- 1Antwerp Management School, Antwerp, Belgium

- 2Faculty Business & Economics, University of Antwerp, Antwerp, Belgium

- 3Department of Management, University of Turin, Turin, Italy

This paper is aimed at elucidating the interrelations between reporting on the Sustainable Development Goals (SDGs) and integrated thinking. A review of online information on sustainability by port community companies in Antwerp, Belgium was applied. The research made use of a database from Port Plus investigating 769 companies. The data were analyzed using a combination of descriptive and inferential analyses. The research shows that reporting on the SDGs and integrated thinking have reciprocal reinforcing relationships, where the SDGs are a good starting point for planning integrated strategies for sustainability. The article reinforces that using the SDGs in communication and reporting can help companies better and more holistically integrate their efforts for sustainability into their strategies and processes.

Introduction

In past studies, non-financial reporting is being increasingly recognized as an important channel through which firms increase transparency, reputation and legitimacy, enable benchmarking against other companies and motivate employees (Herzig and Schaltegger, 2006; Lozano and Huisingh, 2011). In response to increasing public awareness and investor demand for non-financial information from companies, the development as well as the focus of sustainability related reporting has seen a significant evolution (Fifka, 2013). Nevertheless, relative to the evolution of financial reporting over the last 100 years, sustainability reporting is still in its infancy. There remain many insufficiencies in comparability and consistency (Tschopp and Huefner, 2014).

Since “Our Common Future”, also known as the Brundtland Report, was published on October 1987 by the United Nations (UN), the reporting practice evolved considering environmental, social, and governance (ESG) information. The work of many involved in sustainable reporting, including the Global Reporting Initiative (GRI), is based on the definitions and frameworks set out by the Brundtland Commission. The GRI has developed protocols for the development of sustainability reports. Since GRI became recognized as a common language for organizations to report on their sustainability impacts in a consistent and credible way, firms experimented with social, environmental, financial or integrated reporting (Vormedal and Ruud, 2009; Kolk and Pinkse, 2010; GRI–Global Reporting Initiative, 2011; Hahn and Kühnen, 2013).

In 2015, with the adoption of the United Nations (UN) Agenda 2030 for Sustainable Development, the GRI worked toward the creation of a harmonized indicator set and methodology for companies to report on their contributions to the so-called Sustainable Development Goals or SDGs (GRI–Global Reporting Initiative, 2018). The SDGs define the world's global aspirations and priorities for 2030. Although fundamentally it will be down to governments to tackle SDG implementation at a national level, the goals simply will not be achieved without meaningful action by business (Sachs, 2012; GRI, UN Global Compact and WBCSD, 2015). A great challenge in the implementation of the Agenda 2030 is therefore changing business attitudes toward more sustainable business models and the adoption of new sustainability reporting practices such as reporting on the SDGs (Sachs, 2012). There is even one of the SDG targets (SDG 12.6) that cites the benefits of sustainability reporting and encourages companies to integrate sustainability information in their reporting cycles (GRI, UN Global Compact and WBCSD, 2015).

Since the launch of the 17 SDGs, the UN explicitly asks companies to assess their impact, set ambitious goals, communicate and report transparently about their sustainability progress (GRI, UN Global Compact and WBCSD, 2015). While reading the report “The Sustainable Development Goals and the future of corporate reporting,” we observe two trends in the private sector. First, the integrated nature of sustainability and interlinkages recognized in the Agenda 2030 of the UN. Second, the embracing of the SDGs by the private sector in reporting their impact on society (Corporate Reporting Dialogue, 2018). Although the corporate perspectives toward the SDGs have been approached in several discussion papers and practical reports (Agarwal et al., 2017; PwC, 2018), there is a need to better understand how the business sector report on the SDGs.

Because very limited empirical research exists about reporting on the SDGs (Bebbington and Unerman, 2020), we focus in this paper on the extent of attention by the business sector to sustainability reporting and the SDGs, as well as the interlinkages of reporting on the SDGs and integrated thinking. For doing this, we choose to research sustainability disclosure by companies in the port sector. Given the significant impacts of the port sector on the economy and the growing awareness of sustainability (Walker et al., 2019), it is necessary to communicate the progress and performance of companies working in this industry. Port managers and operators are under pressure to improve not just the port's economic performance, but also implement measures to mitigate port social and environmental impacts as they are increasingly being monitored by the media and public debates (Carpenter et al., 2018). Many scholars have already demonstrated the importance of sustainability in ports (Dinwoodie et al., 2012; Langenus and Dooms, 2018). However, up till now, existing research on sustainability disclosure did not gather insights in such a specific sector like the port industry.

This brings us to our main research question: Is reporting on the Sustainable Development Goals (SDGs) helping the trend toward integrated thinking about sustainability? In order for us to answer this question, we did an assessment of the nature and extent of attention to sustainability reporting in the private sector by doing an extensive quantitative data analysis for companies in the Port of Antwerp region. The remainder of this paper is organized as follows: First, we present a literature review. Our focus lies on the organizational factors that explain whether or not information is disclosed. Next, we outline the research methods. Further, we present the study's findings. And finally, we discuss the study's contributions along with possible avenues for further research.

Literature Review

Attention to sustainability and corporate social responsibility (CSR) has come a long way. In 1987, sustainable development was defined in Our Common Future, also known as the Brundtland Report as “development that meets the needs of the present without compromising the ability of future generations to meet their own needs” (World Commission on Environment and Development, 1987). The following decades became well-known for many international commitments to sustainable development, with the adoption of Agenda 21, the Kyoto Protocol, the Millennium Development Goals (MDGs) and the Sustainable Development Goals (SDGs). At the same time, to ensure companies adhere to responsible environmental conduct principles and in response to increasing demand by key stakeholders of companies for non-financial information, a number of sustainability accounting frameworks have evolved. The first reporting frameworks, such as GRI, were created in line with the international commitments to sustainable development to improve disclosure of environmental, social, and governance (ESG) information. These frameworks have created more easily interpreted information for investors to assess the sustainability impact of firms' capital allocation choices. However, the information that companies wish or need to disclose is often not easy to collect. Complicated reporting processes, extensive data collection, and collaboration with stakeholders are just a few elements that prevent companies from disclosing sustainability information (Bose et al., 2017).

Previous studies in the corporate sustainability literature show that the size of an organization may affect its actions to report on sustainability practices due to various reasons (Blombäck and Wigren, 2009; Hahn and Kühnen, 2013). Hahn and Kühnen (2013), as well as Rosati and Faria (2019b) found that larger organizations show higher performance in sustainability reporting. This result might be due to the fact that larger organizations have access to more resources, in terms of both time and money, which can be crucial for committing to sustainability practices (Hutchinson and Chaston, 1994; Udayasankar, 2008). Large organizations also have more public exposure compared with smaller ones and are therefore more concerned with their reputation and public image (Artiach et al., 2010).

