- 1School of Business and Economics, Faculty of Biosciences, Fisheries and Economics, UiT The Arctic University of Norway, Tromsø, Norway

- 2Department of Media and Social Sciences, Faculty of Social Sciences, University of Stavanger, Stavanger, Norway

Interest on the creation of sustainable value has recently increased as a response to global issues caused by traditional business-as-usual logic. Indeed, corporations pursuing profits and competitive advantage at the expense of social and environmental resources has become a source of pressing concern and institutionalized unsustainability needs to be reversed. To create sustainable value, a paradigm shift is required in who benefits from value creation: beyond customers, suppliers, and business partners, value should be created for an expanded range of stakeholders including governmental and non-governmental entities, local communities, and future generations. This study refers to unique value creation derived from business modeling for sustainability and the stakeholder theory perspective as a theoretical lens for understanding how sustainable shared value is created in the context of carbon capture and utilization. Using an exploratory, in-depth single case study of a microalgae cultivation project, the study gathers empirical evidence to show how engaging stakeholders around a common purpose can serve as a path to open new business opportunities for sustainable shared value. This study challenges the Friedman's assertion of shareholder profits and shows evidence of the power of creating shared value if a company adopts a purpose beyond profits. Through empirical findings on how embedding a sustainable purpose at the core can lead to business opportunities that provide shared value for multiple stakeholders, it outlines how a company can obtain value propositions that cater to economic, environmental, and societal balance in the drive to move toward a more sustainable society. This study thus contributes to the growing body of empirical literature on creating shared value and business models for sustainability. The findings are also relevant for various industry practitioners, presenting insights on sustainable value creation and business modeling for an industry plagued by high emissions and stakeholder pressure to do good.

Introduction

We are now living in the Anthropocene era, where human and social processes are driving major changes in natural cycles (Shrivastava and Zsolnai, 2020). We are also witnessing the rise of the global value chain, enabling efficient production, mass consumption, and disposal on a global scale (Hernández and Pedersen, 2017). An important sector that has been transformed by this global value chain and impacted the natural cycles to a large extent is manufacturing. This sector, as the case in this study, contributed over 16% of the global GDP in 2018 (World Bank, 2021), and despite a temporary downturn due to tariffs, trade tensions, and the COVID-19 pandemic (United Nations, 2020), it remains a significant contributor to the global economy. In addition to the manufacturing sector, some other sectors—such as mining and quarrying, electricity supply, transportation, and construction, ensure the welfare, survival and consumption needs of a nation's current population (Jackson, 2009).

From the start of the Industrial Revolution, to our current worldview of the global value chain, social and environmental grand challenges have emerged mostly because of a capitalist society that has separated ethics from economics (Edgeman, 2019). We have witnessed the rise of sectors with various industry players which irrefutably stand as economic pillars but concurrently harm the natural ecosystem and exploit human capacity by nature of existence (Mohan Das Gandhi et al., 2006). The subject of corporations maximizing shareholder profits at the expense of social and environmental resources is now a pressing concern. We have experienced persistent issues such as resource depletion, pollution, job insecurity, occupational health and safety violations, and unsustainable production and consumption patterns (United Nations, 2020). Notable advances have been made toward addressing these grand challenges; however, most industry players are yet to make necessary changes to embed environmental and social sustainability in their business models (Bocken and Short, 2021). Morris et al. (2005, p. 727) conceptualized business models as a “concise representation of how an interrelated set of decision variables…are addressed to create sustainable competitive advantage in defined markets”. A recurring issue, however, is that while pursuing sustainable competitive advantage, social and environmental unsustainability becomes the norm. Businesses are now urged to move away from institutionalized unsustainability, redefining their business models to holistically integrate sustainability principles and actively engage with various stakeholders.

Scholars have called for more research to understand how sustainable value is created not only for shareholders but also with and for an extended sphere of stakeholders (Ludeke-Freund et al., 2020). Freeman et al. (2010, p. 26) define stakeholders as “any group or individual that can affect or be affected by the realization of an organization's purpose.” This definition includes business partners, employees, customers, financial stakeholders, and societal stakeholders. Stakeholders drive the value creation process (Freudenreich et al., 2020) and facilitate and inspect sustainability performance (Menke et al., 2021). Traditionally, the priority has been to maximizing shareholder value; externalizing social and environmental costs (Ordonez-Ponce et al., 2020) and subsequently addressing accountability through other means such as the corporate social responsibility approach. However, critics have noted that with this approach companies typically fall into traps of self-serving corporate philanthropy and greenwashing (Frynas, 2001; Sheehy, 2015).

From the business model perspective, this trend is a result of the traditional commercial logic of value exchange. Value, a core element of a company's business model (Osterwalder and Pigneur, 2010; Teece, 2010), is typically interpreted as customers' willingness to increase a company's competitive advantage through the purchase of said company's value propositions, as manifested in products and services (Bowman and Ambrosini, 2000; Freudenreich et al., 2020). Literature on Business Models for Sustainability (BMfS) has been growing, especially with regard to manufacturing (Agwu and Bessant, 2021). Extended approaches to value creation such as Elkington's (1994) triple bottom line (focusing on what value is created) and Stubbs and Cocklin's (2008) stakeholder theory approach (focusing on for whom and how value is created) are embraced as the most developed perspectives in BMfS research. The concept of “sustainable value creation” has thus developed, representing a shift from traditional assumptions of value creation, toward a multilevel, pluralistic and stakeholder-responsive interpretation of value that needs to be better understood (Ludeke-Freund et al., 2020).

The Creating Shared Value (CSV) framework was created by Porter and Kramer (2011) to address how value can be created for multiple stakeholders by addressing societal challenges. We conceptualize CSV as businesses improving profitability by addressing societal challenges, creating value with, and for a broad range of stakeholders, and improving environmental performance (Shrivastava and Kennelly, 2013; Ta-Kai and Min-Ren, 2020; Shared Value Initiative, 2021). CSV is an emerging field that proposes a virtuous-circle approach to sustainable value creation. It is positioned as extending beyond Corporate Social Responsibility (CSR). Although some scholars have critically assessed CSV, it remains hugely popular in practice. Compared to Strategic CSR, it has garnered more attention, representing a greater amount of literature in recent times (Menghwar and Daood, 2021). CSV implies a win-win approach, a proactive method of identifying opportunities to create economic and social values for business and society. Shared value itself, “is not social responsibility, philanthropy, or even sustainability,” as Porter and Kramer's (2011) (p. 4) state “but a new way to achieve economic success”. However, when positioned properly, it can serve as a means to pursue sustainability ambitions, creating sustainable value for various stakeholders. Despite the recent and growing body of work on sustainable value creation, little is known about stakeholders' motivations to participate in creating shared value and how sustainable value is created (Evans et al., 2017; Ludeke-Freund et al., 2020; Vishwanathan et al., 2020; Menghwar and Daood, 2021). As Ludeke-Freund et al. (2020) observe, this is a black box that has only just started to open; we thus pose the following research question.

How is shared value created with and for stakeholders when a company adopts a sustainable purpose beyond profits?

To address this, we conducted an exploratory case study arising out of a collaborative project between a ferrosilicon plant and a University in Norway. We focused on how stakeholders create shared value in the pursuit of sustainability. As the CSV framework on its own does not address how businesses can balance economic, social, and environmental sustainability, this work fills a research gap by exploring how this can be done by engaging stakeholders around a purpose. Our data inform a model that illustrates how this engagement can enable opportunities for BMfS based on shared value. Although our case study focuses on manufacturing, an understanding how shared value is created in practice can aid researchers and practitioners across various sectors. This can help uncover relevant relationships, synergies, trade-offs, and ongoing business practices when creating sustainable value and implementing BMfS (Freudenreich et al., 2020). This study thus contributes to the emerging body of work on CSV, sustainable value creation, and BMfS.

The paper is organized as follows. Theoretical Background draws on relevant literature to present theoretical constructs of CSV and BMfS, aiming to create a link between sustainable value creation using shared value and the purposeful inclusion of stakeholders. Subsequently, Research Design and Methodology outlines the research methodology and introduces the study context. Findings reports the results of the analysis, then Discussion discusses the significance of our study, highlighting its contributions to the field, research implications, and how our findings can be integrated into existing discourses. Finally, we conclude and present areas of future research.

Theoretical Background

A Sustainable Purpose Beyond Profits

Sustainable value creation is based on the basic understanding that economic, ecological, and societal added value arises by purposefully embedding a comprehensive approach to sustainability in the company's core business (D'heur, 2015). Freeman and Ginena (2015) showed that cultivating a strong sense of purpose in organizations led to a wide range of benefits. “Purpose” here refers not to Friedman's (1970) implied purpose of organizational profits, but rather Henderson and Henderson and Van Den Steen (2015, p. 327) definition: “a concrete goal for the firm that reaches beyond profit maximization”. Business executives largely agree on the importance of understanding purpose in this manner, although barriers such as shareholder pressure, lack of incentives, and short-term objectives still persist in practice (Harvard Business Review Analytic Services, 2015). With the prevalence of institutionalized unsustainability, the primary purpose of most industry sectors needs a fundamental reappraisal (Bocken and Short, 2021), reshaping the way business leaders design business models, allocate resources and enable compatibility between their business results and the United Nations Sustainable Development Goals (SDGs; Mañas-Viniegra et al., 2020; Ordonez-Ponce et al., 2021). Researchers have argued that for sustainability-oriented organizations, financial drivers are the least valuable, with higher importance placed on contributing resources toward environmental challenges, community sustainability and engagement, relationship building, and experience exchange (Ordonez-Ponce et al., 2020). This reinforces the argument that a sustainability-driven approach involves a purpose transcending profit maximization. Eckert and Silten (2020) propose that embracing purpose beyond profits requires that companies design such purpose to be

• significant—making a meaningful contribution to an unmet social/environmental need;

• authentic—reflected in the company's culture;

• profitable—providing incentives to innovate on scale; and

• serious—accountable by reporting initiatives.

