- Département de Stratégie, Responsabilité Sociale et Environnementale, École des Sciences de la Gestion, Université du Québec à Montréal, Montréal, QC, Canada

Introduction: This paper introduces the concept of Sustainable Land Rent (SLR), providing a comprehensive, multidimensional exploration anchored in the dynamics of its origin, separability, mobility, valuation, and the imperative for equitable distribution. SLR capitalizes on the economic mobility of land’s value to enhance community welfare and promote environmental sustainability. Advocating for the systematic institutionalization of SLR, the research tackles the complex challenge of distinguishing land value from improvements.

Methods: Employing traditional Price, Cost, and Income (PCI) methods as practiced in North America, the study addresses the technical challenge of inseparability by estimating and integrating the SLR value within each of these methods. The methodology clarifies the valuation process and establishes an objective framework for resource allocation and negotiation between public and private sectors.

Results and discussion: Furthermore, our findings highlight SLR’s vital role in advancing public revenue generation and underscore its function as an innovative catalyst for integrating sustainability into economic valuation models and practices in real estate development and urbanization.

1 Introduction

In this study, we introduce and define the concept of Sustainable Land Rent (SLR), delineating its core attributes: sustainability, separability, mobility, measurability, and rewardability. These characteristics establish a robust framework for understanding SLR’s pivotal role in real estate and urban development, positioning it as an innovative tool for enhancing community welfare and advancing environmental sustainability. Employing a tripartite methodological approach—Price, Cost, and Income (PCI)—within the North American real estate appraisal context, this paper elucidates both the theoretical underpinnings and practical applications of SLR. We confirm the feasibility of separate SLR valuation and the necessity for an efficient institutional mechanism to redistribute SLR benefits, ensuring they are directed toward enhancing community needs and promoting environmental restoration. Addressing the dichotomy between the physical immobility of land and the economic mobility of its rent, we highlight SLR’s potential to significantly influence resource distribution policies and sustainable urban planning. Furthermore, we emphasize the need for concurrent SLR valuation methods for different property categories that ensure equitable benefit distribution, advocating for their integration into development strategies to preserve and enrich community and environmental values for future generations.

Livable land, as a non-renewable and finite resource, forms the core of our study, particularly focusing on urban land whose value is derived from both natural attributes and social constructs (Groth, 2007). Drawing on concept of “commons” of Mattei (2013), we examine land as possessing both economic and non-economic utilities, catering to diverse uses and interests (Serageldin, 2000; Nohl, 2001; Hunziker et al., 2008; Beza, 2010; Berque, 2013; Cox et al., 2014; Junge et al., 2015; Klein et al., 2015). The economic utility, often referred to as “exchange value,” is based on the personal utility individuals derive from various land attributes (Lancaster, 1966; Culyer, 1990). In contrast, the non-economic utility, or “use value,” includes non-marketable aspects such as symbolic, esthetic, or communal values (Ikegami, 1992). Historically, ethical and moral community perspectives integrate both the inherent natural value of the land and value-added improvements such as public amenities—transportation, parks, and law enforcement services (Hargrove, 1989; Bluestone, 2000).

Exchange value is typically determined by market-driven PCI metrics, while use value remains subjective, influenced by individual emotions and expectations. The literature largely focuses on urban land value, integrating economic, social, geographical, and political factors (Needham, 1981; Samuelson, 1983; Dekle and Eaton, 1999; Gyourko and Molloy, 2015). Scholars often debate the merits of distinguishing between the distinct values of land and improvements, particularly when considering resource allocation between the private and public sectors within a sustainability framework (Gaffney, 1994; Gihring, 1999). This debate originated with Ely (1922), Ratcliff (1950), and Fisher (1958), who argued that separating these components is both redundant and impractical, as they are inherently part of a unified entity. Conversely, classical (George, 1879; Marshall, 1890; Hoxie, 1905) and modern thinkers (Brueckner, 1986; Peddle, 1994; Oates and Schwab, 1997; Cord and Andelson, 2004) advocate for recognizing separate values for land and improvements. Despite these theoretical discussions, many practitioners lean toward a holistic approach to valuation, particularly for taxation purposes, reflecting ongoing theoretical ambiguities (Andelson, 2000).

In North America, although total property valuation is common, separate assessments for land and improvements offer distinct advantages (Ohno, 1985; Gihring, 1999; Nandinee, 1999; Gloudemans, 2001; Anas, 2002). These separate valuations enable a precise determination of value origins, crucial for owners, investors, courts, and financial institutions (Guofang et al., 2003). Practices such as Land Value Capture (LVC) and variable tax impacts on land and buildings underscore the importance and implications of distinct valuations (Peddle, 1994; Oates and Schwab, 1997; Skaburskis and Tomalty, 1998; Gihring, 1999; Gloudemans, 2001; Alterman, 2012; Chapman, 2017). Such methods address issues like land speculation and urban sprawl, necessitating a clear demarcation between land and building value components (Cowan, 1958; Beecroft, 1961; Becker, 1970; Finnis, 1979; Tideman, 1994; Plassmann, 1997; Arnott et al., 1998; Gihring, 1999). However, Fishell (2000) and Kitchen (2003) contend that even with separate valuations, the valuation of land alone may not provide a reliable or sufficient basis for funding public services. Contrarily, historical criticisms from Rawson (1961), Peddle (1994), and Gihring (1999) highlight potential governmental misuse of revenues derived from land values. Echoing these concerns, recent findings show that in many cities, land values have surpassed those of buildings, further emphasizing the need for precise global and separate valuation methods (Tideman and Plassmann, 2017; Clapp et al., 2023).

The perceived increase in “land value” noted in the literature often reflects changes in PCI metrics rather than intrinsic land value (Nandinee, 1999). This rise in PCI, coupled with a gradual decline in building values, typically results in higher community tax burdens, modestly increasing municipal revenue. Such shifts in utility values are influenced by factors related to community quality and environmental conditions. Research indicates that the burden of taxation disproportionately affects less adaptable entities, such as community members, potentially stifling their economic opportunities (Haurin, 1988; Carroll and Yinger, 1994; Sirmans et al., 1995; De Cesare and Ruddock, 1998; Smith, 2000; Allen and Dare, 2002). The prospect of increasingly costly rents places community members under financial strain from the outset, hindering future growth and credit generation as productivity is channeled into servicing debt rather than fostering economic expansion. To address this cycle of deficit, we propose a sustainable model of Land Rent that allows for precise valuation of land based on its originating community value, thus preventing resource depletion and protecting community assets. This measure seeks not only to reallocate funds more equitably but also to enhance resource conservation and prevent value drainage within communities.

In North America, particularly in Quebec, Canada, the PCI system of property evaluation has been well-established for over a century, supported by extensive historical data and integrated with urban planning, cadaster, and property rights systems (Pomykacz, 2009). Systematically applied every 3 years, these methods uniformly assess market values for properties in mass evaluations, aiming to derive property taxes that fund public services. Since the political agreements of 1979 and the “Ryan reform” of 1991, Quebec has granted cities and municipalities financial autonomy, establishing this valuation system as the cornerstone of public service financing (Government of Quebec, 1990). While municipalities and cities operate with fiscal independence, thanks to the revenues from these evaluations, the traditional model precludes profit, with collected incomes primarily covering the costs of services and infrastructure (Hyman and Pasour, 1973; Zimmerman, 1977; O’Sullivan, 2001; Filipowicz and Globerman, 2019; Robson and Wu, 2021; Bourassa and Wu, 2022; Jerch et al., 2023).

Property values are reaching unprecedented levels in Canada and globally, driven largely by land rent, which is influenced by the quality of location stemming from natural and community contributions. Concurrently, concerns over sustainability have intensified with this increase in land value. In response, we introduce the concept of SLR and advocate for its institutionalization, which requires distinct evaluations of land and building values. Although land rent was not a central topic in economic discussions throughout the 20th century (Gaffney, 1994), it has recently gained attention among academics and sustainability experts (Geisler, 1995; Hammel, 1999; Vejchodská et al., 2022). As highlighted by Mattauch et al. (2018), land rent is resurging as a potential source of public revenue. This discussion becomes increasingly relevant amid the growing disparities in wealth distribution and the decreasing investment in social, environmental, and public infrastructures (Stiglitz, 2015; Munoz Gielen and Lenferink, 2018). Additionally, the concept of sustainable development is gaining political traction as environmental degradation due to resource over-exploitation, including land, becomes more pronounced in many countries (WCED, 1987; McNeill, 2001; Groth, 2007).

This paper advocates for the consideration of rent as a sustainable financing mechanism for public infrastructure and services, focusing on the sustainable characteristics of land rent. While land is inherently permanent and immobile (Plassmann, 1997; Ryan-Collins et al., 2017), the rent derived from it—representing either the value created or net productivity—is notably mobile, facilitating its transformation into various forms of commodities. Our in-depth analysis of rent dynamics highlights a significant societal issue: the transference of value from economically disadvantaged groups to wealthier ones. This study sheds light on the growing gap between private rent accumulation and the availability of public services. We argue that rent can act as a sustainable source of value, provided it is calculated to accurately reflect the intrinsic worth of both natural resources and human-developed infrastructures.

Building on traditional interpretations of PCI, this paper demonstrates its threefold application to a single property, providing a structured approach to differentiate land and building values. This methodology is particularly effective in addressing sustainability concerns related to community and natural resources by enabling precise tracking of value. While the discussion of SLR is directly relevant to the North American context, its significance is even greater in regions facing acute land scarcity. The escalating challenges of environmental degradation, diminishing public funds, and increasing living costs underscore the timeliness and critical relevance of this research, highlighting its value across various fields.

2 Defining sustainable land rent

Land rent, intrinsically linked to the surplus or net product from land development and use, was originally conceptualized by David Ricardo in an agricultural production context. Ricardo (1817) introduced the concept of economic rent as the profit made from land used for agricultural purposes, emphasizing the differential productivity due to inherent variations in soil fertility. This Ricardian model posits that rent arises from the advantages of superior natural resources over marginal lands, where the surplus is calculated as the difference between the costs of producing goods on these varying grades of land fertility. Such a system incentivizes landowners to improve the quality of their land to maximize this surplus, which is perceived as an additional payment for the use of land, beyond the costs required to bring that land into production (Ioris, 2016).

