- Département de Stratégie, Responsabilité Sociale et Environnementale, École des Sciences de la Gestion, Université du Québec à Montréal, Montréal, QC, Canada

Introduction: This paper introduces the concept of Sustainable Digital Rent (SDR), highlighting the shift from traditional economic rent based on tangible assets to rent derived from digital platforms. At the heart of this shift is the “value state,” a dynamic balance between constructive expectations and destructive information. As digital platforms generate increasing amounts of information, expectations are increasingly met and shared more efficiently with all users, leading to a reduction in individual and general motivational, emotional, and cognitive engagement. These platforms, now essential to modern life, facilitate online activities that reduce as well physical engagement and natural interactions, thereby impacting cognitive function and physical health. By extracting rent directly, digital platform operators limit the benefits users could gain to support their mental and physical well-being.

Methods: This paper empirically defines and estimates SDR using the collective estimates of price, cost, and income (PCI) as practiced in North American real estate appraisal, demonstrated through abstract art rent. Our approach provides a new perspective on valuing intangible assets, such as knowledge, by showing the shift from expectation to information, governed by the value state in cognitive evaluations. Emphasizing interdisciplinary relevance, the method underscores the need for an efficient mechanism to redistribute SDR benefits to digital platform users, supporting fair and equitable digital development.

Results and discussion: The results show that digital rent is driven primarily by cognitive and informational content, demonstrating the need for redistribution mechanisms to address the growing inequality on digital platforms. The use of abstract art as a case study provides a convenient and illustrative way to explore how intangible assets, like digital rents, can be evaluated and redistributed. SDR offers insights into how digital rents can be captured and redistributed equitably, ensuring that platform users and creators benefit from the knowledge economy’s growth. The findings underscore the relevance of measuring SDR to guide policy recommendations aimed at reducing digital monopolization and promoting sustainable digital development.

1 Introduction

The classical concept of economic rent, once firmly rooted in tangible assets like land, has undergone a profound transformation in the digital era. With digital interactions and information emerging as key economic commodities, rent has evolved into what we now identify as “digital rent.” Stemming from this transition, we introduce the concept of “Sustainable Digital Rent” (SDR), a framework aimed at addressing the sustainability challenges associated with the growing influence of knowledge and cognitive value in the economy. To fully grasp these challenges, it is important to revisit the historical foundations of rent in economic theory.

Examining Ricardo’s (1817) concept of land rent and comparing it to today’s wealth from knowledge reveals a significant transition, showing how this foundational economic matter has “melted” into digital rent. Seminal theories by Marx (1867, 1894) and Mill (1848) lay the groundwork for exploring SDR, linking the production of physical commodities to the dynamics of immaterial knowledge in digital economies. Marx’s insights into monopolization and capital investment remain pertinent as digital platforms transform ‘digital land’ to exploit information, converting human cognitive expectations into non-renewable digital rent (or information). This non-renewable rent, once generated, loses its emotional value (or expectations) and cannot be replenished in the same way within the conditioned cognitive system of value state valuation. Mid − 20th-century thinkers like Schumpeter (1942) and Keynes (1936) further refined these ideas. Schumpeter’s theory of creative destruction illustrates how innovation disrupts economic models, paralleling the impact of digital technologies on rent structures. Meanwhile, Keynes’ emphasis on the government’s role in stabilizing economies underscores the need for regulatory frameworks to manage digital platforms and ensure equitable distribution of digital rents.

In the digital economy, user contributions are central to platform value creation (Ahmed et al., 2023). However, digital rent remains a relatively new phenomenon (Fuchs, 2022), with no established methods to understand, evaluate, capture, or fairly attribute it to its originators. At the core of SDR is the concept of the ‘value state,’ shaped by the interplay between human expectations and information. Much like physical land in traditional rent models, cognitive expectations are a non-renewable resource. As users engage with digital platforms—through remote education, virtual work, online banking, telehealth, and digital entertainment (Smith et al., 2018; Mayer-Schönberger and Ramge, 2018)—their expectations transform into information, creating digital rent. This shift from natural cognitive and physical engagements to sedentary digital interactions negatively impacts both biological health and cognitive function (Hu et al., 2017; Shanmugasundaram and Tamilarasu, 2023a). Research indicates that excessive digital engagement can lead to cognitive overload, affecting attention, memory, and decision-making (De-Sola Gutiérrez et al., 2016; Dahmani and Bohbot, 2020; Spitzer, 2022). Unlike natural engagements, which intertwine physical activities with conscious learning, digital activities often lack this depth, resulting in diminished cognitive and physical states.

Expectations transformed into cumulative information generate digital platforms from which digital rent emerges. This rent is captured by platform owners or “Mindowners” without fairly compensating the users who create it (Fuchs, 2014a; Corsani, 2014; Zuboff, 2019). This imbalance mirrors the unsustainable practices of traditional rent models, leading to the depletion of human expectations. Sustainable Digital Rent (SDR) proposes an equitable redistribution of digital rents, thereby preserving human motivation and promoting social equity in the digital economy (Fuchs, 2012; Fisher and Fuchs, 2015; Jin and Feenberg, 2015). While modern sustainability frameworks have largely focused on environmental concerns, there is an increasing recognition of the need to address the interaction between societies and digital resources (Ghaderi et al., 2023; Benevene and Buonomo, 2023). This shift in focus emphasizes the importance of developing models that capture, manage, and redistribute digital rent, thereby transforming digital platforms into contributors to a more inclusive society.

Institutionalizing digital rent is central to this transformation. Effective regulatory frameworks are necessary to manage and equitably redistribute the benefits of digital assets. Fisher and Fuchs (2015) advocate for mechanisms that align with a human-centric approach, drawing parallels between traditional rent regulations and the protections required in digital markets. They emphasize fair compensation for personal data use through digital dividends, redistributing profits to the users who contribute their data. This approach not only enhances social welfare but also supports policies that prioritize equitable access to digital resources (Fuchs, 2014b). Pasquinelli (2009) and Scholz (2013) further support these concepts, advocating for a commons-focused approach that ensures the well-being of all participants in the digital economy.

However, to truly operationalize SDR and its institutionalization, it is not enough to merely propose theoretical frameworks; an empirical system is necessary to measure and distinguish SDR within real-world contexts. This measurement system must accurately separate SDR from the total value, ensuring its fair attribution to both users and platform owners (Özdilek, 2011a, 2011b). In pursuit of this goal, we applied the economic tripartite method of price, cost, and income (PCI) in the abstract art market, demonstrating that SDR captures the superior value of knowledge over digital infrastructure—much like an artist’s encoded message commands art rent. By establishing a method for empirically measuring SDR, we highlight its potential to prevent monopolization by conglomerates, thereby facilitating a more equitable distribution. This approach aims to realign the digital economy with human priorities, supporting societal welfare, cultural vitality, and cognitive and physical health.

The main contribution of this study is the development and characterization of digital rent as a fundamentally sustainable concept, bridging traditional economic theories with the complexities of the digital economy. We introduce an innovative approach validated through value valuation methodologies using abstract art, offering a novel perspective on assessing intangible assets. By exploring the ‘value state’ with interdisciplinary examples from economics, biology, and physics, we lay the groundwork for comprehending and quantifying SDR. Our historical analysis traces three key transitions: from classical land rent to digital rent, from expectation to information, and from physical production to knowledge production in the digital economy. This context deepens the understanding of SDR and its implications across both tangible and abstract domains. We propose fiscal policies and regulatory frameworks, including institutionalization principles and the empirical measurement of SDR, to promote equitable distribution of digital wealth, thereby enhancing economic stability and social equity. Additionally, we examine the societal and individual effects of digital rent on cognitive and physical well-being, underscoring the importance of managing human expectations sustainably. Ultimately, this multidisciplinary analysis enriches the understanding of digital rent’s transformative potential and outlines strategies for a more sustainable and equitable digital future.

2 Value state definition

In this section, we explore the value state through an interdisciplinary lens, integrating perspectives from economics, cognitive science, biophysics, and real estate appraisal. We begin by tracing the evolution of value from subjective use to measurable exchange, establishing a link between economic theories and contemporary valuation approaches. The discussion then moves into cognitive science, where human expectations and information interact within the value state. Drawing connections between these disciplines, we examine the neurobiological basis of reward systems, particularly how dopamine influences value perception, highlighting its parallels in abstract art and digital platforms. This interdisciplinary approach underscores the shared mechanisms of evaluation across these fields, illustrating how the value state concept bridges tangible markets and intangible digital ecosystems.

The interdisciplinary methodology adopted here integrates economic, cognitive, and real estate appraisal perspectives to provide a comprehensive view of the value state. Economic theories lay the foundation for understanding value, while cognitive science reveals how human expectations interact with information to shape value states. Real estate appraisal methodologies, defined in a later section, offer practical tools for quantifying value in both tangible and intangible markets. This approach is particularly suited for complex systems like digital platforms and abstract art, where traditional models cannot fully capture the dynamic interplay between expectations and information (Van de Cruys and Wagemans, 2011). By merging these fields, we refine value estimation and underscore the evolving nature of value in modern economies.

Over centuries, the concept of value has been a focal debate in economics and other disciplines, with various schools offering differing perspectives and no unified definition (Tripathi et al., 2023; Kaiser, 2024). In the 21st century, mainstream economics shifted towards practical substitutes like prices, costs, and incomes (PCI) for their tangibility. This left the exploration of value to fields such as cognitive science, neuroscience, sociology, and psychology (Friston et al., 2015), where discussions became more diffuse yet gained renewed interest, as explored further in this section. Value is thus a complex interdisciplinary concept debated across economics, sociology, biology, and physics (Robinson, 1962; Heinich, 2020). Often conflated with PCI, it has caused conceptual confusion (Anderson, 1993; Ariely, 2008). Economically, the notion of value evolved from subjective use to measurable exchange value, particularly after the Industrial Revolution, emphasizing PCI observables as practical proxies for subjective value (Jia et al., 2016). Classical economics initially focused on production costs, while neoclassical economics later shifted to utility derived from consumption, influencing price levels (Landreth and Colander, 2002). Marshall’s (1920) synthesis of supply-cost and demand-price dynamics into an equilibrium model underscores the complexity of value (Joffily and Coricelli, 2013). Given this extensive background and vast literature on value, our work focuses on key theories relevant to our subject, acknowledging the limitations of a comprehensive review within this paper’s scope.

