- Department of Computer Science, University College London, London, United Kingdom

This paper presents a theoretical extension of the Decentralized Token Economy Theory (DeTEcT) framework proposed by Sadykhov et al. (Front. Blockchain, 2023, 6, 1298330), where a formal analysis framework was introduced for modelling wealth distribution in token economies. DeTEcT is a framework for analysing economic activity, simulating macroeconomic scenarios, and algorithmically setting policies in token economies. This paper proposes four ways of parametrizing the framework, where dynamic vs. static parametrization is considered along with the probabilistic vs. non-probabilistic parameters. Using these parametrization techniques, we demonstrate that by adding restrictions to the framework, it is possible to derive the existing wealth distribution models from DeTEcT. In addition to exploring parametrization techniques, this paper explores how money supply in the DeTEcT framework can be transformed to become dynamic and how this change will affect the dynamics of wealth distribution. The motivation for studying dynamic money supply is that it enables DeTEcT to be applied to modelling token economies without maximum supply (i.e., Ethereum) and it adds constraints to the framework in the form of symmetries.

1 Introduction

Token economies are economies that have a medium for valuation, transaction, and value storage in the form of tokens (i.e., currency native to the economy), and these tokens can be minted (i.e., new tokens are created) and burned (i.e., existing tokens are destroyed). The study of tokens and token economies is generally referred to as Tokenomics.

Acting under the assumption that tokens are a mechanism for storage of wealth and representation of the value of scarce resources, we can define tokenomics as the study of the efficient allocation of wealth in a token economy (ISO, 2024; Smith, 2012). Some of the questions that tokenomics aims to address are as follows: how does an economic system provide and allocate scarce resources? How does the economy interact with the external economic systems and stimuli? What guides the behaviour of economic participants? What is the “efficiency” of these processes?

In an attempt to answer these questions, we have previously defined a formal analysis framework called Decentralized Token Economy Theory (DeTEcT) (Sadykhov et al., 2023), which models interactions between groups of heterogeneous agents in token economies, simulates wealth distribution, and can be used to propose policies to be implemented in a token economy to achieve a desired wealth distribution. DeTEcT helps define an economic system as a robust mathematical construction, facilitating theoretical study of the system while maintaining flexibility to be adjusted to analyse economies with specific traits (e.g., economies with different rules of interactions between agents).

However, despite an already wide range of applications, the framework still has some limitations, such as a constant maximum supply of tokens, exclusively static parameters, or the limitations to the numerical solution method. In this paper, we aim to address some of the limiting factors to make DeTEcT a more flexible framework, without losing any mathematical robustness.

1.1 Scope

The aim of this paper is to define different possible configurations for the parametrization of the framework, demonstrate how existing wealth distribution models can be derived from DeTEcT, and define a method for modelling an economy with a dynamic maximum supply (i.e., maximum supply that varies in time). We address the first two questions in Section 3 as these questions are interrelated, while we address the last question in Section 4. It should be noted that these sections are not arranged in a specific order as we believe each of these questions is equally important.

We start Section 3 by demonstrating how to parametrize the framework with parameters that change in time (i.e., dynamic parameters) and with parameters that are defined using probabilistic techniques (i.e., probabilistic parameters). The section concludes with us deriving the existing wealth distribution models from the DeTEcT framework. The importance of this link is that the existing wealth distribution models we refer to have the support of empirical data, in particular the wealth distribution model with individual saving propensities (Chatterjee et al., 2003), as it results in a Pareto tail distribution, which is observed in real-world economies (United Nations Human, 1992).

Section 4 expands the application of our framework to economies where maximum supply changes in time [e.g., Ethereum economy (Buterin, 2014)] and explores time translation symmetry in our framework.

2 Related work

This paper expands on the mathematics of DeTEcT presented in Sadykhov et al. (2023), so the definitions used here are stated in that paper. In this section, we briefly reacquaint ourselves with the key concepts of DeTEcT and focus on some of the existing wealth distribution models from the literature.

2.1 DeTEcT framework

DeTEcT is a formal analysis framework that models wealth distribution in token economies. The fundamental building block for DeTEcT is clustering of agents in the economy into agent categories and categorizing possible interactions between different agent categories.

