- 1Research Center of Finance, Shanghai Business School, Shanghai, China

- 2Centre for Economic Policy Research, London, United Kingdom

- 3School of Economics, Utrecht University, Utrecht, Netherlands

- 4USC-SJTU Institute of Cultural and Creative Industry, Shanghai Jiaotong University, Shanghai, China

- 5Department of Finance, Maastricht University, Maastricht, Netherlands

- 6Independent Researcher, Utrecht, Netherlands

- 7School of Business and Public Administration, Guangxi University of Foreign Languages, Nannning, China

This paper presents a literature review with the aim of facilitating investment funds to understand the practical question of whether investing responsibly can make a fund's portfolios more sustainable without compromising their return/risk profiles. The study contains most of the leading ESG research from the past two decades. We conclude from this research that the relationship between ESG and return/risk profile is predominantly neutral or even positive. Many scholars have found evidence on the performance of stocks, bonds, and real estate. The findings apply to Environmental, Social, and Governance criteria separately and in different regions. We contribute to the body of knowledge accessible to ESG-asset-seeking funds by complementing the impact investment theory and by linking ESG investment to portfolio-level characteristics and investor preferences. Looking into the future, we identify recent trends and developments in this niche field of ESG at the end of the paper.

1 Introduction

Sustainable and responsible investing is a long-term investment approach that incorporates Environmental (E), Social (S), and Governance (G) factors into the investment process. From a practical viewpoint, this paper summarizes related research in analyzing the ESG tools used by capital market investment funds and attempts to answer the question—what are these tools' return/risk consequences on such funds' portfolios? This question was asked in the context of the investment funds embracing Socially Responsible Investment (SRI) policy or sustainable, responsible, and impact investing. To answer this, we have consulted the majority of relevant ESG and investment fund literature.

We choose references according to three criteria. The first is about the time dimension. Given the many rapidly succeeding developments regarding ESG, we decided to include mainly scientific literature after 2005. This delineation avoids including outdated knowledge. However, studies of high quality published before 2005 are not necessarily excluded. Second, we review studies written by leading industry and academic experts, including Lloyd Kurtz (Head of the Wells Fargo Social Impact Investing team), Caroline Flammer (h-index of 14 and 8,329 citations), Rob Bauer (h-index of 33 with 10,389 citations), etc., focusing on papers with many citations (e.g., most cited papers are Bauer et al., 2005 with 1,188 citations, and Renneboog et al., 2008 with 1,075 citations). Third, we focus more on fixed-income and alternative ESG instruments instead of equities, and we utilize sources with different results to paint a picture of the current scientific ESG landscape as realistic as possible. An extensive reference list is enclosed to ensure the representativeness of the chosen references across various contexts, providing full transparency into the literature from which we derive our conclusions. Some references are meta-studies that use many other articles to paint a picture of the findings surrounding an ESG topic. In this case, these studies are not all included in the reference list in isolation but fall under the relevant meta-study and are thus included in the overall conclusion of the paper.

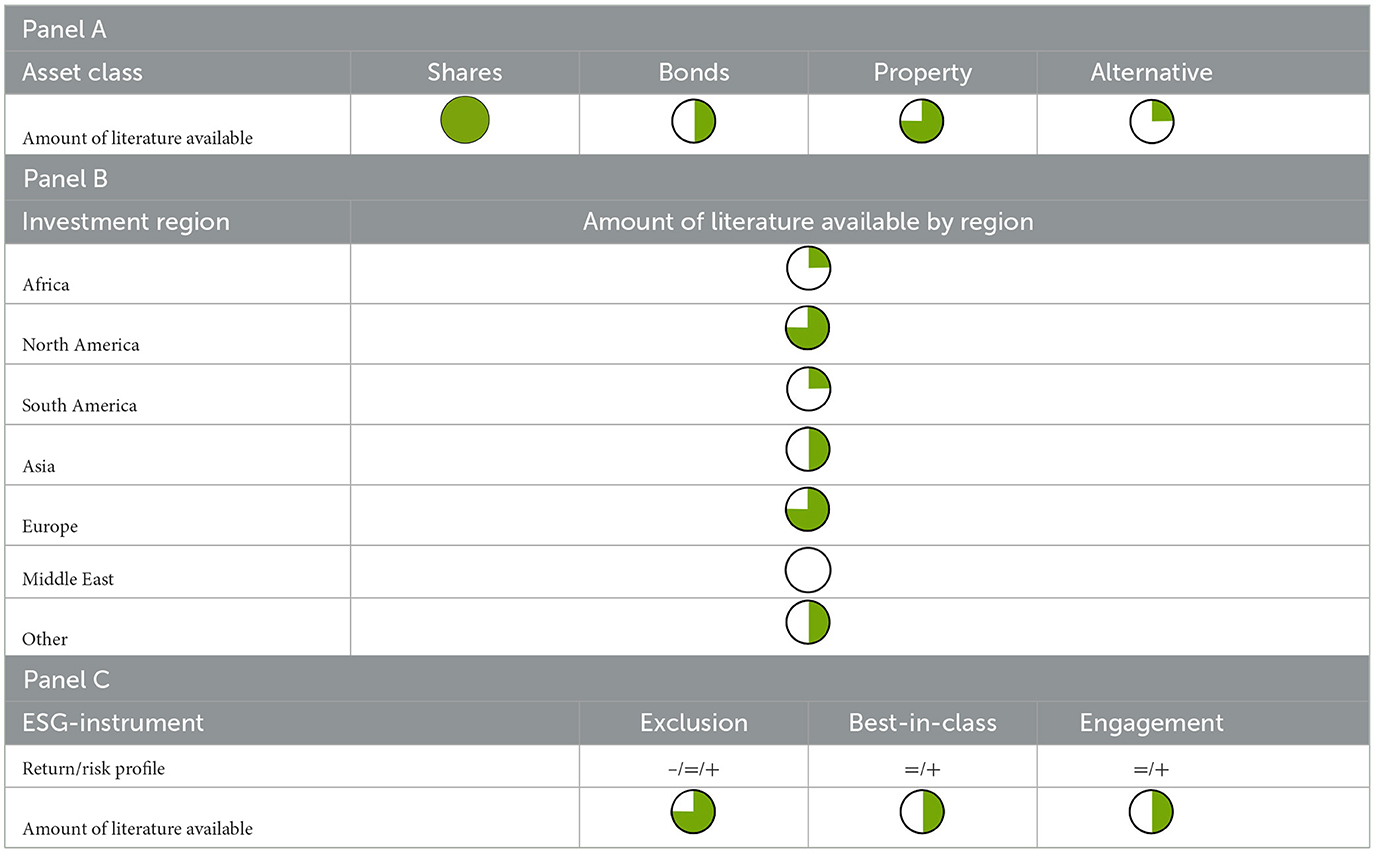

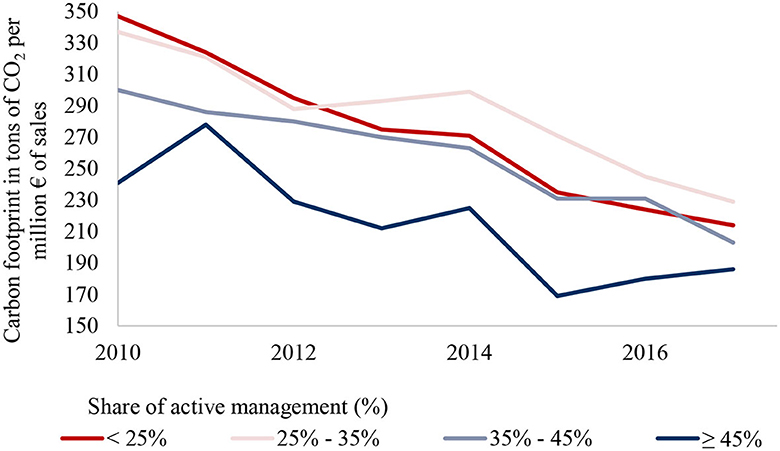

To get a bird's-eye view of the literature that could answer this question, we tabulate Panels A and B of Table 1 to indicate the availability of relevant studies under scenarios of different asset classes and regions. Beyond financial instruments and geographic characteristics, we examine three ESG tools: exclusion, best-in-class, and engagement. Based on the literature on exclusion, it can be concluded that systematically excluding entire sectors can decrease the portfolio's financial return while excluding specific companies, organizations, or countries has no impact, and sometimes a positive one, on the portfolio's return. The best-in-class approach generally has a positive or neutral effect on risk-adjusted financial returns. The consensus is that successful engagement activities positively impact intangible and financial returns. The success of engagement depends in part on the materiality of the engagement topic. These results are summarized schematically in Panel C of Table 1, and an indication of the amount of available literature is also present. Recent literature has shown that when pension funds deviate from benchmark weightings (“underweighting”), they have a significantly lower CO2 footprint. In other words, pension funds with higher levels of active management tend to have lower CO2 footprints. In addition, recent research indicates that excluding fossil energy has no adverse effect on portfolio performance. Follow-up research is needed to reinforce or refute the preliminary results. We pointed out a link to a typical capital market fund's Sustainable Development Goals (SDGs). We also summarized the relevant covenants, frameworks, legislation, and ESG practices that emerged in digital marketplaces. Laws and regulations are more developed in Europe than in other regions. The SDGs and the most important statutes, rules, and regulations are also noted.

