- 1Graphic Era Deemed to be University, Dehradun, India

- 2Universiti Sultan Zainal Abidin, Terengganu Darul Iman, Malaysia

- 3Chandigarh University, Mohali, India

- 4Saudi Electronic University, Riyadh, Saudi Arabia

Introduction: Green banking (GB) strategies are a set of financial practices and activities implemented by banks to encourage sustainability, environmental responsibility, and low-carbon impact. This bibliometric study examines the present state of research in this field by utilizing the Scopus database for data retrieval and VosViewer for network analysis.

Method: A total of 149 researches were retrieved from the Scopus and analyzed using the VosViewer software following the PRISMA guidelines. The study examines year-by-year publication patterns, top-cited articles, contributing countries, journals, co-citation analysis of authors, and co-occurrence analysis of keywords.

Result: Strategies such as online banking, solar ATMs, construction of green buildings, and making provisions for green loans are identified as the key GB strategies that can be adopted by the banks. Furthermore, the fundamental challenges banking organizations encounter while implementing GB strategies are underlined.

Discussion: The study suggests that “green brand image,” “green audit,” “environmental economics,” and “carbon footprint” can be considered as an area of interest in future. The study provides researchers, policymakers, regulators, and financial institutions with valuable insights by presenting the current state of green banking research and identifying emerging areas for further exploration. These findings will help others to discover the areas of interest in GB and advancing sustainable finance practices that can foster environmental responsibility in the financial sector.

1 Introduction

Environmental change jeopardizes humanity’s growth and existence by causing food shortages, extinction of wildlife, and adverse weather (Upadhyay, 2020). Fast economic expansion and modernization have made climate change more severe (Fankhauser and Jotzo, 2018) due to which the atmospheric environment and the planet’s ecosystem are under immense stress and danger (Monasterolo, 2020). The desire to limit the environmental damage triggered by emissions from fossil fuels has prompted demands for divesting from fossil energy operations, as well as a shift toward funding carbon-neutral projects and activities that sustainably protect the environment (Park and Kim, 2020). Several countries, including India, the UK, Japan, Mexico, and Canada, have released remarks to raise consciousness of the threats posed by global warming and the detrimental effects of emissions from fossil fuels on the environment (Ozili, 2022). According to the report, temperatures around the world have increased by 1.5°C since the pre-industrial period, increasing the frequency of severe weather and raising sea levels. The Paris Agreement, an obligatory worldwide agreement on reducing climate change, has been signed by 195 nations worldwide (Batrancea et al., 2021). Global warming should not exceed 2°C, according to the Paris Agreement (Hickel and Kallis, 2020). The shift to ‘low carbon’ or ‘ecologically sound’ economic activity needs unique funding to meet the demands of a modest but rising green economy (Nawaz et al., 2021). As a result, advocates for a sustainable economy have promoted ‘green finance’ as a feasible alternative for meeting the funding needs of people, organizations, and governments engaging in initiatives and projects that sustainably protect the environment (Akter and Akhter, 2018).

The term “green finance” (GF) refers to the monetary contributions made toward organizations, initiatives and goods that motivates environmentally conscious living, as well as to laws and regulations that support the development of a sustainable society (Ali et al., 2021; Yu et al., 2021). The concept’s ‘Finance’ part highlights capital distribution and investment via financial systems and the term “green” denotes the idea that resources should be allocated across all economic sectors for environmental preservation, renewable technology, environmentally friendly infrastructure, ecological issues, societal integration, and corporate governance. The promotion of GF has been greatly aided by the financial sector, particularly the banking industry. Green financing is a multifaceted concept, with green banking (GB) as its foundation (Akomea-Frimpong et al., 2022; Zhixia et al., 2018). Green banking, also referred to as sustainable banking (Ali et al., 2020; Leticia and Ivete, 2022; Shaumya S. and Arulrajah, 2017), is the practice of leveraging financial services to focus on ecological and socioeconomic challenges in order to safeguard the environment (Amir, 2021; Sharma and Choubey, 2022). GB calls for investments in environmentally friendly goods and services to counteract global warming and save the environment (Sullivan, 2013).

GF is becoming more important in the banking industry owing to the need to safeguard banks and society from unforeseen future financial concerns caused by unanticipated global financial happenings, climatic crises, social unrest, and corporate scandals (Weber and Feltmate, 2016). Furthermore, the conventional banking model is changing to provide environmentally friendly services. During the December 2017 ‘One Planet Summit’ in Paris, central banks and important banking players from across the globe committed to working for the creation of eco-friendly banking products (Alexander and Fisher, 2019). The World Bank has announced that it would stop funding businesses and states that lay less focus on environmental protection (Akomea-Frimpong et al., 2022).

“Green banking” is the art of priortising ecological issues into all facets of the banking sector, including customer communications, marketing, delivery of services, internal operations, and project financing decisions (Fernando and Fernando, 2017; Ramya, 2017; Yip and Bocken, 2018). The banking sector is not typically considered as a polluter. However, it affects the environment by using more energy for activities like lighting, air conditioning, and paper usage. The use of cutting-edge sustainable goods and services by banks has grown significantly in recent years.

GB strategies are the specific approaches, processes, and initiatives that financial institutions have used to promote sustainability and environmentally responsible practices in their operations and services (Park and Kim, 2020). These initiatives aim to improve environmental outcomes by incorporating environmental factors into various elements of banking. GB strategies have been divided into four categories by the researchers, i.e., employee-related GB strategies (Risal and Joshi, 2018; Shaumya K. and Arulrajah, 2017), policy-related GB strategies (Chen et al., 2022; Kala, 2020), operations-related GB strategies (Aslam and Jawaid, 2022; Bukhari et al., 2022) and customer-related GB strategies (Chen et al., 2022; Rehman et al., 2021).

GB strategies include switching from branch banking to online banking (Nath et al., 2014), paying bills online rather than by mail (Kapoor et al., 2016), opening accounts at smaller online banks rather than at big brick and mortar banks (Selvaraj, 2022), consuming less energy and paper during daily operations (Aslam and Jawaid, 2022), working in green buildings that are constructed and operated sustainably (Ahuja, 2015) and taking environmental risks into account when evaluating projects to fund (Mir and Bhat, 2022). However, certain challenges hinder the adoption of GB strategies in the banking industry. Regulatory discrepancies, lack of clear guidelines, and high initial cost of adoption of green technologies are the main barriers creating the hinderance in the adoption of GB strategies (Islam et al., 2014; Qureshi and Hussain, 2020). Harmonizing regulations, providing standardized guidelines, and increasing awareness for environmental protection could help in fostering the adoption of GB strategies.

The purpose of the current study is to investigate the following research questions:

1. What are the current research publishing pattern for GB strategies?

2. Which publications and articles have had the greatest influence on research pertaining to GB strategies?

3. Which countries and authors make the most frequent contributions to the area of GB strategies?

4. What are the main keywords and research areas that can be explored in future regarding the GB strategies?

5. What are the current issues and challenges encountered in the implementation of GB?

This article aims to analyze the prevailing patterns in green banking strategies, encompassing comprehensive information on publications, countries, and the most highly cited sources and authors in this field. It also analyzes the specific areas and keywords emphasized within the green banking strategies field. Additionally, this study aims to identify the various concerns and challenges related with the adoption of GB strategies.

The results of this research can inform policymakers, regulators, and banking industry professionals about the current state of green banking strategies. By understanding what has been studied extensively and what gaps exist in the literature, stakeholders can make informed decisions about policies, regulations, and business practices related to sustainability in banking. For researchers and scholars in the field of finance, sustainability, and banking, this study can serve as a foundational reference. It can help researchers identify areas where further investigation is needed and provide a starting point for literature reviews and empirical studies. The study’s results, once published, can serve as a valuable resource for knowledge dissemination and sharing best practices in green banking. This can facilitate collaboration among researchers, financial institutions, and organizations working toward sustainability.

The current paper is structured in the following manner: The introduction to the matter of study, along with the research questions and objectives, are already presented in Section 1. Theoretical background of the research along with the foundational literature of green banking is included in Section 2. The methodology adopted for the research will be discussed in Section 3. Section 4 shows a detailed analysis and discussion regarding the green banking strategies, including the trend of publications, various types of documents published, most cited articles, top journals, co-citation analysis of authors, top contributing countries, keyword analysis and the challenges faced by the banks are also highlighted. The findings of the analysis will be discussed in Section 5. The conclusion will be shown in Section 6, along with the limitations, practical implications and recommendations for future studies. The last section will show the specified references used in this paper.

2 Literature review

The concept of GB was introduced by Triodos Bank in 1980 (Bukhari et al., 2020). It created a “Green Fund” for environmental activities, which in 1990 acted as a model for banks considering adopting green banking strategies (Tara et al., 2015). Consequently, this concept is gaining traction in the banking industry since there is an increasing inclination to establish sustainable and environmentally conscious practices in response to the external challenges faced by banks (Durrani et al., 2020). The term “green” in “GB” pertains to the bank’s commitment to environmental responsibility and its success in conducting commercial activities. Implementing environmentally friendly practices and reducing both internal and external CO2 emissions are integral components of green banking (Zhixia et al., 2018). Corporate social responsibility (CSR) is a prominent component of the GB agenda, leading to its sometimes designation as ethical banking (Hoque et al., 2019). This is a specific kind of banking conducted in a particular region and operational framework, with the objective of mitigating both internal and external carbon emissions. According to Selvaraj (2022), the implementation of green banking is crucial in facilitating the economic shift toward sustainable energy sources and mitigating the impacts of ecological change.

GB strategies related to employees are crucial in fostering employee engagement and empowerment toward promoting sustainability in banking institutions. The implementation of GB strategies related to operations is crucial for the incorporation of sustainable practices into the routine operations and infrastructure of financial 20 institutions. GB strategies related to the policy significantly affect the promotion and facilitation of sustainable practices in the banking sector. Proposing and enforcing regulations pertaining to GB is a crucial measure. The objective of customer-centric GB strategies is to foster customer engagement and promote sustainable behaviors and decisions. Financial institutions can employ diverse tactics to enable customers and advance ecologically conscious financial choices (Kapoor et al., 2016).