For example, assume an economy has an agent that manufactures a good (e.g., car) and sells it to other agents (e.g., retail customers). We can create two agent categories in such an economy: Car Manufacturer and Household. We see that the Car Manufacturer interacts with Household through the sale of cars. So we can describe an interaction between these agent categories as Car Sale.

Each agent is assumed to have some wealth and has a mapping called individual wealth function,

However, we may have an economy where agents do not have a constant agent category and they can change between different agent categories. Therefore, the wealth of an agent category

Agent categories, interactions, and rotations, together, are referred to as the tokenomic taxonomy as it defines the possible routes for wealth movements. This allows us to create a complete set of possible wealth movements and construct the model for possible wealth reallocation between agent categories.

The motivation behind clustering agents into agent categories consists of two points: it allows for quicker processing as we model the macroeconomic state of the economy and, therefore, work with a smaller parameter set and that in most economies the policies are directed at groups of economic participants (e.g., corporate tax for companies vs. income tax for households). Tokenomic taxonomy enables DeTEcT to be used for finding policies to be implemented in an economy, where the policies are directed at well-defined categories of agents.

Before we review DeTEcT framework, we must point out that we will be referring to distribution of tokens between agents in the economy as wealth distribution rather than token distribution. The reason for this destinction is that DeTEcT can be applied to the modelling financial systems with different architectures, and is not limited to modelling only the token economies, despite the scope of this paper mainly concerning with the token economies. Additionally, in section 3 we discuss how DeTEcT links to existing wealth distribution models, and to make a smooth transition from our framework to existing works in this field, we refer to the distribution of tokens as wealth distribution, subject to the assumption that tokens in the closed economic systems act as a measure of wealth.”

To summarize the review of DeTEcT, we define the compartmental dynamical system at the core of our framework. Assuming an economy has a well-defined maximum supply, we state that the sum of all wealth functions of all agent categories in the economy always equals the maximum supply,

where

Furthermore, as described in the “Decentralized Token Economy Theory (DeTEcT)” (Sadykhov et al., 2023), we define interactions between agent categories

where

and

such that the diagonal elements of

These are the fundamental blocks of our framework that we used and generalized in the forthcoming sections in this paper.

2.2 Wealth distribution models

In order to emulate the wealth distribution dynamics in a closed economic system, a family of kinetic theory models was proposed (Patriarca et al., 2005). These models were originally used to model random interactions between gas molecules in a closed container, but in the context of wealth distribution dynamics, they are used to simulate random transactions between the participants (agents) of the economy to find the equilibrium of wealth distribution.

The models from this family follow a transaction rule:

where

2.2.1 Basic model without saving

The basic model, where agents do not preserve a portion of their wealth, has been proposed by Dragulescu and Yakovenko (2000), where the trading rule becomes

with

In a closed economic system with random transactions taking place according to the trading rule in Equation 5, the wealth distribution becomes a Boltzmann distribution and leads to inequitable wealth distribution, where a few agents hold majority of the wealth.

2.2.2 Model with constant global saving propensity

In most economic systems, the agents tend to preserve some proportion of their wealth, which can be represented by a wealth distribution model through the introduction of a saving propensity parameter

with

It should be noted that

2.2.3 Model with individual saving propensities

Individual saving propensities

where the general trading rule in Equation 4 is obtained by setting

If multiple simulations are run using the trading rule in Equation 7 with different individual saving propensity settings each time, the average of the equilibrium wealth distributions is the Pareto distribution. Pareto distribution is commonly used in economics to model the wealth distribution in a society as it describes the disparity of wealth between the “wealthy” and “poor” agents in the economy.

2.2.4 Summary

The wealth distribution models outlined here are well-established in the academic literature and are commonly used for modelling generic macroeconomic principles. For example, the relaxation time for a wealth distribution to return to its equilibrium can be measured (Patriarca et al., 2007), or in the case of the model with individual saving propensities, it is used to describe the Pareto principle (Pareto and Bousquet, 1964) that is observed in real-world economies.

