- 1Management School, Hunan City University, Yiyang, Hunan, China

- 2Hunan New Urbanization Research Institute, Yiyang, Hunan, China

- 3School of Physical Education, Hunan City University, Yiyang, Hunan, China

This paper is based on panel data from 278 prefecture-level cities in China from 2012 to 2021, and studies the relationship between healthy real estate development, land finance, and economic growth. The findings indicate that there are distinct trends in the healthy development of real estate across different city levels in China. By using the PVAR model, the intrinsic connections between real estate health, industrial transformation and upgrading, and economic growth are revealed. The results from the heterogeneity analysis show that the lag periods of real estate health, land finance, and economic growth have a positive impact on themselves in municipalities, provincial capitals, and prefecture-level cities. In prefecture-level cities, there is a significant interactive promotion between healthy real estate development and land finance. Land finance can directly contribute to economic growth, forming a “land finance-economic growth” direct effect channel. Additionally, healthy real estate development has a significant positive impact on promoting economic growth.

1 Introduction

China's real estate sector is a key component of its economy. The government owns all land and heavily relies on revenue from land sales (Cai et al., 2020). Urban land is leased for development, with developers renting land-use rights for a limited period (usually 40–70 years), while rural land has different ownership and usage regulations. Rapid urbanization has driven demand for housing, office, and industrial spaces (Fan et al., 2020). In the 1990s, China transitioned from state-provided housing to a market-based system, triggering a real estate boom (Lu et al., 2012). However, housing prices, especially in large cities, remain high (Tian et al., 2020). The government has attempted to control the market by restricting multiple home purchases and regulating mortgages (Li R. Z. et al., 2020). According to the latest GRETI (JLL, LaSalle, 2024), China is classified in the “Semi-Transparent” category. Smaller cities are less transparent, making it harder for foreign investors to assess risks and opportunities (Li, 2016; Zhang, 2008). This paper analyzes the relationship between the real estate market and economic development based on macroeconomic data from 278 Chinese cities, aiming to improve transparency in property rights, regulatory frameworks, and market data accessibility, which would enhance market access for domestic and foreign investors.

With the advancement of urbanization and the deepening of housing system reform in China, the real estate industry is developing rapidly. Especially since the financial crisis in 2008, real estate has gradually become one of the important industries for China's rapid economic development, and has also driven the development of a large number of upstream and downstream industries, making a great contribution to the economic growth of various regions. However, with the rapid development of real estate and the continuous strengthening of land finance, some problems have gradually become prominent. Firstly, the overheated development of the real estate market will occupy a large amount of real economic resources, leading to industrial hollowing out, overinvestment or resource waste (Xu et al., 2017); Secondly, real estate is strongly correlated with GDP growth, and the government has gradually become dependent on real estate. The problem of supply and demand mismatch in the market is serious, and the gap between housing prices and wages is gradually widening, causing huge pressure on home purchases and loan repayments, which poses risks to social stability and financial instability, indirectly affecting the development of the national economy. It can be said that the healthy development of real estate has become a double-edged sword that affects China's economic growth (Liang et al., 2006).

In order to cope with the excessive development of the real estate market, the Central Economic Work Conference in 2016 proposed to promote the stable and healthy development of the real estate market, adhere to the positioning of “houses are for living, not for speculation,” and re-emphasized the requirements of “healthy development of real estate” and “balanced development of real estate and the real economy” in the “14th Five-Year Plan for National Economic and Social Development and the Outline of Long-term Goals for 2035.” In recent years, due to the impact of the pandemic and economic downturn, residents' consumption capacity has shrunk, and the systemic risks of real estate finance have been increasing (Hu, 2017). In July 2023, the Political Bureau of the CPC Central Committee pointed out that “the supply-demand relationship in China's real estate market has undergone significant changes, requiring the promotion of a stable and healthy development of the real estate market.” Due to the large proportion of real estate in the national economy, the real estate industry will seriously affect the development of the national economy. Based on the above policy background and economic development status, under the requirements of establishing a modern economic system and achieving high-quality economic development, it is necessary to reflect on the inherent relationship between the healthy development of real estate, land finance and economic growth, explore the impact mechanism and provide policy recommendations to promote sustained economic growth.

2 Literature review

The development of real estate is closely tied to national policies (Wei et al., 2020), with favorable regulations effectively encouraging residents to purchase multiple homes (Huang et al., 2020). Additionally, flexible housing supply indirectly boosts urban economic growth by facilitating the flow of human capital (Büchler et al., 2024). The convenience of transportation also helps businesses and individuals reduce housing costs in cities (Zheng and Kahn, 2013). Moreover, the pandemic has led to a decline in real estate sales, as city lockdowns and economic downturns have further intensified this trend (D'Lima et al., 2020; Cheung et al., 2021). At the same time, changes in population structure significantly affect urban housing demand, which in turn influences the overall real estate market development (Zheng et al., 2009).

Facing the current difficulties and challenges in the development of real estate, it is of great significance to study a set of methods that can evaluate the healthy development of real estate, which can provide reference for decision-making departments to formulate and improve housing policies. At present, there is no authoritative or popular model at home and abroad that can measure the health of China's real estate. Research on the healthy development of real estate mainly focuses on the evaluation of real estate market indicators, land market indicators, and the simulation of the impact of public policy variables on the housing system (Chen and Wang, 2013). In traditional research on the healthy development of real estate, health evaluation, health degree, and health policy are all constructed within a relatively closed real estate system, independent of the macroeconomic system, lacking certain rationality (Ye et al., 2021).

There are several research perspectives on the connotation of the health of the real estate market. First, balance. The prerequisite for the healthy development of the real estate market is to achieve a balance between supply and demand in the market. The supply, demand, price, and structure of the real estate market should match the level of economic development in the city, achieving sustainability and low risk (Ni et al., 2008); Second, collaboration. The market size, price and supply growth rate of the healthy development of real estate should be coordinated with the population and economy of the city (Yu et al., 2013); the third is coordination. The connotation of a healthy housing market is the smoothness of internal indicator growth and the responsiveness of external environmental coordination. Regarding the research on the health of the real estate market, some scholars have conducted research on Beijing, Shanghai and other large cities with relatively developed markets, or on the entire Yangtze River Delta region and Beijing-Tianjin-Hebei region (Zhao et al., 2023). The research indicator system has gradually matured from a single indicator to an indicator weighted system, and the indicator system has been integrated into different levels such as supply and demand, scale, structure, speed, price, etc., considering comprehensive aspects such as economic coordination, supply and demand balance, moderate investment, and land control. In terms of regionalization methods, some scholars have used Ward's hierarchical clustering method to analyze the health of China's county-level housing market (Xu et al., 2017).

Regarding the impact of land finance on economic growth, land finance is essentially the financial income obtained by local governments through the transfer of state-owned land use rights (Li Y. et al., 2020; Lu and Teng, 2020). The financial attributes of land have expanded the supply of the real estate market, thereby affecting urban economic development (Chen and Wu, 2020). Local governments can use land finance income to carry out industrial restructuring and upgrading, increase urban infrastructure transformation to attract corporate investment, and promote national economic growth (Wu and Wang, 2017; Hu and Liu, 2020; Guo and Zhou, 2020); Due to the excessive reliance of local governments on land finance, it can lead to neglect of the balanced development of the secondary and tertiary industries and the effective allocation of resources, occupying a large amount of labor and financial resources, and indirectly hindering the development of the national economy (Xia et al., 2014); At the same time, the excessive dependence on land finance will push up housing prices, drive up the cost of hiring for enterprises, and reduce corporate profits, thereby inhibiting the development of the national economy; Therefore, many scholars believe that there is a Kuznets inverted “U” curve between land finance and the national economy (Zou and Liu, 2015). The impact of land finance on the national economy also shows typical regional differences. The dependence of local governments in the eastern region on land finance is more significant than that in the central and western regions, and the rationality of their industrial structure is more affected by land finance (Yue and Lu, 2016; Zhou and Zhou, 2018). Guo studied the mediating effect of land finance on the national economy, pointing out that the upgrading of the industrial structure enhances the promotion effect of land finance on the national economy, but after the urbanization rate reaches a certain level, the promotion effect weakens until it inhibits the growth of the national economy (Guo and Zhou, 2020). Rent-seeking caused by scarcity of land resources will squeeze production, distort the allocation of land finance, and lead to a negative correlation between land finance and national economic growth (Xue and Chi, 2010).

Regarding the impact of the healthy development of real estate on economic growth, there are few studies that explore the impact of the healthy development of real estate on economic growth from the perspective of real estate, mainly focusing on the impact of the real estate industry on related industries such as construction, decoration, and social services. Fan and Zhang (2022) explored the impact of the real estate industry on the real economy by constructing a real estate marketization index and considering the moderating role of finance; Real estate is closely related to government policies (Sternik and Malginov, 2023), combined with the overall planning of the city can positively affect economic development (Turok, 2015), and the development of rental market is negatively correlated with economic growth (Kong and Dong, 2024). Most studies on the relationship between existing real estate and economic growth use a single proxy variable, such as real estate investment, real estate credit, consumption, and real estate bubbles, with real estate prices being the most commonly used (Sun et al., 2023). Some scholars believe that rising housing prices will inhibit the growth of the real economy. The “crowding in” and “crowding out” effects of real estate prices on the real economy exist simultaneously. On the one hand, it will stimulate investment in related industries, but on the other hand, it will also drive up labor costs for enterprises and reduce profit margins for industrial enterprises, thereby inhibiting investment in the real economy sector (Chen et al., 2018). Scholars have used grouping to explore the impact of a single cluster real estate market on economic growth (Dabrowski et al., 2020).

In summary, with the deepening of the market-oriented reform of real estate, a number of theoretical achievements have been made in the study of the mutual influence mechanism between the healthy development of real estate, land finance, and economic growth. The relevant research perspectives, methods, and arguments have important reference significance for this study. However, considering the requirements of building a new development pattern with domestic circulation as the mainstay in the new development stage, there may be the following deficiencies in existing research on deepening the understanding of the healthy development of real estate and the impact of land finance on economic growth:

In terms of the health level of the real estate market, existing research has mostly focused on evaluating the current health status of the real estate market from a static perspective, which is difficult to accurately reflect the continuous characteristics over time and ignores the dynamic evolution process of market development. Therefore, it is particularly necessary to explore the spatial and temporal evolution of the health level of the real estate market. The research level is mostly limited to small-scale and small-scale urban agglomerations. In terms of research perspectives, there are currently few studies analyzing real estate from the perspective of health. In terms of the role of land finance, existing research has explored the intrinsic relationship between land finance and economic growth, but there is insufficient research on how to achieve coordinated development of real estate and the economy through land policy adjustments.

In terms of the impact of the healthy development of real estate on economic growth, most studies choose proxy variables to replace the real estate industry as a whole to analyze its interaction with the national economy, which lacks systematicness and completeness. Second, there are few studies exploring the impact of the healthy development of real estate on economic growth, and there is no clear understanding of the internal mechanism of the impact of the healthy development of real estate on high-quality economic development. Existing studies have focused on measuring the high-quality development level of the national economy in a single province or city, with few studies measuring the high-quality development level of the national economy nationwide and analyzing its differences and spatiotemporal evolution. Thirdly, the mechanism analysis of the impact of the healthy development of real estate on economic growth focuses more on the research object itself, ignoring the common key factors such as land finance that are required for the healthy development of real estate and economic growth, making it difficult to fully reveal the internal connection mechanism between real estate and economic balanced development.