The rest of the paper is organized as follows. Section 2 lays down a theoretical framework of SRI. Section 3 summarizes the relationship between ESG and return/risk profile outlined from the perspective of investment funds. In Section 4, the ESG tools used by capital market funds and the findings of the literature are highlighted. Section 5 links ESG investment with funds' portfolio traits and investor preferences. Section 6 identifies recent trends and developments in the field of ESG investment. Section 7 concludes.

2 Theoretical framework

Beyond financial returns, incorporating non-monetary considerations into funds' investment strategies is increasingly important under the SRI or impact investment framework. This paper reviews recent empirical studies that provide evidence of SRI's impact on environmental, ethical, or social change. We streamline existing theories built in this strand of literature to guide the empirics and clarify how these theoretical predictions, in combination with empirical evidence, can help answer our practical research question. The conclusion not only interests the academia but also draws attention from socially responsible investors who are going one step further—apart from the aspects of diversification, dividends, rate of return, inflation, taxes, and risks, they choose to factor in whether a particular investment positively impacts the environment society.

Research examining the corporate social and financial performance relationship reveals a favorable correlation between these variables. Nevertheless, existing literature needs to provide conclusive evidence about the substantial influence of socially responsible investing on stock market results. In a first attempt, Dam and Scholtens (2015) present a comprehensive modeling framework for ethical investing to tackle this paradoxical situation effectively. The framework provides a theoretical foundation for research on responsible investment by offering a basis for understanding the underlying principles that guide the conduct of market players. Corporate social performance often links to significant financial accounting parameters, such as the market-to-book ratio (which measures the market value of a company relative to its accounting value), return on assets, and stock market return. There is a robust theoretical basis supporting a positive correlation between corporate social responsibility and financial performance. However, it is essential to note that the nature of this link is contingent upon the specific financial performance metric under consideration. This review shows that the existing empirical literature on responsible investment aligns closely with the premises outlined in their model.

Later, according to Easton and Pinder (2018), investors and trustees need guidance regarding the possible influence of socially responsible investment on anticipated returns and risk. Hence, they investigate the theoretical issues about the impact. The available research indicates that organizations that exhibit effective governance, foster excellent employee relations, and demonstrate strong environmental performance, have the potential to generate positive excess returns. However, in the case of corporations with inadequate governance, engaging in socially responsible investing may lead to agency costs that ultimately lead to subpar performance. Moreover, allocating investments toward companies whose primary operations belong to “sin” industries has the potential to provide favorable anomalous returns. Conversely, refraining from investing in such organizations may result in financial repercussions for investors. However, for investors that own a diverse portfolio, the economic outcome of engaging in socially responsible investment may have limited significance. Trustees may violate their fiduciary obligations when socially accountable investing causes financial detriment to fund members. One potential reform regulator could contemplate involves allowing trustees to consider non-financial factors without breaking their fiduciary duties if they adhere to other prudent prerequisites.

Following the above two early theories, Oehmke and Opp (2020) demonstrate the boosting effect exerted by conscious investors on companies' environmental investment by reducing monetary obstacles. Socially aware investors are naturally prepared to satisfy with a lesser financing constraint if doing so encourages businesses to switch from polluting to non-polluting investments. Their analysis focuses on a context where the production activities of firms result in societal costs and financing constraints. The attainment of impact necessitates a comprehensive authorization, wherein socially responsible investors must assimilate social expenses regardless of their investment status in a particular company. One can attain the optimal result by facilitating a scalable expansion in clean production. The collaboration between socially responsible and financial investors is mutually beneficial, since it enables them to collectively generate a greater surplus compared to the outcomes that could be achieved by either investor type in isolation. When socially responsible capital is limited, allocating it following a social profitability index is advisable. This ESG score, based on micro-level analysis, encompasses not only a firm's current social standing but also the hypothetical social costs that would arise without socially responsible investors.

Pedersen et al. (2021) put forth a theoretical framework wherein the ESG score of individual stocks assumes a dual function. They demonstrate that better-rated assets could generate lower gains given investors' non-pecuniary utility for ESG. Still, they might have higher expected returns if many investors are made aware of these ratings and flock into better-scored assets, bidding up the prices. Mechanically speaking, ESG score first serves as an indicator of firm fundamentals, offering valuable information in this regard. Secondly, it influences investor preferences, shaping their decision-making processes. The resolution to the investor's portfolio dilemma could be the ESG-efficient frontier, which exhibits the maximum achievable Sharpe ratio for every ESG level. A fund manager can determine equilibrium asset values using an ESG-adjusted capital asset pricing model. Their model effectively demonstrates the impact of ESG factors on the necessary rate of return, elucidating instances where ESG considerations result in an increase or decrease in the required return. They also test the model with multiple extensive data sets, calculate the empirical ESG-efficient frontier, and present an analysis of the advantages and drawbacks associated with responsible investing.

As argued by Marsiliani et al. (2023), the integration of ESG aspects into investment decisions by socially responsible investors cannot be adequately accounted for by conventional preference models despite their inclination to consider non-financial outcomes. As a result, economists in the theoretical literature have endeavored to enhance preferences by integrating supplementary motives for engaging in socially responsible actions. The authors examine the existing investment literature and introduce a notable advantage known as the warm-glow effect, which arises from engaging in responsible investment practices. Nevertheless, the scholarly discourse on investments must adequately address the underlying mechanisms contributing to warm-glow's positive impact. Hence, the researchers utilize existing scholarly works about public good provision and green consumerism to examine the fundamental social and ethical forces at play. Following this, the authors proposed a plan for future study derived from the two primary inquiries that now dominate the existing body of literature. Firstly, can incorporating morally enriched warm-glow payoffs in non-standard preferences lead to an efficient equilibrium whereby externalities arising from production are internalized? Furthermore, if government involvement becomes necessary, what form would this intervention take in the context of these non-standard preferences? Addressing these inquiries would provide valuable insights for developing policies promoting SRI.

In addition to the models mentioned above for becoming an environmentally responsible fund, practical ways exist to make SRIs consistent with theoretical predictions. An SRI includes a wide range of alternative investment strategies because they are all characterized by beneficial social impact. Specifically, those seeking to engage in these ventures prioritize corporate governance, social, and environmental aspects. Investors evaluate an investment's sustainability or social impact using these three criteria. Investors who uphold social responsibility employ many strategies, such as community investing and positive and negative screening, to guarantee that their projects meet social objectives. As its name suggests, the negative screening technique entails vetting a company's policies, offerings, and services before investing in it. Therefore, a potential investor won't invest in a company if they learn that it manufactures hazardous goods or follows unethical business procedures. Using the setup of positive investment, an investor decides to put money into businesses whose business practices they support. Let's take the case of someone who genuinely cares about the environment. Then, their investments in green energy will likely make up their portfolio. It could also imply that they are only willing to work with businesses that follow sustainable methods. Creating a recycling program at work, saving water, buying energy-efficient equipment, and enforcing eco-friendly work policies are a few examples of such green initiatives. Lastly, a fund that invests in the community involves initiatives that improve the financial standing of nearby communities, such as those that use community resources that are easily accessible and provide opportunities for underprivileged people.

3 Relationship between ESG and investment fund return/risk profile

The first and most important question regarding investment based on ESG criteria is whether this form of investment comes at the expense of returns. After all, based on their fiduciary responsibility, investment funds must act in the best interests of their participants. Therefore, many pension funds operate on the principle that sustainable or socially responsible investments should not negatively affect the return/risk profile of the investments. Recent decades have seen much research done on the effect of ESG on financial returns. Since the early 1970s, more than two thousand scientific studies have been published examining the impact of one or more ESG factors on financial returns (Friede et al., 2015). This section outlines leading studies after 2015 on the relationship between ESG and investment fund return/risk profile.

3.1 ESG criteria and performance

To guide the exposition of relevant literature on the relationship between ESG and performance, the meta-study by Friede et al. (2015), which summarizes the findings of about 2,000 studies, serves as a guide. Their paper shows that most studies find a positive or neutral effect of one or more ESG factors on some form of financial return. The findings are consistent across different methodologies, ESG factors (E, S, or G), asset classes (stocks, bonds, and real estate), and regions, except for Asia, where research is sparse due to data availability.

