- School of Business Administration, Liaoning Technical University, Huludao, Liaoning, China

The impact of financial institution governance on systemic risk is crucial and controversial. In view of the important role of fund shareholding in the corporate governance of financial institutions, this paper takes financial institutions in China as the research object, constructs the association network of financial institutions based on fund shareholding, and empirically examines the impact of fund shareholding in financial institutions on systemic risk. The results show that fund shareholding significantly increases the systemic risk of financial institutions through the network. Convergence in funds’ choice of investment targets is an important mechanism for risk contagion among banks, insurance companies, securities companies, and across sectors. The governance externality created by fund holdings in financial institutions is thus corroborated. Further analysis shows the peer effect of funds’ investment behaviour is an important cause of share price convergence and governance convergence of held financial institutions, while majority shareholder monitoring and information transparency can effectively curb systemic risk contagion from governance externality. The study confirms the proposition of corporate governance externality in financial institutions, enriches the formation mechanism of systemic risk contagion from the perspective of corporate governance, and provides a theoretical guideline for effectively curbing the systemic risk caused by governance externality.

1 Introduction

The modernisation of financial governance capacity and governance system is the necessary meaning of achieving Chinese-style modernisation, and the prevention of systemic financial risks is the fundamental task of financial work. As an important part of China’s financial system, financial institution’s quality of governance is related to China’s financial stability and high-quality economic development. The report of the 20th CPC National Congress mentions that “all types of financial activities should be brought under supervision in accordance with the law, and the bottom line of no systemic risk should be safeguarded”. With the high-speed development of the financial market, the degree of association between financial institutions is increasing (Upper, 2011) [1], when there is an extreme tail event, financial risk accumulates in the financial system and spreads to the whole financial system through the network of association, which will have an impact on the whole financial industry and jeopardise the safe development of the economy and finance (Fang and Liu, 2023) [2]. Therefore, the modernisation of the governance capacity of financial institutions is also an important tool to prevent systemic risk, but there is still some controversy in the academic community about the impact of corporate governance on systemic risk.

Among the share capital of financial institutions, the higher the proportion of institutional investors, the better the long-term performance of the share price (Hartzell and Starks, 2003; Ajinkya et al., 2005) [3, 4], so institutional investors’ shareholding has an irreplaceable role in enhancing the stability of financial institutions. The “Opinions” issued by the Securities and Futures Commission (SFC) in 2022 mentioned that “public funds, as an important institutional investor, play an increasingly important role in the reform, development and stability of the capital market”, and that the professional investment management capability behind the fund makes its investment targets the key focus of investors. In recent years, the fund’s top ten positions in the figure of financial stocks has increased, brokerage, insurance, banking stocks positions accounted for varying degrees of enhancement, the fund’s holdings of financial institutions will also affect the risk performance of financial institutions through the capital market and corporate governance channels.

Generally fund managers will diversify risks by constructing investment portfolios, according to the contagion hypothesis, some studies have shown that even institutional investors will have a herd effect when investing (Deng et al., 2018; Cai et al., 2019) [5, 6], fund managers not only make decisions through market information research, but also through the information network between them for communication and behavioural observation, and influence their own investment decisions (Pareek, 2012) [7]. The herd effect of institutional investors also increases the risk of stock price collapse of investment targets (Xu, 2013) [8], which in turn exacerbates the risk contagion effect and increases the probability of systemic risk events. This paper also confirms the above hypotheses through further empirical tests.

Meanwhile, with the continuous development of complex network measurement methods and systemic risk-related research, exploring the contagion effect of financial risk from the perspective of correlation networks has also become a new research field. Diebold and Yilmaz (2014) [9] explore the risk volatility spillovers in financial markets by constructing risk spillover networks, and Maghyereh et al. (2016) [10] build on this foundation to portrayed the linkages as well as the strength of contagion between different financial sectors and screened out risk spillover centres in the network. There is no lack of information-linked networks based on common shareholders or directors, and Ding and Cao (2013) [11] examined the relationship between management networks and bank risk from a social network perspective and demonstrated that management networks can inhibit bank risk. Wang et al. (2021) [12] examined the impact of network structure on bank efficiency and micro-mechanisms from a social network perspective by constructing a time-varying “bank-shareholder” network. Hong and Ouyang (2022) [13], on the other hand, constructed a financial equity knowledge graph based on a large-scale complex equity network, and analysed the causes and contagion channels of systemic risk.

Does the network among financial institutions formed by common fund holdings exacerbate systemic financial risks through the governance externality channel? The exploration of this question is important for clarifying the effects of systemic risk contagion through the channel of corporate governance externalities. However, existing research is still divided on the relationship between corporate governance and systemic risk. On the one hand, it has been argued that firms’ governance behaviours are affected by the decisions of other firms, leading to a convergence in the overall level of governance in the market (Bouwman, 2011) [14], which can lead to the contagion of systemic risk. On the other hand there are also studies that point out that institutional investors can play a positive regulatory role through cross-holdings, thus helping to mitigate the externality of risk contagion (He et al., 2019) [15]. Meanwhile, the cohort behaviour of institutional investors can inhibit shareholders’ self-interested behaviour (Liu and Gao, 2021) [16] and improve corporate governance through the method of “exit threat” (Firth et al., 2016; Lin and Fu, 2017) [17, 18], but there are also studies suggesting that the peer effect of institutional investors may also exacerbate the hollowing out behaviour of large shareholders (Wang et al., 2022) [19]. In studies related to the relationship between institutional investor shareholding and systemic risk, some scholars believe that institutional investor shareholding increases the risk of stock price collapse (Cao et al., 2015) [20], while others believe that institutional investor shareholding can inhibit the surge or plunge of stock prices (Gao et al., 2017) [21]. Thus, it seems that the current academic disagreement on the relationship between corporate governance and systemic risk focuses on the role of corporate governance externalities caused by institutional investors’ shareholding in influencing systemic risk, etc., so it is crucial to explore the impact of governance externalities of financial institutions on systemic risk.

In this regard, this study will explore the impact of financial institutions’ governance externalities on systemic risk from the perspective of fund holdings. Specifically, this study proposes a new fund holding network construction method on the basis of existing research, taking China’s listed financial institutions as the main body of the study, and the top ten shareholding funds that co-exist among financial institutions as the basis of the network linkage to construct the fund holding network. The study probes into the preference characteristics of financial institutions held by funds, and analyses the cross-sectoral systemic risk contagion effect of financial institutions caused by fund shareholding through governance externalities and its impact mechanism. The results of the study confirm that fund holding networks exacerbate systemic risk in financial institutions from the perspective of corporate governance externalities, enriching the study of the contagion mechanism of systemic risk and providing an important basis for the relevant authorities to prevent and control systemic risk caused by governance externality.

2 Literature review

2.1 Research on corporate governance externality

With the development of financial markets, firms have access to capital market funds through intermediaries other than banks, so it is more important to focus on the relationship between capital markets and firms (Schwarcz, 2008) [22]. Excessive risk-taking by systemically important firms is seen as one of the main causes of financial risk. If it is assumed that investors will oppose excessively risky firms, excessive risk-taking can be controlled and corporate governance regulated by adjusting management and investor interests, thus preventing systemically important firms from engaging in excessive risk-taking and improving the financial regulatory system (Schwarcz and Star, 2017) [23]. However, this assumption is flawed in that firms can engage in risk-taking behaviours that have a positive expected value for investors but a negative expected value for the public, thus giving rise to risky externalities, and in order to reduce systemic risk externalities, corporate managers should also have a certain level of social responsibility (Schwarcz, 2017) [24]. However, a firm’s governance decisions are also influenced by the decisions of other firms, Acharya and Volpin (2010) [25] found that firms’ employee compensation and the level of corporate governance are negatively correlated, and that firms with weak governance will instead offer more generous incentive compensation, leading to well-governed firms to pay too much, and this externality will also lead to a low level of governance in the market as a whole. The governance behaviour of firms will also influence the governance of other firms through the network of common directors, leading to a convergence of corporate governance behaviours in the market (Bouwman, 2011) [14], and thus the market needs stricter and more comprehensive regulation to intervene in the propagation of this systemic risk (Anabtawi and Schwarcz, 2011) [26]. He et al. (2019) [15] based on mutual fund proxy voting data to analyse the role of institutional cross-ownership in corporate governance and found that cross-ownership incentivises institutional investors to play a more active regulatory role, which would be a possibility for financial regulation to have the effect of mitigating risk contagion externalities.

Common institutional ownership also exerts synergistic governance effects on firms (Du et al., 2021) [27]. Crane et al. (2017) [28] found that institutional investors in the US basic market increased their voice in governance behaviours through grouping behaviours. Although the proportion of institutional investors in China is currently low, they can still enhance corporate governance through the governance model of “exit threat”, which in turn improves corporate performance and enhances shareholder value (Firth et al., 2016; Lin and Fu, 2017) [17, 18]. Cross-shareholding by common institutional investors can play the role of an information bridge between shareholding firms (Brooks et al., 2018) [29], and the effective dissemination of corporate information among institutional investors is fuelled by information networks (Kostovetsky and Manconi, 2024) [30]. Liu and Gao (2021) [16] argue that institutional group shareholding can also provide an effective curb on controlling shareholders’ self-interested behaviour, but some scholars believe that this cohort behaviour of institutional investors can result in their collusion with major shareholders, exacerbate major shareholders’ hollowing-out behaviour (Wang et al., 2022) [19], and elevate market risk. At the same time, the existence of agency problems due to information asymmetry may lead to the phenomenon of power abuse by shareholders (Li and Cai, 2024) [31], and the major shareholders may also hollow out listed companies by means of equity pledges (Li et al., 2023) [32]. However, the current academic research related to the formation mechanism of governance externalities due to fund shareholding is still in its infancy. This paper argues that the investment behaviour of funds has a governance convergence effect, which in turn affects the governance status of investee firms and inhibits shareholders’ risk-taking behaviour.