Value, as conceptualized, is a cognitive state probabilistically existing by the combination of its attractive expectation state and its information state. The value of an event attracts us until sufficient information is obtained, at which point the value state collapses into information, fulfilling the expectations. This dynamic holds value in a statewise existence until it becomes a pointwise observable. Higher uncertainty in value correlates with stronger attractive forces, whereas pointwise estimates provide statistical measures. Expectation persists as long as outcomes remain uncertain (Georgescu-Roegen, 1971) and updates with new information, increasing the probabilities of better prediction of outcomes. For similar events, value tends to remain constant, though its expectation and information states dynamically change as depicted in Figure 1A. In an economic context, PCI represents observed manifestations of value state collapses, processed through complex patterns of seeking, comparing, and evaluating. Individual variations in perception evolve under the value state, following the theoretical logistic behavior of its information component through the consumption of expectation while generating new anticipations in perpetual cycles of assessments. Just as the movement and quantity of matter define an object’s total energy, value sets the energetic boundary for a commodity. Potential energy corresponds to unknown information—or expectation—while kinetic energy parallels the observed final decision, or information.

Figure 1. (A) Expectation and Information in Value State: This diagram illustrates the dynamics of value as a cognitive state, transitioning between expectation and information states over time. Higher uncertainty increases the attractive force of expectation until sufficient information is obtained, fulfilling the expectation state through the disclosure of a solution, which in turn leads to an increase in information. (B) PCI Representation: A triadic approach in market value estimation using three competing methodologies—Sales Comparison Approach (SCA), Cost Approach (CSA), and Income Capitalization Approach (ICA)—yielding distinct market valuations. The ‘M’ point, serving as the common coordinate across the different valuation approaches, denotes the most probable approximation of the subject painting’s value.

Figure 1B visually demonstrates the application of the triadic approaches and their corresponding PCI estimates as observables through a three-dimensional representation. Detailed computations and adjustments in these methodologies yield three distinct market value estimations for the same subject abstract painting. The SCA estimates a market price of USD $1,366,428 using data from four comparable paintings, as demonstrated later in the practical example. Adjustments for varied structural, spatial, financial, and temporal attributes align their prices with the subject painting, as highlighted in the boxed region of the illustration. The circles’ sizes represent the range of observed prices influencing the SCA’s final valuation. The CSA and the ICA, though not depicted for clarity and whose details are provided successively within the empirical demonstration, follow similar processes, resulting in market valuations of USD $1,293,760 and USD $1,323,435, respectively. The point ‘M’ in the figure represents the market value, serving as the most probable approximation of the value state of the subject painting.

Abstract art offers valuable insights into its observer’s value creation and destruction mechanisms, serving as a close analogy for user engagements in digital platforms. As a genuine model of intangible value, art exemplifies how intangible value can be far beyond the cost of physical media like canvas and paint. Similar to the value in different media like poetry or music, the high value of abstract art derives from its painted message triggering evaluation, creativity, and intellectual engagement, paralleling the valuation of digital information over physical infrastructures and platforms through which it flows. Fine art articulates complex emotional experiences both in tangible and immaterial media, bringing us closer to the complex dynamic interplay between expectation and experimentation mechanisms in digital environments. Paralleling the cognitive mechanisms in art value and valuation with user engagements and interactions in digital platforms also enhances our understanding of subtle transitions into the digital economy, informing strategies to sustain engagement and enrich societal and cultural connections.

The evaluation of art intertwines with economics and cognitive science, utilizing methods based on value and comparison, with higher valued alternatives favored (Vlaev et al., 2011). Classical economic theories, such as the expected utility theory (EUT), suggest decisions are made to maximize utility or expected utility in probabilistic outcomes (von Neumann and Morgenstern, 1944). The neurological evaluation system is hierarchically organized, with cortical predictive (evaluation) activity flowing top-down to meet bottom-up sensory information (Manousakis, 2009; Clark, 2013). Neurons communicate and process rates of impulsive signals about expectations and information as the neural currency of value using action potentials (Schultz, 2010; Jia et al., 2016). This neural activity is integrated to form conscious decisions (Ljungberg et al., 1992; Ariano et al., 2005; Bromberg-Martin et al., 2010). Practitioners can use observables such as BOLD imaging (Sabri et al., 2013), fMRI (Silvetti et al., 2013), and EEG (Kawabata and Zeki, 2004) to understand the brain’s evaluation system.

Abstract art challenges traditional representation by emphasizing fundamental elements like lines and color patches, thereby inviting unique interpretations and profound cognitive engagement (Aviv, 2014). This interpretative openness enhances the artwork’s value through a dynamic interplay between expectation and realization (Vartanian and Goel, 2004), analogous to user interactions on digital platforms. By introducing ambiguity, artists create multiple potential value states and interpretations, which in turn continuously trigger cognitive evaluations (Zolberg, 2007). These interactions align with predictive coding theories, wherein the brain’s pleasure centers are activated by the confirmation of expectations and the enhancement of pattern recognition, thereby enriching the aesthetic experience (Dodgson, 2009). This framework elucidates how the brain manages expectations and processes information during art appreciation, enhancing pleasure when prediction errors are resolved (Ogawa and Watanabe, 2011). Navigating these cognitive dynamics heightens aesthetic appreciation and emotional responses, mirroring the satisfaction derived from complex problem-solving in controlled environments that replicate the thrill of discovery without associated risks (Ashenfelter and Graddy, 2003; Van de Cruys, 2017).

The genetic and neurobiological underpinnings of our interaction with art are well illustrated by the roles of the DRD4 gene in novelty-seeking behaviors and how dopamine influences neuronal firing during art engagement (Oak et al., 2000). This system’s heightened response to the unpredictability of expected rewards underscores the impact of novel information on reward pathways (Schultz, 2015). Niv and Chan (2011) nuances that the brain’s dopaminergic (DA) system does not encode the absolute value of information but responds to changes in expected outcomes, reflecting the dynamic nature of reward perception. The DA system rewards seeking behaviors under uncertain situations and halts actions once resolution is achieved, explained through anhedonia, incentive salience, and reward prediction error theories (Previc, 1999; Montague et al., 2004; Berridge, 2007; Colombo and Wright, 2017). Theories of liking, learning, and wanting further analyze the DA system’s response to the unpredictability of rewards (Wise, 2004; Berridge, 2007; Pecina, 2008). This adaptive evaluation mechanism continually optimizes decision-making by assimilating new information to maximize benefits (or minimize errors) under varying conditions of resource constraints and uncertainty (Glimcher, 2003; Dreher and Tremblay (2016)).

Cognitive science suggests that when expectations align with reality, dopamine release subsides, leading to reduced interest and engagement, a phenomenon known as the hedonic treadmill effect (McSweeney and Murphy, 2009; Friston, 2003; Schultz, 2010). Vygotsky (1971) posits that aesthetic experiences require active engagement to uncover deeper meanings, contrasting with mere information consumption, which ‘cools’ value states. Art lacking novelty induces boredom and disengagement (Eastwood et al., 2012). This is supported by Hebbian learning experiments, which show that repetitive engagement with art leads to cognitive satiation, diminishing stimulus impact and reducing interest (Citri and Malenka, 2008; Robbins et al., 2007). This reduction in emotional engagement parallels digital interactions where user interest wanes after repeated cycles of expectation fulfillment and information saturation (Watt and Vodanovich, 1999). Preferences for surreal art among those prone to boredom highlight the need for complex artistic expressions to prevent cognitive satiation (Furnham and Avison, 1997). Cognitive satiation, akin to “information overload” (Przybylski et al., 2013; Whelan et al., 2020), undermines cognitive efficiency and emotional well-being, leading to “data smog” and attention deficits (Shenk, 1997; Epstein et al., 2005).

When the outcome of an event becomes entirely predictable, its value state is significantly reduced, thereby eliminating the potential for profit. This is exemplified in stock markets, where the complete disclosure of data, such as PCI, nullifies opportunities for financial gains (Kirkup and Frenkel, 2006). Entities with access to superior information can leverage uncertainties to optimize their returns by accurately forecasting complex value dynamics (Jiang et al., 2021). In a parallel manner, within the art world, the exposure of visual information diminishes an artwork’s intrinsic value, whereas novelty serves to enhance it (Elkins and Fry, 2022). This phenomenon elucidates why personal interest in a piece of art wanes once curiosity has been satisfied, despite the potential for its market PCI to increase due to emerging expectations regarding various facets of the artwork (Kraizberg, 2023). For an informed economic agent, the value state of the event becomes null, providing no scope for emotional engagement (Lazzaro and Coscia, 2022). However, this information continues to hold value for those who have not yet encountered the event, as it can be traded within the market. These individuals navigate through different levels of PCI, thereby engaging with new and uncertain events.

