- 1Department of Law, Universidade São Francisco (USF), Sao Paulo, Brazil

- 2Political Science Department, Stellenbosch University, Western Cape, South Africa

- 3Political Science and International Affairs Department, Northern Arizona University, Flagstaff, AZ, United States

This paper investigates Smith's triumvirate hypothesis that peace, easy taxes, and a tolerable administration of justice inclusively constitute what a state requires to attain the highest degree of economic prosperity. First, the paper constructed a single index of Smith's triumvirate through a principal component analysis (PCA). Then, data analysis using a two-step difference GMM technique was conducted, with results confirming the hypothesis in Sub-Saharan Africa.

1 Introduction

Weak state capacity is a prominent theme in the study of African politics. The theme is studied from the perspective of theories of individualism to neopatrimonialism, which includes patronage, cronyism, and corruption. In this context, the African State is described in several ways: first, as gigantic or “bloated,” operating as a paradise for many top-level government echelons, often recruited based on network connections rather than explicit merit or expertise. On the other hand, the African State is too small or remote, with little relevance for grassroots populations, particularly in distant regions or areas controlled by opposition parties or non-co-ethnics of the ruling parties. Lastly, and commonly observed, the African State is often described as extractive or predatory, dominated by bureaucrats who divert public funds into their own pockets to buy support or loyalty without any intention of improving public services. These characteristics contribute to a weak African state, lacking the capacity to manage its borders, collect taxes, enforce rules, or provide social welfare (Krönke et al., 2022).

Three distinct axioms—security, fiscal, and legal capacities—characterize the completeness of state capacity as described in Besley and Persson's Pillars of Prosperity: The Political Economy of Development Clusters (2011). Further discussion of these concepts will follow in the next section. Using these axioms, the African State, particularly in Sub-Saharan Africa, which is the world's most endowed region with least developed countries (LDCs), attributed to weak state capacity or poor governance (Mkandawire, 2007; Banda, 2023a; Banda and Du Plessis, 2024), exhibits prominent issues of insecurity and instability—attributed to persistent terrorism, violent insurgencies, and armed political upheavals in countries such as Libya, Mali, Nigeria, Ethiopia, Mozambique, Burkina Faso, Somalia, Congo, South Sudan, and the Democratic Republic of Congo (Chido, 2013). At the household level, Sub-Saharan Africa record high rates of robberies, kidnappings, rape, burglary, theft and homicides per 100,000 inhabitants—with South Africa alone recording 332 robberies in 2023 (Harrendorf et al., 2010; Galal, 2023).

Second, the Sub-Saharan region faces a deterioration in fiscal position. For example, at the beginning of the 21st century, the median government debt ratio rose to around 80% of total output (David et al., 2023). A high debt ratio is problematic as it increases the likelihood of defaulting on debt repayment, putting countries under significant financial pressure. A high debt-to-GDP ratio leads to exorbitant taxes, reduced future incomes, and intergenerational inequity (Checherita-Westphal and Rother, 2012; Salmon, 2021).

Lastly, the region suffers from a weakened legal system, which has seen a rise in the pervasive issue of corruption (Chilala et al., 2023). Various indicators of legal system performance, including the Mo Ibrahim Index of African Governance (MIIAG), Freedom in the World survey, World Justice Project (WJP) Rule of Law Index, Worldwide Governance Indicator (WGI) of the Rule of Law Index, and Corruption Perceptions Index (CPI), all show that the poorest-performing countries are from the Sub-Saharan African region. One of the most cited root causes is presidential absolutism, especially the powers to appoint government bureaucrats in strategic positions in government ministries, departments and agencies (Wood and Waterman, 1991; Macedo de Medeiros Albrecht, 2023). Scatter plot analyses in Figure 1 indicate a strong correlation between economic growth and state capacity in most Sub-Saharan African countries. However, advanced analyses are required to establish causation with significant levels.

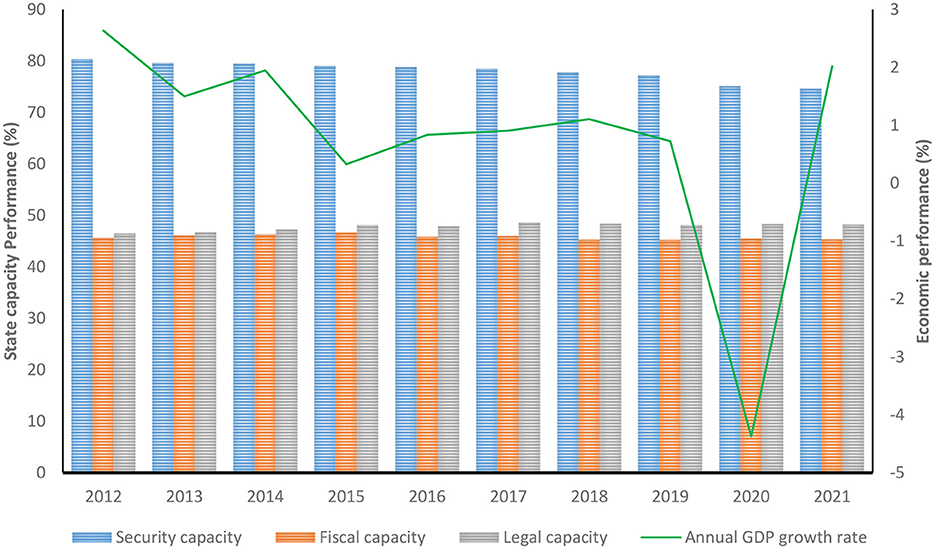

Figure 1. Trend analyses in State capacity and annual growth rate in Sub-Saharan Africa. Authors' analyses of study data (discussed in Section “Data and methods”).

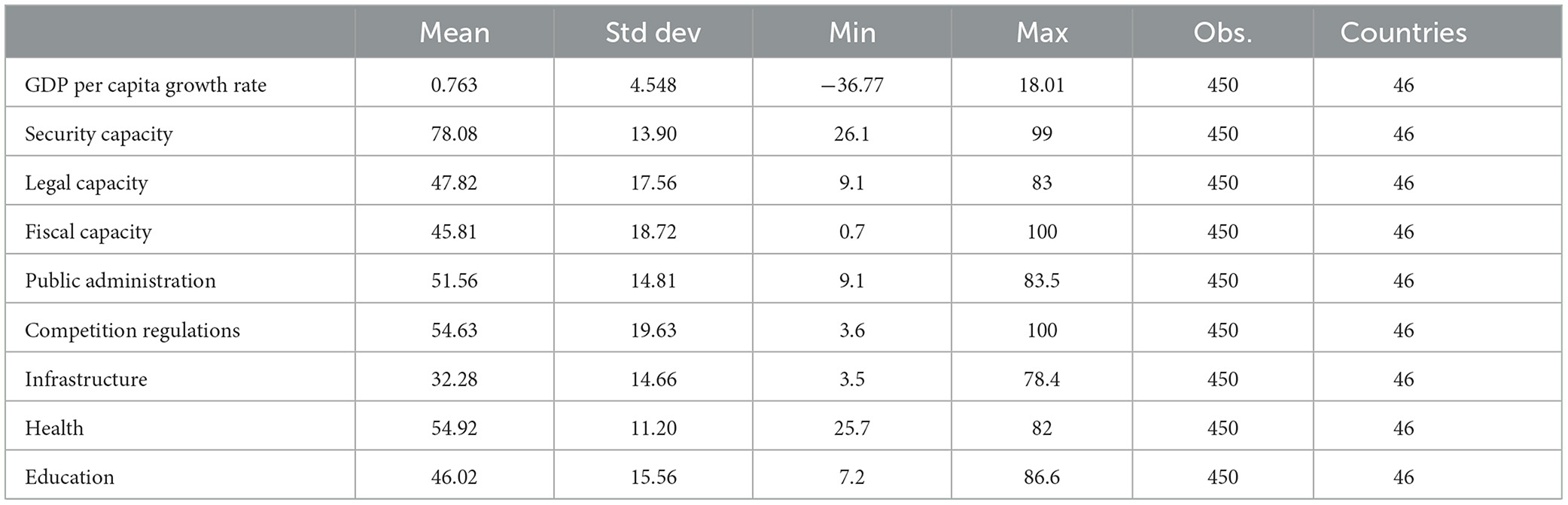

Table 1 illustrates the difficulty of getting insights from data at first glance on the relationship between state capacity components and economic performance, hence the need for advanced analyses. However, a 4.37% drop in economic growth in Sub-Saharan Africa in 2020—though attributable to the global COVID-19 pandemic—provides a shred of evidence of weak state capacity. In 2021, for example, the region recouped a growth rate of around 4%, which is relatively lower than many countries that bounced back from the pandemic. OECD countries, which experienced an output drop of 4% in 2020, recouped by 5.7% in 2021. India and Canada bounced from a 5.8% and 5% decline in 2020 to 9.7% and 5.3% in 2021, respectively. China had an increase in total output of 2%, which was lower than its 2019 growth rate of 2.7%, and bounced to a growth rate of 4.3% in 2021. These statistics concur with some scholars' arguments that a state's inability to manage profound economic shocks within 6 months to a year renders a nation a low state capacity since challenges override state capacity (Jonathan, 2008; Lisner, 2016).

