and how information is presented. NEPOOL stakeholder engagement is open to members but can be difficult for non-members who have more limited access to information. Once a topic has been opened for discussion there is a high level of informal exchange among stakeholders to understand implications, positions, and build voting coalitions. To be credible in this process a stakeholder needs to “show up on a regular basis, meet some of the people, and show that you're competent on the subject matter” (Respondent 401). As a result, well-resourced participants, such as large asset owners, often have a “strong and influential voice” and state policy representatives can be influential, whereas consumer interests are considered not well represented. Within this context, new market entrants may strategically focus on relatively narrow issues with immediate financial implications like delays in the interconnection process, rather than working to develop market rules around a complex issue like fast frequency response (Respondent 195).

NEPOOL voting is strategic and symbolic. Stakeholders trade votes for support on future issues and use voting to signal individual and collective positions.

I'm very careful with how I vote because—It's symbolic about where I stand on the issue, it impacts alliances and stakeholder relationships. You have to be really careful about what you're coming out strongly against and what you're not because you need these people to vote on your stuff later on” (Respondent 403)

Yet, these votes are seen by many stakeholders as simply signaling stakeholder positions for ISO-NE. Several stakeholders stated that the process of translating votes into specific market rules lacks transparency and is not constrained by stakeholder votes.

“[ISO-NE] drafts what they're going to draft … and participants are left to decide whether to support whatever they're doing or to go to FERC and try to get changes that they weren't able to get through the participants' process” (Respondent 179)

Despite compliance with Order 841, storage developers continue to experience technical issues limiting participation. For example, as in other regional markets, hybrid storage and generation projects are looking to be treated as a single resource with the owner or operator managing market risk. Also, stakeholders are suggesting the need for a more agile process and new venues to encourage discussion among market participants, new market entrants, transmission grid operators, distribution service providers, and state policymakers. To this end, attention is now focused on a Future Grid Initiative considering how to align policy goals and market rules in a highly decarbonized and distributed future. This initiative is using new organizational structures that enable joint meetings of the NEPOOL standing committees and bring ISO-NE, NEPOOL, and the states into a common process.

Interconnection of Storage

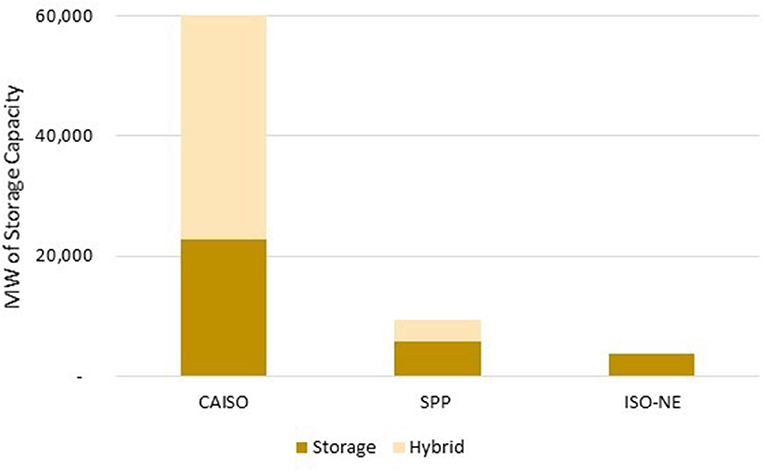

The three RTOs in our study took different approaches in developing market rules to enable storage participation, varied in the modifications made to institutional designs, and have experienced different outcomes in terms of new storage projects seeking interconnection (Figure 4). CAISO has a relatively large amount of interconnected storage but leads in new projects seeking interconnection. SPP has shifted its position from having the lowest amount of interconnected storage among the three studied RTOs. While ISO-NE has not had an increase in the number of projects seeking interconnection, two large storage projects just cleared in the forward capacity market, potentially signaling an opening for storage in this market.

Figure 4. Storage and hybrid (with storage) projects seeking transmission interconnections as of end of 2020. Source: Rand et al. (2021).

Discussion

In guiding RTO governance, FERC emphasizes voluntary participation, regional differences, and the ability for institutions to evolve. The RTO's themselves often voice the importance of regional differences in technologies, resources, and market design and emphasize the need for regional flexibility. The RTOs in this study—CAISO, ISO-NE, and SPP—differ in geographic scope, the extent of regulatory restructuring, and generation resources. Each of these RTOs has a distinct institutional design and is shaped by and shapes different political and economic characteristics. Yet, in comparing these case studies we find common patterns in how institutional arrangements affect the articulation of collective interests and the political dynamics among stakeholders. The emergence of storage technologies and the eventual proactive step by FERC to require new storage participation rules provides a common point at which to compare institutional processes across organizations.