Classical economics traditionally employs algorithmic and statistical models to manage subjectivity in value assessments, acknowledging the probabilistic nature of value within classic decision theory. This theory suggests that rational economic agents optimize for a utility function, typically represented as an optimal selection probability distribution (Khrennikov, 2006; Bruza et al., 2009). These decisions are often modeled using Bayesian probability, indicating that optimal selections are influenced by the accumulation of knowledge (Van den Noort et al., 2016; Bond et al., 2018). Quantum Probability Theory (QPT), however, offers a novel perspective more adept at understanding human information processing and decision-making under uncertainty (Pothos and Busemeyer, 2013; Wang et al., 2013). QPT computes probabilities for different outcomes by incorporating subjective variables such as the observer’s measurement process (Busemeyer et al., 2011). It posits that each quantum entity exists in a superposition—a wave-like state of multiple potential outcomes—until observed (Shimony, 1993). The act of measurement forces the quantum state to assume one of these potential states, a process theorized to occur in mental processes, although this remains a contentious issue (Von Neumann, 1932; Wigner, 1967; Jabs, 2016). Wavefunction collapse theory, particularly as interpreted through the Copenhagen or von Neumann–Wigner frameworks, suggests that observation or even consciousness plays a crucial role in this collapse (Faye, 2019), aligning with Penrose’s (1996) proposition that observation and wavefunction collapse occur simultaneously.

Measuring the value state is inherently complex due to the variability in concepts, observables, and methods (COMs), compounded by diverse definitions across fields. This necessitates synthesis to avoid terminological proliferation. The evaluation system serves as a common framework across disciplines, rooted in the same cognitive processes for both organic and expert evaluations. Organic evaluations are subjective (Pinker, 1997), reflecting individual use values, while expert evaluations employ observables like exchange values (PCI) to approximate value states economically. These evaluations integrate with the organic system, driven by human expectations, even when conducted by computers programmed by humans. Economic assessment methodologies can adapt to other fields and vice versa, maintaining consistency despite COM diversity. Concurrent use of triadic COMs yields robust results by accommodating various decisional contexts and computational processes (The Appraisal Institute, 2020). This system extends beyond economic parameters, fostering holistic integration and recognizing interconnectivity with other disciplines (Popper, 2001).

The application of the triadic evaluation system to practical cases, such as abstract art, elucidates the evolutionary development of its COMs (Özdilek, 2018). This system evolved to address diverse needs, encompassing survival, optimization, and strategic planning (Friston, 2005). Initially, humans relied on historical data to meet immediate needs and avoid dangers (Sih et al., 2011), leading to price-based estimates of value states. This approach is mirrored in cost-based evaluations, where unfolding information provides a second type of value state estimate. As cognitive abilities advanced, humans processed past and present information more effectively and explored future simulations, akin to income-based evaluations for the same event (Di Paolo, 2003; Mekel-Bobrov et al., 2005; Clark, 2013). These evolutionary abilities—survival through past data (price), optimization through present data (cost), and planning through future projections (income)—are integrated for comprehensive evaluations, always aiming to minimize errors or maximize information to better approximate value states across various contexts. This evolutionarily conditioned system is universally applicable in every decision-making process, whether evaluating a skyscraper’s value, interpreting abstract art, or making everyday choices (choosing between coffee and tea), underscoring its robustness and versatility (Ma et al., 2019; Sterzer et al., 2019).

3 Sustainable digital rent

In this section, we explore the evolution of rent from classical economic models to the contemporary digital economy, culminating in the introduction of Sustainable Digital Rent (SDR). The presentation follows a chronological structure, beginning with tangible assets like land and labor in classical economics, then moving through intermediary stages involving intellectual property and financial derivatives, and finally arriving at the modern era of digital platforms and data-driven assets. An accompanying table visually summarizes this progression, illustrating the transition from physical land rent to digital rent, and serving as a guide for the reader. This step-by-step framework lays the foundation for SDR, which captures the commodification of user data and digital interactions, highlighting the growing importance of human expectations and cognitive contributions in today’s knowledge economy. By tracing this transition, we ensure the reader comprehends the layered theoretical foundations of SDR with clarity and coherence. The roadmap further emphasizes the interdisciplinary connections between economics, cognitive science, and digital platforms, showing how these fields intersect to shape modern rent dynamics and their impact on cognitive states and economic structures.

SDR integrates expectational use value into the value state equation, often overshadowed by informational exchange value. Traditional economic models emphasize market exchange value, typically measured through objective metrics like PCI, which often eclipse the intrinsic worth of use value that sustains human expectations. This trend is intensified by digital platforms, where expectations rapidly convert into information, reinforcing the dominance of exchange value. SDR posits that rent, tied to nature’s inherent properties, arises from our current inability to fully replicate the fertility of natural resources. Higher rent reflects the challenge of replicating these attributes and is based on physical properties. As technology advances and more information is extracted, rent diminishes, paralleling the conversion of natural resources into usable forms, evolving into information or knowledge and embodying the shift from a physical to a digital basis (Mayer-Schönberger and Cukier, 2013).

Rent serves as an evolving indicator of the shift from classical to digital economics, illustrating how value transitions from use value to exchange value. This transformation redefines our interactions with both physical and digital environments. SDR ensures that technological progress protects and enhances human motivation and engagement by converting non-renewable human expectations into digital information at a naturally regulated rate. Emanating from the consequences of the interplay between cognitive expectation and information across various scientific fields, particularly economics where value states are prevalent, SDR contributes to improving our understanding and practices in digital environments, promoting both economic efficiency and cognitive health. The profound influence of technology on daily life—reshaping how we live, learn, and interact—necessitates a critical reevaluation of digital advancements and their impact on cognitive perceptions and interactions (Zhao and Zhang, 2016). Consequently, rent becomes ‘sustainable,’ representing undisclosed expectations transformed into exchange value through capital (Milne and Chan, 1999; Clark, 2000).

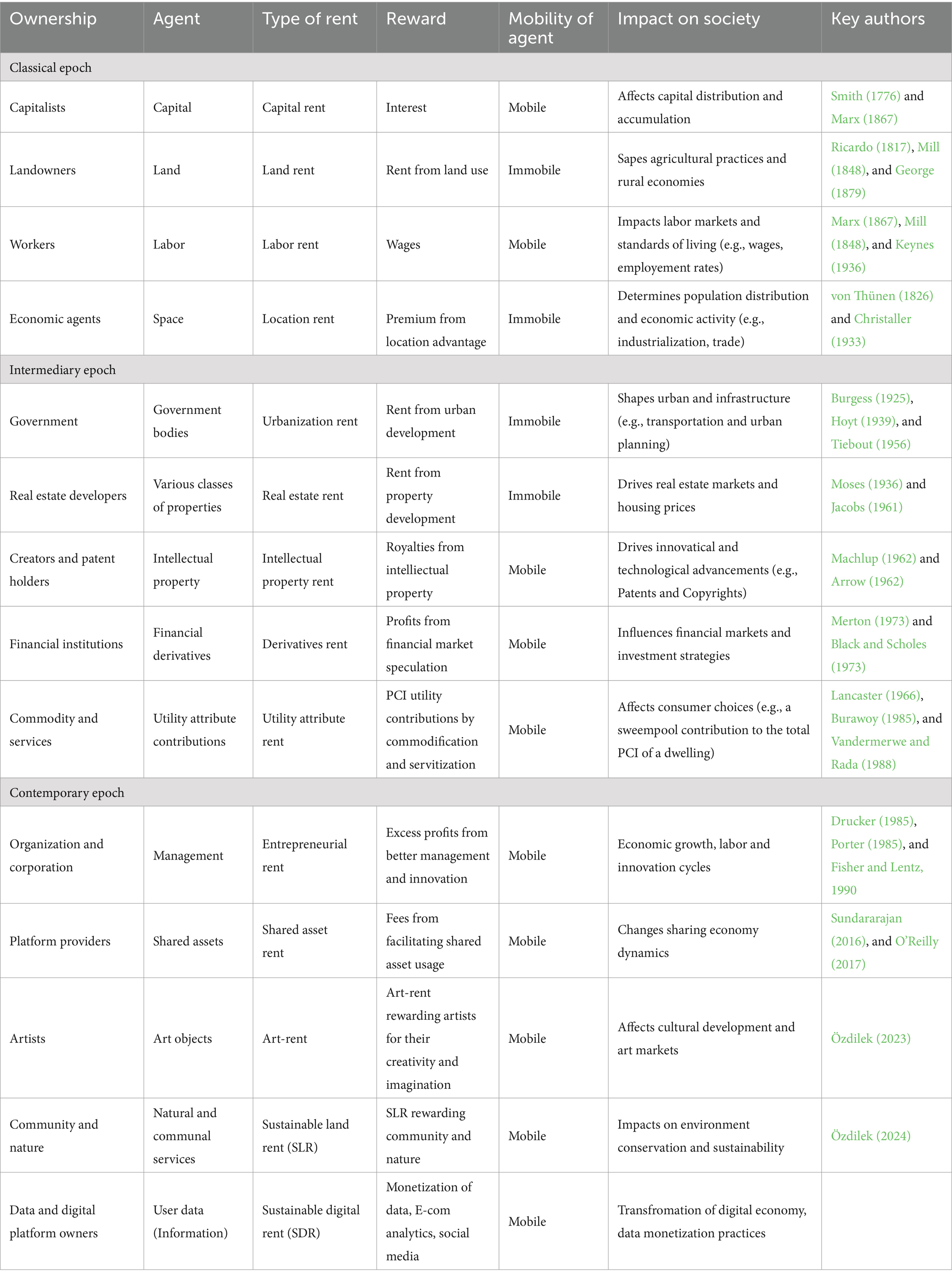

Table 1 illustrates the evolution of economic rent from the Classical to the Contemporary epoch, highlighting the shift from traditional landowners to modern digital platform operators, or “Mindowners,” and detailing the types of rent, their rewards, mobility, and societal impacts across different epochs, supported by key economic theories and authors (Ophir et al., 2009). Historically, rent derived from physical assets like land and labor, as theorized by economists such as Adam Smith (1723–1790) and David Ricardo (1772–1823). In the digital age, the focus has shifted to intangible assets such as information and digital interactions, marking a transition from rent based on our inability to fully understand and exploit the physical properties of commodities to rent derived from abundant information. This shift reflects the move to SDR, generated through the interplay of digital data and user engagement, changing societal structures and economic foundations.

