- Department of Architecture and Design, Politecnico di Torino, Turin, Italy

Investment decisions on demolition and reconstruction vs. refurbishment of the existing building stock can extend beyond financial and economic criteria. However, they must involve energy savings, environmental preservation, material consumption, and waste management for sustainable cities. The regulatory framework used in the past decades and the correlated research seem more unbalanced toward the containment of building energy consumption than toward embodied energy (EE) management in production processes and environmental impact management. Foreshadowing the perspective of a more restrictive regulatory framework on EE, such as prohibiting the displacement of materials with residual energy potential, such as waste in landfills, some challenging frontier issues are involved when facing the limits of the economic evaluation methodologies for transformation projects. Thus, this study aimed to propose a reasoning and an operative modality to support urban governance policies and investment decisions involving private and public subjects in the construction sector. Circular economy and life cycle thinking principles, through life cycle costing (LCC) and life cycle assessment (LCA), are assumed and harmonized with the discounted cash-flow analysis (DCFA): (1) monetizing and modeling into the DCFA the EE and the embodied carbon (EC); (2) internalizing the Global Cost and the new ‘Global Benefit’ into the net present value (NPV) calculation; and (3) focusing on the residual end-of-life value calculation from the early design and investment decision stages. The reasoning can be extended to single buildings, the urban scale, or even entire portions of existing buildings in urban areas concerning typological sub-segments. The operative modality is yet to be explored in a concrete application for orienting urban governance policies and sustainable public–private partnerships, including environmental and, thus, social externalities even in the private real estate investment decision process, in the scope of evolving regulations.

1. Introduction

In the past few decades, urban space operations were partially financial and were encompassed by social, physical, cultural, and economic transformations. Contextually, a shift toward the circular economy and sustainable cities (Petit-Boix et al., 2017) has been set up since the 80s by assuming a systemic conception of urban spaces. Nevertheless, the circular city as an open system is still far from existing. From an ecological viewpoint, the regenerated urban system concept implemented through waste elimination is crucial. From an economic perspective, this final point implies material recovery, recycling, reuse, etc., while maintaining the maximum possible efficiency level. The material/component/system/building recovery or recycling—in terms of EE, exploitation of residual economic and technological performance—is essential to obtain an economic-environmental surplus value, keeping in mind that the demolition and reconstruction scenario reproduces the ‘add value-destroy value’ model, according to a linear economy perspective. Conversely, the retrofitting of existing buildings produces the ‘add value-maintain value’ model from a circular economy perspective.

In this context, the design stage is crucial, adopting a life cycle concept of products and processes with the reuse and recycling of materials and their energy. In this sense, urban areas should be conceived as energy storage that can be reused according to a cradle-to-cradle and systemic approach. Assuming that sustainable development can be achieved by extracting and utilizing all of the energy produced in urban and territorial transformation and production cycles, it is necessary to identify the energy value to internalize the natural and territorial capital into the evaluation models. The concept of sustainable cities encompassing environmental preservation, energy efficiency, and waste management, concretized in retrofitting operations of existing property assets and urban areas, remains in the background (Morano et al., 2021).

Consequently, the economic–energy–environmental valuation of real estate investment projects and building transformations in private and public contexts is also crucial from a planning perspective (Micelli, 2014; Becchio et al., 2020). By 2050, approximately 75% of the world population is expected to live in cities, and with the consequentially growing demand for residential spaces, the evaluation models will be even more essential to support urban policies and governance toward sustainable cities. At the time being, pursuant to the urban sustainable development goals and aiming at achieving zero-impact buildings by 2050, the European regulatory framework, as said, promotes environmental policies in the building and construction sectors. Furthermore, the EU Clean Energy Package (European Commission, 2020a,b) and the EU Circular Economy Package (European Commission, 2019) encourage, among others, policies toward renovation and decarbonization of buildings, reduction in energy/resource consumption and waste, and maintenance of product and material value over time, promoting reuse in new lifecycles (Azcarate-Aguerre et al., 2022).