However, this purpose should not be considered as an end state but rather a continuous journey to propagate organizational change toward a more sustainable society (Jimenez et al., 2021).

Progressing away from business-as-usual involves true collaboration focused on shared value creation with (not value redistribution to) stakeholders (Eckert and Silten, 2020). Freeman (1994) asserts that stakeholder theory focuses on two key questions. First, it asks what the purpose of the firm is, encouraging managers to articulate the shared sense of value they create and what brings core stakeholders together. Second, it emphasizes that this engagement should have a specific purpose. Given that the purpose transcends profits toward creating solutions for societal and environmental challenges, these solutions—as offered through business models—clearly require understanding different stakeholder perspectives (Saari et al., 2019).

Shared Value for Stakeholders

Stakeholder theory in the latter part of the 20th century emerged as an effort to reject the separation thesis and Friedman's doctrine of businesses seeking only to maximize shareholder value. Freeman (1984) proposed that a business can be understood as a set of relationships among groups with a stake in its activities. On this basis, business managers must understand how these relationships work and how to create and distribute as much value as possible to stakeholders amid conflicts and trade-offs. Porter and Kramer's (2011) concept of CSV was later introduced in the Harvard Business Review as the big idea of how to reinvent capitalism and fuel waves of innovation and growth. They interpreted value as economic and societal benefits relative to cost, calling on businesses to go beyond corporate philanthropy and rather understand societal problems as opportunities for the firm. CSV was posited as a transformational model, reshaping business strategy and processes to create positive benefits at different levels. It has since evolved as an important concept, attracting wide public attention from the business environment and gradually increasing scholarly focus within BMfS literature (Menghwar and Daood, 2021). Schaltegger et al. (2015) proposed that BMfS describe, analyze, manage, and communicate a firm's value proposition to its stakeholders and how that value is created, delivered and retained, while maintaining or increasing natural, social, and economic capital beyond the firm's organizational boundaries. This definition reinforces the argument that CSV can stimulate BMfS. By using a virtuous circle of shared value between all stakeholders, the one-dimensional view of value creation for short term financial performance is avoided.

The premise of shared value is that business policies, principles, processes, and practices are redefined and embedded into a virtuous circle that creates opportunities through three sub-strategies:

• reconceiving products and markets.

• redefining productivity in the value chain.

• enabling the development of local or global (Moon et al., 2011) industry clusters.

CSV is an interrelated process (Ta-Kai and Min-Ren, 2020) involving various stakeholders such as companies, social groups, organizations, and partners, as well as the silent, less visible stakeholders—who have limited impact on business decisions affecting them (Simmons, 2004). The urgent sustainability challenges facing the world today are too grand for any single actor to address alone. Accordingly, Porter moved away from the “business is war” assertion popularized by his legendary five forces model, joining Kramer to stress the need for business strategies that are not only virtuous but collaborative, transformational, scalable, and robust.

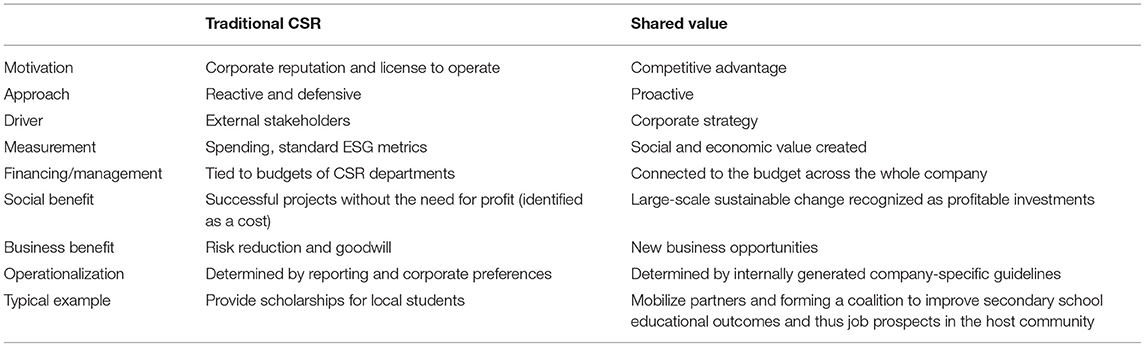

CSV has similarities and differences with other approaches in the field of ethical business behavior, as highlighted by von Liel (2016a). Across scholarly literature, CSV is typically compared with traditional corporate social responsibility (CSR) as illustrated in Table 1. CSV differs from CSR in how it is conceived and practiced (Font et al., 2016; Carroll, 2021). However, in Munro (2020a), it is inferred that the European Commission, in proposing how companies should meet their CSR goals, discusses CSV as a part of CSR. They suggest that in line with the arguments of several authors (George et al., 2012; Munro, 2013; Karam and Jamali, 2017), there is room to integrate both terms under an umbrella CSR strategy and not replace one with the other. CSV extends stakeholder theory with the progressive suggestion that businesses should innovate in terms of societal needs rather than products and services (von Liel, 2016b).

Table 1. Traditional CSR vs. shared value, adapted from Porter and Kramer (2011), Vaidyanathan and Scott (2012), Hidalgo et al. (2014).

CSV and its underlying ideas have received both praise and criticism. Business leaders and large multinational companies such as General Electric, Nestlé, Intel, and Cisco have openly embraced and promoted the approach. By contrast, several scholars have critically assessed CSV, asserting that it is unoriginal and does not address fundamental tensions between business and society (Beschorner, 2013; Hartman and Werhane, 2013; Crane et al., 2014; Dembek et al., 2016; Wieland, 2017). Their criticisms have drawn counter-responses from Porter and Kramer (2014), who note that CSV is based on the work of other scholars in the field and presumes compliance with law and ethical standards. Other scholars, such as Moon et al. (2011) and de los Reyes et al. (2017) have presented extensions of CSV, increasing its legitimacy in the debate on the impacts of business on society.

Although CSV has been criticized for some strong reasons, it need not be abandoned. CSV remains popular because of how it is structured in practice. Practically, it entails finding the points of intersection between the needs of businesses and society, and then building collaborative stakeholder partnerships to address social and environmental problems that traditional business models fail to tackle. The vicious cycle of imitation by competition on cost and quality optimization, so rampant in traditional business models, can be broken through outcomes arising from CSV (den Ouden, 2012). CSV enables outcomes such as competitive advantage, increased social and economic status, economic value, environmental value, firm value and societal value (Ta-Kai and Min-Ren, 2020). Beyond management practitioners, it is also popular amongst research scholars, who attribute its appeal to the attribute that it is simple to understand (Munro, 2020a). Menghwar and Daood (2021) demonstrate that the scholarly use of CSV is gradually increasing, highlighting a meaningful, incremental development. CSV moves away from the reputation-based approach (Beschorner and Hajduk, 2017) and shifts the debate of the impact of business on society from a language of responsibility into that of value (Visser and Kymal, 2015), thus stimulating conceptual perspectives and discussions from scholars who study it in different contexts (Awale and Rowlinson, 2014; Kim, 2018; Islam and Hossain, 2019; Nandi et al., 2022). Indeed, before Hartman and Werhane (2013) criticize CSV, Hartman et al. (2011) empirically applied the approach and concluded that true underlying value is created when the resources of all stakeholders are brought together and a sustained synergy occurs. The three sub-strategies are proposed with a view to scale-up, potentially impacting millions of people with an equivalent environmental impact (Munro, 2020a). These show that the importance of understanding stakeholder perspectives when undertaking CSV cannot be overemphasized.

The active pursuit of shared value requires changes in existing products, processes, and approaches that are beyond incremental (Vaidyanathan and Scott, 2012). It requires a clear social purpose (Font et al., 2016), enabling a shift in thought, internal actions and corporate culture. Considering that societal needs and environmental conditions define markets in which businesses operate, CSV initiates a value proposition emanating from purpose. Thus, competitive advantage is achieved not only through redefined products and services but through the inclusion of an overarching purpose. One with an equally measurable positive impact on a social and environmental issue affecting various stakeholders.

Stakeholders are impacted by the business environment and expect benefits from the company (Donaldson and Preston, 1995). They are essentially at the core of value creation, with some actively providing valuable resources. It is, thus, difficult to execute any business model without sound stakeholder relationships (Freudenreich et al., 2020). Notably, stakeholders have a dual role regarding sustainability problems and solutions—they could either contribute positively or negatively to sustainability issues and concede trade-offs or receive benefits in return for this contribution. In addition, embedding a purpose principle presents easier opportunities to generate sustainable value, align interests, prevent loss of business partners, resources, and legitimacy.

