- Department of Economics, University North, Koprivnica, Croatia

Introduction: Despite the relative harmony of the Western states on essential security issues, the July 2024 parliamentary elections in the United Kingdom (the UK), ending with the overwhelming victory of the Labour Party, who has returned to power after 14 years, may have a significant impact on the relationship this country has with the European Union (the EU). Since Brexit, the diminished trade has contributed to a decline in the economy of the United Kingdom and it is one of the countries most significantly impacted by the “increasing cost of living” crisis.

Methods: Using an Impulse Response Function (IRF), this paper will assess the impact of a further decline of EU-UK relations as well as the policy implications of some proposals supported by significant fractions of the Conservative Party, namely tax cuts.

Results and discussion: The paper concludes that a further decline in trade relations between the EU and the UK will lead to a further decline in the economy of the UK that has few feasible alternatives in terms of trading partners.

1 Introduction

While the European Union (hereafter: the EU) is undergoing inflation pressures throughout the continent, the impact of inflation and the economic downturn is not as pronounced on the continent as it is in the case of the United Kingdom (hereafter: the UK) (MacLeavy and Jones, 2021). While the inflation rate throughout the EU has been significant, annual inflation in the UK still outpaces much of the EU with an annual inflation rate of roughly 4%, despite many attempts by the Bank of England to curb the impact of inflation (Minford and Zhu, 2024). While there are numerous and complicated factors that contribute to such a state, it is undeniable that ending near frictionless trade with much of the continent as a result of Brexit contributed to the negative macroeconomic outlook of the UK (MacLeavy and Jones, 2021; Ryan, 2023; Minford and Zhu, 2024).

While there is some debate as to the level of macroeconomic harm caused by Brexit as evidenced by Mathieu (2020), for the most part, many academic sources agree that the question is how much the overall economic outlook of the UK was damaged, rather than whether such damage occurred (more in: Whitehead, 2020).

Among the many estimates addressing the damage to the UK economy, published so far, we have decided to emphasize a few here, at the same time not disputing nor endorsing the models used. Already in 2020, Van Reenen (2020) from LSE warned that the long-run costs to the economy are likely to be more than twice that of COVID-19—at least 2,000 GBP per person, and advocated delaying the exit from to EU to avoid the impending decades-long damage to the economy and society.

For example, Springford (2022), explaining his model, estimated that Brexit had reduced GDP by 5.5%, investment by 11%, and goods trade by 7% in the second quarter of 2022.

The report by the Mayor of London, published in January 2024, revealed that the UK economy has shrunk by about £140 billion because of Brexit, whilst the economy of London has shrunk by about £30 billion. Independent report by Cambridge Econometrics, commissioned by City Hall, shows London has 290,000 fewer jobs than if Brexit had not taken place, with half the total two million job losses nationwide coming in the financial services and construction sectors. Mayor of London identifies Brexit as “key contributor” to the current cost-of-living crisis—highlighting evidence that it is fueling food price increases. According to the new research, the economic damage is only going to get worse—with more than £300 bn set to be wiped off the value of the UK's economy by 2035 if no action is taken, and more than £60 billion wiped off the value of London's economy alone.1

While these legitimate debates continue and the impact of Brexit continues to be assessed, there is no question that the 2024 UK Parliamentary Election is another factor likely impacting the further development of the UK. While rejoining the EU is currently not politically feasible2 and there are multiple factors that will impact the future of EU—UK relationship, as evidenced in James and Quaglia (2020), every decision that could bring a way back to harmonizing relations between the EU and the UK would likely be to the economic benefit of the UK economy.

The aforementioned claim will be empirically evaluated throughout the methodological approach of the paper, but significant evidence to support it is provided in existing papers but particularly in Minford and Zhu (2024). A political earthquake as pronounced as Brexit cannot be undone with a stroke of a pen nor through the Labor Party ending its draught of winning elections dating back to 2005, but there are significant consequences that can be seen in the programs of both major UK parties.

As a party that has not held power for 14 years, the Labor Party is in a position to criticize the incumbents, find faults in the existing macroeconomic outlook and provide minimal alternatives to the existing policies. The Conservative Party has significantly struggled in outlining a coherent vision and tax cuts, one of the only areas of consensus in a party heavily divided, are inadvisable given the macroeconomic outlook. As such, the paper will focus on analyzing the impact of a further decline in economic growth as a result of decreased trade and analyze the main outcomes of particular policy decisions related to Brexit and the policy solutions of the Conservative Party.

The paper will be organized to provide a literature review highlighting the existing findings in the field, following the introduction. After the literature review, the methodological approach of the paper will be explored in-depth. The paper will present and analyze the empirical results and synthesize the existing findings with the existing contributions to the field. The final paragraph of the paper will consist of policy recommendations based on the empirical findings, taking account the findings of existing papers.

2 Key points of research and literature review

During much of the debate prior to the Brexit referendum, as evidenced by Flinders (2020), the argument was that the UK was somehow paying significant funds for participating in the EU and that many of the benefits of membership could be maintained through some type of understanding with the EU. The practical consequences of what has colloquially been known as “hard Brexit” have proven these ideas to be infeasible in practice. The EU has no significant interest in a competitor on its very borders that would not follow the same rules and conditions as the single market. Indeed, adherence to the acquis communitaire and the underlying principles upon which the EU was constructed was a factor the U.K. negotiators, at least those supporting the Leave campaign, were likely not anticipating.

Such a mood has not substantially changed in Brussels and a decline in UK—EU trade is a clear factor contributing to the economic decline of the UK. While it may seem, given the long history of EU—UK relations, that there is no potential for further escalation, there are some areas where a newly-empowered Conservative government could again distance itself from EU. One particular element of contention has been the migration and the measures that members of the U.K. political elite seem to be comfortable presenting, including openly disregarding or finding ways to navigate around existing international treaties and frameworks, that could cause further friction between London and Brussels.

2.1 The UK is still highly dependent on trading with the EU

In such a state of affairs, every decision taken in 2024 or early 2025 by a newly-elected government could have a significant impact on EU—UK relations and, as such, on the overall economic outlook of the UK.

However, various estimates on how the trade was really affected exist, naturally. Kren and Lawless (2022) state that “when the effect of Brexit is estimated using EU data, it first appears that the impact was highly asymmetric, with trade from the EU to the UK declining by considerably less than that from the UK to EU.”

Therefore, Kren and Lawless (2022) suggest that the most accurate estimation of the impact of Brexit can be found by combining EU data for its trade with the rest of the world and UK data for UK-EU trade. The conclusion is that Brexit has substantially reduced trade in both directions relative to the no-Brexit benchmark: UK to EU trade declined by 16% and trade from EU to UK by 20%. Of course, huge variations in trade reduction for various EU member states exist, as shown in the afore-mentioned paper.

Studying the effects of Brexit on the trade between Spain and the UK, De Lucio et al. (2024) have concluded that Spanish exports and imports to the UK decreased by 24 and 27%, respectively, compared to the period before the Brexit referendum. The probability of Spanish exporters and importers starting a trade relationship with the UK decreased and the probability of ending one increased.

Using firm-level data, Fernandes and Winters (2021) found that 1 year after the Brexit referendum, Portuguese firms decreased their exports to the UK by 5.5% relative to other countries. Douch et al. (2020) showed that British firms increased their exports to non-EU markets relative to EU markets in the 16 months following the Brexit referendum. Crowley et al. (2020) documented that British firms had a lower probability of introducing new products into the EU 6 months after the Brexit referendum if those products were more likely to experience a tariff increase in a hard Brexit scenario.

A significant literature (Dhingra et al., 2017; Hantzsche et al., 2019; Oberhofer and Pfaffermayr, 2021; Stack and Bliss, 2020) that simulated Brexit scenarios (like hard Brexit/hard Brexit plus, global Britain/Soft Brexit) found negative effect on UK trade with EU. Most of these studies have used simulations for lack of complete data over the Brexit period as well as uncertainty over the type of post Brexit trade arrangement that would be struck between the UK and EU. Latorre et al. (2020) review some of the earlier literature on Brexit and there is a consensus in the literature that Brexit is damaging for both the UK and EU (Buigut and Kapar, 2023, p. 1569).