Attention is devoted to the evaluation and quantification of the economic impact of building operations both on new constructions and retrofitted existing assets, also facing the difficulty in reconciling economic and environmental evaluation tools that, as known, often give opposite or very different results (Schneider-Marin and Lang, 20202022; Schneider-Marin et al., 2022). At the same time, there is still the possibility for further developments on the regulatory front as regards the role of EE in building production processes and products. Following the oil crisis of the 70s, much research was developed on the issue of energy dispersion. This comprehensive research has led to the development of technologies and solutions for passive buildings or buildings capable of producing energy to meet their needs or even beyond their requirements, as well as recent bottom-up initiatives such as renewable energy communities (RECs), also due to a growing consumer awareness toward green features in buildings (Barreca et al., 2021). Research on EE in production processes and products has yet to be developed, perhaps due to limited legislation constraining the amount of EE associated with building production. Only a few exceptions must be pointed out in this sense, such as the Swiss ‘Minergie’ building certification standard, adapted to the new energy legislation, providing for a marking including a passive building target and constraints on EE.

That being said, a few questions arise: Is it possible to shift toward a more restrictive regulatory framework in future? Will the legislation evolve to prohibit recyclable construction materials from ending up as waste in landfills? If, as it is probable, the answer to these questions is affirmative, the cost crux will become central for certain reasons discussed in this article. Assuming the perspective of a renovated regulatory framework, the reflection faces some challenging frontier issues from an operational and methodological viewpoint. In the line of reasoning proposed, a focus is made on the EE and EC as components of the real estate property value, incorporated in the market value, for example, of an asset to be purchased for transformation or in the developer’s portfolio, increasing its market value from the perspective of future regulation changes. Consequences on the real estate value appraisal methods are also expected. Assuming the Global Cost concept as formalized in the European norms and assuming a life cycle perspective, the new ‘Global Benefit’ concept is proposed. Then, Global Cost and Global Benefit are modeled into the DCFA as input for the NPV calculation. The final value component is focused on as a crucial criterion for investment decisions. As a result, (1) the proposed approach can support private investors’ decision-making processes by internalizing environmental externalities other than financial ones; and (2) the potential increase in value can be an incentive to use materials that minimize energy costs and CO2 emissions, with an impact on the quantification of the asset’s residual value and its components at the end-of-life stage of the property.

This reasoning seems appropriate for the existing building heritage, which is present in large quantities in Europe. Approximately 25 billion m2 belongs to existing spaces and must face the challenge of building decarbonization (Azcarate-Aguerre et al., 2022). Approximately 85% of the building stock in Italy consists of residential buildings. Three-quarters are single−/double-family houses, largely built during the post-Second World War without restrictive legislation on building energy consumption. Thus, the focus must be on retrofitting operations and, concerning new construction assets, demanding eco-compatible design and production.

In synthesis, this study emphasizes the integration of economic and environmental assessment for supporting urban governance policies and investment decisions involving private and public actors by integrating the Global Cost and Global Benefit into the discounted cash-flow analysis. This integration is extended to the life cycle of the existing buildings and assets. The introduction of residual end-of-life value in investment decision-making processes accompanies it. This operative modality seems to be an answer toward the aim of supporting the valuation of investments by reducing energy and material consumption, waste production, and, in general, achieving the objectives of economic-environmental sustainability.

The theoretical and methodological insight that I will illustrate in this study arises from these premises and the belief that the scientific community must make an effort to effectively adapt to changes in perspective.

2. EE and EC as implicit components of building real estate market value: the ‘Global Benefit’ concept

Let us consider the whole building life cycle, according to the Global Cost formalization, as illustrated in the EN 15459:2007 Standard (and Guidelines accompanying Commission Delegated Regulation (EU) No 244/2012, following the Directive 2010/31/EU-EPBD recast) and summarized in the equation (1) below (EN ISO 15459-1:2007, 2007; European Parliament, 2010 2012 2018):

where CG(τ) stands for the Global Cost, referred to as starting year τ0; CI stands for the initial investment costs; Ca,i (j) stands for the annual running costs (energy costs, operational costs, and maintenance costs) and periodic replacement costs of component j during year i; Rd (i) stands for the discount factor for the year i; Vf,τ(j) stands for the residual value of the component j at the end of the calculation period in the starting year. Notice that the Global Cost is the core of the LCC approach, as illustrated in ISO Standard 15686-5:2008 – Part 5 (Flanagan and Norman, 1983; Norman, 1990; Gluch and Baumann, 2004; Hunkeler et al., 2008; ISO 15686:2008, 2008; Department of Energy, 2014). Then, let us assume the proposal of previous studies (Fregonara et al., 2017), in which a synthetic economic-environmental indicator is formalized through LCA and LCC, encompassing a set of environmental monetized indices: dismantling performance, recycled materials, and waste produced (ISO 14040:2006, 2006). Thus, the Global Cost is rewritten as in the following equation (2):

