95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

OPINION article

Front. Sustain. Energy Policy , 05 May 2023

Sec. Energy and Society

Volume 2 - 2023 | https://doi.org/10.3389/fsuep.2023.1174427

This article is part of the Research Topic Insights in Energy and Society: 2022 View all 10 articles

Eric O'Shaughnessy1*

Eric O'Shaughnessy1* Jenny Sumner2

Jenny Sumner2Every year millions of retail electricity customers voluntarily buy more renewable energy than what is provided by their local grid. In the United States the voluntary renewable energy market accounts for around 38% of non-hydro renewable energy sales and about 6% of all retail electricity sales (O'Shaughnessy and Heeter, 2022). However, despite the market's size, little is known about the role of voluntary procurement in decarbonization policy. Here, we attribute this knowledge gap to analytical challenges of estimating the market's impacts and functional challenges of integrating voluntary actions into policy frameworks. We discuss the problems associated with this knowledge gap and suggest a research agenda. We focus on U.S. voluntary renewable energy markets, though much of our discussion can be extrapolated to voluntary markets in other countries with similar structures. We begin with some basic background on the U.S. voluntary market.

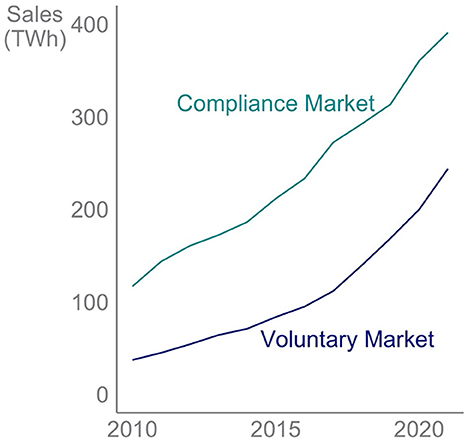

Renewable energy buyers are often sorted into two broad groups. Compliance buyers comprise regulated entities (e.g., utilities) who procure renewables to comply with national or state mandates. Voluntary buyers are retail electricity customers who choose to buy more renewables than otherwise provided by the grid. Renewable energy markets exist to help both types of buyers substantiate renewable energy use claims. These markets address the fundamental problem of the physical impossibility of tracking the generation and use of electricity. The solution is to separately track renewable use through accounting mechanisms known in the United States as renewable energy certificates (RECs). RECs are involved in every legal claim to the use of renewable energy in the United States in both voluntary and compliance markets. A REC equates to an exclusive property right to the clean energy attributes of one megawatt-hour of renewable generation. That right is exercised when a buyer “retires” a REC, removing it from circulation and preventing double claims to the same output. In 2022, about 240 million RECs were retired in voluntary markets, compared to around 390 million RECs in compliance markets (Figure 1).

Figure 1. Voluntary and compliance market renewable energy sales, 2010–2021. Based on data from O'Shaughnessy and Heeter (2022) and Barbose (2021). For more detailed data for annual trends in sales for specific products, see O'Shaughnessy and Heeter (2022).

The voluntary market comprises a diversity of products, buyers, and market contexts. Distinct products package RECs and power in different ways that cater to different types of customers, ranging from residential households making relatively small purchases to non-residential buyers making large purchases. Some products entail contractual obligations allowing customers to make long-term commitments to specific projects, while other products allow customers to easily come and go. Products are offered by a variety of vendors, including project developers, utilities, retail electricity suppliers, and brokers specialized in selling RECs. Many products use RECs that are “unbundled” from the underlying power, meaning that the RECs and electricity are sold separately. Note that prevailing market and legal frameworks ensure that REC buyers own the right to claim the use of renewable energy regardless of the treatment of the underlying power. Procurement also occurs in a diversity of market contexts. In some regions, low development costs and the lack of binding state mandates can result in relatively abundant supplies of low-cost RECs, while in other regions development constraints and binding mandates can drive significant REC scarcity. At any given moment REC prices vary by orders of magnitude across different markets. Hence, while we refer to the voluntary market as a singular entity for simplicity, it is crucial to bear in mind that the market is a mix of buyers, products, and market contexts.

As voluntary markets have grown, buyers, sellers, scholars, and other stakeholders have become increasingly interested in measuring the impact of voluntary procurement. While impact can have several meanings, for the purposes of our discussion impact refers to the degree to which voluntary procurement affects renewable energy supply. Identifying voluntary market impacts is a deceptively complex task, a problem we refer to as the analytical challenge. The simplest way to put the analytical challenge is that a marginal unit of REC demand cannot be directly mapped to an additional unit of deployed capacity. A useful analogy are concert tickets: an additional ticket purchase cannot be directly mapped to an additional concert. Still, in both cases, there is a theoretical if unobserved relationship between demand and supply. Conceptually, a marginal unit of REC demand makes RECs scarcer. REC scarcity is reflected in higher REC prices which signal to the market to deploy more renewable capacity.

