- 1School of Economics and Management, Shanghai Institute of Technology, Shanghai, China

- 2University of Chinese Academy of Sciences, Beijing, China

- 3South-Central Minzu University, Wuhan, China

- 4Nanjing University of Finance and Economics, Nanjing, China

- 5Technical Institute of Physics and Chemistry, CAS, Beijing, China

- 6Belarusian State University, Minsk, Belarus

Introduction: Capital plays a crucial role in the development of regional economies, especially in low-income regions where it acts as a primary driver of economic growth. Efficient capital flow is essential for optimizing resource allocation and facilitating the development of integrated capital markets. This passage introduces the topic of capital, capital flow, and capital market integration and highlights their significance in regional development.

Methods: To gain a comprehensive understanding of capital flow and integration in the Yangtze River Delta region, the researchers conducted a connotative analysis. They constructed indicators from various aspects, including social fixed asset investment, bank capital flow, government transfer payments, social financing structure, and foreign direct investment. By utilizing these indicators, the researchers aimed to assess the current situation and identify bottlenecks related to capital flow and integration. Additionally, they drew on experiences from foreign capital flow and integration development to enrich their analysis.

Results: The analysis revealed several primary bottlenecks affecting capital flow and integration in the Yangtze River Delta region. These bottlenecks include an unsound banking management system, the presence of government competition and administrative barriers, and shortcomings within listed companies. The results highlight the specific challenges that hinder the smooth functioning and integration of capital in the region.

Discussion: To promote the development of capital flows and integration in the Yangtze River Delta region, the researchers propose various recommendations. These suggestions include promoting the development of listed companies, establishing a robust banking management model, improving relevant government policies, and optimizing the investment environment. These recommendations serve as important guidelines for policymakers to enhance capital flow and integration in the Yangtze River Delta city cluster. Furthermore, they emphasize the need to strengthen financial supervision and improve institutional mechanisms within the three provinces and one city comprising the region.

1. Introduction

The Yangtze River Delta region has gained international recognition as one of China's six world-class city clusters with the most vibrant economy, the highest degree of openness, and the most muscular innovation capacity. Moreover, it serves as a crucial intersection between the “Belt and Road” initiative and the Yangtze River Economic Belt, constituting a pivotal component of the “new development pattern with the domestic circulation as the main body and the domestic and international circulation promoting each other.” Its integration is vital for China's participation in global cooperation and competition in a hierarchical manner. However, significant administrative boundary barriers, varying natural resource endowments, and economic development levels across regions still exist in China. Driven by regional interests, various factors of production face constraints in freely circulating in the Yangtze River Delta region, impeding its comprehensive development. From an economic perspective, capital is a general term encompassing social and economic resources that can be utilized for production, ranging from physical, monetary, intangible, and human capital, which can be transformed into assets to generate benefits through enterprise investment and operation. Freely circulating financial resources in the form of money capital within the region could accelerate optimal resource allocation. An efficient capital market, unlike administrative coordination, utilizes its pricing function to quantify and capitalize on various economic interests based on the objective economic interests of different regions within the Yangtze River Delta region. After that, it can leverage its financing and resource optimization functions to consolidate local interests through capital operations, gradually eliminate conflicts of interest and administrative barriers between localities, and promote the region's overall development.

As the Yangtze River Delta integration process continues to evolve, the adequate flow of capital elements and integrated development have become of paramount concern. This is because value creation and value addition can only be achieved through such flows. The 14th Five-Year Plan of Shanghai proposes the establishment of a capital market service base in the Yangtze River Delta to facilitate the effective promotion of capital flow and integrated development. This will help guide capital to serve technological innovation and the real economy better. However, current research on integrating the Yangtze River Delta has mainly focused on integrating industries, urban and rural areas, and infrastructure. There needs to be more research on the connotation and characteristics of capital flows and integration, as well as the current situation, bottlenecks, and path options for developing capital flows and integration in the Yangtze River Delta. The integration of the capital market in the Yangtze River Delta region involves establishing and forming a unified capital market in the region, allowing different economic agents to conduct investment and financing activities and financial institutions to operate relatively freely across the region without being restricted by administrative boundaries. Therefore, based on understanding the connotation of relevant concepts and the summary of foreign experience in capital flows and integration, this paper delves into the current situation and path options for developing capital flows and integration in the Yangtze River Delta region. This discussion aims to promote the process of capital flows, ensure the rational allocation of resources, and promote the high-quality development of the regional economy.

2. Conceptual understanding of relevant concepts

2.1. Regarding the understanding of the connotation of capital and its flows

The concept of capital, which refers to the assets available for use in producing goods and services, has a long and rich history in economic thought. The is widely credited with introducing the concept, arguing that the return earned by the owner of capital is called interest, which represents the rent of capital. Subsequent scholars, including Adam Smith and Ricardo, refined this definition, with characterizing capital as an asset that can be profitably invested and noting the preference of capitalists for investing at home due to the uncertainty of foreign markets. In the 19th century, argued that the forms and conditions of productive activity should be understood in the context of actual relations of production and that even the most primitive human tools can be considered capital. Highlighted the role of labor and capital as the two primary productive forces in society, which together create and distribute wealth. In the 20th and 21st centuries, the definition of capital has continued to evolve, with defining it as durable products used as inputs in further production and distinguishing between physical and financial capital. More recent scholars have expanded the concept of capital to include new forms of value, such as human and social capital. Ke (2011) emphasizes the evolution of modern capital and its uncertain and difficult-to-measure returns. Meanwhile, Gaohui et al. (2018) introduce the concept of natural capital as an asset controlled by nature that can appreciate and add value. This paper defines capital primarily as financial capital, encompassing society-wide fixed asset investment, bank capital flows, government transfer payments, social financing scale, foreign direct investment, stock and bond market financing, and enterprise cross-regional investment. However, we exclude intellectual capital and human capital from our definition. We also discuss capital mobility, which refers to transferring capital from areas with lower marginal incomes to higher incomes to maximize profits and achieve a dynamic change in resources. Ultimately, this paper contributes to the ongoing evolution of the concept of capital and its role in the global economy.

2.2. Scholars have given their definitions of understanding the connotation of capital market integration

Capital market integration refers to removing capital controls and institutional barriers, ultimately resulting in being free of any impediment, as described by Balassa (1977). Categorizes the existing capital market integration as asset liquidity-based and asset substitutability-based. Posit that market competition and market forces enable the optimal allocation of financial capital within a region, ultimately promoting the successfulrous development of regional economies. Yawei and Jianghui (2021) argue that capital flow and effective combination of capital between regions can help improve the overall efficiency of capital use, thus achieving Pareto improvement of regional capital markets, supporting the peaceful development of regional economies, mainly when capital as a resource endowment differs between regions. Furthermore, Zhengzhu and Yaoyao (2021) state that the integration of capital markets encompasses capital and securities markets, where capital markets refer to the market where capital elements are traded and bought and sold as commodities. As capital market integration advances, factors impeding the flow of capital are gradually reduced, financial institutions are free to operate across regions, restrictions on trading activities engaged in financial capital are gradually removed, and the trading environment of capital markets is continuously optimized. In conclusion, capital market integration is a multifaceted phenomenon involving removing barriers and impediments, optimizing trading environments, and allocating financial capital within regions. The perspectives of various scholars highlight the benefits of capital market integration in promoting economic growth and efficiency, which can ultimately lead to the overall prosperity of regional economies.

In finance, it is well-established that capital flows play a crucial role in the economic development of regions. Capital flows toward regions with vibrant economies and high returns as a general trend. Simultaneously, governmental policies play a pivotal role in guiding and regulating the flow of capital, thereby facilitating the optimization of regional economic structures. Moreover, it is widely acknowledged that capital and capital flows are the principal driving force behind regional economic growth and market integration. Effective coordination and cooperation mechanisms are necessary to promote regional capital market integration. Facilitating the free flow of capital and scientific allocation are essential elements that enhance capital market integration. In conclusion, the flow of capital is essential for regional economic growth and market integration. To optimize regional economic structures, governments must actively guide and regulate the flow of capital. Furthermore, establishing effective coordination and cooperation mechanisms is critical to promote regional capital market integration, which will foster economic development in the long run.

3. Current status of capital flows and integrated development in the Yangtze River Delta region

3.1. Aggregate analysis of capital flows

To ascertain the magnitude and direction of capital flows in the Yangtze River Delta region, this study projects the total volume of capital flows in three provinces and a city. It is well-established that the flow of capital within an economy is closely linked to the movement of physical goods, wherein capital is a driver of the latter (Jinlong and Hongwei, 2003). To elaborate, the direction of physical goods flows is the converse of the direction of capital flows. By obtaining the direction (inverse) and magnitude of physical goods flows between regions, one can deduce the direction and scale of capital flows between these regions. In light of this, we employ the methodology of calculating the direction and scale of commodity flows in the regions above the Yangtze River Delta, utilizing the national economic accounts as the primary data source for our calculations.