where CGEnEc represents the life cycle cost, including environmental and economic indicators; CI represents the investment cost; CEE represents the cost related to embodied energy; CEC represents the cost associated with the embodied carbon; Cm represents the maintenance cost; Cr represents the replacement cost; Cdm represents the dismantling cost; Cdp represents the disposal cost; Vr represents the residual value; t represents the year in which the cost occurred; N represents the number of years of the entire period considered for the analysis; and Rd represents the discount factor.

As extensively discussed in the literature, the Global Cost is based on a cost concept referred to as ‘relevant’ cost items during the life cycle of a construction project (or a part of it). The end-of-life stage is critical, expressing the building’s final value (positive or negative) (or the value of a part of it). Recent literature is devoted to exploring the final value calculation and the residual value amount that has been able to influence preventive investment decisions since the early design stages. Extending the life cycle concept to revenue, I propose the ‘Global Benefit’ concept as the sum of the potential incomes from investment in a building reconstruction/transformation and the energy-environmental value components of the existing building. The latter are incorporated in the Global Benefit as implicit or ‘hidden’ values. At the building scale, this value concept can support decision-making processes (e.g., in reconstruction vs. retrofit investment decisions). At the urban/urban area scale, the Global Benefit of existing buildings can even orient urban governance policies, expanding the concept to entire portions of existing buildings in urban areas and also concerning typological sub-segments.

The Global Benefit of an existing building incorporates the residual energy that can be reused in the building’s upcycling process. In addition, the environmental impact on the value can be monetized through the quantity of CO2 embodied in the building in the material/component/system production and operation, and that can be saved or avoided by recycling instead of demolition and reconstruction. Formally, the Global Benefit is expressed in the following equation (3):

where BgEnEnv stands for the economic-energy-environmental Global Benefit, Vtr stands for the market value of the asset to be transformed, Ven stands for the residual energy value (reusable EE quantity), and Venv stands for the environmental value (avoided EC quantity, already incorporated in the reusable elements). Notice that the EE and the EC can be quantified through the LCA approach, as regulated in ISO 14040:2006 and the related literature (Gustafsson et al., 2017; Moschetti and Brattebø, 2017; Thiebat, 2019). Then, RRevenue stands for the potential income obtainable from the market activities (i.e., rental market), t stands for the year in which the income occurred, N stands for the number of years of the entire period considered for the analysis, Vr stands for the residual value, and Rd stands for the discount factor. In summary, the Global Benefit represents the ‘life cycle value’ of existing buildings, encompassing an economic–energy–environmental surplus value that has to be considered in investment decisions, as illustrated below.

3. A methodological proposal to support sustainable real estate investment decisions and urban governance policies

In real estate investments, the feasibility of transformation projects is usually verified through capital budgeting models to evaluate economic-financial profitability. More specifically, discounted cash flow analysis (DCFA) is widely adopted in the Anglo-Saxon approach. The NPV, one of the leading synthetic indicators of financial profitability, is usually calculated through the DCFA according to the following equation (4):

where NPV stands for net present value, R stands for the revenue obtainable through the selling/rental activity, C stands for the sum of the relevant investment cost during the project’s time horizon, r stands for the discounted rate (financial or market rate), and t stands for the reference period in the time horizon n (with t = 1, …, n). By assuming previously illustrated Global Cost and Global Benefit concepts, equation 4 can be finally rewritten as follows equation (5):

where BgEnEnv stands for the energy-environmental Global Benefit and CgEnEnv stands for the energy-environmental Global Cost. The NPV obtained through this formula expresses the financial convenience of the investment by incorporating externalities into the decision-making process throughout the life cycle. Other synthetic indicators, such as the internal rate of revenues (IRRs) and pay-back period (PBP), simple or discounted, including environmental components that in some cases can even be the decision criterion (Gaspar and Santos, 2015), can complete the decisional criteria set (Conci et al., 2019).

