- 1Department of Economics, University of Tashkent for Applied Sciences, Tashkent, Uzbekistan

- 2Department of State and Corporative Strategies, National University of Uzbekistan named after Mirzo Ulugbek, Tashkent, Uzbekistan

Introduction: An increasing number of countries are facing environmental pressure due to factors such as industrialization, rapid economic growth, the overuse of natural resources, energy consumption, and financial crises. We analyzed data from a sample of 131 countries for the period 2000–2024, allowing for the consideration of key factors influencing environmental degradation and testing the hypothesis that nations with higher levels of financial literacy are better positioned to advance toward a sustainable future.

Methods: This study uses two variables as proxies for environmental sustainability. Our first dependent variable is the Environmental Performance Index (EPI) for the year 2024. Our second indicator is the ND GAIN Index presented by the Notre Dame Global Adaptation Initiative. The ND GAIN Country Index is composed of two key dimensions of adaptation: vulnerability and readiness. Considering that financial literacy data are only available at cross-sectional levels, we estimate the relationship between environmental sustainability and financial literacy using the ordinary least squares (OLS) estimator with heteroskedasticity-adjusted robust standard errors.

Results: The bivariate association between financial literacy and EPI suggests that a one standard deviation increase in financial literacy is associated with more than a half standard deviation increase in EPI. The results show that GDP has a non-linear relationship between GDP per capita and environmental indicators, while globalization enhances environmental sustainability.

Conclusion: From the baseline results, we document that the financial literacy of a population is associated with improvements in environmental quality across countries, thus providing additional evidence that financial literacy not only improves financial wealth/capital preservation but also preserves environmental wealth/capital. We also document that financial literacy is an important determinant of environmental sustainability even after controlling for democracy and economic development. This implies that it is crucial to invest in financial literacy even in lower-income countries. The series of robustness tests offer clear evidence that financial literacy is an essential antecedent of environmental sustainability and should be taken into account in long-term policy planning.

1 Introduction

The literature acknowledges that financial literacy and education are crucial for enabling consumers to make informed decisions and exhibit responsible financial behavior (Allgood and Walstad, 2016; Grohmann, 2018; Zahid et al., 2024). As a result, financial literacy enhances the financial inclusion of individuals and households, boosting their capacity to accumulate wealth (Behrman et al., 2012). It is essential for shaping financial behavior and plays a key role in addressing significant modern economic issues, such as growing inequality (Kebede et al., 2023). The potential benefits of financial literacy extend beyond individual gains and have a profound impact at the societal level. These advantages encompass various aspects, including economic development, improved quality of life, financial growth, and, likely, environmental sustainability (Xiao and Xin, 2022; Paşa et al., 2022). The concept of environmental sustainability in the context of economic development has served as a key framework for environmental research and has evolved into a dominant paradigm for development since its introduction in the Brundtland Report in 1987 (WCED, 1987). The Brundtland Report defines sustainable development as a form of progress that fulfills present needs while ensuring that future generations can also meet their own requirements without compromise. As a result, numerous indicators have been developed to assess sustainable development, such as green GDP, ecological footprint, and others (Garnåsjordet et al., 2012). Moreover, research exploring the non-economic determinants of environmental sustainability has rapidly increased. While studies have shown that social capital, cultural values, cognitive abilities, human capital, and education (Disli et al., 2016; Lee et al., 2024; Salahodjaev, 2018; Zhang and Fu, 2023) are linked to climate change mitigation, the role of financial literacy has not been investigated in this context.

An increasing number of countries are facing environmental pressure due to factors such as industrialization, rapid economic growth, the overuse of natural resources, energy consumption, and financial crises. Consequently, there is greater environmental responsibility for future generations. In Europe, these environmental costs surpass 1.6 trillion US dollars, contributing to over 600,000 premature deaths.1 Future generations are already bearing the consequences of environmental degradation, having to confront challenges that previous generations did not fully anticipate. Issues such as climate change, resource scarcity, rising global temperatures, extreme weather events, and the depletion of essential resources such as clean water and fertile land are becoming increasingly evident (Kahn et al., 2021). These burdens underscore the urgent need for data-driven policy solutions to ensure that future generations can thrive in a healthier, more stable environment.

In their efforts to influence policy, design targeted interventions, and deepen our understanding of the causes of environmental degradation, environmental scholars have developed various empirical models that identify multiple factors influencing environmental sustainability. In this study, we argue that considering the importance of financial development and the complex nature of sustainable development, conducting empirical exploration that accounts for financial literacy in cross-national environmental modeling is vital for interdisciplinary research. Thus, our study aims to extend previous research by considering financial literacy as an important variable.

Existing research suggests that financial literacy is a multifaceted concept, simultaneously encompassing knowledge, education, ability, competence, and responsibility (Zait and Bertea, 2014). The definition of financial literacy has become increasingly complex, mirroring the evolving economy. Researchers and financial experts have long debated the precise meaning of the term (Remund, 2010). One of the earliest definitions of financial literacy was proposed by Noctor et al. (1992), who suggested that financial literacy is the capability to effectively apply financial knowledge to make well-informed decisions. In turn, the Organization for Economic Cooperation and Development (OECD) (2013, p. 144) offers one of the most widely used definitions of financial literacy, which encompasses “knowledge and understanding of financial concepts and risks, and the skills, motivation, and confidence to apply such knowledge and understanding in order to make effective decisions across a range of financial contexts, to improve the financial well-being of individuals and society, and to enable participation in economic life”. At the same time, there is consensus that financial literacy is a fundamental skill essential for planning and long-term decision-making. Consequently, it is crucial to theoretically connect financial literacy to sustainable development and evaluate its empirical relationship with environmental degradation.

We analyzed data from a sample of 131 countries for the period 2000–2024, allowing for the consideration of key factors influencing environmental degradation and testing the hypothesis that nations with higher levels of financial literacy are better positioned to advance toward a sustainable future. Our findings, with the aid of the ordinary least squares (OLS) method, show that financial literacy is significantly and positively linked to environmental performance and readiness for climate change. These results have major policy implications. The underlying benefits of financial literacy are numerous, and governments in economies in transition can improve environmental sustainability by providing financial education to citizens.

The remainder of the study is structured as follows: Section 2 provides a theoretical explanation of the relationship between financial literacy and environmental sustainability. Section 3 presents the data and methodology, while Section 4 discusses the main results. Finally, Section 5 concludes the study and offers policy implications.

2 The link between financial literacy and environmental sustainability

Continuing rising greenhouse gas emissions and consequently increased local temperature volatility pose significant risks to the effectiveness of government programs and international efforts to mitigate global climate change. In response, countries are increasingly shifting from a top-down approach to a bottom–up strategy, encouraging communities to adopt green technologies and foster environmentally friendly behaviors, such as sustainable consumption. This shift transfers many decisions regarding climate change adaptation from institutions to communities and individuals, particularly the responsibility to invest in renewable energy technologies or purchase zero-carbon electric vehicles (Kastner and Stern, 2015). This transition has produced several positive implications. For example, when society is aware of climate change and committed to investing in renewable energy production, it leads to job creation and enhances energy security, which in turn empowers communities and reduces migration. As a result, climate change places a greater responsibility on societies to become financially literate, increasing their ability to assess the costs and benefits of green energy consumption and execute informed decisions about household investments. In this vein, financial literacy is an aspect of human capital linked to long-term planning by considering economic information and dynamic scenarios (Remund, 2010). As suggested by Lyons and Kass-Hanna (2021, p. 2), “a key component of financial literacy includes having awareness and knowledge about available products and services and how to access and use them given available tools and modes of delivery”. Since mitigating climate change requires interaction among economic agents and long-term planning, it is possible that societies with higher levels of financial literacy will be able to perform better on established environmental policy targets.

