- Inner Mongolia Technical College of Construction, Hohhot, China

The issue of sustainable development in financial institutions has become a primary concern for both the industry and investors. This study proposes a comprehensive decision-making method by integrating Cumulative Prospect Theory (CPT) with the traditional TOPSIS model for the sustainability assessment of commercial banks. Building on previous research, this study establishes a multi-criteria framework under the Global Reporting Initiative (GRI) that includes five major dimensions: economic, social, environmental, governance, and financial, along with 15 indicators. The study employs this model to conduct a comprehensive evaluation of five Chinese commercial banks. The results indicate that the Bank of China (BOC) ranked first in sustainability performance, particularly excelling in the environmental dimension compared to the second-ranked Industrial and Commercial Bank of China (ICBC), highlighting the importance of environmental indicators in the sustainability assessment of commercial banks. Empirical analysis shows that this model considers cognitive biases at the psychological level while accounting for uncertainties and risk preferences, offering significant advantages over the entropy-weighted TOPSIS model. The contribution of this paper lies in the pioneering introduction of Cumulative Prospect Theory into the study of sustainable development in Chinese commercial banks, combined with 15 related indicators under the GRI framework, providing new theoretical and practical insights for banking performance and sustainability research. This model effectively narrows the gap between the sustainability assessment practices of large Chinese commercial banks and international standards and holds promise as a useful tool for analyzing and improving sustainable development strategies in the banking sector.

1 Introduction

Currently, the sustainable development of many enterprises, especially banks, is receiving increasing attention from managers and various investors (Buallay, 2020; Méndez-Suárez et al., 2020). The Global Reporting Initiative (GRI) framework provides guidance for corporate sustainability reporting, covering multiple aspects such as economic, environmental, and social governance, which have been widely adopted and practiced, becoming an important reference for investors (Orazalin and Mahmood, 2020; Stocker et al., 2020). Notably, John Elkington first proposed the Triple Bottom Line (TBL) performance reporting, defining economic, social, and environmental performance (ESG) as core indicators of corporate sustainability (Güler and Yildirim, 2020). However, sustainability cannot be simply reduced to these three basic dimensions. Although the interaction between governance and environmental and social dimensions has not yet received widespread attention, its importance is increasingly evident (Mooneeapen et al., 2022). Aras and Crowther emphasized that, in addition to environmental, social, and governance aspects, finance should also be considered a key dimension of sustainability (Aras and Crowther, 2008). Financial institutions, particularly banks, play a crucial role in economic growth and stability, hence their focus on sustainable development is particularly important. In this context, Aras et al. (2018a), in their study on the sustainability of Turkish banks, proposed a five-dimensional corporate sustainability model, covering economic, environmental, social, governance, and financial disclosure, and demonstrated its effectiveness. By the end of 2022, six Chinese state-owned commercial banks and 12 joint-stock commercial banks had published multiple sustainable development and social responsibility reports according to the GRI. To further understand these reports, Hussain et al. (2018) conducted an in-depth study on the relationship between corporate governance and triple bottom line performance, using content analysis to examine corporate sustainability reports in depth, concluding that good corporate governance can positively impact sustainability performance. Roca and Searcy (2012) used content analysis to reveal the use of common sustainability indicators in different company reports, providing valuable insights into how companies report their sustainability performance. Additionally, the Multi-Criteria Decision Making (MCDM) model, as an effective decision-support tool, is widely applied in GRI assessments. Through MCDM, different sustainability standards and schemes can be compared and analyzed based on quantified evaluation indicators, enabling a comprehensive assessment of their effects. Among the various methods of MCDM analysis, the TOPSIS method is one of the most widely used, particularly in evaluating and ranking alternative options and decisions in different industries, attracting widespread attention from researchers and practitioners (Behzadian et al., 2012). The main advantages of this method lie in its simplicity, dimensionality reduction, and flexibility in data format, making it a powerful decision-making tool (Tzeng and Huang, 2011). Currently, the application areas of TOPSIS are very broad. For example, in performance evaluation and supplier selection, Chaharsooghi and Ashrafi (2014) proposed the neofuzzy TOPSIS to find optimal solutions for supplier selection problems. Memari et al. (2019) combined intuitionistic fuzzy sets with TOPSIS, developing the Intuitionistic Fuzzy TOPSIS method (IF-TOPSIS) for dealing with fuzzy and uncertain problems in supplier selection decisions. Dos Santos et al. (2019) used Entropy-TOPSIS-F to evaluate the performance of green suppliers and validated its effectiveness. Elsayed et al. (2017) applied the entropy-weighted TOPSIS method to assess the performance of major banks in the kingdom, completing performance ranking and alternative selection. These methods enhance the reliability and efficiency of TOPSIS in decision-ranking problems under different situations by improving the calculation of weights and handling of uncertainties. This improvement not only increases the flexibility of the model but also enhances its potential application in complex and uncertain environments.

However, the traditional TOPSIS method fails to fully consider the inherent psychological cognition involved when decision-makers make decisions based on evaluation scores (Aydogmuş et al., 2022). This suggests that decision outcomes may be influenced by subjective factors, such as perception, memory, and cognition (Turner et al., 1994). Investors, when considering corporate investments, typically assess the risks and growth potential of enterprises based on methods of risk management and financial evaluation (Altman, 1968). Throughout the decision-making process, subjectivity plays a central role, and each decision could be influenced by the decision-makers' viewpoints on specific industries and investment inclinations. Irrational factors, such as subjective experiences, might distort the psychological cognition of objective outcomes (Shefrin and Statman, 1985; Kahneman and Tversky, 2013). This distortion can lead to cognitive biases such as loss aversion and probability distortion, resulting from people's asymmetric reactions to gains and losses (Tversky and Kahneman, 1992), which in turn could lead to investment decision errors and capital losses. Therefore, relying solely on the traditional TOPSIS method for evaluating corporate GRI might not adequately reflect the real situation of investors, especially when considering irrational factors in decision-making. To more accurately and effectively assess the GRI evaluation, and capture the impact of subjective judgments on decision outcomes, we can incorporate Prospect Theory into the evaluation system. By combining the TOPSIS method with Prospect Theory, we assess the GRI of Chinese commercial banks and integrate psychological cognition factors into the evaluation process. The combination of Prospect Theory and TOPSIS has been applied in many studies (Li and Chen, 2014; Cun-bin et al., 2015; Zhu et al., 2023), but in specific applications, the Prospect Theory-TOPSIS model has apparent disadvantages in probability weighting and predictive capability compared to Cumulative Prospect Theory (Tversky and Kahneman, 1992). Considering that traditional models might not adequately capture the impact of irrational factors that investors may experience in the decision-making process, adopting a method that integrates Cumulative Prospect Theory into the traditional TOPSIS model seems more appropriate. The application of this combined method may provide an effective way to assess the impact of irrational factors in an uncertain environment, thereby potentially producing more accurate GRI assessment results.

The novelty and contribution of this study lie in the following aspects: building upon previous research, this study has developed a multi-criteria framework that incorporates 15 indicators across five dimensions: economic, social, environmental, governance, and financial. This framework aims to bridge the gap between the sustainability assessment practices of Chinese commercial banks and international norms. Notably, this study introduces the Cumulative Prospect Theory, offering a fresh theoretical and applied perspective to the current research on banking sustainability.

2 Literature review

2.1 Sustainable development indicators and investment under the GRI framework

The role of the Global Reporting Initiative (GRI) sustainability reporting guidelines in investment can be traced back to early studies. Willis examined the relationship between GRI and investment, and the results showed that GRI guidelines significantly improved the quality of information regarding companies' environmental, social, and economic impacts and performance, bringing their reporting level on par with financial reporting. This provided the Socially Responsible Investment (SRI) community and other stakeholders with more reliable information, enhancing the transparency and reliability of investment decisions (Willis, 2003).

Building on this foundation, scholars, after recognizing the effective role of GRI in investment strategies, have directed their research toward specific GRI indicators, focusing on their role in corporate sustainability. For instance, Weber et al. found that the adoption of GRI indicators was positively correlated with a company's financial performance. Specifically, transparent sustainability reporting helps improve a company's financial health and market performance, particularly with improvements in Environmental, Social, and Governance (ESG) aspects directly reflecting on the company's financial results (Weber et al., 2008). Hussain et al. (2018) from the perspective of the Triple Bottom Line, studied the relationship between corporate governance in GRI and corporate sustainable performance, emphasizing the importance of GRI governance indicators.