Larger companies seem to disclose information more often than smaller ones. Stakeholder pressure and legitimacy in organizational institutionalism can serve as a plausible explanation for this (DiMaggio and Powellm, 1983; Calabrese et al., 2013). Further, authors such as Bony and Matten (2011) discuss how organizations adopt sustainability reporting practices from a socio-political perspective, by which firms investigate networks and relationships among businesses, citizens, and the natural environment (Michelon et al., 2014).

Research from Spiegel (2009) shows how organizations adopt reporting practices from a strategic perspective, depending on their activities, with an emphasis on environmental goals achieved by firms (Spiegel, 2009). In line with this strategic point of view, Reid and Toffel (2009) investigated sustainability reporting as an inquiry for supply chain management, aiming to establish self-regulation (Reid and Toffel, 2009).

Further, Rosati and Faria (2019a) argue that the adoption of voluntary reporting practices and frameworks is, above all, an ethical choice that depends on the organization's CEOs or owners (Rosati and Faria, 2019a). Being key decision-makers, CEOs have, following insights from the upper-echelon theory, considerable influence on strategic choices and, consequentially, organizational outcomes (Hambrick and Mason, 1984). Research by Hillestad et al. (2010) shows how the role of the founder as “cultural architect” can have a positive impact on how external constituents assess the image of the company, especially with regard to the company's innovations and its awareness of environmental issues. The background of the founder, their gender, age and knowledge might have a potential moderating effect on whether or not firms disclose sustainability information (Hillestad et al., 2010).

Lozano and Huisingh (2011) argues that in research, in relation to legitimate or strategic incentives to report on sustainability issues, the influence of organizational factors other than size is often not included (Lozano and Huisingh, 2011). In their study, Rosati and Faria (2019a) tested different organizational factors influencing sustainability reporting, such as financial performance, organization size, and social and environmental commitment. One drawback of their study, as Rosati and Faria indicate, is that they did not include other variables that might also affect the willingness to disclose information, such as a more detailed analysis of resource slack (relative abundance of a resource), age or activity of the organization.

Prior research (Vanacker et al., 2013) shows the importance of organization slack for firms' development. At the same time, financial as well as human resource slack can be an important asset in disclosing information. Previous studies define financial slack as the level of liquid assets in excess of those needed for basic operating expenses, or in other words, a resource that is currently uncommitted and available for redeployment (George, 2004; Bradley et al., 2011; Kim et al., 2019). In their article, Kim et al. (2019) state that the more flexible the capital, the more affordable any additional voluntary disclosure becomes (Fazzari et al., 1988; Kim et al., 2019). Research focused on human resource slack refer to the number of employees in excess of those needed for operational demands (Mishina et al., 2004; Mellahi and Wilkinson, 2010). Usually, human resource slack refers to having more than average human resources (Shahzad et al., 2016). Kim et al. (2019) conclude in their article that firms having more than average employees will be able to adjust the slack in human resources to collect relevant information for new sustainability reports (Kim et al., 2019).

In a study by Trencansky and Tsaparlidis (2014), their seems to be a minor influence of age on adoption of sustainability reporting frameworks. This finding can be confirmed by a study of Hossain and Reaz (2007) which revealed that age is not a significant variable of the level of information disclosure (Hossain and Reaz, 2007). However, research by Godos-Diez et al. (2011) found a significant and positive relationship between firm age and Corporate Social Responsibility (CSR) reporting. The authors provide a reasonable explanation stating that once the CSR activities are implemented, “stakeholder expectations increase and the firm is forced to meet them and even reinforce them.”

Scholars like Murillo and Lozano (2006) explain that, while the stakeholder theory is a relevant theoretical lens to investigate CSR reporting in large firms, social capital is the most suitable theoretical framework for smaller organizations. Since CSR is the outcome of the process through which small and medium sized enterprises (SMEs) gather relationships, the social capital perspective is very relevant to understand the sustainability reporting approach in SMEs (Spence et al., 2003; Murillo and Lozano, 2006; Russo and Perrini, 2010). In their research, Russo and Perrini discuss that since SMEs' sustainability strategy is often based on drivers like networking, trust and legitimacy, the investment in social capital is key to these categories of firms (Russo and Perrini, 2010). They state that older or more experienced organizations seem to attach greater importance to social capital and creating value for stakeholders, whether they are small or large firms. Moreover, the creation of social capital can be a source of competitive advantages for them (Ortiz Avram and Kühne, 2008).

Overall, many studies have examined the relationship between sustainability reporting and financial performance (Knoepfel, 2001; Barnett and Salomon, 2006), operational performance (Walker et al., 2019), market performance (Alexander and Buchholz, 1978; Busch and Hoffmann, 2011), institutional factors (Rosati and Faria, 2019b), reputation risk management (Shad et al., 2019), and many other factors. These studies show that, by disclosing information about sustainable development, firms aim to increase transparency, align with society's values, and improve brand value, reputation and legitimacy. By doing this, companies increase their competitiveness, motivate their employees, and control their operations, without necessarily changing their core strategies and processes (Herzig and Schaltegger, 2011).

As transparency is becoming the new paradigm for conducting business, companies are increasingly using new sustainability frameworks and guidelines to inform the public about their sustainability achievements. In 2015, Agenda 2030 and the SDGs was unanimously adopted by the 193 Member States of the United Nations at the start of a three-day Summit on Sustainable Development. Agenda 2030's 17 Global Goals build on the goal-setting agendas of United Nations conferences and the widely successful Millennium Development Goals that have improved the lives of millions of people. The new agenda recognizes that the world is facing immense challenges, ranging from widespread poverty, rising inequalities and enormous disparities of opportunity, wealth and power to environmental degradation and the risks posed by climate change (GRI, UN Global Compact and WBCSD, 2015).

Since the adoption of the SDGs, many organizations started to use Agenda 2030 and the 17 SDGs to measure and disclose their impact linked to the world's most pressing problems. The UN Global Compact claims that disclosing information on the SDGs will help businesses better engage stakeholders, enhance sustainable decision-making processes and strengthen their accountability (Global Compact, 2016). Practices for corporate reporting on the SDGs, however, have to be further improved and promoted. As there are no universal mandatory standards that can be adopted in company reports, disparate implementation of disclosure on sustainability between companies occurs (Petrescu et al., 2020).