Oberhofer and Pfaffermayr (2017) have studied the effects of Brexit on EU-UK trade by using gravity model, allowing for phasing in effects in counterfactual policy scenarios such as e.g., the conclusion of new bilateral free trade agreements by the UK. They have followed Bergstrand et al. (2015) and applied a distributed lag structure as only considering contemporaneous trade policy effects likely only allows to identify lower bound estimates. Further, they allowed for time trends in border effects. The paper also investigates the sensitivity of the obtained Brexit effects with respect to the empirical identification of the parameter estimates associated with trade policy measures. Similar gravity models for bilateral trade were also used by Brakman et al. (2017) and Felbermayr et al. (2017), taking account for full endowment general equilibrium effects, as proposed by Yotov et al. (2016) and reached consistent conclusions.

Vandenbussche et al. (2017) develop a gravity model with sector-level input-output linkages in production and separately study the impact of UKs withdrawal from the EU for value added production and employment in the UK and for each EU member state. The trade effects of Brexit are inferred by means of sectoral trade elasticities obtained from Imbs and Mejean (2017). This study also differentiates between a hard and soft Brexit scenario closely following Dhingra et al. (2017). While trade has significantly evolved and much of the production is conducted in global centers of production and distributions, the UK still significantly depends on its nearest and most active trading partners.

2.2 Outcomes of the election and the Conservative manifesto

While a significant part of this paper is dedicated to analyzing the impact of how the evolution of trade will impact the economic outlook of the UK, it is also to consider the other economic policies of the Conservative Party. While the party has struggled in outlining a fully coherent position, tax cuts remain one of the rare points of consensus within the party. In the current macroeconomic outlook, given rampant inflation and the attempts by the Bank of England to curb such pressures, increasing the availability of money through tax cuts may be politically popular but also economically inadvisable. As discussed by Alcock et al. (2022), the Conservative Party was willing to present a pragmatic viewpoint in mitigating the economic downfall of the COVID-19 pandemic, yet has since returned to slightly more traditional right-of-center topics. While many aspects of the manifesto are not yet fully disclosed, it can be anticipated that a significant shift countering migration and advantages economic policies are meant to dissuade voters from supporting the Labor Party.

Aside from migration, the aspect of “taking back control” as outlined by Bradbury et al. (2023) may be another point of contention between the EU and the UK. While major diplomatic and political aspects that may significantly undermine relations between the UK and its European counterpart have been resolved to a degree,3 there are still numerous underlying tensions. Per the findings of Godefroidt et al. (2022), while there may be a diplomatic resolution to Northern Ireland, there may be significant sentiment among the electorate that could fuel further antipathy toward London and the central U.K. government. While major escalations of existing issues are not the only area where disputes may arise, it is also likely, as implied by Bradbury et al. (2023) that there may be issues pertaining to diplomatic or economic multilateral frameworks where it will be difficult for the UK and the EU to find common ground. While this is not exclusive to a government led by the Conservative Party, the post-Brexit negotiations have illustrated that good relations with Brussels are not the leading priority compared to domestic priorities. This is specifically stressed by Figueira and Martill (2020) who have placed a significant portion of the blame on a “lack of decision-making and openness, and a lack of EU expertise and contact” in the context of negative outcomes pertaining to Brexit.

Despite the relative lack of content in the Conservative manifesto pertaining to Brexit, it is still viable that crises related to the existing policy positions of the Conservative Party may undermine relations with the EU, as per some of the previously discussed findings (Bradbury et al., 2023; Figueira and Martill, 2020). Issues including the perceived “taking back control” may help to further undermine the stability of UK—EU relations and while this is far from certain, there are possible long-standing policy positions held by the Conservative Party including migration, visa regimes, trade regimes and other policies where any type of minor crisis could lead to a new decline in relations.

A significant number of studies have already considered and evaluated the impact of Brexit on the long-term economic development of the UK and have, by large, found that this effect is negative (Dhingra et al., 2017; Oberhofer and Pfaffermayr, 2017; Buigut and Kapar, 2023; De Lucio et al., 2024). Where these studies have differed, as will be explained in the subsequent section, is the research methods that were employed and the degree to which they found Brexit to have an adverse impact on the economy.

Some theoretical claims and assumptions have been validated through the existing research and the goal of the paper is not to question the immediate impact of Brexit on the economy of the UK as the issue has been sufficiently considered in existing papers (Brakman et al., 2017; Buigut and Kapar, 2023; Latorre et al., 2020; Crowley et al., 2020; Dhingra et al., 2017; Fernandes and Winters, 2021; Hantzsche et al., 2019). Drawing on the findings from existing papers, in particular the empirical evidence presented by Douch et al. (2020) and Latorre et al. (2020), the paper works on an assumption that further negative consequences for the economic development of the UK are feasible as a result of renewed adverse pressures on EU—UK trade. In addition, the paper questions the feasibility of some of the economic policies of the Conservative Party, notably the implementation of tax cuts in a period of macroeconomic uncertainty and heightened inflation. The paper provides a robust model that will consider the impact of some variables and illustrate some of the methodological shortcomings of utilizing such an approach.

2.3 Empirical studies and projections

A significant number of studies have utilized different statistical methods to estimate the long-term impact of Brexit on the economy of the UK or other components impacting the aggregate economy. As a very solid benchmark, Buigut and Kapar (2023) examine the impact of Brexit through the following equation:

