95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Phys. , 17 March 2025

Sec. Social Physics

Volume 13 - 2025 | https://doi.org/10.3389/fphy.2025.1548204

The structure of the bank-firm loan network is crucial for understanding the transmission of systemic risk within the banking system. Drawing on complex network theory, this study analyzes loan data from 370 Chinese commercial banks spanning January 2013 to December 2023 to construct a syndicated loan network, wherein different banks lend to the same enterprise. This analysis reveals how the structure of this network influences systemic risk in the banking sector across various periods. Our findings indicate that, in the long term, network density and centralization significantly mitigate systemic risk, whereas transitivity and average clustering coefficients have a positive effect on systemic risk. In the short term, the network demonstrates strong mean-reverting properties. Additionally, we observe a noteworthy phenomenon: the bank-firm loan relationships exhibit a ‘core-periphery’ hierarchical structure, characterized by a network that is both robust and fragile. These insights offer a novel perspective on the relationship between bank network structures and systemic risk, contributing to the interdisciplinary application of physics in economic and financial studies.

Banks play a crucial role in the financial systems and economic growth of countries [1]. As the primary intermediaries of capital flows, banks not only provide essential financing support to the real economy but also significantly promote the growth of social financing. From March 2015 to March 2024, the renminbi loans extended by Chinese financial institutions to the real economy increased from 85.09 trillion yuan to 244.59 trillion yuan, representing an average of 61.5% of the total social financing scale. This trend indicates that the real economy is highly reliant on bank loans for financing [2, 3], particularly large enterprises that utilize bank financing to sustain their operations and expand, thereby underscoring the indispensable role of banks in economic development.

Bank loans are an essential corporate financing tool in contemporary financial markets. They not only address the substantial financing needs of enterprises but also facilitate the efficient allocation of financial resources, thereby serving as a crucial pillar for economic growth. However, with the rapid advancement of financial markets and the deepening of financial innovation, bank loans have transformed from simple credit transactions into a complex network of bank-firm loans [4]. This networked characteristic has not only improved financing efficiency but also introduced new challenges: the high interconnectedness among banks, as well as between banks and enterprises, may result in the swift transmission and accumulation of risks within the network, potentially jeopardizing the stability of the financial system [5].

Despite this, traditional financial regulation often prioritizes the risk status of individual commercial banks, neglecting the influence of interbank interconnectedness on systemic risk. This oversight was starkly illustrated during the 2008 global financial crisis, which revealed that the intricate network relationships among banks could intensify risk transmission and increase the likelihood of systemic collapse [6]. In recent years, chain reactions initiated by problems within individual banks—such as the successive failures of Silicon Valley Bank, Signature Bank, and First Republic Bank—have further underscored the necessity of addressing systemic risk within the banking system [7]. When a single bank within the system encounters difficulties, these complex interconnections can trigger a chain reaction throughout the entire network, generating systemic risk and posing a significant threat to the sustainable development of the national economy.

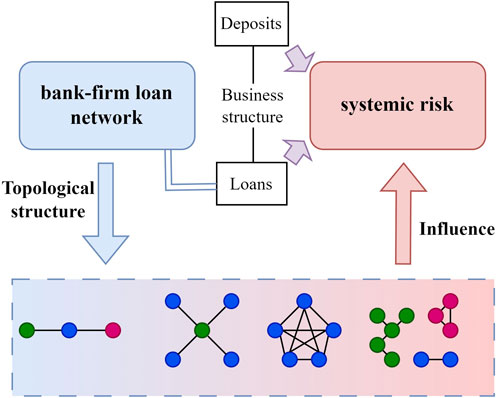

Given the complex and interconnected nature of the banking system [8], when individual banks within this system face difficulties, it may trigger a chain reaction throughout the entire banking network, resulting in systemic risk [9]. Systemic risk refers to the potential for a chain reaction initiated by the failure of a single node or a localized event within a system, which can ultimately result in the loss of functionality or the collapse of the entire system [6, 10]. characteristics of loss-sharing and risk transmission between the banking system and the real economy highlight the interconnectedness and cohesiveness of the banking system, as well as its links to the real economy, which are primary sources and accelerators of systemic risk formation and propagation (as illustrated in Figure 1). Consequently, the implementation of macroprudential regulatory tools to address issues of interbank interconnectedness has become essential for preventing systemic risk.

Figure 1. The impact of the network structure of bank-firm loans on systemic risk in the banking system.

