- Department of Construction and Quality Management, School of Science and Technology, Hong Kong Metropolitan University, Kowloon, Homantin, Hong Kong SAR, China

Research background and significance: As China's economy continues its rapid expansion, the issue of environmental degradation has escalated, particularly within industries with significant environmental impact, such as steel, chemical, pharmaceutical sectors. These sectors are confronted with profound environmental and social responsibility challenges. The development of robust Environmental, Social, and Governance (ESG) systems has therefore become essential for improving environmental performance, meeting social responsibilities, and optimizing corporate governance structures. This study investigates the impact of ESG system implementation on the financial performance of enterprises within these environmentally impactful industries, offering a scientific foundation and practical guidance for corporate leaders and policymakers to facilitate green transformation and sustainable development.

Methods and data: This research integrates empirical analysis with case studies, employing a dataset of 2,376 observations from 792 listed companies within industries with significant environmental impact, spanning the period from 2019 to 2021. The data, sourced from the Wind database, were analyzed using multiple regression techniques. The findings reveal a significant positive relationship between overall ESG scores and corporate performance, measured by Return on Equity (ROE) and Return on Assets (ROA). All three ESG dimensions—environmental (E), social (S), and governance (G)—exhibit positive impacts on corporate performance. Furthermore, factors such as company size and growth rate are positively correlated with performance, whereas leverage ratio is negatively correlated. To further substantiate the empirical findings, a case study of Hunan Valin Steel Co., Ltd. was conducted.

Results and conclusions: The findings of this study demonstrate that the implementation of ESG systems substantially enhances the financial performance of enterprises within industries characterized by significant environmental impacts. Specifically, investments in environmental protection led to greater resource utilization efficiency, social responsibility initiatives foster enhanced employee productivity and customer loyalty, and strong corporate governance improves management structures and decision-making processes. The case study of Hunan Valin Steel Co., Ltd. reinforces these results, illustrating that a comprehensive ESG framework not only helps such enterprises achieve their environmental and social responsibility objectives but also markedly improves their financial outcomes. This research provides robust empirical evidence and actionable management recommendations for ESG system implementation in environmentally impactful industries, along with scientific support for informed policymaking.

1 Introduction

1.1 Research background and significance

The economy of China may be considered as one of the fast-growing economies, which has been proving the word for the last few decades (Aldowaish et al., 2022). Yet, the swift economic development is accompanied by unprecedented level of environmental pollution, especially in industrial sectors where their operations have high environmental implications, such as steel, pharmaceuticals, and chemicals. Since these sectors consume vast amounts of energy and produce high levels of emissions, they are in the frontline of regulations that set more emission control laws. The issue of environmental conservation as well as corporate social responsibility is increasingly becoming a crucial factor when evaluating companies, and it is no longer entirely about profit margins (Chen et al., 2022; Deng et al., 2024).

The establishment of Environmental, Social, and Governance (ESG) systems has been acknowledged by companies as a central task of sustaining competition in the market and fulfilling their social responsibility in the context of sustainable development. Such systems are planned to systematically include ESG elements, focusing on potential recycling improvements, risk mitigations, transparency, and the building of technologies that are in sync with SDGs (Oikonomou et al., 2018; Cek and Eyupoglu, 2020).

Environmental, social, and governance (ESG) concepts have been largely studied, especially in the development of the theory, however, the practical and systemic research, targeting the effect of ESG on company performance in the environmentally hazardous industrial sectors, remains a great research lacuna. The bridge across this gap is essential not only for academia but also for the practical aspect of business.

1.2 Research questions

The primary objective of this study is to investigate the impact of Environmental, Social, and Governance (ESG) system development on the financial performance of companies operating in industries characterized by significant environmental impact. This research is guided by the following key questions:

• What is the status and what are the defining characteristics of ESG system construction within these environmentally impactful industries?

• How do the individual dimensions of ESG—environmental protection, social responsibility, and corporate governance—specifically influence corporate performance?

• In what ways can companies effectively balance the pursuit of economic benefits with the imperatives of environmental protection and social responsibility during the implementation of ESG systems?

1.3 Research objectives

Through empirical analysis and case studies focused on industries in China with significant environmental impact, this study aims to achieve the following objectives:

• To systematically uncover the mechanisms through which ESG system implementation influences corporate financial performance, providing scientific evidence and practical insights for corporate managers. This will facilitate their efforts in achieving green transformation and sustainable development while ensuring continued economic growth.

• To provide a theoretical framework that supports government policymaking, aimed at enhancing corporate performance in environmentally impactful industries as they meet their social responsibilities, thus contributing to the green and high-quality development of the entire sector.

• To broaden the theoretical base of existing literature and address the research gap concerning the application of ESG systems within industries characterized by significant environmental impact.

1.4 Introduction summary

This paper seeks to investigate the impact of ESG system implementation on corporate performance by conducting a comprehensive study of industries in China characterized by significant environmental impact. The research will integrate empirical analysis with case studies to offer fresh insights into the role of ESG systems within these industries. Consequently, the findings are expected to inform effective leadership strategies and provide actionable recommendations for policy improvements.

2 Literature review

2.1 Current research on ESG systems and corporate performance

In recent years, the relationship between Environmental, Social, and Governance (ESG) practices and corporate performance has garnered significant attention from both academia and industry. Globally, a substantial body of literature has emerged since the inception of ESG case studies, with early research primarily focusing on the role of ESG in enhancing corporate performance. Specifically, these studies highlighted how ESG initiatives, particularly in environmental protection, contribute to stakeholder acceptance and improved market performance (Chang and Lee, 2022; Gerard, 2019). Notable early contributions in this field include the works of Hu et al. (2023) and Kluza et al. (2021). However, the current research landscape reflects a more holistic approach to sustainable development, where environmental protection is increasingly integrated with social responsibility and corporate governance, as exemplified by the studies of Gholami et al. (2022) and He et al. (2023).

In China, ESG research has developed more recently, gaining traction due to the country's unique development trajectory and the environmental challenges it faces. Chinese scholars have predominantly focused on the role of ESG in enhancing corporate transparency, mitigating risks, and increasing competitiveness (Liu and Zhang, 2023; Lokuwaduge and de Silva, 2020).

Despite these advancements, much of the existing research remains confined to individual firms or industries, often concentrating on macroeconomic analyses. This leaves the specific dynamics of ESG system performance within industries characterized by significant environmental impact underexplored. A detailed examination of how these industries implement ESG practices in China remains a critical area for future research.