The evolution of rent types shows a progression from location-specific land rent to urbanization, intellectual property, and financial derivatives (Rabianski, 1996). Early debates on organizational creativity expanded the concept of rent to include utility attributes and entrepreneurial knowledge, challenging traditional valuation models (Fisher and Lentz, 1990). Advances in knowledge have progressively neutralized physical constraints, shifting the production basis from physical assets and activities to knowledge, transforming into information (Wheeler, 1989). This shift also signifies a move from location-based rent to the information-centric production of goods and services (Burawoy, 1985; Vandermerwe and Rada, 1988). Technological advancements emphasize platforms anchored in knowledge and creativity, where productivity converges into digital platforms and their rents. SDR examines its sustainability, emphasizing the need to understand and maintain a natural balance in value state mechanisms, where expectation and information drive valuation and decisions. This necessitates a reevaluation of systems across different fields, starting with economics, to reflect the importance of information and cognitive capacity, focusing on knowledge and reduced expectations.

Our analysis reveals a significant transformation in rent distribution, with an increasing focus on sustainability towards the end of the contemporary epoch. This remarkably leads to three pivotal forms of sustainability—cultural, environmental, and human—each reflecting the impact of digital transformation. Cultural sustainability (Art-Rent) values creativity and intellectual expression, aligning with cultural capital (Özdilek, 2023). Environmental and communal sustainability (Sustainable Land Rent, SLR) conserves resources and promotes ecological balance. Human sustainability (SDR) monetizes personal expectational data and interactions, emphasizing the role of digital platforms in the knowledge economy. These forms of rent adapt traditional concepts within the digital economy, guiding future economic models to prioritize knowledge and information, ensuring digital advancements benefit societal and environmental welfare while considering the human value states.

The shift from a goods-based to a knowledge-based economy necessitates a reevaluation of the value state system’s mechanics (Schumpeter, 1942). Efficiently mining knowledge while protecting use value is crucial for safeguarding human cognitive centers in digital spaces. SDR emphasizes the human factor and cognitive vulnerability in digital economies, addressing environmental and societal challenges. The transition towards digital and intellectual property rents requires sustainable management to ensure equitable profit distribution and prevent monopolistic behaviors, demanding robust governance to enhance transparency in digital rent extraction and protect communal resources (Hardin, 1968; Ostrom, 1990). The modern digital economy prioritizes ‘exchange value,’ commodifying user data at the expense of personal and communal well-being, necessitating a redefinition of rent to capture surplus value from cognitive and social interactions within digital platforms. SDR promotes policies to prevent cognitive overload and create environments nurturing creativity and engagement, safeguarding intrinsic values such as anticipation and motivation.

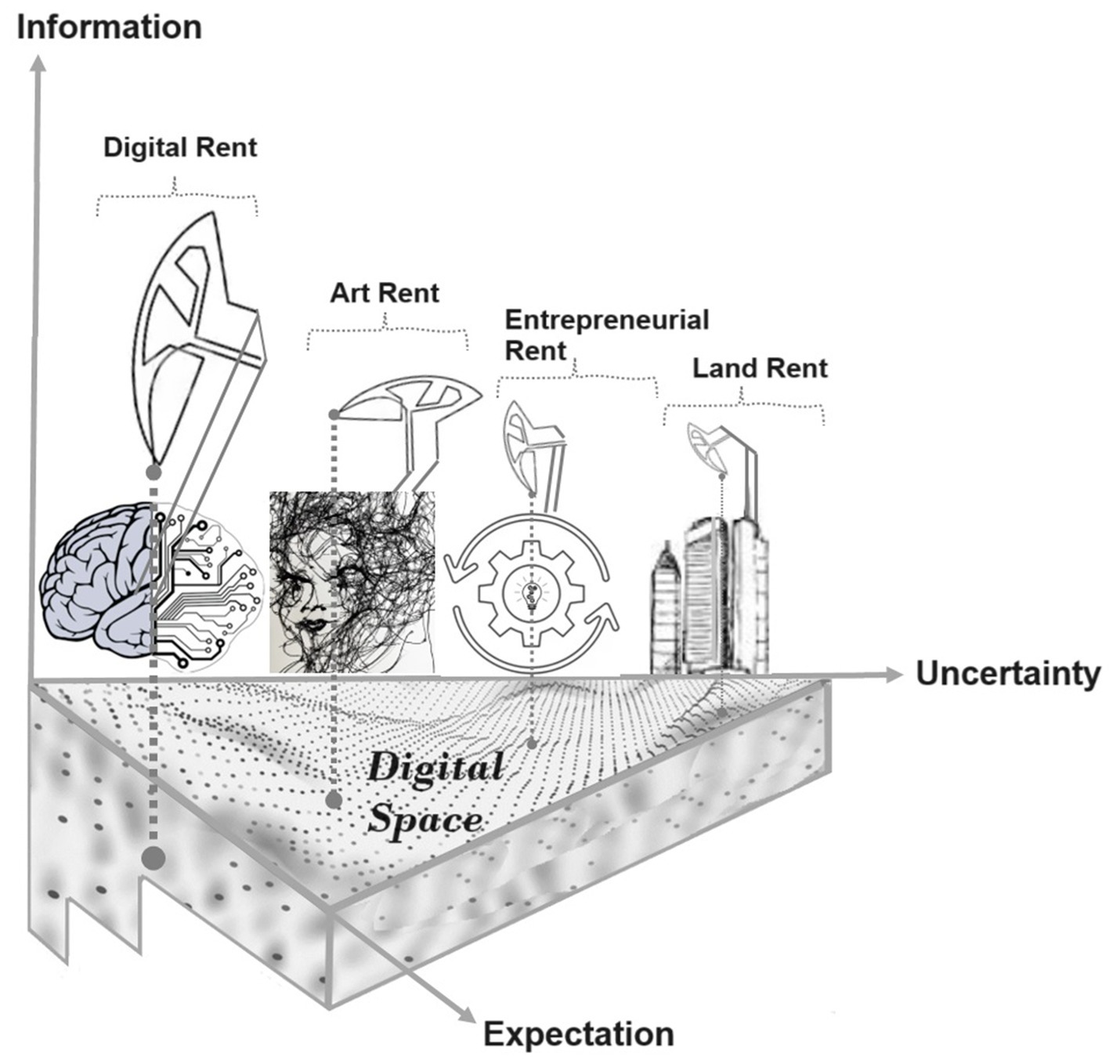

The content in Table 1 is depicted in the accompanying illustration, which captures the evolution of economic rent from traditional land rent to digital rent across three axes: information (Y-axis), uncertainty (X-axis), and expectation (Z-axis). This illustration maps the extraction of rent from physical assets to cognitive and informational outputs, beginning with land rent (buildings) captured by traditional landowners, progressing through entrepreneurial rent (gears) garnered by business leaders and managers, and art rent (Pollock’s painting) mediated by “Artmasters” (galleries, auctioneers, and intermediaries), culminating in digital rent exploited by “Mindowners” (digital platform operators). Traditional rent from physical land is characterized by high uncertainty, whereas entrepreneurial rent reduces this uncertainty through effective management and decision-making. Art rent, which is closer to the value state, embodies the intangible value of artistic creativity. Digital rent, which is nearest to the value state, exemplifies the efficient transformation of human expectations into commoditized information within digital markets. The Z-coordinate illustrates expectation, which increases with low information or high uncertainty. Any value state in various fields can be represented as a coordinate (an “M” point) on these triadic axes. The larger heads of pumps in the illustration signify higher rates of expectation conversion into digital rent and its extraction from digital spaces. This shift underscores the efficiency of converting cognitive expectations into value, necessitating robust regulatory frameworks to safeguard user rights, ensure equitable access, and prevent monopolistic practices (Figure 2).

This study’s discourse on sustainability anchors in the human condition, recognizing that environmental, communal, and cultural improvements enhance life and cognition. SDR emerges as the central framework integrating all facets of sustainability, placing human welfare at the forefront. This shift ensures external enhancements enrich human existence, making SDR the foundation of all sustainability strategies. Positioned at the forefront of sustainability discussions, SDR underscores the need to realign efforts to focus on the human cognitive value state, ensuring every aspect of sustainability is connected to this central value state, contributing to a global sustainable human condition. Building SDR as an integrative framework, this study emphasizes the need for a nuanced understanding of value states in the digital context. SDR signifies a shift from tangible to digital assets, redefining rent for today’s information-driven realities. Rapid digital evolution profoundly impacts cognitive states, necessitating a reevaluation of economic models and regulatory frameworks to protect human well-being from digital data influx. This reevaluation must balance preserving cognitive expectations and managing information overload. For instance, in digital and abstract art, balancing clarity and ambiguity is essential; too much clarity stifles curiosity, while too much ambiguity risks disengagement (Shanmugasundaram and Tamilarasu, 2023b). Similarly, digital economies must balance preventing cognitive overload and maintaining user engagement (Spitzer, 2012). SDR advocates for an approach where digital advancements enhance societal welfare without compromising intrinsic human values, ensuring equitable digital rent distribution.

Resource management has evolved to emphasize a human-centered approach, focusing on the interaction between human societies and natural resources. SDR aligns these principles with digital economy challenges, supported by frameworks like the Universal Declaration of Human Rights (1948), the Kyoto Protocol (UNFCCC, 2007), and the World Commission on Environment and Development (1987). These frameworks advocate for sustainable practices to secure future generations’ needs. Environmental laws such as the Clean Air Act (EPA, 1970) and the Water Framework Directive (European Commission, 2000), along with sustainable urban development initiatives (Townsend, 2013), emphasize the interdependence of ecological and human health. Policies like the 1992 Rio Declaration and subsequent initiatives (Pearce and Barbier, 2000; Zhang et al., 2021) promote environmentally responsible real estate developments, exemplified by certification systems like BREEAM and LEED (Lazar and Chithra, 2020) and green building initiatives (Kohler, 1999), highlighting the evolution towards smart cities (Doukas et al., 2007; Debastiani et al., 2020). Guided by theories on psychological well-being (Ryff, 1989), these developments ensure that digitization in economic interactions supports cognitive and emotional health. This comprehensive approach addresses the unique challenges of digital economies to human expectations, promoting fair distribution of digital wealth and fostering an equitable digital future.