This study makes three significant contributions to the existing literature. First, it offers broader sample coverage. Unlike previous studies that typically focus on a limited sample of listed banks or systemically important banks [11], this research utilizes a comprehensive loan dataset encompassing 370 Chinese commercial banks. This dataset includes banks of various sizes and types, thereby significantly enhancing the breadth of the research and the generalizability of the findings. It provides a more robust empirical foundation for understanding the overall network characteristics and risk relationships within the Chinese banking system. Second, the study employs a complex network model to illustrate the bank-firm loan network, quantifying the dynamic evolution of loan relationship structures over different periods by extracting network features such as density, centralization, transitivity, and clustering coefficient. Third, to thoroughly explore the dynamic relationship between loan relationship structures and systemic risk, the study employs the ECM to differentiate and validate short-term and long-term impacts. Through this approach, the study not only elucidates how the structural characteristics of the loan network influence systemic risk across various time scales but also offers policymakers more targeted, time-sensitive risk management recommendations.

The remainder of this paper is organized as follows: Section 2 reviews and summarizes the main points and findings of existing literature. Section 3 details the research methodology employed, including the construction of the stress index, network construction, and the error correction model. Section 4 presents the empirical analysis results. Section 5 discusses the conclusions and policy recommendations of this study and proposes directions for future research.

China’s financial system is predominantly bank-driven [12, 13]. Existing literature on financial systemic risk has primarily concentrated on modeling interbank lending markets [14–16]. However, the increasing scale of renminbi loans extended by Chinese financial institutions to the real economy suggests that financing for the real economy remains largely reliant on bank loans. In particular, some large enterprises, which possess thousands of subsidiary companies, have substantial credit lines and loan amounts [17]. These enterprises typically serve as the core of supply chains [18], linking numerous upstream and downstream firms of various types. The business activities of these enterprises not only influence the sound operation of the financial institutions that provide financing but also significantly impact the overall structure and stability of the financial network.

Currently, there are limited studies that construct bank-firm loan networks based on bank-firm lending data [19–21]. Syndicated loans serve as a financial tool whereby banks collaborate to address the substantial financing needs of enterprises [22, 23]. In contrast to traditional single-bank loans, syndicated loans allow multiple banks to share both risk and return, thereby providing enterprises—especially those engaged in capital-intensive and green projects—with more reliable financing options [24, 25]. In recent years, syndicated loans have gained widespread adoption globally and have become a crucial area for examining the relationship between systemic risk in banking [19]. The credit lending activities between banks and enterprises establish complex relationships, forming an interdependent financial network within the system through credit-based lending [6].

The credit lending activities between banks and enterprises create complex relationships, forming an interdependent financial network within the banking system. Graph theory provides a natural conceptual framework for analyzing this network. In this framework, participants within the banking system are represented as nodes, while the connections between them indicate relationships, thereby depicting the entire banking system as a network [26]. When a bank node encounters issues, other bank nodes in the network may also be affected through these connections. Network models, which are capable of illustrating risk transmission within the banking system on a micro-level while simultaneously reflecting and predicting the impact of contagion on the broader economic system at a macro-level, have garnered increasing research attention for modeling banking and economic systems [19, 26, 27]. Consequently, complex network theory has emerged as a valuable tool for analyzing and predicting banking risk contagion.

By selecting appropriate metrics to describe the characteristics of the bank-firm loan network, the structure of these relationships can be quantified. Multiple methods are currently available for feature extraction or identification within networks, including neural networks [28], CART decision trees [29], Bayesian networks [30], and complex network models [31, 32]. Among these methods, indicators such as network density, network centralization, transitivity coefficient, and average clustering coefficient in complex network models effectively reflect the concentration of risk, potential contagion strength, and degree of risk clustering within the bank-firm loan network. Therefore, this study employs a complex network model to extract the features of the bank-firm loan network between banks and enterprises, with the aim of quantifying the evolution of interbank risk correlation structures over different periods.

Existing research has examined the characteristics of bank-firm loan networks between banks and enterprises, as well as their impact on the banking system and the economy from various perspectives. Some scholars have concentrated on the topological structure of these networks and their role in risk contagion. For example, network density and centralization are regarded as effective measures of the concentration and dispersion of risk within loan networks [33]. A higher network density signifies closer interbank collaboration, which aids in distributing loan risk; however, excessive centralization may result in the accumulation of systemic risk at certain critical nodes, thereby posing a threat to the overall stability of the network [34].

On the other hand, the contagion properties within bank-firm loan networks have also drawn significant attention from the academic community. Research indicates that when a default event occurs at an enterprise or bank node, its effects can propagate through the network structure, thereby accelerating the formation and dissemination of systemic risk [6, 35]. In light of this, optimizing the structure of bank-firm loan networks to achieve a balance between risk and return has emerged as a primary concern for scholars and policymakers.