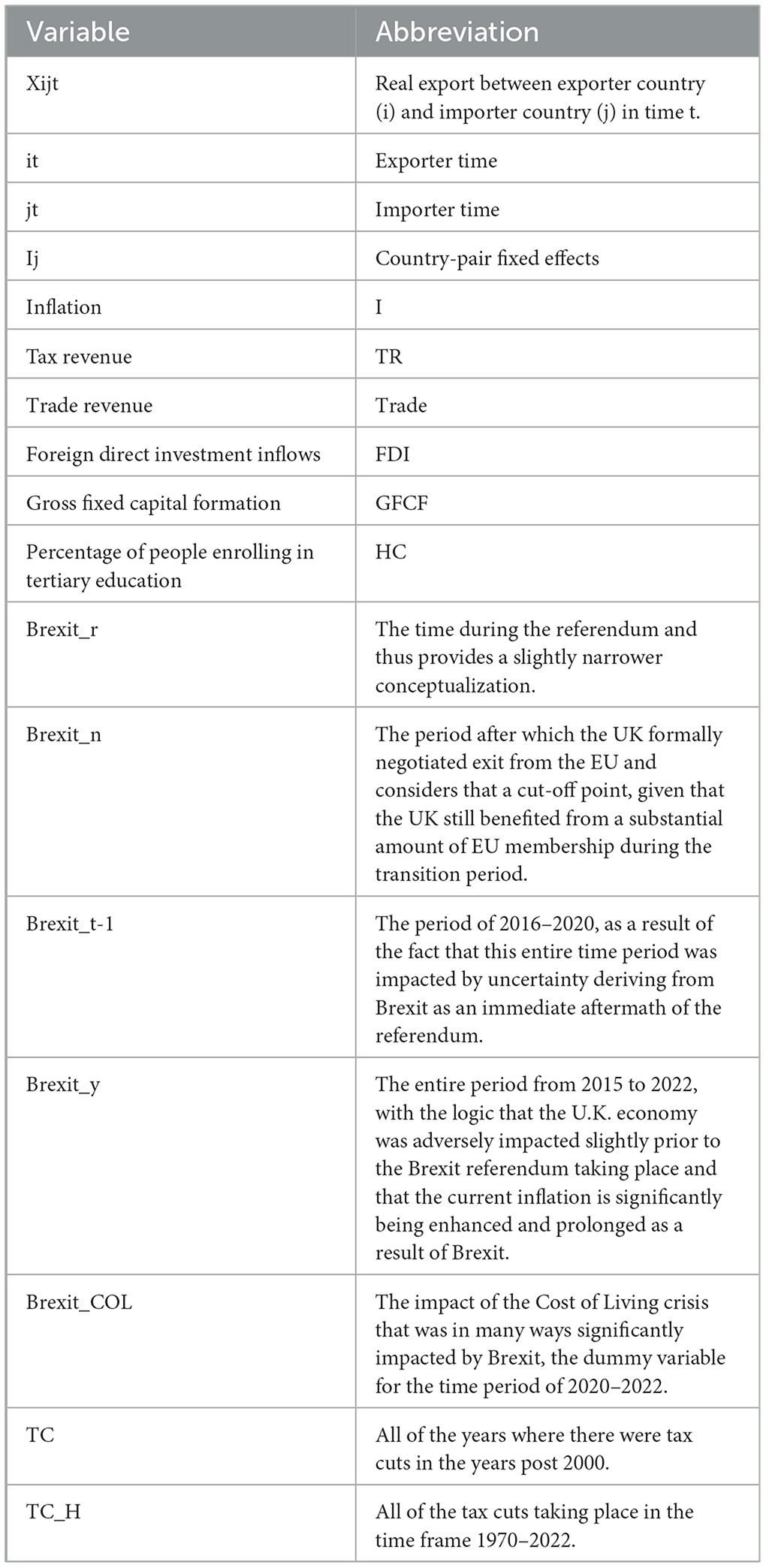

Where Xijt stands for real export between exporter country (i) and importer country (j) in time t. The time-varying fixed effects [exporter-time [it] and importer-time [jt]] account for the multilateral resistance while the time-invariant country-pair fixed effects (ij) control for potential endogeneity bias. This model controls for nearly every variable included in gravity equation and unobserved factors. All other potential drivers of trade flow variation are subsumed in the fixed effects.

In considering this impact, the authors account for “exporter-time and importer-time effects” and thus offer a more nuanced explanation of the impact of Brexit. An array of relevant explanatory variables is included in the paper, including the distance between the capital cities, whether or not the countries share a common border and similar variables in line with expectation of the Gravitational model of trade, with the conclusion that Brexit has decreased trade flows between the EU and the UK by roughly 10% (Buigut and Kapar, 2023). The authors introduce different time frames, anticipating that the impact of the Brexit referendum on trade itself will be negligible and that the implementation of subsequent transition periods and negotiations will have a more adverse impact on the EU—UK trade (Buigut and Kapar, 2023).

While the findings of the paper conform to the aforementioned authors, a different methodological approach is employed in De Lucio et al. (2024). By employing a event study methodology, the paper also attempts to quantify the impact that Brexit has had on Spanish—UK trade and the authors have determined that Spanish exports and imports to the UK have decreased by 27 and 24% (De Lucio et al., 2024). The authors have determined that different regulation including sanitary inspections are one of the main drivers of what the authors portray as “disintegration” between the UK and former EU member-states (De Lucio et al., 2024).

Dhingra et al. (2017) employ a series of macroeconomic models including from data such as the World Input-Output Database and have determined that the impact of any type of Brexit adversely impacts the UK economy. The authors estimated that the economically less detrimental impact was to select a Soft Brexit in line with the relationship between the EU and Norway, but even such an option would be associated with a 1.3% welfare loss. The authors estimated that any detrimental impact of Brexit would also be associated with the real loss of wages, thus undermining the arguments of the Leave Campaign. Furthermore, Dhingra et al. (2017) estimated that the very worst possibility was selecting a hard Brexit, as such an option would be associated with a 2.7% of welfare loss and the authors believed that any form of Brexit would cause a significant decline in per capita GDP, possibly as a result of a loss of foreign investment.

In a similar methodological manner, Oberhofer and Pfaffermayr (2017) employed a research approach centered on the Constrained Poisson Pseudo Maximum Likelihood Estimator in order to establish the impact of Brexit. The range identified by the authors is slightly different compared to slightly more recent studies such as Buigut and Kapar (2023), however the authors found that Brexit would cause a decline in trade between 7.2 and 45.7% over a 6-year time span. Even when accounting for all possible scenarios mentioned by the Leave Campaign, including increased domestic production and enhanced trade flows with third parties, the authors estimate that the most likely outcome is the decline of real income between 1.4 and 5.7%.

Utilizing a similar general gravity model approach, Simionescu (2018) also estimated s that the impact of Brexit on the economic outlook of the UK. The robust research framework consisting of mixed-effects Poisson models as well as counterfactual analysis of the impact of Brexit on FDI found that utilizing an approach centered around a hard Brexit would adversely impact the economy of the UK. The author advocated for an approach similar to the trade framework Norway has in place with the EU, estimating that this would allow for more than 97% of jobs to be safeguarded, but that any type of approach involving significant friction between the EU and the UK may lead to FDI projects decreasing by as much as 65–90% (Simionescu, 2018). A key similarity in the existing literature is the long-term drawbacks of the hard Brexit approach that has since been implemented (Dhingra et al., 2017; Simionescu, 2018).

Aside from the general macroeconomic outlook, Kellard et al. (2021) adopt a more nuanced view of the issue and analyze the impact Brexit had on private equity markets. Among other aspects, the authors stress that one of the mechanisms generating additional difficulties for the private equity markets was the collapse of the value of sterling in the aftermath of the Brexit referendum (Kellard et al., 2021). By building on the existing research by Bloom et al. (2019), the authors concluded that their sample of 765 UK-based companies was adversely impacted by Brexit. Kellard et al. (2021) primarily base that these recommendations largely derive from uncertainty amongst senior management as well as an inability to fully find suitable mechanisms to navigate the complexity and uncertainty of post-Brexit trade.

It can be concluded that while there are some nuances to the approach in forecasting the impact of Brexit in terms of the variables observed with most authors focusing on the macroeconomic outlook or relevant proxies such as FDI, there is a clear consensus that the impact of Brexit is negative in the short-term and will very likely be negative in the long-term as well (Dhingra et al., 2017). While some authors including Dhingra et al. (2017) and Simionescu (2018) have advocated for more moderate approaches to limiting the adverse impact to Brexit, the findings of these papers are not significantly undermined by the fact that these policy recommendations were not conformed to. Indeed, it is an indicator that the underlying assumptions of both the gravity model and the importance of the EU as one the principal trading blocks for the UK were accurate and that even post-Brexit, trade with EU should remain a valuable asset for the UK (Oberhofer and Pfaffermayr, 2017).

3 Data and methodology

3.1 Data and models

In order to conduct the necessary statistical analyses, data was collected from the Khokhar and Vaid (2017) World Bank data (further referred to as World Bank data) and the United Kingdom Office for National Statistics (2024), encompassing a time period of 1970–2023. Despite the aim of the paper primarily being on forecasting and analyzing future trends, taking a longer time period ensures that the relationships between the variables are less impacted by individual events that may be unrelated to the aspects studied by the paper.4 As already stressed by numerous papers (Kellard et al., 2021; Buigut and Kapar, 2023), Brexit was a significantly stressful moment for the macroeconomic outlook of the UK. The previous analysis of the existing literature has identified key aspects of how the decision to implement Brexit impacted the U.K. economy including:

1. Widespread uncertainty—on every level of decision-making, from the private sector to formulating government policy, it was impossible to make long-term decisions that are essential in facilitating trade. As already discussed by Figueira and Martill (2020), such an approach diminished the ability of the UK to encourage larger trade flows with its largest trading partner, in direct opposition to the basic tenants of the Gravity Model of Trade.

2. Diminished economic opportunities—while to an extent diminished trade from the viewpoint of barriers and uncertainty has been discussed previously, it should be noted that other than direct legal barriers to trade, at times the administrative and punitive measures implemented as a result of Brexit further diminished the U.K. economy (Leys and Dolle, 2017).