Building upon Ricardo’s principles, Karl Marx deepened the analysis of land valuation by examining how soil quality and monopoly ownership impact rent dynamics, thus extending the scope beyond Ricardo’s agricultural productivity focus to include the broader exploitative dynamics of capitalism (Evans, 1999). Marx asserted that rent reflects the natural productivity of land—a crucial element of economic surplus (Dick, 1990) and argued that land rent, fundamentally, is part of the surplus value generated by land, moving beyond its direct production costs. This perspective sharply distinguishes Marxist from neoclassical views, where value often derives from market dynamics and subjective valuation. By integrating this principle, SLR challenges conventional neoclassical frameworks and reinterprets land rent within the broader context of surplus value, expanding land valuation to robustly include environmental and social sustainability. This approach not only aligns with Marxist theories by emphasizing land’s role in economic surplus generation but also adapts these theories to modern challenges of sustainability and equity in real estate and urban development.

Further extending the discussion, subsequent theories from the Chicago School have advanced our understanding of land value through frameworks emphasizing social competition or interaction, as exemplified by concentric model of Burgess (1923), sectoral theory of Hoyt (1939), and polycentric approach of Harriss and Ullman (1945). Moreover, Tiebout (1956) and Oates (1969) described that the quality of public services and urban planning decisions significantly influences land values. As urbanization and real estate development have progressed, the traditional principles of agricultural land rent have evolved into the concepts of urban land rent, influenced by infrastructure improvements, particularly notable since the 1960s (Sweezy, 1972). Inspired by Der Von Thünen (1826) early urban economic models, Alonso (1964) advocated for a utility-based approach to location rent, considering factors such as the proximity of land to central areas alongside household income and transportation costs. Modern economists have expanded this framework, applying the concept of rent to any scarce utility attribute, thereby broadening its application beyond mere land to encompass various supply and demand scenarios.

In continuity with the generalization of the land rent concept, notably through neoclassical utility theory, Samuelson and Nordhaus's (2010) distinction between “rent” and “rental” elucidates critical aspects of SLR. He defines rent as the yield from land that retains its value irrespective of market fluctuations, thereby laying a solid foundation for assessing the broader economic implications of land use decisions, especially through the concept of “opportunity cost” or “transfer price,” as Spiller (2011) explores. Complementing this, the hedonic pricing model—originally theorized by Lancaster (1966) and mathematically refined by Rosen (1974)—evaluates commodities based on the marginal utility of their multidimensional attributes (Sirmans et al., 2005). This model considers a broad array of factors, including market supply and demand (Quigley, 2007; Gyourko and Molloy, 2015; Glaeser and Gyourko, 2018), household dynamics and income levels (Muellbauer, 2017; Ryan-Collins et al., 2017), economies of scale and agglomeration (Dekle and Eaton, 1999; Vickrey, 2001), general economic development and overall community trends (Rebelo, 2017), local amenities related to temperature, proximity to water bodies (Leggett and Bockstael, 2000; Albouy, 2016), quality of infrastructures and services provided by municipality (Enoch et al., 2005; Gibbons and Machin, 2008; Gonzalez-Navarro and Quintana-Domeque, 2016; Sharma and Newman, 2018), land use, and planning decisions made by authorities (Havel, 2017; Viallon, 2018; Wu et al., 2019).

In the context of sustainable urban development, cities aim to maximize the value of land resources by balancing economic, societal, and environmental objectives, adapting urban spatial structures as a primary method of sustainable governance (Peng et al., 2022). The shift toward sustainability is particularly evident since the 1970s, when organizations began recognizing social values alongside economic profits, and public relations, impacting their operations across environmental, ethical, and community dimensions (Burke and Logsdon, 1996; Esrock and Leichty, 1998; Lewis and Unerman, 1999; Milne and Chan, 1999; Williams and Pei, 1999; Clark, 2000; Frankental, 2001; Friedman and Miles, 2001; Lantos, 2002). This broader definition of sustainability stresses limiting resource exploitation to preserve non-renewable stocks (Daly, 1991; Rees, 1999), a principle well-articulated in the landmark definition by WCED (1987). Enhancing land value involves meticulous resource allocation and recognizing the importance of public services and urban planning in land valuation, a trend that has led to increasingly viewing land value capture as a sustainable measure (Arnott and Stiglitz, 1979; Oates and Schwaab, 2009; Alterman, 2012; Piketty, 2014; Stiglitz, 2015; Mattauch et al., 2018; Munoz Gielen and Van der Krabben, 2019).

Further, the interaction of resources with human society during urban development has prompted a human-centered, development-oriented approach that allows for some trade-offs in resource management. This perspective gained momentum with the Rio Declaration in 1992 and subsequent environmental legislations, advocating for economically viable, socially supportive, and environmentally responsible real estate developments (Pearce and Barbier, 2000; Yu et al., 2000; Christudason, 2002; Pennington, 2003; Keeping and Shiers, 2004; Baker, 2005). The advent of green building practices, influenced by global protocols such as the Kyoto Protocol, emphasizes sustainable construction to significantly reduce CO2 emissions and energy consumption (IPCC, 2007; UNFCCC, 2007; Mavromatidis et al., 2016; Lin et al., 2022). As urban growth continues to challenge environmental limits, smart sustainable buildings have become pivotal in smart city initiatives, supported by systems like BREEAM and LEED, which assess various sustainability parameters to certify properties based on design, functionality, and ecological performance (Doukas et al., 2007; Lazar and Chithra, 2020; Mofidi and Akbari, 2020).

Understanding land as a critical, shared resource that depletes with overuse underscores the need for sustainable governance models (Ostrom, 1990; Steins and Edwards, 1999; Menatti, 2014; Saunders, 2014). Property titles traditionally secure individual usage rights, but the concept of the commons advocates for collective ownership and governance to prevent commodification and over-exploitation (Sabatier, 1998; Olwig, 2003; Ostrom, 2010; Bollier and Helfrich, 2013). To address these challenges, the Institutional Resource Regime (IRR) emerges as an inspiring framework that harmonizes private and collective actions, ensuring the sustainable management of land resources (Stephenson, 2008; Brown and Brabyn, 2012; Gerber et al., 2020). IRR adapts over time, incorporating a scientific approach to land ownership that emphasizes socio-ecological implications and robust institutional rules for sustainable land utilization (Marx, 1867; George, 1879; Polanyi, 1944; Bernoulli, 1946). This evolving framework guides the development of policies that often overlook the nuanced interplay of property rights in resource regulation, advocating for a resource-based approach that balances controlled measures with the flexibility needed for sustainability (Vatn, 2005; Ostrom, 2007, 2009; Nahrath and Bréthaut, 2016).

The evolving IRR framework, as refined by Gerber and Gess (2017), delineates sustainable versus unsustainable resource uses, integrating political sciences and institutional economics to address the institutional and political dimensions of resource governance (Bourdieu, 1979; Harvey, 2008; Gerber et al., 2020). This comprehensive approach enhances regulatory predictability and includes mechanisms for managing and sanctioning resource use, defining the scope of individual and collective actions within existing institutional frameworks (Bourdieu, 1979; Vatn, 2005; Harvey, 2008). Moreover, it facilitates collaborative efforts between actors and institutions, moving beyond traditional legalistic approaches to foster cooperation across various levels of governance, from local to global (Knoepfel, 1995; Koelble, 1995; Lowndes, 1996). This framework not only supports the sustainability of land resources but also helps to bridge the gap between public and private interests, ensuring that property-right holders and resource users contribute effectively to sustainable development goals.

Continuing the discussion on regulatory frameworks, environmental policies play a pivotal role in resource protection management, often challenged by property rights issues that critically influence policy effectiveness (Gottfried et al., 1996; Kline et al., 2000; Langpap, 2006; Knoepfel et al., 2011). These dynamics, shaped by the interplay between public interests and private property rights, underscore the significant role of jurisprudence in environmental policy outcomes (Varone et al., 2002). Analysis of such policies offers insights into the ecological health of resources and the measures needed to regulate activities affecting sustainability (Hezri and Dovers, 2006). New institutional economics further investigates how property rights inform the governance of limited resource competition, highlighting the strategic use of land for economic leverage (Bromley, 1992; North, 1992; Cole and Grossman, 2002; Ostrom, 2005; Steiger, 2006). However, the regulatory landscape remains fragmented, with scattered legal provisions leading to coordination challenges that impact the enforcement and efficacy of property and usage rights, thereby emphasizing the need for thorough analysis within the framework of protection and use policies (Kirchgässner and Schneider, 2003).

Sustainable Land Rent represents a significant evolution from traditional land rent concepts by integrating long-term economic, environmental, and social sustainability into its valuation framework. Unlike traditional rent, which primarily seeks to maximize immediate economic returns, SLR emphasizes sustainable economic growth, ensuring land utilization contributes positively to future generations without depleting its utility. This approach involves a systematic inclusion of environmental impact assessments to measure how land use affects biodiversity, water resources, and soil health, ensuring ecological services are maintained over time. Furthermore, SLR focuses on social equity, making sure that land development practices equitably benefit all community segments and that a significant portion of the economic benefits derived from land is reinvested into local infrastructure and services such as social housing, addressing a growing concern in North America.

Distinctly from classic land rent debates, which center on maximizing private returns, SLR acknowledges the foundational roles of nature and community as primary originators of land value. Traditional approaches often overlook these contributors, focusing instead on the interests of private landowners and developers, especially in real estate. SLR corrects this oversight by advocating for the rights of nature and community to participate in and benefit from the value they help create. By institutionalizing mechanisms such as LVC, SLR ensures that the economic surplus generated from land is equitably distributed, supporting both environmental sustainability and community welfare. This reorientation marks a paradigm shift from private exploitation to a more balanced, just, and sustainable approach to land rent.

