- 1VIT Business School, Vellore Institute of Technology (VIT), Vellore, India

- 2Finance and Accounting, Indian Institute of Management Nagpur (IIMN), Nagpur, Maharashtra, India

Introduction: The study explores the influence of Status Quo Bias theory constructs and the mediating role of inertia on individuals' resistance in making sustainable green home investment decisions among Indian homeowners and prospective homebuyers.

Methods: A structured questionnaire was administered to 404 participants, and data analysis was performed using Partial Least Squares Structured Equation Modeling (PLS SEM).

Results: The findings indicate that factors such as loss aversion, transition costs, adherence to social norms, and self-efficacy to change significantly contribute to individuals' resistance to green home investments. Inertia further amplifies the relationship between transition costs, social norms, and self-efficacy to change, but does not mediate the impact of loss aversion.

Discussion: This study is valuable for enhancing our understanding of biases in decision-making processes. To combat this resistance, it is crucial to provide clear information about the benefits of green home upgrades and offer incentives that reduce perceived costs and risks. This research sheds new light on the influence of status quo bias and inertia specifically within the context of green home investment decisions, addressing contemporary concerns for environmental sustainability and the increasing importance of such decisions in today's world.

1 Introduction

The residential housing sector is important for all countries around the world, serving a key role in sustainable development (Hoda et al., 2020; Salim and Abu Dabous, 2022). The rise of climate change has created a need for individuals, organizations, and governments to take proactive steps toward reducing their carbon footprint (Li et al., 2020). Due to COVID 19, residentials are at indoor and utilizing most of the energy consuming devices results in further increasing global warming. As a result, the current built environment (non-conventional homes) significantly affects our general health and wellbeing (Dodo et al., 2020), which motivates the current landlords, homeowners, and prospective homebuyers in view of making an investment decision on green homes. Green homes, also known as sustainable homes, are designed to reduce energy consumption, reduce waste, and use environmentally friendly materials. They are becoming increasingly popular as people become aware of the benefits of living in a green home, such as lower energy bills, improved indoor air quality, and a reduced impact on the environment (Zuo et al., 2017; Bhatt et al., 2019; Zhang and Liu, 2021; Ang et al., 2022; Debrah et al., 2022). An environmentally friendly home should be built to take advantages of these resources, resulting in an improved indoor environment and lifestyle (Altomonte et al., 2017). However, despite the increasing popularity of green homes, there still exists resistance toward making the investment because it is highly costly in practice because of the non-readily availability of green construction materials and contractors, particularly in developing countries, which incurs a high search cost (Yue et al., 2020; Bergers, 2022). Since the green premium involves efficient mechanical systems, which are fairly pricey, and a sophisticated, lengthy design process, green building further expenses range from 1 percent to 10 percent (Geng et al., 2019; Nagrale and Sabihuddin, 2020).

Previous research that utilized the Life Cycle Cost (LCC) method found that the expenses for operating and maintaining a system or asset in the future will be three and a half times higher than the initial cost of acquiring it (Dwaikat and Ali, 2016). A financial model showed that projects that are certified under the Leadership in Energy and Environmental Design (LEED) programme cost 10% more than the projects that are not certified (Mao and Yang, 2011). The main reason for this increase in cost is attributed to the high cost of materials and labor which make up the majority of expenses in green building projects (Ross et al., 2007). The business environment is undergoing rapid changes due to an increasing focus on sustainability of the environment, prompting businesses to investigate the costs and advantages of their marketing mix being “green” (Leonidou et al., 2012).

Green homes are expensive (Lockwood, 2008), which takes time and effort in their application, which makes the individual highly resistant to a green home investment decision compared to non-conventional homes (Hofman et al., 2022). There are no explicit incentives in India for creating energy-efficient homes or businesses (Grover, 2015). The majority of individuals save a substantial portion of their disposable income (around 40%) to either buy a new home, build one from scratch, or renovate their current property (Jeon, 2018; WHO, 2020).

Despite the increasing awareness and understanding of the environmental benefits of green homes, many individuals and households continue to face resistance toward making investments in green homes (Ezhilarasi, 2021). There is a significant concern, as the widespread adoption of green homes is essential for reducing greenhouse gas emissions, conserving resources, and improving the overall quality of life. The objective of this study is to investigate the reasons behind the resistance toward green home investment and to identify strategies to overcome these challenges.

Previous research (Darko and Chan, 2016) has found that losses and threats are sources of resistance. This study aims to understand the impact of status quo bias and inertia on resistance toward green home investment decisions. The status quo bias (SQB) refers to the tendency for individuals to prefer things to stay the same, even when change would lead to a better outcome (Samuelson and Zeckhauser, 1988).

Recent studies indicate that this bias can affect a variety of decision-making contexts, but there is limited research on its impact on green home investment decisions specifically. Studies that have been conducted in this area have primarily focused on the role of these biases in energy conservation behaviors rather than on green home investments (Alsaadani, 2022). Additionally, most of these studies have focused on residential energy conservation behaviors whereas green home investments encompass a wider range of environmentally-friendly options such as solar panels, green roofs, and other building materials.

Further research is necessary to thoroughly comprehend the impact of status quo bias on green home investment decisions and to develop successful approaches to overcome this bias and encourage more people to invest in environmentally friendly homes. The goal is to promote wider adoption of green home investments.

As a result, SQB theory is a convenient theoretical approach for understanding people's aversion to investing in green homes, which has not yet been researched. Thus, the mechanisms and backgrounds of resistance to green home investment decisions establish significant and motivating research questions.

RQ1: Can perceived SQB theory variables impact resistance toward green home investment decisions for sustainability?

Inertia is a belief and a way of thinking that come from what people have done in the past. They make it easier to stick with the status quo because they don't have to think about other options or make new plans (Henderson et al., 2020). It is a propensity to continue the existing state in which an individual's personal characteristics have a robust association with status quo bias. Hence, the research question can be taken as

RQ2: Does inertia mediate the association between SQB perspective and on resistance toward green home investment decision?

This research study provides a road map for investors to make appropriate investment decisions related to green homes.

The study recommends a research model built on the SQB theory to solve the above-stated research question. This research work is laid out as a theoretical framework, literature review, model and hypothesis, research methods, statistical tools applied to analyze the data with reasons, data and results from analysis and subsequent findings, with theoretical and practical implications and conclusion.

2 Related literature

2.1 Theoretical framework

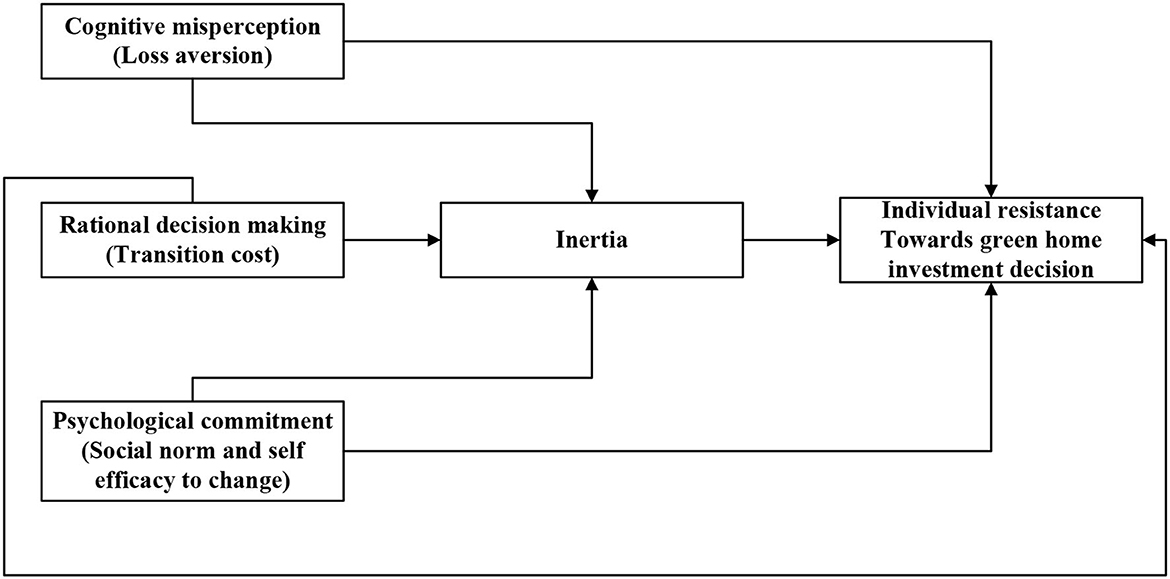

The SQB theory suggests that individuals may have a tendency to stick with what they are familiar with and resist change, even if it is potentially beneficial. The SQB theory outlines three categories that can be used to explain human decision-making. These categories are: cognitive misperceptions, which refer to incorrect beliefs or perceptions; rational decision-making, which involves using systematic and logical analysis; and psychological commitment, which encompasses an individual's emotional attachment to a decision (Samuelson and Zeckhauser, 1988). The first component of misconception is a cognition that has been tainted by our prevailing values or beliefs. Cognitive misconception enables people to realistically weigh the costs and advantages that serve as a foundation for deciding whether to accept or reject a change (Godefroid et al., 2022). Losses in value are perceived as being more serious than gains, which is a mental condition known as loss aversion (Samuelson and Zeckhauser, 1988).