αj is the net value of imports and exports of goods of province (city) No. U = ∑ωjVj calculated from the national economic accounts according to the expenditure method; βj is the net value of external imports and exports of goods of province (city) No. U = ∑ωjVj calculated according to the customs statistical yearbook; ωj represents the net value of imports and exports of goods of province (city) No. U = ∑ωjVj minus the net value of external imports and exports of goods to obtain the overall direction and scale of goods flows of province (city) No. U = ∑ωjVj; This method calculates the full scale and direction of the Yangtze River Delta region's goods flows. In this way, the full scale and direction of commodity flows in the Yangtze River Delta region are calculated, i.e., the full scale and direction of capital flows in the reverse direction are obtained, as shown in Table 1.

Table 1 displays the capital flows within the Yangtze River Delta region from 2010 to 2020. Shanghai experienced a noteworthy increase in inflow, rising from US$11.633 billion in 2010 to US$38.450 billion in 2020, representing a growth of 3.31 times. The total capital inflow in Shanghai amounted to US$221.34 billion throughout the period. Similarly, Jiangsu recorded an increase in inflow from US$11.193 billion in 2010 to US$33.683 billion in 2020, indicating a growth of 3.01 times. The combined capital inflow in Jiangsu amounted to an impressive sum of US$264.873 billion. On the other hand, Zhejiang showed consistent capital outflows in all years except 2013, 2014, 2017, 2019, and 2020. The combined net outflow from Zhejiang stood at US$2.172 billion. Anhui had capital inflows from 2010 to 2016, followed by capital outflows between 2017 and 2019. The combined net inflow of Anhui amounted to US$10.884 billion. Overall, the Yangtze River Delta region experienced a substantial increase in inflow from US$17.660 billion in 2010 to US$75.624 billion in 2020, indicating a growth of 4.28 times. The combined inflow to the region amounted to a staggering US$493.137 billion. The Yangtze River Delta region attracts significant capital inflow from 2010 to 2020, with Shanghai, Jiangsu, and Anhui being the primary beneficiaries. Conversely, Zhejiang shows capital outflows, while Anhui experienced capital outflows in the last 3 years. This discrepancy in the scale and direction of capital flows can be attributed to differences in local economic development. Shanghai and Jiangsu have demonstrated faster economic growth and recorded more significant capital inflows, whereas Anhui shows smaller capital inflows, and Zhejiang's economic growth is relatively slower.

3.2. Component analysis of capital flows

3.2.1. Social-wide investment in fixed assets

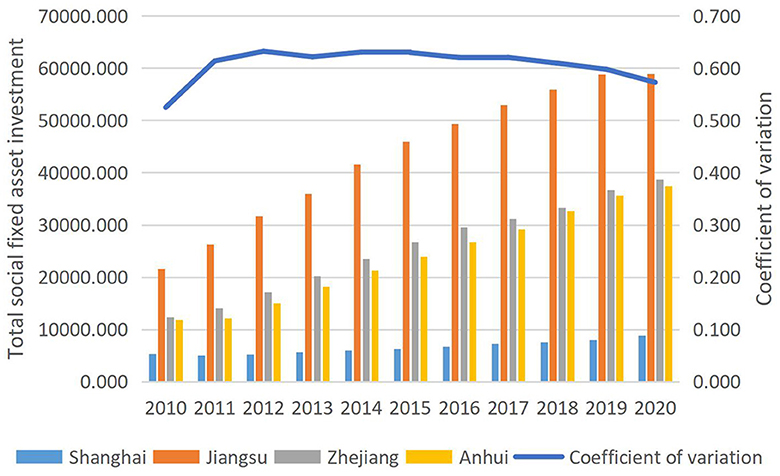

By Yuhan (2021), investment in fixed assets is quantified in monetary units. It pertains to a particular period, the magnitude of labor involved, and the fluctuations in associated costs that enterprises expend to construct or procure fixed assets. Conversely, as highlighted by Wu and Chen (2018), social fixed asset investment represents monetary investments encompassing the scale, pace, proportion, and direction of fixed asset investment comprehensively. Hence, this article utilizes the all-social fixed asset investment indicator, which can significantly impact the economic growth rate of a given region and its economic development paradigm and industrial structure. Figure 1 displays the relevant findings.1

Figure 1. Evolution of social fixed asset investment and coefficient of variation in the three provinces and one city in the Yangtze River Delta, 2010–2020 (unit: billion yuan).

From the data presented in Figure 1, it is evident that the total social fixed asset investment in Shanghai surged from 531.767 billion yuan in 2010 to 883.748 billion yuan in 2020, representing a growth of 1.66 times. The average annual growth rate was reported to be 13.8%. Meanwhile, Jiangsu experienced an exponential rise of 2.72 times, from 216.4302 billion yuan in 2010 to 589.430.20 billion yuan in 2020, with an average annual growth rate of X%. Similarly, Zhejiang's total fixed social asset investment escalated from RMB 123.704 billion in 2010 to RMB 386.8482 billion in 2020, representing an upswing of 3.13 times, with an average annual growth rate of 26.05%. In comparison, Anhui's total fixed social asset investment surged from RMB 118.4943 billion in 2010 to RMB 374.907 billion in 2020, representing an increase of 3.16 times, with an average annual growth rate of 26.05%. Notably, Shanghai had the smallest share of total social fixed asset investment in the Yangtze River Delta region, and its growth rate was comparatively lower. Conversely, Jiangsu held the largest share of about 50% and experienced a faster growth rate. Meanwhile, Anhui and Zhejiang also held a significant share and witnessed a faster growth rate. Additionally, as evidenced by Figure 1, the coefficient of variation of the total social fixed asset investment in the three provinces and one city increased from 0.52 in 2010 to 0.57 in 2020. This indicates that the internal variation of the total social fixed asset investment in the Yangtze River Delta region has increased, and market segmentation has intensified. A lower coefficient of variation indicates higher market integration, whereas an increased coefficient of variation suggests greater market segmentation.

3.2.2. Bank fund flows

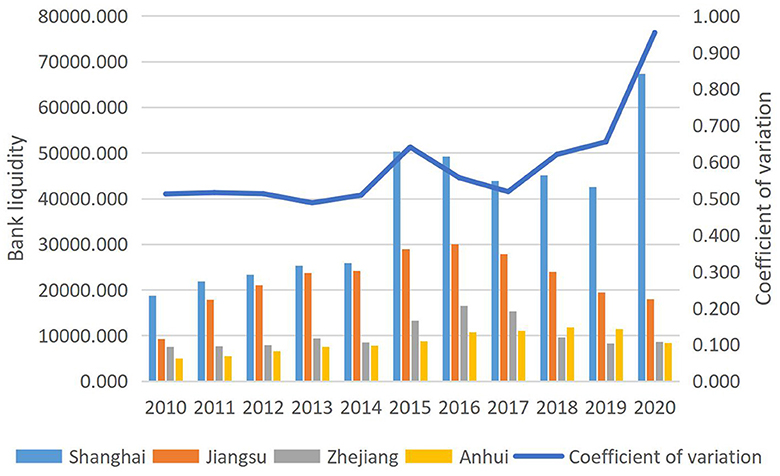

The present study investigates the bank funds flow in regions, primarily manifested in the deposit and lending spread, inter-bank splitting, and inward and outward remittance of bank funds. Although the interbank lending and borrowing market represents a crucial channel for the flow of bank funds, the data about it are not easily obtainable. Hence, our primary focus is examining banks' deposit-credit spread change. Specifically, the balance of deposits minus the balance of loans, where the balance of deposits is based on the balance of all financial institutions' deposits denominated in RMB at the end of the year, and the balance of loans is based on the balance of all loans denominated in RMB at the end of the year. From a conceptual perspective, deposits can be regarded as the value of regional output, while loans represent the value of regional inputs. A positive deposit-credit spread indicates capital outflows from banks in the region, whereas a negative spread implies capital inflows into banks in the region (Wenbin and Chaoxia, 2007). These relationships are depicted in Figure 2. Despite certain limitations, our empirical findings suggest that the deposit-credit spread represents a reliable proxy for analyzing the flow of bank funds in regions.2

Figure 2. Evolution of deposit and loan spread and coefficient of variation in the three provinces and one city of the Yangtze River Delta, 2010–2020 (unit: billion yuan).