Research on the theoretical aspects of green banking implementation is limited. Substantial research is necessary, especially in developing countries, to investigate and get a understanding of the factors impacting the implementation of GB practices. The notion of Socially Responsible Investing (SRI) theory, sometimes referred to as ethical investments or sustainable investments, has a major position within the field (Ibe-enwo et al., 2019). SRI is a methodological approach that incorporates societal, ecological, and ethical factors into the decision-making process pertaining to investments (Ziolo, 2021). SRI theory places particular emphasis on the pursuit of both financial goals and well-being within the realm of financial institutions and socially motivated enterprises (Bhardwaj and Malhotra, 2013; Richardson, 2009). This strategy tries to respond to the expanding ecological issues, provide job opportunities, and facilitate the development of both rural and urban areas. The philosophy of SRI utilizes financial strategies that prioritize the social component to achieve societal and financial principles and goals simultaneously (Alshebami, 2021). In a recent research, (Rehman et al., 2021) used the SRI theory to assess the impact of green banking strategies on a bank’s environmental performance in Pakistan.

3 Methodology

Bibliometric analysis is a “quantitative” technique that assists researchers in exploring and analyzing large amounts of scientific data (Donthu et al., 2021). In contrast to conventional systematic literature reviews, bibliometric reviews can provide information on areas where bibliometric and bibliographic data are abundant. Authors seek to infer the intellectual birth of research on green banking strategies by examining the bibliometric structure that includes the publication patterns of articles, journals, authors, and nations. Scopus is utilized to collect data since it is the database that, when compared to the Web of Science, provides the most comprehensive coverage of peer-reviewed research (Meho and Rogers, 2008; Sivertsen, 2014). Scopus is the perfect option for catching the most recent trends and advancements in green banking research because of its reliable indexing and constant updates, which guarantee the inclusion of the most recent and high-quality research (Sivertsen, 2014).

Data is retrieved from Scopus in CSV format and then transformed into Excel format. The file is imported into the VOSviewer programme (version 1.6.19), where various analyses are carried out in line with the stated research topic. Additionally, a few checks are carried out utilizing the Scopus analysis database as appropriate. Additionally, a number of analysis were done manually by using Google Scholar data, Microsoft Word, and Excel.

The complete bibliometric analysis in this study was conducted using VosViewer, a potent software for creating and presenting bibliometric networks. The software made it easier to thoroughly examine the research landscape by pointing up connections and trends in the literature. In particular, relevant literature was located, cleaned, and imported into VosViewer for co-occurrence analysis to create a network of keywords that exposed major study topics. References were imported for bibliographic coupling analysis to find linkages between papers based on common citations, which aided in the discovery of research clusters. Understanding the linkages and patterns in green banking studies was made possible by these approaches.

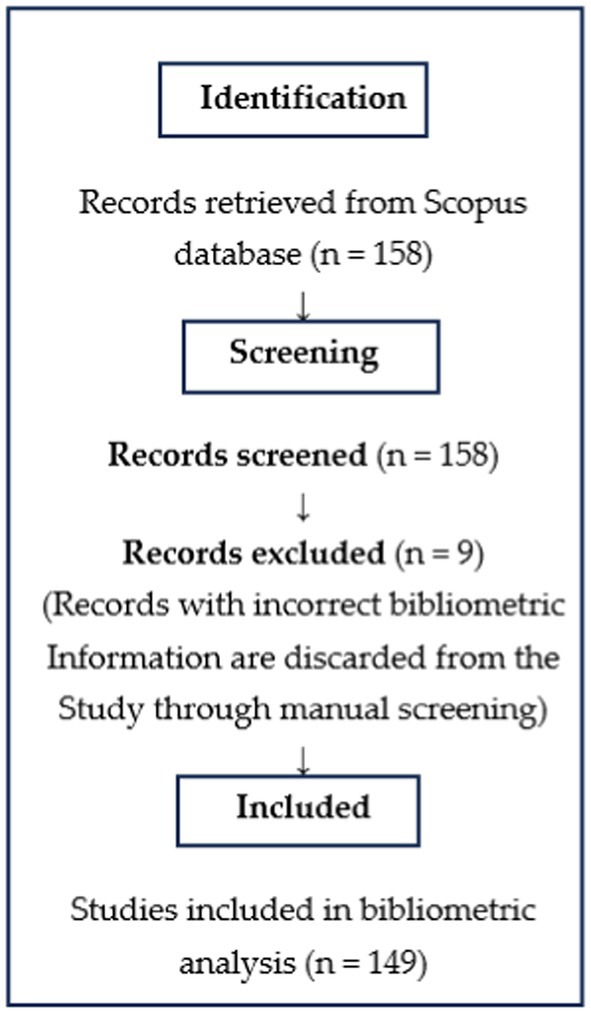

The Scopus database is used to gather the information needed for the investigation. The terms “GB strategies,” “GB practices,” and “GB initiatives” are frequently used interchangeably despite having slightly different scopes because they all refer to the specific actions, programs, and measures taken by banks to uphold sustainability principles and lessen environmental impacts. “Green Banking” OR “Sustainable Banking” AND “Practices” OR “Strategies” OR “Initiatives” are the keywords used to search the research data. One hundred fifty-eight documents on green banking techniques are taken from the Scopus database, including journal articles, conference proceedings, book chapters, and reviews. Inaccurate bibliometric and bibliographic information may have an influence on data from Scopus or any other database and must be updated before processing continues. In order to eliminate mistakes caused by incorrect bibliographic information, data purification is done manually. The documents with incomplete information were eliminated and then, 149 papers are chosen for additional analysis. The sample size of the study is smaller due to the emerging nature of the research on the GB strategies. Figure 1 depicts the process employed for the screening of data utilized in the study.

4 Analysis and discussion

4.1 Documents-based analysis

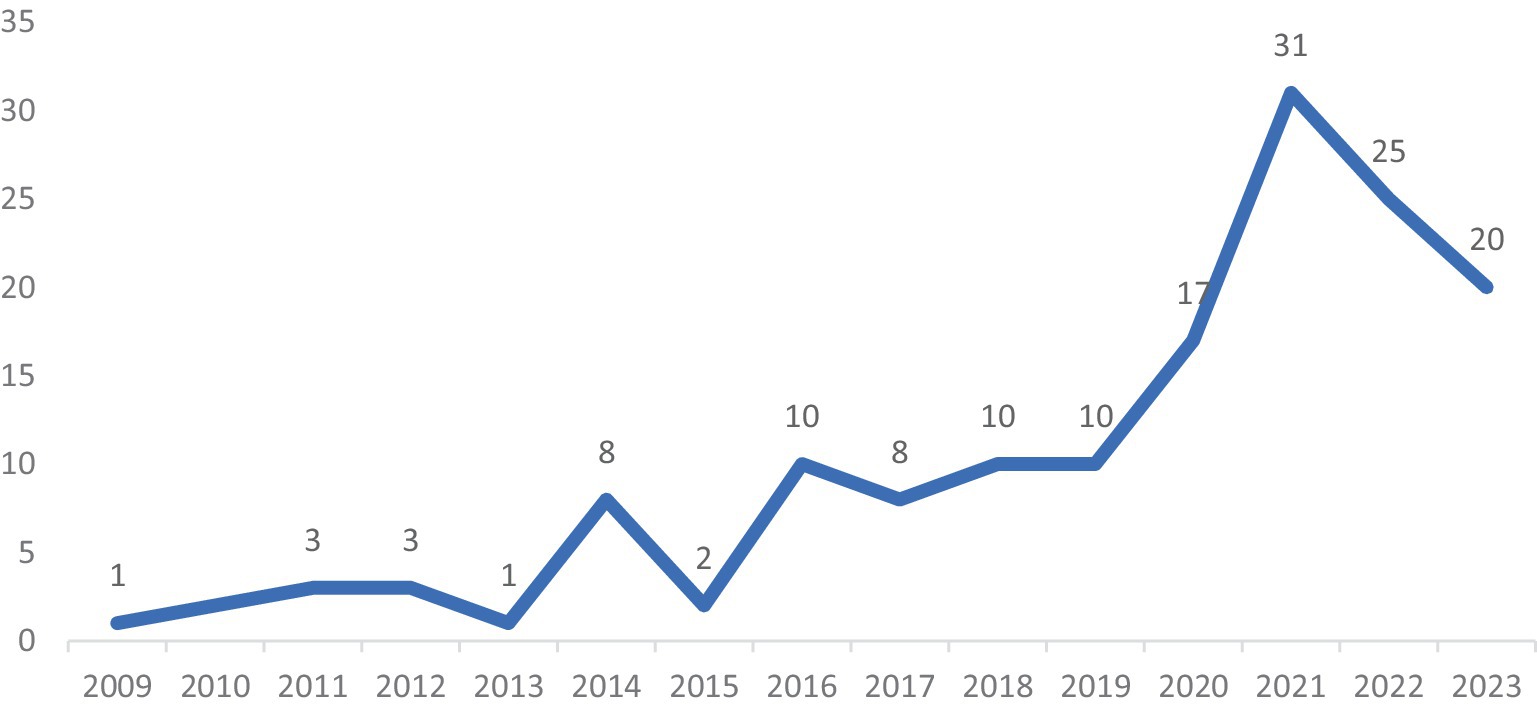

Figure 2 shows the publication trend for documents on green banking strategy and practices. The data reveal a steady rise in research interest and activity in recent years, with a significant increase from 2015 to 2021, peaking at 31 publications in 2021. This rapid increase in publications in 2021 implies that green banking is becoming more critical in the financial sector, likely due to increased awareness of ecological challenges and demand for sustainable financial practices. The consistent number of publications in succeeding years, such as 20 articles in 2023, shows sustained interest and ongoing importance of green banking as a significant field of study and application. The trend demonstrates the financial industry’s shift toward sustainability and ecologically responsible practices, which is helping to combat climate change and promote a greener future.

