- Green Strategies, Inc., Washington, DC, United States

Once a little-scrutinized and largely optional aspect of corporate greenhouse gas emissions disclosure, Scope 3 emissions accounting and reporting is now a common element of voluntary climate best practice and is increasingly being adopted as part of new mandatory corporate climate disclosure policies. As Scope 3 disclosure becomes more central to what companies are asked (or required) to do, we perhaps should ask anew what exactly it is we are trying to accomplish. While those NGOs and other stakeholders that designed the Scope 3 framework and who have included it in highly influential corporate leadership programs were well-intentioned, it is becoming clear that the system as designed is ill-suited to serve its fundamental purpose: driving corporate actions to reduce, avoid, and remove greenhouse gas emissions. Scope 3 inventories are often seen as an end in and of themselves, yet from a climate perspective, they are only tools—and only useful if they help lead to positive emissions impact. What companies are asked to do regarding value chain emissions is not adequately aligned with what climate science demands. Therefore, greenhouse gas accounting, disclosure, and leadership programs and rules must modernize their approaches to Scope 3. Options include: limiting data collection requirements to seeking actionable, primary data; using proxy data only as a baseline from which the demonstrated impact of emissions-reducing interventions can be credited by target setting and leadership programs; and by fully embracing the use of verified market mechanisms to enable investments in positive emissions impact.

Introduction

The past decade-plus has seen a remarkable increase in the number of companies voluntarily calculating and disclosing greenhouse gas footprints, almost always pursuant to the requirements of the two-plus-decades-old Greenhouse Gas Protocol's suite of corporate greenhouse gas (GHG) accounting and reporting standards and the construct of “Scopes 1, 2, and 3 (see Figure 1).” While not without challenges, calculating Scope 1 emissions (direct emissions from a company's operations and assets, such as emissions from company-owned vehicles or from burning fuel in an on-site boiler), and Scope 2 emissions (indirect emissions primarily from purchased energy, such as emissions at the power plant that generates the electricity that a company buys from its utility) has become a relatively straightforward undertaking for most larger companies. Calculating and disclosing Scope 3 emissions (emissions not controlled by the company but in its “value chain,” such as emissions created by suppliers producing goods and services used by the company in conducting its business), however, is an entirely different challenge.

Figure 1. Overview of GHG protocol scopes and emissions across the value chain. Source: Greenhouse Gas Protocol, Corporate Value Chain (Scope 3) Accounting and Reporting Standard.

Calculating Scope 3 emissions represents a step-change increase in effort from Scope 1 and Scope 2 reporting—an effort that can drain corporate climate budgets by seeking to “engage” suppliers and chasing “data” further and further in its value chain in pursuit of “completeness” (but not necessarily in pursuit of actionability). Nevertheless, Scope 3 calculations and disclosures are increasingly expected of major companies1 and are typically a necessary component of a company setting third party-approved “science-based” emissions reduction targets. Even more importantly, perhaps, corporate greenhouse gas emission disclosures based on the Scope 1–3 construct are rapidly moving from the realm of voluntary actions to mandatory requirements for major companies. The UK (UK Department of Business, 2022) and EU (EU Directive, 2022/2464) have adopted mandatory emissions disclosures, with voluntary Scope 3 disclosure in the UK2 and mandatory Scope 3 disclosure in the EU. The State of California is finalizing disclosure rules that will include Scope 3 (Cheng et al., 2023). The U.S. Securities and Exchange Commission (SEC, 2022), after receiving strong objections from industry and others (ESG Dive, 2024), finalized its climate rule without including mandatory Scope 3 disclosure.

In both the voluntary and mandatory contexts, Scope 3 emissions reporting is getting increased attention. At this inflection point in the two-decade journey of corporate greenhouse gas disclosure, it is both fair and important to look anew at Scope 3 accounting and disclosure, ask why Scope 3 emissions accounting was created, and identify what questions a Scope 3 inventory purports to answer.

Scope 3: the “What”

As described by the Greenhouse Gas Protocol (the global standard for scope-based GHG inventory accounting and disclosure), “[s]cope 3 emissions occur from sources that are not owned or controlled by the reporting company, but occur from sources owned and controlled by other entities in the value chain (e.g., contract manufacturers, materials suppliers, third-party logistics providers, waste management suppliers, travel suppliers, lessees and lessors, franchisees, retailers, employees, and customers)” (Greenhouse Gas Protocol, 2011a). While broad, there is logic to this definition: a company's actions in the economy does drive emissions both upstream and downstream from the company itself. Thus, if one asks “what are all the emissions for which a company is responsible?,” Scope 3 is not an unreasonable part of the answer [and a big part—estimates show that Scope 3 emissions typically range from 65% to 95% of total emissions for which a company is responsible (Cox and Herman, 2022)].

In pursuit of finding an answer to this question, companies are faced with an enormous task. The Protocol's 2011 Scope 3 Standard breaks Scope 3 into 15 “categories” (such as emissions from “purchased goods and services,” “transportation and logistics,” and “use of sold products”) (Greenhouse Gas Protocol, 2011b). A Company is expected to “strive for completeness” in its Scope 3 disclosure by calculating emissions for each “relevant” category that “contribute significantly to the company's total anticipated Scope 3 emissions” and justifying any excluded categories (Greenhouse Gas Protocol, 2011c).