3 Parametrization extension and derivation of existing wealth distribution models

3.1 Parameter modification techniques

In our framework, one of the assumptions we used is that the parameters (i.e., interaction and rotation rates) are constant. This is useful either when we simulate wealth distribution based on some “predefined trends” or when we are trying to find the parameters of the dynamical system that allow the dynamical system to reach a desired wealth distribution (i.e., a desired attractor). However, if we drop this assumption and allow parameters to change at different time steps, we will see that DeTEcT becomes a broad framework that can be parametrized in a certain way to replicate existing wealth distribution models.

However, before obtaining other wealth distribution models from DeTEcT, we would like to introduce a taxonomy of different parametrizations that we can use to modify our original approach (Sadykhov et al., 2023).

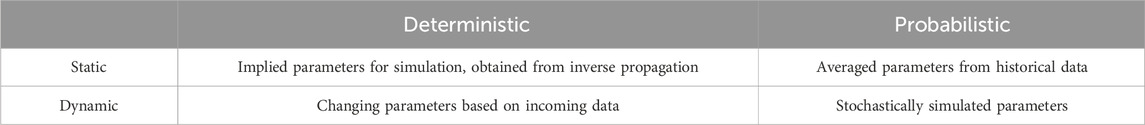

We broadly categorize the interaction and rotation rates using two features, namely, whether the parameters are static or dynamic and whether the parameters are probabilistic or deterministic. These two features allow us to cover all possible extensions that can be introduced to the DeTEcT framework. Table 1 demonstrates some of the applications of different parameter modifications, which we will examine on a case-by-case basis.

Furthermore, we can categorize dynamic parameters by whether they are proactive or reactive. By proactive dynamic parameters, we mean that these parameters are either set in advance for every time step in the simulation or are derived from an arbitrary function that does not consider any history of economic activity (i.e., the function is agnostic to the state of the economy). Reactive dynamic parameters are the parameters that are obtained from some arbitrary function that takes the state of the economy as an input to produce parameters for the next time step (e.g., a change in the sizes of incentives paid to all agent categories follows the review of an inflation reading collected in the last time step).

Table 2 describes use cases for proactive and reactive dynamic parameters. Whether dynamic parameters are proactive or reactive depends on how

Since we focus on modifying the parameters of the dynamical system, we reiterate the original definition of interaction rates, which we have used before (Sadykhov et al., 2023), thereby obtaining

where

Essentially, we can think of

where

We now explore that by modifying the definitions above, we can make DeTEcT more flexible.

3.1.1 Static deterministic parameters

Static deterministic parameters are those that we have defined in the previous section. These are the basic building blocks upon which we can implement our modifications.

The fundamental assumption we use here is that the parameter values do not change in time, and in order for that to happen, we must balance the net wealth redistributed (i.e.,

• Forward propagation: Inaccuracies in modelling real economies, as in real economy interactions and rotation rates, change in time. The parameters themselves are derived from arbitrary historical transaction data, which limits the possible cases. However, the numerical simulation with these “simple” parameters is very quick and straightforward.

• Inverse propagation: If economy governors have control over price setting mechanisms, maintaining constant parameters is easy as it is done via setting appropriate prices. However, in the case of a free market economy, the parameters would not be maintained at a constant level as market participants are free to set their own prices in response to changing demands. The numerical solution employed to perform inverse propagation must be run only once to obtain the desired values of interaction and rotation rates.

The interaction rates are defined as

while the rotation rates are just constants, expressed as

3.1.2 Static probabilistic parameters

Static probabilistic parameters are an extension of the static deterministic parameters, where we add a term that represents a probability of success for each interaction type

The benefit of using static probabilistic parameters, as opposed to static deterministic parameters, is that we simulate the wealth distribution based on the historical data compared to some arbitrary demands. We can use any probability distribution to simulate the distribution of demands, but the only restriction we impose for now is that the choice of probability distribution should match the data format of the demand (i.e., demand cannot be 1.5 if the interaction is Buying car, but it can be

For example, assume that for each interaction type

where

where

We can generalize this notion by defining the static probabilistic interaction rates as

where

The rotation rates

where

3.1.3 Dynamic deterministic parameters

Now, we can add a further generalization to our framework by defining the dynamic deterministic parameters. The dynamic deterministic parameters are the interaction and rotation rates that are time-dependent (i.e.,

The effect of introducing the dynamic deterministic parameters on the simulation has major impacts:

• Forward propagation: Since the parameters can be arbitrary, we could fit our dynamical system on any dynamics with the same number of agent categories and, therefore, fit our model into any economy. This might be useful when we change parameters based on the incoming data to perform an analysis of economic activity in an economy, but this is not helpful when we attempt to simulate future results as the dynamic parameters are too flexible.