Among the literature on the relationship between GRI sustainability and corporate performance and governance, financial institutions like banks, as key components of modern enterprises, have also been widely focused on their role in sustainability. For example, Ielasi used the BESGI score to measure the sustainable performance of banks and found that the BESGI scoring system comprehensively evaluates banks' performance in ESG aspects, emphasizing the synergy between these dimensions. Environmental management practices and social responsibility initiatives, for example, can improve a bank's overall sustainability score (Ielasi et al., 2023).

Avrampou from the perspective of leading European banks, explored measures to promote sustainable development goals, including improving environmental management, strengthening social responsibility, and enhancing corporate governance. These measures significantly improved banks' sustainability performance and provided valuable references for other financial institutions (Avrampou et al., 2019). Furthermore, Khan et al. (2011) studied the sustainable reports of major commercial banks in Bangladesh based on GRI, highlighting the crucial role of GRI's environmental and social dimension indicators in the sustainable development of banks.

The above represents the progress in international academic research. In China, the impact of GRI has also been confirmed. Yang et al. empirically studied the effectiveness of GRI sustainability reports on Chinese listed companies. The results showed that GRI reports have a significant positive impact on the financial performance of Chinese listed companies, increasing their market value and transparency, enhancing investor confidence, and improving corporate image (Yang et al., 2021). Additionally, Dong et al.'s (2020, 2023) studies further revealed the sustainability of the Chinese financial sector and the quality and importance of “green finance” disclosure, indicating that “green finance” disclosure helps improve corporate image and market competitiveness, promoting the sustainable development of the financial sector.

Overall, current literature indicates that GRI has had a significant impact on corporate investment, including banks. International scholars have focused on the role of GRI indicator dimensions, such as financial, environmental, and social governance, on investment. Some scholars have also set up GRI indicator frameworks based on their research objects. However, regarding current research in China, there is still a lack of an effective GRI indicator framework to effectively measure corporate sustainability and guide investment. This is one of the issues this study aims to address.

2.2 TOPSIS method

In today's economic environment, sustainability assessment has become a core focus for enterprises. However, providing reliable and objective sustainability assessments for businesses has always been a challenging task. Past research has attempted to quantify these assessments using various methods, among which multi-criteria decision-making techniques (MCDM) are one of the most focused upon technologies (Erol et al., 2011; Hsu et al., 2015). The main purpose of these techniques is to provide decision-makers with a comprehensive assessment tool across multiple criteria or dimensions.

Particularly, the TOPSIS method, as a multi-criteria decision-making approach, has been widely applied in sustainability studies of banking. For example, Yilmaz and Ine assessed the sustainability performance of banks using the TOPSIS method along with the balanced scorecard approach. Their study provided banks with an effective framework to quantify and assess their performance in economic, environmental, and social domains (Yilmaz and Nuri Ine, 2018). On the other hand, Aras et al. explored the value relevance of multidimensional corporate sustainability performance in banking. Their findings indicated that the multi-dimensional sustainability performance assessments using the TOPSIS method can provide valuable information for investors and stakeholders (Aras et al., 2018b). Overall, the TOPSIS method offers an objective and comprehensive framework for assessing the sustainability performance of enterprises, particularly in the banking sector. With increasing focus on corporate social responsibility and sustainability, we can anticipate the TOPSIS method playing an even more significant role in future sustainability research.

In summary, Cumulative Prospect Theory demonstrates its unique value and potential for application across multiple fields, particularly in investment and sustainable development. These studies not only enhance our understanding of decision-making behavior under uncertainty but also provide valuable tools and frameworks for practical decision-making.

2.3 Cumulative Prospect Theory

Cumulative Prospect Theory (CPT) is a well-known model in the field of decision theory, specifically used to describe how people make decisions under uncertainty. Wakker and Tversky (1993) provided an axiomatic description of this theory, highlighting its significant divergence from traditional expected utility theory in dealing with risks and uncertainties.

In the field of investment, Cumulative Prospect Theory has become an important tool for analyzing and describing investor behavior. Bernard and Ghossoub (2010) explored the application of CPT in the context of static portfolio selection models, examining how investors choose portfolios when faced with risk. More recent studies, such as those by Zhao et al. (2021) and Gong et al. (2018) have further expanded the application of this theory, introducing new methods based on intuitionistic fuzzy multi-attribute decision-making and portfolio optimization, respectively.

At the same time, Cumulative Prospect Theory has also begun to be applied in the field of sustainable development. Liu et al. (2017) provided a sustainable assessment model for the siting of photovoltaic power stations based on gray cumulative prospect theory, specifically focused on a case study in Northwest China. Meanwhile, Chai et al. (2023) combined intuitionistic fuzzy and interval-valued fuzzy multi-criteria decision-making approaches to explore sustainable supplier selection based on CPT.

Combining Cumulative Prospect Theory (CPT) with the TOPSIS method can compensate for the deficiencies of using a single method. CPT has unique advantages in handling uncertainty and risk, while the TOPSIS method is widely and effectively applied in multi-criteria decision making. By integrating these two methods, a more comprehensive and objective framework can be provided to evaluate corporate sustainability performance, particularly in complex and uncertain environments. This combination can better capture a company's performance across different dimensions, providing more comprehensive and reliable information for investors and stakeholders.

2.4 Banking sustainability performance indicator system

Under the GRI framework, although there has been a considerable amount of research on sustainability, Stauropoulou and Sardianou (2019) pointed out that there is still a lack of a single method and indicators to comprehensively measure sustainability performance. Especially for the banking sector, assessing a bank's sustainability within the GRI framework is quite time-consuming and expensive, as it requires domain expertise (Karimi et al., 2022). Due to such intensive and laborious data collection, some scholars have conducted scientific studies using the most useful information in banking sustainability. Fatih identified 17 factors related to banking sustainability across three dimensions: economic, social, and environmental (Ecer and Pamucar, 2022). They not only demonstrated the significant impact of the environmental dimension on banking sustainability but also concluded that “average return on equity,” “electricity usage,” “number of branches,” and “number of employees” are four key drivers affecting the sustainable development of banks. Sobhani et al. (2012) investigated the disclosure of sustainability in annual reports and websites of 29 Islamic and traditional banks in Bangladesh through content analysis. The results, based on the extensive sustainable development indicators derived, showed that the performance in environmental and social dimensions was more effective than in the economic aspect.

On this basis, Aras et al. (2018a) believed that banks' balanced improvement in all dimensions of sustainable development is generally more effective in enhancing their overall scores and market competitiveness than scoring extremely high in just one or a few dimensions. Focusing on the Turkish banking industry, he comprehensively and detailedly identified representative indicators of banks' sustainable development in economic, social, environmental, financial, and governance dimensions, increasing the accuracy and efficiency for subsequent researchers.

In the economic dimension of banking sustainable development, Sheila and Ruslim (2023) found that the capital adequacy ratio positively impacts bank value. This further proves that investors can obtain more information about a bank's capital adequacy through sustainability reports, leading to wiser investment decisions. Avkiran also supported this viewpoint. He explored the relationship between the DEA super-efficiency estimates of Chinese banks and financial ratios, confirming that economic indicators such as capital adequacy ratio are important reflections of banking performance and health (Avkiran, 2011). This not only helps investors more comprehensively understand the economic condition of Chinese banks but also provides a basis for a more in-depth analysis of China's banking industry sustainability reports.

Additionally, Stauropoulou and Sardianou's (2019) research proposed a comprehensive sustainability index for assessing the economic, environmental, and social dimensions of the banking industry. The study particularly involved indirect emissions and electricity consumption in the environmental dimension and branches in the social dimension, providing banks with a comprehensive sustainability assessment reference.