We postulate that by including stakeholders in the CSV approach, the shareholder primacy barrier to sustainability is removed and CSV emerges as a powerful, effective means of achieving a company's purpose aspirations. Stakeholders engaged around the company's purpose present an opportunity to pursue an environmentally, socially, and financially sustainable form of capitalism (Porter and Kramer, 2011). CSV can help fulfill all four of Eckert and Silten (2020) criteria for purpose: it implies significance as it meets a societal/environmental need; authenticity as it relies on business practices and know-how; profitability as it stresses pursuit of new business opportunities; and seriousness as stakeholders' expectations must be communicated. By binding purpose to the notions of CSV for sustainability, businesses regain their social license to operate, moving toward operationalizing the SDGs effectively and collaboratively. The company's purpose, consequently, becomes the stakeholders' purpose, giving rise to new opportunities for sustainable value creation. To realize sustainable innovation, growth, and impact at scale, it is important to rigorously track progress, measure results, and use insights to unlock new forms of sustainable value. This is highly important from the business model perspective, as what is considered sustainable changes over time (Aagaard, 2019). Methods of measuring shared value are still in their infancy; however, leading companies are employing an approach suggested by Porter et al. (2017) to scale the impact of the value created and shift the fundamental connection between business and social progress.

So far, this study has discussed the importance of CSV for stakeholders engaged around a mutual purpose. It should be noted that without integration into business strategy, operations, and talent practices, the shared value created will have limited impact. Strategically, the business model best serving the purpose should be identified and built with stakeholder relationships in mind. The presence of these stakeholder relationships and sustainable purpose for shared value creation is the major difference between BMfS and business models solely built around a customer value proposition (Freudenreich et al., 2020). Bocken et al.'s (2014) seminal work implies that a BMfS puts the purpose journey into practice, facilitating the proposition, delivery, and capture of sustainable value. The authors also present eight sustainable business archetypes subsequently expanded to nine by Ritala et al. (2018)—to categorize and explain the different mechanisms for delivering sustainable value. Furthermore, Wadin and Ode (2019) show that BMfS deliver sustainability through value propositions balancing economic, social and environmental value; business structures delivering value responsibly; revenue models accounting for how each value is captured and delivered among stakeholders; and a customer interface communicating responsible consumption. These elements are fostered by knowledge, trust, collaboration, and a shared understanding of how the shared value created can be sustainable. On these bases, stakeholders can make informed decisions about their contributions to the business model.

Research Design and Methodology

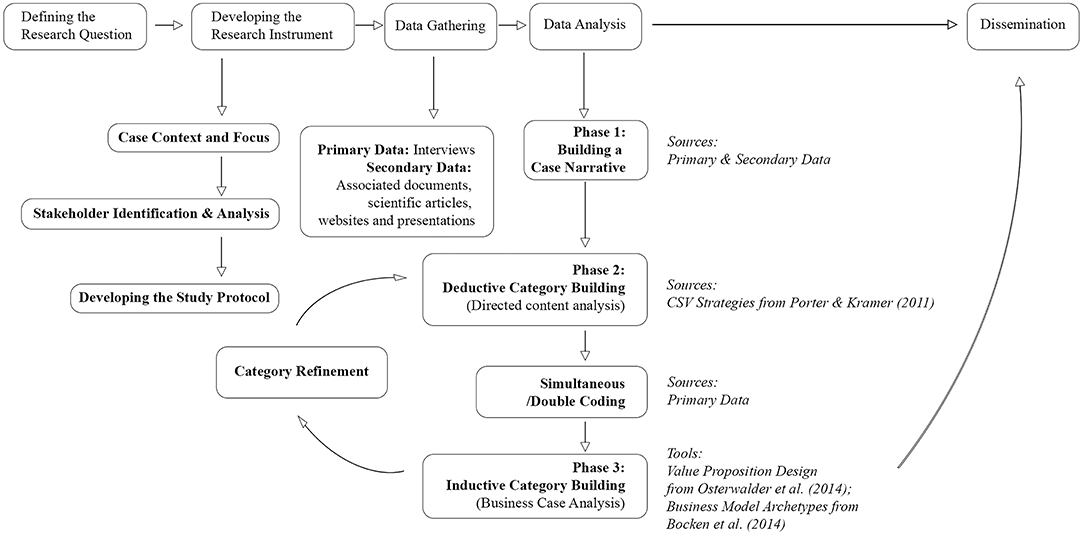

Our research question aims to understand how shared value is created with and for stakeholders when a company adopts a sustainable purpose beyond profits. Considering this, we implemented a research design that enables in-depth understanding of the studied phenomena. The primary author has been involved in the focal project as a doctoral student from its early phases, and thus was well positioned to deeply understand its context. This involvement also enabled analysis as a key informant with unfettered access to information and rich, detailed knowledge of the inner workings of the project and its associated stakeholders. To mitigate the risk of insider bias, the primary author listened attentively to the interviewees and made no attempts to influence their statements during the data collection process. The coauthors have also served as critical colleagues (Yin, 2014, p.76), playing important roles in challenging unjustified assumptions, proposing fruitful directions, and scrutinizing interim conclusions. These methods helped increase the study's objectivity. We adopted an exploratory, in-depth, single case study approach to gather empirical evidence. A case study is useful when investigating real-life interventions in a natural setting, especially where a complex phenomenon is poorly understood (Meredith, 1998; Yin, 2014). In the context of BMfS, value creation has been observed to be of a complex and vague nature (Ludeke-Freund et al., 2020). In addition, the CSV approach is relatively new in research, and the impact of transitioning from traditional business models to BMfS needs to be properly understood. Case studies also aid in contesting or extending existing theories. Hence, to reveal how shared value is created with and for stakeholders when a company adopts a purpose beyond profits, we view CSV as potentially creating new opportunities to be explored via BMfS. To ensure the transparency and traceability of our research process, we followed the research approach suggested by Stuart et al. (2002) with slight modifications to fit our context. Based on this approach, as depicted in Figure 1, the following sections systematically describe our research methodology.

Figure 1. Research process, based on Stuart et al. (2002).

Developing the Research Instrument: The Context of Sustainability in Norwegian Manufacturing

The manufacturing sector is due for a change, and the first step toward realizing this is to provide evidence for the emergence of business opportunities that solve societal/environmental problems using the shared value approach. Scandinavia has been observed to be an inspiring demonstration of the power of the shared value approach (Strand et al., 2015). We chose Norway as our empirical context as the country ranks highly in terms of implementing the SDGs, having pledged to achieve goals within sustainable consumption and production, health and education, equality, employment, and migration by 2030. Norway's manufacturing sector accounts for 27% of total production (Trading Economics, 2022) and the country has achieved many targets with regard to fostering innovation and enabling inclusive, sustainable industrialization. The government allocates large amounts of funding for investment in sustainable value creation: for example, the Grønn platform launched in 2020 with NOK 1 billion to invest in research and innovation-driven sustainable transformation projects over a 3-year period (Forskningsrådet, 2021). Consequently, more companies and institutions are collaborating to research, develop and implement more sustainable production methods, thereby contributing to achieving Norway's overall 2030 and 2050 goals.

Case Company and Case Project

Given the scope of this study's conceptualization of the CSV construct, we follow the criteria developed by Yin (2014) to ensure suitability of our case study. It is observed that the company has been engaged in substantial CSV activities and the non-financial benefits created by the company are visible. Personal contact during data acquisition has ensured access to rich, first-hand content for this case study. In addition, the case company engages multiple active stakeholders to achieve certain strategic social and environmental goals; it thus provides a rich context to study the creation and implementation of shared value.

A unique history and positioning were key reasons for our focus on this company. The case company's operational history dates back to 1960 and has operated as the only solely Norwegian owned heavy industry company in the country. Its current business model is based on the value proposition of offering high quality ferrosilicon, an important metal alloy for the European steel market. Located in the small town of Finnsnes (population 4,720 in 2021), the company supplies just under 15% of the market needs in Europe. In 2007 it emerged as the 14th largest point source emitter of CO2 in mainland Norway, and in 2008, accounted for a third of all emissions in Troms County. Considering the industrialized state of the world today, it is hard to imagine a world without steel, the company thus, adopted a concrete vision of becoming the world's first carbon-neutral smelting plant and a supplemental vision of being the world's most energy-efficient smelting plant (Knutsen, 2017). From 2007, it made numerous attempts to fulfill these visions, attracting the interest of politicians, media, governmental and non-governmental agencies, and the University. Although the company's main value proposition is to manufacture and sell ferrosilicon, it began to explore the pursuit of multiple value propositions in line with its sustainability vision. In 2012, after the completion of its energy recovery facility, it fully implemented a system-wide view of sustainability. This view enables the company to engage in research and development for sustainability, engaging in collaborative value-creation activities and constantly innovating toward a truly sustainable business model.

