94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

SYSTEMATIC REVIEW article

Front. Sustain. Cities , 10 March 2025

Sec. Urban Economics

Volume 7 - 2025 | https://doi.org/10.3389/frsc.2025.1549874

This article is part of the Research Topic Financial Blueprint: Paving the Way for SDG Success View all 4 articles

Introduction: This study explores two decades’ worth of developments and trends in e-business as also in sustainable finance. Despite a vast amount of research on e-business, its overlap with sustainable finance is not vast, which makes a study on the trends as also on digital business models’ relevance with drivers of sustainability necessary.

Methods: Bibliometric analysis is also adopted in the research in order to study global publication trends, citation networks, as well as key contributors in e-business as well as in sustainable finance. The research employs a vast data collection gathered from Scopus that investigates over 459 research studies between 2000 and 2024. The Analytic Hierarchy Process (AHP) is also adopted in order to rank drivers that have been identified from a vast literature review.

Results: Results indicate that the USA, UK, and China are leading in terms of publication as well as authoring. Social sustainability is seen as prioritized followed by technological sustainability, with least prioritized as governance sustainability. AI, blockchain, and IoT have been identified as drivers in e-business as well as finance as a means towards technological advancement.

Discussion: Integrating e-business with sustainable finance holds high promise for innovative, sustainable finance solutions. The study calls for more empirical studies with structural equation models and other decision models that can be adopted in order to foster digital business model sustainability. The study also brings into perspective digital strategy convergence with sustainability challenges in order to enhance growth in the long term.

The turn of the 21st century saw the powerful mixture of digital technologies with sustainability imperatives blur traditional business and financial paradigms. e-Business, electronic commerce, and digital business model paradigms have transformed the way in and through which organizations conduct operations, interface with customers, and manage resources. While this is taking place, it has also emerged that sustainable finance is one of the key frameworks that incorporate a raft of ESG criteria into financial decision-making for the achievement of long-term economic stability, as well as the solution of some pressing societal and environmental challenges. According to Vaidya and Kumar (2006), the blend of e-business and sustainable finance creates an unrivaled opportunity for discussions on the way in which innovations in the digital world can provide supportive directions to the achievement of goals relevant to sustainable development, thereby building a resilient and responsible digital economy.

While much research has been done on e-business and sustainable finance, there is still a wide gap in the number of studies focusing on their integration. This calls for an investigation into the synergistic trends and patterns defining digital business practices and sustainable financial strategies (Sainju and Navlakha, 2021). This paper addresses this gap, which is important to stakeholders comprising business leaders, policymakers, and academics interested in driving growth in light of sustainable and rapidly changing digital landscapes. The novelty of this study consists in its approach, whereby an attempt is made to contribute to filling this gap.

e-Business, in its electronic commerce and digital business models, has redeveloped the form of global business by allowing organizations to be more efficient, reach a greater number of customers, and innovate. The adoption of digital platforms has enabled the smooth flow of operations, customer interaction, and revenue generation. The major components of e-business include online retailing, digital marketing, supply chain management, and customer relationship management systems (Wang et al., 2020). These all help the entity in a way to enhance operational efficiency and market competitiveness.

In general, e-business research has been focused on impacts related to the question of business performance, consumer behavior, and technological change. Viewing this within that direction, it has been indicated how digital change promotes business growth, raises customer satisfaction, and permits personalized marketing strategies (Zhang and Dai, 2020). Advanced technologies such as AI, blockchain, and IoT have also created a thrust to propel further the e-business capability of businesses by enabling them to manage resources better and innovate their services.

Sustainable finance includes a multitude of aspects involving Environmental, Social, and Governance for financial decision-making, with an emphasis on fostering long-term economic stability in concert with societal and environmental issues. This paradigm shift represents heightened awareness of the degree to which financial performance is inextricably linked to sustainable practices that ensure resource conservation, social equity, and ethical governance.

Most of the literature on sustainable finance has been found revolving around ESG investing, green bonds, and corporate social responsibility (Zhu and Geng, 2013). ESG investing is considered a mainstream investment approach wherein investors start to increasingly consider ESG issues for better risk mitigation and portfolio performance. Green bonds, designed to finance projects that at a minimum will have minimal environmental impact, have emerged over the years as an instrument for mobilizing capital toward sustainable projects. Further, CSR practices have been one of the key areas of research for enhancing corporate reputation and stakeholder trust, coupled with overall sustainability performance (Mok and Fung, 2019).

While both e-business and sustainable finance individually are established fields of study, their interaction is relatively unexplored. The interaction of the two areas provides a unique opportunity in the use of digital technologies toward better sustainability of financial practices and business operations (Noland et al., 2017). As Zhang and Zheng (2021) show, this linking of e-business and sustainable finance is very likely to be retrospect to increase transparency, efficiency, and accountability of business models toward the goals of sustainability.

Various studies initially set out to focus on this integration started exploring how digital platforms can contribute to the implementation of sustainable financial practices. Thereby, for example, it has been shown that blockchain technology does make it possible to create full transparency and traceability in supply chains for sustainable business practices. In addition to this, AI and big data analytics are being applied to more precise measures of ESG performance, informed decisions on investments, and responsible financial strategies with data as the driver. In this respect, this research accentuated seven big factors of sustainability that, according to the literature, will be important for the development of the relationship between e-business and sustainable finance (Wang and Zhang, 2022). These are environmental, social, governance, technological, financial, economic and policy, and consumer behavior trends. These factors influence not only how business operates and makes financial decisions but also how well the integration of sustainability concerns in digital business models works.

Environmental Sustainability Factors: This is reflected by the fact that environmental sustainability has become a cornerstone of e-business and sustainable finance, certainly because effective ways need to be found to diminish the ecological impacts (Li and Li, 2018).

This means, pertaining to e-business, making data center power utilization more efficient, reusing electronic devices through proper product designing and participation in green supply chain management (González-Benito and González-Benito, 2006). Sustainable finance facilitates such endeavors for its funding of ecologically viable projects, stimulating the innovation in green technologies for a transitioning low-carbon economy (Liu and Lu, 2020). Whereas studies have estimated, including renewable sources of energy along with energy-efficient technologies into the e-business model contribute significantly to environmental sustainability (Vurro and Rizzi, 2019).

Social Sustainability Factors: Social sustainability provides ideas on how business practices can affect society in aspects such as labor conditions, active community interaction, and consumer wellbeing (Patel and Vasavi, 2021).

It is expected that e-business platforms will provide an increase in social sustainability through inclusive economic opportunities, non-exploitative labor practices in computerized supply chains, and community development with regard to corporate social responsibility. These would be further complemented by sustainable finance in underwriting socially responsible enterprises committed to ethical standards, diversity, and equitable growth. Such a perspective strengthens the social fabric; thus, businesses ought to have concern for the public interest. Sustainable finance includes funding for socially responsible enterprises committed to ethical standards, diversity, and equitable growth, thus strengthening the social fabric. Research has shown that companies with good social sustainability practices have greater customer loyalty and employees who are satisfied as well (Tian and Zhang, 2017).

Governance Sustainability Factors: Governance sustainability involves the creation of strong structures and policies to ensure accountability, transparency, and ethical decision-making within organizations. In fact, governance structures are of utter relevance in areas of e-business, as this can immensely help an organization protect customer data from threats, lessen the tendency toward cyber threats, and also follow regulatory standards (Xu and Shen, 2020). On issues of sustainable finance, it requires strong governance practices in order to help minimize risks further and then enhance financial institutions concerning their credibility. Literature indicates that organizations with better governance frameworks are well placed to sail through such challenges and also retain stakeholder’s trust (Yadav and Ahmed, 2018).

Factors of Technological Sustainability: Technological sustainability applies advanced technologies during the development of sustainable business models.

AI, blockchain, and IoT, among other innovations, are instrumental in increasing operational efficiency while reducing resource consumption (Luo et al., 2022). They provide transparent and traceable supply chains. Sustainable finance facilitates technological sustainability through investment in state-of-the-art technologies for sustainable innovation and resilience, thus supporting the creation of smart, sustainable infrastructures. On the contrary, it has been indicated in the literature that the adoption of sustainable technologies in e-business has a really remarkable improvement comprised in resource management and operation performance (Kashi and Shah, 2023).