Many scholars demonstrate that companies are seeking legitimacy from society by linking to the SDGs and starting integrated social and environmental reporting (Spence and Gray, 2007). And one way to accelerate this process, is to think and act in an integrated way, argues The International Integrated Reporting Council (IIRC). In this paper, we use the definition of integrated thinking raised by Adams (2017) in “The Sustainable Development Goals, integrated thinking and the integrated report”, published by the IIRC and ICAS. According to Adams, integrated thinking is “facilitating high-level engagement and a holistic approach through its emphasis on connectivity and oversight” (Adams, 2017).

The Integrated Reporting (IR) Framework calls on organizations to link their strategy to changes in the external environment including evolving societal expectations and natural resource limitations. Integrated thinking is defined on page 2 of the Framework. It “…takes into account the connectivity and interdependencies between the range of factors that affect an organization's ability to create value over time, including: the capitals that the organization uses or affects, and the critical interdependencies, including trade-offs, between them; [and] … how the organization tailors its business model and strategy to respond to its external environment and the risks and opportunities it faces” (Adams, 2017).

The factors we use in this paper, derived from the IR Framework, indicating the relationship between SDG reporting and integrated thinking are the following:

• The processes of building relationships with stakeholders;

• The considering of all material sustainable development issues impacting on inputs and outcomes in terms of the 17 SDGs; and

• The reflection of the organization's strategy and business model on past performance with respect to the SDGs.

Integrated thinking involves organizational change to require everyone in the organization to increase their contribution to a much broader concept of value creation through a better understanding of how value is created. This will hopefully lead to a better outcome from reporting that responds to systemic risks to capital and financial market systems, and sustainable development challenges (Adams, 2017).

The IIRC believes that the private sector should report on their performance in an integrated way using the IIRC's integrated reporting IR Framework. New initiatives which report and measure value in an integrated way will provide meaningful answers to the challenges of our society. By sharing experiences on issues that are of public interest, explaining the basis on which companies make strategic choices, and how they move toward a fully integrated approach, the private sector is able to re-shape playing fields that incentivize sustainable innovation and create true sustainable impact [Visser and Kymal, 2015; International Integrated Reporting Council (IIRC), 2019]. Literature combining integrated thinking, sustainability and the SDGs is still rather poor. It seems that there is no clear consensus on how companies report on the SDGs and which effect it has on integrated thinking. Therefore, we investigate annual reports and dedicated sustainability reports to analyze disclosures on sustainability and the SDGs, while researching the effects on integrated thinking.

Research Methods

Because studies on the topic of SDG reporting and integrated thinking are still in its infancy, we did research on how companies in the Port of Antwerp region communicate and report on sustainability, by using descriptive statistics (Trochim, 2006). Our review included disclosures on sustainability and CSR themes (we call this implicit), and disclosures specifically mentioning the 17 SDGs (we call this explicit).

For our data, we used the Port Plus directory database (Port+, Port Directory Antwerp, 2020). The Port Plus database gets updated on a regular basis with input from several sources such as port authorities, trade associations, company requests, etc. The objective of the database is to disclose a detailed and up-to-date list of contacts of companies active in Belgian and Zeeland ports. The categories and clusters in this database are defined by Port Plus in cooperation with the ports in Antwerp, Brussels, North Sea Port Flanders, North Sea Port Terneuzen, North Sea Port Vlissingen, Oostende/Nieuwpoort, and Zeebrugge/Brugge. All companies define their own category of activity. Port Plus monitors the division in categories. For example, a ship agency represents the interests of the carrier, a ship supplier (or ship chandler) supplies the ship with equipment. The database contains in total 60 categories listed in five clusters (Governmental and Port Authorities; Marine Services; Other Supporting Services; Transport Services; Warehousing, Terminals and Commodities). More specific information about the profile of companies can be found in Annex 1.

The time horizon chosen for this study is cross-sectional and the period chosen for the study is 2019. In this study, we employed a mixed method approach, where the data was analyzed with SPSS software and through content analysis. A content analysis was performed first to explore in-depth the extent of SDG reporting. Krippendorff (2004) describes content analysis as a technique of study to make replicable and true inferences from texts to their utilization. According to the author, content analysis is an operation to reduce raw data to usable data by researchers (Krippendorff, 2004). The content analysis method was executed through labeling and coding by the researchers. Although content analysis software is available, we opted to code manually, as it was more suited to complicated and nuanced textual data (Rahman, 2017). Thus, we were able to recognize the many terms that organizations use. By contrast, automatic software programs tends to focus on just counting words or phrases. We have rather assessed the meaning and quality of the published text. Moreover, part of the analyzed material was displayed in visual figures and tables, while software tools only analyze the text is available.

We used the Port Plus database to investigate the presence of sustainability disclosure within firms. We conducted a review and analysis of 769 companies in the port region. The raw data was collected from all company reports that could include information about environmental, social, or economic performance. We found that companies are using different names for their reports: responsibility report, sustainability report, integrated report, citizenship report, accountability report, etc. The different nomenclature increased the time needed to collect the data. The sustainability or annual reports were sourced from the companies' websites in 2019. These reports were downloaded and analyzed, including all reports available in English or Dutch and irrespective of length (from few phrases up to 600 pages per reports). After finding the right report to collect our data from, we started by scanning the whole text.

The level of sustainability disclosure was recorded in five levels: no reporting, low reporting (a few sentences), average reporting (up to 1 website page), high reporting (more than 1 website page), and very high reporting (more than 1 page and a sustainability report). For the next step, every sentence of the sustainability report was coded to one of the 17 SDGs goals. The sustainability content was classified as quantitative or qualitative information and the material sustainability issues noted and linked to the SDGs and type of sustainable solutions.

To explore further the high coherence within the SDG-reporting companies, we conducted correlation matrices to analyze the correlation coefficients between the SDGs. To analyze this further, we have executed a factor analysis. And to explore further the correlation significance on which clusters and categories are more likely to report, we analyzed the data with a chi-squared test. The chi-squared test is used to determine whether there is a significant difference between the expected frequencies and the observed frequencies in one or more categories. Finally, we studied some best practices on SDG reporting.

Limitations of our Research Methods

The research methods in this study might be subject to several limitations. First, we perform the analysis on all companies in the Port Plus database, without making a demarcation between micro, small, medium, and large-sized companies. Next, although it is interesting to investigate this specific port industry, the current available data might be too limited in scope. Hence, future research might use an even larger sample of firm observations and look at different organizations across various industries to validate the findings of this study. In line with this limitation, regarding external validity, our findings may not apply outside the context of this study because our empirical analyses were limited to the port industry. Nevertheless, similar findings could possibly emerge in other port industries. Finally, in order to minimize the possible common method bias for further research, it is worth collecting data from multiple sources. Moreover, interpreting the raw data is influenced by the subjectivity of the authors and his personal biases, as the same document can be interpreted differently by different researchers.

