- 1School of Finance, Zhongnan University of Economics and Law, Wuhan, China

- 2School of Finance, Shandong University of Finance and Economics, Jinan, China

The COVID-19 pandemic has profoundly and negatively impacted the global stock markets. Hence, we investigated the time-varying impact of the COVID-19 pandemic on stock returns during the period from January 27, 2020 to December 23, 2021 using the TVP-VAR-SV model and used G7 countries as our research sample. Our results imply that (i) the spread of the COVID-19 pandemic has a significant negative impact on stock returns, but the impact decreases as the time window increases; (ii) the timeliness, compulsoriness, and effectiveness of anti-epidemic policies implemented by governments are the important adjustment factors for stock returns; (iii) the impact of the early stage of the COVID-19 pandemic on the stock market trend gradually weakens as the intermediate time interval increases. In addition, over time, the duration of the negative impact of the COVID-19 pandemic on the stock returns became shorter, and the recovery rate of the impact became faster; (iv) under the managed floating exchange rate regime, the stock returns changed synchronously with the pressures of exchange rate appreciation and depreciation, and under the free-floating exchange rate regime, the effect of the exchange rate on stock returns was almost zero, while the impact of exchange rate channels in eurozone countries was related to the characteristics of national economies. Thus, governments should make greater efforts to improve the compulsion and effectiveness of epidemic prevention policies and strengthen their control over exchange rate fluctuations to alleviate the negative impact of the COVID-19 pandemic on the stock markets.

Introduction

The COVID-19 pandemic broke out in Wuhan in December 2019 and spread rapidly across the world in 2 months, sweeping over 190 countries and regions. The outbreak of this pandemic is characterized by uncertainty and repetition, which has caused immeasurable losses to the global macro economy, and the global capital market has fluctuated violently. The stock markets have especially bore the brunt of the pandemic. On the one hand, the outbreak of the COVID-19 pandemic has accelerated the spread of pessimism among global investors and contributed to the herding effect, resulting in successive stock market declines and a vicious circle; on the other hand, the isolation policy brought by the pandemic has impacted on the economy from both consumption and output, which affected the trend and expectation of the stock market and imposed a serious negative effect on the stock market returns. For example, the US stock market had even experienced a record four meltdowns in 10 days, ending the 11 years of US bull markets occurring since 2009. Stock markets of other major global economies, such as Germany, the United Kingdom, and Japan, also experienced drops of as much as 30–40%.

As a “barometer” of the real economy and the “monitor” of industry and enterprise development, the volatility of a country's stock market returns reflects its macroeconomic situation through investors' expectations, capital valuation, and other channels (1, 2). For instance, the classical life cycle theory (1979) and Tobin's Q effect theory (1969) both emphasize the Indication function of stock price fluctuation. Thus, against the background of the outbreak and spread of the COVID-19 pandemic worldwide, the stock market can more sensitively and fully reflect the impact of the pandemic, which is an ideal empirical research object. Therefore, a quantitative study about the breadth and depth of the impact that the COVID-19 pandemic has had on the stock market both directly and indirectly can enrich the field of research on the influence of emergencies on financial markets. Moreover, clarifying the characteristics and general rules of the impact and exploring its influence channels can help provide a decision-making basis for investors and policy makers, and it can also provide important theoretical and practical knowledge regarding the risk of external emergencies and resolving financial crises in early stages.

Notably, under the current background with increasingly close trade ties and strengthened financial integration, exchange rate has a significant impact on the stock market. From a theoretical point of view, the interest rate parity theory reveals the intrinsic link between the market interest rate and the exchange rate. Combining this theory with the Gordon model, which reveals the relationship between stock prices and the money market interest rate, uncovers the relationship between a country's exchange rate and its stock market. The Dornbusch overshoot hypothesis (1976) explains the excessive volatility of exchange rates and emphasizes the excessive reaction of asset market prices to external shocks through exchange rate overshoots. The cash flow-oriented model (3) and the portfolio-oriented model (4)—which use the current account and capital account as intermediaries, respectively—have been historically proven to be classic explanations describing the relationship between stock prices and exchange rate.

From the perspective of influence mechanism, the exchange rate has a multi-directional and multi-level impact on the stock market. The close relationship between the exchange rate and the stock market creates profit conditions for speculators. Thus, understanding the relationship between exchange rates and stock prices can help fund managers manage and hedge risks (5). For companies, particularly multinationals that are vulnerable to global market trends, familiarity with exchange rate movements helps them avoid risks and mitigate micro-impacts on equities. In addition, the exchange rate can also affect the risk contagion of the stock market at the macro level by affecting international trade relations. Existing empirical studies also show that, due to the outbreak of COVID-19, a series of restrictions and blockade measures have been taken globally, resulting in unexpected changes in cash flows, which has in turn impacted the exchange rate market (6). Thus, the importance of exchange rates cannot be ignored with respect to COVID-19 outbreaks and financial market turmoil.

This study applies TVP-VAR-SV model to capture the dynamic impact of the COVID-19 epidemic on the stock market return, and explores the important intermediary role of exchange rate in this process. The study finds that the spread of COVID-19 has a significant negative impact on stock returns but not lasting, and the stock market recovers faster in the later period; whether the epidemic prevention policy implemented by the government is timely and effective has a significant impact on the recovery of stock market returns; and exchange rates have a synchronous effect on stock returns under managed floating exchange rate regime.

The contributions of this paper are as follows: first, the existing literature mainly focuses on corporate performance (7), corporate social responsibility (8), investor sentiment (9), and trade linkages (10), while few literature explores the impact of the COVID-19 epidemic on stock market returns from the perspective of exchange rate changes. Thus, in order to examine the internal mechanism of the COVID-19 pandemic shock and fill the current academic research gap as much as possible, we incorporate exchange rate factors into the research framework on the impact of the COVID-19 pandemic on stock market returns and fully account for the bridge role of exchange rates in the process of the COVID-19 pandemic affecting stock market returns, which will enrich the research on the influencing mechanism between the COVID-19 pandemic and stock market returns.

Second, the current literature mostly researches the impact of the COVID-19 epidemic on the stock market returns by using GARCH family models. However, GARCH family models, such as GARCH (11) and DCC-GARCH (12), are mostly used to study the correlation and dynamic correlation analysis between variables, and the model is hard to capture the impact direction between variables. Thus, the TVP-VAR-SV model based on dynamic time-varying parameters is used to overcome the shortcoming that GARCH-family models cannot determine the impact direction and describe comprehensively the impact of the COVID-19 pandemic on the stock market returns. Furthermore, compared with GARCH-family models, the TVP-VAR-SV model has a better conditional variance acquisition ability, which can better capture the sharp changes in market volatility. Therefore, the TVP-VAR-SV model enables a more comprehensive and reasonable dynamic simulation of the shock process.

The remainder of the paper is organized as follows. Section Literature Review reviews related literature. Section Methodology and Data introduces the principle of the TVP-VAR-SV model applied in this paper and describes the data used to depict market characteristics. Section Empirical Result presents the empirical results. Section Conclusion concludes the paper.

Literature Review

Considerable effort has been devoted to the study of the impact of the COVID-19 pandemic on stock markets. Whether from a theoretical or empirical perspective, most scholars' research results show that the COVID-19 pandemic has had a huge negative impact on the stock markets of many countries (13–18), which can only be alleviated by the lockdown (19), and lead to a sharp increase of the return connectedness degree across various assets, such as gold, crude oil, world equities, currencies, and bonds (2, 20). Previous studies' research objects include the stock markets of individual countries and national groups, such as emerging market countries (21) or major world economies (14, 22–24). Furthermore, most existing literature takes the volatility of the stock market as its research object and regards it as the market risk reflecting the impact of the COVID-19 pandemic. However, such an assumption ignores the directionality of the market volatility. Reflecting the market situation with the change in stock market returns can depict this impact from the perspectives of both returns and losses. Therefore, this paper takes stock returns as the research object to depict the COVID-19 pandemic impact.