In redefining land rent through the lens of SLR, this paper transcends the classical economic paradigm that treats land as a passive factor of production. Instead, SLR reconceives land—or more aptly, the “Community and Nature” that embody it—as active contributors whose values are integrally sustainable. This approach not only protects and reinvests returns directly back to their origins but also embeds environmental stewardship and social equity into the economic valuation of land. Unlike traditional land rent aimed at maximizing immediate economic returns, SLR prioritizes long-term sustainability, ensuring land utilization remains beneficial for future generations. It challenges the traditional hierarchy of production agents by advocating for the immobility of rent—akin to the physical immobility of land itself. This pivotal shift ensures that the economic benefits derived from land are not siphoned away but are sustainably reinvested to support the very communities and ecosystems that generate them.

As we conclude our exploration of SLR in this section, we have delineated its core aspects through various discussions that underscore its departure from traditional land rent concepts. SLR not only integrates long-term economic, environmental, and social sustainability into its valuation framework but also actively promotes equitable land development practices benefiting all community segments. These discussions lay a solid foundation for the forthcoming detailed exploration of SLR’s capture and measurement mechanisms in Sections 3 and 4, which will highlight practical applications and policy-making strategies aimed at achieving sustainable urban governance.

3 Capturing sustainable land rent

Continuing our delineation of SLR, we now turn to the practical mechanisms for its capture and institutionalization, extending our conceptual framework with strategic insights and potential solutions within the realms of real estate and urban development. This section discusses the dynamic interplay of land ownership, valuation, and the integration of societal and environmental responsibilities, proposing policies such as differential taxes, public land leasing, and development rights trading. These mechanisms aim not only secure continual funding for community services and infrastructure but also to ensure that the economic benefits of land development are equitably distributed, supporting sustainable urban growth and community well-being.

The distinction between private and public ownership of land is a nuanced and politically sensitive issue, intensively debated in scholarly circles. This debate often centers on how land’s value is augmented by natural endowments and public investments, with scholars advocating that landowners are morally and potentially legally obligated to return a portion of this enhanced value to the community, reflecting contributions that are not directly attributable to their own actions (Barnett and Morse, 1963; Lindholm and Lynn, 1978). The genesis of land value often originates from nature’s bounty and is significantly enhanced by public sector initiatives, such as infrastructural services and the transformation of rural areas into urban land (Firman, 1997; Garza and Lizieri, 2016; Nguyen et al., 2017). Additional increases in value may result from planning authorities’ decisions on development control, which alter land use and rights (Almeida et al., 2016; Havel, 2017; Cheshire, 2018), as well as from shifts in socio-economic and market dynamics (Rebelo, 2017). The imperative to capture land value is underscored by scholars who argue that it is crucial for funding infrastructure and supporting the needs and well-being of the community (McAllister et al., 2016; Higgins, 2019; Kresse et al., 2020).

Rising land values, especially those due to improvements in environmental quality and public service provision that landowners have not directly earned, present a compelling case for the adoption of LVC strategies (Garza and Gonzalez, 2021). LVC has recently gained global recognition as an effective and less contentious form of taxation aimed at financing public goods without sparking widespread debate (Connellan, 2004; Rosenberg, 2006; Smith and Gihring, 2006; Higgins, 2019; Kresse et al., 2020). Various scholars advocate for specific LVC implementations, such as a taxation model targeting only land value—whether through a flat-rate or a single rate—to cover public service expenses, support affordable housing initiatives, and fund inclusive urban planning and zoning efforts, thereby addressing the broader social needs of local communities (Haila, 1985; Zhao et al., 2010; McGranahan et al., 2016; Folvary and Minola, 2017; Agyemang and Morrison, 2018). Additionally, the split-rate land tax is emerging as a promising LVC method, along with other innovative revenue-generating approaches like betterment levies, taxation on zoning-induced land value increments, and the public sale of development rights or land leasing (Medda, 2012; Walters, 2013; Hu et al., 2019). The application of impact fees further exemplifies the diverse toolkit available for LVC (Gaffney, 1994; Ihlanfeldt and Shaughnessy, 2004; Mathur et al., 2004; Stiglitz, 2015). Beyond these, LVC encompasses more robust instruments, including joint development partnerships between public and private entities, expropriation, government ownership, nationalization, or the strategic repurchase of lands by the state to ensure the equitable distribution of land-related wealth (Alterman, 2012; Chapman, 2017; Hendricks et al., 2017; Nguyen et al., 2017). These varied approaches highlight the adaptability of LVC as a tool for promoting sustainable development and social equity through strategic land management and taxation policies.

Alternative approaches to LVC present notable benefits, chiefly their potential to mitigate escalating land prices, which are a key factor in housing affordability and rentability challenges. By addressing these issues, such methods contribute to narrowing the socioeconomic divide, promoting more equitable wealth distribution across societal strata (Stiglitz, 2015). They advocate for sustainable and compact urban development models (Elias et al., 2020), playing a crucial role in environmental preservation, curtailing urban sprawl, and reducing the overuse of infrastructure (Farris, 2016). Furthermore, these alternatives facilitate a more equitable allocation of land tax revenues, ensuring that they are not disproportionately derived from the endeavors of landowners (Plummer, 2009), while simultaneously preventing market distortions often associated with land value taxation (Mattauch et al., 2018). However, the implementation of such methods is not without its challenges. A critical concern is the decoupling of land value from income, potentially rendering ownership unaffordable for some and inadvertently shifting the tax burden onto renters. This underscores the need for carefully calibrated strategies that balance economic feasibility with the goals of fairness and sustainability.

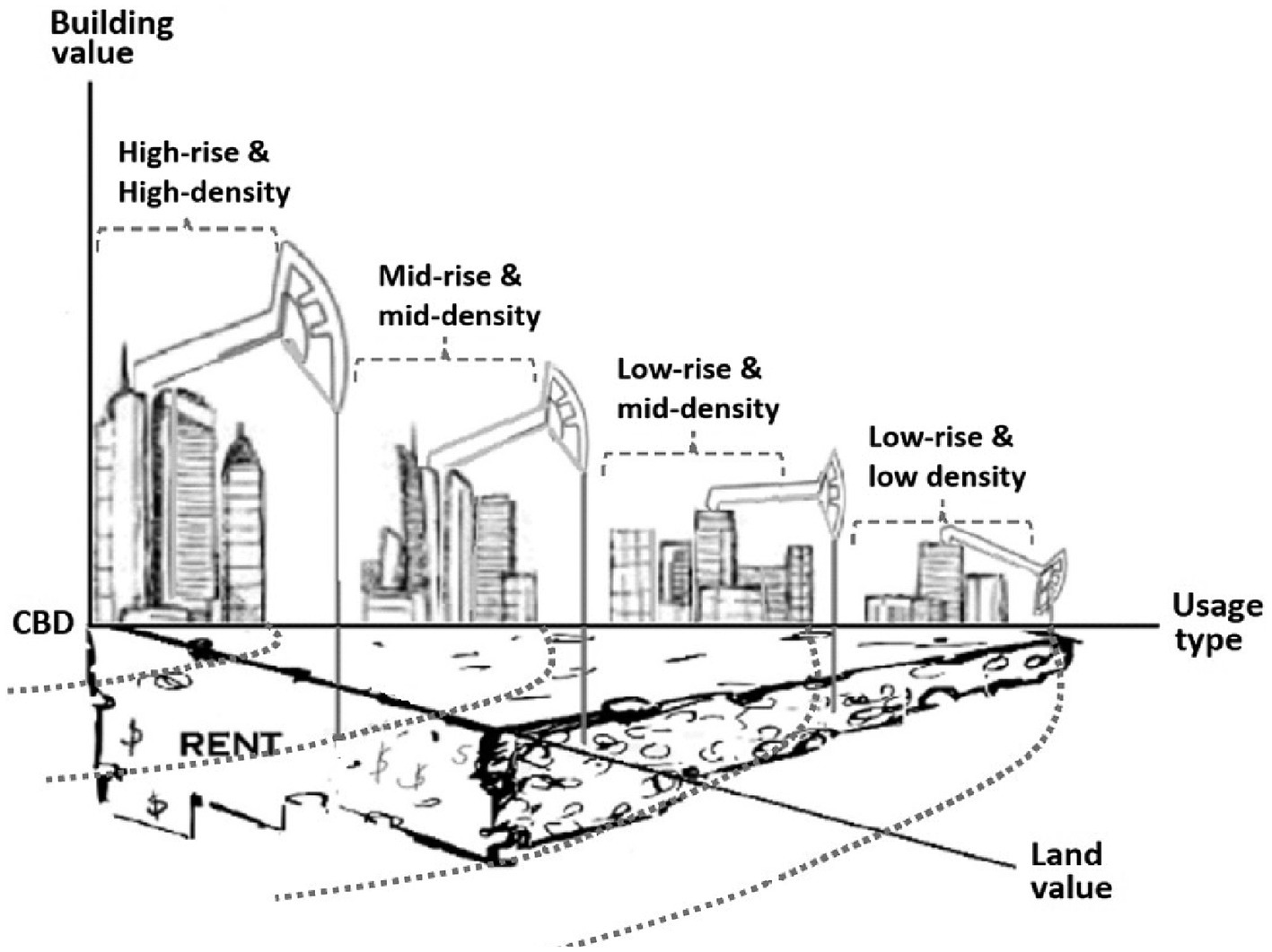

Land servicing is inherently a communal effort, with the accumulated value of land—or rent—mirroring the collective endeavors of the community in nurturing education, security, urban planning, functioning services, political stability, and leveraging the land’s inherent natural resources. Like a sponge soaking up water, land absorbs and retains the non-renewable, irreplaceable, and unique attributes of SLR, influenced by environmental factors over decades, if not centuries. Expanding on this sponge analogy, consider how SLR is extracted, akin to petroleum extraction, where the focus is on maximizing both quantity and quality (HBU). For land to achieve its highest and best use, the capital investment in building development must be optimally aligned with the land’s potential, considering factors such as timing, proximity to the central business district (CBD), and intended land use (residential, commercial, etc.). Misalignments in investment weight or usage can lead to suboptimal rent extraction—either trapping potential rent or incurring unnecessary costs relative to the land’s capacity to yield rent (Ding and Zhao, 2014; Hsieh and Lin, 2015; Ogryzek et al., 2018). From an investor’s perspective, the aim is profit maximization, regardless of industry specialization, drawing SLR as one would pump oil. However, for the community, the objective extends beyond economic gain to fostering a balanced, sustainable, and livable environment. While the pursuit of exchange value motivates the construction of capital by developers, it is the intrinsic use value of land that ultimately shapes the environmental and social character of SLR.