This article selects panel data from 278 prefecture-level cities nationwide from 2012 to 2021, and uses the panel vector autoregression method (PVAR) to conduct empirical analysis on the relationship between the healthy development of real estate, land finance, and economic growth. The marginal contribution of this article is to enrich the research on the indicator system for the healthy development of real estate, explore ways to enhance economic growth from the perspective of real estate healthy development and land finance, and analyze the internal relationship among the three from a spatial and temporal dynamic perspective, providing a reference for promoting the balanced development of real estate and the national economy.

3 Theoretical analysis and research hypotheses

3.1 Interaction mechanism between healthy development of real estate and land finance

Land finance refers to the fiscal revenue developed by local governments outside of general public budget revenue, centered around land revenue, with a huge scale and completely controlled by local governments, including all taxes, rents, and fees obtained by the government from land development, transfer, and operation processes. The inherent requirement for the healthy development of the real estate market is the stable and healthy development of the land market. A healthy land market can achieve effective allocation of land resources, improve land use efficiency, and is closely related to economic development and social stability. The healthy development of real estate promotes the balance of supply and demand of land resources, regulates the scale and speed of land supply, and promotes the stable development of land transfer prices. Land transfer fees are one of the main sources of local government finance, and the healthy development of real estate can effectively increase land fiscal revenue. After the reform of the tax sharing system, local governments relied on land fiscal revenue to make up for the insufficient fiscal expenditure, easing the financial pressure on infrastructure construction, livelihood welfare expenditure, and industrial structure upgrading, driving urban economic development, improving urbanization level, and providing impetus for the sustainable development of the real estate industry. However, excessive reliance on land finance, continued increase in investment in the real estate industry, continuous expansion of land supply area, and lack of coordination between land transfer and urbanization development have resulted in an imbalance between land supply, population, and economic development, leading to serious supply-demand contradictions in the real estate market and hindering its healthy development.

Assumption 1: The healthy development of real estate and the positive interaction between land finance.

3.2 The mechanism of the healthy development of real estate on economic growth

The healthy development of real estate has a positive promoting effect on economic growth. Real estate development can directly drive economic growth, reflected in various aspects of production, sales, and management, including land development, architectural design, construction, material procurement, real estate sales, property management, intermediary services (Shen and Dong, 2018). The healthy development of real estate can promote investment and development in the upstream and downstream industries of real estate, provide employment opportunities for related industries, and promote the full flow of funds in all aspects. Because the main sources of real estate investment funds are banks, insurance, and credit institutions, the healthy development of real estate can also promote the stability and sustainable development of the financial industry. Real estate investment will increase the fiscal revenue of local governments, provide funds for local infrastructure construction, improve the living and investment environment of cities, enhance the ability of urban industries to undertake and serve, lay the foundation for the development of other local industries, and promote urban economic growth (Favilukis et al., 2017).

If the real estate market overheats and housing prices rise too quickly relative to residents' income, it will impose credit constraints and life cycle optimization expenditure needs on consumers (Yang and Yang, 2019). Residents will reduce other consumption in order to buy houses and repay loans, which will have a negative impact on economic development. Both real estate project development loans and residents' mortgage loans need the support of financial institutions. Once the real estate market is unstable and sales data decline, it will bring huge financial pressure to the real estate development enterprises, which will affect the smooth operation of the financial system. The foam of real estate caused by excessive housing prices will also lead to financial risks and affect the healthy and stable growth of the national economy.

Assumption 2: The healthy development of real estate can directly promote economic growth.

3.3 The mechanism of land finance on economic growth

The positive role of land finance in promoting economic growth. Firstly, local governments can make up for the shortage of regional fiscal revenue through land transfer, improve the level of infrastructure construction, provide tax incentives to enterprises within their jurisdiction, reduce the cost of land use for enterprises, create favorable conditions for urban talent introduction, industrial park construction, and investment attraction, and provide endogenous driving force for regional economic development. Secondly, local governments use the land finance model to obtain financing, providing a large amount of funds for regional infrastructure construction and public service supply, in order to attract talents and guide investment, promote industrial structure upgrading, and thus improve the level of regional economic development.

The negative inhibitory effect of land finance on economic growth. First, the government's excessive dependence on land finance has led to the continuous flow of resources into the real estate sector. On the one hand, the real estate market has overheated, resulting in a real estate foam; On the other hand, the real estate industry constantly squeezes resources from other industries, affecting the balanced development of the industrial structure and effective allocation of resources. Secondly, the promotion of housing prices by land finance will lead to an increase in enterprise wage levels, a decrease in enterprise profit margins, and a shift of capital flow from the real to the virtual, thereby suppressing economic growth. In addition, land finance will provide space for government rent-seeking, causing problems such as official corruption and regional development imbalance, and reducing the vitality of economic growth.

Assumption 3: Land finance can directly affect economic growth, and there is a direct channel of “land finance economic growth.” However, the effect of land finance on economic growth has two mechanisms: positive promotion and negative inhibition. The specific impact depends on the comparison of the two effects.

4 Measurement and analysis of the healthy development of real estate

4.1 Connotation of healthy development of real estate

The health of real estate usually refers to the stability and sustainable development ability of the real estate market. A healthy real estate market is not only reflected in price stability, but also involves multiple aspects such as supply-demand balance, reasonable investment return rate, good market order, financial security, and sustainable development environment (Zeng et al., 2008). The theory of real estate health comes from a wide range of sources, integrating economics, sociology, management and other disciplines. Market economy theory provides the basis for assessing the health of the real estate market. It believes that a healthy market should have the characteristics of balanced supply and demand, reasonable price, and effective resource allocation. The supply and demand theory emphasizes how the relationship between supply and demand determines the market price. The economic cycle theory helps the real estate market predict the future trend. Foam economics shows that the real estate foam phenomenon is that housing prices far exceed the intrinsic value. Identifying and preventing the emergence of foam is an important aspect of maintaining the health of the real estate market. Sociological theory believes that a healthy real estate market should not only consider economic benefits, but also take into account social equity and urban sustainable development to ensure that all members of society can enjoy to high-quality living environment. The risk management theory in finance suggests that effective risk management can help prevent financial risks and provide channels for financing and sustainable development in the real estate market.

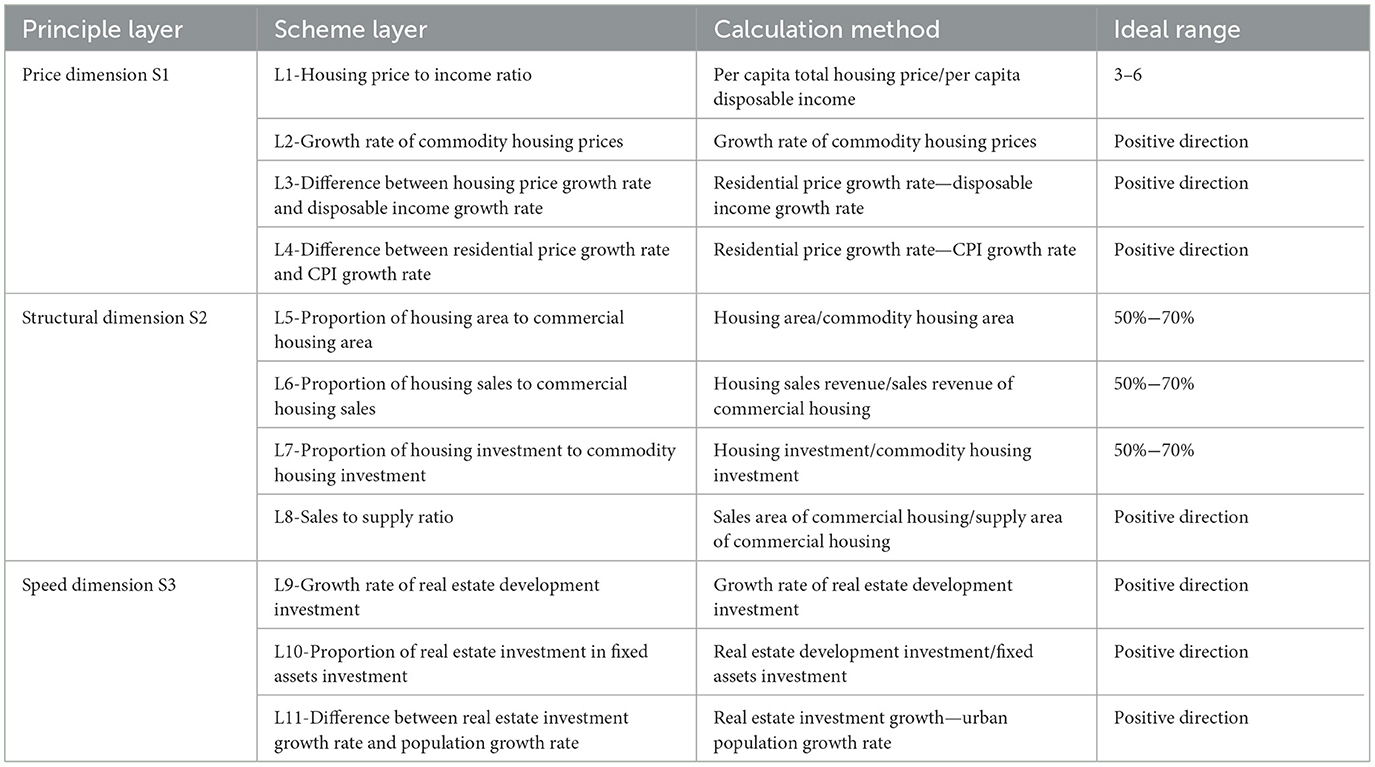

Based on the above connotation explanation and theoretical foundation, this article proposes a theoretical framework for evaluating the healthy development of real estate. The framework system is constructed from three dimensions: price, structure, and speed, covering 14 indicators including housing prices, disposable income, CPI, sales area, investment amount, investment growth rate, etc. Ensure the healthy development of the real estate market through market self-regulation and government macro-control, achieve supply-demand balance in the real estate market, and keep pace with the development laws of the national economic cycle.

4.1.1 Price dimension

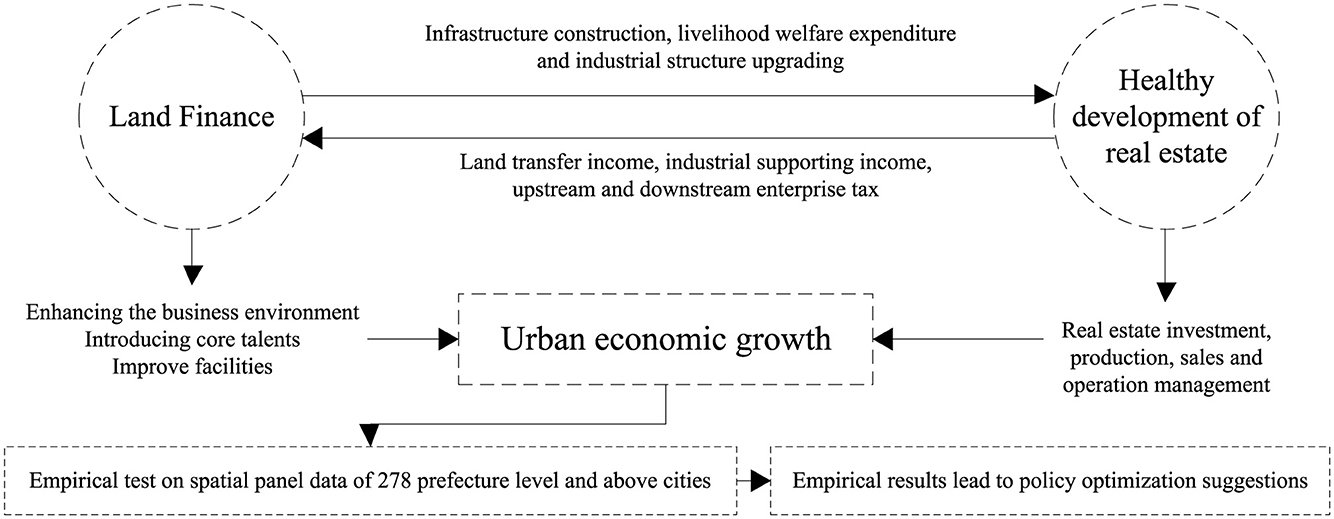

Price is the primary measure of the healthy development of the real estate market. The housing price to income ratio (i.e. the ratio of per capita total housing price to per capita disposable income) reflects the balance between residents' purchasing power and housing prices, and is an important indicator of market rationality. In theory, a reasonable range of housing price to income ratio can effectively balance the contradiction between rising housing prices and residents' payment ability, and promote the stable development of the market. Domestic experience shows that a housing price to income ratio of 3 to 6 is considered a reasonable range, which is in line with the economic theory of affordable housing consumption. The impact mechanism of healthy real estate development, land finance and economic growth is shown in Figure 1.