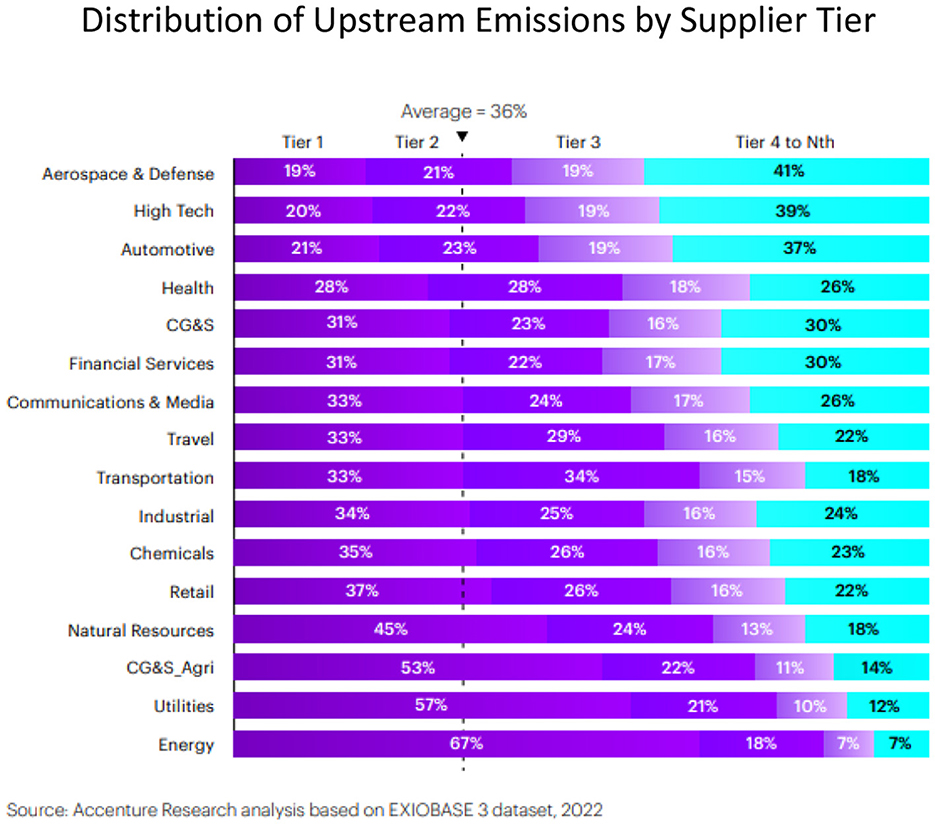

For many companies, emissions associated with their supply chain represent their largest Scope 3 category and accounting for these emissions is particularly challenging. It is estimated that the average company has 3,000 suppliers per US$1 billion in spending (Figbytes., 2023). Across industries, on average only one-third of a company's supply chain emissions come from a company's direct suppliers (often referred to as “Tier One” suppliers). This means that two-thirds of a company's supply chain emissions come from second, and third, and even more remote indirect suppliers that may not be known to the reporting company (Accenture., 2022) (see Figure 2). Getting emissions data from suppliers can be very difficult and complex to incorporate into a reporting company's scope 3 inventory—assuming that the supplier is even willing to calculate its emissions. And since a company's Scope 3 includes its supplier's Scope 3 emissions (e.g., from its suppliers), the data visibility and collection challenges are only multiplied.

Figure 2. Distribution of upstream emissions by supplier tier. Source: Accenture: thought you knew the Scope 3 issues in your supply chain? Think again.

Thus, Scope 3 is different from Scope 1 and Scope 2 in at least two important ways. For Scopes 1 and 2, emissions can be calculated from inputs that are relatively accessible (e.g., my corporate jet flew X miles in a year and that plane emits Y tons of CO2/mile), and importantly, such data provides actionable information for interventions to reduce those emissions (e.g., if a company knows the emissions intensity of its electricity use, it then knows the emissions benefits of an improvement in energy efficiency). But a Scope 3 inventory may not really reflect the specific emissions sources in a company's “value chain.” In the absence of actual emissions data from a company's own suppliers (and their suppliers, and so forth), for example, companies are instructed to “use secondary data to fill data gaps” (Greenhouse Gas Protocol, 2022a) in the inventory, including using “industry-average data, environmentally-extended input output data, proxy data or rough estimates” (Greenhouse Gas Protocol, 2022b) to complete a “full corporate GHG emissions inventory” (Greenhouse Gas Protocol, 2022c). The Protocol thus acknowledges that companies may find that “achieving the most complete Scope 3 inventory requires using less accurate data, compromising overall accuracy (Greenhouse Gas Protocol, 2011d).”

Nevertheless, companies are asked to pursue such compromised inventory completion, both by the terms of the Protocol and by leading target setting programs like the Science-Based Target Initiative (SBTi)3. As discussed below, the problem presented by these rules is that such indirect and proxy data in a Scope 3 inventory is not particularly well-suited to identifying specific opportunities for interventions to reduce emissions; and further, even if such opportunities can be identified, current rules discourage (if not prohibit) companies from using the types of market-based mechanisms that can make such interventions feasible4.