In 2014, the Arctic University of Norway adopted a strategy toward 2022; to drive and participate in interdisciplinary and knowledge-based economic, cultural, and social growth and development in Northern Norway (UiT The Arctic University of Norway, 2019). This strategy, appropriately called Drivkraft I Nord (Driving force in the High North), enables the development and reinforcement University-industry collaborations driven by the UN SDGs as a bid to tackle the challenges of the future. The result of one of these collaborations is our unit of analysis—a public–private partnership project between The Arctic University of Norway and the company, Finnfjord AS. This project involves the mass cultivation of microalgae in tanks using Carbon Capture and Utilization (CCU) technology. CCU entails capturing carbon dioxide from the atmosphere or point source emissions and using it as raw material in a value chain (Faber et al., 2021). It represents one of two promising strategies to tackle the impact of industry on climate and the environment, the other strategy being Carbon Capture and Storage (CCS) (Acatech, 2019). By some estimates, the market could be valued at USD 1 trillion by 2030 (Marshall, 2018), potentially reducing anthropogenic CO2 emissions and generating value from waste CO2 (Dimitriou et al., 2015). In comparison to CCS, which have faced considerable resistance and economical hurdles in some countries, CCU tends to be positively received by the general public. The debate on CCS vs. CCU have generated some controversial opinions. However, we consider them equally important in the journey toward a more sustainable industry. According to Acatech (2019), companies promoting greenhouse gas neutrality strategies and make use of CCU and CCS must act convincingly with regard to climate protection. We find evidence and strategies geared toward climate protection in our case company and project, thus consider it a supporting case for the advancement of CCU.

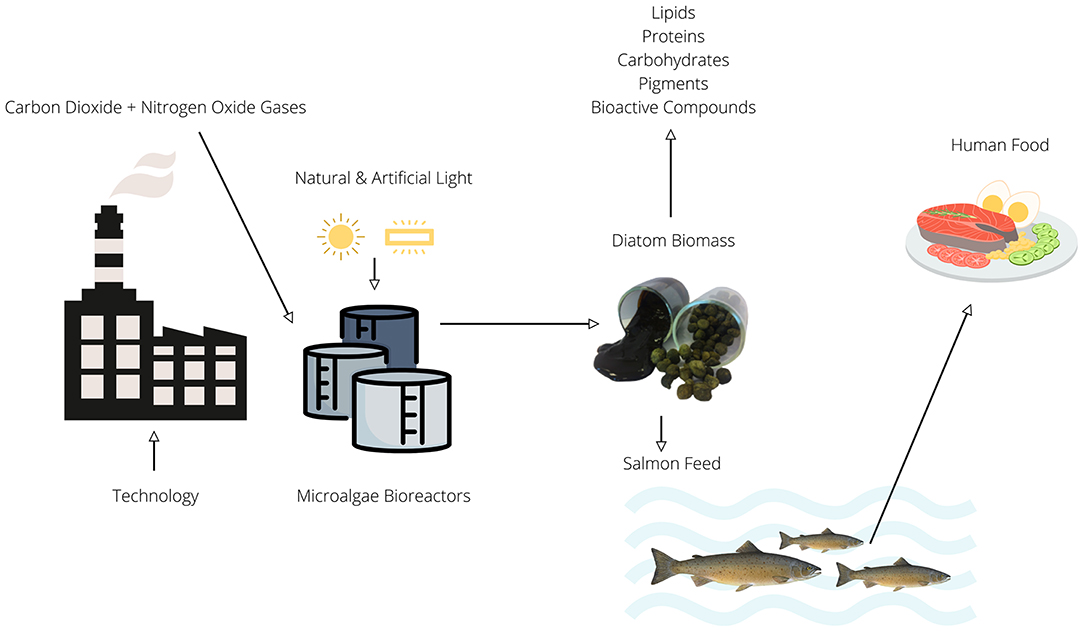

The project has scaled up from using two 600 L photobioreactors (PBRs), shown in Figure 2, to using larger PBRs with 6,000, 14,000, and 300,000 L tanks in 2015, 2016, and 2018, respectively. Extensive testing is done in the 300,000 L PBR, a pre-industrial level sized test reactor (Figure 3). Over recent years, the tests have shown the feasibility of this means of cultivating microalgae using captured CO2 emissions (Osvik et al., 2021). An overview of the technological value chain is illustrated in Figure 4. This value chain represents an Industrial symbiosis approach. Industrial symbiosis is a mutually beneficial collaboration and exchange of resources between two or more traditionally separate industrial entities (Lawal et al., 2021). This type of collaboration has the potential to create economic, environmental, business, and social benefits to all stakeholders involved.

Data Gathering and Analysis

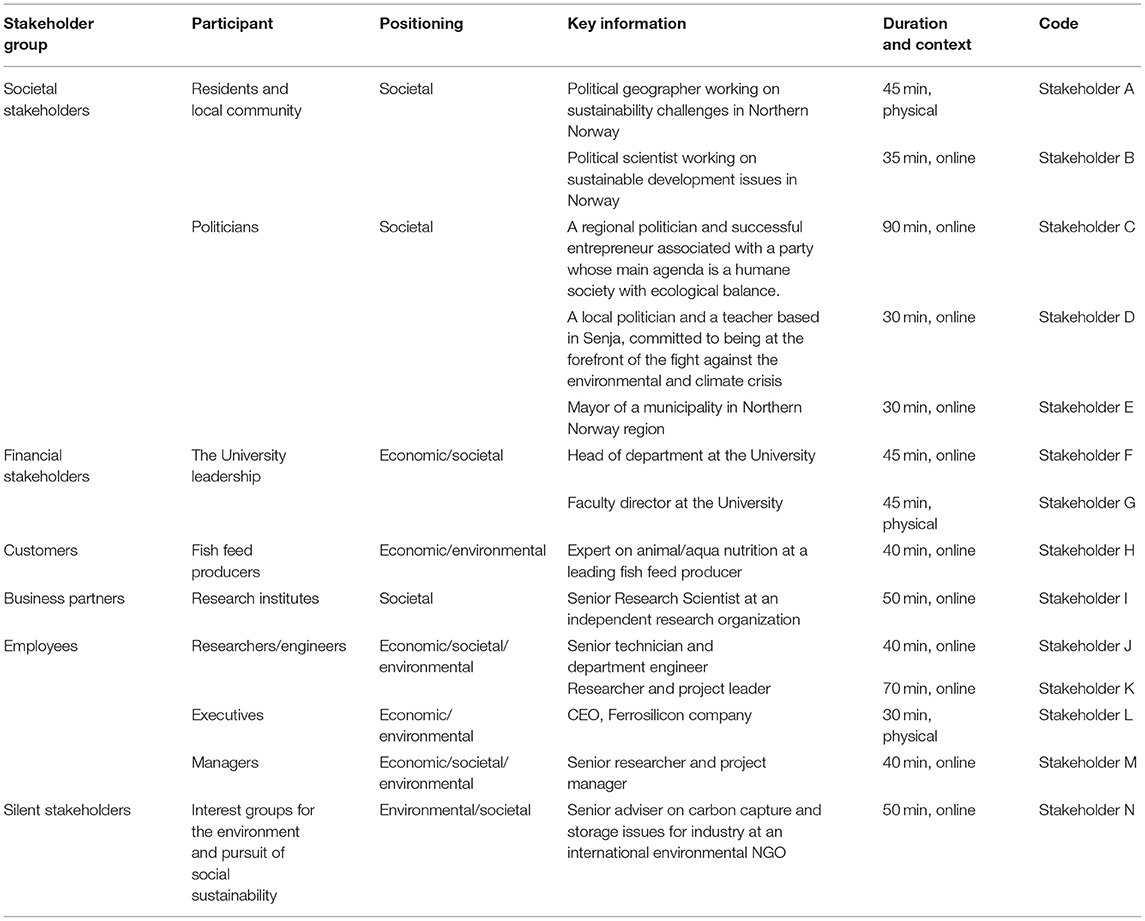

Our data collection process was performed two-fold. The starting point was to identify and analyze the stakeholder groups. This step involved purposive sampling and desk research. Using the four step stakeholder analysis procedure suggested by Varvasovszky and Brugha (2000), our first step involved identifying and mapping the stakeholders to groups in the stakeholder value creation framework for business model analysis by Freudenreich et al. (2020). We mapped each of the potential respondents to five stakeholder groups, adding a sixth group—the silent stakeholders. By combining the personal, participatory insights of the primary author with secondary data (from media, websites and reports), we gained knowledge about the relevant individuals and entities. Our selected respondents were identified via various means, including keyword searches in the media, contacts of working groups, and snowballing to identify further primary sources. Given the emerging nature of knowledge on shared value and BMfS (Ludeke-Freund et al., 2017), we selected individuals who were well informed about or already engaged with the focal case (Palinkas et al., 2015). The sample included individuals at local and regional levels, thus, providing richly detailed data, and localized insights. The contacted members of our stakeholder groups do not constitute a representative sample, as our empirical study did not aim to produce highly generalizable conclusions. Our second step involved collecting data for the stakeholder analysis. For this, we relied on secondary sources, analyzing media statements, websites, reports, and presentations. We thus gained an idea of their relationships and moved on to the third step of organizing and analyzing the stakeholder data. Using the aforementioned sources, we made initial assumptions on their involvement and their major positions with regards to the project and the triple bottom line perspective. We returned to this step after conducting our interviews, thus justifying or reconsidering our assumptions after gaining more relevant and concrete information about their power, behavior, intentions, interrelations, and interests. The selected stakeholders enabled a factual investigation to make new contributions to existing theory on shared value creation and BMfS (Eisenhardt and Graebner, 2007). We gained insights into a specific case with a unique context and history and where stakeholders participate along the CCU technological value chain (Faber et al., 2021)—creating and exchanging shared value in the context of a societal and environmental problem. These insights allowed us to analyze how social welfare in the operating community is improved, and how the company's social license to operate is legitimized.

