- School of Management, Collaborative Innovation Center for Energy Economics and Energy Policy, China Institute for Studies in Energy Policy, Xiamen University, Fujian, China

In the context of the “dual carbon” strategy, how to leverage green finance to promote China's wind power industry is a hot topic. Unlike existing literature, this article uses a nonparametric additive model to investigate the impact and mechanism of green finance on wind power development. Research has found that green finance has an inverted U-shaped nonlinear impact on wind power development, indicating that green finance has a more prominent contribution to the wind power industry in the early stages. Further mechanism research indicates that green finance affects the wind power industry through foreign direct investment and green technology innovation. Specifically, with the relaxation of foreign direct investment conditions in the energy sector, the role of foreign direct investment in promoting the wind power industry more prominent in the later stages. In the early stages, government support was greater, and green technology patents grew rapidly, driving green technology innovation to have a more significant impact on the wind power industry. In addition, the impact of fiscal decentralization, wind power prices, and environmental regulations on the wind power industry also exhibits significant nonlinear characteristics. This article helps to comprehensively understand the mechanism and impact of green finance on wind power development, and provides a reliable basis for optimizing green finance policy and effectively promoting wind power.

1 Introduction

Climate change and its serious ecological and environmental issues have become a common focus of attention in the international community today (Leal Filho et al., 2023). Greenhouse gas emissions are the main source of global warming. How to effectively control greenhouse gas emissions is the most interesting topic for the managers and academia in various countries. Since 2005, China has become the world's largest emitter of carbon dioxide (Liu et al., 2023). In 2021, China's carbon dioxide emissions reached 12.0 billion tons. In 2020, the Chinese government proposed the strategic goal of achieving carbon peak by 2030 and realizing carbon neutrality by 2060.

Renewable energy has the advantages of low-carbon and renewable energy. Vigorously developing renewable energy has become the main direction of the world energy revolution. Compared to other renewable energy sources, wind power has the advantages of flexible installation sites and short construction cycles (Li et al., 2023). China has a vast territory and abundant wind resources. In the past decade or so, local governments have vigorously promoted wind power growth. In 2021, China's wind power production reached 600 billion hours, accounting for 50% of hydropower production. However, wind power enterprises still face some challenges, such as weak technological innovation capabilities, and large funding gaps (Sun et al., 2023).

The report of the 20th National Congress of the CPC clearly pointed out that it should accelerates the green transformation of economic growth, and improve the fiscal, taxation, financial, and investment systems for green development. Developing green finance and leveraging the resource allocation function of the financial system in renewable energy development have become an important national strategy (Shang et al., 2023). Green finance can promote the development of renewable energy enterprises by supporting green technology research and development, and guiding capital flow. Can green finance effectively promote the wind power industry? What is the intermediate mechanism? This issue is related to the construction of a green financial system and the formulation of new energy policies. Green technology innovation is the primary driving force for renewable energy, so does green finance contribute to green innovation? Can green finance drive sustained growth in the wind power industry through green technology innovation? Exploring this issue from both theoretical and empirical perspectives is of great significance.

The literature on green finance has provided valuable reference for this article. However, existing literature mostly focuses on the impact of green finance on renewable energy, or focuses on examining the carbon reduction effect of a certain green financial instrument such as green credit, and green stocks (Alharbi et al., 2023). There is relatively little research on the comprehensive evaluation of the impact of green finance on the wind power industry, and few scholars have examined the impact channels of green finance on wind power development. The marginal contributions of this article are reflected in three aspects. (1) This article investigates the impact mechanism of green finance on wind power development, from the perspectives of foreign direct investment and green technology innovation. Most existing literature investigates the impact of green finance on wind power development from the perspectives of traditional technological progress and market concentration. This study broadens the perspective of existing literature. (2) Most existing literature uses linear methods to investigate the wind power industry, such as system optimization methods, input-output analysis, and spatial econometric models. However, the wind power development and socio-economic variables are often fluctuating and non-stationary, driven by economic cycles. The nexus between economic variables may be nonlinear. The linear model masks the nonlinear nexus between economic variables, and the results obtained do not conform to economic reality. The nonparametric models are data-driven models, and can truly depict the true relationship between economic variables (Denti et al., 2023; Salibian-Barrera, 2023). Therefore, this article constructs a new nonparametric additive model, and uses it to investigate the nonlinear effect of green finance on the wind power industry.

2 Literature review

2.1 The relationship between green finance and wind power development

Green finance has become a strategy for the energy revolution in the world. Green finance has driven a large amount of investment in green energy projects, accelerated energy transformation, and promoted the wind power industry (Sharma et al., 2022). Using a vector error correction model, Ren et al. (2020) analyzed the relationships between green finance, renewable energy consumption, and carbon intensity. The results found that green finance supported the expansion of renewable energy production, which in turn helped to reduce carbon intensity. This conclusion was confirmed by the research results of Zhang and Wang (2021). Li et al. (2021) investigated renewable energy generation in China using wavelet spectral analysis. This study indicated that green finance and renewable energy were mutually reinforcing. Wind power energy also belonged to clean energy. The results of Madaleno et al. (2022) exhibited that green finance could provide funding for technological research and development and infrastructure construction for clean energy. Green finance was positively correlated with green energy, and this relationship exhibits heterogeneity across regions (Li et al., 2022). Green bonds play an important role in renewable energy production (Shang et al., 2023). Specifically, the issuance of green bonds effectively addresses the funding needs of wind power enterprises to implementing green energy projects (Rasoulinezhad and Taghizadeh-Hesary, 2022). Wind energy is most affected by green finance, followed by biofuels and fuel cells (Dogan et al., 2022). From a global perspective, green finance and financial inclusion were beneficial for the development of renewable energy globally, including the emerging wind power industry (Zhang et al., 2022). The impact path is that green finance drove the development of renewable energy through technological innovation, strengthening market openness, and boosting the economy (Lee et al., 2023).

2.2 The intermediary mechanism of green finance affecting wind power development

Playing the role of the financial market can meet the urgently needed funds for wind power development. Moreover, the financial market can influence wind power development through multiple paths. (1) Patents and technologies. Using a panel vector autoregressive model, Ge et al. (2022) discovered that green technology could help break through technical constraints, promote the rapid expansion of the new energy industry and reduce production costs. In this process, green finance provided sufficient funding for technology research and development (Alharbi et al., 2023). The surveys of Chinese listed companies had found that expanding the issuance of green bonds would help wind companies gain much-needed funding for scientific and technological innovation (Tan et al., 2022). Southeast Asian countries were lagging behind in green technology. Expanding technology transfer between countries can help quickly improve the overall level of new energy technology in this region and promote wind power development (Dong et al., 2023). (2) Information disclosure. The research results of Bhutta et al. (2022) showed that green bonds could provide funding for green energy projects. However, the prerequisite was to establish a good information disclosure system. (3) Capital market. A sound capital market was an important factor for green bonds to effectively promote the renewable energy industry (Devine and McCollum, 2022). Using the autoregressive distributed lag model, Taghizadeh-Hesary et al. (2023) discovered a one-way causal links from green bonds to wind energy. The prerequisite for effectively playing the role of green bonds was to establish a sound green bond market. Deepening capital market reform could help attract domestic and international investment and drive the growth of the wind energy industry (Jain et al., 2022).

(4) Utilization efficiency. Using the Fully Modified Ordinary Least Squares (FMOLS) method, Ye and Rasoulinezhad (2023) investigated 15 selected Asia Pacific countries. The results exhibited that green bonds had a positive impact on the utilization efficiency of renewable energy in the short and long term. In addition, green banks invested public and private funds in energy efficiency, which helped the wind power industry quickly expand production scale (Ning et al., 2023). (5) Dong et al. (2023) investigated six countries in Southeast Asia and found that issuing green bonds was an effective green financing tool for implementing renewable energy development. The degree of trade openness had a driving effect on expanding wind power consumption. The main reason was to improve the development level of green finance to attract more international investment, which in turn drove the wind power industry (Sun and Chen, 2022). (6) Spillover effect. There was a significant regional imbalance in wind energy resource endowment, technology, and industrial policies, leading to spatial effects in wind power development (Khezri et al., 2021). Yadav et al. (2023) found that in the long run, green bonds had a spillover effect on renewable energy.