Existing scholarship provides valuable insights into the nexus between state capacity and economic growth. However, these studies often focus on only one of the axioms of state capacity. For example, some scholars empirically demonstrate that improvements in security capacity yield positive effects on economic growth (Santhirasegaram, 2008; Tillman, 2017; Enyi et al., 2020). Conversely, evidence suggests that insecurity or political instability reduces economic growth in various regions of the world (Chtouki and Raouf, 2021; Maximilian and Torsten, 2023). On the other hand, fiscal capacity is shown to be a significant stimulant of economic growth (Savić et al., 2015; Dincecco and Katz, 2016; Setiawan and Aritenang, 2019; Balasoiu et al., 2023; Mosikari and Stungwa, 2023). Moreover, studies utilizing indices of the rule of law or protection of property rights indicate that improvements in legal institutions can foster growth (Ahmed Lahsen and Piper, 2019; Ata et al., 2012; Banda, 2023b; Jonathan et al., 2020; Ozpolat et al., 2016). Table A3 (Appendix A) provides further details on the reviewed literature.

The scientific contribution of this study, therefore, is 2-fold. First, it constructs a composite index of state capacity that aggregates security, fiscal, and legal dimensions and investigates how this index influences economic growth in Sub-Saharan Africa. Second, it fills a gap in the literature by offering a new and comprehensive conceptualization of state capacity beyond sparse indicators such as income taxes, fiscal decentralization, protection of property rights, military spending, and government expenditure. Given that weak state capacity is a significant issue in African politics, this research advances the broader governance literature by providing insights into the state dynamics of Sub-Saharan African countries plagued by inadequate security, legal, and fiscal management. The remainder of the paper is organized as follows: The next section presents state capacity's theoretical (conceptual) underpinnings. This is followed by describing the study data and econometric analysis techniques. The results are then interpreted and discussed, leading to the concluding section.

2 Theoretical underpinnings

Existing scholarship posits that State capacity constitutes the ability of the State to enforce laws, monopolize the means of violence, and collect taxes or the ability of the State to implement and accomplish policy goals (Besley and Persson, 2011; Johnson and Koyama, 2017; Berwick and Christia, 2018; Lambach et al., 2015; Herre and Arriagada, 2023; Singh, 2023). This definition aligns with what Adam Smith thought about the role of the State in what is referred to as the triumvirate of peace, easy taxes and a tolerable administration of justice. Smith is popularly quoted as saying.

“Little else is requisite to carry a state to the highest degree of opulence from the lowest barbarism, but peace, easy taxes, and a tolerable administration of justice: all the rest being brought by the natural course of things, …” (Kennedy, 2008).

These three dimensions of state capacity are not coincidental for economic prosperity as both require strategic management decisions by governments and influential groups supported by institutions and values (Dann et al., 2021). High or low state capacity typologies are associated with different levels of economic prosperity, with the former being seen as a stimulant to economic growth. However, the debate still needs to be explored due to the difficulty of measuring state capacity (Bardhan, 2016), with existing research utilizing one of the component indicators of state capacity. The current study innovatively explores the role of state capacity from a broader conceptualization along Smith's hypothesis of peace (Security capacity), easy taxes (fiscal capacity) and a tolerable administration of justice (legal capacity).

According to this hypothesis, the strength of the State is measured by its capacity to provide essential political goods, including security, legitimate institutions, economic governance, and social welfare (Mavhura, 2020). Thus, Smith's thoughts of what a strong state should be embody the concept of good governance as enshrined in Substantial Development Goals (SDGs). The United Nations underscores the multiplier effects of SDG 16, emphasizing peace, justice, and strong institutions for attaining all SDGs (Banda, 2023a). Similarly, studies attribute the “East Asian Miracle” to the Asian State's ability to enforce laws and order, regulate economic activity, and provide public goods (Johnson, 1982; Amsden, 1989; Wade, 1990; Evans, 1995; Acemoglu et al., 2015). It is not far-fetched that scholars link the economic stagnation of Africa and Latin America to weak state capacity (Herbst, 2000; Centeno, 2002; Levy and Kpundeh, 2004; Krönke et al., 2022).

Adam Smith's triumvirate of security, fiscal, and legal capacity embodies a conception of good governance aiming to harmonize the State's interests with the rights and needs of its citizens. Smith posited that by endowing the State with sufficient capacity to establish these three pillars as institutions capable of quelling civil unrest, adeptly managing taxes, and guaranteeing private property rights and justice for all, a societal transformation toward prosperity becomes plausibly attainable. Smith's triumvirate, therefore, cultivates an atmosphere conducive to social order, economic prosperity, and the comprehensive welfare of society. When peace is maintained, taxes are reasonable, and justice is practical, it lays the foundation for a stable and flourishing nation (Besley and Persson, 2011).

3 Data and methods

We constructed a panel dataset from 2012 to 2021 consisting of 52 African countries, 46 of which are from the Sub-Saharan African region (excluding Eritrea and South Sudan). Creating a region dummy variable consisting of Sub-Saharan countries (1) and non-Sub-Saharan countries (0) is particularly important as it allows us to compare the results of our region of interest to that of the continent. The two omitted countries—Eritrea and South Sudan—do not have data for the dependent variable for our selected year range. In contrast, the choice of data year range owes to the availability of data from the Mo Ibrahim Foundation (MIF) at the time of analysis. Restricting the sample to Sub-Saharan economies similar in economic challenges, political institutions, and socio-cultural values is advantageous concerning the empirical estimation as it allows the exploitation of cross-country dimension in a dynamic panel estimation framework and increases the precision of inference.

The per capita Gross Domestic Product growth rate (GDP per capita growth) is the dependent variable that proxies economic prosperity. The variable is measured as an annual percentage growth rate of GDP per capita based on constant local currency, and data is obtained from World Development Indicators (WDI) (World Bank, 2024). Despite being an average measure that does not translate to the wellbeing of all residents (Banda, 2023a), GDP per capita or capita growth rate variable is the most widely used indicator of economic prosperity in empirical research (Enyi et al., 2020; Chtouki and Raouf, 2021; Balasoiu et al., 2023; Maximilian and Torsten, 2023).

State capacity is defined differently by different scholars. Dincecco (2017) and Lindsey (2021) define state capacity as the government machinery's capability to effectively implement and commit to achieving its policy goals. Others broadly define it as the State's capacity to sustainably raise adequate revenues, build a sufficient skilled workforce, provide impartial security, justice, and public service, and gather accurate national statistics (Banda and Du Plessis, 2024; Herre and Arriagada, 2023). With these definitions, we note that previous studies used narrow measures of state capacity. For instance, Knutsen (2013) used the Freedom House Index (FHI), while Noort (2018) used effective enforcement from the World Justice Project to capture state capacity. This study uses the security, legal, and fiscal capacity interaction described above to capture state capacity from a broader perspective of Adam Smith's triumvirate. First, we use the Security and Safety Index from the Mo Ibrahim Foundation, Mo Ibrahim Foundation (MIF) (2024). The variable assesses the absence of armed conflict and violence against civilians, the absence of forced migration, human trafficking and forced labor as well as the absence of crime. Security is an essential driver of economic prosperity. Tillman (2017), for example, found in the impact evaluation of the 2009 Amnesty peace policy that the initiative led to an acceleration of education, self-employment income, and household expenditure in Niger.