Figure 1. The impact mechanism of healthy development of real estate, land finance, and economic growth.

4.1.2 Structural dimension

The healthy development of the real estate market cannot be achieved without optimizing the supply and demand structure of products. The proportion of residential products in the commodity housing market can reflect the balance of supply and demand, which is the basic law of market regulation. According to the theory of supply and demand, a reasonable proportion of residential product supply not only helps alleviate the risk of market supply-demand imbalance, but also improves market operational efficiency. Currently, the reasonable range for the proportion of residential properties in commercial housing is generally considered to be 50%−70%. The recognition of the rationality of this structure is based on the theory of supply and demand balance, and is verified through indicators such as sales area, sales revenue, investment amount, and supply to sales ratio.

4.1.3 Speed dimension

The growth rate of investment is an important dimension for measuring the vitality of the real estate market. In theory, the faster the growth rate of real estate investment and the more active the market, the greater its development potential. The proportion of real estate investment in fixed assets investment can further verify this trend. The correlation between investment acceleration and market prosperity is in line with the expectations of investment promotion theory, that is, an increase in investment can drive the linkage effect between the upstream and downstream of the industrial chain, thereby promoting the overall development of the market.

Based on the analysis of the above three dimensions, the healthy development of real estate is not only reflected in the rationality of prices and the balance of structures, but also in the growth trend of investment speed. A multidimensional evaluation system can reveal the inherent operating laws of the real estate market from a theoretical perspective and provide strong support for policy-making. To construct an indicator system for the health of the real estate market, based on existing research, two levels of indicator systems have been determined: the principle level and the scheme level. The principle layer includes three main principles, each of which is subdivided into multiple specific scheme layers, totaling 11 schemes. The construction of the indicator system is based on expert opinions and in-depth analysis of relevant literature. The calculation method of the indicators is shown in Table 1.

4.2 Indicator weight and comprehensive score calculation

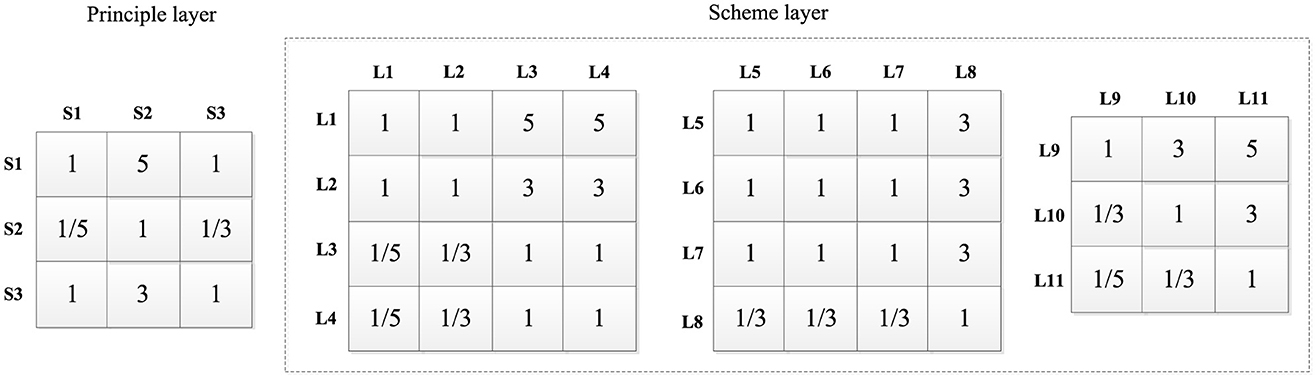

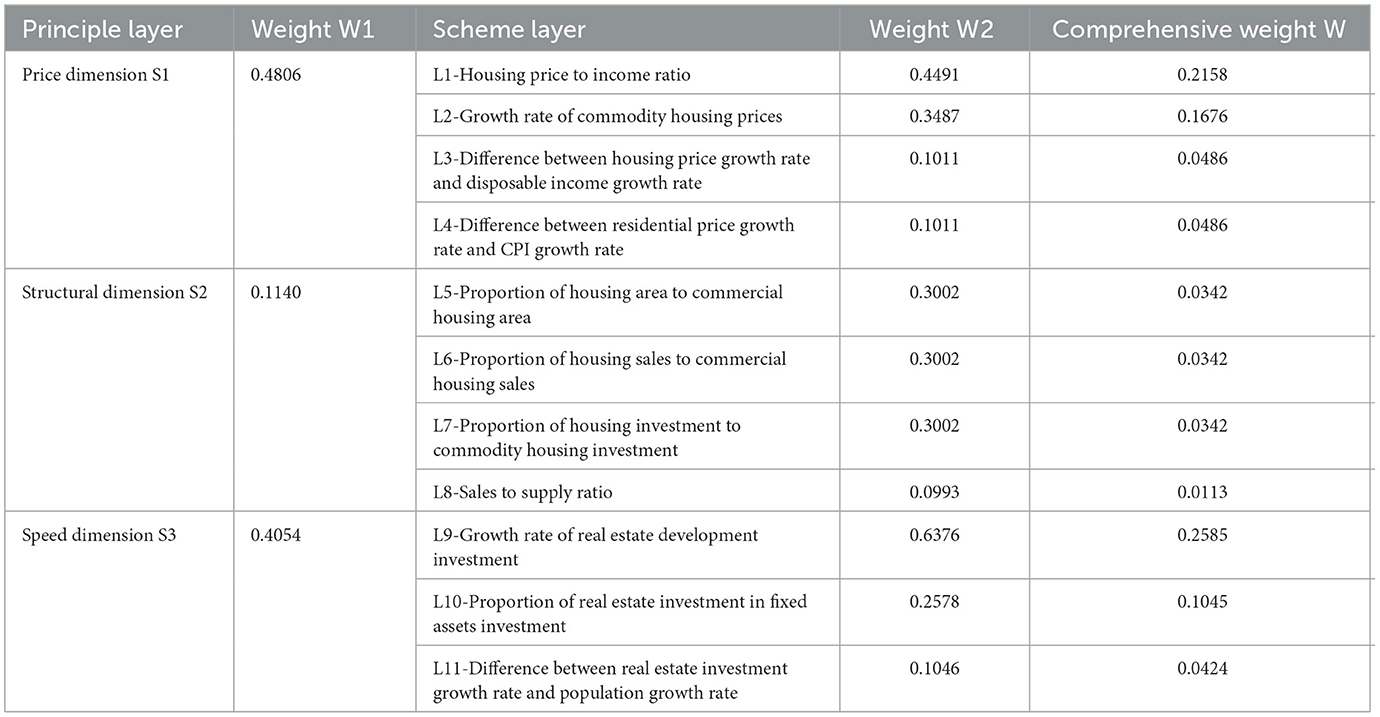

Based on the existing research foundation (Li, 2019; Dong, 2020). This paper uses analytic hierarchy process to determine the comprehensive weight value of real estate health indicators. To ensure the reliability of the weight determination, a 50 person panel of experts in real estate, economics and urban development was established based on their extensive experience and qualifications in real estate market analysis; For each level of factors, experts compare different indicators to form a comparative judgment matrix. For the three principle layers, a 3 × 3 judgment matrix is constructed. For the sub indicators under the principle layer, the corresponding pairwise judgment matrix is also constructed, and each sub indicator needs to be compared with other sub indicators under the principle layer. The scoring criteria are based on Saaty's 1–9 scale, where 1 means that two indicators are equally important and 9 means that one indicator is far more important than the other. The weighted average method is used to summarize the scoring results of experts and construct four corresponding judgment matrices. In order to ensure the rationality of the judgment matrix, the consistency test method is used to test the judgment matrix, and the consistency ratio C is tested ▪ R is far < 0.1, and the judgment matrix is considered acceptable. The judgment matrix is shown in Figure 2.

According to the judgment matrix, the relative weights of the criterion layer and sub indicators are calculated by the feature vector method, and then the weights of the sub indicator layers under each criterion layer are allocated, and finally the comprehensive weight value of the indicators of the real estate health scheme layer is obtained, as shown in Table 2.

4.3 Data sources and result analysis

Normalize and calculate the raw data Pij(i). The evaluation indicators in the real estate health measurement index system shown in Table 1 are interval indicators and positive indicators. The normalization formula for the positive indicators is as follows:

The optimal interval value for interval setting indicators is, and the normalization formula for each indicator value is as follows:

Among them: xij represents the original value of the j indicator of the i sample, max(xj) and min(xj) represent the maximum and minimum values of the j indicator in all samples, respectively.

The research sample is the panel data of 278 prefecture level cities in China from 2012 to 2021. The period covers several important economic phases, including the post-global financial crisis recovery, China's economic restructuring phase, the implementation of the “13th Five-Year Plan,” and the global economic impact of the COVID-19 pandemic. This dataset can comprehensively reflect the changes in the relationship between real estate market and economic growth under different economic conditions, providing a complete timeline for analyzing the dynamic relationship between real estate market and the macroeconomy. The panel data can reflect differences in the development of real estate market and economic growth across different provinces, cities, and regions. By analyzing panel data, one can reveal the similarities and differences in how real estate market contributes to economic growth in various regions, providing more targeted policy recommendations.