Further literature shows that classical GARCH (11, 25) and its extended models such as EGARCH (26), FIGARCH (27), APGARCH (28), DCCGARCH (12), and BEKK (29) are the main research methods. These methods have been applied to evaluate the impact of the pandemic shock on the expected average return and volatility of each stock index and to then depict the asymmetry of this impact and the long-term memory characteristics reflected by the stock market. Some scholars use the wavelet framework to assess the relationship between the COVID-19 pandemic and the stock market (30–32). By constructing an international stock market risk contagion network, some scholars have also estimated the impact and tail risk changes of the COVID-19 pandemic under extreme market conditions and have analyzed the topological structure changes of stock market linkages (33, 34).

To sum up the above, the researchers have predominantly selected the corresponding analysis model based on the characteristics of stock market volatility. As a result, the further exploration of the impact path of the COVID-19 pandemic at the empirical level remains insufficient. For example, GARCH models do well in evaluating the correlation between variables but do not describe the impact direction. The construction of a network topology can realize the visualization effect before and after the incident but cannot reflect the specific dynamic time-varying impact process. Hence, unlike previous studies, this paper applies the TVP-VAR-SV model, which overcomes the shortcomings of previously used research methods. This model can dynamically simulate the changes of the impact that the COVID-19 pandemic has had on the stock market via pulse graph responses to realize the multi-impact relationship with specific direction.

Furthermore, the COVID-19 pandemic has been regarded as a major negative external shock event, and the current academic circles divide the impact of the COVID-19 pandemic on stock market into micro and macro perspectives. As far as the micro level of the impact of the COVID-19 pandemic concerned, firstly, the COVID-19 pandemic affects the performance of enterprises in the stock market by affecting corporate performance and corporate social responsibility, which then indirectly impacts the stock market. Many scholars have examined the short-term impact of corporate social responsibility on stock returns and its potential mechanisms during the crisis (7, 8, 35), but their conclusions remain divergent. The second is to reflect the impact of the COVID-19 pandemic on the stock market by depicting the financial channels of this impact from the perspective of investor sentiment. The impact of known negative events will trigger a chain reaction and promote the spread of pessimistic expectations (9), leading to increased financial instability. The outbreak of COVID-19 has undoubtedly led to a surge in global economic and political uncertainty, which induces investors to act irrationally (36) and exacerbates the turmoil in the capital market. Some studies constructed COVID-19 global fear indexes to measure investors' attention and fear regarding COVID-19 (37–39) and then examined the impact of the pandemic on stock market volatility and returns using investor sentiment channels. From a macro perspective, the existing literature mostly considers the trade links between countries as a new type of COVID-19 shock channel. The trade exchanges among different economies will become a risk transmission channel among the stock markets (10) and further amplify the impact of the pandemic. Secondly, the relationships among multiple capital markets have been investigated to further understand the impact channels of the pandemic shock. However, few studies pertaining to the relationship between the COVID-19 pandemic and stock market returns have used exchange rates in an intermediary role.

Additionally, most existing studies on the Granger causality or non-linear relationship between stock market prices and exchange rate fluctuations have made it clear that there is a close correlation between the exchange market and the stock market (40–42) and that exchange rate volatility mediated by the money market (43) has an important risk conduction effect on the stock market (41, 44), which to some extent exacerbates the financial vulnerability of a country's economy. Besides that, with the development of econometric models, the time-varying correlation between them has been further confirmed. In addition, according to the historical experience of previous crises such as the 2008 financial crisis, the linkage degree between the stock market and the exchange market is further enhanced during the crisis, which is also sufficiently credible. Therefore, in the context of the global economic recession caused by the COVID-19, it is of more important research value to explore the role of exchange rate in stock market volatility. However, referring to the investigation of existing literature, there are relatively few studies on the linkage effect of stock market and foreign exchange market with the COVID-19 outbreaks as the background, and the role of exchange rates in this shock of the COVID-19 pandemic on the stock returns has not yet been demonstrated. After comprehensive consideration, this paper takes the exchange rate as an important transmission channel for the impact of COVID-19 pandemic on the stock market. This means that the pandemic has an impact on exchange rate fluctuations, which in turn affects the stock price level and thus the real economy. Thus, the impact channel of the COVID-19 pandemic affecting the stock market can be further researched.

Based on the above discussion, this paper aims to solve the following problems: 1) What is the dynamic impact process of the COVID-19 pandemic on the stock market? 2) How does the COVID-19 pandemic affect stock market returns in a specific time nodes? 3) Does the exchange rate play a role in this shock, and if so, how? This paper uses the TVP-VAR-SV model to simulate the dynamic process of the COVID-19 pandemic affecting the stock market and focuses on the role of the exchange rate as an intermediary in this process to achieve an accurate description of the whole impact process at different points in time. Our research extends the existing literature work, considering the exchange rate as an index that cannot be ignored in this impact, and obtains a more accurate and comprehensive impact process with a time-varying model, which enriches the research on the content of the COVID-19 impact on the stock market.

Methodology and Data

Research Design

To investigate the impulse impact of the COVID-19 pandemic on stock market returns, we used the TVP-VAR-SV model to do the following:

• Identify the time-varying impact of the COVID-19 pandemic on stock returns;

• Introduce the exchange rate into the research framework and analyze the indirect effect of the COVID-19 pandemic on stock returns according to the transmission chain: the COVID-19 pandemic—exchange rate fluctuation—stock returns;

• Study the dynamic impact of the COVID-19 pandemic on stock returns in a specific period.

This research will provide evidence regarding the impact of the COVID-19 pandemic on stock returns.

Methodology

The TVP-VAR-SV model proposed by Nakajima (45) is used to investigate the equal-interval impulse impact of the COVID-19 pandemic on stock returns, to explore the time-varying and non-linear characteristics of the impulse impact, and to analyze the intermediary effect of the exchange rate and the impact of the COVID-19 pandemic on the stock returns for a specific period. At present, few studies have used this method to study the impact of the COVID-19 pandemic on stock returns. We attempted to use this method to deeply explore the time-varying impact of the COVID-19 pandemic on stock returns to accurately characterize the characteristics and heterogeneity of the impact of pandemics on stock returns at different times.