Figure 1 aids in elucidating the SLR conceptual framework within the realms of real estate and urban development by metaphorically portraying land as a sponge that absorbs economic and ecological values. The illustration depicts buildings as structures akin to extraction rigs, drawing economic rent from the land, which serves as a platform. It underscores the importance of aligning investments with key factors such as timing, proximity to the central business district (CBD), and intended land use to prevent misalignments that could trap potential SLR or incur unnecessary costs, addressing critical concerns in urban economics and development. The illustration contrasts the developers’ pursuit of exchange value with the intrinsic use value of land, highlighting how public services and natural attributes are “infused into the land sponge.” Additionally, it emphasizes the mobility of land rent, demonstrating that while physical structures remain stationary, the extracted rent can flow away, potentially depriving local communities and environments of their rightful benefits. This dynamic underscores the need for equitable distribution of economic benefits from land development and integration of private investment with public interests. By challenging traditional valuation practices and advocating for a transformative approach in real estate and urban planning that integrates community welfare and environmental conservation into economic valuations, Figure 1 supports a deeper understanding of the SLR concept.

The influence of real estate investors in molding our urban and rural landscapes is profound, often overshadowing the direct input of nature and local communities, whose voices typically emerge through resistance or engagement with public authorities (McGlynn, 1993). It falls upon states and municipalities to delineate the permissible scope of development—be it commercial, residential, industrial, or institutional—thereby shaping the trajectory of land utilization and enhancing the development potential of the territory. Land itself does not inherently possess capital; instead, its value is derived from a constellation of location-specific qualities bestowed by natural endowments and the cumulative enhancements brought about by community endeavors over time. The realization of a location’s potential hinges on strategic investment that aligns with the land’s highest and best use (HBU), ensuring that development efforts are not only economically viable but also conducive to the broader welfare of the community and the environment.

Developers, drawn to the allure of land rent potential in specific locations, often secure a larger share of rent early in a project’s lifecycle, facing diminishing returns as competition, local dynamics, and negative externalities—such as traffic congestion, speculative pricing, increased density, shifting socio-economic profiles, and rising crime rates—begin to erode the location’s desirability and rent value. This downward trend in rent persists throughout the economic lifespan of the development, imposing greater burdens on the community in the form of externalities, heightened tax liabilities, escalated infrastructure expenses, and the need for expanded services to accommodate diverse uses. These communal burdens may offset some of the rent initially captured by developers, particularly during redevelopment phases that attract fresh investment yet yield considerably reduced rent levels. Moreover, the capital utilized by investors is often sourced from financial institutions where community members deposit their savings, accepting minimal interest rates in stark contrast to the substantial rents garnered by these investments. Upon completion of a project and settlement of production costs, developers are prone to replicate this cycle in new locales. This turnover can be swift, typically spanning 2–3 years for extensive projects, or gradual, manifesting through the slow, sustained accrual of rental income over the structure’s lifespan—effectively perpetuating a cycle of rent extraction with smaller, yet increasingly frequent, intervals.

The extraction and outward flow of sustainable land rent by developers, through either outright sale or periodic income transactions, precipitate a spectrum of negative externalities that linger long after the developers have shifted their focus to new ventures. These adversities, while originating from the development site, often ripple outwards, affecting surrounding areas and cascading through to the wider region and even at a national level. The ramifications of such extensive rent extraction manifest in a variety of socio-economic and environmental externalities with long-term, accumulative impacts that transcend the immediate vicinity of the project. Key among these externalities are elevated taxation levels driven by increased exchange values, urban sprawl, the consumption of agricultural and environmental lands, the intensive exploitation of natural resources, and heightened inter-regional mobility. Such dynamics invariably lead to price escalations, displacing local populations to more affordable locales, thereby exacerbating demands for services and infrastructure. Complications extend to the challenge of securing social housing, escalating urban density, and consequent increases in traffic and pollution. These issues collectively underscore the profound, multifaceted negative impacts that sustainable land rent extraction can have on communities, environments, and broader societal structures (Brueckner, 2000).

The concept of rent, defined as payments for utilizing natural resources on land (Tratnik et al., 2009), has a fluid nature, allowing it to be transferred and converted into different forms of capital with relative ease (Solow, 2014). This fluidity enables a cyclical process where SLR is continuously captured and reinvested to generate additional rent. However, this cycle complicates efforts to trace and quantify SLR that has been diverted into various capital forms over time. When these rents are redirected away from the local community, it not only represents a missed opportunity to fund community needs or address environmental and infrastructural deficits, but also poses risks of tangible damage. Moreover, certain practices enable the withholding of SLR from community coffers, such as underdevelopment or minimal renovation of properties, thereby evading taxation on potential income, for instance, from underutilized commercial lands earmarked for parking. This strategy benefits from lower property valuations, resulting in diminished tax revenues from property taxes. Similarly, the frequent resale of developed properties can serve as a mechanism for SLR evasion, with properties often changing hands multiple times over their lifecycle. This turnover process can artificially inflate property values at the community’s expense, privileging private capital gains over the inherent value owed to the community by nature. In addition, operational and renovation expenses on these properties further diminish the share of rent that could potentially benefit the community.

The community and nation face significant challenges due to the mismanagement of SLR, evidenced by a discrepancy between the property’s market value and its true value derived from natural and societal contributions. This misalignment can lead to substantial financial losses—amounting to billions—and environmental degradation, impacting air and water quality, agriculture, and woodlands. Public authorities play a crucial role in rectifying this situation by institutionalizing mechanisms to reclaim and redirect lost SLR toward community and environmental revitalization. Rather than merely addressing symptoms of environmental neglect, such as retrofitting buildings with energy-saving windows, a fundamental reassessment and proper valuation of SLR are imperative to prevent its drainage from local economies. Crucially, it highlights a paradox where funding for public services often comes from entities that have profited from the extraction of wealth via SLR, underscoring the need for a systemic overhaul to ensure that SLR benefits are equitably distributed and contribute to sustainable development.

4 Measuring sustainable land rent

Because of market imperfections and the complexity of the value concept, property valuation is considered an “art” rather than an exact science (Gau et al., 1992). Despite this, appraisal practice in North America has become increasingly standardized over the past century. This standardization was aided by the use of explicit measurement of sales, cost, and income, first by Hurd in 1903, and further developed by Babcock (1924), Ratcliff (1950), and Wendt (1974). Urban land valuation in particular, faces challenges, primarily due to the dwindling number of comparable vacant land transactions. While the cost method is not suitable for land valuation alone, the income method works for income-producing lands. For non-income-producing lands, like those under single-family homes, the sales comparison method is favored, though its utility diminishes with fewer vacant land sales. Various techniques, from direct comparison to land residual, have emerged based on the three foundational methods. There are multiple techniques for land valuation, such as direct comparison, allocation, extraction, subdivision, and land residual. Despite the availability and applicability of these recognized techniques, the standard is to use the income capitalization method. However, in practice the preference of method(s) and/or technique(s) would depend on the type of property and the purpose of the appraisal (e.g., purchase, liquidation, acquisition, insurance, or compensation). For instance, stadiums cannot be appraised using the direct comparison method due to a lack of comparables. While literature delves deeper into popular methods, it sometimes glosses over the nuances of well-established ones. Theories, like traditional urban economic theories, serve to elucidate and back these methods, not supplant them, aiding in understanding city-wide land value patterns without addressing site-specific values (Atak and Margo, 1998; Han and Basuki, 2001).

Debates around land value separability often revolve around revenue imputation and tax system impacts. While the literature touches upon these through land value capture discussions, it seldom addresses the SLR’s evaluation, which seeks to discern the land sustainability portion in the total value. According to the economic utility theory, land, as a commodity, derives its value from various utility attributes that can be distinctly measured (Lancaster, 1966; Rosen, 1974). This distinct measurement is crucial to the definition and capture of land rent. Land value estimation necessitates the separation in building rent and land rent, achievable throughout PCI estimation. The rent residual technique, part of the global income method, does not explicitly showcase this. However, when political consensus swings toward SLR, its evaluation becomes paramount.

In regions including North America, the system of evaluation is primarily concerned with the total value of the property for taxation purposes, without separate estimation of the land and building values. In situations where the land market is rare or there are environmental concerns, separate value estimations become necessary (Peddle, 1994). There is a growing need in knowing the separate values of land and building in order to justify various practices such as land value capture and taxation (Andelson, 2000). However, the general public and political have a limited understanding of separate evaluations and taxations, and politically driven increases in taxation often cause public negativity.

Separate value conceptions for components of land and improvements (buildings) have worldwide multiple implications in practice, particularly in land use and valuation policies such as LVC, differential or unique taxation rates. By institutionalizing and separately integrating appropriate measures within the body of existing modern systems of mass evaluation, cadastre, property rights and urban planning, local authorities can objectively and methodically extract wealth in SLR and reinvest it in the sustainable development of their community and environment. This can include development strategies that favor globally growing needs in public services such as social housing (Berto et al., 2020), while promoting integrative and collaborative developments in partnership with private sectors. Often, an inadequate supply of affordable houses causes spatial segregation for low-income households (Anderson et al., 2003).

To measure SLR, three different methods can be used together to approximate the value state for a specific property. While these estimates might vary significantly for the same property, using multiple approaches provides a better approximation and justification of value state. The three approaches are universally concurrent and support a system of evaluation, but variations in definitions and practical steps can lead to multiple versions and interpretations in different contexts around the world, which can make the process seem complex and confusing. Despite this complexity, the triadic basis of concepts, observables, and PCI approaches is universal and aimed at approximating a value state by its market value estimate (Appraisal Institute, 2020).

According to the main concepts of value and rent we have defined; evaluation of total and separate values is necessary as property’s main components are land and building (Gau et al., 1992). The ability to make separate estimations is particularly important when assessing SLR, in relation to the portion of the product that rewards other types of agents such as capital, labor, and organization. It is also crucial to have practical separate values in order to evaluate and address the various impacts from these types of agents. To avoid confusion, it is worth noting that the separation process is not a physical separation like separating the white and yellow particles in an omelet, but rather a quite objective process of separation of value between the identifiable and measurable attributes of land and building components.