Fiscal capacity, representing the concept of “easy tax” in Smith's triumvirate, is captured by an index of tax and revenue mobilization, which measures the efficiency of African tax administration bodies (Mo Ibrahim Foundation (MIF), 2024). Savić et al. (2015) found that a relatively efficient tax administration system reduces the likelihood of tax evasion, hence high government revenues and expenditure on fixed capital formation. While Ogbonna and Appah (2016) found that a proper tax administration positively influences growth in the Nigerian economy. Lastly, an index of the Rule of Law and Justice captures a tolerable administration of justice (legal capacity). Specifically, this index assesses compliance with the rule of law by the executive, the impartiality of the judicial system, judicial processes (including access, affordability, due and fair process, timeliness and enforcement), equality before the law, law enforcement and property rights (Mo Ibrahim Foundation (MIF), 2024). Banda (2024) argues that injustice and intolerance obstruct or make social interaction hard or impossible, where people hardly abstain from injuring each other, hence creating problems in coordinating market activities. Similarly, using a panel of the 20 highest-income countries, Ozpolat et al. (2016) found that an efficient and fair legal institution improves economic growth.

The independent variable interest for this study is a composite index that encapsulates Smith's triumvirate of security, fiscal, and legal capacity. We expect these three state capacity dimensions to depict a common underlying construct related to the quality of good governance. Nevertheless, these variables are likely not to align regarding their contribution to the unobserved single variable. Consequently, we perform a Principal Components Analysis (PCA) to capture a common variance and synthesize these aspects into a cohesive index. PCA is a statistics technique that reduces dimensionality by identifying principal components that account for the highest variance among the selected indicators, thereby summarizing them into a unified without compromising the meaning, units, and interpretations of the original data series (Emara and Chiu, 2016; Banda, 2021, 2023a).

The remaining explanatory variables (see Figure A1) used in this study include education, competition (business and competition regulations), infrastructure, health, and public administration. The data for these variables is also obtained from the Mo Ibrahim Foundation. These variables are included based on their expected and empirically proven significance to economic growth. Figure A1 (Appendix A) provides further information about these variables, including definitions.

3.1 Model specification and empirical strategy

While a review of the literature shows that the totality of Smith's triumvirate remains to be empirically tested, the study specifies the model similar to institutional studies that adopt the standard growth model (Mankiw et al., 1992; Jacob and Osang, 2020; Adeleye et al., 2023; Hussen, 2023). The empirical model specification is given as follows:

Where lnGDPPC_GROit and lnGDPPC_GROi, t−1 are the logarithmically transformed annual GDP per capita growth and its lag, respectively. The natural log transformations help to stabilize variance and interpret coefficients as elasticities. Z' is the vector of state capacity, and W' is the vector of control variables. The time-invariant factors specific to sample cross-sections (i) are denoted by μi, Dt represents a dummy variable for year t, while λt denote coefficients for the year dummies that capture time-specific effects. Contrary to μi, Dt allows the model to account for global shocks or system-wide effects that occur in a specific year and impact all countries equally. While θ, y, and ϑ are the parameters to be estimated. Subscripts i and t represent the number of cross-sections (i = 1, 2, …, N) and time period (t = 1, 2, …, T), respectively.

Estimation of Equation 1 poses several difficulties that need to be addressed. Firstly, the endogeneity of the lagged dependent variable and the possible endogeneity of Smith's triumvirate owing to measurement error, omitted variables, and/or reverse causality require using instrumental variable estimation methods (Jacob and Osang, 2020). The Generalized Method of Moments (GMM) estimation offers a solution to this problem. In addition to its suitability with a combination of a smaller number of observations (T) and larger cross-sections (N), and a dependent variable that is dynamic in nature (Roodman, 2009b; Banda, 2023a), the estimation technique deals with the problem of endogeneity by using the variations in the data's time series while holding constant the unobserved group-specific effects. That is, due to the challenge of finding external instruments, GMM technique is viable as it can be operationalized without needing additional variables outside the model (i.e., external instruments), instead using functional forms of variables already in the model (i.e., internal instruments), such as higher order lags of the endogenous variables (Jacob and Osang, 2020; Fingleton, 2023; Gui et al., 2023).

4 Empirical findings

This section reports, interprets, and discusses the results of our data analyses, from basic statistics to econometric computations. We employed the STATA 18 statistical package to analyse our dataset. This version was the latest from StataCorp LLC at the time of analysis for this study.

4.1 Basic statistics

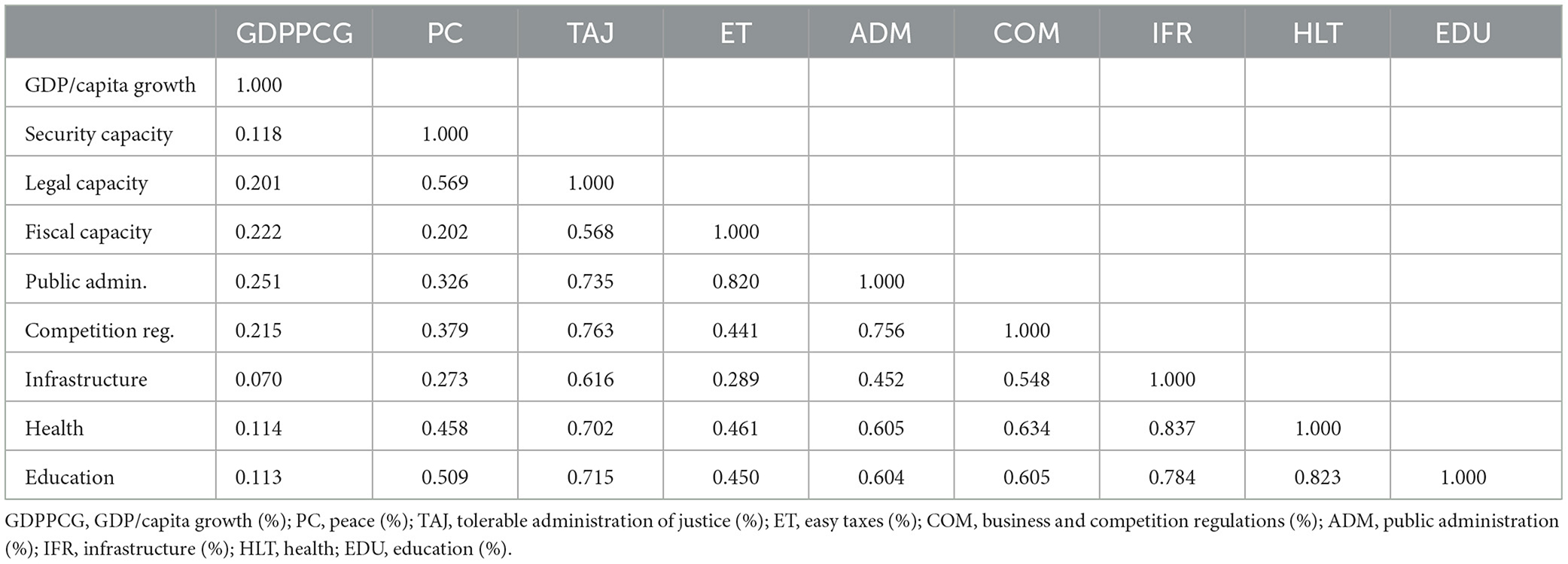

Tables 1A, B reports the results of summary statistics and correlation coefficients performed on raw data. The results indicate that annual GDP per capita growth averages 0.76% in Sub-Saharan Africa between 2012 and 2021. The minimum growth rate of −36.78 is attributable to Central African Republic in 2013, while the maximum growth rate was attained by Sierra Leone in 2013. In terms of security, legal and fiscal capacity, Sub-Saharan African countries' performance averages 78.08%, 47.82%, and 45.81%, indicating that the quality of the state in Smith's triumvirate lens is poor in the region. Evidence shows that Sub-Saharan Africa has serious inefficiencies in fiscal and legal capacities, with the mean tax efficiency and Justice falling below average. Somalia is the most unpeaceful country in the region due to its continuous civil and armed conflicts and scooped the minimum-security score of 26.1% in 2018. São Tomé and Príncipe scoops maximum values for security for years from 2020 to 2021 and scoring above 98% since 2012. While the business and competition regulations average 54.63%, it still shows that governments' support of businesses and protection of competition is minimal. In addition, the quality of health, infrastructure and education, which are key enablers of economic performance are also worrying with none of the variables averaging above 55%. Nevertheless, this is not surprising considering that the deep determinants—state capacity and public administration—responsible for public amenities are ones which are themselves performing poorly. On the other hand, pairwise correlation coefficients in Table 1B indicate that all variables are positively related with no pair of variables correlated above 0.8, which also indicate less likelihood of autocorrelation.