Keeping in line with the previously mentioned conclusions, the paper analyses the impact that Brexit has had on key macroeconomic variables through a Vector Autoregressive (VAR) framework and then utilizing Impulse Response Functions (IRFs) to analyze the impact of changes as a result of Brexit. The general model considers the impact of the following sets of equations:

Where I is inflation, FDI is foreign direct investment, TR is trade, GFCG is Gross Fixed Capital Formation, HC is percentage or people enrolling in tertiary education, and TC is tax cuts in the years post 2000.5

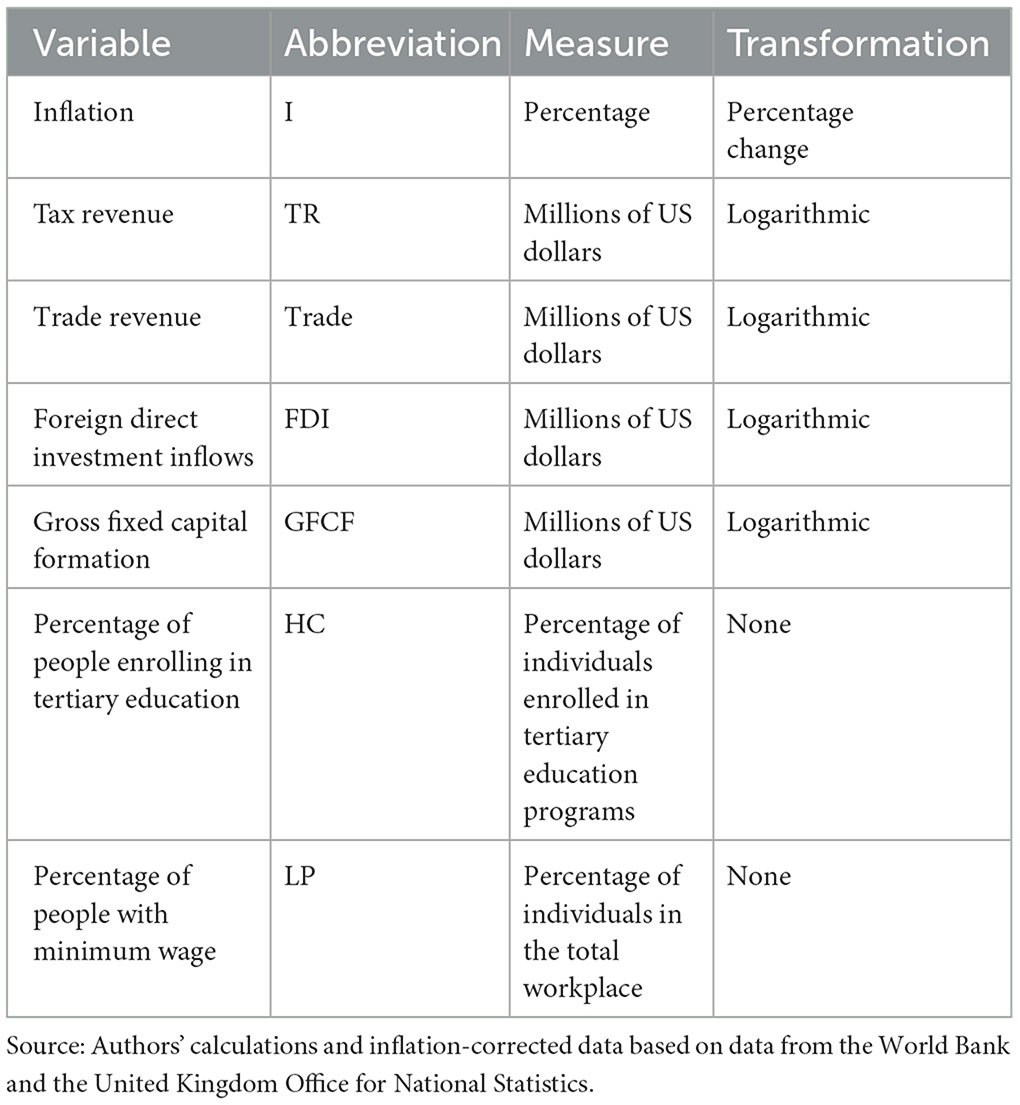

Both sets of equations consider the impact of an array of variables and lags on inflation, trade revenue and the percentage of individuals earning low wages (2) and tax revenue as a significant proponent of economic activities that can be used to stimulate significant positive externalities for society (3). Both equations consider the appropriate lag length based on the Akaike information criterion, which will likely differ between the two estimated equations, as represented with n, in the observed time period of 1970–2022, as represented by t. In addition, both models include a constant and an error term. While there is an additional explanation considering the use of dummy variables in the continuation of the methodology, the main independent and dependent variables observed in the model are summarized in Table 1.

Primarily, for most of the independent variables, the existing literature has already established a strong connection between these and the primary dependent variables (Simionescu, 2018; Mathieu, 2020). For some of the variables, they ensure a better fit of the model with tertiary enrollment serving as a proxy variable for human capital, as a measure that in the long-term ensures higher taxation revenue. As already mentioned in Table 1, some transformations were necessary in order to ensure the structural stability of the model. Primarily, several of the variables underwent log transformations in order to minimize difficulties resulting regarding kurtosis and skewness of these particular variables. Aside from the variables abbreviated and explained in Table 1, a set of dummy variables, introduced as Brexit and TC, are responsible for capturing the possible impact of further adverse impacts deriving from Brexit, as well as passing further tax cuts on the economic outlook of the UK.