Digital technologies have transformed the economy from traditional, tangible assets to a knowledge-based framework, altering business models and daily interactions. Enhanced productivity through digital and algorithmic technologies supports activities from online shopping to virtual consultations, demonstrating the dominance of digital information (Stigler, 1961; OECD, 2017; Peitz and Waldfogel, 2012; Srikanth and Thakur, 2022). This transition redefines economic rent, shifting from agricultural and land-based models to Sustainable Digital Rent (SDR), capturing shifts from physical to informational commodities, impacting environmental sustainability, socio-economic structures, and cognitive states (Ward and Aalbers, 2016; Bliss and Egler, 2020; Pirgmaier, 2021). As digital platforms become primary venues in the economy, exploiting user data and interactions, economic rent digitizes, emphasizing the scarcity of knowledge over physical commodities (Harrison, 2021; Deak, 2022; Qiao and Feng, 2023).

The digital revolution has reshaped societal and economic structures, necessitating a comprehensive overhaul of existing frameworks to address new challenges and opportunities (Iqbal and Horvitz, 2007). Zuboff (2015) and Sadowski (2019) highlight surveillance capitalism’s impact on personal data management, advocating for robust regulatory frameworks to ensure fair wealth distribution from digital assets. Karaganis (2007) and Harrison (2021) discuss how digital platforms have transformed creators’ and consumers’ roles, promoting new economic models like ‘digital feudalism’ where user data is commodified. This calls for updated regulations to address psychological impacts and ensure fair compensation for creators, as emphasized by Murayama and Jach (2024) and Kozłowski et al. (2014), supporting societal and economic sustainability. Digital technologies also influence non-economic aspects like healthcare, with Chamakiotis et al. (2020) noting significant cognitive and professional advancements. Carayannis et al. (2014) describe this as ‘creative destruction’, advocating for a balance between innovation and sustainability. Addressing technical challenges, Lanza et al. (2019) highlight the need for effective data sharing and standardization within IoT ecosystems to manage digital rents transparently. Coiera (2000) underscores how digital platforms challenge traditional economic models, highlighting the need for strategies that ensure the utility and sustainability of digital environments.

Theories of predictive coding and the Bayesian brain hypothesis illustrate how excessive information disrupts predictions based on past experiences, leading to cognitive overload. This impairs anticipatory mechanisms, causing decision paralysis (Jacoby, 1977) and reduced productivity due to digital interruptions (Mark et al., 2008). These disruptions also lead to declines in psychological health and life satisfaction (Kross et al., 2013), privacy erosion (Zuboff, 2019), and weakened interpersonal connections (Turkle, 2011), highlighting the need for balanced information management systems. In digital and abstract art, valuation approaches informed by predictive coding integrate expectation with sensory input to minimize prediction errors and maintain balance (Olshausen and Field, 1996; Clark, 2013). The brain’s processing, involving top-down predictions and bottom-up feedback (Rao and Ballard, 1999), is regulated by dopamine, adjusting neuronal firing rates to encode reward expectations (Caplin and Dean, 2008; Schultz, 2010). However, habituation to predictable stimuli can reduce cognitive resource allocation, leading to disinterest in triggering evaluation mechanisms (Summerfield et al., 2008; Todorovic and De Lange, 2012). This understanding is crucial for designing digital environments that maintain user engagement and ensure content remains compelling and cognitively stimulating.

Institutionalizing digital rent is essential for equitable digital asset management and fair distribution of digital benefits. Breznitz and Ornston (2018) highlight the effectiveness of such frameworks, while Di Giulio and Vecchi (2023) advocate for dedicated agencies to oversee distributions and integrate digital rent policies with existing economic systems. Creating these agencies can be a potent strategy for implementing technological innovations, ensuring policy sustainability, and addressing trade-offs between long-term effectiveness and the risks of ossification. This integration aims to compensate data and content contributors and prevent monopolistic behaviors, aligning with the SDR concept (Fuchs and Sevignani, 2013). Schwerhoff et al. (2020) and Connellan (2019) argue that digital platforms should be taxed similarly to landowners, harnessing economic value for public benefit. Mansell (2012) and Zuboff (2019) underscore the need for transparency and trust to protect consumer and creator rights and prevent data monopolization. Continuous policy review and adjustment, as noted by Patashnik (2008) and Weiss (2014), are critical for adapting to emerging challenges and promoting societal welfare, supported by revenue-sharing models (Fuchs and Sevignani, 2013; Pohle et al., 2016).

Effectively managing cognitive load is crucial for maintaining user engagement in the digital economy. Sweller (2011) emphasizes optimizing information processing to enhance learning, while Gazzaley and Rosen (2016) focus on designing digital environments aligned with human cognitive capacities. Gamification techniques (Hamari et al., 2014) and engagement strategies (O'Brien and Toms, 2013) are vital for sustaining interest. Educating users about their data rights is essential for informed decision-making (Kang et al., 2013; Acquisti et al., 2015), supported by privacy-enhancing technologies (Balebako and Cranor, 2016) and ‘Privacy by Design’ principles (Cavoukian, 2012). Open standards for data interoperability (Weber, 2010; Greenstein and Stango, 2007) promote competition and innovation, while partnerships between governments, technology firms, and academic institutions (West, 2015; Ostrom, 1990) address challenges like digital equity and access, ensuring effective integration of technological advancements into societal frameworks.

4 Value state evaluation

Living systems evaluate rewards to satisfy diverse needs, shaping abstract states like happiness and perception. Pinker (1997, p. 21-22) describes the mind as a “system of organs of computation” engineered by natural selection, while Popper (2001) emphasizes that evaluative processes are essential and universal across scientific fields. Determining value is crucial across economic, physical, social, and psychological dimensions, facilitating decision-making. The sustainability of expectations within the value state must reflect human motivations driving the continuous search for information.

In this section, we consider the case of art value valuation as a convenient medium for demonstrating the practicality of SDR. Although the evaluation of art is inherently subjective, unlike real estate valuation in more consolidated markets with richer data (Mooya, 2018), its market has moved towards efficiency with better information, greater liquidity, and increased participation (Louargand and McDaniel, 1991; Agnello, 2002). Despite its economic exceptionalism, art becomes part of the market (Beech, 2015). Modern techniques like Agent-Based modeling, Deep Learning, and AI add sophistication but still operate within classic PCI frameworks (Özdilek, 2020a, 2020b).

Given the lack of established methods to estimate SDR or the value generated by digital platforms, we developed a novel tripartite PCI evaluation methodology inspired by North American real estate appraisal techniques. The application of these classic approaches in art valuation is adapted to the non-standardized nature of artworks and the dynamics of a knowledge-based economy (USPAP, 2014). By applying this methodology to abstract art, we gain unique insights into valuing intangible assets, such as human expectations and knowledge, which are transformed into information, revealing shifts governed by the value state. To further contextualize this economic approach, we also incorporate interdisciplinary insights from biology and physics, demonstrating how mechanisms of value state creation and destruction operate across various fields.

In the following analysis, we apply three economic evaluation methods—Sales Comparison Approach (SCA), Cost Summation Approach (CSA), and Income Capitalization Approach (ICA)—to estimate the market value of abstract art, specifically a Jackson Pollock painting. Each method offers distinct advantages: the SCA uses comparable market sales to reflect price perceptions in secondary markets, the ICA converts future income streams from art exhibitions or rentals into present value, and the CSA focuses on physical reproduction costs, particularly useful when market data is insufficient. While each method provides a reliable individual value estimate, their simultaneous application enables a more comprehensive assessment, accounting for both tangible and intangible factors. This approach is particularly valuable when considering the Sustainable Artistic Rent (SAR) component, which incorporates the intellectual contributions of the artist. Using all three methods together enhances the accuracy of value estimation in complex, knowledge-driven markets, where converting human expectations into information is essential.

Building on the outlined tripartite PCI evaluation methodology, we now apply this framework to the empirical case of abstract paintings by the American artist Jackson Pollock (1912–1956). Pollock, a pivotal figure in abstract expressionism, revolutionized the art world with his innovative drip painting technique, wherein he poured, dripped, or splattered paint onto a horizontal surface to craft dynamic compositions. Gaining significant fame during the late 1940s and early 1950s, his works are characterized by their chaotic yet harmonious structures, reflecting a deep engagement with spontaneity and subconscious creation. These qualities have secured his paintings a prominent place in the art market, celebrated for their innovation and emotional intensity. For our analysis, we gathered information on a specific Pollock painting and its comparables from publicly accessible databases such as Artnet and Artprice, supplemented by literature and expert opinions from galleries, museums, and auctioneers. This empirical foundation allows us to further explore the nuances of SDR in the context of abstract art.