There are several channels through which financial literacy may affect environmental sustainability. First, financial literacy may have important implications for taking part in collective action but also for social capital. Financial literacy may affect decisions to participate in climate change mitigation programs via social trust, as Guiso et al. (2008, p. 2,557) define trust as “the subjective probability individuals attribute to the possibility of being cheated”. Since cooperation between different economic agents is instrumental in addressing the problems of climate change, and cooperation requires trust among actors, financial literacy may play an important role as it is directly related to interpersonal and institutional trust (Nitoi and Pochea, 2024). Adoption of climate change mitigation technologies, such as renewable energy and novel methods of sustainable agriculture, is a complex task that requires advanced financial solutions. Financial literacy can improve an individual's capacity to participate in these activities and manage green investments effectively. It can also empower communities to oversee the implementation of climate change initiatives and ensure that the allocation of resources aligns with their investment objectives. By doing so, financial literacy may boost the willingness to engage in climate change solutions, either independently or through intermediaries. For example, Fisch and Seligman (2022) show that both trust and financial literacy are positively correlated with the willingness to participate in financial markets. One psychological mechanism that helps explain how financial literacy can affect sustainable decision-making is delay discounting.

Delay discounting refers to the tendency to devalue rewards or benefits that are delayed in time. In essence, people are often inclined to prefer immediate, smaller rewards over larger, delayed rewards, even when the delayed rewards are more beneficial in the long run (Madden et al., 2003). This cognitive bias is commonly observed in financial decisions (e.g., choosing immediate spending over saving for future financial security). Similarly, delay discounting is relevant to influencing environmental decisions as well (e.g., prioritizing short-term consumption over long-term environmental health) (Beauchaine et al., 2017). Individuals with higher financial literacy are typically better able to assess and manage long-term financial consequences, such as saving for retirement or investing in assets that appreciate over time (Yeh, 2022). In terms of environmental sustainability, this can translate into behaviors such as investing in renewable energy, conserving resources, or supporting policies that foster long-term environmental health, even when such actions may involve short-term costs or inconveniences. Moreover, individuals with high financial literacy are likely more attuned to the long-term economic costs of environmental degradation, which could motivate them to make more sustainable choices.

Second, financially literate individuals are more likely to have virtues, such as patience, planning, and long-term orientation (Brent and Ward, 2018; Davoli and Rodríguez-Planas, 2020), which are often seen as central to environmentalism and beneficial to both themselves and society (Cai et al., 2020). For example, financial literacy predicts lower levels of energy consumption (Kalmi et al., 2021), saving energy (Morgan and Long, 2020), and adopting renewable energy (Twumasi et al., 2022), which is important for the implementation of environmental policies. At the cross-country level, financial literacy improves financial development (Clichici and Moagar-Poladian, 2022), raises financial inclusion, and promotes economic growth (Grohmann et al., 2018; Paşa et al., 2022). These variables have been associated with environmental sustainability in cross-country empirical studies (Jamel and Maktouf, 2017; Le et al., 2020). Similarly, studies report that financial literacy may play an essential moderating role in enabling societies to harness the positive effects of digitalization and innovation and assist in increasing climate change mitigation efforts (Luo and Cheng, 2023; Huang et al., 2024).

Research on financial literacy has largely concentrated on decisions related to financial behavior and stock market involvement (Van Rooij et al., 2011; Khan et al., 2020). While these are undoubtedly significant choices, other contexts also demand similar abilities and can lead to costly errors. One prominent area in which society is believed to mismanage resources is the efficient management of natural wealth. The unsustainable practice of allowing domestic savings to fall below the depletion of natural assets, which imposes long-term costs on society, has been widely discussed in the literature (Madreimov and Li, 2019).

A general finding in economics research is that agents often opt for the wrong choices, driven either by behavioral biases or a lack of necessary information to pursue optimal choices. There is an expanding body of research on financial literacy, emphasizing how financial education can develop critical skills for making important decisions related to investment and retirement. While research on financial literacy has primarily focused on long-term personal wealth management, such as debt and retirement planning, there are notable parallels between financial literacy and natural resource management. Both areas require the integration of technical knowledge with complex mathematical calculations. Thus, as suggested by Brent and Ward (2018 p. 195), “an alternative mechanism is that financial literacy simply reduces optimization error for cognitively difficult decisions”. Our analysis builds on these previous studies by focusing specifically on financial literacy. Hence, based on the above discussion, we formulate the following hypotheses:

H1: Financial literacy has a significant relationship with environmental sustainability indicators.

3 Data and methods

This study uses two variables as proxies for environmental sustainability. Our first dependent variable is the Environmental Performance Index (EPI) for the year 2024 from Block et al. (2024). We use the EPI as the primary indicator of environmental sustainability for a number of reasons. First, the EPI is calculated from 58 performance indicators across 11 issue categories, which enables it to capture the multidimensional nature of environmental sustainability. Second, it is available for 180 countries, which allows us to maximize the sample size. Finally, as socio-economic variables, such as GDP or education, are not included in the EPI, we can use conventional empirical models to control for the effect of economic policies on environmental degradation.

Our second indicator is the ND GAIN Index presented by the Notre Dame Global Adaptation Initiative. The ND GAIN Country Index is composed of two key dimensions of adaptation: vulnerability and readiness. While vulnerability assesses a country's exposure, sensitivity, and capacity to adapt to the negative effects of climate change, readiness captures a country's ability to leverage investments and convert them into adaptation actions. This index has been widely used in environmental research studies (Halkos et al., 2020; Kling et al., 2021; Regan et al., 2019).

Our main independent variable is financial literacy, which is taken from Klapper et al. (2015). In their study, financial literacy was estimated based on a set of “questions assessing basic knowledge of four fundamental concepts in financial decision-making: knowledge of interest rates, interest compounding, inflation, and risk diversification” (Klapper et al., 2015 p. 2). In our sample, financial literacy ranged from 13% in Yemen to 71% in Sweden.

We estimate the following empirical model to assess the relationship between financial literacy and EPI:

where ES stands for one of the indicators for environmental sustainability, FL is financial literacy, DEM denotes democracy, GDP is GDP per capita, Pgrowth is population growth, KOF is KOF Index of Globalization, and ε is an error term satisfying normality assumptions.