The second concept, rational decision-making, shows how people think through the advantages and values gained from switching to a new system (Godefroid et al., 2022). People are less likely to switch to a new system when they perceive higher switching costs or any potential threats related to the new technology (Li et al., 2016; Zhang et al., 2017). In addition to the expenses previously incurred (a “sunk cost”), which people estimate as the cost necessary to invest further funds in order to adapt to a new system, rational decision-making also includes essential transition costs.

The third concept of psychological commitment refers to the internal commitment people maintain when they oppose acceptance of a new system. Psychological commitment commonly arises due to two motives: (i) social norms are cultural goods, such as beliefs, practices, and traditions, that reflect people's fundamental understanding of what other people do and what other people believe they should do (Li et al., 2016). (ii) Control, which is measured in terms of self-efficacy to change, refers to the person's ability to change.

2.2 Review of existing literature

Status Quo Bias is a result of behavioral theories' perspectives and has been widely researched in the decision-making discipline areas of economic choices (Masatlioglu and Ok, 2005), marketing (Yen and Chuang, 2008; Labrecque et al., 2016; Zarifis et al., 2021), healthcare systems (Zhang et al., 2017; Chi et al., 2020), knowledge management systems (Li et al., 2016), innovation (Claudy et al., 2014), and AI-Powered Voice Assistants (Balakrishnan et al., 2021; Chaudhuri et al., 2023), resistance toward organization automation success (Almatrodi et al., 2023), investment decision (Mamidala et al., 2023). The radical growth of new technologies and people's varied approaches to adoption, however, have recently drawn new interest from researchers to the SQB theory.

Affective, cognitive, and behavioral components of change resistance cause an individual to psychologically reject making a change (Forsell and Åström, 2012). Cognitive rigidity is a type of stubbornness that involves a refusal to examine different ideas and viewpoints (Oreg, 2003). The encouraging aspects for GBs at the individual level comprise numerous emotional aspects, counting perceived value, ethical wants, behavioral control, and ecological beliefs (Pilkington et al., 2011; Aliagha et al., 2013). Bergers (2022) carried out the research by using status quo bias variables and individual differences from price management perspective and found that there exists significant effect on these variables on price management. Ayuthia et al. (2020) explored the perceptions of potential home buyers toward green residential buildings. They used qualitative methodology, while face-to-face interview have been the primary source of data collection. According to the study, 81% of potential residents agreed that green buildings may save money on utilities and that adopting air flows and circulation can reduce heat. The study also discovered that 67% of respondents were uninformed of the notion green residential buildings, while the remaining 23% were aware of the concept but had only a hazy understanding of it. Darko and Chan (2016) present a systematic evaluation of research available in academic journals on challenges to green building adoption. The most commonly stated impediments in the literature include lack of information, incentives, interest, demand, and high cost involved. Another major setback is the lack of GB norms and laws. Recommendations are made to address the obstacles and make GB adoption easier. De Bruin and Flint-Hartle (2003) found that people who invest in residential properties do not display perfect knowledge, but rather imperfect understanding and contentment with its limitation behavior, using a postal survey. Hammond (2019) results show that as an outcome of social norms and SQB, people abandon the profits connected with green construction and instead employ traditional, non-green methods of construction, even though there is a provision of proper incentives. Shu and Bazerman (2011) explored how the three cognitive variables—positive illusion, tendency to discount the future, and egocentrism have an impact on behavioral decision making in particular with respect to environmental climate change. Grover (2015) aimed to improve the degree of knowledge about residential green buildings among developers, buyers, and local governments in India's Tier-II cities. The findings demonstrate that housing green buildings can be built in Tier-II cities in India if all of the above-mentioned parties involved in the course of housing green building development work together.

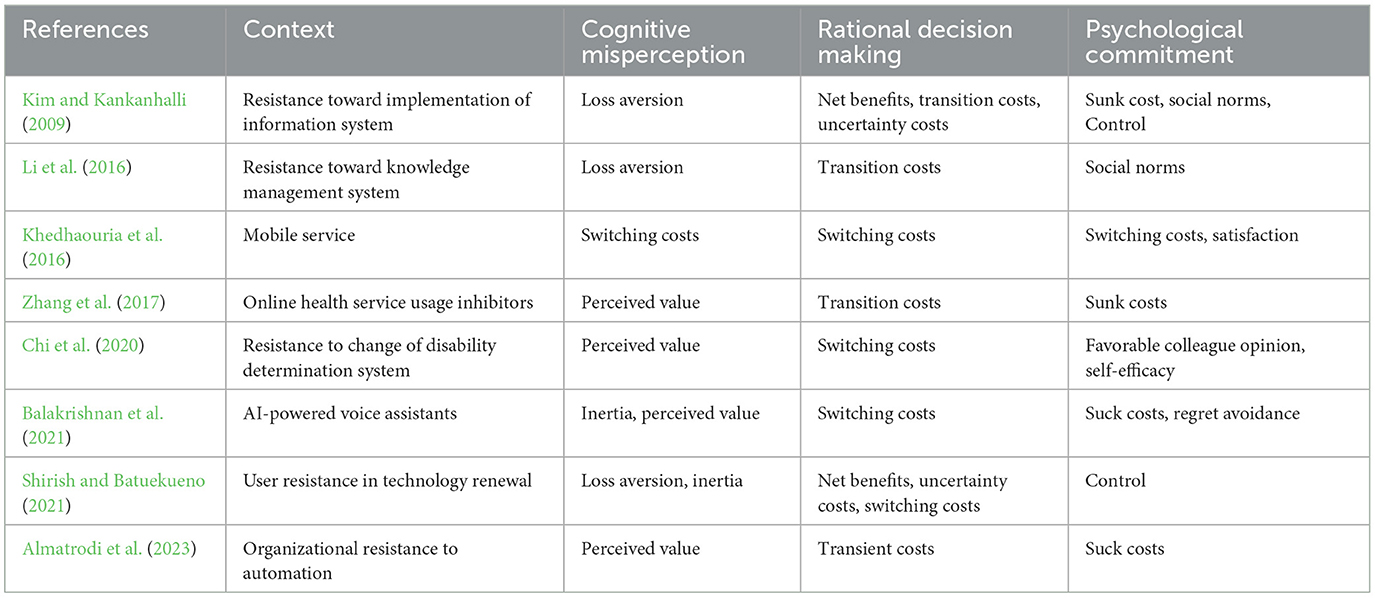

Previous study suggest that green homes offer numerous advantages to homeowners, including enhanced health and productivity, lower water and energy usage, lower operational and maintenance expenses, and better interior eco-friendliness (Kats et al., 2003; Zarifis et al., 2021). However, due to a lack of understanding or misunderstanding regarding these benefits, the number of current landlords, prospective homebuyers, and homeowners that invest in green measures remains low (De Vries et al., 2019). The market for green residential construction is now quite limited, owing to a 30% cost increase over a normal home. This scenario exists because human investment decisions and behavior are greatly influenced by biases and emotions that deviate from the conventional economic theory of rationality, according to the explanation of the concept of bounded rationality (Dolan et al., 2012). Adoption of or resistance to a green home investment decision is primarily an individual decision. Hence, research about resistance to adoption of green home investment decisions should emphasis on an individual viewpoint. But it has been observed that people-oriented research was lacking from the literature review. However, SQB theory variables and inertia acting as a mediating variable have not been tested together (Zhang et al., 2017). Table 1 reports a list of variables reported in the literature. To address this research gap, we examine individuals' resistance to green home investment decisions based on the SQB theory from their viewpoint. Additionally, the mediating impact of inertia on the variables of SQB theory (loss aversion, transition costs, social norm, and self-efficacy to change) is examined.

Table 1. Summary of literature on variables related to three core aspects of status quo bias theory.

2.3 Model and hypothesis

Adapting from the earlier theoretical thoughts and to respond to the planned research query, a model was developed. In economics, psychology, and rational choice theory, this prejudice has been thoroughly documented (Samuelson and Zeckhauser, 1988). As a result, the SQB theory gives a valuable theoretical clarification for the phenomenon in which people prefer to stick with an existing approach rather than move to a new (perhaps better) one.

2.3.1 Cognitive misperception and individual resistance

The initial concept for status quo bias is the cognitive misinterpretation of loss aversion, which refers to people's tendency to strongly avoid potential losses and be less motivated by potential gains (Samuelson and Zeckhauser, 1988). Loss aversion is a mental phenomenon that has been found in human decision-making, where individuals place more weight on potential losses than on potential gains in their evaluation of value (Kahneman et al., 2000). Loss aversion can contribute to status quo bias, as even small losses that may occur from altering one's current situation impact an individual's decision-making (Passarelli and Del Ponte, 2020). Individuals are more likely to want to prevent losses than to maximize earnings (Kahneman and Tversky, 1990).