Findings

Most of the companies (62%) have no reporting on sustainability issues on their website or in their annual reports. 53 (7%) companies do not have a sustainability report, nor a website or their website is under construction. 12% have little reporting, 9% have average reporting, 4% high reporting, and 6% very high reporting. POA companies with low sustainability reporting (i.e., including only a few sentences) tended to disclose general, qualitative information, without specifying material issues.

Of all the reviewed POA organizations, only 38 companies (4.8%) explicitly mention working with the SDGs. These 38 companies clearly referred to stakeholder management processes in their reports. Thus, the processes of building relationships with stakeholders clearly indicates a strong relationship between SDG reporting and integrated thinking.

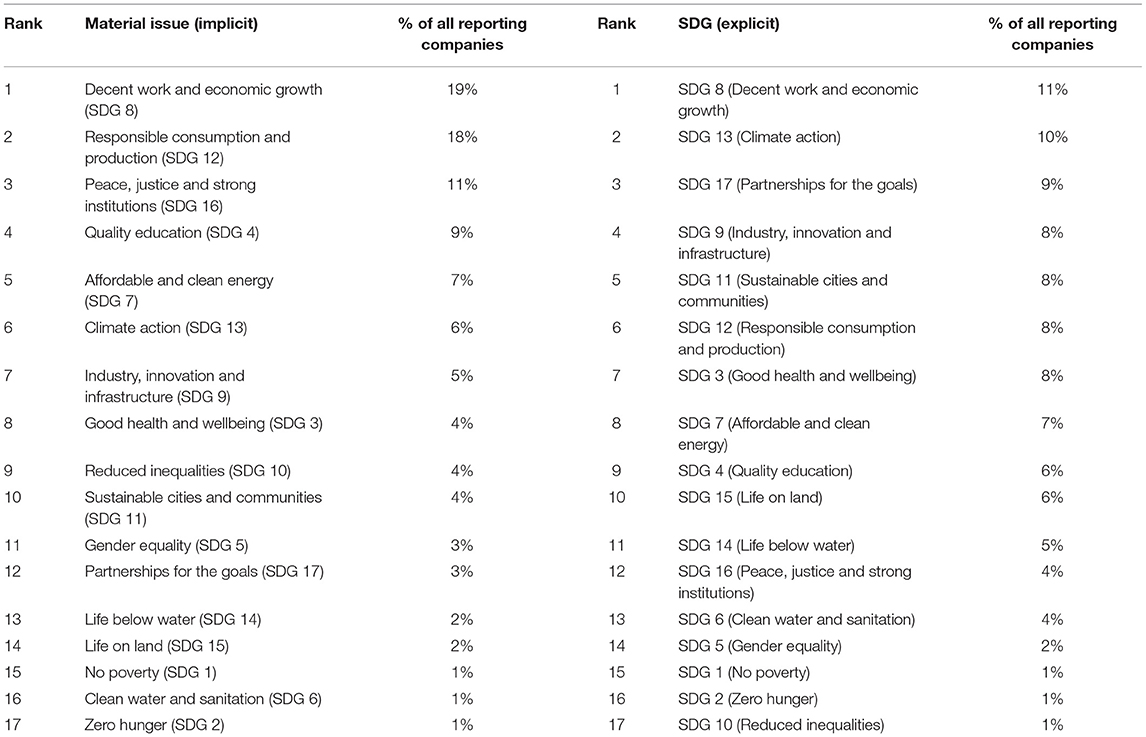

Table 1 shows the ranking of the implicit and explicit SDGs. It shows that SDG 8 (decent work and economic growth) ranks the highest for both analyses. A material issue is considered implicit if it relates to the theme of an SDG, but does not explicitly mention that SDG.

Table 1. Ranking implicit and explicit SDG reporting of all reporting companies (little, average, high, and very high reporting).

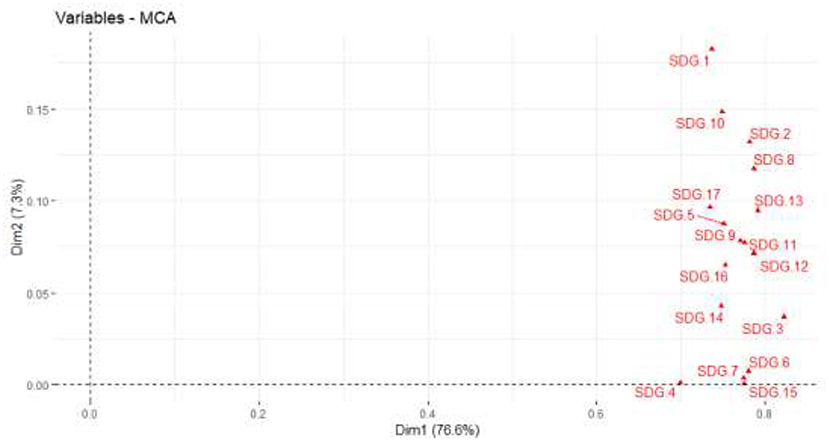

From our correlation matrix (Annex 2), we can conclude that there is a high correlation between the SDGs, which means that a company that communicates on one SDG is more likely to report also on other SDGs. To analyze this further, we've executed a factor analysis. From Figure 1, we can conclude that once the SDG framework has been used by companies, they tend to link various SDGs in their reporting. In other words, there seems to be a high coherence. The considering of all material sustainable development issues impacting on inputs and outcomes in terms of the 17 SDGs indicate a strong relationship between SDG reporting and integrated thinking. The factor analysis is made on two dimensions for graphical reasons. Looking at the 17 SDGs, we can say that 76.6% are explained on the basis of one overlapping sustainability dimension.

When executing a factor analysis for the non-SDG driven decision dimensions of the companies who implicitly communicate about sustainability topics (Figure 2), we can conclude that there is less coherence. In other words, companies who do not use the SDG framework to communicate, are more likely to report on single topics.

Also, we can conclude that two dimensions come forward in this analysis: economic and environmental topics vs. social topics plus climate and energy related topics. Companies who communicate on social topics such as (gender) equality and education, are less likely to communicate about environmental topics such as water efficiency, sustainable mobility or conservation, and vice versa. Furthermore, topics such as poverty reduction and food security are not easy to include in one of the dimensions.