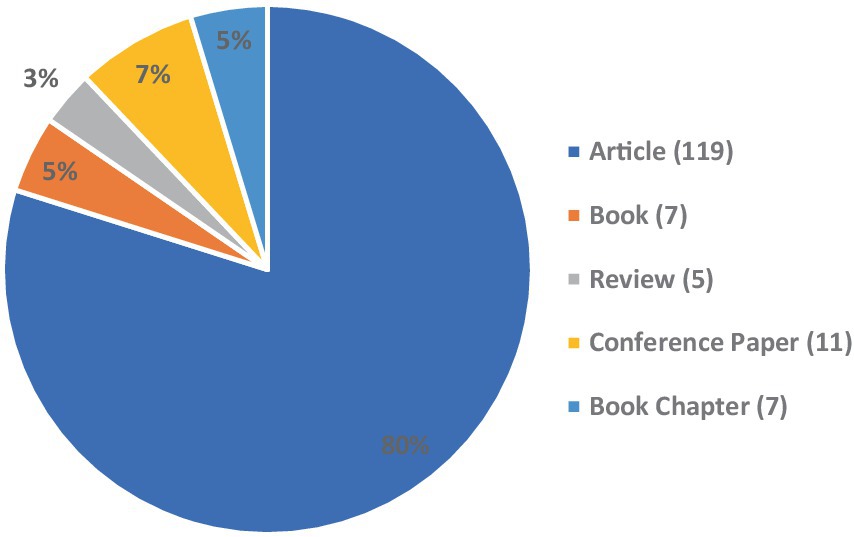

Figure 3 depicts the distribution of document types on green banking strategies and practices published in the Scopus database. The majority of publications are articles (119), with conference papers (11), books (7), book chapters (7), and review papers (5). The overwhelming number of research articles reflects the enormous research and academic interest in green banking, emphasizing its importance as a field of scholarly investigation. The availability of conference papers shows significant participation and knowledge exchange in conferences related to green banking. Furthermore, the availability of books and book chapters demonstrates efforts to consolidate and share extensive knowledge about green banking practices. The variety of document types reflects a multidisciplinary approach to green banking research, including researchers, practitioners, and academics.

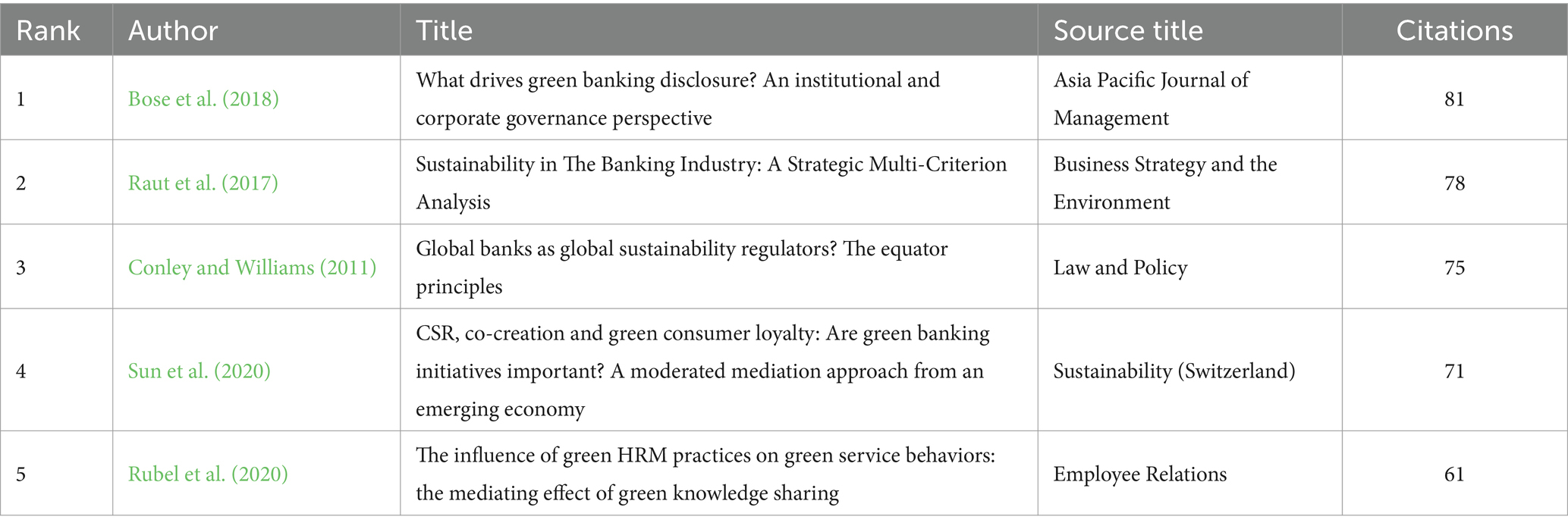

Table 1 provides the most influential articles on green banking strategies and practices based on total citations. The list includes research articles that have gained a lot of attention and recognition from the academic world. The top article with 81 citations is “What drives green banking disclosure? An Institutional and corporate governance perspective” by Bose et al. (2018), this top-cited article suggests that the green banking regulatory guidance by the central bank and the corporate governance mechanisms of the banks have the positive impact on the green banking disclosures. “Sustainability in The Banking Industry: A Strategic Multi-Criterion Analysis” by Raut et al. (2017) is the second highly cited article with 78 citations. These widely cited articles in the list cover a wide range of topics, including the impact of green HRM practices on GB, the investigation of sustainability performance in Islamic banks, and the evaluation of sustainable banking performance in the banking sector. The examination of such prominent publications in green banking is critical since it aids in the identification of significant research areas and their impact on the field. Researchers, policymakers, and financial institutions can get a better insights about the goals and interests in the field of green finance by identifying which publications have garnered the most citations.

4.2 Sources-based analysis

Table 2 lists the top journals for articles on green banking practices and strategies, as measured by the number of citations. Notably, “Sustainability (Switzerland)” tops the list with 15 documents and 324 citations, highlighting its importance as a major research platform in the green finance topic. With eight documents and 126 citations, “Environment, Development, and Sustainability” comes in second position, proving its significant impact in supporting research on sustainable development and environmental elements of banking practices. “Business Strategy and the Environment” comes third with three documents and 89 citations, underlining its importance to green banking strategy considerations. The presence of various journals highlights the variety of research pathways available within the broader issue of green banking. “Emerald” emerges as the top publisher for the research articles pertaining to green banking strategies as out of the top 10 journals, four are published by “Emerald”; this highlights the publisher’s interest in green banking. This analysis gives significant insights into the prominence of these journals, assisting academics and professionals in gaining access to credible and influential research to promote green finance and green banking practices.

4.3 Country-wise analysis

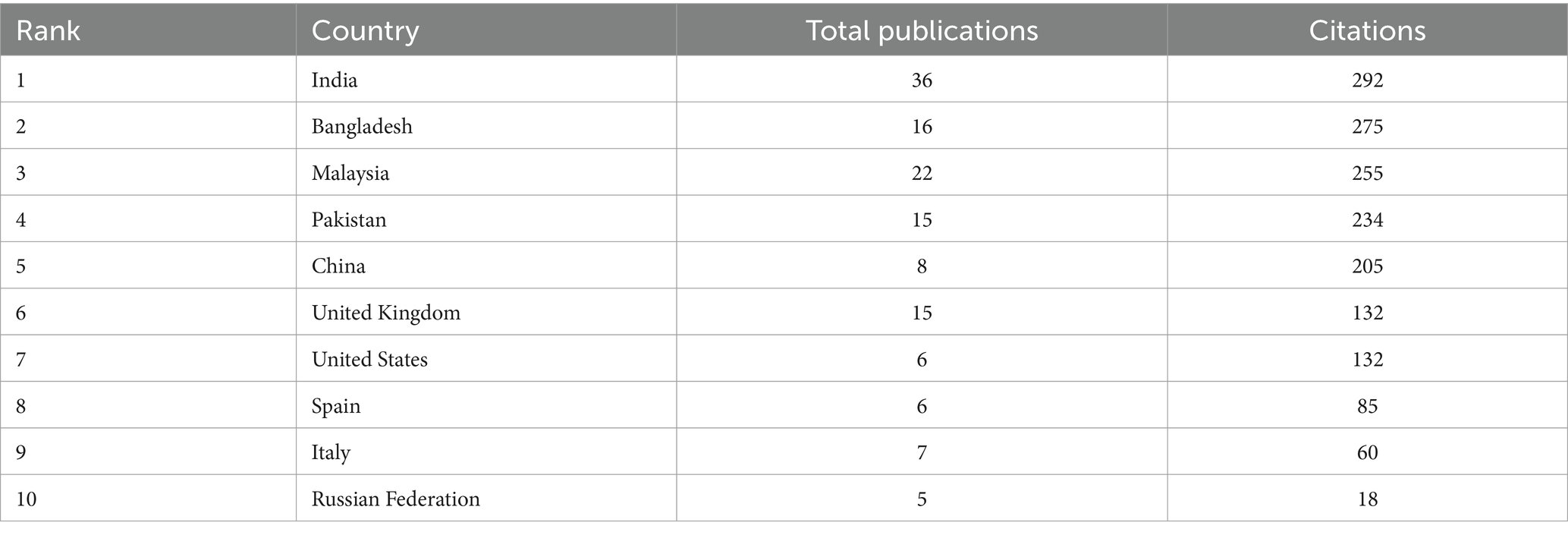

Table 3 lists the top 10 nations that publish articles on green banking and strategy, ranked by the total citations. India emerges as the largest contributor, with 36 articles and 292 citations, demonstrating its major involvement and impact in green banking research. State Bank of India (SBI), a major public sector bank in India, has issued green bonds to finance environmentally friendly projects. The bank has tied its GB efforts to the nation’s ambitions to achieve net zero emissions by the year 2070 (Kumar and Akula, 2023). Bangladesh is in second place, with 16 articles and 275 citations, indicating its significant contribution to developing sustainable finance. Bangladesh bank has mandated all the financial institutions of the nation to synchronize their banking policies with the nation’s efforts toward promoting sustainable agriculture and disaster-resilient infrastructure (Bin Amin et al., 2022). Malaysia ranks third with 22 papers and 255 citations, highlighting its substantial commitment to green banking research. Despite having fewer publications (8), China receives significant recognition with 205 citations, indicating the importance of its research efforts. This analysis gives valuable insights into the global distribution of research efforts and impact in the field of GB practices, recognizing the active participation of nations worldwide in advancing sustainable finance and responsible banking strategies.

