- Research Group Business Innovation, Fontys University of Applied Sciences, Venlo, Netherlands

Circular business models have been developed in recent years, driven by concerns over environmental sustainability. The circular business models are initially tested domestically, but businesses may aspire to expand internationally with it. However, entering foreign markets with circular business models, which include novel products and innovative services, may be challenging. Moreover, generalized foreign market entry criteria for circular business models are lacking. This in-depth case study utilized a mixed-method approach to shed light on the tactical adaptations businesses need to make in their circular business model when entering foreign markets while also ensuring economic competitiveness. The case includes foreign market entry with a circular “service" business model; therefore, we emphasized the customer side of the business model canvas related to customer relationships. In our conclusion, we identify five tactical adaptations, namely implementing a co-creation tool for customization, offering tangible customized benefits, increasing investment in social media marketing, utilizing start-up incubators/accelerators/co-working spaces as a marketing channel and offering adjustable contract lengths. Foreign markets with circular business models and involving the value network partners of the business are also expected to expand the positive externalities of circular economy internationally.

1 Introduction

Concerns over environmental sustainability and the diminishing availability of natural resources catalyzed the emergence of a circular economic concept to minimize waste and externalities by reusing, refurbishing, and recycling resources and products (Kirchherr et al., 2017). A circular economy typically involves the redesign of commodities, practices, or systems to establish a closed-loop system that maximizes resource longevity (Arruda et al., 2021). This transition from a linear to a circular economy necessitates new business models (Lieder et al., 2018) that encompass strategies for slowing (e.g., access-based models and product life extension) and closing (e.g., resource and value extension and industrial symbiosis) resource loops (Bocken et al., 2016). In other words, circular business models (CBMs) focus on resource cycling, extension, intensification, and dematerialization to reduce resource inputs and waste leakage (Geissdoerfer et al., 2020). CBMs aim to rejuvenate materials, preserve resource value, and help redefine natural ecosystems while decreasing waste and pollution (Sehnem et al., 2022). Nevertheless, benefits of adopting circular economy practices in their business models are not always apparent to managers. Rosa et al. (2019a) aim to clarify these benefits for companies, highlighting not only the environmental but also the economic and social ones. Urbinati et al. (2020) explain the managerial practices for circularity and how they can support the design of their business models. A variety of CBMs and associated earning models can be designed as per the strategic goals of the businesses.

Rosa et al. (2019b) identified Product Service Systems (PSS), which combine services with tangible goods, as the predominant archetypes for a CBM. PSS are categorized into three types: product-oriented (servicing, maintenance), use-oriented (leasing, renting, sharing), and result-oriented (user pays per service) (Tukker, 2004). Tukker (2015) highlighted the potential of use- and result-oriented business models in facilitating the transition to a circular economy, while product-oriented models still prioritize product sales. Although PSS can simultaneously offer a customer-centric value proposition, environmental benefits, and economic profitability (Tukker and Tischner, 2006; Bocken et al., 2016; Geissdoerfer et al., 2020), it still requires a deep understanding of customer demands and preferences. Therefore, while the product remains significant, the customer experience is essential to the value proposition in the PSS (Bocken et al., 2014).

The adoption process of PSS in businesses, termed as “servitization”, is later on complemented by the emergence of models such as Product-as-a-Service (PaaS). PaaS has emerged as an alternative to traditional product ownership, where customers access items through payment rather than ownership, promoting resource preservation and value integration (Nußholz, 2017; Kjaer et al., 2018). PaaS emphasizes delivering value through product performance over ownership through services such as maintenance, repair, and improvements across the product's lifecycle, thereby contributing to circularity and balancing the client's and the business's incentives (Lacy and Rutqvist, 2015). In addition to resource efficiency and waste reduction, PaaS can stimulate sustainable economic growth, leading to the development of diverse methodologies for environmental enhancements of PSS (Tukker and Tischner, 2006; Pieroni et al., 2020; Brissaud et al., 2022). Circular supply chains, in the end, contribute to sustainable development (Montag et al., 2021).

Despite the perceived benefits, transition from linear business model to CBM is a challenging task and requires the collaboration of all stakeholders involved. Lewandowski (2016) suggests that for a successful transition, companies must align three key aspects: “the fit between value proposition and customer segments, the balance between cost structure and revenue streams, and the adjustments made by the company to embrace more CBMs along with necessary adaptation factors”. On the other hand, researchers have also highlighted especially the role of customers when transitioning toward a CBM (Kahraman and Kazançoğlu, 2019; Calvo-Porral and Lévy-Mangin, 2020; Chen et al., 2020). In this context, such a transition requires catering to customers' specific needs, and not just offering circular-driven products (Hankammer et al., 2019). This in essence means a shift in the relationship structure between the businesses and customers (Urbinati et al., 2017). This shift becomes more important in PSS, where the service component in the CBM is more emphasized. Moreover, such a shift becomes more challenging when working with customers in foreign markets.

Although substantial research has focused on CBM strategies in domestic contexts, there is a lack of understanding regarding their implementation and adaptation in foreign markets. Foreign market entry for businesses imply that, the companies expand into the other markets relying on the success of their original business models in the domestic context and they aim to use the same business model in foreign markets (Winter and Szulanski, 2001; Rogers, 2003; Han et al., 2022). However, research indicates that upon entry into foreign markets the original business models constantly evolve in line with the needs of the local business environment (Dunford et al., 2010; Ahlgren Ode and Lagerstedt Wadin, 2019). Therefore, although foreign market entry with CBMs presents opportunities for sustainability, differentiation, and relationship-based approaches to international trade (Bolton et al., 2007; Ostrom et al., 2010); entering foreign markets with CBMs also poses unique challenges and necessitates tactical adaptations (TA) (Ahlgren Ode and Lagerstedt Wadin, 2019) to the local needs.

In this regard, this paper is organized as follows: we initially introduce the Furniture-as-a-Service business model, to be subsequently examined within our case study as a distinct type of CBM with the objective of entering into international markets. Since this is a service oriented CBM (more specifically a PSS), we focus on the fit between value proposition and customer segments. Afterwards, we discuss foreign market entry with CBMs. Our aim here is to identify research that explores the developing landscape of international trade, emphasizing the shift from transaction-based to relationship-based models, where effective relationship management, interdependence, and advanced servitization become crucial for successful foreign market entry. After introducing and analysing our case study, we conclude with implications for foreign market entry with CBMs.

1.1 Furniture-as-a-Service (FaaS)

FaaS is a service-oriented CBM where furniture is leased or rented, often including maintenance and repair services. FaaS providers aim to shift ownership and maintenance responsibility from customers to themselves. This in turn, contributes to circularity, customer-centricity, and B2B services (Rosman, 2018). Besch (2005) suggested FaaS as a suitable choice for office furniture, improving user experience, resource efficiency, and environmental impact. Most of the environmental impact of furniture stems from its production and material sourcing, making it a logical path to extend its lifespan (Cordella and Hidalgo, 2016; Lingegård and von Oelreich, 2023). Furthermore, Bhattacharya and Bhattacharya (2021) included FaaS as a subtype of the broader Everything-as-a-Service (XaaS) model, offering flexibility and cost-effectiveness. While the eco-friendly furniture market is expected to grow at an 8.6% CAGR globally (Grand View Research, 2022), the FaaS market witnessed a remarkable 48.2% growth from 2019 to 2020 and is projected to reach $139.05 billion by 2029 at a 9.6% CAGR (Insights, 2023).

Start-ups frequently struggle with financing issues because they lack sufficient funding for initial investments. With no long-term ownership obligations, leasing furniture through a FaaS provider minimizes cash invested in assets. This allows start-ups to direct their limited financial resources toward other strategic business costs with the added flexibility for ad hoc office configurations, staff sizes, and location changes. Moreover, furniture leasing enables experimenting with diverse designs, layouts, and styles, creating a distinctive and dynamic office space representing brand identity and corporate culture. Start-ups are also considered more open to innovation and innovative services or products (Spender et al., 2017).

1.2 Foreign market entry with CBMs

To transition toward a sustainable global economy, companies must innovate in ways that they offer value while addressing environmental and social issues (DeWeerdt, 2022; King, 2022; Syberg, 2022). Global sustainability challenges necessitate that companies not only develop innovative business models domestically but also adapt and implement these models internationally (Tallman et al., 2018). Although research has expanded on sustainable business model innovations within domestic markets (Foss and Saebi, 2017; Geissdoerfer et al., 2018; Shakeel et al., 2020) and on the internationalization of business model innovation (von Delft et al., 2019), there's a gap in studies that link these areas to explore sustainable business model innovation in a global context (Ostrom et al., 2010; Josephson et al., 2015; Gölgeci et al., 2021). The circular economy represents a key area of sustainable business model innovation with potential for multinational application. While international business research has thoroughly examined the standardization and adaptation of international business strategies across borders (Zou and Cavusgil, 2002; Dow, 2006), it has seldom considered these aspects in relation to sustainability and CBMs.