Green homes have several advantages over traditional houses. They not only help the environment but also result in reduced costs over their lifetime and provide other benefits (Dwaikat and Ali, 2016). However, there are cost (losses) associated with the practice (Ezema et al., 2016); high capital and transaction costs (Darko and Chan, 2016); and furthermore, conventional (non-green) buildings can serve as a substitute for green buildings, i.e., conventional structures can meet the basic needs of human habitat despite the fact that they are not green. As a result, the losses will appear to be greater than the gains because homeowners and prospective property purchasers are satisfied. This will lead to a desire for familiarity, despite the fact that the benefits of moving to a green home outweigh the expenses. Due to status quo bias, they will misunderstand the true costs and benefits, resulting in a preference for traditional (non-green) housing even if green housing is viewed as preferable.

According to the phenomenon of cognitive misperception of the fear of loss, any apparent loss as a result of deciding to invest in green housing will be met with opposition. Even if the individual sees other advantages to having a green home, he or she will have a strong desire to avoid investing in green homes. As a result, the subsequent hypothesis is set.

H1: Loss aversion is certainly linked with green home investment decision resistance.

2.3.2 Rational decision-making and resistance

The second construct for status quo bias is rational decision-making. Before switching to a new option, rational decision-making requires a cost-benefit analysis. Status quo bias occurs when costs exceed benefits. From the perspective of rational decision-making, the researchers identify “transition cost” as a construct in this study. The costs of adjusting to a new circumstance are known as “transition costs.” High switching costs have been hypothesized to reduce the net benefits or perceived value of the change to users and hence have an indirect positive impact on user resistance (Kim and Kankanhalli, 2009). Transient costs are one of the costs that occur during the change (Burnham et al., 2003). Green homes are more expensive to build than conventional (non-green) structures, and the additional costs include higher labor costs as well as installation costs that adhere to design criteria for GB technologies like solar heating equipment and ground-source heat pumps, in addition to their higher purchase and acquisition costs (Darko and Chan, 2016).

In the current study, transient costs include switching costs like acquisition costs, installation costs, and usability costs. When an individual views the transition costs as high enough to balance out the transition benefit, he or she will resist the green home purchase or investment decision, giving consideration to the transition costs in rational decision-making

H2: Transition cost is positively associated with green home investment decision resistance.

2.3.3 Psychological commitment and resistance

The final construct underpinning status quo bias is “psychological commitment.” Hence, the current study focuses on social norms and control, using self-efficacy to change as a proxy for control over psychological commitment.

Individuals' basic understanding of what others do and what others believe they should do is represented by social norms. In this context, social norms mention the opinions of family members, friends, relatives, and neighbors about the resistance attitude toward green home investment decisions, which can either strengthen or impair someone's SQB. Individuals are expected to return the favor by listening to the views of those in the group. Because people draw their signals from what others do and compare their own behavior to it, social norms can have an impact on behavior (Clapp and McDonnell, 2000). Therefore, social norms should have a positive effect on green home investment decision resistance. So, the following hypothesis is proposed for testing:

It “is concerned with the assessments of what one can do with whatever skills one possesses, rather than the skills one possesses” (Wang and Netemeyer, 2002). Through its implications on transition costs, self-efficacy for change may also affect individuals' resistance (Rastekenari et al., 2013). Individuals are less likely to sense nervousness and ambiguity about change if they possess a strong sense of their ability to change (Tang et al., 2019). People with low self-efficacy focus on risks that should be avoided, whereas those with high levels of self-efficacy develop the flexibility and fortitude desired in indefinite conditions (Kim and Kankanhalli, 2009).

H3: Social norms and self-efficacy to change are positively associated with the intention to resist green home investment decisions.

2.3.4 Inertia and resistance

The physical force that maintains anything in a fixed position or in a single direction is known as inertia (Cambridge Advanced Learner Dictionary). In social science, the term “inertia” refers to an individual's personal characteristics that have a propensity to continue the existing state. Inertia can be explained by three components. They are an affective component of inertia, which explains the strong emotional attachment to the present style of doing it. According to behavioral component of inertia, the user continues to utilize the system merely because they have done so in the past (Hulland and Houston, 2021). Lastly, cognitive component of inertia explains why individuals knowingly remain to practice the system despite they are conscious that it might not always be the most effective or efficient approach to doing something (Oreg, 2003; Li et al., 2020). In the investment decision context, inertia refers to an individual's attachment to the current state even though the new alternative is better than the existing one (Henderson et al., 2020). It is important to keep in mind that inertia and SQB are distinct, where inertia is an individual's personal trait and SQB is a misunderstanding after the conversion choice investigation. Therefore, we hypothesized the following:

H4: Inertia has a significant positive relationship with resistance toward green home investment decisions.

2.3.5 Inertia as a mediator

The literature shows empirical evidence that loss aversion leads to a heightened sensitivity to the potential losses associated with making a change, such as investing in green home upgrades. This heightened sensitivity can increase the perceived effort required to make the change, which in turn increases the level of resistance due to inertia (Polites and Karahanna, 2012; Fok and Henry, 2015). Also, individuals may perceive the transition costs as a loss, leading to loss aversion and resistance to change. Inertia amplifies this effect by increasing the perceived effort required to make the change, which can make individuals less likely to take action. Moreover, social norms refer to the unwritten rules and expectations that influence behavior within a given society (Chung and Rimal, 2016). For example, if the majority of people in a given community do not invest in green home upgrades, this can create a social norm that disincentivizes individuals from making such investments. Self-efficacy refers to an individual's belief in their ability to successfully complete a task or make a change. If individuals do not believe that they have the skills or resources required to make a change, this can decrease their self-efficacy and increase their resistance. Inertia can amplify the effect of social norms and self-efficacy to change on resistance toward green home investment decisions. Based on the above discussion, inertia may mediate the association between SQB and resistance toward acceptance of green home investment decisions. When individuals have high inertia traits, they will be more inclined to live in non-green homes, and vice-versa. So, the influence of social bias theory variables on resistance toward green home investment decisions will be stronger and vice versa.

In light of the above literature, the relationships were hypotheses as

H5: Inertia mediates the relationship between Loss aversion and resistance toward green home investment decision.

H6: Inertia mediates the relationship between Transition cost and resistance toward green home investment decision.

H7: Inertia mediates the relationship between social norms, self-efficacy to change and resistance toward green home investment decision.

After formulating the hypothesis, a need has been felt to structure a model for the current study and the following research model has been prepared by the researchers depicted in Figure 1.

3 Methods

The methods section includes a list of stages, each of which will be detailed in the following chapter. The purpose of this study was to examine the influence of status quo bias theory variables on inertia and resistance toward adopting green home investment decisions. Choosing the scales that would be used to measure the aforementioned constructions was the first step in the process. After that, a survey was carried out. Using the results of the survey, one can evaluate the confirmatory factor analysis as well as a second-order factor model to assist in determining the characteristics of each scale. The last step was to conduct an experiment to evaluate the research hypothesis that inertia plays a role in resistance to the acceptance of real estate investment decisions.

3.1 Data collection

This study targeted in India with homeowners who live in conventional homes and prospective home buyers. Quota sampling (Etikan, 2017; Iliyasu and Etikan, 2021) was used to select the sample and data was collected through a self-administered questionnaire. We employed quota sampling to ensure a balanced representation of two critical categories: “Homeowners” and “Prospective Home Buyers,” with 49 and 51% of respondents respectively and to facilitate meaningful comparisons between these groups, aligning with the research objectives and potential population distribution. Informed consent was obtained from all participants, who were then provided with structured questionnaires to capture their perspectives on green home investments. The data collected was subsequently analyzed to draw insights into the investment decisions of these two distinct groups, all while adhering to strict ethical guidelines and data protection measures throughout the process. This approach allowed us to comprehensively explore the dynamics at play when “Homeowners” and “Prospective Home Buyers” consider green home investments.

The questionnaire consisted of two sections, one for demographic information and the other for questions on main constructs, such as status quo bias theory variables, inertia, and resistance toward green home investment decisions. The items were measured using a five-point Likert scale, with the responses ranging from “strongly agree” to “strongly disagree.” The survey was conducted online, as it allowed for a wider geographical reach (Coppock and McClellan, 2019), and a total of 494 responses were received. After removing responses with errors such as missing or inaccurate data, 404 responses were qualified for analysis with a response rate of 81.7%.