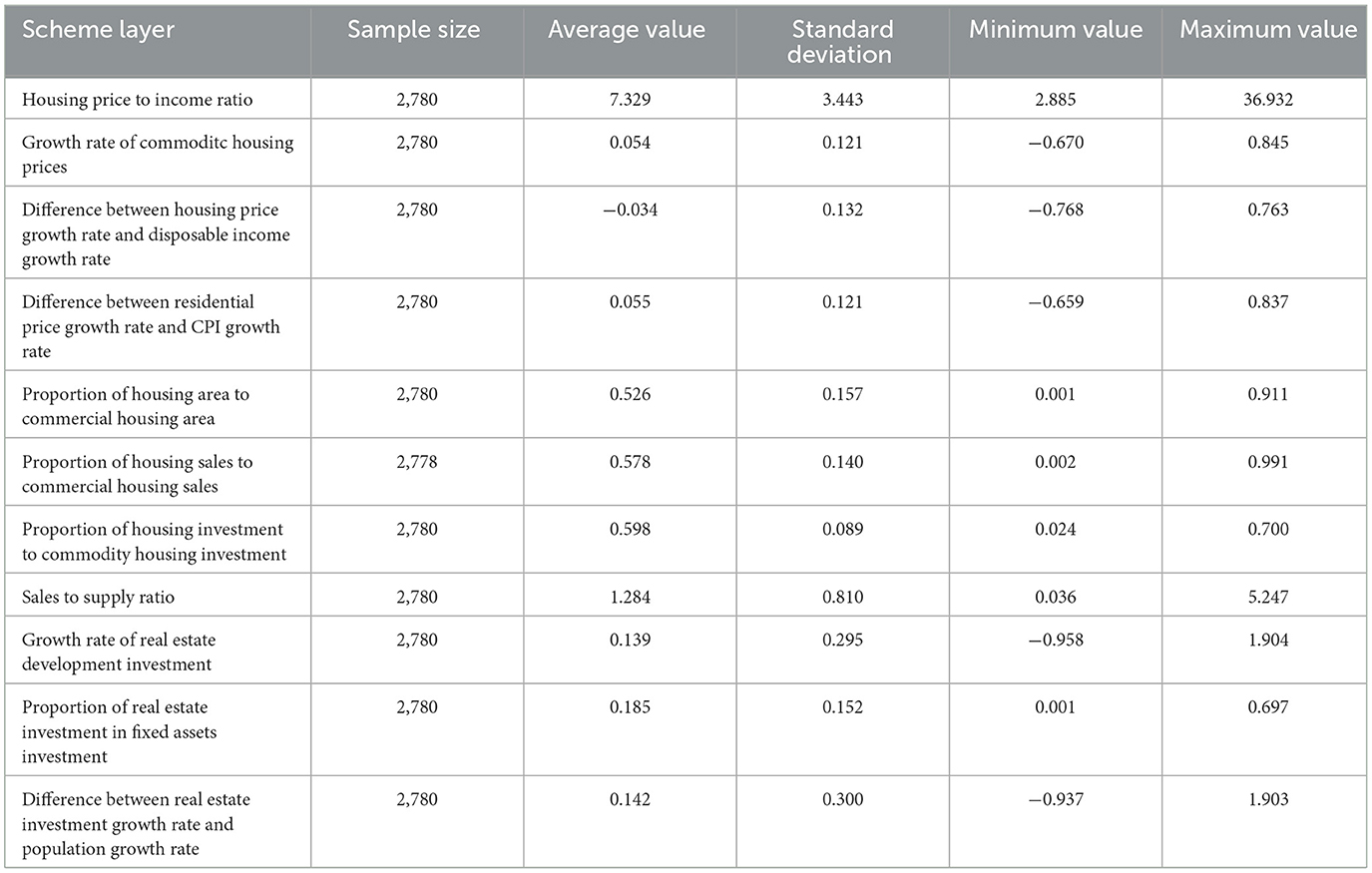

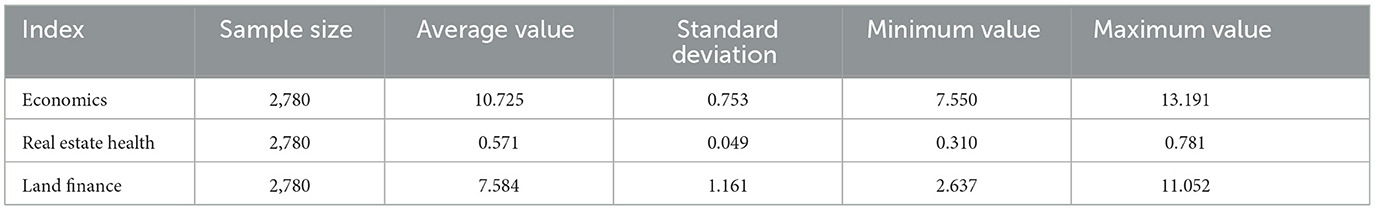

The urban housing price is from the national average price data of urban housing sales monitored by Xitai database (Xilai Known for its comprehensive financial and market data, offers highly detailed information on real estate market, making it a reliable source for economic and market analyses). The amount of fixed assets investment and urban population growth rate are from the China Urban Statistical Yearbook. The per capita disposable income, housing area, commercial housing area, housing sales, commercial housing sales, housing investment, commercial housing investment, real estate development investment and other data are from the wind database (Wind is widely recognized as one of the most reliable financial information platforms in China, offers a wide range of data, including financial reports, stock prices, and macroeconomic indicators, sourced from authoritative market regulators, financial institutions, and listed companies, ensuring its accuracy and timeliness). Some missing values are linearly interpolated and regressed. The descriptive statistical results of the variables in this study are shown in Table 3.

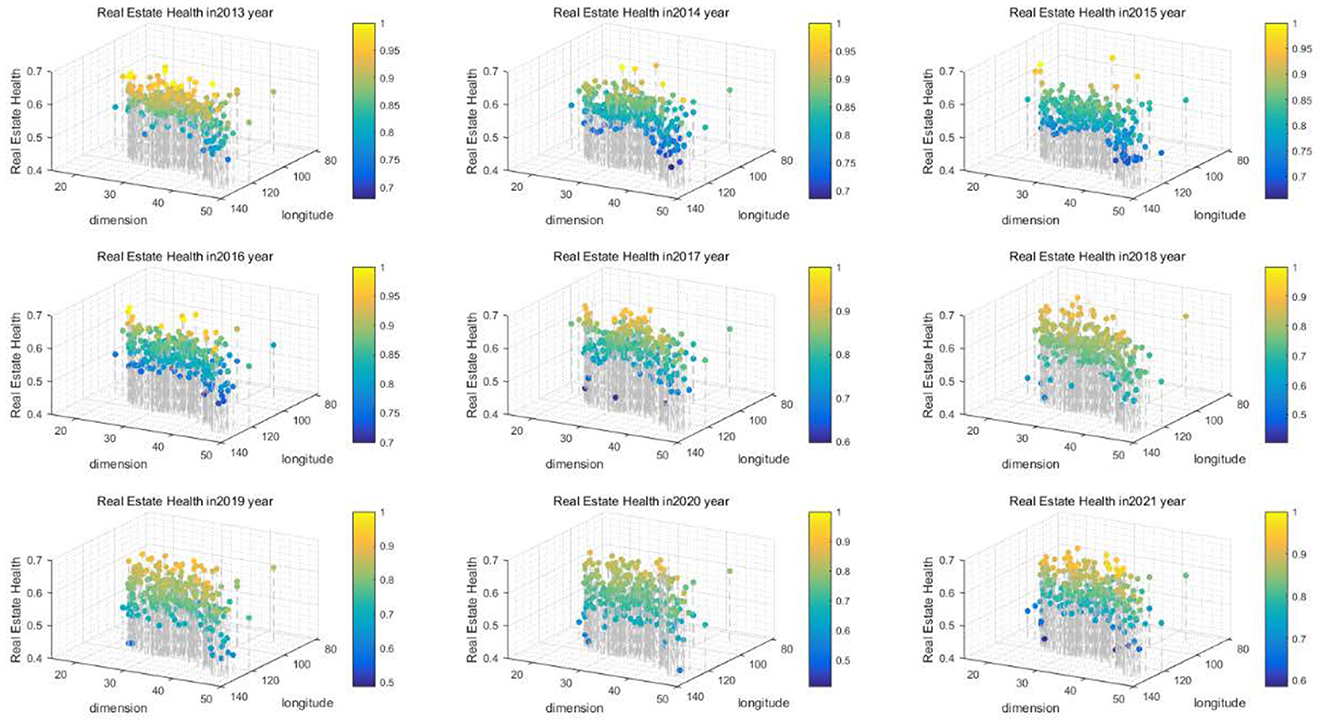

From Figure 3, it can be seen that the healthy development level of China's urban real estate market showed a clear trend of first decreasing and then increasing from 2013 to 2021 (inverted U-shaped). The healthy development index decreased from 0.558 in 2013 to 0.543 in 2015, and then gradually increased to 0.590 in 2021. The shantytown renovation and destocking policy introduced by the State Council in 2015 not only addressed the inventory problem caused by previous oversupply, but also stimulated the development of the real estate market from both the supply and demand sides. At the same time, it improved the living environment of urban residents and promoted the healthy development of the real estate market. In 2018, in order to curb the overheating phenomenon in China's real estate market, speculative real estate activities were prevalent. The central government has proposed the policy of “housing is not for speculation” to guide the real estate market to return to its residential nature and promote the stable and healthy development of the real estate market.

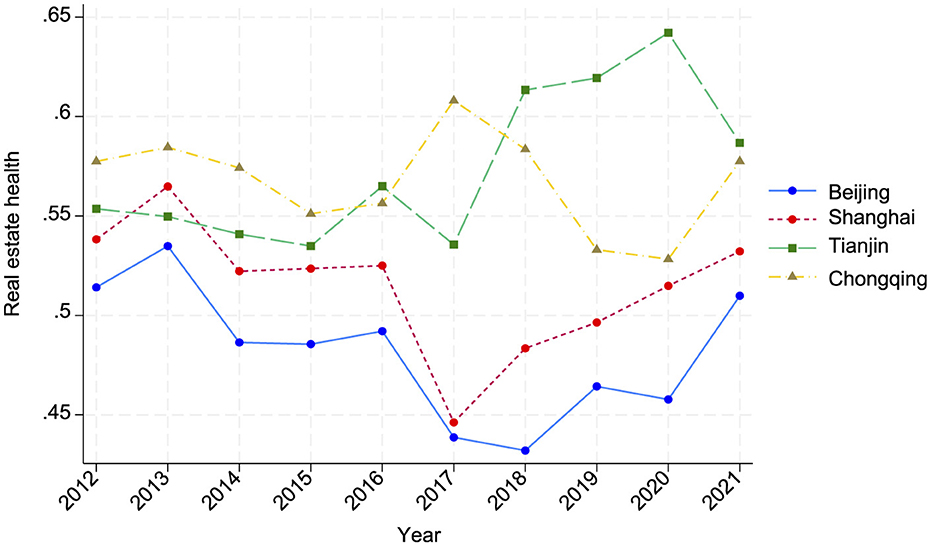

From Figure 4, it can be seen that the four cities have their own characteristics and development trajectories in the real estate market. Beijing and Shanghai, as first tier cities, have high economic growth rates and population densities. The real estate market is active and fiercely competitive. Since 2010, Beijing has introduced purchase restrictions and the “Beijing Twelve Measures” and “Beijing Eight Measures,” which have put the real estate market into a frozen mode. In 2015, the “330 Policy” restarted the real estate market mode, promoting the release of housing demand through 2 years of continuous interest rate cuts, leading to a rebound in the real estate market; Shanghai has a developed economy and a large influx of population, so it is greatly affected by policy regulation. Before 2015, housing prices showed a high-speed growth trend, with an annual growth rate of over 20%. After the government strengthened regulation, the annual growth rate has decreased year by year to the current 2%. Tianjin and Chongqing are located in the Bohai Rim region and the upper reaches of the Yangtze River, respectively, with significant geographical characteristics and regional economic development advantages. The real estate market performance is relatively stable.

