- International Institute for Applied Systems Analysis (IIASA), Laxenburg, Austria

Disasters associated with natural hazards as well as climate change are happening within complex socio-economic systems and desired system states, including sustainable development and resource management, are formulated on the global as well as regional and national levels. However, complex system approaches are yet only rudimentarily incorporated in related applications, and we discuss modeling as well as policy challenges focusing on fiscal risk. As an intermediate step we suggest a gap approach which we relate to fiscal stress levels a complex system may experience due to natural hazard events. We argue that in case of no gaps one can assume a no stress situation and therefore modeling of disruptions including cascading effects is less necessary. However, at the same time we also acknowledge that there is an urgent need to address corresponding challenges with complex system methods. Policy-wise our paper responds to concerns for real-world applications and can provide insights to support current discussions within the UNFCCC and Paris Agreement around both adaptation finance and the new funding arrangements for loss and damage from climate impacts established at COP27.

Introduction

Our interconnected world is a complex system, i.e., consisting of situated, adaptive, diverse individuals whose interactions produce higher-order structures (such as patterns and forms) as well as functionalities (Thurner et al., 2018; Arthur, 2021). Quantitative complex systems modeling has focused on physical, biological, and ecological complex systems, but only recently started to explicitly consider human agency (Page, 2015; Kertész et al., 2019; Otto et al., 2020). Concurrent events, such as the financial crisis, pandemics, disasters associated with natural hazards, climate change and conflicts have boosted interest in socio-economic complex systems analysis, including similarities and differences with other non-human-related complex systems (Frank et al., 2014; Hochrainer-Stigler et al., 2020). For example, it is questioned whether research on physical tipping points also yields generalisable results that can be applied to socio-economic systems and their tipping points (Juhola et al., 2022). Notably, social systems are understood as not adhering to universal rules in the same way as natural systems, as choices are prone to behavioral biases and social influences (Ermakoff, 2015).

From a real-world application perspective there are therefore calls for iterative approaches to reflect the special nature of human agency and to enable a constant updating of the social system and its current state (Hochrainer-Stigler et al., 2020). This should go hand in hand with the development of new modeling approaches to tackle current and emerging challenges including cascading and compound events (Reichstein et al., 2021). Several methodologies have been put forward to study complex systems in different disciplines (see Castellani and Hafferty, 2009 for a detailed overview through a map of complexity science) and they are usually related to specific questions about the desired system state or system thread. The latter is usually discussed within systemic risk research, which originally focused on the collapse or at least serious disruption of a system and was modeled primarily through network dynamics methods (Kharrazi et al., 2013; Kreis et al., 2019). The former can be related to the question of the controllability of complex networks which is usually determined to a great extent by the underlying networks degree distribution (see Liu et al., 2011) and analyzed through Graph-Theory, see for example Rahmani et al. (2009). We refer for an overview of disciplines and methodologies applied for complex systems analysis to Castellani and Hafferty (2009) and more specifically on quantitative approaches to Thurner et al. (2018).

Climate-related disasters happen within complex (socio-economic) systems as well. Their desired system states (e.g., in the form of goals that should be achieved in the future) are formulated across various governance levels and codified in agreements such as the Sendai Framework for Disaster Risk Reduction (UNDRR, 2015), the Paris Climate Agreement (UNFCCC, 2015) and the Sustainable Development Goals (UN, 2015) along with regional, national and community-based climate adaptation and risk reduction strategies and plans. Many quantitative modeling frameworks have been developed over the years to study climate change impacts and provide policy recommendations (Gambhir et al., 2019; Markandya and González-Eguino, 2019; Nikas et al., 2019). Yet, integrating non-linear dynamics in such models (as well as other approaches, for a review see Botzen et al., 2019) is challenging, especially when dealing with complex socio-economic systems (Castellani and Hafferty, 2009). As a subset of this challenge, we will focus on the assessment of climate-related disaster risk and related fiscal consequences, specifically delving into the quantitative modeling of non-linear dynamics.

Our primary area of concern centers on governments and the fiscal risks intertwined with these challenges. We propose a so-called “gap approach” to tackle fiscal risks caused by disasters stemming from natural hazards and climate change. This approach relates to fiscal stress levels to be avoided, considering international finance flows that would assist in such situations (Hochrainer-Stigler et al., 2023). We argue that until a specific gap level, indicative of a critical stress point within the complex system, is not reached, modeling of non-linear disruptions is not always essential and complex systems do not need to be assessed in such detail. We suggest this approach as an intermediate step for tackling complex systems that may be necessary in the short term for such kind of risks as complex system methodologies are yet seldom used. We also explore how such an approach can be operationalized to quantify the capitalization levels for sustainable international resource (focusing on finance) management in case of gaps using a so-called risk-layer approach. However, we also acknowledge that there is a pressing need to address corresponding challenges in relation to non-linear dynamics using complex system methods.

