- 1School of Economics, Xiamen University, Xiamen, Fujian, China

- 2School of Economics and Management, Nanchang University, Nanchang, China

- 3Ministry of Education (MOE) Key Laboratory of Econometrics, School of Economics, Xiamen University, Xiamen, China

Corporate risk-taking (CRT) is crucial for sustainable business development. The focus of this study is to examine the relationship between components of ESG performance (ESGP) and corporate risk-taking. We conduct an empirical analysis using CSI ESG score data of A-share listed companies on the Shanghai and Shenzhen stock exchanges from 2009 to 2022. The conclusions are as follows: (1) ESGP exerts a facilitating effect on CRT. Specifically, environmental performance inhibit CRT, whereas social responsibility and corporate governance performance enhance CRT. (2) The facilitating effect of ESGP on CRT is more pronounced at lower levels of equity concentration. (3) ESGP enhances CRT by increasing the level of innovation and institutional investor shareholding. The contribution of this study is to help firms change CRT by adjusting the components of ESGP.

1 Introduction

Corporate risk-taking (CRT) reflects the willingness and ability to choose projects with uncertain expected returns and cash flows (Wang et al., 2024; Liu et al., 2023). CRT is an effective means for companies to generate substantial profits and plays a crucial role in the stable development of companies (Kish-Gephart and Campbell, 2015). BRICS countries are often confronted with the challenge of economic policy uncertainty, characterized by variations in trade regulations and alterations in monetary and fiscal policies (Aydin et al., 2022). This uncertainty can have far-reaching effects on business strategies, and CRT is more likely to change. Research suggests that CRT may be affected by the level of corporate Environment, Social and Governance performance (ESGP) engagement (Du et al., 2024; Ellili, 2022). ESG, as a kind of corporate evaluation standard, evaluates corporate performance in terms of environmental performance (EP), social responsibility performance (SP) and governance performance (GP), and conveys the value of sound corporate development to the public (Shen et al., 2023; Vilanova et al., 2009). Therefore, this paper takes China as a representative of the BRICS countries to examine how ESGP affects CRT, which can help companies find a more appropriate mode of operation and development in the process of continuously improving ESG governance, thus laying a foundation for sustainable development.

According to studies conducted by BlackRock Consulting, listed companies with stronger ESGP have exhibited a trend of outperforming the broader market in terms of market capitalization in recent years. This has led investors to believe that ESG-performing companies are better equipped to deal with future uncertain events. ESGP contributes significantly to the creation of a favorable social image for the company. This, in turn, enhances CRT by creating more external funding advantages and operational benefits (Habib and Hasan, 2017b; Ioannou and Serafeim, 2015). However, sometimes, in order to maintain and enhance the ESG image of the firm, some managers tend to show risk-averse behavior when faced with potentially risky investment projects, thus reducing the CRT tendency (Chen et al., 2024; Shahzad et al., 2019). Therefore, to further clarify the impact of ESGP on CRT, it is necessary to explore how each component of ESG affects CRT.

Existing research into the factors that influence CRT currently focuses on three main areas: individual manager, corporate governance and the external environment. For individual manager, most studies have focused on the factors which includes practitioner experience, psychological characteristics and age, among others (Chen et al., 2024; Cialdini and Goldstein, 2004). For corporate governance, agency model and equity incentives have been identified as significant factors influencing CRT (Xue and Ying, 2022). According to agency theory, the interests of managers and shareholders are sometimes in conflict (Habib and Hasan, 2017b). Due to the drive of self-interest, managers tend to prefer investment and financing decisions that are more robust, which reduces the overall level of CRT while avoiding risk (Shleifer and Vishny, 1986; Li et al., 2024). However, equity incentives can link company risk and return to the immediate interests of the managers (Bova et al., 2015). However, equity incentives can link corporate risk and reward to the immediate interests of managers (Bova et al., 2015). In the pursuit of economic efficiency, managers will strive to increase the level of CRT (Kim et al., 2017). In terms of the external environment, companies with better ESG performance receive positive external feedback, which increases their level of CRT (Habib and Hasan, 2017a).

Existing study demonstrates that only some scholars have investigated the influence of corporate governance on CRT. While, there has been an absence of analysis concerning the interrelationship between the various components of ESGP and CRT. This impedes the exploration of the intrinsic mechanism of ESGP on CRT. It is significant to study the role relationship between the components of ESGP and CRT, as this can help enterprises find a more suitable operating model for them in the process of continuously improving ESG governance, which will in turn lay the foundation for their sustainable development.

This study explores the influence of ESGP and the individual ESG elements on CRT by analyzing a dataset consisting of all A-share listed companies in Shanghai and Shenzhen for the period 2009 to 2020. It is found that, drawing on corporate information asymmetry theory and stakeholder theory, the improvement of ESGP may enhance CRT. Specifically, improvements in environmental performance may inhibit CRT, while social responsibility performance and corporate governance performance may enhance it. Furthermore, the study examines the moderating role of equity concentration on the association in the relationship between ESGP and CRT. In general, the promotion of CRT by ESGP is enhanced when equity is relatively dispersed. Moreover, the mechanism test suggests that the facilitating effect of ESGP on CRT is mediated through two channels, namely the level of innovation and the percentage of investor ownership.

The research contribution of this paper consists of three points. Firstly, this study further reveals the relationship between the performance of each ESG component and CRT. This contributes to a deeper understanding of how each component of ESG performance affects the level of CRT. And by adjusting EP, SP and GP, we find the appropriate CRT level for their business development. Secondly, as a complement to existing studies on the mechanisms by which ESGP affects CRT, we find that equity concentration moderates the relationship between ESGP and CRT, while the level of innovation and investor ownership have mediating effects. Accordingly, we propose new ideas for regulating CRT.

The rest of the paper is structured as follows: in Section 2, we formulate the research hypothesis; Section 3 describes the variables and research design, including data collection and model construction; Section 4 presents the analysis of the empirical results and tests the robustness; Section 5 further tests the moderating effect and analyses the influencing mechanism; Section 6 summarizes the conclusions and implications of this paper.

2 Theoretical foundation and research hypothesis

2.1 Corporate ESGP and CRT

Based on signaling theory, good ESGP can send positive signals to the market. The public usually believes that firms with good ESGP have efficient corporate governance and less risk of non-compliance (Gao et al., 2017). For external stakeholders, in order to reduce their investment risks and protect their own interests, they will tend to invest more resources in companies with better ESGP under limited resource allocation. As a result, good ESGP signals to the market that firms are focused on environmental protection, actively fulfilling their social responsibilities and improving corporate governance (Albuquerque et al., 2019). This helps firms to build good social relationships with different stakeholders and is crucial for enhancing corporate risk-taking (Lins et al., 2017).

According to information asymmetry theory, the information gap between shareholders and managers was inevitable before the emergence of ESG. Financial data could not provide shareholders with a comprehensive understanding of a company's operations, which could easily lead to trust issues between shareholders and managers. The non-financial information contained in ESGP can alleviate the information asymmetry, which reduces the risk premium demanded by investors and creditors (Drempetic et al., 2020), and also inhibits the risk aversion tendency of managers to a certain extent (Wang H. J. et al., 2024).