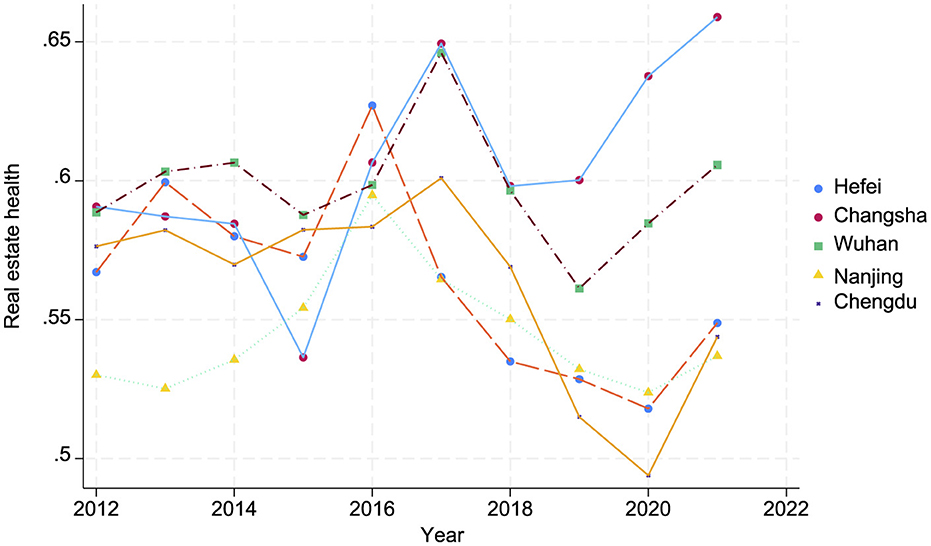

From Figure 5, it can be seen that the real estate markets in the five provincial capital cities are experiencing sustained and healthy development as a whole, influenced by rapid economic growth, net population inflows, and micro regulatory policies. The health data of the real estate market has not fluctuated significantly. In addition, the housing prices in Changsha are at a relatively low level compared to other provincial capitals, and are greatly affected by the real estate development in prefecture level cities. In 2015, there was a boom in shantytown renovation in prefecture level cities, and brand developers such as Evergrande and Country Garden actively joined the real estate development in third- and fourth tier cities, which has had a certain impact on the real estate development in Changsha. After the shantytown renovation policy was suspended in 2018, the real estate development in Changsha continued to rebound.

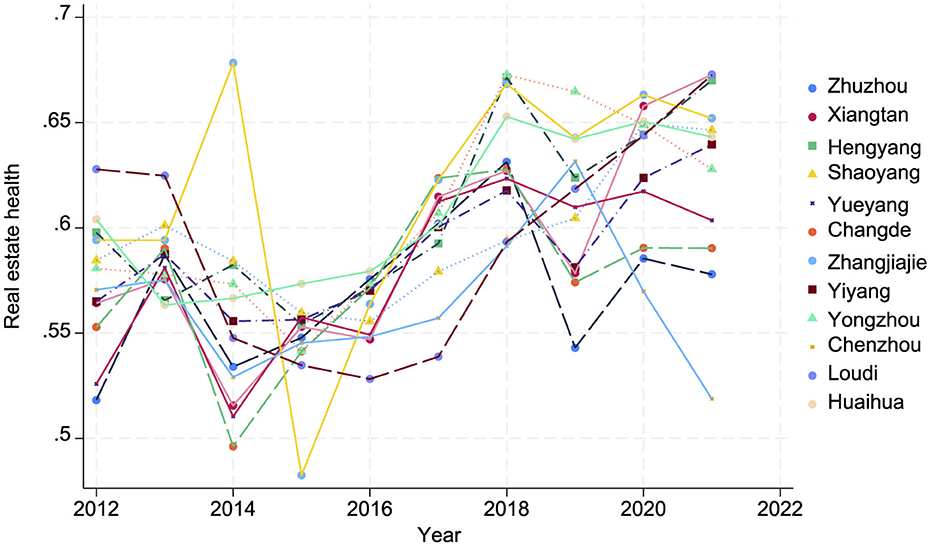

The fluctuation of real estate health in various prefecture level cities in China is greatly affected by national macroeconomic policy regulation. In 2015, the State Council issued the “Opinions of the State Council on Further Improving the Renovation of Urban Shantytowns and Urban Rural Dangerous Buildings and Supporting Infrastructure Construction,” which made huge breakthroughs in the scope of renovation, renovation subjects, and financing methods. Especially, the conversion of housing resettlement to monetary resettlement has created a large demand for housing purchases, which has led to the rapid development of the real estate market in various prefecture level cities. As shown in Figure 6, since 2015, the real estate health in various prefecture level cities in Hunan Province has continued to rise. After China Development Bank regained its approval authority for shantytown renovation projects in 2018, the real estate health has begun to decline. Due to Zhangjiajie being a typical tourist city with a relatively remote location, the development of its real estate market is greatly influenced by the tourism market, resulting in significant fluctuations in the health of the real estate market. In recent years, the opening of high-speed rail has greatly promoted the local economic development and driven the sustained and healthy development of the real estate market.

5 PVAR model setting and variable selection

5.1 PVAR model setting

Considering the possible bidirectional feedback mechanisms among the three, and the impact is in a dynamic evolution process. Therefore, based on data availability and completeness, this article will use panel vector autoregressive PVAR model to systematically identify the impact relationship between economic growth, land finance, and real estate health.

The panel vector autoregressive model PVAR combines the dual advantages of time series and panel data, and is used to analyze the dynamic influence relationship between variables. It is conducive to identifying the dynamic relationship between indicators that are endogenous variables in panel data and revealing the bidirectional causality of variables (Wang, 2022; Liu et al., 2023). The PVAR model constructed in the article includes model estimation (generalized moment estimation GMM), impulse response, variance decomposition, and Granger causality test. Among them, GMM preliminarily reports the impact relationship between variables and the lag period; Pulse response further measures the changes between variables caused by random perturbations of a certain variable; Variance decomposition measures the contribution rate of a variable to changes in other variables, and Granger causality test further identifies causal relationships between variables. The model expression is:

In Equation 3, i represents different cities, t represents different years, j represents lag order, Yi, t represents core variables such as economic growth, real estate health, land finance, etc; αj regression coefficients representing lagged endogenous variables; μi and βt represent individual fixed effects and time effects respectively, which εi, t are random perturbation terms assumed to follow a normal distribution.

GMM estimation helps address potential endogeneity issues by using lagged variables as instruments, thereby mitigating biases that could arise from the simultaneity between variables. Impulse response measures the dynamic changes between variables caused by random shocks in a specific variable, variance decomposition quantifies the contribution of one variable to the changes in others, and the Granger causality test further identifies causal relationships between the variables. These methods enhance the robustness of the analysis; however, given the inherent complexity of the relationships between economic growth, land finance, and real estate health, additional heterogeneity analysis at the city or regional level, incorporating fixed effects and time effects, could be added to address residual endogeneity concerns.

5.2 PVAR model variable selection

5.2.1 Economic growth

Economic growth is one of the important indicators for measuring the economic health of a country or region, reflecting the overall productivity level and activity level of the economy. It plays an indispensable role in understanding the current economic status, predicting future trends, and formulating effective economic policies. Economic growth is generally measured by per capita GDP size or economic growth rate indicators, including per capita GDP calculated at comparable prices and per capita GDP calculated at current prices. Considering that other selected variables are measured at current prices, per capita GDP calculated at current prices is used as the indicator to measure regional economic growth.

5.2.2 Land finance

Land finance is one of the important sources of revenue for local governments, usually including four aspects: land transfer revenue; Attracting investment and driving local economic development by selling industrial land at low prices; Urban expansion promotes the development of the construction and real estate industries, leading to an increase in local taxes such as urban maintenance and construction tax, land use tax, and real estate tax; Using land as collateral to obtain bank loans for infrastructure investment and urban construction financing. This article selects land transfer revenue as the variable for local government land finance decision-making. The reason is that land transfer revenue accounts for a large proportion and can accurately measure the actual scale of fiscal revenue obtained by local governments through land transfer. At the same time, it belongs to the government's off budget revenue and can better reflect the local government's resource endowment and financing capacity for economic development.

5.2.3 Health of the real estate market

The healthy development of the real estate market is a goal repeatedly proposed by the central government, and the government has also introduced relevant policies to ensure that the real estate market develops in a healthy direction, such as the “housing for living, not for speculation” and “three red lines” policies. Currently, there is no unified standard for evaluating the health of the real estate market. Based on existing research and relevant macro databases, this article establishes a relatively objective evaluation system from the dimensions of real estate market quality, structure, and speed, and uses data from 278 prefecture level cities in China from 2012 to 2021 as the research object to evaluate the health status of the real estate market. The larger the health measurement result, the healthier the real estate market.

5.3 Data sources and processing

The data of land transfer fees are from the Statistical Yearbook of China's Land and Resources and the wind database, the economic GDP data is from the wind database, the population data is urban registered residence population, and the data is from the Statistical Yearbook of China's Cities. Some missing values are processed by linear interpolation and regression filling. The health data of the real estate market comes from the calculation results mentioned earlier. Descriptive statistical results of variables is shown in Table 4.

6 Empirical testing and result analysis

6.1 Stability test and selection of lag period number

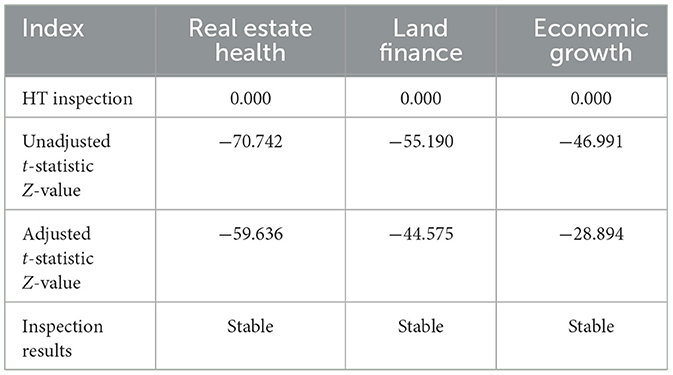

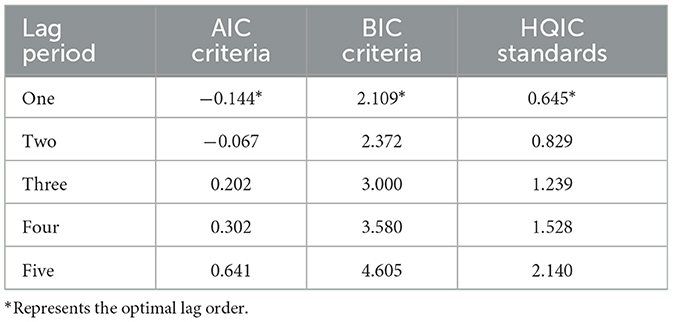

Unit root test was conducted on panel data, and the p-values of all three variables were < 0.01, indicating a strong rejection of the null hypothesis of unit roots at the 1% level (see Table 5). Therefore, the sequence of real estate health, land finance, and economic growth is stable. Meanwhile, the results of the PVAR model are sensitive to the choice of lag order. Choosing too few lags may lead to omitted variable bias, while too many lags can overfit the model and reduce efficiency, according to the AIC criterion, BIC criterion, and HOIC criterion, the optimal lag order for PVAR model analysis is determined to be 1st order (see Table 6), thus establishing the PVAR (1) model.

6.2 PVAR model analysis

6.2.1 GMM estimation

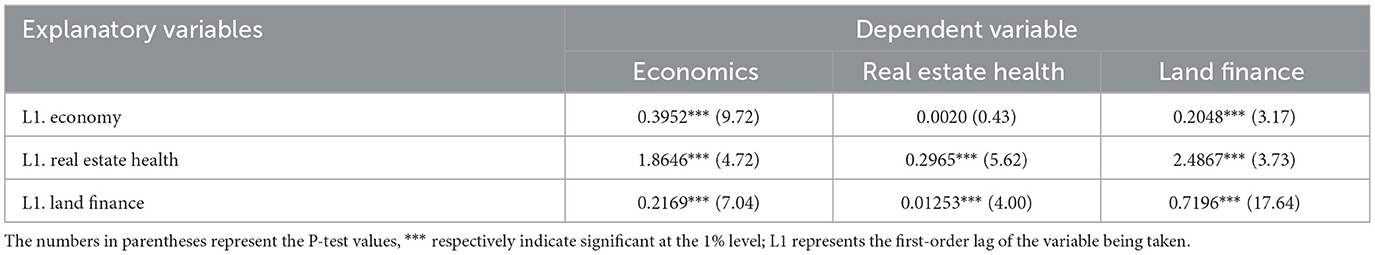

By selecting the lag order, it is ensured that the lagged variable is orthogonal to the explained variable and independent of the residual term, indicating that the latter term can be used as an instrumental variable for GMM generalized moment estimation. To simplify the analysis model, homogeneity assumptions were made for all cities in the early stage, assuming that variables have the same potential relationship. Further detailed research will be conducted in the subsequent heterogeneity analysis of the article. The specific results are shown in Table 7.