3.1. Building upcycling or building reconstruction?

Global Benefit can truly tip the scale in decision-making processes for private and public subjects. A delicate decisional step for all stakeholders is choosing between demolition and reconstruction scenarios vs. retrofitting the built heritage (Locurcio et al., 2022). The comparison between scenarios can be strengthened by focusing on the asset’s residual under-construction value, calculated through the Global Cost and Global Benefit components. For this purpose, the authors remind us of the concept of ‘effective embodied energy’ as an indicator of the environmental/energy value of existing buildings to support investment decisions in green retrofitting and eco-oriented design solutions (Monsù Scolaro, 2018), as we will see in the next section.

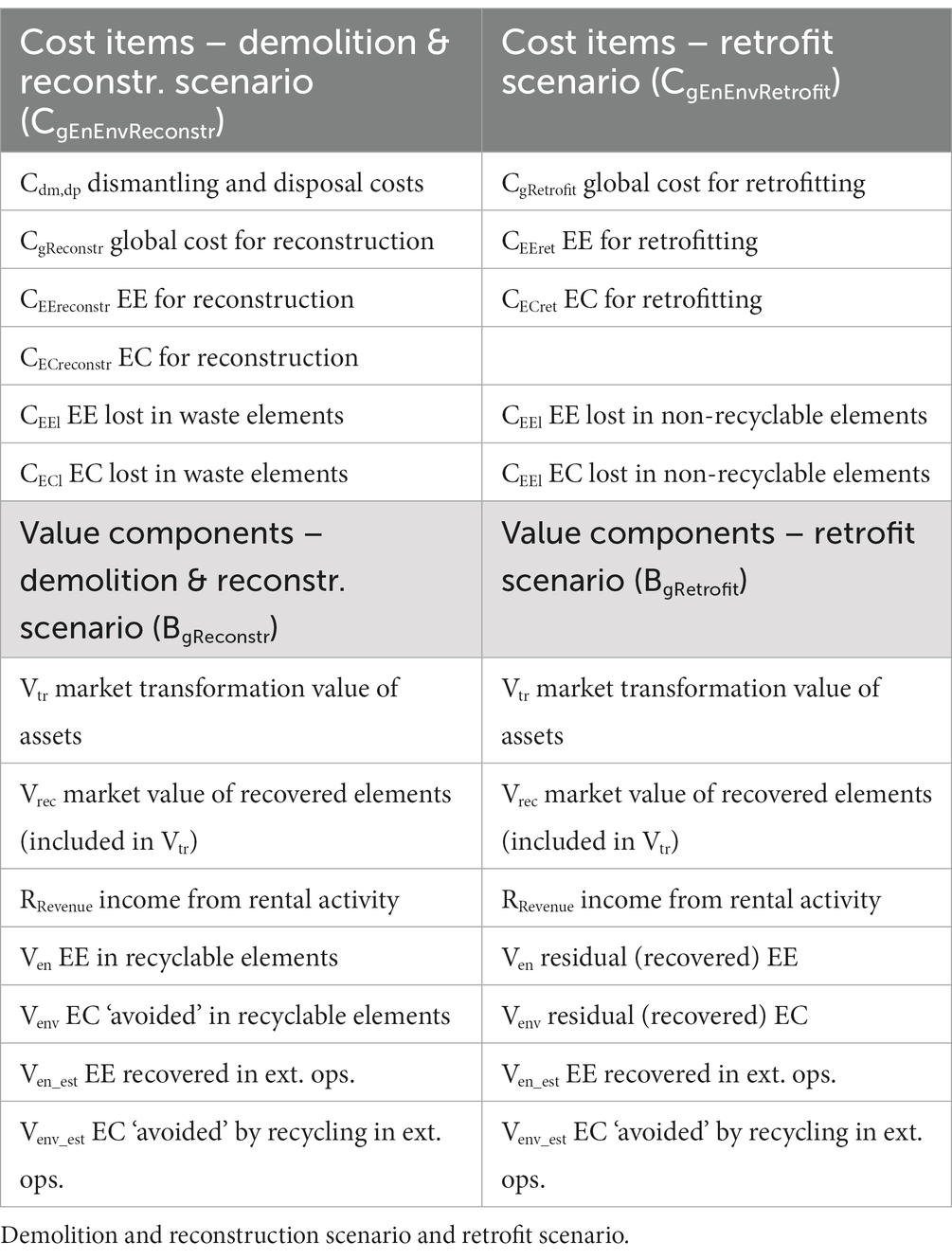

For example, consider an existing building that is being retrofitted and then placed on the rental market. Let us assume a potential developer is involved in selecting a preferred development project to invest in. Consider that the property’s market value has, from our perspective, recycling potential. Thus, let us assume the synthetic list of costs/value items to be modeled in a DCF model, referring to the demolition and construction scenario on the one hand and the retrofit scenario on the other hand, as synthesized in Table 1.