To explore further the correlation significance on which clusters and categories are more likely to report, we analyzed the data with a chi-squared test. The chi-squared test is used to determine whether there is a significant difference between the expected frequencies and the observed frequencies in one or more categories. For the categories, we focused on the 10 largest in the Port Plus database: Freight Forwarders (1), warehouse (2), ship agencies (3), terminal (4), ship suppliers & ship chandlers (5), road transport (6), sea and coastal transport (7), other transport services (8), business and professional services (9), custom brokers (10). In our analysis, we excluded “commodities” such as the category “chemicals, foodstuff, and industry,” and “other supporting services” such as “construction and engineering.” The first chi-squared test shows the correlation coefficients between the largest categories and the explicit SDGs. We measured a correlation for SDG 3, 4, 8, 13 and 15. Companies within the category “terminal” are more likely to report on SDG 3 and SDG 13 and SDG 15. SDG 4 is mainly addressed in “other transport services.” “Freight forwarders” are more likely to report on SDG 8. From these findings, it is difficult to conclude that there is a clear reflection of the organization's strategy and business model on past performance with respect to all 17 SDGs. Rather, it really depends on the categories of the organizations and the way they report on specific SDGs. The chosen SDGs align with the core business of the companies, suggesting that the other SDGs are more difficult to translate in specific objectives.

Another chi-squared test shows the correlation coefficients between the largest categories and the implicit SDGs. Here, we detected that the “terminal” and “warehouse” category are more likely to report on water efficiency. It is worth noting that other categories barely report anything on this topic. Further, the categories “terminal,” “warehouse,” and “sea and coastal transport” are more likely to report on the topic of sustainable energy, compared with other categories. For the topic of responsible and productive employment, the categories “terminal,” “warehouse,” and “road transport” are more likely to report. Also, we detected a correlation between the categories “terminal,” “sea and coastal transport,” “business and professional services,” and the topic sustainable urbanization, mobility, and air quality. For waste treatment, especially “freight forwarders,” “warehouse,” “terminal,” and “road transport” are more likely to report. When it comes to conservation, restoration and sustainable use of ecosystems, the “terminal” category in particular reports. It is worth noting that other categories barely report anything on this topic. Lastly, there is a correlation between “freight forwarders” and the “warehouse” category with the topic of transparency, protection of human rights and business ethics.

Discussion

The findings show that sustainability reporting is still immature in the port business community. Only 4.8% of the companies explicitly mention the SDGs. While explicit SDG reporting is low, far more companies already implicitly report on the SDGs. This may be explained by the fact that Agenda 2030 and the SDGs are not well-known yet in the port community. The holistic scope of sustainable development may be a barrier for many companies in this sector. This may lead to resistance toward integrated thinking. For those with established sustainability strategies, companies may simply emphasize the good work they have done so far and merely reframe communications to align their actions to the SDGs. This may help companies who seek legitimacy from society (Spence and Gray, 2007).

Looking back on the first two factors indicating the relationship between SDG reporting and integrated thinking—the processes of building relationships with stakeholders, and the considering of all material issues impacting on inputs and outcomes in terms of the SDGs—we can conclude that companies using the SDG framework refer more often to stakeholder engagement processes. Just as stakeholder management is key to large firms, drivers like networking and trust seems key to small and medium firms. This is in line with findings from previous research by Russo and Perrini (2010). Port organizations operate in a global world, characterized by various interdependencies and trade-offs as well as by many expectations of stakeholders. Port companies are increasingly required to implement a comprehensive approach to planning, measurement, and reporting on sustainability issues. The SDGs can definitely serve as an ideal sustainability framework to navigate through these global challenges.

Instead of a mishmash of sustainability actions, integrated thinking involves an integrated approach of planning, executing, and monitoring business decisions and strategies for long-term value creation (Busco et al., 2017). Companies using the SDGs in reporting consider this integrated approach by addressing all material sustainable development issues impacting the inputs and outcomes in terms of the 17 global goals. When companies use the SDGs in their communication, they tend to look at a broader scope of sustainable development, where they also report on the indirect impact of their actions. When companies do not use the SDGs in their communication, they are more likely to report on isolated sustainability topics.

Looking back on the third factor indicating the relationship between SDG reporting and integrated thinking—the reflection of the organization's strategy and business model on past performance with respect to the SDGs—we can conclude that companies that have taken the step to communicate on their contributions to the SDGs usually also set internal ambition levels. These targets are often influenced by internal factors, including available resources and performance levels that seem achievable, rather than being driven by what is needed to fulfill Agenda 2030. While it is common and legitimate for companies to define goals and objectives from an “inside-out” approach (based on their own knowledge, experience, interpretations and ambitions), many of the SDGs require target setting based on the actual state of the issue. SDGs such as those related to climate change and biodiversity are notable examples of this.

It is worth noting that, from all analyzed companies, the 38 organizations explicitly mentioning the SDGs are larger companies (high number of employees and significant annual revenue) with an extensive sustainability report. From the studies in our literature review, we understood that pressures from customers, environmental protection organizations, employees, shareholders, and governments determine the reporting quality (Barnea and Rubin, 2010; Vitolla et al., 2019). And similar research by Rudyanto and Siregar (2018) shows that listed companies which get pressure from stakeholders are reporting more on sustainability issues. Moreover, it seems that pressure from employees positively affects the quality of sustainability reports (Rudyanto and Siregar, 2018). All these studies attach great importance to the concept of legitimacy when it comes to sustainability reporting.

The embracing of the SDGs by the private sector in reporting their impact on society is an important new trend in sustainability disclosure (Corporate Reporting Dialogue, 2018). Large firms operating in the port of Antwerp, such as Deme, BASF Antwerp, and Indaver all report on the SDGs. Strategic incentives from large firms, as well as insights based on organizational ecology, organizational learning and resource dependence theory, in which organizations find themselves continuously pressed in a resource-oriented struggle that might be aimed at proliferation, might serve as a credible clarification (Hannan and Freeman, 1977; Barney, 1991; March, 1991). Large firms might have more available resources. These additional resources tend to buffer environmental shocks and allow for more flexibility in responding to competitors. At the same time, large companies often want to be the first to report on new sustainability frameworks (Hannan and Freeman, 1977; March, 1991), such as the SDGs. This might explain why established and well-known companies align their sustainability work more often with the SDGs and make their commitment visible in attractive reports and on their websites.

It is worth noting that sustainability reporting is a proxy—rather than a guarantee—of sustainability engagement. There are exceptions, i.e., companies that are active on sustainability but do not adequately reflect this in their public reporting. Further, sustainability reporting may not fully portray the sustainability activities of the companies, and some companies may only communicate about their positive impact. Next, the generalizability of this research's findings to all companies in the private sector may be limited to the focus on companies in the Antwerp port region. Despite the above limitations, port authorities can use our research to decipher what to do and how to support companies in their port region on sustainability issues.