The Financial Market Stress Index has proven effective in assessing systemic risk conditions within financial systems and in identifying risk events, thereby offering practical implications [32, 36, 37]. The emphasis is placed on comparing financial risks rather than on absolute values to monitor the operations of financial markets.

This study utilizes the Chinese Banks Stress Index (CBSI) synthesis method of cumulative distribution function [32, 38], which involves ranking the original observed indicators

where the subscript

Using the empirical cumulative distribution function, we map the observed values representing risk conditions to the interval (0,1]. To give the stress index a more intuitive economic meaning, each mapped indicator is equally weighted to synthesize the CBSI. The CBSI is constructed as follows:

where

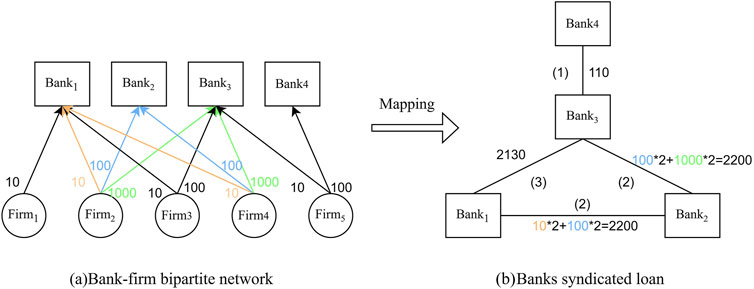

Following the approach outlined by Hao et al. and Jia et al. [19, 39], this study begins by analyzing loan data from publicly listed companies. A connection is established between a bank and a listed company if a loan is extended during a specific period; otherwise, the connection is considered absent. Figure 2a depicts a simplified bipartite network consisting of four banks and five listed companies. To focus on the interbank network structure, the bipartite network is transformed into a network comprising only commercial banks, where each bank serves as a node. To measure the strength of connections between banks and listed companies, the study opts not to use the number of loans as the weight of the link [19]. Instead, the loan amount shared by two banks with a bank-firm loan relationship is utilized as the link weight between them. For instance, Bank one and Bank three have a shared loan relationship with three companies (Company 2, Company 3, and Company 4), resulting in a link weight of

Figure 2. Network mapping of bank-firm loan relationships. (a) Bank-firm bipartite network, (b) Banks syndicated loan.

The mapped one-mode commercial bank network is denoted by set

In this study, we analyze a weighted undirected network, where

The unique characteristics of the topological structure of the bank-firm loan network may exhibit specific properties that cannot be fully captured through network diagrams alone. Hence, choosing suitable measurement criteria becomes crucial in examining the topological characteristics and evolutionary trends of bank-firm loan networks. This research delves into four complex network topological metrics to investigate the alterations in the general properties of commercial banking bank-firm loan network, including network density, network centralization, transitivity coefficient, and average clustering coefficient.

The density of a network is a metric that quantifies the level of connection between nodes in the network and is computed by dividing the existing edges by the total potential edges. It is denoted by a numerical value ranging from 0 to 1, wherein higher values signify increased interconnectedness. The calculation for network density can be expressed by the following Equation 4:

where

Within the framework of the bank-firm loan network in commercial banking, a higher level of network density suggests an increased amount of bank-firm loan relationships between banks, leading to a more varied network configuration. With a constant total loan demand from enterprises, this diversification allows the risk of bank-firm loans from a single bank to be spread across multiple banks, avoiding the concentration of risk in any one bank. As a result, in the event of a risk occurrence in one bank, other banks can help absorb and distribute this risk through diverse connections, ultimately reducing systemic risk.

Network centralization measures the importance of specific nodes within a network. Centralization is highest in star-shaped networks and lowest in fully connected networks. The calculation for centralization can be expressed by the following Equation 5:

where

In the specific case of the bank-firm loan network, centralization refers to the extent to which a small number of banks have control over loan relationships. A high level of centralization suggests that these banks wield significant influence and control within the system, and their risk status can greatly affect systemic risk.

According to Barrat et al. [41], the transitivity coefficient is a measure that indicates the probability of neighboring nodes being linked to a particular node, reflecting the degree of clustering within the network. Increased transitivity coefficient values indicate more pronounced clustering among nodes in the network, particularly in the realm of weighted networks. The calculation for transitivity can be expressed by the following Equations 6, 7:

where

In the bank-firm loan network of commercial banks, a high transitivity coefficient suggests the existence of triangular connections among banks. For instance, if Bank A is in a loan agreement with Bank B, and Bank B has a loan deal with Bank C, it implies that Bank A is also connected with Bank C through a loan arrangement. These triangular connections generate additional routes for risk transmission, potentially increasing systemic risk.