• Backward Propagation: With the dynamic parameters we can perfectly fit our model on the empirical data as at every time step we can change the rates appropriately to link wealth distributions at different time steps. However, this is overfitting of the model, and the rates we obtain this way are not useful for making any predictions. Overfitting can be pre-vented using different techniques such as adding penalty terms to the loss function of the nu-merical solver, bootstrapping results of multiple simulations with random initial positions, or even splitting the data into compartments (e.g., split economy data by the timestamps of policy implementations) and training the model on individual compartments. We will leave the discussion of simulation engine design, model fitting, and methods used for prevention of overfitting to our future paper.

In order for the interaction rates to become dynamic, we must lift the constraint that we imposed when defining static deterministic interaction rates, which is the vector of demands and the vector of prices will balance out the wealth functions of agent categories

The rotation rates become dynamic by assuming that for a rotation of wealth from

Note that since we removed the rebalancing constraint, in the forward propagation, we are free to change the function

3.1.4 Dynamic probabilistic parameters

The last case of parameter modification is the dynamic probabilistic parameters, where the interaction and rotation rates are time-dependent and are defined by stochastic processes. The motivation for this procedure is that we can create stochastic processes that satisfy the distribution of empirical data at different time steps, and we can feed these processes inside the simulation in order to gauge what an economy may look like.

Compared to the dynamic deterministic parameters, we now have explainable parameters that are based on the distribution of historical data. This allows for a good risk assessment tool, where the economic dynamics is simulated multiple times so that we can examine the possible “bad” cases for the economy, how they may evolve, and what the impacts of these cases are on different agent categories. However, this means that backward propagation is fruitless in this case as the stochastic processes ensure that every time we run the dynamical system, the dynamic of the simulated wealth distribution is different.

The static probabilistic parameters were defined using the probability distribution

where

However, lifting the rebalancing constraint also allows for price to become a stochastic process

where demand is a deterministic function and the price is described by the stochastic process, and

where both the demand and price are defined by different stochastic processes. It should be noted that this is applicable only to forward propagation as backward propagation will not work with the dynamic probabilistic parameters.

Since all the stochastic processes used are not necessarily the same, all of them have to be simulated and each must be

Similar to that with static probabilistic interaction rates, we need to ensure that the values simulated by the stochastic processes “make sense” so that we do not obtain infeasible demands (e.g., half a car being sold).

The rotation rates themselves become stochastic processes and are defined as

where

3.2 Relationship with existing wealth distribution models

In this section, we demonstrate how our framework is related to the existing wealth distribution models. To proceed, we must first state that it is common for wealth distribution to be studied from the perspective of agent-based models, where individual agents transact with one another, resulting in wealth redistribution.

As seen in the previous section, we can redefine the dynamical system so that it has dynamic parameters, which is expressed as

where the matrix of interaction rates

and the matrix of rotation rates

This new generalized definition of the dynamical system can help us with the task of connecting DeTEcT to existing wealth distribution models as they tend to use dynamic parameters.

Furthermore, in the context of our framework, let us assume that the agent categories contain only one agent such that each individual agent has its own agent type (i.e.,

Remark. The assumption that there is only one agent per agent category is not necessary for the wealth distribution models that are yet to be described; what is necessary is the assumption that there are no rotations defined between the agent categories. The reason we assume that there is only one agent per agent category is the demonstration of how our framework integrates with the existing wealth distribution models, where the notion of the agent category is not defined. In this section, we refer to

The notions of interaction types and interaction quantities are also exclusive to DeTEcT; in the previous literature on wealth distribution models, the net wealth redistributed between agents is directly defined by one transaction at time step

where

With these limitations, we can rewrite Equation 9 so that the dynamical system becomes

with the individual interaction rates now being given by

We can further simplify Equation 10 by applying the finite difference method. If there are

Using Equation 11, we simplify the aforementioned equation to

which is a version of the dynamical system that is often considered in the literature and studies on wealth distribution (Patriarca et al., 2005).