Thus, the NPV equation (5) can be reformulated for both scenarios. Formally, in the demolition and reconstruction scenario, the NPV can be expressed with the following equation (6):

where BgReconstr stands for the Global Benefit, which includes the initial investment market value and the discounted potential income due to the transformation, plus the value components due to the EE and EC limited to the recyclable elements; CgEnEnvReconstru stands for the Global Cost, which includes the initial investment cost CI, the running cost Cr, and the maintenance cost Cm; CEE component stands for the energy incorporated in the production/management processes, only partially recoverable; and the CEC component stands for the CO2 emissions due to the production/management process, only somewhat avoidable in another cycle, while other hidden costs are the EE and EC lost as waste and thus not recoverable. Moreover, r’ represents the financial or market rate and r” represents the ‘hurdle rate.’ Notice that the use of different discount rates—the conventional ‘time preference’ or financial rate and the ‘environmental hurdle rate’—is due to the capacity of the latter to model the expectations of future knowledge—e.g., on technology development, as illustrated in previous studies (Pearce and Turner, 1990; Gray et al., 1993; Fregonara and Ferrando, 2023). This last, crucial point confirms the perspective nature of the line of reasoning.

Analogously, considering the retrofit of an existing building scenario, we obtain the following equation (7):

In the retrofit scenario (concerning Table 1), to measure the environmental value obtainable, it is necessary to quantify (1) the primary energy and resource savings and (2) the reduction of the associated environmental effects (negative externalities)—e.g., by using the decrease in the EC amount. The EC and EE, which are not recyclable in this case, and lost waste must be considered in the calculation. The EC ‘avoided’ by maintaining the materials/components/system and the residual EE contributed to reducing the new EE required for the retrofitting operation (or for external operations), positively impacting the value and the potential income in the holding period.

3.2. Residual value and residual performance indicators

From a ‘cradle to cradle’ viewpoint, the final residual value is a fundamental decision criterion. For both demolition and reconstruction scenario and retrofit scenario, the final value calculated in the end-of-life stage comprises the asset’s residual market value plus the market value of the potentially recovered materials/components/systems, plus the EE incorporated in the recyclable elements, plus the EC incorporated in the recyclable materials/components/systems and, thus, avoided for the production of new elements (the dismantling and disposal costs have to be subtracted in an upcycling scenario). Formally, the final value is given by the following equation (8):

where Vf,n stands for the final asset value, Vrs stands for the residual market value, VEErec stands for the residual incorporated energy, and VECrec stands for the EC included in the residual materials/components/systems. Notice that, in this case, the final value Vf,n is calculated according to the hypothesis of an investment and management scenario (rental market). In the investment and selling scenario, the tangible ownership of the asset is not considered. The evaluation is focused on the project’s economic-environmental sustainability in the early design stage, regardless of the developer’s financial convenience. Thus, the final value incorporates the asset’s residual market value and externalities. The final value is only apparently similar in both scenarios, being a function of the model input. Furthermore, the entire model is highly sensitive to the uncertainty incorporated in the input data, as discussed in the literature (Curto and Fregonara, 1999).

The decision process can be further supported by calculating specific indicators based on the residual EE and technological performance available in the literature to define the environmental potential of existing buildings. These indicators can better specify the terms of equation (8).

For example, Monsù Scolaro (2018, p. 228) proposes a residual performance index (RPI) of a specific technical element as the ratio between the performance supplied and the performance required by a new intended use. As the author illustrates, the result depends on:

1. the EEresidual value concerning the specific costs/technological elements considered;

2. the EEeffective value (within the 0–1 range), concerning the elements reused in the retrofit operation, minus the EEwaste (lost or not utilized). Notice that the EEwaste value is obtained by the ratio EEresidual/EEprevious.

Thus, it is possible to calculate the residual environmental potential (REP) by multiplying the RPI by the EEeffective. The product yields a value equal to 100 when the whole amount of the material is recoverable; otherwise, for values lower than 100, the final embodied energy EEfinal, provided by the sum of EEresidual and EEadded (i.e., the quantity of EE incorporated in the materials necessary to complete the development), must be as low as possible (e.g., by using materials with a low carbon footprint).