4.1 SCA opinion

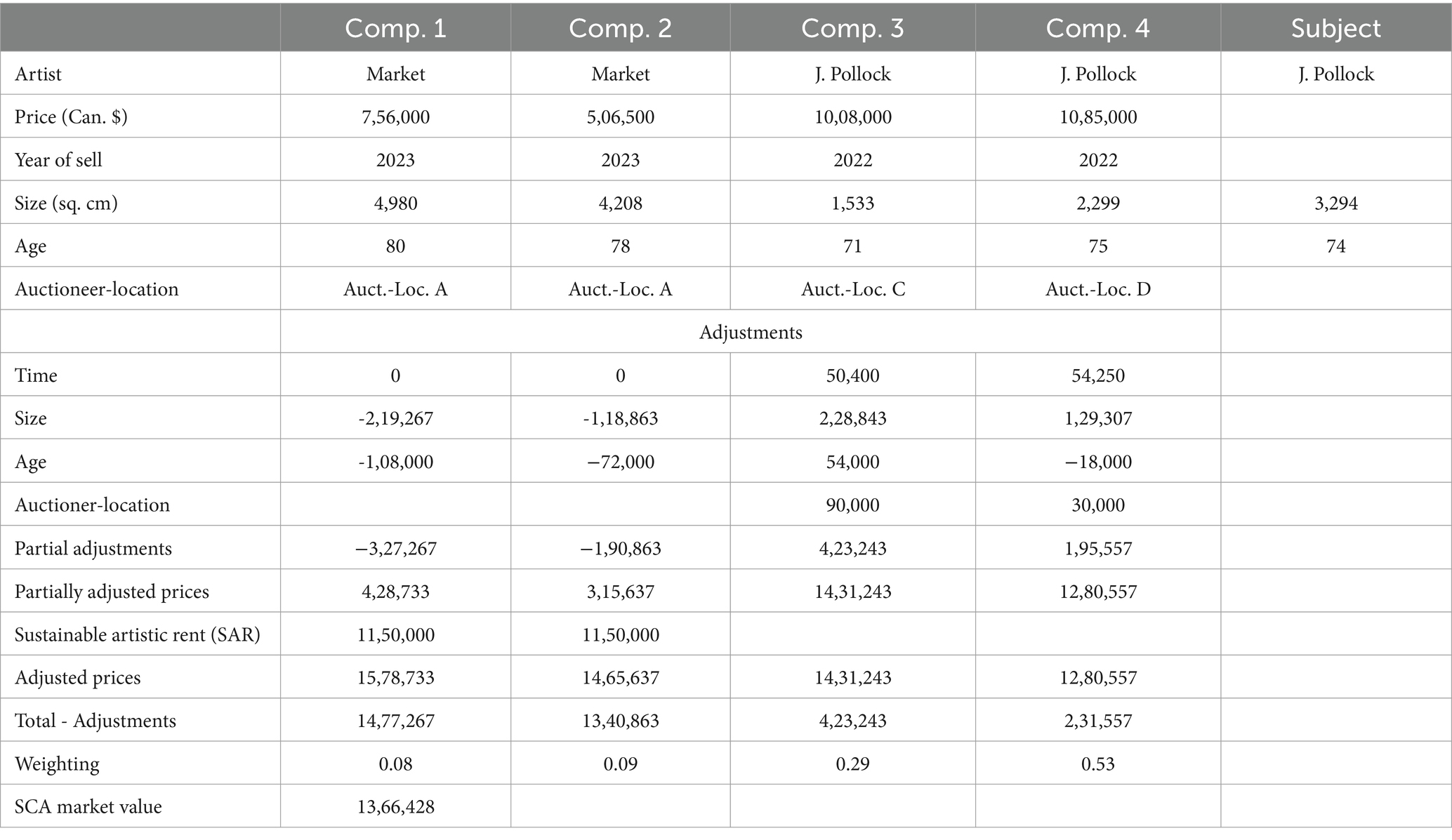

We estimated the market value of a Jackson Pollock painting on December 1st, 2023, through a rigorous analysis of observed prices and characteristics of similar abstract expressionist paintings sold between 2021 and 2023 in various cities and auction houses. This market segmentation identified closely comparable artworks, facilitating price standardization (Lipscomb and Gray, 1990). Detailed grid-adjustment calculations accounted for the fundamental attributes of the paintings, adjusting their prices to align more precisely with the subject painting. Pairwise comparisons within the Sales Comparison Approach (SCA) allowed for the adjustment of prices of less similar artworks, modifying them based on their relative comparison to the subject painting. This method provided reliable market value references by meticulously accounting for differences in each painting’s characteristics.

When estimating the price of an unsold painting using the SCA, we focus on total prices of comparable artworks to derive the SAR component. This component captures the impact of expectations reflected in price variations, particularly related to the artist’s renown or the piece’s rarity, addressing unique informational demands expressed through price levels. For example, an artwork’s distinctiveness and creative elements can justify a higher price, with SAR accounting for these qualitative attributes that contribute to price differences. Increasing the number of comparable artworks in similar physical and financial states enhances the objectivity of SCA estimations, stabilizing the SDR factor as it becomes a more objective price determinant.

Among the attributes considered, the contribution of SAR to the total price was particularly noteworthy, serving as a marginal price factor that rewards the potential impact of the artist’s codified message within the painting. Our analysis also revealed other significant findings. Market analysis indicates that art prices experience a positive linear adjustment of 5% annually, and the size of the painting contributes approximately $130 per square centimeter to the final price. Expert opinions, as reflected in the SCA, suggest that a painting’s value appreciates by $18,000 for each additional year of age highlighting the reputational factors on the market. Furthermore, variations in auctioneer can lead to price adjustments between $30,000 and $90,000, depending on geographical locations (Table 2).

The grid-adjustment table’s estimates align well with practical considerations. We validated these adjustments using an ordinary least squares (OLS) statistical approach, analyzing data from 197 abstract painting sales during the same period. The model included dummy variables for four artists with similar styles (the same market), yielding comparable results across attributes. The estimated SAR reward for Jackson Pollock is $1,150,000 when compared to other artists. The SAR estimation represents most of the effects from the popularity of the artist on the market, which also transpires through other adjustment factors such as the increase in paintings’ value due to their aging or size. In these attributes, Pollock’s popularity effects continue, showing the interaction effects among two or more attributes (the popularity and size effects at the same time). This means the more realistic SDR contribution is higher than the indicated adjustment for artistic rent. While adjusted prices of four comparables are closer, some differences remain. The final market value estimation for the subject painting is $1,366,428, based on adjustment weights, with less weight given to comparables requiring larger adjustments.

The provided example illustrates the methodology for determining the probable market value of a subject painting by dissecting its individual price components. This approach is akin to how our memory forms connections with similar past experiences. In the art market, the prices of comparable artworks serve as benchmarks, indicating the most likely outcome if the subject piece were listed and negotiated between buyers and sellers. When comparable sales closely match the subject’s characteristics, no adjustments are needed. However, if differences are present, appropriate upward or downward adjustments are made. These adjustments help define potential outcomes, reflecting past market behaviors and negotiated prices.

The particularity of this method, in comparison to two others which subsequently follow, rests thus on the observed behavior of buyers and sellers on the market. Their consistent and rational evaluations on each parameter is important as these ones are considered in estimating SAR as well as other parameters affecting prices levels. Assuming these behaviors are sufficiently rational, without forgetting the comparative training effects of observed prices for abstract paintings in the market, the SCA allows to derive quite objectively the artistic rent by comparing different artists of similar style and market, everything else being under control either in that classic grid-adjustment method or OLS regression with high number of sales. Obviously, more sales are included in the model, better are the adjustment estimates for SAR component. The SCA is oriented towards the manifested price levels of abstract painting and these per attribute such as SAR. The estimate on SAR we plugged in the classic grid adjudgment method are derived from 197 sales which not only provides a robust estimate, but it also consolidates other parameters taken into account simultaneously.

The particularity of this method, in comparison to two others which subsequently follow, rests on the observed behavior of buyers and sellers in the market. Their consistent and rational evaluations of each parameter are important as these are considered in estimating SAR as well as other parameters affecting price levels. Assuming these behaviors are sufficiently rational, without forgetting the comparative training effects of observed prices for abstract paintings in the market, the SCA allows one to derive quite objectively the artistic rent by comparing different artists of similar style and market, everything else being under control either in that classic grid-adjustment method or OLS regression with a high number of sales. Obviously, the more sales are included in the model, the better the adjustment estimates for SAR components. The SCA is oriented towards the manifested price levels of abstract painting and these per attribute such as SAR. The estimate on SAR we included in the classic grid adjustment method is derived from 197 sales which not only provide a robust estimate, but also consolidate other parameters taken into account simultaneously.

4.2 ICA opinion

Compared to traditional assets, paintings can generate stable income streams for artists and investors (Anderson, 1974). Profits primarily derive from sales and periodic rents paid by individuals, museums, and galleries (Zanni, 2020). Dealers play a crucial role in brokering art sales, promoting artwork, attracting buyers, and facilitating transactions. Even in the absence of rent payments from museums and galleries, income is realized through value appreciation driven by the artist’s rising popularity and market demand (Caves, 2000).

Evaluating abstract art using the income method involves actualizing net benefits over time, encompassing direct sales, rents, and value appreciation, balanced against expenses such as administration, maintenance, storage, promotion, insurance, security, and logistics (Frey and Pommerehne, 1989). Additionally, sales commissions, typically ranging from 5 to 25% of the artwork’s value, must be considered (Kirk, 2019). Stable income from abstract art hinges on effective operational cost management and strategic sales timing to capitalize on market trends (Baumol, 1986). The aesthetic appeal and reputation of the artist significantly influence the artwork’s valuation and investment potential (Throsby, 1994). By understanding these factors and applying rigorous income-based methods, investors can better assess the long-term financial benefits of abstract art (Frey and Eichenberger, 1995).