From a resource acquisition perspective, firms with strong ESGP have a resource pooling effect. It helps firms to acquire multiple resources from different stakeholders, increasing the capacity of the “resource pool” within the firm (Pedersen et al., 2021). These resources form a buffer in times of crisis, which in turn improves the firm's ability to survive and grow in the event of external shocks, and increases the level of CRT (Vial, 2019). By publicizing the fulfillment of their ESG responsibilities, companies balance financial returns and social benefits, which helps to increase shareholder value and gain stakeholder support (Zhang et al., 2010), and provides companies with the capital to take high risks.

Active corporate ESGP can help mitigate the problem of over-investment and under-investment caused by environmental uncertainty and play a protective role for stable business operations (Samet and Jarboui, 2017). At the same time, it can help companies establish a good relationship with local governments. This is conducive to obtaining government support in terms of funding, policies, etc., to mitigate the impact of environmental uncertainty on enterprises' business operations.

H1

Corporate ESGP may enhance CRT.

2.2 Environmental performance and CRT

The traditional trade-off hypothesis posits that companies' environmental protection initiatives may adversely affect their financial performance due to the additional costs incurred, with the potential economic benefits of improved environmental performance not fully offsetting these costs. In China, the externalities of pollution remain largely uninternalized (Liu et al., 2022), requiring firms to make significant investments in green innovation, energy conservation and emissions reduction efforts. These investments increase business risks, potentially threatening the survival of companies. In addition, environmental performance constraints limit polluting companies' access to credit resources, hindering their ability to secure external financial support (Zhao et al., 2024). In Iran, the relationship between companies' environmental performance and CRT is even more pronounced, with the former having a direct dampening effect on the latter (Khairollahi et al., 2016). Therefore, the following hypothesis is derived:

H2

Environmental performance may inhibit CRT.

2.3 Social responsibility performance and CRT

Stakeholder theory suggests that investing in social responsibility performance increases shareholder wealth because it increases the willingness of other stakeholders to provide resources to the company (Freeman, 1984). In addition, social responsibility contributes to the firm's reputation for keeping its implicit promises, which improves the firm's relationship with its stakeholders (Harjoto and Laksmana, 2018). Therefore, social responsibility improves the level of corporate risk-taking by managing the interests of both invested (shareholders) and non-invested stakeholders (employees, customers, etc.). According to risk management theory, social responsibility performance creates “moral capital” for the firm, which provides protection and mitigates negative comments from stakeholders (Godfrey et al., 2009), leading to higher risk-taking (Chakraborty et al., 2019). Therefore, the following hypothesis is derived:

H3

Social responsibility performance may enhance CRT.

2.4 Corporate governance performance and CRT

Management serves as the primary decision-maker in CRT endeavors. With the objective of maximizing corporate value, management makes risky investment decisions tailored to their individual risk appetites, aiming to achieve efficient allocation of corporate resources (Zhang et al., 2021; Nakano and Nguyen, 2012). For example, during financial crises, insurance industry firms with better governance structures have been observed to mitigate tail risks and expected loss probabilities, thereby fostering a more aggressive CRT stance (Magee et al., 2019). For external investors and stakeholders, the level of corporate governance provides a crucial insight into a firm's legitimacy and reputation. Improvements in corporate governance play a pivotal role in enabling firms to gain strategic advantages and outperform their competitors (Wang et al., 2023). In addition, public disclosure of corporate governance standards by firms can help governments reduce the costs associated with screening firms, increase the likelihood that such firms will be included in government support programs, and ultimately increase their CRT capacity. Based on existing research, we can formulate the hypothesis that:

H4

Corporate governance performance may enhance CRT.

2.5 Mechanism analysis

Several studies have found that equity concentration plays a key role in shaping the relationship between ESGP and CRT. Firstly, higher equity concentration hinders information exchange between companies, exacerbating information asymmetry and increasing transaction costs (Liu et al., 2024). This, in turn, enhances companies' propensity to engage in risky activities (Wang S. J. et al., 2024; Massa and Zaldokas, 2017; Faccio et al., 2016). Secondly, a high degree of equity concentration implies that minority shareholders have disproportionate decision-making power. This concentration of power may lead to decisions that are not well-hedged against firm risk, as decisions may be heavily influenced by minority preferences and experience (Harford et al., 2018). The following hypothesis is therefore proposed:

H5a

Equity concentration operates a moderating role in the relationship between ESGP and CRT, and the effect of ESGP is more pronounced at lower levels of equity concentration.

ESGP has the potential to reduce their risk appetite by encouraging entrepreneurship and innovation. Proactive disclosure of environmental information by companies not only helps to maintain a positive corporate image, but also provides incentives to phase out energy-intensive and polluting technologies, thereby stimulating technological innovation (Al Amosh and Khatib, 2023). In addition, ESGP signifies a commitment to social responsibility, which increases investor confidence and reduces the cost of corporate innovation (Wang H. J. et al., 2024). An increase in the level of technological innovation is conducive to maintaining a leading edge and establishing a favorable market position, which increases the level of CRT (Vilanova et al., 2009). Therefore, we propose the following hypothesis:

H5b

ESGP may effectively enhance CRT by stimulating innovation.

The higher the shareholding of institutional investors in a company, the more the company is inclined to take higher risks. Some studies have shown that institutional investors have a higher preference for companies with high information transparency and sustainable development capability, and stocks of listed companies with good ESGP are more likely to be favored by institutional investors. When institutional investors hold shares in target companies as an important external governance mechanism, they can play a better role in monitoring target companies as their shareholding increases. This improves corporate governance, mitigates the free-rider problem, and helps firms to further improve their own risk-taking (Hao et al., 2020; Ongsakul et al., 2022). Therefore, the following hypotheses are proposed:

H5c

Corporate ESGP may enhance CRT by increasing institutional investor shareholdings.

3 Variables and research design

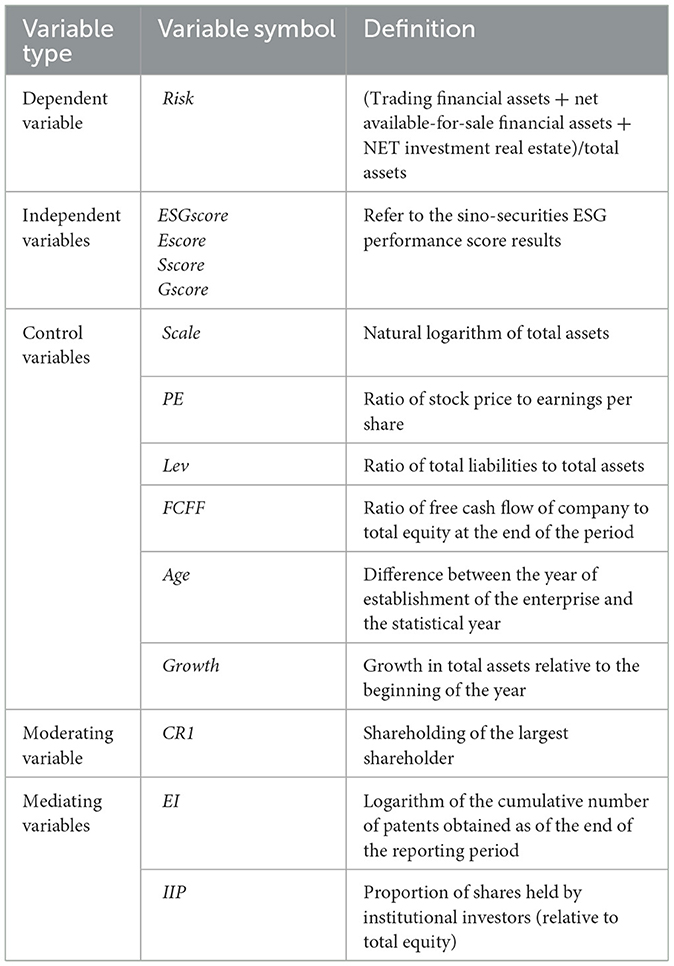

3.1 Dependent variable

CRT plays a key role in corporate strategic decision-making, reflecting a company's willingness and ability to pay higher returns in pursuit of higher earnings. Referring to the method proposed by Sitkin and Pablo (1992), we measure CRT as the ratio of a firm's risk assets to its total assets in the current year. This represents a series of CRT decisions and is an external manifestation of a company's risk appetite (Hanelt et al., 2021). A stronger willingness to take risks by the company leads to higher CRT levels as a consequence of its decision-making behavior.