The integration of storage into RTO markets allows us to identify relevant processes that link RTO governance design and energy transition outcomes, as well as the processes that contribute to institutional stability and change. Integrating new storage technologies involves creating new market rules to provide opportunities for non-discriminatory participation in a full range of market services, as well as creating inclusive, fair, representative, and responsive opportunities for storage participation in the governance of the organization. In this context, we compare industry actors, old and new, across these case studies to better understand structural power and institutional stability through four mechanisms drawn from the literature: (1) self-reinforcing interests, (2) participation in and position of groups, (3) influence over communication and information, and (4) control over problem framing and pace of decisions.

Self-Reinforcing Institutional Arrangements for Regulation

The ability of incumbent electric utilities to resist regulatory and institutional changes that threaten their interests has been studied in the United States (Hess, 2014; Stokes, 2020; Peskoe, 2021). Yet, the complexity of institutional arrangements and interests resulting from the partial restructuring of the electricity sector is often overlooked. The IOUs in the CAISO region own transmission, distribution, and some power resources. The California storage mandate requires these utilities to procure specified amounts of storage. Thus, the interests of these utilities have been more aligned with new market entrants and state policy than in other regions, particularly in relation to utility-scale resources. The utilities in the SPP region are also vertically integrated, but the state policy influence and trajectory differ from the CAISO region. SPP serves a multi-state region and a relatively large number of public utilities and cooperatives that are not subject to state rate regulation. The states in the SPP region negotiated a delegation of authority over transmission cost allocation and resource adequacy. Additionally, a committee of state regulators has an established role in the RTO governance structure. In this case, state regulatory participation and influence in RTO governance is embedded in institutional design but requires coordination among the states. Furthermore, unlike the aggressive clean energy agenda in California policy, the states served by SPP have generally not pursued active clean energy or storage policy mandates. In SPP, the expansion of wind resources has been driven largely by economics. Storage providers are primarily seeking contracts with utilities, rather than pursuing independent market participation. In our third case, ISO-NE serves a region that is highly restructured and has a range of state clean energy and storage policy goals. In this region, storage is more often directly competing with incumbent actors. Moreover, the states in this region lack a formal institutionalized role in ISO-NE governance. Rather, the organizations representing states in New England periodically meet with and seek to exert influence through communication with the RTO board and members. In this setting, state policymakers and regulators have relatively less influence compared to industry actors. This has resulted in open conflicts between ISO-NE and state regulators supporting clean energy goals and new technologies. These differences in the institutional arrangements for regulation in each region align with differences in collective identities and dominant logics identified in the cases.

The comparison of these cases indicates that RTO integration of new technologies is facilitated when doing so aligns with the interests of legacy industry actors. This finding is consistent with previous research that suggests self-reinforcing interests contribute to the ability of legacy electricity industry actors to exert influence through strategic action. Importantly, it also expands our understanding of how this mechanism operates in different contexts by highlighting the influence of institutional arrangements for regulation at multiple levels and across different policy systems and functions. Whereas much of the research on the role of government has identified an alignment in the power exerted by incumbent industry and the state (Hess, 2014; Smink et al., 2015; Brisbois and de Loë, 2016), the ISO-NE and SPP cases illustrate the limits of state power in regional settings that cross jurisdictional boundaries.

Misalignment of Participation Structures

Storage has unique technical capabilities and does not fit neatly into existing market participation models, the stakeholder engagement sectors that organize participants, or the standing committees responsible for different decisions. The institutionalization of these structures helps explain the slow pace of change and dynamics among actors (Fuenfschilling and Truffer, 2014). Each of the three RTOs began by allowing storage to participate in existing market products. Initial efforts to modify the products and participation models developed for legacy technologies, including pumped-storage hydroelectricity, left gaps that prevented storage from providing a full range of services. Similarly, efforts to allow participation in governance through the existing membership sectors and committee hierarchies in SPP and ISO-NE have limited the participation and influence of new market entrants in developing the RTO market design, operating practices, or planning processes.

RTOs, other than CAISO, have formal rules for participation in governance and these structures institutionalize how interests are grouped, the relative power of different groups in voting processes, and which stakeholders are included or excluded from conversations. The sectors used to form RTO interest groups evolved from interest alignments formed as the electricity industry sought economic efficiencies and along with legacy technologies that differ from the business models, capabilities, and interests of newer storage technologies. As a result, new market entrants must align with a particular business model or service, such as generation or transmission, despite having capabilities and interests that span existing groups or differ from others in the group. Unaddressed, these structural misalignments create an institutional bias toward incumbent approaches.