On the other hand, international trade is evolving from being financial transaction-based to being relationship-based (Obadia and Vida, 2011). In this context, it is also important to note that CBMs emphasize the importance of customer relationships toward becoming co-creational. According to the multinational theory (Buckley and Casson, 1985, 2003; Hennart, 2001), the co-creational relationship becomes efficient only when there is substantial pre-established interdependence between manufacturers and foreign customers. Such interdependence, nourished by effective relationship management, may lead to advanced servitization. Therefore, advanced servitization providers must prioritize gaining their foreign customers' attention, trust, and loyalty when aiming for international expansion (Vaillant et al., 2018; Sjödin et al., 2020; Vendrell-Herrero et al., 2021).

The factors influencing internationa l market entry with CBMs and the associated TAs remain novel topics requiring exploration (Isaksson et al., 2009; Ritzén and Sandström, 2017; Ranta et al., 2018). Large multinational enterprises (MNEs) traditionally dominated global import and export markets, while small and medium-sized enterprises (SMEs) served local markets. Although historically, there have been mixed views on whether foreign trade activities, especially through MNEs, have positive or negative impacts, especially in developing countries (Oetzel and Doh, 2009), recently, there has been a shift toward minimizing negative externalities and accentuating positive ones. Therefore, entering into foreign markets with CBMs can provide such an opportunity. Entry into foreign markets can be challenging also because the differences in home and host institutions (Zhang, 2022). Additionally, in international markets, SMEs require adaptable production systems to manage the challenges of foreign environments (Hewitt-Dundas, 2006). In this regard, technological advancements and lower trade barriers have created opportunities for SMEs to compete effectively in international markets (Dabić et al., 2019).

To effectively compete in foreign markets, the concepts of servitization and PSS have been studied to ascertain whether they provide the requisite flexibility for SMEs. Numerous studies have examined the impact of servitization on export performance, consistently showing the quality-enhancing effect of services. For instance, Ariu et al. (2020) showed that providing services enhanced the perceived quality of the goods, enhancing demand and export values in a “bi-exporting" model that involves selling both products and services abroad. Similarly, Aquilante and Vendrell-Herrero (2021) demonstrated that offering integrated solutions of goods and services positively correlated with export intensity, defying prior expectations that smaller firms would struggle with export entry. Additionally, Dachs et al. (2013) showed a high degree of servitization in smaller firms, indicating that smaller companies leverage their flexibility to serve a select group of key customers, potentially overcoming internationalization constraints. These findings indicate that entering into foreign markets with CBMs have the potential to succeed given the right fit between value proposition and customers segments is achieved.

1.3 Research questions

While CBMs have the potential to expand the environmental and economic externalities of circularity internationally, launching CBMs in other countries can be challenging and requires TA for sustaining better relationships with foreign customers (Bolton et al., 2007; Campbell et al., 2011; Ahlgren Ode and Lagerstedt Wadin, 2019). Therefore, this in depth single case study was designed to answer the following research questions related to a primarily domestic FaaS provider from Northern Europe (hereafter referred to as “EcoTech") that aspires to enter the German B2B market:

Main RQ: What are the TAs that need to be made to the customer side of the CBMs upon entry into foreign markets?

RQ-1: What are the strengths and opportunities of domestic FaaS business model?

RQ-2: What is the ideal customer/target group in the German B2B market that would enable a successful foreign market entry with the FaaS business model?

RQ-3: What are the preferences and expectations of the ideal German customer/target group for FaaS businesses, and how do they differ from current FaaS business model?

RQ-4: What TAs must be made to meet the ideal customers'/target group's expectations and preferences enabling successful foreign market entry, and how can the TAs be prioritized?

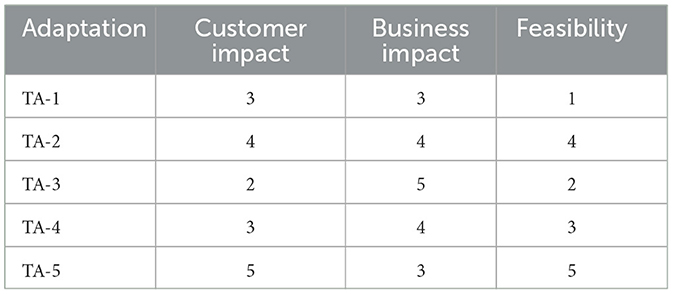

As depicted in Figure 1, the gap-analysis was chosen as an overarching and guiding research framework for this particular research. We aim to identify and close gaps at every research question (RQ), which in the end will lead to answering the main research question (MRQ). The first step of the gap-analysis leading to RQ1, is the analysis of the current state and is tackled by the identification of EcoTech's current FaaS business model. This was achieved by interviewing EcoTech's executives. The next step leading to RQ2, is the analysis of the desired state and is attained by conducting a survey, aimed at obtaining data on the likelihood of different types of companies considering furniture leasing. Utilizing this data ensured the correct identification of interview partners for RQ3, which was about gaining insights on the ideal customer's/target group's preferences and expectations concerning furniture leasing. Finally, the gaps between the current state and desired state were identified and closed by comparing the current business model with the expectations and preferences of the ideal customer/target group, which is embedded in the third step of the gap-analysis. This resulted in detailed recommendations for changes and improvements, that need to be made in the customer side of a CBM in order to successfully introduce its services in the German B2B market.

Figure 1. Illustration of the research framework. Adapted from Gap Analysis by Kim and Ji (2018).

While existing literature on CBMs remains primarily conceptual, this empirical study provides valuable insights into the practical implementation of CBMs in an international context.

2 Methodology

2.1 Case study

EcoTech specializes in crafting coatings and finished products using recycled materials like cork, leather, sandblasting waste, and flooring remnants. Their commitment to reducing ecological footprint starts at the design phase by sourcing local waste materials. EcoTech envisions a sustainable, circular economy with materials designed for repair, refurbishment, and recycling. To achieve this vision, the company creates highly adaptable solutions for application, form, and waste material utilization, aligning with various Sustainable Development Goals (SDGs), notably “responsible consumption and production" and “partnerships for the goals." EcoTech shares its technological expertise with global licensees through a partnership model encompassing training, consulting, machinery, and materials.

Additionally, the company has tested the potential of a FaaS business model on a small scale at the domestic level. It aims to have large-scale international partnerships, especially in emerging economies, collaborate with companies and brands worldwide, and make the knowledge and innovations available under licenses and franchising. Upon successful testing phase, EcoTech plans to expand its model into the larger German B2B market.

2.2 Gap analysis

We used an exploratory sequential multi-phase mixed-method approach (Creswell and Clark, 2017). This research design can help obtain a more comprehensive picture with greater generalizability, contextualization, and credibility than a solitary quantitative or qualitative investigation. Gap analysis (Jennings, 2000) was chosen as the guiding research framework for achieving a systemic research approach in three stages, as shown in Figure 1.

In an exploratory sequential multi-phase mixed-method design, the qualitative component precedes the quantitative component, to help explain or elaborate on the results found in the previous stage. Exploratory research is often used when the issue studied is new and requires initial exploration. In our research, we wanted to explore the FaaS concept before validating it, which would enable us have “greater versatility in discovering novel ideas” in the later stages, as also suggested by Gogo and Musonda (2022). Therefore, the inputs from the initial qualitative data collection led to exploring EcoTech's current FaaS business model and in turn is followed by quantitative data collection to test and verify relationships found through qualitative data collection phase. These relationships are later on tested and verified at a larger sample in the target country. In the end, findings of the quantitative phase were verified with qualitative data collection through interviews with start-ups. In each phase, we aimed at closing the gaps identified, toward answering the MRQ in the end.