Value plays a pivotal role in understanding land rent and exhibits complex evolution within economic thought, adopting diverse interpretations across multiple disciplines (Hutcheon, 1972). Its manifestations, particularly through PCI components, often used interchangeably, underscore an ongoing debate and lack of consensus regarding its definition (Vlaev et al., 2011). The broad applicability and interpretative flexibility of value, as highlighted by perspectives from various fields, reflect the intricate interplay of factors that influence its meaning and determination (Berlyne, 1971; Baumol, 1986; Hayn-Leichsenring, 2017). Within the SLR framework, the utilization of PCI not only aids in estimating both the total and segmented values but also integrates economic, social, and environmental dimensions into its valuation. This approach marries the concepts of “use value” and “exchange value,” where traditionally, exchange value through PCI was seen as objective enough to supplant use value (Söllner, 1997; Landreth and Colander, 2002; Screpanti and Zamagi, 2005; Pirgmaier, 2021). Consequently, SLR facilitates a more nuanced understanding of value, pivotal for the appraisal process and crucial for accurately determining the value state of real property without giving undue precedence to either component, thereby ensuring elsewhere the sustainability of its estimation process.

Price, Cost, and Income are interconnected metrics crucial for valuing commodities in market negotiations (Goetzmann, 1993; Özdilek, 2019). Price arises from economic negotiations, reflecting diverse subjective valuations converging into observable market prices. This negotiated price serves as a benchmark for estimating market value, illustrating the interplay between individual valuation processes and market dynamics. Similarly, cost embodies economic sacrifices associated with production, reflecting labor, capital, and natural resources invested. Income focuses on future net rewards, introducing temporal flexibility into value expression. Together, these metrics highlight economic value expressions, crucial for understanding valuation dynamics within urban development and sustainable land rent considerations. Land’s value originates from its utilization surplus, with land rent fluctuating as a representation of this inherent value. Ricardian theory emphasizes rent as the differential yield between lands of varying fertility, incentivizing land quality enhancement (Ioris, 2016). This rent reflects additional economic benefits accruing to landowners beyond production costs, shaping land’s economic value and emphasizing the dynamic interplay between land utilization and value creation.

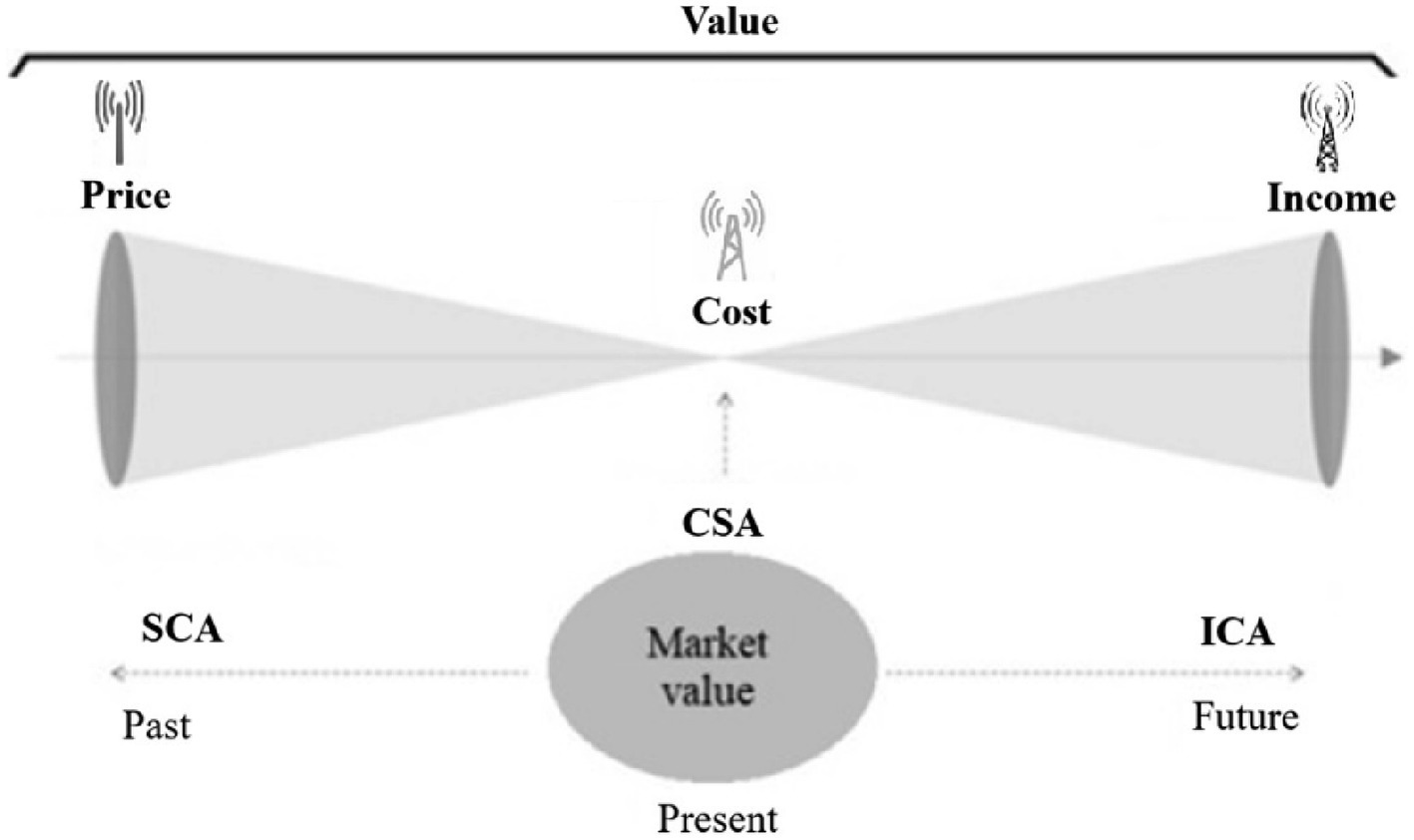

As illustrated in Figure 2, PCI (i.e., price, cost, and income) support one of three different classic valuation methods in the real estate field: the Sales Comparison Approach (SCA), the Cost Summation Approach (CSA), and the Income Capitalization Approach (ICA). The SCA is the most direct estimate of the value of properties, as subjectivities of economic agents are expressed in price amounts. The SCA involves comparing the subject property to similar properties that have recently sold in the area in order to determine its value. The CSA involves estimating the cost of reproducing the subject property. It evaluates the value of a property by estimating the new or depreciated cost of the building component, and then adding the market value of the land, estimated either using the SCA or ICA. The ICA involves estimating the potential income that the subject property could generate in future and then actualize that information to determine its value. The ICA is particularly useful for properties that are expected to generate stable periodic incomes over their useful economic life. It is also possible to use a modern version of each one of these classic methods based on more intensive data, mathematical modeling programs, and tools (Sirmans et al., 2005).

Figure 2 illustrates the economic system of value valuation, which is highly efficient for mass evaluations of millions of properties across Quebec’s territory. The Quebec evaluation system’s main goal is the collection of total values for taxation purposes, in which land and building’s separate values are indicative ratios in general. One interesting characteristic of the Quebec evaluation system is the incorporation of the concept of “Unités de voisinage” (or Neighborhood units), a little-known concept which integrates spatial polygons of similar properties with common structural and spatial characteristics into the mass evaluation process (Government of Quebec, 2022) This simplifies and accelerates the process of evaluation, without the need to process to separate value estimations.

There are several techniques of separating land and building value, mainly through approximations using typical ratios. However, the lack of land markets makes it difficult to apply the most reliable SCA. Instead, techniques such as the allocation and extraction methods are used. Based on SCA, the allocation technique uses a typical ratio of land value based on historical prices of empty land markets, adjusted for its evolution to determine its typical portion in the total price. The extraction technique uses the CSA to estimate the (depreciated) cost of the building component from the total sale price of the property, isolating the portion of the land price. If the property is income generating, there is another technique known as rent residual within the ICA that estimates the separate value of the land from the portion of total rent, after accounting for other production agents. These techniques have weaknesses and advantages, leading to approximate estimates in general. Özdilek (2011a,b, 2016, 2020a,b) present these details and develop potential alternatives.

In the following sections, we will discuss the practicality and importance of separating SLR and building values within each of the triadic SCA, CSA, and ICA. This will demonstrate the significance of SLR separation, which is necessary for taxation purposes and for capture within the framework of the existing classic system of triadic evaluations. We apply these three approaches to estimate the total and separate market values of a same single-family property in December 2022, in Montreal (Canada). Information on the subject and its comparables are gathered from the appraisal division of the City of Montreal.