The present study scrutinizes the bank deposit-lending gap of four key provinces and cities in the Yangtze River Delta of China, namely Shanghai, Jiangsu, Zhejiang, and Anhui, from 2010 to 2020. As depicted in Figure 2, the findings reveal that the bank deposit-lending gap in Shanghai has surged from RMB 187,795 million in 2010 to RMB 6,733,662 million in 2020, indicating a notable increase of 3.60 times with an average annual growth rate of 29.99%. Likewise, Jiangsu's bank deposit-lending gap has risen from RMB 921,214 million in 2010 to RMB 180,462 million in 2020, showcasing a growth of 1.96 times with an average annual growth rate of 16.31%. Meanwhile, Zhejiang's bank deposit-lending gap has escalated from RMB 754.375 billion in 2010 to RMB 862.200 billion in 2020, indicating a modest increase of 1.14 times with an average annual growth rate of 10.39%. Lastly, Anhui's bank deposit-lending gap has increased from RMB 499.372 billion in 2010 to RMB 837.730 billion in 2020, signifying a growth of 1.68 times with an average annual growth rate of 15.25%. Notably, the positive bank deposit and loan spread in all three provinces and one city during the stated period indicates a net outflow of funds. Furthermore, Shanghai's most significant deposit and loan spread indicates a massive capital outflow. Conversely, Jiangsu demonstrates a slightly larger bank deposit and loan spread with a slow growth rate. Meanwhile, Zhejiang displays a smaller bank deposit and loan spread with the slowest growth rate, whereas Anhui showcases a lower bank deposit and loan spread but with a faster growth rate. Additionally, the coefficient of variation of the deposit-lending gap indicator of banks in these regions revealed an upward trend, from 0.51 in 2010 to 0.95 in 2020, suggesting an expanding internal gap and intensified market segmentation of bank capital flows. Figure 2 captures the patterns and trends of the bank deposit-lending gap across these four regions, highlighting the dynamics of capital flows and their implications for regional development.

3.2.3. Government financial subsidies

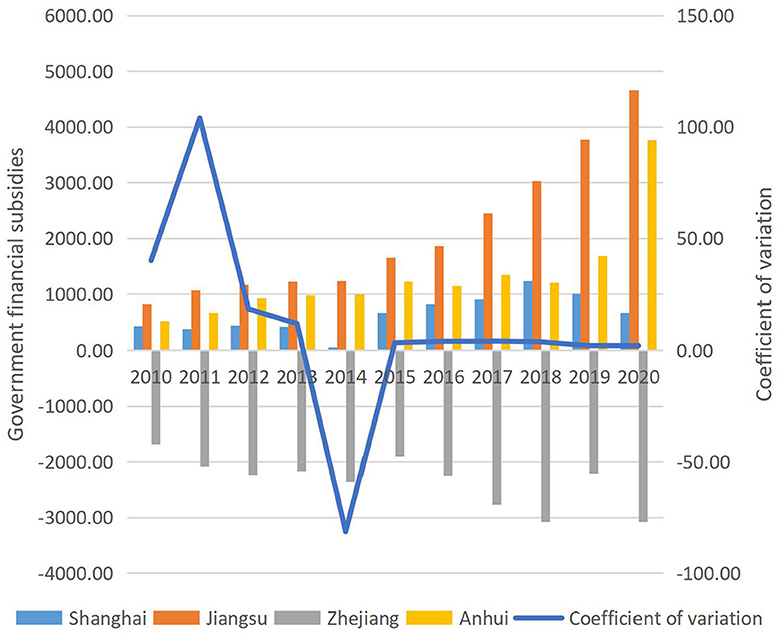

In financial control, the Chinese government employs various strategies such as direct investment, fiscal transfers, and preferential policy compensation. Among these, fiscal transfers are a means of distributing income from higher-level governments to their lower-level counterparts, granting the government a more robust grip on fund allocation (Yunhui and Sulan, 2022). However, information on fiscal transfers is often challenging to procure. To circumvent this obstacle, this study utilizes the difference between local budget expenditure and revenue to measure financial subsidies from higher-level governments. A positive difference denotes government financial subsidies to the region, while a negative difference indicates that the area contributes to higher-level governments. Figure 3 demonstrates this concept.

Figure 3. Evolution of the difference between local budget expenditure and revenue and the coefficient of variation in the Yangtze River Delta, 2010–2020 (unit: billion yuan).

As illustrated in Figure 3, the disparity between local budget expenditure and revenue in Shanghai escalated from RMB 42.931 billion in 2010 to RMB 67.020 billion in 2020, signifying an upsurge of ~1.56 times and an average annual growth rate of 14.19%. In contrast, the difference between local budget expenditure and revenue in Jiangsu surged from RMB 83.420 billion in 2010 to RMB 466.169 billion in 2020, indicating an increase of about 5.59 times and an average annual growth rate of 23.93%. Meanwhile, the gap between local budget expenditure and revenue in Zhejiang plummeted from −168.753 billion yuan in 2010 to −307.524 billion yuan in 2020, denoting a decrease of ~1.82 times and an average annual decline of 16.57%. Finally, the difference between local budget expenditure and revenue in Anhui soared from 52.379 billion yuan in 2010 to 376.370 billion yuan in 2020, representing a surge of about 7.19 times and an average annual growth rate of 65.32%.

The present study sheds light on the pattern of government financial subsidies and budgetary flows across several Chinese provinces. Notably, Shanghai, Jiangsu, and Anhui have been beneficiaries of government financial subsidies from 2010 to 2020 and have enjoyed a steady inflow of government budgetary funds. Conversely, Zhejiang has been a net outflow recipient of government budgetary funds during the same period. These observations suggest a divergent allocation of financial resources across the studied provinces. To further delve into the intricacies of budgetary trends in the region, we turn to Figure 3. Here, we analyze the coefficient of variation of the difference between local budget expenditure and revenue for the three provinces and one city from 2010 to 2020. We note that the coefficient of variation displays a marked fluctuating decline, with a steep decrease from 40.09 in 2010 to 2.01 in 2020. This observation points toward a noticeable reduction in the internal differences between local budget expenditure and revenue in the Yangtze River Delta region, indicative of an encouraging trend of integrated development.

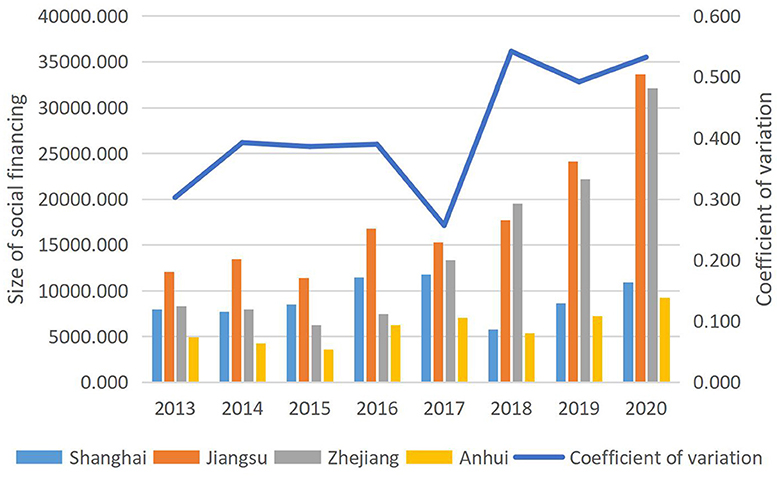

3.2.4. Scale of social financing

According to Songcheng and Jieyu (2016), the magnitude of regional social financing is widely regarded as a comprehensive measure of the local financial system's capacity to fund the local enterprise economy. Enhancing the favorable interaction between finance and the economy can expedite the transformation, optimization, and upgrading of the regional economic structure and narrow the gap in regional economic development. Against this backdrop, this study compares social financing scale evolution dynamics in the Yangtze River Delta's three provinces and one city. Data on the social financing scale for 2013–2020 were identified from the wind database, as data for 2010–2012 were unavailable. Figure 4 depicts the findings.

Figure 4. Comparison of the social financing scale and the evolution of the coefficient of variation in the three provinces and one city of the Yangtze River Delta (unit: billion yuan).

This study examines the dynamics of the social financing scale among the three provinces and one city in the Yangtze River Delta region. Using data from 2013 to 2020, we find that social financing has significantly expanded, with significant variation across provinces. Jiangsu has the most extensive social financing scale, followed by Zhejiang and Shanghai, while Anhui lags. Our analysis reveals that the social financing scale in Shanghai increased from 796.4 billion yuan in 2013 to 109.16 billion yuan in 2020, with an average annual growth rate of 12.46%. In Jiangsu, the scale of social financing rose from 1,207.0 billion yuan in 2013 to 336.11 billion yuan in 2020, with an average annual growth rate of 25.32%. Meanwhile, Zhejiang's social financing scale experienced the most substantial increase, rising from 834.50 billion yuan in 2013 to 3,215.50 billion yuan in 2020, with an average annual growth rate of 35.03%. Finally, Anhui's social financing scale grew from 496.90 billion yuan in 2013 to 925.10 billion yuan in 2020, with an average annual growth rate of 16.92%. Our findings suggest that the social financing scale of the three provinces and one city in the Yangtze River Delta region is characterized by a fluctuating upward trend, as evidenced by the coefficient of variation, which increased from 0.30 in 2013 to 0.53 in 2020. This result indicates that the internal gap between the social financing scale of the three provinces and one city is widening, intensifying market segmentation. Our study contributes to a better understanding of the financial landscape in the Yangtze River Delta region. It underscores the importance of monitoring social financing dynamics to facilitate regional financial integration.