The average clustering coefficient is calculated as the mean value of the clustering coefficients in the network. This coefficient represents the degree to which nodes are interconnected within their immediate surroundings. The calculation for average clustering coefficient can be expressed by the following Equations 8, 9:

where

Within the bank-firm loan network, the clustering coefficient reflects the tightness of the network, showing the level of interconnected bank-firm loan relationships among banks. A high average clustering coefficient indicates the presence of numerous small cliques or subnetworks among the banks. These closely linked groups can accelerate the spread of risk within cliques, potentially affecting the overall stability of the banking system.

Constructing a monthly trade network of bank-firm loans among various commercial banks reveals evolving syndication relationship structures over time. This study seeks to investigate how these relationship characteristics impact banks’ systemic risk. While the ordinary least squares (OLS) method is commonly used, it assumes that economic variables are stationary. However, many macroeconomic variables are time series data and nonstationary in practice. Utilizing the OLS method in such cases can lead to ‘spurious regression.’ Engle and Granger [42] introduced the cointegration method and ECM to address this issue by examining the significance of variable coefficients to determine short-term and long-term relationships among variables. Therefore, this research aims to empirically analyze the network structure characteristics of the commercial banking system and banks’ systemic risk using cointegration and ECM methods. The model is outlined as follows:

Equation 10 represents the cointegration regression equation, while Equation 11 represents the ECM. In these equations,

China has not faced systemic banking risk; therefore, the banking stress index is utilized to assess systemic risk. Monthly data on various factors, such as the nonperforming loan ratio (NPL), the TED spread, the weighted interest rate of the 7-day interbank pledged repo (RR), the liquidity ratio (LR), the capital adequacy ratio (CR), and the excess reserve ratio (PR) from January 2013 to December 2023 were collected. By applying Formulas 1, 2, a monthly CBSI was calculated for the mentioned period. All the data used in this analysis were obtained from the WIND database. To address the fact that NPL, LR, CR, and PR are reported quarterly, cubic spline interpolation was employed to convert quarterly data into monthly data. The systemic stress index for commercial banks, synthesized using the cumulative distribution function method in this study, is calculated as shown in Equation 12:

Where,

Figure 3 illustrates the monthly trend of the CBSI from January 2013 to December 2023. This index is constructed from multiple indicators, including the nonperforming loan ratio (NPL), the TED spread, the 7-day interbank pledged repo weighted interest rate (RR), the liquidity ratio (LR), the capital adequacy ratio (CR), and the excess reserve ratio (PR). Data obtained from the WIND database reflects systemic risk within the Chinese banking sector over time. Key observations include the ‘money shortage’ events in June and December 2013, which resulted in a significant increase in liquidity risk for commercial banks; the prolonged Sino-US trade war during 2018–2019, which hampered trade financing and credit activities, leading to a deterioration in asset quality within affected industries and an escalation of the CBSI; and the financial strain on enterprises during the COVID-19 pandemic (2020-2021). This strain was coupled with diminished demand for corporate loans and challenges in loan repayments, which exerted additional pressure on the banking sector, culminating in a peak of the CBSI in December 2021.

This index effectively captures the varying levels of systemic risk confronting Chinese commercial banks, closely aligning with real-world events and reflecting the broader economic challenges faced by the banking industry during these periods.

This study establishes a bank-firm loan network among Chinese banks by analyzing loan data from listed companies in the CSMAR database. The dataset covers the period from January 2013 to December 2023 and includes five state-owned commercial banks, 13 joint-stock commercial banks, 125 urban commercial banks, and 227 rural commercial banks, for a total of 370 commercial banks. The data processing steps involved excluding information from the People’s Bank of China, three policy banks, foreign banks, and some nonbanking financial institutions to ensure sample homogeneity. Additionally, invalid data such as undisclosed loan details, non-RMB settlements, vague bank names, and loans from nontraditional banks were eliminated. The monthly aggregation of daily loan data and consolidation of loans from different branches at the head office level resulted in 132 months of data and 84,210 bank loan records. Considering that bank-firm loan involve long-term loan risks, this study focuses on the stock amount of bank-firm loans between banks.