4.1 SLR estimation based on SCA

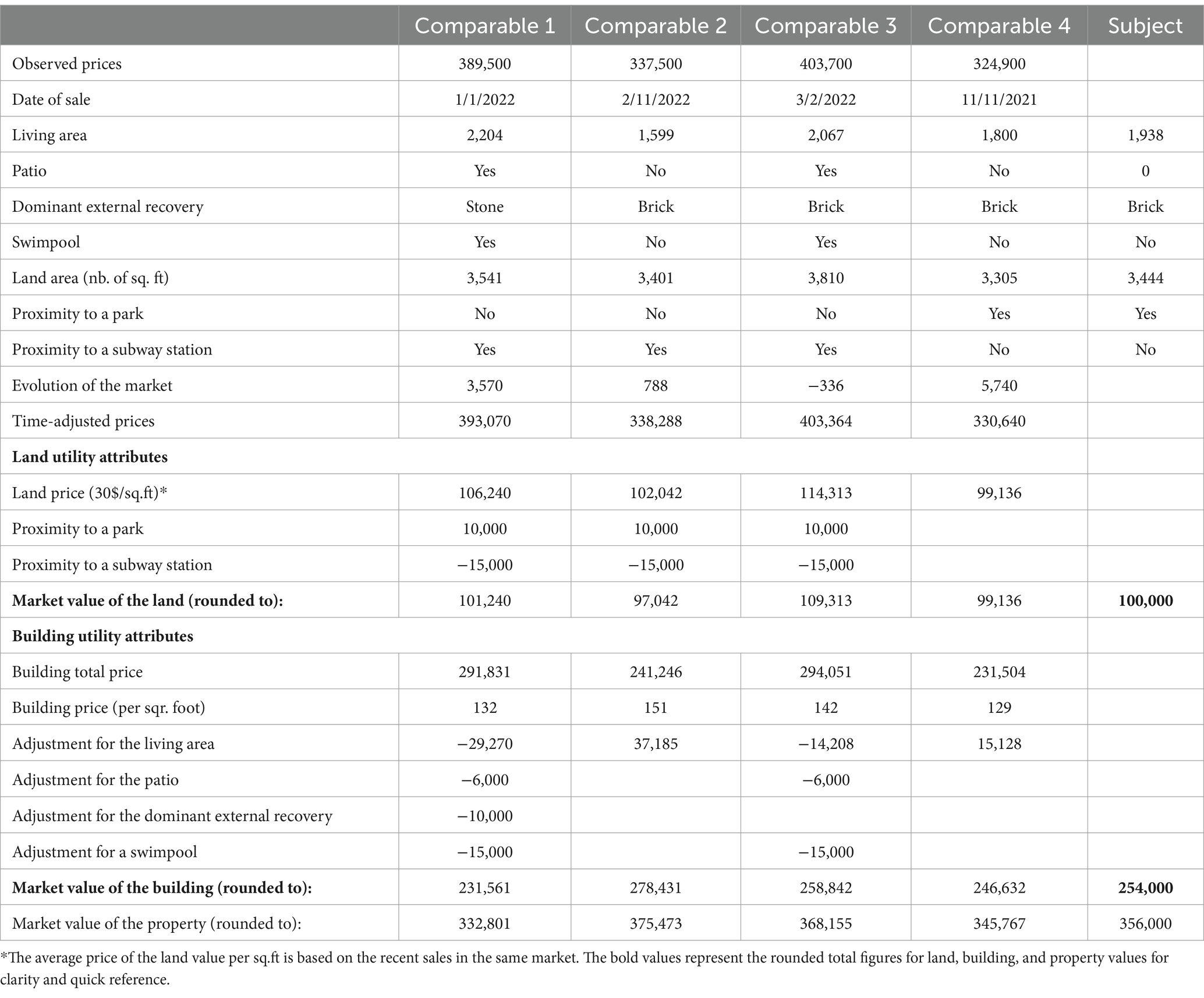

Using the SCA, to calculate the market value of the subject property, we considered the observed prices of four similar comparable properties located in the same neighborhood. This approach is the most direct one in approximating the value state, although it has some limitations when data is insufficient, with a growing number of property characteristics to be adjusted (Lipscomb and Gray, 1990). The data in the following grid-adjustment table contain two main sections: basic attributes and adjustment amounts. We perform pairwise comparisons of the SCA to adjust the prices of dissimilar properties, making them more comparable to the subject property (the one for which a value estimation is needed). For instance, if a comparable property is inferior to the subject property, the price of the inferior property is adjusted upward; if the comparable property is superior, a downward adjustment is made. Adjusted prices of comparables thus become reliable references for the market value of the subject property.

In this exercise, we are interested in separate values of the land and the building, as well as their specific attributes. There were three attribute adjustments for land components and five other adjustments for the building component, both considering the time evolution on the market. While our focus is on the separate values, the results of adjustments of attributes are also interesting. The estimates of the adjustments in the table are computed using an ordinary least squares (OLS) statistical approach and were based on 400 sales made during the same period.

For instance, the time evolution on the market indicated a yearly positive adjustment of 5% to the selling prices. According to the market of recently sold empty lands, each square foot is about $30. The differences between this land price and the total price allows to derive a building price of about $110 per square foot. Properties closer to urban parks add $10,000 to the total price and $15,000 for being less than 500 meters from a subway station. These are considered as land price adjustment attributes as they are not movable, reproducible or substitutable by the owners. Estimated land value with these attributes is $100,000. Concerning the building parameters, which are reproducible capital, an external recovery in stone/vinyl, in comparison to brick/vinyl, adds $10,000 to the market value and a swimming pool adds $15,000 to the value, while an additional fireplace adds $6,000. The estimated market value of the building with these attributes is $254,000 on the day of evaluation.

Sales Comparison Approach estimates for the property’s total market value is $356,000. However, it is important to note that this estimate assumes that the values of the land and building components are independent and can be linearly combined. There may be interactions between these components that could affect the accuracy of the estimate. By modeling the data there are fewer biased separate value estimations (Özdilek, 2020b). Therefore, the total rent estimation is based on components of land and building related attributes and their contributions to price differentials. The SCA calculates these contributions using the rent factor, which takes the quality/quantity of property attributes into account. This approach considers negotiated prices, using past data on land price and building component price. In our approach, we maintained the traditional computation form and process, but introduced distinctions between land and building attributes and their respective adjustments (Table 1).

There are technical details that warrant discussion like the amount of adjustments we used for land and building attributes. For instance, the adjustment of $10,000 was informed by the collective judgment of 400 buyer–seller pairs, reflecting the perceived value of proximity to a park. This value represents capitalization of the utilities associated to the access to the park during the possession of the property. Similar exercises were conducted for other attributes, with the cumulative adjustments shaping the total prices of the four comparables used in this study. Each adjustment underwent rigorous statistical validation before being incorporated into the SCA. The precision and objectivity of these measurements are crucial, as they directly influence our proposed sustainability basis for public service provision. Notably, attribute such as “Proximity to the park” are classified under land component and not buildings. Multiple criteria, such as its establishment by public authorities and its immovable nature, support this classification, distinguishing it from building attributes (Özdilek, 2020b).

It is essential to recognize that the total land value estimation and its attribute-based monetary contributions stem from the judgments of economic agents, expressed as price variations based on property attributes. The aggregated and individual prices for each attribute serve as value indicators, reflecting the consensus of economic agents during negotiations. In this SCA, we used four comparable’s prices as benchmarks to estimate the most probable price (market price or market value) of the subject property had it been listed for sale. This estimation, based on observed prices and attribute quality and quantity comparisons, allows us to propose separate market values for land ($100,000) and building ($254,000) components. These values serve as a dependable foundation for land rent sustainability. This reliability is further bolstered when considering alternative approaches, such as the cost of production, as we show in the next exercise.

4.2 SLR estimation based on CSA

When the data from the market are poor regarding price and income, the cost method can be used to estimate property prices. Unlike property valuation which considers both land and improvements, the cost method applies only to the structural portion of the property and is not applicable to land. The cost approach provides a current value approximation by using replacement (or reproduction) cost data available on the market at the time of evaluation. It is objective and more reliable when the building component of the property has not experienced significant depreciation and if the land is used optimally, as estimated by other methods mentioned in this paper.

The cost approach is considered less subjective than the sales comparison and the income capitalization approach because it is based on new costs, such they exist on the market at the time of the evaluation as opposed to historical or speculative assessments of future incomes and expenses. Consequently, it requires less personal interpretations from the analyst. While the cost method relies on possibly unique characteristics of the property, it uses cost averages for each item of direct and undirect costs available on the market for each characteristic.

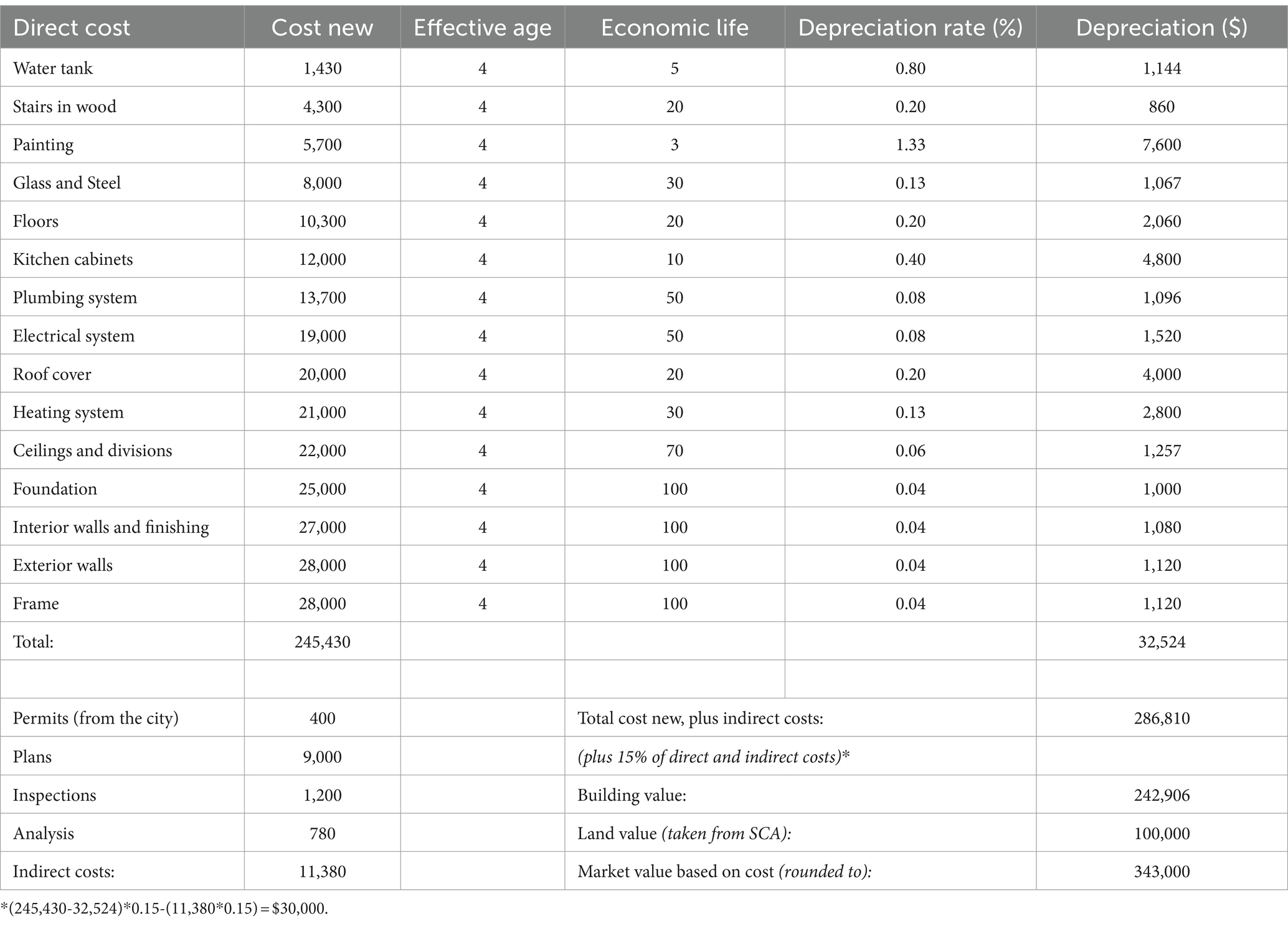

The CSA was used to estimate the structural components of the subject property as shown in Table 2. The cost of production of all the components and the indirect charges were summed to $286,810 (including the interests for the payment of the capital, the profit of the entrepreneur, and the labor cost as the components are installed). Since the property was not newly built, linear depreciation was calculated for each structural component based on its effective age and total economic life. The sum of direct cost depreciation was $32,524, to which $11,380 of indirect costs were added to derive a market value of $242,906 for the building component using the CSA. Since the CSA cannot estimate the land market value, the previous estimate of $100,000 from the SCA was used. The total estimate for the subject property was $343,000.

