- Guangzhou Railway Polytechnic, Guangzhou, Guangdong Province, China

Introduction: In the context of hybrid e-commerce platforms with reselling mode and agency mode, this study considers the issue of channel management by manufacturers through recommendation strategies.

Methods: For three dual-channel structures composed of e-commerce platforms, manufacturers, and third-party retailers, game models were constructed for manufacturer’s non-recommendation, differentiated recommendation, and indiscriminate recommendation scenarios to investigate the optimal recommendation strategy for manufacturers.

Conclusion: (1) For different dual-channel structures, compared to scenarios without recommendations, it is not always profitable for manufacturers to adopt a recommendation strategy as recommended parties may not necessarily gain higher profits from recommendations. (2) The optimal recommendation strategy for manufacturers is influenced by channel structure, commission rates, and relative scale in the recommended market. Recommending direct sales channels is the preferred choice for manufacturers with a higher relative scale in the recommended market prompting them to recommend all channels to consumers. (3) Numerical simulations reveal that retail prices, total market demand, and supply chain profits are positively correlated with relative scale within the recommended market. Additionally, any recommendation strategy can increase demand for recommended parties as well as overall supply chain profit levels.

1 Introduction

More and more consumers are choosing to shop online, and hybrid e-commerce platforms provide manufacturers with more options for online sales. Manufacturers can open official flagship stores on e-commerce platforms to sell directly, or they can wholesale products to e-commerce platforms or third-party retailers [1]. The multi-channel options provided by e-commerce platforms create a special phenomenon where different sellers may compete for the same brand products in the same market. For example, as a typical hybrid e-commerce platform, JD.com has sellers of Oppo mobile phones, including the manufacturer, JD.com, and other small-sized third-party retailers. Cap and Champion are respectively provided with fulfillment services by JD.com and manufacturers. Huawei and Apple both adopt JD’s self-operated and third-party authorized sales model.

Under the trend of multi-channel retail development, effective management of channels is a key concern for manufacturers. In addition to price regulation, commission agreements, and cost sharing measures [2–4], many manufacturers use recommendation methods to manage their online channels, i.e., displaying designated online retailers on their official websites. For example, the homepage of Midea Group’s website (midea.com) features an entryway to “Midea Platform”. Gree Electric Appliances provides official flagship store sales links, including Tmall and Gome, at the bottom of its website (gree.com). Canon’s website (canon.com) features a “Online Sales Stores” page that showcases multiple sales channels, including official flagship stores, e-commerce platform stores, and third-party authorized certified stores. Manufacturer recommendations can effectively guide consumers who directly access the official website, by providing differentiated or undifferentiated recommendations to direct consumer channel shifts.

Recommendation methods play an important role in consumer guidance and channel management, but recommendations can both enhance channel conflicts and discourage non-recommended party sales efforts. Therefore, how to build an efficient channel collaboration paradigm based on identifying channel interactions and how to develop recommendation strategies according to the channel structure are urgent issues that manufactures need to address.

2 Literature review

The literature relevant to this study mainly includes the online recommendation and the multi-channel retail.