After identification and initial analysis of our selected stakeholders and their associated groups, we developed a data collection protocol to facilitate the next steps, ensuring consistency in the information collected (Yin, 2014). From November 2021 to February 2022, we interviewed respondents linked with the six stakeholder groups, as shown in Table 2. We initially aimed to interview four respondents per group, totaling 24 respondents. However, we only received 14 positive responses—five assigned to societal stakeholders, four assigned to employees, two assigned to financial stakeholders, one each assigned to customers, business partners and silent stakeholders. We did not weigh the stakeholders equally, as they have varying degrees of power and interest with regards to the focal issue. We however, considered the issue of data saturation, as multiple respondents within the same group typically have similar perspectives. In addition to primary sources, we consulted documents such as PowerPoint presentations from workshops, newspaper articles about the case, company websites, press releases and reports to identify themes reinforcing the perspectives that emerged from the interviews. This combination resulted in a detailed understanding of the studied phenomena (Stuart et al., 2002).

A total of 14 people were interviewed using the interview protocol detailed in Appendix 6. The interview theme was sent to each respondent before the interview, and each interview was conducted with a semi-structured format. Interviews lasted between 30 and 90 min, and the interviewer made notes while recording on a portable recorder. During the interview process, we briefly explained the project and encouraged interviewees to reflect on and discuss shared value creation from their perspective. As participants had a vague knowledge of “shared value” as an academic concept, we posed probing questions to help them understand it. The first set of questions sought a general overview of interviewees' knowledge about the project. The second set of questions sought to elicit their perceptions of the purpose of the project and the shared value it creates. We asked a third set of questions concerning how this shared value is exchanged and any barriers, trade-offs, and impacts they may experience in the value-creation process. These set of questions fed back into our stakeholder analysis, aiding in assessing the power and interest each stakeholder had on the focal project. The interview process was designed to be flexible, enabling the interviewees to openly reflect on their perspectives without interruption. After the interviews, all responses were transcribed using NVivo AI transcription, scanned for errors, and corrected. We then grouped the interviews based on the stakeholder classifications and conducted data analysis. We also completed the fourth step of the stakeholder analysis, mapping the stakeholder power and interest into Johnson et al.'s (2005) modification of Mendelow's (1981) matrix. This foundation helped us capture engagement decisions for each stakeholder group.

All participants gave informed consent and confirmed their understanding that collected data would be anonymized and remain confidential. Recordings were made with the participants' permission.

The analysis of our interview data was carried out in three phases. Firstly, we created a chronological case narrative of the project. By thoroughly reading and profiling the events described by our informants and combining their insights with information gathered from available documents, we were able to create well defined, convergent storylines related to “purpose.” We conducted a microlevel analysis, thoroughly exploring the activities, motivations, and decisions conveyed by each identified stakeholder. This helped us acquire concrete knowledge of shared value creation in this context and how the various stakeholders contribute, reaping rewards and experiencing trade-offs in the process.

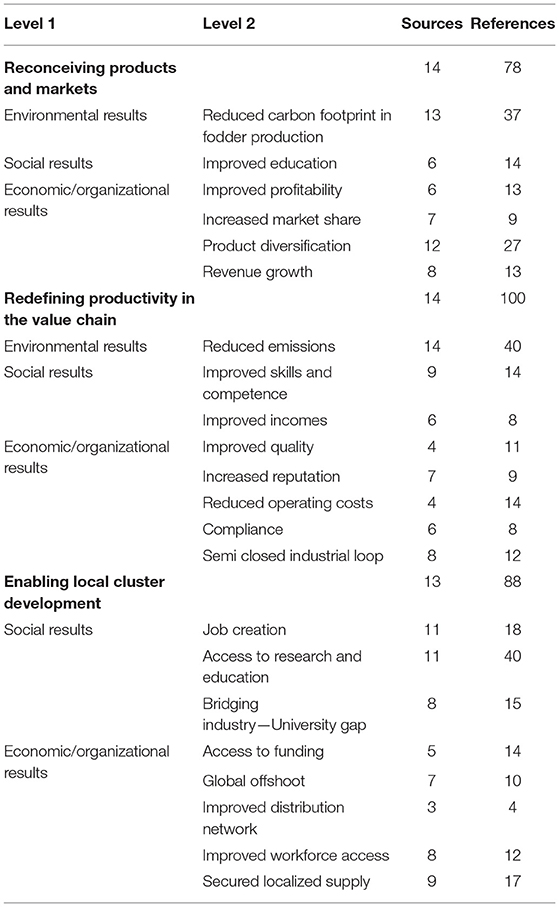

Following this first phase, we used directed content analysis to organize and analyze the data. As a research method, directed content analysis is a structured process aiming to validate a theoretical framework using existing theory. This method of analysis is more moderate than a purely inductive approach. Leaning on the method suggested by Elo and Kyngäs (2008), our directed content analysis approach consisted of preparation, organization, and reporting. To prepare, we selected key concepts indicated in in Porter et al. (2017) framework and carefully read the interviews several times to gain a deep understanding of the data in relation to the framework. We proceeded to organization, mapping our first level codes to the identified perspectives of the CSV framework, interpreting the results under three categories:

• reconceiving products and markets;

• redefining productivity in the value chain;

• enabling the development of local clusters.

We used simultaneous coding (also called double coding), whereby two or more codes are assigned to single or sequential text passages (Saldaña, 2013). This method is useful in qualitative inquiry due to the presence of nuanced data which suggests multiple meanings. For our first category, we coded for subthemes focused on perceived benefits from revenue growth, market share, and profitability arising from environmental, social, or economic development. For instance, the statement “we will get a very nutrient rich marine biomass comparable to, for example, fish like anchovies, nutrient wise”, was coded to reconceiving products and markets. The second category codes were related to subthemes on improvements in internal operations—including environmental improvements, better resource utilization, investment in employees, and improved supplier capability—that enhance costs, input access, quality, and productivity. An example of a statement coded to this category was “For us as human beings, this will reduce the emission of CO2 and other gases that may drive the climate change further.” Codes for enabling the development of local clusters focused on subthemes such as improving the company's external environment through community investments and strengthening local suppliers, institutions, and infrastructure in ways that enhance business productivity. An example of a coded statement matched with this category was “As a research institution and a partner, a potential benefit is that we have got a large project which will occupy many researchers for years”. Operational definitions for each category were determined using the theory, and this process was conducted for all transcribed interviewed. Finally, to report our findings, we have used tables and appendices to demonstrate the links between data and results.

The third phase involved analyzing the business case for shared value creation in the focal context. By utilizing the value proposition design canvas of Osterwalder et al. (2014) and mapping our data to the sustainable business model archetypes developed by Bocken et al. (2014), we identified the appropriate direction for business models for sustainability enabled by shared value creation in our context.

Findings

The results of our stakeholder analysis, as detailed in Appendix 1, show the power, interest, position, and triple bottom line alignment for the various stakeholders. We identified that for the societal stakeholders and business partners, there was a high interest and low power over the outcome and success of the project. However, these two groups were observed to be generally supportive of the project. The customers and the silent stakeholders were observed to hold high power over the outcome and success of the project although there was a low level of interest in this exact project. The stakeholder groups identified with high levels of power and interest were the employees and financial stakeholders, who are highly dependent on the success of the project.

The following subsections report the results of our investigation into shared value creation in the case study. Section Chronological Case Analysis: Descriptive Findings on Engaging Around a Purpose presents insights on how the stakeholders understood and engaged around purpose as a starting principle for stakeholder inclusion. Section Bridging Shared Value with Purpose presents our findings on bridging shared value with purpose, using Porter and Kramer's (2011) CSV constructs. These findings provide an in-depth perspective on how shared value is created in the focal context. Finally, Section Emerging Opportunities for Stakeholders Across the Sustainability Dimensions uses the value proposition canvas to develop emerging opportunities for environmental, social, and economic value creation, establishing the foundation for building BMfS.

Chronological Case Analysis: Descriptive Findings on Engaging Around a Purpose

The idea to create a facility utilizing carbon dioxide from factory smoke had been incubating for years. In the early 1980s, Stakeholder M was conducting groundbreaking research at the University on constructing a live food chain based on phytoplankton. Studies were conducted on how to improve the means of feeding cod larvae used in the lab. Over time, the Stakeholder M's research group constructed an automatic cultivation device and discovered a societal need that could be solved by improving this method of microalgae cultivation.