Scope 3: the “Why”

Why was Scope 3 created? All of a company's Scope 3 emissions are someone else's Scope 1 and Scope 2 emissions—but the designers of the Protocol knew it was unrealistic to expect that all emitters in a company's value chain would themselves calculate and report those emissions. Scope 3 was a way to assign “responsibility” (albeit indirect) to those otherwise orphaned emissions. In a fundamental sense, Scope 3 was essentially a “work-around (Ballentine, 2023).” Further, some companies outsource significant business functions (such as manufacturing) and thus may show relatively few Scope 1 and Scope 2 emissions while their overall footprint is much larger. The concern was that without three scope disclosure, stakeholders could get an incomplete picture of emissions. These may be reasonable justifications for the creation of Scope 3, but the environmental NGOs and stakeholders that designed the Scope 3 standard have put forth other questions that Scope 3 is intended to answer.

Identifying GHG-related risks

Corporate climate calculations and disclosures can, in theory, serve two distinct purposes: providing relevant information to capital market stakeholders and creating incentives for companies to mitigate emissions. One of the original justifications for Scope 3 accounting and disclosure was roughly aligned with the first function: to identify risks associated with value chain emissions (Greenhouse Gas Protocol, 2011e). When the Scope 3 Standard was under development, there was an anticipation that strong climate policy such as cap and trade or carbon pricing was forthcoming and that few companies were adequately assessing the regulatory risks such policies presented based on emissions in operations and value chains.5 While the business risk of direct emissions-based regulation has receded, the climate crisis nevertheless presents multiple forms of risk for companies—physical risks to assets and supply chains, reputational/market share risks deriving from increasingly climate aware customers, and so forth.

Identifying and managing risk is an essential element of corporate governance; companies that do a poor job tend to pay the price in the market. And while the mandatory disclosures of climate-related information that are emerging across the global economy, including the U.S., are, in part and appropriately, intended to provide information on corporate climate risks, it is a problem that most of these regulatory regimes default, at least in part, to the GHG Protocol for how such disclosures should be made. It is highly questionable, however, that a Scope 3 inventory filled with indirect, modeled, and proxy data provides adequate answers to the question from capital markets of what climate-related risks a company faces in its value chain.

Finding new opportunities for efficiency and cost savings

Another cited reason for building a Scope 3 inventory is that it can lead to efficiency and cost savings (Greenhouse Gas Protocol, 2011f). Certainly, there are many examples where companies that examined their own operational emissions found opportunities for cost-saving investments in efficiency and other mitigation investments. It is therefore plausible that identification of actual emissions in a company's value chain could yield cost-saving opportunities, such as when using actual Tier 1 supplier emissions data, if obtainable, to identify efficiency opportunities that if undertaken by that supplier would reduce the costs of purchased goods (SBTi, 2023a)6. However, identifying and seizing these cost savings opportunities requires (1) collecting supplier and/or product specific data at a granular level (e.g., information on a supplier's boiler type, boiler age, and fuel supply), and (2) the ability to use that supplier data to structure financeable interventions that produce emissions reductions that will be reflected in the reporting company's Scope 3 inventory. Unfortunately, Scope 3 accounting, with its reliance on industry average data to meet its expansive boundary requirements and its deterrence of market-mechanisms to execute emissions-reducing interventions, is not well designed to support identifying cost or emissions savings opportunities or executing reduction investments in a company's value chain.

Needing a Scope 3 inventory in order to get a complete picture of a company's impact

In addition to the objective of providing (theoretically) material information to capital market stakeholders on climate risk, Scope 3 calculations and disclosures were also intended to provide to all interested stakeholders a full picture of a company's emissions impact (Greenhouse Gas Protocol, 2011g). However, the current Scope 3 rules do not provide a particularly good way to vindicate this goal. While adding Scope 3 calculation and disclosure does broaden the picture of a company's footprint, the fact that a Scope 3 inventory inevitably relies on estimated, modeled, and proxy data undercuts the objective of documenting a company's complete picture of their actual emissions impact. A Scope 3 inventory is an answer to the question of what a company's “complete picture of impact” is, though not a very accurate one.

Further, while providing stakeholders with a “complete” picture of emissions impact is a laudable goal, it is not a climate-sufficient one. The Protocol's entire approach to corporate GHG accounting was built around a foundational theory of change: By attributing emissions to a company through the creation of inventories, and then exposing those inventories to the light of day, companies would feel pressure to reduce their reported emissions. Two decades ago, when the Protocol's Corporate Standard was published, and when very few companies were otherwise inclined to take any proactive steps to reduce emissions, this theory made some sense. Under the “sunlight is the best disinfectant” approach of assembling and disclosing inventories, the assumption was that the final “impact” step would take care of itself. But as discussed below, this theory of change breaks down when it comes to value chain emissions.

Completing a Scope 3 inventory as a prerequisite for setting corporate reduction goals

What are the prerequisites to a company setting (and making progress toward) a GHG reduction goal? Today it is widely accepted that a “complete” Scope 3 inventory is a necessary part of the answer. The Scope 3 Accounting and Reporting Standard maintains that “[c]onducting a GHG inventory according to a consistent framework is also a prerequisite for setting credible public GHG reduction targets (Greenhouse Gas Protocol, 2011h).” And SBTi will not even consider approving a company's science-based target if the company has not “completed” a full Scope 3 inventory (SBTi, 2023b).