The above research provides valuable references for this article. (1) However, these literatures overlook an important fact that there are significant spatial effects in wind power development. There are significant regional differences in wind power resources. For example, the northwest region of China has the most abundant wind power resources, and the coastal wind resources are also relatively abundant. (2) The literature investigating the effect of green finance on wind power is rare. Green finance has only achieved rapid development in recent years, becoming the main influencing factor of wind power. In view of this, this article constructs a nonparametric additive model and uses it to explore the effect of green finance on wind power development and its impact mechanism. Finally, this article proposes targeted suggestions to optimize the financial system, guiding green technology innovation, and promoting wind power development.

3 Method and model specification

3.1 Nonparametric additive regression model

The common feature of linear models is to assume that the links between variables is assumed to be a linear pattern in advance. In fact, any economic phenomenon is affected by many factors. It results in that the economic series being non-stationary, and further causes the nexus between variables to be non-linear (Chen H. et al., 2023). In the nonparametric model, the nexus between variables is determined by the variable data itself, and is not set manually. However, the nonparametric model also needs to be improved. For example, the estimation process is slow to converge, and the estimation effect is poor under the condition of small samples. Stone (1985) first proposed the nonparametric additive model, which can avoid the defects of the nonparametric model (Equation 1).

Where X is the explanatory variable, Y is the dependent variable, f (x) is a nonparametric function, P is the number of explanatory variables, and α is a constant term. Adding the parameter section of all explanatory variables to the right side of model 1, this paper builds a complete nonparametric additive model (Equation 2).

where βiXi is the parameter part. The estimation of model (2) is implemented by the Back-fitting method, which specific estimation process can refer to Buja et al. (1989).

3.2 Model specification

Existing relevant literature has proven that green finance (Li and Umair, 2023), urbanization (Dilanchiev et al., 2023), economic growth (Ahmad et al., 2023), fossil fuel prices (Mohammed and Mellit, 2023), wind power price (Atems et al., 2023), fiscal decentralization (Shahzad and Fareed, 2023), and environmental regulations (Du et al., 2023) also have a significant impact on wind power development. This article takes these variables as control variables into the analysis framework, and establishes a model (Equation 3).

Where LWIND stands for wind power development, LGFIN stands for green finance, LFIX means fixed asset investment, LGDP indicates economic growth, LURB represents urbanization, LGASP stands for fossil fuel price, LWP denotes wind power price, and LFIS means fiscal decentralization, LFINI indicates financial innovation, LGC indicates green credit. L represents the logarithmic processing of economic variable data. The parameter to be estimated is denoted by β1, β2,…,β8, and the disturbance term is denoted by μ. Equation (3) gives the main explanatory variables of wind power development. Equation (3) gives the main explanatory variables of rural poverty reduction. Based on the form of Equation (2), this article constructs a specific nonparametric additive regression model (Equation 4).

Where fi(·) (i=1, 2,…,7) means nonparametric functions.

3.3 Variable selection and data source

The dataset consists of the panel data of 30 provinces from 2013 to 2021. (1) Dependent variable. Wind power development is measured by the output of wind power generation (100 million kilowatt hours). (2) Core explanatory variable: green finance (LGFIN). This article uses the coupling coordination degree between urban financial development and urban green development to measure the level of urban green finance. The calculation formula for the degree of coupling coordination is as follows (Equation 5):

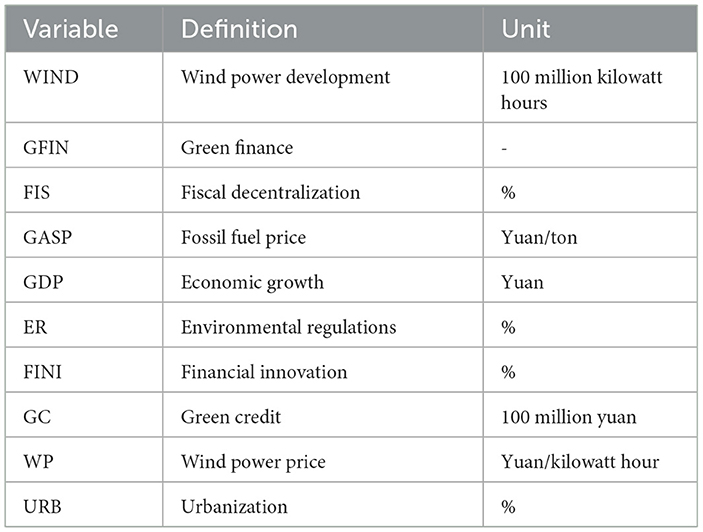

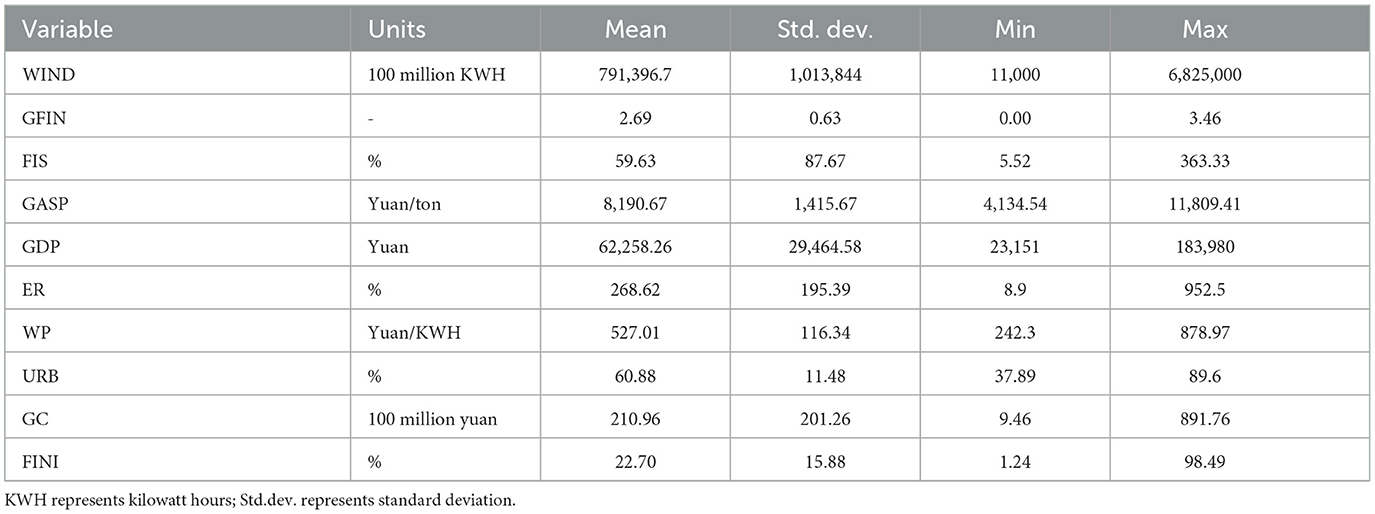

Where fina means the level of urban finance, which is equal to the ratio of bank loans to regional GDP (%). Gree means urban green development, which is equal to the sum of industrial wastewater emissions + industrial sulfur dioxide emissions + industrial dust emissions/GDP. (3) Control variable. Environmental regulations (LER) are expressed by the rate of environmental governance investment in GDP (%); economic growth (LGDP) is expressed in terms of per capita GDP (yuan); urbanization (LURB) = urban population/the total population (%), fossil fuel price (LGASP) is expressed by gasoline price (yuan/ton), wind power price (LWP) is expressed by the price of wind power entering the grid (yuan/kilowatt hour); fiscal decentralization (LFIS)=local per capita fiscal expenditure/national per capita fiscal expenditure (%). Financial innovation (LFINI) is represented by the proportion of non-interest income, which can measure the level of financial innovation in commercial banks (%). Green credit (LGC) is measured by the loan amount for non-high energy consuming industries (100 million yuan). The six high energy consuming industries include: petroleum, coal, and other fuel processing industries, chemical manufacturing industry, non-metallic mineral product industry, black metal smelting and rolling processing industry, nonferrous metal processing industry, and electricity, heat, gas and water production and supply. (4) Data source. The raw data on wind power development, fossil fuel price, wind power price, and green finance come from the Wande database. The original data of fixed asset investment, environmental regulation, economic growth, urbanization, and fiscal decentralization come from the China Statistical Yearbook. The original data of all variables are collected through various types of statistical yearbooks. The definition of economic variables is presented in Table 1, and the statistical results of economic variables are shown in Table 2.