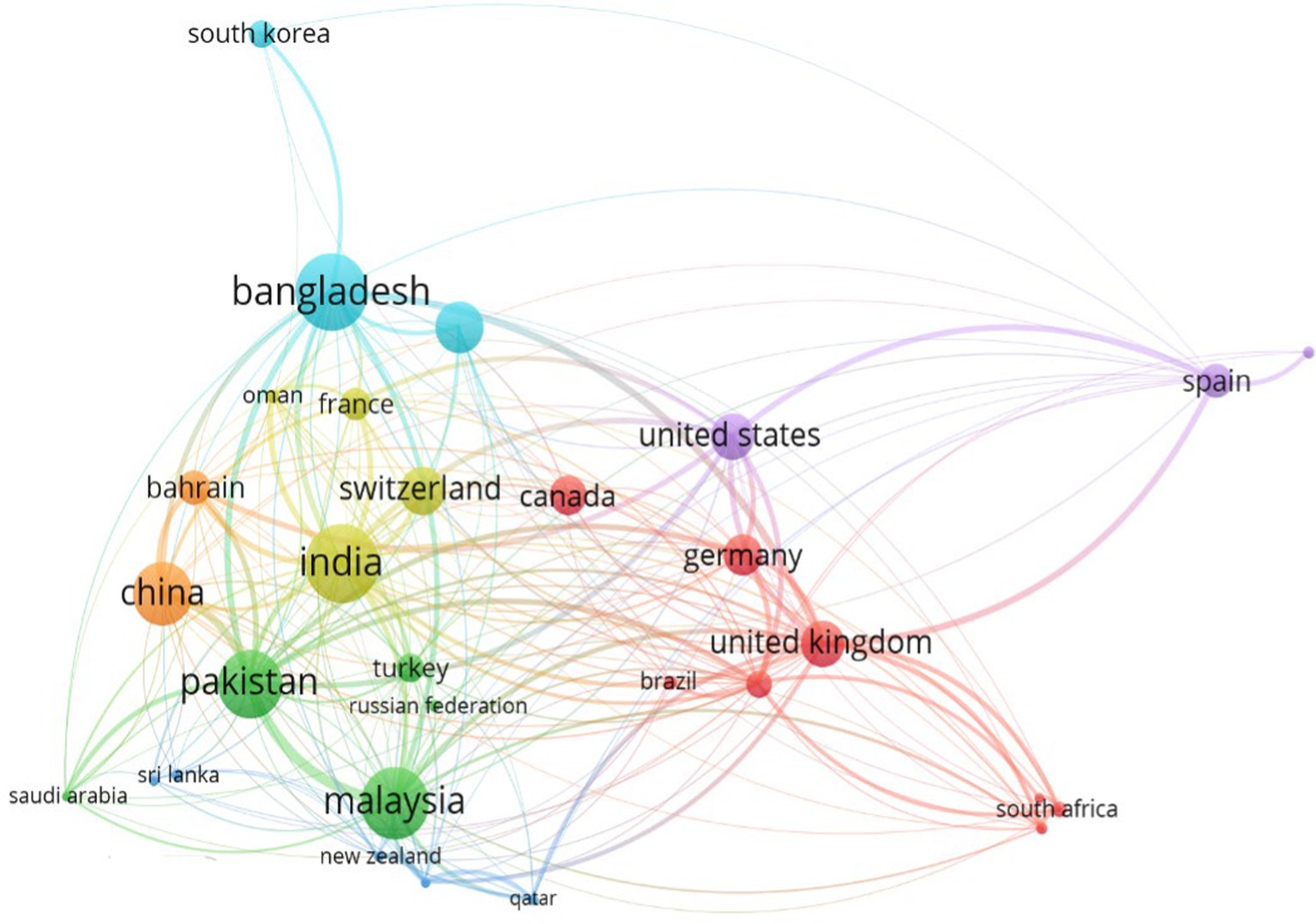

Bibliographic coupling refers to the association of two countries based on the citations they share in their published works (Sajovic et al., 2018). Figure 4 shows that, there are seven clusters and each cluster encompasses nations that undertaken studies in the green banking strategies. The first and the largest cluster contains eight countries while the second and third clusters contains five countries each. Fourth cluster has four countries, fifth and sixth cluster has 3 countries each whereas seventh is the smallest cluster with only two countries. With a total link strength of 2017, Pakistan appears to have the highest level of collaboration and shared research interests. India comes in second with 1,427 overall link strength, demonstrating strong collaboration in the field of green banking practices. Bangladesh, with 1,152 total link strength, and Malaysia, with 1,246 total link strength, both show substantial research connections and collaboration activities. This analysis sheds light on the extent of collaboration and research synergy among nations, thereby contributing to the dissemination and advancement of sustainable financial practices on a global scale.