4.2 Model results and discussion

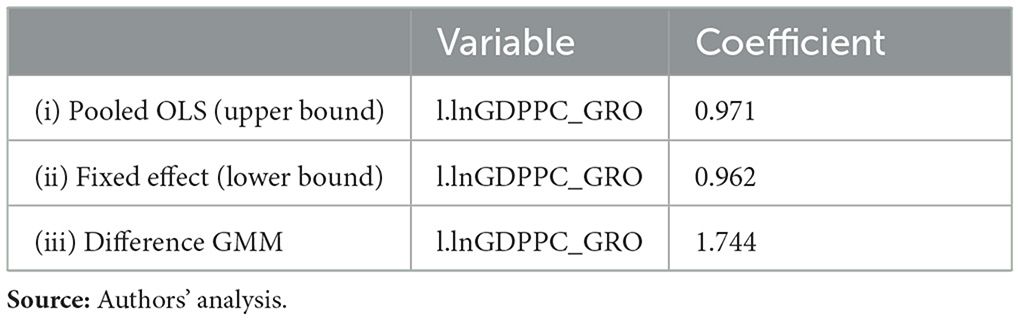

Two major GMM estimator types exist: the Arrelano-Bond (difference GMM) approach and its extension to the “System GMM” (SyGMM) context. Bond et al. (2001) established a principle for selecting the type of GMM appropriate for specific data characteristics to yield more efficient and consistent estimates. The criteria involve estimating an autoregressive model with pooled OLS (upper bound), a fixed effect model (LSDV), which we considered lower bound, and a difference GMM model. The decision criteria assert that a SyGMM should be used when and only when the coefficient of the lagged dependent variable in a difference GMM estimation is lower and/or closer to the lagged dependent variable of the lower bound. In our case, however, the coefficient of the lagged dependent variable in a difference GMM is higher than that of the lower bound, making us to select a difference GMM (see Table 2). Thus, in this case, the superiority of a SyGMM makes little difference as the difference GMM does not suffer from weak instrumentation.

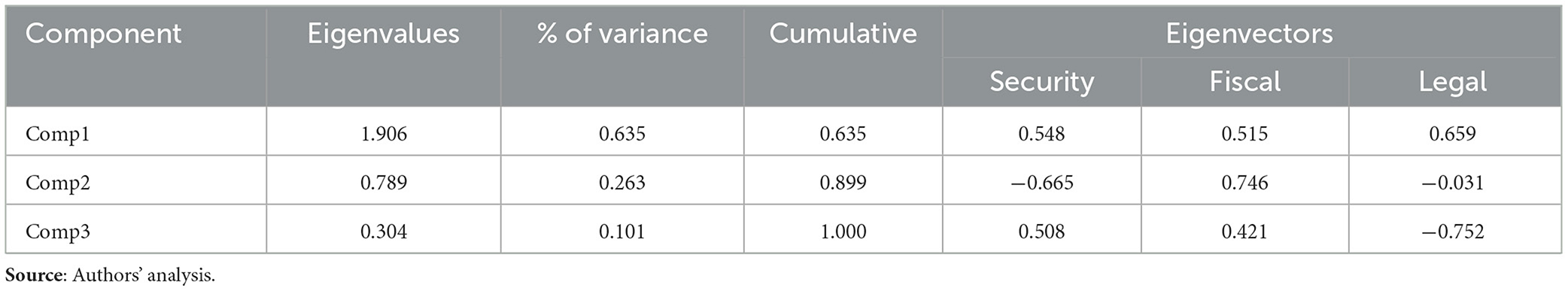

Since the independent variable of interest is Smith's triumvirate of security, fiscal and legal capacity, we constructed a composite index using a principal component analysis (PCA). Table 3 reports the PCA components and variance, revealing three principal components with different degrees of variance. The first component, Comp1, consists of an eigenvalue of 1.906, making up a total variance of 63.5%. This component captures the core shared variance across the three variables, which suggests that it is the most comprehensive representation of the underlying Smith's triumvirate construct. On the other hand, the second component (Comp2), consisting of an eigenvalue of 0.789, accounts for 26.3% of the total variance, taking the cumulative variance explained to 89.8%. Thus, Comp2 is less dominant, though accounting for the aspect of variance not accorded by the first component. Lastly, Comp3 has an eigenvalue of 0.304, which makes up only 10.1% of the variance. Hence, it is highly likely to depict any unique variance and potential noise. Overall, the first component emerges as the principal component selected to represent Adam Smith's triumvirate.

In addition, for Comp1, all three variables—Security, Fiscal, and Legal—depict strong positive loadings above 0.5, with values of 0.548, 0.515, and 0.659, respectively. The highest value is noted for a legal capacity (0.659) with minor disparity from other variables. This suggests that Comp1 significantly captures the essence of our desired composite measure, a balanced aggregation of fiscal capacity. As for Comp2, evidence suggests a diversion in the relationship between security and legal capacity, as shown by the negative loadings, does not account for a cohesive dimension of Smith's triumvirate. Like Comp2, Comp3 constitute a strong negative loading for legal capacity (−0.752), indicating a lack of glue with security and fiscal capacity. Overall, while the second and third components present additional insights, the dimension of variance they capture is secondary and likely not central to the core construct of interest. Comp1 is selected as the primary aggregate index as it offers a robust and interpretable measure of governance quality derived from the theoretical framework of Adam Smith's principles.

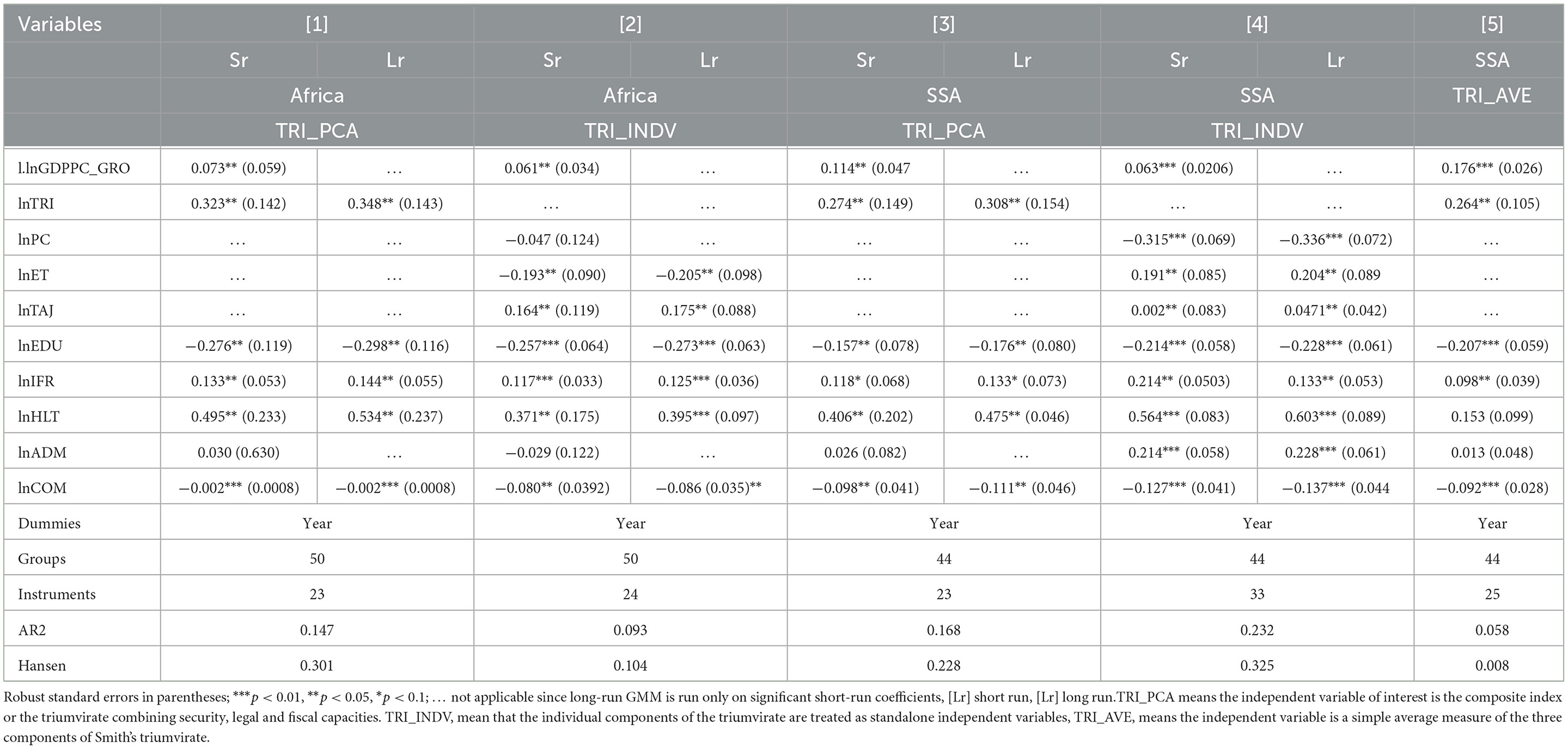

Table 4 reports model estimation results from two-step difference GMM. Model 1 reports results with Smith's PCA aggregate index (TRI) as an independent variable interest, while Model 2 reports results with disintegrated Smith's components (PC, ET, & TAJ) for Africa. Models 3 and 4 report repeated estimation of Model 1 and 2 for Sub-Saharan African countries. For robustness check, model 5 presents the results of our basic model with an independent variable interest computed as a simple average measure of peace, fiscal and legal capacities. This index is important as it helps us to establish baseline results for comparison with PCA series regressions.