Financial Sustainability Factors: Financial sustainability will make sure the business is profitable to achieve any genuinely sustainable goals. e-Business models, such as subscription services or platform economies, offer scalable and resilient revenue streams that support long-term financial health. For instance, Rogers says that e-business models comprising subscription services or platform economies offer streams of revenue that are scalable and resilient, hence supporting financial health in the long term (Verma et al., 2023). Sustainable finance contributes through the integration of ESG-criteria into investment decisions, making sure that financial performance is in line with sustainability objectives, and limiting exposure to ESG-related risks. Accordingly, studies have documented that those companies whose financial sustainability practices are stronger hold the best chances of recording long-term growth as well as earn the confidence of responsible investors too.

Economic and Policy Factors: Also, the adoption and integration of e-business and sustainable finance practices will be highly dependent on the economic and policy factors.

The fiscal policies for digital transformation support incentives toward sustainability and regulatory frameworks that organizations innovate and put forward strategies in line with the national and international agendas on sustainability (Rodriguez-Rojas et al., 2022). Other economic factors such as market demand for sustainable products and services, according to Naeem et al. (2023), further propel the integration of e-business and sustainable finance in creating an enabling environment for sustainable economic growth. Likewise, literature emphasizes that supporting policy environments serves to complement or act as an enabler in incorporating sustainability effectively and seamlessly within the realms of a digital business model (Kasmawati et al., 2024).

Consumer Behavior Trends: Consumer behavior trends hold a very crucial status in the determination and shaping of directions in e-business and sustainable finance.

For today’s modern consumers, viability is the mantra as consumers’ expectations are soaring high on the transparency and accountability of companies with which they deal (Alsmadi et al., 2023). e-Business platforms must address such consumer preference by offering sustainable product offerings and services, hence influencing the uptake of sustainable finance practices through active consumer demand (Secinaro et al., 2020). It has also been proved that there is a positive relation: the more the consumer preference for sustainable products rises, the more sales go up, and with them, brand loyalty, which therefore provides an incentive to embed sustainability into core strategies (Dima et al., 2022).

While the intersection of e-business and sustainable finance holds significant promise, existing research predominantly addresses these domains separately. The novelty of this study is in that it seeks to bridge this gap by providing an integrated analysis of the trends and patterns that define the relationship between e-business and sustainable finance from 2000 to 2024. Utilizing bibliometric analysis and the Analytic Hierarchy Process (AHP), this research prioritizes sustainability factors and identifies key themes, contributors, and emerging trends. By doing so, it offers valuable insights into how sustainability can be effectively incorporated into digital business models and financial strategies, thereby contributing to the advancement of both fields.

Ethical considerations and e-commerce finance are also merging today. A growing number of people are realizing that digital technology is highly effective in successful and effective business practice and ethics. In this way, digital platforms will help in channeling proper funds into the sustainability of businesses. Digital platforms facilitate effective allocation of funds into sustainable investments, provide clarity in ESG reporting, and enable the development of new financial products such as green bonds and sustainable funds. Despite increased attention and research, the dynamics of these fields remain incompletely understood in terms of their interactions and evolution. The purpose of this study is to address this deficiency by illustrating research trends through bibliometric analysis, main themes, and possible future directions in the area where e-business and sustainable finance meet and to present the significance of various factors related to sustainability. This study looks at many academic papers to not only make a map of the relevant work done globally but also find possible areas for further research (Alshater et al., 2023).

When e-business and sustainable finance come together, it changes everything about business and finance. The goal of this study is to shed light on the ways that these fields are coming together, which will help us learn more about how to run a business in the digital age in a way that is sustainable. e-Business and sustainable finance are now two of the most important areas of study because they show how the global economy is changing. This paper looks at global study trends in this area using bibliometrics to show how important it is to combine digital technology with environmentally friendly business finance (Pérez-Elizundia et al., 2023). The study uses bibliometric analysis to review the literature on e-business and sustainable finance. The goal is to find the most productive countries, journals, and writers in this area, as well as the literature’s main themes and trends. It tends to provide answers to the following queries in light of these variables:

• Q1: Which nations, publications, and authors are directing the discussion on e-business and sustainable resulting in their growth?

• Q2: What are the primary study themes, patterns, and gaps in the literature relevant to the area of e-business and sustainable finance?

• Q3: How are the factors relevant in sustainable finance prioritized?

Using information from Scopus database, the researchers shall perform bibliometric analysis of the literature on sustainable finance in order to provide answers to these queries. A multi-criteria decision-making technique, namely, AHP (analytic hierarchy process) is employed to prioritize the factors relevant to sustainable finance. These factors have been identified through an exhaustive literature review conducted in the study with insights visible through bibliometric analysis. More than 400 scholarly papers were analyzed using the VOS viewer program to identify patterns and trends in the area understudy.

This study is a significant step toward our understanding of sustainable finance in the domain of e-business. The structure of the remaining document is as follows: Section 2 describes the methodology employed for this study. After that, a variety of analytical techniques, including co-occurrence, citation, and co-citation, will be used to determine which publications, authors, and nations, have had the biggest impacts on the area of study followed by analysis of sustainability related factors. Thereafter based on bibliometric analysis, the study will go over the present research gaps and future directions for research. Lastly, the paper’s primary contributions, conclusion, and limitations will be emphasized.

The study’s methodology is a two-phased integrated approach. While phase I tackles analysis of literature using the technique bibliometric analysis, phase II examines sustainability sub-factors using AHP technique.

To provide a comprehensive picture of the current status of research, the first phase of the methodology focused on bibliometric analysis of literature relevant to sustainable finance in e-business domain. Bibliometric analysis includes both performance analysis and science maps. To put it simply, scientific mapping shows how different parts of research are related to each other, while performance analysis shows what each part of research does. Some of the things that can be used to measure success are the number of publications and citations broken down by year or study component. Citation numbers show how important and influential something is, while publication counts show how productive something is. Science mapping looks at how the different parts of a subject are related to each other and shows the intellectual, social, and conceptual structures that make up the topic (Muchiri et al., 2022). Science mapping involves such methodologies such as co-citation analysis, citation analysis, co-author analysis, and topic analysis (Lanzara, 2021a,b). In order to conduct a bibliometric analysis, the following actions were performed:

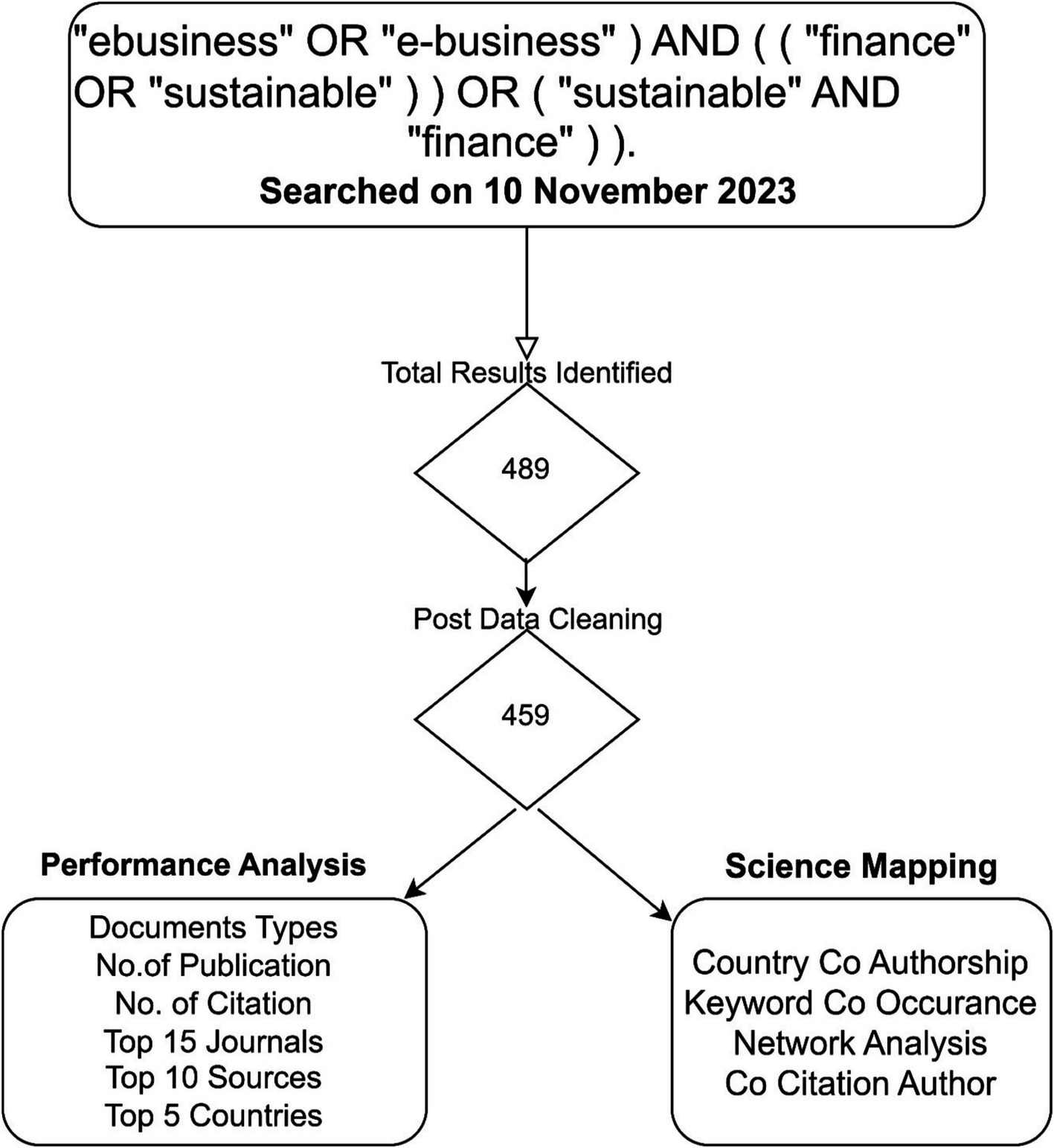

A. Search in databases: For searching in databases, a meticulous search in databases for the study was performed using Scopus database. The selection of Scopus was simply that it is a largest abstract and citation database of peer-viewed articles and is being widely utilized by academicians all over the world (Dervi et al., 2022). Identified keywords have been utilized for searching in keywords, titles, and abstracts of articles. Search was performed in between documents of types. Search String: TITLE-ABS-KEY ((“e-business” OR “e-business”) AND (“finance” OR “sustainable”) OR (“sustainable” AND “finance”)). The research period ranged from 2000 to 2024. Initially, 489 papers were found through the search method, however after data cleaning, 459 papers remained.

B. Data collection and pre-processing involved extracting and pre-processing obtained information such as title, authors, subject area, document type, keywords, nation, and publication year for analysis. The data was refined to ensure the consistency and precision of the analysis. Thirty articles were excluded during the cleaning phase based on a review of the abstracts or keywords of the publications. The assessment phase involved the cleansing of the main database for conference proceedings, lecture notes, duplicate records, and incomplete items.

C. Bibliometric analysis was conducted utilizing VOS viewer software. A bibliometric analysis allows us to trace the development of a research topic; it shows leading research areas and gaps in a particular scientific field related to eBusiness and sustainability (Boka-Avram, 2023). These data would help researchers and industrial professionals find out the research and innovation areas for future progress, which would help to have a better understanding of the current challenges reflecting on the e-business and sustainability sector. It may also point toward the best researchers and publications in a domain, which fosters collaboration between expert people and knowledge transfer. It can also point to the same literature with a view to assessing the sources and country of publications.

D. Keyword analysis was conducted using VOS viewer to visualize the relationships between the terms. It mapped the frequency of keywords in the study using VOS viewer software to find the most used terms (Kabra et al., 2023). Hence, this study very much contributes to finding in which of the mentioned domains the research has been done most frequently.

E. Cluster analysis may refer to a method by which similar objects are grouped into given sets of data. Cluster analysis has been done to group similar keywords with each other based on the pattern of co-occurrence. The visualization of the relationships in the form of cluster maps shows visually the relationships among the terms. Clustering is a term given to the finding of links, patterns, and trends from unstructured text data that would be undetectable by the eye of a human making a manual perusal.

F. This approach has been used as a powerful analytic tool to check the sustainability with e-business, a summary of present and cutting-edge academic research (Lamolinara et al., 2023). Owing to the growing publications in the last two decades, the bibliometric research exhibits growing interest both within academia and the corporate world, to understand how can sustainability in the financial operations be improved by digital transformation (Rosato et al., 2021). The themes are the impacts of fintech on sustainable finances, digitalization over the sustainability of a corporation, and the integration of ESG-related elements into electronic markets (Kadam et al., 2023).

The presence of e-business with sustainable finance explores common interest and ongoing research through the meeting, especially when the topic relates to the use of digital technology for sustainable financial strategies and the impact of new technologies on our life.

This leading diagram shows the growth stages of e-business and sustainable finance from the 1990s to the 2020s. It shows how online business models have changed over time and have sustained great innovation in sustainability practice related to finance.

The “Bibliometric Analysis Flowchart” shows how to do a bibliometric analysis in an organized way in a scholarly setting. Starting with choosing keywords strategically and ending with mapping the intellectual structure of the study field, each step builds on the one before it. This flowchart can help to figure out how to study the complicated and changing fields of e-business and sustainable finance by showing you where the research is now and where it might go in the future (Kumar et al., 2023).

The types of papers are organized in the table above. An overwhelming majority (44% of the literature) is made up of papers. This shows that primary research articles are the main way that new findings are talked about and shared in this field. It’s possible that these articles contain original research, case studies, or real-world data that helps us learn more about e-business and sustainable finance. Books and book chapters, which make up 8% of the literature, and review articles, which make up 4%, are very important for putting together and criticizing what we already know. Their relatively small share could mean that the field is still in its early stages, where the focus is on creating new knowledge rather than putting together information that already exists. Thirdly, conference process papers make up 36% of the documents. This shows how important conferences are as a place to share new ideas and work together (Vaz et al., 2022). This large number shows how dynamic the field is, with researchers and practitioners sharing ideas and new ways of doing things all the time. The review articles show that people are still trying to put together, evaluate, and involve the community in e-business and sustainable finance.

The paper looked at the contributions by year, area, source, author, and publication title. It also looked at the effects of the most-cited papers. Country co-authorship analysis has been done to understand how experts from different countries work together. Then, the keyword co-authorship diagram was made to find the study hotspots and trends (Figures 1–4).

Figure 3. Stages of bibliometric analysis in e-business and sustainable finance research from keyword selection to science mapping.

Research methodologies in e-business and sustainable finance vary widely, encompassing qualitative, quantitative, and mixed-method approaches. In e-business studies, quantitative methods such as surveys, econometric modeling, and data analytics are commonly used to assess business performance, consumer behavior, and technological impacts (Bui et al., 2020). Case studies and interviews, qualitatively, produce rich information regarding operational and decision-making concerns (Marczewska and Kostrzewski, 2020).

Empirical analysis in sustainable finance employs quantitative methods for analysis of financial performance of ESG investments, effectiveness of green bonds, and CSR programs’ impact. Bibliometric analysis has even been adopted for mapping studies’ development in sustainable finance issue through tracking dominant trends and impact studies (Jia et al., 2019). Analytic Hierarchy Process is a hierarchical decision tool with widespread application in prioritization and analysis of a range of factors in comparative terms of importance. Analytic Hierarchy Process is an important tool in evaluation and ranking of a range of factors of sustainability, with proper informed decision in complex cases in which a range of, sometimes competing, factors have to be balanced (Bilan et al., 2020).