The CSA was utilized to determine the structural components of the subject property, as detailed in Table 2. The combined cost of all components and indirect charges amounted to $286,810, which includes interest on capital payment, entrepreneur profit, and labor costs for component installation. Given that the property wasn’t newly constructed, linear depreciation was calculated for each structural component based on its effective age and overall economic lifespan. The direct cost depreciation totaled $32,524, and when combined with $11,380 of indirect costs, resulted in a building component market value of $242,906 using the CSA. As the CSA does not provide a land market value estimate, the $100,000 value from the SCA was adopted, bringing the total property estimate to $343,000. The CSA offers a direct focus on the subject property and its cost components, without the need for comparisons with similar properties. It requires a thorough understanding of product agents and their individual costs to determine the separate building cost. This capital cost, built atop the land, can either generate income from property sales or yield cyclical rents if the property is exploited. If sold, the separate land value can be discerned by subtracting the building’s cost from the total price of the same or comparable properties.

In applying the SCA within the framework of SLR, we not only segregate land value from other production factors—labor, capital, and organization—but also distinctly quantify the economic contributions of each. This quantitative segregation allows us to illustrate how “Community and Nature,” representing the land in the context of SLR, are not just passive elements but active contributors whose value must be sustainably managed and reinvested. Each factor’s traditional economic reward—salaries for labor, interest for capital, profits for organization—is reevaluated to reflect contributions toward long-term sustainability. Specifically, the “rent” attributed to land, traditionally considered as the residual in classical economic theory, is recalibrated to acknowledge its role in generating sustainable value. This redefinition challenges the traditional mobility of economic benefits derived from land, advocating instead for their immobility to ensure that gains are retained within local ecosystems and communities that generate them. This approach not only fulfills the empirical requirements but also enhances our understanding of SLR as a mechanism that can effectively capture and redistribute land value in alignment with sustainability goals. By clearly delineating how SLR can be quantified and applied, this section provides a robust foundation for policy-making that leverages land value to support comprehensive social, urban and environmental well-being.

With this CSA, we demonstrate how to measure the separate values for the land and building. Contrary to separating price by attribute utility, we separate by material costs and wages; the remainder constituting a residual rewarding land and determines its value. Elsewhere, the cost provides a second estimate to verify and validate separate estimations, but primarily to consider the decision-making context which differs with cost. Instead of paying separate prices for the land and building, economic agents calculate based on the cost of their realization. This approach acknowledges competing dynamics while also providing a basis for comparison between two methods. In the subsequent approach, we will further expand this comparative foundation and incorporate another context with income.

4.3 SLR estimation based on ICA

Besides SCA and CSA, ICA allows estimates of a property value by factoring in its income generating capability in the future. When assessing these factors, some of the aspects of the property are stable while others are unpredictable. ICA factors in the value that agents place on generated income streams, dividends and earnings from capital. The ICA translates anticipated future benefits into current values through the process of capitalization, which assumes that the value of the utilities in the future will be lower than their current values. The ICA relies on uncertain parameters and derivations from intermediary estimations made by other methods (Hallett, 1979; Rice, 1982; Chavas and Thomas, 1999).

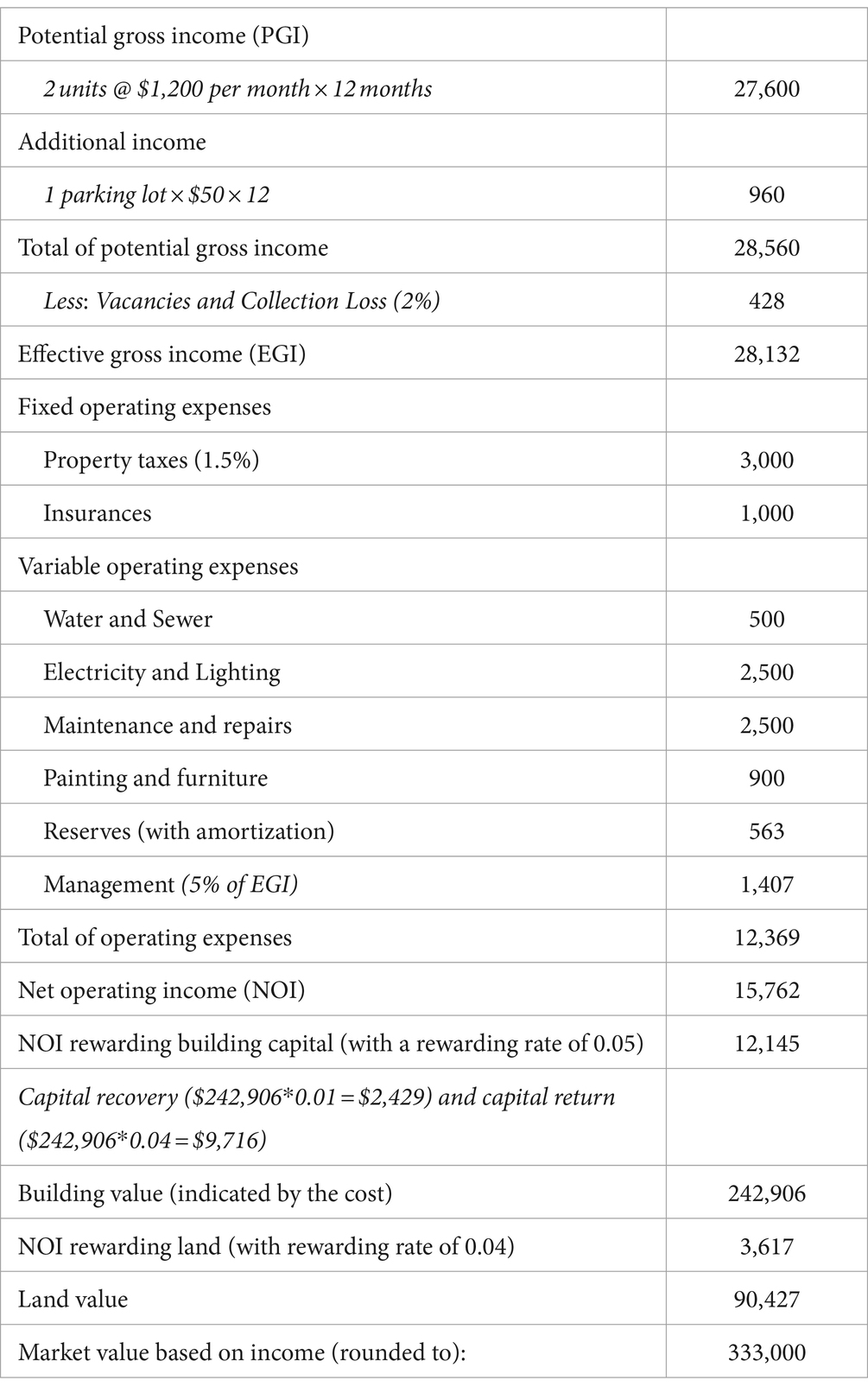

The ICA involves comparing the detailed monthly income and expenses of the subject property to similar income-generating properties in order to adjust and stabilize them on an annual basis. The property in the example is a two-unit cottage, generating an effective gross income of $28,132 and a total operating expense of $12,369 per year. The property’s net operating income (NOI) is $15,762. An analysis of typical ratios of comparable properties NOI over their total sold prices suggests a capitalisation rate of 5% for the subject (including 1% of amortization). At this rate, the periodical return on the building’s capital is $12,145. The difference of $3,617 represents a yearly surplus or land rent, which is used to determine the land value. The capitalization of this rent at the rate of 4% (which does not include amortization) indicates a market value of $90,427 for the land. As shown in Table 3, according to the ICA, the market value of the same subject property is $333,000.

Among the three approaches, the residual rent in the ICA is the most widely used method in real estate appraisal to determine the separate value of land after accounting for other production factors. In the ICA, if the periodic total income is known, it is possible to separate the value of building capital based on its cost of replacement or reproduction and the periodic return on the market as interest. The estimation of the income portion which rewards building capital allows for the derivation of the separate annual surplus that goes to land and determines its total value.

Diverging from traditional price-based value expressed in price and current cost of production insights, the ICA process considers future benefits or disadvantages related to the subject property. Economic agents also weigh future income streams against current ones. Instead of benefitting from the utility attributes of a subject by paying a price or producing the same property by assuming its cost, they might opt for a strategic investment, deferring immediate benefits to capitalize on future contextual factors. This approach highlights the competitive balance between the natural value of land and the value of man-made structures. As observed in previous discussions, value dynamics shift when land rent is converted into interest that rewards capital. While the ICA offers insights, our perspective remains to show additional estimate, on how separate land and building values can be measured.

These three different methods enable the estimation of total values of the same property, as well as the separate valuation of building and land value components. The outcomes also demonstrate that the total value of the property and its separate values change in each approach. Finally, we estimate an average total value (assuming equal reliabilities for the three methods) of $345,000 for the subject property, with portions of $247,000 (72%) for the building and $98,000 for the land (28%).