Stakeholder M, now retired from the University, but serving as a research manager in the project, described the need:

We realized more and more that this could lead to something, to put it that way. The world needs more energy, needs more food; we cultivate crops on land. We need large areas, and we need fertilizers... Why not use the sea? I mean, more than half of the oxygen we breathe comes from the sea. It is produced every year by phytoplankton, by microalgae. More biomass is produced in the sea than on land. So why don't we take farming on land into tanks?

The research group began formulating a vision for cultivating a special species of microalgae (diatoms) in tanks. At first, they used carbon dioxide from commercially purchased pressurized tanks; over time, however, they discovered that since heavy industry emits large amounts of carbon dioxide, there was an opportunity to provide the carbon dioxide needed to grow the diatoms and potentially create solutions for the industry with regard to emissions. Stakeholder F described this initial thought as follows:

He was doing groundbreaking basic research for years, and he didn't do that to make a factory. He did the research to know more about these [phytoplankton]. And then you get the discussion of, say, climate change like 20, 30 years later on. And then somebody thinks, how can we clean this or reduce the pollution? You can argue that these things fit, in a way.

In early 2012, the research group contacted the nearest heavy industry company to express an interest in using carbon dioxide from factory smoke to grow microalgae in tanks. Coincidentally, the company was also seeking new ways to reach certain environmental targets as, according to Stakeholder L, it understood the impact of its production on the environment. The company had invested NOK 800 million in an energy-recovery system in its production line, producing up to 340 GWh of electricity per year and reducing energy wastage. Generally, the company understood the need to amend the nature of its business and was open to new methods of improving the circular economy in its production line. Within the company, this direction brought about creative proposals such as bio-oil refinement, on-shore halibut farming, greenhouse gardens for tomato production and boats that can transport warm water to nearby cities (Knutsen, 2017). Although none of the aforementioned proposals were realized, this change in business culture, thoughts, and process proved fruitful in 2018 as the company became recognized as one of the world's most environmentally friendly and energy-efficient ferrosilicon plants. Regarding the case project, although the company did not initially understand how disciplines such as marine biology and metallurgical processes could be combined, it was open to suggestions for reducing its environmental impact. As Stakeholder L explained:

We said we are going to be the first ferrosilicon producer without CO2 emissions… What we are doing here is straining nature: we are consuming a lot of resources, we are consuming a lot of electricity, we are emitting a lot of CO2, sulfur dioxide… there is a certain amount of environmental pressure when you are producing ferrosilicon.

In 2020, the industry sector in Senja municipality emitted over 300,000 tons CO2 equivalent (Miljødirektoratet, 2020). The company understood that as one of the three top sources of greenhouse gas emissions in Senja, it had to act. Conversely, producers of ferrosilicon compete globally on price point. This meant that charging final customers a premium for less environmentally stressing ferrosilicon would reduce the company's competitiveness. To overcome this hurdle, it was important for the company to look beyond transactional gains as the main purpose of its operations.

The initial idea and collaboration started as a means to connect basic research with an industrial challenge. However, as the small-scale production of biomass succeeded beyond expectations, the research team and the company identified a potential opportunity to solve societal and environmental problems for aquaculture and the manufacturing sector, provided they could scale up production to an industrial level.

The research group focused on cultivating Arctic diatoms due to their ability to handle low light and temperatures prevalent above the Arctic Circle (Eilertsen et al., 2022). Over time, their studies revealed that these microalgae are rich in long-chained polyunsaturated fatty acids, needed by aquatic and terrestrial animals (Morales-Sánchez et al., 2020; Dalheim et al., 2021; Osvik et al., 2021). Another study showed that adding these microalgae to the diet of salmon can significantly reduce the level of salmon lice—a recurring problem in Norway's aquaculture industry (Hustad et al., 2020). Svenning et al. (2019) also inferred that large-scale production has the potential to provide an essential nutrient source for the aquaculture industry, replacing the conventional, non-sustainable sources of fish meal and fish oil currently used.

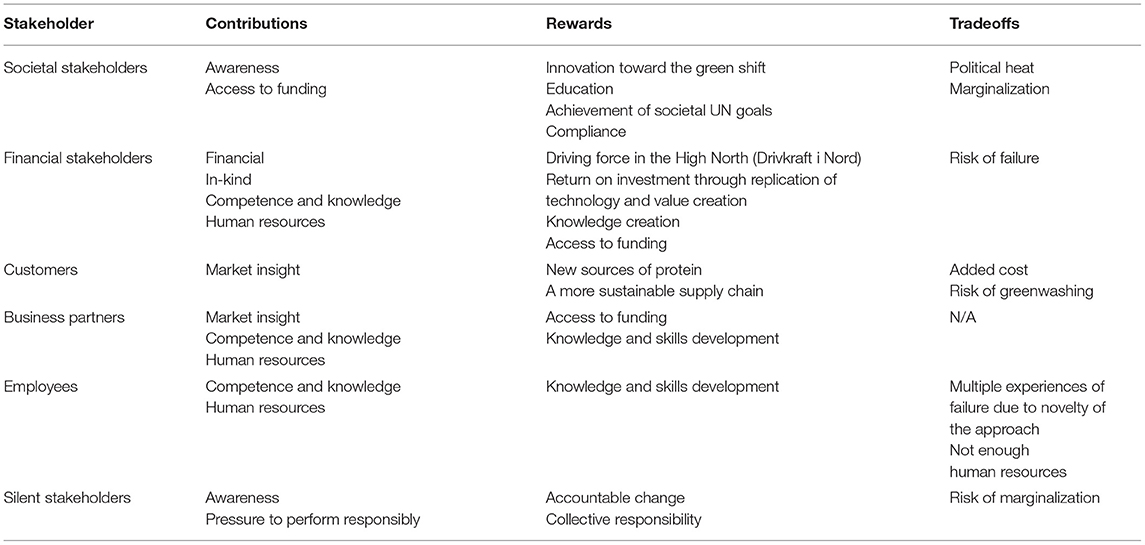

Our findings revealed that the combination of different factors, and the subsequent presence of converging objectives, caused the inclusion and engagement of more stakeholders around the common goal. As Table 3 illustrates, our interviews showed that stakeholders understood the contributions, rewards, and trade-offs they might experience by engaging around the purpose of solving a societal need in the focal context. The trade-offs converged around various risks such as greenwashing, due to inadequate measurements and reporting, and marginalization, due to conflicting or diverging opinions. It was also highly important that the project succeeded, given the scale of tangible and intangible investments required to build it up to its current scale. In addition, the success of the project would provide inspiration for the pursual of similar projects by various industry players.

Bridging Shared Value With Purpose

Table 4 highlights the number of interviews (sources) in which we found evidence of a shared value concept and the number of incidences (total occurrences) of such evidence. We classified the evidence into business/research results and social results. The following subsections detail the recognized elements of CSV in the evidence collected from interviews.

Reconceiving Products and Markets

Considering that the possibility to solve environmental and societal challenges can open new opportunities, businesses constantly evaluate how this might positively affect their value chain. The scientists employed on the project implied that the microalgae harvested from the facility could be used as a carbon sink, stored at the bottom of the sea as a CCS approach. However, the data revealed the early realization of collaborating actors that the CCU approach—including the algae in another industry's supply chain could provide a win–win situation. This was mostly highlighted by interviewees expressing an observation of reduced carbon footprint in fish fodder production, as well as a diversified line of products enabled by merging manufacturing and aquaculture. Both interviews and secondary data suggest that the aquaculture industry, as the second-largest contributor to Norway's GDP, is moving in a more sustainable direction. Indeed, the extensive use of soy-based protein in the fish food supply chain has been criticized for its harmful social and environmental impacts (Rainforest Foundation Norway, 2018; Hansen, 2019). Furthermore, extensive usage of soy in the aquaculture value chain has led to decreased omega-3 content in Atlantic salmon (Eilertsen et al., 2022). These developments have led to the inclusion of fish catches into the aquaculture supply chain as sources of eicosapentaenoic (EPA) and docosahexaenoic (DHA) omega-3 acids. Multiple informants commented that, in Norway, the salmon aquaculture industry also faces a limited and dwindling supply of marine protein and oil sources. Appendix 2 presents some example interviewee quotes highlighting perspectives on reconceiving products and markets.

The analyzed reports revealed a growing awareness of the unsustainability of diverting high amounts of food-grade fish catches to non-human consumption (e.g., by farmed fish, chicken, and pigs), and the need to move toward different types of raw material, with a lower environmental footprint, in the aquaculture supply chain. For the manufacturing company, this industrial symbiosis signified that besides reducing point source emissions, it could also have additional sources of revenue when the market prices of ferrosilicon were low. Although the project is not yet profitable, the company recognized that success would establish it as a profitable manufacturing business with diversified revenue sources in a rather competitive market for ferrosilicon.

The consequences of reconceiving products and markets were not universally supported, however. The financial stakeholder suggested a risk of failure, which would greatly impact on all other active stakeholders considering the amount of tangible and intangible resources they have invested to reach the project's current stage.