Equation 12 describes the redistribution of wealth between agents in the economy from the perspective of individual transactions and is referred to as the transaction rule. The terms

Without the loss of generality, we can pick a time interval

and the change in wealth of the counterparty

Note that for the invariance of wealth to be satisfied, the net change in wealth is antisymmetric, which is expressed as

With the reformulated transaction rule defined in Equations 13, 14, along with the antisymmetric constraint on net change in wealth, we can demonstrate how existing wealth distribution models are derived from our framework.

3.2.1 Wealth distribution model with no saving

The first model we consider is the wealth distribution model with no saving, introduced by Dragulescu and Yakovenko (2000). This model assumes that an agent transacts a random portion of their wealth at time step

Given the transaction rule defined in Equations 13, 14, the net change in wealth in this model is defined to be

where

where

This model describes the wealth distribution dynamics through random interactions, similar to a kinetic model of gas particles interacting inside a closed container. The simulation of this model produces an equilibrium of wealth distribution (i.e., the attractor of the dynamical system describing the wealth distribution) and as shown by Dragulescu and Yakovenko (2000) fits the Boltzmann distribution (else known as the Gibbs distribution):

with

where

An interesting feature of the Boltzmann distribution in Equation 16 is its “robustness” with respect to different factors such as initial conditions or multi-agent interactions, which do not impact the accuracy of the fit of the Boltzmann distribution over the equilibrium of the wealth distribution obtained from the trading rule in Equation 15.

In terms of economic modelling this result implies that if the transactions in the economy are random and are more akin to gambling, then the majority of wealth will belong to a small num-ber of individuals and most agents in the economy will be poor. Also, due to the robustness of Boltzmann distribution, we can expect that no matter the initial state, the economy where agents act according to the transaction rule 43 will always result in having small number of “rich” and large number of “poor” agents.

The reason this model is said to have “no saving” is because

3.2.2 Wealth distribution model with minimum investment and no saving

The model proposed by Chakraborti (2002) introduces a concept of minimum transaction value,

The net change in wealth is defined as

where

is the minimum investment that both agents

Applying this definition of net change in wealth to the general transaction rule (Equations 13, 14), we obtain

The dynamics of this system is unique in the sense that over the course of the simulation, agents will lose their wealth such that

This peculiarity of the model leads to the wealth distribution equilibrium to be described by a power law (i.e.,

It should be noted that here, we did not drop the time dependence of the wealth function

3.2.3 Wealth distribution model with global saving propensities

In this model, a global saving propensity

For this model, the net change of wealth is

where

The equilibrium of the wealth distribution dynamics in this system is described by the gamma distribution, which is derived by Chakraborti and Chakrabarti (2000). For an effective dimension

and the temperature defined by the relation

through the equipartition theorem, the probability density function of “reduced” wealth

The saving propensity in the range

The temperature

Therefore, for an economy where agents are transacting randomly, but with only a predefined proportion of their wealth, the wealth distribution will depend on the saving propensity, and the shape of the wealth distribution density function will depend on the shape parameter

3.2.4 Wealth distribution model with individual saving propensities

The shortcoming of the wealth distribution model with the global saving propensity is the assumption that every agent’s saving propensity is the same. In the real world, agents are likely to have a different risk tolerance, which means their saving propensities will differ. Therefore, a wealth distribution with individual saving propensity is introduced, where every agent

The net change in wealth is defined as

and the associated transaction rule is

This transaction rule leads to the equilibrium being described by different probability densities, and the choice of the probability density depends on the configuration of the individual saving propensities

where the parameter

This is an interesting result since the Pareto exponent

4 Dynamic money supply extension

In Section 2.1, we mentioned that we assume the maximum supply to be constant, and for some real-world token economies [e.g., Bitcoin (Nakamoto, 2008)], this assumption is satisfied. However, there are plenty of token economies that do not have a capped maximum supply and can, in practice, mint infinite number of tokens [e.g., Ethereum (Buterin, 2014)].