Although the results are generally positive (or at least non-negative), notable differences exist. Figure 1 shows that the effect of non-portfolio studies (effect on individual stocks or bonds) tends to be positive, while portfolio studies (funds) tend to show no effect or a mixed effect. Mixed results, for example, contain both positive and negative coefficients. Only 5.8% of non-portfolio studies and 11.0% of portfolio studies show a negative effect. This effect can be partly explained by the fact that several funds exclude investment securities on non-financial (ethical) grounds without mitigating their impact on the portfolio and that smaller-sized funds have higher management fees.

Figure 1. Effects of ESG studies on financial performance (Friede et al., 2015).

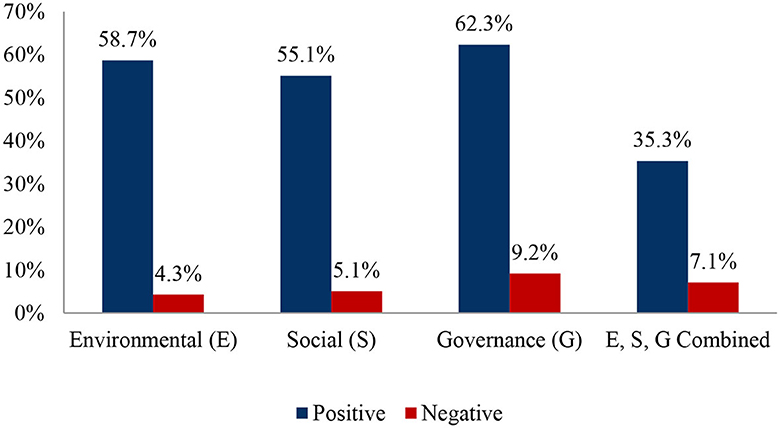

The meta-study by Friede et al. (2015) shows an above-average positive consensus in studies focusing on the effects of E, S, and G factors on investment returns. Here, it is found that each factor contributes to performance positively (see Figure 2).

Figure 2. Effects of E, S, and G based on 644 studies (Friede et al., 2015).

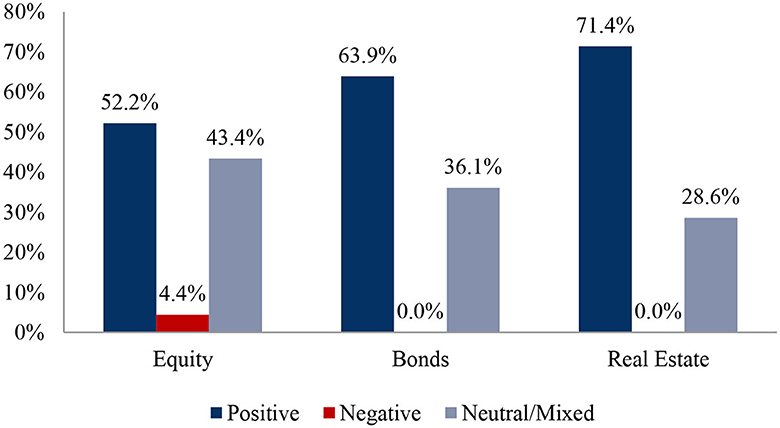

Figure 3 shows the consensus regarding the effects of ESG by asset class. The majority of studies attribute either a positive effect or no or insignificant effect to ESG. It should be noted for all the preceding figures that these are multiple ESG strategies and/or instruments, and no distinction is made between them.

Figure 3. Effects of ESG by asset class based on 334 studies (Friede et al., 2015).

Concerning equities, most studies find a positive (52%) or insignificant (43%) effect for ESG. To some extent, this is consistent with the findings of other studies. Since most studies indicate that ESG has no or a positive effect on financial returns, funds that factor ESG criteria into their investment decisions (e.g., through screening) will generally not achieve lower returns than conventional mutual funds. A critical earlier study in this regard is by Bauer et al. (2005). For the first time, this study used more sophisticated methods (4-Factor Carhart instead of Capital Asset Pricing Model, CAPM) to measure the effect of ESG on financial returns while correcting for other proven risk/return determinants. The main finding of this study is that there are no significant differences in risk-adjusted returns between ESG and conventional funds. However, some caution is warranted regarding the bond and real estate percentages, as there are few studies. Even though research for both asset classes is emerging, this shortcoming should be considered. Over the past two decades, several ESG studies have adopted the same methodology as Bauer et al. (2005). These include the studies by Barnett and Salomon (2006), Renneboog et al. (2008), Gil-Bazo et al. (2010), Edmans (2011), and Leite and Cortez (2014). The results of these studies confirm the findings of Bauer et al. (2005) and tend toward a non-negative effect.

The overall picture is that there is no leading new literature proving that responsible investment and sustainability of the investment portfolio come at the expense of the return/risk profile. The next two subsections look more closely at ESG and performance, specifically for bonds and real estate. Then, Section 4 outlines recent findings for various ESG instruments.

3.2 Bonds

To properly review the academic literature on how a company or institution's sustainability performance affects its bond valuation, it is necessary to distinguish between a company's sustainability performance and the underlying resources/projects of a specific bond. This subsection will first review the academic literature on the relationship between sustainability performance and bond valuation. Then, we discuss the literature on the relationship between a specifically sustainable bond, such as a “green bond” (a bond whose proceeds are used for specifically sustainable projects), and its valuation difference vs. non-specifically sustainable bonds (“gray bonds”).

3.2.1 Corporate bonds

Several studies show that higher corporate sustainability performance leads to a lower credit spread of issued bonds. Ge and Liu (2015) show that higher ESG scores affect the ratings given by credit rating agencies. The study further indicates that a higher ESG score still hurts the credit spread even when adjusted for credit rating. Whether this additional lower credit spread also means a lower risk rating (and thus a comparable risk/return ratio) is not apparent from the available literature. An alternative explanation could be a higher demand for such bonds—analogous to the reason for patterns in the green bond market. Oikonomou et al. (2014) draw similar conclusions to Ge and Liu (2015) but add that controversies in market participants may lead to a higher credit spread.

Looking specifically at the “Governance” aspect of ESG, the literature tells us that better governance has a negative relationship with credit spread on corporate bonds (Klock et al., 2005; Menz, 2010; Magnanelli and Izzo, 2017; Ghouma et al., 2018). Furthermore, Hasan et al. (2017) examine the “Social” aspect of ESG. This research shows that companies with more social capital can issue bonds at a lower cost of debt, which is again reflected in a lower credit spread. In addition, Bauer and Hann (2010) primarily investigate the “Environmental” aspect of ESG by relating the effect of environmental performance to the credit spread and credit risk of a bond issue. They find that a negative relationship between a company's environmental performance and its credit spread or cost of debt of its bond issue, partly explained by a reduction in the respective credit risk.

Other studies focus on the return performance of sustainable bond funds. Henke (2016) demonstrates that sustainable bond funds in the Eurozone outperform comparable conventional funds due to the mitigation of ESG risk, which is especially visible in times of economic recession. Leite and Cortez (2018) find mixed results for the performance of sustainable bond funds in the Eurozone. However, they document that investing in sustainable bond funds does not involve financial concessions. Also, the authors conclude that sustainable bond funds provide financial protection during recessions. Hoepner and Nilsson (2017a) explicitly mention the importance of engagement and intensive screening on sustainable issues as the differentiating factor in the performance of sustainable bond funds. The authors conclude that funds underperform when they have yet to actively undertake engagement and screening, while the opposite is true for active funds undertaking those tasks. The same authors argue in another study that bond portfolios with neutral ESG ratings perform best compared to portfolios with pronounced ESG strengths and weaknesses (Hoepner and Nilsson, 2017b). Such phenomenon can be partly attributed to “no news is good news”, which implies that investors are risk-averse to fluctuations in the information signaled by ESG ratings.

3.2.2 Government bonds

Since a significant portion of a typical capital market fund's investment portfolio is allocated to government bonds, it is also necessary to elaborate on the performance of sustainable government bonds. The literature on sustainable government bonds' performance still needs to be more extensive than the available literature examining other asset classes. First Crifo et al. (2017) and Capelle-Blancard et al. (2019) investigate the linkages between countries' sustainability ratings and credit spreads. Specifically, Capelle-Blancard et al. (2019) discovered a negative relationship. This relationship is solid for social and governance factors and slightly stronger for Eurozone countries. Crifo et al. (2017) draw a similar conclusion about the relationship between sustainability rating and credit spread. These authors conclude that higher sustainability performance leads to a lower cost of debt. The authors also argue that investors consider sustainability performance to complement financial ratings. In terms of magnitude, the effect of sustainability performance on credit spread (i.e., market opinions) is about three times smaller than financial rating (i.e., third-party opinions). Drut (2010) examines how creating a portfolio of sustainable government bonds is possible without sacrificing the return-to-risk ratio. The author suggests that creating a bond portfolio that meet a specific sustainability score without significantly sacrificing returns or increasing volatility by several hundredths of a percentage point. The effect of the sustainability score varies by category. Specifically, there is a marginal sacrifice in terms of diversification for a higher environmental and social score but a somewhat greater sacrifice in terms of diversification for a higher governance score. The authors thus point out that the dimension or theme of sustainability is relevant in the issue of whether sustainability concerns would impair a healthy return/risk ratio of an investment portfolio.