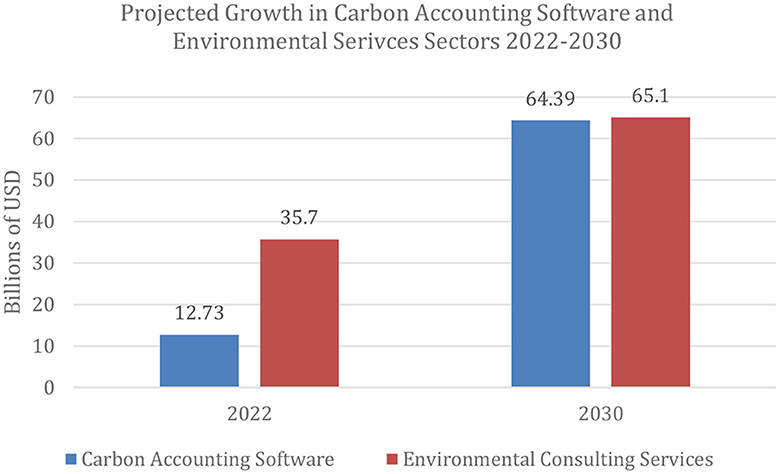

Thus, complete Scope 3 inventory construction is commonly discussed as an end-goal itself (including, by not surprisingly, the over $15 billion carbon accounting software and over $35 billion environmental consulting industries (see Figure 3) (Businesswire., 2023; Fortune Business Insights, 2023) that are eager to help companies complete this tall task). But putting aside that for most companies identifying and disclosing “the impacts of every supplier in their value chain” is asymptotic (and expensive) folly, is such a “complete” inventory a worthwhile endeavor?

Figure 3. Projected growth in carbon accounting software and environmental services sectors 2022–2030. Own Work. Data for this graph retrieved from Fortune Business Insights (2023) and Businesswire. (2023) Global Environmental Consulting Services Strategic Market Report.

The Protocol notes that “[e]xternal stakeholders, including customers, investors, shareholders, and others, are increasingly interested in companies' documented emissions reductions” (Greenhouse Gas Protocol, 2011h). That is often true, but it does not necessarily follow that completing a Scope 3 inventory under current practice vindicates those interests particularly well. Science-based targets today are set and met by completing an initial, base-year Scope 3 inventory and then taking steps to improve data collection and tracking reductions in that reported inventory over time. But we know that neither the base year nor any succeeding annual inventory is a true measurement of a company's actual value chain emissions because these inventories are, in significant part, based on secondary and estimated data. As a result, even a reduction in an inventory over time, as conceded by the Protocol, “may not always correspond to actual changes in GHG emissions to the atmosphere (Greenhouse Gas Protocol, 2022d).”

Without any nefarious intent, a company could use one proxy emissions factor for a given Scope 3 category where primary data is not available in one year, and then perhaps because of a change in consultants or software tools, use a different proxy emissions factor the next year, and potentially show a reduction and progress toward its goals—without doing anything at all to reduce actual emissions (the converse is also true, as subsequent inventories could reflect increases in emissions based only changes in secondary data). Thus, reported progress (or retrenchment) on Scope 3 goals under current rules may show changes to a Scope 3 inventory, but may not, in fact, meet the needs of stakeholders for information on “documented emissions reductions (Greenhouse Gas Protocol, 2011h).” Scope 3 inventory accounting under current practices is not well-suited for setting and meeting targets for actual emissions reduction.

Calculating and disclosing a Scope 3 inventory enhances reputation and stakeholder relations

Today, this is essentially correct. Stakeholders such as NGOs and sustainability ratings agencies often look for “boxes to check” in evaluating corporate climate performance. If a company has published a “complete” Scope 3 inventory under the rules or has an approved SBTi target, stakeholders do tend to give that company “credit” for those steps (CDP., 2023)7. But while measurement of leadership today is at least in part based on process steps and inventory metrics that may or may not align with actual beneficial climate impact, it is not clear that such proxies will—or should endure as adequate touchstones for reputational benefit and strong stakeholder relations.

Legacy justifications are not enough to support the current approach to Scope 3

At least for Scope 3, there is little evidence that the theory of attribution→inventories→disclosure = emissions impact is working particularly well. Corporate climate budgets are drained on things like finding proxy sectoral emissions factors, creating models to populate inventories across multiple Scope 3 categories, or creating supplier survey tools that may or may not yield actionable data—often with the help of costly consultants and software tools (ERM., 2022; Fortune Business Insights, 2023) –typically before capital expenditures on actual emissions reduction interventions are even considered8, While it is likely that no one has (or probably could) add up all the money companies have spent trying to assemble “complete” Scope 3 inventories, and then add up all the actual, real world emission reductions that followed from those expenditures (per the theory of change), but almost certainly the result would be a very high price per ton of GHGs reduced or avoided when all the costs of compiling a complete inventory are added to the numerator. In other words: a bad return on investment for the climate.

But the problem is not simply that current Scope 3 inventory processes drain employee bandwidth and company climate budgets (corporate climate leadership does—and should require investment). The problem is that (1) so much of that available capital goes to process steps that may or may not translate into real emissions reductions, and (2) under current practices, some opportunities to direct capital toward actual and measurable emissions mitigation are discouraged, if not prohibited, by current accounting and leadership rules.