2.2 Research on governance externality and systemic risk contagion

Institutional investors tend to have higher expertise in making investment decisions, but they also have a certain degree of convergence. According to the peer effect, institutional investors form interconnected investment networks, and co-operation among network members can reduce competitive trading (Park et al., 2019) [33] and impede the rapid incorporation of private information into the stock price, whereas such co-operation may hide negative information about a firm, leading to an increase in the risk of information accumulation and centralised releases, and raising the likelihood of a stock price crash (Kothari and Wysocki, 2009; Hutton et al. 2009; Wu et al. 2019) [34–36]. This peer effect amplifies market uncertainty while reducing information transparency. The current regulatory system of the capital market still needs to be improved, institutional investors are more inclined to short-term speculation, and the increasing size of institutional investors in the market pushes the market bubble to inflate, thus contributing to the possibility of a sharp rise and fall in stock prices (Chen et al., 2010) [37]. Cao et al. (2015) [20] also argued that an increase in the proportion of shares held by institutional investors increases the risk of a firm’s future share price collapse. However, Gao et al. (2017) [21] take the opposite view that the increase in institutional investors’ shareholding can inhibit the surge or crash of firms’ share prices. While some studies point out that long-term institutional investor holdings can inhibit share price crashes, short-term institutional investor holdings can increase the likelihood of share price crashes (An and Zhang, 2013) [38], and studies have shown that the phenomenon of “group hugging” by institutional investors in their investments significantly increases the volatility of a company’s share price (Jiang and Qian, 2021) [39]. While the herd behaviour of institutional investors may further exacerbate market volatility (Palao and Pardo, 2017; Blasco et al., 2012) [40, 41], lead to distortion of stock prices and deviation from their true value (Gu et al., 2022) [42], and even exacerbate the vulnerability of the financial system, increasing the financial crisis possibility (Cai et al.,2019) [6].

Meanwhile, common institutional investors can promote inter-firm collusion and thus reduce firms’ investment efficiency (Azar et al., 2018) [43], and group-hugging behaviour represented by funds can also negatively affect firms’ investment efficiency, with non-state-owned firms being affected to a greater extent (Xue et al., 2022) [44]. Institutional investor hugging behaviour can also have an inverted U-shaped moderating effect on the rate of convergence of firms’ financial assets (Shao and Li, 2023) [45], and Wang and Yang (2024) [46] find that common institutional ownership can also promote the cohort effect of green innovation in the industry. Risk issues due to common institutional investor ownership and information sharing have gradually attracted academic attention, Guo et al. (2018) [47] confirm that important institutional investors in the network enhance market risk through information sharing and their own importance by constructing an institutional investor network, and Huang and Bai (2021) [48] also demonstrate network contagion when fund managers specify their investment strategies through an institutional investment relationship network. Therefore, fund holdings can affect the systemic risk of the held financial institutions through internal and external governance.

2.3 Institutional investors, fund holding network and systemic risk

Despite the strong information acquisition capabilities of institutional investors (Boehmer and Kelley, 2009) [49], with the current development of data analysis and decision-making algorithmic capabilities of institutional investors, their ability to mine information varies, and there is a potential correlation between the investment performance of institutional investors and their information acquisition capabilities (Bushee and Goodman, 2007) [50] At the same time, different types of institutional investors have different information advantages, so the heterogeneity of institutional investors will also lead to different decision-making tendencies when they participate in corporate decision-making (Brickley et al., 1988) [51], and heterogeneous investor shareholdings will also lead to different levels of impact on market risk, while An and Zhang (2013) [38] argue that stable and trading institutional investors have different impacts on the risk of stock price collapse.

The risk contagion effect represented by funds has gradually become a hot topic among the risk studies of mutual institutional investors. Li et al. (2017) [52] investigated the micro level of fund network information transfer effect affecting firms’ investment efficiency, while Luo et al. (2020) [53] explored its impact on the stock information environment by constructing a fund network. With the growing concern over the issue of contagion of relevant risks due to fund linkages, there is a general concern in the academic community that risks arising from fund collapses, as well as risks due to regulatory failures, are spreading through the system. Chan et al. (2007) [54] argue that hedge funds are closely related to systemic risk, and thus the exposure of the hedge fund industry may have a significant impact on the banking sector, leading to new systemic risk sources. Billio et al. (2012) [55] capture systemic risk among several financial sectors, including the fund industry, while Boyson et al. (2010) [56] demonstrate that large adverse shocks to fund liquidity can significantly increase risk contagion. Specifically, credit spreads, TED spreads, stock prices, and stock market liquidity have a significant impact on systemic risk contagion are significantly correlated.

In the process of risk contagion, the direct affiliation network or indirect information affiliation network formed by funds is often the main contagion channel, Greenwood et al. (2011) [57] analysed the relationship between the ownership structure of financial assets and non-fundamental risks based on the data of common stock holdings by US funds, Chen et al. (2017) [58] also found that by constructing an information network model of fund holdings, the network density increases the probability of extreme stock declines and rises, and the information sharing mechanism between funds is also prone to trigger black swan events. Braverman et al. (2018) [59], on the other hand, analysed the impact of the structural characteristics of fund common stockholding networks on fund returns through the relationship between funds’ common stockholding interactions. Guo and Li (2019) [60] empirically examined the mechanism by which information sharing among institutional investors affects the risk of stock price crashes based on data from China’s A-share market and public funds, and the study showed that information sharing among institutional investors reduces the risk of stock price crashes, and that information interactions in the social network can also have an impact on the fund’s position decisions as well as on the stock market price (Guo and Zhou, 2019) [61]. Wang et al. (2023) [62], on the other hand, based on the risk contagion model of fund common holdings, investigated the relationship between fund network centrality and fund systemic risk and its influence mechanism, and found that fund network centrality and fund systemic risk exhibit a significant positive correlation. Therefore, the investment behaviour of funds has significant externalities, and their investment risks may be transmitted to other financial institutions through the fund’s direct or indirect affiliation network, thus triggering systemic financial risks.

2.4 Review of the literature review

Academics have thoroughly explored the involvement of institutional investors in corporate governance and the mechanisms of network contagion of systemic risk. Specifically, current research has found that institutional investors can influence the level of corporate governance through the external governance of cross-holdings and the internal governance of influencing shareholders’ behaviours or remuneration, etc. At the same time, funds, as an important institutional investor, may also trigger a series of risks in the held company through the network of associations. However, from the perspective of governance externalities, research on the contagion effect of fund shareholding networks on the systemic risk of financial institutions and the formation mechanism of corporate governance externality has not received extensive attention.

In view of this, this study proposes a new fund holding network construction method, taking China’s listed financial institutions as the main body of the study, and the top ten shareholding funds co-existing among financial institutions as the basis of the network linkage to construct the fund holding network. The study probes deeply into the investment preferences of the funds and the resulting contagion effect of financial institutions’ governance externalities, and further analyses the impact mechanism of the fund holding network on the systemic risk of financial institutions from the internal and external governance channels of the financial institutions.

3 Methods

3.1 Data

This paper focuses on exploring the relationship between fund holding networks and systemic risk of financial institutions, and selects the panel data of 33 listed financial institutions in China for the period of January 2013 to December 2022 as the research sample to carry out a series of empirical analyses. The sample period includes a variety of important events that have an impact on financial system risk, such as monetary policy adjustment, fintech development and digital transformation, and the COVID-19 epidemic. At the same time, the paper identifies and controls for multiple variables that may affect this relationship, but the core analysis focuses on network centrality indicators and systemic risk indicators of financial institutions. These indicators reflect the location and importance of financial institutions in the network of fund holdings and aim to reveal their impact on the systemic risk of financial institutions.

Due to the limited number of listed financial institutions in China, especially under the premise of meeting multiple requirements such as the amount of data needed for the study, time span and data quality, this paper selects the sample financial institutions based on the principles of representativeness, data availability, sample size and industry distribution to ensure the broad applicability and reliability of the research results. Finally, according to the comprehensive situation of listed financial institutions in China, this paper selected 33 listed financial institutions as the research sample. These include 16 banks, four insurance companies, and 13 securities companies.

In order to ensure data quality, we firstly ensure that financial institutions have sufficient and comprehensive data during the sample period, which includes but is not limited to financial statements, transaction records, regulatory reports and other multi-dimensional data sources, so as to ensure that we can comprehensively reflect the financial institutions’ operating conditions and market performance. At the same time, the integrity of the data is strictly verified to avoid interference with the analysis results. Before the data analysis, we carried out detailed data cleaning and pre-processing work, including outlier treatment, missing value filling, data standardisation and normalisation and other steps, so as to eliminate the noise in the data and improve the efficiency and accuracy of data analysis.

The sample covers financial institutions of different natures, sizes and business scopes. The bank sample includes state-owned commercial banks, joint-stock commercial banks and city commercial banks with comprehensive and representative data during the sample period. The insurance company sample includes all the current listed insurance companies in China. The securities company sample includes representative and certain size securities companies with data available during the sample period. Despite the number of listed financial institutions in China is limited, the screened sample ensures that the characteristics of each type of financial institutions can be adequately represented. In addition, the balanced distribution of industries avoids the bias caused by the over-concentration of a single industry. Considering that due to the limitation of data availability, some financial institutions may be excluded due to unlisted, insufficient data disclosure or limited data availability, which may have some impact on the full representativeness of the sample. In this regard, this paper strengthens the robustness test along with the regression analysis in an attempt to maximise the comprehensiveness and accuracy of the study and seeks to provide a deeper insight into the complex mechanisms affecting the impact of the fund holding network on the systemic risk of financial institutions. This paper also explores the complex mechanism of fund holding network and financial institutions’ systemic risk.