Since Sims (46) proposed the vector autoregressive (VAR) model, the VAR model has been continuously extended, and the TVP-VAR-SV model is one important variation. Primiceri (47) first introduced time-varying parameters into the VAR model, and this model was further improved by Nakajima (45). The basic structural VAR model is as follows:

where t = s + 1, ⋯ , n, t represents time, and s is the number of lag periods; yt is the k × 1 order vector composed of the investigated variables, and k is the number of investigated variables. Combined with the research content of this paper, the variables to be investigated are the growth rate of confirmed cases of the COVID-19 pandemic, stock returns, and the exchange rate volatility index. Both A and B1, …, Bs are k × k parameter matrices; μt measures the structural shock; and μt ~ N(0, ψψ), where:

In Equation (2), σ is the standard deviation. Assuming that the structural impact obeys recursive identification, that is, matrix A is a matrix with a lower triangular form,

Equation (1) can be transformed into the following VAR model:

In Equation (4), εt is a residual, and εt ~ N(0, Ik), Ik is a unit matrix; , and i = 1, 2, …, s. We processed the elements on each row of the matrix Φi and converted them into β form; β is the k2s × 1 order vector. Meanwhile, we defined , where ⊗ is the Kronecker product. Thus, the VAR model can be expressed as follows:

The parameters in the model are non-time-varying. Considering that the parameters are variable over time, the model is the TVP-VAR model. The TVP-VAR model with random volatility (i.e., the TVP-VAR-SV model) can be expressed as follows:

In Equation (6), the parameters βt, At, and ψt are time-varying. According to the research of Primiceri (47), the elements of the lower triangle in matrix At can be transformed and expressed as ; while ; ; j = 1, 2, ⋯ , k; and the volatility of a country's stock market returns reflects its macroeconomic situation t = s+1, ⋯ , n. Assuming that the parameters in Equation (6) follow the random walk process where βt+1 = βt+μβt; at+1 = at+μat; ht+1 = ht+μht; and there is:

In Equation (7), βs+1 ~ N(μβ0, ψβ0); as+1 ~ N(μa0, ψa0); and hs+1 ~ N(μh0, ψh0). To reduce the processing difficulty of the likelihood function under random fluctuations, we utilized the Monte Carlo (MCMC) method to simulate sampling and estimated the model parameters after obtaining their posterior distribution.

Data

To study the dynamic impact of the COVID-19 pandemic on stock returns, we selected G7 countries as research samples. The sample countries are the major developed countries in the world and include American countries, European countries, and Asian countries, among which the sum of their gross domestic product in 2020 accounted for about 44.58%1 of the total global gross domestic product. Thus, the sample is representative.

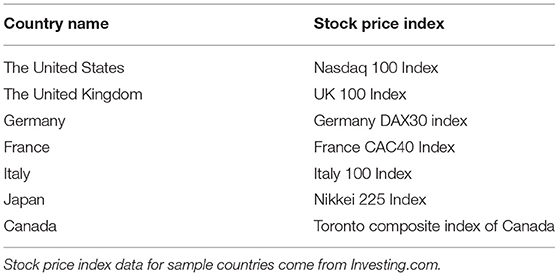

We measured the COVID-19 pandemic degree and the COVID-19 pandemic spreading speed for the sample countries using the first-order logarithmic difference of the number of confirmed COVID-19 cases. The cumulative data of the number of confirmed COVID-19 cases in various countries comes from the COVID-19 pandemic database of Johns Hopkins University (https://coronavirus.jhu.edu/map). In addition, we measured the stock returns of each country using the first-order logarithmic difference of the national stock index. The stock price index selection of sample countries is shown in Table 1 and comes from investment.com (https://cn.investing.com/indices/).

The domestic exchange rate fluctuations are represented by the first-order logarithmic difference of the exchange rates of sample countries (using the direct price method, with the US dollar as the benchmark currency and the sample country's currency as the quoted currency). It is worth noting that the sample countries include the United States, and the US currency is the benchmark reference currency. Thus, its exchange rate is a constant of 1. To characterize the US dollar exchange rate fluctuations, we used the US Dollar Index (USDX) as the proxy variable of the US exchange rate. Additionally, Germany, France, and Italy are all EU countries whose circulating currency is the euro. Therefore, the exchange rate data of these three countries are all based on the euro exchange rate, which come from the Wind database.

Given the availability of sample data and the data available after the first-order logarithmic difference processing, the sample period in this paper covers the period from February 3, 2020 to December 23, 2021. It is worth noting that the length of time from December 20, 2021 to December 23, 2021 is <1 week, and this paper is treated as 1 week. The frequency of sample data is weekly data, and the sample comprises a total of 2,079 observations.

Empirical Results

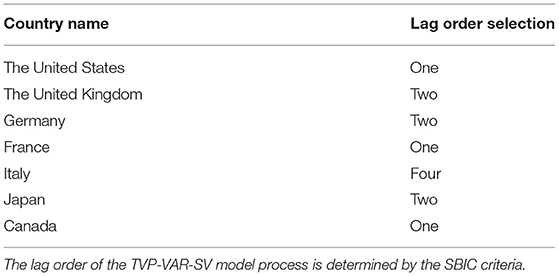

To ensure the robustness of the results, we determined the lag period of the TVP-VAR-SV model process according to SBIC. The selection of lag order in the estimation processes of sample countries is shown in Table 2.

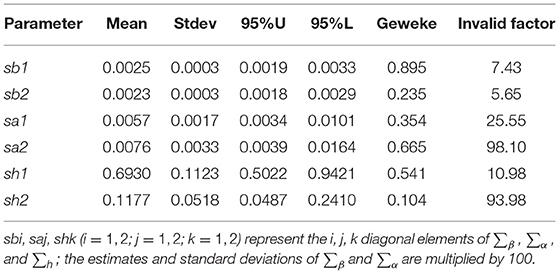

In accordance with the method of Nakajima (45), we set the initial value of parameters to obtain the posterior distribution of the estimated model parameters and then simulated the sampling using the MCMC method with 20,000 samplings. The mean, standard deviation, 95% confidence interval, and diagnostic statistical results of the TVP-VAR-SV model's parameter posterior distribution for the United States are shown in Table 3, and the results of the TVP-VAR-SV model's parameter posterior distribution for other countries are detailed in the Appendix. As shown in Table 3, the Geweke's convergence diagnostic value does not pass the significance test at the 5% level, indicating that the parameters converge to the posterior distribution. In addition, the invalid factors are small, and the maximum value of the invalid factor is 98.10. Thus, at least 20,000/98.10 = 203 irrelevant samples were obtained in this paper, which proves that the simulation using the MCMC algorithm is effective. The model estimation and diagnostic results in the Appendix also show that the simulation using the MCMC algorithm is reasonable.

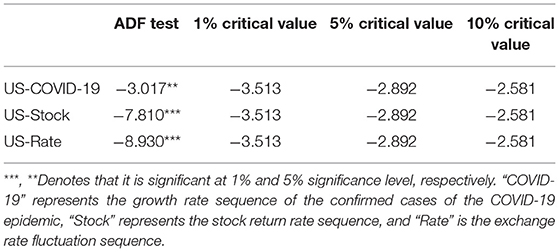

Given that the basic data used in this study are time-series data, it is necessary to test the stability of each sequence. The augmented Dickey-Fuller (ADF) test results for the US stock returns, exchange rate fluctuations, and the growth rate sequence of the number of confirmed COVID-19 cases are shown in Table 4, and the ADF test results of other sample countries are detailed in the Appendix.