3.2.3 Green bonds

Green bond issuance has experienced significant growth in recent years. For example, total issuance in 2022 was $487.1 billion, and $36.6 billion in 2014 (Climate Bonds Initiative, 2023). Green bond issuance has also become a global phenomenon. The literature on green bond valuation generally suggests that green bonds display a lower credit spread than regular bonds of the same company. The distinguishing factor from regular bonds (gray bonds) is that green bonds are characterized as such by the bond issuer, and the proceeds of the bonds are for specific earmarked projects. In addition to green bonds (proceeds are for “green” projects), there are also “social bonds” and “SDG” bonds. Much of the literature examines green bonds, which are also the focus of this literature review.

The first stream of literature focuses on the primary market, or green bond valuation at issuance. Ehlers and Packer (2017) examine the difference in credit spread between green and conventional or gray bonds, showing that a lower credit spread characterizes green bonds. In addition, Gianfrate and Peri (2019) speak of a so-called “financial convenience”, meaning a lower credit spread for green bond issuers, and Kapraun and Scheins (2019) also show that green bonds have relatively higher issue prices than gray bonds. In their studies, Baker et al. (2018) and Partridge and Medda (2018) focus on municipal bond issuance in the US. Both studies show that investors pay a so-called “green bond premium”, reflected in a lower credit spread. In doing so, Baker et al. (2018) find that the premium is more pronounced for externally certified bonds, where the risk of mislabeling a sustainable bond is significantly lower. The study by Flammer (2020) focuses on the relationship between green bonds and the performance of the green bond issuer in the stock market. She concludes that the issuance of a green bond positively affects the issuer's performance in the stock market, as well as the issuer's financial and environmental performance. Certified green bond shows a more substantial effect.

A second stream of literature focuses on the secondary bond market or the valuation of bonds after issuance in the primary market. By comparing a green bond to a gray bond, the so-called matching strategy, Hachenberg and Schiereck (2018) and Zerbib (2019) show that green bonds trade at a relatively lower credit spread. Nanayakkara and Colombage (2019) conclude that green bonds trade at a higher price than gray bonds. Several investment banks and financial institutions have conducted similar studies on green bonds. Barclays (2015) and Nationale Nederlanden Investment Partners (2018) agree that a relatively lower credit spread characterizes green bonds. The above studies speak of a mismatch between supply and demand in the secondary market as a possible reason for the relatively higher valuation of green bonds.

3.3 Sustainable real estate

While most published studies focus on stocks and bonds, one can also derive implications for the real estate asset class. Real estate is mainly responsible for (a) total energy consumption (32%), (b) total electricity consumption (51%), and (c) total CO2 emissions (at least 20%) (International Plant Protection Convention, IPCC, 2014a,b). Thus, the importance of sustainability concerning environmental and social impacts is high. Extant studies already concluded that adopting ESG in the real estate investment process has no negative impact on financial returns. It is essential to mention that research on real estate is, in most cases, limited to homes and offices; other real estate types have yet to be researched to date, if at all.

One of the first studies to establish a link between energy efficiency and sales prices is that of Eichholtz et al. (2010). Following-up studies further show that sustainability and property performance correlate positively (Eichholtz et al., 2013). The research by Brounen and Kok (2011) shows that reducing the energy consumption of Dutch real estate (from G-label to A-label) results in a 15% higher sales value. This effect is not only limited to the Netherlands; similar effects are observed in China (Zheng et al., 2012), Singapore (Deng et al., 2012), the US (Kahn et al., 2013), Sweden (Cerin et al., 2014), and other countries. Labels concerning sustainable real estate are becoming increasingly relevant, such as Leadership in Energy and Environmental Design (LEED), Building Research Establishment Environmental Assessment Method (BREEAM), and Energy Star. The Global Real Estate Sustainability Benchmark (GRESB) measures and scores the ESG performance of real estate and infrastructure portfolios.

Based on the above, property sustainability improves indirect returns or values. Some studies, including Kok and Jennen (2012), also find evidence of an increase in direct returns, which come with improvements with respect to sustainability and the subsequent increase in the incoming cash flows in the form of rental income. Take the Netherlands as an example; this effect will be partially reinforced by the goals of governments that only want to locate properties with an energy label of at least C starting from 2023.

Concerning indirect real estate investment, there also appears to be a positive correlation between sustainability and profitability. Research on US REITs shows that sustainability improves profitability ratios such as Return on Assets, Return on Equity, and total returns (Eichholtz et al., 2013). In terms of abnormal returns, long-term sustainability in indirect real estate portfolios appears to have no or insignificant effect. Nevertheless, abnormal returns appear to be observed in the short term, indicating that financial markets are pricing in long-term sustainability: the “learning effect” (see following subsection). Despite the lack of long-term outperformance, sustainable real estate portfolios are less affected by fluctuations in the real estate market. This insensitivity leads to a reduction in the market risk of the investment and, thus, a lower beta.

Key findings from previous studies are summarized in two meta-studies. Chegut et al. (2019) show that there has been extensive research on the value of energy efficiency in the housing market in previous years. These studies show that homes characterized as energy efficient, as measured by energy labels, certification, and other criteria, have higher market values and rents. However, there is some variation among the different studies regarding the delineation of the housing market, the characterization of energy certifications, the measurement of energy performance related to these certifications, and the size of the relevant green premium. There are several leading studies on different geographic housing markets. The longest sample period goes back to 1995 and the results relate to both collateral value and rental income. Almost all these articles show a significant value premium, and some also show that energy-efficient homes are more liquid.

The meta-study by Dalton and Fuerst (2018) analyzes the results of 42 studies conducted between 2008 and 2016 that attempt to demonstrate a relationship between energy efficiency and residential and commercial property values. Based on two general and six academic databases, the authors calculated a significant positive weighted average green premium of 7.6% for sales prices and 6.0% for rents compared to non-green buildings. The average green premiums for residential properties are 5.5% for value and 8.2% for rent. The international scientific literature has led to a clear consensus: energy efficiency in homes and offices leads to higher collateral values, higher rents, and more liquidity. Given the scope of the literature and the fact that it covers different periods and a vast collection of countries, the reliability of these results is high.

3.4 Financial materiality and the learning effect

The meta-study by Friede et al. (2015) shows that ESG studies have mixed results. Some possible explanations for the mixed outcomes include that not all ESG aspects are financially material for all companies and sectors and the occurrence of a “learning effect”. The following two subsections explore these issues in more detail.

3.4.1 Financial materiality

Financial materiality is best described as the relevance of a sustainability factor to a company's financial performance. ESG factors that are financially relevant can significantly impact on a company's business model and value drivers like revenue, risk, and capital requirements. This impact can be either positive or negative. Whether certain factors are material can vary by industry. The Sustainability Accounting Standards Board (SASB) has created a “Materiality Map” that identifies sustainable aspects by sector that are most likely to affect companies' financial condition and performance. Currently, SASB uses a framework consisting of 26 ESG-related aspects. Factors can become financially material more quickly if a large and widely spread portion of the world considers something important. Global trends and developments can serve as indicators of materiality. One of the leading studies on materiality is that of Khan et al. (2016), which distinguishes between material and non-material ESG aspects, with materiality varying by sector based on the SASB framework. They find that companies with high ratings on material sustainability outperform those with poor ratings. In contrast, companies with high ratings on intangible (non-financial) aspects do not beat companies with low ratings.

3.4.2 The “learning effect”

Another factor that could explain the differences between various survey results and for which empirical evidence has also been found concerns the so-called “learning hypothesis”. According to this hypothesis, ESG data provides information about future risk-adjusted corporate outcomes. Since not many investors initially took this into account, ESG data used to be a source of additional and material information and, thus, a source of potential outperformance (alpha). However, this potential disappears when the capital market starts paying more attention to ESG. Such disappearance could negatively affect the possibility of generating additional investment returns in the form of alpha using ESG factors.