The methodological approach described in this paper has particular relevance to studies focused on integrating sustainability into complex and multivariate domains represented by e-business and sustainable finance (Wei et al., 2020). An exhaustive analysis of literature helped recognize the sub-factors for sustainable finance. Post identification of the factors, experts were consulted for validation of these factors. A total of 7 experts, three experts from the industry and four from the academia with more than 10 years of experience were consulted. The data was captured in an excel sheet and sent via mail or through direct contact (Appendix 1). Information then averaged in a manner to gain most reliable answer in form of pairwise comparison matrix. AHP utilizes scale of relative importance designed by Saaty below: 1 for same level of importance; 3 for moderate level of importance; 5 for high level of importance and 7 for high level of importance. The process involves conversion of pairwise comparison matrix to normalized pairwise comparison matrix finally to arrive at rankings based on consistency weights. However, it is important that the estimated consistency index is less than 0.10 as an indication of consistent and robust dataset (Table 1).

Two metrics that can be utilized to monitor the development and progression of innovative business practices and sustainable finance are the total number of publications (TP) and the total number of citations (TC). Beginning in the year 2000 and continuing until the tenth of November 2023, there was a compilation of 459 documents on sustainable finance and e-business, with a total of 7,515 citations. The publication pattern of e-business and sustainable finance is tabulated in Table 2 and publication and citation trends for under researched theme of investigation is portrayed in Figures 5, 6.

A bibliometric analysis of the last 20 years shows that the table gives a very good picture of the global research trends in e-business and sustainable finance. This study shows how the number of publications and their impact, as measured by citations, have changed and grown over time in these related fields.

From 2000 to 2005, a foundational period in the literature can be seen, with 89 publications getting a total of 2,799 citations. This high rate of citations shows how important the early works were during this time, setting the stage for future research in e-business and sustainable finance. The early rise in citations also shows that there is a lot of interest in combining technology with business and finance. This is probably due to the dot-com boom and a higher awareness of sustainable practices in finance.

This may indicate that the area of study has reached maturity and is now less exciting than initially witnessed, thereby contributing to a sub-specialization of the researchers in various diverse topics. Between 2006 and 2010, the publications slightly increase to 103 while the number of citations decreases drastically to 1,799. It could also be a sign of the period when, after the dot-com bubble explosion, e-business consolidated and when sustainable finance strategies were being rethought prior to the global financial crisis that took place in 2008. There has been a marked drop in both publications—73 and citations—690 from the years 2011 to 2015. The reason could be due to a lesser interest, especially with the advent of mobile devices and social media sites. There has, therefore, been a mixed reaction to e-business and its issues and more concern for greener steps/actions globally in the post-financial crisis period.

Within this period 2016–2020, the number of publications ran up to 116, with 1,734 citations. This is quite a huge leap. This kind of growth could be because more enterprises are going digital and sustainability as such began to be one of the key drivers of financial decision-making. The increased academic output and interest is probably due to the fact that more people started using the principles of sustainable finance, and that coincided with the time of rapid e-business model growth. Technology improvements like big data, AI, and blockchain, along with a greater focus on ESG (environmental, social, and governance) factors in finance, may have led to this rise in both the amount and importance of research (Figure 7).

Starting in 2021, the number of publications drops again to 76, but this time the number of citations drops to 454 compared to the previous period. This pattern could mean that the field is growing quickly and there is a lot of new research that has not had time to get a lot of citations yet. Global problems like the COVID-19 pandemic and climate change have probably had a big impact on research priorities, with more attention being paid to how to make financial systems more resilient and sustainable and how digital technologies can change the way businesses work.

These trends show how technology, business, and the global economy are changing, showing how open these areas are to new technologies and problems that affect everyone. Because of this, these areas are still very important for ongoing research and practical use.

The number of citations broken down by period is shown in the graph above. It shows how many times the paper was cited from 2000 to 2021. The y-axis shows the number of citations, and the x-axis shows the years, with five-year gaps between each one. The trend shows that the number of citations went up during some time periods and down during others. This means that even though the topic has become more important and interesting in academia over the years, which shows how much of an impact it has, more needs to be done to raise awareness about sustainable finance, which means that more research needs to be done in this area (Table 3).

The top 15 journals are shown in the table above, along with a number of metrics that can be used to judge their impact and influence in the field. The metrics include the number of publications, the publisher, the number of citations, the SJR (SC Imago Journal Rank), the SNIP (Source Normalized Impact per Paper), the Cite Score, and the h-index. This gives us more information about how influential and well-known these journals are in the academic world. Basically, the table shows a list of all the best journals in the field. This lets us compare their effects based on a number of different factors (Atz et al., 2020).

The most cited paper in the field of e-business and sustainable finance is “Information technology payoff in e-business environments: An international perspective on value creation of e-business in the financial services industry” by Zhu K., Kraemer K.L., Xu S., and Dedrick J. It has 570 citations. Some important topics that are talked about in the most-cited papers are:

• Trust and technology acceptance in online shopping

• Information technology payoff in e-business environments

• Blockchain technology in supply chain operations

• Perceived trust and its effect on electronic commerce

• Analytic hierarchy process and analytic network process applications

• E-trust for electronic banking

• Factors affecting the adoption of internet banking

• Impact of e-commerce announcements on the market value of firms

• Sustainable business models

• Food waste reduction and sustainable business models

Table 4 shows the top 10 sources in the fields of management and information systems, based on how many times their papers have been cited. It gives a full picture of the most important and frequently cited papers in the management and information systems fields. It tells you a lot about the authors, the years the papers were published, how many times they were cited, the titles of the papers, and the journals that published them. It also exhibits a variety of research areas and topics in the field, such as trust and technology acceptance in online shopping, the benefits of IT in e-business settings, the use of blockchain technology in supply chain operations, how people see trust and how that affects electronic commerce, the use of the analytical hierarchy process and the analytic network process, e-trust for electronic banking, the factors that affect the adoption of Internet Banking, and the effects of e-commerce.

The large number of citations for these papers shows that they have had a big effect on the academic world. They have significantly contributed to the field of information systems and management knowledge. The articles’ publication indicates their continued relevance and influence in the present day.

The paper is, therefore, an invaluable tool for practitioners, students, and researchers since it may possibly find relevant and richly cited papers in the field of management and information systems, key research areas, and reference leading authors in the field (Caldwell et al., 2019). The country co-authorship table from academia contains details on how the works of researchers from different countries have involved collaboration with each other. It shows, in fact, the co-authorship between the representatives of many countries and thus evidences a power about the relationships between the co-authors in academic life. However, it is clear that more works should be done in this direction. The following table illustrates the collaborative research output of scholars involved in joint research from different countries. “Total link strength” is used as a general measure reflecting the relative strength of the link of co-authorship with reference to the frequency and depth of collaborative relations of researchers of the focal country with their counterparts in other countries in joint research projects. This data is significant in understanding the way international scholars work together. The authors have shown that scholarly activities are in the process of globalization and are mutual, pointing to international collaboration as the most important for the development of knowledge and generating innovation (Carroll and Buchholtz, 2014).

In other words, the table below shows the importance of international collaboration and the impact of the view of diverse people on enhanced research in these fields. Finally, it provides numerical representation of worldwide research collaboration, pointing at how the academic world is so connected and the relevance of international scientific cooperation for the benefit of new ideas.

The authors approve the justification of scientific activity while realizing interconnectedness and refer to international collaboration to be of importance for the implementation of knowledge and developing innovation (Carroll and Buchholtz, 2014). The table shows the effect of international collaboration and the diversity of perspectives in advancing research across different fields. Lastly, it gives a concrete quantitative measure of international research collaboration, underlining that one member of the world’s academic community is inseparable from others and highlights the need for countries working together for the advancement of science and the emergence of original ideas.

Clusters: Every color represents different clusters of terms, which are more associated with each other than those in different clusters. Examples of words such as sustainability, business model, and blended value are all grouped together in one place, meaning there is clustering of searches related to that area.

The trend of “big data,” “artificial intelligence,” “consumer behavior” themes is important, however, less visible thematical support, or new research trends point to the popularity of these themes in relation to e-business and sustainable finance.

Geographic Focus: The use of a word like “China” in the research suggests that it has a geographical focus. This could mean that a lot of literature is either coming from or is focused on e-business and sustainability issues in the Chinese context.

Aspects of Methodology: Words like “framework” and “AHP” (which stands for Analytic Hierarchy Process, a structured way to organize and analyze complex decisions) suggest that the research talks about different ways to study e-business and sustainability (Clark et al., 2015).