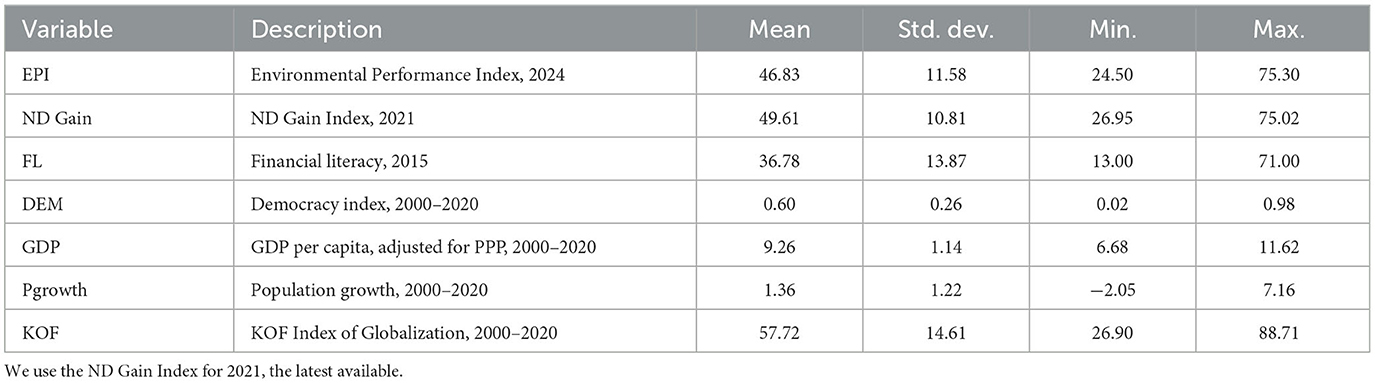

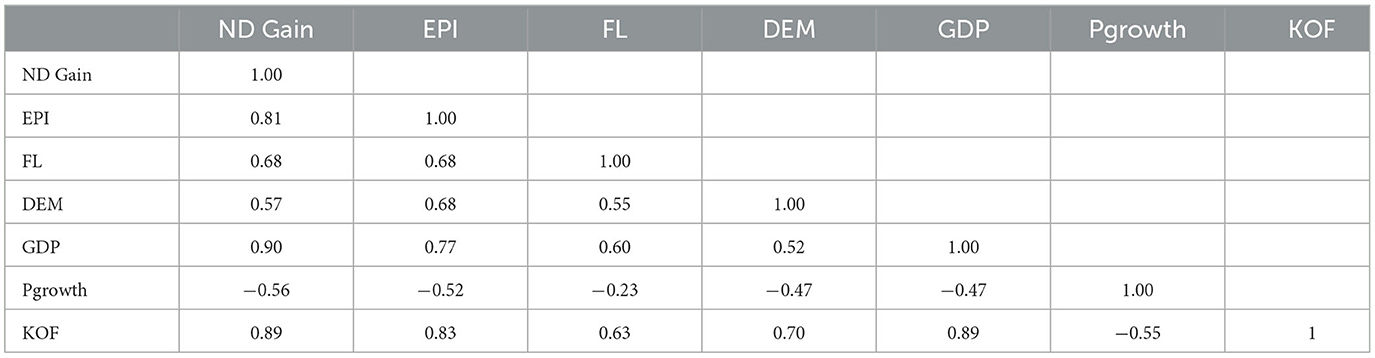

We include several control variables following Salahodjaev (2016), who models the relationship between human capital and EPI across countries. First, GDP per capita is included to model the relationship between economic growth and environmental sustainability. Then, the Environmental Kuznets Curve (EKC) theory suggests that the relationship between economic development and environmental degradation follows an inverted U-shape. In the early stages of economic progress, an increase in GDP results in increased environmental deterioration; however, once a certain level of GDP per capita is reached, further increases in GDP per capita are expected to lead to environmental improvement through abatement and conservation efforts (Dinda, 2004). However, studies show that, apart from economic growth, political institutions such as democracy may play an important role in explaining cross-country differences in environmental sustainability (Obydenkova and Salahodjaev, 2016). Therefore, we include a democracy index from the Democracy Matrix, hosted by the University of Wurzburg. Next, we include population growth to account for population pressure. The data were obtained from the World Bank. Finally, we include the KOF Index to account for global interdependencies in environmental sustainability (Zhuo and Qamruzzaman, 2022). Table 1 presents the summary statistics for the variables used in this study. For example, the EPI ranges from 24.5 in Vietnam to 75.3 in Estonia. The average financial literacy level is 37, which is comparable to the levels of Togo or Serbia. The average population growth rate is 1.36%. Figure 1 shows the visual association between financial literacy and EPI. The scatter plot suggests that financial literacy is positively correlated with environmental performance. The correlation coefficient between these two variables is 0.67. The countries used in this analysis are listed in Table A1. Considering that financial literacy data are only available at cross-sectional levels, we estimate Equation 1 using the ordinary least squares (OLS) estimator with heteroskedasticity-adjusted robust standard errors. The correlation matrix is presented in Table 2. The control variables are averaged over the period 2000–2020 to reduce the problem of reverse causality and macroeconomic volatility. We inspected whether multicollinearity could pose a problem for our main estimates. VIF test shows that individual VIF scores are well below threshold values (VIF = 4). Only VIF scores for GDP per capita and its squared term exceed VIF threshold values due to the direct mathematical relationship between these two variables.