Figure 4 illustrates the evolution of the bank-firm loan network in China, highlighting the relationships between banks and firms in December of each year from 2013 to 2023. The network comprises various types of banks, with state-owned commercial banks (red triangles) and joint-stock commercial banks (blue quadrilaterals) forming the core tier, while urban commercial banks (green pentagons) and rural commercial banks (yellow circles) occupy the periphery. Key observations include: (1) December 2013: The bank-firm loan relationships were predominantly organized into dense clusters led by large banks, with limited inter-cluster connections. This suggests that financial activities were concentrated in the core institutions, while peripheral banks had fewer direct connections to firms. (2) December 2023: Over the years, the network has evolved to become more interconnected, forming a ‘core-periphery’ tiered structure [43–45]. This indicates that smaller banks are gradually becoming more integrated into the financial system, contributing to better resource allocation and risk diversification. (3) The transformation of the network into a ‘group loan model’ signifies that multiple city commercial banks are now revolving around key listed companies. This shift underscores the growing role of small- and medium-sized banks in crucial financial activities, enhancing the inclusivity and sustainability of the financial system. (4) The increasing involvement of city and rural commercial banks at the network’s center suggests that these banks are emerging as new “systemically important institutions” [46, 47], reflecting a trend toward a more balanced and equitable distribution of financial resources, particularly between urban and rural areas.

This evolution enhances the overall resilience and stability of the financial system, contributing to improved financial inclusion and a more sustainable allocation of resources.

Figure 5 illustrates the evolution of four key topological indicators—network density, network centralization, transitivity coefficient, and average clustering coefficient—from January 2013 to December 2023. These indicators provide critical insights into the structure and dynamics of the bank-firm loan network, highlighting the changing patterns of collaboration among commercial banks in China over the past decade. Key observations include: (1) Network Density: Fluctuating between 0.22 and 0.25, network density exhibits a cyclical pattern. During periods of robust economic activity, density increases as bank-firm loan relationships expand, indicating more frequent collaborations. Conversely, during economic downturns, the frequency of interbank cooperation diminishes, resulting in reduced density. This trend suggests that the network is highly responsive to economic conditions, with banks adjusting their loan relationships in response to fluctuations in demand. (2) Network Centralization: Ranging from 0.50 to 0.55, network centralization remains relatively stable, albeit with some volatility. A higher centralization score indicates that certain banks consistently occupy central roles within the network, underscoring their significance in lending activities and their influence on systemic risk. (3) Transitivity Coefficient: With an average value of approximately 0.50, the transitivity coefficient remains stable over time. This stability suggests that banks in the network tend to maintain consistent relationships with their partners, thereby reinforcing a dense and stable cooperation structure. (4) Average Clustering Coefficient: Varying between 0.18 and 0.20, the clustering coefficient shows a gradual increase over the period. This trend indicates that interbank cooperative relationships are becoming more tightly-knit, reflecting a clustering effect. A higher clustering coefficient may signify stronger, more resilient cooperative ties among banks, which could contribute to enhancing the stability of the financial system.

The dynamic analysis of these indicators offers a deeper understanding of how changes in bank-firm loan networks can influence systemic risk, highlighting the evolving nature of interbank collaborations. This comprehensive view is crucial for assessing financial stability and formulating policies to mitigate potential risks in the banking sector.

This study draws on the relevant literature on financial crises and includes traditional macrolevel control variables. These variables consist of the year-on-year growth rate of the money supply (M1), which reflects the central bank’s monetary policy position; the banking prosperity index (Bank); and the corporate prosperity index (Cop). Detailed descriptive statistics can be found in Table 1.

The ADF unit root test method was used to assess the stationarity of the variables, with the lag length determined based on the Akaike information criterion (AIC). The test results in Table 2 reveal that the original variables all fail to reject the null hypothesis, indicating that they are nonstationary series. However, after first-order differencing, the ADF values of the variables are all below the critical value at the

This study utilizes the Engle-Granger two-step method to investigate the cointegration between variables [42]. The first step involves using the ordinary least squares method to regress the equation formulated in Equation 10, which depicts the correlation between the bank-firm loan network structure and the systemic risk of commercial banks. The findings of the model calculations are outlined in Equation 13.

Subsequently, the residual series

The regression results in Table 4 indicate that the long-term impact coefficients of the bank-firm loan network structure on the systemic risk of banks are statistically significant. The regression coefficient for network density is −1.3267 and is almost significant at the

Similarly, the regression coefficient for network centralization is −0.5882, which is also nearly significant at the

The regression coefficient for the transitivity coefficient is 1.5296, which is statistically significant at the

Similarly, the regression coefficient for the average clustering coefficient is 0.9977, which is also significant at the

To summarize, the results of the regression analysis indicate that the structural features of the network formed by bank-firm loans play a significant role in the overall risk faced by commercial banks. More precisely, network density and centralization are found to reduce systemic risk, whereas the transitivity coefficient and average clustering coefficient are associated with an increase in systemic risk. Additionally, the degree of monetary policy tightness is shown to have a moderate effect on systemic risk. These results provide concrete data that elucidate the relationship between interbank network structures and systemic risk, offering valuable insights for both bank risk mitigation strategies and policy-making.