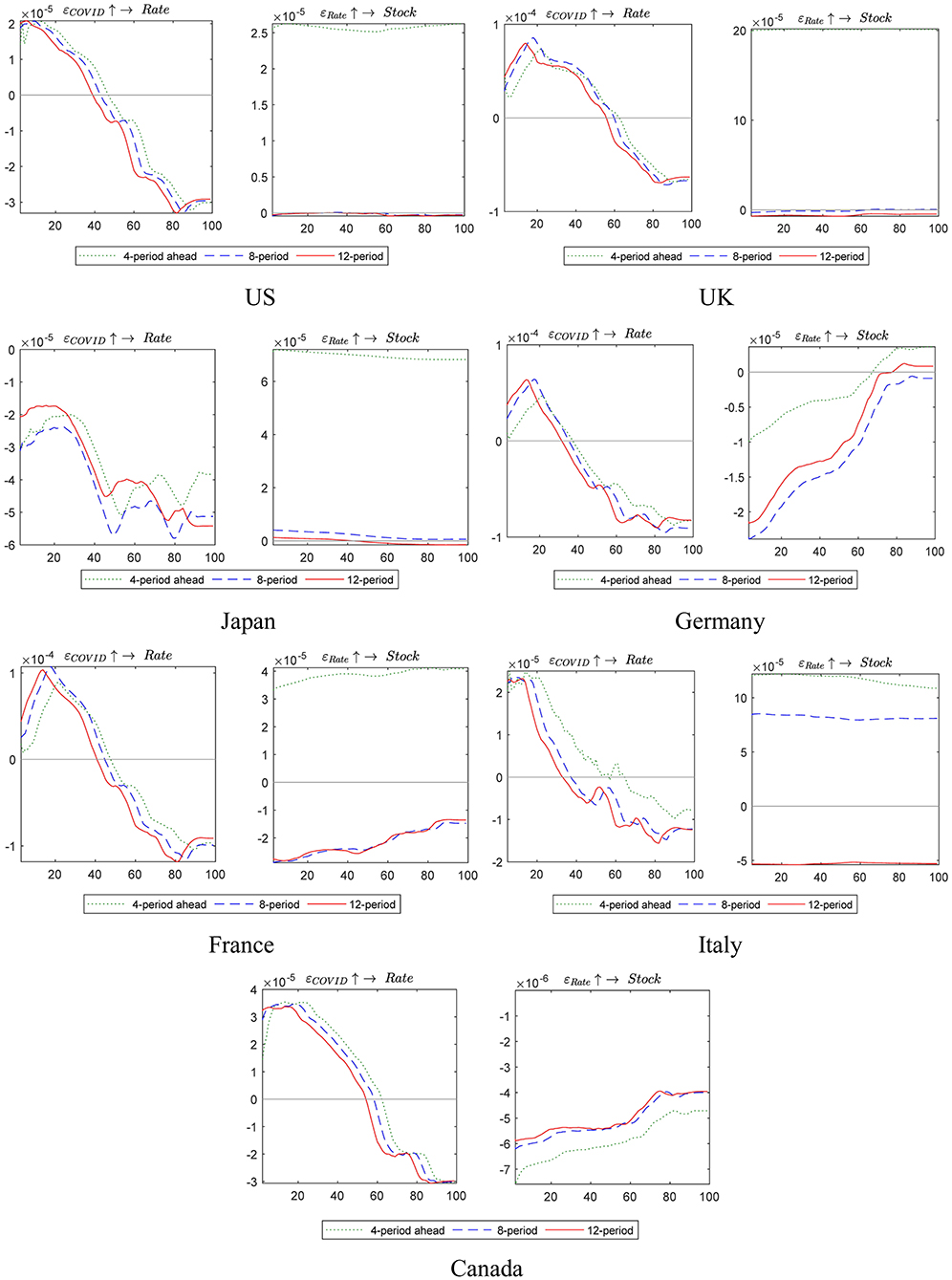

Equal-Interval Impulse Response of Stock Returns

In contrast to the fixed parameter VAR model, the TVP-VAR-SV model can simulate the impulse response of different lag periods. We estimated the impulse impact of the growth rate of the number of confirmed cases of COVID-19 in lag period 4, lag period 8, and lag period 12 on the stock returns. The estimation results of sample countries are shown in Figure 1. We clearly found that, at the beginning of the COVID-19 pandemic, its spread harmed stock market indices, and the stock market deficit effect was obvious. This finding is consistent with the research conclusions of Ashraf (48), Rahman et al. (49), Ahmar and del Val (50), Anh and Gan (51), and Alfaro et al. (52). It may be related to the negative impact of the COVID-19 pandemic on national economic systems, financial markets, and investor expectations. For example, the COVID-19 pandemic has led to the shutdown of enterprises and factories in globally important countries, resulting in a gap in production capacity, which has had a serious impact on the global production system and severely restricted the development of the domestic macroeconomic economy. Since the returns of the stock market are a barometer of the economy, they decreased in accordance with the mentioned developments. Simultaneously, global capital liquidity has tightened due to the COVID-19 pandemic, which also exacerbated the instability of the financial market. Thus, the risk of the stock market continued to increase. In addition, investor sentiment has also been seriously affected by the global spread of COVID-19, resulting in increasing global panic. Therefore, the expectations of investors and trading behavior have changed, which has had a serious negative impact on stock market returns (53). This impact will not be mitigated by economic assistance plans or fiscal stimulus in the short term (16).

However, the impact of the COVID-19 pandemic on the stock returns is time-varying and related to the length of the time window. With the extension of the time window, the impact of the COVID-19 pandemic shock gradually weakens. In Figure 1, the negative impact of the domestic epidemics in Germany, France, Italy, the United Kingdom, Canada, and Japan on stock returns declined over time, and the impact of the US epidemic on its stock market also declined by November 2020. There are three main reasons for this decline in impact. First, with the global spread of the COVID-19 pandemic, more attention has been paid by each country to the COVID-19 pandemic, and various measures have been successively taken, such as shutdowns, laying off, and home isolation. Meanwhile, as the pandemic has become normalized, countries have accumulated considerable experience in the prevention and control of the pandemic, and their prevention and control has been continuously improved. Second, the pessimism of the ordinary investors regarding the economy and stock market was only shown in the short term (54) after the stock market crash. Over time, the panic emotions of investors gradually stabilized, and the effectiveness of the investor sentiment mechanism on stock market returns declined. Third, some new investment opportunities for some industries have also been produced due to the COVID-19 pandemic, such as low-end (mask production) and high-end (ventilator manufacturing) manufacturing, the pharmaceutical industry (COVID-19 vaccine and related drug research and development), and the Internet communication industry (cloud-computing industry chain), which have led to technical and structural bull markets in the stock market. Hence, over time, the negative impact of COVID-19 on stock market returns gradually weakened, and the pandemic in some sample countries even had a positive effect on stock market returns.

Additionally, the impact of the COVID-19 pandemic on stock returns is also heterogeneous in different lag periods. For example, the pulse curve of Germany for lag period 4 is always lower than that of lag period 8 and lag period 12. During the period from August 2021 to December 2021 (the time interval from 80 to 100 on the horizontal axis in Figure 1), the COVID-19 pandemic began to positively impact the stock market returns during lag period 12, while the COVID-19 pandemic still imposed an inhibitory effect on the stock market returns during lag period 4, which proves that the longer the lag period is, the weaker the negative impact of the COVID-19 pandemic on the stock returns is, that is, the impact of the early pandemic on the later stock market trend gradually decreases over time.

Notably, the impact of the COVID-19 pandemic on stock returns is also heterogeneous in different countries. As Europe is one of the global outbreak centers of the COVID-19 pandemic, European stock markets have been hit disastrously by the COVID-19 pandemic. Compared with Italy, the COVID-19 epidemics in the United Kingdom, France, and Germany have had a stronger impact on stock market returns. However, compared with the United Kingdom, France, and Italy, the impulse effect of the German COVID-19 epidemic on the stock market changed from negative to positive, that is, the inhibitory effect of the epidemic on the returns of the German stock market gradually declined, which is mainly due to the rich medical resources of Germany, the continuous improvement of the German government's anti-epidemic measures, and the efficiency of the country's epidemic prevention. Thus, the panic emotions of investors have gradually slowed down, and pessimistic expectations have dissipated (55). Similar to Germany, Japan has also benefited from earlier mandatory shutdowns and home isolation policies, which effectively inhibited the spread of the COVID-19 epidemic in Japan and reduced its negative impact on the country's stock market returns. Therefore, the impact of the Japanese COVID-19 epidemic on the stock market returns showed a positive reversal in November 2020, indicating that the timeliness and mandatory nature of the government's anti-epidemic policy were crucial regulatory factors for the stock market returns.