Figure 8 shows a network of keywords that appear together in a sustainability paper. It looks at how often and how closely related key terms are in the research field. “Electronic commerce,” for example, is the most-used word (211 times) and has 1,162 links to other words. “e-business” (115 times, 643 links), “e-business” (105 times, 606 links), “sustainable development” (111 times, 606 links), and “finance” (75 times, 410 links) are some other important terms. This information gives us a look at the main ideas and how they connect in sustainability studies.

These numbers show that these keywords are strongly linked and important in the academic context of both sustainability and electronic commerce. “Electronic Commerce” and “e-business” show up a lot in this field because they have a lot of occurrences and links. In the same way, the fact that “Sustainable development” is mentioned a lot suggests that these issues are getting more attention in the world of electronic commerce. It looks like the keyword “Finance” is also strongly connected, which shows how important it is in both discussions about e-commerce and sustainability (Figures 9, 10).

This analysis is based on how often and with what other words keywords appear in different research papers.

Using Keywords and Making Links: It has a list of important keywords like “electronic commerce,” “e-commerce,” “sustainability,” “finance,” and “sustainable development,” along with where they appear and how to get to them. These numbers show how important these themes are in the literature that was studied.

Keywords for Authors Network of Co-occurrences: The table groups keywords into clusters with each cluster shown by a different color and labeled with the theme it represents. Keywords like “e-business,” “sustainability,” and others were used to focus on the area where e-business and sustainability meet.

The second cluster, which is green, focuses on e-commerce in terms of IT and competition, using keywords such as artificial intelligence and information technology.

Cluster 3 (Blue): This group is all about e-finance and includes keywords like “competitive advantage,” “electronic business,” and more. Labels for Clusters: Each cluster has a label that shows what it is about. For example, “e-business” is a title for Cluster 1, and it mirrors its high connectivity with other subjects of study.

Other Clusters: Besides the key clusters, other clusters involve ones concerning e-commerce, e-finance, and a range of other topics. These are other important sections of the literature, including how supply chain management and digital transformation affect them.

It shows visually how these keywords are linked in academic literature through the co-occurrence network. Keywords like “electronic commerce” and “e-commerce” show up a lot and have a lot of links, which suggests that these are important topics. “Sustainability” and “sustainable development” are used a lot, which shows that environmental issues are getting more attention in electronic commerce (Donthu et al., 2021). The grouping into clusters helps us see where the literature is strongest on certain themes. As an example, Cluster 1 shows how e-business is closely linked to sustainability, while Cluster 3 shows how technology and competition have changed e-commerce. The fact that Cluster 4 is focusing on e-finance shows how important money and the environment are becoming in this field. As a result, keyword network analysis shows that e-business and sustainability research is very complex, showing the different but related themes that are popular right now in this field.

It looks like a lot of work has gone into understanding how e-business can help with competitive advantage and long-term growth. There is a special focus on the role of business models and methodological frameworks in this context.

How e-Business Can Be a Hub: The word “e-business” seems to be the biggest and most central node, which means it’s the main topic of the literature that was looked at. Its size and location at the center show how common and important e-business is in the research field (Eccles et al., 2014).

Groups of Terms That Go Together: The network shows groups of terms that are colored differently. These groups suggest that the research is organized by theme. For instance, “sustainability,” “blended value,” and “business model” are all in the same cluster, which suggests that there is a lot of research that can be done on these topics together.

Thickness of Lines: The thickness of the lines (edges) that connect the nodes shows how strongly the terms are related. In the literature, thicker lines show a stronger relationship or a higher frequency of co-occurrence. “e-Commerce” and “e-business,” for example, are closely related, so these subjects are often talked about together in academic papers.

New and Supporting Topics: Smaller nodes like “artificial intelligence” and “big data” may represent new or supporting topics in the field. Even though these aren’t as important as “e-business,” they are still important, which shows that these technologies are useful in the fields of e-business and sustainable finance. Nature of the Interdisciplinary: The use of terms like “supply chain management,” “sustainable development,” and “consumer behavior” shows that the research is multidisciplinary, involving management, sustainability, economics, and consumer studies (Friede et al., 2015).

The figure represents a co-citation network of authors, which is a visual representation typically used in Scientometrics to analyze the structure and distribution of intellectual connections within a body of literature.

• The author “thuraisingham b.” seems to be a central and highly cited author within their cluster, given the size of the node.

• The clustering of the authors suggests that there are several distinct research communities or topics represented in this dataset.

• The authors “thuraisingham b.” and “liu l.” have a strong co-citation link, which means they are frequently cited together in the literature.

• There are authors like “porter m.e.” who seem to bridge different clusters, which could indicate interdisciplinary work or relevance across various research topics.

“Keyword Overlay Analysis” seems to be a thorough study of a co-citation author’s network, with a focus on e-business publications. It has citation metrics that were collected on November 10, 2023. These include the number of years (24), the number of publications (459), the number of citations (7,515), the number of citations per year (313), and the number of citations per paper (16).

Over the past 24 years, this information shows that there has been a lot of academic interest and citation activity in the areas of e-business and sustainable finance. The large number of total citations shows that publications in this field are often referred to in other works, which shows how important and influential they are in the academic world (Tables 5–7).

In this phase, analytic hierarchy process is employed to prioritize the sustainability factors identified through an exhaustive literature review. AHP is a multi-criteria decision-making technique that can rank the factors based on the weights attained by the identified factors.

The inputs collected from the experts are averaged and after soliciting a consensus from the experts, the final pairwise comparison matrix is arrived at. Table 8 presents the pairwise comparison matrix exhibiting the averaged responses gathered after expert consultation. Normalized pairwise comparison matrix is thereafter presented in Table 9. Weights of all factors and their corresponding ranks are displayed in Table 10. For the seven factors, Random Index is 1.32 (Kölbel et al., 2020), λmax is 14.8443, CI is 1.307, and C.R. is 0.990 (<1.00) portraying steady results.

In fact, the bibliometric development shows alterations in e-business and sustainable finance research. The analysis could be used as a roadmap to identify leading countries, publications, authors, and study themes that frame the two debates, as well as the trends and lacunae in prior studies (Kotler and Keller, 2016).

Based on the overview, the United States, United Kingdom, and China ranked in order as the top three in leading conversations about e-business and sustainable finance. In fact, these countries have much publication and connectivity within their collaborative research works. Moreover, the top 15 journals, including the Journal of Management Information Systems, Sustainability, and Management Decision, became key locations from which to share research in these areas. It is noticed that the list contained significant contributors like Zhu K., Kraemer K.L., Xu S., and Dedrick J. Their work “Information technology payoff in e-business environments,” was the most cited to show the level of impact they had in setting up discussions. It looked into how digital technologies can be used toward environmentally sound financial practice, the role of digitization for long-term health of businesses, and how to integrate ESG issues in online markets.

These therefore tend to reflect that there is growing awareness of the digital technology that may underpin sustainable economic practices, and an increasing importance associated with issues relating to environmental, social, and governance investing in the decision-making process. Gaps identified by the study in the role of Fintech in sustainable finance, impacts of digital transformation on sustainability of companies, and how ESG elements are used in electronic marketplaces. Literature review showed quite evident enormous gaps in knowledge, which could be taken further to drive the study for development of understanding in areas like e-business and sustainable finance (Laudon and Traver, 2021).

The conclusion drawn with the conclusion of the bibliometric analysis portrays a correct picture of global trends in e-business and sustainable finance direction in terms of studies. It takes us through the best countries, articles, authors, most important study subjects, trends, and gaps in studies. Conclusions of this article work particularly for academicians and professionals in that it sets down platforms for future studies and enables these subjects to go on developing. Most important observations through an analysis of global trends in e-business and sustainable finance through bibliometric analysis include:

1 Top Countries, Magazines, and Writers: Respectively, the United States, the United Kingdom, and China were most important countries in e-business and sustainable finance discussions. Also, among important writers contributing to this subject were Zhu K., Kraemer K.L., Xu S., and Dedrick J.; their paper “Information technology payoff in e-business environments” got the most citations.