2.2.1 Assessing EcoTech's current FaaS business model

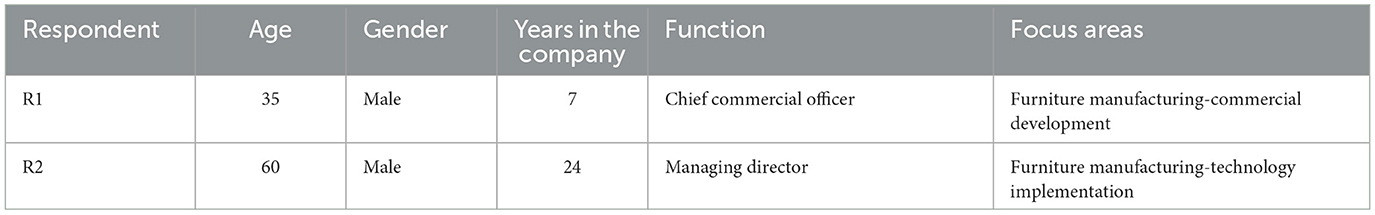

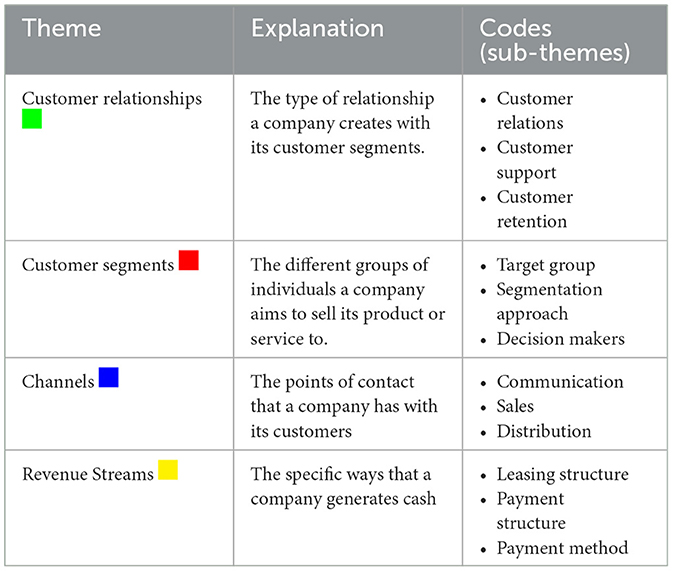

EcoTech's current domestic FaaS business model was identified by interviewing its executives (Table 1). The interviews with the executives were analyzed using the four-step deductive thematic analysis approach as reported by Malterud (2012) using Atlas.ti. Briefly, preliminary themes were established in the first step (“total impression"), followed by coding the interview under the previously identified themes (“identifying and sorting meaning units"). The final two steps involved contextualizing (“condensation") and summarizing (“synthesizing") the data into a coherent overview to ensure a correct interpretation.

The Business Model Canvas (BMC) is commonly used for analyzing the value proposition of businesses, including CBMs (Rosa et al., 2019b), and was used as a guiding framework for assessing the interviews. BMC is a strategic management tool that helps improve, develop, test, and communicate a company's business model (Osterwalder and Pigneur, 2010) and allows for a direct comparison between the current and desired state of the business model. It comprises nine building elements: customer segments, value propositions, channels, revenue streams, resources, activities, partnerships, cost structure, and customer connections.

BMC conceptualizations highlight that marketable eco-innovations, sustainable development barriers, and marketing eco-innovations affect elements on the left side of the canvas (partnerships, activities, resources) and the customer value on the right side (customer relationships, customer segments, channels, and revenue streams) (Lewandowski, 2016). Circular value proposition design requires an adaptation of and alignment with customer segments, tailoring the PSS to the needs and requirements of different (foreign) markets. For instance, distribution channels in CBMs can be adapted through virtualization, allowing businesses to offer customizable solutions virtually or through direct sales, promoting circularity (Lewandowski, 2016). Similarly, revenue streams, whether through product, use, or result-oriented, will also change upon entry into foreign markets. This research focuses on the customer-centric right-hand side components of the BMC (Chungyalpa, 2022) to align with foreign market entry priorities.

2.2.2 Ideal customer profile

Although businesses have increasingly considered leasing furniture, firmographic variables influencing a company's choice to lease furniture rather than purchase it outright are poorly understood. Therefore, we designed a survey of B2B companies in Germany to identify the types of companies most likely to consider furniture leasing. The survey was pilot tested in a group of volunteers to ensure validity. A sample of 76 companies have responded to the survey.

Company-related variables in the survey included (Q1) the number of years in operation, (Q2) the number of employees, (Q3) industry type, (Q4) financial position, (Q5) ownership type, (Q6) work culture, (Q7) location, (Q8) annual revenue, (Q9) who makes the purchasing decisions for furniture, (Q10) sustainability policy, (Q11) whether the company publishes a CSR/sustainability report, (Q12) the importance of sustainability when choosing furniture for the company, (Q13) whether the term “circular economy" is used in the organization, and (Q14) whether the organization publishes formal reports on organizational circular economy performance aspects.

The responses were measured on a five-point Likert scale. A Chi-Square test followed by ordinal logistic regression was performed to determine potential correlations between the decision or willingness to lease furniture and various company-related variables using Statistical Package for Social Sciences Software (Version 17.0, SPSS Inc, Chicago, IL, USA).

Businesses utilize ICP to determine the type of customer who will profit most from and buy their goods or services and establish customized business models suited to their ideal customers' requirements (Ekbote, 2017). In this study, the ICP was utilized to summarize the survey data. This approach ensures the establishment of a comprehensive customer profile containing the characteristics of a company most likely to pursue furniture leasing in Germany.

2.2.3 Preferences and expectations of potential customers

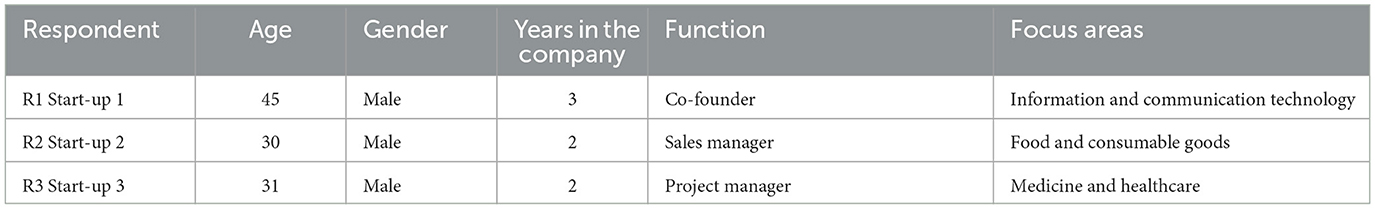

The survey data also informed the identification of participants for customer discovery interviews (CDI) for gaining insights into the ideal customers/target group's preferences and expectations from an FaaS provider (Table 2).

The same methodology was used to analyze CDI and the interviews with EcoTech's representatives to directly compare the current business model with the expectations and preferences of the ideal customer/target group. Strengths, opportunities, aspirations, and results (SOAR) analysis (Stavros, 2013) was utilized to evaluate the preferences or expectations of the target group identification and identify the TAs EcoTech should make relative to its strengths, opportunities, and gaps to successfully introduce its CBM in the German B2B market.

2.3 Analytical hierarchy process

AHP is a decision-making model that assists in determining the best option from several possibilities based on a set of criteria. The AHP paradigm structures a complicated decision issue into a hierarchy and divides it into smaller, more manageable sections (Saaty, 1990). This study utilized a six-step AHP model to prioritize the TAs, allowing EcoTech to allocate its limited resources to the most beneficial changes. These steps include “Problem Structuring (1) defining the decision problem and goal, (2) identification of alternatives, (3) identification of the decision criteria; AHP utilization (4) judge relative importance of the decision criteria, (5) judge the relative value of the alternatives on each of the decision criteria; Analysis (6) calculating the weights of the criteria and priorities of the alternatives by group aggregation of judgements” (Kip et al., 2019).