4 Results

4.1 Unit root test

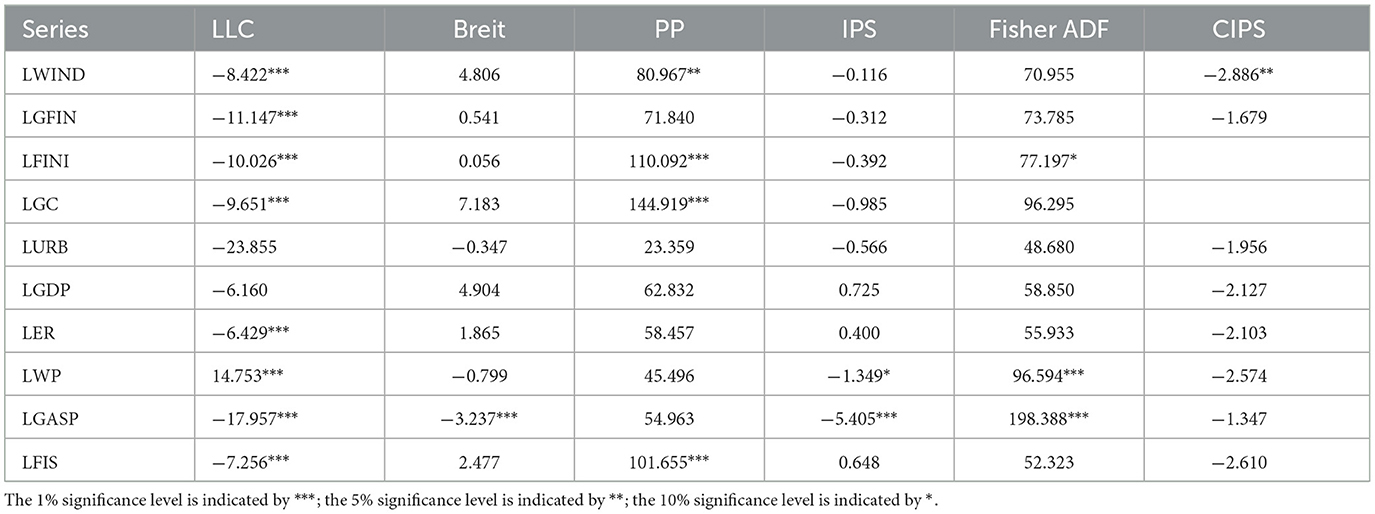

Since the second half of the 20th century, new econometric methods and theories are constantly emerging. The effectiveness of simulating socioeconomic phenomena has attracted more and more scholars to pay attention to econometric methods. Econometric model is a regression model established according to economic theory and some assumptions. It can describe the mutual causality between various economic variables. However, the precondition of model estimation is that the variable sequence is stable. The main methods of testing whether the panel data is stable include LLC test, Breit test, PP test, IPS test, and Fisher ADF test. However, these methods cannot explain the possible cross-sectional correlations. The CIPS test can consider the cross-sectional correlation of economic variable sequences, and then test whether the variable sequences are stationary. If the test results reject the unit root process, the economic variables are stationary. The results in Table 3 show that no variable sequence has passed all stationarity tests, meaning that these economic variables are not stationary.

4.2 Cointegration tests

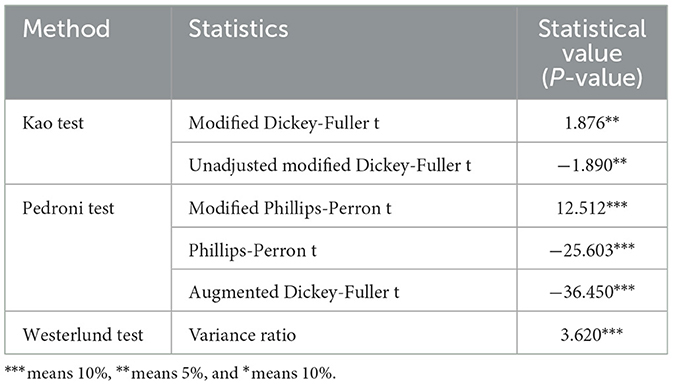

Econometrics theory deems that only economic variables with a long-term cointegration relationship can construct a model and perform regression estimation (Granger, 1988). The main methods used for the cointegration relationship test of panel data include the Kao, Pedroni, and Westerlund tests. In order to improve the reliability of the test results, this article simultaneously uses these three methods to test whether there is a cointegration relationship between economic variables. Table 4 indicates that all statistical values reject the original hypothesis. Therefore, this paper can draw a conclusion that there is an equilibrium causal nexus between rural poverty reduction and its explanatory variables.

4.3 Testing the forms of variable relationships

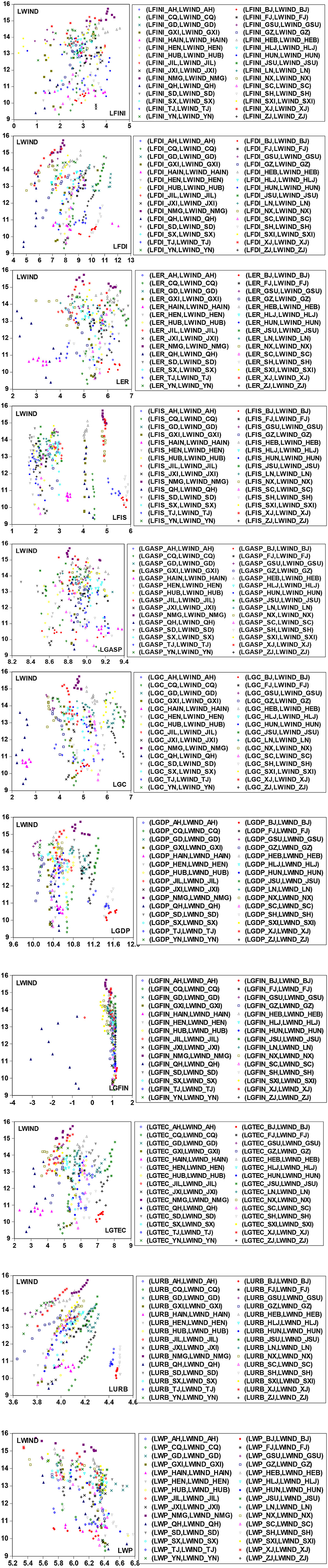

Before performing regression estimation, this paper draws a scatterplot of the links between wind power development and its core variables. Figure 1 displays that there are many nonlinear relationships between the three core variables and wind power development. Compared with the parametric models, a significant feature of the non-parametric model is that the pattern of nexus between variables is completely dominated by the data. The nonlinear connection existing between the variables can be faithfully estimated by the nonparametric model. Therefore, the results in Figure 1 also confirm that the use of non-parametric additive model to estimate wind power development is reasonable and applicable.

Figure 1. The scatter plot of panel data of economic variables. The vertical axis of the graph represents the dependent variable, and the horizontal axis represents the explanatory variables.