2.2 Impact of the environmental dimension on corporate performance

Environmental responsibility is a core component of ESG, and its impact on corporate performance presents both advantages and challenges (Matakanye et al., 2021). While academic research highlights the benefits that companies can derive from investments in environmental protection, such investments also tend to attract positive attention from customers and investors (Oprean-Stan et al., 2020; Patil et al., 2020). For instance, a study conducted in the United States, utilizing event study data, demonstrated that market movements increased when public firms announced environmental strategies (Popescu et al., 2022). However, it is also observed that environmental investments can elevate overall operational costs, which may not necessarily lead to favorable financial outcomes in the long run. This effect is particularly pronounced in industries in China that have significant environmental impacts, as they require substantial capital investment to comply with stringent state-imposed environmental regulations (Senadheera et al., 2021).

This paper aims to explore the relationship between ESG factors, and the performance of industries characterized by significant environmental impact. It seeks to identify the unique characteristics of these factors and to determine how companies can balance environmental and financial considerations to make informed and effective investment decisions.

2.3 Impact of the social responsibility dimension on corporate performance

Corporate Social Responsibility (CSR), as a critical but often underintegrated aspect of the broader ESG framework, raises important questions regarding its impact on corporate performance. According to several studies, companies that effectively engage in CSR activities can enhance their brand image, attract valuable talent, and reduce financial burdens through cost savings (Teng et al., 2021; Tiefenbacher, 2022). For instance, Teng et al. (2021) found that businesses engaged in socially responsible activities performed well in capital markets, benefiting from access to loans at more favorable interest rates. However, other studies have highlighted that meeting social obligations can also lead to increased transaction costs, particularly during economic downturns, which may impose additional financial pressures on companies (Xie et al., 2019; Yin et al., 2023).

This study aims to examine how CSR initiatives specifically influence the overall performance of industries in areas characterized by significant environmental impact. It will explore how companies should implement CSR strategies to ensure a positive effect on their financial outcomes.

2.4 Impact of the corporate governance dimension on corporate performance

Effective corporate governance is widely recognized as a critical driver of corporate performance. Research indicates that adherence to sound governance principles significantly enhances financial outcomes (Zhang et al., 2020, 2024). For instance, Alsayegh et al. (2020) demonstrated that achieving a balance among shareholders ultimately contributes to improved corporate performance. Similarly, Baratta et al. (2023) highlighted that transparency in information disclosure, as an aspect of corporate responsibility, is closely linked to a company's reputation and brand value, which in turn positively influences market performance.

The importance of governance is particularly pronounced in industries with substantial environmental and social responsibilities. In industries characterized by significant environmental impact, corporate governance assumes even greater importance, as these sectors are often under heightened scrutiny to report on their environmental and social responsibilities (Shaikh, 2022). By refining their governance frameworks and enhancing transparency in operations, companies in these industries can better navigate these challenges and achieve superior financial results. This study will provide a detailed analysis of corporate governance and its role in industries with significant environmental impact, examining how governance practices influence corporate performance and outcomes.

2.5 Overall impact of ESG systems on corporate performance

The existing literature on the overall impact of ESG systems on corporate performance offers three primary perspectives: negative correlation, no significant impact, and positive correlation. Studies that support a negative correlation argue that investments in ESG initiatives require substantial resources, which can reduce investment efficiency, particularly in relation to stock market returns (e.g., Yeaw, 2023). The no-correlation perspective suggests that there is no meaningful relationship between ESG efforts and corporate performance (e.g., Cao et al., 2024). However, the majority of research tends to support the positive correlation viewpoint, positing that investments in ESG can enhance organizational efficiency, lower costs, and ultimately improve corporate performance (e.g., Chen et al., 2023, 2024). This positive correlation is especially pronounced in companies from developed countries, where ESG system implementation has been significantly linked to improved financial performance.

Despite these findings, the specific mechanisms through which ESG systems influence corporate performance in industries characterized by significant environmental impact remain underexplored. This study seeks to address this gap by conducting empirical analysis and case studies to systematically uncover the mechanisms by which ESG system implementation affects corporate performance in these industries. The goal is to provide both theoretical insights and practical guidance for corporate management and policy development.

3 Methods

3.1 Overall framework and methodology

This study employs a quantitative research approach to investigate the impact of ESG system implementation on the performance of companies within industries characterized by significant environmental impact (Ding et al., 2023). The research framework encompasses the following steps.

3.1.1 Data collection

The data for this study were sourced from the Wind database, focusing on ESG scores and financial metrics for 792 publicly listed companies in environmentally impactful industries in China, spanning the years 2019 to 2021. The selection criteria included companies that consistently published ESG reports over three consecutive years, with data that were both complete and free of errors.

3.1.2 Data analysis

The collected data were analyzed using Stata software, employing multiple regression analysis to examine the relationship between the ESG dimensions (environmental, social, governance) and corporate performance indicators (ROE, ROA). Additionally, an event study methodology was utilized to assess the short-term effects of significant ESG-related events on company performance.

3.1.3 Research design

The conceptual framework guiding this study is illustrated in Figure 1, which delineates the relationship between the independent variables (ESG dimensions: environmental, social, governance) and the dependent variables (ROE, ROA). The specific form of the regression model used in this analysis is as follows:

where Performance represents ROE and ROA, ESG represents ESG scores, and Size, Leverage, Growth, Industry, and Year are control variables.

3.2 Data collection and processing

3.2.1 Data sources and sample selection

The data for this study were sourced from the Wind database, focusing on listed companies operating within industries characterized by significant environmental impact in China from 2019 to 2021.

3.2.2 Wind ESG rating overview

The Wind database is a prominent think-tank in China, providing one of the most widely utilized ESG rating systems. Launched in 2018, Wind ESG Ratings primarily target A-share listed companies, evaluating them across three key dimensions: Environmental (E), mid-Social (mid-S), and Governance (G). These dimensions are assessed through 27 topics and over 300 best practice indicators, encompassing both quantitative and qualitative metrics, which help mitigate biases in the ESG evaluation process.

The Wind ESG methodology is tailored to reflect China's domestic market conditions and policies. For example, it incorporates local factors such as the presence of high-tech patents and the enterprise's role in poverty alleviation. The ESG scores are ranked on a scale from CCC to AAA, with quarterly updates to capture changes in corporate practices. These ESG metrics are crucial for investors and stakeholders, guiding their decision-making based on the ESG performance of the Chinese companies in which they invest.

3.2.3 Sample selection criteria

• ESG report consistency: companies included in the sample must have consistently published ESG reports throughout the research period to ensure data consistency and completeness.

• Data integrity: companies must have clear ESG ratings and associated investment data from the Wind database, with no missing or anomalous data.

3.2.4 Sample description

The study focuses on four sectors known for generating significant ESG-related risks—chemical manufacturing, steel production, mining, and waste management. These industries are recognized for their substantial environmental impact, including pollution, excessive energy consumption, and waste production.