Redefining Productivity in the Value Chain

It was observed that for actively involved stakeholders, productivity was redefined through various actions. The stakeholders reflect that the project's success will further close the loop in the manufacturing process, mostly through using previously wasted carbon dioxide as feedstock for microalgae production. Informants also noted that, besides ensuring compliance with regulations, the project has the potential to reduce the costs of energy production and taxes on emissions. The fish feed producer representing the customer stakeholder group stressed the importance of improving the nutritional quality of their final product. They also expressed a motivation to receive value through other qualities, such as parasite prevention. Speaking on behalf of the fish farmers who buy their product, they highlighted that it was also imperative that the cost of receiving sustainable value from the product is not too high.

Secondary data showed that a challenge for productive and profitable microalgae cultivation is achieving low-cost, energy-efficient production. For both aquaculture and manufacturing, informants implied that there is high motivation to contribute actively to sustainability transition, but complexities and challenges should be expected. In addition to a potential lack of adoption due to the aforementioned challenges, some stakeholders expressed the potential risk of greenwashing if climate impact is not correctly calculated and accounted for. Appendix 3 presents illustrative interviewee quotes regarding elements of redefining productivity in the value chain.

Enabling Local Cluster Development

Informants emphasized that engaging around the pursuit of more sustainable manufacturing and aquaculture industries would bridge the gap between University and industry. The evidence elucidates how the University, as a core social institution, can provide extensive value in transitioning to a sustainable future.

Although it was coincidental that the research group contacted a company able to provide resources to explore its idea, the partner's physical proximity was highly important for the group. What started as a collaborative initiative to use carbon dioxide from factory smoke has quickly grown into a fully-fledged project set to develop into a national CCU center. Our findings provide evidence that if proven successful, similar projects in northern Norway may have the opportunity to not only emerge as key drivers for innovation and the sustainability transition but also instill a sense of pride in the regional population. Focus on impacts in the region were highlighted by multiple informants, who implied that the project presents a local solution to a global problem. The local perspective was further emphasized by multiple informants expressing that the project would make the region more attractive, helping to gain and retain talents with various attributes. Illustrative interviewee quotes regarding elements of local cluster development are shown in Appendix 4.

Although the original active actors were the University and the company, they recognized the fundamental need for collaboration and communication with other actors in the aquaculture supply chain. In its early stages, the project received funding from Norway's Regional Research Fund. The project has grown past incubation stage, and as of February 2022, four active actors have been mobilized to develop a business ecosystem that can be viewed as an internal and localized cluster, supported by NOK 93 million (~USD 10 million) from the Research Council of Norway. With this funding, the next stage of the project is to upscale the mass cultivation of microalgae and enable extensive testing on its nutritional value as a CO2-neutral salmon feed. The plan is to scale up into a facility that continually grows and harvests microalgae on an industrial scale, manufacturing value-added products such as fish feed in a fully-fledged circular economy system. The company has also joined the Arctic Cluster Team, a 95-member organization enabling partnerships for radical sustainable transition of the process industry toward a circular low-emission society. The University has opened a satellite campus hub on site, providing access to the necessary knowledge and equipment needed for research on the bioprospecting of microalgae. Some informants highlighted the possibility of this hub, as a national CCU center, increasing value in the region through workforce access, job creation, and education. The focal project was the only one in Troms and Finnmark county to receive a grant from public authorities, further reinforcing competitiveness, and improving the opportunities for researching and developing viable solutions to sustainability problems.

A large proportion of our informants highlighted the case company's influence on the project's potential success. The company has invested in financial, human, physical, and in-kind resources, without focusing on short-term profitability. It understands that when success is finally achieved at the required scale, the shared value generated will deliver adequate returns to various stakeholder groups.

Criticisms observed in this category include the risk of marginalization, due to expressed support for an unsuccessful initiative, and tense atmosphere and emotions, due to diverging or conflicting opinions on the environmental and social impacts.

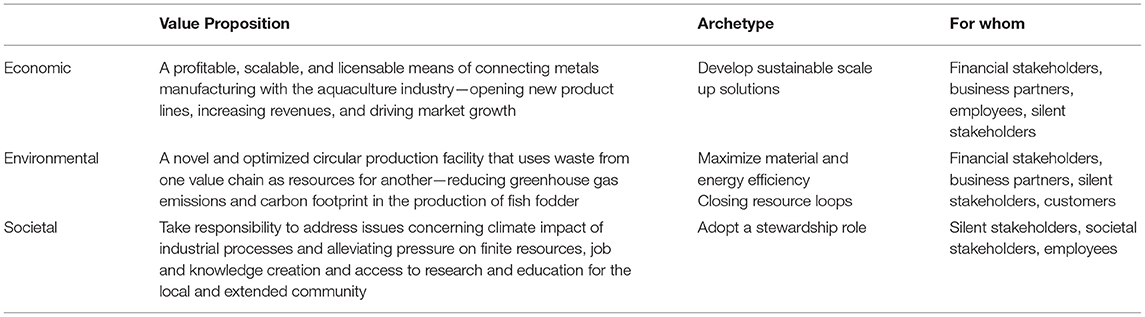

Emerging Opportunities for Stakeholders Across the Sustainability Dimensions

For each of the stakeholder groups, the data provided insights into a value package that can be viewed as emerging business opportunities for a successful scale-up. Using Osterwalder et al.'s (2014) value proposition canvas, we sifted through the data to identify implied jobs (problems the stakeholders are trying to solve, or the needs they are trying to satisfy), pains (risks and potential bad outcomes) and the appropriate pain relievers, gains (desired benefits, results and characteristics) and the appropriate gain creators. We used the results of this to create an emerging value package serving as a starting point for value propositions that targeted all stakeholders along the triple bottom line. Appendix 5 presents full details of how we identified the emerging value package. The data suggest that although the various stakeholders have a shared understanding of the project's purpose, they have varied expectations regarding the rewards for their contributions. Considering that the purpose converged toward creating business opportunities to solve a societal and environmental problem, we can infer that stakeholder expectations converged to cover the triple bottom line of economic, environmental, and societal sustainability (detailed in Table 5).

Table 5. Emerging value propositions and business model archetypes (adapted by Ritala et al., 2018 from Bocken et al., 2014).

Discussion

This qualitative study aimed to empirically explore how shared value is created with and for stakeholders when a company adopts a purpose beyond profits. Using a research design that extends existing conceptual research into the empirical realm, our paper makes an important contribution to theory through its integration of purpose with the stakeholder theory perspective (Freudenreich et al., 2020) and CSV strategies by Porter and Kramer (2011). We use these as the basis for designing our research and conducting the initial analysis. We extended our analysis by drawing on value proposition design principles of Osterwalder et al. (2014) and sustainable business model archetypes of Bocken et al. (2014). The study was designed and conducted in this way to produce findings applicable to researchers and practitioners alike, providing a valuable understanding of how to proceed with business model innovation and navigate the paradigm shift that occurs when benefits transcend transactional gains.

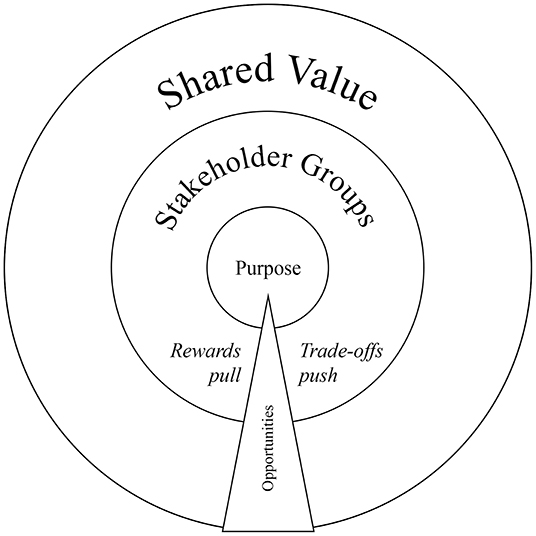

The qualitative evidence illustrates how engaging stakeholders around a purpose can create shared value, opening new opportunities for BMfS as illustrated in Figure 5. The nested circles show when stakeholders engage around a purpose, favorable circumstances for creating shared value can emerge. Stakeholders expect to receive rewards due to their contributions and concede trade-offs as a consequence of interest and power. These rewards and trade-offs affect environmental, societal, and economic impacts of business opportunities realized by engaging around a purpose. This scenario is depicted in Figure 5 by stakeholder rewards pulling open the opportunity triangle and stakeholder trade-offs pushing it closed. The following sections provide insight into the nested implications of engaging around a purpose, stakeholder rewards and tradeoffs and the power of shared value in the pursuit of a paradigm shift from business-as-usual.

Purpose

Our study showed that for shared value to be created, there needs to be a shared vision and adequate contributions from various stakeholder groups. Nonetheless, this shared vision must be driven by the core business through a redefinition of its fundamental purpose. The core business also needs to understand that making a purposeful change requires investments that might not be profitable in the short term. Friedman's (1970) separation thesis implies that the sole purpose of a business is to increase its profits within the rules of the game, i.e., without deception or fraud. Our study, by placing purpose centrally, reinforces calls to reject the separation thesis; we infer from our results that business purpose should transition toward providing solutions to social problems, within environmental constraints, and striving for a sustainable competitive advantage through the impacts of these solutions on society and the environment. Indeed, in proposing a framework for 21st-century business, The British Academy (2019) (p. 5) argued that “the purpose of business is to solve the problems of people and planet profitably, and not profit from causing problems”.