4 Results

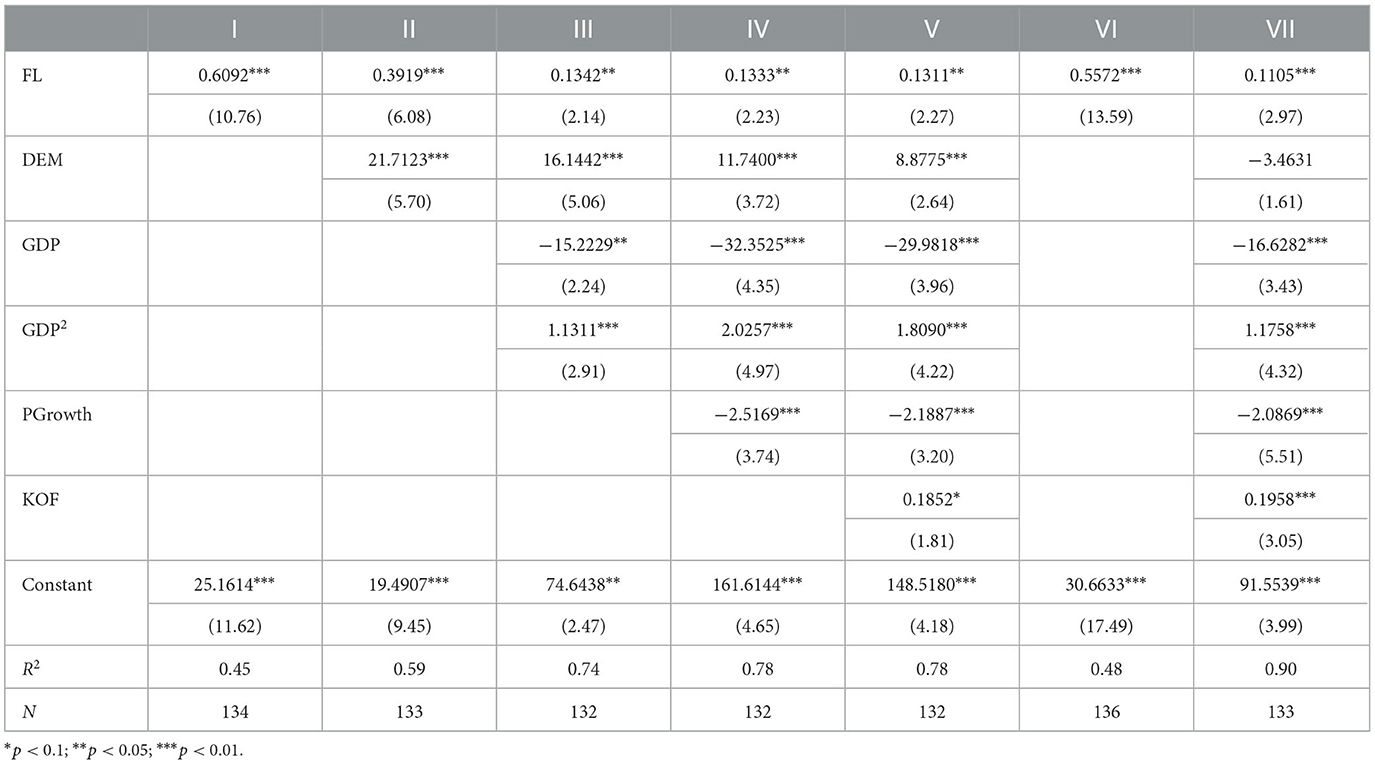

The main results are presented in Table 3. Column I provides estimates for the bivariate association between financial literacy and EPI. The coefficient is positive and significant at the 1% level, as predicted. In particular, a one standard deviation increase in financial literacy is associated with more than a half-standard deviation increase in EPI. Column I represents the overall relationship (both direct and indirect) between financial literacy and environmental sustainability. In column II, following nascent research on cross-country sustainability, we considered the democratization rate (Obydenkova and Salahodjaev, 2016). Democracy and financial literacy were both positive and significant. Next, in column III, we include GDP per capita and GDP per capita squared to assess the existence of the EKC trend in our model. GDP per capita has a U-shaped link with environmental quality, which is consistent with existing environmental studies (Dutt, 2009). Financial literacy has a positive link with EPI even after controlling for economic development and the quality of political institutions. In column IV, the KOF index is included as a proxy for globalization in the empirical analysis. The link between globalization and environmental degradation has been intensively studied over the past two decades (Farooq et al., 2022; Rehman et al., 2023). The evidence is, at best, mixed. In our study, we find that globalization is positively linked to environmental sustainability and that financial literacy remains positive and significant at the 5% level. Column V includes the population growth. Population growth can negatively impact environmental quality by increasing the demand for resources, for example, leading to greater deforestation, pollution, and the depletion of natural habitats. While population growth has a negative impact on environmental quality, financial literacy remains positive and significant. Similarly, in column VI, we test the bivariate association between financial literacy and the NG Gain index. Again, there is a significant positive relationship between financial literacy and climate change readiness. Column VII, which includes control variables, further confirms that financial literacy is a robust predictor of environmental sustainability. The results in Table 3 show that GDP has a non-linear relationship between GDP per capita and environmental indicators, while globalization enhances environmental sustainability.

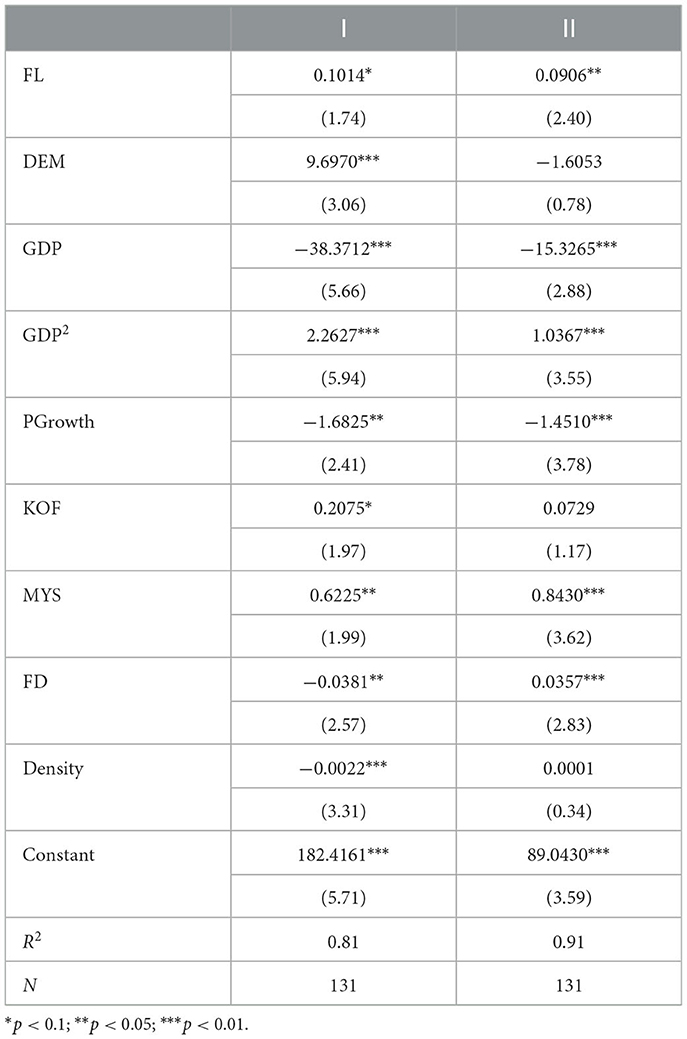

In Table 4, we test whether the link between financial literacy and EPI can be due to other variables related to environmental sustainability. In particular, we include financial development measured by domestic credit to the private sector as a percentage of GDP from the World Bank. Research suggests that financial literacy is related to financial development (Clichici and Moagar-Poladian, 2022) which, in turn, is a predictor of EPI (Adeel-Farooq et al., 2023). Studies have also linked financial literacy to human capital and other socio-economic outcomes (Thomas and Spataro, 2018; Muñoz-Murillo et al., 2020; Twumasi et al., 2022). Therefore, we include the average years of schooling from the UN database. Finally, we add population density data from the World Bank to capture the relationship between population pressure and sustainable development. Financial literacy retains its significant relationship with EPI (column I) and the ND Gain Index (column II) even after controlling for additional antecedents of environmental degradation. In addition, we found that human capital is a significant determinant of sustainable development across countries.