Managing stress: understanding multiple gaps and funding requirements

Complex systems exhibit sensitivity to initial conditions and path dependence (i.e., final outcomes are contingent on the outcomes that occur along the way). For climate change impacts path dependency arises from decisions on future mitigation pathways and on the evolving state of resilience of our societies (IPCC, 2022; Thaler et al., 2023). In our discussion we draw on an understanding of resilience as the ability of agents to bounce back or absorb a shock without major long-term consequences. What may seem an oversimplification, can be connected when analyzing stress levels and sustainability concerns as outlined below. The desired system can be related to the objective of being sustainable in the sense that disasters are not existentially disrupting the system, enabling it to keep progressing over time. Sustainability in this context can be related subsequently to the concept of resilience which can support the handling of disaster impacts so that the system exposed to these events is sustainable (to this threat) in the long run. Resilience, and in our case fiscal resilience, then has to be seen in the context of financial resources to address losses from disasters. Consequently, for being sustainable (defined here to be a state where no serious disruptions of the complex system will be experienced over time) the society should be resilient to disasters associated with natural hazards and climate change impacts. As indicated earlier, methods from complexity science are seldom used for this task due to the modeling challenges involved (Botzen et al., 2019). However, as we argue here, a first step involves determining the resilience levels that are needed in a complex system to ensure no serious consequences arise from disasters and therefore remains sustainable over time even under climate change. Afterward, these resilience levels could be related through the application of a gap approach.

Multiple gap approach

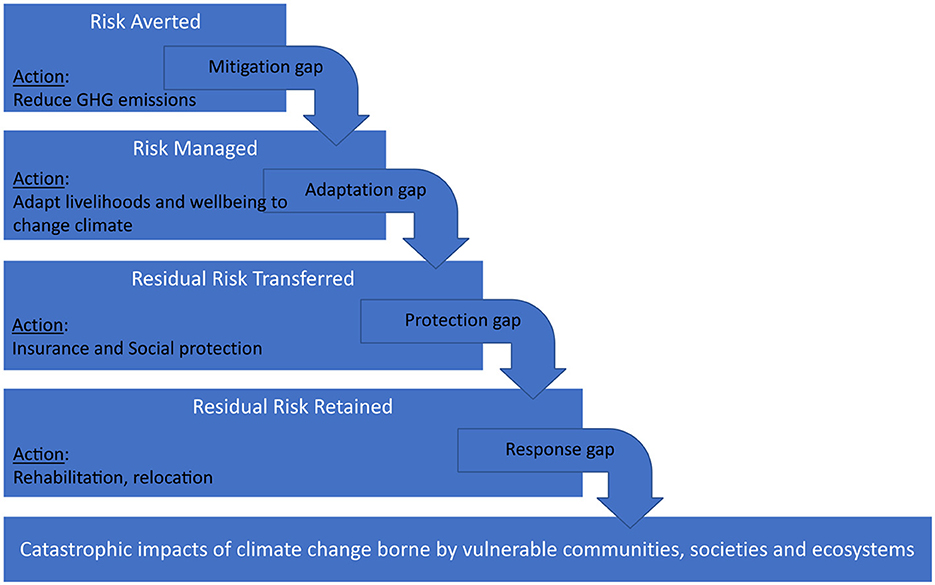

In complex real-world systems, a system (or element of the system) may experience stress up to a certain threshold before serious disruptions occur (Hochrainer-Stigler et al., 2018). Examples include ecosystems losing significant biomass over time before they collapse or banks defaulting if many important stressors are experienced at once. Such stress situations increase the susceptibility of a complex system to serious cascading risks (for a discussion we refer to Hochrainer-Stigler et al., 2020). Consequently, maintaining stress at manageable levels becomes key to mitigating the expected impact of disruptions. We first argue that stress levels can be related to gaps, indicating that the absence of resources to address a negative event leads to a gap, inducing stress. We leverage Mechler et al. (2023)'s typology of gaps related to climate change risks and corresponding actions (see Figure 1) to further explore this relationship.

Figure 1. Four identified gaps of the climate policy framework on Loss and Damage. Source: Building on Mechler et al. (2023).