3.2 Measurement tools

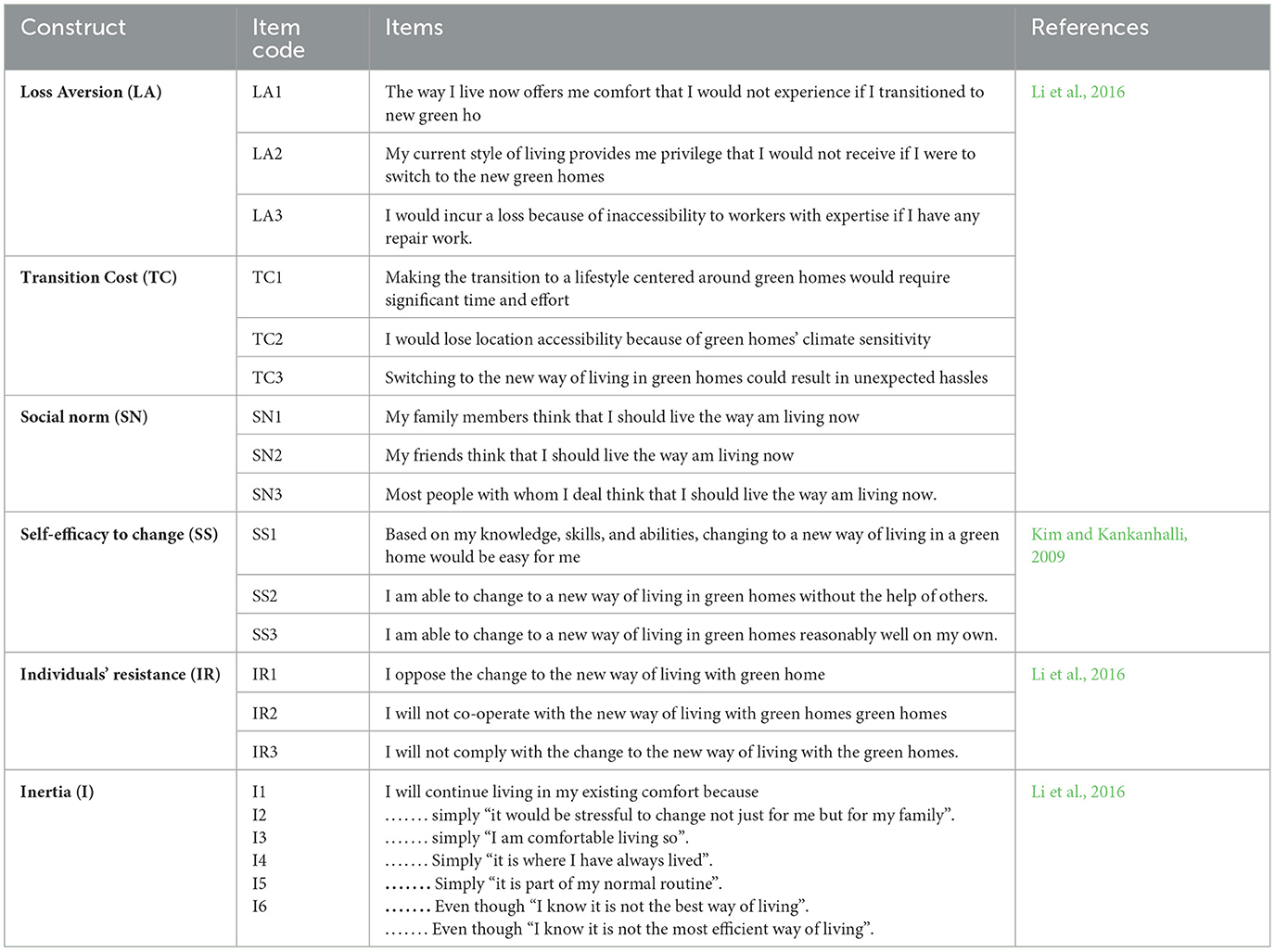

The measure for SQB theory variables like Loss aversion, Transition cost, Social norms, Inertia and Individual resistance was adapted from Li et al. (2016), the measure for self-efficacy to change was adapted from Kim and Kankanhalli (2009). The present study used measurement scales based on previously validated instruments, with slightly modified item statements, as shown in Table 2. Additionally, the study aimed to examine the demographic profiles of home buyers and owners. The SEM technique was applied using PLS 3.0, and the latent construct was considered reflective.

4 Data analysis and results

In this study, there are three stages to the analysis of data. The first stage of analysis deals with studying the characteristics of the respondent. Then measurement model was evaluated for the validity and reliability after first analyzing the demographic information. The structural model is examined in the third stage to determine how the hypothesis relate to one another. The data was analyzed using Smart PLS 3.0. The reason for using PLS-SEM is first, a study with prediction-oriented goals can benefit from using PLS-SEM. It is also adaptable because models can include both formative and reflective measures (Martínez and Cervantes, 2021).

4.1 Descriptive statistics

In this research article, we present a comprehensive demographic profile of our study's participants, shedding light on the characteristics of the surveyed population as indicated in Table 3. Our data is drawn from a survey, and it encompasses a diverse range of demographic variables. Firstly, with regards to age distribution, we find that the majority of respondents fall into the 31–40 age group (44%), followed closely by those under 30 (37%), while individuals above 41 constitute 19% of the sample. Gender distribution indicates a predominance of male respondents (74%) compared to females (26%). Furthermore, educational qualifications are well-distributed among the participants, with post-graduates and professionals each comprising 24% of the sample, alongside those with graduation (23%) and less than graduation (19%). In terms of occupation, the private sector (36%) and business (29%) are the primary sources of employment, and income is fairly evenly distributed among income brackets. Notably, 54% of respondents are aware of green home investment decisions, and the sample is equally divided between homeowners (49%) and prospective home buyers (51%). These findings offer valuable insights for targeted marketing and decision-making in areas related to home investments and sustainable housing. Majority of the respondents, 74%, were male, with most being between the ages of 31–40 and 36% were privately employed.