Current Scope 3 rules can lead to emissions impact, but they also stymie action

It is fair and important to acknowledge that incumbent Scope 3 rules can lead to interventions with climate value. For example, value chain emissions include both upstream emissions and downstream emissions (such as emissions from the use of a company's products). Unlike upstream emissions, often the sightline to emissions-impacting interventions downstream is clear and largely in the control of the reporting entity. If a company redesigns its widget device to be 10% more energy efficient than products it sold the previous year, it knows that that redesigned product will result in emissions savings vis a vis the company's previously deployed products (and in turn should count toward a Scope 3 goal since all other things being equal emissions from use of products will go down in year two). Perhaps the most ambitious example of a downstream value chain emissions reduction target is Trane Technologies' Gigaton Challenge (Trane Technologies, 2023). The largest part of Trane's carbon footprint comes from the energy used to power its HVAC products and from the inevitable leakage of the refrigerants used in those products. By reducing the global warming potential and the amount of the refrigerants used in the systems, and by making those systems more energy efficient, Trane can be certain that emissions will be reduced and its Scope 3 category of “use of sold products” will go down9.

It is also the case that upstream efforts to assess and influence emissions can have clear impact. For example, if a company can access data on the relative GHG intensity of alternative suppliers providing the same good or services, a company's choice to do business with the lower impact supplier is an intervention that could yield climate benefit (assuming that such a preference leads to increased market share for the lower carbon supplier, and with the caveat that it really depends on suppliers doing the work of determining the carbon intensity of their goods and services). But that example does not rely on the ability of a company to get a particular supplier to do something different (a degree of influence that many companies do not possess) and it is not predicated on an expensive wild goose chase after multiple tiers of unknown suppliers' suppliers' data.

The current Scope 3 rules of the Protocol and SBTi also inhibit GHG emissions mitigation investments—an outcome incompatible with the urgency of the climate crisis. The following reflect real examples from companies exploring potential emissions reduction interventions.

• The “free rider” problem and the risk of changing suppliers. Company A, a manufacturer of hardware products, seeks to invest in the decarbonization of Tier 1 suppliers' natural gas boilers by paying the cost of converting to electric boilers. Under the current accounting guidance, there are two reasons that Company A might not make that investment. First, the reduction in the emissions factor for the supplier's products resulting from the boiler conversion would be shared across the Scope 3 inventories of all of that supplier's customers. This causes a “free-rider problem” and disincentivizes Company A from making the investment since it would only realize a portion of the inventory-reducing effect of the intervention based on their percentage offtake from that supplier (what is “attributed” to them under the strict inventory approach of Scope 3 rules). Second, even that resulting partial benefit that appears in Company A's Scope 3 inventory would be lost if, for whatever business reason, it switches suppliers—despite the fact that the climate benefit caused by the company's investment remains.

• Tying the impact of specific emissions reductions to specific suppliers may not be possible. Company B, a food and beverage company, wished to support regenerative agricultural practices in agricultural commodity cultivation by its Tier 2+ suppliers. Given the lack of visibility into its Tier 2+ suppliers, Company B would like to fund these regenerative practices in its agricultural commodity “supplier shed,” a group of suppliers that is likely (but not certain) to include their supplier farmers. Since Company B is not able to trace the emissions reduction clearly to their specific suppliers, absent clear guidance on the use of “insets” in corporate GHG targets, they will not be able to claim this reduction in their inventory. As a result, Company B will not invest in the projects, despite a real contribution to lower-carbon agricultural practices.

• Even for an intervention with a tier 1 supplier, the resulting decarbonization impact may not be traceable to the precise goods and services provided to the company. Company C has Scope 3 emissions from product delivery with medium- and heavy- duty trucks. To help meet its climate targets the Company would like to finance the conversion of some of its trucking company supplier's trucks to electric or alternative fuels. However, the supplier cannot always tie a specific truck to the specific delivery of Company C's products. In addition, Company C also knows it may decide to switch logistics suppliers in the future during the expected lifespan of the converted trucks. Because the Company cannot trace the investment (lower carbon trucks) to the delivery of their actual goods the Company cannot claim this reduction in their inventory or against their science-based target and the investment is not made.

• Inability to use market instruments to overcome traceability and risk of supplier switching. Company C declines to make the investment in electric or alternative fueled trucks with their logistics supplier as described above. If, however, the Company could measure and verify the actual emissions reductions resulting from the intervention, and use resulting carbon credits against its science-based target, it might then have made the investment. Traceability to the delivery of its goods would become irrelevant and even if the Company did switch suppliers in the future, it would still retain ownership of the emissions reductions. But under current rules, the Company would not be able to show an inventory reduction or credit toward a science-based target even from verifiable emissions if done using carbon credits. The investment and the emissions reduction does not occur.

• Even the use of otherwise favored carbon credits disfavored. Noting the critical need for solutions to decarbonize aviation and given the growth in the production of sustainable aviation fuel (SAF), Company D wishes to reduce its Scope 3, Category 6 (business travel) emissions with SAF. Much like it does with renewable electricity credits, Company D was willing to purchase SAF credits from a carbon credit marketplace. While it is likely that the Company could get the information needed to verify the production, use, and decarbonization value of the fuels underlying each credit, the Company cannot demonstrate that the exact commercial flights its employees take are powered by the exact SAF it enabled by paying for the environmental attributes via the credit marketplace. While acknowledging that use of market-based instruments (RECs) to reduce inventories is allowed for Scope 2, SBTi states that because the Protocol “does not provide guidance for market-based accounting for scope 1 or scope 3 emissions... as part of the checks carried out during the target validation process, it is not currently possible for the SBTi to assess whether inventories that include market-based approaches to scope 1 and scope 3 emissions are aligned with the GHGP” (SBTi, n.d.). Because Company D is not allowed to “book” documented carbon benefits of its investment and “claim” those benefits against its Scope 3 inventory and science-based target, the investment in SAF is not made.