The research reveals a notable long-term equilibrium relationship between the structure of the bank-firm loan network and systemic risk within banking institutions. However, there can be short-term deviations from this equilibrium. To remedy these deviations, the lagged term of the residuals from Equation 13 functions as the lagged error correction term. This effectively integrates both the short-term and long-term impacts of the bank-firm loan network structure on systemic risk in banks. Equation 11 defines the error correction model, with Equation 14 illustrating the derived effects of the bank-firm loan network structure on systemic bank risk.

Equation 14 depicts the short-term dynamic adjustment relationship between variables. The error correction model results are detailed in Table 5, showing a significant adjustment speed coefficient of −0.4962 at the

This study explores the network of bank-firm loans between Chinese commercial banks through the analysis of loan announcements made by publicly traded companies. The evolution of its topological structure is examined using a complex network model. Additionally, an error correction model is employed to study how the bank-firm loan network structure impacts the systemic risk of commercial banks. The findings reveal that the connections among commercial banks in the modern banking system exhibit both resilience and vulnerability. The research results suggest the following:

The outcomes of the error correction model and the risk characteristics of the bank-firm loan network highlight the necessity of balancing “short-term stability” with “long-term sustainability” within the banking system for sustainable development. By optimizing loan network structures, fostering medium-to long-term cooperation, and strengthening risk-buffering mechanisms, banks can not only diminish their systemic risk but also more effectively support the sustainable development goals of society and the environment.

Based on the above conclusions, the following policy recommendations are proposed to effectively reduce systemic risk in commercial banks and achieve sustainable development in the banking sector.

While this study provides a comprehensive examination of the impact of bank-firm loan network structure on the systemic risk of commercial banks, several limitations must be acknowledged. Firstly, the analysis relies exclusively on loan data from publicly listed companies, whereas small and medium-sized enterprises (SMEs) are generally more susceptible to default risks. Secondly, we did not differentiate loan data across various industries, despite the fact that default risk associated with loans can vary significantly between sectors. Lastly, the ECM method does not comprehensively address all endogeneity issues, particularly the potential risks introduced by lagged variables. Due to constraints in the existing dataset and research design, more robust causal inference tools, such as the instrumental variable (IV) approach or a natural experiment framework, were not utilized in this study. Future research could benefit from incorporating loan data from SMEs and developing multi-layer network models to more effectively capture the network structures at the industry level. Additionally, further investigation into the influence of network structure on systemic risk is warranted. Furthermore, employing instrumental variables derived from exogenous shocks or utilizing a natural experiment framework should also be considered to enhance the robustness of conclusions through improved causal inference mechanisms. These significant issues will be explored in greater depth in our forthcoming studies.

The raw data supporting the conclusions of this article will be made available by the authors, upon reasonable request. Requests to access these datasets should be directed to Zhengyong Li, bHp5MzMwM0BvdXRsb29rLmNvbQ==.

ZL: Conceptualization, Funding acquisition, Methodology, Project administration, Software, Validation, Writing–original draft. DF: Conceptualization, Supervision, Writing–review and editing. HL: Data curation, Formal Analysis, Resources, Visualization, Writing–original draft.

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This research was funded by Gansu Provincial Department of Education University Faculty Innovation Fund Project (2024A-076), Gansu Provincial Department of Education Soft Science Special Youth Project (23JRZA438) and the doctoral research innovation project of Lanzhou University of Finance and Economics (2022D03).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

The author(s) declare that no Generative AI was used in the creation of this manuscript.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

1. Allen F, Qian J, Qian M. Law, finance, and economic growth in China. J financial Econ (2005) 77(1):57–116. doi:10.1016/j.jfineco.2004.06.010

2. He Z, Wei W. China’s financial system and economy: a review. Annu Rev Econ (2023) 15(1):451–83. doi:10.1146/annurev-economics-072622-095926

3. Jiménez G, Mian A, Peydró J-L, Saurina J. The real effects of the bank lending channel. J Monetary Econ (2020) 115:162–79. doi:10.1016/j.jmoneco.2019.06.002

4. Lu Y, Springer C, Steffen B. Cofinancing and infrastructure project outcomes in Chinese lending and overseas development finance. World Development (2024) 175:106473. doi:10.1016/j.worlddev.2023.106473

5. Jackson MO, Pernoud A. Systemic risk in financial networks: a survey. Annu Rev Econ (2021) 13(1):171–202. doi:10.1146/annurev-economics-083120-111540