With respect to the United States, which is one of the centers of the COVID-19 pandemic, the impact of the COVID-19 pandemic on stock returns shows strong repeatability, which is mainly related to the American COVID-19 epidemic situation and the economic status of the United States. For example, since March 2020, the number of confirmed COVID-19 cases in the United States has surged, yet the government has not paid enough attention to the COVID-19 epidemic. As a result, pessimistic domestic expectations have been continuously amplified, and the panic emotions have spread rapidly due to the fear of the economy being shocked severely. Moreover, as the United States is the global economic center, there is a close economic and trade relationship between the United States and other countries, which leads to the frequent recurrence of the domestic COVID-19 epidemic. Therefore, the returns of the US stock market have fluctuated and gradually fallen. The COVID-19 epidemic in adjacent Canada is also severe, which has had a strong negative impact on Canada domestic stock market returns.

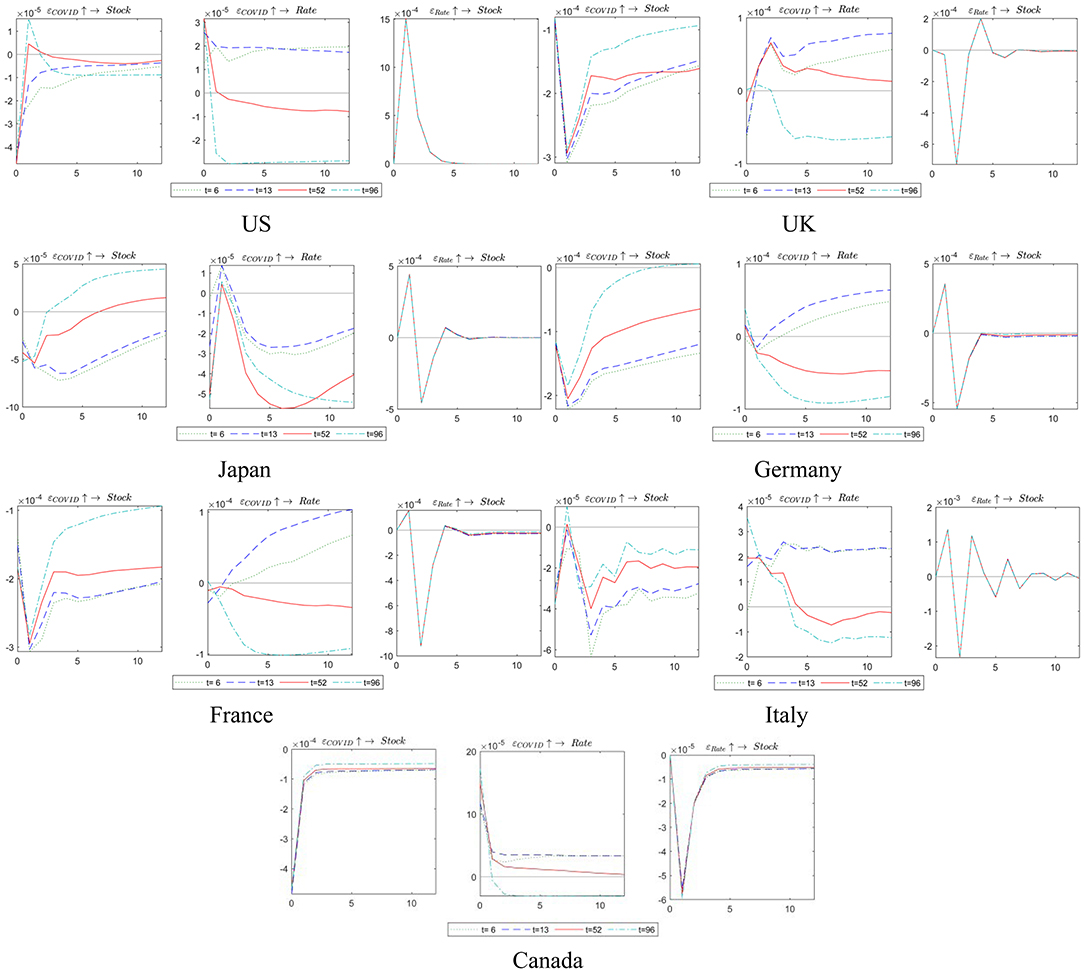

Impulse Impact of the Exchange Rate Channel on the COVID-19 Pandemic

With the above analysis, the direct impact of the COVID-19 pandemic on stock market returns can be clarified. However, as an important part of the financial market, the stock market is affected by multiple financial factors, such as exchange rates, which may become an indirect channel for the impact of the COVID-19 pandemic on the stock market. This paper will therefore add to the research on the relationship between the COVID-19 pandemic and the stock market returns. We introduced the exchange rate channel into the research framework and examined the indirect impact of the COVID-19 pandemic on the stock market returns according to the transmission chain: the COVID-19 pandemic—exchange rate fluctuation—stock market returns. In this paper, the exchange rate regime classification criteria in Ilzetzki et al. (56) is used to determine the exchange rate regimes of each sample country. Among them, the United States, the United Kingdom, and Japan have free-floating exchange rate regimes, Canada has the managed floating exchange rate regimes, and Germany, France, and Italy have fixed exchange rate regimes.

The empirical results are shown in Figure 2. First, the shocks of the COVID-19 pandemic on the exchange rates of various countries have clear dynamic characteristics. For example, the continual impact of the COVID-19 epidemic in the United States on the domestic exchange rate gradually changed from appreciation pressure to depreciation pressure. By contrast, the domestic exchange rate fluctuation pressure of other countries has been shifted from depreciation pressure to appreciation pressure. The main reasons for this phenomenon are that the United States, as a global economic center, is a safe haven for investors to avoid risks. Therefore, at the beginning of the outbreak of the COVID-19 pandemic, the global currency flowed to the United States, which opened the appreciation channel of the US dollar, while the pressure on other currencies to devalue increased. Along with the increasingly serious domestic epidemic in the United States, domestic capital has shown an outflow trend. Thus, the appreciation rate of the US dollar has slowed down, and the depreciation pressure has risen.

In addition, the impact of exchange rate fluctuations due to the shock of the COVID-19 pandemic on stock market returns is heterogeneous. For the United States, the United Kingdom, and Japan, the impact of exchange rate fluctuations on stock market returns under the free-floating exchange rate regime is almost zero, mainly because the sensitivity of the stock market to exchange rate fluctuations has been reduced by the free-floating exchange rate mechanism. In addition, the ternary paradox shows that the floating exchange rate system can absorb external uncertainty shocks under the free flow of cross-border capital, which is also an important reason for the weak impact of the outbreak of the COVID-19 epidemic in the floating exchange rate countries on the stock market. As far as Canada is concerned, the fluctuation direction of the exchange rate under the managed floating exchange rate regime partly indicates the tolerance of the government to exchange rate fluctuation, the direction of government policy, and the expectation of the government to domestic economic development. Therefore, the fluctuation direction of the Canadian exchange rate is synchronized with the change direction of stock market returns, which means that, when the domestic exchange rate is under the pressure of depreciation, domestic capital flows into the foreign exchange market, market liquidity is extracted, and stock market returns decline; when the domestic exchange rate is under the pressure of appreciation, investors show optimistic investment expectations, and domestic returns rise. Accordingly, under the managed floating exchange rate regime, the guidance and intervention of government on the exchange rate has also become one of the important measures regulating the trend of the stock market. As far as Germany is concerned, there is an inverted “N” trend in the impact of exchange rate fluctuations on stock market returns during lag period 4 and lag period 12, while the pressure of exchange rate appreciation and depreciation changes synchronously with the stock market returns during lag period 8. As far as France and Italy are concerned, the increase of the stock market returns in the short-term lag period is promoted by the depreciation pressure of the exchange rate, which is mainly caused by the export-oriented economic characteristics of the two countries. In lag period 12, the depreciation pressure of the exchange rate and the stock market returns change synchronously, indicating that the changes of the domestic liquidity brought by the exchange rate fluctuation in the long-term lag period and investors' expectations are important factors affecting the domestic stock returns.