These are examples of the types of emissions reduction projects that might be considered by companies but that are forgone in large part because of the rules of the Protocol and programs like SBTi. Under the Protocol, calculated emissions reductions from intervention projects using market mechanisms must be reported “outside” of a company's inventory (thus providing no benefit to meeting numerical/science-based goals, which are measured solely by changes to its inventory), and SBTi does not currently allow the use such market-based instruments for meeting science-based targets (SBTi, 2023a).

Making Scope 3 a better answer to a better question

The Protocol and the myriad of voluntary disclosure and target setting programs that have been built upon it were created for only one plausible reason: to help meet the challenge of climate change. Thus, each part of this greenhouse gas accounting, disclosure, and leadership ecosystem should be assessed by how well it leads to climate-beneficial impact. Regarding Scope 3, therefore, the right question is: “how can looking into value chain emissions lead a company to identify and act on opportunities to reduce, avoid, or remove greenhouse gas emissions?” When asking this right question, the current Scope 3 inventory accounting and reporting systems do not provide a good enough answer. Completing a Scope 3 inventory does not itself mean emissions have been reduced, avoided, or removed. And there is no compelling reason that a “complete” Scope 3 inventory should be considered a prerequisite to identifying and investing in emissions reductions. And as demonstrated above, even if the process of mapping value chain emissions sheds light on potential emissions-reducing interventions, current Scope 3 guidance and leadership program rules create obstacles to acting on that information.

Thus, the rules and expectations related to Scope 3 should be updated so as to focus more squarely on incentivizing, enabling, and optimizing actual beneficial climate impact. For example, it might be better to sacrifice the breadth of value chain emissions data companies are asked to collect in favor of narrower but more accurate data. Instead of assembling modeled and estimated data deep into and far across their supply chain, companies could be directed to instead only focus on acquiring actual (primary) data, such as from the direct suppliers. Armed with this narrower but more actionable data, and without the distraction and budget drain of first “completing” a Scope 3 inventory, companies then should be broadly encouraged and enabled to design financeable interventions to reduce emissions and to apply those reductions against their inventory and toward their science-based targets.

Shifting focus from the completeness of an inventory to incentivizing and enabling impact could still include a role for imperfect data. If a company used industry average or standardized data to measure emissions in a particular part of its supply chain, that less than accurate data could be used effectively as a baseline. A company could then be encouraged to finance, measure, and verify interventions to reduce emissions against that baseline. Here, the emphasis on measurement and accuracy would apply to the intervention more than the inventory. We should care less about whether the baseline inventory number for a particular part of an inventory is exact than we should about the actual and measured emissions impact from a subsequent intervention (the climate really does not care whether the baseline is 100 or 125 tons; it cares about the tons reduced by the intervention). Those reduced tons, in turn, should be fully reflected and credited under Scope 3 accounting and leadership program rules. Again, robust use of various types of market instruments including verified carbon credits should be encouraged.

Conclusion

Attributing emissions through inventories is only a tool; the goal is what climate science demands: positive greenhouse gas emissions impact. Scope 3 and science-based target regimes should be focused on little else.

In one sense, the current Scope 3 ecosystem is working—if success is measured by the number of companies working to complete inventories and setting Scope 3 targets. But the climate demands we do better. While the Protocol's aspiration is that “GHG accounting and reporting of a scope 3 inventory... be based on the following principles: relevance, completeness, consistency, transparency, and accuracy (Greenhouse Gas Protocol, 2011i),” the fact is that no Scope 3 inventory ever has or ever will meet this standard. Nevertheless, companies are directed to drain their climate budgets “engaging” suppliers and chasing data deeper and deeper up their supply chain in pursuit of “completeness”—but at the expense of accuracy and actionability. Meanwhile, as we pursue Scope 3 data as an end in and of itself—instead of only a tool to enable interventions—Rome burns. But we can overcome these shortcomings if, while acknowledging the importance of transparency, we approach value chain emissions squarely with the aspiration of identifying and incentivizing beneficial emissions impact.

Author contributions

RB: Writing – original draft, Writing – review & editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article.

Acknowledgments

The author wishes to thank the many experts, practitioners, and climate advocates who shared their experiences and perspectives. Thanks also go to Liana Biasucci for her valuable advice and assistance.

Conflict of interest

RB is the President of Green Strategies Inc. which supported his time in completing the Manuscript. Meta Platforms also provided funding to support the time for drafting of this manuscript. The content of the manuscript is entirely the work product of the author, and no funder or other entity exercised any editorial control over the design or content.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1. ^42% of companies disclosing to CDP in 2023 including Scope 3.

2. ^Department for Energy security and Net Zero, UK Government. UK greenhouse gas emissions reporting: Scope 3 emissions. Available online at: https://www.gov.uk/government/calls-for-evidence/uk-greenhouse-gas-emissions-reporting-scope-3-emissions (accessed October 19, 2023).

3. ^Science-Based Targets Initiative (SBTi). Available online at: https://sciencebasedtargets.org/.