3.2.5 Distribution of sample companies by industry

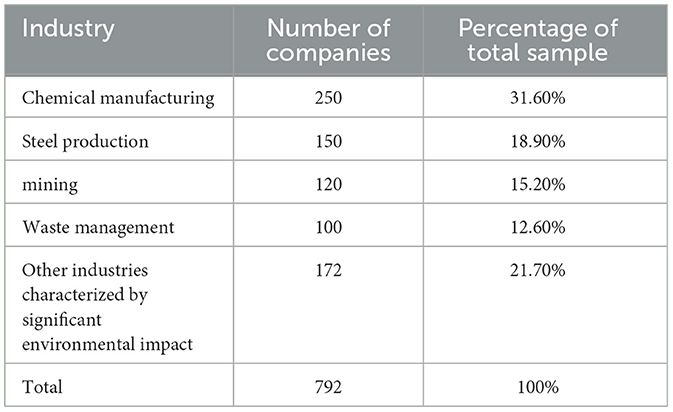

Table 1 details the number of companies and their distribution across the major pollutant industries examined in this study.

Table 1. Distribution of industries characterized by significant environmental impact companies in the sample.

This distribution reveals the large portion of chemical manufacturing and steel production companies in our Stanford sample. The study's observation of these two sectors provides insight into the simple and short-term influence of implementing an ESG system on the performance of enterprises with the largest environmental effect.

3.2.6 Variable selection and research design

To investigate the impact of ESG system implementation on the performance of companies within industries characterized by significant environmental impact, this study identified the following key variables and developed a corresponding empirical analysis model:

3.2.7 Explanatory variables (independent variables)

• ESG scores (ESG): this includes the overall ESG score as well as the scores for the three individual dimensions: Environmental (E), Social (S), and Governance (G).

3.2.8 Explained variables (dependent variables)

• Return on equity (ROE): a profitability measure calculated as Net Profit/Shareholders' Equity, reflecting the company's ability to generate profits from shareholders' investments.

• Return on assets (ROA): a measure of asset utilization efficiency, calculated as Net Profit/Total Assets, indicating how effectively a company uses its assets to generate profits.

3.2.9 Control variables

• Company size (size): represents the scale of the company, often measured by the natural logarithm of total assets.

• Leverage ratio (leverage): indicates the proportion of debt in the company's capital structure.

• Growth potential (growth): measured by the year-over-year growth rate in revenue or earnings.

• Industry effect (industry): accounts for differences in performance across various industries.

• Year effect (year): controls for time-specific effects that might influence company performance.

3.3 Empirical analysis methods

3.3.1 Regression analysis and correlation analysis

To systematically examine the impact of ESG system implementation on the performance of companies within industries characterized by significant environmental impact, the following analytical methods were employed.

3.3.1.1 Correlation analysis

A correlation analysis was initially conducted to explore the relationships between variables (Fu et al., 2023). The Pearson correlation coefficient was calculated to assess the correlation between the ESG dimension scores (Environmental, Social, Governance) and corporate performance metrics (ROE, ROA).

3.3.1.2 Multiple regression analysis

Building on the correlation analysis, multiple regression analysis was performed to test the impact of ESG system implementation on corporate performance (Gu et al., 2023). The OLS approach was employed, and robust standard errors were used with the aim of tackling as much heteroscedasticity as possible. Besides, subgroup regression examination was performed to go in detail on the special effect of each ESG dimension on corporate performance and to check the robustness of the model.

3.3.1.3 Event study method

Additionally, to validate the influence of ESG system adoption on companies' performance, the event study methodology selected a sample of representative major events for analysis. The specific steps are as follows.

• Event selection: The Hunan Valin Steel Company was considered a good example to find out the effect of publicizing ESG construction targets and schemes for a big investment conference on corporate influence.

• Event window: An event window of 10 trading days was found in both cases preceding as well as succeeding the occurrence to view the short-term impact of the happenings on the price of the stock and on the company's performance. The car estimation windows were set for 120 days to 20 days before the event. This was to estimate the car normal return model.

• Abnormal returns calculation: The abnormal return (AR) and cumulative abnormal return (CAR) were computed within the event window to analyze the short-term effect of interest concerned events on the stock performance.

Through these analytic approaches, this study is to show how ESG principles implementation affects corporate performance for those sectors that have bigger business environment, thus giving clearer evidence by detailed examples and case studies through it. Data processing and analysis were realized by SPSS and Stata software programs for the results to have both scientific correctness and consistency of them.

3.4 Robustness tests

To ensure the robustness of the research findings, the following robustness tests were conducted.

3.4.1 Group regression analysis

Group regression was performed across different company sizes, industry types, and other contextual variables to verify whether the impact of each ESG dimension on corporate performance remains consistent across various contexts (Han et al., 2024).

3.4.2 Alternative variable tests

The study also introduced alternative variables, such as using net profit margin instead of ROA, to assess the impact of ESG system implementation under different corporate performance indicators, thereby ensuring the robustness of the conclusions (Li et al., 2024).

4 Results

4.1 Analysis of the current state of ESG system construction in industries characterized by significant environmental impact

In recent years, as China's economy has rapidly developed and environmental concerns have become increasingly prominent, the Environmental, Social, and Governance (ESG) system has garnered significant domestic attention. The Chinese government has introduced a series of policies and regulations aimed at encouraging companies to enhance their ESG information disclosure and practices. Notable documents such as the “Guidelines for Environmental Information Disclosure of Listed Companies” and the “Guidelines for Social Responsibility of Listed Companies” have clearly defined companies' obligations and standards concerning environmental protection, social responsibility, and corporate governance. Moreover, domestic ESG rating agencies like SynTao Green Finance, China SIF, the Institute of Finance and Sustainability (IFS), and Wind have progressively established comprehensive ESG evaluation systems, providing crucial references for investors.

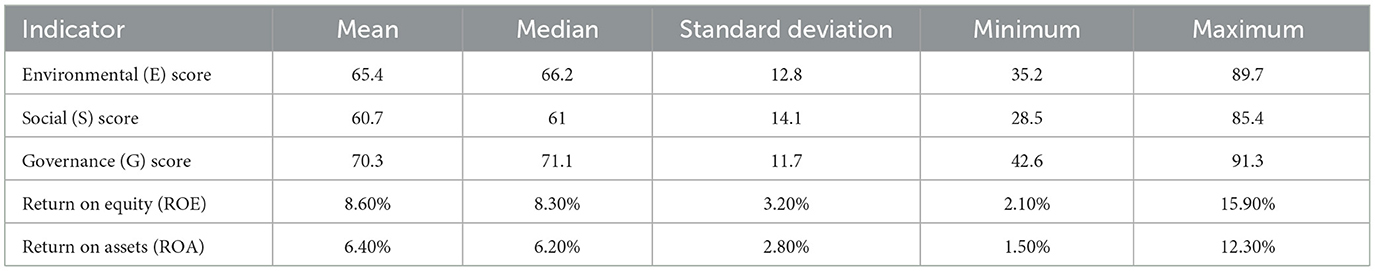

In industries characterized by significant environmental impact, disparities in the construction of ESG systems are evident. According to data from the Wind database, ESG scores of listed companies in these industries generally exhibited an upward trend from 2019 to 2021, though the development across different dimensions was uneven. Specifically, the governance (G) dimension consistently scored higher, reflecting a strong focus on governance structures and transparency. The environmental (E) dimension experienced the most rapid growth, indicating significant investments and advancements in environmental protection. However, the social (S) dimension recorded relatively lower scores, suggesting that companies still have considerable room for improvement in addressing social responsibility.