3.2 Independent variables

The Sino-Securities ESG evaluation system not only covers all A-shares, but also uses technical means to track the historical data since 2009, which makes the data more comprehensive and relevant to the Chinese market. Based on this, we select the score of total ESGP, score of EP, score of SP and score of GP in the Sino-Securities ESG evaluation system as the independent variables in this study.

3.3 Control variables

Existing research has shown that various factors, such as corporate value and nature, affect CRT. Therefore, the following control variables are established: firm size (Scale), price-earnings ratio (PE), gearing ratio (Lev), firm free cash flow per share (FCFF), firm age (Age) and firm growth (Growth) (Zhang et al., 2024; Chen et al., 2024).

3.4 Moderating variable

As ESG is a product of social progress at a certain stage, its performance outcomes can vary due to its unique attributes. Based on this, the following moderating variable is selected for further study: equity concentration (CR1) (Wang S. J. et al., 2024).

3.5 Mediating variables

To further study the mechanism by which ESGP affects CRT, mediating variables are introduced: corporate innovation level (EI) (Qian et al., 2023) and institutional investor shareholding (IIP) (Wang and Wang, 2024). As detailed in Table 1.

3.6 Data source and model construction

The data sample selected for this study is comprised of publicly available data for Type A companies listed on the Shanghai and Shenzhen stock exchanges from 2009 to 2022. The data encompasses both A-share markets, objectively and accurately reflecting the operational status of public companies in these markets. Following the exclusion of financial companies, ST companies and those with missing data on key variables, the continuous financial data were trimmed to 1 and 99%. After the aforementioned data processing steps, a total of 23,146 data samples of A-share listed companies were obtained for the study. The data employed in this study are derived from the CSI ESG scoring system and the CSMAR database. The basic regression model employed to test the hypotheses is presented in Equation 1.

Furthermore, it should be noted that the impacts of EP, SP and GP are operating simultaneously and interacting to influence business. Therefore, we also constructed the baseline regression model of the impact of individual components of ESGP on CRT, which is set up in Equation 2.

4 Analysis of empirical results

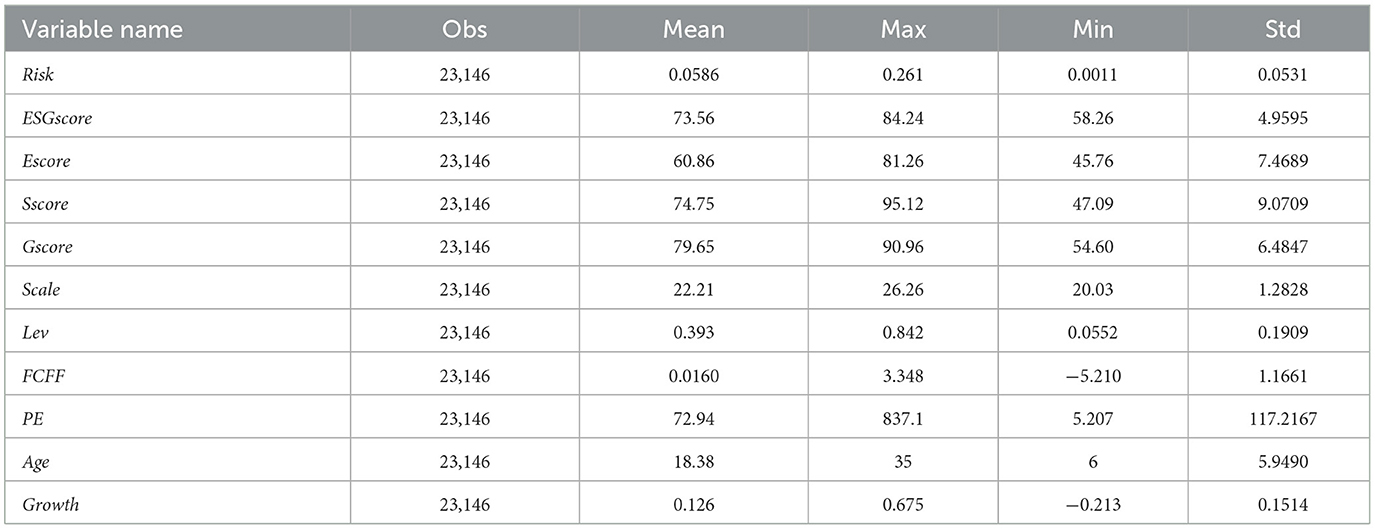

4.1 Descriptive statistical analysis

Table 2 shows the descriptive statistics of the main variables of this study. A statistical analysis of the data reveals the following observations for the 23,146 sample points: Firstly, the difference in the level of corporate risk-taking between Shanghai and Shenzhen A-share listed companies is relatively small. Second, the difference in the comprehensive ESG performance of each company is relatively significant. Finally, most companies in the sample have relatively low environmental performance scores. Social responsibility performance scores are relatively high, indicating that listed companies contribute more positively to social welfare. In addition, corporate governance performance scores are also relatively high.