6. Acemoglu D, Ozdaglar A, Tahbaz-Salehi A. Systemic risk and stability in financial networks. Am Econ Rev (2015) 105(2):564–608. doi:10.1257/aer.20130456

7. Erer E, Erer D. The domino effect of silicon valley bank’s bankruptcy and the role of fed’s monetary policy. Borsa Istanbul Rev (2024) 24(3):573–91. doi:10.1016/j.bir.2024.03.002

8. Chabot M, Bertrand J-L. Complexity, interconnectedness and stability: new perspectives applied to the european banking system. J Business Res (2021) 129:784–800. doi:10.1016/j.jbusres.2019.09.046

9. Gao Q, Fan H. Systemic risk caused by the overlapping portfolios of banks under a bilateral network. Front Phys (2021) 9:638991. doi:10.3389/fphy.2021.638991

10. Battiston S, Farmer JD, Flache A, Garlaschelli D, Haldane AG, Heesterbeek H, et al. Complexity theory and financial regulation. Science (2016) 351(6275):818–9. doi:10.1126/science.aad0299

11. Yan C, Ding Y, Liu W, Liu X, Liu J. Multilayer interbank networks and systemic risk propagation: evidence from China. Physica A: Stat Mech its Appl (2023) 628:129144. doi:10.1016/j.physa.2023.129144

12. Dong J, Yin L, Liu X, Hu M, Li X, Liu L. Impact of internet finance on the performance of commercial banks in China. Int Rev Financial Anal (2020) 72:101579. doi:10.1016/j.irfa.2020.101579

13. Allen F, Zhang C, Zhao M. China’s financial system: opportunities and challenges. (2012). doi:10.3386/w17828

14. Wang C, He J, Ma J. Indirect correlation network between banks based on common assets. China Manag Sci (2019) 27(11):23–30. doi:10.16381/j.cnki.issn1003-207x.2019.11.003

15. Wang Z, Zhao Q, Qiu L. Multi-dimensional factor correlation, multiple interbank network contagion, and conditional var of banks. Front Phys (2022) 10:895603. doi:10.3389/fphy.2022.895603

16. Anand K, Craig B, Von Peter G. Filling in the blanks: network structure and interbank contagion. Quantitative Finance (2015) 15(4):625–36. doi:10.1080/14697688.2014.968195

17. Chai S, Zhang K, Wei W, Ma W, Abedin MZ. The impact of green credit policy on enterprises’ financing behavior: evidence from Chinese heavily-polluting listed companies. J Clean Prod (2022) 363:132458. doi:10.1016/j.jclepro.2022.132458

18. Jie Z. Coupling open innovation: network position, knowledge integration ability, and innovation performance. J Knowledge Economy (2023) 14(2):1538–58. doi:10.1007/s13132-022-00932-z

19. Qingmin H, Shen JH, Lee C-C. Risk contagion of bank-firm loan network: evidence from China. Eurasian Business Rev (2023) 13(2):341–61. doi:10.1007/s40821-022-00237-w

20. Drago D, Gallo R. The impact of financial crises on the syndicated loan spreads applied to public and private firms. J Financial Stab (2020) 46:100718. doi:10.1016/j.jfs.2019.100718

21. Hasan I, Kim S-J, Politsidis PN, Wu E. Loan syndication under basel ii: how do firm credit ratings affect the cost of credit? J Int Financial Markets, Institutions Money (2021) 72:101331. doi:10.1016/j.intfin.2021.101331

22. Dennis SA, Mullineaux DJ. Syndicated loans. J financial intermediation (2000) 9(4):404–26. doi:10.1006/jfin.2000.0298

23. Gustafson MT, Ivanov IT, Meisenzahl RR. Bank monitoring: evidence from syndicated loans. J Financial Econ (2021) 139(2):452–77. doi:10.1016/j.jfineco.2020.08.017

24. Del Gaudio BL, Previtali D, Sampagnaro G, Verdoliva V, Vigne S. Syndicated green lending and lead bank performance. J Int Financial Management and Account (2022) 33(3):412–27. doi:10.1111/jifm.12151

25. Hale G, Meisenbacher B, Nechio F. Industrial composition of syndicated loans and banks’ climate commitments. Tech Rep Natl Bur Econ Res (2024) 2024:01–37. doi:10.24148/wp2024-23

26. Galletta S, Mazzù S, Naciti V. A bibliometric analysis of esg performance in the banking industry: from the current status to future directions. Res Int Business Finance (2022) 62:101684. doi:10.1016/j.ribaf.2022.101684

27. Liu J, Ding H, Shahroudy A, Duan L-Y, Jiang X, Wang G, et al. Feature boosting network for 3d pose estimation. IEEE Trans pattern Anal machine intelligence (2019) 42(2):494–501. doi:10.1109/tpami.2019.2894422