4.2 Commonalities in ESG system construction in industries characterized by significant environmental impact

This study examines the commonalities in ESG system development among companies in industries characterized by significant environmental impact, focusing on Porton Pharma Solutions Ltd., SKSHU Paint Co. Ltd., and Shanying International Holdings Co. Ltd., which represent the pharmaceutical manufacturing, chemicals, and papermaking sectors, respectively. These companies play a central role in their respective industries and serve as benchmarks for ESG practices.

4.2.1 Common elements in environmental management execution

Environmentally, these corporations have set up systems that offer comprehensive energy consumption and waste management. As an example, Porton Pharma Solutions has developed membrane wastewater treatment systems; SKSHU Paint produces environment-friendly water-based paints; and Shanying International applies state-of-the-art technologies for water conservation and treatment in their paper industry. These activities have led us to see an impressive decline in emissions and energy consumption, and the overall environment pollution. Additionally, these environment protection measures, and their impact are disclosed in a very transparent way, making people get to know that the companies practice ethical behavior, which strengthens the trust of various stakeholders in the companies.

4.2.2 General trends of resilience framework construction

These industrial enterprises, along with social responsibility, show a strong adherence to the improvement of living and working conditions of their employees and to the development of the communities they operate in. As for the preventive health departments, they have opened them, regularly conducted health check-ups and taught safety training for their workers. Furthermore, not only did they accomplish it, but they also are part of some community programs like building shelters for students and launching projects in healthcare services. For one, Shanying International and SKSHU Paint added to their positive social image by provision of uniforms and school supplies, respectively, to schools and scholarship to qualifying students.

4.2.3 Highlighting corporation stewardship framework commonalities

Corporate governance mechanisms that are based on scientific principles complement these businesses, which means that shareholders and stakeholders receive timely communication. Effective ESG risk management is integral to their governance practices, with specialized risk management committees tasked with identifying and mitigating ESG-related risks. Additionally, these companies have strengthened their internal financial and ESG audit systems and implemented rigorous quality control measures.

4.3 Descriptive statistics of indicators

A summary table of descriptive statistics is provided to facilitate clear interpretation of the key indicators (Table 2). This table includes the mean, median, standard deviation, minimum, and maximum values for the ESG scores and financial performance indicators (ROE and ROA) across the 792 companies operating in industries characterized by significant environmental impact.

That table has brought to the surface the complete situation about the ESG score and financial performance in the group of companies analyzed. The use of descriptive statistics defines the locality and the complexity range, thus making it easier to understand the subject and the results of the study.

4.4 The impact of ESG system construction on corporate performance in industries characterized by significant environmental impact

4.4.1 Empirical analysis results of ESG system implementation and corporate performance

This study conducted an empirical analysis of 2,376 samples from 792 listed companies operating in industries characterized by significant environmental impact between 2019 and 2021 to investigate the impact of ESG system implementation on corporate performance. Multiple regression analysis was employed to analyze the data, and the key findings are as follows.