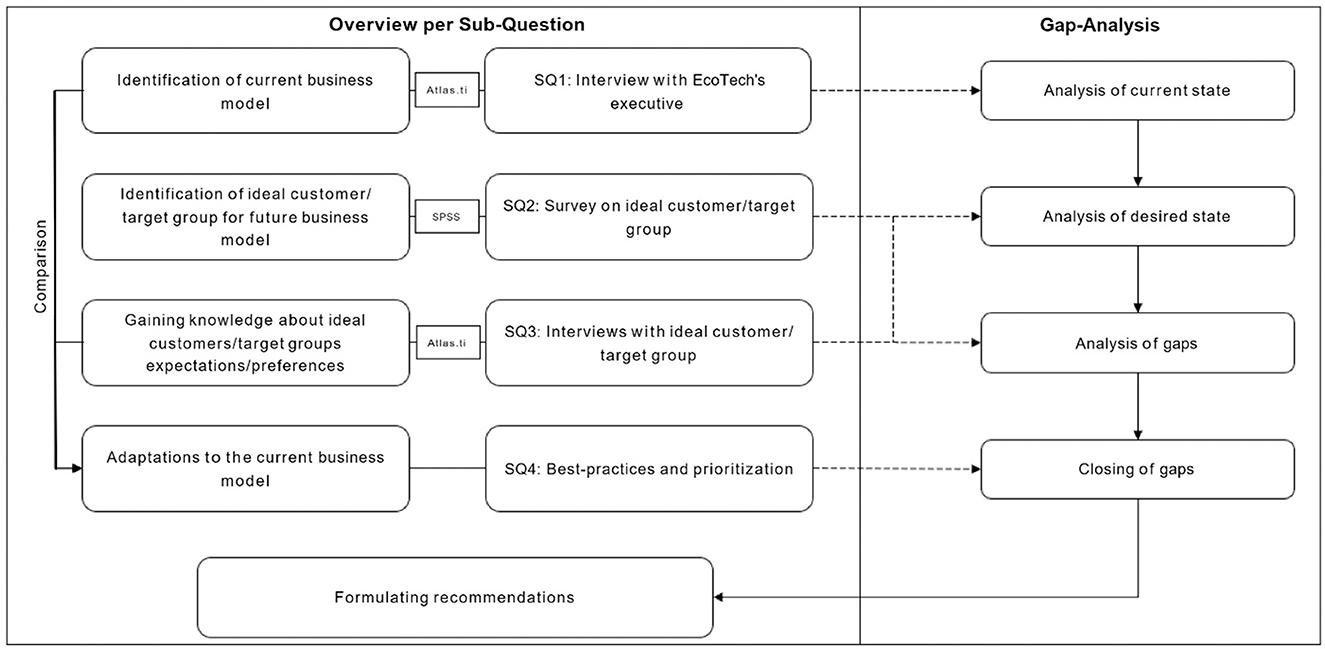

Five TAs (TA-1 to TA-5) were identified in this study, which were weighted based on a score from one (low) to five (high) depending on their relative importance with three criteria: customer impact (value for the customer), business impact (economic impact for EcoTech), and feasibility (considering practical aspects like cost, time, and resources).

Customer impact was considered the most important due to the high dependence of a successful entry into the German B2B market on the customers and was allocated the maximum score of five. Business impact was assigned a score of four because while creating customer impact, the adaptations should still deliver a positive economic result for EcoTech. Lastly, the feasibility of the adaptations was assigned a score of three, as EcoTech is still a young enterprise with limited human resources and financial capabilities. Similarly, the alternatives' relative value on each decision criterion was scored from one to five. Next, the criteria are weighted and normalized according to their importance. This is done by dividing a criterion's individual previously assigned relative importance by the sum of the total importance of all the criteria: Customer Impact: 5/(5 + 4 + 3) = 0.4167; Business Impact: 4/(5 + 4 + 3) = 0.333; Feasibility = 3/ (5 + 4 + 3) = 0.25. Finally, the weighted score for each alternative is calculated by multiplying each adaptation's score for a criterion by the weight of that criterion and then summing these for every adaptation.

3 Main findings and analysis

3.1 Current FaaS business nodel

Interviews with EcoTech's executives yielded four preliminary themes, each with three sub-themes (Table 3).

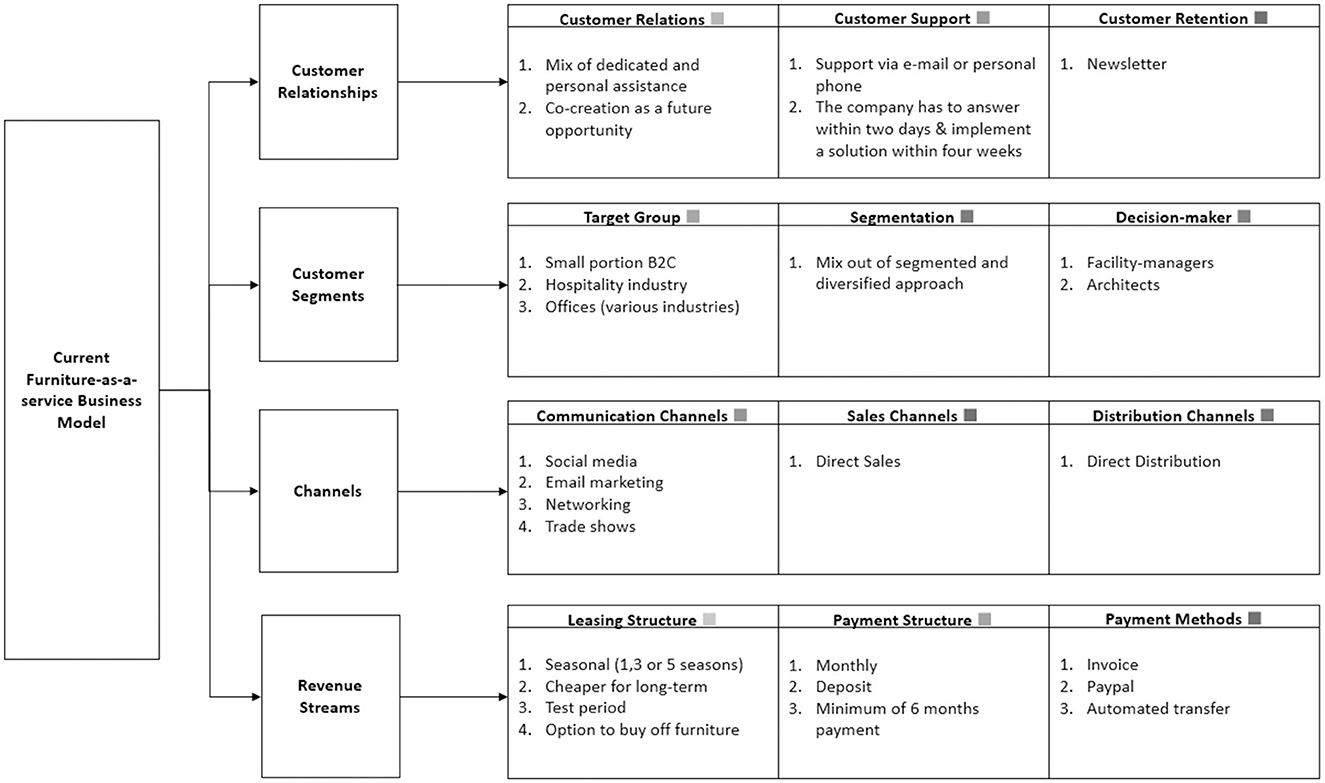

3.1.1 Theme 1: customer relationships

EcoTech prioritizes dedicated and personal customer relationships due to the uniqueness and innovation of its products and materials in the furniture market. Instead of self-service or automation, sales associates guide customers through the entire process, emphasizing a customized strategy to explain the rationale behind their products and leasing model. While not currently implemented, the company executive suggests that a co-creation approach could be a future opportunity, allowing customers to use a configurator to create their furniture using EcoTech's adaptable technology.

Customer support is provided through phone or email, with a commitment to respond within two days and resolve issues within four weeks. Although no designated hotline exists, customers can still contact a centralized number for customer support.

Customer retention measures are limited, but the company employs a take-back approach to monitor and maintain furniture to extend its lifespan, aligning with CBM principles of resource conservation.

3.1.2 Theme 2: customer segments

EcoTech primarily serves the hospitality industry, including restaurants, hotels, and pubs. They also cater to a smaller portion of the B2C and office markets without a specific industry focus. While each customer is individually approached, there are differences in how each segment is addressed. EcoTech offers slightly higher discounts and promotional deals to the hospitality sector to stay competitive. They also participate in segment-specific trade shows for targeted marketing. However, the overall sales approach remains similar across segments. In the domestic market, facility managers are typically the primary decision-makers for B2B purchases, but if an architect is involved, they determine the design decisions.

3.1.3 Theme 3: channels

EcoTech utilizes various communication platforms, including social media platforms like Instagram, Facebook, and LinkedIn, as well as email marketing, networking, and participation in trade shows such as the Milan fair, facility fair, hospitality fair, independent hotel show, and design fairs. They primarily focus on organic growth through content delivery and collaborations on social media, with a minimal annual budget of ~€1,000 for digital advertising.

Domestically, EcoTech employs both direct sales and direct distribution channels. The company executive highlighted the challenge of marketing the novel concept to traditional industries and distributors. They also handle furniture delivery, using in-house employees and vehicles, allowing adaptability and control over the delivery process.

3.1.4 Theme 4: revenue streams

EcoTech provides lease terms from one to five seasons. Customers who sign long-term contracts are preferred and pay a cheaper predetermined monthly charge. Even if the customer wants to utilize the furniture for a shorter time, a minimum of 6 months' payment is required. Moreover, two month's rent is required as a deposit at the start of the lease, which is refunded if the furniture is returned intact. Customers can opt to buy the furniture entirely, in which case 60% of the lease payment is subtracted from the purchase price. The company invoices its customers monthly, who usually pay through bank transfer. Alternative payment options include PayPal and automated cash transfers.