4.1 Dynamic money supply models

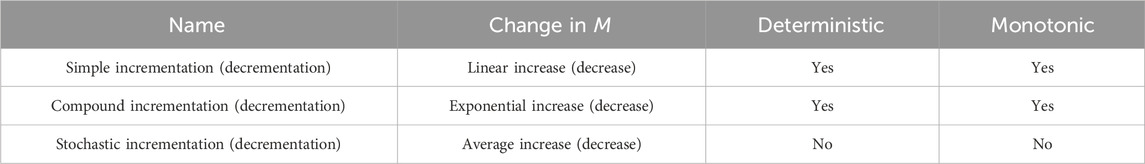

To model wealth distribution in token economies where maximum supply is not constant, we must define an extension to our framework. Maximum supply can increase or decrease, and in the context of this paper, we refer to these processes as incrementation and decrementation, respectively. We define some of the possible models of dynamic maximum supply in Table 3 and further elaborate on these below (note that the taxonomy is not exhaustive as there can be an infinite number of functions that model the change of maximum supply).

4.1.1 Deterministic maximum supply models

We start by looking at the simplest model from Table 3, which is the simple incrementation and decrementation. This model linearly changes the maximum supply such that at every time step

In our framework, we cannot have a zero maximum supply as generalized Equation 3 will be undefined. Moreover, negative maximum supply does not make sense in practice, so we must introduce a constraint on the input rate of incrementation (decrementation) we set in order to ensure the range of maximum supply stays in the

Definition 1. Simple incrementation (decrementation) is the incrementation (decrementation) of maximum supply with the same amount of wealth at every time step. At time

where

The compound incrementation (decrementation) model changes the maximum supply by adding (subtracting) a constant percentage of the maximum supply from the previous time step

Definition 2. Compound incrementation (decrementation) is the incrementation (decrementation) of maximum supply with the exponentially growing (shrinking) amount of wealth at every time step. At time

where

4.1.2 Stochastic maximum supply models

The stochastic incrementation and decrementation model introduces a stochastic process

Definition 3. Stochastic incrementation (decrementation) is the average incrementation (decrementation) of maximum supply with the discrete-time stochastic process

where

4.2 The time translation symmetry and the discount factor

In physical systems, the concept of continuous symmetry, or invariance, of the system is deeply associated with the conservation laws, and in particular, the Noether’s theorem (Noether, 2018) states that for every continuous symmetry that a physical system exhibits, it must have a corresponding conservation law. This statement can be reformulated to state that if a system has a symmetry, then there will be a quantity, or quantities, that is conserved (e.g., in most physical systems, energy is the conserved quantity with respect to time translation symmetry).

The consequence of Noether’s theorem is that there must exist a vector

In finance and economics, we implicitly use time translation symmetry to compare values within the time series. For example, portfolio theory defines a concept of stochastic discounting factor (SDF), which allows us to connect time series of returns. In discounting models, we use a discounting rate to compare nominal cashflows values that are separated in time. In general, we often employ a discounting factor to provide us with a point of reference that allows us to compare values of the time series, and connect them from one time step to another.

In the context of our framework, we would like to explicitly demonstrate that under certain con-ditions, the discounting factor emerges as the property of the modelled system, rather than an assumed definition.The objective of this section is to demonstrate that an economic system whose maximum supply can be described using the models above, has a time transla-tion symmetry and that this symmetry gives rise to the conservation principle stated in the Equations 1, 2.

By time translation symmetry we mean that there exists an invariant quantity that will be conserved for any point

Theorem 4.1. Time translation symmetry: If maximum supply is constant or has simple, compound, or stochastic incrementation (decrementation), there exists a time translation symmetry in the economy.