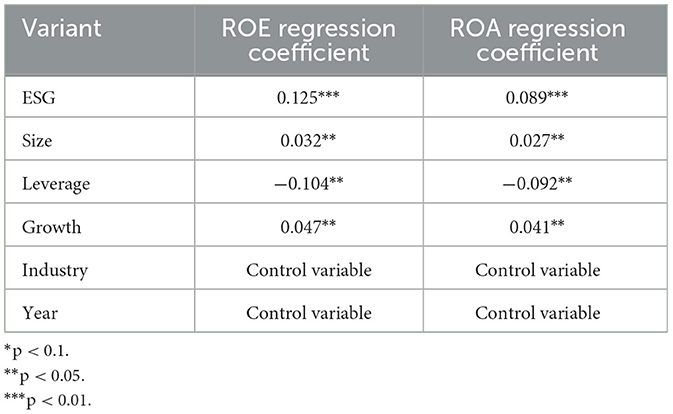

4.4.2 Overall regression results

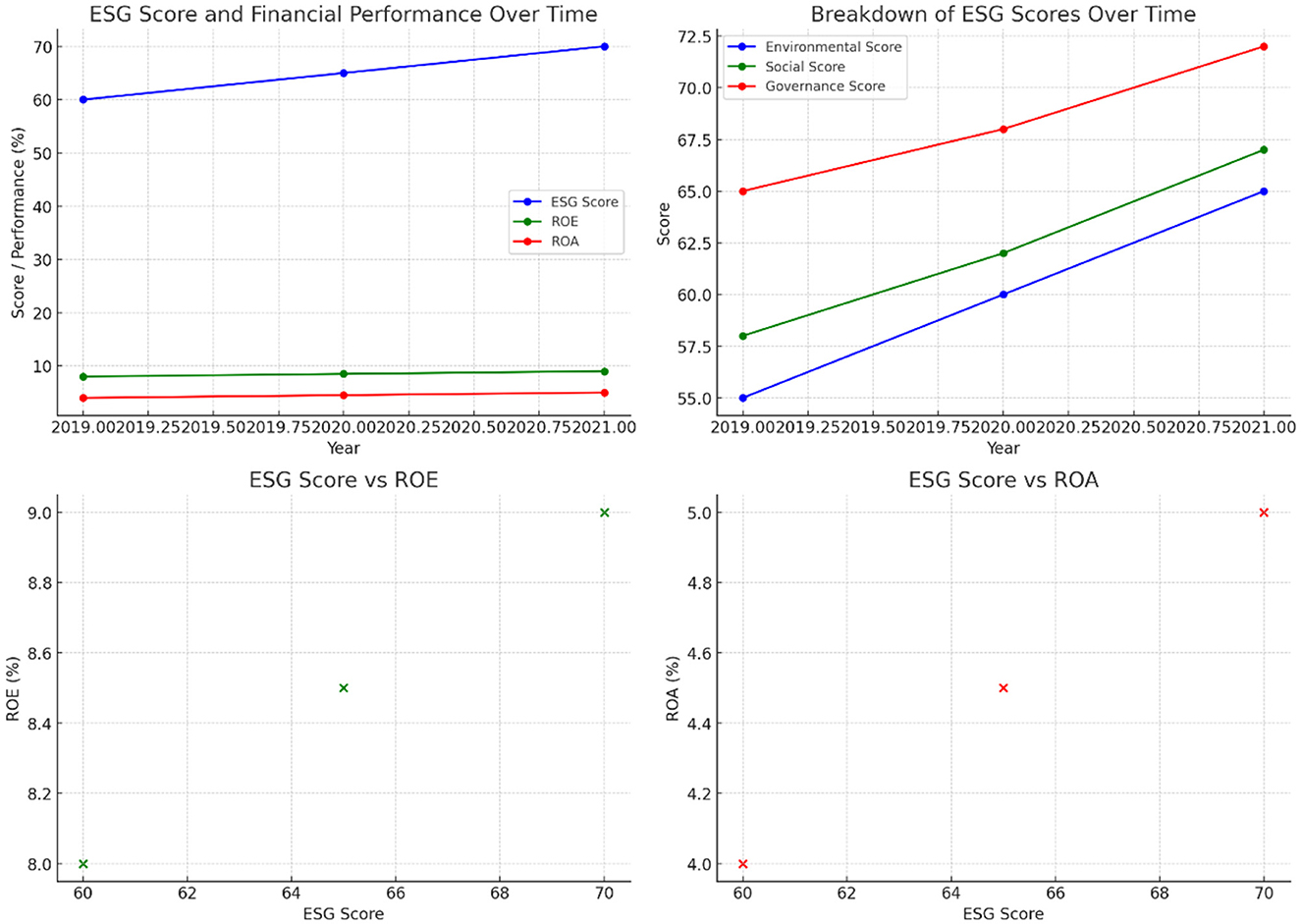

The results indicate a significant positive relationship between comprehensive ESG scores and corporate performance, as measured by ROE and ROA (Table 3). This suggests that the implementation of ESG systems may lead to a substantial improvement in financial performance for companies within these industries.

The efforts of industries characterized by significant environmental impact have shown a positive effect on overall corporate performance, as indicated by improvements in ROE and ROA. These findings suggest that the implementation of ESG systems can enhance investment outcomes (Figure 1). Additionally, company size and growth positively contribute to corporate development, whereas the leverage ratio has a negative impact on corporate performance.

Figure 1 shows the relationship between the ESG score and ROA, further supporting the empirical evidence of a positive correlation between comprehensive ESG efforts and corporate profitability.

To accurately assess the individual impact of each pillar of the ESG system on corporate performance, this study applies regression techniques focused on the Environmental (E) dimension, as well as the Social (S) and Governance (G) dimensions (Table 4).

Table 4 presents the regression analysis results for the environmental dimension, revealing a significant positive impact on both ROE and ROA (*p < 0.01). These findings suggest that increased investment in environmental protection by companies within industries characterized by significant environmental impact strongly contributes to enhanced financial performance.

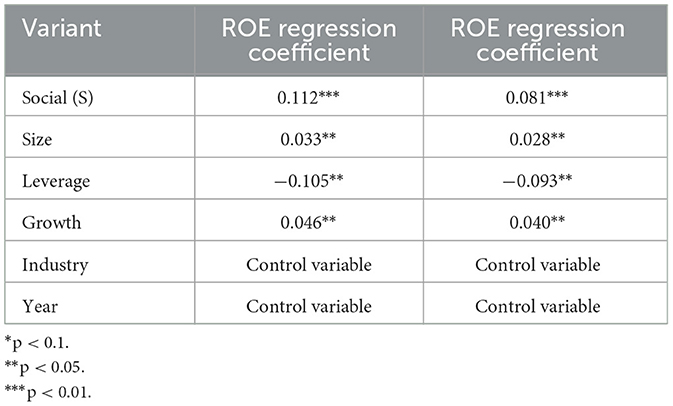

The influence of the social dimension (S) (Table 5) on business performance is detailed in Table 5.

Table 5. Social dimensions and their relationships with ROE and ROA revealed by regression analysis.

Table 5 illustrates the positive correlation between the social responsibility score and financial performance. The findings indicate that increased investments in environmental protection and corporate social responsibility directly contribute to improved financial performance. The table also explicitly notes the statistical significance and observed trends to ensure clarity in interpretation.

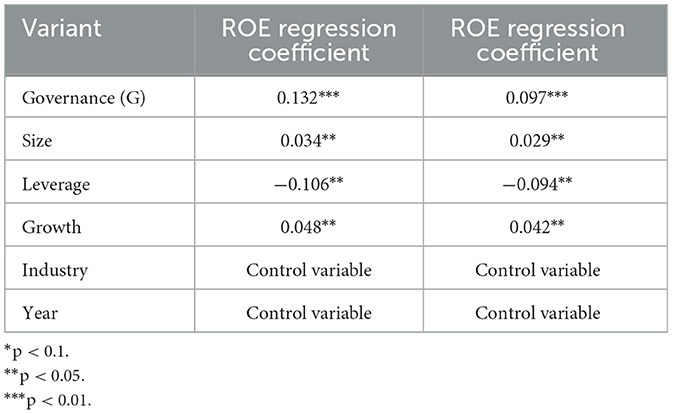

The influence of the governance dimension (G) (Table 6) on corporate performance is presented in Table 6.

The results of the regression analysis on the governance dimension (G) reveal a highly significant positive relationship with both ROE and ROA. These findings underscore the importance of corporate governance structures and practices in enhancing an organization's financial performance.

The descriptive statistics of the key performance indicators display a wide range of values, reflecting the diverse environmental impacts and governance structures across the sampled companies. The mean, median, and standard deviation of these indicators provide valuable insights into sector-specific performance and compliance levels.

In conclusion, each component of the ESG framework—environmental, social, and governance—has a significantly positive impact on the profitability of organizations within industries characterized by significant environmental impact. Therefore, by comprehensively implementing an ESG framework, these industries can fulfill their environmental and social responsibilities while simultaneously improving their financial performance.

5 Discussion

5.1 Research conclusions

This study systematically examines the impact of ESG system implementation on firm profitability in industries characterized by significant environmental impact in China. The findings indicate that companies with comprehensive ESG systems achieve substantially better financial outcomes over a 4-year period compared to those without such systems.

5.1.1 Overall impact of ESG systems on corporate performance

Multiple regression analysis reveals a significant positive correlation between a company's overall ESG score and its financial performance, as measured by ROA and ROE. This suggests that increased investments in environmental protection, social responsibility, and corporate governance can lead to higher financial returns for companies in industries with substantial environmental impact. These findings provide organizations with a stronger scientific basis for developing effective ESG strategies (Li and Pang, 2023).