3.1.5 SOAR interim conclusion—current state

We identified the uniqueness and innovation of products, concepts, and materials as EcoTech's distinctive selling propositions. Additionally, they maintain control over their sales and distribution process. However, there is an opportunity to adopt a co-creation approach that would enable customers to customize their furniture using EcoTech's unique technology. Customer loyalty is important, but only one customer retention measure is currently in place, indicating room for improvement. Furthermore, there is an opportunity for EcoTech to increase advertising to target and attract more potential customers (Figure 2).

3.2 Firmographic factors associated with furniture leasing

The Chi-Square test of association was significant for Q1 [χ2(20) = 82.594, p < 0.001], Q2 [χ2(16) = 74.316, p < 0.001], Q5 [χ2(4) = 13.978, p = 0.007], Q6 [χ2(12) = 32.818, p = 0.001], Q8 [χ2(16) = 74.316, p < 0.001], and Q10 [χ2(4) = 36.933, p< 0.001]. However, ownership (Q5), revenue (Q8), and sustainability report (Q11) were excluded from ordinal logistic regression as they had a beta coefficient of zero and, therefore, do not significantly affect the log-odds of changing the outcome of the analysis (Forthofer et al., 2007).

Only the company's number of years in operation had a statistically significant predictive effect on whether it would prefer leasing furniture over purchasing [χ2(4) = 11.564, p = 0.021]. Specifically, companies that had been in operation for less than a year were 75.227 times more likely (95% CI, 1.705–3,319.813) to consider leasing furniture than those in operation for more than 20 years [χ2(1) = 5.00, p = 0.025]. Companies that had been in operation for one to five years were 5.034 times more likely (95% CI, 0.236–107.413) to consider leasing furniture compared to those that had been in operation for more than 20 years [χ2(1) = 1.071, p = 0.301]. Companies that had been in operation for six to ten years were 19.838 times more likely (95% CI, 0.978–402.187) to consider leasing furniture compared to those that had been in operation for more than 20 years [χ2(1) = 3.786, p = 0.052]. Companies that had been in operation for eleven to fifteen years were 0.464 times less likely (95% CI, 0.036–5.935) to consider leasing furniture compared to those that had been in operation for more than 20 years [χ2(1) = 0.349, p = 0.555]. Lastly, companies that had been in operation for sixteen to twenty years were 0.626 times less likely (95% CI, 0.045–8.695) to consider leasing furniture compared to those that had been in operation for more than 20 years [χ2(1) = 0.122, p = 0.727].

On the other hand, the number of employees [χ2(4) = 2.968, p = 0.563], company culture [χ2(3) = 4.729, p = 0.193], company's sustainability policy [χ2(1)=0.205, p = 0.651], and the importance of sustainability in furniture choice [χ2(3) = 0.082, p = 0.994] did not show statistically significant predictive effects on whether the company would consider leasing furniture.

The goodness-of-fit test [χ2(120) = 54.471, p = 1.00] showed that the model fit the observed data well. Furthermore, the final model was able to statistically predict the likelihood of companies considering leasing furniture instead of purchasing beyond the intercept-only model [χ2(16) = 86.104, p< 0.001]. Furthermore, the model exhibited good predictive ability, as indicated by a Nagelkerke R2 value of 0.719, which suggests that the model explains a substantial portion of the variance in the dependent variable.

3.3 The ideal customer

Companies that have been in operation between 1 and 3 years, with annual revenue of €50,000 to €500,000, up to 18 employees, dealing with information and communication technology, medicine and healthcare, or food and consumable goods, and located in Berlin, Munich, Hamburg, or Cologne were most likely to be the customer for EcoTech's FaaS model. Additionally, we identified C-level management of the ideal customer company as the likely decision-maker for furniture leasing.

This aligns with the profile of typical German start-ups, located mostly in Berlin, Munich, Hamburg, and Cologne, which are three years old on average, with 18 employees, and the highest percentage (32.2%) in the revenue range of €50,000 to €500,000 (Kollmann et al., 2020). Most revenue is generated in the B2B sector (71.5%) and locally in Germany (79.7%). Moreover, roughly 30% of German start-ups are active in the information and communication technology industry, followed by the medicine and healthcare sector (10.6%) and food and consumable goods (10.2%). However, start-ups do not have roles like procurement managers or facility managers due to the low headcount, and the CEO is typically the primary decision-maker unless the business has already established VPs or has co-founders in the particular segment one is selling into (such as a CTO for the product or a CMO for marketing).

3.3.1 SOAR interim conclusion—desired state

This analysis indicates that start-ups are more open to innovation and innovative services, which aligns with the previously identified strength of EcoTech's highly distinctive and innovative products, concepts, and materials and its ideal customer profile in the German B2B market. Given that young enterprises were most likely to pursue furniture leasing in our survey, we identified focusing on start-ups in the German B2B market as the opportunity. Ideally, C-level management should be targeted for purchasing, as they were identified as the decision-makers while constructing the ICP.

3.4 The ideal customers' preferences and expectations

Start-up representatives expressed the need for a dedicated hotline, live chat, chatbots, or troubleshooting guides for customer support during CDI. Moreover, start-up representatives highly value personalized benefits like loyalty programs or customized discounts for customer retention. EcoTech's current business model lacks such customer support and retention strategies. However, the start-up representatives favorably viewed EcoTech's personalized assistance by having sales associates guide customers through the entire process over self-service or automation. The idea of a customization feature for furniture was also well-received, as personalization is considered necessary in the furniture leasing process for accommodating unique start-up needs.

Regarding customer segments, EcoTech currently targets B2C hospitality businesses. However, start-up representatives indicate that the flexibility and cash flow benefits of furniture leasing make it an attractive solution for their office spaces. Facility managers and architects were identified as key decision-makers in the furniture leasing process for EcoTech's current model. When entering the German market and targeting start-ups, the executives suggested focusing on C-level management, as they have the ultimate procurement decision-making power. One interviewee mentioned the involvement of the entire start-up team in the decision-making process due to flat hierarchies. EcoTech's segmentation approach is described as a mix of segmented and diversified, considering the varied needs of start-ups based on factors like size and growth. The start-up representatives highly valued the sustainable and circular vision of EcoTech, providing a competitive edge in their target segment.

Regarding the communication channels, EcoTech current focus on social media is primarily on organic growth through content delivery and collaborations, with a limited annual budget for advertising. However, start-up representatives revealed their preference for social media, particularly LinkedIn in the B2B sector, and tradeshows over networking or email marketing, which they deemed unnecessary. The interviews also uncovered a new communication channel through marketing to start-up incubators, accelerators, or co-working spaces, as these are crucial starting points for German start-ups and an opportunity to build relationships with key stakeholders. The data from the interviews supported the effectiveness of both direct sales and direct distribution, which provide a personalized and tailored approach that resonates with start-ups, offering flexibility, adaptability, and long-term relationships with leasing providers.

Regarding revenue streams, start-up representatives prefer flexibility and adaptability in a FaaS provider. They value adjustable contract lengths that accommodate a start-up's rapidly changing business environment, growth, and budget limitations. The representatives also support the idea of a test period and price deduction when signing a long-term contract with the provider. Additionally, two out of three representatives found the option of purchasing the furniture from the provider at a discounted price after the leasing duration attractive. German start-ups deem monthly payments ideal as they ensure a consistent cash flow and enable more accurate financial forecasting. The start-up representatives also consider payment options such as invoices, PayPal, or bank transfer to be applicable and convenient.

3.4.1 SOAR interim conclusion—desired state and gaps

The start-up representatives emphasized the sustainability and circularity of products and services, validating EcoTech's highly innovative and sustainable product design as its strength. Moreover, EcoTech's strength of direct sales with dedicated personnel and direct distribution was seen as ideal by the start-up representatives.

The opportunities that result from the exploration of the ideal customer's preferences and expectations toward FaaS business models and the resulting gaps comparing them to EcoTech's current FaaS business model are the following: (1) Co-creation for personalization, (2) Tangible customized benefits such as customized discounts or loyalty programs, (3) Social media identified to be the most important marketing channel, (4) Start-up incubators/accelerators/co-working spaces for early targeting, and (5) Adjustable contract lengths to increase flexibility. These factors were identified based on the frequency of these issues being raised during the CDI. The aspiration for this analysis section is the utilization of identified gaps to formulate TAs for EcoTech's current FaaS business model.