Gaps, in this context, signify potential escalating negative consequences for society if left unaddressed. For quantification purposes, one needs to conceptualize them in measurable terms. In Figure 1, the mitigation gap pertains to greenhouse gas emissions, where lower emissions correlate with reduced climate risk. Representative Concentration Pathways (RCPs) outline various emission scenarios related to the possible consequences of a changing climate (Van Vuuren et al., 2011). Reducing the mitigation gap, i.e., reducing emissions, primarily focuses on energy transitions at global or regional scale and mostly relies on natural science methods (IPCC, 2021). As the RCPs are usually discrete scenarios, we argue that the mitigation gap can be determined by comparing different RCP scenarios in regards to changing risks of disasters. For current or future risks, the gaps can be categorized according to risk-layers (Mechler et al., 2014) as managable through risk reduction (adaptation gap), managable through risk transfer, such as insurance (protection gap), as well as residual risk requiring assistance (response gap). It should be noted that risk transfer instruments, like insurance, are typically employed by risk averse individuals due to higher expected costs than expected losses (Malevergne and Sornette, 2006). Consequently, they are often employed for less frequent risks that cannot be addressed through other means or by the risk bearer themselves (similar to deductibles in insurance contracts). This leads to a distinction between the adaptation and protection gap based on the frequency of risks, with less frequent risks causing a protection gap and more frequent risks that could be reduced but are not, causing an adaptation gap (drawing on the concept of risk-layering as introduced by Mechler et al., 2014). The different gaps can be related to current and future system states according to changes in risk. Hence, based on the mitigation gap which is path dependent, the other gaps will change over time as well. Consequently, one can now compare the current state with a desired future state and deviations from it using the gap concepts as explained above.

Filling the gaps

We indicated that given a specific resilience level gaps may or may not occur. We also indicated that the adaptation and protection gap are related to the frequency of risk which may change in the future. As already specified, we are restricting our attention to fiscal resilience to indicate how to quantify the gaps and the international finance flows needed to cover these gaps. In other words, gaps which cannot be financed are assumed to cause stress and therefore could lead to possible serious disruptions within the complex societal system. In case the gap would be funded, for example through support via an international fund or finance initiatives, one could assume that serious repercussions on public (and private) finances in the affected country would be kept to a minimum. Dependent on what kind of gap occurs there is the corresponding question how much international finance would be needed on average. Such an estimate is required as we argue that in case of no gaps there would also be no stress to the system and no need for a detailed complex system analysis of follow-on effects that could lead to instability and unsustainability in the long run. Methodological wise, if one is able to calculate the different gaps a specific government cannot cope with, one also will know what financial assistance would be needed to cover remaining losses. Relating estimates of disaster risks through a loss distribution with the financing resources available enables such an assessment. Hochrainer-Stigler et al. (2021) did a similar analysis but in the context of flood adaptation costs for countries across the globe. The authors essentially calculated current fiscal resources for all countries in the world, related the resources to country losses due to flood events and calculated the average fiscal gap for all possible events that could happen for each country. A fiscal gap is defined as the probability level where for the first-time resources are not enough to cover all losses the government is responsible for. Afterwards, they included climate change impacts for the near and far future and calculated corresponding gaps assuming no adaptation. Important for our discussion here is the fact that they also calculated the total global gap for today and in the future which one can use as an indication about the international finance flows that would be required (on average) so that no gaps would occur.

Addressing modeling and policy challenges

Modeling challenges

We discussed that unfinanced losses from disasters cause stress in a system, emphasizing the role of international finance in preventing such stress. Failure to finance such losses may trigger ripple effects, so called indirect risks, across the system. Drawing on complex systems modeling, especially insights from systemic risk research, we propose linking direct losses to indirect losses through the concept of dependencies. In contrast to direct risk, which focuses solely on the elements exposed to natural hazards need to be looked at, the hazards' effects experienced beyond these areas and elements must be considered when assessing indirect risk (Naqvi et al., 2020). Indeed, indirect risk only realizes through dependencies, as direct risk (individual damages or failures due to the hazard event itself) can only cascade if it is connected to other elements in the system. It is important to note that dependencies can also increase the resilience to a system (Walker, 2020); however, for the case of disasters, one can assume only downside indirect risk as this is what should be managed for. How and why individual risk can cascade through a system are questions at the heart of systemic risk research. Several measures have been suggested for assessing elements in the system that are, from a system perspective, either too big to fail, too interconnected to fail or too important to fail etc. (see Hochrainer-Stigler, 2020 for an overview). Irrespective of how different these measures are, the dependencies between the individual elements in the system are at the center of most of them. Also, within complex systems research dependencies and structuredness are key dimensions to understand underlying mechanisms and eventually lead the system to a desired system state.