Certain sectors and industries are intrinsically harmful to the natural environment. In this study, it is recognizable that although our case study operates in such, it has nonetheless adopted a purpose that targets a social and environmental problem. As our findings imply, the first step to adopting this purpose is a recognition that some aspects of the value creation activities, no matter how important they are for the economy, create issues that impact the environment and/or society. We infer that a business can adopt a purpose targeting its value offering (final products and services) and/or the processes and activities it employs to deliver that offering. Industry players fear the loss of competitive advantage due to high risk and cost, hence, it might be potentially difficult to radically adopt a purpose targeting the final product/service. A reasonable first step is in the understanding that to deliver the value offering, there exist negative externalities that can be internalized as the target of an adopted purpose. In our case, Finnfjord AS adopted a purpose of being the world's first carbon-neutral smelting plant. We observe that this purpose meets two of Eckert and Silten (2020) four criteria. First, it is significant, in targeting a social and environmental need for manufacturing—consequently providing benefits for aquaculture through an industrial symbiosis. Second, it is authentic, as the purpose is reflected in the organizational culture. However, given the current stage of the project, the purpose is not yet profitable or serious. This observation highlights that profitability and business success requires a long-term vision, especially when operationalizing the SDGs (Busco et al., 2017). Seriousness and accountability more likely to manifest following scale-up and impact measurements.

Another key finding from our analysis indicates the strength of the University as a strategic source of knowledge for business clusters. Business clusters typically comprise businesses, suppliers, and associated institutions within a particular field. However, they may include trade and standards organizations and draw on broader assets such as schools and universities (Porter and Kramer, 2011). By adopting a purpose of driving sustainability within their strategies (Hurth and Stewart, 2022), academic and research institutions such as universities can help drive the paradigm shift away from business-as-usual. This strategic positioning, however, will be most likely impactful if the institution maintains an operating and active presence through its participation in the business ecosystem through a cluster.

Stakeholder Rewards and Tradeoffs

Contrary to Friedman's assertion, our findings on emerging opportunities highlight the importance of offering multiple value propositions to stakeholders on all sustainability dimensions. Previous studies suggest that entrepreneurs and business managers use a structured approach to this process (Vladimirova, 2019), so that the sustainable value realized is targeted and can be properly communicated. In line with Eckert and Silten (2020), we suggest that proper communication is essential to imply the seriousness of the purpose. Turning to Table 3, our study also revealed that these stakeholder groups, engaged around the inner circle of purpose are not solely receivers of the value proposition but also play a significant role in defining it through their contributions. For example, governments and non-governmental organizations (NGOs) play an important role in this context (Porter and Kramer, 2011). Rules, regulations, and governmental policies help drive responsible behavior from businesses, thus enabling strategic collaboration between various industrial actors for the benefit of society. The silent stakeholders such as nature and future generations, to an extent, have a voice in NGOs supporting their needs, political parties including them in their agendas and societal stakeholders that want to ensure the wellbeing of generations succeeding them. In line with their values and independent, political and personal interests, these groups request accountability and responsibility from the focal business. Employees, typically understood as beneficiaries, contribute competence and knowledge in their efforts to create something novel.

It is worth noting that as in every business relationship, there might exist conflicting or diverging interests requiring trade-offs in terms of costs, stakeholder perceptions, business reputation, social and environmental performance, and other aspects (Ollivier de Leth and Ros-Tonen, 2021). It is, therefore, highly important that the focal business understands and embraces these tensions at an early stage. In management literature, there is a rising endorsement of the paradox perspective when dealing with divergent stakeholder interests. This perspective accentuates the objective of achieving superior business contributions to sustainable development by accommodating interrelated yet conflicting economic, environmental, and social concerns (Hahn et al., 2018). It can be argued that in scenarios when the conflicting views are concerning the interpretation of sustainable development, the paradox perspective can help to increase the chance of business success. However, not all divergent perspectives might be perceived in that manner. It is, thus, equally important to understand the rudimentary cause of stakeholder disputes in such cases when they are engaged toward a common goal. The needs and opinions of stakeholders who are external to the company are largely driven by their philosophical values. By merging economics and ethics, the black box (Ludeke-Freund et al., 2020) is opened and in some cases, might seem more black on the inside. We call on researchers to help untangle issues and variables relating to stakeholder disputes and relationships when creating shared and sustainable value. We also place an emphasis on the time factor. Time enables relationships to develop and mature; thus, the path to purpose becomes clearer and it typically becomes easier to implement mediation strategies. These strategies would prove useful in minimizing interest divergence and enable the business to retain its social license to operate.

The Power of Shared Value

The business opportunities realized through shared value at each level require an understanding of certain variables, such as industrial positioning, geography, and political atmosphere. The company must understand how its business and strategy intersect with social issues facing the communities its activities impact. In addition, the company should be aware that business and social results are achieved over different time horizons: some results may be observable in the short term whereas others require a long-term outlook. For instance, improved skills and competence for the workforce is not achieved simultaneously with enhanced compliance. Additionally, as business and operating environments are constantly evolving, strategies and results considered positive today may be viewed as outdated or even negative in the future. Despite these caveats, our study implies that doing good and doing well are not mutually exclusive, and CSV can emerge as a factor for competitive advantage in the future (von Liel, 2016a).

Reflecting on results from Tables 3, 4, we observe a high number of references to redefining productivity in the value chain. This was most likely due to the current business model of the company. As manufacturing involves energy intensive processes with high emissions, it is not surprising that most stakeholders would emphasize a value chain that efficient and environmentally optimized. To minimize tradeoffs that stakeholders might experience in their support or contributions in this regard, it is highly important to be transparent. Transparency has the potential to help relieve tensions that might for instance occur due to greenwashing or diverging opinions about certain issues. It was surprising to observe that following redefining productivity in the value chain, elements that touched on enabling local cluster development was referred to more than reconceiving products and markets. We infer that this difference might occur due to the influence of stakeholders on the rewards that they expect. These rewards are mostly external to the products and services offers. For instance, job creation opportunities, or access to publicly funded research and education. These are not what a focal company might understand as an obvious business opportunity. Hence it is important to understand that these have a potential to positively influence its revenues in the long run. Business opportunities powered by shared value are influenced by the degree to which rewards are appreciated and tradeoffs are experienced. Some rewards, especially when expected by multiple stakeholders can serve as the lowest hanging fruit, creating more opportunities to move in a sustainable direction.

In contrast to a positive outlook, results pertaining to reconceiving products and markets suggest that CSV involves high risks. In our focal context, the case company is not risk-averse and, as its annual tax reports indicate (Proff.no, 2022), it is financially solid and has the advantage of being family-owned. Reconceiving products and markets, redefining value chain productivity, and enabling local (or global) clusters require organizational changes that are more radical than incremental. Accordingly, our findings imply that CSV might be easily embraced by companies that are financially well off and able to make decisions quickly. This somewhat echoes Jones and Wright (2018) inference that already financially successful companies are most inclined to embrace CSV-type activities, perceiving such activities as good business practice in which they should engage. Nonetheless, these companies must be well prepared to take financial hits and stand the test of time.

Indeed, the focal company in our case did not implicitly adopt a structural CSV approach from the start. Nonetheless, they adopted a purpose that enabled them engage stakeholders in a more inclusive manner. This embedded purpose helped to unfold and facilitate a meaningful and impactful shared value approach, shifting to a more sophisticated form of capitalism. However it should be noted that not all societal problems can be solved through shared value solutions, and not every company is able to create shared value on its own (Porter and Kramer, 2011). CSV implies win-win scenarios where benefits can be easily identified and created for both society and the business. However, there exist alternate scenarios where such mutually beneficial situations cannot be easily identified. This is where a central sustainable purpose rises to power. As purpose is driven by benefits that transcend profits, business leaders would need to rely on norms and guidelines rooted in ethics and sustainability to proceed on the journey. Nonetheless, a purpose-driven company which structurally follows the CSV approach might face a multitude of challenges. For instance, how do they choose which social issue to address? How can they measure their social outcomes? Another challenge lies in the fact that CSV measurement tools are still in their infancy. However, it is important to understand that collaboration is key to successful transformation into a company that benefits the environment and society while succeeding economically. Notably, companies in the same sector might have different competences, and by collaborating to match their respective competences with certain social and/or environmental issues, the effect of CSV could be enhanced, and the chance of success increased.

As our results demonstrate, pursuing shared value without proper implementation in business strategy, operations, and people presents the risk of failure, with substantial impacts on direct and indirect stakeholders. Echoing Eckert and Silten (2020), we call for practitioners to contribute to developing a more sustainable business environment by finding and solving unmet societal needs. Business operations should be led by a mindset that embraces collaboration to mutually benefit business and society within environmental constraints. Businesses should aim to attract, retain, and develop talents through meaningful work and a purpose beyond profits. They should adopt an organizational culture that embraces creativity, co-creation, learning from mistakes, vulnerability, and challenging the status quo. Our case study exemplifies how a purposeful and stakeholder-inclusive understanding of value can help a business identify the rewards and trade-offs that affect its business opportunities when creating shared value. These results and its associated viewpoints can be a contribution to the wider discourse on sustainable value creation.

Conclusion