The argument that the effect of ESG is often temporary also emerges from the literature (see Borgers et al., 2013; Bansal et al., 2016). Two studies that clearly show the “learning effect” with respect to ESG factors are the studies by Bebchuk et al. (2013) and Borgers et al. (2013). The former study shows that when corporate governance becomes mainstream, the ability to generate alpha with it disappears. A portfolio in which “long” and “short” companies with good and bad governance, respectively, generate alpha in the period with little attention to ESG but no longer generate alpha in the subsequent period. The second study obtained similar results. In periods with more attention to ESG, the positive effect of ESG on risk-adjusted financial returns disappears. The presence of the learning effect implies that investors need a more active investment style toward ESG choices if the goal is to generate alpha. A more recent study by Pereira et al. (2019) shows that a learning effect is also present within sustainable bond portfolios. These authors argue that, at an early stage, bond funds with better sustainability ratings outperform their comparables with lower ratings. But this outperformance disappears as time goes on. Therefore, investors can construct sustainable bond portfolios without sacrificing financial performance.

3.5 Risk profile

While understanding the relationship between ESG and investment returns has priority, scholars have also started to pay attention to whether applying ESG criteria reduces risk. Nofsinger and Varma (2014) examine whether the downside risk of ESG funds in economic crises is lower than that of conventional funds. Their study reveals that ESG funds achieve lower returns (15.8 vs. 16.6%) in good economic times. In contrast, losses of ESG funds are more limited in times of crisis (−18.7 vs. −19.7%). Another interesting finding in this area is that ESG in the form of Corporate Social Responsibility (CSR) reduces systematic firm risk, which confirms that ESG can positively impact the risk profile of corporate investments (Oikonomou et al., 2012). Risk measurement in almost all studies is based on historical models, and future risk profiles may vary significantly in the future.

3.5.1 Climate risk

In addition to general ESG risks, investors are increasingly concerned with climate risk. With alarms set by an IPCC report on maximum global warming of 1.5°C, the attention to and the literature surrounding climate risk have increased significantly in recent years. Influential entities such as the Network of Central Banks and Supervisors for Greening the Financial System, an alliance of central banks and supervisors co-founded by De Nederlandsche Bank, underscore that climate risk involves financial risks. We can further categorize climate risk into transition risk, the risk arising from legislation and technological developments, physical risk, flooding risk, water scarcity, and effects on crops, people, and animals. The historical CO2 cycle no longer applies, and there is a debate about whether climate risk is underestimated. Four factors fuel the discussion. The first is a high degree of uncertainty. High concentrations of CO2 in the atmosphere increase uncertainty about long-term outcomes. Uncertainty is the classic definition of financial risk. The second factor is the illusion of a threshold. The system cannot absorb CO2 indefinitely. There may be a sudden adverse reaction in an environment that appears to be under control, such as the breach of a dam. The third one is the compression of time. Several researchers think climate change will be gradual. Others believe a succession of adverse events over a short period could have a domino effect. The last factor is the precautionary principle. Many believe avoiding potential problems is the best approach, even when outcomes are uncertain.

Climate risk can materialize in several forms, such as transition and physical climate risks. A typical transition risk is known as the carbon price risk, which describes the consequence of some new carbon policy that will reprice CO2 emissions, and stranded assets risk, defined as the risk that assets will be subject to unexpected depreciation, partly because of new technologies or legislation. Take the real estate sector in the Netherlands for illustration. A law in 2023 mandates a mandatory minimum C label for offices. Offices that have a D label or worse will be worth practically nothing from then on. As illustrated using this Netherlands example, this risk could apply to all sectors worldwide. For example, introducing a sugar tax would drastically affect Coca-Cola's business and financial position. Physical climate risk, i.e., the risk that climate change will damage assets, is clarified in research by Bernstein et al. (2019). They show that homes exposed to an expected sea level rise sell for about 7% less than comparable homes with the same distance to the sea but without this predicted sea level rise. The strength of this effect has been gradually increasing, partly due to growing concerns about climate change. Eichholtz et al. (2018) characterize a similar risk and show that homes in areas at higher risk of hurricanes are less likely to increase in value than equivalent homes without this risk. Another study by Addoum et al. (2020) finds a relationship between extreme temperature fluctuations and business turnover in the US in 40% of the industries studied. This relationship can be either positive or negative, but its existence demonstrates the need for investors to consider the effect of climate risk on firms' financial position. These studies add to the growing literature on long-term financial risk.

Given the potentially disastrous impact of the above risks on financial returns, especially for individual companies and particular sectors, it is interesting to consider whether equity markets price these risks Hong et al. (2019) examine the relationship between the Palmer Drought Severity Index (PDSI) and financial returns. The PDSI measures the long-term drought severity of a country. Based on the Efficient Market Hypothesis, the effect of the PDSI score on financial returns is either zero (assuming no drought risk premium) or negative (considering a drought risk premium). This expectation was examined using a strategy in which the investor takes a long position in a portfolio with a high PDSI score (extremely moist) and a short position in a portfolio with a low PDSI score (extremely dry). The results indicate that the effect of the PDSI score on financial returns is positive. This long-short strategy brings in a substantial annual excess return, demonstrating that equity markets still need to price in climate risk in the case of the risk of drought. Additionally, Cohen (2016) establishes the relationship between voluntary disclosure of climate risk by companies, higher-quality financial reporting, and more efficient investment activities. Section 4 of the present paper discusses the potential trade-offs and synergies related to climate risk and SDGs.

3.5.2 Reputational risk

Reputation risk is also an increasingly important risk regarding ESG for companies and organizations. This risk can include reputation damage because of violating human rights (e.g., Foxconn), causing irreparable damage to the environment (e.g., BP and Exxon Valdez), or committing accounting fraud (e.g., Enron). What is typical of these examples is the relatively significant impact of their damages. Here, the damage is not only limited to the financial aspect, but the reputation of these companies and their industries also suffers. As Karpoff et al. (2005) described early on, the above examples represent reputation damage resulting from the violation of ESG factors. To some extent, reputational risk is a tail risk with a relatively small probability but a rather large loss (Karpoff et al., 2005). This risk is not only limited to companies and organizations; investment and pension funds also are subject to these risks. It should be noted, however, that no verified scientific articles are yet to be available in this area. Now that it has been clarified that ESG factors generally have a neutral or positive effect on performance, it is logical to look further into their implementation through the extensive spectrum of ESG strategies and instruments. The following section outlines what tools are available, the main findings from the literature, and trends and developments.

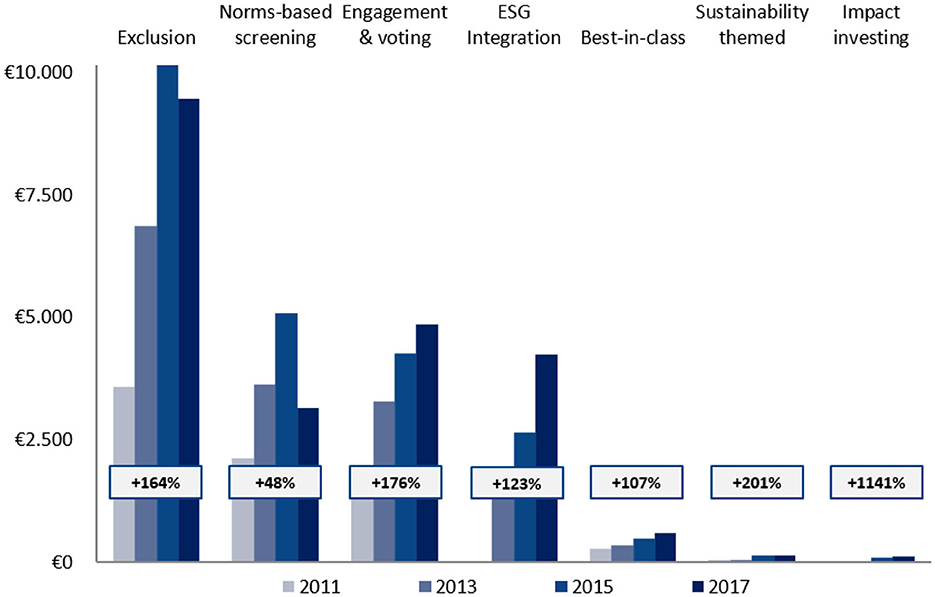

4 ESG investment tools

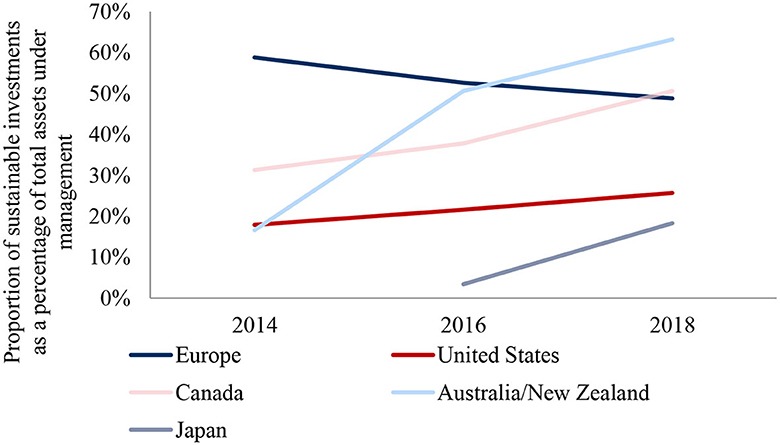

The available literature on ESG instrument tools has historically focused primarily on ESG in general and the negative screening or exclusion tool. The popularity of negative screening studies has been driven by the high popularity of this instrument among investors. However, there has been an increasing focus on other tools, such as positive screening and best-in-class, ESG integration, and engagement. The shifts in investor demand for these tools, as shown in Figure 4, also drive the amount of available literature.