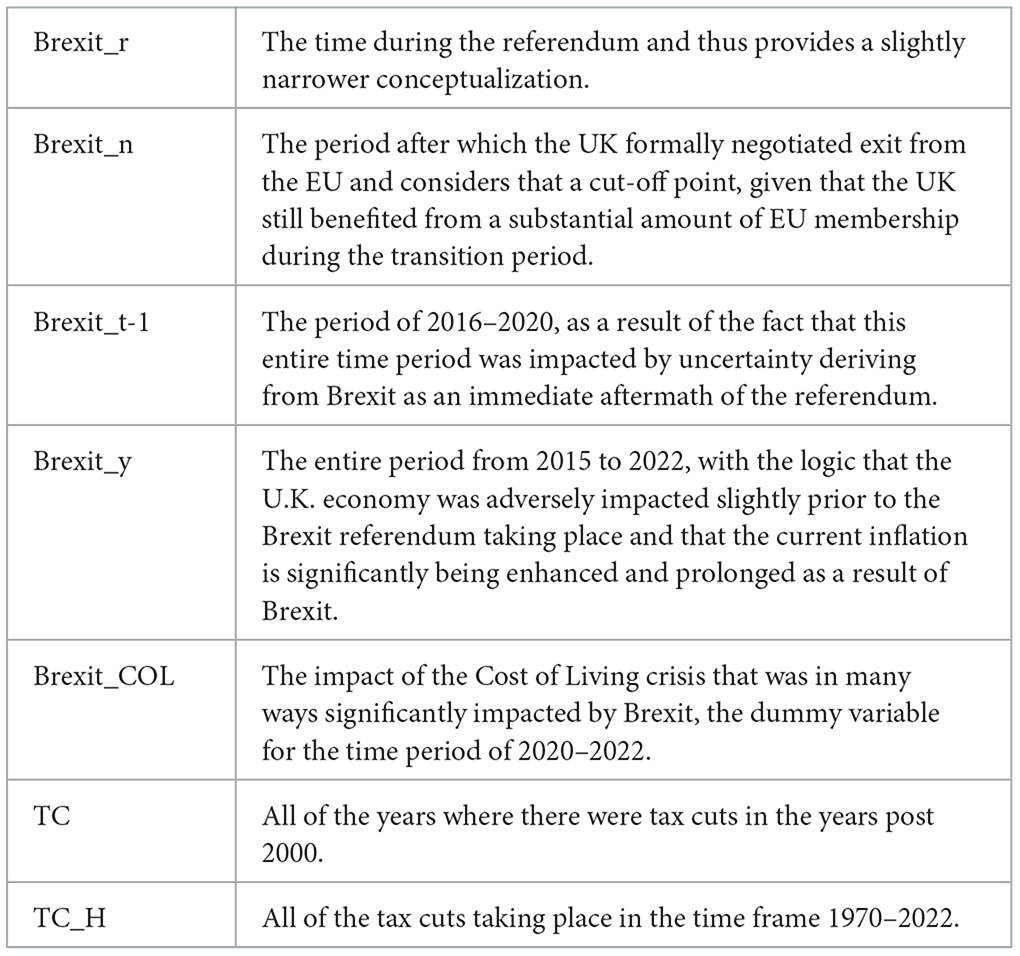

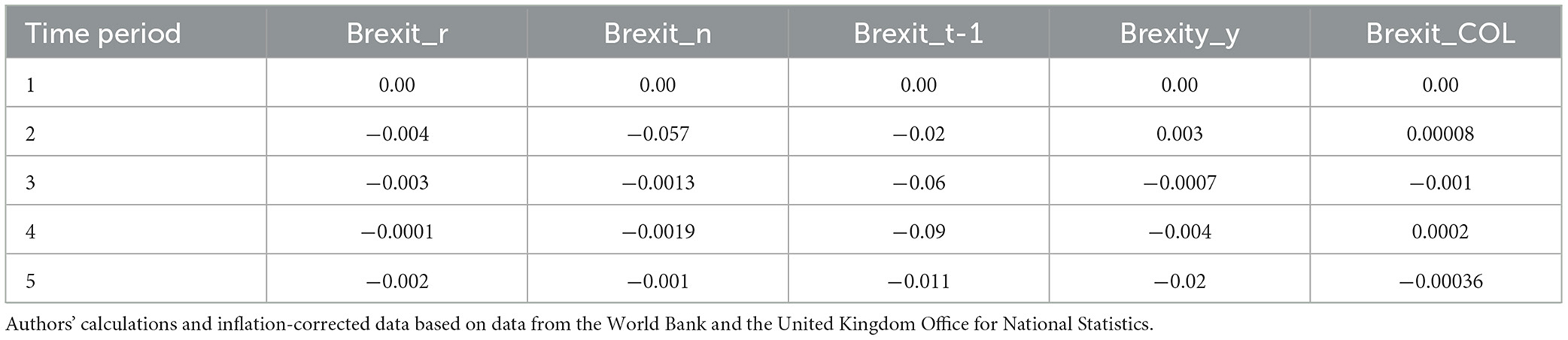

As was previously noted in the existing literature, notably in Buigut and Kapar (2023), it can be difficult to conceptualize the impact of the aftermath of Brexit. The corresponding uncertainty derived from Brexit started even prior to the formal referendum taking place and was only accentuated through the entirety of the Brexit negotiation process. As such, several dummy variables have been introduced to account for the impact of Brexit. The first dummy variable, Brexit_r only accounts for the time during the referendum and thus provides a slightly narrower conceptualization, considering that a significant shift occurred as a result of the referendum. The second dummy variable, Brexit_n, considers only the period after which the UK formally negotiated exit from the EU and considers that a cut-off point, given that the UK still benefited from a substantial amount of EU membership during the transition period. A third dummy variable, Brexit_t-1, considers the time period of 2016–2020, as a result of the fact that this entire time period was impacted by uncertainty deriving from Brexit as an immediate aftermath of the referendum.

A fourth dummy variable Brexit_y considers the entire period from 2015 to 2022, with the logic that the U.K. economy was adversely impacted slightly prior to the Brexit referendum taking place and that the current inflation is significantly being enhanced and prolonged as a result of Brexit. To capture some of the uncertainty deriving from Brexit beyond the immediate aftermath and to primarily capture the impact of the Cost of Living crisis that was in many ways significantly impacted by Brexit, the dummy variable for the time period of 2020–2022, Brexit_COL was also included. For tax revenue, given that there is no certainty as to the percentage rate the Conservative Party will favor, dummy variables have also been included. The dummy variable TC accounts for all of the years where there were tax cuts in the years post 2000, while the dummy variable TC_H accounts for all of the tax cuts taking place in the time frame 1970–2022. With the use of these dummy variables, particularly for Brexit, more robust results can be obtained to ensure that the results are not a misrepresentation of an incorrectly conceptualized variable. The dummy variables are shown in Table 2.

4 Discussion and results

Proponents of Brexit were accurate in stating that the UK has long-standing ties with multiple countries, including previous or current Commonwealth members and that there is no legal or substantial political factor preventing the UK from negotiating new trade frameworks or treaties with these countries. However, this argument when examined from an economic viewpoint is entirely faulty and fails to consider the shelf life of a significant aspect of U.K. exports. The distance between Dover and Callais is around 20 miles and, while there are some practical and geographical obstacles to overcome in goods and services passing that area, that distance was far from insurmountable prior to Brexit. Currently, administrative and other barriers, as well as increased tariffs remain the largest detractor for more effective trade between the UK and the EU.

On the other hand, even if legal trade conditions between the UK and Australia, for example, could be reproduced, the geographical distance between these countries is significantly larger. Even if identical trade conditions could be replicated, there are many items that do not have the necessary shelf life, or can be sold in an inferior state or with added costs, compared to simply exporting goods and services to a large market that is geographically not distant. Even if ignoring factors such as shelf life or the necessary costs induced to make sure a good does not decay over time, there are other practical factors that make trade less feasible over such a distance. Costs of transport are far greater, with significant security challenges on naval trading routes also likely leading to larger insurance costs and, particularly for small and medium enterprises, highlighting that trade with countries at such a significant distance will bring few practical benefits for the U.K. economy.

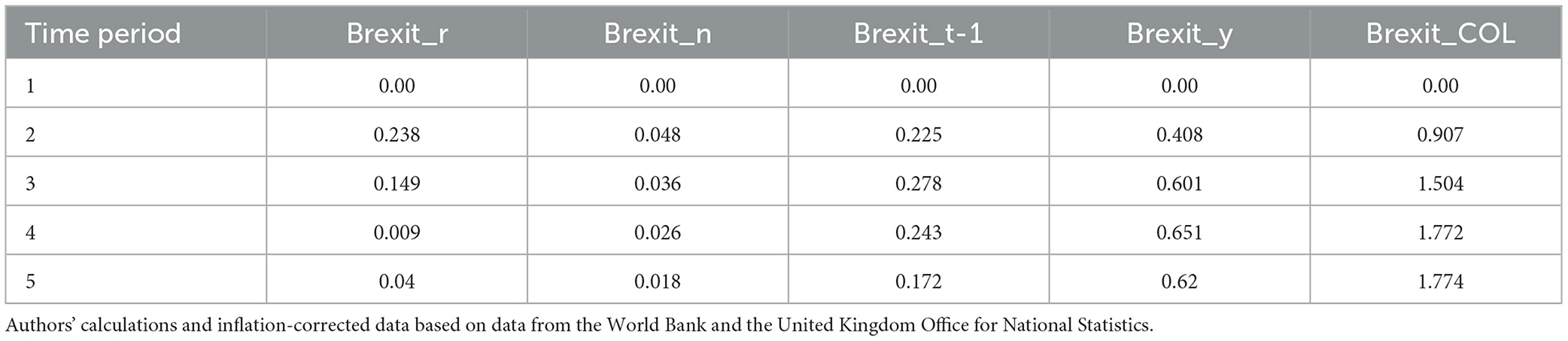

The results for the impact of Brexit on inflation, as a major cause of the Cost of Living crisis that has worsened the living standards of the population in the UK, is shown in Table 3.