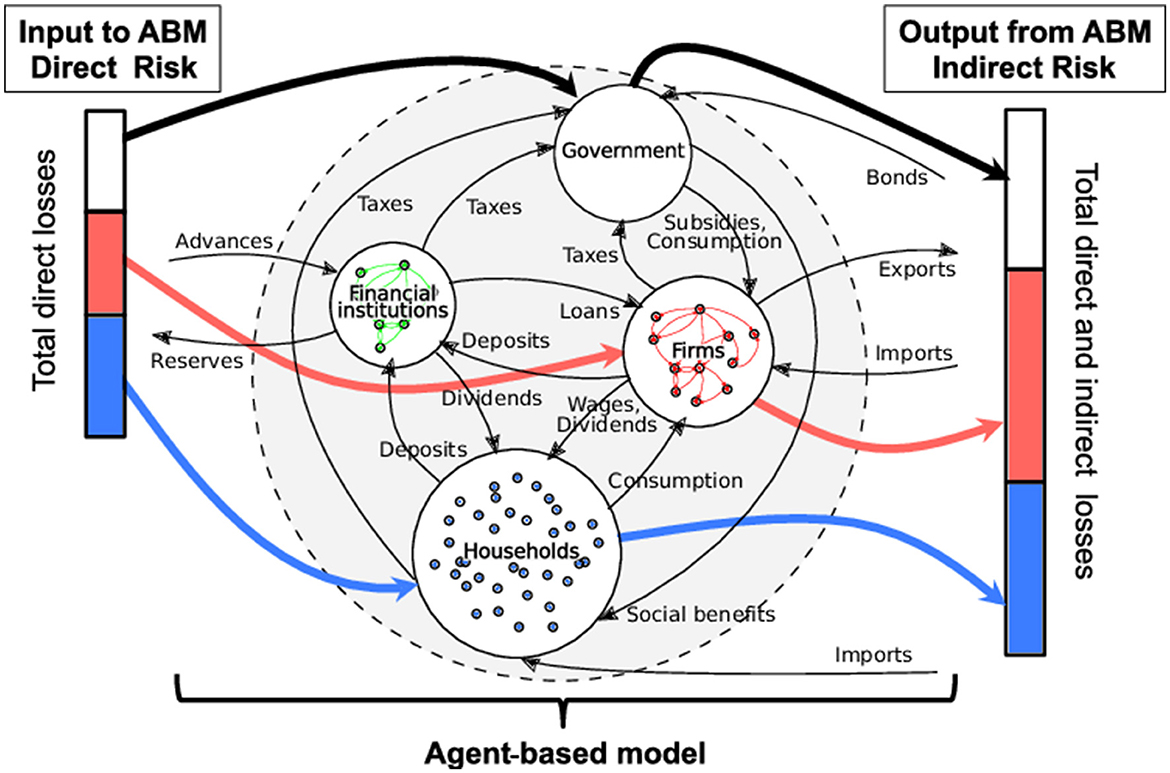

Agent-Based models provide a promising way forward to tackle these mechanisms from a complex systems perspective (Abar et al., 2017). Within such a framework, the interaction of agents determines meso- and macro-outcomes, which can further feedback into the micro-decision-making of individual agents resulting in non-linear, path-dependent outcomes. Consequently, ABMs are better equipped to handle large parameter spaces, non-linear thresholds, boundary conditions and out-of-equilibrium states (Bachner et al., 2024). Thus, they outperform state-of-the-art modeling tools typically used in disaster analysis especially when non-linear dynamics are the focal point. One way forward with our suggested gap approach would be then to not assume international finance flows covering the gap but instead use the gaps as an input to the ABM model (Poledna et al., 2018). In that way, the indirect consequences due to such events that spread through the socio-economic system can be better understood and be related to other sustainability dimensions (Bachner et al., 2024). As indicated, such models need to be calibrated in quite some detail (see Reichstein et al., 2021) and will take time to be build. Nevertheless, they would provide a more holistic picture also in regard to dimensions usually outside the disaster domain and could enable joint efforts with other sustainability dimensions to increase resilience and ultimately to achieve sustainability on various scales.

Once the ABM model is sufficiently calibrated the approach suggested above can be readily applied as quantitative techniques and tools are already established in the disaster, systemic risk and climate change community. As one concrete way forward, the suggested gap analysis for financing losses can be used as an input to an ABM model as per Figure 2 (left hand side) and the ABM models the indirect effects and possible non-linearities (e.g., across sectors) due to these gaps over time, ultimately calculating the performance of the system under stress (right hand side of Figure 2). Due to the detailed information of the agents within the system, different mechanisms can be analyzed and corresponding instruments across sectors investigated to derive at a pre-defined system state, e.g., to achieve sustainable development across multiple sectors under various disaster situations. However, given the very nature of complex systems, especially their tendency to be non-predictive and contingent, iterative approaches in this context have to be assumed to work best as they would allow for a constant monitoring, updating of models and policies as well.