5.1.2 Impact of the environmental dimension

The research highlights that the environmental protection score significantly influences business efficiency, particularly through improved resource utilization and cost-effectiveness. Investments in environmental protection can yield long-term financial benefits. By enhancing environmental performance, companies in industries with significant environmental impact can not only comply with increasingly stringent regulations but also improve their market competitiveness (Liu et al., 2024).

5.1.3 Impact of the social dimension

The study also validates a positive correlation between social responsibility and corporate performance. Investments in employee welfare, community engagement, and supply chain management can enhance brand value and customer loyalty, thereby contributing to improved financial performance.

5.1.4 Impact of the governance dimension

The governance dimension has the most pronounced impact on corporate performance. Strong corporate governance not only increases management efficiency but also enhances transparency and investor confidence, leading to significant improvements in financial performance (Qiang et al., 2023).

5.2 Research contributions

This study makes significant contributions both theoretically and practically:

• Theoretical contributions: by thoroughly analyzing the specific impact of each ESG dimension on corporate performance, this study enriches the existing literature on the relationship between ESG systems and corporate outcomes, particularly in the context of industries characterized by significant environmental impact. The findings illuminate the unique role of ESG system implementation in these sectors, filling a critical research gap and providing new perspectives for future studies.

• Practical contributions: the study offers actionable management recommendations for executives in industries with substantial environmental challenges, guiding them to balance environmental, social, and economic goals when formulating ESG strategies. Additionally, the results provide robust scientific evidence to inform government policy, encouraging companies to actively fulfill social responsibilities, promote green transformation, and achieve high-quality economic growth (Qing and Jin, 2023).

5.3 Policy and management recommendations

Based on the research findings, the following policy and management recommendations are proposed:

• Strengthen ESG system implementation: companies in industries with significant environmental impact should continue to increase investments in ESG system implementation, particularly in optimizing governance structures and improving environmental performance (Shen and Wang, 2024). Through systematic management and transparent disclosure, companies can enhance both their market competitiveness and financial performance.

• Set long-Term ESG goals: companies should establish clear long-term ESG objectives and develop scientific performance evaluation mechanisms. Regular assessment and monitoring of progress in environmental, social responsibility, and governance areas through both quantitative and qualitative indicators will ensure sustained improvement (Su et al., 2023).

• Government policy support: governments should develop and refine relevant laws and regulations, clearly defining corporate obligations in environmental protection and social responsibility (Tan et al., 2024). Policies such as tax incentives, financial subsidies, and green credit should be leveraged to encourage companies to increase investments in environmental technologies and sustainable development (Wang et al., 2023).

5.4 Conclusion

This study provides a systematic analysis of the impact of ESG system implementation on the performance of companies in industries characterized by significant environmental impact in China. By employing quantitative methods such as multiple regression analysis and event study methodology, the research reveals significant relationships between the ESG dimensions—environmental, social, and governance—and corporate performance indicators, specifically ROE and ROA. The findings underscore the critical role of ESG practices in enhancing financial performance, particularly in sectors facing substantial environmental and social challenges.

The research offers empirical evidence linking ESG factors with corporate performance in industries with significant environmental impact in China. These findings are further validated through robustness tests and event analysis, providing valuable insights for both practitioners and policymakers. However, the study also acknowledges its limitations and offers recommendations for future research to address these gaps and extend the findings. It is asserted that implementing and maintaining an ESG system not only aids a company in achieving sustainability but also drives sustained financial performance in sectors with substantial environmental challenges. As societal expectations for ESG practices continue to grow, future studies will be essential in deepening our understanding of the complex relationships between ESG practices and business efficiency across various sectors and regions.

6 Conclusion

6.1 Research conclusions

6.1.1 Overall impact of ESG system implementation on corporate performance in industries with serious environmental impact

The outcomes of this investigation validate a similar impact in practice among corporate organizations adopting the environmental, social, and governance (ESG) system, since it is backed with both empirical evidence and case studies. The findings suggest that the successful implementation of ESG systems is much more than just an association with a healthy bottom line but is also an essential driver in financial management for the sectors that are at the same time hardest hit by the environmental crisis. Sense fully, Triple ESG Three Pillars—Environment, Social Responsibility, and Corporate Governance provide positive impact on corporate management performance (Wang and Chang, 2024). The properly designed ESG system creates the way out for companies in industries with emerging environmental challenges and helps to gain not only economics but also social objectives by approaching environmental and social concerns more effectively (Wang et al., 2022; Zhang et al., 2022).

6.1.2 Major findings and contributions

6.1.2.1 Research findings

• Positive correlation between ESG system implementation and corporate performance: the analyses of multiple regressions give great evidence for a connection between a firm's general ESG score and relevant indicators of corporate performance like return on equity (ROE) and return on assets (ROA). This signifies that the use of an ESG framework can massively boost the returns from businesses in this sector.

• Elements of environmental dimension: the environmental protection (E) score shown in the regression analysis appears to be high and is significantly and positively associated with performance. This implies that, provided a company in an industry with a lot of impact on the environment, an investment in environmental protection, it can lessen environmental costs, enhance utilization efficiency, and probably improve financial performance.

• Impact of the social responsibility D (S): the results substantiate the fact that a certain degree of correlation exists between social responsibility profiles and corporate performance. From this perspective, initiatives exhibited in organizational culture (including employee well-being, community responsibilities, and customer interactions) have considerable effects on productivity and customer loyalty level leading to corporate success.

• Consequence of a governance factor (G): the governance aspect manifests a perfect positive relationship with the corporation's performance. This means that structuring governance systems to allow for expedient decision making and efficient managerial actions could be the means through which financial performance is maximized.

6.1.2.2 Research contributions

• Theoretical contribution: this research advances the theoretical understanding of the relationship between ESG systems and corporate performance by elucidating the specific impact mechanisms of ESG implementation in industries characterized by significant environmental challenges, supported by empirical analysis and case studies.

• Practical contribution: the study provides empirical evidence and actionable management recommendations for companies in environmentally impactful industries, guiding them in achieving environmental and social responsibility goals while enhancing financial performance.

• Policy contribution: this research offers a scientific foundation for government policy formulation and the promotion of ESG practices, supporting the transformation and sustainable development of industries facing significant environmental challenges.