Thormark (2002, p. 431) proposed the calculation of the recycling potential Rpot through the equation (9):

where EEi stands for the embodied energy of a product (material) that a recycled one replaces, remaining lifetime stands for the residual service life of material i (with i = 1, …, n), and Erec.proc i stands for the energy used for the recycling process (upgrading process) of the material i.

In conclusion, considering that the unavailability of energy in nature is the result of a production process, it must be involved in the economic convenience decision from the early design up to the end-of-life stage, with a perspective to implement economic sustainability objectives and to reduce energy and material consumption and waste production. The main challenges will be the evolving times and maturity levels in technology, the market, and production, as well as policy-making.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

EF: Writing – original draft, Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Azcarate-Aguerre, J. F., Conci, M., Zils, M., Hopkinson, P., and Klein, T. (2022). Building energy retrofit-as-a-service: a total value of ownership assessment methodology to support whole life-cycle building circularity and decarbonisation. Constr. Manag. Econ. 40, 676–689. doi: 10.1080/01446193.2022.2094434

Barreca, A., Fregonara, E., and Rolando, D. (2021). EPC labels and building features: spatial implication over housing prices. Sustainability 13:2838. doi: 10.3390/su13052838

Becchio, C., Bottero, M., Bravi, M., Corgnati, S., Dell’Anna, F., Mondini, G., et al. (2020). “Integrated assessments and energy retrofit: the contribution of the energy center lab of the Politecnico di Torino, values and functions for future cities” in Values and functions for future cities. green energy and technology. eds. G. Mondini, A. Oppio, S. Stanghellini, M. Bottero, and F. Abastante (Cham: Springer), 365–384.

Conci, M., Konstantinou, T., Dobbelsteen, A. V. D., and Schneider, J. (2019). Trade-off between the economic and environmental impact of different decarbonization strategies for residential buildings. Build. Environ. 155, 137–144. doi: 10.1016/j.buildenv.2019.03.051

Curto, R. A., and Fregonara, E. (1999). Decision tools for investments in the real estate sector with risk and uncertainty elements. Jahrbuch fuer Regionalwissenshaft 19, 55–85.

Department of Energy (2014). Life cycle cost handbook guidance for life cycle cost estimate and life cycle cost analysis. Department of Energy: Washington, DC, USA.

EN ISO 15459-1:2007 (2007). Energy performance of buildings—economic evaluation procedure for energy systems in buildings. European Committee for Standardization: Brussels, Belgium.

European Commission (2019). Closing the loop: commission delivers on circular economy action plan. Available at: https://ec.europa.eu/commission/presscorner/detail/en/IP_19_1480

European Commission (2020a). Clean energy for all Europeans package – Energy European Commission. Available at: https://ec.europa.eu/energy/topics/energy-strategy/clean-energy-all-europeans_en

European Commission. A renovation wave for Europe—greening our buildings, creating jobs, improving lives. In communication from the European commission to the European parliament, the council, the European economic and social committee, and the committee of the regions. European Commission: Brussels, Belgium (2020b).

European Parliament (2010). Directive 2010/31/EU of the European Parliament and of Council of 19 May 2010 on the Energy Performance of Buildings (Recast). Off. J. Eur. Union 57, 13–35.

European Parliament (2012). Guidelines accompanying commission delegated regulation (EU) No 244/2012 of 16 January 2012 supplementing directive 2010/31/EU. European Parliament: Brussels, Belgium.

European Parliament (2018). Directive (EU) 2018/844 of the European Parliament and the Council. Off. J. Eur. Union 6, 75–91.

Flanagan, R., and Norman, G. (1983), Life cycle costing for construction ; Royal Institution of Chartered Surveyors: London.