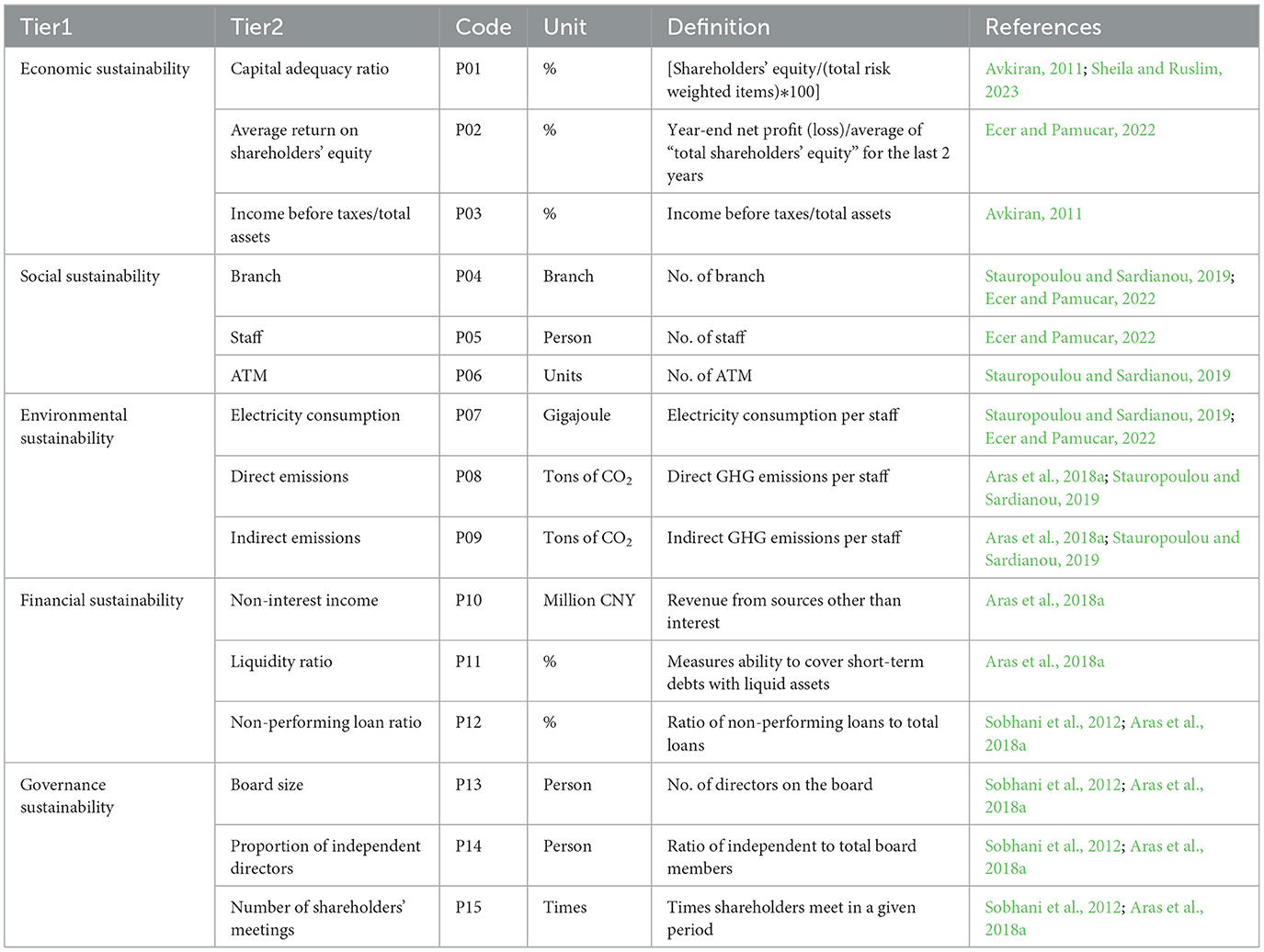

In light of this, fully respecting the findings of the aforementioned literature, we integrated 15 indicators across five dimensions: economic, social, environmental, governance, and financial. This is aimed at constructing a more effective bank sustainability performance assessment indicator system based on the GRI framework. The specific indicators are shown in Table 1.

3 Methods

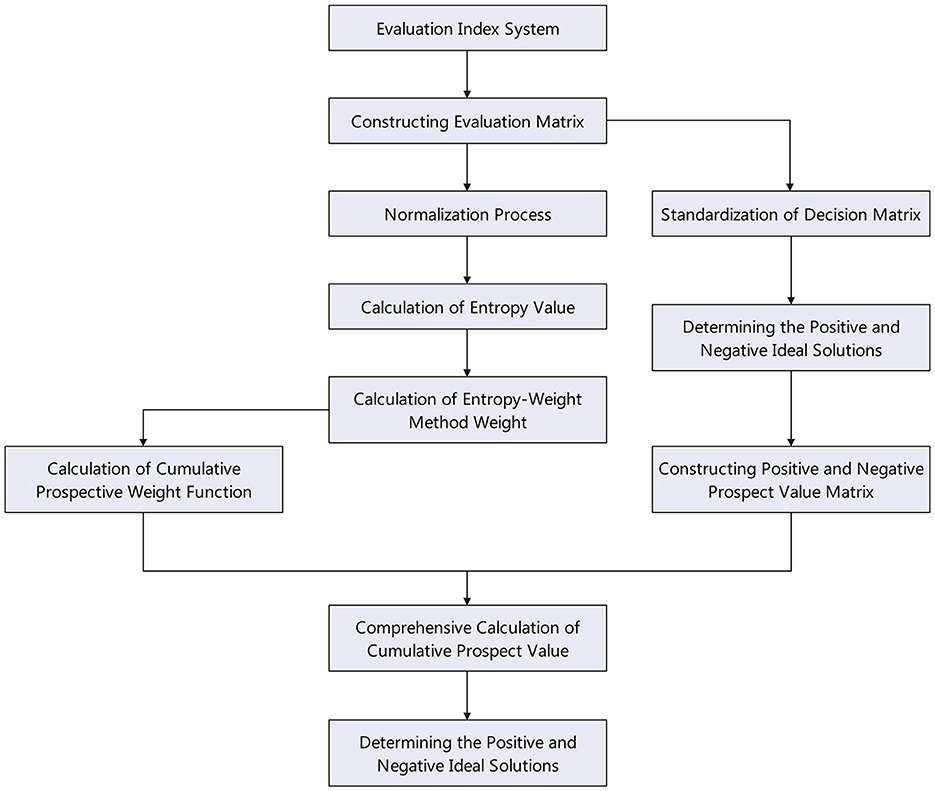

The framework of this study is primarily divided into two key stages:

First, the construction of an evaluation index system and the determination of its weights. After establishing the evaluation system, we use the entropy weight method to normalize the matrix and calculate the comprehensive weight of each index.

Second, the sorting and optimization of results. To more comprehensively consider the risk preferences of decision-makers, this study incorporates Cumulative Prospect Theory into the evaluation process. To reduce the subjective bias that decision-makers might have when choosing reference points, we select positive and negative ideal solutions as the reference points for Cumulative Prospect Theory (Su and Sun, 2023). By calculating the distance between the evaluation indices and the reference points, we construct positive and negative prospect value matrices, and further process these matrices using the TOPSIS method to obtain the final ranking results. The entire evaluation process is illustrated in Figure 1.

3.1 Entropy weight method for weight calculation

The Entropy Weight Method (EWT) utilizes the original evaluation information of the evaluation indices to determine their utility values. This method determines the weight of each index based on its degree of variation using information entropy, and it uses entropy weight to revise these weights (Shannon, 1948). The basic steps (Huang, 2008) are as follows.

Firstly, construct the evaluation matrix. Suppose there are m alternative schemes, each with n evaluation indices, then the evaluation matrix is:

In the formula: xij—the actual score value of the i index for the j design scheme.

Next, the matrix is normalized. The meanings of positive and negative index values are different (the higher the value of a positive index, the better; the opposite is true for a negative index). Therefore, heterogeneous algorithms are used for the data normalization of positive and negative indices.

The positive index:

The negative index:

Calculating the proportion of evaluation object i under indicator j.

Calculate the entropy value of the i index.

Calculate the entropy weight of the i index.

3.2 CPT-TOPSIS evaluation method and calculation steps

To reduce the subjectivity in personal preference when choosing reference points, we use positive and negative ideal solutions as decision references. The positive ideal solution represents the optimal attribute value of each alternative under the same index; when used as a reference point, it leads decision-makers to pursue risks due to potential losses. Conversely, the negative ideal solution represents the worst attribute value of each alternative under the same index; under this reference point, decision-makers exhibit a risk-averse attitude when facing gains (Su and Sun, 2023). After determining the reference points, we calculate the distance between the attribute values of each evaluation index of the alternatives and the reference points, thus constructing positive and negative prospect value matrices. Further, using the prospect value matrix and cumulative prospect weights, we calculate the comprehensive cumulative prospect value of each alternative to determine their priority ranking. The specific calculation process (Wu et al., 2019; Sha et al., 2021) is as follows:

Firstly, construct a decision-making scheme matrix. Suppose there are m design schemes, each with n evaluation indices, then the decision-making scheme matrix is:

Secondly, process the decision-making scheme matrix to be dimensionless:

Thirdly, calculate the standardized matrix for decision-making schemes:

In the formula: —The standardized value of the i index for the j decision scheme.