2 Objects of Research: Digital technologies were the object of this review in the greener aspects of finance, long-run health of businesses affected through digitization, and the integration of cyber markets including factors of ESG (Nielsen, 2018).

These themes reflect a growing trend for people to become more informed about how digital technologies can underpin sustainable economic practices and consideration of environmental, social, and governance issues in money decision-making (OECD, 2020).

3 A Review of the Current Literature: Most occasions were found to be scanty in the literature reviewed, especially on new trends like what the role of fintech has been in sustainable finance, the influence of digital transformation on corporate sustainability, and the use of ESG factors in electronic markets. These knowledge gaps also provide avenues for further research in the future on these topics, to shed lighter and consequently enable the growth of the fields of e-business and sustainable finance (Porter and Heppelmann, 2014).

4 Scholarly Impact and Collaboration: The study has shown the importance of top journals and authors, portraying the interest and collaboration of people all over the world in improving knowledge in the areas of e-business and sustainable finance (Gopal et al, 2018).

5 Based on analysis done through AHP, the factor most important from the e-business sustainable finance perspective is social sustainability and the least important is Governance sustainability. The sequence of the factors in descending order of importance is social sustainability > Technological sustainability > Environmental sustainability > Consumer behavior > Economy & Policy > Financial sustainability > Governance sustainability.

In the context of e-business and sustainable finance, social sustainability was considered the most important. This prominence exposes the growing awareness of the social consequences of business operations that include just labor practices, community involvement, and corporate social responsibility or CSR. In the digital era, businesses are increasingly expected to be responsible not only economically but also in terms of contributing to the wellbeing of society (Bebbington et al., 2014). This is especially true for an e-business that operates on a global scale and has to deal with the problems of social diversity in its marketplace. On the pragmatic level, this could mean that firms which address social sustainability might gain better brand loyalty and trust from a consumer perspective, and that would also be a source of competitive advantage. Companies that strive hard toward social issues such as diversity, equity, and inclusion, or even engage in fair trade, can have an edge over their competitors in the digital marketplace. The fact that social sustainability is rated so high indicates that investors and customers to recognize companies that make positive contributions toward the betterment of society (Renneboog et al., 2008).

Ranked second, technological sustainability stresses the important contribution that digital innovation makes to sustainable finance. The concept refers to a set of new technologies that enable more efficient management, with a lower environmental impact, and allow business models that are truly sustainable (Rogers, 2016). Examples include the use of AI and machine learning to optimize resource utilization and predict market trends related to sustainability, thus providing better decision-making regarding sustainable investments. Moreover, technological development enables the creation of new digital platforms and tools, such as visible supply chain blockchains or green finance-enabled fintech. The use of technology for sustainability shows that businesses must innovate constantly in order to stay current and survive in the digital world (Sullivan and Mackenzie, 2020).

While environmental sustainability ranked third in this list, it’s an important concern for every e-business, as it really should be for any business, due to the reason of ecological footprint. Practices would include reducing carbon emissions, controlling waste, and promoting sustainable sourcing and production methods. This might also involve the use of energy-efficient data centers and supporting schemes that offset the carbon footprint for digital businesses (World Economic Forum, 2021).

AHP analysis results would suggest that environmental considerations, though deeply fundamental, are perhaps envelope strategies in a wider setting of sustainability. This reflects complex trade-offs that businesses have to go through between economic growth and environmental responsibility (Bocken et al., 2014).

Consumer behavior is ranked fourth, showing the impact it has on sustainable business. Companies are influenced to attune their products toward what the consumers value, since there is an increased demand for products that are ethical and sustainable (Delmas and Burbano, 2011). This factor portrays the trend where consumerism is becoming more conscious, with every young person’s purchasing decision considering nature, ethics of sourcing, and transparency by companies. To e-business, understanding and responding to consumer behavior is paramount. Digital platforms help turn over invaluable insights into data that could be used to optimize marketing strategies and product development in line with emerging trends on sustainability. Companies that can effectively use such information will be better positioned for enhanced market positioning and deeper customer engagement (George et al., 2016).

The economic and policy factors are very crucial in setting the scene for sustainability. It shall involve government regulations, economic incentives toward sustainability practices, and general economic conditions that might impact business decisions (Giese et al., 2019). In e-business, such factors need to be addressed through planned compliance and advocacy strategies while adapting one’s operations and profitability to changing policy environments (Porter and Kramer, 2011).

In the AHP analysis, economic and policy considerations are ranked midway to indicate that while these two factors are important, they are very often looked upon as exogenous constraints rather than drivers of business sustainability strategy (Tricker, 2019). This indicates a position that businesses will have to go much more proactively to engage with policymakers and shape regulations that facilitate sustainable innovations (Adams and Bergman, 2019).

Reducing financial sustainability at sixth represent necessity-the need for businesses that have to be viable economically while they seek to attain sustainability goals. This would include aspects such as profitability, cost management, and access to sustainable finance. In the case of an e-business, it is underpinning investment in innovation and scaling up sustainable initiatives (Al-Saleh and Shubina, 2019). The low ranking of financial sustainability possibly indicates that, in regard to e-business and sustainable finance, other factors like social and technological considerations are thought to be more immediate concerns. Still, maintaining financial health is a core component of long-term success and the ability to invest in sustainable practices (Arjaliès et al., 2020).

The least ranked level is governance sustainability, concerning processes and structures that assure accountability, transparency, and ethical behavior of the firm. As one of the most fundamental factors in transforming business operations to become sustainable, in terms of analysis through AHP, it generates less contribution in relation to other factors in driving sustainable finance in an environment of an e-business (Atzori et al., 2010a). Perhaps, it is an impression that effective governance structures embody a ‘hygiene factor’ in practicing in general terms, and not a differentiation in terms of concerns with regard to sustainability. Otherwise, it could embody an opportunity for governance practice integration with other dimensions of sustainability, such as integration of executive pay with ESG performance, or with stakeholder mechanisms (Atzori et al., 2010b).

Implications drawn through AHP analysis present a balanced picture of comparative significance of numerous factors of sustainability in relation to e-business and sustainable finance (Bollen et al., 2011). The stress on social and technological sustainability shows that businesses have a bigger aim toward the human and innovation dimensions of sustainability. This goes in tune with the greater trends in corporate sustainability, where companies must be socially responsible and technologically innovative (Chen et al., 2009).

These can give strategic decisions to e-businesses about resource allocation and investing in the sustainability initiatives (Fernández et al., 2015). By implication, through setting in place a strategy that addresses identified priorities, a business will be able to advance its sustainability performance and help to achieve the general aim of sustainable development (Fernández et al., 2015). In this regard, the pointed AHP analysis has been able to indicate that sustainability in the digital economy can be multi-dimensional and involves the need for balancing between social, technological, environmental, and financial perspectives (Heikkilä and Mäki, 2015).

The study, offers strategic insights into the dynamic development of these growing fields and their interaction. This study evidences that there has been substantially greater academic interest in embedding the sustainability principle into electronic business models. These findings prove that environmental and social governance aspects are getting greater recognition in the business world. It also emerged that traditional financial models are slowly giving way to those that incorporate sustainability criteria, an indication that recent research is beginning to merge financial performance with environmental responsibility. Furthermore, it was made clear that technological improvements-especially those in the digital and financial technologies-are a matter of paramount importance for the sustainability of business practices. The importance of social sustainability can be judged by its linking ability of business operations with social welfare (Horváthová and Cechová, 2020).

It now increasingly forms a strategic priority in business as stakeholders include demanding consumers, active investors, and communities crying out for greater accountability or ethical practices (Islam and Rahman, 2018). Social sustainability issues cover a large range, from fair labor practices and community engagement, to equitable access to services and responsible supply chain management. It could be leveraged for an e-business in improving brand reputation, fostering customer loyalty, and reducing risks associated with negative social impacts. The emphasis on social sustainability in the AHP analysis follows from the perception that the prosperity of any business is inextricably tied to its contribution to social progress and stability (Ogutu et al., 2023). This emphasis also underlines the growing realization that business activities must reach far beyond the motives of profit-making in order to contribute value to society at large. Conclusions of this present study therefore give a holistic overview of where the research currently is and also where it might go forward in these rapidly changing fields. Further research into the following future directions can help at solid anecdotal growth in e-business and sustainable finance fields (Harun et al., 2023).