Firstly, from the perspective of the impact of economic growth on itself, its lag period has a positive effect on itself, indicating that economic growth has strong development inertia and path dependence characteristics. Cities with good economic foundations and strong industrial development will continue to enhance their ability to resist external economic shocks. Secondly, the lag period of real estate health also has a sustained and significant positive impact on its own performance, indicating the advantage accumulation effect of the healthy development of the real estate industry. Once again, the lag of one period in land finance has a positive impact on itself, indicating that land finance, with the support of the government, accelerates local urban infrastructure construction, thereby promoting the sale of land and increasing fiscal revenue, and has a certain positive effect.

Secondly, based on the previous assumptions, the following results can be obtained from the correlation analysis data of healthy development of real estate, land finance, and economic growth:

(1) The interactive impact of healthy development of real estate and land finance

According to the estimation results in Table 7, the regression coefficient of real estate health on land finance is significantly positive at the 5% level, and the regression coefficient of land finance on real estate health is also significantly positive at the 5% level, indicating a significant interactive promotion effect between real estate health and land finance, confirming hypothesis 1 of the article.

The healthy development of the real estate market means a reasonable and orderly supply of commercial housing, as well as stable transaction prices and volumes. Prices and volumes can give investors enough confidence to continue to acquire land, thereby promoting the development of the land market, increasing government land fiscal revenue, and accelerating the construction of urban infrastructure or providing policy support to the real estate market, thereby promoting the development of the real estate market in a healthier direction; For an unhealthy real estate market, investors lack confidence in acquiring land, and the government has no funds to promote the transformation of land from “raw land” to “mature land.” The slow pace of urban infrastructure construction has led to a loss of confidence in the real estate market among homebuyers, a decrease in their willingness to buy, and an even more sluggish market. The real estate market is unhealthy, and the land market is bound to be sluggish. On the contrary, if the land market supply is too fast or too slow, it will have a very negative impact on the health of the real estate market; Excessive supply can lead to an oversupply of commercial housing, causing developers to trade price for quantity and investors to lose confidence. Both buyers and developers suffer heavy losses, resulting in a sluggish real estate and land markets. This is particularly evident in third- and fourth tier cities in China, where some cities have even issued price limit orders to alleviate market risks and boost real estate confidence; too slow land supply will lead to too high land transfer price, which will eventually reflect the financial foam on the housing price. Because of the unsustainable situation of such a high price, once there is a collapse, it will lead to heavy losses for buyers. For example, Japan once caused many people to go bankrupt and become insolvent due to the collapse of housing prices, causing social unrest. This is also the reason why the Chinese government focuses on preventing systematic risks in real estate.

(2) The impact of real estate health on economic growth

The regression coefficient of the health of real estate on economic growth is also significantly positive at the 5% level, indicating that the healthy development of real estate has a direct impact on economic growth, and the direct impact effect is positive. There is a direct channel of “healthy development of real estate ↑” → “economic growth ↑,” which well confirms hypothesis 2 of the article.

The positive impact of the healthy development of real estate on economic growth mainly comes from two aspects: on the one hand, the real estate industry has always been an important component of the national economy, and China's urbanization construction continues to promote the development of the real estate industry. The government's regulation and policy stimulation of the real estate industry have led to the amplification of the wealth effect and mortgage effect multiplier of commercial housing, providing sufficient capital support for driving economic growth. The healthy development of real estate has also driven the growth of local government fiscal revenue, prompting the government to accelerate infrastructure investment, introduce advantageous industries, and improve social welfare, thereby ensuring the long-term stable development of the economy; On the other hand, the real estate industry can drive the development of a large number of upstream and downstream industries, such as construction, manufacturing, services, etc., creating a large number of job opportunities and business demands, and making a huge contribution to improving the national economy.

(3) The impact of land finance on economic growth

The regression coefficient of land finance on economic growth is also significantly positive at the 5% level, indicating that land finance has a direct impact on economic growth, and the direct effect is positive, that is, the direct channel of “land finance ↑” → “economic growth ↑,” which also confirms hypothesis 3 of the article.

The positive impact of land finance on economic growth is mainly due to two reasons: on the one hand, as a part of the real estate market, the land market accounts for a relatively high proportion of investment costs in real estate, and the higher the city level, the greater the proportion. For example, in Beijing, land cost accounts for 40%. Therefore, the higher the land finance, the higher the income contributed to GDP.

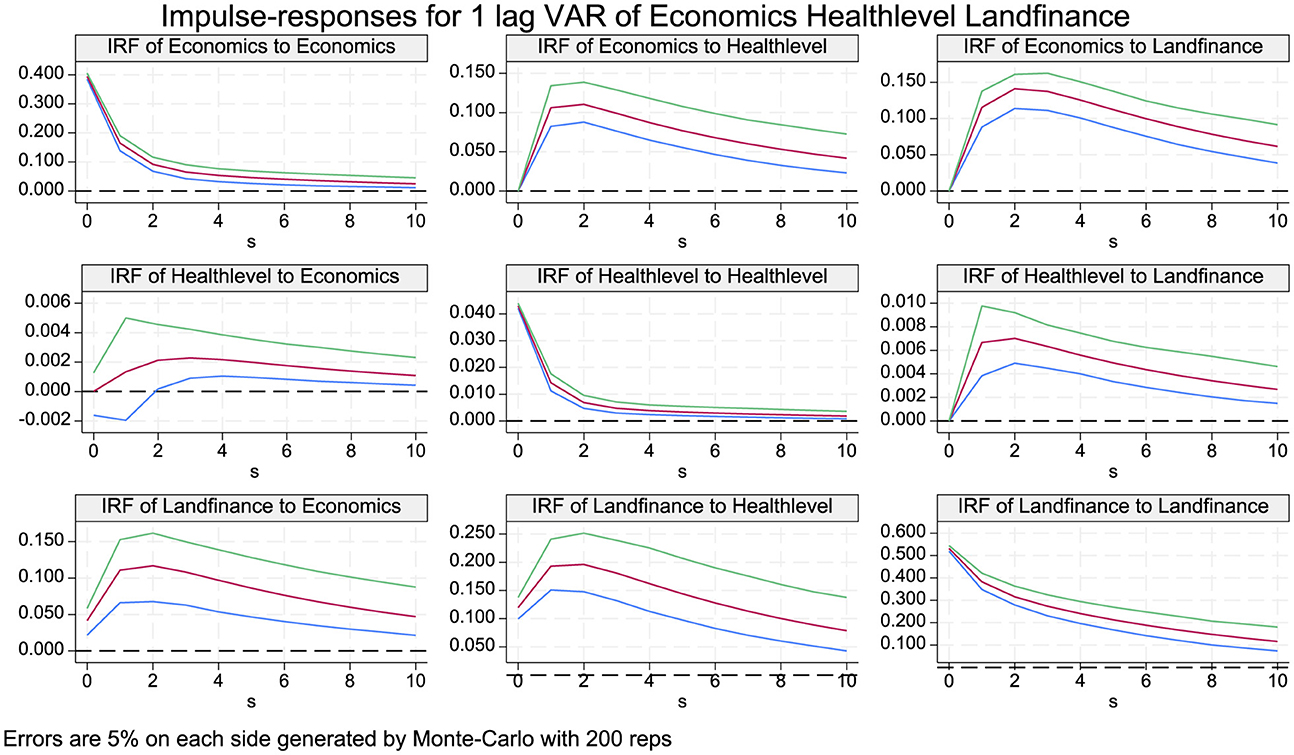

6.2.2 Impulse response function

Based on the above research conclusions, further analysis of the dynamic conduction path between variables is conducted through the impulse response function. The impulse response function provides a more intuitive depiction of the dynamic interactions between variables. By applying a shock of 1 standard deviation to the variable, a Monte Carlo simulation was conducted 200 times to obtain the impulse response function with a lag of 1 period, and the 95% confidence interval was displayed (as shown in Figure 7). It can be seen that the impulse response between the variables generally shows a convergence trend, and the effect is good.

Firstly, the rapid and positive response of economic growth, real estate health, and land finance to their own shocks indicates that all three variables have strong development inertia and good self reinforcing effects.

Secondly, after being impacted by the health of the real estate industry, the response value of economic growth remains positive, indicating that a healthy real estate market has always played a strong role in urban economic growth, proving that the real estate industry is an important component and key driving force of urban economy. When impacted by the rationalization of land finance, there is always a positive response, indicating that good land finance revenue can provide the government with sufficient capacity and methods to promote urban economic development, which better verifies the previous conclusion. To achieve sustainable economic development, it is more important to cultivate and strengthen advantageous industries, improve the level of specialized cooperation, and resist shocks. In the long run, we should promote dynamic changes in industrial structure and shift toward advanced high-tech, high information, and high intensive industries, which will help enhance economic resilience.

Thirdly, when the health of the real estate industry is used as a response variable, the short-term response value after being impacted by economic growth is positive or negative, indicating that the impact of economic growth on the healthy development of the real estate industry is unclear. Due to the financial attributes of real estate, it was once regarded as a tool for investment and speculation, known as “housing speculation”. Once the real estate industry develops excessively, it will lead to a large amount of capital flowing into the real estate industry, limiting the development of the real economy and affecting the overall development of the economy. Therefore, the country has put forward the concept of “housing without speculation” since 2016 to reduce the financial attribute of real estate and ensure the sustainable and healthy development of the real estate market. The impact of economic growth on real estate is not obvious, which may be due to the foam economy generated by real estate, or the steady development of the real economy. The development trend of real estate is different in different situations.