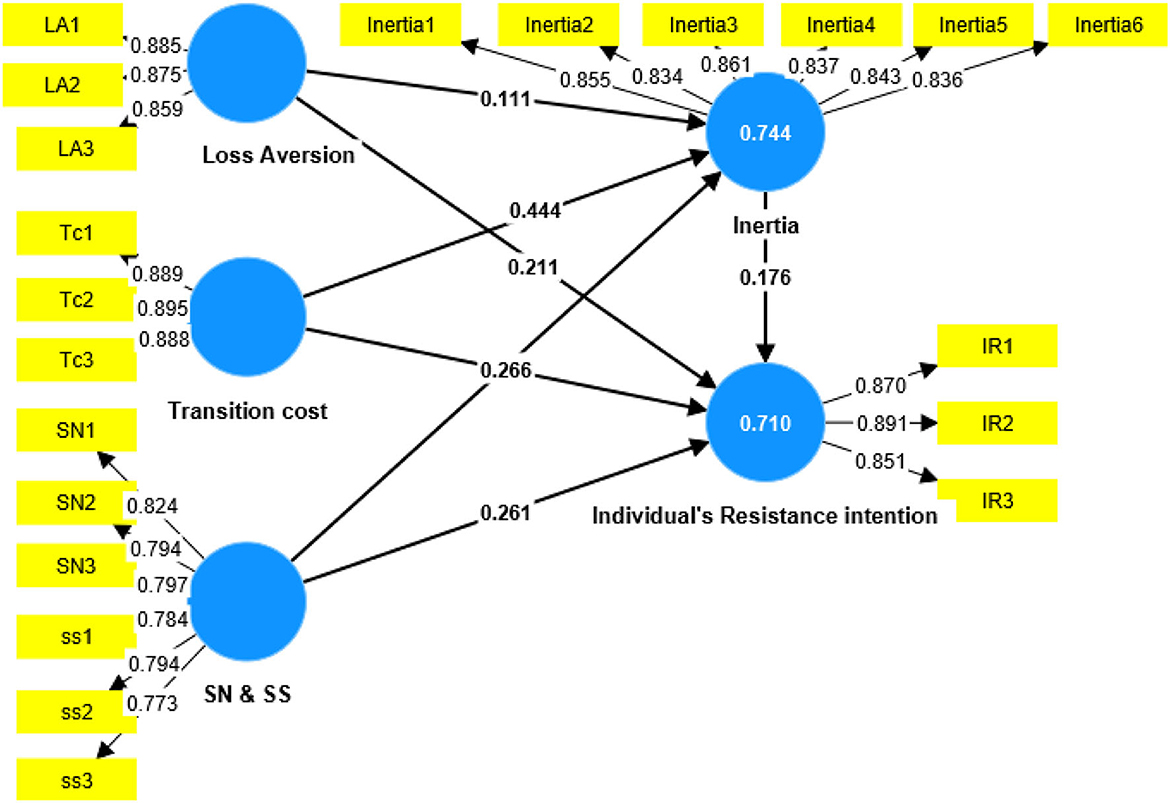

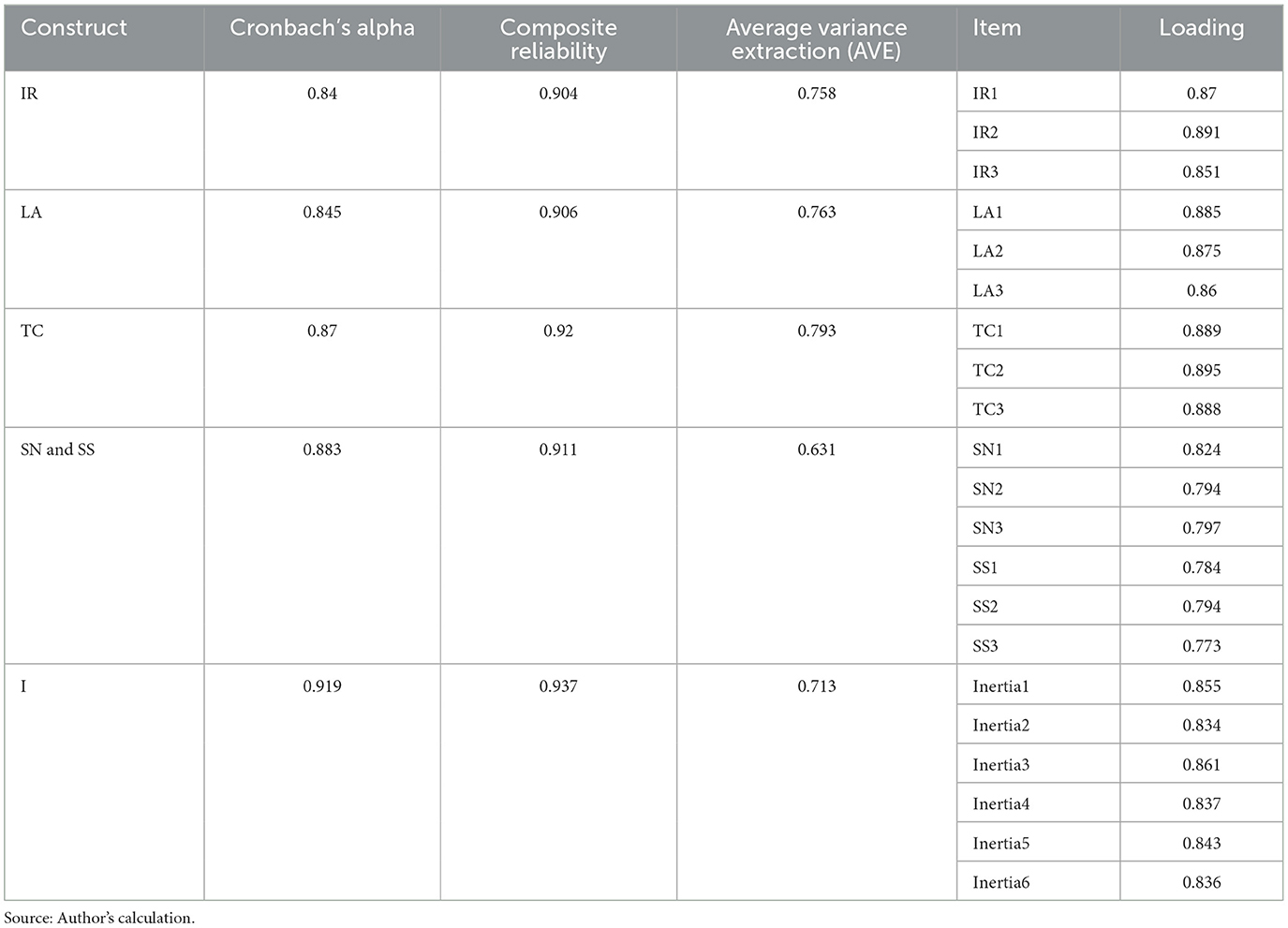

4.2 Measurement model

As the initial stage of Smart-PLS is executed, the measurement model is obtained (Figure 2). It displays the reliability and validity (convergent and discriminant validity) of the scales that were employed. The findings from the measurement model in this investigation are presented in Table 3. The permissible ranges were indicated by the factor loadings for the items used to calculate each variable: specifically, they should be >0.7 (Hair et al., 2013). The cut-off value is exceeded by all values found in factor loadings. The obtained Cronbach's alpha for reliability values also meets the established criteria that they should be near 1. The obtained values, which fall within the range of 0.773 to 0.895, satisfy the requirements for Cronbach's alpha reliability (Hair et al., 2011). Additionally, the literature specifies a threshold value of 0.5 for the average variance extraction. The variables are legitimate because all of the values acquired from the measurement model in the study are higher than the stated threshold, additional proof of variables used in the study are valid which is represented in Table 4.

4.3 Discriminant validity

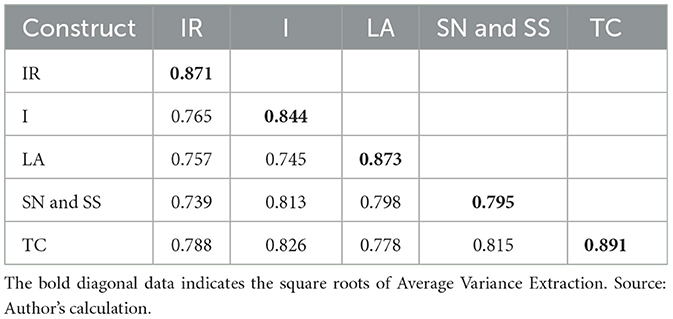

The degree to which a construct differs from other constructs is determined by its discriminant validity (Hair et al., 2013). The Fornell and Larcker criterion was used to further validate the data in this study. Table 3 show the values of the Fornell and Larcker criterion.

According to the Fornell-Larcker criterion, a construct should share more variance with its indicators than with other constructs in the model if it has appropriate discriminant validity. To put it another way, the values of the correlations between the construct and other constructs should be smaller than the square root of the construct's AVE (Hair et al., 2011). Table 5 makes it evident that the square root values were greater than the other values in their respective rows and columns, satisfying the criteria for the constructs' discriminant validity.

4.4 Structural model

Through the results of bootstrapping with 5,000 resampling, the hypotheses are put to the test. Table 5 demonstrates the bootstrapping results along with the algorithm of a structural model which is depicted in the Figure 3.

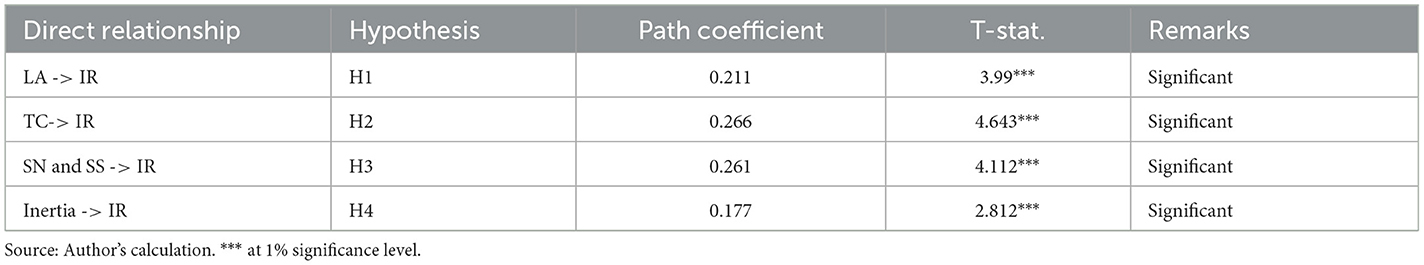

4.4.1 Direct relationships of latent variables

Table 6 demonstrates that all the direct hypotheses have strong path coefficients and T values. For the first, second, and third hypotheses that address the influence of loss aversion (β = 0.211, t-statistic = 3.99, p-value = 0.000), transition cost (β = 0.266, t = 4.643, p-value = 0.000), social norms, and self-efficacy to change (β = 0.261, t-statistics = 4.112, p-value = 0.000) on individuals' resistance intention toward green home investment decisions is found to be significant. S0 H1, H2, and H3 have not been rejected at a 5% significance level. Finally, Hypothesis 4 was also not rejected, confirming the significant relationship of Inertia which is also the mediator in the study, and resistance toward green home investment decisions.