4.4 Estimation result

4.4.1 The results of linear effect

(1) Table 5 shows that the coefficient of green finance is 0.334, and the positive coefficient indicates that from a linear point of view, green finance promotes the growth of the wind power industry. This is mainly because green finance has led to the growth of green bonds, green stocks, and green loans, which can provide adequate financial support for wind power enterprises. Sufficient funds promote wind power enterprises to accelerate technological innovation, expand production scale, reduce the price of wind power, thereby driving wind power consumption. (2) The coefficient of environmental regulations is 0.419, indicating that the strengthening of environmental policies has promoted the development of wind power. The main reason is that the improvement of environmental policies has led to an increase in the pollution cost of enterprises. In order to reduce economic and administrative penalties, enterprises expand wind power use, thus driving wind power development.

(3) The coefficient of wind power price is −2.057, indicating that wind power price is not conducive to promoting the expansion of the wind power industry. This is mainly because at this stage, the price of wind power is still high. In the context of the gradual reduction of price subsidies, the cost performance of wind power is low. (4) The regression coefficient of urbanization is 1.469, indicating that for every 1% increase in urbanization rate, wind power output will increase by 1.469%. City managers increase clean energy consumption, thus driving wind power development.

(5) The coefficient of economic growth is 0.593, and a positive coefficient indicates that economic growth has driven wind power development. The main reason is that green economic growth has become the consensus of countries around the world. Vigorously developing the wind power industry can not only improve the industrial structure, but also reduce the carbon intensity. (6) The coefficient of fiscal decentralization is −0.028, indicating that fiscal decentralization has not significantly promoted the wind power industry. The main tool of the financial sector to support the wind industry is energy subsidies. However, excessive financial subsidies have led many wind power companies to rely too much on government support and lack innovation motivation. In order to stimulate the sustainable growth of the wind power industry, governments at all levels have significantly reduced wind power subsidies. Therefore, fiscal decentralization does not promote wind power. (7) The coefficient of fossil fuel price is 0.756, and a positive coefficient indicates that the higher the fuel prices, the better the development of the wind power industry. There is an alternative relationship between fossil energy and wind power. Higher fossil fuel prices encourage consumers to expand wind power consumption.

4.4.2 The results of nonlinear effect

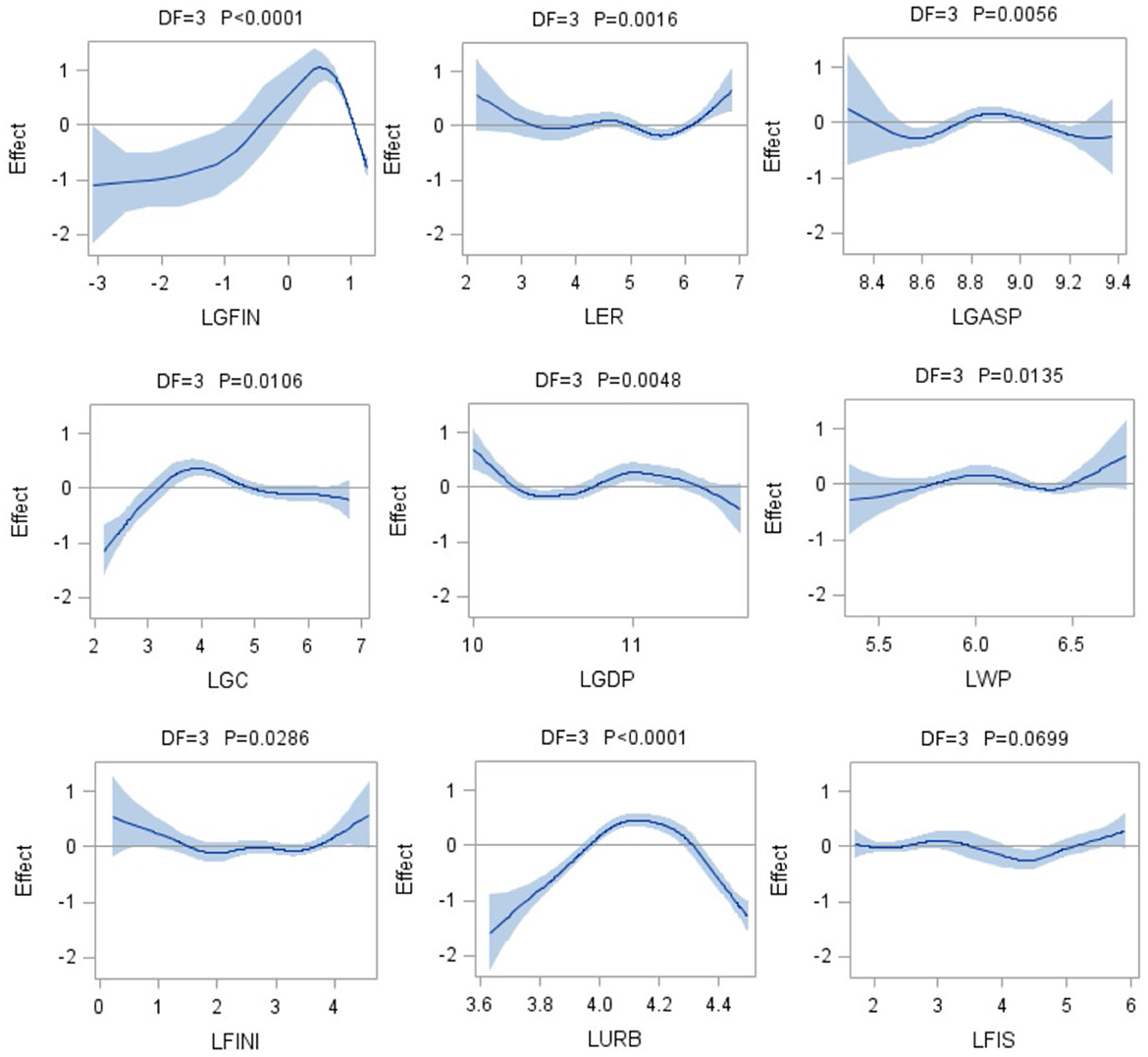

(1) Figure 2 shows that the nonlinear impact of green finance on the development of wind power shows an inverted U-shaped pattern. It indicates that in the early stages, the driving role of the green financial market in wind power development is prominent. In the later stage, the driving effect of green finance on wind power development gradually decreases. This is mainly because the wind power industry started late and had a small scale, and a large number of wind power enterprises lacked funds. The government gradually establishes a green financial system, and enriches financial tools, More and more wind power enterprises are receiving financial support, and their production scale is rapidly expanding (Shahbaz et al., 2021). In the long run, the key factor of driving the sustained growth of the wind power industry is technological innovation, and the contribution of green finance has narrowed. (2) The nonlinear effects of fiscal decentralization and wind power prices both exhibit a U-shaped pattern. It indicates that the promotion effect of fiscal decentralization and wind power prices on the wind power industry is not obvious in the early stages. In the later stage, the promoting effect gradually highlights. (3) Both fossil fuel prices and economic growth have an inverted N-shaped impact on the wind power industry. In addition to some fluctuations in the mid-term stage, the driving effect of fossil fuel prices and economic growth on the wind power industry is relatively small.

(4) The impact of environmental regulations manifests as a W-shaped pattern, indicating that in the early stages, the impact of environmental regulations is fluctuating. This is mainly due to the changes in environmental policies influenced by economic cycles. Economic prosperity has led to the expansion of industrial production and rapid growth of pollutant emissions. In order to control pollution, the government has increased the intensity of environmental regulations. On the contrary, when the economy shrinks, the government often relaxes environmental regulations. Industrial enterprises and residents will increase the use of cost-effective fossil fuels and reduce the demand for wind power. The government has also formulated more clean energy policies to promote wind power.