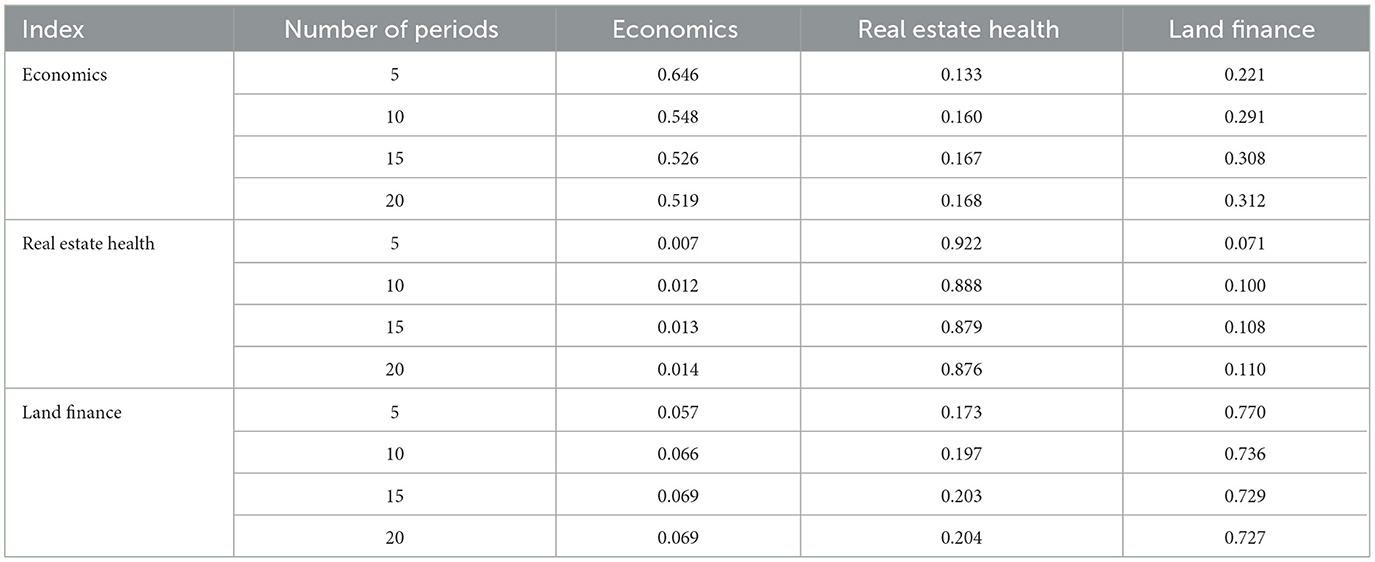

6.2.3 Variance decomposition results

According to the variance decomposition results, economic development, real estate health, and land finance all rely mainly on their own development, but they have a certain explanatory power for each other. The specific characteristics are: firstly, the healthy development of real estate and the continuous increase in the contribution rate of land finance to economic development, especially the contribution degree of land finance to economic growth, indicating that stable and sustained land finance revenue is a strong support for economic growth; Secondly, the contribution rate of land finance to the healthy development of real estate has continued to rise to 20.5%, which is closely related to the proportion of the land market in the real estate market. This indicates that the healthy development of real estate cannot be achieved without the support and stable development of land finance. Overly hot and cold land policies will seriously affect the healthy development of real estate; Finally, the contribution rate of economic development to land finance has significantly increased, indicating that the overall development of the national economy can effectively drive land finance revenue. In the process of rational planning of industrial economic structure, the government should make effective combinations of short-term, medium-term, and long-term to ensure sustainable economic development, promote dynamic optimization of industries, and achieve a positive interaction between land finance revenue and economic growth. Variance decomposition results of each variable is showed in Table 8.

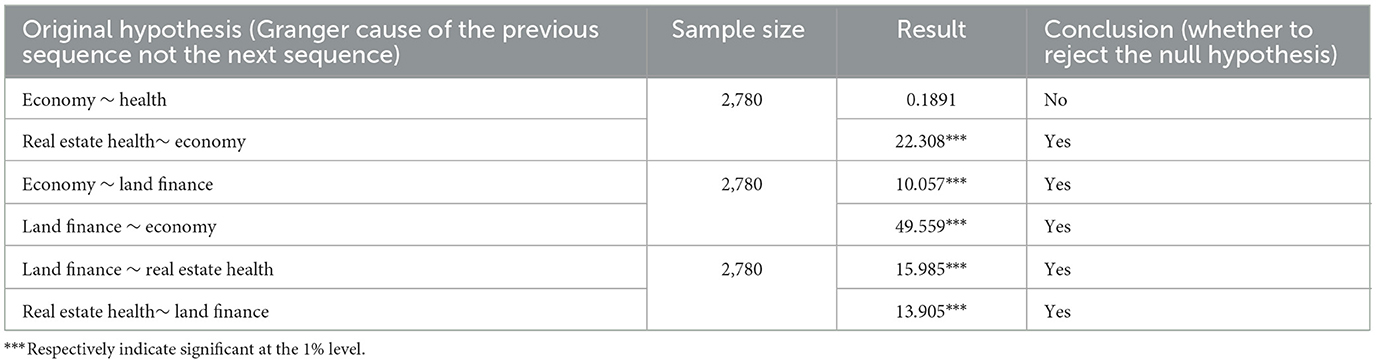

6.2.4 Granger causality test

To further verify whether there is a temporal causal relationship among the variables, the article conducted a Granger causality test with a lag of 1 period at the 5% significance level. The results showed that except for economic development, which is not a Granger causality relationship for real estate health, all other pairwise variables are Granger causality relationships. It can be seen that the healthy development of real estate is the driving force behind economic growth; Land finance is also crucial for the healthy development of the real estate industry, with mutual support and coordinated progress; Land finance is a barometer of economic growth, and long-term stable land finance revenue is also a guarantee for sustained economic growth. Granger causality test results is showed in Table 9.

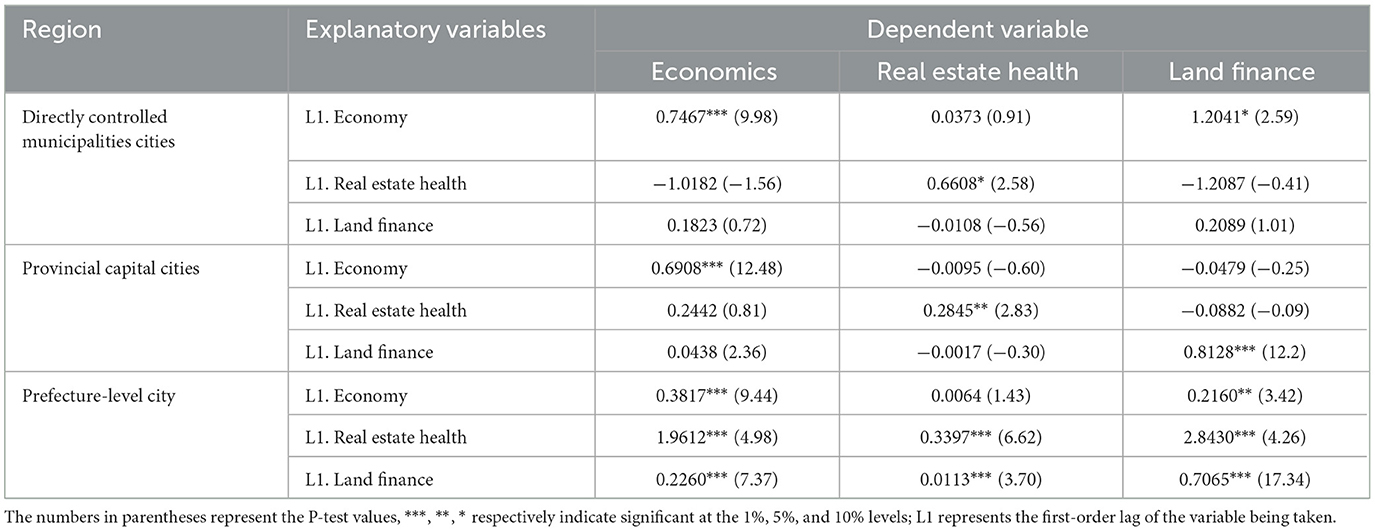

6.2.5 Heterogeneity analysis

As urbanization accelerates, significant differences emerge in the economic development models and real estate markets across municipalities, provincial capitals, and prefecture-level cities in China. Municipalities such as Beijing, Tianjin, Shanghai, and Chongqing serve as the core economic regions, characterized by robust economic foundations, dense populations, and advanced infrastructure. Provincial capitals (e.g., Harbin, Changchun, Shenyang, Wuhan, Guangzhou) act as regional economic centers, influenced by local industrial structures, economic policies, and population migration patterns. Prefecture-level cities, which make up a large portion of China's urban system, exhibit distinct relationships between real estate markets and economic growth compared to municipalities and provincial capitals.

By categorizing Chinese cities based on their scale, this study conducts a heterogeneity analysis on real estate health, land finance, and economic growth. Such an analysis allows for a deeper understanding of the complex dynamics between the real estate market and economic development across different city types. This approach not only aids in formulating more precise real estate policies but also provides a decision-making basis for the sustainable development of local economies. This paper constructs a PVAR model using three subsamples (municipalities, provincial capitals, and prefecture-level cities), and the estimation results are shown in Table 10.

From the data results in Table 10, it can be seen that there are significant differences in the relationship between real estate health, land finance, and economic growth among municipalities directly under the central government, provincial capitals, and prefecture level cities. The specific analysis is as follows:

The strong driving force of the economy of a municipality directly under the central government indicates that it has a highly developed economic foundation, convenient transportation facilities, complete community facilities, and stable population inflow. Especially, the construction of infrastructure such as subways and high-speed railways has driven the development of the entire city. Due to the early urbanization process in municipalities directly under the central government, there is limited land available for building houses, which greatly affects the development of real estate and has a relatively low impact on economic growth. Similarly, economic growth will increase the income and investment demand of enterprises and individuals, thereby promoting the effective supply of land resources.

Compared to the impact of real estate health and land finance, the economic growth of provincial capital cities is more influenced by their own factors, which may be related to the diversification of industries in provincial capital cities. The real estate market is not the only driving force for economic growth. Unlike municipalities directly under the central government, the development of real estate in provincial capital cities is less affected by land supply, while the health of real estate and land finance are more affected by their own development. A reasonable and orderly pace of real estate development and land supply can continuously and stably promote the healthy development of the real estate market. The improvement of infrastructure and the convenience of transportation are also favorable conditions for promoting the healthy development of real estate.

Due to the low level of economic development in prefecture level cities, local governments often rely on large-scale land transfers to maintain fiscal revenue, promote infrastructure construction, and drive economic development. Due to insufficient infrastructure and serious population outflow, prefecture level cities often face the phenomenon of oversupply and insufficient demand for real estate. The data shows that the health of real estate, land finance, and economic growth are closely related in prefecture level cities. The health of real estate has the most significant impact on land finance, indicating that any fluctuations in the real estate market in prefecture level cities will indirectly have a significant impact on economic growth through the intermediary role of land finance.

7 Main conclusions and policy recommendations

7.1 Research conclusions

Based on panel data from 278 prefecture-level cities in China from 2012 to 2021, this paper uses the PVAR model to explore the interrelationships between healthy real estate development, land finance, and economic growth. The cities are categorized by size into municipalities directly under the central government, provincial capital cities, and prefecture-level cities for heterogeneity analysis. The main conclusions are as follows:

(1) Positive lag effects of real estate health, land finance, and economic growth

In municipalities, provincial capitals, and prefecture-level cities, the lag periods of real estate health, land finance, and economic growth have positive effects on themselves. The positive lag effect of economic growth indicates that steady economic improvement provides a solid foundation for the real estate market and boosts housing demand by increasing household incomes and promoting employment. The positive lag effect of land finance revenue shows that land sales play a significant role in driving infrastructure construction and urban expansion, further contributing to economic growth and the healthy development of the real estate market. Healthy real estate development boosts market confidence, attracts more investors, and stabilizes housing prices and market activity. Continuous improvement in real estate health not only enhances housing quality and supply efficiency but also supports long-term sustainable economic growth. As the real estate market and economic growth interact positively, housing demand will continue to increase. In the future, the real estate market will focus more on healthy and sustainable development, avoiding over-reliance on land finance and speculative behavior. With policy regulation, the market will trend toward rational development, and the government's fiscal policy will shift from land sales income to a more diversified tax structure.

(2) Significant scale differences in real estate development

The level of real estate health varies significantly across cities of different sizes. A “one-size-fits-all” housing policy is not suitable for all cities. Cities with strong economic foundations need policies to manage housing demand and affordability, while prefecture-level cities benefit from policies that stimulate investment and stabilize the real estate market. Customizing housing policies is necessary. Municipalities have significant political and economic advantages and well-developed infrastructure, but limited land resources lead to an imbalance in housing supply and demand, driving up housing prices. To prevent a real estate bubble, the government has implemented strict regulations in these cities, such as purchase and loan restrictions, which have curbed the development of the real estate market to some extent. Provincial capital cities, with their diversified industrial structures and developed financial markets, are supported by flexible real estate policies, further driving continuous growth in their real estate markets. Additionally, improvements in infrastructure and convenient transportation promote healthy real estate development. In contrast, the development level in prefecture-level cities is lower due to weak economic foundations, insufficient infrastructure, serious population outflows, and oversupply of land, which makes the real estate market's fluctuations directly affect local economic growth.