Impulse Shock of COVID-19 at Different Times

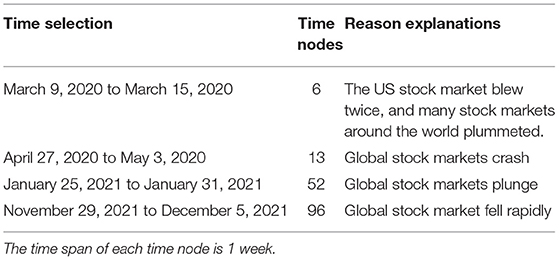

To further explore the impact characteristics of the COVID-19 pandemic on stock returns in a specific period, this paper selects four points in time, as shown in Table 5.

The empirical results are shown in Figure 3. During the US stock market meltdown period from March 9, 2020 to March 15, 2020, the outbreak of the COVID-19 pandemic in sample countries had a significant negative impact on stock market returns. In the following three periods, the negative impacts of the COVID-19 pandemic on stock market returns were successively shorter, and the recovery speeds were successively faster. Especially following the period of the global stock market plunge from January 25, 2021 to January 31, 2021 and the rapid decline of the global stock market on November 29, 2021 and December 5, 2021, stock market returns recovered rapidly and even became greater than previously. This occurrence was closely related to improved national epidemic prevention and control efforts and the dissipation of investor panic. Meanwhile, the impact direction of the COVID-19 pandemic on the exchange rates varies during different periods. For example, along with the specific time period, the impact of the COVID-19 pandemic on the US dollar gradually shifted from appreciation pressure to depreciation pressure, while other countries experienced the inverse, which confirms the robustness of the above conclusions.

Furthermore, it is worth noting that, since the exchange rate regimes of the sample countries have not changed in the short term, the change trend of the impact of the exchange rate fluctuation adding a standard deviation on the stock market returns almost coincides at different time periods.

Conclusion

In this article, the TVP-VAR-SV model was used to explore the time-varying impact of the COVID-19 pandemic on stock returns. On the basis of existing literature, relevant research conclusions have been enriched and expanded. The main conclusions of this paper are as follows.

First, the spread of the COVID-19 pandemic has had a significant negative impact on stock returns, while the impact has time-varying characteristics, which means that the impact degree is related to the length of the time window. As the time window increased, the negative impact of the COVID-19 pandemic on stock returns gradually decreased. For example, the negative impact of domestic COVID-19 epidemics in Germany, France, Italy, the United Kingdom, Canada, and Japan on stock returns gradually decreased with the extension of the time window.

Second, the timeliness, compulsoriness, and effectiveness of the anti-epidemic policies implemented by governments have been crucial regulatory factors for stock market returns. For example, the impact of the COVID-19 pandemic in Germany and Japan on stock returns has changed from negative to positive due to effective anti-epidemic measures. However, the U.S. domestic COVID-19 pandemic is frequently repeated, thus, the negative impact of the COVID-19 pandemic on stock returns in the United States shows strong repeatability and even an increasing trend.

Third, the impact of the early stage of the COVID-19 pandemic on the stock market trend was stronger than in the later stage, where it gradually weakened with increases in the intermediate time interval. For example, compared with lag period 4, the negative impact of the COVID-19 pandemic on the stock returns in lag period 12 is less and even begins to have a positive effect on the stock market. Over time, the duration of the negative impact of the COVID-19 pandemic on the stock returns decreased, and the recovery rate following the impact became faster.

Fourth, under the managed floating exchange rate regime, stock market returns changed synchronously with the pressures of exchange rate appreciation and depreciation, especially in the middle and later periods. The exchange rate can be used as a “buffer” against the impact of the COVID-19 pandemic on the stock market. Under the free-floating exchange rate regime, the effect of the exchange rate on stock returns was almost zero; for the eurozone countries, the impact of exchange rate channels is related to the characteristics of the national economies, while in the medium and long term, exchange rates were still used as an important tool to moderate the negative impact of the COVID-19 pandemic on the stock market.

Some policy implications can be drawn from the above conclusions. First, governments need to respond quickly to the COVID-19 pandemic because adopting strong short-term policies is more practical than adopting long-term ones. For example, governments should apply big-data technology to set up sensitive early warning and response mechanisms and strengthen its risk assessment of the stock market to effectively counteract the impact of the pandemic in the short term. Second, the effectiveness of the anti-epidemic policies implemented by governments is a crucial factor that offsets the negative impact of the COVID-19 pandemic on stock market returns. Therefore, to curb risk shocks from their root, governments still need to pay attention to epidemic prevention and control, efficiently utilize existing medical resources, and ensure policy implementation by improving the compulsion and effectiveness of epidemic prevention policies. Third, governments should fully consider the time lag of their policies and implement policies according to the stage of an epidemic. For example, in the early stage of a shock, prevention and control should be given priority, and in the long term, attention should be paid to helping the stock market recover through means such as guiding the direction of public opinion with positive policy predictions and maintaining the authenticity of disseminated information to ensure the stability of the capital market. Fourth, governments should make appropriate monetary interventions, strengthen their control of exchange rate fluctuations, and extend the duration of monetary intervention measures to ensure the stability of exchange rates, such as reducing large-scale quantitative easing policies and limiting currency trade between countries; simultaneously, the direction of exchange rate fluctuation can be flexibly adjusted by the governments to maximize the role of the exchange rate as the “buffer” between the COVID-19 pandemic and the stock market.

It is worth noting that the research conclusions of this paper with G7 group as the sample still have applicability and reference value for emerging economies.

After the outbreak of the COVID-19 pandemic, it spread rapidly around the world in a short period of time. Under the process of global economic integration, the COVID-19 epidemics among countries mutually infect, the dynamic correlation level of global epidemics is increasing, and the characteristics of the epidemics globalization are increasingly obvious. Specifically, the global spread of the COVID-19 pandemic is centered on the United States, the United Kingdom and Indonesia, and the central divergence mode and chain mode are the main transmission modes (55). Thus, countries with close economic and geographical connections with the above three countries have suffered epidemic input shocks, such as Mexico, Turkey and India. As the global COVID-19 epidemics gradually resonate, the severity of domestic epidemics in some countries has become increasingly similar, such as the United States and Canada, Canada and Mexico, the United States and Indonesia, Indonesia and Canada. Therefore, both the G7 group and emerging economies face common challenges from the global COVID-19 epidemic in the current context. In addition, with the COVID-19 epidemic sweeping the world, the global capital market has suffered a serious impact, and under the continuous spillover of global financial risks, the frequency of capital markets across countries is gradually consistent. For example, China's Shanghai Composite Index reached a huge drop of 7.72% on February 3 (the first trading day after the Spring Festival), and more than 3,000 stocks in the A-share market fell. The stock indexes of other developed and developing countries have plummeted since March, triggering a “meltdown” in multinational stock markets including the US, Brazil, South Korea, Canada and the Philippines. Systemic financial risk spreads rapidly among international markets, global investor risk preferences decline rapidly, and panic spreads globally. Subsequently, however, stock indexes rose steadily and the negative impact of the COVID-19 epidemic weakened, such as the Nasdaq 100 index, the Russian RTS index, the Jakarta composite index, the Kuala Lumpur index of Malaysia, the MXX index of Mexico, the IBOVESPA index of São Paulo, Brazil and the Shanghai Composite Index of China.