Fourthly, select positive and negative ideal solutions as reference points. In the standardized decision-making scheme matrix F, the set composed of the maximum values of the same index for each decision scheme is the positive ideal solution:

Fifthly, calculate positive and negative prospect value matrices. When the negative ideal solution is used as a reference point, and the attribute values of the scheme indices are greater than the corresponding reference points, indicating gains, the positive prospect value matrix can be calculated:

In the formula: fi—The standardized value of the negative ideal solution for the i index;

α— Decision-maker's sensitivity coefficient to gains.

When the positive ideal solution is used as a reference point, and the attribute values of the scheme indices are less than the corresponding reference points, indicating losses, the negative prospect value matrix can be calculated:

In the formula: —the standardized value of the positive ideal solution for the i index;

β— Decision-maker's sensitivity coefficient to losses;

θ— Risk aversion parameter.

According to the research of Tversky and Kahneman (1992), Cumulative Prospect Theory is composed of two parts: the value function and the cumulative weighting function. In the equations, α and β represent the risk attitude coefficients, while λ represents the loss aversion coefficient, the values of these coefficients are α = β = 0.88 and λ = 2.25. It is noteworthy that the values of these coefficients have been effectively used in similar studies by many scholars, such as Su and Sun (2023), making sensitivity analysis unnecessary.

Next, calculate positive and negative cumulative prospect weight functions. The formulas for the positive cumulative prospect weight function and the negative cumulative prospect weight function are:

In the formula: r+, r−—risk attitude coefficients, 0 <r+, r− <1.

Then, calculate the comprehensive cumulative prospect value and prioritize the alternative schemes. The comprehensive cumulative prospect value for the j decision scheme is:

3.3 Justification for choosing the modified TOPSIS formula

In practical applications, the traditional TOPSIS method may not fully account for the specific performance of banks across different sustainability indicators. The traditional TOPSIS method assumes that the weights and normalization of indicators are applicable to all situations, which may not comprehensively reflect the actual performance of banks in different sustainability dimensions.

Combining insights from the literature review, to more accurately and effectively evaluate the sustainable performance of banks, this study incorporates Cumulative Prospect Theory (CPT) into the traditional TOPSIS method. By using the positive and negative prospect value matrices, CPT better handles the performance of banks across different indicators, providing a more accurate and comprehensive evaluation.

4 Case study: evaluation of sustainability performance of Chinese commercial banks under the GRI framework

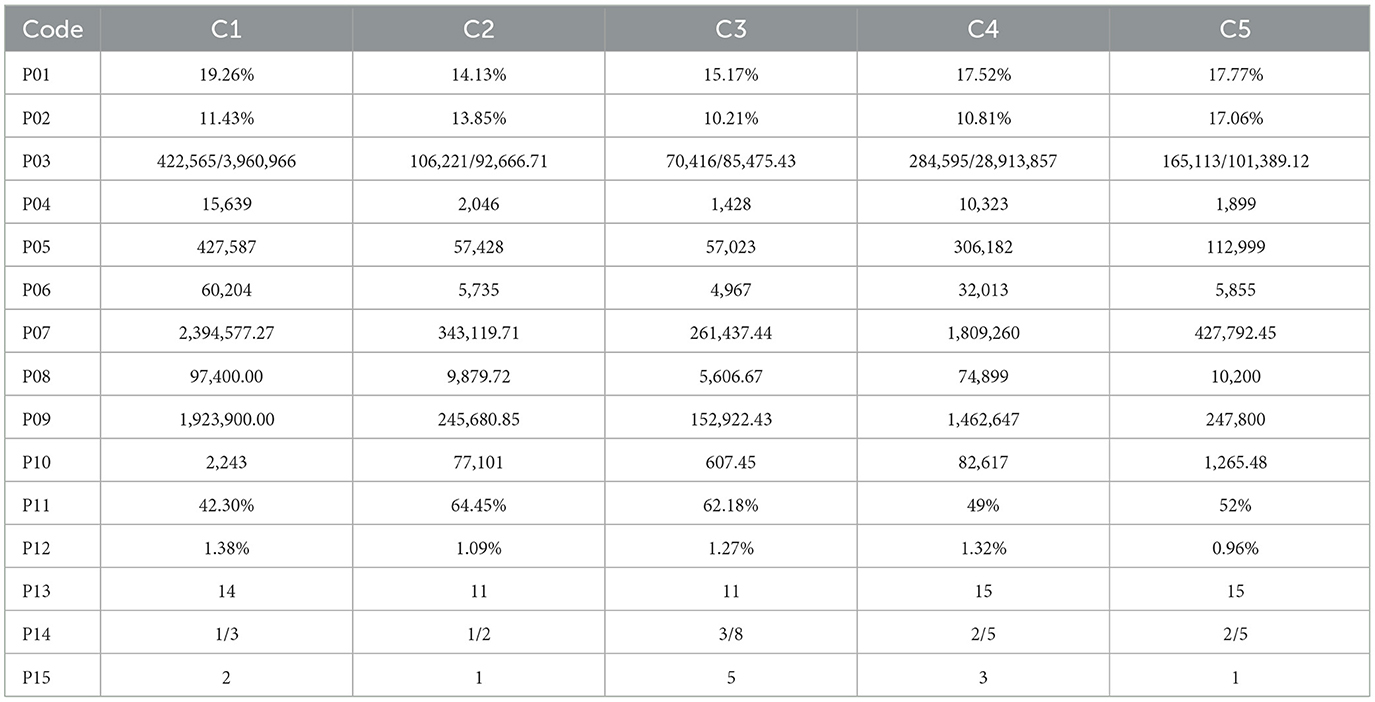

The data collection for this study primarily relied on the 2022 social responsibility reports and sustainability reports of five Chinese commercial banks: Industrial and Commercial Bank of China (ICBC), Industrial Bank Co., Ltd. (CIB), China CITIC Bank, Bank of China (BOC), and China Merchants Bank (CMB). These banks are all publicly listed companies and are included in the Fortune Global 500. Their reports are publicly available and transparent, allowing researchers to obtain the relevant data through the banks' official websites or search engines.

Specifically, the sample data sources for this study include:

“ICBC 2022 Social Responsibility Report.”

“CIB 2022 Sustainability Report.”

“China CITIC Bank 2022 Sustainability Report.”

“BOC 2022 Social Responsibility Report.”

“CMB 2022 Sustainability Report.”

These reports are prepared in accordance with the Global Sustainability Standards Board's (GSSB) “GRI Sustainability Reporting Standards,” ensuring data consistency and comparability.

During the data processing, researchers manually reviewed each relevant section of these reports to extract the required indicator data. The specific steps are as follows:

Data extraction: researchers read each report page by page to extract specific data related to sustainability and corporate social responsibility. This process requires a high degree of meticulousness and accuracy to ensure that all relevant information is collected.

Data unification: since data in different reports might use different measurement units, researchers standardized all data to ensure consistency and comparability. For example, all monetary data was converted to Chinese Yuan (RMB), or different environmental indicators were converted to the same units.

Data verification: to ensure the accuracy and reliability of the data, researchers invited relevant experts to review the extracted and processed data. Specific steps include: Randomly selecting portions of the data for verification to ensure consistency with the original reports. Checking the data unification process to ensure all data had been converted to standardized measurement units.

Data analysis: using Excel, the indicator calculations and comparisons were performed according to the “Sustainable Performance Index Framework.”