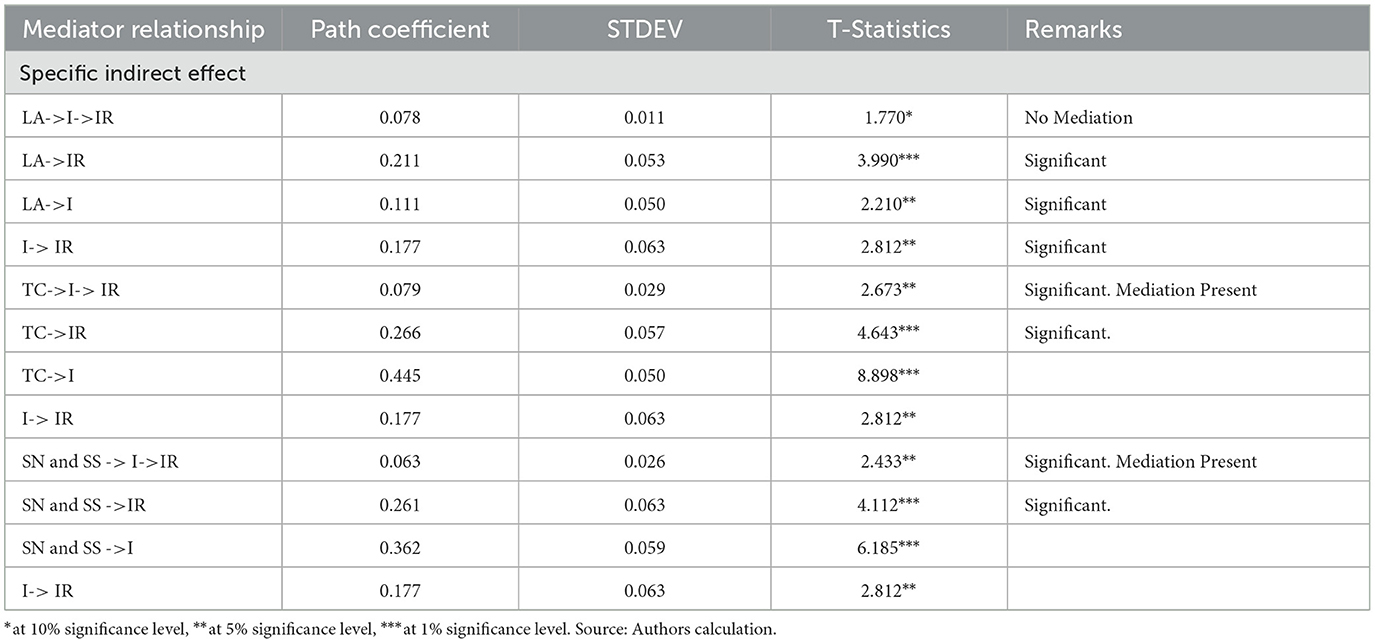

4.4.2 Mediating relationships of latent variables

Table 7 shows the results of mediation of inertia between loss aversion, transition cost, social norms, self-efficacy to change, and resistance toward green home investment decisions. For Hypothesis 5, the specific indirect effects revealed that inertia is not mediate the relationship between loss aversion (β = 0.078, t-statistics = 1.77, p-value = 0.077) and resistance toward green home investment decision. Regarding Hypotheses 6 and 7, complimentary mediation of inertia was found between transition cost (β = 0.02, t-statistics = 2.673, p-value = 0.008) and social norms, self-efficacy to change (β = 0.063, t-statistics = 2.433, p-value = 0.015) on resistance toward green home investment decisions.

Therefore, only (transition cost, social norms and self-efficacy to change act as significant factors in Inertia and individuals' resistance intentions toward green home investment decisions.

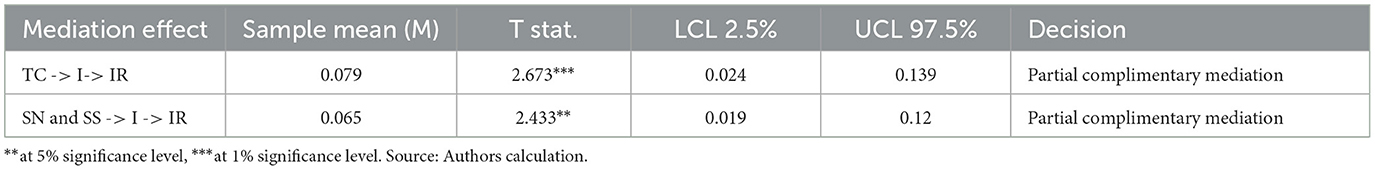

4.4.3 Complimentary mediation effect

As both direct and indirect effects were found to be significant, and the LCL 2.5% and UCL 9.5% of transition cost, social norm, and self-efficacy to change were found to be positive, it is evident that partial complementary mediation has happened shown in Table 8 (Zhao et al., 2010).

5 Discussion

First of all, loss aversion has a strong positive influence on individual resistance to green home investment decision-making. This shows that a homeowner may be reluctant to invest in green home upgrades because they are concerned about the cost of the investment and potential loss of money if the investment does not perform as expected. The homeowner may also be concerned about the potential loss of their current comfort level if the upgrade involves changing familiar systems or practices which increases the possibility of resistance toward a green home investment decision.

Second, transition Cost has a strong positive influence on individual resistance to green home investment decision-making. The costs include the initial investment required to upgrade to more energy-efficient systems or materials, as well as the costs of learning new habits or routines associated with using these systems effectively. This result suggests that the individuals who are more cost-conscious than the benefits of switching to green home investments have a higher possibility of resisting the investment decision.

Third, social norms have a positive impact on individual resistance to green home investment decision-making. This expresses that those individual's resistance to green home investment decision-making has been influenced by family members, friends, relatives, and neighbors. If the family members and the people with whom they deal are not supportive of green home investments, they may be less likely to make these investments, as they see it as deviating from the norm. Moreover, self-efficacy to change has an impact on individuals' resistance intention toward green home investment decision. This is because of by indirectly reducing switching costs.

Lastly, the positive influence of SQB theory variables transition cost, social norm, self-efficacy to change on individuals' resistance intentions except loss aversion is positively mediated by inertia. This means the people who are afraid of transition costs and social pressure like family, friends, and relatives, with low self-efficacy to change, and with high inertia (maintaining the existing state), will have a strong resistance to change, which leads to the resistance in green home investment decisions, and vice versa.

5.1 Theoretical implication

This research broadens the body of information in several ways. First, this study looks into a significant issue of individual resistance to green home investment decisions that dominated in the previous investment decision-making. Second, this research applies the existing SQB paradigm to green home investment decisions. The SQB framework has been utilized in other fields, but it has not been verified in the background of individual resistance to green home investment decisions. In order to position our hypotheses, this study has included additional theories like the cognitive psychology theory and the rational choice theory.

The knowledge gained from cognitive psychology theories is the source of psychological commitment and cognitive misperception. The theories used in this study gave researchers a comprehensive grasp of how individuals feel about their resistance toward green home investment decisions. This knowledge will help practitioners place their value plans appropriately.

5.2 Practical implications

The outcomes of this research can be useful for practitioners, particularly marketers, to tailor their strategic strategies. Using the findings of the study, the following strategic points are discussed in this section: Marketers can emphasize certain points in their marketing messaging by: (1) designing the benefits of green homes in order to break the effects of sunk costs and habits; (2) reducing the perceived costs of using green homes over non-green homes.

Marketing managers who aim to convince customers who use traditional construction methods to switch to green homes must create a slightly negative or uncertain emotional state by highlighting the downsides of their current homes in order to reduce their tendency to stick with the status quo. Managers may think about producing mildly positive and certainty-associated affective states, for example, by providing little rewards or a service guarantee to the individuals who make green home investment decisions.

Additionally, this study has some useful applications for government and the people. First, according to our findings, loss aversion is a key component that will have an impact on an individual's resistance to green home investment decision. To reduce any potential resistance behavior, government should minimize the perceived risk associated with shifting to green homes through subsidies, by reducing interest rates on green home loans, increasing the tax rate on the equipment used for the implementation of green home investment decisions, and forming awareness programs. Second, our results indicate that the transition costs are significant factors that will directly influence an individual's resistance to a green home investment decision. Third, our findings suggest that social norms are important determinants of behavior. Individual resistance to the green home investment decision. Individuals should make green practices a part of their culture, which helps to reduce or cope with resistance toward green home investment decisions.

To reduce the effect of loss aversion, transition costs, and societal rules on the resistance to green home investment by encouraging people on sustainability, eco-friendly behavior, innovative thinking, motivating or encouraging open-minded innovative ideas, and tolerating creation failure.

6 Limitation and future direction

To enhance the study's scope and address the dynamic nature of human behavior, particularly in the current volatile and unpredictable times, a transition from a cross-sectional design to a longitudinal research approach is warranted. Longitudinal research allows for the observation of changes and differences in human behavior over time, providing a more comprehensive understanding of how individuals' attitudes and decisions regarding green home investments evolve in response to various economic, social, and environmental factors. This approach can help capture the fluctuations and adaptations in the real estate market and investors' behavior, thereby offering valuable insights for both researchers and policymakers. Moreover, the study focused primarily on examining the resistance of home owners and prospective buyers toward green home investment decisions. To present a more comprehensive picture and deepen the insights into green real estate investments, future studies should consider widening the scope to include seasoned investors and real estate promoters and brokers. These stakeholders possess unique perspectives, knowledge, and experiences that can significantly enrich the understanding of the dynamics within the green real estate market. Their insights can shed light on the challenges, opportunities, and strategies related to green investments, thereby contributing to a more holistic assessment of the subject. Lastly, investigating whether resistance to green home investments varies across different demographic groups, such as age, income, and education levels can be done in the future studies. Identifying specific segments that are more resistant can guide marketing and policy strategies.

7 Conclusion

In this study, we have delved into the complex web of factors influencing resistance to sustainable green home investment among Indian homeowners and prospective homebuyers. Our investigation was grounded in the Status Quo Bias theory constructs and the concept of inertia, shedding light on the barriers and motivations that shape individuals' decisions in the context of green home upgrades. Our findings underscore the significance of several key factors in driving or impeding the adoption of sustainable home investments. First and foremost, we have identified that loss aversion, transition costs, adherence to social norms, and self-efficacy to change significantly contribute to resistance in this domain. These findings emphasize the psychological and practical hurdles individuals face when considering a shift toward green home investments. Moreover, our exploration of inertia has unveiled its role in amplifying the relationships between transition costs, adherence to social norms, and self-efficacy to change. While it does not mediate loss aversion directly, inertia underscores the importance of understanding the persistence of existing behaviors and routines in influencing decision-making. It is vital for policymakers to facilitate access to clear and unbiased information regarding the benefits of green home upgrades. This information can help address uncertainties and misconceptions surrounding the adoption of sustainable practices. Policymakers should consider the development of incentive programs to mitigate the perceived costs and risks associated with green home investments. These incentives may include financial benefits, tax credits, or subsidies to make sustainable options more attractive. The study underscores the growing importance of green home investment decisions in today's world, driven by environmental sustainability concerns. Policymakers should work to align these investments with broader sustainability goals and advocate for eco-friendly practices. As our world grapples with the imperative of environmental responsibility, these findings have significant implications for shaping a more sustainable and eco-conscious future in the housing sector.