Differences in Influence Over Communication and Shared Information

New policy actions, such as the FERC order requiring storage participation rules, could be expected to create positive feedback by empowering different stakeholders and building capacity through new access to decision-makers or new forums (Pierson, 1993). Our cases show an important aspect of this mechanism is the nature of previous practices for communication and information sharing. While the CAISO case study provides support for the classic view of policy feedback, the operation of this mechanism in SPP and ISO-NE differ. In CAISO, communication processes are focused on providing staff with information and new knowledge for decision-making. The emergence of storage as an issue for RTO staff led to new stakeholders gaining influence and ad hoc venues to share knowledge. In contrast, communication processes in SPP, and to an even greater extent in ISO-NE, depend more on communication among stakeholders to building voting coalitions and strategic alliances. In this context, the emergence of storage as an issue within RTO governance requires reconsideration of stakeholder relationships. While SPP did little to engage stakeholders around storage before Order 841, it has since created new governance forums that create opportunities for both information exchange and the development of stakeholder relationships. Thus far, ISO-NE has done little to change access or venues. In this context, storage developers are focusing on narrow issues or developing relationships with stakeholders, such as solar developers, that have existing access and influence in the process. In this case, policy feedback was resisted by incumbent actors.

Control Over the Agenda and Problem-Framing in Highly Technical Settings

Our cases show that the ability to influence problem definitions, the range of solutions considered, and the pace of the process are particularly important in highly technical decision-making venues. The influence of competing ideas is shaped by the ability to define the focus of decision-making processes and the framing of problems and solutions (Breslau, 2013; Hess, 2019; Kungl and Hess, 2021). Stakeholders in each of the studied RTOs describe how some stakeholders are more constrained than others by the time and expertise required to be an influential participant. Highly technical decision-making venues create barriers for some stakeholders, including small organizations, disparate interests, new market entrants, and groups with broad participation, such as consumers. These stakeholders must balance how to engage in processes that require high levels of expertise and a consistent presence with their own available capacity and uncertain gains. Within this context, the RTO boards, in conjunction with management and staff, influence market design through strategic guidance, priority settings, and management of the pace of decision-making. Our cases provide evidence of this influence, as well as differences in the ability of powerful stakeholders to influence problem-framing. For example, in CAISO staff develop the initial problem framing whereas, in other RTOs stakeholders are more directly involved in developing problem statements.

Conclusion

New technologies, business models, and policy priorities require new market participation models and rules, but also require new governance and new institutional designs. This paper compares three case studies of RTO rule development and identifies common mechanisms that describe the relationship between RTO institutional design and market rule outcomes. Across all three RTOs, we identify similar structures and practices shaping administrative rules. Institutional theory suggests that political processes create self-reinforcing feedback mechanisms and are especially difficult to reform because it can be difficult to evaluate how they are performing. This complexity is heightened in highly technical settings. However, a focus on the mechanisms that operate within RTO governance provides insight into needed institutional reform and the findings in this study suggest that RTO stakeholder engagement practices could be strengthened.

State and federal regulators are increasingly being called to address the complexities of energy federalism and the blurring of previously well-defined allocation of authority between state and federal regulators. Central to this challenge is consideration of the institutional designs for the interface between federal and state authority within RTO governance structures. This study highlights how the political and economic characteristics of each region shape the relative influence of different stakeholders. In regional settings that limit the power of state regulators relative to industry actors, FERC needs to re-examine the mechanisms that grant industry actors structural power in RTO processes. The existing diversity of structural relationships between state regulators and RTOs provide accepted examples of alternative arrangements.

Additionally, this study shows that traditional RTO participation structures designed around legacy technologies and to promote market restructuring are not aligned with new market participants and interests. Rather than continuing to grant structural power to incumbent actors by approving these institutional designs, regulators should develop processes to illuminate the details of existing designs. Furthermore, regulators, perhaps through the newly created FERC Office for Public Participation, should also engage in a process with a broad range of stakeholder interests to realign public interests with RTO governance participation rules, sectors, and venues. Finally, in addition to gaining a better understanding of how RTO stakeholder voting regimes operate, more attention should be directed to the procedural mechanisms that affect influence over new knowledge, access to information, priority setting, problem framing, and the pace of decisions. It is possible that providing guidance to and requiring additional accountability of RTO boards may be useful in addressing these procedural mechanisms.