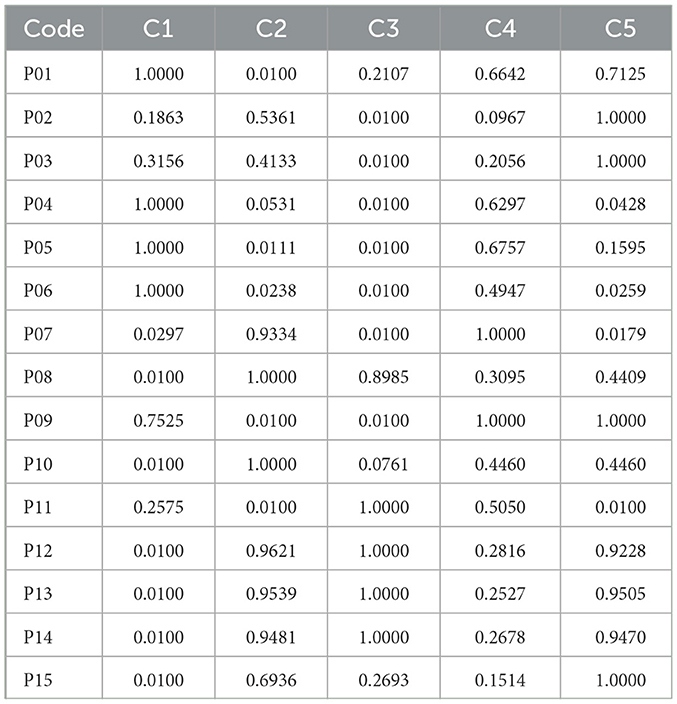

The research results are presented in Table 2. The new indicator data and their sources have undergone rigorous processing and verification, with C1–C5 corresponding to the indicator data for ICBC, CIB, China CITIC Bank, BOC, and CMB, respectively.

4.1 Computational process

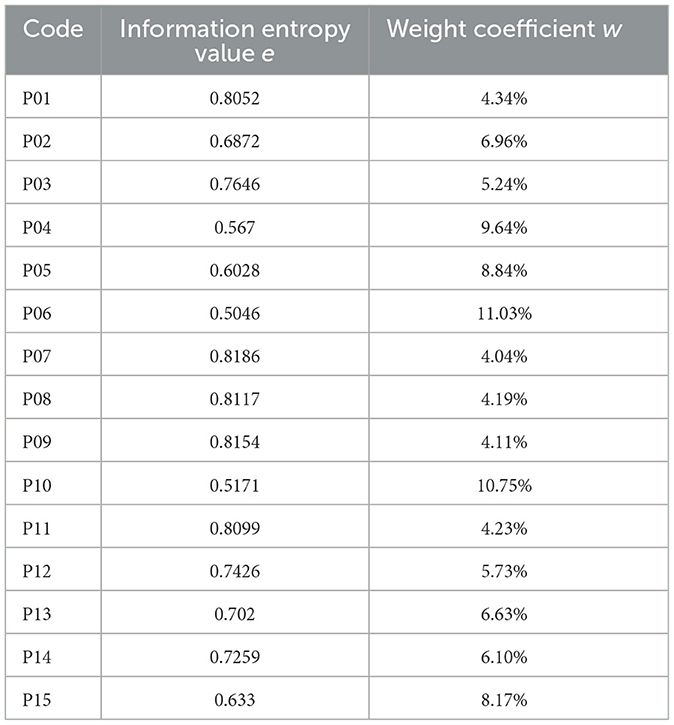

First, it is necessary to determine the entropy weight. In this study, 11 positive indicators were selected, for which the optimal solutions are their maximum values, while the worst solutions are their minimum values. Additionally, there are four negative indicators: electricity consumption, direct emissions, indirect emissions, and the ratio of non-performing loans, where the definitions of optimal and worst solutions are the opposite of those for the positive indicators. The entropy weights are calculated using Formulas 1–7, as shown in Table 3.

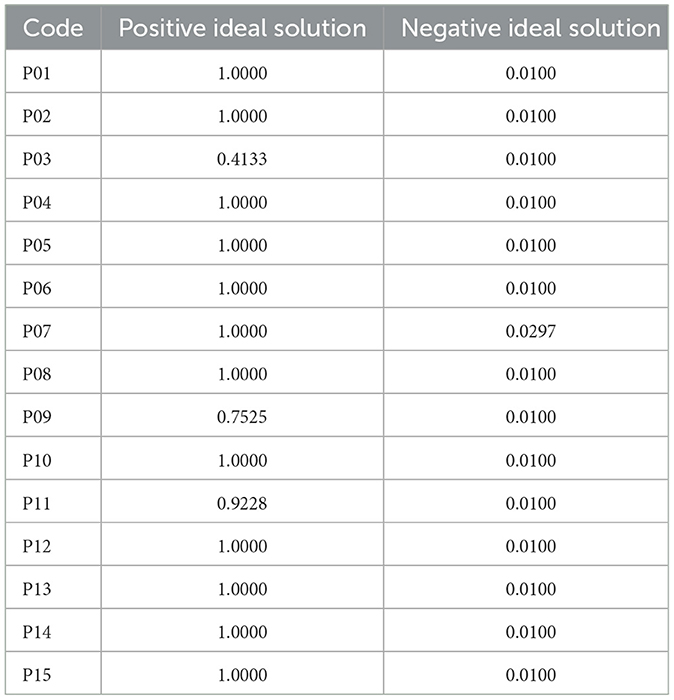

After calculating the entropy weight, the standardized decision matrix is computed using Formulas 8–10, as shown in Appendix Table A1. The positive ideal solution F+ and the negative ideal solution F− are identified as reference points, with the results presented in Table 4.

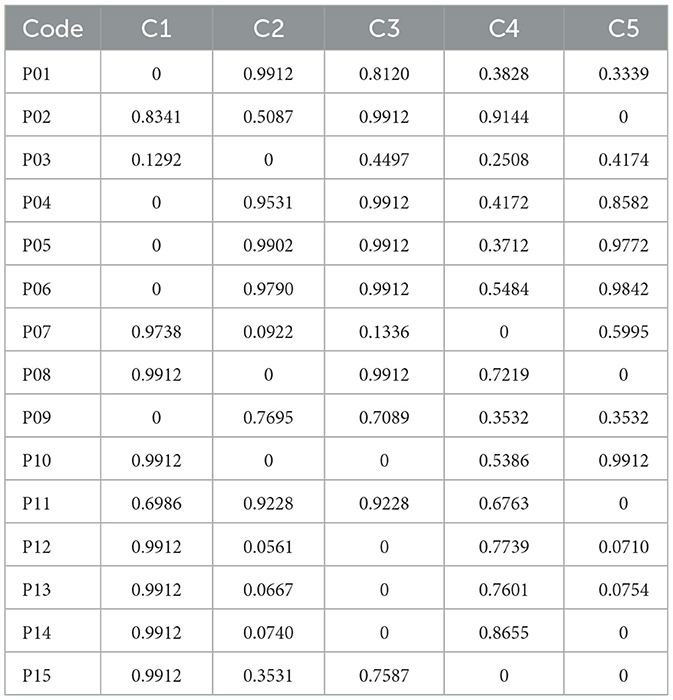

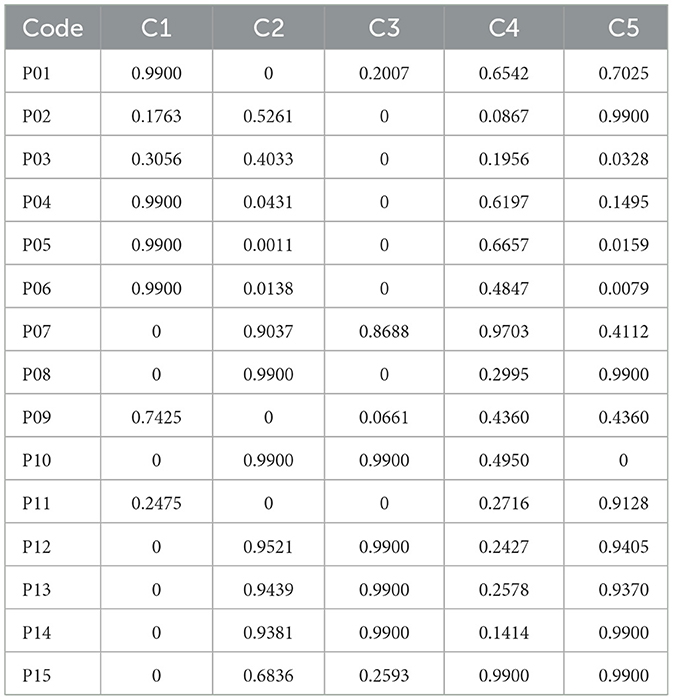

Next, the positive prospect values are calculated using Formula 11, as shown in Table 5. The negative prospect values are calculated using Formula 12, as presented in Table 6.