As can be seen from Table 3, all conceptualizations of the Brexit dummy variable result in further adverse impacts related to inflation. This is especially highlighted in the aftermath of UK deciding to leave the EU, as can be evidenced by the impact of the Brexit_COL variable. However, in that instance it is difficult to distinguish whether the impact is a result of external macroeconomic shocks or that of Brexit alone, but it is possible to determine from previous findings including Breinlich et al. (2021) that Brexit has led to an increase in aggregate prices that has made it more difficult for most individuals to purchase everyday necessities. As argued in Breinlich et al. (2021), it is possible to determine that there is a causal link between an increase in prices and the immediate aftermath of Brexit, namely through a significant depreciation in the value of sterling.

A slight novelty of the proposed approach is differentiating different conceptualizations of Brexit based on an approach comparable to Buigut and Kapar (2023). Different conceptualizations of Brexit dummy variables highlight that viewing Brexit as a one-time event, that happened and ended within the span of a year, is likely limited. Even while the two variables that indeed take such an approach to viewing Brexit both highlight an increase in the value of inflation in the IRF functions, this is much less pronounced compared to the two variables that consider a slightly larger time frame.

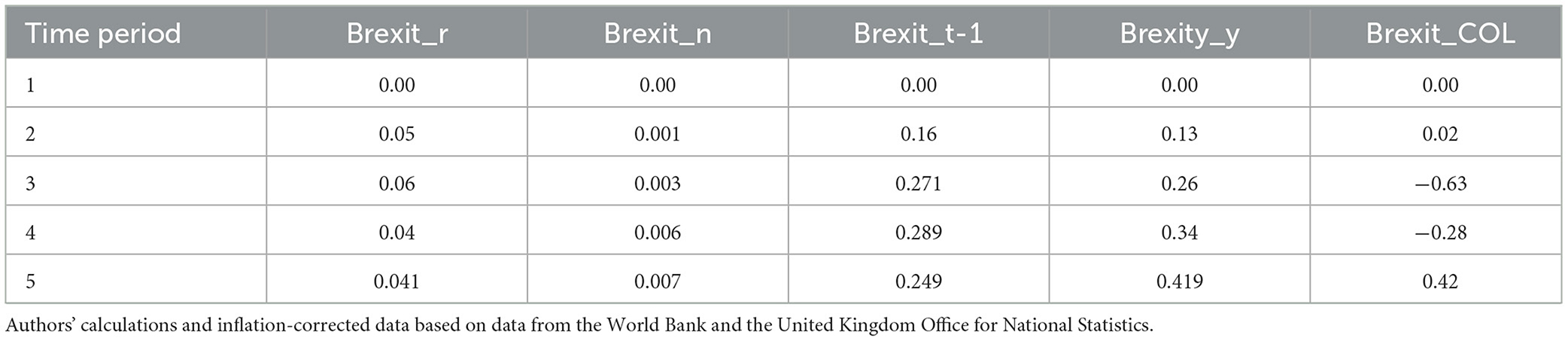

Another significant factor when discussing the macroeconomic outlook is the shift in wages as a result of Brexit. Table 4 indicates the IRF responses for this variable, considering the same different conceptualizations of the variables as explored in the methodology and as was presented in Table 3.

While the impact of the conceptualized Brexit variables was significantly associated with an increase in the level of aggregate prices, this is slightly different with the Brexit_COL variable and its impact on wages. However, this should consider that the variable LP is calculated as the percentage of people living below the level of minimal income and given the significant inflationary pressures in the 2020–2023 period, it is possible that a methodological shortcoming is responsible for a lack of a more significant increase in welfare loss as a shock of a response of the Brexit_COL variable.

For all of the remaining variables, a similar pattern emerges as it had in the case of the IRF functions for inflation. It should be noted that the impact of the variables Brexit_r and Brexit_n is statistically almost negligible, despite being slightly negative, and that such a conceptualization of Brexit consistently fails to account for a more comprehensive view of the changes taking place. These findings generally conform to Oberhofer and Pfaffermayr (2017) as they indicate that there is a decline in the living standard and an increase in inequality as a result of Brexit taking place. A potential cause of this is identified in Griffith et al. (2021), stressing that many of consequences of Brexit adversely impact a segment of society that already had lesser income or jobs that were more likely to be associated with a high turnover rate. As argued by Griffith et al. (2021), a significant reason for further inequality deriving from Brexit could be the increased risk of major manufacturers deciding to slim down or shut down operations due to increased administrative or regulatory barriers. It is also feasible that additional costs for small entrepreneurs have limited their profit margins and, as a result, have had to limit the wages of their employees as they were unable to pass the additional cost to consumers in a time of rampant inflation. As the EU remains one of the only viable major trade partners, it should also be considered how Brexit impacted the trade revenue of the UK.

The results of the IRF functions concerning trade differ the most compared to the existing literature including to those identified by Mathieu (2020). While many of the datasets analyzing the impact of Brexit analyzed quarterly or short-term trends, this paper applied a methodological approach to consider a larger time period. As such, the findings concerning inflation, while consistent with much of the existing literature, indicate that some of the models underestimated the impact of Brexit on inflation. Comparatively, while Brexit did lead to a mostly statistically negative response to trade revenue, in a longer period of time the impact does not appear to be statistically as significant as in some of the other relevant studies namely the projections made by Kellard et al. (2021).

While the paper agrees with many of the findings in the existing literature, namely that Brexit has led to declining trade opportunities as a result of increased administrative barriers to trade and that Brexit has led to a significant decline in trade exports, a possible cause of the difference in estimates may be due to the conceptualization of the variables. While this paper centered on trade revenue, many other papers preferred other conceptualizations of trade, e.g., De Lucio et al. (2024) consider trade inflows and trade outflows and thus it is possible that different conceptualizations have led to minor differences in the final estimates. Regardless, in all of the variables concerning the impact of Brexit, it is clear that the result of Brexit over time is statistically significant and negative. The impact of the variable Brexit_COL is more nuanced as inflation is usually associated with increased competitiveness on foreign markets, but the results indicate that a shock in this variable is not statistically significant on the value of trade revenue. The IRF responses of trade are shown in Table 5.

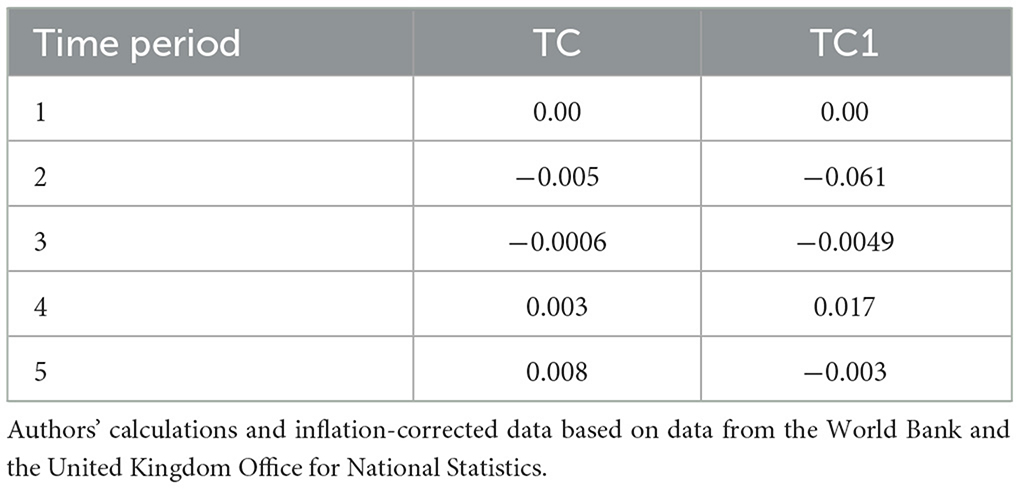

While it is clear that any conceptualization of Brexit negatively impacted the main observed macroeconomic variables, it is also significant to study the impact of further tax changes. As observed in Caldara and Kamps (2017), there are some underlying difficulties in measuring the impact of proposed tax changes, so the following results primarily reflect the impact of tax cuts more broadly rather than a specific policy proposal. The results of the IRF functions are presented in Table 6.