4.2 Regression analysis

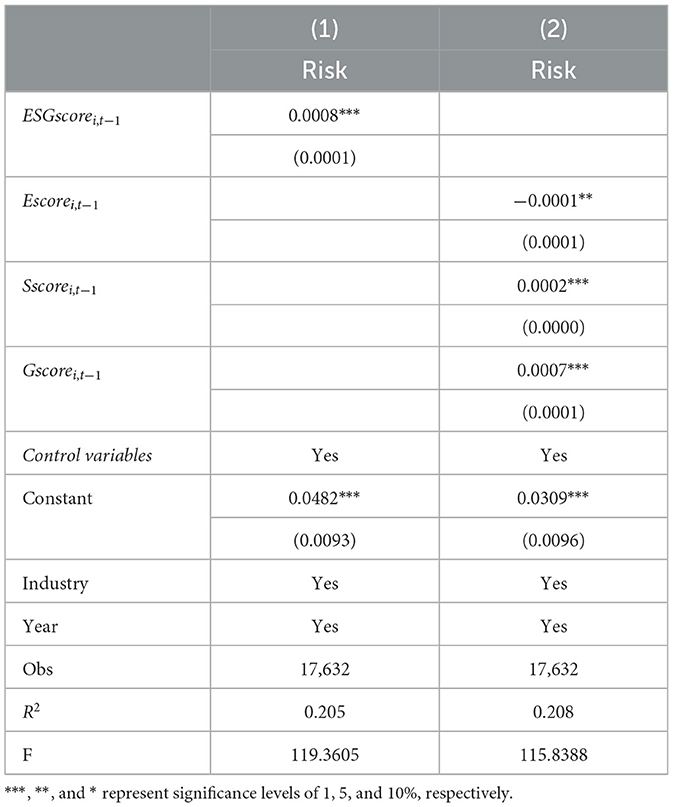

Table 3 illustrates the baseline regression model examining the influence of ESGP on CRT. Column (1) of Table 3 demonstrates that the regression coefficient of corporate ESGP is 0.0009 and is significant at the 1% level. The results show that there is a facilitating effect of corporate ESGP on CRT, and hypothesis H1 is verified. The improvement of corporate ESGP releases positive signals to the public, improves information asymmetry, and can effectively inhibit managers' risk aversion. At the same time, good ESGP is more conducive to the acquisition of resources and the establishment of a good reputation image, which in turn improves CRT.

Column (2) of Table 3 presents the findings of the primary regression analysis for each component of ESGP. The regression coefficient for Escore is negative and statistically significant at the 1% level, thereby supporting hypothesis H2. The regression coefficient for Sscore is positive and significant at the 1% level, thereby supporting H3. The regression coefficient for Gscore is positive and significant at the 1% level, thereby supporting H4. From the above results, it can be concluded that the improvement of environmental performance inhibits the CRT, while the improvement of social responsibility performance and governance performance can increase the level of CRT.

4.3 Robustness test

4.3.1 Independent variable lagged one period

Given that there is a lag in the value effect of carbon disclosure quality, this paper lags the dependent variable, companies' ESGP, as well as the performance of each component by one period. It also mitigates the endogeneity problem of reverse causality. They are denoted by ESGscorei,t−1, Escorei,t−1, Sscorei,t−1, Gscorei,t−1, respectively.

The variables of ESGP lagged by one period are employed to re-estimate model (1), the results of which are presented in Table 4. It can be observed that the lagged one-period ESGP regression coefficient for all enterprises is 0.0008, which is significant at the 1% level. This suggests that the conclusion that companies' ESGP enhance CRT level is robust.