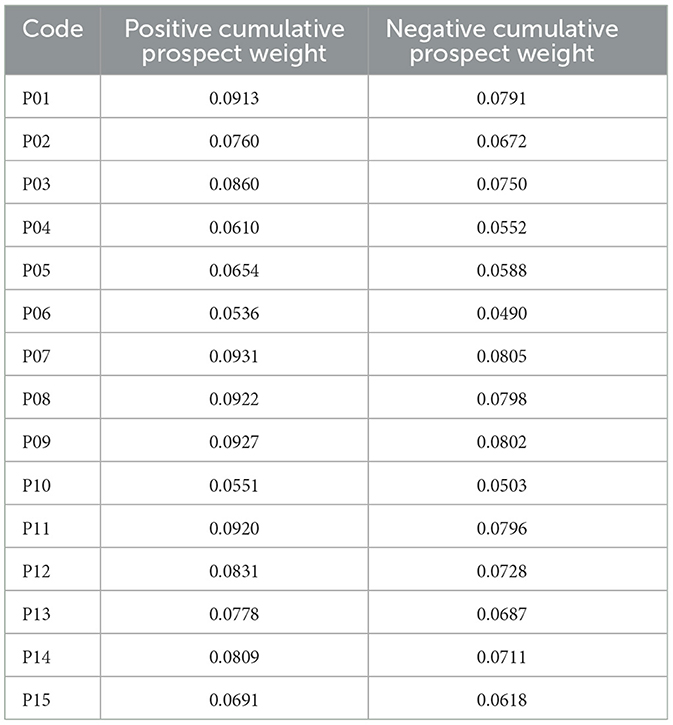

Subsequently, the positive cumulative prospect weights are calculated using Formula 13, and the negative cumulative prospect weights are determined using Formula 14. The results are shown in Table 7.

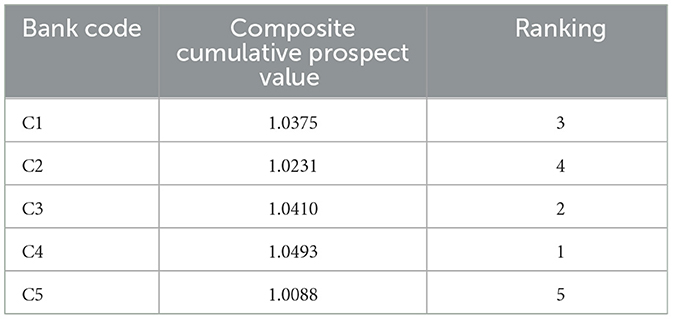

Finally, using Formula 15, the comprehensive cumulative prospect values for each alternative are calculated, and the alternatives are ranked accordingly. The results are presented in Table 8.

Based on this, we have determined the sustainability performance levels of Chinese commercial banks under the GRI framework, ranked from highest to lowest as follows: C4 > C3 > C1 > C2 > C5. These codes correspond to Bank of China, CITIC Bank, Industrial and Commercial Bank of China, Industrial Bank, and China Merchants Bank, respectively.

4.2 Comparative analysis

To validate the effectiveness of the modified TOPSIS formula, we compared the results with those obtained using the traditional TOPSIS formula. Firstly, following the approach of Elsayed et al. (2017) and others, we applied the entropy weight TOPSIS method to assess the sustainability performance levels of Chinese commercial banks. The calculation steps of the traditional TOPSIS method are as follows:

1. Construct the decision matrix.

2. Normalize the decision matrix.

3. Calculate the weighted normalized matrix.

4. Determine the positive and negative ideal solutions.

5. Calculate the distance of each alternative to the positive and negative ideal solutions.

6. Calculate the relative closeness of each alternative.

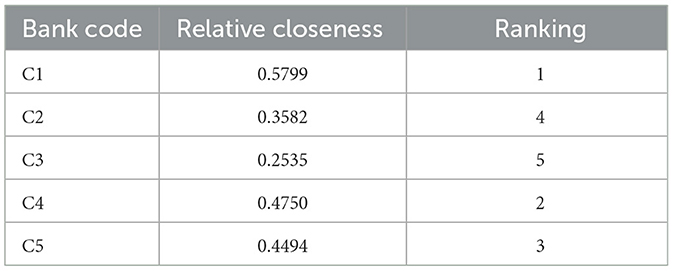

Based on this, we completed the performance ranking, with the results shown in Table 9.

The relative closeness ranks from highest to lowest are as follows: C1 > C4 > C5 > C2 > C3, corresponding to: Industrial and Commercial Bank of China, Bank of China, China Merchants Bank, Industrial Bank, and CITIC Bank, respectively. The results indicate that the rank of C2 Industrial Bank remains unchanged, C4 Bank of China moved from the first to the second rank, C1 Industrial and Commercial Bank of China advanced from third to first rank, and C3 CITIC Bank dropped from second to fifth rank. This reflects certain differences between the results of the CPT-TOPSIS method and the entropy weight TOPSIS method in assessing the sustainability performance levels of the five banks.

To evaluate the effectiveness of this model in assessing the sustainability performance levels of Chinese commercial banks under the GRI framework, a comparative analysis with previous studies is necessary. According to the research by Sheila and Ruslim (2023), there is a positive impact of the capital adequacy ratio on the sustainable development of banks. Furthermore, Aras et al. (2018a) and others used the entropy weight TOPSIS method to examine the sustainable performance of Turkish banks, indicating that environmental performance ranks second in entropy weight, just after economic performance. According to the data in Table 2, the P01 capital adequacy ratios of Bank of China and Industrial and Commercial Bank of China are very close, at ~18 and 19%, respectively, while those for Industrial Bank and CITIC Bank are also close, at ~14 and 15%, respectively.

However, the differences in environmental performance are more pronounced. According to the sustainable development reports and corporate social responsibility reports of the aforementioned banks, in terms of important environmental indicators such as electricity consumption, direct emissions, and indirect emissions, and with similar numbers of P04 branches and P05 total employees, Bank of China has an advantage over Industrial and Commercial Bank of China. Similarly, CITIC Bank has an advantage over Industrial Bank.

4.3 Result validation

To further validate our results, we collected rating data from five banks, as detailed below:

Wind ratings: this data is sourced from Wind Information Co., Ltd., a prominent financial information service provider in China. Wind's Environmental, Social, and Governance (ESG) ratings focus on evaluating companies' performance and risks in sustainable development, serving as an important reference for banks and their investors. According to the company's website, in 2022, Wind rated the Bank of China as “A,” while the other four banks were rated “BBB.”

Runling Global ratings: the “2022 ESG Rating Analysis Report of China's A-Share Companies” published by Runling Global. The report indicates that among commercial banks rated “A” in this ESG rating, there was little difference in the overall average scores. The Bank of China ranked first with an average ESG score of 5.8, while Industrial Bank, China CITIC Bank, China Merchants Bank, and Industrial and Commercial Bank of China (ICBC) tied for second with an average score of 5.7.

Sustainalytics ratings: sustainalytics is a globally leading independent ESG and corporate governance research, ratings, and analysis company. Its ratings are widely used in investment analysis, fund management, and corporate sustainability assessment. According to Sustainalytics data, ICBC's ESG risk rating is 31.0, ranking 877th out of 1,037 in the industry; the Bank of China's ESG risk rating is 30.1, ranking 813th out of 1,037 in the industry.

These rating results indicate that the Bank of China has a more advantageous rating compared to ICBC, while also confirming the rationality of the rankings of the other three banks. This leads to the conclusion that the traditional TOPSIS method, which ranked ICBC first, is evidently unreasonable. This further validates the effectiveness and reliability of the CPT-TOPSIS research method and evaluation indicators in measuring the sustainability of Chinese commercial banks.

5 Discussion

This study proposes a sustainability evaluation method for the banking industry based on the CPT-TOPSIS model and verifies its effectiveness through empirical analysis.

Furthermore, the CPT-TOPSIS model not only demonstrates its advantages in the sustainability evaluation of the banking industry but also provides new insights and methods for assessing sustainable development in other sectors. For example, governments can utilize the CPT-TOPSIS model to formulate more reasonable and effective public policies by evaluating the sustainability impacts of different policies. The model can also offer comprehensive sustainability evaluation tools for enterprises, helping them identify and improve deficiencies in sustainable development. Through quantitative analysis, enterprises can gain a clearer understanding of their performance in environmental protection, social responsibility, and corporate governance, thus formulating corresponding improvement measures to enhance overall sustainability performance. Although this study primarily focuses on the banking industry, the CPT-TOPSIS model has broad application prospects in other industries as well. For instance, in the manufacturing, energy, and service sectors, this model can be used to assess the sustainable development capabilities of enterprises, thereby promoting the entire industry toward green and sustainable development.