Due to this analytical challenge, we lack a rigorous understanding of voluntary market impacts based on empirical data, statistical methods honed to address the specific statistical challenges of identifying voluntary market impacts, and analysis that appropriately accounts for market heterogeneity (we expand on these themes in Discussion). As a result, the default assumption in some analyses is that voluntary impacts are small or non-existent. The problem is that this default assumption could form the basis of assessments of the potential role of voluntary markets in decarbonization policy. The lack of understanding of these impacts could inefficiently constrain the contributions of the voluntary market to decarbonization efforts.

Some scholars may dispute our assessment that existing literature does not provide a rigorous understanding of voluntary market impacts. We note two reasons why the existing evidence on voluntary market impacts does not meet the standards of rigor we explore further in our Discussion.1 First, existing literature does not address the specific methodological challenges of statistically identifying voluntary market impacts. The existing literature has, for example, not addressed the simultaneous causation of voluntary demand and renewable energy output, a theme we expand on further below. Second, theoretical assumptions about voluntary markets in specific contexts are often used to make generalized claims. For instance, one approach is to assume that voluntary demand does not affect REC prices and thus does not affect supply at all relevant levels of voluntary demand. Such assumptions may or may not be valid in specific circumstances with limited REC scarcity. However, broad analyses based on contextual assumptions homogenize the voluntary market to an unrealistic extent and do not necessarily extrapolate to valid conclusions for the broader market.

The voluntary market is partly defined by its independence from policy. Because RECs are exclusive, all voluntary procurement is demonstrably exclusive of compliance procurement, a market characteristic known as regulatory surplus. Voluntary markets are perceived to pick up where regulations fall short. Booming corporate renewable energy demand in recent years, for instance, has been partly perceived as a reaction to a lack of federal action (Plumer, 2018). The notion that voluntary markets operate independently from policy poses a functional challenge: how to incorporate voluntary markets into decarbonization policy.

The functional challenge entails practical problems. The individual interests of voluntary buyers do not necessarily align with the needs of a decarbonizing grid (O'Shaughnessy et al., 2021). Certain buyers may, for instance, want to buy “local” renewables in a market already saturated with clean energy. Conversely, lack of cooperation between grid operators and voluntary buyers could result in missed opportunities. For instance, renewable energy developers need new transmission lines to finance their projects while regulators typically require developer commitments before approving transmission investments (Leisch and Cochran, 2016). Voluntary buyers could potentially help solve this chicken-and-egg problem by committing to projects that will be supported by transmission expansions (Gardiner et al., 2018). Failing to engage voluntary markets could result in missed opportunities to solve such problems. Finally, in states with ambitious renewable targets, increasing competition between voluntary and compliance for dwindling REC supplies could inflate prices, potentially driving an inefficient allocation of decarbonization investments.

The analytical and functional challenges broadly stem from gaps in knowledge. We therefore propose research directions to address both challenges. Beginning with the analytical challenge, we argue that what is needed is empirical, rigorous, and nuanced analysis of voluntary impacts. Let's explore each of these three characteristics.

First, we need empirical analysis based on market data. Given the nature of the analytical challenge, some theory and modeling are inevitable. Still, conclusions about voluntary market impacts should be based primarily on empirical claims. To that end, better data is required, meaning data on a diversity of market variables representing as much of the market as possible. Voluntary buyers and other stakeholders would do the market a service by increasing data transparency, such as open-sourcing more data on REC procurement terms. Better insights into REC procurement terms would inform how voluntary RECs drive deployment decisions in specific contexts. Further, access to a diversity of variables—beyond REC prices—would help inform how voluntary procurement may have qualitatively distinct impacts on deployment.

Second, we need rigorous analysis, meaning analysis designed with appropriate econometric identification strategies. Identification is a difficult but tractable challenge in this context. Part of this challenge is developing methods to map continuous demand to discrete and seemingly unrelated investments in new capacity. Another challenge is that voluntary demand is likely endogenous in models of renewable energy supply: voluntary demand may increase supply, but voluntary demand also responds to renewable energy supply. This simultaneity is partly based in the notion of voluntary demand as a reaction to renewable energy supply. The simultaneity is also partly mathematical, given that the potential voluntary market size is inversely proportional to state mandates. Accurate analysis of voluntary impacts will thus likely require some type of structural modeling.