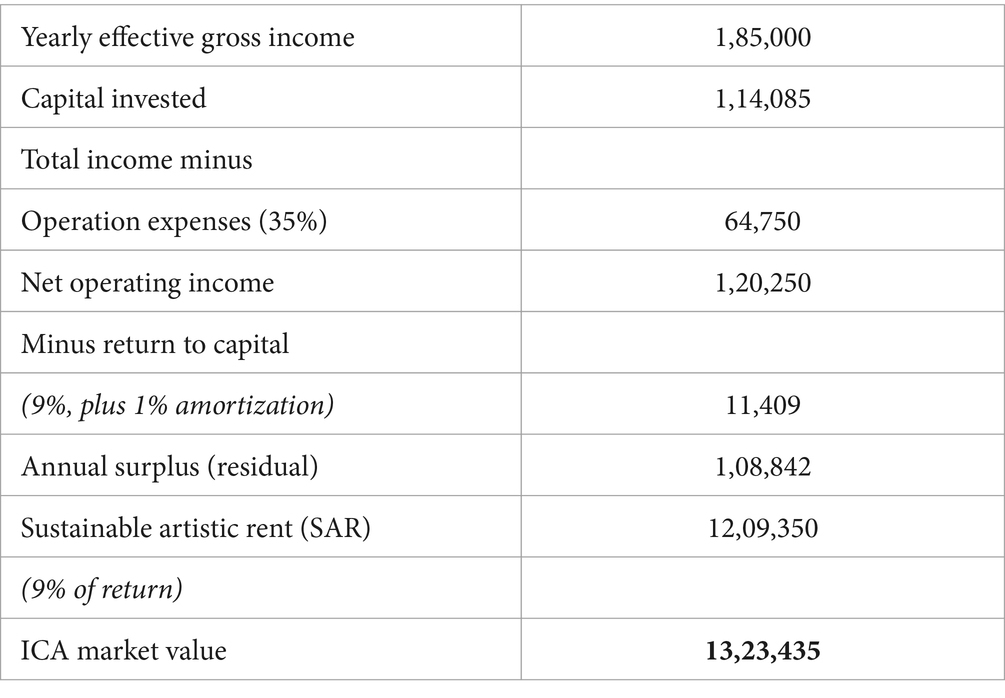

In considering the income-determining parameters of the same abstract painting, we now apply the Income Capitalization Approach (ICA) to derive an estimate as a second comparable opinion on its market value. The ICA analyzes the expected income generated by this painting, accounting for all relevant expenses, and applies an appropriate capitalization rate. For accuracy, we use parameters consistent with the current market for Pollock’s abstract paintings. Accordingly, the estimated yearly effective gross income from exhibition fees is set at $185,000. Operating expenses, including labor, organization, management, maintenance, and insurance, account for 35% of this income, totaling $64,750, leaving a net operating income (NOI) of $120,250. Next, we deduct the return to capital, calculated at 10% (comprising 9% interest and 1% amortization), amounting to $11,409, which yields an annual surplus or residual of $108,842. This residual represents the Intellectual or Artistic Rent attributed to Pollock, the creator of the artwork. The sum of the Sustainable Art Rent (SAR) and the Capital Invested indicates $1,209,350 as the market value of the subject artwork from Pollock according to this ICA (Table 3).

This example demonstrates the utility of the ICA in estimating the market value of artwork and highlights the sustainable allocation of rent to the artist. The residual income, or Artistic Rent, naturally belongs to the artist, ensuring fair compensation for their creative efforts, thus reflecting the sustainable nature of rent allocation. The ICA provides a quantifiable method to assess the value generated by the painting, comprehensively accounting for all relevant income and expenses. This example bridges the understanding of rent from tangible assets like land to intangible assets in the digital economy, illustrating how value transitions from physical to digital platforms. Notably, the canvas serves as an analogy for the digital platform, demonstrating that the true value lies in the content and knowledge created. Using abstract art and estimating its Sustainable Artistic Rent (SAR) portion as a case study helps elucidate the concept of Sustainable Digital Rent (SDR) and offers a comparative measure.

Art and its derived rent play a crucial role in understanding the transition mechanisms from traditional product-based economies to knowledge-based economies. In this context, rent and its bases become ephemeral with the knowledge embedded in these properties. The value of abstract art is derived not from the physical canvas but from the information and knowledge encoded by the artist. Abstract art bridges this transition by demonstrating that its worth lies in creative knowledge and expression rather than material components. Observers often pay exorbitant sums, sometimes tens of millions of dollars, for a piece of art made from simple materials. This analogy extends more receptively to digital platforms, where the ultimate reward is information or knowledge. Abstract art’s message, encoded in the canvas (akin to a surface, land, or platform), closely aligns with the digital domain in which rent becomes digital. Similar to a digital platform, observers of art engage in a process of evaluation, striving to unveil new insights and understandings using their cognitive evaluation systems.

As demonstrated in Özdilek (2024), the principle of sustainability in Sustainable Land Rent (SLR) argues that rent, as a surplus of production, naturally benefits its creators—nature and the community. In the realm of art, the creator is clearly the artist. However, “Artmasters” or intermediaries like art galleries frequently appropriate substantial portions of the rent, leaving artists with a fraction of the total value. While these intermediaries are essential for promoting and preserving artwork, they are not the primary source of the intrinsic value. This scenario parallels historical misallocations where landowners capture the rent meant for nature and the community, leading to socio-economic disparities and long-term environmental degradation. The digital realm and knowledge economy transform land rent into digital rent, requiring a revised framework to understand these transitions. The demonstration with ICA showed that abstract art serves as a critical intermediary, helping us grasp the nuanced shifts in the allocation and basis of rent, particularly when the agent or creator is obscured.

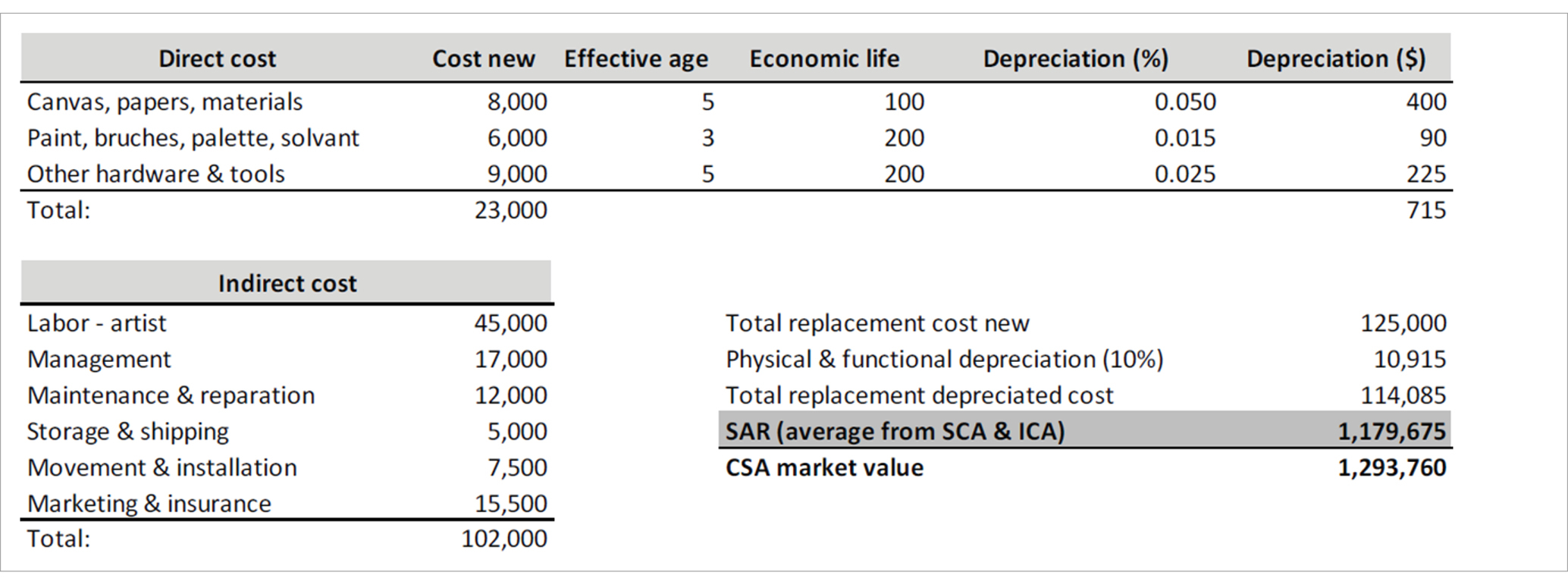

4.3 CSA opinion

The Cost Summation Approach (CSA) is frequently used in evaluating unique real estate properties, such as churches or stadiums, where traditional methods like the Sales Comparison Approach (SCA) and the Income Capitalization Approach (ICA) fall short due to insufficient market signals. CSA focuses on the reproduction costs of physical assets, factoring in depreciation over time. When applied to paintings, CSA considers relevant cost factors including the artwork’s size, labor, materials (such as canvas, paint, and brushes), and maintenance costs (Beech, 2015). However, CSA often falls short in estimating the total value of renowned, unique paintings from the primary market. To address these limitations, we developed an alternative approach that integrates the Sustainable Artistic Rent (SAR) component, providing a more comprehensive evaluation process that considers both physical and intangible value attributes. This integrated methodology surpasses the conceptual and practical shortcomings of CSA by incorporating broader aspects of value associated with intellectual content. This intellectual content, referred to as “cognitive knowledge capital,” represents the creators’ intellectual contributions. In this framework, cognitive knowledge capital becomes predominant, yielding a reward termed “Digital Rent.” The following example demonstrates how our integrated approach provides a more accurate and holistic assessment of value using CSA.

The inclusion of the SAR component in the CSA estimation provides a valuable third perspective, deepening our understanding of the shift from a tangible to an intangible economic basis. As previously discussed, the sustainability of this rent is rooted in the non-renewable nature of human expectation and, most importantly, its capture and exploitation by agents other than those who generated that rent. For example, SAR represents the cognitive satiation or desensitization from exhausted expectation in art, manifesting as disclosed information or acquired knowledge that conditions the cognitive evaluation system. This disclosure is encapsulated within the SAR amount, enabling the owner to sell or rent the painting to others. However, as more market participants engage with a specific painting or similar artworks, cognitive satiation pressure develops, leading to general market obsolescence. This obsolescence can be considered a negative factor, akin to other cost elements within the CSA. In this context, the traditional reluctance to incorporate positive value into a cost-based framework is mitigated.