Specifically, five state-owned commercial banks (Agricultural Bank of China, Bank of Communications, Industrial and Commercial Bank of China, China Construction Bank, Bank of China), eight joint-stock commercial banks (Ping An Bank, Shanghai Pudong Development Bank, Huaxia Bank, China Minsheng Bank, China Merchants Bank, China Industrial Bank, China Everbright Bank, and China CITIC Bank), as well as three city commercial banks (Bank of Ningbo, Bank of Nanjing, and Bank of Beijing), are selected for the bank sample. The insurance company samples are selected from Ping An Insurance Company of China, New China Life Insurance Company, China Pacific Insurance Company, and China Life Insurance Company. The sample of securities companies are selected from Guoyuan Securities, Guangfa Securities, Changjiang Securities, CITIC Securities, Sinolink Securities, Haitong Securities, Orient Securities, Everbright Securities, China Merchants Securities, Industrial Securities, Soochow Securities, Huatai Securities, and Founder Securities.

The sample interval of this paper is from 1 January 2013 to 31 December 2022. Some variables are missing due to individual data, then the missing sample data will be filled in during the subsequent empirical research using interpolation. The research data are obtained from CSMAR, Wind and Choice database.

3.2 Systemic risk indicator measurement

Based on the study of Adrian and Brunnermeier (2016) [63], the daily closing prices of individual stocks of financial institutions and the Shanghai Stock Exchange Index are selected to measure the financial institutions and financial system returns, and the systemic risk of financial institutions is measured based on the quantile regression method.

Where

Because this paper measures a dynamic indicator of systemic risk, its evolution is not only driven by a single factor, but also by multiple factors, such as regulatory policy adjustments, changes in market conditions, and unforeseen events, at which point the value of systemic risk fluctuates to some degree, and this fluctuation is universal among financial institutions. For example, when the COVID-19 pandemic occurred, the systemic risk of financial institutions all showed an upward trend. In order to cope with the impact of other event shocks on the results of the systemic risk of this study, this paper controls the relevant factors in the control variables and ensures the validity of the study through methods such as the robustness test.

3.3 Fund holding network construction and topological characteristics measurement

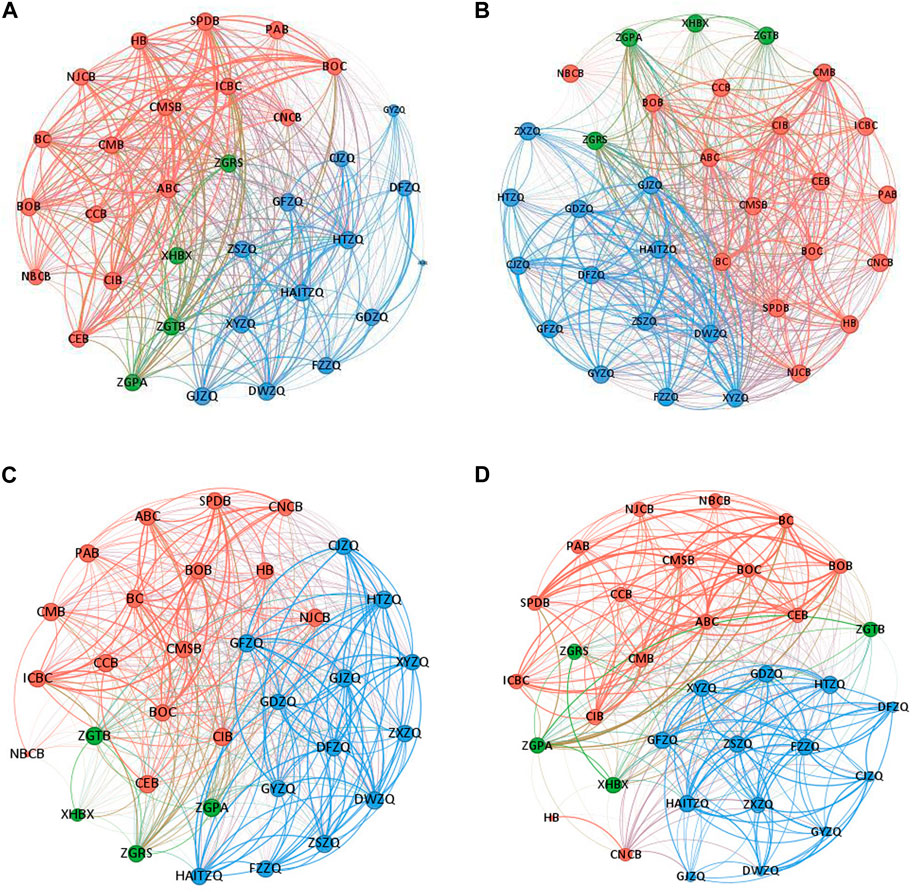

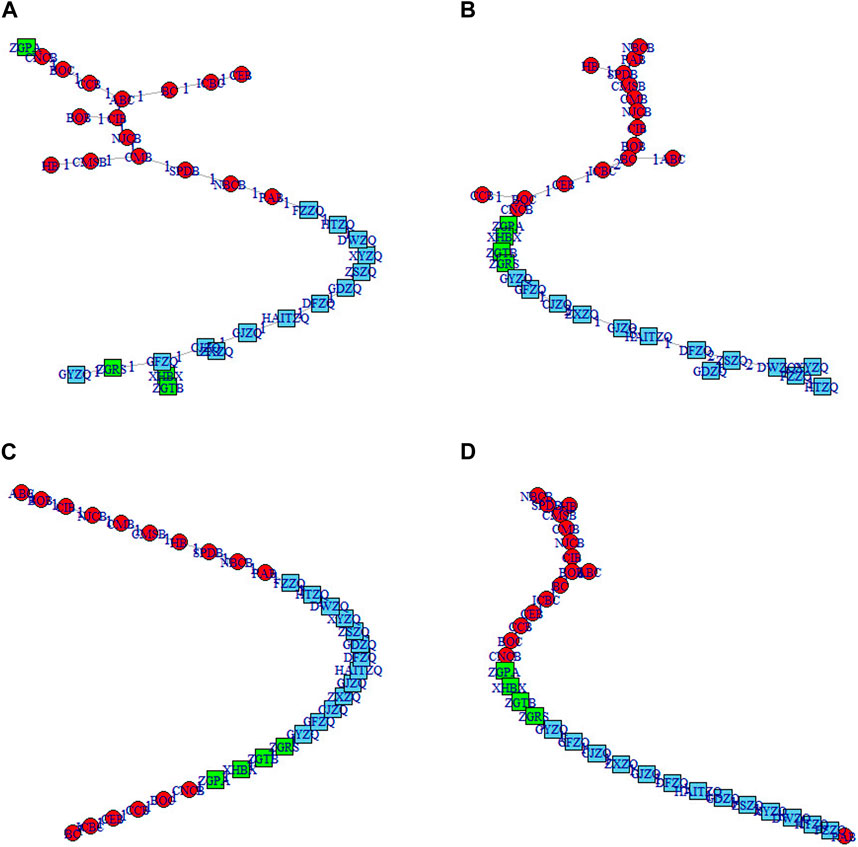

Based on the data of the top ten fund holdings of financial institutions, the network of fund holdings among financial institutions is constructed as in Figure 1. The red nodes denote the bank samples, the green nodes denote the insurance company samples, and the blue nodes denote the brokerage firm samples. If a fund holds shares in both sample financial institutions, there is a connecting edge between the two financial institution nodes. The weight of the connected edge in the network is the number of mutual fund shareholders among the financial institutions, and the weight of the node is the degree of centrality of the financial institution.

Figure 1. Network of fund holdings among listed financial institutions in China, 2015 (A), 2018 (B), 2020 (C) and 2022 (D). Note: The meaning of the abbreviations of the financial institutions in the figure is as follows. ICBC (Industrial and Commercial Bank of China), ABC (Agricultural Bank of China), BOC (Bank of Communications), CCB (China Construction Bank), BC (Bank of China), PAB (Ping An Bank), NBCB (Bank of Ningbo), SPDB (Shanghai Pudong Development Bank), HB (Huaxia Bank), CMSB (China Minsheng Bank), CMB (China Merchants Bank), NJCB (Bank of Nanjing), CIB (China Industrial Bank), BOB (Bank of Beijing), CEB (China Everbright Bank), CNCB (China CITIC Bank). ZGPA (Ping An Insurance Company of China), XHBX (New China Life Insurance Company), ZGTB(China Pacific Insurance Company), ZGRS(China Life Insurance Company). GYZQ (Guoyuan Securities), GFZQ (Guangfa Securities), CJZQ (Changjiang Securities), ZXZQ (CITIC Securities), GJZQ (Sinolink Securities), HAITZQ (Haitong Securities), DFZQ (Orient Securities), GDZQ (Everbright Securities), ZSZQ (China Merchants Securities), XYZQ (Industrial Securities), DWZQ (Soochow Securities), HTZQ (Huatai Securities), FZZQ (Founder Securities).

In order to represent the topological structure of each financial institution node in the network, this paper selects closeness to centrality (Closeness) as a proxy variable for the network characteristics of node institutions. This indicator can effectively determine whether a financial institution node is in the centre of the network. The specific calculation formula is as follows:

It is worth noting that Figure 1 presents a clear clustering feature. Clustering occurs within the network between the samples of three types of financial institutions (banks, insurance, and securities companies) due to common holdings of funds. It suggests that the same fund prefers intra-sectoral investment holdings within banks, insurance companies, and securities companies, which increases systemic risk connectivity between financial institutions of the same type, but also creates some barriers to risk contagion between different types of financial institutions.

To further explore the clustering phenomenon of similar financial institutions in the fund holding network, the minimum spanning tree (MST) algorithm is used to identify the minimum spanning tree of this network, and the core network and core conduction paths of the network association evolution pattern are found as shown in Figure 2. The shortest path of the network shown in Figure 2 confirms that internal clustering between banks and banks, insurance companies and insurance companies, securities companies and securities companies is presented in the network of fund holdings. This suggests that the same fund prefers to hold on a single type of financial institution when considering the underlying investment. From the direction of risk control, the business model and risk characteristics of a single class of financial institutions are relatively more uniform, which enables the fund to be more precise and efficient in assessing and managing risks. At the same time, by focusing on a single type of financial institution, the fund can gain a deeper understanding of the market situation, competitive landscape and policy trends in that area, thereby improving investment efficiency and reducing investment risk.