5 Mechanism analysis

(1) The relationship between green finance and foreign direct investment. Financial institutions play an important role in the economic system, and stock markets and banks can actively reflect the changes in capital accumulation and productivity. A good financial development status helps to adjust the internal financing structure of the company and reduce external financing costs (Shahzad et al., 2022). The relationship between green finance and the direct investment dominated by foreign investor is complex. The first viewpoint suggests that the level of green finance has a certain inhibitory effect on FDI. According to the theory of financial development, financial structures are divided into market-oriented financial structures and bank-oriented financial structures (Guan et al., 2020). China's financial structure is mainly dominated by state-owned banks, and risks are relatively concentrated. Financial institutions, as the main borrowers of private enterprises, provide indirect financing for wind power enterprises. In addition, there is serious information uncertainty in the asset credit information of private enterprises, which greatly increases the lending risk of financial institutions. This distorted financial market has led to passive financing type FDI in wind power enterprises. In general, foreign investment is introduced to compensate for the shortage of temporary funds, when a country's financial system is imperfect. On the contrary, it will reduce the introduction of foreign investment, when financial development is relatively sound. The second viewpoint believes that the development of green finance can help drive foreign direct investment. Compared to the massive financial and technological demands of wind power enterprises, foreign direct investment in wind power projects is far from sufficient (Wei et al., 2022). The financial support from domestic financial institutions helps to expand the scale of foreign-funded projects, thereby driving the rapid development of the domestic wind power industry. (2) The relationship between green finance and green technology innovation. Domestic financial institutions provide a large amount of funding to support the research and introduction of green technologies, which is conducive to the improvement of wind power technology (Wasiq et al., 2023). The improvement of green technology not only improves the efficiency of wind power generation, but also helps to reduce the cost of power generation (Feng et al., 2022).

According to the above theoretical mechanism analysis, green finance mainly affects wind power development through two mechanisms: foreign direct investment and green technology innovation. Thus, this section selects foreign direct investment and green technology innovation as intermediary variables, and uses a mediation model to analyze the mechanism of green finance affects wind power development. The mediation model is set as follows (Equations 6–8):

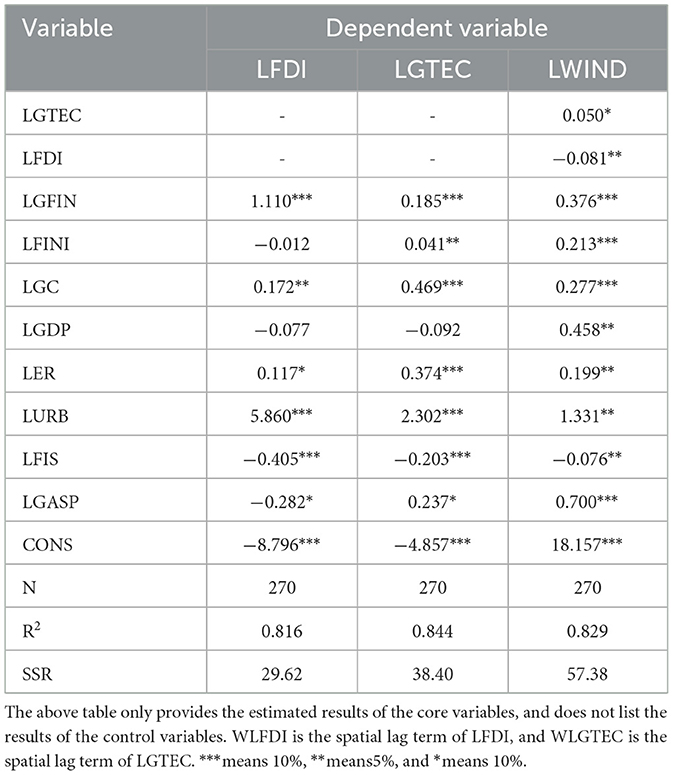

Where LFDI stands for economic openness, and measured by foreign direct investment (100 million yuan). GTEC represents green technology innovation, measured by the number of renewable energy patented technologies (piece). The renewable energy patents include solar energy, wind power, energy storage, and biomass energy patents. At present, an accurate number of wind power patent technologies cannot be obtained. Moreover, there is a certain relationship between other renewable energy patented technologies and wind power development. Therefore, this article uses the number of renewable energy patents to measure green technology innovation. The other variables are the same as that in Model 5. (1) Table 6 shows that the linear impact of green technology innovation on wind power development is 0.050, indicating that green technology innovation contributes to wind power development. Compared to traditional technologies, the nexus between green technology and wind power development is close. Expanding technological research and development can help to acquire more new technologies, such as wind turbines, energy storage, and ultra-high voltage transmission technologies. The technology updates promote more efficient growth in the wind power industry. (2) The linear impact coefficient of foreign direct investment on wind power is −0.081, indicating that the impact of foreign direct investment on wind power development is limited. The main reason is that the power industry belongs to the strategic industry, and it is difficult for foreign investment to enter the wind power industry.

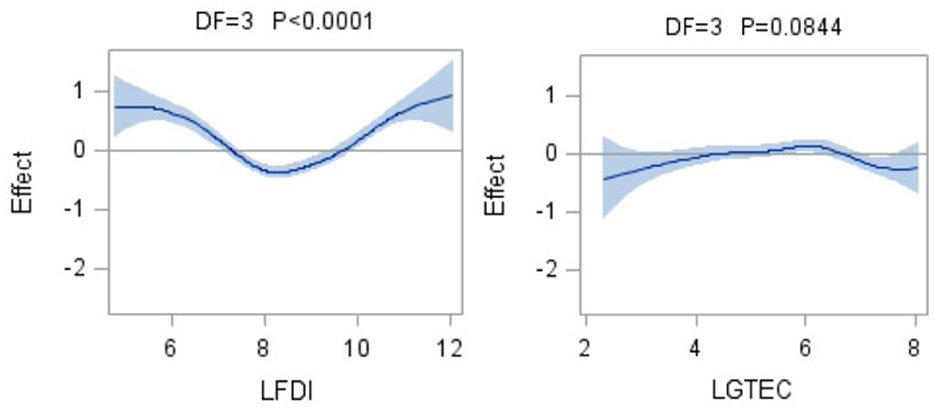

Figure 3 displays that the nonlinear effect of green technology innovation on wind power development exhibits an inverted U-shaped pattern. This indicates that in the early stages, green technology innovation had a prominent driving effect on wind power development. In the later stage, the role of green technology innovation gradually diminishes. This is mainly because the wind power industry is a strategic emerging industry. In order to promote rapid growth in the wind power industry, the government has formulated a series of preferential measures to incentivize green technological research and development. The rapidly growing investment in technology research and development has obtained a large number of green technology patents. Therefore, in the early stages, the promoting effect of green technology innovation on wind power is obvious. In the later stage, the growth rate of green technological research and development investment decreases. This has led to a gradual reduction in the role of green technology in promoting wind power development. (2) The non-linear effect of foreign direct investment on wind power development exhibits a U-shaped pattern. It means that the driving effect of foreign direct investment on the wind power industry has gradually become prominent over time. This is mainly because in the early stages, China restricted foreign investment in the energy sector. In the later stage, the government relaxes the entry threshold for the energy sector and encourage more foreign enterprises to enter China's new energy industry.

Figure 3. The impact of mediating variables on wind power development. LGTEC represents green technology innovation and LFDI means foreign direct investment.