6.2 Research limitations and future directions

6.2.1 Limitations

There are several limitations in this study that must be acknowledged. First, the sample consists primarily of listed companies in China within industries characterized by significant environmental impact. As a result, the research findings may not be generalizable to other regions or industries. Additionally, the Wind database used in this study may not capture all aspects of ESG, particularly in the social and environmental dimensions, due to data gaps. Furthermore, the linearity assumption in the regression model suggests that there may be other important factors influencing the relationship between ESG scores and corporate performance that were not considered in this analysis. It is also important to note that the event study methodology employed here focuses on short-term implications of ESG practices, which may not fully capture long-term effects.

6.2.2 Future research directions

To enhance the validity and generalizability of future research, it is recommended that researchers diversify the sample to include companies from different countries and economic sectors. Extending the study's timeframe from short-term to long-term could also help identify persistent trends and the enduring impact of ESG practices on corporate objectives. Future studies should consider incorporating additional factors into the regression model, such as corporate governance and market conditions, to provide a more comprehensive understanding of the mechanisms at play. Moreover, qualitative research methods, including case studies and expert interviews, could offer deeper insights into how ESG activities influence corporate performance. Finally, further examination of the interactions among the three ESG dimensions—environmental, social, and governance—could yield a more nuanced understanding of their collective impact on company performance.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

QL: Writing – original draft, Writing – review & editing. WT: Conceptualization, Data curation, Supervision, Writing – review & editing. ZL: Supervision, Validation, Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Aldowaish, A., Kokuryo, J., Almazyad, O., and Goi, H. C. (2022). Environmental, social, and governance integration into the business model: literature review and research agenda. Sustainability 14:2959. doi: 10.3390/su14052959

Alsayegh, M. F., Abdul Rahman, R., and Homayoun, S. (2020). Corporate economic, environmental, and social sustainability performance transformation through ESG disclosure. Sustainability 12:3910. doi: 10.3390/su12093910

Baratta, A., Cimino, A., Longo, F., Solina, V., and Verteramo, S. (2023). The impact of ESG practices in industry with a focus on carbon emissions: insights and future perspectives. Sustainability 15:6685. doi: 10.3390/su15086685

Cao, G., She, J., Cao, C., and Cao, Q. (2024). Environmental protection tax and green innovation: the mediating role of digitalization and ESG. Sustainability 16:577. doi: 10.3390/su16020577

Cek, K., and Eyupoglu, S. (2020). Does environmental, social and governance performance influence economic performance? J. Bus. Econ. Manag. 21, 1165–1184. doi: 10.3846/jbem.2020.12725

Chang, Y.-J., and Lee, B.-H. (2022). The impact of ESG activities on firm value: multi-level analysis of industrial characteristics. Sustainability 14:14444. doi: 10.3390/su142114444

Chen, C., Fan, M., and Fan, Y. (2023). The impact of ESG ratings under market soft regulation on corporate green innovation: an empirical study from informal environmental governance. Front. Environ. Sci. 11:1278059. doi: 10.3389/fenvs.2023.1278059

Chen, H.-M., Kuo, T.-C., and Chen, J.-L. (2022). Impacts on the ESG and financial performances of companies in the manufacturing industry based on the climate change related risks. J. Clean. Prod. 380:134951. doi: 10.1016/j.jclepro.2022.134951

Chen, L., Chen, Y., and Gao, Y. (2024). Digital transformation and ESG performance: a quasinatural experiment based on China's environmental protection law. Int. J. Energy Res. 2024, 1–16. doi: 10.1155/2024/8895846

Deng, M., Tang, H., and Luo, W. (2024). Can the green experience of CEO improve ESG performance in heavy polluting companies? Evidence from China. Manage. Decis. Econ. 45, 2373–2392. doi: 10.1002/mde.4149

Ding, X., Xu, Z., Petrovskaya, M. V., Wu, K., Ye, L., Sun, Y., et al. (2023). Exploring the impact mechanism of executives' environmental attention on corporate green transformation: evidence from the textual analysis of Chinese companies' management discussion and analysis. Environ. Sci. Pollut. Res. Int. 30, 76640–76659. doi: 10.1007/s11356-023-27725-4

Fu, Q., Zhao, X., and Chang, C.-P. (2023). Does ESG performance bring to enterprises' green innovation? Yes, evidence from 118 countries. Oecon. Copernic. 14, 795–832. doi: 10.24136/oc.2023.024

Gerard, B. (2019). ESG and socially responsible investment: a critical review. Beta 33, 61–83. doi: 10.18261/issn.1504-3134-2019-01-05

Gholami, A., Murray, P. A., and Sands, J. (2022). Environmental, social, governance and financial performance disclosure for large firms: is this different for SME firms? Sustainability 14:6019. doi: 10.3390/su14106019

Gu, X., Zhu, Y., and Zhang, J. (2023). Toward sustainable port development: an empirical analysis of China's port industry using an ESG framework. Humanit. Soc. Sci. Commun. 10:944. doi: 10.1057/s41599-023-02474-4

Han, F., Mao, X., Yu, X., and Yang, L. (2024). Government environmental protection subsidies and corporate green innovation: evidence from Chinese microenterprises. J. Innov. Knowl. 9:100458. doi: 10.1016/j.jik.2023.100458

He, X., Jing, Q., and Chen, H. (2023). The impact of environmental tax laws on heavy-polluting enterprise ESG performance: a stakeholder behavior perspective. J. Environ. Manag. 344:118578. doi: 10.1016/j.jenvman.2023.118578

Hu, A., Yuan, X., Fan, S., and Wang, S. (2023). The impact and mechanism of corporate esg construction on the efficiency of regional green economy: an empirical analysis based on signal transmission theory and stakeholder theory. Sustainability 15:13236. doi: 10.3390/su151713236

Kluza, K., Ziolo, M., and Spoz, A. (2021). Innovation and environmental, social, and governance factors influencing sustainable business models - meta-analysis. J. Clean. Prod. 303:127015. doi: 10.1016/j.jclepro.2021.127015

Li, S., Lin, D., and Xiao, H. (2024). Green finance and high-pollution corporate compensation - empirical evidence from green credit guidelines. Heliyon 10:e27851. doi: 10.1016/j.heliyon.2024.e27851

Li, W., and Pang, W. (2023). The impact of digital inclusive finance on corporate ESG performance: based on the perspective of corporate green technology innovation. Environ. Sci. Pollut. Res. 30, 65314–65327. doi: 10.1007/s11356-023-27057-3

Liu, H., and Zhang, Z. (2023). The impact of managerial myopia on environmental, social and governance (ESG) engagement: evidence from Chinese firms. Energy Econ. 122:106705. doi: 10.1016/j.eneco.2023.106705

Liu, Y., Huang, H., Mbanyele, W., Wang, F., and Liu, H. (2024). Does the issuance of green bonds nudge environmental responsibility engagements? Evidence from the Chinese green bond market. Financ. Innov. 10:92. doi: 10.1186/s40854-024-00620-8

Lokuwaduge, C., and de Silva, K. (2020). Emerging corporate disclosure of environmental social and governance (ESG) risks: an australian study. Australas. Account. Bus. Finance J. 14, 35–50. doi: 10.14453/aabfj.v14i2.4

Matakanye, R. M., van der Poll, H. M., and Muchara, B. (2021). Do companies in different industries respond differently to stakeholders' pressures when prioritising environmental, social and governance sustainability performance? Sustainability 13:12022. doi: 10.3390/su132112022

Oikonomou, I., Brooks, C., and Pavelin, S. (2018). The effects of corporate social responsibility on the cost of corporate debt and credit ratings. Financ. Rev. 53, 263–298.