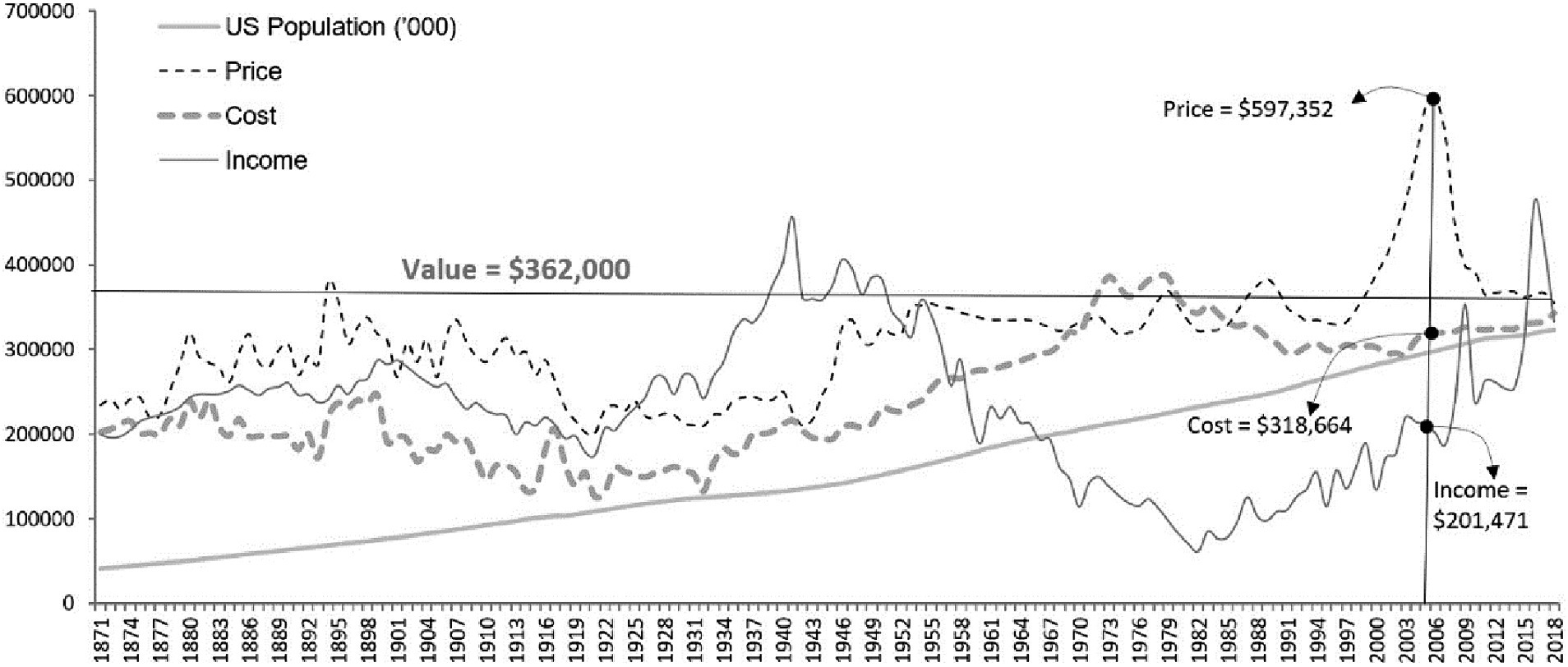

This exercise demonstrates that the measurement of the land value/rent component is related to the attributes considered by their cost (of production factors), their utility in price differentials, and projections of future streams of periodic incomes. Such assessments are linked to PCI, which inform the value of the building component and set a sustainable basis of future value for the land component. When the PCI and their market values are near each other, sustainable content in land value is eliminated, and the ultimate value state is reached. To measure the portion of sustainable basis in comparison to informational PCIs of the same subject property, it is necessary to consider their estimated market values over time, as shown in Figure 3.

We analyzed historical trends in the United States, for a single-family property between 1871 and 2018 made available online by Robert Shiller, a Yale economist and Nobel Prize winner, who used it in his various works such as Irrational Exuberance (Shiller, 2015). Using data starting in 1871, we multiplied the Property Cost Index by a constant value to reach the exact amount of market value estimation based on CSA in 2018. The same process is followed using constant multiplications for the SCA and the ICA. The generalization of results of approximations of market value estimates by three PCI approaches are shown in Figure 3, following their historical evolution over 147 years in the United States, particularly with regard to long-term interest rate which we assumed to be the capitalization rate. However, the constant of transition provides insight into the PCI of the United States housing market. In these historical trends, we would expect PCI values to be similar when considering the same property throughout the entire period, considering that any necessary adjustments are made in Shiller’s data. In fact, if the property is the same and the market is efficient, we would expect the same estimates by PCI approaches, yet this is not the case as shown in Figure 3. Ultimately, PCI levels converge to a steady value state of $362,000 in 2018, reflecting the reference point of constant conversions of expectations in land rent sustainability into the capital building component.

In theory, we would have expected that PCI estimations would converge over time given that the same methodology and property types are used for value estimation. However, significant variations in estimations indicate otherwise, suggesting competitive behavior between PCI. Notably, while price and cost estimations positively correlate with each other, income exhibits a negative correlation. Crucially, PCIs balance to maintain a constant value which is expected for the same property. This inverse relationship which results in PCI fluctuations around constant warrants further investigation. It would be interesting to assess how these values fluctuate over time and what determines value convergence. Such nuanced insights might have been overlooked had we only considered standalone valuations from a specific time frame.

The longitudinal analysis illustrated in Figure 3 goes beyond a mere temporal comparison of property cost indices (PCIs) by providing a critical perspective on the appreciation of land value as it corresponds to demographic and economic shifts. As we observe the population growth trajectory, we discern a correlative uptrend in the land component of PCI, reflecting the burgeoning demand for land in the face of finite supply. This appreciative trend substantiates the SLR concept, underscoring land’s escalating contribution to property valuation amidst advancing urbanization. Concurrently, the depreciative arc of building value, weighed down by physical depreciation and technological advancements in construction, highlights the contrasting dynamics between land and built structures. The dichotomy presented in this figure reinforces the argument for distinguishing land value in property assessments and showcases the vital role of land as a perpetually renewable source of communal wealth, validating the pertinence of SLR in urban sustainability narratives.

Moreover, Figure 3 elucidates the competitive interplay between various PCI estimations, contradicting the expectation of convergence over an extended temporal scope. The discrete behaviors of price, cost, and income components challenge the notion of an efficient market’s homogenous response to a constant property. This divergence emphasizes the resilience and dynamic nature of land value, capturing the essence of SLR as a critical economic factor that transcends mere physical attributes, tapping into the core of sustainability and value creation. The strategic significance of this finding lies in its affirmation of land’s inherent capacity for value retention and growth, solidifying its position as a foundation for equitable taxation and sustainable development funding. By accentuating the mutable and enduring attributes of land rent within the broader context of property valuation, this analysis champions a reinvigorated understanding of SLR—both as a theoretical construct and as a practical apparatus for fostering sustainable urban futures in an era where spatial economics intersects with ecological and societal imperatives.

In operationalizing SLR, this paper has demonstrated the application of the PCI methodology across three distinct evaluations, providing comparative insights into the separable valuation of land and improvements for a single property. This not only challenges traditional perceptions of inseparability between land and building values but also sets a precedent for transparent valuation applicable to various property types beyond residential housing. Each methodological approach—tailored to specific property classes such as industrial, commercial, and institutional—enhances our ability to universally apply these valuations, ensuring that SLR’s potential is fully realized across the real estate spectrum. While the focus here is on a single-family residence for illustrative simplicity, the methodologies employed are adaptable and scalable, offering robust tools for assessing SLR in diverse property markets.

This section has demonstrated methodologies for distinctly evaluating the value contributions of improvements and land, specifically the SLR. With these valuation techniques, policymakers and urban planners now have the tools to objectively ascertain the economic basis of land and improvements. This knowledge is crucial for devising equitable strategies for redistributing land-derived wealth, particularly in addressing pressing community needs such as social housing and environmental restoration. While this provides a framework for potential fiscal policies and collaborative efforts with private entities, the actual implementation of such strategies would require careful negotiation and adaptation to local contexts. The decision on the allocation of SLR, whether fully or partially reinvested into community and environmental sustenance, involves complex political debates and technical assessments. These discussions, while essential, extend beyond the scope of this paper and suggest a rich avenue for future research. The nuances of these processes vary significantly across different administrative and cultural contexts, indicating the need for region-specific adaptations of the proposed methodologies.

5 Conclusion

In this study, we have systematically explored and elucidated the concept of SLR while rigorously demonstrating its applicability within existing frameworks for property evaluation. Our comprehensive examination of SLR’s core principles—its distinction from conventional agents of production, its sustainability credentials, and its quantifiable impacts—has introduced methodological innovations that underscore the role of SLR in promoting equitable distribution of resources. Through a detailed analysis of the intricacies of land valuation debates, this research has not only validated the separability and operational viability of SLR but also underscored its potential to catalyze a significant transformation in real estate development and urbanization strategies.

Our study underscores the distinct evaluability and sustainability of SLR within North America’s established property evaluation system and demonstrates its operational feasibility through empirical analysis. Employing a nuanced triadic PCI methodological framework, it highlights the practical applicability and substantial benefits of SLR’s separability. Each PCI approach, uniquely adapted, enables not just separate valuations for diverse property types but also supports a comprehensive understanding of SLR’s potential to advance sustainability goals and address community needs, including efforts toward the restoration and conservation of natural environments impacted by developments.

Building upon our foundational exploration of SLR, we demonstrate its nuanced application within contemporary real estate and urban development contexts. Exploring practical mechanisms for operationalizing SLR, our analysis extends beyond theoretical underpinnings to highlight its implications for sustainable, real-world developments. By examining how traditional land rent concepts transform into a model that values land as a dynamic asset, we emphasize the critical role of strategic SLR integration in shaping long-term development strategies. This focus becomes increasingly pertinent given the ongoing impacts of new technologies and digitization efforts in the field.