3.5 Adaptations for the CBM

The analysis of EcoTech's current FaaS business model, its strengths and opportunities, and the preferences and expectations of the ideal customer toward FaaS business models and providers in the German B2B market was used to formulate five TAs:

3.5.1 TA-1: implement a co-creation tool for customization

The circular economy context is especially pertinent to co-creation processes; joint action between actors can help close, slow, or extend the resource loops more effectively due to the network effect of co-creation (Aarikka-Stenroos et al., 2021). Involving the actors in the ecosystem enables the actors to collaborate and maximize the value of products (Bocken et al., 2018). Moreover, expanding this network internationally can accelerate the impact across borders, making it more valuable. Co-creation takes several forms: co-design, where the customer is involved in refining the details of the product features, which allows the customer to appreciate and use the product longer; co-maintenance, where the customer can either buy the product or lease it and maintains under the agreed conditions; co-disposal where the customers bring the product back to the firm for disposal and the produce can recycle/reuse/regenerate the product; and co-promotion where the customer promotes the product in their network. The analysis revealed that potential international customers would also be interested in the co-creation approaches.

3.5.2 TA-2: offer tangible customized benefits

Despite its novelty in the German markets, potential customers are interested in EcoTech's product and the CBM. However, they expect flexibility in purchasing, leasing, or other personalized benefits to adopt the product. This issue may be related to the Liability of Foreignness (LoF), and EcoTech may have to make extra efforts to introduce itself in foreign markets to get a strong foothold and foster long-term relationships with repeat customers. For instance, a loyalty program could include exclusive discounts and benefits such as personalized customer support or extended moving services to meet the needs of loyalty program members precisely.

3.5.3 TA-3: increase investment in social media marketing

Social media is very effective in circularity, especially when expanding into international markets, which was also echoed during CDI. Social media strategies may require customization per country, and German start-ups emphasized the importance of LinkedIn for B2B companies. EcoTech utilizes social media effectively domestically and can readily adapt to international markets. For instance, it could utilize Instagram not only as a marketing tool but also as a purchasing tool. Additionally, engaging with customers online and involving the customers in the circular activities of the firm would lead to an international commitment to circularity.

3.5.4 TA-4: utilize start-up incubators/ accelerators/co-working spaces as a marketing channel

Every country requires the usage of marketing channels depending on local start-up culture. In Germany, the interviewees emphasized the importance of incubators, accelerators, and co-working spaces where the FaaS of EcoTech may be attractive for start-ups. The partnership of CORT, an American furniture leasing firm, and Upsuite, a marketplace for co-working spaces, represents an excellent example of utilizing start-up co-working spaces in the furniture industry (Upsuite, 2022). The marketplace of Upsuite provides the ideal grounds for presenting, marketing, and evaluating the furniture leasing option to possible target customers.

3.5.5 TA-5: offer adjustable contract lengths

Since start-ups are the potential customers of EcoTech in Germany, it may be worthwhile to assess their financial situations before making a purchase or leasing offer. The start-ups value flexibility in contractual obligations due to their limited financial resources. Again, CORT can be an example for EcoTech. CORT assists in finding the ideal fit for the customer's needs, whether staying for 3 months, a year, or longer, and the customer may keep the furniture as long as needed due to flexible lease term options. In terms of pricing, extended lease periods result in a price reduction, whereas shorter lease periods are more expensive to cover the operational cost of the business.

3.6 Prioritization of the TAs

The resulting prioritized list of five TAs to EcoTech's existing FaaS business model (Table 4), aimed at optimizing its suitability for the German B2B market and corresponding target audience, ensuring a successful introduction, is as follows:

1. Offer adjustable contract lengths (4.3334)

2. Offer tangible customized benefits (3.6667)

3. Utilize start-up incubators/accelerators/co-working spaces as a marketing channel (3.2842)

4. Increase investment in social media marketing (2.9999)

5. Implement a co-creation tool for customization (2.499)

4 Conclusions and limitations

The focus of this study was to determine the necessary modifications for a company with a CBM to successfully enter the German B2B market. We propose that entering into foreign markets with CBMs will cause the positive externalities of the circularity expand beyond borders. Therefore, the study aimed to identify the ideal customer and propose TAs to optimize the existing FaaS model for the German B2B market, ensuring a successful introduction.

The study emphasized the importance of understanding customer needs and maintaining strong relationships when entering into foreign markets with circular services, since this aspect was identified as a critical factor in the literature for foreign market entry with services (Bolton et al., 2007; Ostrom et al., 2010; Obadia and Vida, 2011). In previous studies, Lewandowski (2016) emphasized key adaptation areas, one of which was the fit between value proposition and customer segments, which we also focused on in this paper. Additionally, customer-focused studies emphasized the necessity to address specific customer needs during this transition rather than solely offering circular-driven products (Hankammer et al., 2019; Kahraman and Kazançoğlu, 2019; Calvo-Porral and Lévy-Mangin, 2020; Chen et al., 2020). Building and maintaining relationships with customers support the main principle of the circular economy, waste reduction, through producing on order and enabling customers to decide which products to make (Lacy and Rutqvist, 2015). Notably, studies like Ariu et al. (2020) emphasize the synergistic effects of offering services alongside goods, positively impacting demand and export values, while Aquilante and Vendrell-Herrero (2021) challenge the notion that smaller firms struggle with export entry, highlighting the advantages of offering integrated solutions of goods and services.

Hence, using the “entry into foreign markets with a CBM” as a central focus, this study aims to identify the critical factors that could determine customers' buying intentions toward CBMs. In line with previous studies (Bolton et al., 2007; Ostrom et al., 2010; Obadia and Vida, 2011) the case demonstrated that keeping strong customer relations is essential when expanding into foreign markets with circular services. It necessitates a focus on building trust and loyalty with foreign customers, as underscored by Sjödin et al. (2020) and Vendrell-Herrero et al. (2021).

Therefore, our case provides, through an empirical case, valuable factors of adaptation to the domestic CBM regarding customers' requirements when entering into the foreign market. Five TAs for entering the German market are proposed: adjustable contract lengths, offering tangible customized benefits, utilizing start-up channels, increased social media marketing, and providing co-creation tools.

The study is carried out as an in-depth single case study and in one foreign market. In novel cases such as the one studied in this paper and in B2B markets where customization level of the value proposition between the company and client is high, finding similar case studies to add to the comparison proves difficult. Nevertheless, in the future, more case studies and entry into other foreign markets could contribute to generalizability of the findings.

Data availability statement

The datasets presented in this article are not readily available because due to 3rd party privacy, survey and interview data will not be made available. Requests to access the datasets should be directed to DY, ZC5lc2tpeWVybGlAZm9udHlzLm5s.

Ethics statement

Ethical review and approval was not required for the study on human participants in accordance with the local legislation and institutional requirements. Written informed consent from the (patients/ participants OR patients/participants legal guardian/next of kin) was not required to participate in this study in accordance with the national legislation and the institutional requirements.

Author contributions

DY: Writing – review & editing. SE: Writing – original draft, Writing – review & editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This research was funded by Regio Deal Noord Limburg, Circular Transitions Field Lab.

Acknowledgments

The authors would like to thank Mr. Khalid Raihan for his contributions to research design and supervision.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Aarikka-Stenroos, L., Ritala, P., and Thomas, L. (2021). Circular Economy Ecosystems: A Typology, Definitions, and Implications (Cheltenham: Elgar), 260–277.

Ahlgren Ode, K., and Lagerstedt Wadin, J. (2019). Business model translation—the case of spreading a business model for solar energy. Renew. Energy 133, 23–31. doi: 10.1016/j.renene.2018.09.036

Aquilante, T., and Vendrell-Herrero, F. (2021). Bundling and exporting: evidence from german smes. J. Bus. Res. 132, 32–44. doi: 10.1016/j.jbusres.2021.03.059

Ariu, A., Mayneris, F., and Parenti, M. (2020). One way to the top: how services boost the demand for goods. J. Int. Econ. 123:103278. doi: 10.1016/j.jinteco.2019.103278

Arruda, E. H., Melatto, R. A. P. B., Levy, W., and Conti, D. M. (2021). Circular economy: a brief literature review (2015–2020). Sustain. Operat. Comp. 2, 79–86. doi: 10.1016/j.susoc.2021.05.001

Besch, K. (2005). Product-service systems for office furniture: barriers and opportunities on the european market. J. Clean. Prod. 13, 1083–1094. doi: 10.1016/j.jclepro.2004.12.003

Bhattacharya, S., and Bhattacharya, L., (eds). (2021). “Introduction, in Xaas: Everything-as-a-Service (Singapore: World Scientific), 1–41.