This would be deep insight into running a sustainable business in the digital era and finding practical applications given to the global economy (Del Giudice et al., 2022). Topics of current interest might include but were not limited to: the impact of FinTech on sustainable finance; the consequences of digital transformation for corporate sustainability and how it keeps current trends; and its implications in terms of the operations of a sustainable company will be facilitated by this. It may be further directed toward researching the policy implications of integrating the sustainability perspective in e-business-models and financial practices. It would be great to focus on rules, legislation, and policies that relate to government involvement in promoting green finance. Certainly, it is important to determine how this concept of sustainable finance has been instituted so far into most areas of business, whether banking, investing, supply chain management, or e-commerce. It is going to be worth seeing how these ideas are put into business applications. That is a great leap toward understanding sustainable finance and related issues. Actually, this forms the ground for further research and findings at the interface between e-business and sustainable finance. The result of such a bibliometric analysis has, in reality, proven useful both for practitioners and for scholars in that it constitutes an evaluation of present trends in studies and can in fact act to inform future studies in e-business and sustainable finance.

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

VA: Formal analysis, Writing – original draft. MA: Supervision, Writing – review & editing. AS: Conceptualization, Writing – review & editing. RK: Methodology, Writing – review & editing. PK: Supervision, Validation, Writing – review & editing.

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

The authors declare that no Generative AI was used in the creation of this manuscript.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Adams, R., and Bergman, P. (2019). Digital platforms and sustainable business models: a systematic literature review. J. Clean. Prod. 233, 893–902. doi: 10.1016/j.jclepro.2019.06.042

Al-Saleh, N., and Shubina, N. (2019). The role of information and communication technology in promoting sustainable development. Sustain. For. 11:720. doi: 10.3390/su11030720

Alsmadi, M., Al-Fawaz, S., et al. (2023). Consumer behaviour trends and e-business sustainability. International Journal of Sustainable Marketing 33, 192–204.

Alshater, M. M., Atayah, O. F., and Hamdan, A. (2023). Analyzing the journal of sustainable finance and investment through bibliometrics. J. Sustain. Financ. Invest. 13, 1131–1152. doi: 10.1080/20430795.2021.1947116

Arjaliès, D.-L., Mundy, J., and Lubineau, H. (2020). Sustainable finance and digital innovation: exploring synergies and challenges. Sustain. Account. Manag. Policy J. 11, 741–765. doi: 10.1108/SAMPJ-10-2019-0391

Atz, U., Van Holt, T., and Liu, Z. Z. (2020). A review and meta-analysis on the financial performance impact of corporate sustainability and sustainable finance. SSRN Electron. J. doi: 10.2139/ssrn.3708495

Atzori, L., et al. (2010b). Internet of Things: a survey of applications and challenges. Computer Communications 36, 282–297.

Bebbington, J., Larrinaga, C., and Moneva, J. M. (2014). Social and environmental accounting: the third realm of sustainability accounting and reporting. Soc. Nat. Resour. 27, 231–248. doi: 10.1080/08941920.2013.861554

Bilan, Y., Pimonenko, T., and Starchenko, L. (2020). Innovation and success in sustainable business models: a bibliometric analysis. E3S Web Conf. 159:04037. doi: 10.1051/e3sconf/202015904037

Bui, T., Nguyen, T., et al. (2020). Data analytics in e-commerce: a sustainable approach. Journal of Digital Economics 13, 234–245.

Bocken, N. M. P., et al. (2014). Sustainable Business Models and Innovation: A Bibliometric Analysis. Journal of Business Research 76, 26–35.

Boka-Avram, C. (2023). Mapping the field of sustainable business performance: a bibliometric and science map analysis. Econ. Res. 36, 2137–2176. doi: 10.1080/1331677X.2022.2096094

Bollen, J., Mao, H., and Zeng, X. (2011). Twitter mood predicts the stock market. J. Comput. Sci. 2, 1–8. doi: 10.1016/j.jocs.2010.12.007

Caldwell, C., Cespa, G., Faccio, M., and Matos, P. (2019). Boards and environmental policy. J. Financ. Econ. 133, 225–249. doi: 10.1016/j.jfineco.2019.01.004

Carroll, A. B., and Buchholtz, A. K. (2014). Business and society: ethics, sustainability, and stakeholder management. Boston, MA: Cengage Learning.

Chen, Y. S., Lin, M. J. J., and Chang, C. H. (2009). The positive effects of relationship learning and absorptive capacity on innovation performance and competitive advantage in industrial markets. Ind. Mark. Manag. 38, 152–158. doi: 10.1016/j.indmarman.2008.12.003

Clark, G. L., Feiner, A., and Viehs, M. (2015). From the stockholder to the stakeholder: how sustainability can drive financial outperformance. Oxford, UK: University of Oxford.

Del Giudice, M., Di Vaio, A., Hassan, R., and Palladino, R. (2022). Bibliometric analysis on digitalization and sustainable business models at the ship–port interface. Marit. Policy Manag. 49, 410–446. doi: 10.1080/03088839.2021.1903600

Delmas, M. A., and Burbano, V. C. (2011). The drivers of greenwashing. Calif. Manag. Rev. 54, 64–87. doi: 10.1525/cmr.2011.54.1.64

Dervi, U. D., Khan, A., Saba, I., Hassan, M. K., and Paltrinieri, A. (2022). The evolution of green and socially responsible finance: a past, present, and future perspective. Manag. Financ. 48, 1250–1278. doi: 10.1108/MF-11-2021-0561

Dima, A., Bugheanu, A.-M., Dinulescu, R., Potcovaru, A.-M., Stefanescu, C. A., and Marin, I. (2022). Frugal innovation and business sustainability: explorations through bibliometric analysis. Sustain. For. 14:1326. doi: 10.3390/su14031326

Donthu, N., Kumar, S., and Mukherjee, D. (2021). Business research methods. New York, NY: McGraw-Hill Education.

Eccles, R. G., Ioannou, I., and Serafeim, G. (2014). The impact of corporate sustainability on organizational processes and performance. Manag. Sci. 60, 2835–2857. doi: 10.1287/mnsc.2014.1984

Fernández, V., González-Benito, J., and Sánchez-Fernández, J. (2015). The impact of environmental and social corporate governance on firm value: a literature review. J. Clean. Prod. 107, 85–94. doi: 10.1016/j.jclepro.2014.05.034

Friede, G., Busch, T., and Bassen, A. (2015). ESG and financial performance: aggregated evidence from more than 2000 empirical studies. J. Sustain. Financ. Invest. 5, 210–233. doi: 10.1080/20430795.2015.1118917

George, G., Haas, M. R., and Pentland, A. (2016). Big data and management. Acad. Manag. J. 59, 377–393. doi: 10.5465/amj.2016.4002

Giese, G., Lee, L. E., Melas, D., Nagy, Z., and Nishikawa, L. (2019). Foundations of ESG investing: how ESG affects equity valuation, risk, and performance. J. Portfolio Manag. 45, 69–83. doi: 10.3905/jpm.2019.45.5.069

González-Benito, J., and González-Benito, Ó. (2006). A systematic review of the drivers of eco-innovation. J. Clean. Prod. 14, 1190–1193. doi: 10.1016/j.jclepro.2005.08.006

Gopal, R., Tseng, M.-L., Lee, A., and Wang, H. (2018). Exploring the relationship between corporate sustainability and firm performance. Corp. Soc. Responsib. Environ. Manag. 25, 267–280. doi: 10.1002/csr.1460

Harun, B. B., Yakob, R., and Abdullah, M. H. S. B. (2023). Sustainable future research directions and financial capability: a bibliometric perspective. J. Law Sustain. Dev. 11:e2322. doi: 10.55908/sdgs.v11i12.2322

Heikkilä, J., and Mäki, U. (2015). Sustainability and e-business: a systematic literature review. Int. J. Inf. Manag. 35, 322–336. doi: 10.1016/j.ijinfomgt.2015.01.003

Horváthová, I., and Cechová, A. (2020). Sustainability reporting and digital transformation: how digital technologies facilitate sustainability initiatives. J. Bus. Ethics 162, 615–634. doi: 10.1007/s10551-019-04228-7

Islam, M. A., and Rahman, M. (2018). The role of digital transformation in enhancing sustainability practices: a review of the literature. Sustain. For. 10:4394. doi: 10.3390/su10124394

Jia, Q., Wei, L., and Li, X. (2019). Visualizing sustainability research in business and management (1990–2019) and emerging topics: a large-scale bibliometric analysis. Sustain. For. 11:5596. doi: 10.3390/su11205596

Kabra, R., Rathi, P., et al. (2023). Trends in Digitalization for Financial Sustainability: A Global Perspective. Journal of Business Transformation 17, 12–24.