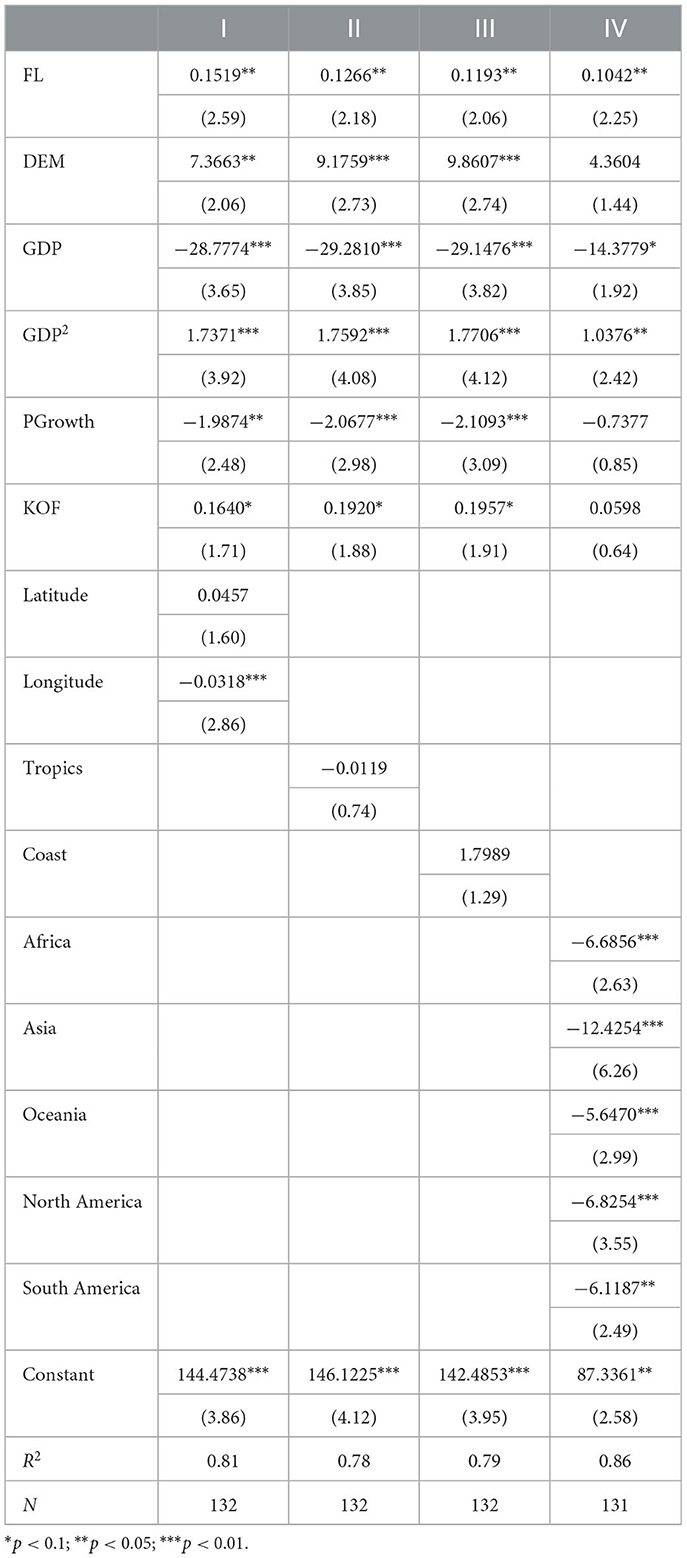

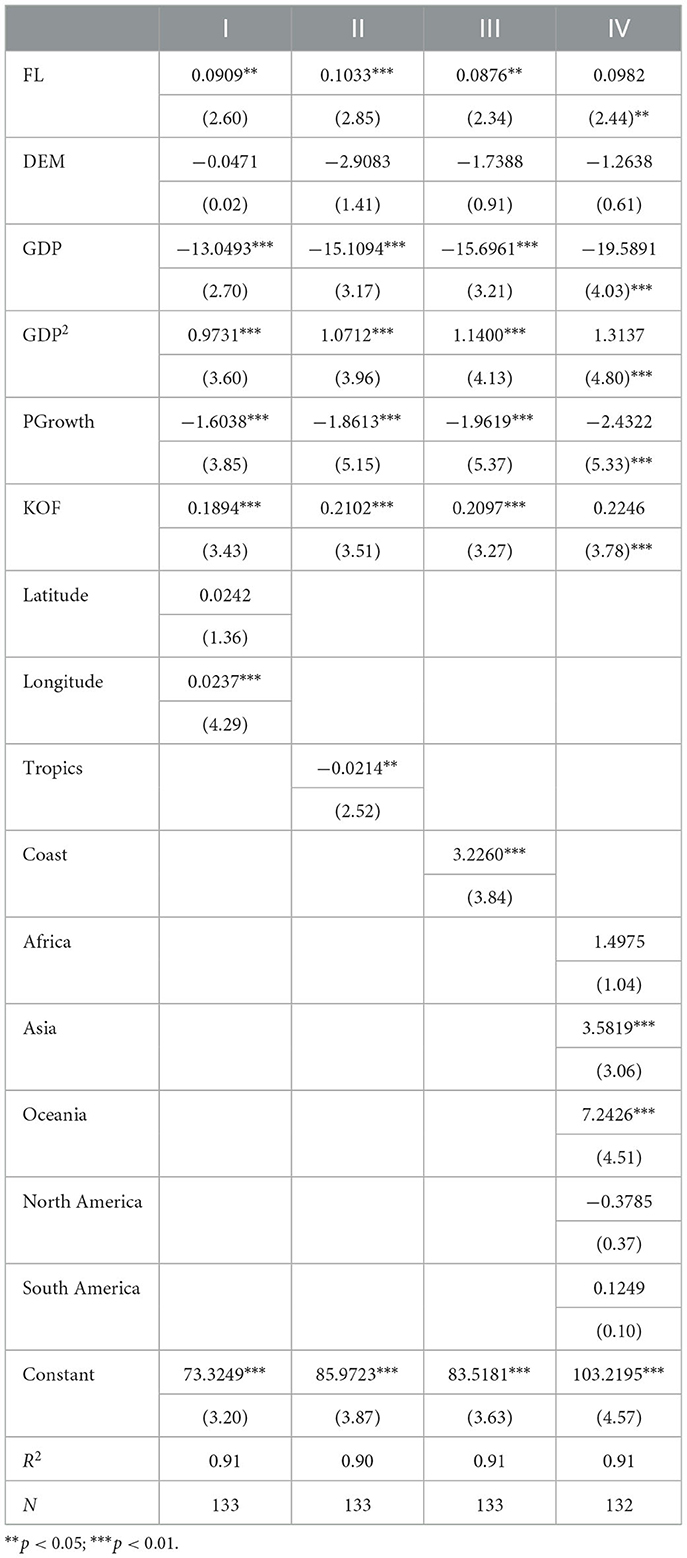

When exploring the deep roots of socio-economic development and quality of life, scholars consider the role of geography. Social norms and human capital indicators are also correlated with geography (Torpe and Lolle, 2011; Nikolaev and Salahodjaev, 2017). This may be particularly useful since De Beckker et al. (2020) show that financial literacy is strongly correlated with cultural values. Therefore, in Table 5, we include latitude and longitude (column I), share of population living in the tropics (column II), distance to the coast (column III), and continental dummies (column IV). Across all specifications, financial literacy was positive and statistically significant. Similarly, the results remain robust when we use the ND Gain as a dependent variable in Table 6.