Oprean-Stan, C., Oncioiu, I., Iuga, I. C., and Stan, S. (2020). Impact of sustainability reporting and inadequate management of ESG factors on corporate performance and sustainable growth. Sustainability 12:8536. doi: 10.3390/su12208536

Patil, R. A., Ghisellini, P., and Ramakrishna, S. (2020). “Towards sustainable business strategies for a circular economy: environmental, social and governance (ESG) performance and evaluation,” in An Introduction to Circular Economy, eds. L. Liu, and S. Ramakrishna (Singapore: Springer), 527–554. doi: 10.1007/978-981-15-8510-4_26

Popescu, C., Hysa, E., Kruja, A., and Mansi, E. (2022). Social innovation, circularity and energy transition for environmental, social and governance (ESG) practices—a comprehensive review. Energies 15:9028. doi: 10.3390/en15239028

Qiang, S., Gang, C., and Dawei, H. (2023). Environmental cooperation system, ESG performance and corporate green innovation: empirical evidence from China. Front. Psychol. 14:1096419. doi: 10.3389/fpsyg.2023.1096419

Qing, C., and Jin, S. (2023). Does ESG and Digital Transformation Affects Corporate Sustainability? The Moderating Role of Green Innovation. Available at: https://ideas.repec.org/p/arx/papers/2311.18351.html

Senadheera, S. S., Withana, P. A., Dissanayake, P. D., Sarkar, B., Chopra, S. S., Rhee, J. H., et al. (2021). Scoring environment pillar in environmental, social, and governance (ESG) assessment. Sustain. Environ. 7:1960097. doi: 10.1080/27658511.2021.1960097

Shaikh, I. (2022). Environmental, social, and governance (ESG) practice and firm performance: an international evidence. J. Bus. Econ. Manag. 23, 218–237. doi: 10.3846/jbem.2022.16202

Shen, S., and Wang, L. (2024). The impact of environmental protection tax on corporate performance: a new insight from multi angles analysis. Heliyon 10:e30127. doi: 10.1016/j.heliyon.2024.e30127

Su, X., Wang, S., and Li, F. (2023). The impact of digital transformation on ESG performance based on the mediating effect of dynamic capabilities. Sustainability 15:13506. doi: 10.3390/su151813506

Tan, X., Liu, G., and Cheng, S. (2024). How does ESG performance affect green transformation of resource-based enterprises: evidence from Chinese listed enterprises. Resources Policy 89, 104559–104559. doi: 10.1016/j.resourpol.2023.104559

Teng, X., Wang, Y., Wang, A., Chang, B.-G., and Wu, K.-S. (2021). Environmental, social, governance risk and corporate sustainable growth nexus: quantile regression approach. Int. J. Environ. Res. Public Health 18:10865. doi: 10.3390/ijerph182010865

Tiefenbacher, J. P. (2022). “Environmental management: pollution, habitat, ecology, and sustainability,” in Google Books. BoD – Books on Demand. Available at: https://books.google.com/books?hl=zh-CN&lr=&id=XGVnEAAAQBAJ&oi=fnd&pg=PP14&dq=Tiefenbacher,+J.+P.+(2022).+%E2%80%9CEnvironmentalmanagement:+pollution,+habitat,+ecology,+and+sustainability,%E2%80%9D+in+Google+Books.+BoD+%E2%80%93+Books+on+Demand

Wang, J., Hong, Z., and Long, H. (2023). Digital transformation empowers ESG performance in the manufacturing industry: from ESG to DESG. SAGE Open 13. doi: 10.1177/21582440231204158

Wang, S., and Chang, Y. (2024). A study on the impact of ESG rating on green technology innovation in enterprises: an empirical study based on informal environmental governance. J. Environ. Manag. 358, 120878–120878. doi: 10.1016/j.jenvman.2024.120878

Wang, X., Elahi, E., and Khalid, Z. (2022). Do green finance policies foster environmental, social, and governance performance of corporate? Int. J. Environ. Res. Public Health 19:14920. doi: 10.3390/ijerph192214920

Xie, J., Nozawa, W., Yagi, M., Fujii, H., and Managi, S. (2019). Do environmental, social, and governance activities improve corporate financial performance? Bus. Strategy Environ. 28, 286–300. doi: 10.1002/bse.2224

Yeaw, R. (2023). Determinants of environmental, social, and governance disclosure: a systematic literature review. Bus. Strategy Environ. 33, 2314–2330. doi: 10.1002/bse.3604

Yin, F., Xiao, Y., Cao, R., and Zhang, J. (2023). Impacts of ESG disclosure on corporate carbon performance: empirical evidence from listed companies in heavy pollution industries. Sustainability 15:15296. doi: 10.3390/su152115296

Zhang, Q., Loh, L., and Wu, W. (2020). How do environmental, social and governance initiatives affect innovative performance for corporate sustainability? Sustainability 12:3380. doi: 10.3390/su12083380

Zhang, Q., Zhang, Y., Liao, Q., and Guo, X. (2022). Analysis of the pollution reduction effect of green taxation under ESG concept. doi: 10.21203/rs.3.rs-2247362/v1

Keywords: ESG system, industries characterized by significant environmental impact, empirical analysis, environmental protection, green transformation

Citation: Li Q, Tang W and Li Z (2024) ESG systems and financial performance in industries with significant environmental impact: a comprehensive analysis. Front. Sustain. 5:1454822. doi: 10.3389/frsus.2024.1454822

Received: 27 June 2024; Accepted: 09 September 2024;

Published: 26 September 2024.

Edited by:

Hamid Doost Mohammadian, Fachhochschule des Mittelstands, GermanyReviewed by:

Camelia Hategan, West University of Timișoara, RomaniaSorinel Capusneanu, Titu Maiorescu University, Romania

Copyright © 2024 Li, Tang and Li. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Qingwen Li, czEyODgwODZAbGl2ZS5oa211LmVkdS5oaw==

Qingwen Li

Qingwen Li Waifan Tang

Waifan Tang Zhaobin Li

Zhaobin Li