Figure 2. Example of ABM modeling approach going from direct to indirect disaster risks. Source: Poledna et al. (2018).

Policy dimensions

Given our suggestion on how to estimate fiscal gaps and corresponding (average) international finance flow needs to prevent stress to the system of national fiscal resources, it is crucial to examine the viability of such an approach and its integration into ongoing discussions about global funding schemes addressing the adaptation funding gap. For example, an impending strain on available government resources due to large-scale flooding in future climate scenarios is expected (Hochrainer-Stigler et al., 2021). This strain is expected to extend to other climate-related hazards like storms and droughts, given current climate predictions and already tight fiscal resources today. This looming challenge underscores the urgency of scaling up climate finance for adaptation and for loss and damage under the UNFCCC, the Paris Agreement and related initiatives. Adaptation has historically been underfunded compared to mitigation efforts and represents only a fraction of total climate finance flows (OECD, 2022). The 2023 Adaptation Gap Report found that adaptation finance needs in developing countries are 10 to 18 times higher than the public international adaptation finance flows currently provided (UNEP, 2023). Against this background, the USD100 billion pledge for both mitigation and adaptation put forward by developed countries at COP 15 and reiterated at COP 21 is a drop in the ocean (Timperley, 2021). While the latter was a political target, the New Collective Quantified Goal on Climate Finance, which is currently being negotiated and will supersede the USD 100 billion target from 2025, will be based on the needs and priorities of developing countries (UNFCCC, 2023).

The gap approach proposed here could provide valuable insights regarding the scale of finance needed to enhance the fiscal resilience of vulnerable countries in the context of broader adaptation support (Pill, 2022; Vanhalla et al., 2023). For example, our approach can inform the implementation of initiatives for addressing the protection gap, such as the G7-G20 Global Shield Against Climate Risks (InsuResilience, 2022), which was officially launched at COP27. The Global Shield aims to improve coordination within the global climate and disaster risk finance and insurance architecture and develop a financing structure to mobilize and pool donor and other funds for a more systematic global approach to closing protection gaps (InsuResilience, 2022). Other initiatives, such as the Caribbean Catastrophe Risk Insurance Facility (CCRIF), exemplify successful risk transfer instruments that could serve as a model for closing protection gaps. Similar risk transfer instruments could be instrumental in addressing the protection gap, with global funding arrangements facilitating their implementation (see in this context also Ciullo et al., 2023).

It should be noted that the uncertainties around future impacts are large necessitating a multi-model analysis and using multiple lines of evidence. Including such additional uncertainties within formal decision-making models is challenging especially as the underlying models cannot be determined to be fully true or false. One way forward to include such ambiguity for decision making purposes is through ambiguity sets that compare the models and their differences in terms of specific distance metrics (Pflug and Pohl, 2018). One other way is through the use of dynamic adaptive policy pathways where different threshold levels over time are assumed and can be navigated through (Schlumberger et al., 2022). In our context, an iterative process that can update international finance flow needs over time related to the mitigation gap and related pathways may be the best way forward under such large uncertainties.

Last but not least, while knowing the possible financial flows needed to cover gaps, an important additional question is in regards to funding of these flows and different financing schemes could be thought of including a polluter pays or a wealth-based criteria (see also Hochrainer-Stigler et al., 2021 for an analysis). However, recent analysis is suggesting that current models are not fit yet to tackle the attribution challenge in regard to extreme events and climate change (King et al., 2023). Nevertheless, for the specific subset of the sustainability challenge, namely fiscal risks due to disasters associated with natural hazards and climate change, such a global financing arrangement could be operationalized with the methods available and can provide an intermediate step to tackle the complex system challenges we are living in.