The importance of taking institutional design seriously is underscored by the dynamic nature of energy transitions. Although FERC now requires RTOs to meet minimum storage participation provisions, evolving technological capabilities, policy goals, and community interests will require continued market and governance adaptations. For example, in each of the studied RTOs, market design attention has shifted from storage gaining access to the market to exploring how to integrate hybrid storage and generation projects. Moreover, expanding the discussion to consider the implications of hybrid resources for the transmission-distribution interface has been more difficult. Without additional RTO governance reform, the scale and pace of transition that integrates new technologies and new design for system operations may continue to differ across the RTOs and may continue to diverge from state policy goals. FERC and state regulators could take important action to enable system resilience and sustainability by opening technical conferences and other information-gathering efforts to better understand the technical and legal challenges of this anticipated transformation in grid operations.

Data Availability Statement

The datasets presented in this article are not readily available because only anonymized interview transcriptions may be made available. Requests to access the datasets should be directed to Stephanie Lenhart, stephanielenhart@boisestate.edu.

Ethics Statement

The studies involving human participants were reviewed and approved by Duke University Campus Institutional Review Board. Written informed consent for participation was not required for this study in accordance with the national legislation and the institutional requirements.

Author Contributions

SL designed the study, collected data, conducted participant interviews, conducted data analysis, and wrote manuscript. DF conducted participant interviews. All authors contributed to the article and approved the submitted version.

Funding

This work was supported by the Alfred P. Sloan Foundation (G-2019-12335), the Heising-Simons Foundation, and the Energy Policy Institute/Center for Advanced Energy Studies (CAES).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Acknowledgments

We thank participants at the RTO Governance Workshops, the Nicholas Institute for Environmental Policy Solutions at Duke University and the Center for Energy Law and Policy at Pennsylvania State University, for their comments and suggestions.

Supplementary Material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fclim.2021.749021/full#supplementary-material

Abbreviations

CAISO, California Independent System Operator; FERC, Federal Energy Regulatory Commission; FPA, Federal Power Act; IOU, investor-owned utility; ISO-NE, Independent System Operator of New England; NOPR, Notice of Proposed Rulemaking; SPP, Southwest Power Pool; RPS, renewable portfolio standard; RSC, Regional States Committee; RTO, independent system operator and regional transmission operator.

Footnotes

1. ^Power pools coordinate a range of activities. A distinction is often made between “tight” power pools that coordinate operations through central dispatch and “loose” power pools that coordinate some services, but do not have central dispatch.

References

21st Century Power Partnership (2017). An Introduction to Retail Electricity Choice in the United States. Golden, CO: National Renewable Energy Lab (NREL).

Akhil, A. A., Huff, G., Currier, A. B., Kaun, B. C., Rastler, D. M., Chen, S. B., et al. (2013). DOE/EPRI 2013 Electricity Storage Handbook in Collaboration with NRECA. Albuquerque, NM: Sandia National Laboratories.

Albertus, P., Manser, J. S., and Litzelman, S. (2020). Long-duration electricity storage applications, economics, and technologies. Joule 4, 21–32. doi: 10.1016/j.joule.2019.11.009

Avelino, F. (2017). Power in sustainability transitions: analysing power and (dis)empowerment in transformative change towards sustainability. Environ. Policy Gov. 27, 505–520. doi: 10.1002/eet.1777

Baldwin, E. (2018). From regulation to governance in the electric sector. Curr. Sustain. Energy Rep. 5, 86–92. doi: 10.1007/s40518-018-0102-z

Baldwin, E., and Tang, T. (2021). Hierarchies, markets, and collaborative networks in energy governance: multilevel drivers of renewable energy deployment. J. Environ. Manage. 290:112614. doi: 10.1016/j.jenvman.2021.112614

Beach, D., and Brun, P. R. (2019). Process-Tracing Methods: Foundations and Guidelines. Second. Ann Arbor, MI: University of Michigan Press.

Blumsack, S. (2007). Measuring the benefits and costs of regional electric grid integration. Energy Law J. 28:147. Available online at: https://heinonline-org.libproxy.boisestate.edu/HOL/P?h=hein.journals/energy28&i=153

Borenstein, S., and Bushnell, J. (2015). The U.S. electricity industry after 20 years of restructuring. Annu. Rev. Econom. 7, 437–463. doi: 10.1146/annurev-economics-080614-115630

Boulden, J. (2016). 75 years of relationship-powered energy. Arkansas Living Mag. Available online at: https://arkansaslivingmagazine.com/article/75-years-of-relationship-powered-energy/ (accessed October 30, 2021).