28. Xin R, Zhang J, Shao Y. Complex network classification with convolutional neural network. Tsinghua Sci Technol (2020) 25(4):447–57. doi:10.26599/tst.2019.9010055

29. Li H, Long F, Lin C. The impact of the overall network structure and cooperation intensity on innovation performance. Stud Sci Sci (2022) 1–18. doi:10.16192/j.cnki.1003-2053.20220602.001

30. Gandy A, Veraart LAM. A bayesian methodology for systemic risk assessment in financial networks. Management Sci (2017) 63(12):4428–46. doi:10.1287/mnsc.2016.2546

31. Xu J, Li J, Vincent C, Xin Z. Evolution of the rare earth trade network: a perspective of dependency and competition. Geosci Front (2024) 15(3):101653. doi:10.1016/j.gsf.2023.101653

32. Li M, Liang S. Monitoring systemic financial risks: construction and state identification of China’s financial market stress index. J financial Res (2021) 6:21–38.

33. Gai P, Kapadia S. Contagion in financial networks. Proc R Soc A: Math Phys Eng Sci (2010) 466(2120):2401–23. doi:10.1098/rspa.2009.0410

34. Bhattacharya M, Inekwe JN, Valenzuela MR. Credit risk and financial integration: an application of network analysis. Int Rev Financial Anal (2020) 72:101588. doi:10.1016/j.irfa.2020.101588

35. Pan H, Fan H. Systemic risk arising from shadow banking and sustainable development: a study of wealth management products in China. Sustainability (2024) 16(10):4280. doi:10.3390/su16104280

36. Gil-Alana LA, Abakah EJA, Abakah MK. Financial stress spillover across asian countries. Rev Financial Econ (2021) 39(2):146–62. doi:10.1002/rfe.1113

37. Sheng X, Kim WJ, Gupta R, Ji Q. The impacts of oil price volatility on financial stress: is the covid-19 period different? Int Rev Econ and Finance (2023) 85:520–32. doi:10.1016/j.iref.2023.02.006

38. Tan S-R, Li C, Yeap XW. A time-varying copula approach for constructing a daily financial systemic stress index. The North Am J Econ Finance (2022) 63:101821. doi:10.1016/j.najef.2022.101821

39. Jia K, He Y, Mohsin M. Digital financial and banking competition network: evidence from China. Front Psychol (2023) 13:1104120. doi:10.3389/fpsyg.2022.1104120

40. Freeman LC. Centrality in social networks: conceptual clarification. Social Netw Crit concepts Sociol (2002) 1:215–39. doi:10.1016/0378-8733(78)90021-7

41. Barrat A, Barthelemy M, Pastor-Satorras R, Vespignani A. The architecture of complex weighted networks. Proc Natl Acad Sci (2004) 101(11):3747–52. doi:10.1073/pnas.0400087101

42. Engle RF, Granger CWJ. Co-integration and error correction: representation, estimation, and testing. Econometrica: J Econometric Soc (1987) 55:251–76. doi:10.2307/1913236

43. Van der Leij M, Hommes C, Hommes C. The formation of a core-periphery structure in heterogeneous financial networks. J Econ Dyn Control (2020) 119:103972. doi:10.1016/j.jedc.2020.103972

44. Peng S, Tanna S, Zhou D. Financial contagion in a core-periphery interbank network. The Eur J Finance (2020) 26(7-8):691–710. doi:10.1080/1351847x.2019.1630460

45. Yanchenko E, Sengupta S. Core-periphery structure in networks: a statistical exposition. Statistic Surv (2023) 17:42–74. doi:10.1214/23-ss141

46. Jiang C, Sun Q, Ye T, Wang Q. Identification of systemically important financial institutions in a multiplex financial network: a multi-attribute decision-based approach. Physica A: Stat Mech Its Appl (2023) 611:128446. doi:10.1016/j.physa.2023.128446

Keywords: bank-firm loan network, systemic risk, topological structure, network formation, ECM

Citation: Li Z, Fu D and Li H (2025) The influence of bank-firm loan network structure on systemic risk: from the perspective of complex networks. Front. Phys. 13:1548204. doi: 10.3389/fphy.2025.1548204

Received: 19 December 2024; Accepted: 24 February 2025;

Published: 17 March 2025.

Edited by:

Satyam Mukherjee, Shiv Nadar University, IndiaReviewed by:

Haroldo V. Ribeiro, State University of Maringá, BrazilCopyright © 2025 Li, Fu and Li. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Zhengyong Li, bHp5MzMwM0BvdXRsb29rLmNvbQ==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.