Conclusion

The findings in this study show that reporting on the SDGs and integrated thinking have reciprocal reinforcing relationships, where the SDGs are a good starting point for planning integrated strategies for sustainability. Our study reinforces the fact that using the SDGs in communication and reporting can help companies better and more holistically integrate their efforts for sustainability into their management systems. By aligning the SDGs to a conceptual reporting, such as the GRI or the IR Framework, this paper provides conceptual rigor required to support integrated thinking in contributing to the SDGs, which builds further on the work by Adams, The Sustainable Development Goals, integrated thinking and the integrated report (2017).

Further quantitative and qualitative research, incorporating other variables like size, revenue, and sector categories, will be necessary to explore the research question more in-depth. Much more research is desired about why organizations—especially smaller-sized companies—report on sustainability and the SDGs. Therefore, we suggest future research might focus on smaller-sized organizations to test the results of our study. Indeed, researchers who have started to study sustainability reporting practices in smaller-sized companies found empirical results different from those ones valid for large firms, and assert that further investigation is required to improve the understanding and the knowledge of reporting practices (Campopiano et al., 2012).

While the popular mantra “what you measure can be managed” may reflect a widely acknowledged truism, it can be a challenge to measure and report impacts in a meaningful and credible way. Self-measured, self-reported impacts will only be credible if methods of quantification and reporting are transparent, accurate, consistent and independently verified by auditors. Data needs to be quantitative so that progress toward the SDGs can be properly measured and compared over time. However, not everything can be measured in a quantitative way and metrics alone may actually obscure important transformational impact.

Data Availability Statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found in the article/Supplementary Material.

Author Contributions

WV contributed to conception and design of the study and wrote sections of the manuscript. IA organized the database. JB performed the statistical analysis and wrote the first draft of the manuscript. JB and WV contributed to manuscript revision, read, and approved the submitted version. All authors contributed to the article and approved the submitted version.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary Material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/frsus.2021.689739/full#supplementary-material

References

Adams, C. A. (2017). The Sustainable Development Goals, Integrated Thinking and the Integrated Report. Available online at: https://integratedreporting.org/resource/sdgs-integrated-thinking-and-the-integrated-report (accessed November 20, 2020).

Agarwal, N., Gneiting, U., and Mhlanga, G. (2017). Raising the Bar: Rethinking the Role of Business in the Sustainable Development Goals. Available online at: https://www-cdn.oxfam.org/s3fs-public/dp-raising-the-bar-business-sdgs-130217-en_0.pdf

Alexander, G. J., and Buchholz, R. A. (1978). Corporate social responsibility and stock market performance. Acad. Manag. 21, 479–486. doi: 10.5465/255728

Artiach, T., Lee, D., Nelson, D., and Walker, J. (2010). The determinants of corporate sustainability performance. Account. Finance 50, 31–51. doi: 10.1111/j.1467-629X.2009.00315.x

Barnea, A., and Rubin, A. (2010). Corporate social responsibility as a conflict between shareholders. J. Bus. Ethics 97, 71–86. doi: 10.1007/s10551-010-0496-z

Barnett, M. L., and Salomon, R. M. (2006). Beyond dichotomy: the curvilinear relationship between social responsibility and financial performance. Strateg. Manag. J. 27, 1101–1122. doi: 10.1002/smj.557

Barney, J. B. (1991). Firm resources and sustained competitive advantage. J. Manag. 17, 99–120. doi: 10.1177/014920639101700108

Bebbington, J., and Unerman, J. (2020). Advancing research into accounting and the UN sustainable development goals. Account. Audit. Account. J. 33, 1657–1670. doi: 10.1108/AAAJ-05-2020-4556

Blombäck, A., and Wigren, C. (2009). Challenging the importance of size as determinant for CSR activities. Manag. Environ. Qual. Int. J. 20, 255–270. doi: 10.1108/14777830910950658

Bony, K., and Matten, D. (2011). The relevance of the natural environment for corporate social responsibility research, in The Oxford Handbook of Business and the Natural Environment, eds P. Bansal, and A. J. Hoffman (Oxford: Oxford University Press), 519–536.

Bose, S., Saha, A., Khan, H. Z., and Islam, S. (2017). Non-financial disclosure and market-based firm performance: the initiation of financial inclusion. J. Contemp. Account. Econ. 13, 263–281. doi: 10.1016/j.jcae.2017.09.006

Bradley, S. W., Wiklund, J., and Dean, S. (2011). Swinging a double-edged sword: the effect of slack on entrepreneurial management and growth. J. Bus. Ventur. 26, 537–554. doi: 10.1016/j.jbusvent.2010.03.002

Brundtland Commission (1987). Report of the World Commission on Environment and Development: Our Common Future. Transmitted to the General Assembly as an Annex to document A/42/427–Development and International Co-operation: Environment. Brundtland Commission.

Busch, T., and Hoffmann, V. H. (2011). “How Hot Is Your Bottom Line? Linking Carbon and Financial Performance,” Business and Society. Los Angeles, CA: SAGE Publications. 233–265.

Busco, C., Granà, F., and Quattrone, P. (2017). Integrated Thinking (CIMA Research Executive Summary; Vol. 13, No. 3). London: Chartered Institute of Management Accountants.

Calabrese, A., Costa, R., Menichini, T., Rosati, F., and Sanfelice, G. (2013). Turning corporate social responsibility-driven opportunities in competitive advantages: a two-dimensional model. Knowl. Process Manag. 20, 50–58. doi: 10.1002/kpm.1401

Campopiano, G., De Massis, A., and Cassia, L. (2012). The relationship between motivations and actions in corporate social responsibility: An exploratory study. Int. J. Bus. Soc. 13, 391–425.

Carpenter, A., Lozanoac, R., Sammalistoa, K., and Astnerd, L. (2018). Securing a port's future through Circular Economy: Experiences from the Port of Gävle in contributing to sustainability. Mar. Pollut. Bull. 128, 539–547. doi: 10.1016/j.marpolbul.2018.01.065

Corporate Reporting Dialogue (2018). The Sustainable Development Goals and the Future of Corporate Reporting. Available online at: https://integratedreporting.org/resource/sdgs-and-the-future-of-corporate-reporting/ (accessed December 14, 2020).