Data availability statement

The datasets generated for this study are available on request to the corresponding author.

Ethics statement

Ethical review and approval was not required for the study on human participants in accordance with the local legislation and institutional requirements. Written informed consent from the [patients/ participants OR patients/participants legal guardian/next of kin] was not required to participate in this study in accordance with the national legislation and the institutional requirements.

Author contributions

SR: Writing—original draft, Methodology. SP: Supervision, Writing—review & editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Aliagha, G. U., Hashim, M., Sanni, A. O., and Ali, K. N. (2013). Review of green building demand factors for Malaysia. J. Energy Technol. Policy 3, 471–478.

Almatrodi, I., Li, F., and Alojail, M. (2023). Organizational resistance to automation success: how status quo bias influences organizational resistance to an automated workflow system in a public organization. Systems 11, 191. doi: 10.3390/systems11040191

Alsaadani, S. (2022). A statistical review of a decade of residential energy research in Egypt. Energy Rep. 8, 95–102. doi: 10.1016/j.egyr.2022.01.086

Altomonte, S., Schiavon, S., Kent, M. G., and Brager, G. (2017). Indoor environmental quality and occupant satisfaction in green-certified buildings. Build. Res. Inform. 47, 255–274. doi: 10.1080/09613218.2018.1383715

Ang, Y. Q., Polly, A., Kulkarni, A., Chambi, G. B., Hernandez, M., and Haji, M. N. (2022). Multi-objective optimization of hybrid renewable energy systems with urban building energy modeling for a prototypical coastal community. Renew. Energy 201, 72–84. doi: 10.1016/j.renene.2022.09.126

Ayuthia, G. T., Dewi, O. C., and Panjaitan, T. H. (2020). “Green user and green buyer as supporters for the achievement of green buildings: a review,” in Proceedings of the 3rd International Conference on Dwelling Form (IDWELL 2020). doi: 10.2991/assehr.k.201009.004

Balakrishnan, J., Dwivedi, Y. K., Hughes, L., and Boy, F. (2021). Enablers and inhibitors of AI-powered voice assistants: A dual-factor approach by integrating the status quo bias and technology acceptance model. Inf. Syst. Front. doi: 10.1007/s10796-021-10203-y

Bergers, D. (2022). The status quo bias and its individual differences from a price management perspective. J. Retail. Consumer Serv. 64, 102793. doi: 10.1016/j.jretconser.2021.102793

Bhatt, A., Desai, S., and Gulabani, S. (2019). “Energy-efficient green building with sustainable engineering of natural resources,” in Sustainable Engineering, eds. A. Agnihotri, K. Reddy, A. Bansal (Singapore: Springer), 329–336. doi: 10.1007/978-981-13-6717-5_32

Burnham, T. A., Frels, J. K., and Mahajan, V. (2003). Consumer switching costs: a typology, antecedents, and consequences. J. Acad. Market. Sci. 31, 109–126. doi: 10.1177/0092070302250897

Chaudhuri, R., Chatterjee, S., Vrontis, D., Galati, A., and Siachou, E. (2023). Examining the issue of employee intentions to learn and adopt digital technology. Worldw. Hospit. Tour. Themes 15, 279–294. doi: 10.1108/WHATT-02-2023-0020

Chi, W., Lin, P., Chang, I., and Chen, S. (2020). The inhibiting effects of resistance to change of disability determination system: A status quo bias perspective. BMC Med. Inform. Dec. Mak. 20, 82. doi: 10.1186/s12911-020-1090-7

Chung, A., and Rimal, R. N. (2016). Social norms: a review. Rev. Commun. Res. 4, 1–28. doi: 10.12840/issn.2255-4165.2016.04.01.008

Clapp, J. D., and McDonnell, A. (2000). The relationship of perceptions of alcohol promotion and peer drinking norms to alcohol problems reported by college students. J. Coll. Stud. Dev. 41, 19–26.

Claudy, M. C., Garcia, R., and O'Driscoll, A. (2014). Consumer resistance to innovation—a behavioural reasoning perspective. J. Acad. Market. Sci. 43, 528–544. doi: 10.1007/s11747-014-0399-0

Coppock, A., and McClellan, O. A. (2019). Validating the demographic, political, psychological, and experimental results obtained from a new source of online survey respondents. Res. Polit. 6, 205316801882217. doi: 10.1177/2053168018822174

Darko, A., and Chan, A. P. (2016). Review of barriers to green building adoption. Sustain. Dev. 25, 167–179. doi: 10.1002/sd.1651

De Bruin, A., and Flint-Hartle, S. (2003). A bounded rationality framework for property investment behaviour. J. Property Invest. Finance 21, 271–284. doi: 10.1108/14635780310481685

De Vries, G., Rietkerk, M., and Kooger, R. (2019). The hassle factor as a psychological barrier to a green home. J. Consumer Policy 43, 345–352. doi: 10.1007/s10603-019-09410-7

Debrah, C., Chan, A. P., and Darko, A. (2022). Green finance gap in green buildings: A scoping review and future research needs. Build. Environ. 207, 108443. doi: 10.1016/j.buildenv.2021.108443

Dodo, Y., Cm, G., and Qp, M. (2020). “Green buildings: a post COVID-19 analysis of preventive measures of spreading the virus,” in International Conference” Innovative Trends in Engineering & Management (ITEM-2020).

Dolan, P., Hallsworth, M., Halpern, D., King, D., Metcalfe, R., and Vlaev, I. (2012). Influencing behaviour: the mindspace way. J. Econ. Psychol. 33, 264–277. doi: 10.1016/j.joep.2011.10.009

Dwaikat, L. N., and Ali, K. N. (2016). Green buildings cost premium: a review of empirical evidence. Energy Build. 110, 396–403. doi: 10.1016/j.enbuild.2015.11.021

Etikan, I. (2017). Sampling and sampling methods. Biometr. Biostat. Int. J. 5. doi: 10.15406/bbij.2017.05.00149

Ezema, I. C., Ediae, O. J., and Ekhaese, E. N. (2016). Prospects, barriers and development control implications in the use of green roofs in Lagos State, Nigeria. Covenant J. Res. Built Environ. (CJRBE) 4, 53–70.

Ezhilarasi, A. (2021). Consumer awareness and satisfaction of using the eco-friendly products in Chennai city. Emperor Int. J. Finance Manage. Res. 7, 15–22. doi: 10.35337/EIJFMR.2021.7702

Fok, C. C., and Henry, D. (2015). Increasing the sensitivity of measures to change. Prevent. Sci. 16, 978–986. doi: 10.1007/s11121-015-0545-z

Forsell, L. M., and Åström, J. A. (2012). An analysis of resistance to change exposed in individuals' thoughts and behaviours. Compr. Psychol. 1, 17. doi: 10.2466/09.02.10.CP.1.17

Geng, Y., Ji, W., Wang, Z., Lin, B., and Zhu, Y. (2019). A review of operating performance in green buildings: energy use, indoor environmental quality and occupant satisfaction. Energy Build. 183, 500–514. doi: 10.1016/j.enbuild.2018.11.017

Godefroid, M., Plattfaut, R., and Niehaves, B. (2022). How to measure the status quo bias? A review of current literature. Manage. Rev. Quart. doi: 10.1007/s11301-022-00283-8

Grover, P. (2015). Analysing market feasibility of residential green buildings in tier-II cities in India. IOSR J. Bus. Manage. I 17, 2319–7668.

Hair, J. F., Ringle, C. M., and Sarstedt, M. (2011). PLS-SEM: indeed a silver bullet. J. Market. Theory Pract. 19, 139–152. doi: 10.2753/MTP1069-6679190202

Hair, J. F., Ringle, C. M., and Sarstedt, M. (2013). Partial least squares structural equation modeling: Rigorous applications, better results and higher acceptance. Long Range Plan. 46, 1–12. doi: 10.1016/j.lrp.2013.01.001

Hammond, S. (2019). “Rethinking the challenges to attaining sustainable cities and communities: Lessons from social norms and status quo bias,” in WABER 2019 Conference Proceedings.