Conclusion

In the face of escalating climate-related risks, countries and communities around the world are facing unprecedented challenges. Acknowledging current modeling limitations in employing complex system approaches directly within this global context, we have proposed an intermediate step: focusing on ways how to prevent stress in such systems, defined as not reaching a gap. This approach does not negate the eventual need for explicit modeling of complex socio-economic systems under these emerging challenges. Instead, we have outlined pathways for expanding our gap approach in the future. Specifically, we have emphasized the importance of integrating new methods from the disaster and climate change community to account for the complex, intricate dynamics within systems. We advocate for ABMs as a cornerstone for addressing the complex challenges ahead, especially in handling non-linearities and tipping points. Given the multifaceted challenges involved – not only in modeling but also generating actionable insights and policy recommendations – we propose a toolbox-based approach in a next step. Furthermore, an adaptive strategy that is based on forward-looking analyses of the fiscal adaptation and protection gaps will enable a more comprehensive and nuanced response to the complex challenges posed by climate change, setting the stage for designing more sustainable resilience-building measures and management approaches (Fath, 2022). Various tools and approaches are needed for achieving this goal ranging from full probabilistic assessments (Hochrainer-Stigler, 2020) to dynamic adaptive policy pathways approaches (Schlumberger et al., 2022) as well as climate storyline methodologies (van den Hurk et al., 2023).

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

SH-S: Conceptualization, Formal analysis, Funding acquisition, Investigation, Methodology, Resources, Supervision, Visualization, Writing – original draft, Writing – review & editing. RM: Conceptualization, Methodology, Writing – review & editing. TD-H: Conceptualization, Resources, Writing – review & editing. EC: Conceptualization, Resources, Writing – review & editing. RŠT: Conceptualization, Resources, Writing – review & editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. SH-S acknowledges funding by the EU Horizon 2020 RECEIPT project, grant agreement no. 820712 (Stress Levels) and EU Horizon DIRECTED project, grant agreement no. 101073978 (Risk-Layer). TD-H and RM acknowledge funding from the Zurich Flood Resilience Alliance. RŠT acknowledges funding from the Horizon 2020 MYRIAD-EU project, grant agreement no. 101003276.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abar, S., Theodoropoulos, G. K., Lemarinier, P., and O'Hare, G. M. (2017). Agent based modelling and simulation tools: a review of the state-of-art software. Comput. Sci. Rev. 24, 13–33. doi: 10.1016/j.cosrev.2017.03.001

Arthur, W. B. (2021). Foundations of complexity economics. Nat. Rev. Phys. 3, 136–145. doi: 10.1038/s42254-020-00273-3

Bachner, G., Knittel, N., Poledna, S., Hochrainer-Stigler, S., and Reiter, K. (2024). Revealing indirect risks in complex socioeconomic systems: a highly detailed multi-model analysis of flood events in Austria. Risk Anal. 44, 229–243. doi: 10.1111/risa.14144

Botzen, W. W., Deschenes, O., and Sanders, M. (2019). The economic impacts of disasters associated with natural hazards: a review of models and empirical studies. Rev. Environ. Econ. Policy. 13, 167–188. doi: 10.1093/reep/rez004

Castellani, B., and Hafferty, F. W. (2009). Sociology and Complexity Science: A New Field of Inquiry. Cham: Springer Science and Business Media.

Ciullo, A., Strobl, E., Meiler, S., Martius, O., and Bresch, D. N. (2023). Increasing countries' financial resilience through global catastrophe risk pooling. Nat. Commun. 14:922. doi: 10.1038/s41467-023-36539-4

Fath, B. D. (2022). Challenges in sustainable resource management. Front. Sust. Res. Manage. 1:943359. doi: 10.3389/fsrma.2022.943359

Frank, A. B., Collins, M. G., Levin, S. A., Lo, A. W., Ramo, J., Dieckmann, U., et al. (2014). Dealing with femtorisks in international relations. Proc. Nat. Acad. Sci. 111, 17356–17362. doi: 10.1073/pnas.1400229111

Gambhir, A., Butnar, I., Li, P. H., Smith, P., and Strachan, N. (2019). A review of criticisms of integrated assessment models and proposed approaches to address these, through the lens of BECCS. Energies 12:1747. doi: 10.3390/en12091747

Hochrainer-Stigler, S., Colon, C., Boza, G., Brännström, Å., Linnerooth-Bayer, J., Pflug, G., et al. (2020). Measuring, modeling, and managing systemic risk: the missing aspect of human agency. J. Risk Res. 23, 1301–1317. doi: 10.1080/13669877.2019.1646312

Hochrainer-Stigler, S., Pflug, G., Dieckmann, U., Rovenskaya, E., Thurner, S., Poledna, S., and Brännström, Å. (2018). Integrating systemic risk and risk analysis using copulas. Int. J. Disaster Risk Sci. 9, 561–567. doi: 10.1007/s13753-018-0198-1

Hochrainer-Stigler, S., Schinko, T., Hof, A., and Ward, P. J. (2021). Adaptive risk management strategies for governments under future climate and socioeconomic change: an application to riverine flood risk at the global level. Environ. Sci. Policy 125, 10–20. doi: 10.1016/j.envsci.2021.08.010