6 Discussion

6.1 Green finance has an inverted U-shaped impact on wind power development

This is explained by the phased changes in the scale of green finance. Green finance has four major functions in supporting the wind power industry: investment orientation, capital agglomeration, information transmission, and incentive constraints. First, from the perspective of investment orientation, green finance has a financing punishment effect on high polluting enterprises, guiding green funds from high polluting industries to flow into energy-saving and environmental protection industries (Irfan et al., 2022). This enables green finance to play an investment orientation function of “suppressing pollution and promoting green industry”. Second, from the perspective of capital agglomeration, green finance belongs to the emerging financial model. Green finance effectively solves the allocation of fund for green projects, providing sufficient material support for the wind power industry. Third, from the perspective of information transmission function, the efficient market hypothesis believes that product information is contained in the transaction prices of the securities market. Green finance sends policy signals to encourage wind power development to the public, thereby promoting the wind power industry (Hafner et al., 2020). Fourth, from the perspective of incentive mechanisms, enterprises often do not attach enough importance to negative externalities in the pursuit of maximizing their own interests. Green finance policies can guide green funds to withdraw from high polluting industries and encourage enterprises to invest in low-carbon wind power industries. In the initial stage, wind power enterprises lack funds. The government and financial regulatory agencies formulate preferential funding policies to facilitate wind power enterprises to obtain sufficient financing (Akomea-Frimpong et al., 2022). The rapid growth of financial capital has driven the rapid growth of the wind power industry. Since 2013, China's wind power production has grown rapidly, consistently ranking first in the world. In the later stage, when the wind power industry reaches a certain scale, the key factors driving the sustained growth of wind power are technological and business model innovations. Therefore, in the later stage, the contribution of green finance to the wind power industry gradually decreases.

6.2 Foreign direct investment produces a u-shaped impact on wind power development

This result can be explained by the periodic changes in foreign investment. From the perspective of the industry, foreign investment has intensified market competition in China's new energy industry. The increase in competition may force domestic new energy enterprises to adjust the technology and production processes to maintain their market share. The competition generated by the introduction of foreign capital may be detrimental to the survival and development of domestic enterprises. Foreign funded enterprises, relying on their advantages in product prices, quality, and environmental friendliness, have squeezed out the market share of domestic enterprises (Qiu et al., 2022). This reduces the enthusiasm of domestic enterprises to carry out green technology innovation activities. Therefore, the impact of intra industry competition on the technological innovation of host country wind power enterprises depends on the degree of mutual cancellation between the promoting effect and the crowding out effect. The spillover effect of foreign direct investment between industries is mainly reflected in the market transactions between upstream and downstream enterprises. The cooperation between local enterprises and foreign enterprises in the upstream can contact the green production equipment and low-energy-consumption production mode. Meanwhile, local enterprises can learn from green product design and advanced organizational management methods of foreign suppliers, so as to enhance their own green technology level (Jain et al., 2021). Statistics show that from 2013 to 2017, foreign direct investment in the clean energy industry averaged $2.51 billion. Compared with the capital needs of the wind power industry, this scale of investment is not enough. This makes it difficult for foreign direct investment to play a significant role in driving the growth of the wind industry. In recent years, the Chinese government has gradually relaxed restrictions to allow more foreign investment in the clean energy sector (Fahad et al., 2022). Statistics show that from 2018 to 2021, the average foreign direct investment in China's clean energy industry was $3.72 billion. More foreign investment into the wind power industry not only promotes technological upgrading, but also helps to improve the production efficiency of the entire industry. Therefore, the contribution of foreign direct investment to the wind power industry has gradually become prominent in the later stage.

6.3 Green technology innovation has an inverted U-shaped impact on the wind power industry

This result can be explained by the changes in R&D investment in green technology. Green technology has improved the power generation efficiency and resource allocation efficiency of wind power. The dissemination of green technology has led to the evolution of industrial structure from labor intensive industry to green technology intensive industrial. The application of green technology has a low dependence on production factors such as labor and energy, promoting industries to utilize production factors in a more efficient manner (Lee et al., 2022). Green technological innovation is complementary to other technological innovations. This has led to a continuous improvement in the specialization, socialization, and energy-saving efficiency of the wind power production. This has changed the way industries are interconnected, thereby promoting the green evolution of the wind power industry. Green technology innovation can not only directly enter production as an input factor, but also have a significant impact on other economic activities, thereby promoting the wind power industry (Chen J. et al., 2023). Green manufacturing technology can update the production technology and equipment of enterprises. In the early stages, wind power enterprises faced many technological bottlenecks, so the government and enterprises to increase investment in technological research and development. The number of green technology patents is growing rapidly. Statistical data exhibited that from 2014 to 2017, the average growth rate of the number of green patented technologies reached 14.0%. The rapidly growing green patents are driving the rapid growth of the wind power industry. In recent years, the investment in green technology has decreased, with the reduction of government subsidies (Hussain et al., 2022). The growth rate of the number of green patented technologies has decreased. Statistical data showed that from 2018 to 2021, the average growth rate of green patent technology decreased by 8.1%. The slowdown in green technology growth has led to a gradual reduction in the contribution of green technology innovation to wind power development.

7 Conclusions and policy implications

This article constructs a nonparametric additive regression model to investigate the wind power industry in China. The research results show that green finance has a greater promoting effect on wind power in the early stages. Foreign direct investment and green technology progress are important intermediary mechanisms that green finance impacts the wind power industry. The impact of foreign direct investment on wind power shows a U-shaped pattern, indicating that in the later stage, the pulling effect of foreign investment introduction on the wind power industry is more prominent. Green technology innovation has an inverted U-shaped impact on the wind power industry, indicating that green technology research and development has effectively pushed the wind power industry in the early stage. In addition, the impact of fiscal decentralization, wind power prices, and environmental regulations on the wind power industry also exhibits significant nonlinear characteristics. These results have important policy implications.

7.1 In the later stage, the government ought to take flexible measures to develop the green financial industry

(1) Increase the proportion of green credit in the overall credit scale. However, commercial banks face the problem of insufficient internal driving force when issuing loans to the wind power industry. At present, the scale of green credit in China is still relatively small. The government can provide green guarantees and tax incentives for green energy projects through subsidies and taxation. The bank can increase its support for green loans of commercial banks, and improve the supervision mechanism for the implementation of green loans. (2) Commercial banks should change their strategies for providing green credit. A reasonable strategy of investing green credit funds is the foundation for maximizing the utility of green credit. For national commercial banks, they should shift green credit funds from the areas with high levels of financial development to the areas with underdeveloped financial markets. For local banks, local governments can formulate more flexible policies to incentivize them to expand the credit scale of green energy projects. Local governments can provide certain credit guarantees for green loans, promoting wind power enterprises to obtain urgently needed funds. (3) Financial regulatory authorities should establish energy investment funds. Wind power companies can issue venture capital shares to attract some savings deposits to be converted into energy investment funds. New energy enterprises can issue energy investment securities to attract surplus private capital. The establishment of energy investment fund is conducive to the rapid expansion of capital for new energy enterprises and the cultivation of large new energy enterprises.

7.2 In the early stages, the government should attract targeted investment in new energy projects to optimize the structure of foreign investment

(1) The government should lead a high-level of trade openness and improve the quality of foreign investment. Trade management agencies should improve their ability to identify foreign investment, and actively guide foreign investment into the fields of technological innovation and energy conservation. Investment promotion agencies ought to expand the introduction of cutting-edge industries and green environmental protection projects. (2) The industry managers effectively encourage domestic enterprises to enhance the technological absorption ability and actively learn advanced foreign original technologies. Wind power enterprises improve their technological level through the inflow and spillover of foreign direct investment. In the process of exchanging with upstream and downstream foreign-funded enterprises, wind power enterprises fully utilize the spillover effect, and absorb more advanced green technologies. (3) Local governments should consider the quality of foreign direct investment, while introducing a large amount of foreign investment. The investment management department should strengthen the assessment of the qualifications of foreign investment to avoid introducing high-risk and low-quality foreign investment projects. The government provides preferential tax policies to attract the investment in wind power projects, energy storage projects, and new energy material technologies.