Breetz, H., Mildenberger, M., and Stokes, L. (2018). The political logics of clean energy transitions. Bus. Polit. 20, 492–522. doi: 10.1017/bap.2018.14

Breslau, D. (2013). Designing a market-like entity: economics in the politics of market formation. Soc. Stud. Sci. 43, 829–851. doi: 10.1177/0306312713493962

Brisbois, M. C. (2019). Powershifts: a framework for assessing the growing impact of decentralized ownership of energy transitions on political decision-making. Energy Res. Soc. Sci. 50, 151–161. doi: 10.1016/j.erss.2018.12.003

Brisbois, M. C., and de Loë, R. C. (2016). State roles and motivations in collaborative approaches to water governance: a power theory-based analysis. Geoforum 74, 202–212. doi: 10.1016/j.geoforum.2016.06.012

Brisbois, M. C., Morris, M., and de Loë, R. (2019). Augmenting the IAD framework to reveal power in collaborative governance—an illustrative application to resource industry dominated processes. World Dev. 120, 159–168. doi: 10.1016/j.worlddev.2018.02.017

California Independent System Operator (2015). Amended and Restated Bylaws of California Independent System Operator Corporation. Folsom, CA: CAISO.

California Independent System Operator (2017). Comment of the California Independent System Operator Corporation: Electric Storage Participation in Markets Operated by Regional Transmission Organizations and Independent System Operators. Docket Nos. RM16-23-000, AD-16-200.

California Independent System Operator (2020). CAISO At-A-Glance. Available online at: http://www.caiso.com/Documents/CaliforniaISO-GeneralCompanyBrochure.pdf (accessed May 17, 2021).

California Independent System Operator (2021a). 2020 Annual Report on Market Issues & Performance. Available online at: http://www.caiso.com/market/Pages/MarketMonitoring/AnnualQuarterlyReports/Default.aspx (accessed October 30, 2021).

California Independent System Operator (2021b). Initiative: Energy Storage and Distributed Energy Resources. Folsom, CA: CAISO.

Chairman's Opening Remarks NEPOOL IMAPP Initiative (2016). Available online at: https://nepool.com/zimapp/ (accessed August 11, 2016).

Chang, J., Pfeifenberger, J., Spees, K., Davis, M., Karkatsouli, I., Regan, L., et al. (2014). The Value of Distributed Electricity Storage in Texas. Boston, MA: The Brattle Group.

Chen, J. (2019). Stakeholder Soapbox: Is PJM's Reserve Proposal Helping or Hindering a Transition to a Clean, Flexible Grid? Potomac, MD: RTO Insider, 1–6.

Chen, J., and Murnan, G. (2019). State Participation in Resource Adequacy Decisions in Multistate Regional Transmission Organizations. NI PB 19-03, 1–19.

Cramer, C., and Tschirhart, J. (1983). Power pooling: an exercise in industrial coordination. Land Econ. 59, 24–34.

Cramton, P. (2003). “Electricity market design: the good, the bad, and the ugly,” in Proceedings on 36th Annual Hawaii International Conference System Science, HICSS 2003.

Cullenward, D., and Welton, S. (2018). The quiet undoing: how regional electricity market reforms threaten state clean energy goals. Yale J. Regul. Bull. 36, 106–130. doi: 10.2139/ssrn.3212687

Denholm, P., Nunemaker, J., Gagnon, P., and Cole, W. (2020). The potential for battery energy storage to provide peaking capacity in the United States. Renew. Energy 151, 1269–1277. doi: 10.1016/j.renene.2019.11.117

Dennis, J. S., Kelly, S. G., Nordhaus, R. R., and Smith, D. W. (2016). Federal/State Jurisdictional Split: Implications for Emerging Electricity Technologies Energy Analysis and Environmental Impacts Division. Berkeley, CA: Lawrence Berkeley National Laboratory.

Dworkin, M., and Goldwasser, R. A. (2007). Ensuring consideration of the public interest in the governance and accountability of Regional Transmission Organizations. Energy Law J. 28:543. Available online at: https://heinonline-org.libproxy.boisestate.edu/HOL/P?h=hein.journals/energy28&i=551

Dworkin, M. H., Sidortsov, R. V., and Sovacool, B. K. (2013). Rethinking the scale, structure and scope of U.S. energy institutions. Daedalus 142, 129–145. doi: 10.1162/DAED_a_00190

Eisen, J. B. (2016). FERC's expansive authority to transform the electric grid. UC Davis Law Rev. 49:1783. Available online at: https://heinonline-org.libproxy.boisestate.edu/HOL/P?h=hein.journals/davlr49&i=1809

Energy Storage Association (2019). Overview of FERC Order 841. Issue Briefs. Available online at: https://energystorage.org/policy-statement/overview-of-ferc-order-841/ (accessed August 10, 2020).