Hochrainer-Stigler, S., Zhu, Q., Ciullo, A., Peisker, J., and Van den Hurk, B. (2023). Differential fiscal performances of plausible disaster events: a storyline approach for the Caribbean and central American governments under CCRIF. Econ. Disasters Clim. Change 2, 1–21. doi: 10.1007/s41885-023-00126-0

InsuResilience (2022). Annual Report 2021: Milestones, Achievements and Progress Towards Vision 2025. InsuResilience Global Partnership. Available online at: https://www.insuresilience.org/wp-content/uploads/2022/03/InsuResilience-Annual_Report-2021_web-1.pdf (accessed March 1, 2024).

IPCC (2021). Climate Change 2021: The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change. Intergovernmental Panel on Climate Change. Cambridge: Cambridge University Press.

IPCC (2022). Climate Change 2022: Impacts, Adaptation and Vulnerability. Climate Change 2022: Impacts, Adaptation and Vulnerability Working Group II Contribution to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge: Cambridge University Press.

Juhola, S., Filatova, T., Hochrainer-Stigler, S., Mechler, R., Scheffran, J., Schweizer, P. J., et al. (2022). Social tipping points and adaptation limits in the context of systemic risk: Concepts, models and governance. Front. Clim. 8:1009234. doi: 10.3389/fclim.2022.1009234

Kertész, J., Mantegna, R. N., and Miccichè, S. (2019). Computational Social Science and Complex Systems, Vol. 203. London: IOS Press.

Kharrazi, A., Rovenskaya, E., Fath, B. D., Yarime, M., and Kraines, S. (2013). Quantifying the sustainability of economic resource networks: an ecological information-based approach. Ecol. Econ. 90, 177–186. doi: 10.1016/j.ecolecon.2013.03.018

King, A. D., Grose, M. R., Kimutai, J., Pinto, I., and Harrington, L. J. (2023). Event attribution is not ready for a major role in loss and damage. Nat. Clim. Change 22, 1–3. doi: 10.1038/s41558-023-01651-2

Kreis, Y., Leisen, D., and Ponce, J. (2019). Systemic Risk: History, Measurement And Regulation. New York, NY: World Scientific.

Liu, Y. Y., Slotine, J. J., and Barabási, A. L. (2011). Controllability of complex networks. Nature 473, 167–173. doi: 10.1038/nature10011

Malevergne, Y., and Sornette, D. (2006). Extreme financial Risks: From Dependence to Risk Management. Cham: Springer Science and Business Media.

Markandya, A., and González-Eguino, M. (2019). Integrated assessment for identifying climate finance needs for loss and damage: a critical review. Loss Damage Clim. Change Concepts Methods Policy Options 22, 343–362 doi: 10.1007/978-3-319-72026-5_14

Mechler, R., Bouwer, L. M., Linnerooth-Bayer, J., Hochrainer-Stigler, S., Aerts, J. C., Surminski, S., et al. (2014). Managing unnatural disaster risk from climate extremes. Nat. Clim. Change 4, 235–237. doi: 10.1038/nclimate2137

Mechler, R., McQuistan, C., and Rosen Jacobson, B. (2023). Falling Through the Gaps: How Global Failures to Address the Climate Crisis are Leading to Increased Losses and Damages. Zurich: Zurich Flood Resilience Alliance.

Naqvi, A., Gaupp, F., and Hochrainer-Stigler, S. (2020). The risk and consequences of multiple breadbasket failures: an integrated copula and multilayer agent-based modeling approach. OR Spectrum 42, 727–754. doi: 10.1007/s00291-020-00574-0

Nikas, A., Doukas, H., and Papandreou, A. A. (2019). “Detailed overview and consistent classification of climate-economy models,” in Understanding Risks and Uncertainties in Energy and Climate Policy: Multidisciplinary Methods and Tools for a Low Carbon Society, eds. H. Doukas, A. Flamos, and J. Lieu (Cham: Springer International Publishing), 54.