4. ^SBTi's Net Zero Standard does include a recommendation that companies invest in “beyond value chain mitigation (BVCM)” through investment in activities such as carbon removals or carbon avoidance and mitigation credits. BVCM activities must remain strictly outside of a company's greenhouse gas inventory and may not be counted as progress toward meeting a science-based target.

5. ^The Scope 3 Standard's Business Goals Chapter states that developing a scope 3 inventory may improve planning for potential future carbon regulations.

6. ^An SBTi 2022 survey found that only 6% of respondents use supplier-specific emissions factors and 81% reported that the ability to influence suppliers in their value chain is a barrier to meeting Scope 3 targets.

7. ^CDP's Climate Change Scoring Methodology, for example, awards points simply for reporting emissions in at least one Scope 3 category. Disclosing this minimum of one Scope 3 Category is sufficient to be considered for an A-level grade.

8. ^A recent survey of companies across sectors found that an average of $533 000 per year per company was spent on voluntary climate-related data collection (inventories) and disclosures.

A market forecast by Fortune Business Insights projects that the carbon accounting software market to grow from 15B in 2023 to 64B in 2030.

9. ^Yet while Scope 3 rules enable such downstream efforts, they are still arguably sub-optimal. When a company sells an energy-consuming product, it is told to report the full lifetime of emissions from that product in the year it is sold. This means that companies are penalized for producing long-lived products (otherwise a sustainability value) and they are not allowed to reflect the actual emissions impact of changing grid carbon intensities over time.

References

Accenture. (2022). Thought you know the Scope 3 issues in your supply chain? Think again: Gaining visibility to hidden hot spots to move from targets to action to value, page 9. Available online at: https://www.accenture.com/content/dam/accenture/final/markets/growth-markets/document/Accenture-visibility-into-scope-3-emissions-in-supply-chain-report-option-optimized.pdf

Ballentine, R. S. (2023). The unusual suspects: are well-meaning environmental stakeholders and institutions undercutting the contributions that companies can make to fighting climate change? Oxford Open Clim. Change 3:kgad009. doi: 10.1093/oxfclm/kgad009

Businesswire. (2023). Global Environmental Consulting Services Strategic Market Report 2023. Available online at: https://www.businesswire.com/news/home/20231030430921/en/Global-Environmental-Consulting-Services-Strategic-Market-Report-2023-Market-to-Reach-65.1-Billion-by-2030—Digitalization-Renewed-Focus-on-Efficiency-Gives-New-Lease-of-Life-for-the-Market—ResearchAndMarkets.com

CDP. (2023). CDP 2023 disclosure fact sheet. Available online at: https://www.cdp.net/en/companies/cdp-2023-disclosure-data-factsheet (accessed January 11, 2024).

Cheng, L., Zilberberg, D. A., and Roberts, E. (2023). Harvard Law School, Forum on Corporate Governance. California Enacts Major Climate-related Disclosure Laws. Available online at: https://corpgov.law.harvard.edu/2023/10/22/california-enacts-major-climate-related-disclosure-laws/

Cox, E., and Herman, C. (2022). Tackling the Scope 3 Challenge. PwC. Available online at: https://www.pwc.com/gx/en/issues/climate/scope-three-challenge.html

ERM (2022). Costs and Benefits of Climate-Related Disclosure Activities by Corporate Issuers and Institutional Investors, page 5. Available online at: https://www.sustainability.com/globalassets/sustainability.com/thinking/pdfs/2022/costs-and-benefits-of-climate-related-disclosure-activities-by-corporate-issuers-and-institutional-investors-17-may-22.pdf (accessed January, 2024).

ESG Dive (2024). SEC drops scope 3 from final climate rule, takes phased approach to scope 1 and 2 reporting. https://www.esgdive.com/news/sec-final-climate-rule-scope-3-out-phased-approach-scope-1-scope-2/709420/ (accessed March 11, 2024).

EU Directive (2022/2464). Directive (EU) 2022/2464 of the European Parliament and of the Council of 14 December 2022 amending Regulation (EU) No 537/2014, Directive 2004/109/EC, Directive 2006/43/EC and Directive 2013/34/EU, as regards corporate sustainability reporting (Text with EEA relevance).

Figbytes. (2023). Engage Suppliers to Reduce Scope 3 Emissions and Beyond, page 2. Available online at: https://figbytes.com/wp-content/uploads/2023/09/Engage_Suppliers_to_Reduce_Scope_3_Emissions_FigBytes_White_Paper.pdf (accessed January, 2024)

Fortune Business Insights (2023). Carbon Accounting Software Market Size. Available online at: https://www.fortunebusinessinsights.com/carbon-accounting-software-market-107292 (accessed February 28, 2024).