4.4 Analysis based on keywords

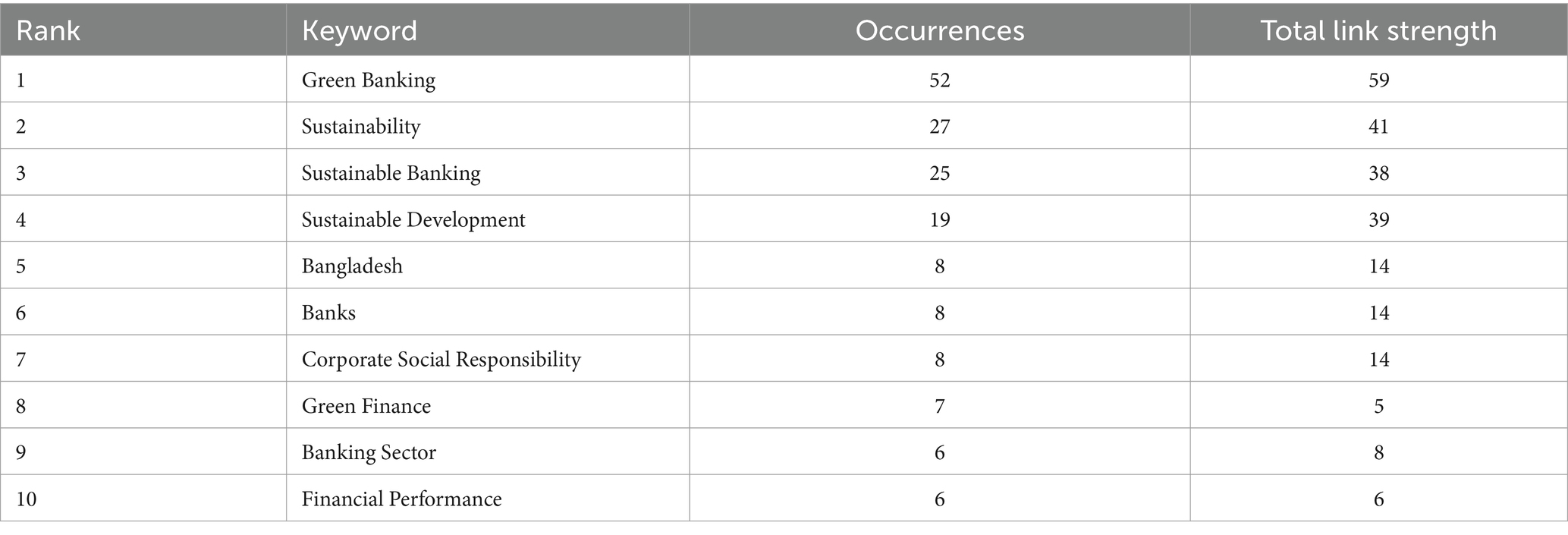

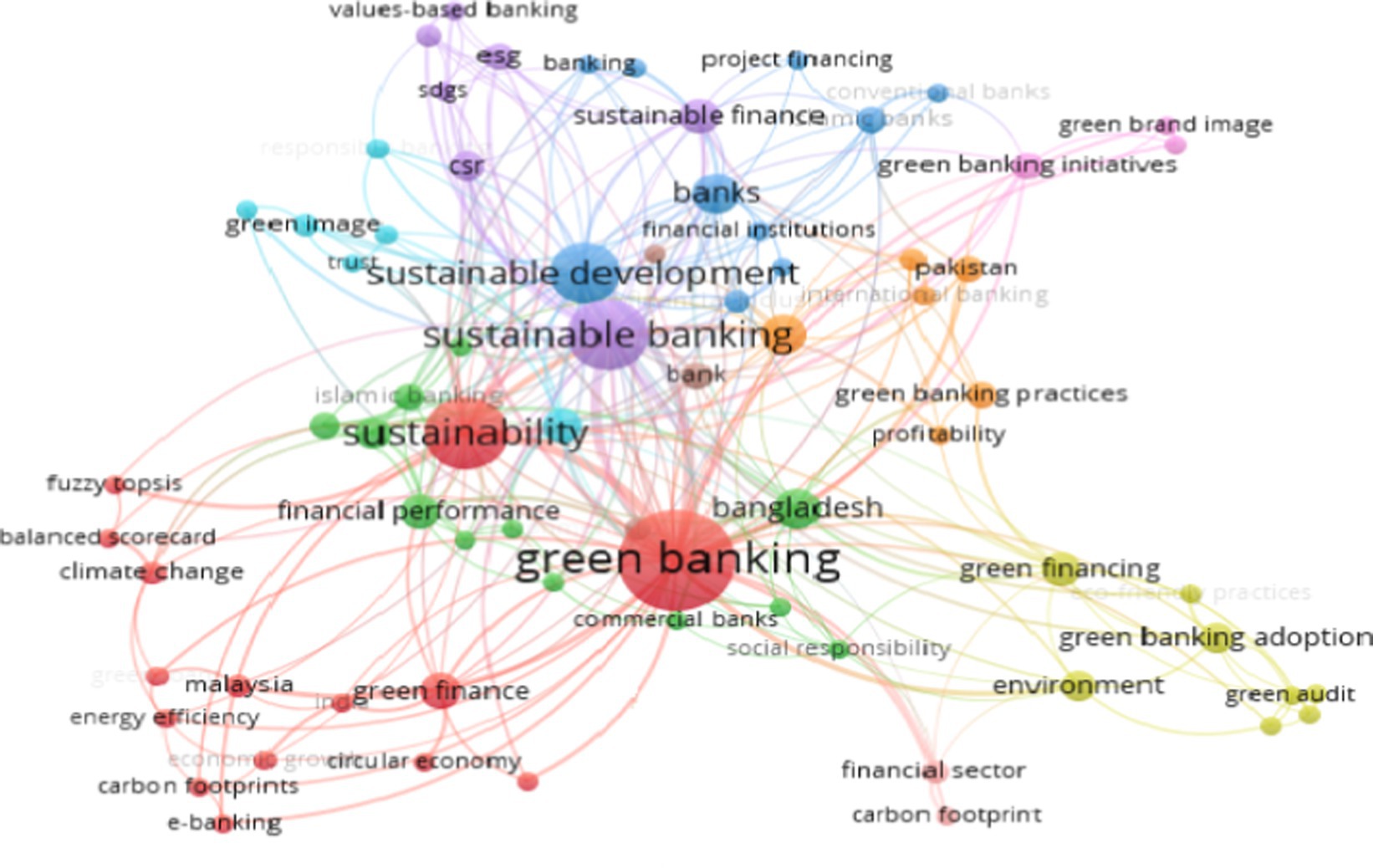

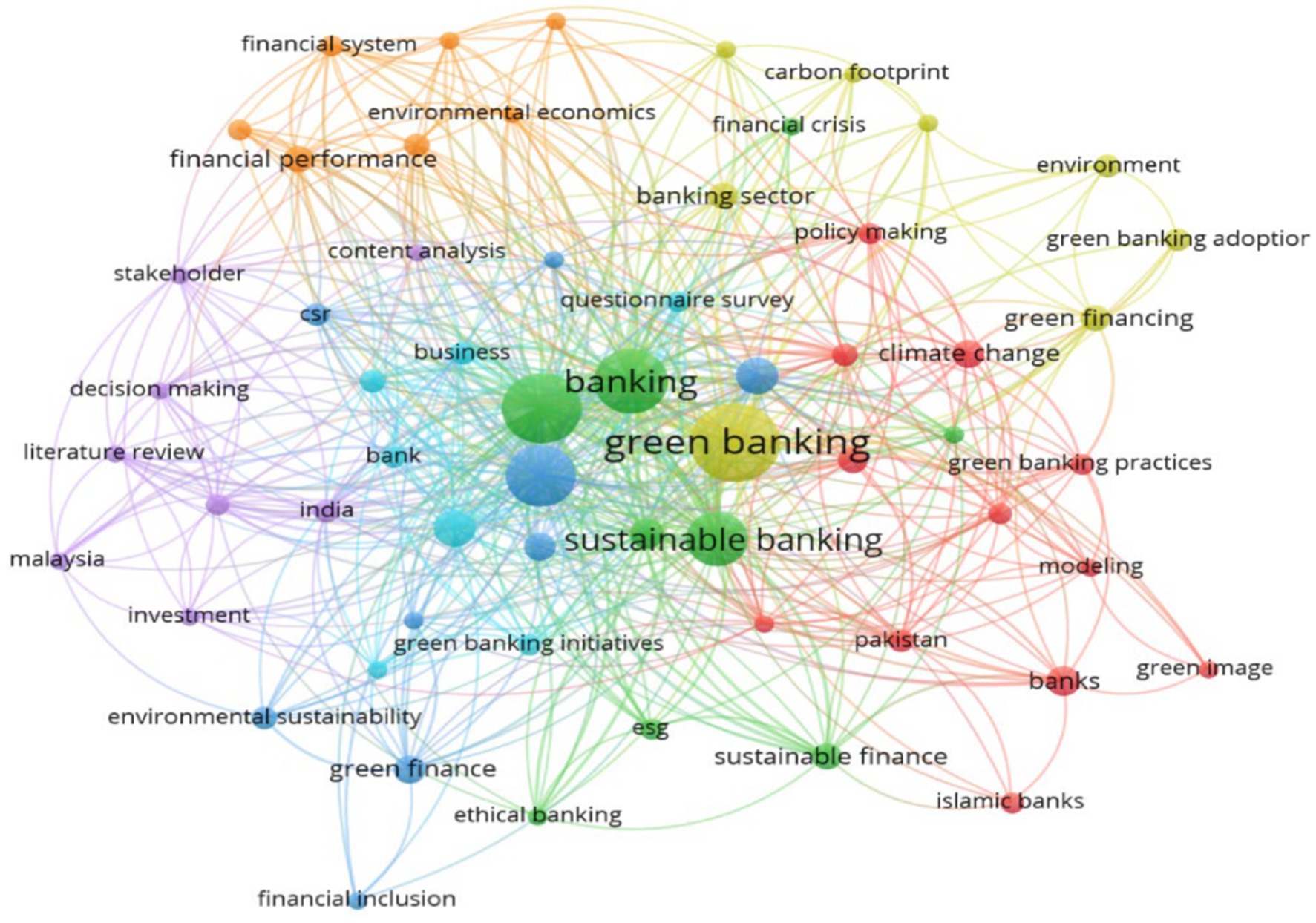

Table 4 lists the top author keywords used in studies on green banking strategies, ranked by occurrences. The keyword “green banking” has 52 occurrences and 112 total link strength, suggesting its importance in the academic discourse. Other important keywords, such as “sustainability” (27 occurrences, 41 total link strength), “sustainable banking” (25 occurrences, 38 total link strength), and “sustainable development” (19 occurrences, 39 total link strength), highlight the strong emphasis on ecological and social considerations in the context of banking practices. Figures 5, 6 show the visual representation of the co-occurrence of the author’s keyword and all keywords, respectively. Co-occurrence and total link strength analysis for each keyword provide a comprehensive view of the research landscape. Researchers can acquire valuable insights into the academic community’s priorities and research emphasis by determining the most prevalent and significant keywords. Furthermore, examining the total link strength of keywords can reveal which subjects have received considerable attention and collaboration among experts. Figure 5 depicts that “green banking,” “sustainability,” and “sustainable banking” have the highest occurrence, whereas “green brand image,” “green audit,” and “carbon footprint” have fewer occurrences. In Figure 6 also, the most occurred keywords are “green banking” and “sustainable banking,” whereas the keywords like “green image,” “environmental economics,” “financial crisis,” and “carbon footprint” are the least occurred. This analysis assists researchers in performing comprehensive literature assessments and in directing future research efforts to solve essential sustainability concerns in the banking sector.

4.5 Author-based analysis

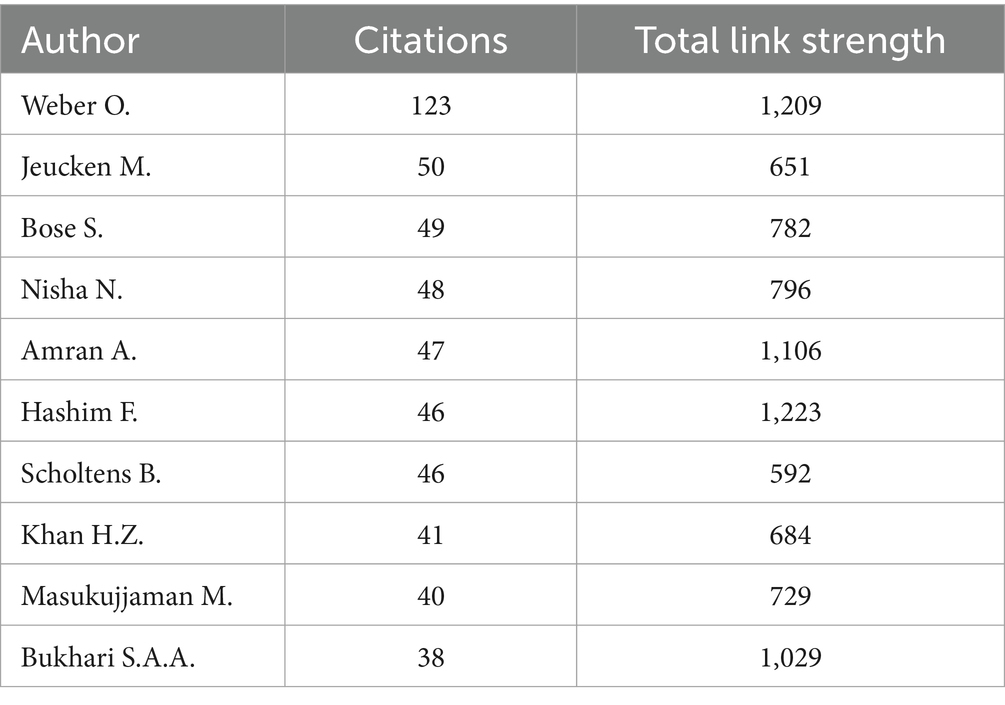

Table 5 shows the top 10 most productive co-cited authors with their connections.