Figure 2. Minimum Spanning Tree (MST) network of fund holdings among financial institutions, 2015 (A), 2018 (B), 2020 (C) and 2022 (D).

Governance externalities in this paper refer to governance impacts that go beyond the internal boundaries of a single financial institution as a result of a fund’s shareholding behaviour. Such impacts are not only confined within the financial institution in which the fund invests, but also spread to other financial institutions through the complex structure of the financial network and even across different financial sectors. Figures 1, 2 visualise this phenomenon, revealing how fund holdings can facilitate the spread of risk within the same type of financial institution sector through governance externalities and further exacerbate risk contagion across sectors. Therefore, internal risk management and cross-sectoral risk monitoring of financial institutions should be strengthened to capture the path of network risk transmission and provide timely early warning to prevent internal and cross-sectoral contagion of systemic risks caused by governance externalities arising from fund holdings.

Nevertheless, we believe that the clustering behaviour of fund holdings continues to be affected by external factors such as economic conditions and regulatory changes. At the same time, on the one hand, the phenomenon of clustering contributes to enhanced risk management within the sector, and through pooling of investments and professional collaboration, funds are able to respond to market volatility more effectively and achieve resource sharing and risk diversification. For share-holding financial institutions, the enhancement of market recognition is an intangible asset. When the Fund chooses to co-invest in a certain type of financial institution, this often conveys a positive signal from the market on the soundness of the operation and future development potential of the institution, which attracts more investors and partners to pay attention to it, broadens the financial institutions’ business channels and co-operation network, and promotes business co-operation and resource-sharing among the share-holding financial institutions. It also promotes business co-operation and resource sharing among the shareholding financial institutions. On the other hand, such clustering may also lead to homogenisation of fund portfolios without the necessary diversification, thus increasing vulnerability to specific sector or market shocks. When a sector is hit by an unfavourable factor, funds in the clustering may face larger losses at the same time, and the more similar the fund’s holdings are the lower its performance may be instead (Augustiani et al., 2015) [64]. At this point, institutional investor networks further proliferate information and influence trading decisions, which subsequently exacerbates systemic risk for the market (Ozsoylev et al., 2014) [65]. Therefore, the relevant department needs to pay high attention to and prevent the resulting homogenisation risk, and take comprehensive risk management measures to ensure the stability and healthy development of the financial market.

3.4 Modelling

In this paper, the model is set up based on a two-way fixed-effects model with the

Where

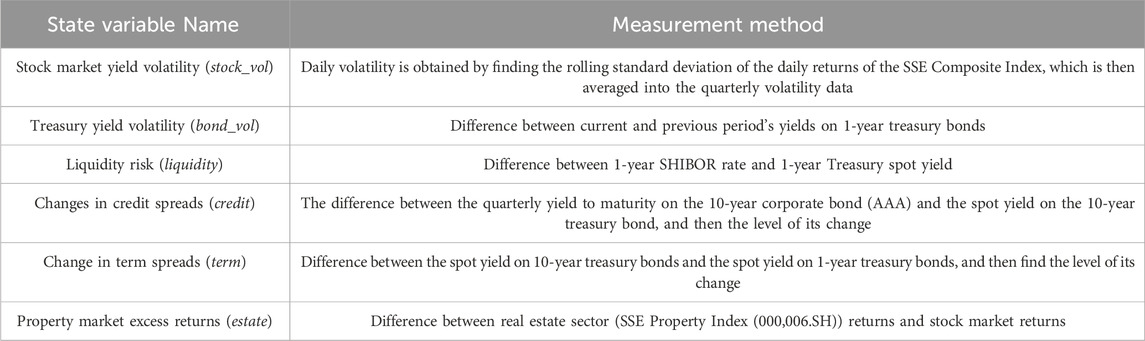

The control variables in this paper comprehensively consider several aspects of financial indicators, market risk, credit risk and macroeconomic indicators of financial institutions, and the following nine variables are selected. In terms of micro characteristics of financial institutions, seven variables are selected as control variables: return on equity (ROE), price-earnings ratio (PE), total asset turnover (ATO), age of financial institutions listed on the stock exchange (Age), asset-liability ratio (Lev), number of shares held by institutional investors (Insti), and ownership concentration (OwnerCR). In terms of macroeconomic characteristics, two variables of the chain growth rate of GDP (GDP) as well as the amount of broad money (M2) are selected as control variables.

4 Empirical analysis

4.1 Descriptive statistics

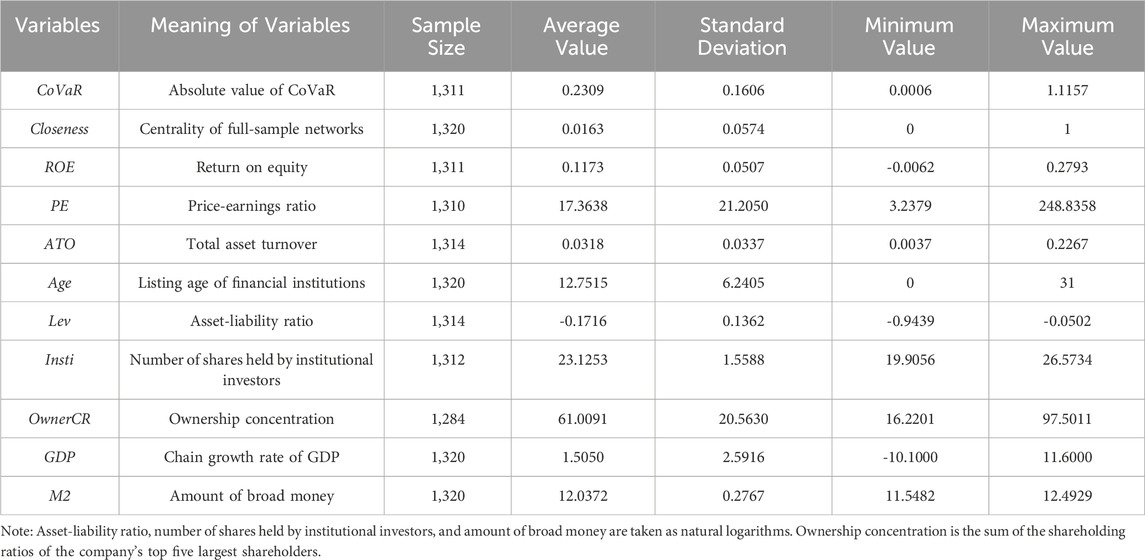

Table 2 reports the main variables of the paper and their descriptive statistics. From the data in the table, it can be seen that the absolute minimum value of CoVaR for the sample financial institutions is 0.0006 and the maximum value is 1.1157, which indicates that the systemic risk of different financial institutions varies widely across time. This may be due to the impact of fund holdings, as well as the institution’s own business conditions, and macro factors such as economic cycles and uncertainty crises. In terms of the topological eigenvalues of the fundholding network, we adopt the proximity to centrality (Closeness) as a key measure of the importance of a node. Specifically, proximity centrality reflects the inverse of the average distance from a node to all other nodes in the network, and the higher its value, the more central the node is in the network and the closer it is connected to other nodes. The mean value of the proximity centrality index in this paper is 0.0163, and the standard deviation is also 0.0163, with the maximum value reaching 1, while the minimum value is 0. This result indicates that, although the proximity centrality level of the nodes in the network is low overall, the centrality of financial institutions in the network varies significantly, i.e., there are some financial institutions that occupy extremely central positions in the network. These financial institutions with high proximity centrality are usually regarded as systemically important financial institutions, which play a key role in the transmission network of financial risks, both as an important source of risk spillovers and potentially as the main subject of risk taking.

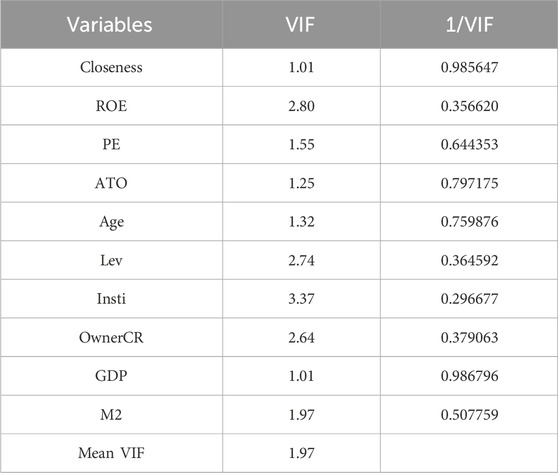

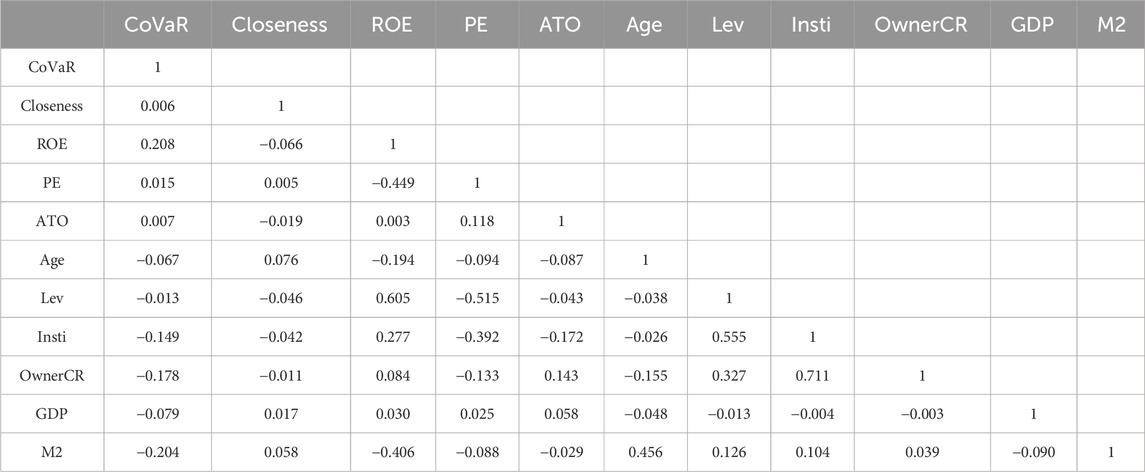

In order to test the possible problem of multicollinearity between variables, Table 3 demonstrates the VIF values between variables, and the results show that the VIF values are all strictly less than five and much less than 10, and the 1/VIF values are all greater than 0.1, so it can be assumed that there is no problem of multicollinearity caused between variables. Meanwhile, Table 4 demonstrates the correlation coefficient matrix between the variables, and it can be seen that the correlation coefficient between systemic risk and the centrality indicator of financial institutions in the fund holding network is positive, and this positive correlation provides the basis for the next empirical research in this paper.