OECD (2022). Aggregate Trends of Climate Finance Provided and Mobilised by Developed Countries in 2013-2020, Climate Finance and the USD 100 Billion Goal. Paris: OECD Publishing. doi: 10.1787/d28f963c-en

Otto, I. M., Wiedermann, M., Cremades, R., Donges, J. F., Auer, C., Lucht, W., et al. (2020). Human agency in the Anthropocene. Ecol. Econ. 167:106463. doi: 10.1016/j.ecolecon.2019.106463

Page, S. E. (2015). What sociologists should know about complexity. Annual Rev. Sociol. 41, 21–41. doi: 10.1146/annurev-soc-073014-112230

Pflug, G. C., and Pohl, M. (2018). A review on ambiguity in stochastic portfolio optimization. Set-Valued Variational Anal. 26, 733–757. doi: 10.1007/s11228-017-0458-z

Pill, M. (2022). Towards a funding mechanism for loss and damage from climate change impacts. Clim. Risk Manage. 35:100391 doi: 10.1016/j.crm.2021.100391

Poledna, S., Hochrainer-Stigler, S., Miess, M. G., Klimek, P., Schmelzer, S., Sorger, J., et al. (2018). When does a disaster become a systemic event? Estimating indirect economic losses from natural disasters. arXiv [Preprint]. arXiv:1801.09740.

Rahmani, A., Ji, M., Mesbahi, M., and Egerstedt, M. (2009). Controllability of multi-agent systems from a graph-theoretic perspective. SIAM J. Control Optim. 48, 162–186. doi: 10.1137/060674909

Reichstein, M., Riede, F., and Frank, D. (2021). More floods, fires and cyclones—plan for domino effects on sustainability goals. Nature 592, 347–349. doi: 10.1038/d41586-021-00927-x

Schlumberger, J., Haasnoot, M., Aerts, J., and Ruiter De, M. (2022). Proposing DAPP-MR as a disaster risk management pathways framework for complex, dynamic multi-risk. Iscience 25:105219. doi: 10.1016/j.isci.2022.105219

Thaler, T., Hanger-Kopp, S., Schinko, T., and Nordbeck, R. (2023). Addressing path dependencies in decision-making processes for operationalizing compound climate-risk management. Iscience 26:107073. doi: 10.1016/j.isci.2023.107073

Thurner, S., Hanel, R., and Klimek, P. (2018). Introduction to the Theory of Complex Systems. Oxford: Oxford University Press.

Timperley, J. (2021). The broken $100-billion promise of climate finance—And how to fix it. Nature 598, 400–408. doi: 10.1038/d41586-021-02846-3

UNEP (2023). Adaptation Gap Report 2023: Underfinanced. Underprepared. Inadequate Investment and Planning On Climate Adaptation Leaves World Exposed. Nairobi.

UNFCCC (2023). Work on New Collective Quantified Goal for Climate Finance Reaches Halfway Mark. Available online at: https://unfccc.int/news/work-on-new-collective-quantified-goal-for-climate-finance-reaches-halfway-mark#:~:text=%E2%80%9CThe%20new%20goal%20on%20climate,Change%20Executive%20Secretary%20Simon%20Stiell (accessed March 1, 2024).

van den Hurk, B. J., Pacchetti, M. B., Boere, E., Ciullo, A., Coulter, L., Dessai, S., et al. (2023). Climate impact storylines for assessing socio-economic responses to remote events. Clim. Risk Manage. 40:100500. doi: 10.1016/j.crm.2023.100500

Van Vuuren, D. P., Edmonds, J., Kainuma, M., Riahi, K., Thomson, A., Hibbard, K., et al. (2011). The representative concentration pathways: an overview. Clim. Change 109, 5–31. doi: 10.1007/s10584-011-0148-z

Vanhalla, L., Calliari, E., and Thomas, A. (2023). Understanding the politics and governance of climate change loss and damage. Global Environ. Politics 23, 1–11. doi: 10.1162/glep_e_00735

Keywords: gap approach, fiscal risk, complex systems, Agent-Based modeling, loss and damage

Citation: Hochrainer-Stigler S, Mechler R, Deubelli-Hwang T, Calliari E and Šakić Trogrlić R (2024) A gap approach for preventing stress in complex systems: managing natural hazard induced fiscal risks under a changing climate. Front. Sustain. Resour. Manag. 3:1393667. doi: 10.3389/fsrma.2024.1393667

Received: 29 February 2024; Accepted: 15 April 2024;

Published: 09 May 2024.

Edited by:

Gabriel Faimau, University of Botswana, BotswanaReviewed by:

Naser Valizadeh, Shiraz University, IranCopyright © 2024 Hochrainer-Stigler, Mechler, Deubelli-Hwang, Calliari and Šakić Trogrlić. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Stefan Hochrainer-Stigler, aG9jaHJhaW5AaWlhc2EuYWMuYXQ=

Stefan Hochrainer-Stigler

Stefan Hochrainer-Stigler Reinhard Mechler

Reinhard Mechler Teresa Deubelli-Hwang

Teresa Deubelli-Hwang Elisa Calliari

Elisa Calliari Robert Šakić Trogrlić

Robert Šakić Trogrlić