Third, we need nuanced analysis, meaning analysis that estimates heterogenous impacts consistent with the diverse products and markets that comprise voluntary procurement. Voluntary market impacts likely vary substantially across different products and market contexts. Policymakers and buyers need to understand the factors that drive differences in impacts to make informed decisions to meet specific objectives. The need for nuanced analysis is increasing as the voluntary market innovates and develops new, more complex products. A prominent example is the emergence of so-called 24/7 procurement, where buyers aim to procure renewable energy that spatially and temporally matches their demand. Arguments can be made that 24/7 or similar approaches are more impactful than conventional procurement (Miller, 2020). Demonstrating such differentiated claims requires nuanced analysis that captures the market's diversity.

Moving on to the functional challenge, future research can build on common themes in a growing literature exploring the role of voluntary buyers in decarbonization. One prominent theme is the potential for increased customer choice and market access, such as by restructuring retail electricity markets or expanding open wholesale markets (Miller, 2020; Shawhan et al., 2022). Another theme is direct engagement between grid operators and voluntary buyers, such as engaging voluntary buyers in long-term procurement planning processes (Bonugli et al., 2021). Finally, regulators can help develop new standards and legal bases for innovative voluntary market strategies such as 24/7 products (Bird et al., 2021). Beyond these established themes remain unanswered questions related to the functional challenge. One challenge is defining a role for voluntary markets in “deep” decarbonization, generally meaning more than 80% carbon-free generation. Conventional voluntary market products are not equipped to address specific deep decarbonization challenges, such as the need for more system flexibility and a more diverse portfolio of clean generation and storage resources. Future research could further explore how voluntary markets could adapt, possibly with the assistance of policymakers and regulators, to the changing needs of decarbonizing grids.

The analytical and functional challenges are difficult but soluble problems. Addressing these challenges will help buyers make more informed decisions in their renewable energy procurement. Buyers would benefit from a clearer understanding of the heterogeneous impacts of different products and being able to make more precise claims about their procurement. Addressing these challenges would also inform policymakers about the potential contributions of voluntary markets to grid decarbonization and clean energy policies. Voluntary buyers have been trying to accelerate the clean energy transition for years. It is time to take them up on the offer.

EO'S: drafting and visualizations. JS: review and drafting. All authors contributed to the article and approved the submitted version.

Clean Kilowatts is the consulting alias of EO'S.

The remaining author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

1. ^It is not our intention here to criticize specific studies, but the discussion and examples provided are all based on work published in the academic literature.

Barbose, G. (2021). U.S. Renewable Portfolio Standards: 2021 Status Update. Berkeley, CA: Lawrence Berkeley National Laboratory.

Bird, L., O'Shaughnessy, E., and Hutchinson, N. (2021). Actions Large Energy Buyers Can Take to Transform and Decarbonize the Grid. Washington, DC: World Resources Institute.

Bonugli, C., O'Shaughnessy, E., Bishop Ratz, H., and Womble, J. (2021). Solar Energy in Utility Integrated Resource Plans: Factors That Can Impact Customer Clean Energy Goals. Washington, DC: World Resources Institute.

Gardiner, D., Hodum, R., Rekkas, A., and Sherman, W. (2018). Transmission Upgrades & Expansion: Keys to Meeting Large Customers Demand for Renewable Energy. Washington, DC: Wind Energy Foundation.

Leisch, J., and Cochran, J. (2016). Renewable Energy Zones: Delivering Clean Power to Meet Demand. Golden, CO: National Renewable Energy Laboratory.

Miller, G. (2020). Beyond 100% renewable: policy and practical pathways to 24/7 renewable energy procurement. Elect. J. 33, 106695. doi: 10.1016/j.tej.2019.106695

O'Shaughnessy, E., and Heeter, J. (2022). Status and Trends in the U.S. Voluntary Green Power Market (2021 Data). Golden, CO: NRE Laboratory.

O'Shaughnessy, E., Heeter, J., Shah, C., and Koebrich, S. (2021). Corporate acceleration of the renewable energy transition and implications for electric grids. Renew. Sustain. Energy Rev. 146, 111160. doi: 10.1016/j.rser.2021.111160

Keywords: renewable energy, voluntary action, markets, impact, policy, sustainability

Citation: O'Shaughnessy E and Sumner J (2023) The need for better insights into voluntary renewable energy markets. Front. Sustain. Energy Policy 2:1174427. doi: 10.3389/fsuep.2023.1174427

Received: 26 February 2023; Accepted: 05 April 2023;

Published: 05 May 2023.

Edited by:

Tian Tang, Florida State University, United StatesReviewed by:

Inna Vorushylo, Ulster University, United KingdomCopyright © 2023 O'Shaughnessy and Sumner. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Eric O'Shaughnessy, ZXJpYy5vc2hhdWdobmVzc3lAY2xlYW5rd3MuY29t

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.