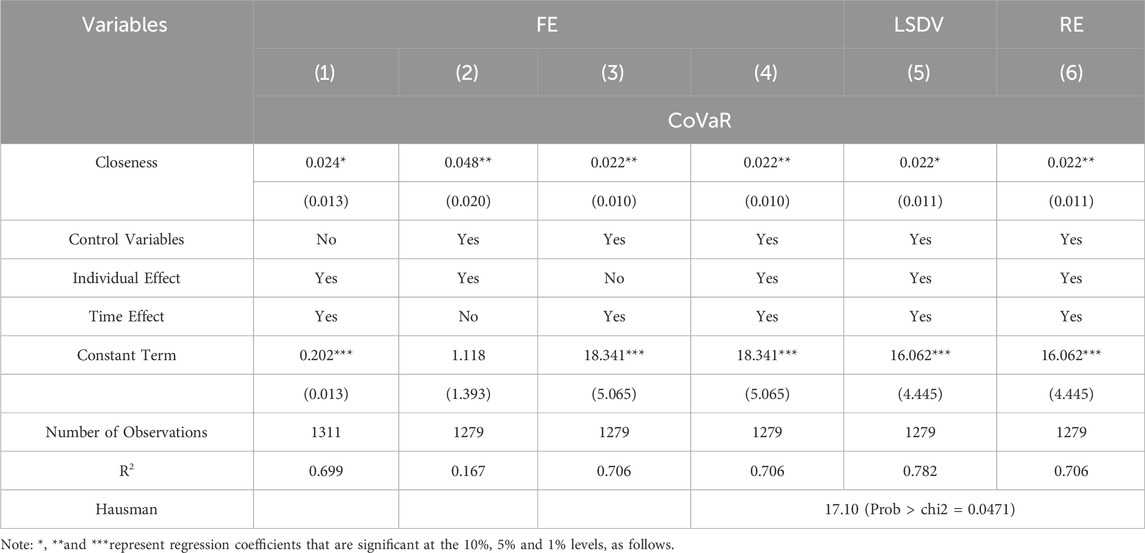

4.2 Regression to baseline

Table 5 demonstrates the results of the regression analysis of the impact of fund holding network centrality on the systemic risk of financial institutions. In this paper, we firstly conducted a benchmark regression analysis based on the fixed-effects model, and the results are displayed in Columns (1)-Columns (4). Meanwhile, in order to verify the applicability of the model, we further used the least squares dummy variable (LSDV) method and random effects model for estimation, and the results are presented in Column (5) and Column (6), respectively. Through the Hausman test, we obtain the p-value is 0.0471, which shows the statistic result rejects the original hypothesis that the random effects model is better at the 5% significance level, therefore, the fixed effects model is finally selected as the analytical framework in this paper.

The regression results show that the effect of fund holding network centrality on the systemic risk of financial institutions is significantly positive at the 5% level, indicating that fund holding networks exacerbate systemic financial risk contagion among financial institutions. When there is a risk event shock, the greater the network centrality of the financial institutions, the greater the impact on the risk of the entire banking system. This is due to a certain homogeneity in the funds’ choice of investment targets. As the Fund’s focus on financial institutions rises, the network of fund holdings linking various financial institutions increases the linkages between financial institutions. In extreme risk events, the bearishness or bullishness of a portion of the funds towards a financial institution influences the holding movements of other funds, affecting the operating conditions of the institution being held, and thus increasing the systemic risk of the financial institution. Therefore, in order to better prevent and resolve systemic risks of financial institutions, it is necessary to comprehensively improve governance capacity as well as to pay attention to the shareholding movements of institutional investors, improve its own risk assessment system, and safeguard the stable development of the financial system.

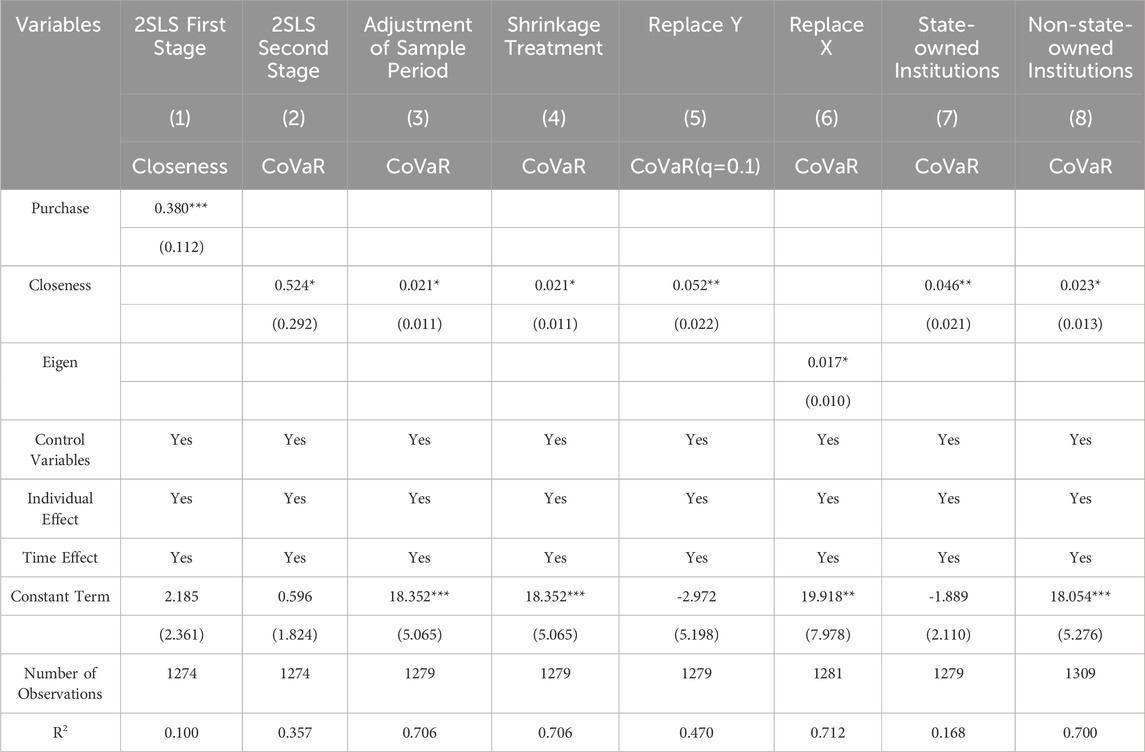

4.3 Robustness test

Firstly, to overcome potential endogeneity problems such as two-way causation and sample selection, this paper draws on Fang and Liu (2023) [2] and selects the growth rate of fund subscription shares (Purchase) in the current period as an instrumental variable for the centrality of fund holding networks. The share of fund subscriptions is affected by a number of factors, including fund issuance, willingness to subscribe, and relevant policy regulation. The faster the fund subscription share grows, the more likely the fund will invest in financial institutions. And it is not related to individual financial institutions, so this variable meets the requirements of instrumental variables. The results of the one-stage regression of instrumental variables based on the 2SLS method are shown in column (1) of Table 6, where it can be seen that the instrumental variable Purchase is significantly positive at the 1% level, suggesting a low likelihood of it being a weak instrumental variable. The two-stage regression results in column (2) show that the direction and significance of the core explanatory variables are consistent with the baseline regression results, confirming the robustness of the results.

To further test the robustness of the benchmark regression results, this paper also conducts robustness tests based on the following methods.

First, the sample period is adjusted. The regression is conducted by adjusting the sample period to the sample window after being affected by the COVID-19 shock. As a representative market shock event in recent years, COVID-19 has a far-reaching and wide-ranging impact on the systemic risk of financial institutions, and the regression results are shown in column (3) of Table 6. It can be found that the variable of fund holding network centrality is still significantly positive after the epidemic shock, indicating that the result is still robust to uncertain event shocks.

Second, the shrinking-tail treatment. In order to eliminate the potential interference of extreme values on the results of the regression analysis, this paper implements a one-sided tailing process at the 5% level for the fund holding network centrality indicator, which means that the extreme small values below the 5% quartile are adjusted to the value of that quartile, and then subsequently performs the regression analysis based on the processed data. The regression results are shown in column (4) of Table 6. It can be found that the regression results after the extreme value treatment still make the core explanatory variables significantly positive, indicating that the results are robust.

Third, replacement of the dependent variable. Considering that the systemic risk indicators measured at different quartile levels may be different, the ΔCoVaR indicator for the case of q = 0.1 is calculated to replace the original explanatory variables in the regression, and the results are shown in column (5). The explanatory variables remain significantly positive and the regression results are robust.

Fourth, replacement of the independent variables. To compensate for the limitations of the proximity centrality indicator, this paper simultaneously measures the eigenvector centrality of network nodes (Eigen) instead of the original centrality indicator for regression, and the results are shown in column (6) of Table 6, where the centrality indicator is significantly positive, and the baseline regression results are robust.