Research on online recommendation has achieved some results [5–10], mainly including consumer word-of-mouth recommendation based on reward programs, manufacturer and retailer recommendation related to the supply chain upstream and downstream, and information intermediary recommendation providing specialized recommendation platforms. This study falls within the scope of manufacturer recommendation, which is different from advertising plans and other paid promotion. Manufacturer recommendation is the manufacturer’s spontaneous recommendation of its direct sales channels or reseller channels on its official website to specific consumers. Ghose et al. compared the impact of information intermediary recommendation and manufacturer recommendation on the downstream retailer’s decision, and the study found that the recommendation services provided by information intermediaries and manufacturers can enable retailers to effectively identify consumer valuation and implement price discrimination. Moreover, manufacturers have the incentive to recommend all retailers to avoid profit transfer from the supply chain to information intermediaries [11]. Wu et al. built a game model of a manufacturer selling through two heterogeneous retailers, and the results showed that the manufacturer prefers differentiated recommendation when the cost of the smaller retailer is lower, and the market size is smaller [4]. If the market size of the recommended retailer is large enough, undifferentiated recommendation is the manufacturer’s equilibrium choice, otherwise, differentiated recommendation is superior. Li et al. shifted their research focus to manufacturers’ and retailers’ risk-averse preferences and found that when the recommended market size is moderate and market competition intensity is low, an increase in risk aversion will enhance manufacturers’ motivation to recommend resale channels; when the recommended market size is moderate and market competition intensity is high, retailers’ risk aversion will reduce manufacturers’ motivation to recommend resale channels [12]. These literatures, although including market competition relationships between retailers-retailers and retailers-manufacturers, ignore the possible income-sharing relationships in the supply chain. Third-party retailers and manufacturers who join e-commerce platforms and share a certain percentage of sales revenue to obtain the opportunity to be represented by the platform, will third-party retailers and the e-commerce platform obtain the opportunity to be recommended by the manufacturer? None of the above studies has addressed this agency relationship.

Artificial intelligence techniques, especially computational intelligence and machine learning methods and algorithms are also widely used in the field of online recommendations. In the development of recommendation systems, artificial intelligence is used to improve the prediction accuracy and solve the problem of sparse data. Zhang et al. [13] reviewed the improvements made to the recommendation system by using artificial intelligence methods such as fuzzy technology, transfer learning, genetic algorithm, evolutionary algorithm, neural network, deep learning and active learning. Yu et al. [14] proposed a cascade prediction model to estimate the popularity of information dissemination in complex networks, to identify viral marketing and the spread of fake news in social media. Liu [15] analyzed data mining in machine learning algorithms and real-time online recommendation algorithms of Gaussian processes and analyzed abnormal advertising monitoring systems to maintain the accuracy of recommended advertising campaigns. Danaf et al. [16] proposed a framework for estimating and updating user preferences in an application-based recommendation system, that is, a recommendation system that provides users with personalized option menus. Guo et al. [17] developed a social Internet of Things architecture for social recommendation computing scenarios, using an embedded model-based graph neural network model based on deep learning as the core algorithm for performing fuzzy sensing SR to ensure reliable data management.

Both the game theory approach and the AI approach are important approaches in the field of online recommendation. The difference between the two is that the game theory approach focuses on the strategic interaction between multiple sellers, while the AI approach focuses on the personalized recommendation of a single merchant for multiple products. The data modeling analysis based on game theory can better describe the competition and cooperation relationship in online market, and the literature research also supports the validity and reliability of the game method. This paper takes the lead in using game theory to expand the revenue-sharing relationship between game parties, which is innovative.

Research on multi-channel retailing has yielded rich results. First, extensive and in-depth research has been conducted on pricing and coordination issues related to channels. Wolk and Ebling found that, although most retailers adopt consistent pricing strategies for most products over time, many multi-channel retailers still engage in channel-based price differentiation [18]. Boyaci pointed out that traditional contracts are difficult to coordinate inventory decisions in mixed dual-channel systems under uncertainty [19]. Tsay and Agraw studied the repurchase price summed wholesale price contract to coordinate the dual-channel supply chain with promotional externalities [20]. Xiong et al. studied the combination of revenue-sharing contract and rebate contract to achieve dynamic pricing supply chain coordination [21]. Secondly, involving cross-channel synergy and integration strategies and extending to the full channel scope. Cao and Li used grounded theory to build a cross-channel integration measurement tool and proposed a framework for the impact path of channel integration on sales growth of enterprises [22]. Shen et al. used empirical methods to analyze the influence of channel integration quality on customer channel perception [23]. Li et al. explored the role of retailer’s uncertainty, identity attractiveness, and switching costs in channel integration for consumers [24]. Finally, considering the channel mode selection problem from the perspective of manufacturers or e-commerce platforms, Abhishek et al. studied that when the online channel suppresses the offline channel demand, the e-commerce platform tends to open agency to third parties, while when the online channel promotes offline demand, the platform tends to wholesale self-operated mode [25]. Zhao et al. studied the platform model choice of dual-headed manufacturers under the influence of price and service and analyzed the product features of dual-mode platforms [26]. Unlike the previous studies on multi-channel problems, this paper considers a multi-channel market structure where a manufacturer sells through an e-commerce platform. The manufacturer and the e-commerce platform are not in a single wholesale or agency relationship, and the complex multi-party cooperative and competitive relationships have different impacts on the manufacturer’s pricing and recommendation decisions.