3.2.5. Foreign direct investment (FDI)

(1) Foreign direct investment (FDI) plays a pivotal role in the current internationalization of capital factors, serving as a critical barometer of capital flow volumes. By fostering productivity, promoting technological progress, and generating employment opportunities, FDI provides various benefits for host economies. Furthermore, vertical and horizontal spillover effects and competitive spillover can help to reduce the technological gap between regions. To enhance the value chain and promote the dynamic transformation of regional comparative advantages, it is essential to optimize the structure of foreign investment to accommodate the industrial transfer. To adapt to the rapidly changing landscape of the global economy, policymakers should pay close attention to the characteristics of foreign investment flows and their impact on local economies. In particular, efforts should be made to attract high-quality foreign investment and enhance its positive spillover effects. Practical measures, such as preferential policies and streamlined administrative procedures, can create a favorable environment for foreign investment to flourish. Moreover, enhancing the competitiveness of local industries and fostering innovation can also optimize the structure of foreign investment, leading to greater economic prosperity and progress. In summary, FDI serves as a crucial barometer of capital flows, and its spillover effects can help to narrow the technological gap between regions. By adjusting the structure of foreign investment to adapt to industrial transfer, enhancing the value chain, and promoting the dynamic transformation of regional comparative advantages, policymakers can create a more favorable environment for foreign investment to thrive, leading to a range of positive economic outcomes.

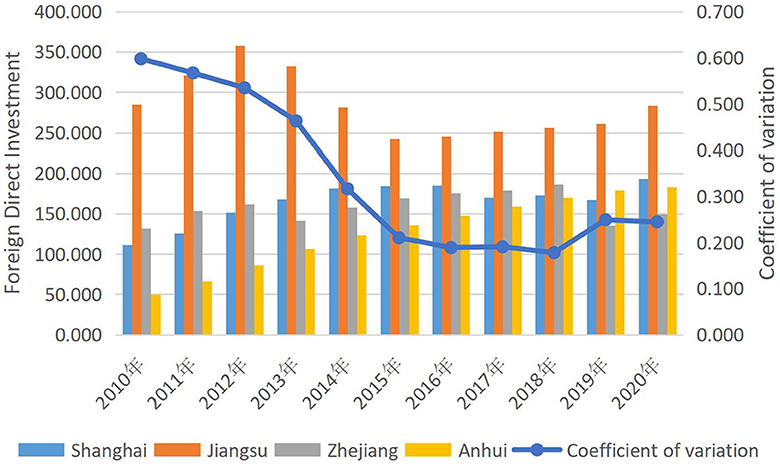

According to the data presented in Figure 5, foreign investment utilization in Shanghai has witnessed an impressive growth trajectory, soaring from US$11.121 billion in 2010 to US$19.308 billion in 2020, signifying an increase of roughly 1.74 times and an average annual growth rate of 15.78%. Conversely, Jiangsu's foreign investment utilization has experienced a dip, falling from US$28.498 billion in 2010 to US$28.380 billion in 2020, indicating a decrease of ~8.33%. Meanwhile, the actual foreign investment utilized in Zhejiang surged from US$13.226 billion in 2010 to US$15.00 billion in 2020, representing a growth of about 1.13 times and an average annual growth rate of 10.31%. On the other hand, Anhui's foreign investment utilization displayed the fastest growth rate amongst the four regions, surging from US$5.014 billion in 2010 to US$18.310 billion in 2020, a remarkable increase of around 3.65 times and an average annual growth rate of 33.20%. The foreign investment utilization trends among the four Yangtze River Delta regions were quite distinct from 2010 to 2020. While Shanghai sustained its rapid growth rate, Zhejiang witnessed moderate fluctuation, and Jiangsu experienced a decline. In comparison, Anhui had the smallest absolute value but the highest growth rate. Additionally, it is worth noting that the coefficient of variation of foreign investment utilization in the four regions exhibited a general decrease from 0.6 in 2010 to 0.25 in 2020, indicating a significant decrease in the internal gap between the regions and an acceleration of the integration process in the Yangtze River Delta area. This observation is also supported by the data presented in Figure 5.

Figure 5. Evolution of the amount of actual FDI used and the coefficient of variation in the three provinces and one city in the Yangtze River Delta, 2010–2020 (Unit: USD billion).

3.2.6. Stock and bond market financing

Roxana and Stoica (2018) assert that stock market capitalization and capital liquidity are the primary factors that positively influence capital markets' contribution to economic growth. Similarly, Orlowski (2020) contends that integrating stock and bond markets in the European Union (EU) could enhance capital financing access, promote counter-cyclical and sustainable real economic growth, and mitigate market and systemic risks. To investigate the status of capital markets in China, this study turns to the wind database, which reports that there were 4,140 A-share listed companies in the country by the end of 2020. Among these, 339 were listed in Shanghai, accounting for almost 9% of the total, with a total market capitalization of 7.65 trillion yuan. Meanwhile, Jiangsu had 481 listed companies, representing 11.6% of the total market capitalization of 6.2786 trillion yuan. Zhejiang had 517 listed companies, accounting for 12.5% of the total, with a total market capitalization of 6.2786 trillion yuan. Anhui had 126 listed companies, accounting for almost 3% of the total, with a total market capitalization of RMB 1.9 trillion. Finally, the financing structure of non-financial institutions in the three provinces and one city in the Yangtze River Delta in 2020 is presented in Table 2, providing valuable insights into the current state of capital markets in this region.

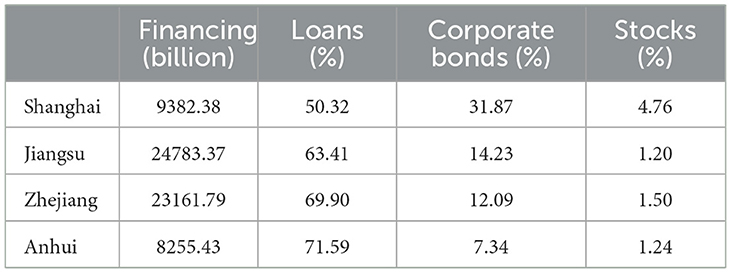

Table 2. Non-financial institution financing structure of the three provinces and one city in the Yangtze River Delta in 2020.

Table 2 presents the financing statistics of non-financial institutions in the Yangtze River Delta region during 2020. Shanghai exhibited a financing volume of RMB 938.238 billion, of which loans, corporate bonds, and stock bonds represented 50.32, 31.87, and 4.76%, respectively. Meanwhile, Jiangsu's financing volume amounted to RMB 2,478.337 billion, of which loans, corporate bonds, and stock bonds comprised 63.41%. Similarly, Zhejiang's financing volume reached RMB 2,316.179 billion, of which loans, corporate bonds, and stock bonds accounted for 69.9, 12.09, and 1.5%, respectively. In comparison, Anhui's financing volume was RMB 825.543 billion, of which loans, corporate bonds, and stock bonds constituted 71.59, 7.34, and 1.24%, respectively. These results suggest that indirect financing far outweighs direct financing in the Yangtze River Delta region. Furthermore, corporate bond financing is notably more prevalent among direct financing options than equity financing.