Finally, group regression. Based on whether the original financial institution sample is a state-owned bank, a state-owned insurance company or a state-owned securities company, the sample is divided into state-owned institutions and non-state-owned institutions for the regression while keeping the original network unchanged. The results are shown in Columns (7)–(8), and it is found that the centrality of both state-owned and non-state-owned financial institutions in the network has a significantly positive effect on their systemic risk. The regression results are robust.

In summary, the regression results confirm the positive and significant effect of fund holding network centrality on the systemic risk of financial institutions, highlighting that this mechanism exacerbates risk contagion among financial institutions. Specifically, financial institutions with a high degree of centrality can be more likely to spill over to the financial system as a whole during a risk event, as the homogeneity of fund investments drives close linkages among financial institutions. Therefore, upgrading governance capacity, monitoring institutional investors’ shareholding movements and improving risk assessment systems are crucial to preventing systemic financial risks. In addition, a series of endogeneity and robustness tests further validate the reliability of the paper’s conclusion that the positive effect of fund holding network centrality on systemic risk is significant in different contexts, providing a solid theoretical basis for policy formulation.

4.4 Analysis of contagion mechanism

According to the results of the empirical study, there is a contagion effect of systemic risk of financial institutions in the fund holding network. And in general, the higher the degree of centrality in the network, the higher the systemic risk of financial institutions. Then what are the channels of systemic risk contagion through fund holding network? And how should relevant institutions and departments prevent this risk contagion channel? This issue of contagion mechanism deserves in-depth discussion.

The investment behaviour of funds in financial institutions will directly affect the macro-prudential indicators of financial institutions, while funds and other institutional investors, as shareholders or creditors of financial institutions, will also affect the decision-making in the process of corporate governance of financial institutions, which in turn affects the systemic risk of financial institutions and the stability of the financial system. In summary, this paper will explore the role of fund holding network centrality in influencing the systemic risk of financial institutions from the signalling mechanism of financial institutions in the capital market as well as the optimisation of the financial institutions’ own governance in two aspects.

4.4.1 Capital market signalling mechanism

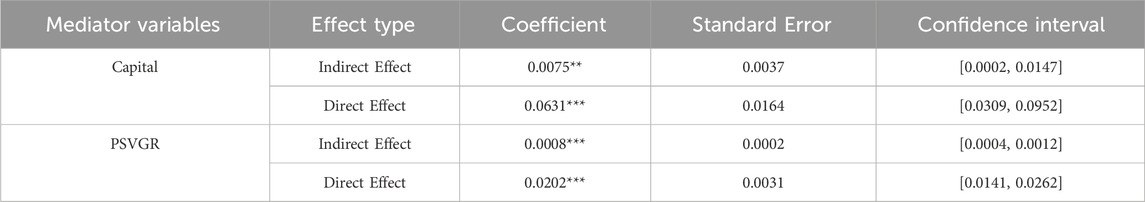

A connected network of financial institutions constructed by fund holdings affects the price reflection of the financial institutions themselves in the capital market as well as the investment strategies of other investors. Based on the above analysis, in order to clarify the contagion channel of risk among networks, this paper draws on Guo and Li (2019) [60], Guo et al. (2018) [47], and Li et al. (2017) [52] to select the natural logarithmic index of individual stock market capitalisation (Capital) as a mediator variable of the fund shareholding network affecting the systemic risk of financial institutions, and based on Baron and Kenny (1986) [66], Alesina and Zhuravskaya (2011) [67], and Jiang (2022) [68], the contagion channel test was conducted using stepwise regression.

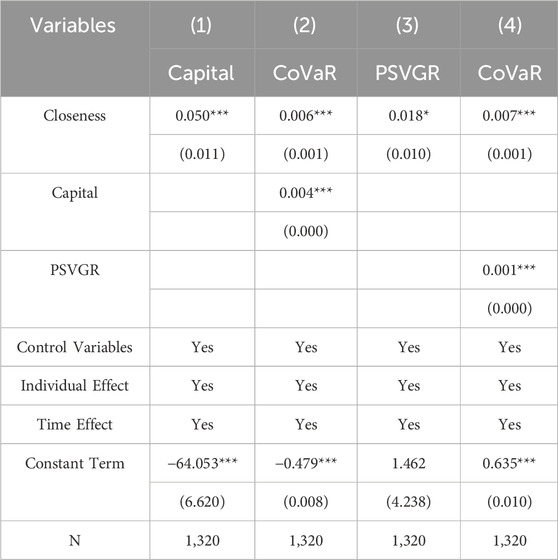

The results are shown in columns (1)–(2) of Table 7. Column (1) indicates the existence of an indirect effect of fund holding network centrality on the market value of financial institutions’ stocks. When the centrality of a financial institution in the fund holding network is elevated, i.e., the fund pays more attention to the financial institution, the investors in the market are more willing to buy its shares and the stock liquidity increases accordingly (Jiang and Qian, 2021) [39], which pushes the increase of the stock trading volume and the rise of the stock price, and thus directly raises the market value of individual shares of the financial institution. However, this market capitalisation enhancement is often accompanied by excessive optimism in market sentiment and concentration of capital flows, which makes the share prices of financial institutions more susceptible to fluctuations in market sentiment and the emergence of a convergence effect on share prices. In addition, when the market capitalisation of individual financial institutions rises to a high level, their market influence and systemic importance also increase. As a result, an excessive increase in the market capitalisation of individual financial institutions’ shares may exacerbate the vulnerability of the financial system, which in turn may exacerbate the systemic risk of financial institutions. The results in Column (2) indicate that the parameters of fund holding network centrality and financial institutions‘ stock market capitalisation on financial institutions’ systemic risk are both significantly positive, further confirming the existence of the mediation effect. When the centrality of a financial institution in the fund holding network is high, it will lead to higher market capitalisation due to its high attention in the capital market, which will exacerbate the systemic risk of the financial institution by increasing the price concentration volatility and increasing the information asymmetry.

Table 7. Mechanisms of systemic risk contagion in financial institutions among fund holding networks: mediation effect tests based on capital market and corporate governance indicators.

4.4.2 Governance optimisation mechanism

From the perspective of the financial institutions themselves, the increase in the centrality of the fund’s shareholding network also reflects their own operational efficiency and development prospects. In order to reflect the development prospects of financial institutions, the indicator of net per share value growth rate (PSVGR), which can represent the development potential and asset preservation and appreciation of financial institutions, is chosen as the mediator variable, and the higher the indicator is, the stronger the vitality of the enterprise’s operation and the stronger the potential for future development.

Based on the stepwise regression method, we investigate the contagion channels of systemic risk of financial institutions through the influence of fund holding network on the development potential of financial institutions. The regression results in column (3) of Table 7 show that the existence of fund ownership network centrality has an indirect effect on the development potential of financial institutions, and the results in column (4) show that the coefficients of the development potential of financial institutions and the centrality of the fund ownership network are both significantly positive, which indicates that there is an intermediary effect. The greater the centrality of a financial institution in the network, the more attention it receives from investors, which often reflects the market’s recognition and expectation of its business performance, development strategy and future growth potential, which in turn attracts more capital inflow and helps the financial institution to expand the scale of its business, optimise the allocation of resources, enhance market competitiveness, and further enhance its future development potential. However, with the continuous development and business expansion of financial institutions, in the long run, it may exacerbate the vulnerability of the financial system and increase systemic risks. In particular, when there are unfavourable changes in the market environment, the over-expansion and high-risk investments of financial institutions may expose their inherent vulnerabilities, triggering chain reactions and posing a threat to financial stability. Therefore the higher the centrality of the fund’s shareholding network, the greater the financial institution’s potential for growth at the moment, but the potential risk of increased systemic risk in the long term still exists. Therefore, while enjoying the development opportunities brought about by the increased attention of funds, financial institutions must be vigilant and effectively manage the resulting systemic risks.

In order to further test the validity of the analysis of mediation mechanism, based on Bootstrap method to test the above two mediation effects, if the observed confidence interval does not contain 0, the mediation effect is significant, and vice versa is not significant. As shown in Table 8 of the test results, the confidence intervals of the indirect effect and the direct effect in the capital market signalling mechanism significantly do not contain 0 and the regression coefficients are significantly positive. Similarly, the confidence interval of the mediation effect through the governance optimisation mechanism also does not contain 0, and both the indirect and direct effects are significant, indicating the existence of some mediation effects. Therefore, the mediation effect of fund ownership affecting systemic risk through the capital market signalling mechanism and governance optimisation mechanism is significant and the regression results are robust.

5 Further exploration

5.1 Internal governance moderating role of major shareholder monitor

Based on the theory and the empirical analysis above, it can be seen that fund investment has convergence, which in turn leads to the occurrence of the governance convergence behaviour of the company being held, and ultimately shows the phenomenon that the fund shareholding network enhances the systemic risk of financial institutions. The question of whether the majority shareholders of a company fulfil a supervisory role to inhibit the enhancement of systemic risk is worth exploring further.

It is mentioned in the “Measures for the Supervision of the Behaviour of Major Shareholders of Banks and Insurance Institutions” issued by China in 2021 that the major shareholders of banks and insurance institutions should actively maintain the sound operation of banks and insurance institutions and the stability of the financial market, prevent and control financial risks, and legally and effectively participate in the corporate governance in accordance with the relevant provisions. As the higher the shareholding ratio of the company’s largest shareholder, the more control it has over the company, and the more motivated it is to perform the function of supervising the management layer (Zeng et al., 2018) [69]. Therefore, this paper argues that the supervisory role of a company’s major shareholders has a negative moderating effect in the relationship between fund shareholding and systemic risk of financial institutions, i.e., the supervision of major shareholders can inhibit the enhancement of systemic risk. Referring to the studies of Zeng et al. (2018) [69] and Wang and Hu (2024) [70], this paper introduces the shareholding ratio of the first largest shareholder of financial institutions (Holder1) into the model and constructs the cross-multiplier term between the shareholding ratio of the first largest shareholder and the centrality of the fund shareholding network to join the model for regression, and the results are shown in Table 9. From Table 9 columns (1)-column (2), the coefficient of the impact of the proportion of firms‘ major shareholders’ shareholdings on systemic risk is significantly negative, indicating that the supervisory role of major shareholders effectively inhibits the enhancement of financial institutions’ systemic risk. Before the introduction of the moderating effect cross term the fund shareholding network has a significant enhancement effect on the systemic risk of financial institutions, after the introduction of the cross-multiplier regression it is found that, as the proportion of large shareholders continues to rise, its supervisory role so that the fund shareholding of the positive impact on the systemic risk of financial institutions is gradually weakened, with the proportion of large shareholders’ holdings, to a certain extent, avoiding the financial institutions by the influence of the fund holdings of the As the shareholding ratio of major shareholders increases, it avoids, to a certain extent, the governance convergence performance of financial institutions affected by fund shareholding, inhibits the further rise of systemic risk, and thus realises the external risk control performance of financial institutions’ internal governance.