As can be seen from both conceptualizations of dummy variables aiming to capture the impact of tax cuts, the impact of implementing tax changes has an initially negative response, making it an inadvisable policy option for a country that is recovering from an adverse macroeconomic outlook. Despite the fact that the initial negative response seems to moderate in the medium to short-term, it is necessary to remember the shortcomings identified in Caldara and Kamps (2017), notably that most predictive functions based on VAR models are snapshots of a current moment in time. As a result, it is feasible that, as was the case with the attempted mini budget6 of the Truss cabinet, there may be further negative consequences on the macroeconomic outlook of the UK that would further decrease private spending and diminish confidence of individuals in the economy. As a result of changes on these highly related variables that cannot fully be captured through the VAR models, the final consequences may be far more negative than what is anticipated from the model itself. As a result, stabilizing prices and ensuring that preconditions for stable growth are met should be the immediate priorities for any government taking power in the aftermath of the election.

4.1 Limitations of this study

While the methodology of the paper attempts to utilize a robust framework that would ensure that the final findings are not resulting from a model with a low predictability value or spurious results, there are some shortcomings to the proposed research models in the paper. One main shortcoming is the assumption that the Conservative Party will continue to uphold and preserve similar principles and policy positions as outlined in Figueira and Martill (2020). It is also rather difficult to quantify the impact of voters selecting one political party ahead of another and there is no guarantee as to what the post-election political and economic landscape will resemble.7 Another limitation of the research is the lacking inability to conceptualize all of the aspects of certain variables. For example, while the economic volume of UK—EU trade can be measured, this does not consider all of the intricacies in UK—EU relations and it does not fully capture much of the political impact that can again spill-over back into the realm of economic relations in the long-term.

While many of the identified methodological limitations are connected to the inability to predict the instability of the macroeconomic and political outlook, the proposed models still do provide insight as to how key aspects related to the Parliamentary Elections may impact the economic outlook of the UK.

5 Conclusions

The paper implements an approach centered around a VAR framework to conclude that further similar shocks to the macroeconomic outlook of the UK that resemble Brexit or that may provide similar policy outcomes would adversely affect the economy both in the short and the long-term. Based on the analysis conducted through IRF functions, the paper finds that conceptualizations of Brexit that best capture the long-term impact, notably the dummy variable, Brexit_y indicate that further approaches to distance the UK from the EU would further aggravate the already complex macroeconomic outlook of the EU. These conclusions conform to much of the existing literature, notably Bloom et al. (2019) and Buigut and Kapar (2023) in identifying that increased macroeconomic uncertainty has hampered the economic growth of the UK. Increased uncertainty, regulatory barriers to trade, a lack of a feasible alternative trade partner, and decreased foreign investment are all factors that have made the Cost of Living crisis an example of inflation that far outpaces that faced by much of the EU member-states.

While Brexit has significantly diminished the economy of the UK, there are clear possibilities for a worse-case scenario as already discussed in De Lucio et al. (2024). Further disintegration, as conceptualized in De Lucio et al. (2024) or viewing it as a continuation of adverse macroeconomic conditions, displays that while the UK economy has diminished through accepting a Hard Brexit, there is potential for a worse outcome. While it is not in the interest of the EU to withdraw from the agreement made with the UK, policy options such as ignoring asylum regulation or implementing practices incompatible with the acquis communitaire may lead the EU to further increase barriers to trade or strengthen administrative regulation against U.K. exports. As such, any political party should be warried of ensuring that there is constructive dialogue with Brussels and aim to ensure stronger trade, if not stronger ties, with the EU. As was visible from the attempted mini budget under the Truss government, the economy would further be negatively impacted through the implementation of such policies. This is confirmed by the findings of the paper that find any tax cuts would negatively impact tax revenue in the short-term, thus limiting economic growth and potentially worsening the economic outlook of the UK.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

PK: Conceptualization, Resources, Writing – original draft, Writing – review & editing. FK: Data curation, Formal analysis, Methodology, Software, Writing – review & editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. Support given from the competitive project funding at the University North, Croatia.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

The author(s) declared that they were an editorial board member of Frontiers, at the time of submission. This had no impact on the peer review process and the final decision.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1. ^https://www.london.gov.uk/new-report-reveals-uk-economy-almost-ps140billion-smaller-because-brexit

2. ^This remains true despite the fact that the mood of the electorate has shifted significantly since the original referendum. Neither would there be a willingness to renegotiate terms within the EU, given the complex nature of the departure of the UK from the EU. While there is no doubt that Brexit was a legitimate desire of the mood of the electorate at the time, it should be noted that many of the facts around Brexit were heavily misrepresented. This discussion, while highly relevant, is beyond the scope of the paper and some elements discussing it are included in works such as Flinders (2020).

3. ^Including rather complicated issues such as the position of Northern Ireland, which Ireland as an EU member-state was closely monitoring. While this is another issue beyond the scope of the paper, some main aspects of this discussion are well-covered in Godefroidt et al. (2022) and Murphy (2021).

4. ^For example, any global crisis is likely to have a pronounced impact on the macroeconomic outlook of the UK and the Global Financial Crisis of 2008 significantly impacted the UK. As a result, reviewing a narrower set of quarterly data may not be as centered on long-term trends that the paper aims to capture.

5. ^All the variables on the left from the equation mark in both models represent dependent variables, whilst all the variables on the right side from the equation mark are independent variables.

6. ^While this was a relevant and contemporary incident in UK politics, highlighting that a significant fraction of the Conservative Party was willing to advance ideological principles even when such principles could hamper the economy, it is slightly beyond the scope of the paper. For further reference on the impact of the mini budget and such an approach to government spending, a comprehensive analysis is provided in Li (2023) that highlights all of the shortcomings of such a short-term approach to governance.

7. ^While it should be noted that the overall challenges facing the UK and EU will likely remain challenging in the slightest, this shortcoming is more focused on specific challenges that cannot be anticipated at the time. Despite some of the underlying difficulties presented in Godefroidt et al. (2022), it is not possible to anticipate whether economic uncertainty or other factors will cause these potentially contentious topics to further escalate and thus present further difficulties for EU—UK relations.

References

Alcock, P., Haux, T., McCall, V., and May, M. (2022). The Student's Companion to Social Policy. Wiley Blackwell. Available at: https://www.perlego.com/book/994155/the-students-companion-to-social-policy-pdf

Bergstrand, J. H., Larch, M., and Yotov, Y. V. (2015). Economic integration agreements, border effects, and distance elasticities in the gravity equation. Eur. Econ. Rev. 78, 307–327. doi: 10.1016/j.euroecorev.2015.06.003

Bloom, N., Bunn, P., Chen, S., Mizen, P., Smietanka, P., and Thwaites, G. (2019). The Impact of Brexit on UK Firms. Working paper 26218. Available at: https://www.nber.org/papers/w26218

Bradbury, J., Convery, A., and Wall, M. (2023). Brexit as a critical juncture in the politics of UKdevolution: a comparative analysis of the effects of Brexit on parties' territorial strategies. Reg. Feder. Stud. 34, 575–596. doi: 10.1080/13597566.2023.2185610

Brakman, S., Garretsen, H., and Kohl, T. (2017). “Consequences of Brexit and Options for a Global Britain,” in CESifo Working Paper 6448. Available at: https://ideas.repec.org/p/ces/ceswps/_6448.html

Breinlich, H., Leromain, E., Novy, D., and Sampson, T. (2021). The Brexit vote, inflation and U.K. living standards. Int. Econ. Rev. 63, 63–93. doi: 10.1111/iere.12541

Buigut, S., and Kapar, B. (2023). How did Brexit impact EU trade? Evidence from real data. World Econ. 46, 1566–1581. doi: 10.1111/twec.13419

Caldara, D., and Kamps, C. (2017). The analytics of svars: a unified framework to measure fiscal multipliers. Rev. Econ. Stud. 84, 1015–1040. doi: 10.1093/restud/rdx030

Crowley, M. A., Exton, O., and Han, L. (2020). The looming threat of tariff hikes: entry into exporting under trade agreement renegotiation. AEA Papers Proc. 110, 547–551. doi: 10.1257/pandp.20201020