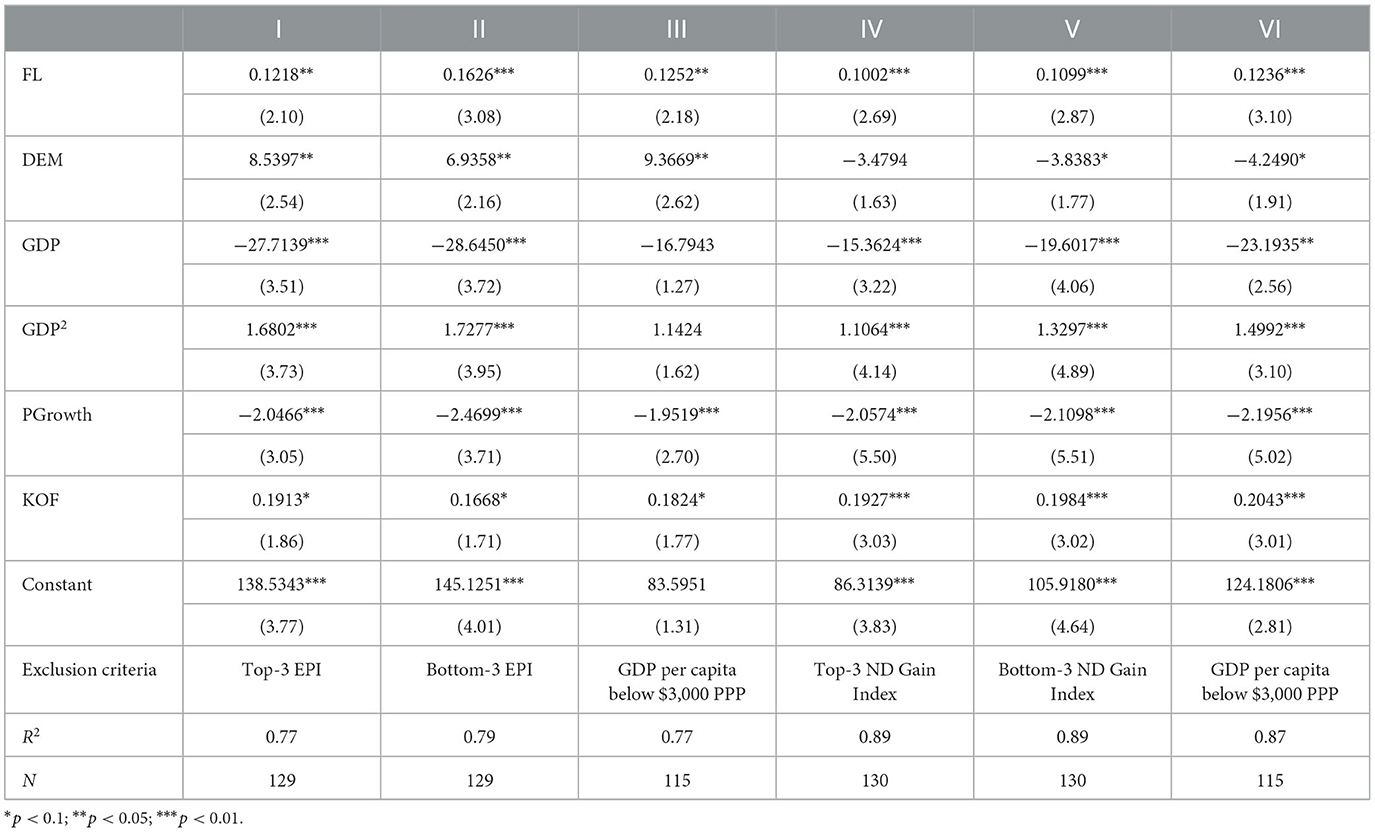

Controlling for extreme data points is crucial in cross-country research, particularly when dealing with a limited number of observations without a time dimension. Outliers or influential observations can disproportionately affect statistical estimates, potentially leading to biased or insignificant conclusions. By excluding extreme data points, we aim to mitigate the risk of such distortions and provide additional robustness tests for the general relationship between financial literacy and environmental sustainability. Thus, in Table 7, we re-estimated the main findings after removing influential or extreme data points from the sample. Specifically, we excluded the top three countries by the EPI, the bottom three countries by the EPI, the top three countries by the ND Gain Index, the bottom three countries by the ND Gain Index, and countries with GDP per capita (adjusted for purchasing power parity) below 3,000 international dollars. This approach helps assess whether the findings are driven by outliers or extreme cases that might skew the overall results. Across all columns, financial literacy is a significant predictor of environmental sustainability.

5 Conclusion

From the perspective of environmental research, this study mainly examines the effect of financial literacy on environmental sustainability in more than 131 countries over the period 2000–2024. Financial literacy is measured as average population responses to a set of questions measuring various dimensions of financial knowledge, while two indicators for environmental sustainability are used: EPI and ND Gain Index. From the baseline results, we document that the financial literacy of a population is associated with improvements in environmental quality across countries, thus providing additional evidence that financial literacy not only improves financial wealth/capital preservation (Morgan and Long, 2020) but also preserves environmental wealth/capital. We also document that financial literacy is an important determinant of environmental sustainability even after controlling for democracy and economic development. This implies that it is crucial to invest in financial literacy even in lower-income countries. The series of robustness tests offer clear evidence that financial literacy is an essential antecedent of environmental sustainability and should be taken into account in long-term policy planning.

Our study offers several policy implications for governments in developing countries. Developing countries should prioritize incorporating financial literacy into their national education curricula. By embedding financial literacy early on, countries can empower individuals to make informed financial and environmental decisions. Public awareness campaigns and community-based financial education programs can also be used to target a broader population, including adults and vulnerable segments of the population in climate change affected areas. Policymakers can work with educational institutions to create initiatives that teach individuals how their consumption, savings, and investment choices impact the environment. For example, promoting green finance and sustainable investment options could help populations contribute to environmental preservation. In addition, promoting financial knowledge among small-scale farmers and entrepreneurs can help them adopt sustainable agricultural practices or eco-friendly business models, which not only improve livelihoods but also support environmental preservation.

It is important to mention that our study offers preliminary cross-country evidence and has a number of limitations. First, due to the nature of the data on financial literacy scores across countries, we are not able to examine the dynamic effect of financial literacy on environmental degradation over time. Moreover, our study provides financial literacy for the year 2015, which is lagged compared to our dependent variables. At the same time, studies show that financial literacy scores are relatively stable across time (Angrisani et al., 2023; Hung et al., 2009).

Consequently, the use of more complex methods such as the system GMM estimator or instrumental variable regression to unbundle the causal relationship between financial literacy and environmental indicators is not feasible at this stage. Second, while the financial literacy scores cover a large sample of countries, they are only available for 2015, which restricts our analysis from using financial literacy indices for the most recent years. While PISA and other schooling test results offer other proxies for financial literacy, these studies cover only a proportion of our global sample. Prospective studies should examine the effects of financial literacy on climate change awareness and environmental decisions at the individual level in both rural and urban areas. In addition, it is essential to examine whether financial literacy can indirectly influence environmental degradation via other channels, such as renewable energy consumption or the adoption of energy-efficient technologies that are linked to environmental degradation (Huang et al., 2021; Mirziyoyeva and Salahodjaev, 2023). Further studies should explore these relationships in greater detail, focusing on the role of financial literacy in shaping the public's understanding of environmental issues and influencing their actions toward reducing environmental harm.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: World Bank.

Author contributions

RS: Formal analysis, Investigation, Writing – original draft. AS: Conceptualization, Supervision, Writing – original draft.