Henderson, C. M., Steinhoff, L., Harmeling, C. M., and Palmatier, R. W. (2020). Customer inertia marketing. J. Acad. Market. Sci. 49, 350–373. doi: 10.1007/s11747-020-00744-0

Hoda, N., Jafri, S. A., Ahmad, N., and Hussain, S. M. (2020). An empirical testing of a house pricing model in the Indian market. J. Asian Finan. Econ. Bus. 7, 33–40. doi: 10.13106/jafeb.2020.vol7.no8.033

Hofman, B., De Vries, G., and Van de Kaa, G. (2022). Keeping things as they are: How status quo biases and traditions along with a lack of information transparency in the building industry slow down the adoption of innovative sustainable technologies. Sustainability 14, 8188. doi: 10.3390/su14138188

Hulland, J., and Houston, M. (2021). The importance of behavioural outcomes. J. Acad. Market. Sci. 49, 437–440. doi: 10.1007/s11747-020-00764-w

Iliyasu, R., and Etikan, I. (2021). Comparison of quota sampling and stratified random sampling. Biometr. Biostat. Int. J. 10, 24–27. doi: 10.15406/bbij.2021.10.00326

Jeon, J. (2018). The impact of Asian economic policy uncertainty: evidence from Korean housing market. J. Asian Finan. Econ. Bus. 5, 43–51. doi: 10.13106/jafeb.2018.vol5.no2.43

Kahneman, D., Knetsch, J. L., and Thaler, R. H. (2000). Anomalies: the endowment effect, loss aversion, and status quo bias. J. Econ. Perspect. 5, 193–206. doi: 10.1257/jep.5.1.193

Kahneman, D., and Tversky, A. (1990). Prospect theory: an analysis of decision under risk. Econometrica 47, 140–170. doi: 10.2307/1914185

Kats, G., Alevantis, L., Berman, A., Mills, E., and Perlman, J. (2003). The Costs and Financial Benefits of Green Buildings. California's Sustainable Building Task Force, 134. Available online at: http://www.usgbc.org/resources/costs-and-financial-benefits-green-buildings-report-california's-sustainable-building_tast

Khedhaouria, A., Thurik, R., Gurau, C., and van Heck, E. (2016). Customers' continuance intention regarding mobile service providers: a status Quo Bias perspective. J. Glob Inf. Manag. 24, 289–303. doi: 10.4018/JGIM.2016100101

Kim, H., and Kankanhalli, A. (2009). Investigating user resistance to information systems implementation: a status quo bias perspective. MIS Quart. 33, 567. doi: 10.2307/20650309

Labrecque, J. S., Wood, W., Neal, D. T., and Harrington, N. (2016). Habit slips: when consumers unintentionally resist new products. J. Acad. Market. Sci. 45, 119–133. doi: 10.1007/s11747-016-0482-9

Leonidou, C. N., Katsikeas, C. S., and Morgan, N. A. (2012). “Greening” the marketing mix: do firms do it and does it pay off? J. Acad. Market. Sci. 41, 151–170. doi: 10.1007/s11747-012-0317-2

Li, J., Liu, M., and Liu, X. (2016). Why do employees resist knowledge management systems? An empirical study from the status quo bias and inertia perspectives. Comput. Hum. Behav. 65, 189–200. doi: 10.1016/j.chb.2016.08.028

Li, Q., Long, R., Chen, H., Chen, F., and Wang, J. (2020). Visualized analysis of global green buildings: development, barriers and future directions. J. Cleaner Product. 245, 118775. doi: 10.1016/j.jclepro.2019.118775

Lockwood, C. (2008). The Dollars and Sense of Green Retrofits. Washington, DC: Deloitte, 1–8. Available online at: http://campbellfilm.com/wp-content/uploads/2012/01/dollarssenseretrofits.pdf

Mamidala, V., Kumari, P., and Singh, D. (2023). Should I invest or not? Investigating the role of biases and status quo. Qual. Res. Finan. Mark. doi: 10.1108/QRFM-12-2022-0198 [Epub ahead of print].

Mao, Y. H., and Yang, G. H. (2011). Sustainable development drivers for green buildings: Incremental costs-benefits analysis of green buildings. Adv. Mater. Res. 374, 76–81. doi: 10.4028/www.scientific.net/AMR.374-377.76

Martínez, M. C. V., and Cervantes, P. A. M. (2021). Partial Least Squares Structural Equation Modeling (PLS-SEM) Applications in Economics and Finance. Basel, Switzerland: MDPI.

Masatlioglu, Y., and Ok, E. A. (2005). Rational choice with status quo bias. J. Econ. Theory 121, 1–29. doi: 10.1016/j.jet.2004.03.007

Nagrale, S. S., and Sabihuddin, S. (2020). Cost comparison between normal building and green building considering its construction and maintenance phase. Int. J. Sci. Res. Eng. Dev. 3, 77–80.

Oreg, S. (2003). Resistance to change: Developing an individual differences measure. J. Appl. Psychol. 88, 680–693. doi: 10.1037/0021-9010.88.4.680

Passarelli, F., and Del Ponte, A. (2020). Prospect theory, loss aversion, and political behaviour. Oxford Research Encyclopedia of Politics. doi: 10.1093/acrefore/9780190228637.013.947

Pilkington, B., Roach, R., and Perkins, J. (2011). Relative benefits of technology and occupant behaviour in moving towards a more energy efficient, sustainable housing paradigm. Energy Policy 39, 4962–4970. doi: 10.1016/j.enpol.2011.06.018

Polites, G. L., and Karahanna, E. (2012). Shackled to the status quo: The inhibiting effects of incumbent system habit, switching costs, and inertia on new system acceptance. MIS Quart. 36, 21. doi: 10.2307/41410404

Rastekenari, M. A., Monsef, S. M., and Majnoon, K. (2013). Study of factors associated with employees' resistance to change and its relation with customer responsiveness and outcome performance in private banks of Rasht. Singaporean J. Bus. Econ. Manag. Stud. 2, 57–66. doi: 10.12816/0003889

Ross, B., López-Alcalá, M., and Small, A. A. (2007). Modeling the private financial returns from green building investments. J. Green Build. 2, 97–105. doi: 10.3992/jgb.2.1.97

Salim, A. M., and Abu Dabous, S. (2022). A review of critical success factors for solar home system implementation in public housing. Int. J. Energy Sector Manag. 17, 352–370. doi: 10.1108/IJESM-11-2021-0004

Samuelson, W., and Zeckhauser, R. (1988). Status quo bias in decision making. J. Risk Uncert. 1, 7–59. doi: 10.1007/BF00055564

Shirish, A., and Batuekueno, L. (2021). Technology renewal, user resistance, user adoption: status quo bias theory revisited. J. Organ. Change Manag. 34, 874–893. doi: 10.1108/JOCM-10-2020-0332

Shu, L. L., and Bazerman, M. H. (2011). Cognitive barriers to environmental action: Problems and solutions. Oxford Handbooks Online. doi: 10.1093/oxfordhb/9780199584451.003.0009

Tang, S., Huang, S., Zhu, J., Huang, R., Tang, Z., and Hu, J. (2019). Financial self-efficacy and disposition effect in investors: the mediating role of versatile cognitive style. Front. Psychol. 9, 2705. doi: 10.3389/fpsyg.2018.02705

Wang, G., and Netemeyer, R. G. (2002). The effects of job autonomy, customer demandingness, and trait competitiveness on salesperson learning, self-efficacy, and performance. J. Acad. Market. Sci. 30, 217–228. doi: 10.1177/0092070302303003

WHO (2020). Nearly 1 in 5 lower-income households in OECD countries spend over 40% of their income on housing. Technical Report.

Yen, H. R., and Chuang, S. (2008). The effect of incidental affect on preference for the status quo. J. Acad. Market. Sci. 36, 522–537. doi: 10.1007/s11747-008-0084-2

Yue, B., Sheng, G., She, S., and Xu, J. (2020). Impact of consumer environmental responsibility on green consumption behaviour in China: The role of environmental concern and price sensitivity. Sustainability 12, 2074. doi: 10.3390/su12052074

Zarifis, A., Cheng, X., Jayawickrama, U., and Corsi, S. (2021). Can global, extended, and repeated ransomware attacks overcome the user's status quo bias and cause a switch of system? Int. J. Inform. Syst. Serv. Sector 14, 1–16. doi: 10.4018/IJISSS.289219

Zhang, W., and Liu, L. (2021). How consumers' adopting intentions towards eco-friendly smart home services are shaped? An extended technology acceptance model. Ann. Reg. Sci. 68, 307–330. doi: 10.1007/s00168-021-01082-x

Zhang, X., Guo, X., Wu, Y., Lai, K., and Vogel, D. (2017). Exploring the inhibitors of online health service use intention: a status quo bias perspective. Inf. Manag. 54, 987–997. doi: 10.1016/j.im.2017.02.001

Zhao, X., Lynch, J. G., and Chen, Q. (2010). Reconsidering baron and Kenny: myths and truths about mediation analysis. J. Consumer Res. 37, 197–206. doi: 10.1086/651257

Keywords: status quo bias, inertia, individual resistance, sustainability, green home, investment decision

Citation: R SD and Perumandla S (2023) Do individuals' resist green home investment decisions? An empirical study from status quo bias and inertia perspective. Front. Sustain. Cities 5:1295357. doi: 10.3389/frsc.2023.1295357

Received: 16 September 2023; Accepted: 31 October 2023;

Published: 15 December 2023.

Edited by:

Krishna Kumar Mohbey, Central University of Rajasthan, IndiaReviewed by:

Sukanya Das, TERI School of Advanced Studies (TERI SAS), IndiaGaurav Meena, Central University of Rajasthan, India

Brijesh Bakariya, I. K. Gujral Punjab Technical University, India

Copyright © 2023 R and Perumandla. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Swamy Perumandla, c3dhbXl2aXZlay5wQGdtYWlsLmNvbQ==

Sharmila Devi R

Sharmila Devi R Swamy Perumandla1,2*

Swamy Perumandla1,2*