Figure 4. Popularity of ESG investment instruments Europe, Asset under Management (€ billion) (Eurosif, 2014, 2016, 2018).

Academia can contribute to the demand for ESG tools and products by continuing to publish on the relationship between ESG factors and returns. The market will then begin to price in the insights that emerge. Likely, the availability of the literature and the demand for ESG products will increase as asset managers and implementers further concretize and standardize ESG-responsible products—the next step concerning ESG-responsible investing. The following subsections outline the main findings on the ESG tools a typical capital market fund uses.

4.1 Exclusion

Most pension funds in Europe have adopted exclusion policies on specific investments. Investments in producers of cluster munitions or producers of their crucial components, for example, are prohibited by law in the Netherlands, making adopting an exclusion policy evident. Apart from the obligation to systematically exclude investments, most pension funds active in the Netherlands apply a limited additional exclusion policy based on United Nations (UN) Global Compact violations. Due to the popularity of using an exclusion policy, much academic literature is already available in this area. This strand of literature tends to highlight the financial consequences of pursuing such an exclusion policy for investors.

4.1.1 Reduction of investable companies

An important question is whether reducing the number of investment securities hurts the investment portfolio's risk. Earlier in this field of study, most studies show that ESG generally has a non-negative effect on risk-adjusted financial returns. However, it is imperative to know whether diversification potential is harmed when companies are excluded. Markowitz (2012), the founder of the Modern Portfolio Theory, stated that an ethical reduction from 8,000 to 4,000 investment companies results in an investment portfolio similar in terms of return/risk profile. Verheyden et al. (2016) examine the effects of screening (excluding companies) on portfolio return, risk, and diversification potential. Their study defined different portfolios and considered the impact of a certain degree of exclusion based on ESG criteria. This study shows that excluding companies based on ESG performance does not reduce returns and diversification potential in most situations. Indeed, a reduction in the number of companies in the investable universe positively affects the mentioned characteristics. Thus, excluding investable companies per se does not have direct financial disadvantages.

4.1.2 Negative screening

Capelle-Blancard and Monjon (2014) find that a higher intensity of negative screening for ESG factors slightly reduces a fund's financial performance. Excluding entire sectors or industries, such as the sin-stock sector, is generally detrimental to the financial performance of an investment. Banning all sin stocks (e.g., alcohol, tobacco, and gambling) can lead to lower financial returns, as was already indirectly demonstrated in Hong and Kacperczyk (2009). They claim that sin stocks achieve an annual outperformance of 3–4%, with the underlying rationale being the clientele hypothesis (Merton, 1987). This observation is consistent with the fact that sin-stock firms have a higher cost of capital and are thus disadvantaged relative to other firms. This effect takes place at the industry level, effectively reducing an industry's legitimacy without distorting the relative relationships within it. Equivalently, the systematic exclusion of these stocks excludes significant returns, which can negatively affect total returns (Derwall et al., 2011; Trinks and Scholtens, 2017). The clientele hypothesis posits that investment securities that are ignored by many investors (e.g., social norms can lead to the exclusion of sin stocks) usually have a lower price and thus may achieve higher future returns.

Excluding companies need not hurt financial returns when only a limited number of organizations are excluded, such as UN Global Compact violators (Capelle-Blancard and Monjon, 2014). One possible explanation is that negative screening or exclusionary policies can be seen as the opposite of positive screening. The following example provides a best explanation. When the bottom 10% of worst-performing companies in terms of ESG are excluded from the investment universe, the effect is analogous to positive screening, where the top 90% of best-performing companies are selected. More attention is paid to positive screening in the next subsection. Therefore, the inconsistency in the results of different articles, stems primarily from the intensity of negative screening. Whereas, excluding entire sectors or industries is generally perceived as financially harmful due to losing access to certain risk/return characteristics, excluding specific companies typically has no negative impact and sometimes adds value to the portfolio. Some variation in the literature is present, however. Very little research has been done on excluding fossil energy, but the existing thin literature shows no negative effects.

Beyond the financial effects of negative screening, little is said about its intangible returns. Systematically excluding investable securities may contribute to intangible returns. In contrast to a value-driven constituency, a morally-driven constituency appears to place considerable value on excluding companies and/or countries on principle (Derwall et al., 2011). The constituency may find it desirable to exclude certain stocks despite the loss of returns. In this situation, increased intangible returns may offset the potential financial loss of exclusion.

To summarize, exclusion is the most popular ESG investment vehicle worldwide. Research on exclusion leads to both positive and negative outcomes. Based on the literature on exclusion, it can be concluded that systematically excluding entire sectors can decrease portfolio financial returns while excluding specific companies, organizations, or countries has no impact, and sometimes a positive one, on portfolio returns. ESG often leads to exclusion, but aren't alpha sources dropping out unnecessarily? Harry Markowitz answers this question by making two comments below. First, an ethical screening scheme that reduces available securities from about 8,000 to about 4,000 would make it impossible to select a reasonably liquid, well-diversified portfolio with returns comparable to those of well-established companies with similar levels of portfolio volatility. Second, the empirical analysis associated with this theoretical paper reports that efficient portfolios constructed based on more than 4,000 investable companies from the ethically screened universe lose slight inefficiency compared to those built based on the entire investable universe of more than 8,000 names.

4.2 Best-in-class

It is easier to understand the best-in-class tool by comparing it to the investing fund's inclusion policy. This approach generally has a positive or neutral effect on risk-adjusted financial returns. Negative screening usually uses norms-based screening, but positive screening often occurs based on ESG scores. Positive screening is a more impactful approach than exclusion (Khan et al., 2016; Amel-Zadeh and Serafeim, 2018). One standard tool of positive screening is the best-in-class approach. This approach selects only companies that are leaders in ESG within the relevant sectors. It is the best proxy for a typical capital market fund's current ESG policy.

Nofsinger and Varma (2014) show that, compared to conventional mutual funds, socially responsible mutual funds that use positive screening techniques perform better during periods of market crisis. However, this comes at the cost of underperformance during periods without crisis. The observed patterns are attributed to socially responsible factors rather than differences in fund management or the characteristics of the companies in the portfolios. Leite and Cortez (2015) also find that SRI funds significantly underperform compared to conventional funds during periods without a crisis. However, the low performance of SRI funds is mainly caused by funds using negative screenings. During periods of market crisis, they find no significant differences between the two funds. Nevertheless, the bottom line is that SRI funds with positive screenings showed no significant differences in performance compared to conventional funds.

Regarding the best-in-class approach, it is agreed upon that it has either a positive or non-negative effect on risk-adjusted financial returns. Derwall et al. (2005) find that a best-in-class portfolio before transaction costs outperforms a worst-in-class portfolio by about 3% points. They show that a portfolio of companies with a high ranking in eco-efficiency outperforms the low-ranked counterparty, even after adjusting returns for market risk, investment style, and industry securities. This finding is confirmed again in Kempf and Osthoff (2007) research, which documents that a best-in-class approach can lead to abnormal returns of 8.7% per year. When transaction costs are incorporated, these abnormal returns remain significant. Whether replicating these studies with recent data still generates significant results is uncertain because of the learning effect described earlier.

Edmans (2011) shows that a portfolio consisting of the “100 best companies to work for” in the US produced an annual four-factor alpha (a proxy for the abnormal risk-adjusted return) of 3.5% between 1984 and 2009. This result suggests that a positive screen based on employee satisfaction can lead to superior returns. The alphas measured in Edmans' (2011) study using the US company sample are not automatically generalized to every country. The study by Edmans et al. (2015) shows that if a firm is among the “best companies to work for” list, this is associated with superior returns, mainly in countries with high labor market flexibility, such as the UK and the US. Fulton et al. (2012) also find that if one focuses on a well-executed best-in-class approach, superior risk-adjusted returns can be achieved. Also, the study by Trunow and Linder (2015) finds that when ESG factors are incorporated into investment decisions, they improve risk-adjusted financial returns. On the other hand, there are studies such as those by Lee et al. (2013). They examined the performance of portfolios that differ with respect to corporate social performance (CSP) rankings. Their results show no significant difference in risk-adjusted performance between high- and low-ranked CSP-ranked portfolios. Positive screening on real estate, or excluding poorly performing real estate investments on ESG, also makes sense because Eichholtz et al. (2013) find that real estate funds with high ESG scores are less risky.