DiMaggio, P., and Powellm, W. (1983). The iron cage revisited: institutional isomorphism and collective rationality in organizational fields. Am. Sociol. Rev. 48, 147–160. doi: 10.2307/2095101

Dinwoodie, J., Tuck, S., Knowles, H., Benhin, J. K. A., and Sansom, M. (2012). Sustainable development of maritime operations in ports. Bus. Strategy Environ. 21, 111–126. doi: 10.1002/bse.718

Fazzari, S., Hubbard, G., and Petersen, B. (1988). Finance constraints and corporate investment. Brook. Pap. Econ. Act. 19, 141–195. doi: 10.2307/2534426

Fifka, M. S. (2013). Corporate responsibility reporting and its determinants in comparative perspective: a review of the empirical literature and a meta-analysis. Bus. Strategy Environ. 22, 1–35. doi: 10.1002/bse.729

George, G. (2004). Slack resources and the performance of privately held firms. Acad. Manag. J. 48, 661–676. doi: 10.5465/amj.2005.17843944

Godos-Diez, R., Fernandez-Gago, A., and Martinez-Campillo, A. (2011). How important are CEOs to CSR practices? an analysis of the mediating effect of the perceived role of ethics and social responsibility. J. Bus. Ethics 98, 531–548. doi: 10.1007/s10551-010-0609-8

GRI UN Global Compact WBCSD. (2015). SDG Compass—A Guide for Business Action to Advance the Sustainable Development Goals. Available online at: https://sdgcompass.org/ (accessed September 26, 2019).

GRI–Global Reporting Initiative (2011). A New Phase: The Growth of A New Phase: The Growth of Sustainability reporting. Amsterdam: GRI–Global Reporting Initiative.

GRI–Global Reporting Initiative (2018). Business reporting on the SDGs. Available online at: https://www.globalreporting.org/public-policy-partnerships/sustainable-development/integrating-sdgs-into-sustainability-reporting/ (accessed October 19, 2020).

Hahn, R., and Kühnen, M. (2013). Determinants of sustainability reporting: a review of results, trends, theory, and opportunities in an expanding field of research. J. Clean. Prod. 59, 5–21. doi: 10.1016/j.jclepro.2013.07.005

Hambrick, D. C., and Mason, P. A. (1984). Upper echelons: organizations as a reflection of its top managers. Acad. Manag. Rev. 9, 193–206. doi: 10.5465/amr.1984.4277628

Hannan, M. T., and Freeman, J. (1977). The population ecology of organizations. Am. J. Sociol. 83, 929–984. doi: 10.1086/226424

Herzig, C., and Schaltegger, S. (2006). “Corporate sustainability reporting: an overview,” in Sustainability Accounting and Reporting, eds S. Schaltegger, M. Bennett, and R. L. Burritt (Dordrecht: Springer), 301–324.

Herzig, C., and Schaltegger, S. (2011). ‘Corporate Sustainability Reporting’, in Sustainability Communication. Dordrecht: Springer, 151–169.

Hillestad, T., Xie, C., and Haugland, S. (2010). Innovative corporate social responsibility: the founder's role in creating a trustworthy corporate brand through “green innovation”. J. Prod. Brand Manag. 19, 440–451 doi: 10.1108/10610421011085758

Hossain, M., and Reaz, M. (2007). The determinants and characteristics of voluntary disclosure by Indian banking companies. Corp. Soc. Responsib. Environ. Manag. 14, 274–288. doi: 10.1002/csr.154

Hutchinson, A., and Chaston, I. (1994). Environmental management in devon and cornwall's small and medium sized enterprise sector. Bus. Strategy Environ. 3, 15–22. doi: 10.1002/bse.3280030102

International Integrated Reporting Council (IIRC) (2019). The International IR Framework. Available online at: https://integratedreporting.org/wp-content/uploads/2013/12/13-12-08-THE-INTERNATIONAL-IR-FRAMEWORK-2-1.pdf (accessed October 26, 2020).

Kim, S.-I., Shin, H., Shin, H., and Park, S. (2019). Organizational Slack, corporate social responsibility, sustainability, and integrated reporting: evidence from Korea. Sustainability 11:4445. doi: 10.3390/su11164445

Knoepfel, I. (2001). Dow jones sustainability group index: a global benchmark for corporate sustainability. Corp. Environ. Strategy 8, 6–15. doi: 10.1016/S1066-7938(00)00089-0

Kolk, A., and Pinkse, J. (2010). The integration of corporate governance in corporate social responsibility disclosures. Corp. Soc. Responsib. Environ. Manag. 17, 15–26. doi: 10.1002/csr.196

Krippendorff, K. H. (2004). Content Analysis: An Introduction to Its Methodology, 2nd Edn. https://www.google.com/search?sxsrf=ALeKk01Yg4hDvawle8ED_HeV2aTJ6mThig:

1625727132057&q=Thousand+Oaks&stick=H4sIAAAAAAAAAOPgE-

LUz9U3sEw2MC9R4gAxiyySLbS0spOt9POL0hPzMqsSSzLz81A4VhmpiSmFpYl

FJalFxYtYeUMy8kuLE_NSFPwTs4t3sDICAGo7m7JWAAAA&sa=

X&ved=2ahUKEwi3xNTB8dLxAhVh-nMBHWQ3C-8QmxMoATAfegQIGxAD Thousand Oaks, CA: Sage Publications.

Langenus, M., and Dooms, M. (2018). Creating an industry-level business model for sustainability: the case of the European ports industry. J. Clean. Prod. 195, 949–962. doi: 10.1016/j.jclepro.2018.05.150

Lozano, R., and Huisingh, D. (2011). Inter-linking issues and dimensions in sustainability reporting. J. Clean. Prod. 19, 99–107. doi: 10.1016/j.jclepro.2010.01.004

March, J. G. (1991). Exploration and exploitation in organizational learning. Organ. Sci. 2, 71–87. doi: 10.1287/orsc.2.1.71

Mellahi, K., and Wilkinson, A. (2010). Managing and coping with organizational failure: introduction to the special issue. Group Organ. Manag. 35:24. doi: 10.1177/1059601110383404

Michelon, G., Pilonato, S., and Ricceri, F. (2014). CSR reporting practices and the quality of disclosure: an empirical analysis. Crit. Perspect. Account. 33, 59–78. doi: 10.1016/j.cpa.2014.10.003

Mishina, Y., Pollock, T. G., and Porac, J. F. (2004). Are more resources always better for growth? resource stickiness in market and product expansion. Strat. Manag. J. 2004, 25, 1179–1197. doi: 10.1002/smj.424

Murillo, D, and Lozano, J. M. (2006). SMEs and CSR: an approach to CSR in their own words. J. Bus. Ethics 67, 227–240. doi: 10.1007/s10551-006-9181-7

Ortiz Avram, D., and Kühne, S. (2008). Implementing responsible business behavior from a strategic management perspective: developing a framework for austrian SMEs. J. Bus. Ethics 82, 463–475. doi: 10.1007/s10551-008-9897-7

Petrescu, A., Bîlcan, F., Petrescu, M., Oncioiu, I., Cǎtǎlina, M., and Cǎpuşneanu, S. (2020), Assessing the benefits of the sustainability reporting practices in the top Romanian companies. Sustainability. 12:3470. doi: 10.3390/su12083470

Port+, Port Directory Antwerp (2020). Available at: https://www.portplus.be (accessed June 2018 and August 2019).