7.3 In the long run, the technology management department is supposed to adopt flexible policies to encourage green technology innovation

(1) The policy-making department should encourage wind power enterprises and research institutions to innovate in green technology. The government can increase investment incentives for funding, talent, and innovation infrastructure for green technology innovation. Green technology innovation not only has a high degree of complexity, but also has a high risk of investment return. In the process of investment and operation, the costs of green technology research are expensive, and the short-term returns are not significant. Therefore, the government needs to increase the financial budget for green technology investment, and provide tax incentives to reduce the financial pressure on wind power enterprises. In the application and promotion of green technology, financial institutions should provide low interest loans. (2) The government should improve the intellectual property protection system for green technology innovation, and enhance the application ability of technological innovation achievements. Inadequate protection of intellectual property rights will affect the independent innovation ability of enterprises. The government ought to improve intellectual property protection system, increased research and development subsidies, and promoted the transformation of scientific and technological achievements. (3) Wind power enterprises should leverage the upgrading potential of digital transformation to enhance green technology innovation capabilities. The government has introduced multiple supportive policies to support the digital transformation of enterprises and promote the deep integration of products and organizational structure. Digital transformation enhances the green technology innovation capability of enterprises, which can lay a solid foundation for achieving high-quality development. In addition, enterprises should actively introduce emerging technologies and intelligent application equipment to overcome information barriers between research, production, and management. The mutual adaptation of digital transformation and green technology innovation can build an advantageous platform for enterprise green technology innovation.

Data availability statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found in the article/Supplementary material.

Ethics statement

The studies involving humans were approved by BL, Xiamen University School of Management. The studies were conducted in accordance with the local legislation and institutional requirements. The participants provided their written informed consent to participate in this study.

Author contributions

BX: Writing – original draft. BL: Project administration, Writing – review & editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. The paper was supported by the National Natural Science Foundation of China (No. 71974085) and fundamental research projects of central universities (No. 20720221050).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fsuep.2024.1344166/full#supplementary-material

References

Ahmad, M., Dai, J., Mehmood, U., and Abou Houran, M. (2023). Renewable energy transition, resource richness, economic growth, and environmental quality: assessing the role of financial globalization. Renewable Energy 216, 119000. doi: 10.1016/j.renene.2023.119000

Akomea-Frimpong, I., Adeabah, D., Ofosu, D., and Tenakwah, E. J. (2022). A review of studies on green finance of banks, research gaps and future directions. J. Sustain. Finance Invest. 12, 1241–1264. doi: 10.1080/20430795.2020.1870202

Alharbi, S. S., Al Mamun, M., Boubaker, S., and Rizvi, S. K. A. (2023). Green finance and renewable energy: a worldwide evidence. Energy Econo. 118, 106499. doi: 10.1016/j.eneco.2022.106499

Atems, B., Mette, J., Lin, G., and Madraki, G. (2023). Estimating and forecasting the impact of nonrenewable energy prices on US renewable energy consumption. Energy Policy 173, 113374. doi: 10.1016/j.enpol.2022.113374

Bhutta, U. S., Tariq, A., Farrukh, M., Raza, A., and Iqbal, M. K. (2022). Green bonds for sustainable development: Review of literature on development and impact of green bonds. Technol. Forecast. Soc. Change 175, 121378. doi: 10.1016/j.techfore.2021.121378

Buja, A., Hastie, T., and Tibshirani, R. (1989). Linear smoothers and additive models. Ann. Math. Stat. 453–510. doi: 10.1214/aos/1176347115

Chen, H., Yi, J., Chen, A., Peng, D., and Yang, J. (2023). Green technology innovation and CO2 emission in China: evidence from a spatial-temporal analysis and a nonlinear spatial durbin model. Energy Policy 172, 113338. doi: 10.1016/j.enpol.2022.113338

Chen, J., Li, L., Yang, D., and Wang, Z. (2023). The dynamic impact of green finance and renewable energy on sustainable development in China. Front. Environm. Sci. 10, 1097181. doi: 10.3389/fenvs.2022.1097181

Denti, F., Camerlenghi, F., Guindani, M., and Mira, A. (2023). A common atoms model for the Bayesian nonparametric analysis of nested data. J. Am. Stat. Assoc. 118, 405–416. doi: 10.1080/01621459.2021.1933499

Devine, A., and McCollum, M. (2022). Advancing energy efficiency through green bond policy: multifamily green mortgage backed securities issuance. J. Clean. Prod. 345, 131019. doi: 10.1016/j.jclepro.2022.131019

Dilanchiev, A., Nuta, F., Khan, I., and Khan, H. (2023). Urbanization, renewable energy production, and carbon dioxide emission in BSEC member states: implications for climate change mitigation and energy markets. Environ. Sci. Pollut. Res. 1–13. doi: 10.1007/s11356-023-27221-9

Dogan, E., Madaleno, M., Taskin, D., and Tzeremes, P. (2022). Investigating the spillovers and connectedness between green finance and renewable energy sources. Renew. Energ. 197, 709–722. doi: 10.1016/j.renene.2022.07.131

Dong, W., Li, Y., Gao, P., and Sun, Y. (2023). Role of trade and green bond market in renewable energy deployment in Southeast Asia. Renew. Energ. 204, 313–319. doi: 10.1016/j.renene.2023.01.022

Du, J., Shen, Z., Song, M., and Vardanyan, M. (2023). The role of green financing in facilitating renewable energy transition in China: perspectives from energy governance, environmental regulation, and market reforms. Energy Econ. 120, 106595. doi: 10.1016/j.eneco.2023.106595

Fahad, S., Bai, D., Liu, L., and Baloch, Z. A. (2022). Heterogeneous impacts of environmental regulation on foreign direct investment: do environmental regulation affect FDI decisions? Environ. Sci. Pollut. Res. 29, 5092–5104. doi: 10.1007/s11356-021-15277-4

Feng, S., Zhang, R., and Li, G. (2022). Environmental decentralization, digital finance and green technology innovation. Struct. Chang. Econ. Dyn. 61, 70–83. doi: 10.1016/j.strueco.2022.02.008

Ge, T., Cai, X., and Song, X. (2022). How does renewable energy technology innovation affect the upgrading of industrial structure? The moderating effect of green finance. Renewable Energy 197, 1106–1114. doi: 10.1016/j.renene.2022.08.046

Granger, C. W. (1988). Causality, cointegration, and control. J. Econ. Dynam. Cont. 12, 551–559. doi: 10.1016/0165-1889(88)90055-3

Guan, J., Kirikkaleli, D., Bibi, A., and Zhang, W. (2020). Natural resources rents nexus with financial development in the presence of globalization: is the “resource curse” exist or myth? Res. Policy 66, 101641. doi: 10.1016/j.resourpol.2020.101641

Hafner, S., Jones, A., Anger-Kraavi, A., and Pohl, J. (2020). Closing the green finance gap–A systems perspective. Environm. Innovat. Societal Transit. 34, 26–60. doi: 10.1016/j.eist.2019.11.007

Hussain, J., Lee, C. C., and Chen, Y. (2022). Optimal green technology investment and emission reduction in emissions generating companies under the support of green bond and subsidy. Technol. Forecast. Soc. Change 183, 121952. doi: 10.1016/j.techfore.2022.121952

Irfan, M., Razzaq, A., Sharif, A., and Yang, X. (2022). Influence mechanism between green finance and green innovation: exploring regional policy intervention effects in China. Technol. Forecast. Soc. Change 182, 121882. doi: 10.1016/j.techfore.2022.121882

Jain, K., Gangopadhyay, M., and Mukhopadhyay, K. (2022). Prospects and challenges of green bonds in renewable energy sector: case of selected Asian economies. J. Sustain. Finance Invest. 1–24. doi: 10.1080/20430795.2022.2034596

Jain, S., Jain, N. K., Choudhary, P., and Vaughn, W. (2021). Designing terawatt scale renewable electricity system: a dynamic analysis for India. Energy Strat. Rev. 38, 100753. doi: 10.1016/j.esr.2021.100753

Khezri, M., Heshmati, A., and Khodaei, M. (2021). The role of R&D in the effectiveness of renewable energy determinants: a spatial econometric analysis. Energy Econ. 99, 105287. doi: 10.1016/j.eneco.2021.105287

Leal Filho, W., Nagy, G. J., Setti, A. F. F., Sharifi, A., Donkor, F. K., Batista, K., et al. (2023). Handling the impacts of climate change on soil biodiversity. Sci. Total Environ. 869, 161671. doi: 10.1016/j.scitotenv.2023.161671