3.2.7. Development of the headquarters economy

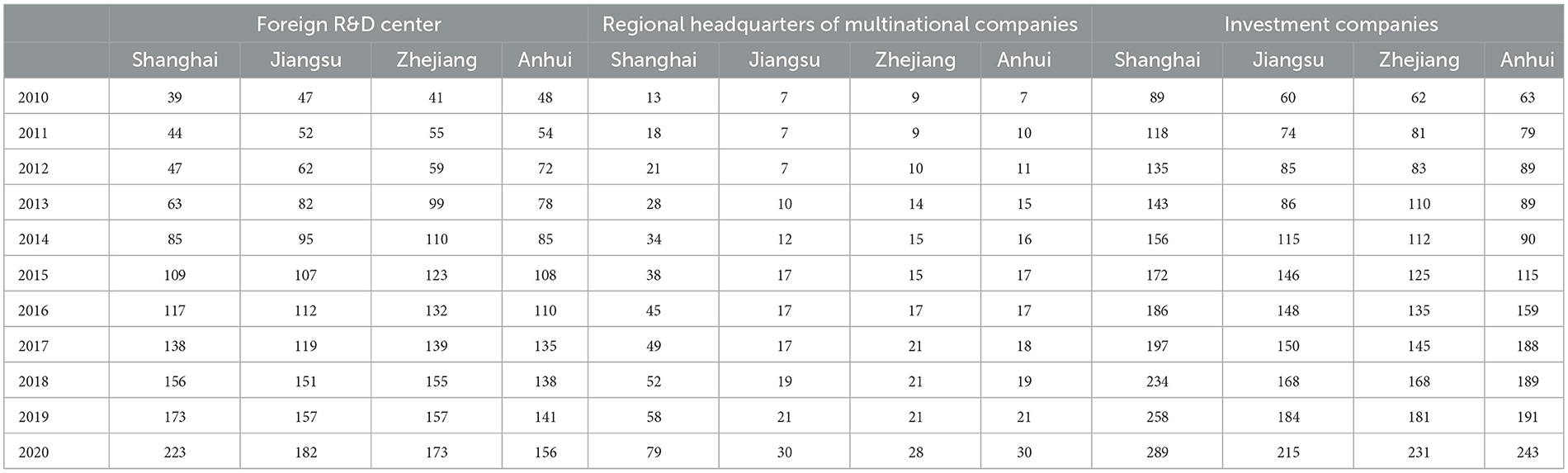

In the realm of global resource allocation, acceleration of regional headquarters economy clustering can potentially augment the capacity for such allocation. The development of the headquarters economy is typically gauged through a range of key indicators such as foreign-funded R&D centers, multinational corporations' headquarters, and investment companies. In this regard, Table 3, derived from the Oracle database, presents an overview of the evolution of the headquarters economy in the three provinces and one city from 2010 to 2020.

Table 3. Development of headquarters economy in the three provinces and one city in the Yangtze River Delta, 2010–2020 (unit: pcs).

Table 3 presents a comprehensive overview of the development of the headquarters economy across the four regions in China, namely Shanghai, Jiangsu, Zhejiang, and Anhui, over the past decade. First, regarding foreign-funded R&D centers, the number of foreign-funded R&D centers in Shanghai rose from 39 in 2010 to 223 in 2020, a remarkable surge of 5.72 times. In Jiangsu, the number of foreign-funded R&D centers grew from 47 in 2010 to 182 in 2020, an increase of 3.87 times. In Zhejiang, the number of foreign-funded R&D centers climbed from 41 in 2010 to 151 in 2020, whereas in Anhui, the number of foreign-funded R&D centers increased from 48 in 2010 to 156 in 2020, indicating a growth rate of 3.25 times. Secondly, from the viewpoint of regional headquarters of multinational corporations, there was an impressive increase in the number of regional headquarters of multinational companies in Shanghai, which rose from 13 in 2010 to 79 in 2020, a substantial surge of 6.08 times. In Jiangsu, the regional headquarters of multinational companies grew from 7 in 2010 to 30 in 2020, with a growth rate of 4.29 times. Likewise, in Zhejiang, the regional headquarters of multinational companies increased from 9 in 2010 to 39 in 2020. In Anhui, the regional headquarters of multinational companies rose from 7 in 2010 to 30 in 2020, reflecting a growth rate of 4.29 times. Thirdly, in terms of investment companies, there was a considerable increase in the number of investment companies across the four regions. Specifically, the number of investment companies in Shanghai surged from 89 in 2010 to 289 in 2020, an increase of 3.25 times. In Jiangsu, the number of investment companies increased from 60 in 2010 to 215 in 2020, representing a growth rate of 3.58 times. In Zhejiang, the number of investment companies climbed from 62 in 2010 to 231 in 2020, a remarkable surge of 3.73 times. In Anhui, the number of investment companies rose from 63 in 2010 to 243 in 2020, reflecting a growth rate of 3.86 times. The rapid development of the headquarters economy in these regions underscores the effectiveness of the headquarters economy model in promoting the process of capital market integration in the Yangtze River Delta (Lina, 2015).

4. Significant bottlenecks in the development of capital flows and integration in the Yangtze River Delta region

4.1. The main existing problems of listed companies make it difficult to effectively promote capital flows and integration

Firstly, the study points out that listed companies need more financing channels, resulting in unstable returns. Companies generally raise capital through debt financing to meet their business expansion and project investment funding needs. However, during the tightening of the financing environment or policy changes, the financing capacity of the companies might not match the required operating expenses, leading to a situation where the company's capital does not cover its debts. This might lead to lower profits, operating losses, rapid growth in debt, and unstable future earnings. Furthermore, project investment funds are difficult to recover in the short term, leading to high financial risks for the companies. Secondly, the study highlights that imperfect internal control systems are a significant reason for triggering financial risks in the listed companies. This imperfection is manifested in several ways. Firstly, some listed companies need more adaptability in their internal control system and need to establish effective risk control methods. Secondly, even though some listed companies have established a financial risk control system, they need to be stronger in practicality and do not dovetail enough with internal audits to give full play to their role. Thirdly, some listed companies need more technical means, internal factors, and professional staff, resulting in weak control ability, even though they know the financial risks. Finally, the study examines listed companies' financial risk response and control ability. It is found that there are two aspects of listed companies that affect the effectiveness of risk control. Firstly, preventive measures are not in place. Risk management is limited to the preliminary judgment of financial risks, resulting in the expansion or spread of risks due to inappropriate prevention and control measures. Secondly, the early warning mechanism for financial risks needs to be completed. The risk response personnel are not professional, their responsibilities could be more precise, and their decisions could be more scientific, leading to missing the best time for risk warning. In conclusion, the study reveals that financial risks are prevalent in the listed companies and are primarily caused by limited financing channels, imperfect internal control systems, and weak financial risk response and control ability. The study findings can help policymakers and practitioners in the financial industry to take appropriate measures to mitigate financial risks in the listed companies.

4.2. The bank's existing regulatory system is unsuitable for capital factor flows and integrated development

The development of capital flows and integration in the Yangtze River Delta region has been hindered by various factors, such as the regional administrative system, head office and branch system of commercial banks, and the lagging construction of the credit system. These issues significantly impact the process of capital market integration, which calls for attention and prompt resolution. The regional supervision and financial regulation system established by the central bank in China has been identified as a significant hindrance to capital flows. The central bank's management principle emphasizes balancing each region's total economic volume rather than strengthening the degree of regional economic ties. As a result, the financial institutions in the Yangtze River Delta region are supervised by six first-tier branches of the People's Bank of China located in Shanghai, Hangzhou, and Nanjing. When the central bank formulates regional financial policies, differences depending on the region often arise, leading to difficulties conducting business across regions. The head office branch system implemented by commercial banks is another challenge that hinders the flow of funds. The large market share of commercial banks, with branches and sub-branches operating independently, limits their ability to conduct business across regions. This leads to difficulties in cross-provincial and cross-industry cooperation. The funds absorbed in each region can only be used locally, further impeding the flow of funds and hindering the process of capital market integration. The lagging construction of the credit system has been identified as a significant barrier to the free flow of credit funds. Inability to share corporate loan information across regions or even across banks in the same region results in enterprises having to repeatedly handle loan applications, audits, credit audits, guarantees, and other financial services. This increases transaction costs for enterprises and wastes banking system resources. Despite the declaration by local governments in the Yangtze River Delta region to build a unified social credit system, progress in establishing the system has needed to be faster, exacerbating difficulties in supervision and hindering the free flow of credit funds. To address these challenges and promote the development of capital flows and integration, local governments in the Yangtze River Delta region must promptly establish a unified social credit system. This will facilitate sharing of credit information across regions, enhance supervision, reduce enterprise transaction costs, and promote the free flow of credit funds across the region.

4.3. Government competition and administrative barriers weaken capital flows and integrated development

The paper discusses the challenges facing regional capital markets in China, focusing on the Yangtze River Delta region. The authors identify three key issues hindering the region's capital market integration and development. Firstly, the administrative and fiscal powers of the central and local governments need to be unified. Despite establishing a hierarchical fiscal system in the 1990s, the division of fiscal powers and responsibilities between various levels of government remains to be determined. Local governments, in particular, wield significant control over various financial instruments, including finance, taxation, investment, and credit. There needs to be more unity in fiscal powers and affairs to ensure the smooth functioning of the regional capital markets. Secondly, competition between local governments inhibits capital flows and integrated development. The authors highlight the intricate affiliation of the three provinces and one city in the Yangtze River Delta region, which restricts the outflow of local and foreign capital inflow. The resulting fragmentation of the capital markets makes achieving integration and coordinated development difficult. Thirdly, administrative barriers and local protectionism exacerbate the problem of capital market fragmentation. The authors argue that administrative barriers and protectionism among the governments of the Yangtze River Delta region hinder the free flow of capital and exacerbate structural convergence. This leads to widening internal differences in social fixed asset investment and government budget funds invested by the three provinces and one region city. Local protectionism also leads to a large amount of construction duplication, resulting in irrationally allocated resources. Foreign direct investment (FDI) could alleviate the shortage of regional capital. However, the authors caution that the vicious competition among local governments in terms of taxation, land resources, and other policies could be more conducive to sustainable economic development in the long term. The authors emphasize the need for a coordinated effort to overcome these challenges and achieve a more integrated and efficient regional capital market.