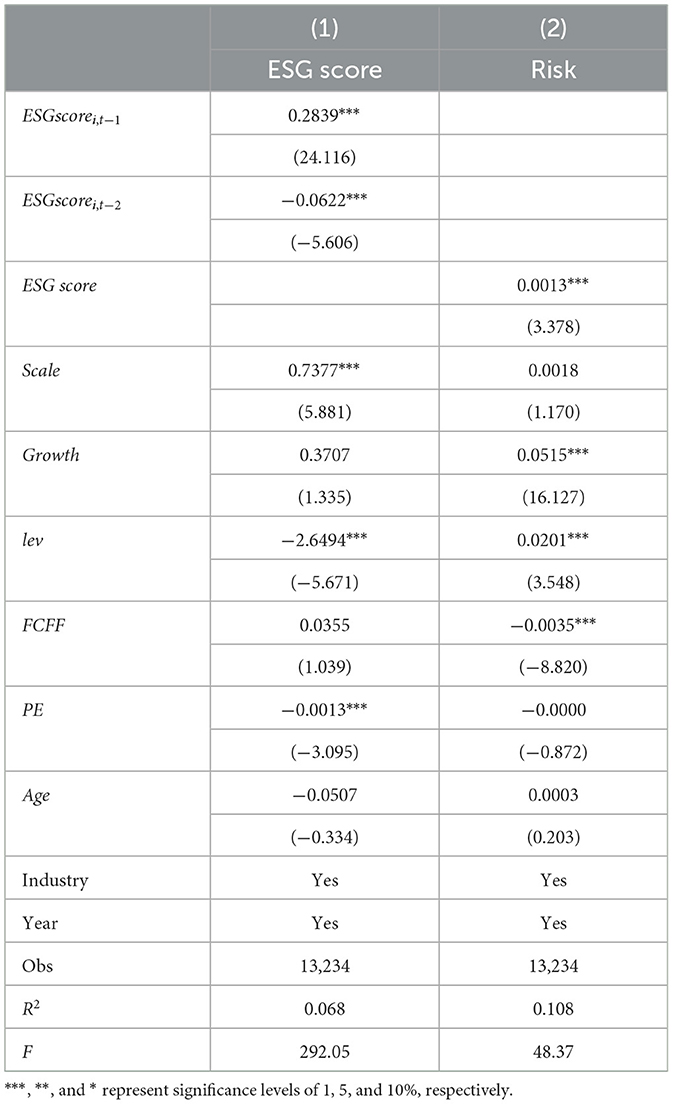

4.3.2 Endogeneity correction test

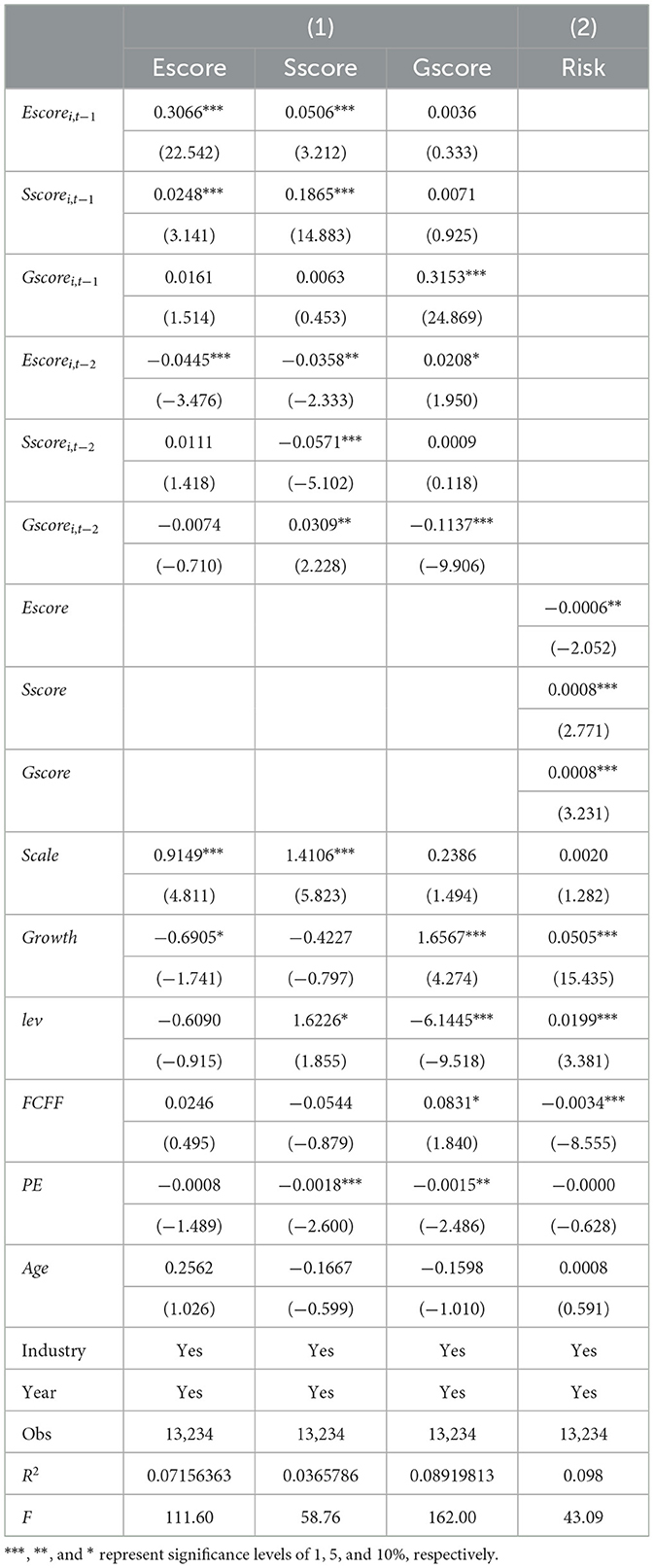

To further eliminate the interference of endogeneity, this paper adopts the instrumental variable method, using the first-order and second-order lag terms of the independent variable ESG performance as instrumental variables. The results are shown in Table 5. After considering the endogeneity problem, the regression coefficient of ESG composite performance is significantly positive at the 1% level, which is consistent with the previous regression results, indicating that the results of the baseline model are somewhat robust.

Similarly, the first-order and second-order lagged terms of each component of ESGP are used as instrumental variables, and the results are shown in Table 6. After mitigating the endogeneity problem, the regression coefficients of environmental performance are significantly negative at the 5% level, the regression coefficients of social performance are significantly positive at the 1% level, and the regression coefficients of corporate governance performance are significantly positive at the 1% level, which is consistent with the results of the previous regressions.

4.3.3 Replacement of the dependent variable

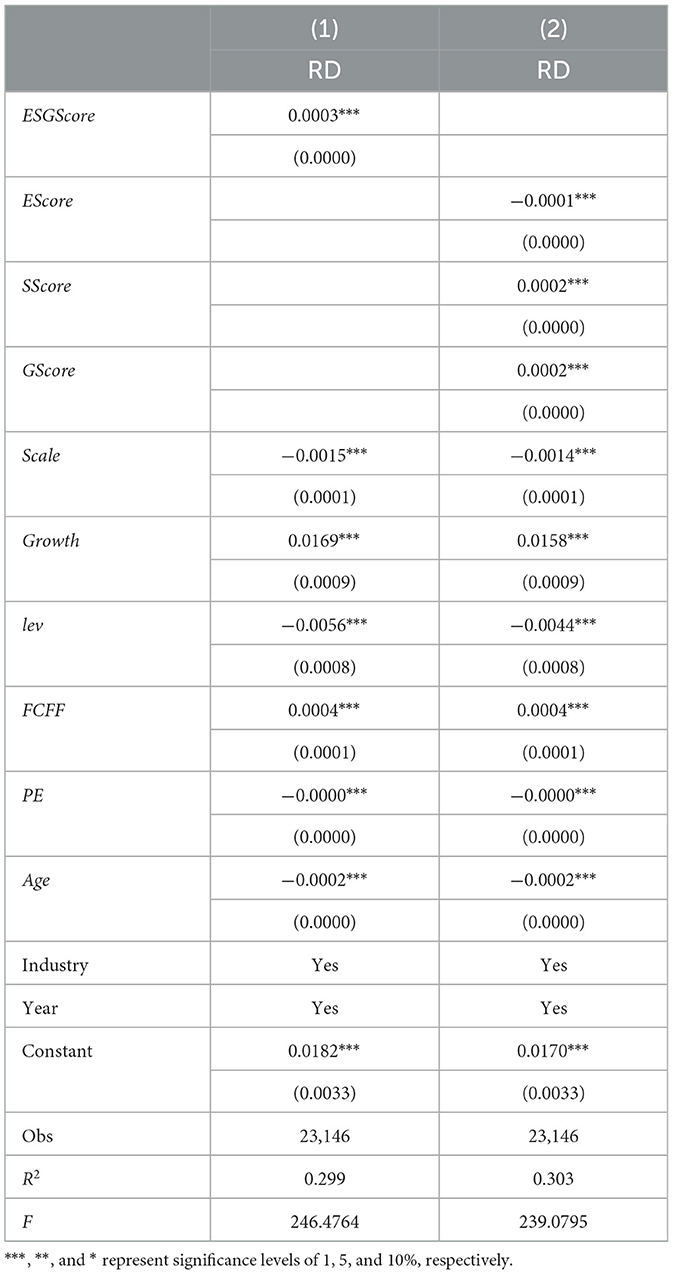

R&D investment, as a highly representative high-risk investment activity of enterprises, is an important element of their technological innovation. Research has shown that firms with a high risk appetite tend to invest more in R&D (Kini and Williams, 2012). Therefore, this paper selects the firm's R&D investment as a proxy variable for risk-taking, and conducts benchmark regression for models (1) and (2). The results are shown in Table 7, which again verifies the robustness of the benchmark regression results.

5 Further analysis

5.1 Moderating effect

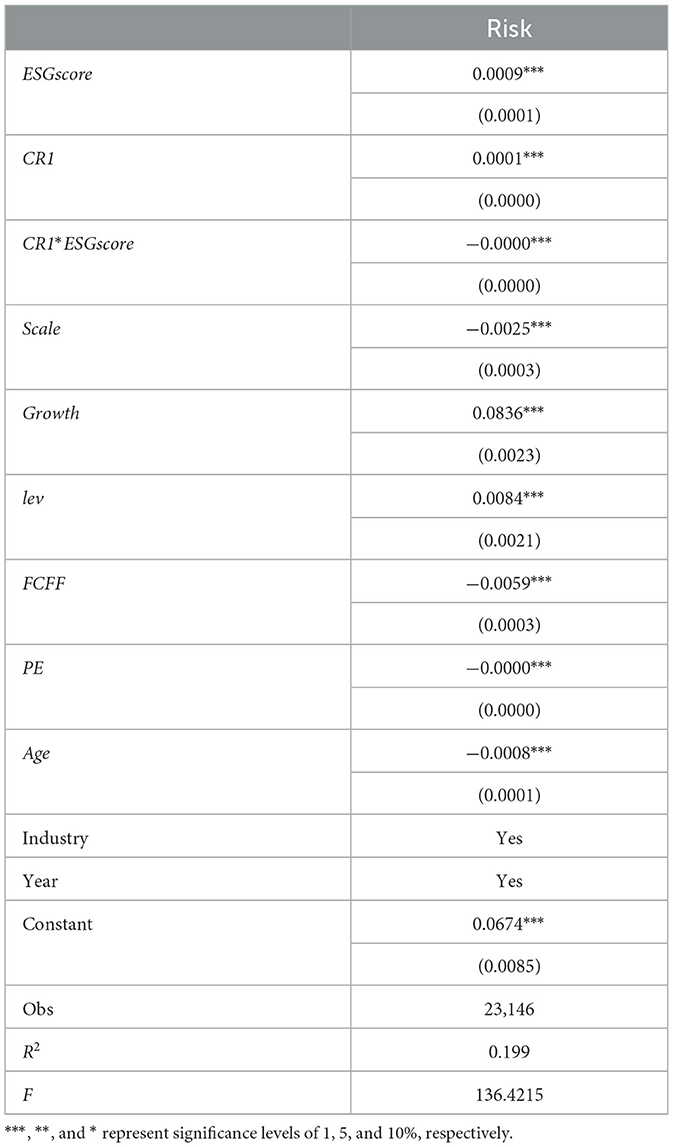

This study examines the moderating effect of equity concentration (CR1) on the relationship between corporate ESGP and CRT capability. The results of the moderation test are shown in Table 8. It indicates that the lower the equity concentration, the greater the contribution of ESGP to CRT, which verifies the hypothesis H5a.