De Lucio, J., Mínguez, R., Minondo, A., and Requena, F. (2024). The negative impact of disintegration on trade: the case of Brexit. Eur. Econ. Rev. 163, 1–18. doi: 10.1016/j.euroecorev.2024.104698

Dhingra, S., Huang, H., Ottaviano, G., Pessoa, J. P., Sampson, T., and Reenen, J. V. (2017). The costs and benefits of leaving the EU: trade effects. Econ. Policy 32, 651–705. doi: 10.1093/epolic/eix015

Douch, M., Du, J., and Vanino, E. (2020). Defying Gravity? Policy Uncertainty, Trade Destruction and Diversion. Research Paper No. 3. Lloyds Banking Group Centre for Business Prosperity. Available at: https://www.research.ed.ac.uk/en/publications/defying-gravity-policy-uncertainty-trade-destruction-and-diversio

Felbermayr, G., Groschl, J., and Steininger, M. (2017). Britain Voted to Leave the EU: Brexit Through the Lens of New Quantitative Trade Theory. EconPol Policy Report, No. 04, Institute - Leibniz Institute for Economic Research at the University of Munich. Available at: https://hdl.handle.net/10419/219507

Fernandes, A. P., and Winters, L. A. (2021). Exporters and shocks: the impact of the Brexit vote shock on bilateral exports to the UK. J. Int. Econ. 131, 1–22. doi: 10.1016/j.jinteco.2021.103489

Figueira, F., and Martill, B. (2020). Bounded rationality and the Brexit Negotiations: Why Britain failed to understand the EU. J. Eur. Public Policy 28, 1871–1889. doi: 10.1080/13501763.2020.1810103

Flinders, M. (2020). ‘Not a Brexit election? Pessimism, promises and populism “UK-style”’. Parliam. Aff. 73(Suppl. 1), 225–242. doi: 10.1093/pa/gsaa030

Godefroidt, A., Dyrstad, K., and Bakke, K. (2022). The past, Brexit, and the future in Northern Ireland: a quasi-experiment. J. Elect. Public Opin. Part. 33, 149–161. doi: 10.1080/17457289.2022.2090951

Griffith, R., Levell, P., and Norris Keiller, A. (2021). Potential Consequences of Post-Brexit Trade Barriers for Earnings Inequality in the UK. Economica. 88, 1–24. doi: 10.1111/ecca.12381

Hantzsche, A., Kara, A., and Young, G. (2019). The economic effect of the UK government's proposed Brexit deal. World Econ. 42, 5–20. doi: 10.1111/twec.12770

Imbs, J., and Mejean, I. (2017). Trade elasticities. Rev. Int. Econ. 25, 383–402. doi: 10.1111/roie.12270

James, S., and Quaglia, L. (2020). “Brexit and the future UK-EU relationship,” in The UK and Multi-level Financial Regulation (Oxford University Press), 150–178. doi: 10.1093/oso/9780198828952.003.0009

Kellard, N. M., Kontonikas, A., Lamla, M., and Maiani, S. (2021). Deal or no deal? Modelling the impact of Brexit uncertainty on UK Private Equity Activity. Br. J. Manag. 33, 46–68. doi: 10.1111/1467-8551.12479

Khokhar, T., and Vaid, V. (2017). World Bank Open Data. Available at: https://data.worldbank.org/ (accessed June 16, 2024).

Kren, J., and Lawless, M. (2022). “How has Brexit changed EU-UK trade flows?,” in ESRI Working Paper [Dublin: The Economic and Social Research Institute (ESRI)], 735.

Latorre, M. C., Olekseyuk, Z., Hidemichi, Y., and Sherman, R. (2020). Making sense of Brexit losses: an in-depth review of macroeconomic studies. Econ. Model. 89, 72–87. doi: 10.1016/j.econmod.2019.10.009

Leys, D., and Dolle, T. (2017). The trade and Customs law consequences of Brexit. Global Trade Cust. J. 12, 117–124. doi: 10.54648/GTCJ2017017

Li, Y. Y. (2023). Britain's economic crisis in mini-budget perspective. Acad. J. Manag. Soc. Sci. 2, 1–5. doi: 10.54097/ajmss.v2i1.5400

MacLeavy, J., and Jones, M. (2021). Brexit as Britain in decline and its crises (revisited). Polit. Q. 92, 444–452. doi: 10.1111/1467-923X.13039

Mathieu, C. (2020). Brexit: What economic impacts does the literature anticipate? Rev. l'OFCE 3, 43–81. doi: 10.3917/reof.167.0043

Minford, P., and Zhu, Z. (2024). Modeling the effects of Brexit on the British economy. J. Forecast. 43, 1114–1126. doi: 10.1002/for.3076

Murphy, M. C. (2021). Northern Ireland and Brexit: where sovereignty and stability collide? J. Contemp. Eur. Stud. 29, 405–418. doi: 10.1080/14782804.2021.1891027

Oberhofer, H., and Pfaffermayr, M. (2017). “Estimating the trade and welfare effects of brexit: a panel data structural gravity model,” in WIFO Working Papers, 2–32. doi: 10.2139/ssrn.3129951. Available at: https://ideas.repec.org/p/wfo/wpaper/y2017i546.html

Oberhofer, H., and Pfaffermayr, M. (2021). Estimating the trade and welfare effects of Brexit: a panel data structural gravity model. Can. J. Econ. 54, 338–375. doi: 10.1111/caje.12494

Office for National Statistics (2024). Available at: https://www.ons.gov.uk/ (accessed June 16, 2024).

Ryan, J. M. (2023). How Brexit damaged the United Kingdom and the City of London. Econ. Voice 20, 179–195. doi: 10.1515/ev-2022-0042

Simionescu, M. (2018). The impact of Brexit on the UK inwards FDI. Econ. Manag. Sustain. 3, 6–20. doi: 10.14254/jems.2018.3-1.1

Springford, J. (2022). The Cost of Brexit to June 2022. Available at: https://www.cer.eu/insights/cost-brexit-june-2022 (accessed September 5, 2024).

Stack, M. M., and Bliss, M. (2020). EU economic integration agreements, Brexit and trade. Rev. World Econ. 156, 443–473. doi: 10.1007/s10290-020-00379-x

Van Reenen, J. (2020). The Cost of Brexit Is Likely to be More Than Double That of Covid - it Must be Delayed. Available at: https://blogs.lse.ac.uk/brexit/2020/10/22/the-cost-of-brexit-is-likely-to-be-more-than-double-that-of-covid-it-must-be-delayed/ (accessed September 5, 2024).

Vandenbussche, H., Connell, W., and Simons, W. (2017). “Global value chains, trade shocks and jobs: an application to Brexit,” in CEPR Working Paper DP12303. doi: 10.2139/ssrn.3052259

Yotov, Y. V., Piermartini, R., Monteiro, J. A., and Larch, M. (2016). An Advanced Guide to Trade Policy Analysis: The Structural Gravity Model. Geneva: World Trade Organization.

Appendix

Keywords: Brexit, inflation, the Cost of Living, 2024 UK Parliamentary Elections, trade regimes

Citation: Kurecic P and Kokotovic F (2024) Potential impact of the 2024 UK Parliamentary Elections: the long shadow of Brexit. Front. Polit. Sci. 6:1467452. doi: 10.3389/fpos.2024.1467452

Received: 19 July 2024; Accepted: 16 September 2024;

Published: 10 October 2024.

Edited by:

Yen-Chiang Chang, Dalian Maritime University, ChinaReviewed by:

Erick da Luz Scherf, University of Alabama, United StatesNelly Tincheva, Sofia University, Bulgaria

Copyright © 2024 Kurecic and Kokotovic. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Petar Kurecic, cGV0YXIua3VyZWNpY0B1bmluLmhy

Petar Kurecic

Petar Kurecic Filip Kokotovic

Filip Kokotovic