(3) Impact of healthy real estate development on economic growth

Healthy real estate development in prefecture-level cities positively promotes urban economic development. As an essential component of the national economy, with strong driving capabilities for upstream and downstream industries, real estate significantly enhances economic development. A healthy real estate market boosts investor and buyer confidence, encouraging more capital into the market and driving fixed asset investment growth. It also generates considerable land finance revenue for local governments, providing sufficient funds for infrastructure improvements, such as transportation, education, and healthcare. These infrastructure upgrades further enhance urban economic vitality, attracting more businesses and talent, promoting sustainable economic growth.

(4) Impact of healthy real estate development on land finance

In prefecture-level cities, healthy real estate development and land finance exhibit significant interactive promotion effects. A healthy real estate market allows local governments to rely on land sales revenue for fiscal stability, enhancing their financial autonomy and flexibility. By effectively utilizing land finance, local governments can better implement regional development plans and invest in public services. A healthy real estate market also helps control excessive housing price increases, ensuring stable land finance revenue growth while preventing real estate bubbles and market overheating. Additionally, a healthy real estate market increases a city's overall attractiveness, helping attract foreign investment and businesses, which further drives urban economic growth. This not only boosts land finance revenue but also provides local governments with additional financial resources, promoting comprehensive economic and social progress.

(5) Impact of land finance on economic growth

In prefecture-level cities, there is a significant interactive promotion relationship between land finance and economic development. Land finance directly contributes to GDP, and a sound government economic foundation and well-planned industrial layouts can attract foreign investment, which also increases land finance revenue. However, excessive reliance on land sales can lead to more resources and policies flowing into the real estate sector, limiting the development of other industries like manufacturing and high-tech sectors. Additionally, banks and financial resources may concentrate on real estate, making it difficult for other sectors, especially small and medium-sized enterprises, to access financing. Government focus on real estate can also overshadow support for other industries, leading to a single economic structure and reducing the potential for long-term growth. High housing prices can further distort household spending, reducing consumption in other areas and weakening overall economic vitality. The risk of a real estate bubble may also impact the broader economy and financial system.

7.2 Policy recommendations

Based on the above research conclusions and heterogeneity analysis, the following policy recommendations can be drawn:

• Municipalities: (1) Control rapid housing price increases and maintain market stability: the government should use purchase and loan restrictions to curb speculative buying and ensure healthy market operations. It is particularly important to strengthen regulations on speculative behavior. (2) Increase affordable housing supply: by increasing the supply of public, affordable, and shared housing, the housing needs of low- and middle-income groups can be met, alleviating housing pressure. (3) Improve the rational use of land resources: through higher land-use efficiency, encourage the development of high-density residential and commercial areas while strictly controlling new land supply to protect limited land resources.

• Provincial Capital Cities: (1) Promote coordinated real estate development and economic diversification: while developing the real estate market, governments should promote high-tech and advanced manufacturing industries to reduce excessive reliance on land finance. (2) Moderately increase housing supply and control market overheating: governments should adjust housing supply based on market demand to prevent supply-demand imbalances caused by large-scale construction and ensure stable growth in the real estate market. (3) Optimize infrastructure construction to enhance urban attractiveness: further improving transportation, education, and healthcare infrastructure can increase the city's appeal, promoting urbanization and urban expansion.

• Prefecture-Level Cities: (1) Carefully manage land supply to prevent a real estate bubble: as prefecture-level cities are prone to excessive real estate expansion, governments should strictly control land supply and reasonably plan land sales to avoid a real estate bubble. (2) Strengthen industrial development and reduce over-reliance on real estate: local governments should focus on diversifying industries, encouraging the development of local specialty industries and service sectors to reduce the dependence of the local economy on the real estate market. (3) Promote urban renewal and old city redevelopment: in prefecture-level cities, governments should prioritize urban renewal and old city redevelopment projects to improve living environments and infrastructure quality, rather than over-developing new districts.

By adjusting differentiated policies for cities at different levels, the healthy development of the real estate market can be effectively promoted, and sustainable economic growth in various regions can be achieved.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

HQ: Writing – original draft, Data curation, Conceptualization. QS: Writing – original draft. ML: Writing – review & editing, Formal analysis, Data curation. YL: Writing – review & editing, Visualization, Validation, Supervision. FL: Writing – review & editing, Supervision, Software, Resources, Project administration.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This work was supported by the National Natural Science Foundation of China (72373037) and the Scientific Research Project of Hunan Provincial Department of Education (23c0318) for $50 per project.

Acknowledgments

The authors would like to thank the reviewers for their constructive comments.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Büchler, S. C., Niu, D., Thompson, A. K., and Zheng, S. (2024). The impact of human capital and housing supply on urban growth. Urban Stud. 61, 214–230. doi: 10.1177/00420980231182074

Cai, Z., Liu, Q., and Cao, S. (2020). Real estate supports rapid development of China's urbanization. Land Use Policy 95:104582. doi: 10.1016/j.landusepol.2020.104582

Chen, B. K., Huang, S. A., and Ouyang, D. F. (2018). Can growing housing price drive economic growth? China Econ. Q. 17, 1079–1102. doi: 10.13821/j.cnki.ceq.2018.04.10

Chen, H. Y., and Wang, Q. S. (2013). Evaluation criteria and connotations for the healthy development of the real estate market. Jiangxi Soc. Sci. 57–61. doi: 10.3969/j.issn.1004-518X.2013.05.011

Chen, J., and Wu, F. (2020). Housing and land financialization under the state ownership of land in China. Land Use Policy. doi: 10.1016/j.landusepol.2020.104844

Cheung, K. S., Yiu, C. Y., and Xiong, C. (2021). Housing market in the time of pandemic: a price gradient analysis from the COVID-19 epicenter in China. J. Risk Financ. Manag. 14:108. doi: 10.3390/jrfm14030108

Dabrowski, I., Mach, L., Mikolajczyk, L., and Kuswik, A. (2020). Correlation of economic development of countries with the potential of their housing real estate markets: a case study in the European Union. Eur. Res. Stud. J. 23, 660–678. doi: 10.35808/ersj/1784

D'Lima, W., Lopez, L. A., and Pradhan, A. (2020). COVID-19 and housing market effects: evidence from U.S. shutdown orders. Real Estate Econ. 50, 303–339. doi: 10.1111/1540-6229.12368

Dong, W. G. (2020). Research on real estate investment risk evaluation and risk response strategies based on analytic hierarchy process. J. Anhui Univ. Technol. 37, 28–31. doi: 10.3969/j.issn.1671-9247.2020.04.008

Fan, G. Y., and Zhang, X. K. (2022). The market-oriented reform of real estate and the development of the real economy - also on the regulatory role of finance. South. Econ. 35–55. doi: 10.19592/j.cnki.scje.390915

Fan, X., Qiu, S., and Sun, Y. (2020). Land finance dependence and urban land marketization in China: the perspective of strategic choice of local governments on land transfer. Land Use Policy 99:105023. doi: 10.1016/j.landusepol.2020.105023

Favilukis, J., Ludvigson, S. C., and Van Nieuwerburgh, S. (2017). The macroeconomic effects of housing wealth, housing finance, and limited risk sharing in general equilibrium. J. Polit. Econ. 125, 140–223. doi: 10.1086/689606

Guo, W. W., and Zhou, Y. (2020). Will land finance promote high-quality economic development? Based on the mediating effect of urbanization and industrial structure upgrading. South China Finance 28–39. doi: 10.3969/j.issn.1007-9041.2020.10.003

Hu, H. S., and Liu, H. M. (2020). Study on land revenue, production expenditure and economic growth: Non-linear threshold analysis based on provincial panel data. Theory Pract. Finance Econ. 41, 78–85. doi: 10.16339/j.cnki.hdxbcjb.2020.04.011

Hu, J. X. (2017). Strictly control the financial risks of real estate in the era dominated by existing housing. Explor. Free Views 42–44. doi: 10.3969/j.issn.1004-2229.2017.12.010

Huang, Y., Yi, D., and Clark, W. A. (2020). Multiple home ownership in Chinese cities: an institutional and cultural perspective. Cities 97:102518. doi: 10.1016/j.cities.2019.102518

JLL, LaSalle. (2024). Global Real Estate Transparency Index 2024 Rankings. Available at: https://www.jll.co.in/en/trends-and-insights/research/global-real-estate-transparency-index/greti-global-rankings-and-methodology.

Kong, Y., and Dong, J. (2024). Does the size of the housing rental market stabilize regional economic fluctuations? Evidence from China's large-and medium-sized cities. Habit. Int. 153:103189. doi: 10.1016/j.habitatint.2024.103189

Li, D. X. (2016). Research on the role of real estate economy in China's national economic growth. Natl. Bus. Intell. Theor. Res. 3–4. doi: 10.3969/j.issn.1009-5292.2016.04.001

Li, D. Y. (2019). Feasibility study on evaluation of real estate foam degree with fuzzy analytic hierarchy process. Archit. Budget 11–14.

Li, R. Z., Liu, Y. B., Wang, W. G., and Dejin, X. (2020). China's urban land finance expansion and the transmission routes to economic efficiency. Acta Geograph. Sin. 75, 2126–2145. doi: 10.11821/dlxb202010007

Li, Y., Zhu, D., Zhao, J., Zheng, X., and Zhang, L. (2020). Effect of the housing purchase restriction policy on the Real Estate Market: evidence from a typical suburb of Beijing, China. Land Use Policy 94:104528. doi: 10.1016/j.landusepol.2020.104528

Liang, Y. F., Gao, T. M., and He, S. P. (2006). Empirical analysis of coordinated development between real estate market and national economy. China Soc. Sci. 74–84.

Liu, J. M., Luo, S., and Wu, J. G. (2023). The dynamic relationship between tax reduction and fee reduction, industrial structure upgrading, and the quality of economic growth: an analysis based on the PVAR model. J. Hunan Univ. 37, 44–52.

Lu, P., Zhen, H., and Xu, Y. (2012). Irrational Prosperity, Housing Market and Financial Crisis. Global Housing Markets: Crises, Policies, and Institutions. Hoboken, NJ: Wiley.

Lu, X. X., and Teng, Y. H. (2020). How the heterogeneity of land financial dependence affects regional economic development? Study Expl. 120−129.

Ni, P. F., Jin, H. B., and Wu, B. L. (2008). Health standards and empirical research on the urban real estate market in China. Res. Urban Dev. 46–53 + 67.

Shen, Y., and Dong, P. G. (2018). Heterogeneous panel threshold approach to housing price fluctuations, investment constraints and economic growth. J. Dalian Univ. Technol. Soc. Sci. 39, 39–47.

Sternik, S. G., and Malginov, G. N. (2023). Trends in the housing market and housing construction in Russian regions in 2022. Real Estate: Econ. Manag. 6−15.

Sun, Q., Tang, Y., Zhao, X., and Feng, Y. (2023). The relationship between urban housing prices, land finance, and economic growth: a study based on panel data from 277 prefecture level and above cities in China. J. Syst. Sci. Math. Sci. 43, 1486–1503.

Tian, L., Yan, Y., Lin, G. C. S., Wu, Y., and Shao, L. (2020). Breaking the land monopoly: can collective land reform alleviate the housing shortage in China's mega-cities? Cities 106:102878. doi: 10.1016/j.cities.2020.102878

Turok, I. (2015). Housing and the urban premium. Habitat Int. 54, 234–240. doi: 10.1016/j.habitatint.2015.11.019

Wang, J. B. (2022). Qiao Huiling Human capital level, industrial structure transformation and upgrading, and urban economic resilience: an analysis based on the PVAR model of Chinese urban panels. Res. Technol. Econ. Manag.80–86.