5.2 Mechanism testing

The above research indicates that the improvement in corporate ESGP has a facilitating effect on CRT. This impact mechanism might involve several intermediary mechanisms. To investigate whether the degree of corporate financing restricts and the level of corporate innovation are among these intermediary mechanisms, relevant tests were conducted.

5.2.1 Corporate innovation level

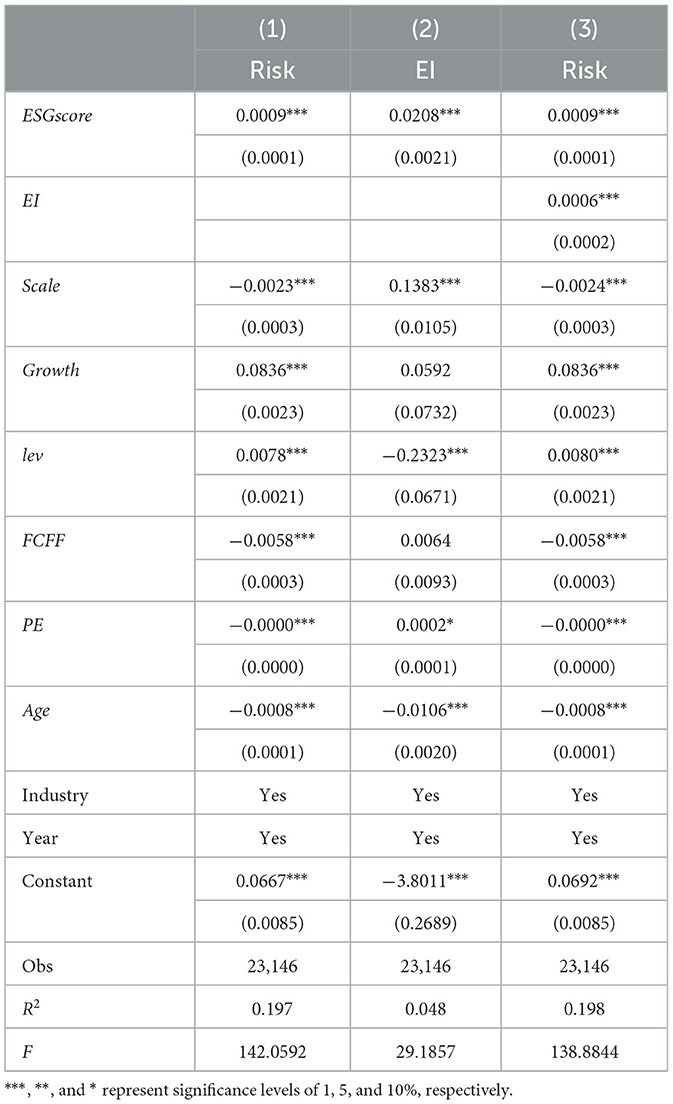

From Table 9, it can be seen that corporate innovation level operates a fully mediating role in the effect of ESGP on CRT, thereby validating H5b. These tests suggest that ESGP can enhance CRT by influencing the level of corporate innovation.

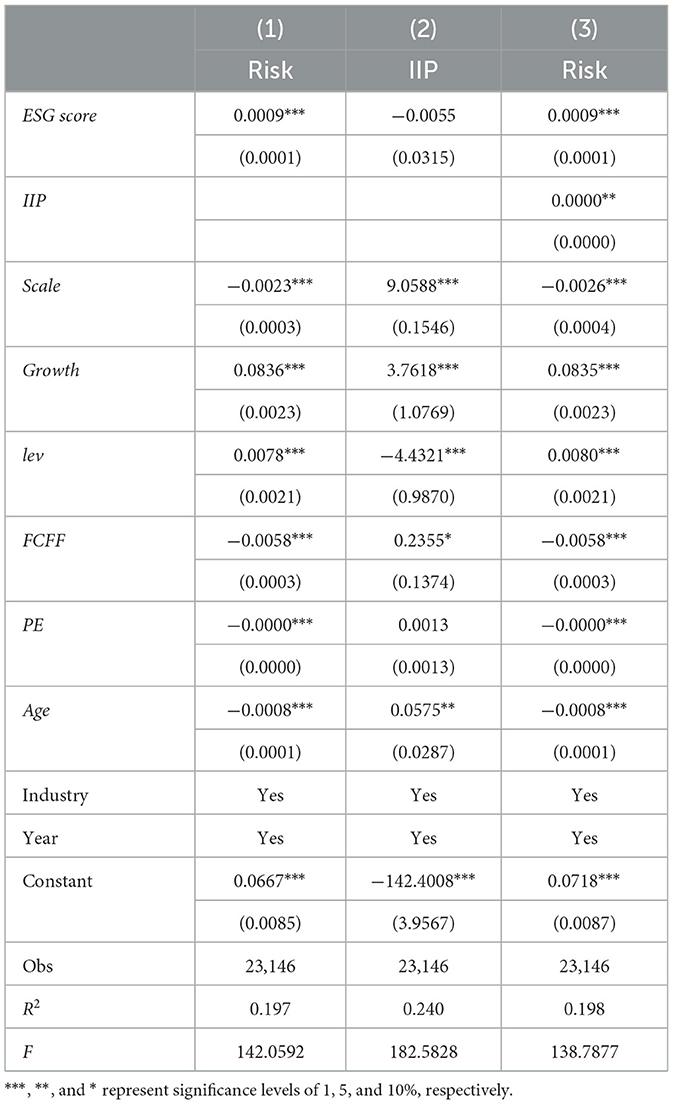

5.2.2 Institutional investor shareholding

The mediation effect test of the stepwise regression method is shown in Table 10: In the test in column (1), the regression coefficient of the independent variable ESGP is significantly positive at the 1% level, indicating a significant direct effect. In the test in column (2), the regression coefficient of ESGP on the mediator variable institutional investor ownership is −0.0055 and significant at the 1% level, implying that improving ESGP will increase institutional ownership. The regression coefficient of ESGscroe in column (2) and the regression coefficient of IIP in column (3) are significant, and the indirect effect is significant. The direct effect is positive and the indirect effect is positive, which means that the shareholding of institutional investors (IIP) has a partial mediating effect in the model. ESGP makes a positive contribution to corporate governance by increasing the shareholding of institutional investors, which promotes the improvement of CRT.

6 Conclusions and implications

Based on the data samples of A-share listed companies for the period 2009–2022, this paper conducts econometric analyses and scientific assessments of the relationship between ESGP and CRT. The conclusions are shown below:

1) The improvement of ESGP has a promoting effect on CRT. Among them, improvements of environmental performance inhibit the level of CRT, while social responsibility and corporate governance performance may enhance CRT.