6 Conclusions

This paper builds upon previous research and proposes a bank sustainability performance evaluation system based on the GRI framework, integrating 15 indicators across five dimensions: economy, society, environment, governance, and finance. The CPT-TOPSIS model is applied for the first time in the research on the sustainable development of Chinese commercial banks, with a quantitative analysis conducted on five differently sized Chinese commercial bank samples. The study reveals the advantages of the CPT-TOPSIS model over the entropy weight TOPSIS in our sustainability performance evaluation system. It finds that environmental indicators become a significant factor in bank sustainability when economic indicators are similar, confirming the conclusions drawn by Aras et al. (2018a) and others in their research on sustainable development in the banking industry.

The advantage of the CPT-TOPSIS method used in this paper lies in its combination of traditional multi-criteria decision-making tools with theories from behavioral economics. It quantifies risk preferences and accurately reflects the multi-dimensional risks faced by the banking industry, uniquely considering the behavioral psychological characteristics of decision-makers. This reveals decision-makers' attitudes toward risk and loss aversion in potential scenarios, providing the banking industry with a performance evaluation tool more in line with actual decision-making psychology.

This paper offers insights for bank investors. Research by Su and Sun (2023) on the sustainable development of mining companies has shown that traditional TOPSIS ignores psychological preferences in decision-making behaviors. In contrast, the CPT-TOPSIS model accounts for cognitive biases at the psychological level and considers uncertainties and risk preferences, aligning more closely with the real psychological evaluations of investment decision-makers. Our study further demonstrates the applicability of the CPT-TOPSIS model in evaluating sustainable development in the Chinese banking industry for investors, offering a reference for bank investment decisions.

For bank managers, this paper concludes that environmental indicators have become a significant factor in sustainable banking development. This should shift managers' focus from purely economic factors to environmental aspects, such as reducing direct and indirect emissions, saving electricity, and controlling the total number of employees and branches for scale operation.

It is important to note that this study has certain limitations. Firstly, the research sample is based on domestic banks in China, so the results may have limited applicability to bank sustainability research in other parts of the world. Secondly, although the data for the research indicator framework is accurate and comprehensive, the studied banks are all large listed commercial banks. Applying the same methodology to smaller financial institutions within China may not yield as extensive and accurate indicator data. Lastly, it is encouraged that more industries conduct sustainable development research under the GRI framework, allowing for further development and refinement of the research method in terms of indicator frameworks and evaluation systems.

Data availability statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found in the article/Supplementary material.

Author contributions

LC: Writing – original draft, Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/frsus.2024.1417512/full#supplementary-material

References

Altman, E. I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J. Finance 23, 589–609. doi: 10.1111/j.1540-6261.1968.tb00843.x

Aras, G., and Crowther, D. (2008). Governance and sustainability: an investigation into the relationship between corporate governance and corporate sustainability. Manag. Decis. 46, 433–448. doi: 10.1108/00251740810863870

Aras, G., Tezcan, N., and Furtuna, O. K. (2018a). Multidimensional comprehensive corporate sustainability performance evaluation model: evidence from an emerging market banking sector. J. Clean. Prod. 185, 600–609. doi: 10.1016/j.jclepro.2018.01.175

Aras, G., Tezcan, N., and Kutlu Furtuna, O. (2018b). The value relevance of banking sector multidimensional corporate sustainability performance. Corp. Soc. Responsib. Environ. Manag. 25, 1062–1073. doi: 10.1002/csr.1520

Avkiran, N. K. (2011). Association of DEA super-efficiency estimates with financial ratios: investigating the case for Chinese banks. Omega 39, 323–334. doi: 10.1016/j.omega.2010.08.001

Avrampou, A., Skouloudis, A., Iliopoulos, G., and Khan, N. (2019). Advancing the sustainable development goals: evidence from leading European banks. Sustain. Dev. 27, 743–757. doi: 10.1002/sd.1938

Aydogmuş, M., Gülay, G., and Ergun, K. (2022). Impact of ESG performance on firm value and profitability. Borsa Istanbul Rev. 22, S119–S127. doi: 10.1016/j.bir.2022.11.006

Behzadian, M., Otaghsara, S. K., Yazdani, M., and Ignatius, J. (2012). A state-of the-art survey of TOPSIS applications. Expert Syst. Appl. 39, 13051–13069. doi: 10.1016/j.eswa.2012.05.056

Bernard, C., and Ghossoub, M. (2010). Static portfolio choice under cumulative prospect theory. Math. Financ. Econ. 2, 277–306. doi: 10.1007/s11579-009-0021-2

Buallay, A. (2020). Sustainability reporting and firm's performance: comparative study between manufacturing and banking sectors. Int. J. Product. Perform. Manag. 69, 431–445. doi: 10.1108/IJPPM-10-2018-0371

Chaharsooghi, S. K., and Ashrafi, M. (2014). Sustainable supplier performance evaluation and selection with neofuzzy TOPSIS method. Int. Sch. Res. Notices. 2014:434168. doi: 10.1155/2014/434168

Chai, N., Zhou, W., and Jiang, Z. (2023). Sustainable supplier selection using an intuitionistic and interval-valued fuzzy MCDM approach based on cumulative prospect theory. Inf. Sci. 626, 710–737. doi: 10.1016/j.ins.2023.01.070

Cun-bin, L., Jian-ye, Z., Yun-dong, G., and Zhi-qiang, Q. (2015). Method for fuzzy-stochastic multi-criteria decision-making based on prospect theory and improved TOPSIS with its application. Oper. Res. Manag. Sci. 24:92.

Dong, S., Xu, L., and McIver, R. (2020). China's financial sector sustainability and “green finance” disclosures. Sustain. Account. Manag. Policy J. 12, 353–384. doi: 10.1108/SAMPJ-10-2018-0273

Dong, S., Xu, L., and McIver, R. P. (2023). Sustainability reporting quality and the financial sector: evidence from China. Meditari Account. Res. 31, 1190–1214. doi: 10.1108/MEDAR-05-2020-0899

Dos Santos, B. M., Godoy, L. P., and Campos, L. M. (2019). Performance evaluation of green suppliers using entropy-TOPSIS-F. J. Clean. Prod. 207, 498–509. doi: 10.1016/j.jclepro.2018.09.235

Ecer, F., and Pamucar, D. (2022). A novel LOPCOW-DOBI multi-criteria sustainability performance assessment methodology: an application in developing country banking sector. Omega 112:102690. doi: 10.1016/j.omega.2022.102690

Elsayed, E. A., Dawood, A. S., and Karthikeyan, R. (2017). Evaluating alternatives through the application of TOPSIS method with entropy weight. Int. J. Eng. Trends Technol. 46, 60–66. doi: 10.14445/22315381/IJETT-V46P211

Erol, I., Sencer, S., and Sari, R. (2011). A new fuzzy multi-criteria framework for measuring sustainability performance of a supply chain. Ecol. Econ. 70, 1088–1100. doi: 10.1016/j.ecolecon.2011.01.001

Gong, C., Xu, C., Ando, M., and Xi, X. (2018). A new method of portfolio optimization under cumulative prospect theory. Tsinghua Sci. Technol. 23, 75–86. doi: 10.26599/TST.2018.9010057

Güler, A., and Yildirim, F. M. (2020). Is there a relationship between environmental social performance and GDP per capita? Evidence from the G-20 countries. Öneri Dergisi 15, 463–479.