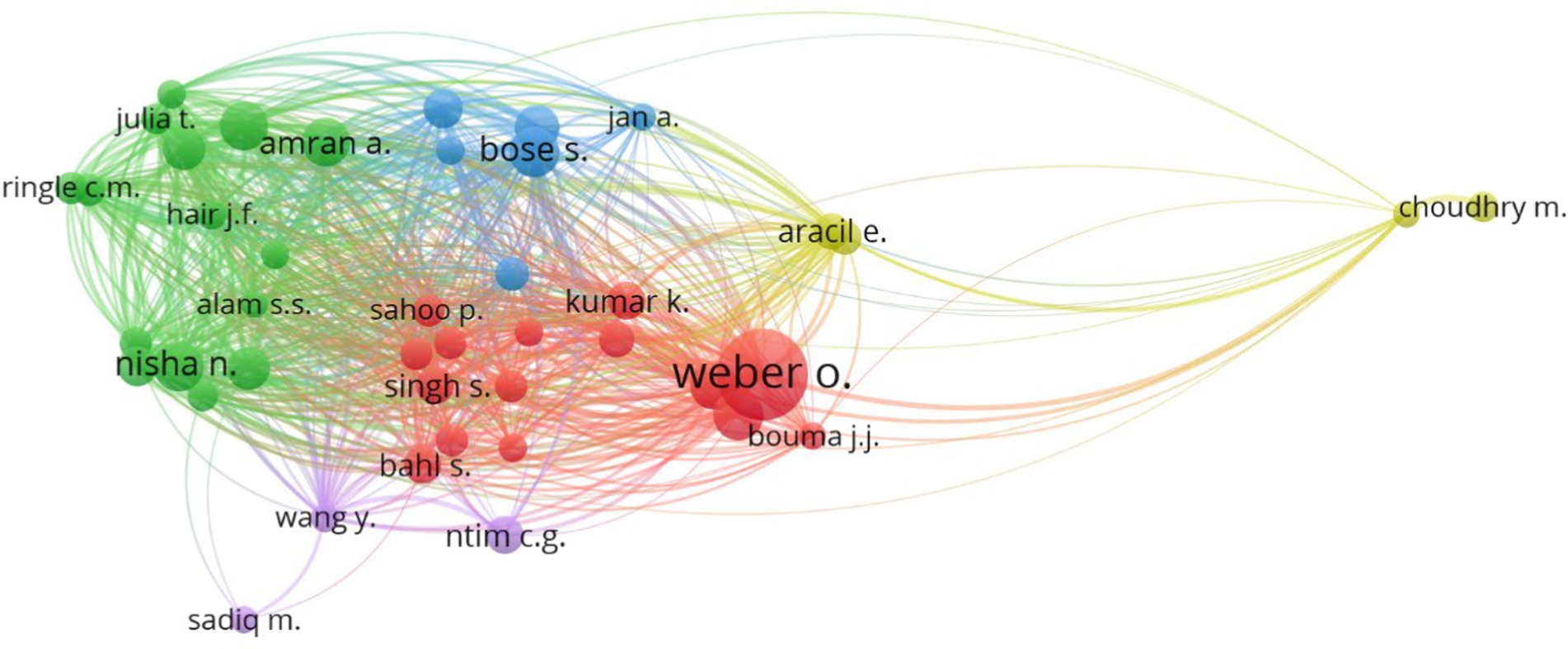

Co-citation analysis investigates the frequency with which two authors are referenced together in the same papers, revealing relationships and influence among scholars in a certain topic. Table 5 shows interesting patterns and relationships from the co-citation analysis of the most significant authors of green banking strategies. With 123 citations and a total link strength of 1,209, Weber O. emerges as the most cited author, suggesting the tremendous impact and collaboration associated with their work. Jeucken M. and Bose S. are closely cited, with 50 and 49 citations each, and significant total link strengths of 651 and 782, respectively, indicating their significant influence and participation in the field. Based on the network analysis performed using the VOS viewer, five clusters are identified in Figure 7. Clusters indicate areas of shared research interest and collaboration among authors, suggesting shared knowledge and contributions to certain topics within a field of study, such as green banking strategies. Clusters are important in co-citation analysis because they could reveal cohesive groups of authors who aare frequently cited together in the same publications. The clusters 1 (Red) and cluster 2 (Green) are the largest clusters with 15 authors each whereas the smallest cluster, i.e., Cluster 5 (Purple) has only three authors. Co-citation analysis emphasizes the value of collaborative efforts in developing knowledge and understanding of green banking initiatives, as well as the importance of multidisciplinary research and collaboration in tackling financial sector sustainability concerns.

4.6 Analysis based on challenges faced in adoption of green banking strategies

The implementation of GB strategies poses challenges and issues for banks. The limited knowledge and comprehension of sustainable finance principles and advantages among bank employees and stakeholders could impede the implementation of eco-friendly banking practices (Qureshi and Hussain, 2020). Additionally, banks may encounter challenges in implementing green banking initiatives due to their limited expertise and skills in areas such as sustainable finance, environmental risk assessment, and impact quantification (kanu et al., 2020). The financial viability and return on investment of sustainable projects can be challenging due to potentially lower short-term returns compared to conventional investments (Bhardwaj and Malhotra, 2013). Moreover, the reliability and consistency of environmental performance data and ESG metrics can vary, hindering the precise evaluation and monitoring of environmental effects (Shaumya K. and Arulrajah, 2017). Incorporating sustainability into core banking operations requires significant organizational changes and investments (Islam et al., 2014). However, banks may face challenges in maintaining green banking strategies due to regulatory and policy uncertainty (Park and Kim, 2020). The management and measurement of environmental hazards necessitate specialized tools and methodologies while establishing collaborations and partnerships with external stakeholders can be intricate. Transitioning existing customers to adopt sustainable finance may face challenges such as resistance or a lack of interest in environmentally-friendly financial products (Nath et al., 2017). To overcome these challenges, a strategic approach is necessary. This approach should include skill development, regulatory support, stakeholder engagement, and ongoing evaluation of sustainable initiatives. By doing so, organizations can effectively leverage the opportunities offered by green banking strategies.

Bank of America (BofA) is a prominent financial institution in the United States that has gained worldwide recognition. The bank’s Environmental Business Initiative aims to facilitate the transition toward a sustainable economy with reduced carbon emissions. To achieve this, the bank plans to mobilize a sum of $1 trillion by the year 2030. The bank’s annual report highlights the provision of financial and intellectual capital over multiple years to facilitate the development of solutions to address environmental challenges, particularly climate change. The initiative prioritizes developing and implementing low-carbon energy sources, energy-efficient practices, and sustainable transportation methods. Furthermore, it addresses critical issues such as water preservation, land management, and waste reduction. The bank has attained carbon neutrality in its operations by exclusively sourcing its electricity from 100% renewable sources in 2019.

5 Findings

Based on the first research question, it is evident that there is a visible upward trend in the number of documents that signify a rising interest in the study of green banking strategies. There has been significant rapid growth in the number of documents published and citations.

To evaluate the second research question, Tables 1, 2 show the best 10 articles and journals along with their parameters. “What drives green banking disclosure? An institutional and corporate governance perspective” has emerged as the most popular article published in the Asia Pacific Journal of Management. Sustainability (Switzerland) has achieved the highest number of publications, with a total of 15 papers, and has garnered significant attention with 324 citations.

Based on the findings for the third research question, it is evident that India has emerged as the leading contributor in terms of publications, with 36 total publications and 292 citations. These statistics highlight India’s significant competence in the field of green banking strategies, as seen in Table 3. According to the data presented in Figure 4, Pakistan exhibits the highest level of connectivity with other nations, as indicated by a total link strength of 2017. The author plays a significant role in showcasing the research capacity and evaluating the progress of an academic matter. According to the authors’ co-citation network analysis results, Weber O. and Jeucken M. emerged as the most often cited authors, with 123 and 50 citations, respectively. These findings are presented in Table 5 and Figure 7.

As per the fourth research question, a network map of the authors’ keywords (Figure 5) and all keywords (Figure 6) is given, which will be helpful to academics for a deeper examination of green banking strategy research fields. More studies have been done using the terms green banking, sustainability, and sustainable banking, according to the results of VOSviewer. Fewer research has been conducted on the terms “green brand image,” “green audit,” “environmental economics,” “carbon footprint,” and “financial inclusion.” If researchers work in these areas, they are likely to find meaningful results.

To address the fifth research question, the available literature is manually analyzed to highlight the key issues and challenges that are faced by banks in the implementation of GB strategies. The key challenge that the bank encounters is the availability of limited knowledge and skills among the stakeholders regarding green and sustainable practices. A low rate of return on sustainable investments is another issue that is faced by banks. The development of reliable and efficient tools and techniques to measure the impact of sustainable practices is a challenging task for banks.

6 Discussion

The findings of this study may provide crucial information to the financial institutions regarding the implementation of the GB strategies. It is suggested that the banks include GB strategies in the core operational activities such as paperless transactions, energy-efficient infrastructure and the installation of solar ATMs (Rehman et al., 2021). Banks could make efforts for the promotion of digital banking services. Moreover, banking institutions should focus on formulating GB policies, such as formulating rules and regulations for evaluating environmental risk while providing loans. Banks can also prioritize loans for environmentally-friendly projects (Shaumya S. and Arulrajah, 2017).

Banks should focus on enhancing the knowledge of their customers regarding environmentally friendly practices. Banks may provide eco-friendly products to their customers that can incentivize their eco-friendly behaviors, such as providing green loans at favorable interest rates and opening green savings accounts (Karyani and Obrien, 2020). Employees of the banking institutions could play a significant role in the promotion of GB strategies. Banks should provide training to their employees regarding the implementation of the GB strategies (Hoque et al., 2019).