Funding

The author(s) declare that no financial support was received for the research and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Gen AI was used in the creation of this manuscript.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1. ^https://www.who.int/europe/news-room/28-04-2015-air-pollution-costs-european-economies-us-1-6-trillion-a-year-in-diseases-and-deaths-new-who-study-says

References

Adeel-Farooq, R. M., Raji, J. O., and Qamri, G. M. (2023). Does financial development influence the overall natural environment? An environmental performance index (EPI) based insight from the ASEAN countries. Environ. Dev. Sustain. 25, 5123–5139. doi: 10.1007/s10668-022-02258-x

Allgood, S., and Walstad, W. B. (2016). The effects of perceived and actual financial literacy on financial behaviors. Econ. Inq. 54, 675–697. doi: 10.1111/ecin.12255

Angrisani, M., Burke, J., Lusardi, A., and Mottola, G. (2023). The evolution of financial literacy over time and its predictive power for financial outcomes: evidence from longitudinal data. J. Pension Econ. Fin. 22, 640–657. doi: 10.1017/S1474747222000154

Beauchaine, T. P., Ben-David, I., and Sela, A. (2017). Attention-deficit/hyperactivity disorder, delay discounting, and risky financial behaviors: a preliminary analysis of self-report data. PLoS ONE 12:e0176933. doi: 10.1371/journal.pone.0176933

Behrman, J. R., Mitchell, O. S., Soo, C. K., and Bravo, D. (2012). How financial literacy affects household wealth accumulation. Am. Econ. Rev. 102, 300–304. doi: 10.1257/aer.102.3.300

Block, S., Emerson, J. W., Esty, D. C., de Sherbinin, A., and Wendling, Z. A. (2024). 2024 Environmental Performance Index. New Haven, CT: Yale Center for Environmental Law and Policy.

Brent, D. A., and Ward, M. B. (2018). Energy efficiency and financial literacy. J. Environ. Econ. Manage. 90, 181–216. doi: 10.1016/j.jeem.2018.05.004

Cai, M., Murtazashvili, I., Murtazashvili, J. B., and Salahodjaev, R. (2020). Patience and climate change mitigation: global evidence. Environ. Res. 186:109552. doi: 10.1016/j.envres.2020.109552

Clichici, D., and Moagar-Poladian, S. (2022). Financial literacy, economic development and financial development: a cross-country analysis. Roman. J. Eur. Aff. 22, 35–49.

Davoli, M., and Rodríguez-Planas, N. (2020). Culture and adult financial literacy: evidence from the United States. Econ. Educ. Rev. 78:102013. doi: 10.1016/j.econedurev.2020.102013

De Beckker, K., De Witte, K., and Van Campenhout, G. (2020). The role of national culture in financial literacy: Cross-country evidence. J. Consum. Aff. 54, 912–930. doi: 10.1111/joca.12306

Dinda, S. (2004). Environmental Kuznets curve hypothesis: a survey. Ecol. Econ. 49, 431–455. doi: 10.1016/j.ecolecon.2004.02.011

Disli, M., Ng, A., and Askari, H. (2016). Culture, income, and CO2 emission. Renew. Sustain. Energy Rev. 62, 418–428. doi: 10.1016/j.rser.2016.04.053

Dutt, K. (2009). Governance, institutions and the environment-income relationship: a cross-country study. Environ. Dev. Sustain. 11, 705–723. doi: 10.1007/s10668-007-9138-8

Farooq, S., Ozturk, I., Majeed, M. T., and Akram, R. (2022). Globalization and CO2 emissions in the presence of EKC: a global panel data analysis. Gondwana Res. 106, 367–378. doi: 10.1016/j.gr.2022.02.002

Fisch, J. E., and Seligman, J. S. (2022). Trust, financial literacy, and financial market participation. J. Pension Econ. Fin. 21, 634–664. doi: 10.1017/S1474747221000226

Garnåsjordet, P. A., Aslaksen, I., Giampietro, M., Funtowicz, S., and Ericson, T. (2012). Sustainable development indicators: from statistics to policy. Environ. Policy Govern. 22, 322–336. doi: 10.1002/eet.1597

Grohmann, A. (2018). Financial literacy and financial behavior: evidence from the emerging Asian middle class. Pacific-Basin Fin. J. 48, 129–143. doi: 10.1016/j.pacfin.2018.01.007

Grohmann, A., Klühs, T., and Menkhoff, L. (2018). Does financial literacy improve financial inclusion? Cross country evidence. World Dev. 111, 84–96. doi: 10.1016/j.worlddev.2018.06.020

Guiso, L., Sapienza, P., and Zingales, L. (2008). Trusting the stock market. J. Fin. 63, 2557–2600. doi: 10.1111/j.1540-6261.2008.01408.x

Halkos, G., Skouloudis, A., Malesios, C., and Jones, N. (2020). A hierarchical multilevel approach in assessing factors explaining country-level climate change vulnerability. Sustainability 12:4438. doi: 10.3390/su12114438

Huang, S., Yang, L., Yang, C., Wang, D., and Li, Y. (2024). Obscuring effect of income inequality and moderating role of financial literacy in the relationship between digital finance and China's household carbon emissions. J. Environ. Manage. 351, 119927. doi: 10.1016/j.jenvman.2023.119927

Huang, Y., Kuldasheva, Z., and Salahodjaev, R. (2021). Renewable energy and CO2 emissions: empirical evidence from major energy-consuming countries. Energies 14:7504. doi: 10.3390/en14227504

Hung, A. A., Parker, A. M., and Yoong, J. (2009). Defining and Measuring Financial Literacy. Rand Working papers, WR-708. Santa Monica: RAND Corporation

Jamel, L., and Maktouf, S. (2017). The nexus between economic growth, financial development, trade openness, and CO2 emissions in European countries. Cogent Econo. Fin. 5:1341456. doi: 10.1080/23322039.2017.1341456

Kahn, M. E., Mohaddes, K., Ng, R. N., Pesaran, M. H., Raissi, M., Yang, J. C., et al. (2021). Long-term macroeconomic effects of climate change: a cross-country analysis. Ener. Econ. 104:105624. doi: 10.1016/j.eneco.2021.105624

Kalmi, P., Trotta, G., and Kažukauskas, A. (2021). Energy-related financial literacy and electricity consumption: survey-based evidence from Finland. J. Consum. Aff. 55, 1062–1089. doi: 10.1111/joca.12395

Kastner, I., and Stern, P. C. (2015). Examining the decision-making processes behind household energy investments: a review. Energy Res. Soc. Sci. 10, 72–89. doi: 10.1016/j.erss.2015.07.008

Kebede, J., Naranpanawa, A., and Selvanathan, S. (2023). Financial inclusion and income inequality nexus: a case of Africa. Econ. Anal. Policy 77, 539–557. doi: 10.1016/j.eap.2022.12.006

Khan, M. S. R., Rabbani, N., and Kadoya, Y. (2020). Is financial literacy associated with investment in financial markets in the United States? Sustainability 12:7370. doi: 10.3390/su12187370

Klapper, L., Lusardi, A., and Van Oudheusden, P. (2015). Financial Literacy Around the World. World Bank, vol. 2 (Washington DC: World Bank), 218–237.