To construct the practical demonstration in Table 4 both direct and indirect cost information for paintings was meticulously gathered from the market in the weeks leading up to the evaluation on December 1st, 2023. This data, supplemented by cost directories and relevant literature, provided average cost estimates, adjustment rates, depreciation figures, and the economic life cycle for comparable artworks. A 10% physical and functional depreciation rate was applied to the indirect costs, revealing a total initial replacement cost of $125,000. After accounting for $10,915 in depreciation, the depreciated replacement cost amounted to $114,085. By incorporating $1,179,675 of SAR, calculated as an average of the SCA and ICA estimations, we derived the CSA market value of $1,293,760. SAR represents the exhausted expectation for the comparable paintings in the market, manifested through price and income metrics of previous SCA and ICA evaluations. As previously discussed, PCI content is conceptualized as the dynamic transformation of expectation into information, capturing the impact on the value state and anticipating reduced future appreciation due to market obsolescence or diminished market motivation. This effect, long present in art valuation, becomes more explicit when considering cost depreciation.

The cost method, when comparing painting space to land for real estate, demonstrates that increased knowledge significantly reduces the value basis for the cost dimension, a trend similarly observed in price and income methods. Technological advancements and improved construction design generally lower the value state of materials and labor, to which the cost indicator refers. Consequently, value, or “rent,” increasingly accrues to design and innovation—the unique, non-replicable knowledge (the “blue-print”) that becomes the primary source of value, particularly with advancements in processing and automation. This shift underscores a broader transition from an industrial-based to a knowledge-based economy, where information itself becomes a valuable commodity. Value expectation and realization are progressively linked to intellectual rather than physical capital. As the unknown knowledge within physical mediums decreases, a larger portion of rent shifts to digital rent, transforming its classical concept as a reward in physical objects. The case of abstract painting exemplifies this shift, as evidenced by our calculations. Compared to land rent for physical properties, such as dwellings, it becomes clearer how this transformation operates concretely in art valuation, making it more tangible rather than purely theoretical. This transition is not about the immaterialization of physical matter but the digitization of its properties and utility basis, enabling the extraction of use value faster and easier. This is especially pertinent as it occurs in a new space—digital platforms—which are themselves digitized. For example, digital activities mapped in computers with digital houses, where telework and other digitized activities will increasingly dominate.

Triadic individual evaluations completed on December 1st, 2023, represented by “M” in Figure 1B, highlight a specific point in time. However, these evaluations lack the comparative dynamics needed to align or diverge from the theoretical evolution of information shown in Figure 1A. They offer a singular snapshot within a broader trend, emphasizing the necessity for multiple evaluations over a long period for more informed decision-making. Ideally, this would include triadic PCI data spanning several years. A recent study on the housing market demonstrated this approach by analyzing triadic evaluations over 148 years (1871–2018) in the USA (Özdilek, 2024). The study revealed that PCI estimates converge and progressively stabilize at a constant value state for the same subject property. In this context, increased PCI observables do not signify a rise in value, which remains constant. Instead, this increase and stabilization indicate reduced expectations, converted into PCI information, particularly in housing. The cooling of PCI towards a constant value state is often accompanied by isolated crises, especially notable in the behaviors of price and income components.

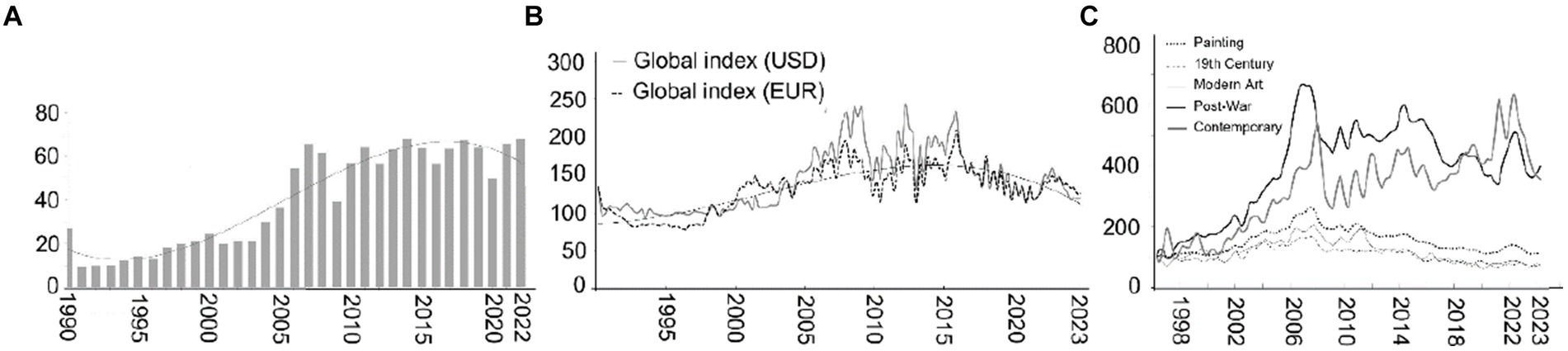

Unlike the real estate market, where long-term trend analysis of PCI observables is feasible, the art market lacks similar extensive data. To demonstrate the utility of integrating a pointwise estimate within broader trends, we present graphics on global market sales, art price indexes, and art price indexes by styles from 1990 to 2023. These aggregates of average observed prices, rather than estimates, underscore the need for comparative cost and income data. Global market sales (Graph 1a) and Art price indexes (Graphs 1b,c) exhibit behaviors akin to a Gaussian cumulative distribution function, where the theoretical decline in expectations slows in rate as PCI growth stabilizes, influenced by intensified competition and diminishing rewards in the value state (see Figure 1A). These graphics generally indicate that price behaviors stabilize over time with market interest shifting towards novel styles of artwork.

GRAPH 1. Art sales and price Indexes. (a) Global market sales (in billion). (b) Art price indexes. (c) Art price indexes (by styles).

The average price estimate of $1,327,874 for the Pollock abstract art market in 2023, reported over these 33 years of trends in Post-War and Contemporary styles, serves as a benchmark for mitigating risks in transactions, such as offering (or selling for) $1.5 million for the same piece (based on the average estimate provided here). These studies, which utilize similar data sources, also reflect trends of stabilizing prices, aligning with our observations. Theoretical concepts and these observations can be supported by analyses from literature, such as Baumol (1986) and Filipiak and Filipowska (2016), which indicate rising interest in art as an alternative investment since the 1960s. Artprice.com statistics show that art and antiques sales reached $67.8 billion in 2022, with significant growth in global Post-War and Contemporary art, accounting for 65% of the market (Artprice, 2023). McAndrew (2023) notes that the market increasingly favors unique pieces, influenced by region, artist, and type, with Contemporary Art driving market growth.

5 Discussion

In this discussion, we explore how the evolving dynamics of the rent and the value state, particularly through the lens of abstract art value valuation, reveal the fragile nature of human cognitive expectations. We introduce Sustainable Digital Rent (SDR) and highlight its foundation in classical rent theories, linking it to the modern shift towards a knowledge economy. By examining SDR’s implications for digital platforms, we advocate for institutional mechanisms to equitably manage cognitive contributions, focusing on sustainability and human well-being.

The theoretical foundation for SDR stems from classical value, valuation, and rent theories (for further explanation, see Mooya, 2016; Hesselmann and Schendzielorz, 2019; Stratford, 2022), cognitive value processes, and sustainable economics. Classical economists like Ricardo and Marx explored rent as a surplus derived from natural resources. In the digital age, information and knowledge become central to economic activity (Nee et al., 2023). Our study extends these theories by incorporating cognitive evaluation into the value state (Sznycer, 2022), placing human expectations at the center of digital rent creation. This aligns with Fuchs' (2022) work on digital labor and value on platforms. By integrating PCI methods, we demonstrate that digital rent arises not only from production but also from the exchange of cognitive capital, highlighting the need for sustainable digital practices (Stratford, 2022). Evolving discussions around digital rent have recently focused on user data and cognitive engagement. Zuboff's (2019) ‘surveillance capitalism’ shows how digital platforms extract value from user data, similar to traditional land rent. Our SDR framework extends this, exploring how cognitive expectations transform into digital rent, affecting user well-being.

In our view, rent fundamentally arises from the exploitation of its origins as the net product of its basis—land—while being constrained by ignorance, which we define as the inability to fully extract or comprehend the full information inherent in exploitable resources. Evolving from this basis of ignorance to one now centered on information, rent has always served as an empirical gauge or measure of economic progress, a role that has become even clearer in today’s digital economy. Initially, rent was directly linked to products from natural resources, like corn from land. This evolves into a digital basis where physical land and yield transform into ‘digital’ versions—knowledge or intelligence embedded in information. For example, chemical treatments to enhance land productivity and machinery for harvesting represent layers of knowledge. If this blueprint of knowledge was available at the start of agricultural development, centuries of learning could have been bypassed. This evolution addresses Marx’s concern (Bryan, 1990) of natural rent turning artificial. Today, land, corn, and rent have become digital knowledge, highlighting that rent’s original purpose reflected limitations that knowledge has now overcome. In this context, traditional agents of production—labor, capital, and land—and their respective rewards (wages, interest, and rent) merge into knowledge itself.

This transition impacts economic systems as value state becomes information-centric. The traditional economy, once focused on physical goods, now emphasizes knowledge production. This shift fundamentally changes production, interaction, and exchange, moving from physical land to digital platforms. It underscores the increasing importance of knowledge and cognitive contributions in determining value in the digital economy, necessitating a re-evaluation of how production and value are understood and rewarded (Nicolescu and Nicolescu, 2021).

While digital economy is celebrated for its positive impacts on nature and the environment (Yan et al., 2022; Kuang et al., 2024), our work cautions against overlooking the fragility of human cognitive states, emphasizing the need to center human expectations in sustainability. We propose that managing human expectations against the growth of information becomes a new basis for sustainability, as mismanagement can lead to decreased motivation and health. Using abstract art, we demonstrate methods for estimating the balance between digital rent’s information and expectations, advocating for policies that ensure an equitable distribution. This approach underscores the importance of cognitive well-being alongside environmental stewardship.