The top-cited article from Bose et al. (2018) suggested that GB regulatory guidance provided by the Central Bank of Bangladesh positively impacts GB disclosures. The second highly cited paper by Raut et al. (2017) implemented Multi-Criterion Decision Making (MCDM) model to evaluate the impact of sustainability practices on the banking industry and found that internal business processes, customer relationship management system, and financial stability had a major impact on the sustainability practices of the banking industry than an environmentally-friendly management system. Another article by Conley and Williams (2011) concluded that banks act as global sustainability regulators. Therefore, the authors highlighted the significance of the banking industry in promoting sustainability globally. Sun et al. (2020) explained that GB initiatives and the CSR activities by the banks had a significant impact on enhancing green consumer loyalty. Another highly cited article by Rubel et al. (2020) suggested that green HRM practices in the banking industry had a positive and direct impact on green service behavior, and green knowledge sharing further strengthens this relationship.

On the basis of the various studies, it can be concluded that GB strategies could play a significant role in the reduction of the bank’s carbon footprint.

7 Conclusion

GB refers to financial procedures that support environmental responsibility and reduce a bank’s carbon impact. The implementation of green banking strategies is of utmost importance in advancing sustainability efforts, reducing environmental hazards, and facilitating the shift toward a low-carbon economy. This study had utilized the bibliometric technique to understand the trend of scholarly research on green banking strategies. The data for the study was derived from the Scopus database and then analysis was done using the VosViewer software and Microsoft Excel. The study aims to address the five research questions. The results of the analysis revealed that green banking strategies are emerging as an area of interest among the researchers worldwide as there is a significant growth in the number of documents in the recent years. India has emerged as the top nation contributing toward the research on green banking strategies. Operations-related GB strategies and policy-related GB strategies have major impact on the environmental performance of the bank. The main challenges faced by the banks in the implementation of the green banking strategies are also highlighted. Overall, this study will provide the valuable insights to the other researchers about the status of the research on green banking strategies.

However, there are some limitations of the present study: The only dependence on information from the Scopus database is a noteworthy limitation. While Scopus provides a wide range of peer-reviewed research, the inclusion of additional databases such as Web of Science and Google Scholar can augment the comprehensiveness of the study and offer a more comprehensive perspective on the subject area. Furthermore, the utilization of complementary research approaches, such as the Systematic Literature Review (SLR) and various network analyses, including co-citation analysis of sources, network analysis of indexed keywords, and bibliographic coupling, can provide more profound insights and enhance the overall understanding of the research patterns and connections within the field of green banking. The utilization of a wide range of data sources and approaches will enhance the reliability as well as the validity of the results, allowing researchers to derive strong conclusions and make well-informed judgments in their efforts to promote sustainable finance practices.

The findings of this bibliometric study on green banking strategies have substantial practical implications for various financial industry stakeholders. Firstly, the considerable increase in the number of publications and citations indicates a growing interest and awareness in green banking practices. This suggests that financial institutions should pay attention to this emerging area and consider incorporating sustainable finance initiatives into their operations, like-installation of solar ATMs, construction of green buildings, reducing the use of paper and providing training to the employees regarding the GB strategies. Banks may capitalize on this momentum by developing and promoting green financial products and services to meet the growing demand from environmentally concerned customers and investors. Secondly, the key sources of information and experience in green banking are highlighted by identifying the most popular publications and journals and the major contributors, such as India. Policymakers, financial regulators, and researchers can use this information to learn from successful implementations and focus their emphasis on the most important studies. Countries and organizations can cooperate and share expertise to further progress sustainable banking practices globally.

This study also has significant theoretical implications. The study will contribute to the enrichment of the sustainable finance literature. It also identifies green brand image, carbon footprint, and green audit as key areas of research which can enhance the adoption of green banking strategies in the financial sector.

The study has provided valuable insights that suggest several viable areas for further research in the realm of green banking practices. Initially, it is suggested that researchers undertake further investigation into the previously mentioned areas that have been subject to little research, including “green brand image,” “green audit,” “environmental economics,” and “carbon footprint.” Exploration of these domains may provide undiscovered prospects and innovative perspectives to augment the influence and efficacy of environmentally conscious banking strategies. Additionally, the study shed light on the challenges encountered by financial institutions in the adoption of environmentally sustainable banking practices. However, future investigations may delve into potential effective solutions to tackle these challenges. For example, examination of successful case studies pertaining to banks that have effectively addressed challenges associated with limited knowledge and skills, low returns on sustainable investments, and impact measurement could provide significant insights and exemplary approaches for other financial institutions to adopt.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding authors.

Author contributions

ST: Writing – review & editing, Writing – original draft, Validation, Supervision, Software, Project administration, Methodology, Investigation, Formal analysis, Data curation, Conceptualization. NB: Writing – review & editing, Writing – original draft, Validation, Supervision, Software, Project administration, Methodology, Investigation, Formal analysis, Data curation, Conceptualization. AJ: Writing – review & editing, Writing – original draft, Validation, Supervision, Software, Project administration, Methodology, Investigation, Formal analysis, Data curation, Conceptualization. MA: Writing – review & editing, Writing – original draft, Validation, Supervision, Software, Project administration, Methodology, Investigation, Formal analysis, Data curation, Conceptualization. ZS: Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ahuja, N. (2015). Green banking in India: a review of literature. Int. J. Res. Manag. Pharm. 4, 11–16.

Akomea-Frimpong, I., Adeabah, D., Ofosu, D., and Tenakwah, E. J. (2022). A review of studies on green finance of banks, research gaps and future directions. J. Sustain. Financ. Invest. 12, 1241–1264. doi: 10.1080/20430795.2020.1870202

Akter, A., and Akhter, H. (2018). Green banking practices and its present scenario in Bangladesh. IOSR J. Bus. Manag. 20, 69–76. doi: 10.9790/487X-2003076976

Alexander, S. K., and Fisher, P. (2019). Banking regulation and sustainability. SSRN Electron. J. 1, 1–20. doi: 10.2139/ssrn.3299351

Ali, E. B., Anufriev, V. P., and Amfo, B. (2021). Green economy implementation in Ghana as a road map for a sustainable development drive: a review. Sci. African 12:e00756. doi: 10.1016/j.sciaf.2021.e00756

Ali, Q., Parveen, S., Senin, A. A., and Zaini, M. Z. (2020). Islamic bankers’ green behaviour for the growth of green banking in Malaysia. Int. J. Environ. Sustain. Dev. 19, 393–411. doi: 10.1504/IJESD.2020.110650

Alshebami, A. S. (2021). Evaluating the relevance of green banking practices on Saudi banks’ green image: the mediating effect of employees’ green behaviour. J. Bank. Regul. 22, 275–286. doi: 10.1057/s41261-021-00150-8

Amir, M. K. (2021). Banker attitudes and perception towards green banking: an empirical study on conventional banks in Bangladesh. Int. J. Finance Bank. Stud. 10, 47–56. doi: 10.20525/ijfbs.v10i2.1163

Aslam, W., and Jawaid, S. T. (2022). Green banking adoption practices: improving environmental, financial, and operational performance. Int. J. Ethics Syst. 39, 820–840. doi: 10.1108/IJOES-06-2022-0125

Batrancea, L. M., Pop, C. M., Rathnaswamy, M. M., Batrancea, I., and Rus, M. I. (2021). An empirical investigation on the transition process toward a green economy. Sustainability (Switzerland) 13, 1–22. doi: 10.3390/su132313151

Bhardwaj, B. R., and Malhotra, A. (2013). Green banking strategies: sustainability through corporate entrepreneurship. Greener J. Bus. Manag. Stud. 3, 180–193. doi: 10.15580/GJBMS.2013.4.122412343

Bin Amin, S., Taghizadeh-Hesary, F., and Khan, F. (2022). Facilitating green digital finance in Bangladesh: importance, prospects, and implications for meeting the SDGs. Econ. Law Inst. Asia Pacific 1, 143–165. doi: 10.1007/978-981-19-2662-4_7

Bose, S., Khan, H. Z., Rashid, A., and Islam, S. (2018). What drives green banking disclosure? An institutional and corporate governance perspective. Asia Pac. J. Manag. 35, 501–527. doi: 10.1007/s10490-017-9528-x

Bukhari, S. A. A., Hashim, F., and Amran, A. (2020). Green banking: a road map for adoption. Int. J. Ethics Syst. 36, 371–385. doi: 10.1108/IJOES-11-2019-0177

Bukhari, S. A. A., Hashim, F., and Amran, A. (2022). Pathways towards green banking adoption: moderating role of top management commitment. Int. J. Ethics Syst. 38, 286–315. doi: 10.1108/IJOES-05-2021-0110

Chen, J., Siddik, A. B., Zheng, G.-W., Masukujjaman, M., and Bekhzod, S. (2022). The effect of green banking practices on banks’ environmental performance and green financing: an empirical study. Energies 15:1292. doi: 10.3390/en15041292

Conley, J. M., and Williams, C. A. (2011). Global banks as global sustainability regulators?: the equator principles. Law Policy 33, 542–575. doi: 10.1111/j.1467-9930.2011.00348.x

Donthu, N., Kumar, S., Mukherjee, D., Pandey, N., and Lim, W. M. (2021). How to conduct a bibliometric analysis: an overview and guidelines. J. Bus. Res. 133, 285–296. doi: 10.1016/j.jbusres.2021.04.070

Durrani, A., Rosmin, M., and Volz, U. (2020). The role of central banks in scaling up sustainable finance–what do monetary authorities in the Asia-Pacific region think? J. Sustain. Finance Invest. 10, 92–112. doi: 10.1080/20430795.2020.1715095

Fankhauser, S., and Jotzo, F. (2018). Economic growth and development with low-carbon energy. Wiley Interdiscip. Rev. Clim. Chang. 9, 25–38. doi: 10.1002/wcc.495

Fernando, P. M. P., and Fernando, K. S. D. (2017). Study of green banking practices in the Sri Lankan context: a critical review. In Selected papers from the Asia-Pacific conference on economics & finance (APEF 2016). Springer, Singapore, (pp. 125–143).