Two critical issues regarding model specification include. First, the dependent variable lnGDP, which represents the log-transformed annual growth rate, is modeled as a function of its lag (1.lnGDP) to enable capturing the persistence in economic growth over time. The lagged dependent variable is particularly important as it recognizes that past growth dynamics influence current economic growth. Second, the instrumental variables (IVs) and moment conditions are selected to reduce endogeneity. In this regard, we treated the lagged dependent variable as endogenous and instrumented with deeper lags. We created these instruments in a collapsed form to reduce the risk of instrument proliferation and potential finite sample bias (Roodman, 2009a). Lastly, the GMM allowed for the inclusion of control variables that are specified so that they do not bias the estimation results through simultaneity or feedback results. These variables included the log transformation of education (EDU), infrastructure (IFR), health (HLT), public administration (ADM), and business competition regulations (COM).

Noting that some scholars consider GMM as a model that yields only short-run coefficients (Banda and Du Plessis, 2024; Banda et al., 2024; Xaisongkham and Liu, 2024), we conducted a separate simulation on variables significant in the short-run to generate long-run coefficients. Long-run coefficients are computed by dividing the coefficient of each variable, which is significant in the short run, by the coefficient of the lagged dependent variable (Shin, 2014; Kripfganz and Schwarz, 2019), as shown below:

It is important to highlight that the standard errors for the long-run estimates were obtained using the delta method, which linearizes non-linear functions of random variables to approximate their variances (Wooldridge, 2010). Equation 3 demonstrates how these standard errors are calculated, in a way that ensures the proper propagation of uncertainty from the estimated coefficients into the derived long-run impacts.

However, our findings note little difference in the coefficients between short and long-run estimates, allowing us to interpret results on long-run columns. To begin with, the triumvirate of Smith (lnTRI) is positive and statistically significant for Sub-Saharan African countries. That is, a one-unit improvement in the complementarity of security, legal and fiscal capacity (State capacity) will improve economic prosperity by 0.31%, at ceteris paribus. Notably, the results remain positive and statistically significant, with almost equal coefficients in the sample of all African countries. The findings significantly conform to the findings of other studies that improvement in state capacity predicts economic prosperity (Tillman, 2017; Setiawan and Aritenang, 2019; Banda, 2023a; Maximilian and Torsten, 2023; Mosikari and Stungwa, 2023), even though narrower measures of state capacity were used.

The consensus shown in a wide array of literature is that strong state capacity is crucial to the durability of political and economic institutions that create conducive environments for efficient market operations and economic prosperity (Johnson and Koyama, 2017; Jacob and Osang, 2020; Ogilvie, 2022). Indeed, it has been established that long-lasting and centralized political institutions are the main ingredient to the economic prosperity of the world's high-income countries (Besley and Persson, 2011; Dincecco and Katz, 2016). On the same, the East Asia miracle is also attributed to strong and inclusive institutions that enforce laws and order, regulate economic activity, and provide sufficient public goods in a manner that encourages participation and creates incentives for prosperity (Johnson, 1982; Amsden, 1989; Wade, 1990; Evans, 1995; Acemoglu et al., 2015). It is not far-fetched that scholars link the economic stagnation of Africa and Latin America to predatory state characteristics, which leads to weak state capacity (Herbst, 2000; Centeno, 2002; Levy and Kpundeh, 2004; Krönke et al., 2022), as most states lack the history of centralized government, are internally fragmented, and they are vulnerable to civil wars and internal conflicts (Johnson and Koyama, 2017).

When disintegrated, fiscal and legal capacities remain positive and statistically significant for the Sub-Saharan Africa sample. Counterintuitively, security capacity is negative and statistically significant. This result contradicts the findings of Enyi et al. (2020), Santhirasegaram (2008), and Tillman (2017), who found that an increasingly peaceful environment increases national output in 7 SSA countries, 70 developing countries, and the Nigerian economy, respectively. On the same, Maximilian and Torsten (2023) and Chtouki and Raouf (2021) found an asymmetrical relationship between political instability and stability in economic growth. The former observed that political instability thwarts prosperity in 34 highly developed countries, while the latter found that political stability enhances economic prosperity in 40 African countries. However, our results align with Dunne and Uye's (2010) review of the literature, which finds a high likelihood of little or no evidence of the positive effect of security capacity on growth. Possible reasons in developing countries include the diversion of resources to productive economic sectors such as health, education, and infrastructure development (Dunne and Tian, 2013; Xiangming et al., 2020), which the current status for our study sample we have shown on descriptive statistics remains far from optimum. Research also shows that increased security spending is more on the longevity of political leaders, such as surveillance, which costs billions of dollars due to its technical demands (Ndayikeza, 2021; Roberts, 2023).

However, a surprising finding for the African sample is that a one-unit improvement in fiscal capacity leads to decreased economic prosperity. This is true considering the large scale of the informal sector, which contributes 36% on average to the region's GDP. As a result, attempts to expand the tax base can inadvertently push individuals and small businesses into the informal economy, harming government revenue collection and overall economic growth (Coulibaly and Gandhi, 2018; World Bank, 2019). It may also result from the costs of implementing a robust tax mobilization system, outweighing the benefits. Potential reasons for the outweighed benefits include administrative inefficiencies and corruption, as resources collected will likely be inefficiently allocated among economic sectors. Another reason encapsulated in the study is weak infrastructure. The absence of comprehensive tax databases and weak collection systems entails countries incurring higher administrative costs in areas such as compliance and enforcement (Carnahan, 2015; Chen, 2017). The scenario will lower taxpayer compliance and discourage investments in productive economic sectors as well as growth enablers such as education, health, and infrastructure (Ebeke and Ehrhart, 2012; Coulibaly and Gandhi, 2018).

Regarding control variables, health and infrastructure are positive and statistically significant at conventional levels in Sub-Saharan Africa. For example, a one-unit improvement in health and infrastructure leads to a 0.48% and 0.13% increase in economic prosperity. Notably, health and infrastructure maintain a positive and statistically significant relationship with economic growth in the African sample. Regarding health, scholars argue that a sick population is an unproductive population (Bloom et al., 2004). Empirical studies confirm that an improvement in the health system improves economic outcomes at both micro (individual and family) and macro level (growth) (Albulescu et al., 2017; Raghupathi and Raghupathi, 2020).

On the other hand, every economic sector and process requires adequate infrastructure to perform efficiently. Economic theory identifies five channels through which infrastructure can positively impact on economic growth: (a) infrastructure as a direct input into the production system and hence a factor of production; (b) infrastructure is a complement to other inputs into the production process, in the sense that its improvements may lower the cost of production or its deficiency may create a number of costs for firms, (c) infrastructure may stimulate factor accumulation through, for example, providing facilities for human capital development; (d) infrastructure investment can also boost aggregate demand through increased expenditure during construction, and possibly during maintenance operations; and finally, (e) infrastructure investment can also serve as a tool to guide industrial policy; Government might attempt to activate this channel by investing in specific infrastructure projects with the intention of guiding private-sector investment decisions (Kumo, 2012; Fedderke and Garlick, 2020). According to Banda et al. (2024) adequate infrastructure development fills the puzzle that ensures the survival and maintenance of an economic system and the growth of its international trade relations.