PwC (2018). From Promise to Reality: Does Business Really Care About the SDGs? Available online at: https://www.pwc.com/gx/en/sustainability/SDG/sdg-reporting-2018.pdf (accessed September 26, 2020).

Rahman, S. (2017). The advantages and disadvantages of using qualitative and quantitative approaches and methods in language “testing and assessment” research: a literature review. J. Educ. Learn. 6, 102–112. doi: 10.5539/jel.v6n1p102

Reid, E. M., and Toffel, M. W. (2009). Responding to public and private politics: corporate disclosure of climate change strategies. Strateg. Manag. J. 30, 1157–1178. doi: 10.1002/smj.796

Rosati, F., and Faria, L. G. D. (2019a). Addressing the SDGs in sustainability reports: the relationship with institutional factors. J. Clean. Prod. 215, 1312–1326. doi: 10.1016/j.jclepro.2018.12.107

Rosati, F., and Faria, L. G. D. (2019b). Business contribution to the Sustainable Development Agenda: Organizational factors related to early adoption of SDG reporting. Corp. Soc. Responsib. Environ. Manag. 26, 588–597. doi: 10.1002/csr.1705

Rudyanto, A., and Siregar, V. S. (2018). The effect of stakeholder pressure and corporate governance on the quality of sustainability report. Int. J. Ethics Syst. 34, 233–249. doi: 10.1108/IJOES-05-2017-0071

Russo, A., and Perrini, F. (2010). Investigating stakeholder theory and social capital: CSR in large firms and SMEs. J. Bus. Ethics 91, 207–221 doi: 10.1007/s10551-009-0079-z

Sachs, J. D. (2012). From millennium development goals to sustainable development goals. Lancet 379, 2206–2211. doi: 10.1016/S0140-6736(12)60685-0

Shad, M. K., Lai, F.-W., Fatt, C. L., Klemeš, J. J, and Bokhari, A. (2019). Integrating sustainability reporting into enterprise risk management and its relationship with business performance: a conceptual framework. J. Clean. Prod. 208, 415–425. doi: 10.1016/j.jclepro.2018.10.120

Shahzad, A. M., Mousa, F. T., and Sharfman, M. P. (2016). The implications of slack heterogeneity for the slack-resources and corporate social performance relationship. J. Bus. Res. 69, 5964–5971. doi: 10.1016/j.jbusres.2016.05.010

Spence, C., and Gray, R. (2007). Social and Environmental Reporting and the Business Case. London: Certified Accountants Educational Trust.

Spence, L., Schmidpeter, R., and Habisch, A. (2003). Assessing social capital: small and medium sized enterprises in Germany and the UK. J. Bus. Ethics 47, 17–29. doi: 10.1023/A:1026284727037

Spiegel, D. S. (2009). Green management matters only if it yields more green: an economic/strategic perspective. Acad. Manag. Perspect. 26, 5–16. doi: 10.1108/sd.2010.05626bad.006

Trencansky, D., and Tsaparlidis, D. (2014). The effects of company's age, size, and type of industry on the level of CSR: the development of a new scale for measurement of the level of CSR (master thesis). Umeå University, Umeå, Sweden.

Trochim, W. M. K. (2006). Research Methods Knowledge Base. Available online at: http://www.socialresearchmethods.net/kb/scallik.php (accessed September 26, 2019).

Tschopp, D., and Huefner, R. (2014). Comparing the evolution of CSR reporting to that of financial reporting. J. Bus. Ethics 127, 565–577 doi: 10.1007/s10551-014-2054-6

Udayasankar, K. (2008). Corporate social responsibility and firm size. J. Bus. Ethics 83, 167–175. doi: 10.1007/s10551-007-9609-8

Vanacker, T., Collewaert, V., and Paeleman, I. (2013). The relationship between slack resources and the performance of entrepreneurial firms: the role of venture capital and angel investors. J. Manag. Stud. 50, 1070–1096. doi: 10.1111/joms.12026

Visser, W., and Kymal, C. (2015). Integrated Value Creation (IVC): beyond Corporate Social Responsibility (CSR) and Creating Shared Value (CSV). J. Int. Bus. Ethics 8. Available online at: https://www.researchgate.net/publication/318094908_Integrated_Value_Creation_IVC_Beyond_Corporate_Social_Responsibility_CSR_and_Creating_Shared_Value_CSV

Vitolla, F., Raimo, N., Rubino, M., and Garzoni, A. (2019). How pressure from stakeholders affects integrated reporting quality. Corp. Soc. Responsib. Environ. Manag. 26, 1591–1606. doi: 10.1002/csr.1850

Vormedal, I., and Ruud, A. (2009). Sustainability reporting in Norway: an assessment of performance in the context of legal demands and socio-political drivers. Bus. Strategy Environ. 18, 207–222. doi: 10.1002/bse.560

Keywords: sustainability, reporting, integrated thinking, communication, sustainable development goals

Citation: Beyne J, Visser W and Allam I (2021) Sustainability Reporting in the Antwerp Port Ecosystem, Belgium: Understanding the Relationship Between Reporting on the Sustainable Development Goals and Integrated Thinking. Front. Sustain. 2:689739. doi: 10.3389/frsus.2021.689739

Received: 01 April 2021; Accepted: 05 July 2021;

Published: 07 September 2021.

Edited by:

Kim Ceulemans, TBS Business School, FranceReviewed by:

Ana Rita Domingues, Nottingham Trent University, United KingdomWan Norhaniza Wan Hasan, Universiti Sains Malaysia (USM), Malaysia

Hiroshan Hettiarachchi, Independent Researcher, Michigan, United States

Copyright © 2021 Beyne, Visser and Allam. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jan Beyne, amFuLmJleW5lQGFtcy5hYy5iZQ==

Jan Beyne

Jan Beyne Wayne Visser

Wayne Visser Imane Allam

Imane Allam