4.4. The existing investment environment is hardly effective in promoting capital flows and integrated development

The present study examines the infrastructure and regulatory impediments hindering the development of capital flows and integration in the Yangtze River Delta region. The region is yet to form a cohesive and integrated network environment for transportation, information, energy, and other infrastructure, which presents a significant connectivity challenge among the three provinces and one city. Moreover, the contradiction between the rising demand for regional infrastructure and the inadequate supply capacity is increasingly evident. For instance, the intelligent and adaptive requirements of information infrastructure networks are yet to be met, and the isolation of information networks among cities persists, further complicating the process of capital flow and integration. Furthermore, the supervision of the regional capital market is insufficiently uniform, and the legal environment is struggling to adapt to the effective flow of capital. The lack of standardization in the regulation of the capital markets in the Yangtze River Delta region has had adverse effects on the transmission of information and capital flows and has impeded the overall development of the regional capital markets. These limitations pose significant challenges for the development of a cohesive and efficient capital market in the Yangtze River Delta region, hampering its integration into the global economy. This study suggests that the creation of an integrated network infrastructure and the establishment of a standardized regulatory framework is imperative to facilitate the efficient flow of capital and further enhance the economic growth potential of the region.

5. Lessons from foreign experience in capital flows and integrated development

5.1. US capital flows and the integration process

5.1.1. The early stages of capital market development

During the pre-1929 era, the United States witnessed the emergence and advancement of its capital markets, as chronicled in the annals of financial history. The nascent U.S. securities market began to coalesce during the late 18th and early 19th centuries. However, the early years of this period were characterized by high levels of speculative hunger and a shortage of safeguards to protect the interests of small and medium-sized businesses, thereby rendering the stock market investment market a somewhat risky proposition. In the late 19th century, the U.S. capital market experienced rapid growth. However, the lack of robust regulatory oversight increased insider trading and market manipulation. In response to these challenges, the Federal Reserve Bank was established in the early 20th century, and the government intervened in Wall Street by introducing the Clayton Act of 1916. The latter act aimed to curb monopolistic practices and strengthen antitrust regulations, thereby enhancing market efficiency and promoting fair competition.

5.1.2. Roosevelt's New Deal, which enacted a series of legal regulations

Between 1929 and 1954, the United States of America witnessed a significant shift in its socioeconomic landscape. The ascension of Franklin D. Roosevelt, a Democrat, to the presidential office in 1933 marked the inception of the “New Deal”—a series of economic policies designed to strengthen government intervention in the economy and Wall Street. This epochal event was marked by the enactment of numerous regulatory statutes, such as the Securities Act of 1933, the Banking Act of 1933, the Securities Exchange Act of 1934, the Public Utility Holding Act of 1935, the Maloney Act of 1938, the Trust The Contracts Act, the Investment Company Act of 1940, and the Investment Advisers Act of 1940, among others. These legal instruments provided lucid provisions on securities issuance, trading and fraud, the deposit insurance system for banks, the control of public institutions, and investment conduct and regulation. Implementing these regulations effectively facilitated the flow of capital, engendering an environment conducive to robust economic growth.

5.1.3. U.S. capital entered the modern investment era

In the annals of financial history, the third epoch commencing in 1954 proved to be a period of prodigious growth for the United States capital market. 1958 marked a watershed moment, as the advent of a modern investment philosophy witnessed the gradual assimilation of growth and value investment concepts. This watershed was attributed to a propitious alignment, as the returns on equity investments dwindled below the long-term government bond yields for the first time, offering an amenable environment conducive to fostering the capital market's sound and consistent growth.

5.2. Capital flows and integration processes in East Asia

(1) The onset of the 1997 financial crisis in Thailand instilled a sense of unease and a drive for financial reform across the region. Its rapid contagion to neighboring economies, such as Korea, the Philippines, and Japan, intensified the situation's urgency. In response, Japan championed the establishment of an Asian Monetary Fund to assist member countries in acquiring liquidity from capital markets and promote financial system reform. However, this initiative encountered opposition due to concerns over the moral hazard. The ASEAN+3 cooperation meeting convened in December of the same year aimed to address the financial crisis and foster economic growth in East Asia. In retrospect, the 1997 Asian financial crisis proved to catalyze regional development. The formation of the ASEAN+3 model of regional dialogue and cooperation emerged due to the crisis, highlighting the potential opportunities brought about by the calamity. Notably, regional cooperation in East Asia is distinct from traditional forms of regional collaboration since it was initiated through financial cooperation.

(2) On May 6, 2000, the ASEAN+3 Finance Ministers' Meeting bore witness to a monumental milestone in East Asian monetary cooperation, as China, Japan, Korea, and ASEAN jointly launched the Chiang Mai Initiative. This initiative established the groundwork for regional monetary cooperation. It paved the way for establishing a new regional monetary cooperation mechanism, featuring a regional self-bailout mechanism as its centerpiece. The decision to create this new regional monetary cooperation mechanism was predicated on the leadership of its governments and was based on the political basis for capital flows. The transition from the Chiang Mai Initiative to the multi lateralization of the Chiang Mai Initiative was a critical turning point that facilitated East Asian monetary cooperation. This transition was marked by converting previously fragmented bilateral aid currency exchange agreements into a singular self-help currency pool, thus providing a solid foundation for East Asian monetary cooperation. The multi-lateralization of the Chiang Mai Initiative proved to be a meaningful step toward enhancing the region's economic resilience and promoting excellent financial stability.

(3) In the aftermath of the global financial crisis, several initiatives have been aimed at promoting the development of capital flows in the East Asian region. Of particular note are the initiatives put forward by China in 2013, which included the Silk Road Economic Belt, the 21st Century Maritime Silk Road, and the establishment of the Asian Infrastructure Investment Bank. These initiatives have been further elaborated in the “Vision and Action for Promoting the Construction of the Silk Road Economic Belt and the 21st Century Maritime Silk Road,” released in 2015, and in the “Belt and Road Development” roadmap. Against the backdrop of greater regional cooperation and “connectivity,” it is essential to accelerate the construction of telecommunications payment, clearing, and settlement systems across East Asian countries. Furthermore, promoting the networked layout of commercial banks and unifying accounting standards across countries will help facilitate trade and investment facilitation. The measures above will undoubtedly contribute to developing regional capital flows, creating new opportunities for growth and investment.

5.3. EU capital flows and the integration process

5.3.1. The initial development of the early EU capital markets

In the mid-1960s, the European Union (EU) undertook a significant policy initiative to eliminate restrictions on the national capital's cross-border movement and permit foreign financial institutions to participate in domestic capital markets to enhance financial competition. This regulatory drive marked a decisive turn toward promoting cross-border financial integration within the European Union. The First Banking Order, issued in the mid-1970s, was a vital component of this regulatory scheme, providing a framework for supervising cross-border financial activities of banks between member states. It sought to establish a set of guiding principles for the adequate supervision of banks operating across borders, laying the groundwork for the future development of cross-border banking in Europe. Thus, the early EU capital markets were shaped by two distinct phases of market liberalization, characterized by the opening up of banking markets and the harmonization of credit institution regulation to facilitate the free flow of capital within member states. This approach played a pivotal role in transforming the European financial landscape, paving the way for the emergence of a more integrated and efficient financial system.

5.3.2. A single capital market in the medium term was basically completed

In April of 1983, the European Union (EU) presented a White Paper on Financial Policy, which implored member states to enhance their regional savings and investment allocation mechanisms. The EU followed up on this initiative in the subsequent year with a report on establishing an extensive internal market to eradicate impediments to capital flows between member states and create a unified market for financial services. Subsequently, in June of 1985, the EU adopted the White Paper on establishing a Single Large Internal Market. This policy paper proposed that, by the culmination of 1992, obstacles associated with material, technical, and financial resources would be dismantled, culminating in the fundamental establishment of a singular, large market. Additionally, a series of legislative measures were to be promulgated to ensure the actualization of this objective.