However, education and business competition regulations depict a negative and statistically significant impact on economic prosperity for all models, including the Sub-Saharan Africa sample. There are several reasons why an increase in education in Africa does not contribute positively to economic growth. The challenges are intertwined, ranging from insufficient avenues for educated people to utilize their knowledge and skills. In connection to deeper determinants of growth, most African countries are characterized by bad governance, limited economic development and industrialization initiatives, political squabbles, civil unrest, and armed conflicts that affect productivity and economic development regardless of having educated people. In Zimbabwe, for instance, Mbofana (2024) posits that despite its high literacy rate, ranked over 90% by the United Nations Educational, Scientific and Cultural Organization (UNESCO), the country remains poor, with high unemployment and consistent economic turmoil precisely due to the inability to leverage education for national development. The author highlighted that elites' corruption, and the mismanagement of resources contribute to a lack of economic development while educated people are relocating to the diaspora. Indeed, countries with better governance, effective law enforcement, and low corruption levels can strengthen enablers and experience robust growth (Abu Alfoul et al., 2024), hence underscoring the need to strengthen deeper determinants of growth.

Lastly, we performed specification tests to assess the validity of our two-step difference GMM estimates. First, since we used the lagged values as instruments, whose set we collapsed into a smaller dimension matrix (Roodman, 2009b), we ensured that all our regressions had no problems of instrument proliferation as shown that in all cases, the number of instruments was far less than the number of groups. On the other hand, using the lagged dependent variable in the instrument set requires the absence of second-order serial autocorrelation to confirm unbiased estimation. Thus, using the Arellano-Bond AR(2) test, the P-values in all our models, except model 5, the p-values are sufficiently high, hence the absence of second-order autocorrelation. Second, we performed the Hansen J-test to test the validity of the exclusion restrictions under the null hypothesis that the instruments are correctly excluded from the model. All models' p-values are significantly lower or slightly above 0.3, implying that the instruments used in our difference GMM are valid. That is, there is insufficient evidence that our instruments are correlated with the error term, thereby satisfying the over identification restrictions. Failure to meet these specification tests, renders our model 5 invalid. The findings are not far-fetched considering that the “naïve” index found by averaging Smith's component variables has no weight optimization as that computed using PCA. In addition, the simple average index suffers from double counting of similar information in highly correlated series, hence no consideration for multi-collinearity.

5 Conclusions

Employing a panel sample for 46 Sub-Saharan African countries (N = 46) over 10 years (N = 10) between 2012 and 2021, coupled with the persistency of the dependent variable, enabled us to use the GMM to test Smith's triumvirate hypothesis, which we find valid in both Sub-Saharan Africa and Africa as a whole. As deep determinants of economic growth, Smith's articulation of State Capacity into security, fiscal, and legal capacities encapsulates an element of the quality of governance as well as inclusive institutions amenable to growth.

Addressing issues of instrument proliferation and weak identification afflicting dynamic panel data research, we conducted recommended tests that show evidence of correct exclusion of our restricted instrument sets and do not suffer from under-identification. While soft determinants such as health, infrastructure, and education appear to be valid determinants of economic growth in the region, differences in the magnitude and direction of causality are noted. Health and infrastructure, for example, depict a positive and statistically significant influence on growth in the region. On the other hand, education surprisingly shows a negative and statistically significant impact on growth in all our regressions. The scenario is also observed for business and competition regulations, which indicate the presence of laws that do not support the growth of firms in different countries. Public administration is another aspect of deep determinants of growth, from the perspective of individuals, that the paper finds a positive and statistically significant impact on growth.

Lastly, while this study offers a broader exploration of state capacity than prior research, it is not immune to limitations. By employing the annual GDP growth rate as a dependent variable, the study does not capture the duality of Smith's hypothesis—“…from the lowest barbarism to the highest degree of opulence.” While opulence means economic prosperity, barbarism translates to socio-economic evils such as poverty, inequality, unemployment, corruption, discrimination, and social exclusion. Considering the existence of many indicators of these socio-economic evils, we suggest that future researchers consider exploring the backward approach to Smith's hypothesis. This approach will involve specifying econometric equations normalized on socio-economic evils as dependent variables. Exploring Smith's hypothesis with a retrospective approach, utilizing indicators like the multidimensional poverty index and the Gini coefficient of income inequality, among other indices may provide more evidence required for the hypothesis' generalization.

Data availability statement

Data on Mo Ibrahim Index of African Governance (MIIAG) indicators can be found from the Mo Ibrahim Foundation at https://mo.ibrahim.foundation/topics/data, and data on GDP per capita can be found from the World Bank's World Development Indicators at https://databank.worldbank.org/source/world-development-indicators.

Author contributions

LB: Conceptualization, Data curation, Formal analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review & editing. FA: Conceptualization, Funding acquisition, Project administration, Supervision, Validation, Visualization, Writing – original draft, Writing – review & editing. JC: Conceptualization, Validation, Visualization, Writing – original draft, Writing – review & editing. BM: Conceptualization, Validation, Visualization, Writing – original draft, Writing – review & editing. CC: Conceptualization, Validation, Visualization, Writing – original draft, Writing – review & editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. LB received a travel grant (GRADSCH012023) from the Gerda Henkel Foundation through the Graduate School, Stellenbosch University to present the research paper at the 2023 Academic Convention at the Universidad Hemispherios in Quito, Ecuador, between 16–18 November 2023.

Acknowledgments

The authors wish to express their sincere gratitude to the two reviewers for their insightful comments, which significantly contributed to improving the quality of this paper. Special thanks are extended to the handling editor, Thamas Osang, whose meticulous attention to detail greatly enhanced both the presentation and overall quality of the manuscript. LB would like to particularly acknowledge the participants of the IAPSS 2023 Academic Convention at Universidad Hemispherios, where the paper was first presented between 16 and 18 November 2023, for their valuable feedback and support.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fpos.2024.1487658/full#supplementary-material

References

Abu Alfoul, M. N., Bazhair, A. H., Khatatbeh, I. N., Arian, A. G., and Abu Al-Foul, M. N. (2024). The Effect of education on economic growth in Sub-Saharan African Countries: do institutions matter? Economies 12:300. doi: 10.3390/economies12110300

Acemoglu, D., García-Jimeno, C., and Robinson, J. A. (2015). State capacity and economic development: a network approach. Am. Econ. Rev. 105, 2364–2409. doi: 10.1257/aer.20140044

Adeleye, B. N., Arogundade, S., and Mduduzi, B. (2023). Empirical analysis of inclusive growth, information and communication technology adoption, and institutional quality. Economies 11:124. doi: 10.3390/economies11040124

Ahmed Lahsen, A., and Piper, A. T. (2019). Property rights and intellectual property protection, GDP growth and individual well-being in Latin America. Latin Am. Econ. Rev. 28:12. doi: 10.1186/s40503-019-0073-5

Albulescu, C., Oros, C., and Tiwari, A. (2017). Is there any convergence in health expenditures across EU countries? Econ. Bullet. 37, 2095–2101. Available at: https://hal.science/hal-01981082v1

Amsden, A. H. (1989). Asia's Next Giant: South Korea and Late Industrialization. New York, NY: Oxford University Press.

Ata, A., Koc, A., and Akca, H. (2012). The relationship between economic growth and institutional structure in OECD countries: cross sectional analysis. Actual Probl. Econ. 10, 323–333. Available at: https://avesis.cu.edu.tr/yayin/63ebfe88-5165-413b-9612-8b2023578979/the-relationship-between-economic-growth-and-institutional-structure-in-oecd-countries-cross-sectional-analysis

Balasoiu, N., Chifu, I., and Oancea, M. (2023). Impact of direct taxation on economic growth: empirical evidence based on panel data regression analysis at the level of Eu Countries. Sustainability 15:7146. doi: 10.3390/su15097146

Banda, L. (2021). ‘Determinants of commercial banks' performance in Malawi: an autoregressive distributed lag (ARDL) approach. Natl. Account. Rev. 3, 422–438. doi: 10.3934/NAR.2021022

Banda, L. (2023a). Good governance and human welfare development in Malawi: an ARDL approach. Malawi J. Soc. Sci. 22, 89–119. doi: 10.2139/ssrn.4235681

Banda, L. (2023b). The institutions of rule of law and inclusive economic development: empirical evidence from Southern African development community. SSRN Electr. J. 2023, 1–33. Available at: https://ssrn.com/abstract=4386273

Banda, L. (2024). Does legal capacity matter for inclusive economic development? Empirical evidence from Southern Africa. Ius Humani. Law Journal 13, 131–152. doi: 10.31207/ih.v13i1.347

Banda, L. G., and Du Plessis, D. (2024). The contingent role of state capacity on the impact of e-government on environmental sustainability in developing countries. Front. Polit. Sci. 6:1459973. doi: 10.3389/fpos.2024.1459973