Kling, G., Volz, U., Murinde, V., and Ayas, S. (2021). The impact of climate vulnerability on firms' cost of capital and access to finance. World Dev. 137:105131. doi: 10.1016/j.worlddev.2020.105131

Le, T. H., Le, H. C., and Taghizadeh-Hesary, F. (2020). Does financial inclusion impact CO2 emissions? Evidence from Asia. Fin. Res. Lett. 34:101451. doi: 10.1016/j.frl.2020.101451

Lee, H., Park, C., and Jung, H. (2024). The role of tertiary education on CO2 emissions: evidence from 151 countries. Environ. Dev. Sustain. 26, 32081–32103. doi: 10.1007/s10668-024-04828-7

Luo, W., and Cheng, J. (2023). Transition to sustainable business models for green economic recovery: role of financial literacy, innovation and environmental sustainability. Econ. Change Restruct. 56, 3787–3810. doi: 10.1007/s10644-022-09408-1

Lyons, A. C., and Kass-Hanna, J. (2021). A methodological overview to defining and measuring “digital” financial literacy. Finan. Plann. Rev. 4:e1113. doi: 10.1002/cfp2.1113

Madden, G. J., Begotka, A. M., Raiff, B. R., and Kastern, L. L. (2003). Delay discounting of real and hypothetical rewards. Exp. Clin. Psychopharmacol. 11:139. doi: 10.1037/1064-1297.11.2.139

Madreimov, T., and Li, L. (2019). Natural-resource dependence and life expectancy: a nonlinear relationship. Sustain. Dev. 27, 681–691. doi: 10.1002/sd.1932

Mirziyoyeva, Z., and Salahodjaev, R. (2023). Renewable energy, GDP and CO2 emissions in high-globalized countries. Front. Energy Res. 11:1123269. doi: 10.3389/fenrg.2023.1123269

Morgan, P. J., and Long, T. Q. (2020). Financial literacy, financial inclusion, and savings behavior in Laos. J. Asian Econ. 68:101197. doi: 10.1016/j.asieco.2020.101197

Muñoz-Murillo, M., Álvarez-Franco, P. B., and Restrepo-Tobón, D. A. (2020). The role of cognitive abilities on financial literacy: new experimental evidence. J. Behav. Exp. Econ. 84:101482. doi: 10.1016/j.socec.2019.101482

Nikolaev, B., and Salahodjaev, R. (2017). Historical prevalence of infectious diseases, cultural values, and the origins of economic institutions. Kyklos 70, 97–128. doi: 10.1111/kykl.12132

Nitoi, M., and Pochea, M. M. (2024). Trust in the central bank, financial literacy, and personal beliefs. J. Int. Money Fin. 143:103066. doi: 10.1016/j.jimonfin.2024.103066

Noctor, M., Stoney, S., and Stradling, R. (1992). Financial Literacy: A Discussion of Concepts and Competencies of Financial Literacy and Opportunities for its Introduction into Young People's Learning. London: National Foundation for Education Research.

Obydenkova, A., and Salahodjaev, R. (2016). Intelligence, democracy, and international environmental commitment. Environ. Res. 147, 82–88. doi: 10.1016/j.envres.2016.01.042

Organization for Economic Cooperation and Development (OECD) (2013). PISA 2012 Assessment and Analytical Framework: Mathematics, Reading, Science, Problem Solving and Financial Literacy. Paris: OECD Publishing.

Paşa, A. T., Picatoste, X., and Gherghina, E. M. (2022). Financial literacy and economic growth: how eastern europe is doing? Economics 16, 27–42. doi: 10.1515/econ-2022-0019

Regan, P. M., Kim, H., and Maiden, E. (2019). Climate change, adaptation, and agricultural output. Reg. Environ. Change 19, 113–123. doi: 10.1007/s10113-018-1364-0

Rehman, A., Alam, M. M., Ozturk, I., Alvarado, R., Murshed, M., Işik, C., et al. (2023). Globalization and renewable energy use: how are they contributing to upsurge the CO2 emissions? A global perspective. Environ. Sci. Pollut. Res. 30, 9699–9712. doi: 10.1007/s11356-022-22775-6

Remund, D. L. (2010). Financial literacy explicated: the case for a clearer definition in an increasingly complex economy. J. Consum. Aff. 44:276. doi: 10.1111/j.1745-6606.2010.01169.x

Salahodjaev, R. (2016). Does intelligence improve environmental sustainability? An empirical test. Sustain. Dev., 24, 32–40. doi: 10.1002/sd.1604

Salahodjaev, R. (2018). Is there a link between cognitive abilities and environmental awareness? Cross-national evidence. Environ. Res. 166, 86–90. doi: 10.1016/j.envres.2018.05.031

Thomas, A., and Spataro, L. (2018). Financial literacy, human capital and stock market participation in Europe. J. Fam. Econ. Issues 39, 532–550. doi: 10.1007/s10834-018-9576-5

Torpe, L., and Lolle, H. (2011). Identifying social trust in cross-country analysis: do we really measure the same? Soc. Indic. Res. 103, 481–500. doi: 10.1007/s11205-010-9713-5

Twumasi, M. A., Asante, D., Fosu, P., Essilfie, G., and Jiang, Y. (2022). Residential renewable energy adoption. Does financial literacy matter? J. Clean. Prod. 361, 132210. doi: 10.1016/j.jclepro.2022.132210

Van Rooij, M., Lusardi, A., and Alessie, R. (2011). Financial literacy and stock market participation. J. Financ. Econ. 101, 449–472. doi: 10.1016/j.jfineco.2011.03.006

Xiao, H., and Xin, Z. (2022). Financial literacy is better than income to predict happiness. J. Neurosci. Psychol. Econ. 15:119. doi: 10.1037/npe0000161

Yeh, T. M. (2022). An empirical study on how financial literacy contributes to preparation for retirement. J. Pension Econ. Fin. 21, 237–259. doi: 10.1017/S1474747220000281

Zahid, R. A., Rafique, S., Khurshid, M., Khan, W., and Ullah, I. (2024). Do women's financial literacy accelerate financial inclusion? Evidence from Pakistan. J. knowl. Econ. 15, 4315–4337. doi: 10.1007/s13132-023-01272-2

Zait, A., and Bertea, P. E. (2014). Financial literacy–conceptual definition and proposed approach for a measurement instrument. J Account Manage. 4, 37–42.

Zhang, Y., and Fu, B. (2023). Social trust contributes to the reduction of urban carbon dioxide emissions. Energy 279:128127. doi: 10.1016/j.energy.2023.128127

Zhuo, J., and Qamruzzaman, M. (2022). Do financial development, FDI, and globalization intensify environmental degradation through the channel of energy consumption: evidence from belt and road countries. Environ. Sci. Pollut. Res. 29, 2753–2772. doi: 10.1007/s11356-021-15796-0

Appendix

Keywords: financial literacy, environmental degradation, sustainability, cross country, climate change

Citation: Salahodjaev R and Sadikov A (2025) Financial literacy and environmental sustainability: a cross-country test. Front. Sustain. 6:1514393. doi: 10.3389/frsus.2025.1514393

Received: 20 October 2024; Accepted: 27 February 2025;

Published: 19 March 2025.

Edited by:

Omaima Hassan, Robert Gordon University, United KingdomReviewed by:

Hasan Hanif, Air University, PakistanBenjamin Ighodalo Ehikioya, Covenant University, Nigeria

Copyright © 2025 Salahodjaev and Sadikov. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Raufhon Salahodjaev, c2FsYWhvZGphZXZAZ21haWwuY29t

Raufhon Salahodjaev

Raufhon Salahodjaev Avazbek Sadikov2

Avazbek Sadikov2