Hsu, L.-C., Ou, S.-L., and Ou, Y.-C. A. (2015). Comprehensive performance evaluation and ranking methodology under a sustainable development perspective. J. Bus. Econ. Manag. 16, 74–92. doi: 10.3846/16111699.2013.848228

Huang, J. (2008). “Combining entropy weight and TOPSIS method for information system selection,” in Proceedings of the 2008 IEEE conference on cybernetics and intelligent systems (Chengdu: IEEE), 1281–1284. doi: 10.1109/ICCIS.2008.4670971

Hussain, N., Rigoni, U., and Orij, R. P. (2018). Corporate governance and sustainability performance: analysis of triple bottom line performance. J. Bus. Ethics 149, 411–432. doi: 10.1007/s10551-016-3099-5

Ielasi, F., Bellucci, M., Biggeri, M., and Ferrone, L. (2023). Measuring banks' sustainability performances: the BESGI score. Environ. Impact Assess. Rev. 102, 107216. doi: 10.1016/j.eiar.2023.107216

Kahneman, D., and Tversky, A. (2013). “Prospect theory: an analysis of decision under risk,” in Handbook of the Fundamentals of Financial Decision Making: Part I, eds. L. C. MacLean and W. T. Ziemba (Singapore: World Scientific), 99–127. doi: 10.1142/9789814417358_0006

Karimi, T., Hojati, A., and Forrest, J. Y.-L. (2022). A new methodology for sustainability measurement of banks based on rough set theory. Cent. Eur. J. Oper. Res. 1–17. doi: 10.1007/s10100-020-00698-2

Khan, H. U. Z., Azizul Islam, M., Kayeser Fatima, J., and Ahmed, K. (2011). Corporate sustainability reporting of major commercial banks in line with GRI: Bangladesh evidence. Soc. Responsib. J. 7, 347–362. doi: 10.1108/17471111111154509

Li, X., and Chen, X. (2014). Extension of the TOPSIS method based on prospect theory and trapezoidal intuitionistic fuzzy numbers for group decision making. J. Syst. Sci. Syst. Eng. 23, 231–247. doi: 10.1007/s11518-014-5244-y

Liu, J., Xu, F., and Lin, S. (2017). Site selection of photovoltaic power plants in a value chain based on grey cumulative prospect theory for sustainability: a case study in Northwest China. J. Clean. Prod. 148, 386–397. doi: 10.1016/j.jclepro.2017.02.012

Memari, A., Dargi, A., Jokar, M. R. A., Ahmad, R., and Rahim, A. R. A. (2019). Sustainable supplier selection: a multi-criteria intuitionistic fuzzy TOPSIS method. J. Manuf. Syst. 50, 9–24. doi: 10.1016/j.jmsy.2018.11.002

Méndez-Suárez, M., Monfort, A., and Gallardo, F. (2020). Sustainable banking: new forms of investing under the umbrella of the 2030 agenda. Sustainability 12:2096. doi: 10.3390/su12052096

Mooneeapen, O., Abhayawansa, S., and Mamode Khan, N. (2022). The influence of the country governance environment on corporate environmental, social and governance (ESG) performance. Sustain. Account. Manag. Policy J. 13, 953–985. doi: 10.1108/SAMPJ-07-2021-0298

Orazalin, N., and Mahmood, M. (2020). Determinants of GRI-based sustainability reporting: evidence from an emerging economy. J. Account. Emerg. Econ. 10, 140–164. doi: 10.1108/JAEE-12-2018-0137

Roca, L. C., and Searcy, C. (2012). An analysis of indicators disclosed in corporate sustainability reports. J. Clean. Prod. 20, 103–118. doi: 10.1016/j.jclepro.2011.08.002

Sha, X., Yin, C., Xu, Z., and Zhang, S. (2021). Probabilistic hesitant fuzzy TOPSIS emergency decision-making method based on the cumulative prospect theory. J. Intell. Fuzzy Syst. 40, 4367–4383. doi: 10.3233/JIFS-201119

Shannon, C. E. (1948). A mathematical theory of communication. Bell Syst. Tech. J. 27, 379–423. doi: 10.1002/j.1538-7305.1948.tb01338.x

Shefrin, H., and Statman, M. (1985). The disposition to sell winners too early and ride losers too long: theory and evidence. J. Finance 40, 777–790. doi: 10.1111/j.1540-6261.1985.tb05002.x

Sheila, S., and Ruslim, H. (2023). The role of sustainability reports in the disclosure of risk management, capital adequacy, and liquidity risk to company value in indonesian banking companies. Return Study Manag. Econ. Bus. 2, 640–648. doi: 10.57096/return.v2i7.120

Sobhani, F. A., Amran, A., and Zainuddin, Y. (2012). Sustainability disclosure in annual reports and websites: a study of the banking industry in Bangladesh. J. Clean. Prod. 23, 75–85. doi: 10.1016/j.jclepro.2011.09.023

Stauropoulou, A., and Sardianou, E. (2019). Understanding and measuring sustainability performance in the banking sector. IOP Conf. Ser. Earth Environ. Sci. 362:012128 doi: 10.1088/1755-1315/362/1/012128

Stocker, F., de Arruda, M. P., de Mascena, K. M., and Boaventura, J. M. (2020). Stakeholder engagement in sustainability reporting: a classification model. Corp. Soc. Responsib. Environ. Manag. 27, 2071–2080. doi: 10.1002/csr.1947

Su, J., and Sun, Y. (2023). An improved TOPSIS model based on cumulative prospect theory: application to ESG performance evaluation of state-owned mining enterprises. Sustainability 15:10046. doi: 10.3390/su151310046

Turner, J. C., Oakes, P. J., Haslam, S. A., and McGarty, C. (1994). Self and collective: cognition and social context. Pers. Soc. Psychol. Bull. 20, 454–463. doi: 10.1177/0146167294205002

Tversky, A., and Kahneman, D. (1992). Advances in prospect theory: cumulative representation of uncertainty. J. Risk Uncertain. 5, 297–323. doi: 10.1007/BF00122574

Tzeng, G.-H., and Huang, J.-J. (2011). Multiple Attribute Decision Making: Methods and Applications. Boca Raton, FL: CRC press. doi: 10.1201/b11032

Wakker, P., and Tversky, A. (1993). An axiomatization of cumulative prospect theory. J. Risk Uncertain. 7, 147–175. doi: 10.1007/BF01065812

Weber, O., Koellner, T., Habegger, D., Steffensen, H., and Ohnemus, P. (2008). The relation between the GRI indicators and the financial performance of firms. Prog. Ind. Ecol. 5, 236–254. doi: 10.1504/PIE.2008.019127

Willis, A. (2003). The role of the global reporting initiative's sustainability reporting guidelines in the social screening of investments. J. Bus. Ethics 43, 233–237. doi: 10.1023/A:1022958618391

Wu, Y., Ke, Y., Xu, C., and Li, L. (2019). An integrated decision-making model for sustainable photovoltaic module supplier selection based on combined weight and cumulative prospect theory. Energy 181, 1235–1251. doi: 10.1016/j.energy.2019.06.027

Yang, Y., Orzes, G., Jia, F., and Chen, L. (2021). Does GRI sustainability reporting pay off? An empirical investigation of publicly listed firms in China. Bus. Soc. 60, 1738–1772. doi: 10.1177/0007650319831632

Yilmaz, G., and Nuri Ine, M. (2018). Assessment of sustainability performances of banks by TOPSIS method and balanced scorecard approach. Int. J. Bus. Appl. Soc. Sci. 4.

Zhao, M., Wei, G., Wei, C., and Wu, J. (2021). Improved TODIM method for intuitionistic fuzzy MAGDM based on cumulative prospect theory and its application on stock investment selection. Int. J. Mach. Learn. Cybern. 12, 891–901. doi: 10.1007/s13042-020-01208-1

Zhu, Y., Gu, J., Chen, W., Luo, D., and Zeng, S. (2023). Multiple attribute decision-making based on a prospect theory-based TOPSIS method for venture capital selection with complex information. Granul. Comput. 8, 1751–1766. doi: 10.1007/s41066-023-00398-7

Appendix

Keywords: sustainable development, Cumulative Prospect Theory, TOPSIS model, commercial banks, multi-criteria decision analysis

Citation: Chao L (2024) Sustainable performance evaluation of the banking industry based on CPT-TOPSIS: a case study of commercial banks in China. Front. Sustain. 5:1417512. doi: 10.3389/frsus.2024.1417512

Received: 15 April 2024; Accepted: 27 August 2024;

Published: 11 September 2024.

Edited by:

Pier Luigi Marchini, University of Parma, ItalyReviewed by:

Georgios Tsaples, University of Macedonia, GreeceVincenzo Basile, University of Naples Federico II, Italy

Copyright © 2024 Chao. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Lu Chao, c2hpczUyMzAzQGdtYWlsLmNvbQ==

Lu Chao

Lu Chao