Banda, L. G., Yusufu, E. G., and Nyirenda, G. C. (2024). Exploring the modification effect of corporate governance on the relationship between good governance and logistics performance. J. Bus. Strat. Finance Manage. 6, 74–89. doi: 10.12944/JBSFM.06.01.06

Bardhan, P. (2016). State and development: the need for a reappraisal of the current literature. J. Econ. Lit. 54, 862–892. doi: 10.1257/jel.20151239

Berwick, E., and Christia, F. (2018). State capacity redux: integrating classical and experimental contributions to an enduring debate. Ann. Rev. Polit. Sci. 21, 71–91. doi: 10.1146/annurev-polisci-072215-012907

Besley, T., and Persson, T. (2011). Pillars of Prosperity. Princeton, NJ: Princeton University Press. doi: 10.1515/9781400840526

Bloom, D. E., Canning, D., and Sevilla, J. (2004). The effect of health on economic growth: a production function approach. World Dev. 32, 1–13. doi: 10.1016/j.worlddev.2003.07.002

Bond, S., Hoeffler, A., and Temple, J. (2001). GMM Estimation of Empirical Growth Models, No 2001-W21. Economics Papers, Economics Group, Nuffield College, University of Oxford.

Carnahan, M. (2015). Taxation challenges in developing countries. Asia Pacific Policy Stud. 2, 169–182. doi: 10.1002/app5.70

Centeno, M. (2002). Blood and Debt: War and Nation-State in Latin America. Princeton, NJ: Princeton University Press.

Checherita-Westphal, C., and Rother, P. (2012). The impact of high government debt on economic growth and its channels: an empirical investigation for the euro area. Eur. Econ. Rev. 56, 1392–1405. doi: 10.1016/j.euroecorev.2012.06.007

Chen, J. (2017). “Testing and implementing digital tax administration,” in: Digital Revolutions in Public Finance, eds. S. Gupta, M. Keen, A. Shah, and G. Verdier (International Monetary Fund). doi: 10.5089/9781484315224.071

Chido, D. (2013). From Chaos to Cohesion: A Regional Approach to Security, Stability, and Development in Sub-Saharan Africa. Carlisle, PA: Strategic Studies Institute, US Army War College.

Chilala, K. R. S., Banda, L. G., Chirwa, I., and Yusufu, E. G. (2023). Access to information legislation in Malawi: investigating the altruistic perspective of the 22-year advocacy resilience. SSRN Electr. J. [Preprint].

Chtouki, Z., and Raouf, R. (2021). The impact of political stability on economic performance in Africa: evidence from 40 African countries. Int. J. Econ. Manage. Res. 1, 35–58. Available at: https://www.researchgate.net/publication/356109923_The_impact_of_political_stability_on_economic_performance_in_Africa_Evidence_from_40_African_countries

Coulibaly, B., and Gandhi, D. (2018). Mobilization of Tax Revenues in Africa: State of Play and Policy Options, African Growth Initiative: Brookings. Available at: https://www.brookings.edu/articles/mobilization-of-tax-revenues-in-africa/ (accessed 13 November 2024).

Dann, C., Persson, T., and Besley, T. (2021). State Capacity and Development Clusters. London: The Centre for Economic Policy Research (CEPR).

David, A., Eyraud, L., Comelli, F., and Kovacs, P. (2023). Navigating Fiscal Challenges in Sub-Saharan Africa: Resilient Strategies and Credible Anchors in Turbulent Waters. DP/2023/007. Washington, DC : International Monetary Fund. doi: 10.5089/9798400230349.087

Dincecco, M. (2017). State Capacity and Economic Development. Cambridge Books; Cambridge University Press.

Dincecco, M., and Katz, G. (2016). State capacity and long-run economic performance. Econ. J. 126, 189–218. doi: 10.1111/ecoj.12161

Dunne, J. P., and Tian, N. (2013). Military expenditure and economic growth: a survey. Econ. Peace Sec. J. 8, 5–11. doi: 10.15355/epsj.8.1.5

Dunne, J. P., and Uye, M. (2010). “Military spending and development,” in: The Global Arms Trade: A Handbook (ed.) T. Andrew (London: Routledge), 293–305. doi: 10.4324/9780203851456-25

Ebeke, C., and Ehrhart, H. (2012). Tax revenue instability in Sub-Saharan Africa: consequences and remedies. J. Afr. Econ. 21, 1–27. doi: 10.1093/jae/ejr026

Emara, N., and Chiu, I.-M. (2016). The impact of governance on economic growth: the case of Middle Eastern and North African Countries. Top. Middle East. Afr. Econ. 18, 126–144. Available at: https://ssrn.com/abstract=3810284

Enyi, E., Rufus, A. I., and Iyanuoluwa, A. T. (2020). The impact of peace accounting on economic growth of Sub-Saharan African countries. Int. J. Business Manage. 8:34. doi: 10.24940/theijbm/2020/v8/i3/BM2003-034

Fedderke, J., and Garlick, R. (2020). Infrastructure Development and Economic Growth in South Africa : A Review of the Accumulated Evidence. Cape Town: University of Cape Town.

Fingleton, B. (2023). Estimating dynamic spatial panel data models with endogenous regressors using synthetic instruments. J. Geogr. Syst. 25, 121–152. doi: 10.1007/s10109-022-00397-3

Galal, S. (2023). Robbery rate in Africa as of 2023, by country, Statista. Available at: https://www.statista.com/statistics/1400440/robbery-rate-in-africa-as-of-by-country/

Gui, R., Meierer, M., Schilter, P., and Algesheimer, R. (2023). REndo: internal instrumental variables to address endogeneity. J. Stat. Softw. 107:i03. doi: 10.18637/jss.v107.i03

Harrendorf, S., Heiskanen, M., and Malby, S., (eds) (2010). International Statistics on Crime and Justice. Helsinki: European Institute for United Nations Office on Drugs and Crime (UNODC) Crime Prevention and Control, PO Box 500 Affiliated with the United Nations (HEUNI).

Herbst, J. (2000). States and Power in Africa: Comparative Lessons in Authority and Control. Princeton, NJ: Princeton University Press.

Herre, B., and Arriagada, P. (2023). State Capacity. OurWorldinData.org. Available at: https://ourworldindata.org/state-capacity

Hussen, M. S. (2023). Institutional quality and economic growth in Sub-Saharan Africa: a panel data approach. J. Econ. Dev. 25, 332–348. doi: 10.1108/JED-11-2022-0231

Jacob, J. A., and Osang, T. (2020). Democracy and growth: a dynamic panel data study. Singapore Econ. Rev. 65, 41–80. doi: 10.1142/S0217590817470075

Johnson, C. A. (1982). MITI and the Japanese Miracle: The Growth of Industrial Policy, 1925–1975. Stanford: Stanford University Press. doi: 10.1515/9780804765602

Johnson, N. D., and Koyama, M. (2017). States and economic growth: capacity and constraints. Explor. Econ. Hist. 64, 1–20. doi: 10.1016/j.eeh.2016.11.002

Jonathan, J. (2008). Conceptualizing the Causes and Consequences of Failed States: A Critical Review of Literature. Crisis States Working Papers Series No.2. London: Destin Development Studies Institute.

Jonathan, O., Orji, A., Eigbiremolen, G., and Manasseh, C. O. (2020). The role of institutions in the FDI-growth relationship in a developing economy: a new evidence from Nigeria. Stud. Commer. Bratislavensia 13, 348–363.

Kennedy, G. (2008). Peace, Easy Taxes, and Justice. London: Palgrave Macmillan UK. doi: 10.1057/9780230227545_14

Knutsen, C. H. (2013). Democracy, state capacity, and economic growth. World Dev. 43, 1–18. doi: 10.1016/j.worlddev.2012.10.014

Kripfganz, S., and Schwarz, C. (2019). Estimation of linear dynamic panel data models with time-invariant regressors. J. Appl. Econ. 34, 526–546. doi: 10.1002/jae.2681

Krönke, M., Mattes, R., and Naidoo, N. (2022). Mapping State Capacity in Africa: Professionalism and Reach. Working Paper No. 190. Accra: Afrobarometer.

Kumo, W. (2012). Infrastructure Investment and Economic Growth in South Africa: A Granger Causality Analysis. Pretoria. Available at: https://www.afdb.org/sites/default/files/documents/publications/working_paper_160_-_infrastructure_investment_and_economic_growth_in_south_africa_a_granger_causality_analysis.pdf (accessed 9 November 2024).