Proof. Let the set of

Without loss of generality, assume that at

where in the first equality, it is assumed that

For every

Case 1: Constant maximum supply

Assume for arbitrary

It is sufficient to prove that this holds for time

By discrete differentiation, the differential form of Equation 19 is

By translating in time

where for the second equality, the property in Equation 20 was used. Therefore, the statement in Equation 19 is proved by induction for all

Case 2: Maximum supply with simple incrementation (decrementation)

According to Definition 1, assume for arbitrary

It is sufficient to prove that this holds for time

By discrete differentiation, the differential form of Equation 21 is

By translating in time

where for the second equality, the property in Equation 22 was used. Therefore, the statement in Equation 21 is proved by induction for all

Case 3: Maximum supply with compound incrementation (decrementation)

Given Definition 2, assume for arbitrary

It is sufficient to prove that this holds for time

By discrete differentiation, the differential form of Equation 23 is

By translating in time

where for the second equality, the property in Equation 24 was used. For the last equality, the Taylor expansion of an exponential in general form was used:

since

Therefore, the statement in Equation 23 is proved by induction for all

Case 4: Maximum supply with stochastic incrementation (decrementation)

Assume for arbitrary

The expected value is used to stochastically discount the wealth function from one time step to the next,

Assuming that under time translations

By discrete differentiation, the differential form of Equation 25 is

By translating in time

where for the second equality, the property in Equation 26 was used. For the last equality, the Taylor expansion approximation of

Therefore, the statement in Equation 25 is proved by induction for all

General Case: General form of the incrementation function.

Assume for arbitrary

where

By discrete differentiation, the differential form of Equation 27 is

By translating in time

where we used the infinitely differentiable property of

Therefore, the statement in Equation 27 is proved by induction for all

This theorem demonstrates that an economy where maximum supply function is infinitely differentiable, the economy will have a time translation symmetry. This result allows us to make a couple of interesting statements about economies modelled with DeTEcT.

First, the time translation symmetry allows us to connect the values in the time series of wealth distribution by discounting changes in the maximum supply. By proving the theorem above, we have demonstrated that an economy whose maximum supply is described by the given supply models, the notion of the discounting factor is promoted from the definition to the property of the system. For example, if we assume that an economy has a simple incrementation (decrementation), then the sum of wealth functions at a given time step

where

Second, we note that we can now add the incrementation term to the general equation of the dynamical system in Equation 3 such that it reflects the dynamic money supply.

For us to add the general maximum supply function,

Let

We can define a vector of wealth changes,

Now, we add the incrementation (decrementation) mechanism to the dynamical system in Equation 3 to obtain its modified version,

We can prove that by induction, Equation 28 holds for future time steps. First, assume that the equation holds for

where we used Equation 28 and ignored all terms of

The finite difference of

which proves that Equation 28 holds by induction for all time steps. This equation is the general form of the dynamical system with static parameters and dynamic money supply.

4.3 Dynamic money supply and parametrization techniques

At last, we address the case where dynamic money supply and different parametrization techniques are applied simultaneously. The dynamical system with dynamic maximum supply and dynamic parameters will have the same form as the system in the section above, but with the explicit time dependence of

It can be proven that this form of the dynamical system stands for the future time step using the same methodology, as described in the previous section, but we will alleviate the calculation for the purpose of the paper.

5 Conclusion

The aim of this paper was to demonstrate how our proposed framework, DeTEcT (Sadykhov et al., 2023), fits into theoretical research on wealth distribution models and how it can be improved to be more flexible for modelling a wider range of real-world token economies with different features.

In this paper, we described multiple ways that our framework can be parametrized to remain very flexible. Static probabilistic parametrization enables us to model the wealth distribution dynamics based on the real-world data, and dynamic deterministic parametrization can be used to simulate the dynamically changing set of policies in the economy, while static deterministic and dynamic probabilistic parametrizations are convenient for simulating different economic scenarios with the static or variable set of policies. In forward propagation, the dynamic parametrization techniques can be customized further with the choice of deterministic functions or stochastic processes that define demands and prices for individual goods.

Additionally, we introduced a dynamic money supply extension that covers token economies with time-dependent money supply (e.g., Ethereum (Buterin, 2014)). This extension works harmoniously with the parametrization techniques and expands the use cases for DeTEcT.

In summary, we have added improvements to our framework, which will help us with building the simulation engine that performs an analysis and runs simulations of wealth distribution in real-world token economies and will allow us to study the interactions between different agents and agent categories. Despite these improvements, this paper does not present an exhaustive list of modifications and features that can be added to DeTEcT (e.g., tokens with expiration mechanism), but we believe that the extensions we have presented here are those that carry the most significance for the framework and demonstrate the approaches in which researchers can modify the framework to use it in a different context.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material; further inquiries can be directed to the corresponding authors.