Lee, C. C., Qin, S., and Li, Y. (2022). Does industrial robot application promote green technology innovation in the manufacturing industry? Technol. Forecast. Soc. Change 183, 121893. doi: 10.1016/j.techfore.2022.121893

Lee, C. C., Wang, F., and Chang, Y. F. (2023). Does green finance promote renewable energy? Evidence from China. Resources Policy 82, 103439. doi: 10.1016/j.resourpol.2023.103439

Li, C., and Umair, M. (2023). Does green finance development goals affect renewable energy in China. Renew. Ener. 203, 898–905. doi: 10.1016/j.renene.2022.12.066

Li, J., Dong, K., Taghizadeh-Hesary, F., and Wang, K. (2022). 3G in China: how green economic growth and green finance promote green energy? Renew. Ener. 200, 1327–1337. doi: 10.1016/j.renene.2022.10.052

Li, L., Zhu, D., Zou, X., Hu, J., Kang, Y., and Guerrero, J. M. (2023). Review of frequency regulation requirements for wind power plants in international grid codes. Renew. Sust. Ener. Rev. 187, 113731. doi: 10.1016/j.rser.2023.113731

Li, M., Hamawandy, N. M., Wahid, F., Rjoub, H., and Bao, Z. (2021). Renewable energy resources investment and green finance: Evidence from China. Res. Policy 74, 102402. doi: 10.1016/j.resourpol.2021.102402

Liu, M., Yang, X., Wen, J., Wang, H., Feng, Y., Lu, J., et al. (2023). Drivers of China's carbon dioxide emissions: Based on the combination model of structural decomposition analysis and input-output subsystem method. Environ. Impact Assess. Rev. 100, 107043. doi: 10.1016/j.eiar.2023.107043

Madaleno, M., Dogan, E., and Taskin, D. (2022). A step forward on sustainability: the nexus of environmental responsibility, green technology, clean energy and green finance. Ener. Econ. 109, 105945. doi: 10.1016/j.eneco.2022.105945

Mohammed, K. S., and Mellit, A. (2023). The relationship between oil prices and the indices of renewable energy and technology companies based on QQR and GCQ techniques. Renew. Ener. 209, 97–105. doi: 10.1016/j.renene.2023.03.123

Ning, Y., Cherian, J., Sial, M. S., Álvarez-Otero, S., Comite, U., and Zia-Ud-Din, M. (2023). Green bond as a new determinant of sustainable green financing, energy efficiency investment, and economic growth: a global perspective. Environ. Sci. Pollut. Res. 30, 61324–61339. doi: 10.1007/s11356-021-18454-7

Qiu, W., Bian, Y., Zhang, J., and Irfan, M. (2022). The role of environmental regulation, industrial upgrading, and resource allocation on foreign direct investment: evidence from 276 Chinese cities. Environ. Sci. Pollut. Res. 29, 32732–32748. doi: 10.1007/s11356-022-18607-2

Rasoulinezhad, E., and Taghizadeh-Hesary, F. (2022). Role of green finance in improving energy efficiency and renewable energy development. Energy Effici. 15, 14. doi: 10.1007/s12053-022-10021-4

Ren, X., Shao, Q., and Zhong, R. (2020). Nexus between green finance, non-fossil energy use, and carbon intensity: empirical evidence from China based on a vector error correction model. J. Clean. Prod. 277, 122844. doi: 10.1016/j.jclepro.2020.122844

Salibian-Barrera, M. (2023). Robust nonparametric regression: review and practical considerations. Economet. Statist. 241, 1–16. doi: 10.1016/j.ecosta.2023.04.004

Shahbaz, M., Topcu, B. A., Sarigül, S. S., and Vo, X. V. (2021). The effect of financial development on renewable energy demand: the case of developing countries. Renew. Ener. 178, 1370–1380. doi: 10.1016/j.renene.2021.06.121

Shahzad, F., and Fareed, Z. (2023). Examining the relationship between fiscal decentralization, renewable energy intensity, and carbon footprints in Canada by using the newly constructed bootstrap Fourier Granger causality test in quantile. Environ. Sci. Pollut. Res. 30, 4617–4626. doi: 10.1007/s11356-022-22513-y

Shahzad, M., Qu, Y., Rehman, S. U., and Zafar, A. U. (2022). Adoption of green innovation technology to accelerate sustainable development among manufacturing industry. Journal of Innovat. Knowl. 7, 100231. doi: 10.1016/j.jik.2022.100231

Shang, Y., Zhu, L., Qian, F., and Xie, Y. (2023). Role of green finance in renewable energy development in the tourism sector. Renew. Ener. 206, 890–896. doi: 10.1016/j.renene.2023.02.124

Sharma, G. D., Verma, M., Shahbaz, M., Gupta, M., and Chopra, R. (2022). Transitioning green finance from theory to practice for renewable energy development. Renew. Ener. 195, 554–565. doi: 10.1016/j.renene.2022.06.041

Stone, C. J. (1985). Additive regression and other nonparametric models. Ann. Math. Stat. 13, 689–705. doi: 10.1214/aos/1176349548

Sun, H., and Chen, F. (2022). The impact of green finance on China's regional energy consumption structure based on system GMM. Res. Policy 76, 102588. doi: 10.1016/j.resourpol.2022.102588

Sun, L., Yin, J., and Bilal, A. R. (2023). Green financing and wind power energy generation: Empirical insights from China. Renew. Ener. 206, 820–827. doi: 10.1016/j.renene.2023.02.018

Taghizadeh-Hesary, F., Phoumin, H., and Rasoulinezhad, E. (2023). Assessment of role of green bond in renewable energy resource development in Japan. Res. Policy 80, 103272. doi: 10.1016/j.resourpol.2022.103272

Tan, X., Dong, H., Liu, Y., Su, X., and Li, Z. (2022). Green bonds and corporate performance: a potential way to achieve green recovery. Renew. Ener. 200, 59–68. doi: 10.1016/j.renene.2022.09.109

Wasiq, M., Kamal, M., and Ali, N. (2023). Factors influencing green innovation adoption and its impact on the sustainability performance of small-and medium-sized enterprises in Saudi Arabia. Sustainability 15, 2447. doi: 10.3390/su15032447

Wei, X., Mohsin, M., and Zhang, Q. (2022). Role of foreign direct investment and economic growth in renewable energy development. Renew. Ener. 192, 828–837. doi: 10.1016/j.renene.2022.04.062

Yadav, M. P., Pandey, A., Taghizadeh-Hesary, F., Arya, V., and Mishra, N. (2023). Volatility spillover of green bond with renewable energy and crypto market. Renew. Ener. 212, 928–939. doi: 10.1016/j.renene.2023.05.056

Ye, X., and Rasoulinezhad, E. (2023). Assessment of impacts of green bonds on renewable energy utilization efficiency. Renew. Ener. 202, 626–633. doi: 10.1016/j.renene.2022.11.124

Zhang, B., and Wang, Y. (2021). The effect of green finance on energy sustainable development: a case study in China. Emerg. Mark. Finan. Trade 57, 3435–3454. doi: 10.1080/1540496X.2019.1695595

Keywords: green finance, green technology innovation, wind power, nonparametric additive regression model, China

Citation: Xu B and Lin B (2024) Exploring the role of green finance in wind power development: using the nonparametric model. Front. Sustain. Energy Policy 3:1344166. doi: 10.3389/fsuep.2024.1344166

Received: 25 November 2023; Accepted: 08 February 2024;

Published: 11 March 2024.

Edited by:

Luluwah Al-Fagih, Hamad bin Khalifa University, QatarReviewed by:

Piyush Choudhary, Oil and Natural Gas Corporation, IndiaGuoxiang Li, Nanjing Normal University, China

Furkan Ahmad, Hamad bin Khalifa University, Qatar

Copyright © 2024 Xu and Lin. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Boqiang Lin, YnFsaW5AeG11LmVkdS5jbg==

Bin Xu

Bin Xu Boqiang Lin*

Boqiang Lin*