Lambach, D., Johais, E., and Bayer, M. (2015). Conceptualising state collapse: an institutionalist approach. Third World Q. 36, 1299–1315. doi: 10.1080/01436597.2015.1038338

Levy, B. L., and Kpundeh, S. (2004). Building State Capacity in Africa: New Approaches, Emerging Lessons. Washington, DC: World Bank Publications.

Lindsey, B. (2021). State Capacity: What Is It, How We Lost It, and How to Get It Back. Washington, DC: Niskanen Center. Available at: https://www.niskanencenter.org/wp-content/uploads/2021/11/brinkpaper.pdf

Lisner, M. (2016). Failed States and the Effects of Instability. Masters. The State University of New Jersey.

Macedo de Medeiros Albrecht, N. F. (2023). Bureaucrats, interest groups and policymaking: a comprehensive overview from the turn of the century. Human. Soc. Sci. Commun. 10:565. doi: 10.1057/s41599-023-02044-8

Mankiw, N. G., Romer, D., and Weil, D. N. (1992). A contribution to the empirics of economic growth. Q. J. Econ. 107, 407–437. doi: 10.2307/2118477

Mavhura, B. (2020). Explaining the emergence of Boko Haram: state failure and relative deprivation (Master's thesis). Stellenbosch University. Available at: https://www.researchgate.net/publication/349075363_Explaining_the_Emergence_of_Boko_Haram_State_Failure_and_Relative_Deprivation

Maximilian, D., and Torsten, S. (2023). The relationship between political instability and economic growth in advanced economies: empirical evidence from a panel VAR and a dynamic panel FE-IV analysis. Ruhr Economic Papers 1000, RWI – Leibniz–Institut für Wirtschaftsforschung, Ruhr-University Bochum, TU Dortmund University, University of Duisburg-Essen.

Mbofana, T. R. (2024). Zimbabweans are Educated for Nothing: A Nation of Intellectuals with No Voice. Bulawayo24. Available at: https://bulawayo24.com/index-id-opinion-sc-columnist-byo-247678.html#google_vignette (accessed 13 November 2024).

Mkandawire, T. (2007). “Good governance”: the itinerary of an idea. Dev. Pract. 17, 679–681. doi: 10.1080/09614520701469997

Mo Ibrahim Foundation (MIF) (2024). Data: Research and Materials Addressing Key Issues on Data From an African Perspective. Mo Ibrahim Foundation. Available at: https://mo.ibrahim.foundation/topics/data

Mosikari, T., and Stungwa, S. (2023). Fiscal decentralization and economic growth in South Africa: a South African perspective. Acta Universitatis Danubius. Œconomica 19, 95–110. Available at: https://dj.univ-danubius.ro/index.php/AUDOE/article/view/2085

Ndayikeza, M. A. (2021). Government expenditure and longevity of African leaders. Sci. Afr. 13:e00929. doi: 10.1016/j.sciaf.2021.e00929

Noort, S. (2018). The Importance of Ective States: State Capacity and Economic Development. Cambridge: Cambridge Working Papers in Economics 1821, Faculty of Economics, University of Cambridge.

Ogbonna, G., and Appah, E. (2016). Effect of tax administration and revenue on economic growth in Nigeria. Res. J. Finance Account. 7, 49–58.

Ogilvie, S. (2022). State capacity and economic growth: cautionary tales from history. Natl. Inst. Econ. Rev. 262, 28–50. doi: 10.1017/nie.2022.42

Ozpolat, A., Guven, G. G., Ozsoy, F. N., and Bahar, A. (2016). Does rule of law affect economic growth positively? Res. World Econ. 7:107. doi: 10.5430/rwe.v7n1p107

Raghupathi, V., and Raghupathi, W. (2020). Healthcare expenditure and economic performance: insights from the United States data. Front. Public Health 8:e00156. doi: 10.3389/fpubh.2020.00156

Roberts, T. (2023). African Governments Spend Too Much on Surveillance Tech for the Wrong Reasons, African Libert. Available at: https://www.africanliberty.org/2023/11/07/african-governments-spend-so-much-on-surveillance-tech-for-the-wrong-reasons/ (accessed 16 November 2024).

Roodman, D. (2009a). A note on the theme of too many instruments*. Oxf. Bull. Econ. Stat. 71, 135–158. doi: 10.1111/j.1468-0084.2008.00542.x

Roodman, D. (2009b). How to do Xtabond2: an introduction to difference and system GMM in stata. Stata J. 9, 86–136. doi: 10.1177/1536867X0900900106

Salmon, J. (2021). The impact of public debt on economic growth. Cato J. 41, 487–509. Available at: https://www.cato.org/cato-journal/fall-2021/impact-public-debt-economic-growth

Santhirasegaram, S. (2008). “Peace and economic growth in developing countries: pooled data cross-country empirical study,” in: International Conference on Applied Economics (ICOAE), ed. N. Tsounis (Kastoria: Technological Educational Institute of Larissa), 807–814.

Savić, G., Dragojlović, A., Vujošević, M., Arsić, M., and Martić, M. (2015). Impact of the efficiency of the tax administration on tax evasion. Econ. Res. Ekonomska IstraŽivanja 28, 1138–1148. doi: 10.1080/1331677X.2015.1100838

Setiawan, F., and Aritenang, A. F. (2019). The impact of fiscal decentralization on economic performance in Indonesia. IOP Confer. Series Earth Environ. Sci. 340:012021. doi: 10.1088/1755-1315/340/1/012021

Singh, M. K. (2023). What is state capacity and how does it matter for energy transition? Energy Policy 183:113799. doi: 10.1016/j.enpol.2023.113799

Wade, R. H. (1990). Governing the Market. Princeton, NJ: Princeton University Press. doi: 10.1515/9780691187181

Wood, B. D., and Waterman, R. W. (1991). The dynamics of political control of the Bureaucracy. Am. Polit. Sci. Rev. 85, 801–828. doi: 10.2307/1963851

Wooldridge, J. M. (2010). Econometric Analysis of Cross Section and Panel Data. Cambridge, MA: MIT Press.

World Bank (2019). Mobilizing Tax Resources to Boost Growth and Prosperity in Sub-Saharan Africa, World Bank Group. Available at: https://www.worldbank.org/en/results/2019/09/09/mobilizing-tax-resources-to-boost-growth-and-prosperity-in-sub-saharan-afric (accessed 13 November 2024).

World Bank (2024). DataBank: World Development Indicators. World Bank. Available at: https://databank.worldbank.org/source/world-development-indicators

Xaisongkham, S., and Liu, X. (2024). Institutional quality, employment, FDI and environmental degradation in developing countries: evidence from the balanced panel GMM estimator. Int. J. Emerg. Markets 19, 1920–1939. doi: 10.1108/IJOEM-10-2021-1583

Xiangming, F., Kothari, S., McLoughlin, C., and Yenice, M. (2020). The Economic Consequences of Conflict in Sub-Saharan Africa. WP/20/21. Available at: https://www.imf.org/en/Publications/WP/Issues/2020/10/30/The-Economic-Consequences-of-Conflict-in-Sub-Saharan-Africa-49834 (accessed 16 November 2024).

Keywords: Smith's triumvirate, growth, GMM, PCA, Sub-Saharan Africa

Citation: Adaid FAP, Banda LG, Chirwa JA, Chidzanja C and Mavhura B (2025) State capacity and growth in Sub-Saharan Africa: a dynamic panel examination of the pillars of prosperity. Front. Polit. Sci. 6:1487658. doi: 10.3389/fpos.2024.1487658

Received: 28 August 2024; Accepted: 23 December 2024;

Published: 28 February 2025.

Edited by:

Thomas Osang, Southern Methodist University, United StatesReviewed by:

Indro Dasgupta, Southern Methodist University, United StatesJeff Jacob, Bethel University, United States

Copyright © 2025 Adaid, Banda, Chirwa, Chidzanja and Mavhura. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Felipe A. P. Adaid, ZmVsaXBlLmFkYWlkQHVzZi5lZHUuYnI=; Lloyd George Banda, bGxveWRnZW9yZ2U1ODVAZ21haWwuY29t

Felipe A. P. Adaid1*

Felipe A. P. Adaid1* Lloyd George Banda

Lloyd George Banda Joseph Amazuwa Chirwa

Joseph Amazuwa Chirwa Chikondi Chidzanja

Chikondi Chidzanja Bathromeu Mavhura

Bathromeu Mavhura