4.3 Engagement

Engagement includes all activities an investor undertakes to persuade a company or organization to act in the investors' interest. The consensus is that successful engagement activities positively impact on both intangible and financial returns. The success of engagement is highly dependent on the financial materiality of the engagement topic.

Engagement, and active ownership in general, is seen by several academics as a form of ESG investing with a higher level of engagement than other instruments. Overall, there are multiple forms of active share ownership, including the use of voting rights, engaging in verbal or written dialogue, class actions, and media campaigning (Gillan and Starks, 2000, 2007; Becht et al., 2008; Dyck et al., 2008). As a result of the strong growth of ESG engagement, research has become available in recent years, revealing the effect of engagement on both financial and intangible returns. The SASB (2018) Materiality Map distinguishes between financially tangible and intangible ESG themes. Although engagement on both themes can be successful, engagement on intangible themes has the greatest positive effect on ESG ratings. Progress on intangible themes is usually easier and cheaper, as they often involve fewer fundamental changes. Other possible explanations include agency problems, lack of knowledge about materiality, or attempting to divert attention from poor performance on material themes. It is important to realize that the degree of success of engagement only sometimes affect ESG rating (Barko et al., 2018). High-rated companies are more likely to receive a downgrade (“not yet priced in”) in case of an unsuccessful engagement path. In contrast, low-rated companies are more likely to receive an upgrade (“improvement is shown”). Incidentally, it is equally important to note that ESG ratings, like many other ratings and financial forecasts, always contain a degree of subjectivity.

Dimson et al. (2015) conducted a study on the effects of engagement activities at 603 publicly traded companies in the US over the period 1999–2009. Their analysis defines engagement as successful if a particular milestone is achieved and reported on. They show that the success rate is 18%, it takes approximately two to three engagement activities to achieve success, and the average time to success is a year and a half. It is shown that engagement has a positive effect on intangible non-financial returns, being an improvement in one or more ESG factors. Grewal et al. (2016) show that shareholder proposals on ESG improve in the company's performance on the relevant ESG component, even though such proposals are rarely adopted. They also find that financially tangible engagement activities positively affect returns, but intangible activities generally intervene with returns. One possible explanation for the negative return is that corporate social performance can be seen as philanthropic activities of management at shareholders' expense.

In addition, Dimson et al. (2015) find that successful engagement activities, as opposed to unsuccessful ones, have a positive effect on risk-adjusted financial returns. This is true in both the short- and long-term, as visible in Dimson's (2015) Figure 1 Panel A, and is confirmed in several other studies. Flammer and Bansal (2017) examine shareholder proposals on long-term executive compensation that succeed or fail by a slim majority vote (called the close call proposal). Adopting such proposals leads to higher risk-adjusted financial returns, evident by an improvement in return on assets and net profit margin. Successful engagement activities can mitigate investment risk (Hoepner et al., 2018), boost firm revenue (Barko et al., 2018), and generate outperformance (Grewal et al., 2016). Gibson et al. (2020) show that outperformance is due to mitigating investment risk. However, it should be noted that the positive effect of good corporate governance diminishes the moment it becomes mainstream due to the learning effect (Bebchuk et al., 2013). Finally, Barko et al. (2018) find that the duration of outperformance can last, on average, 6 months and often more than 12 months.

Gollier and Pouget (2014) show that investors can achieve positive abnormal returns by investing in non-responsible companies and turning them into responsible companies. Dimson et al. (2015) also find that an organization is more likely to become engaged if (a) it is a larger and relatively mature company, (b) the proportion of socially conscious institutional investors is higher, and (c) the company in question suffers from reputation problems. Their study concludes that the success rate is higher if several engagers work together. Appel et al. (2016) claim that passive investors are increasingly important in influencing company decisions. This leads to decreased activism by non-passive investors and to improvements in firm performance over time. Barko et al. (2018) examine the effect of shareholder engagement on ESG performance. They find that companies subject to engagement and ex-ante fall in the lowest ESG quartile and perform 4.7% better than non-engaged companies. They also find that successful engagements generate higher returns than unsuccessful engagements.

In summary, the conclusion around engagement is that successful engagement activities have a positive impact on both intangible and financial returns. The success of engagement depends in part on the materiality of the engagement theme. Successful engagement processes positively impact on long-term performance. ESG proposals that are honored result in positive market reaction. As a result, engagement enhances the return/risk profile provided a financially material issue is held and a successful trajectory is achieved. Furthermore, the consequences are most prominent for the social (S) component of ESG.

5 ESG investment and funds' portfolio and preferences

The previous sections have emphasized how ESG considerations can protect against return drawbacks and boost long-term returns for each asset class, especially for bonds and real estate. Therefore, the portfolio return is closely related to ESG. But in a portfolio context, although we have previously identified some new risk categories in Section 3.5, portfolio-level risk also constitutes a key part, and the ESG stock investments are being contemplated precisely due to the purpose of decreasing portfolio risks by utilizing their low correlation with the funds' current portfolio constituent stocks. Hence, this section is devoted to discussions about the effect of ESG on funds' portfolio risk-return tradeoff and, in turn, the fund investors' preferences.

5.1 Portfolio characteristics

Much research has shown that company financial performance and sustainability are positively correlated. However, many investors still need help deciding how important ESG is to portfolio performance. Verheyden et al. (2016) are among the first studies to tackle this problem; they examine how ESG screening affects return, risk, and diversification by comparing the results of applying various ESG filters to an investable universe that acts as a fund manager's starting point. The authors ascertain the degree to which ESG data can boost any investment strategy in this manner, irrespective of inclinations toward sustainable investing. Using a 10% best-in-class ESG screening approach—effectively eliminating companies with the lowest 10% of ESG rankings—the authors demonstrate a significant contribution to risk-adjusted returns on both a global and a developed markets universe. More precisely, despite the decline in the number of companies, the international and developed markets portfolios exhibit greater returns, lower tail risk, and no appreciable loss of diversity potential because of this screening. Although there was a more significant departure from the unscreened universe, it was discovered that using a 25% screening filter also add benefit, mainly by lowering tail risks. The authors conclude that including ESG data improves decision-making across the board for all investing strategies, with the ideal arrangement relying on a fund manager's inclinations and readiness to depart from an unscreened benchmark.

In line with the above research, Jin (2022) proposes a paradigm for ESG integration in portfolio optimization, considering that systematic ESG risk could explain the simultaneous movement in security prices. His framework comprises the double-index model, the two-layer grouping, and the extended-criteria decision procedure for ideal portfolio selection. Through portfolio optimization, institutional investors can effectively control systematic ESG risk by following Jin's (2022) methodology. In addition, the framework offers a straightforward decision rule that serves as a valuable supplement to intricate non-linear programming techniques and demonstrates the security features that make it appealing. The method can assist investors in understanding how systematic ESG risk relates to future hazards or returns, managing systematic ESG risk strategically, and enhancing the portfolio's risk-adjusted return, according to an application of the framework to US equities mutual funds. The author's theory may offer a manageable empirical technique that aligns with current theoretical evaluations of ESG factor investment.

Alternatively, Hill (2020) offers a comprehensive and well-balanced examination of the traits of a sustainable portfolio, with particular emphasis on how portfolio managers incorporate ESG concerns into their investment strategy. With $23 trillion in total assets under management globally and about $9 trillion in the US, ESG funds are anticipated to make up 25% of all new investments. While some support the sustainability objectives outlined by ESG, others would instead optimize profits and donate their gains to charitable organizations. Defining and measuring the benefits of sustainability investment is the main challenge facing people who wish to advance sustainability goals.

Raghunandan and Rajgopal (2022) try to determine if investing in ESG funds is stakeholder-friendly or not. In recent years, there has been an increase of investment funds claiming to concentrate on socially conscious stocks. Their study confirms that ESG mutual funds invest in companies with a history of being stakeholder-friendly. Using a large sample of self-labeled ESG mutual funds (as defined by Morningstar) in the US from 2010 to 2018, they discovered that, in comparison to portfolio firms held by non-ESG funds managed by the same financial institutions in the same years, these funds have portfolio firms with worse track records for compliance with labor and environmental laws. ESG funds hold stocks with higher carbon emissions per unit of revenue as well as stocks that are more likely to voluntarily publish carbon emissions performance when compared to other funds offered by the same asset managers in the same years. ESG funds own portfolio companies with higher average ESG scores despite these findings. Their research demonstrates no correlation between corporations' actual carbon emissions or compliance records and ESG scores and the volume of voluntary ESG-related disclosures. Lastly, ESG funds seem to charge greater fees and do less well financially than other funds under the same asset management and year. The accompanying data imply that socially conscious funds must address stakeholders' concerns.