2) Equity concentration plays a moderating role in the relationship between ESGP and CRT. When equity is relatively dispersed, it enhances the contribution of ESGP to CRT.

3) The inhibitory effect of ESGP on CRT can be achieved by influencing the innovation level of firms and the shareholding of institutional investors. Corporate ESGP can promote the level of scientific and technological innovation, which leads to a higher risk-taking capacity. In addition, ESGP can also increase the level of risk-taking by increasing the share of institutional investors.

Based on the empirical findings, the key implications of this study are as follows:

Firstly, we should encourage companies to further deepen their understanding of ESG concepts and implement effective incentives to promote management's implementation of ESG responsibilities. Managers should take full advantage of the positive role of ESG performance in raising the level of corporate innovation, and promote the improvement of corporate risk-taking by strengthening the support of institutional investors.

Secondly, companies can modulate their CRT behavior by adjusting the performance standards of individual ESG components. A higher CRT stance may have an adverse impact on environmental performance, as it may hinder environmental governance efforts. Consequently, it is recommended that the government introduce further environmental incentives and subsidies to encourage companies to enhance their planning and investment in environmental management. In addition, improved social governance performance can create a positive and favorable image for companies. It is recommended that governments take the lead in encouraging companies to invest more in social welfare. At the same time, internal corporate governance should be optimized to avoid the trust risks associated with information asymmetry.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

SL: Formal analysis, Methodology, Writing – original draft, Writing – review & editing, Visualization. YZ: Conceptualization, Methodology, Supervision, Writing – original draft, Writing – review & editing. CS: Funding acquisition, Supervision, Validation, Writing – original draft, Writing – review & editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This work was supported by the Major Program of the National Fund of Philosophy and Social Science of China (No. 21&ZD109), National Natural Science Foundation of China (Nos. 72074186 and 71673230), Basic Scientific Center Project of National Science Foundation of China (No. 71988101), and the Fundamental Research Funds for the Central Universities concerned Chinese modernization (No. 20720231061).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

The author(s) declared that they were an editorial board member of Frontiers, at the time of submission. This had no impact on the peer review process and the final decision.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Al Amosh, H., and Khatib, S. F. A. (2023). COVID-19 impact, financial and ESG performance: evidence from G20 countries. Bus. Strat. Dev. 6, 310–321. doi: 10.1002/bsd2.240

Albuquerque, R., Koskinen, Y., and Zhang, C. (2019). Corporate social responsibility and firm risk: theory and empirical evidence. Manage. Sci. 65, 4451–4469. doi: 10.1287/mnsc.2018.3043

Aydin, M., Pata, U. K., and Inal, V. (2022). Economic policy uncertainty and stock prices in BRIC countries: evidence from asymmetric frequency domain causality approach. Appl. Econ. Anal. 30, 114–129. doi: 10.1108/AEA-12-2020-0172

Bova, F., Dou, Y., and Hope, O.-K. (2015). Employee ownership and firm disclosure. Contemp. Account. Res. 32, 639–673 doi: 10.1111/1911-3846.12084

Chakraborty, A., Gao, L. S., and Sheikh, S. (2019). Managerial risk taking incentives, corporate social responsibility and firm risk. J. Econ. Bus. 101, 0148–6195. doi: 10.1016/j.jeconbus.2018.07.004

Chen, F., Liu, Y. H., and Chen, X. Z. (2024). ESG performance and business risk—Empirical evidence from China's listed companies. Innovat. Green Dev. 3:100142. doi: 10.1016/j.igd.2024.100142

Cialdini, R. N., and Goldstein, N. J. (2004). Social influence: compliance and conformity. Annu. Rev. Psychol. 55, 591–621. doi: 10.1146/annurev.psych.55.090902.142015

Drempetic, S., Klein, C., and Zwergel, B. (2020). The influence of firm size on the ESG score: corporate sustainability ratings under review. J. Bus. Ethics 167, 333–360. doi: 10.1007/s10551-019-04164-1

Du, Q. Y., Sun, Z. N., Goodell, J. W., Du, A. M., and Yang, T. L. (2024). Ecological risk and corporate sustainability: examining ESG performance, risk management, and productivity. Int. Rev. Finan. Anal. 96, 1057–5219. doi: 10.1016/j.irfa.2024.103551

Ellili, N. O. (2022). Impact of ESG disclosure and financial reporting quality on investment efficiency. Corp. Gov. 22, 1094–1111. doi: 10.1108/CG-06-2021-0209

Faccio, M., Marchica, M. T., and Mura, R. (2016). CEO gender, corporate risk-taking, and the efficiency of capital allocation. J. Corp. Finan. 39, 193–209. doi: 10.1016/j.jcorpfin.2016.02.008

Freeman, R. E. (1984). Strategic Management: A Stakeholder Perspective. Boston, MA: Pitman Publishing Inc.

Gao, C., Zuzul, T., Jones, G., and Khanna, T. (2017). Overcoming institutional voids: a reputation-based view of long-run survival. Strat. Manag. J. 38, 2147–2167. doi: 10.1002/smj.2649

Godfrey, P. C., Merrill, C. B., and Hansen, J. M. (2009). The relationship between corporate social responsibility and shareholder value: an empirical test of the risk management hypothesis. Strat. Manag. J. 30, 425–445. doi: 10.1002/smj.750

Habib, A., and Hasan, M. M. (2017a). Firm life cycle, corporate risk-taking and investor sentiment. Account. Finan. 57, 465–497. doi: 10.1111/acfi.12141

Habib, A., and Hasan, M. M. (2017b). Social capital and corporate cash holdings. Int. Rev. Econ. Finan. 52, 1059–0560. doi: 10.1016/j.iref.2017.09.005

Hanelt, A., Bohnsack, R., Marz, D., and Marante, C. A. (2021). A systematic review of the literature on digital transformation: insights and implications for strategy and organizational change. J. Manag. Stud. 58, 1159–1197. doi: 10.1111/joms.12639

Hao, Y., Wang, L. O., and Lee, C. C. (2020). Financial development, energy consumption and China's economic growth: new evidence from provincial panel data. Int. Rev. Econ. Finan. 69, 1132–1151. doi: 10.1016/j.iref.2018.12.006

Harford, J., Kecskés, A., and Mansi, S. (2018). Do long-term investors improve corporate decision making? J. Corporate Finan. 50, 424–452. doi: 10.1016/j.jcorpfin.2017.09.022

Harjoto, M., and Laksmana, I. (2018). The impact of corporate social responsibility on risk taking and firm value. J. Bus. Ethics 151, 353–373. doi: 10.1007/s10551-016-3202-y

Ioannou, I., and Serafeim, G. (2015). The impact of corporate social responsibility on investment recommendations: analysts' perceptions and shifting institutional logics. Strat. Manag. J. 36, 1053–1081. doi: 10.1002/smj.2268

Khairollahi, F., Shahveisi, F., Vafaei, A., and Alipour, M. (2016). From Iran: does improvement in corporate environmental performance affect corporate risk taking? Environ. Qual. Manag. 25, 17–33. doi: 10.1002/tqem.21471

Kim, K., Patro, S., and Pereira, R. (2017). Option incentives, leverage, and risk-taking. J. Corp. Finan. 43, 1–18. doi: 10.1016/j.jcorpfin.2016.12.003