Based on this, both developed and emerging economies face similar COVID-19 epidemic shocks and the trend of the stock market response are roughly the same, especially in the context of global economic and financial integration and low threshold cross-border spillover of systemic risk, even if the level of economic development and characteristics of each country are different, which is closely related to the flow of cross-border capital driven by investor sentiment factors and there are similarities between human panic and greed. In addition, G7 countries have the same classification of exchange rate regimes as some new economies, such as Canada and Brazil, Indonesia, Malaysia, Mexico; Germany, France, Italy and Denmark, Saudi Arabia. Therefore, the research conclusions of this paper with G7 group as the sample still have applicability and reference value for emerging economies.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author Contributions

XT: conceptualization, validation, writing original draft, supervision, and funding acquisition. SM: methodology and writing—review and editing. XW: writing—review and editing and visualization. YZ: software, visualization, and formal analysis. ZW: validation, resources, and data curation. LX: software, data curation, project administration, and visualization. All authors contributed to the article and approved the submitted version.

Funding

We acknowledge the financial support from Youth Foundation of Humanities and Social Sciences of the Ministry of Education in China (20YJC790122). All errors remain our own.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary Material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fpubh.2022.859647/full#supplementary-material

Footnotes

1. ^Data source: the World Bank Database.

References

1. Ferreruela S, Mallor T. Herding in the bad times: the 2008 and COVID-19 crises. North Am J Econ Finan. (2021) 58:101531. doi: 10.1016/j.najef.2021.101531

2. Bouri E, Demirer R, Gupta R. COVID-19 pandemic and investor herding in international stock markets. Risks. (2021) 9:168. doi: 10.3390/risks9090168

4. Gavin M. The stock market and exchange rate dynamics. J Int Money Finan. (1989) 8:181–200. doi: 10.1016/0261-5606(89)90022-3

5. Kumar M. Returns and volatility spillover between stock prices and exchange rates: empirical evidence from IBSA countries. Int J Emerg Mark. (2013) 8:108–28. doi: 10.1108/17468801311306984

6. Gunay S. COVID-19 pandemic versus global financial crisis: evidence from currency market. SSRN. (2020) 56:3584249. doi: 10.2139/ssrn.3584249

7. Hogarth K, Hutchinson M, Scaife W. Corporate philanthropy, reputation risk management and shareholder value: a study of Australian corporate giving. J Bus Ethics. (2018) 151:375–90. doi: 10.1007/s10551-016-3205-8

8. Zhao C, Guo J, Qu X. Stock market reaction to corporate philanthropic response and silence: does charity style matter? Appl Econ Lett. (2021) 28:1344–50. doi: 10.1080/13504851.2020.1814943

9. Petrella L, Laporta AG, Merlo L. Cross-country assessment of systemic risk in the European stock market: evidence from a CoVaR analysis. Soc Indic Res. (2019) 146:169–86. doi: 10.1007/s11205-018-1881-8

10. Forbes KJ, Chinn MDA. Decomposition of global linkages in financial markets over time. Rev Econ Stat. (2004) 86:705–22. doi: 10.1162/0034653041811743

11. Setiawan B, Ben Abdallah M, Fekete-Farkas M, Nathan RJ, Zeman Z. GARCH (1, 1) models and analysis of stock market turmoil during COVID-19 outbreak in an emerging and developed economy. J Risk Finan Manag. (2021) 14:576. doi: 10.3390/jrfm14120576

12. Abuzayed B, Bouri E, Al-Fayoumi N, Jalkh N. Systemic risk spillover across global and country stock markets during the COVID-19 pandemic. Econ Anal Policy. (2021) 71:180–97. doi: 10.1016/j.eap.2021.04.010

13. Saif-Alyousfi AYH. The imapact of COVID-19 and the stringency of government policy responses on stock market returns worldwide. J Chin Econ Foreign Trade Stud. (2022) 15:87–105. doi: 10.1108/JCEFTS-07-2021-0030

14. Baker SR, Bloom N, Davis SJ, Kost KJ, Sammon MC, Viratyosin T. The unprecedented stock market impact of COVID-19. Natl Bureau Econ Res. (2020). doi: 10.3386/w26945

15. Zhang D, Hu M, Ji Q. Financial markets under the global pandemic of COVID-19. Finance Res Lett. (2020) 36:101528. doi: 10.1016/j.frl.2020.101528

16. Gormsen NJ, Koijen RSJC. Impact on stock prices and growth expectations. Rev Asset Pricing Stud. (2020) 10:574–97. doi: 10.1093/rapstu/raaa013

17. Liu HY, Manzoor A, Wang CY, Zhang L, Manzoor Z. The COVID-19. Int J Environ Res Public Health. (2020) 17:2800. doi: 10.3390/ijerph17082800

18. Al-Awadhi AM, Alsaifi K, Al-Awadhi A, Alhammadi S. Death and contagious infectious diseases: impact of the COVID-19 virus on stock market returns. J Behav Exp Finan. (2020) 27:100326. doi: 10.1016/j.jbef.2020.100326

19. Bouri E, Naeem MA, Nor SM. Government responses to COVID-19 and industry stock returns. Econ Res Ekonomska IstraŽivanja. (2021) 34:1–24. doi: 10.1080/1331677X.2021.1929374

20. Bouri E, Cepni O, Gabauer D. Return connectedness across asset classes around the COVID-19 outbreak. Int Rev Finan Anal. (2021) 73:101646. doi: 10.1016/j.irfa.2020.101646

21. Yang Y, Li L, Jiang J. The impact of COVID-19 pandemic on emerging country stock markets: evidence of the value effect. Emerg Mark Finance Trade. (2022) 58:70–81. doi: 10.1080/1540496X.2021.1973423

22. Wang D, Li P, Huang L. Volatility spillovers between major international financial markets during the covid-19 pandemic. SSRN. (2020) 3645946. doi: 10.2139/ssrn.3645946

23. Song R, Shu M, Zhu W. The 2020 global stock market crash: Endogenous or exogenous? Phys. A: Stat. Mech. Appl. (2022) 585:126425. doi: 10.1016/j.physa.2021.126425

24. Verma P, Dumka A, Bhardwaj A, Ashok A, Kestwal MC, Kumar P. A statistical analysis of impact of COVID19 on the global economy and stock index returns. SN Comp Sci. (2021) 2:1–13. doi: 10.1007/s42979-020-00410-w

25. Yousfi M, Dhaoui A, Bouzgarrou H. Risk spillover during the COVID-19 global pandemic and portfolio management. J Risk Finan Manag. (2021) 14:222. doi: 10.3390/jrfm14050222

26. Insaidoo M, Arthur L, Amoako S, Andoh FK. Stock market performance and COVID-19 pandemic: evidence from a developing economy. J Chinese Econ Foreign Trade Stud. (2021) 14:60–73. doi: 10.1108/JCEFTS-08-2020-0055