Table 9. Moderating effects of large shareholder monitor and information transparency on systemic risk.

5.2 External governance moderating role of information transparency

To further explore how information transparency of a financial institution affects the relationship between fund holding networks and systemic risk through external governance channels, this paper refers to the study of Zhong et al. (2024) [71], where the natural logarithm of analysts’ attention is used as a proxy for information transparency of that financial institution. Analysts, as professional observers of the financial market, are able to gain a deeper understanding of a financial institution’s operating conditions, risk conditions and future trends through their professional analyses and research. Therefore, when a financial institution receives higher attention from analysts, its operating conditions and risk profile will be more comprehensively revealed, and its information transparency will be higher, which will help the market to form a more accurate judgement, thus affecting the systemic risk of the financial institution by external governance channels.

In view of this, the cross-multiplier term between information transparency (Inform) and the centrality of fund holding network of financial institutions is constructed and the cross-multiplier term is introduced into the model for regression. The results, as shown in column (3) of Table 9, show that information transparency, as a moderating variable, plays a significant negative moderating role in the relationship between fundholding networks and financial institutions‘ systemic risk, which implies that the role of fundholding networks’ exacerbation of systemic risk will be weakened when financial institutions’ information transparency is higher. When the cross-multiplier term is introduced, the main effect coefficient is significantly reduced as shown by the regression result column (4), which indicates that the role of fund holding network centrality in exacerbating financial institutions’ systemic risk is significantly reduced as the information transparency of financial institutions rises. Although fund holding network itself can exacerbate the systemic risk of financial institutions, the increase in information transparency of financial institutions can weaken the exacerbating effect of fund holding network on the systemic risk of financial institutions from the external governance perspective by reducing the information asymmetry, improving the market transparency, and facilitating the enhancement of risk management by financial institutions. At the same time, analyst attention may also prompt financial institutions to focus more on risk management and internal controls, thereby reducing their systemic risk.

6 Conclusion

It is of great significance for the development of financial stability and security to raise attention to institutional investors, prevent systemic risks caused by corporate governance externalities, scientifically prevent and control the occurrence of systemic risks in the financial industry, and be alert to the cross-sectoral contagion of systemic risks among affiliated networks and clarify their contagion mechanisms. This paper mainly uses the data of 33 listed financial institutions in China from 2013 to 2022 to construct the fund holding network among financial institutions based on the common shareholding affiliation relationship of funds to banks, insurance and securities companies. And through measuring the systemic risk indicators of the sample financial institutions to carry out empirical research, in-depth discussion of the impact of the fund holding network on the systemic risk of financial institutions and the role of the mechanism.

The results of the study show that, firstly, as the centrality of financial institutions within the fund shareholding network increases, the systemic risk of financial institutions rises significantly, indicating that fund shareholding has a limited inhibiting effect on the systemic risk of financial institutions due to governance externalities. Secondly, the network of fund holdings exhibits obvious clustering characteristics, suggesting that funds have convergence in choosing investment targets (governance contagion), further validating the significant intra-sectoral risk contagion between banks, insurance companies and insurance companies, and securities companies and securities companies, as well as the cross-sectoral risk contagion mechanism. Thirdly, the risk transmission mechanism is further analysed based on the contagion hypothesis, which finds that the convergence of funds’ common holdings can increase the investor attention of financial institutions in the capital market and enhance the market value of financial institutions, but is accompanied by the risk of market bubbles. At the same time, it promotes the development of financial institutions through corporate governance channels, which in turn leads to changes in the systemic risk of financial institutions. Finally, in terms of the internal and external governance of financial institutions, the monitoring role of major shareholders and the improvement of information transparency of financial institutions effectively suppress the positive impact of fund shareholdings on the systemic risk of financial institutions.

In this regard, financial institutions need to further improve their own risk control system, incorporate risk changes of major shareholders, especially institutional investors, and information on fund holdings into the micro-prudential framework for risk assessment, improve their own internal and external governance capabilities, regulate shareholder behaviour and strengthen information disclosure. At the same time, policymakers should attach great importance to the position of financial institutions in risk transmission networks and their impact on systemic risk. They should also establish a sound system of indicators for monitoring systemic risk, especially by strengthening the monitoring and analysis of institutional investors’ connected shareholding behaviour. Promote financial institutions to improve their internal risk control systems, incorporate the risks of large shareholders and institutional investors into the micro-prudential regulatory framework, encourage the enhancement of information transparency, and regulate shareholders’ behaviours, so as to effectively curb the occurrence of systemic risks and cross-sectoral transmission. In addition, regulators should also strengthen cross-sectoral regulatory coordination, clarify risk contagion mechanisms, and formulate targeted and highly operational policy measures to maintain the stability and security of financial markets.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: https://data.csmar.com/, https://www.wind.com.cn/, and https://choice.eastmoney.com/.

Author contributions

KJ: Writing–review and editing, Conceptualization, Methodology, Supervision. LY: Data curation, Formal Analysis, Software, Visualization, Writing–original draft.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This work was supported by “2023 Liaoning Provincial Department of Education Basic Research Project (Key Research) (JYTZD2023080)” and “Innovation Centre for Digital Business and Capital Development of Beijing Technology and Business University (SZSK202205)”.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

1. Upper C. Simulation methods to assess the danger of contagion in interbank markets. J Financ Stab (2011) 7(3):111–25. doi:10.1016/j.jfs.2010.12.001

2. Fang Y, Liu JL. Bank correlation and systemic financial risk: contagion or sharing? J Fin Res (2023)(06) 57–74.

3. Hartzell JC, Starks LT. Institutional investors and executive compensation. J Finance (2003) 58(6):2351–74. doi:10.1046/j.1540-6261.2003.00608.x

4. Ajinkya B, Bhojraj S, Sengupta P. The association between outside directors, institutional investors and the properties of management earnings forecasts. J Account Res (2005) 43(3):343–76. doi:10.1111/j.1475-679x.2005.00174.x

5. Deng X, Hung S, Qiao Z. Mutual fund herding and stock price crashes. J Banking Finance (2018) 94(9):166–84. doi:10.1016/j.jbankfin.2018.07.014

6. Cai F, Han S, Li D, Li Y. Institutional herding and its price impact: evidence from the corporate bond market. J Financial Econ (2019) 131(1):139–67. doi:10.1016/j.jfineco.2018.07.012

7. Pareek A. Information networks: implications for mutual fund trading behavior and stock returns. SSRN Electron J (2012). doi:10.2139/ssrn.1361779 (AFA 2010 Atlanta Meetings Paper).

8. Xu NX, Yu SY, Yi ZH. Herd behaviour of institutional investors and the risk of stock price collapse. Manag World (2013)(7) 13.

9. Diebold FX, Yılmaz K. On the network topology of variance decompositions: measuring the connectedness of financial firms. J Econom (2014) 182(1):119–34. doi:10.1016/j.jeconom.2014.04.012

10. Maghyereh AI, Awartani B, Bouri E. The directional volatility connectedness between crude oil and equity markets: new evidence from implied volatility indexes. Energy Econ (2016) 57:78–93. doi:10.1016/j.eneco.2016.04.010

11. Ding L, Cao TQ. Management networks, relationship governance and bank risk taking. Fin Dev Res (2013)(09) 15–9. doi:10.19647/j.cnki.37-1462/f.2013.09.003

12. Wang L, Shao YH, Wang YN. Network structure and bank efficiency: a study based on time-varying “bank-shareholder” networks. Econ Res (2021) 56(12):60–76.

13. Hong L, Ouyang XF. Knowledge association discovery and risk analysis of financial equity knowledge big picture. J Manag Sci (2022) 25(04):44–66. doi:10.19920/j.cnki.jmsc.2022.04.003

14. Bouwman CH. Corporate governance propagation through overlapping directors. Rev Financ Stud (2011) 24(7):2358–94. doi:10.1093/rfs/hhr034

15. He JJ, Huang J, Zhao S. Internalizing governance externalities: the role of institutional cross-ownership. J Financ Econ (2019) 134(2):400–18. doi:10.1016/j.jfineco.2018.07.019

16. Liu XZ, Gao C. Can institutional investors' group hugging inhibit controlling shareholders' self-interest behavior? An analysis based on the social network perspective. Nankai Manag Rev (2021) 24(04):141–54. doi:10.3969/j.issn.1008-3448.2021.04.014

17. Firth M, Gao J, Shen J, Zhang Y. Institutional stock ownership and firms' cash dividend policies: evidence from China. J Bank Finance (2016) 65:91–107. doi:10.1016/j.jbankfin.2016.01.009

18. Lin YR, Fu XM. Does institutional ownership influence firm performance? Evidence from China. Int Rev Econ Finance (2017) 49:17–57. doi:10.1016/j.iref.2017.01.021

19. Wang L, Sha YF, Kang WL. Working together or fighting in the dark: institutional investor grouping and major shareholder hollowing out behavior. Chinese Rev. of Fin. Stu. (2022) 14(06):37-57+122–3.