Kini, O., and Williams, R. (2012). Tournament incentives, firm risk, and corporate policies. J. Financ. Econ. 103, 350–376. doi: 10.1016/j.jfineco.2011.09.005

Kish-Gephart, J. J., and Campbell, J. T. (2015). You don't forget your roots: the influence of CEO social class background on strategic risk taking. Acad. Manag. J. 58, 1614–1636. doi: 10.5465/amj.2013.1204

Li, Y. Z., Zhao, Y., Ye, C. F., Li, X. F., and Tao, Y. Q. (2024). ESG ratings and the cost of equity capital in China. Energy Econ. 136:107685. doi: 10.1016/j.eneco.2024.107685

Lins, K. V., Henri, S., and Ane, T. (2017). Social capital, trust, and firm performance: the value of corporate social responsibility during the financial crisis. J. Finan. 7, 1785–1824. doi: 10.1111/jofi.12505

Liu, G., Yang, Z., Zhang, F., and Zhang, N. (2022). Environmental tax reform and environmental investment: a quasi-natural experiment based on China's Environmental Protection Tax Law. Energy Econ. 109:11. doi: 10.1016/j.eneco.2022.106000

Liu, M. Y., Li, C. Y., Wang, S., and Li, Q. H. (2023). Digital transformation, risk-taking, and innovation: evidence from data on listed enterprises in China. J. Innovat. Knowl. 8:100332. doi: 10.1016/j.jik.2023.100332

Liu, Y., Jin, M. X., Kim, C. L., and Mai, Y. (2024). The relationship between heterogeneous institutional investors' shareholdings and corporate ESG performance: evidence from China. Res. Int. Bus. Finan. 71:102457. doi: 10.1016/j.ribaf.2024.102457

Magee, S., Schilling, C., and Sheedy, E. (2019). Risk governance in the insurance sector—determinants and consequences in an international sample. J. Risk Insur. 86, 381–413. doi: 10.1111/jori.12218

Massa, M., and Zaldokas, A. (2017). Information transfers among co-owned firms. J. Finan. Intermediat. 31, 77–92. doi: 10.1016/j.jfi.2016.11.002

Nakano, M., and Nguyen, P. (2012). Board size and corporate risk taking: further evidence from Japan. Corp. Govern. 20, 369–387. doi: 10.1111/j.1467-8683.2012.00924.x

Ongsakul, V., Chatjuthamard, P., and Jiraporn, P. (2022). Does the market for corporate control impede or promote corporate innovation efficiency? Evidence from research quotient. Finan. Res. Lett. 46:102212. doi: 10.1016/j.frl.2021.102212

Pedersen, L. H., Fitzgibbons, S., and Pomorski, L. (2021). Responsible investing: the ESG-efficient frontier. J. Financ. Econ. 142, 572–597. doi: 10.1016/j.jfineco.2020.11.001

Qian, K., Liang, X. Y., and Liu, X. F. (2023). Managerial ability, managerial risk taking and innovation performance. Finan. Res. Lett. 57, 1544–6123. doi: 10.1016/j.frl.2023.104193

Samet, M., and Jarboui, A. (2017). How does corporate social responsibility contribute to investment efficiency? J. Multinatl. Finan. Manage. 40, 33–46. doi: 10.1016/j.mulfin.2017.05.007

Shahzad, F., Lu, J., and Fareed, Z. (2019). Does firm life cycle impact corporate risk taking and performance? J. Multination. Financ. Manage. 51, 23–44. doi: 10.1016/j.mulfin.2019.05.001

Shen, H. T., Lin, H. H., Han, W. Q., and Wu, H. Y. (2023). ESG in China: a review of practice and research, and future research avenues. China J. Acc. Res. 16, 1755–3091. doi: 10.1016/j.cjar.2023.100325

Shleifer, A., and Vishny, T. W. (1986). Large shareholders and corporate control. J. Politi. Econ. 94, 461–488. doi: 10.1086/261385

Sitkin, S. B., and Pablo, A. L. (1992). Reconceptualizing the determinants of risk behavior. Acad. Manage. Rev. 17, 9–38. doi: 10.2307/258646

Vial, G. (2019). Understanding digital transformation: A review and a research agenda. J. Strateg. Inf. Syst. 28, 118–144. doi: 10.1016/j.jsis.2019.01.003

Vilanova, M., Lozano, J. M., and Arenas, D. (2009). Exploring the nature of the relationship between CSR and competitiveness. J. Bus. Ethics 87, 57–69. doi: 10.1007/s10551-008-9812-2

Wang, H. J., Jiao, S. P., and Ma, C. (2024). The impact of ESG responsibility performance on corporate resilience. Int. Rev. Econ. Finan. 93, 1059–0560. doi: 10.1016/j.iref.2024.05.033

Wang, H. T., Qi, S. Z., and Li, K. (2023). Impact of risk-taking on enterprise value under extreme temperature: from the perspectives of external and internal governance. J. Asian Econ. 84:101556. doi: 10.1016/j.asieco.2022.101556

Wang, S. J., Zhang, X. Q., Cebula, R. J., and Foley, M. (2024). Cross-shareholding, managerial capabilities, and Strategic risk-taking in enterprises: a game or a win-win? Finan. Res. Lett. 62:105228. doi: 10.1016/j.frl.2024.105228

Wang, Y., and Wang, X. K. (2024). From ratings to action: the impact of ESG performance on corporate innovation. Heliyon 10:e26683. doi: 10.1016/j.heliyon.2024.e26683

Xue, C. Y., and Ying, Y. (2022). Financial quality, internal control and stock price crash risk. Asia Pac. J. Account. Econ. 29, 1671–1691. doi: 10.1080/16081625.2020.1754254

Zhang, R., Zhu, J., and Zhu, Y. C. (2010). Corporate philanthropic giving, advertising intensity, and industry competition level. J. Bus. Ethics 94, 39–52. doi: 10.1007/s10551-009-0248-0

Zhang, S. F., Xu, G. H., Shu, Y., and Zhu, J. (2024). Corporate ESG competitive disadvantage and cost of debt financing. Finan. Res. Lett. 69, 1544–6123. doi: 10.1016/j.frl.2024.106102

Zhang, X., Li, F. C., and Ortiz, J. (2021). Internal risk governance and external capital regulation affecting bank risk-taking and performance: evidence from P.R. China. Int. Rev. Econ. Finan. 74, 276–292. doi: 10.1016/j.iref.2021.03.008

Keywords: ESG performance, corporate risk-taking, equity concentration, innovation levels, institutional investor shareholding

Citation: Sun C, Lu S and Zhang Y (2024) How components of ESG performance impact corporate risk-taking? Front. Sustain. Energy Policy 3:1493355. doi: 10.3389/fsuep.2024.1493355

Received: 09 September 2024; Accepted: 14 October 2024;

Published: 06 November 2024.

Edited by:

Liang Li, Nanjing University of Information Science and Technology, ChinaReviewed by:

Guoxiang Li, Nanjing Normal University, ChinaMengmeng Xu, Nanjing University of Science and Technology, China

Copyright © 2024 Sun, Lu and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yaodan Zhang, enlkeXlkczA2MDNAMTYzLmNvbQ==

Chuanwang Sun

Chuanwang Sun Shuangji Lu

Shuangji Lu Yaodan Zhang2*

Yaodan Zhang2*