5.3.3. Deeper development of capital markets in the later period

Under the auspices of the EEC and the Euratom Treaty, signed by the Netherlands, Italy, and other member states in March 1957, the European Union (EU) created a more favorable monetary and financial environment to enhance stability ensure the efficient flow of capital in the region. The objective was to promote the development of a typical financial services market, which would facilitate deeper integration among member states. In 1999, the EU Executive Committee released the EU Financial Services Action Plan (FSAP), which aimed to deepen the region's capital transactions, capital investment, and financing markets by combining wholesale banking, securities investment, and retail insurance markets. The plan was a crucial step toward achieving the EU's long-term goal of establishing a single market for financial services. In the same year, Amsterdam, Brussels, and Paris stock exchanges established a shared trading platform for equities, creating the continent's most extensive stock, bond, and financial derivatives exchanges. The exchanges also signed new agreements for trading in equities, bonds, and financial derivatives, further enhancing the integration of the region's financial markets.

Moreover, the EU reinforced the Capital Risk Harmonization Supervisory Scheme to reconsider capital risk in the process of capital flows. The objective was to establish a more competitive financial order and improve the efficiency of the circulation of money and financial instruments. The EU's efforts have significantly promoted the growth and stability of the region's financial sector, a crucial pillar of the European economy.

5.4. Capital flows and integration processes in Africa

5.4.1. Capital will continue to increase in the African region

In 1997, they witnessed the continuation of Africa's economic growth streak, which lasted for 4 years. Concurrently, foreign capital inflows into the continent continued to surge. According to the World Investment Report 1997 statistics released by UNCTAD in September 1997, external direct investment flows to Africa amounted to ~US$4.949 billion in 1996, reflecting a 5.3% increase from US$4.699 billion in 1995. Some African countries experienced even more significant external direct investment inflows in 1997. For instance, Egypt attracted US$2.1 billion of foreign investment, 3.5 times the amount it drew in 1996, of which US$800 million was a direct investment, reflecting a US$200 million rise from the preceding year. A remarkable feature of this phenomenon is the exceptional momentum that US multinational corporations (MNCs) display in their move toward Africa. For example, the American Telegraph and Telephone Company invested US$2 billion in constructing a 35,000-kilometer-long submarine fiber-optic cable around Africa, underpinned by its optimism about the prospects of the telecommunications industry in Africa. Likewise, the American Honeywell Company established a subsidiary in South Africa to manufacture electronic control devices. International financial institutions have also been actively involved in African economies, providing official development assistance and concessional loans, particularly to the poorest nations. For instance, the World Bank approved a loan to South Africa for US$46 million on 30 May 1997. Furthermore, international investment institutions have shown a keen interest in Africa as they continue to pour into the continent and establish new funds. In the past 2 years alone, a total of US$1 billion has been set up in Africa, such as the “Mauritius Fund” and the “Africa Fund,” established by the World Bank's International Finance Corporation, and the “Africa Investment Fund,” set up by Morgan Stanley & Co. (Güngör et al., 2019).

5.4.2. Africa still relies heavily on remunerative economic relations with advanced countries for its economic progress

The United States of America (US) has emerged as one of the largest investors in Africa, serving as a critical source of foreign direct investment and a significant trading partner for the continent. Many goods, including consumer, intermediate, and capital products, are imported from the US, with Africa relying on the American market for most of its raw material and mineral exports. Furthermore, the US is among the top ten destinations for crude oil exports from prominent African nations such as Libya, Morocco, and Nigeria, with oil exports constituting a significant source of revenue for these countries. The flourishing agricultural exports of Ethiopia and Kenya to developed economies, including the US, have been instrumental in generating foreign exchange earnings and spurring economic growth. Thus, Africa's substantial foreign exchange earnings and surge in international reserves are primarily attributed to its economic engagement with the US. The growth of African economies has been heavily reliant on their interaction with other economies, incredibly advanced countries, and increased inter-country trade. Over the past two decades, African economies have maintained steady economic progress, prompting the International Monetary Fund to upgrade several African countries, such as Ghana, Kenya, Nigeria, and Tanzania, to emerging market status. The capitalization of financial markets in various African countries during the late 1990s to 2000 and the expansion of financial markets from 2010 to 2015 have significantly contributed to the growth of African stock markets, which have become more accessible to foreign investors. Notably, Nigeria currently boasts the largest stock exchange market in Africa as of 2018, while Ghana's stock market index surpasses that of numerous countries across the globe (Olasehinde-Williams and Olanipekun, 2020).

5.4.3. Inefficient factor allocation in Africa leads to poverty in regional development

Poverty in Africa is a developmental issue that poses a significant challenge to the continent. While development has the potential to alleviate poverty, the existence of poverty, in turn, constrains development. Microcosmic reflections of urbanization and development are observed in factor mobility and allocation, with the inefficient unidirectional flow of factors in Africa hampering development efforts and exacerbating poverty. Despite the economic growth experienced by numerous African countries, the unidirectional factor flow and inefficient allocation have resulted in a vast gap between the living standards of African people and those in the rest of the world, necessitating urgent action to improve the situation. The United Nations' Millennium Development Plan (MDG) seeks to halve global poverty levels by the end of 2015, based on 1990 poverty levels. However, uneven progress has been observed across African countries, with several yet to attain the MDG's objectives. As the final year of the MDG, 2015 has highlighted the enormity of the task at hand, with many people in Africa still living in poverty. Unfortunately, several people have been plunged into poverty due to wars, diseases, and other factors, complicating efforts to achieve the MDG's goals. Agriculture remains a critical sector in many African economies, accounting for a significant proportion of GDP. However, moving to urban areas has led to a lack of capital and technology in rural areas and agriculture, impeding agricultural development and stifling overall economic growth, consequently worsening poverty. The negative impact of this trend on poverty reduction underscores the urgent need for policy interventions that encourage the optimal allocation and mobility of factors across the continent.

5.5. Key lessons from foreign capital flows and integration development

This paper examines the lessons that can be learned from developing capital markets in the United States, East Asia, and the European Union (EU). Our analysis highlights three main factors that have contributed to the success of these regions in promoting capital flows and integration. Firstly, the importance of a robust legal framework must be considered. In the US, for example, laws and regulations on banking, securities, investment, and trusts were enacted during Roosevelt's New Deal. Similarly, the EU implemented the First Banking Order in the mid-1970s and signed the European Economic Community Treaty and the European Atomic Energy Community Treaty. These measures have facilitated the development of a more compelling investment and regulatory system, thereby promoting capital flows and spurring economic growth. Secondly, establishing a coordinated system for regional capital markets has been crucial in promoting capital flows and integration. In East Asia, for instance, the “ASEAN+3” regional dialogue and cooperation system was created after the financial crisis, while the EU and the United States established “cross-regional government agencies.” These mechanisms have provided a solid institutional foundation for regional capital market cooperation and exchanges, facilitating the capital flow process. Thirdly, a sound regulatory system is essential for effective risk control and ensuring the sustainable development of capital markets. To this end, the Yangtze River Delta region can draw upon foreign experience to improve its regulatory system. Its primary objective is to protect the interests of investors and shareholders, ensure the effective operation of capital markets, and reduce market risks. This can be achieved through strict monitoring and standardized operations to improve the quality of listed companies and transition from a “money-spinning” market to an investment market that provides investors with lucrative returns. Ultimately, these measures will promote the free flow of capital in the Yangtze River Delta and contribute to the sustainable development of its capital markets.

6. Options for the path of capital flows and integrated development in the Yangtze River Delta region

6.1. Promote the development of existing listed companies and actively cultivate resources for listed companies

To sustain its rapid economic development, the Yangtze River Delta region must recognize the capital market's unique and integral role in driving the economy's structural transformation and regional economic development. This article proposes a three-pronged approach to achieving this goal. Firstly, the introduction of classification guidelines to enhance financing capacity is paramount. The government must focus on market operations, actively promote classification, mergers, and restructuring, and improve the refinancing capacity of listed companies. By enhancing financing capacity, the capital market can better serve the economy and promote regional economic development. Secondly, improving the institutional mechanism is essential to enhance the management level of listed companies. This can be achieved by improving the corporate governance structure to form a genuinely operational mechanism with mutual checks and balances among the power organ, decision-making organ, supervisory organ, and operators. It is essential to strengthen the system, mechanism, and management innovation of listed companies, establish a sound incentive and restraint mechanism, regulate the behavior of controlling shareholders, and effectively improve corporate regulation. Lastly, the ability to monitor financial risks dynamically must be strengthened. Rather than staying at a particular stage, companies must remain vigilant and view financial risks as a dynamic process. Corresponding measures must be taken to prevent and control financial risks based on timely analysis. By strengthening the ability to monitor financial risks dynamically, the capital market can better mitigate risks and promote sustainable economic development.