Fregonara, E., and Ferrando, D. G. (2023). The discount rate in evaluating project economic-environmental sustainability. Sustainability 15:2467. doi: 10.3390/su15032467

Fregonara, E., Giordano, R., Ferrando, D. G., and Pattono, S. (2017). Economic-environmental indicators to support investment decisions: a focus on the buildings’ end-of-life stage. Buildings 7:65. doi: 10.3390/buildings7030065

Gaspar, P. L., and Santos, A. L. (2015). Embodied energy on refurbishment vs. demolition: a southern Europe case study. Energ. Buildings 87, 386–394. doi: 10.1016/j.enbuild.2014.11.040

Gluch, P., and Baumann, H. (2004). The life cycle costing (LCC) approach: a conceptual discussion of its usefulness for environmental decision-making. Build. Environ. 39, 571–580. doi: 10.1016/j.buildenv.2003.10.008

Gray, R.H., Bebbington, J., and Walters, D. (1993), Accounting for the environment. Paul Chapman Publishing: London

Gustafsson, M., Di Pasquale, C., Pioppi, S., Bellini, A., Fedrizzi, R., Bales, C., et al. (2017). Economic and environmental analysis of energy renovation packages for European office buildings. Energ. Buildings 148, 155–165. doi: 10.1016/j.enbuild.2017.04.079

Hunkeler, D., Lichtenvort, K., and Rebitzer, G. (2008), Environmental life cycle costing. Taylor & Francis: Abingdon.

ISO 14040:2006 (2006). Environmental management—life cycle assessment—principles and framework. International Organization for Standardization: Geneva, Switzerland.

ISO 15686:2008 (2008). Buildings and constructed assets—service-life planning—Part 5: life cycle costing. International Organization for Standardization: Geneva, Switzerland.

Locurcio, M., Tajani, F., Morano, P., Di Liddo, F., and Anelli, D. (2022). To rebuild or to refurbish? An analysis of the financial convenience of interventions on urban consolidated contexts. WSEAS Trans. Environ. Dev. 18, 226–231. doi: 10.37394/232015.2022.18.24

Micelli, E. (2014). L’eccezione e la regola. Le forme della riqualificazione della città esistente tra demolizione e ricostruzione e interventi di riuso, Valori e Valutazioni 12, 47–56.

Monsù Scolaro, A. (2018). Embodied Energy and residual performances: assess environmental value of existing buildings. Dent. Tech. 16, 226–234. doi: 10.13128/Techne-23003

Morano, P., Tajani, F., Guarini, M. R., and Sica, F. (2021). A systematic review of the existing literature for the evaluation of sustainable urban projects. Sustainability 13:4782. doi: 10.3390/su13094782

Moschetti, R., and Brattebø, H. (2017). Combining life cycle environmental and economic assessments in building energy renovation projects. Energies 10:1851. doi: 10.3390/en10111851

Pearce, D.W., and Turner, R.K. (1990), Economics of natural resources and the environment. The Johns Hopkins University Press: Baltimore, MD.

Petit-Boix, A., Llorach-Massana, P., Sanjuan-Delmas, D., Sierra-Pérez, J., Vinyes, E., Gabarrell, X., et al. (2017). Application of life cycle thinking towards sustainable cities: a review. J. Clean. Prod. 166, 939–951. doi: 10.1016/j.jclepro.2017.08.030

Schneider-Marin, P., and Lang, W. (2020). Environmental costs of buildings: monetary valuation of ecological indicators for the building industry. Int. J. Life Cycle Assess. 25, 1637–1659. doi: 10.1007/s11367-020-01784-y

Schneider-Marin, P., and Lang, W. (2022). A temporal perspective in Eco2 building design. Sustainability 14:6025. doi: 10.3390/su14106025

Schneider-Marin, P., Winkelkotte, A., and Lang, W. (2022). Integrating environmental and economic perspectives in building design. Sustainability 14:4637. doi: 10.3390/su14084637

Keywords: sustainable cities, discounted cash-flow analysis, life cycle costing, Global Cost, Global Benefit, embodied energy, embodied carbon, recycling potential

Citation: Fregonara E (2023) Building upcycling or building reconstruction? The ‘Global Benefit’ perspective to support investment decisions for sustainable cities. Front. Sustain. Cities. 5:1282748. doi: 10.3389/frsc.2023.1282748

Edited by:

Francesco Tajani, Sapienza University of Rome, ItalyReviewed by:

Maria Rosa Trovato, University of Catania, ItalySalvatore Giuffrida, University of Catania, Italy

Francesco Calabrò, Mediterranea University of Reggio Calabria, Italy

Copyright © 2023 Fregonara. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Elena Fregonara, ZWxlbmEuZnJlZ29uYXJhQHBvbGl0by5pdA==

Elena Fregonara

Elena Fregonara