20. Cao F, Lu B, Li ZG, Xu K. Do institutional investors reduce the risk of stock crash? Account Res (2015)(11) 55–61+97. doi:10.3969/j.issn.1003-2886.2015.11.008

21. Gao HY, Yang XG, Ye YY. The inhibitory effect of institutional investors on surge and fall: empirical evidence based on Chinese market. J Fin Res (2017)(02) 163–78.

23. Schwarcz SL, Star SA. Controlling systemic risk through corporate governance. Govern Direct (2017) 69(4):244–9.

24. Schwarcz SL. Regulating corporate governance in the public interest: the case of systemic risk. In: The most important concepts in finance. United Kingdom: Edward Elgar Publ (2017). p. 83–92. doi:10.4337/9781786431134.00010

25. Acharya VV, Volpin PF. Corporate governance externalities. Rev Fin (2010) 14(1):1–33. doi:10.1093/rof/rfp002

26. Anabtawi I, Schwarcz SL. Regulating systemic risk: towards an analytical framework. Notre Dame L Rev (2011) 86:1349. doi:10.2139/ssrn.1670017

27. Du Y, Sun F, Deng X. Common institutional ownership and corporate surplus management. China Ind Econ (2021)(06) 155–73. doi:10.19581/j.cnki.ciejournal.2021.06.010

28. Crane AD, Koch A, Michenaud S. Institutional investor cliques and governance. Soc Sci Electron Publ (2024). doi:10.2139/ssrn.2841444

29. Brooks C, Chen Z, Zeng Y. Institutional cross-ownership and corporate strategy: the case of mergers and acquisitions. J Corp Finance (2018) 48:187–216. doi:10.1016/j.jcorpfin.2017.11.003

30. Kostovetsky L, Manconi A. Common institutional ownership and diffusion of innovation. Soc Sci Electron Publ (2024). doi:10.2139/ssrn.2896372

31. Li XF, Cai XY. Institutional investors are distracted and major shareholders are hollowing out. Shanghai, China: J Sys and Manag. (2024). p. 1–22. Available from: http://kns.cnki.net/kcms/detail/31.1977.N.20240517.2035.002.html (Accessed September 16, 2024).

32. Li M, Li BX, Zhang TT. Does short-selling mechanism restrain stock pledge by controlling shareholders? ——evidence from a quasi-natural experiment in China. J Sys and Manag (2023) 32(3):634–50. doi:10.3969/j.issn.1005-2542.2023.03.016

33. Park J, Sani J, Shroff N, White HD. Disclosure incentives when competing firms have common ownership. Soc Sci Electron Publ (2024). doi:10.2139/ssrn.3271940

34. Kothari SP, Wysocki SPD. Do managers withhold bad news? J Account Econ (2009) 47(1):241–76. doi:10.1111/j.1475-679X.2008.00318.x

35. Hutton AP, Marcus AJ, Tehranian H. Opaque financial reports, R2, and crash risk. J Financ Econ (2009) 94(1):67–86. doi:10.1016/j.jfineco.2008.10.003

36. Wu XH, Guo XD, Qiao Z. Institutional investor group hugging and the risk of stock price collapse. China Ind Econ (2019)(02) 117–35. doi:10.19581/j.cnki.ciejournal.20190131.007

37. Chen GJ, Zhang YJ, Liu C. Are institutional investors an enabler of stock market surge and fall? --Empirical evidence from Shanghai A-share market. J Fin Res (2010)(11) 45–59. doi:10.1360/972010-1084

38. An H, Zhang T. Stock price synchronicity, crash risk, and institutional investors. J Corp Finance (2013) 21:1–15. doi:10.1016/j.jcorpfin.2013.01.001

39. Jiang S, Qian Y. A study of the impact of institutional investor hugging on the stock market in fund networks. Finance Econ (2021)(10) 82–90. doi:10.19622/j.cnki.cn36-1005/f.2021.10.010

40. Palao F, Pardo A. Do carbon traders behave as a herd. The Nor Amer J Econ Fin (2017) 41:204–16. doi:10.1016/j.najef.2017.05.001

41. Blasco N, Corredor P, Ferreruela S. Does herding affect volatility? Implications for the Spanish stock market. Quant Fin (2012) 12(2):311–27. doi:10.1080/14697688.2010.516766

42. Gu C, Guo X, Zhang C. Analyst target price revisions and institutional herding. Intern Rev Fin Anal (2022) 82:102189. doi:10.1016/j.irfa.2022.102189

43. Azar J, Schmalz MC, Tecu I. Anticompetitive effects of common ownership. J Finance (2018) 73(4):1513–65. doi:10.1111/jofi.12698

44. Xue HG, Li QH, Zhou JY. The impact of fund hugging on the investment efficiency of listed companies in China. Financ Theor Pract (2022) 43(03):49–58. doi:10.16339/j.cnki.hdxbcjb.2022.03.007

45. Shao JB, Li N. Institutional investor grouping and dynamic allocation of corporate financial assets: “Supervision” or “Collusion”. Econ Manag (2023) 45(09):122–44. doi:10.19616/j.cnki.bmj.2023.09.007

46. Wang XL, Yang X. Research on the cohort effect of corporate green innovation - based on the perspective of common institutional ownership. Soft Sci (2024). Available from: http://kns.cnki.net/kcms/detail/51.1268.G3.20240322.1100.002.html (Accessed April 19, 2024).

47. Guo XD, Ke YR, Wu XH. Bad news cover-ups and revelations: institutional investor network centrality and stock price crash risk. Econ Manag (2018) 40(04):152–69. doi:10.19616/j.cnki.bmj.2018.04.010

48. Huang YR, Bai YX. Is network contagion a “real flock” or a “pseudo-flock”? --The impact of network contagion on capital market pricing efficiency. China Manag Sci (2021) 29(09):12–24. doi:10.16381/j.cnki.issn1003-207x.2019.1155

49. Boehmer E, Kelley EK. Institutional investors and the informational efficiency of prices. The Rev Fin Stu (2009) 22(9):3563–94. doi:10.1093/rfs/hhp028

50. Bushee BJ, Goodman TH. Which institutional investors trade based on private information about earnings and returns? J Acco Res (2007) 45(2):289–321. doi:10.1111/j.1475-679x.2007.00234.x

51. Brickley JA, Lease RC, Smith JCW. Ownership structure and voting on antitakeover amendments. J Fin Econ (1988) 20:267–91. doi:10.1016/0304-405x(88)90047-5

52. Li WA, Qi LJ, Ding ZS. Listening to both sides makes you clear, believing in both sides makes you dark - the information effect of fund networks on firms' investment efficiency. Econ Manag (2017) 39(10):44–61. doi:10.19616/j.cnki.bmj.2017.10.004

53. Luo RH, Tian ZL. Fund networks, competitive barriers and the stock information environment. China Ind Econ (2020)(03) 137–54. doi:10.19581/j.cnki.ciejournal.2020.03.018

54. Chan N, Getmansky M, Haas SM, Lo AW. Systemic risk and hedge funds. The risk of fin insti. Chicago, United States: Uni of Chic Pre (2007). 235–338. doi:10.2139/ssrn.671443

55. Billio M, Getmansky M, Lo AW, Pelizzon L. Econometric measures of connectedness and systemic risk in the finance and insurance sectors. J Financ Econ (2012) 104(3):535–59. doi:10.1016/j.jfineco.2011.12.010

56. Boyson NM, Stahel CW, Stulz RM. Hedge fund contagion and liquidity shocks. J Finance (2010) 65(5):1789–816. doi:10.1111/j.1540-6261.2010.01594.x

57. Greenwood R, Thesmar D. Stock price fragility. J Financ Econ (2011) 102(3):471–90. doi:10.1016/j.jfineco.2011.06.003

58. Chen XC, Liu Y, Luo RH. Will institutional investor information sharing attract black swans? --Fund information networks and extreme market risk. J Fin Res (2017)(07) 140–55. doi:10.12094/1002-7246(2017)07-0140-16

59. Braverman A, Minca A. Networks of common asset holdings: aggregation and measures of vulnerability. J Netw Theor Finance (2018) 4:53–78. doi:10.21314/jntf.2018.045

60. Guo BY, Li J. Institutional investor information sharing and stock price crash risk—an analysis based on social relationship networks. Econ Manag (2019) 41(07):171–89. doi:10.19616/j.cnki.bmj.2019.07.011

61. Guo BY, Zhou RY. Information interaction, investment decision and stock prices—analysis based on institutional investors' information network. J Fin Res (2019)(10) 188–206.

62. Wang H, Li SW, Ma YY, Liu XX. Research on fund systematic risk based on common shareholding network. China Manag Sci (2023) 31(06):82–90. doi:10.16381/j.cnki.issn1003-207x.2020.2092

64. Ozsoylev HN, Walden J, Yavuz MD, Bildik R. Investor networks in the stock market. The Rev Fin Stu (2014) 27(5):1323–66. doi:10.1093/rfs/hht065

65. Augustiani C, Casavecchia L, Gray J. Managerial sharing, mutual fund connections, and performance. Intern Rev Fin (2015) 15(3):427–55. doi:10.1111/irfi.12054

66. Baron RM, Kenny DA. The moderator–mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J Persona Soci Psycho (1986) 51(6):1173–82. doi:10.1037/0022-3514.51.6.1173

67. Alesina A, Zhuravskaya E. Segregation and the quality of government in a cross section of countries. Amer Econo Rev (2011) 101(5):1872–911. doi:10.1257/aer.101.5.1872

68. Jiang T, Luo ZB. LOC102724163 promotes breast cancer cell proliferation and invasion by stimulating MUC19 expression. China Indus Econo (2022) 23(05):100–20. doi:10.3892/ol.2022.13220

69. Zeng ZY, Cai DL, Wu XK. Supervising Management or Disciplining Major Shareholders? The impact of fund shareholding on the value of Chinese listed companies. J Fin Res (2018)(12) 157–73.

70. Wang WNX, Hu RD. Can common institutional ownership curb controlling shareholders' self-interested behaviour? Res Financ Econ (2024) 39(02):107–24.