Bocken, N. M. P., de Pauw, I., Bakker, C., and van der Grinten, B. (2016). Product design and business model strategies for a circular economy. J. Ind. Prod. Eng. 33, 308–320. doi: 10.1080/21681015.2016.1172124

Bocken, N. M. P., Schuit, C. S. C., and Kraaijenhagen, C. (2018). Experimenting with a circular business model: lessons from eight cases. Environ. Innovat. Soc. Transit. 28, 79–95. doi: 10.1016/j.eist.2018.02.001

Bocken, N. M. P., Short, S. W., Rana, P., and Evans, S. (2014). A literature and practice review to develop sustainable business model archetypes. J. Clean. Prod. 65, 42–56. doi: 10.1016/j.jclepro.2013.11.039

Bolton, R. N., Grewal, D., and Levy, M. (2007). Six strategies for competing through service: an agenda for future research. J. Retail. 83, 1–4. doi: 10.1016/j.jretai.2006.11.001

Brissaud, D., Sakao, T., Riel, A., and Erkoyuncu, J. A. (2022). Designing value-driven solutions: the evolution of industrial product-service systems. CIRP Ann. 71, 553–575. doi: 10.1016/j.cirp.2022.05.006

Buckley, P. J., and Casson, M. (1985). The Economic Theory of the Multinational Enterprise. London; Basingstoke: Springer.

Buckley, P. J., and Casson, M. (2003). The future of the multinational enterprise in retrospect and in prospect. J. Int. Bus. Stud. 34, 219–222. doi: 10.1057/palgrave.jibs.8400024

Calvo-Porral, C., and Lévy-Mangin, J.-P. (2020). The circular economy business model: examining consumers' acceptance of recycled goods. Administr. Sci. 10:28. doi: 10.3390/admsci10020028

Campbell, J. T., Eden, L., and Miller, S. R. (2011). Multinationals and corporate social responsibility in host countries: does distance matter? J. Int. Bus. Stud. 43, 84–106. doi: 10.1057/jibs.2011.45

Chen, L.-H., Hung, P., and Ma, H.-,w. (2020). Integrating circular business models and development tools in the circular economy transition process: a firm-level framework. Bus. Strat. Environ. 29, 1887–1898. doi: 10.1002/bse.2477

Chungyalpa, W. (2022). Developing business models using the business model canvas (bmc) based on dependencies and interconnections. Galaxy Int. Interdiscipl. Res. J. 10, 103–112. Available online at: https://internationaljournals.co.in/index.php/giirj/article/view/1810

Cordella, M., and Hidalgo, C. (2016). Analysis of key environmental areas in the design and labelling of furniture products: application of a screening approach based on a literature review of lca studies. Sustain. Prod. Consumpt. 8:2. doi: 10.1016/j.spc.2016.07.002

Creswell, J., and Clark, V. (2017). Designing and Conducting Mixed Methods Research. Los Angeles, CA: SAGE Publications, 3rd Edn.

Dabić, M., Maley, J., Dana, L.-P., Novak, I., Pellegrini, M. M., and Caputo, A. (2019). Pathways of sme internationalization: a bibliometric and systematic review. Small Bus. Econ. 55, 705–725. doi: 10.1007/s11187-019-00181-6

Dachs, B., Biege, S., Borowiecki, M., Lay, G., Jäger, A., and Schartinger, D. (2013). Servitisation of european manufacturing: evidence from a large scale database. Serv. Ind. J. 34, 5–23. doi: 10.1080/02642069.2013.776543

DeWeerdt, S. (2022). How to make plastic less of an environmental burden. Nature 611, S2–S5. doi: 10.1038/d41586-022-03644-1

Dow, D. (2006). Adaptation and performance in foreign markets: evidence of systematic under-adaptation. J. Int. Bus. Stud. 37:8400189. doi: 10.1057/palgrave.jibs.8400189

Dunford, R., Palmer, I., and Jodie, J. B. (2010). Business model replication for early and rapid internationalisation. The ing direct experience. Long Range Plann. 43:4. doi: 10.1016/j.lrp.2010.06.004

Ekbote, B. (2017). Modeling Ideal Customer Profile for Maximum Return on Investment. Available online at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3670461

Forthofer, R. N., Lee, E. S., and Hernandez, M. (2007). Linear Regression. San Diego, CA: Academic Press, 349–386.

Foss, N. J., and Saebi, T. (2017). Fifteen years of research on business model innovation. J. Manage. 43, 200–227. doi: 10.1177/0149206316675927

Geissdoerfer, M., Morioka, S. N., de Carvalho, M. M., and Evans, S. (2018). Business models and supply chains for the circular economy. J. Clean. Prod. 190, 712–721. doi: 10.1016/j.jclepro.2018.04.159

Geissdoerfer, M., Pieroni, M. P. P., Pigosso, D. C. A., and Soufani, K. (2020). Circular business models: a review. J. Clean. Prod. 277:123741. doi: 10.1016/j.jclepro.2020.123741

Gogo, S., and Musonda, I. (2022). The use of the exploratory sequential approach in mixed-method research: A case of contextual top leadership interventions in construction h&s. Int. J. Environ. Res. Public Health 19:7276. doi: 10.3390/ijerph19127276

Gölgeci, I., Gligor, D. M., Lacka, E., and Raja, J. Z. (2021). Understanding the influence of servitization on global value chains: a conceptual framework. Int. J. Operat. Prod. Manag. 41, 645–667. doi: 10.1108/IJOPM-08-2020-0515

Grand View Research (2022). Eco-friendly Furniture Market Size, Share & Trends Analysis Report by Application (Residential, Commercial), by Distribution Channel (Offline, Online), by Region, and Segment Forecasts, 2023-2030. Grand View Research. Available online at: https://www.grandviewresearch.com/industry-analysis/eco-friendly-furniture-market/methodology#

Han, D., Konietzko, J., Dijk, M., and Bocken, N. (2022). How do companies launch circular service business models in different countries? Sustain. Prod. Consum. 31, 591–602. doi: 10.1016/j.spc.2022.03.011

Hankammer, S., Brenk, S., Fabry, H., Nordemann, A., and Piller, F. T. (2019). Towards circular business models: identifying consumer needs based on the jobs-to-be-done theory. J. Clean. Prod. 231, 341–358. doi: 10.1016/j.jclepro.2019.05.165

Hennart, J.-F. (2001). “Theories of the multinational enterprise 68,” in The Oxford Handbook of International Business, 127.

Hewitt-Dundas, N. (2006). Resource and capability constraints to innovation in small and large plants. Small Bus. Econ. 26, 257–277. doi: 10.1007/s11187-005-2140-3

Isaksson, O., Larsson, T. C., and Rönnbäck, A. O. (2009). Development of product-service systems: challenges and opportunities for the manufacturing firm. J. Eng. Des. 20, 329–348. doi: 10.1080/09544820903152663

Jennings, M. D. (2000). Gap analysis: concepts, methods, and recent results*. Landsc. Ecol. 15, 5–20. doi: 10.1023/A:1008184408300

Josephson, B. W., Johnson, J. L., Mariadoss, B. J., and Cullen, J. (2015). Service transition strategies in manufacturing. J. Serv. Res. 19, 142–157. doi: 10.1177/1094670515600422

Kahraman, A., and Kazançoğlu, I. (2019). Understanding consumers' purchase intentions toward natural-claimed products: a qualitative research in personal care products. Bus. Strat. Environ. 28, 1218–1233. doi: 10.1002/bse.2312

Kim, S., and Ji, Y. (2018). Gap analysis. The International Encyclopedia of Strategic Communication. Boston: Wiley Blackwell, 1–6.

King, S. (2022). Recycling our way to sustainability. Nature 611:S7. doi: 10.1038/d41586-022-03646-z

Kip, M. M. A., Hummel, J. M., Eppink, E. B., Koffijberg, H., Hopstaken, R. M., Mj, I. J., et al. (2019). Understanding the adoption and use of point-of-care tests in dutch general practices using multi-criteria decision analysis. BMC Fam. Pract. 20:8. doi: 10.1186/s12875-018-0893-4

Kirchherr, J., Reike, D., and Hekkert, M. (2017). Conceptualizing the circular economy: an analysis of 114 definitions. Resour. Conserv. Recycling 127, 221–232. doi: 10.1016/j.resconrec.2017.09.005

Kjaer, L. L., Pigosso, D. C. A., Niero, M., Bech, N. M., and McAloone, T. C. (2018). Product/service—systems for a circular economy: The route to decoupling economic growth from resource consumption? J. Ind. Ecol. 23, 22–35. doi: 10.1111/jiec.12747

Kollmann, T., Jung, P. B., Kleine-Stegemann, L., Ataee, J., and De Cruppe, K. (2020). “Deutscher startup monitor 2020,” in Innovation statt krise, 20–26.