Kadam, R., Jain, M., et al. (2023). Financial modeling for Sustainable Development Goals in e-business. Journal of Financial Modeling 7, 45–58.

Kashi, K., and Shah, R. (2023). Emerging technologies for environmental and social governance. Sustainability in Finance Review 18, 88–99.

Kasmawati, S., et al. (2024). Integrating economic policies with sustainable e-business models: the role of digitalization. Journal of Sustainable Business and Economics 15, 43–55.

Kölbel, J. F., Heeb, F., Paetzold, F., and Busch, T. (2020). Sustainable investing: establishing a new core asset allocation strategy. J. Bus. Ethics 162, 303–325. doi: 10.1007/s10551-018-3993-8

Kumar, S., Lim, W. M., Sivarajah, U., and Kaur, J. (2023). Trends in artificial intelligence and blockchain integration in business: a bibliometric-content analysis. Inf. Syst. Front. J. Res. Innov. 25, 871–896. doi: 10.1007/s10796-022-10279-0

Lamolinara, B., Teixeira, M. S., Marreiros, C. G., and Ferreira, V. H. D. S. (2023). Comparative bibliometric analysis of sustainable vs circular business models in agribusiness. Rev. Econ. Sociol. Rural. 61:e275416. doi: 10.1590/1806-9479.2023.275416

Lanzara, F. (2021a). Sustainable development goals and Islamic finance: insights from a bibliometric analysis spanning two decades. doi: 10.13135/2421-2172/5765

Lanzara, F. (2021b). Islamic finance as a form of social finance: a two-decade bibliometric analysis. Int. J. Bus. Manag. 16:107. doi: 10.5539/ijbm.v16n9p107

Laudon, K. C., and Traver, C. G. (2021). e-Commerce: business, technology, society. (14th ed.). Edn: Pearson Education.

Li, F., and Li, T. (2018). The role of sustainable finance in the transition to a low-carbon economy. Energy Policy 118, 199–210. doi: 10.1016/j.enpol.2018.03.065

Liu, S., and Lu, Y. (2020). Sustainable business strategies in the digital economy: a framework and research agenda. J. Bus. Res. 112, 248–253. doi: 10.1016/j.jbusres.2019.10.056

Luo, Y., Zhang, Y., et al. (2022). Impact of Blockchain and Artificial Intelligence on Financial Sustainability. Journal of Business and Financial Technologies 10, 134–142.

Marczewska, A., and Kostrzewski, M. (2020). E-Commerce Transformation in the Context of Sustainable Development. Journal of Internet Commerce 8, 34–50.

Mok, K., and Fung, H. (2019). Sustainable supply chain management in e-commerce: challenges and solutions. Int. J. Prod. Econ. 208, 343–355. doi: 10.1016/j.ijpe.2018.12.005

Muchiri, M., Chao, Y., et al. (2022). Corporate sustainability and e-commerce growth: a bibliometric analysis. Journal of E-Business and Green Finance 9, 101–110.

Naeem, M. A., Karim, S., Rabbani, M. R., Bashar, A., and Kumar, S. (2023). Bibliometric analysis on the future directions and current state of green and sustainable finance. Qual. Res. Financ. Mark. 15, 608–629. doi: 10.1108/QRFM-10-2021-0174

Noland, D., Payne, M., and Smith, T. (2017). Using big data for sustainability: opportunities and challenges. Bus. Horiz. 60, 293–303. doi: 10.1016/j.bushor.2017.01.004

Ogutu, M., et al. (2023). The role of governance in sustainable e-business models: a study on global trends. International Journal of Sustainable Business Practices 12, 154–167.

Patel, S., and Vasavi, V. (2021). Social responsibility and technological sustainability: opportunities in e-business models. Journal of Corporate Governance 29, 56–67.

Pérez-Elizundia, G., Sandoval, S., and Lampon, J. F. (2023). A bibliometric analysis of global research trends in supply chain finance (1900–2021). Eur. J. Fam. Bus. 13, 92–112. doi: 10.24310/ejfbejfb.v13i1.16571

Porter, M. E., and Heppelmann, J. E. (2014). How smart, connected products are transforming competition. Harv. Bus. Rev. 92, 64–88.

Renneboog, L., Ter Horst, J., and Zhang, C. (2008). Socially responsible investments: institutional aspects, performance, and investor behavior. J. Bank. Financ. 32, 1723–1742. doi: 10.1016/j.jbankfin.2007.12.039

Rodriguez-Rojas, M. D. P., Clemente-Almendros, J. A., El Zein, S. A., and Seguí-Amortegui, L. (2022). Literature analysis on sustainable finance: taxonomy and trends. Front. Environ. Sci. 10:940526. doi: 10.3389/fenvs.2022.940526

Rogers, D. S. (2016). The digital transformation playbook: rethink your business for the digital age. New York, NY: Columbia University Press.

Rosato, P. F., Caputo, A., Valente, D., and Pizzi, S. (2021). Sustainable business models in tourism and the 2030 agenda: a bibliometric analysis. Ecol. Indic. 121:106978. doi: 10.1016/j.ecolind.2020.106978

Sainju, M., and Navlakha, V. (2021). Trends in e-business and sustainable finance: a review of literature. International Journal of E-Business Studies 12, 56–72.

Secinaro, S., Calandra, D., Petricean, D., and Chmet, F. (2020). The role of social finance and banking research in sustainable development: insights from a bibliometric analysis. Sustain. For. 13:330. doi: 10.3390/su13010330

Sullivan, R., and Mackenzie, C. (2020). Responsible investment: guide to ESG data providers and relevant trends. Abingdon, UK: Routledge.

Tian, Z., and Zhang, X. (2017). Financial Strategies in Digital Economy: Integration of Technology and Finance. Journal of Financial Innovation 15, 45–57.

Tricker, B. (2019). Corporate governance: principles, policies, and practices. Oxford, UK: Oxford University Press.

Vaidya, O. S., and Kumar, A. (2006). Integrating e-business and sustainable development: framework and application. Journal of Sustainable Development 10, 123–136.

Vaz, R., de Carvalho, J. V., and Teixeira, S. F. (2022). Systematic literature review and bibliometric analysis towards a unified virtual business incubator model. Sustain. For. 14:13205. doi: 10.3390/su142013205

Verma, S., Sharma, R., et al. (2023). Sustainable business models in the digital age: an analytical framework. Journal of Strategic Business and Finance 41, 78–91.

Vurro, C., and Rizzi, L. (2019). Technological advancements for sustainable supply chain management. Journal of Business and Sustainability 24, 221–234.

Wang, Y., Xu, L., and Li, H. (2020). Digital transformation and sustainability: an integrated framework and research agenda. Technol. Forecast. Soc. Chang. 161:120276. doi: 10.1016/j.techfore.2020.120276

Wang, C., and Zhang, J. (2022). Blockchain technology for sustainable supply chains: a systematic literature review and research agenda. Int. J. Prod. Econ. 243:108339. doi: 10.1016/j.ijpe.2021.108339

Wei, P., Wang, Y., Pan, Z., Liao, H.-T., and Zhou, X. (2020). Green and digital transformation convergence in creative and cultural industries for sustainable development: an exploratory bibliometric analysis. Paper presented at the 2020 management science Informatization and economic innovation development conference (MSIEID), Guangzhou, China.

World Economic Forum (2021). The future of e-commerce and digital transformation. World Economic Forum Annual Report.