Wang (2024) draws our attention to the often-ignored linkage between ESG investment preference and fund vulnerability. This research examines the investment allocation decisions made by actively managed US mutual funds in emerging market stocks following the 1990s market crises, and looks at institutional policies and disclosure at the national and company levels that affect mutual fund allocation decisions about major stock market indexes. He discovers that US funds spend more in open emerging nations with more robust legal frameworks, shareholder rights, and accounting standards. At the firm level, discretionary initiatives like increased accounting openness and issuing an American Depositary Receipt are shown to be more frequently invested in by US funds.

5.2 Investors' preferences

During the past few decades, the financial industry has undergone significant changes, with one of the leading causes being the impact of ESG issues. Initially a passive approach to exclusion-based investing, it has evolved into various investment techniques, including proactive participation with ESG by shareholders. Döttling and Kim (2021) demonstrate that investors are drawn to ESG investing. Rau and Yu (2023) provide a more recent review based on the interactions among investors, institutions, and firms.

Naturally, one should wonder what has spurred this growth. More importantly, why would an investor behave in this way? Are ESG characteristics more appealing to investors because they offer better risk-return tradeoffs or can be used as a hedging tool, meaning that they are more beneficial from a financial standpoint? Or has there been a recent development of a specific “taste” for ESG that provides investors with a non-financial utility, like the sense of moral fulfillment that comes from having had an impact on the environment and society? Do these various forms of demand for ESG investing have different consequences in the future? This last question is one of the most important financial concerns among practitioners, and scholars have started to address it. In this subsection, we examine the emerging body of finance research to try and comprehend ESG investments and the investor preferences behind them.

Investing in ESG first satisfies the funds' desire to mitigate risks via financial rewards. Hedging long-term climate change-related risk is unquestionably one of the main reasons, as it has been extensively established to be a substantial risk factor, especially in the eyes of institutional investors. Because of this, institutional investors have pushed for firms they invest in to disclose their risk exposures. A significant area of scholarly inquiry has concentrated on the theoretical formulation of climate risk and its impact on asset values. Many studies have investigated whether real estate, options, and equity markets price in this risk based on cross-sectional and time-series data across various asset classes and about different climate risk scenarios like extreme weather or sea level rise. The substantial gain exposed to weather events reflects the general agreement that climate is a crucial source of risk. Such consensus is why hedging measures to reduce this risk appeal to investors. Beyond climate risk, downside risk is an issue for ESG investors. Corporate involvement in CSR is, in fact, generally argued and shown to be a helpful hedge against downside risk in the literature on CSR. For instance, earlier investments might retain key employees and attract repeat customers or mark distinctiveness in market, safeguarding the investor in the event of a reputational or economic shock. One such shock that has affected businesses globally is the pandemic. Companies with strong ESG performance saw a substantially smaller decline in stock prices in economy meltdown. It has been demonstrated that institutional investors' involvement in ESG-related shareholder engagements significantly lowers the underlying issuer's exposure to downside risk, supporting ESG investment's purpose of obtaining hedging benefits.

Investors may also be motivated to prioritize ESG investments due to the non-financial benefits they derive from matching their investments to their social preferences. Hart and Zingales (2017) contend that shareholders prefer pro-social targets would induce firms pursuing shareholder welfare maximization instead of focusing solely on value maximization, even though internalizing environmental and social externalities in investments is costly for businesses. Fama and French (2007) illustrate how to include a non-financial dimension in a pro-social investor's preference, in which the authors represent assets as consumption products that investors have preferences for. They demonstrate that investors who have preferences for assets that are like those of socially conscious investors experience negative alphas in equilibrium. In a comparable CAPM, Baker et al. (2018) theorize that investors who hold green bonds receive non-pecuniary utility. This concept explains empirical evidence that green bonds are priced higher than ordinary bonds. Numerous studies have offered a range of empirical evidence supporting these non-financial incentives for ESG investing. Contrary to popular belief, which holds that fund flows are typically quite sensitive to performance, ESG fund flows, for instance, are smoother and reluctant to drawbacks. Riedl and Smeets (2017) show that impact investors in an experiment setup donate more and buy more shares of SRI equity funds. Furthermore, their results show that these investors purchase ESG funds even when they anticipate poor performance from those funds, demonstrating that they are prepared to forfeit profit to match their investments with social values. According to experimental data presented by Humphrey et al. (2021), people change their investment strategy when their choices harm charities that are important to them. Bauer et al. (2021) prove that investor preferences for SRI influence investment behavior. Specifically, they discovered that members of Dutch pension plans direct their money manager to prioritize SDGs.

Third, investor-side demand considerations have an impact on ESG investing, in addition to the above identified hedging-demand and pro-social factors. Investors with non-financial motivations and those concerned about climate and other adverse risks can coexist in the market. The core of contemporary theoretical frameworks for ESG investing is investor heterogeneities or changes in investor preferences for ESG. For instance, Pástor et al. (2021) provide more insights than the earlier research by incorporating investor preferences for “green” investments. Their model demonstrates that ESG investments are more expensive due to their buffer effects for environmental penalties, even in the absence of non-financial advantages. It makes sense that when climate concerns materialize, and environmental regulations tighten, “brown” assets will fare poorly. Green assets warn of a reduced expected return by acting as a buffer against such hazards. The model also demonstrates that although long-term predicted returns for green assets should be lower, they might beat brown holdings in the short term if investor sustainability preferences are positively shocked.

Next, ESG preferences of retail mutual fund investors were strengthened by crises. The reactions of different investor classes' ESG investment flows to a negative economic shock are still debatable. Lai, Bogoch, Ruktanonchai, Watts, Lu and Yang (2022) research addresses this topic by examining the sustainability or fragility of retail mutual fund investors' demand for ESG due to the significant economic shock caused by COVID-19. According to them, the COVID-19 shock caused a considerable decline in retail demand for ESG investments. This decline is consistent with pro-social preferences, which become more difficult to pursue in hard times. On the other hand, they record strong institutional investor demand for ESG, as institutions make ESG investments as a safeguard against negative returns. The economic crisis due to the coronavirus outbreak offers a perfect setting for researching how unanticipated economic shocks affect ESG investment decisions. Firstly, it has set off the first considerable crisis in the real economy in this era of rising sustainable investment. The second point that supports the causal relationship between economic distress and ESG demand is that the underlying cause of the economic shock varies across regions and are unrelated to economic preconditions. Third, the ongoing decline in economic conditions helps differentiate shifts in ESG demand from straightforward valuation effects, as it starkly contrasts to the initial stock market fall and the following post-stimulus resurgence. One can use this shock to quantify the revealed preference for ESG by looking at how retail investors responded to investments made in mutual funds with better SDG scores. Retail investors are known to aggressively reallocate capital among funds in response to fluctuations in opinion and preference, so retail sustainable fund flows are a useful metric. Retail investors account for more than 60% of all net mutual fund assets, are also significant to the economy. Based on sustainability ratings and weekly retail fund flows for US-domiciled open-end equities mutual funds, as well as data from Morningstar, Lai et al. (2022) conclude that retail investor demand for ESG investments significantly declines when COVID-19 stresses the economy. When the pandemic-induced economic slowdown began, the funds scored better in SDG ratings—which had seen higher-than-average flows before the crisis—saw a sharper flow decrease, eventually falling to the level of funds with worse SDG ratings.

Turning to financial institutions, their flows into sustainable funds are still occurring. The demand for sustainable investments by institutional investors is sensitive to economic situations. This is in line with the pro-social ESG demand of retail investors. When comparing the fund flows from individual and institutional investors, institutional investors have higher minimum investment requirements and are subject to significantly less financial constraint. Furthermore, institutional investors' primary risk-hedging strategies include robust, explicit ESG mandates, and ESG shareholder involvement. If ESG investment is motivated by pro-social preferences, then given these distinctions, one would anticipate that individuals in distress will reduce ESG investment more severely under challenging periods than dedicated risk-neutral market participants—institutional flows fall less significantly for high sustainability funds in reaction to external shocks. Indeed, during the early stages of any crisis, institutional flows declined precipitously, primarily for low sustainability funds, but only momentarily. This suggests that retail flows follow non-financial preferences for ESG, which is regarded as a “luxury good” that retail investors can no longer purchase in a down economy.