A review of the literature reveals that there is not much discussion on the pricing and channel management of manufacturers under recommendation intervention, and the research scenarios involving recommendation strategies are often quite limited. Considering that manufacturers sell through e-commerce platforms in a multi-channel manner, the channels need to be priced reasonably and coordinated, and the diversity of sales models complicates the manufacturer’s channel management. Therefore, this paper will introduce the recommendation strategy as a channel management tool into the manufacturer’s strategy of seeking maximum profit, and, based on clarifying different channel structures, explore the optimal recommendation strategy of manufacturers, with the aim of providing theoretical suggestions for manufacturing enterprises’ online channel management.

The rest of the paper is arranged as follows. Section 3 proposes the basic assumptions and constructs the demand function. Sections 4–6 solve the optimal pricing decisions of different recommendation strategies in the dual-channel EM structure, dual-channel ET structure, and dual-channel MT structure, analyze the impact of recommendation strategies on the profits of recommended parties and non-recommended parties, and finally obtain the optimal recommendation strategy of manufacturers. Section 7 uses numerical simulations to compare the optimal prices, demand, and overall profit levels of different recommendation strategies. Section 8 summarizes the research findings and presents research prospects.

3 Model construction

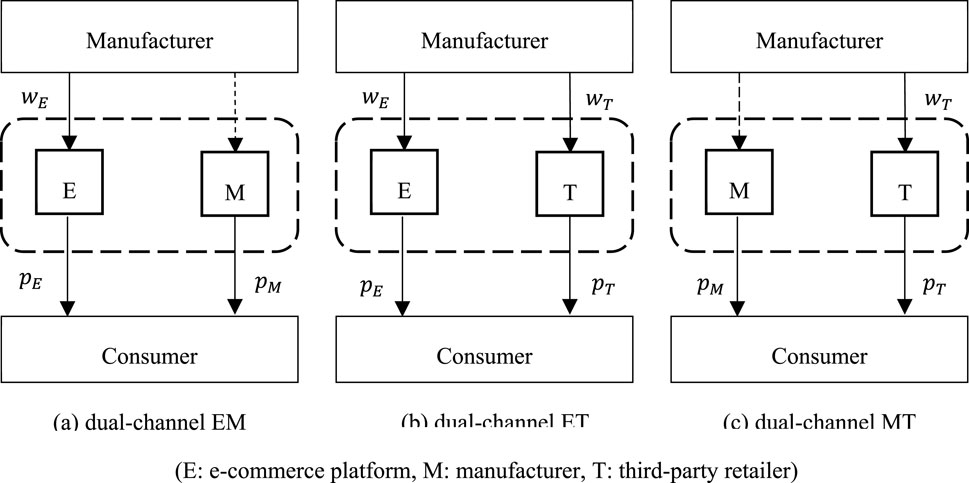

Consider a supply chain system consisting of a manufacturer, a hybrid e-commerce platform and a third-party retailer. The manufacturer plans to sell a certain product through the e-commerce platform and can choose to open a manufacturer-owned store (direct channel) or authorize the e-commerce platform or the third-party retailer to open a reseller store (indirect channel). According to the actual operator of the channel, the e-commerce platform presents three different dual channel structures: the dual-channel EM composed of the e-commerce platform and the manufacturer, the dual-channel ET composed of the e-commerce platform and the third-party retailer, and the dual-channel MT composed of the manufacturer and the third-party retailer. The corresponding channel structures are shown in Figure 1.