27. Lahmiri S, Bekiros S. The effect of COVID-19 on long memory in returns and volatility of cryptocurrency and stock markets. Chaos Solitons Fractals. (2021) 151:111221. doi: 10.1016/j.chaos.2021.111221

28. Shehzad K, Xiaoxing L, Kazouz H. COVID-19's disasters are perilous than Global Financial Crisis: a rumor or fact?. Finance Res Lett. (2020) 36:101669. doi: 10.1016/j.frl.2020.101669

29. Malik K, Sharma S, Kaur M. Measuring contagion during COVID-19 through volatility spillovers of BRIC countries using diagonal BEKK approach. J Econ Stud. (2021) 49:227–42. doi: 10.1108/JES-05-2020-0246

30. Sharif A, Aloui C, Yarovaya L. COVID-19 pandemic, oil prices, stock market, geopolitical risk and policy uncertainty nexus in the US economy: fresh evidence from the wavelet-based approach. Int Rev Finan Anal. (2020) 70:101496. doi: 10.1016/j.irfa.2020.101496

31. Rehman MU, Kang SH, Ahmad N, Vo XV. The imapct of COVID-19 on the G7 stock markets: a time-frequency analysis. North Am J Econ Fina. (2021) 58:101526. doi: 10.1016/j.najef.2021.101526

32. Chien FS, Sadiq M, Kamran HW, Nawaz MA, Hussain MS, Raza M. Co-movement of energy prices and stock market return: environmental wavelet nexus of COVID-19 pandemic from the USA, Europe, and China. Environ Sci Pollut Res. (2021) 28:1–15. doi: 10.1007/s11356-021-12938-2

33. Tiwari A, So MKP, Chong ACY, Chan JNL, Chu AMYP. risk of COVID-19 outbreak in the United States: an analysis of network connectedness with air travel data. Int J Infect Dis. (2021) 103:97–101. doi: 10.1016/j.ijid.2020.11.143

34. So MKP, Chan LSH, Chu AMY. Financial network connectedness and systemic risk during the COVID-19 pandemic. Asia-Pacific Finan Mark. (2021) 28:649–65. doi: 10.1007/s10690-021-09340-w

35. Lee YC, Lu YC, Wang YCC. social irresponsibility, CEO overconfidence, and stock price crash risk. Appl Econ Lett. (2019) 26:1143–7. doi: 10.1080/13504851.2018.1540835

36. Bash A, Alsaifi K. Fear from uncertainty: an event study of Khashoggi and stock market returns. J Behav Exp Finan. (2019) 23:54–8. doi: 10.1016/j.jbef.2019.05.004

37. Salisu AA, Akanni LOC. a global fear index for the COVID-19 pandemic. Emerg Mark Finan Trade. (2020) 56:2310–31. doi: 10.1080/1540496X.2020.1785424

38. Haroon O, Rizvi SAR. COVID-19: Media coverage and financial markets behavior—A sectoral inquiry. J Behav Exp Finan. (2020) 27:100343. doi: 10.1016/j.jbef.2020.100343

39. Subramaniam S, Chakraborty M. COVID-19 fear index: does it matter for stock market returns? Rev Behav Finan. (2021) 13:40–50. doi: 10.1108/RBF-08-2020-0215

40. Rahman ML, Uddin J. Dynamic relationship between stock prices and exchange rates: evidence from three South Asian countries. Int Bus Res. (2009) 2:167–74. doi: 10.5539/ibr.v2n2p167

41. Walid C, Chaker A, Masood O, Fry J. Stock market volatility and exchange rates in emerging countries: a Markov-state switching approach. Emerg Mark Rev. (2011) 12:272–92. doi: 10.1016/j.ememar.2011.04.003

42. Mwambuli EL, Xianzhi Z, Kisava ZSV. spillover effects between stock prices and exchange rates in emerging economies: evidence from Turkey. Bus Econ Res. (2016) 6:343–59. doi: 10.5296/ber.v6i2.10245

43. Branson WH, Henderson DWT. specification and influence of asset markets. Handb Int Econ. (1985) 2:749–805. doi: 10.1016/S1573-4404(85)02006-8

44. Bodart V, Reding P. Do foreign exchange markets matter for industry stock returns? An empirical investigation. Université catholique Louvain Institut Rech Econ Soc (IRES) Discussion Paper. (2001) 2001016:2001–16. Available online at: http://hdl.handle.net/2078.1/5580

45. Nakajima J. Time-varying parameter VAR model with stochastic volatility: an overview of methodology and empirical applications. J. Monet. Econ. Studies. (2011) 29:107−42. Available online at: https://EconPapers.repec.org/RePEc:ime:imemes:v:29:y:2011:p:107-142

47. Primiceri GE. Time varying structural vector autoregressions and monetary policy. Rev Econ Stud. (2005) 72:821–52. doi: 10.1111/j.1467-937X.2005.00353.x

48. Ashraf BN. Stock markets' reaction to COVID-19: cases or fatalities? Res Int Bus Finan. (2020) 54:101249. doi: 10.1016/j.ribaf.2020.101249

49. Rahman ML, Amin A, Mamun MAAT. COVID-19 outbreak and stock market reactions: evidence from Australia. SSRN Electr J. (2021) 38:101832. doi: 10.2139/ssrn.3948700

50. Ahmar AS, Del Val EB. SutteARIMA: short-term forecasting method, a case: Covid-19 and stock market in Spain. Sci Total Environ. (2020) 729:138883. doi: 10.1016/j.scitotenv.2020.138883

51. Anh DLT, Gan C. The impact of the COVID-19 lockdown on stock market performance: evidence from Vietnam. J Econ Stud. (2020) 48:836–51. doi: 10.1108/JES-06-2020-0312

52. Alfaro L, Chari A, Greenland AN. Aggregate and Firm-level Stock Returns During Pandemics, in Real Time. NBER Working Papers No. 26950 (2020).

53. Barberis N, Shleifer A, Vishny RA. Model of investor sentiment. J financ econ. (1998) 49:307–43. doi: 10.1016/S0304-405X(98)00027-0

54. Giglio S, Maggiori M, Stroebel J. Inside the Mind of a Stock Market Crash. NBER Working Papers No. 27272 (2020).

55. Xiang LJ, Ma SQ, Yu L, Wang WH, Yin ZC. Modelling the global dynamic contagion of COVID-19. Front Public Health. (2022) 9:809987. doi: 10.3389/fpubh.2021.809987

Keywords: COVID-19, stock returns, dynamic impact, TVP-VAR-SV model, Bayesian estimation

Citation: Tan X, Ma S, Wang X, Zhao Y, Wang Z and Xiang L (2022) The Dynamic Impact of COVID-19 Pandemic on Stock Returns: A TVP-VAR-SV Estimation for G7 Countries. Front. Public Health 10:859647. doi: 10.3389/fpubh.2022.859647

Received: 21 January 2022; Accepted: 14 March 2022;

Published: 21 April 2022.

Edited by:

Tsangyao Chang, Feng Chia University, TaiwanReviewed by:

Chi Wei Su, Qingdao University, ChinaWen-Yi Chen, National Taichung University of Science and Technology, Taiwan

Elie Bouri, Lebanese American University, Lebanon

Copyright © 2022 Tan, Ma, Wang, Zhao, Wang and Xiang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xiaoyu Tan, dGFueGlhb3l1MTAxMkAxNjMuY29t

Xiaoyu Tan

Xiaoyu Tan Shiqun Ma2

Shiqun Ma2 Lijin Xiang

Lijin Xiang