Author contributions

RS: conceptualization, formal analysis, methodology, software, writing–original draft, and writing–review and editing. GG: supervision, validation, and writing–review and editing. PT: supervision, validation, and writing–review and editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Buterin, V. (2014). Ethereum: a next-generation smart contract and decentralized application platform. Available at: https://ethereum.org/669c9e2e2027310b6b3cdce6e1c52962/Ethereum_Whitepaper_-_Buterin_2014.pdf (Accessed February 12, 2024).

Chakraborti, A. (2002). Distributions of money in model markets of economy. Int. J. Mod. Phys. C13, 1315–1321. doi:10.1142/s0129183102003905

Chakraborti, A., and Chakrabarti, B. K. (2000). Statistical mechanics of money: how saving propensity affects its distribution. Eur. Phys. J. B 17, 167–170. doi:10.1007/s100510070173

Chatterjee, A., Chakrabarti, B. K., and Manna, S. S. (2003). Money in gas-like markets: Gibbs and Pareto laws. Phys. Scr. T106, 36. doi:10.1238/physica.topical.106a00036

Dragulescu, A., and Yakovenko, V. M. (2000). Statistical mechanics of money. Eur. Phys. J. B 17, 723–729. doi:10.1007/s100510070114

ISO (2023). Blockchain and distributed ledger technologies - vocabulary. Available at: https://www.iso.org/obp/ui/iso:std:iso:22739:dis:ed-2:v1:en (Accessed March 4, 2024).

ISO (2024). Information Technology - security techniques - information security management - organizational economics. Available at: https://www.iso.org/obp/ui/iso:std:iso-iec:tr:27016:ed-1:v1:en:term:3.7 (Accessed March 4, 2024).

Noether, E. (2018). Invariante variationsprobleme, transport theory and statistical physics. Transl. M.A. Tavel 1 (3). doi:10.48550/arXiv.physics/0503066

Patriarca, M., Chakraborti, A., Heinsalu, E., and Germano, G. (2007). Relaxation in statistical many-agent economy models. Eur. Phys. J. B 57, 219–224. doi:10.1140/epjb/e2007-00122-7

Patriarca, M., Chakraborti, A., Kaski, K., and Germano, G. (2005). Kinetic theory models For the Distribtion of wealth: power law from Overlap of exponentials, econophysics of wealth distribution. Milano: Springer, 93–110. doi:10.1007/88-470-0389-X_10

Sadykhov, R., Goodell, G., de Montigny, D., Schoernig, M., and Treleaven, P. (2023). Decentralized token economy theory (DeTEcT): token pricing, stability and governance for token economies. Front. Blockchain 6, 1298330. doi:10.3389/fbloc.2023.1298330

United Nations Human (1992). Development report 1992, 34. New York: Oxford University Press. Available at: https://hdr.undp.org/content/human-development-report-1992 (Accessed April 19, 2024).

Keywords: DeTEcT, tokenomics, token economy, economy simulation, blockchain economy, mechanism design, simulation engine, control theory in economics

Citation: Sadykhov R, Goodell G and Treleaven P (2025) DeTEcT: dynamic and probabilistic parameters extension. Front. Blockchain 7:1448160. doi: 10.3389/fbloc.2024.1448160

Received: 12 June 2024; Accepted: 05 December 2024;

Published: 14 January 2025.

Edited by:

Xiao Fan Liu, City University of Hong Kong, Hong Kong SAR, ChinaReviewed by:

Piotr Nowak, Polish Academy of Sciences, PolandAxel Cortes Cubero, Protocol Labs, Puerto Rico

Stylianos Kampakis, London Business School, United Kingdom

Copyright © 2025 Sadykhov, Goodell and Treleaven. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: R. Sadykhov, cnNhZHlraG92QGdtYWlsLmNvbQ==; G. Goodell, Zy5nb29kZWxsQHVjbC5hYy51aw==

R. Sadykhov

R. Sadykhov G. Goodell

G. Goodell P. Treleaven

P. Treleaven