Hickel, J., and Kallis, G. (2020). Is green growth possible? New Polit. Econ. 25, 469–486. doi: 10.1080/13563467.2019.1598964

Hoque, N., Mowla, M. M., Uddin, M. S., Mamun, A., and Uddin, M. R. (2019). Green banking practices in Bangladesh: a critical investigation. Int. J. Econ. Financ. 11:58. doi: 10.5539/ijef.v11n3p58

Ibe-enwo, G., Igbudu, N., Garanti, Z., and Popoola, T. (2019). Assessing the relevance of green banking practice on bank loyalty: the mediating effect of green image and bank trust. Sustainability (Switzerland) 11, 1–16. doi: 10.3390/su11174651

Islam, M. A., Yousuf, S., Hossain, K. F., and Islam, M. R. (2014). Green financing in Bangladesh: challenges and opportunities—a descriptive approach. Int. J. Green Econ. 8:74. doi: 10.1504/IJGE.2014.064469

Kala, K. N. (2020). A study on the impact of green banking practices on Bank’s environmental performance with special reference to Coimbatore City. African J. Bus. Econ. Res. 15:2020. doi: 10.31920/1750

Kanu, C., Ogbaekirigwe, C., Anon, O., Anon, N., Anon, C., Anon, C., et al. (2020). Green banking awareness, challenges and sustainability in Nigeria. Int. J. Mech. Eng. Technol. 11, 30–54. doi: 10.34218/ijmet.11.3.2020.005

Kapoor, N., Jaitly, M., and Gupta, R. (2016). Green banking: a step towards sustainable development. Int. J. Res. Manag. 6, 69–72.

Karyani, E., and Obrien, V. V. (2020). Green banking and performance: the role of foreign and public ownership. Jurnal Dinamika Akuntansi Dan Bisnis 7, 221–234. doi: 10.24815/jdab.v7i2.17150

Kumar, S. S., and Akula, R. (2023). Green banking practices of state Bank of India – some insights. Asian J. Econ. Bus. Account. 27–34, 27–34. doi: 10.9734/ajeba/2023/v23i4928

Leticia, D. S. I., and Ivete, D. (2022). Sustainable banking: a systematic review of concepts and measurements. Environ. Dev. Sustain. 24, 1–39. doi: 10.1007/s10668-021-01371-7

Meho, L. I., and Rogers, Y. (2008). Citation counting, citation ranking, and h-index of human-computer interaction researchers: a comparison of Scopus and web of science. J. Am. Soc. Inf. Sci. Technol. 59, 1711–1726. doi: 10.1002/asi.20874

Mir, A. A., and Bhat, A. A. (2022). Green banking and sustainability – a review. Arab Gulf J. Sci. Res. 40, 247–263. doi: 10.1108/AGJSR-04-2022-0017

Monasterolo, I. (2020). Climate change and the financial system. Ann. Rev. Resour. Econ. 12, 299–320. doi: 10.1146/annurev-resource-110119-031134

Nath, V., Goel, A., and Singhal, N. (2017). Development of model on adoption of green banking in Indian banking sector. IMPACT Int. J. Res. Bus. Manag. 5, 11–20.

Nath, V., Nayak, N., and Goel, A. (2014). Green banking practices – a review. IMPACT Int. J. Res. Bus. Manag. 2, 45–62.

Nawaz, M. A., Seshadri, U., Kumar, P., Aqdas, R., Patwary, A. K., and Riaz, M. (2021). Nexus between green finance and climate change mitigation in N-11 and BRICS countries: empirical estimation through difference in differences (DID) approach. Environ. Sci. Pollut. Res. 28, 6504–6519. doi: 10.1007/s11356-020-10920-y

Ozili, P. K. (2022). Green finance research around the world: a review of literature. Int. J. Green Econ. 16:1. doi: 10.1504/IJGE.2022.10048432

Park, H., and Kim, J. D. (2020). Transition towards green banking: role of financial regulators and financial institutions. Asian J. Sustain. Soc. Responsib. 5, 1–25. doi: 10.1186/s41180-020-00034-3

Qureshi, M. H., and Hussain, T. (2020). Green banking products: challenges and issues in Islamic and traditional banks of Pakistan. J. Account. Finance Emerg. Econ. 6, 703–712. doi: 10.26710/jafee.v6i3.1177

Ramya, S. (2017). A study on service quality of green banking services through SERQUAL model. Pezzottaite J. 6, 2918–2928.

Raut, R., Cheikhrouhou, N., and Kharat, M. (2017). Sustainability in the banking industry: a strategic multi-criterion analysis. Bus. Strateg. Environ. 26, 550–568. doi: 10.1002/bse.1946

Rehman, A., Ullah, I., Afridi, F.-A., Ullah, Z., Zeeshan, M., Hussain, A., et al. (2021). Adoption of green banking practices and environmental performance in Pakistan: a demonstration of structural equation modelling. Environ. Dev. Sustain. 23, 13200–13220. doi: 10.1007/s10668-020-01206-x

Richardson, B. J. (2009). Climate finance and its governance: moving to a low carbon economy through socially responsible financing? Int. Compar. Law Quart. 58, 597–626. doi: 10.1017/S0020589309001213

Risal, N., and Joshi, S. K. (2018). Measuring green banking practices on Bank’s environmental performance: empirical evidence from Kathmandu valley. J. Bus. Soc. Sci. 2, 44–56. doi: 10.3126/jbss.v2i1.22827

Rubel, M. R. B., Kee, D. M. H., and Rimi, N. N. (2020). The influence of green HRM practices on green service behaviors: the mediating effect of green knowledge sharing. Empl. Relat. 43, 996–1015. doi: 10.1108/ER-04-2020-0163

Sajovic, I., Tomc, H. G., and Podgornik, B. B. (2018). Bibliometric study and mapping of a journal in the field of visualization and computer graphics. Collnet J. Scientometrics Inf. Manag. 12, 263–287. doi: 10.1080/09737766.2018.1453677

Selvaraj, S. (2022). A conceptual study on factors influencing green banking facilities in India. J. Corp. Finance Manag. Bank. Syst. 31, 17–22. doi: 10.55529/jcfmbs.31.17.22

Sharma, M., and Choubey, A. (2022). Green banking initiatives: a qualitative study on Indian banking sector. Environ. Dev. Sustain. 24, 293–319. doi: 10.1007/s10668-021-01426-9

Shaumya, K., and Arulrajah, A. A. (2017). Measuring green banking practices: evidence from Sri Lanka. SSRN Electron. J. 5, 77–90. doi: 10.2139/ssrn.2909735

Shaumya, S., and Arulrajah, A. (2017). The impact of green banking practices on banks environmental performance: evidence from Sri Lanka. J. Finance Bank Manag. 9, 92–102. doi: 10.15640/jfbm.v5n1a7

Sivertsen, G. (2014). Scholarly publication patterns in the social sciences and humanities and their coverage in Scopus and Web of Science. Proceedings of the science and technology indicators conference, Leiden, 598–604.

Sullivan, S. (2013). Banking nature? The spectacular Financialisation of environmental conservation. Antipode 45, 198–217. doi: 10.1111/j.1467-8330.2012.00989.x

Sun, H., Rabbani, M. R., Ahmad, N., Sial, M. S., Guping, C., Zia-Ud-din, M., et al. (2020). CSR, co-creation and green consumer loyalty: are green banking initiatives important? A moderated mediation approach from an emerging economy. Sustainability (Switzerland) 12, 1–22. doi: 10.3390/su122410688

Tara, K., Singh, S., and Kumar, R. (2015). Green banking for environmental management: a paradigm shift. Curr. World Environ. 10, 1029–1038. doi: 10.12944/cwe.10.3.36

Upadhyay, R. K. (2020). Markers for global climate change and its impact on social, biological and ecological systems: a review. Am. J. Climate Change 9, 159–203. doi: 10.4236/ajcc.2020.93012

Weber, O., and Feltmate, B. (2016). “Introduction to sustainable banking” in Sustainable banking: managing the social and environmental impact of financial institutions (Toronto: University of Toronto Press).

Yip, A. W. H., and Bocken, N. M. P. (2018). Sustainable business model archetypes for the banking industry. J. Clean. Prod. 174, 150–169. doi: 10.1016/j.jclepro.2017.10.190

Yu, X., Mao, Y., Huang, D., Sun, Z., and Li, T. (2021). Mapping global research on green finance from 1989 to 2020: a bibliometric study. Adv. Civil Eng. 2021, 1–13. doi: 10.1155/2021/9934004

Zhixia, C., Hossen, M. M., Muzafary, S. S., and Begum, M. (2018). Green banking for environmental sustainability-present status and future agenda: experience from Bangladesh. Asian Econ. Financial Rev. 8, 571–585. doi: 10.18488/journal.aefr.2018.85.571.585

Keywords: green banking, green banking strategies, sustainability, bibliometric analysis, VosViewer

Citation: Taneja S, Bansal N, Johri A, Asif M and Shamsuddin Z (2024) Mapping the landscape of green banking strategies: a bibliometric approach. Front. Sustain. Cities. 6:1404732. doi: 10.3389/frsc.2024.1404732

Edited by:

Qaisar Ali, Bandung Institute of Technology, IndonesiaReviewed by:

Olatunji Shobande, University of Aberdeen, United KingdomMuhammad Bilal Zafar, Minhaj University Lahore, Pakistan

Copyright © 2024 Taneja, Bansal, Johri, Asif and Shamsuddin. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Sanjay Taneja, ZHJzYW5qYXl0YW5lamExQGdtYWlsLmNvbQ==; Amar Johri, am9ocmlhbWFyQGdtYWlsLmNvbQ==

Sanjay Taneja

Sanjay Taneja Neha Bansal3

Neha Bansal3 Amar Johri

Amar Johri Mohammad Asif

Mohammad Asif