6.2. Sound bank management model to improve the quality of credit fund operations

In this paper, we propose several measures to enhance China's banking supervision model and stimulate the enthusiasm of commercial banks, with a focus on promoting the integrated financial development of the Yangtze River Delta region. Firstly, we suggest optimizing the financial supervision model by adopting mixed and functional supervision. This model aligns with the current trend of diverse industry operations and the context of regional economic integration, which promotes the transformation of financial supervision from sectoral and institutional supervision to functional supervision. By supervising a particular financial activity with the same regulator, this model could effectively improve the efficiency of banking supervision. Secondly, we emphasize the importance of improving the financing mechanism of banks and enhancing the quality of their operations. To achieve this, we advocate cultivating a group of backbone enterprises with significant industrial advantages, which could create a favorable development environment for banks and enterprises.

Additionally, banks should prioritize credit allocation and risk prevention, leading to their own healthy, coordinated, and sustainable development while driving the rapid growth of the national economy and, lastly, strengthening financial institutions, promoting financial innovation, and improving the financial market system to advance the integrated financial development of the Yangtze River Delta region. To achieve this, we propose to deepen financial system reform and support regional enterprises to go public and raise capital. These enterprises could contribute to the region's financial innovation and integration by improving their corporate governance structure and actively developing investment.

6.3. Improve relevant government policies to promote capital flows and integrated development

Standardizing preferential tax policies is a crucial strategy for improving investment advantages in finance. To attract investment, implementing differential tax rates, income tax exemptions, and other preferential tax policies are common in many countries. For instance, the importation of tax-exempt materials by enterprises and the exemption of import duties for a specified period for large and medium-sized state-owned enterprises undertaking technological transformation projects are illustrative examples of such practices. Standardizing these policies is critical to ensure their uniform implementation across the region. Introducing high-quality foreign investment resources is a crucial objective of the Yangtze River Delta region. However, the fierce competition to attract foreign investment has led to disorderly competition. Thus, it is necessary to make adjustments to the investment attraction policy: Standardization of investment promotion policies, including land concessions and removal of various controls, are essential to promote the free flow of capital. The Yangtze River Delta region should sign equal preferential terms in foreign exchange management and infrastructure construction, allowing capital to flow freely within the region without damaging the overall interests of the region. Introducing high-quality foreign investment should align with industrial development planning and the situation. Reducing income tax rates for foreign enterprises can also encourage foreign investment.

6.4. Optimizing the investment environment and improving the efficiency of capital flows and integrated development

The Importance of Infrastructure and Soft Investment Environment in the Development of the Yangtze River Delta: A Journal of Finance Perspective The Yangtze River Delta region plays a vital role in developing the Chinese economy. To further boost economic growth in this region, focusing on infrastructure construction and innovation in a peaceful investment environment is essential. This article proposes several measures to promote infrastructure development and optimize the investment environment in the Yangtze River Delta region. Firstly, infrastructure development is crucial to enhance the ease of transport for enterprise products, promote inter-local capital flows, and reduce transportation costs. The local government should consolidate the location advantages of the region and accelerate the pace of information technology. Optimizing the capital flow environment can significantly reduce the risks and costs of capital flows, which further promotes the harmonious development of the regional economy and the optimal allocation of resources in the delta. Secondly, the soft investment environment is equally important in attracting investors. The government should continuously improve the quality of its services and create a fair and reasonable market environment where the law is enforceable and complied with. To this end, the government can formulate policies for foreign and private industrial investment and gradually relax restrictions on foreign and private investment.

Moreover, the government can build a multi-level and diversified banking and securities market system that meets foreign investment needs and private economic development. Gradual removal of some policy restrictions on equity and bond financing by private enterprises can also reduce policy costs. Thirdly, the government should adhere to the “market-led, government-promoted” integrated capital market development strategy. The government can play a significant role in optimizing the development environment of the Yangtze River Delta by establishing a regional financial market, strengthening economic and financial ties and communication, improving information asymmetry, and ensuring local financial security. Furthermore, improving the system of non-bank financial institutions in the Yangtze River Delta region and improving government efficiency and service quality can ensure that capital invested in the region stays in the region and provides financial assurance for local economic growth. In conclusion, this article highlights the significance of infrastructure development and a peaceful investment environment in the development of the Yangtze River Delta region. By adopting the proposed measures, the local government can promote a fair and reasonable market environment, attract more capital, and achieve sustainable economic growth in the region.

6.5. Research gaps and outlook

In this study, we examine the issue of capital mobility in the Yangtze River Delta using a system of indicators. However, certain limitations in our methodology need to be addressed in future research. Firstly, we rely on existing academic literature to indirectly reflect the strength of regional capital mobility, mainly through the analysis of the variation of the coefficient of variation using a system of indicators. In the future, exploring the strength of regional capital mobility based on regional capital and empirically analyzing the characteristics of regional capital flows would be beneficial. This would enable us to measure capital mobility directly and explore the evolution of regional capital flows. Secondly, the research object of this paper is limited to the Yangtze River Delta. While it is somewhat representative, future research could benefit from a comparative analysis of other urban agglomerations, such as Beijing, Tianjin, Hebei, Guangdong, Hong Kong, and Macao Greater Bay Area. More robust conclusions can be drawn by conducting a comparative analysis, and a better overall understanding of the development of capital mobility in integrated regions across the country can be achieved. In conclusion, while our study sheds light on the issue of capital mobility in the Yangtze River Delta, future research should strive to improve the methodology and expand the comparative analysis to understand better the evolution of regional capital flows and their impact on integrated regions across the country.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: https://d.qianzhan.com/.

Author contributions

JY: conceptualization. GL: data curation. ZZ: formal analysis. QL: visualization. GD: Language logic and grammar check. JG: data collection and analysis.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1. ^The statistical yearbooks of three provinces and one city from the preceding years constitute the primary data source depicted in the chart under consideration.

2. ^i.e., the balance of deposits minus the balance of loans, where the balance of deposits is based on the balance of all deposits of financial institutions in RMB at the end of the year and the balance of loans is based on the balance of all loans in RMB at the end of the year.

References

Balassa, B. (1977). The Theory of Economic Integration. London: George Allen and Unwin, Vol. 3, 34–35.

Gaohui, L., Lile, H., XiaoG, Leshan, D., Junsheng, L., and Nengwen, X. (2018). Research on the connotation of natural capital and its accounting. Ecol. Econ. 34, 153–157+163.

Güngör, H., Balcilar, M., and Olasehinde-Williams, G. O. (2019). The empirical relationship between financial development and foreign exchange regimes: Did global financial crisis of 2007-2009 change regime preferences? Euro. J. Sustain. Develop. 8, 324–338.

Jinlong, G., and Hongwei, W. (2003). A study of inter-regional capital flows and regional economic disparities in China. Manag. World 45–58.

Ke, X. (2011). The controversy, evolution and contemporary development of the concept of capital: a general interpretation of Marx's theory of capital. New Theory Tianfu 44–48.

Lina, Z. (2015). Headquarters economy and regional economic development: an example of headquarters economy development in Shandong. J. Theory 61–67.

Olasehinde-Williams, G. O., and Olanipekun, I. O. (2020). Unveiling the causal impact of US economic policy uncertainty on exchange market pressure of African economies. J. Public Affairs. 22, e2278. doi: 10.1002/pa.2278

Orlowski, L. T. (2020). Capital markets integration and economic growth in the European Union. J. Policy Model. 42, 893–902. doi: 10.1016/j.jpolmod.2020.03.012

Roxana, O. O., and Stoica, O. (2018). Capital markets integration and economic growth. Montenegrin J. Econ. 14, 23–35. doi: 10.14254/1800-5845/2018.14-3.2

Songcheng, S., and Jieyu, X. (2016). Social financing scale and monetary policy transmission - intermediary target selection based on credit channel. China Soc. Sci. 60–82+205–206.

Wenbin, P., and Chaoxia, W. (2007). An empirical analysis of the impact of capital flows on regional economic disparities in China. Prod. Res. 82–83+161.

Wu, M., and Chen, Y. (2018). Study on the spatial spillover effect of financial agglomeration on China's regional economic growth. Shanghai Fin. 72–81+86.

Yawei, Y., and Jianghui, L. (2021). Evaluation, measurement and future development suggestions of the degree of capital market integration in the Yangtze River Delta region. J. Soochow Univ. 42, 18–31.

Yuhan, H. (2021). Research on the impact of financing constraints on corporate investment structure. Invest. Entrepr. 32, 11–15.

Yunhui, S., and Sulan, Z. (2022). Research on the value of supplying the legal system of fiscal transfer payments for the transformation of resource-based cities. Tax. Econ. 69–78.

Keywords: Yangtze River Delta region, capital flows, capital market integration, major bottlenecks, path options