Lacy, P., and Rutqvist, J. (2015). The Product as a Service Business Model: Performance over Ownership, book section Chapter 8. London: Palgrave Macmillan, 99–114.

Lewandowski, M. (2016). Designing the business models for circular economy-Towards the conceptual framework. Sustainability 8:43. doi: 10.3390/su8010043

Lieder, M., Asif, F. M. A., Rashid, A., Mihelič, A., and Kotnik, S. (2018). A conjoint analysis of circular economy value propositions for consumers: using “washing machines in stockholm" as a case study. J. Clean. Prod. 172, 264–273. doi: 10.1016/j.jclepro.2017.10.147

Lingegård, S., and von Oelreich, K. (2023). Implementation and management of a circular public procurement contract for furniture. Front. Sustain. 4:1136725. doi: 10.3389/frsus.2023.1136725

Malterud, K. (2012). Systematic text condensation: a strategy for qualitative analysis. Scand. J. Public Health 40, 795–805. doi: 10.1177/1403494812465030

Montag, L., Klünder, T., and Steven, M. (2021). Paving the way for circular supply chains: Conceptualization of a circular supply chain maturity framework. Front. Sustain. 2:781978. doi: 10.3389/frsus.2021.781978

Nußholz, J. L. (2017). Circular business models: defining a concept and framing an emerging research field. Sustainability 9:1810. doi: 10.3390/su9101810

Obadia, C., and Vida, I. (2011). Cross-border relationships and performance: revisiting a complex linkage. J. Bus. Res. 64, 467–475. doi: 10.1016/j.jbusres.2010.03.006

Oetzel, J., and Doh, J. P. (2009). Mnes and development: a review and reconceptualization. J. World Bus. 44, 108–120. doi: 10.1016/j.jwb.2008.05.001

Osterwalder, A., and Pigneur, Y. (2010). Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers. Hoboken, NJ: John Wiley & Sons.

Ostrom, A. L., Bitner, M. J., Brown, S. W., Burkhard, K. A., Goul, M., Smith-Daniels, V., et al. (2010). Moving forward and making a difference: research priorities for the science of service. J. Serv. Res. 13, 4–36. doi: 10.1177/1094670509357611

Pieroni, M. P. P., McAloone, T. C., and Pigosso, D. C. A. (2020). From theory to practice: systematising and testing business model archetypes for circular economy. Resour. Conserv. Recycling 162:105029. doi: 10.1016/j.resconrec.2020.105029

Ranta, V., Aarikka-Stenroos, L., Ritala, P., and Mäkinen, S. J. (2018). Exploring institutional drivers and barriers of the circular economy: a cross-regional comparison of china, the us, and europe. Resour. Conserv. Recycling 135, 70–82. doi: 10.1016/j.resconrec.2017.08.017

Ritzén, S., and Sandström, G. O. (2017). Barriers to the circular economy - integration of perspectives and domains. Proc. CIRP 64, 7–12. doi: 10.1016/j.procir.2017.03.005

Rosa, P., Sassanelli, C., and Terzi, S. (2019a). Circular Business Models versus circular benefits: an assessment in the waste from Electrical and Electronic Equipments sector. J. Clean. Prod. 231, 940–952. doi: 10.1016/j.jclepro.2019.05.310

Rosa, P., Sassanelli, C., and Terzi, S. (2019b). Towards circular business models: A systematic literature review on classification frameworks and archetypes. J. Clean. Prod. 236:117696. doi: 10.1016/j.jclepro.2019.117696

Saaty, T. L. (1990). How to make a decision: the analytic hierarchy process. Eur. J. Oper. Res. 48, 9–26. doi: 10.1016/0377-2217(90)90057-I

Sehnem, S., Farias Pereira, S. C., Silva, M. E., Gomes Haensel Schmitt, V., Rivas Hermann, R., and Batista, L. (2022). Circular business models and strategies-the key to sustainable business and innovative supply chains. Front. Sustain. 3:897974. doi: 10.3389/frsus.2022.897974

Shakeel, J., Mardani, A., Chofreh, A. G., Goni, F. A., and Klemeš, J. J. (2020). Anatomy of sustainable business model innovation. J. Clean. Prod. 261:121201. doi: 10.1016/j.jclepro.2020.121201

Sjödin, D., Parida, V., Kohtamki, M., and Wincent, J. (2020). An agile co-creation process for digital servitization: a micro-service innovation approach. J. Bus. Res. 112, 478–491. doi: 10.1016/j.jbusres.2020.01.009

Spender, J.-C., Corvello, V., Grimaldi, M., and Rippa, P. (2017). Startups and open innovation: a review of the literature. Eur. J. Innovat. Manag. 20, 4–30. doi: 10.1108/EJIM-12-2015-0131

Stavros, J. (2013). The generative nature of soar: applications, results and the new soar profile. AI Pract. 15, 7–30. doi: 10.12781/978-1-907549-16-8-2

Syberg, K. (2022). Beware the false hope of recycling. Nature 611:S6. doi: 10.1038/d41586-022-03645-0

Tallman, S., Luo, Y., and Buckley, P. J. (2018). Business models in global competition. Global Strat. J. 8, 517–535. doi: 10.1002/gsj.1165

Tukker, A. (2004). Eight types of product-service system: eight ways to sustainability? Experiences from suspronet. Bus. Strat. Environ. 13, 246–260. doi: 10.1002/bse.414

Tukker, A. (2015). Product services for a resource-efficient and circular economy—a review. J. Clean. Prod. 97, 76–91. doi: 10.1016/j.jclepro.2013.11.049

Tukker, A., and Tischner, U. (2006). Product-services as a research field: past, present and future. Reflections from a decade of research. J. Clean. Prod. 14, 1552–1556. doi: 10.1016/j.jclepro.2006.01.022

Upsuite. (2022). Find Your Target Market for Coworking Spaces. Available online at: https://www.upsuite.com/blog/find-your-target-market-for-coworking-spaces

Urbinati, A., Chiaroni, D., and Chiesa, V. (2017). Towards a new taxonomy of circular economy business models. J. Clean. Prod. 168, 487–498. doi: 10.1016/j.jclepro.2017.09.047

Urbinati, A., Rosa, P., Sassanelli, C., Chiaroni, D., and Terzi, S. (2020). Circular business models in the european manufacturing industry: a multiple case study analysis. J. Clean. Prod. 274:122964. doi: 10.1016/j.jclepro.2020.122964

Vaillant, Y., Lafuente, E., and Bayon, M. C. (2018). Early internationalization patterns and export market persistence: a pseudo-panel data analysis. Small Bus. Econ 53, 669–686. doi: 10.1007/s11187-018-0071-z

Vendrell-Herrero, F., Vaillant, Y., Bustinza, O. F., and Lafuente, E. (2021). Product lifespan: the missing link in servitization. Prod. Plann. Control 33, 1372–1388. doi: 10.1080/09537287.2020.1867773

von Delft, S., Kortmann, S., Gelhard, C., and Pisani, N. (2019). Leveraging global sources of knowledge for business model innovation. Long Range Plann. 52:3. doi: 10.1016/j.lrp.2018.08.003

Winter, S. G., and Szulanski, G. (2001). Replication as strategy. Org. Sci. 12, 730–743. doi: 10.1287/orsc.12.6.730.10084

Zhang, S. (2022). Why did they get in trouble? The influence of firm characteristics and institutional distance on chinese firms' foreign market entry attempt. Front. Psychol. 13:972384. doi: 10.3389/fpsyg.2022.972384

Keywords: circular business model, PSS, FaaS, foreign market entry, customer co-creation

Citation: Yurdaanik Eskiyerli D and Ewertz S (2024) Foreign market entry with circular business models: a customer-centric approach. Front. Sustain. 5:1344801. doi: 10.3389/frsus.2024.1344801

Received: 26 November 2023; Accepted: 03 April 2024;

Published: 24 April 2024.

Edited by:

Claudio Sassanelli, Politecnico di Bari, ItalyReviewed by:

Marcelo Gaspar, Polytechnic Institute of Leiria, PortugalOkechukwu Okorie, University of Exeter, United Kingdom

Copyright © 2024 Yurdaanik Eskiyerli and Ewertz. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Devrim Yurdaanik Eskiyerli, ZC5lc2tpeWVybGlAZm9udHlzLm5s

Devrim Yurdaanik Eskiyerli

Devrim Yurdaanik Eskiyerli Simon Ewertz

Simon Ewertz