Greenhouse Gas Protocol (2011a). Corporate Value Chain (Scope 3) Accounting and Reporting Standard, Chapter 6, Page 61. Available online at: https://ghgprotocol.org/sites/default/files/standards/Corporate-Value-Chain-Accounting-Reporing-Standard_041613_2.pdf

Greenhouse Gas Protocol (2011b). Corporate Value Chain (Scope 3) Accounting and Reporting Standard, Chapter 5, Page 32. Available online at: https://ghgprotocol.org/sites/default/files/standards/Corporate-Value-Chain-Accounting-Reporing-Standard_041613_2.pdf

Greenhouse Gas Protocol (2011c). Corporate Value Chain (Scope 3) Accounting and Reporting Standard, Chapter 6, Page 60. Available online at: https://ghgprotocol.org/sites/default/files/standards/Corporate-Value-Chain-Accounting-Reporing-Standard_041613_2.pdf

Greenhouse Gas Protocol (2011d). Corporate Value Chain (Scope 3) Accounting and Reporting Standard, Chapter 4, Page 24. Available online at: https://ghgprotocol.org/sites/default/files/standards/Corporate-Value-Chain-Accounting-Reporing-Standard_041613_2.pdf

Greenhouse Gas Protocol (2011e). Corporate Value Chain (Scope 3) Accounting and Reporting Standard, Chapter 2, Page 11. Available online at: https://ghgprotocol.org/sites/default/files/standards/Corporate-Value-Chain-Accounting-Reporing-Standard_041613_2.pdf

Greenhouse Gas Protocol (2011f). Corporate Value Chain (Scope 3) Accounting and Reporting Standard, Chapter 2, Page 13. Available online at: https://ghgprotocol.org/sites/default/files/standards/Corporate-Value-Chain-Accounting-Reporing-Standard_041613_2.pdf

Greenhouse Gas Protocol (2011g). Corporate Value Chain (Scope 3) Accounting and Reporting Standard, Chapter 1, page 5. Available online at: https://ghgprotocol.org/sites/default/files/standards/Corporate-Value-Chain-Accounting-Reporing-Standard_041613_2.pdf

Greenhouse Gas Protocol (2011h). Corporate Value Chain (Scope 3) Accounting and Reporting Standard, Chapter 2, Page 14. Available online at: https://ghgprotocol.org/sites/default/files/standards/Corporate-Value-Chain-Accounting-Reporing-Standard_041613_2.pdf

Greenhouse Gas Protocol (2011i). Corporate Value Chain (Scope 3) Accounting and Reporting Standard, Chapter 4, Page 23. Available online at: https://ghgprotocol.org/sites/default/files/standards/Corporate-Value-Chain-Accounting-Reporing-Standard_041613_2.pdf

Greenhouse Gas Protocol (2022a). Scope 3 Frequently Asked Questions, page 17. Available online at: https://ghgprotocol.org/sites/default/files/standards_supporting/Scope%203%20Detailed%20FAQ.pdf (accessed January, 2024).

Greenhouse Gas Protocol (2022b). Scope 3 Frequently Asked Questions, page 9. Available online at: https://ghgprotocol.org/sites/default/files/standards_supporting/Scope%203%20Detailed%20FAQ.pdf

Greenhouse Gas Protocol (2022c). Scope 3 Frequently Asked Questions, page 2. Available online at: https://ghgprotocol.org/sites/default/files/standards_supporting/Scope%203%20Detailed%20FAQ.pdf

Greenhouse Gas Protocol (2022d). Scope 3 Frequently Asked Questions, page 18. Available online at: https://ghgprotocol.org/sites/default/files/standards_supporting/Scope%203%20Detailed%20FAQ.pdf

SBTi (2023a). SBTi's current position is that it will “assess insetting on a case-by-case basis... and may not approve their use.” Target Validation Protocol for Near-term Targets, page 47. Version 3.1. Available online at: https://sciencebasedtargets.org/resources/files/Target-Validation-Protocol.pdf

SBTi (2023b). Target Validation Protocol for Near-term Targets, page 14. Version 3.1. Available online at: https://sciencebasedtargets.org/resources/files/Target-Validation-Protocol.pdf (accessed March, 2024).

SBTi (n.d.) FAQs – What role do market instruments play in target setting with the SBTI? Available online at: https://sciencebasedtargets.org/faqs#what-role-do-market-based-accounting-approaches-play-in-target-setting-with-the-sbti (accessed December 2023).

SEC (2022). SEC Proposes Rules to Enhance and Standardize Climate-Related Disclosures for Investors. Available: https://www.sec.gov/news/press-release,/2022-46 (accessed March, 2024).

Trane Technologies (2023). The Gigaton Challenge. Webpage. Available online at: https://www.tranetechnologies.com/en/index/sustainability/gigaton-challenge.html (accessed February, 2024).

UK Department of Business Energy and Industrial Strategy. (2022). Mandatory climate-related financial disclosures by publicly quotes companies, large private companies and LLPs. Available online at: https://www.gov.uk/government/publications/climate-related-financial-disclosures-for-companies-and-limited-liability-partnerships-llps

Keywords: Scope 3, carbon accounting, greenhouse gas emissions, voluntary carbon market, corporate sustainability, corporate social responsibility

Citation: Ballentine R (2024) Scope 3: what question are we trying to answer? Front. Sustain. Energy Policy 3:1378390. doi: 10.3389/fsuep.2024.1378390

Received: 29 January 2024; Accepted: 28 March 2024;

Published: 10 April 2024.

Edited by:

Eric O'Shaughnessy, Berkeley Lab (DOE), United StatesReviewed by:

Magdalena Wójcik-Jurkiewicz, Kraków University of Economics, PolandPiyush Choudhary, Oil and Natural Gas Corporation, India

Copyright © 2024 Ballentine. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Roger Ballentine, cm9nZXJAZ3JlZW5zdHJhdGVnaWVzLmNvbQ==

Roger Ballentine

Roger Ballentine