Figure 1. Dual-channel structures in e-commerce platform. (A) dual-channel EM. (B) dual-channel ET. (C) dual-channel MT.

The manufacturer or the third-party retailer pays a transaction commission to the e-commerce platform based on sales revenue [27], assuming that the commission ratio

The manufacturer also has an official website that attracts a special group of consumers seeking product information and purchasing channels. To guide consumers who directly visit their website for better online channel management, the manufacturer faces decisions about whether to set recommendations on its official website and how these recommendations should be made. For each dual channel

In addition, consumer utility functions are constructed using demand functions following Wu et al.'s research [4]. In a dual-channel

Similarly, in the recommended market, the consumer utility function is represented as:

In summary, the total market demand consists of two parts: traditional market demand and recommended market demand. The total demand for channel

Next, we will first construct a dual-channel pricing game model for the three channel structures within the e-commerce platform, considering different recommendation strategy scenarios. We will then solve subgame perfect Nash equilibrium and use reverse induction to determine the optimal recommendation strategy for manufacturers. Subsequently, we will analyze optimal prices, demands, and overall supply chain profits using numerical examples under different recommendation strategies.

4 Dual-channel EM structure

For a dual-channel EM composed of the e-commerce platform and the manufacturer, the e-commerce platform and the manufacturer have product ownership, respectively opening their e-commerce stores and official flagship stores for sales and are responsible for fulfillment services in their respective channels. Taking “not recommending” as the benchmark model (referred to as N strategy), the manufacturer can choose to only recommend the e-commerce platform (referred to as E strategy) or the manufacturer (referred to as M strategy), or they can choose to recommend both the e-commerce platform and the manufacturer simultaneously (referred to as B strategy). The sequence of the game is as follows: first, the manufacturer decides whether to make recommendations and selects a recommendation strategy; then the manufacturer determines wholesale price

The profit of the e-commerce platform consists of the sales profit from the distribution channel and the commission fees from the direct sales channel, while the profit of the manufacturer consists of the sales profit from the direct sales channel and wholesale income from the distribution channel.

4.1 Equilibrium results

Using reverse induction to solve for the equilibrium of each recommendation strategy. First, for a given

Proposition 1. In the dual-channel EM structure, the optimal wholesale and retail prices for the four recommendation strategies are as follows:

(a) No recommendation (N strategy)

(b) Only recommend e-commerce platform (E strategy)

(c) Only recommend manufacturer (M strategy)

(d) Simultaneously recommend e-commerce platform and manufacturer (B strategy)

Lemma 1. Holding other parameters constant, as the relative size of the recommended market

Lemma 1 indicates that regardless of the form of recommendation, the more consumers attracted to the e-commerce platform through recommendations, the more attention is paid to these recommended consumers by the recommended party, resulting in a larger premium space. Although non-recommended parties cannot directly serve recommended consumers, they can also benefit from alleviated market competition. Therefore, both retail and wholesale prices for the e-commerce platform and the manufacturer will increase. The influx of recommended consumers leads to deviations in pricing in traditional markets from optimal pricing, hence traditional market demand decreases. In addition, as the relative size of the recommended market increases, the rate at which e-commerce platforms raise their retail prices through distribution channels is faster than that of wholesale prices (

4.2 Comparative analysis

The impact of different recommendation strategies on the profits of the e-commerce platform and the manufacturer is as follows:

Conclusion 1. In the dual-channel EM structure, comparing recommendation strategies

(a) The E strategy increases the profits of both the e-commerce platform and the manufacturer, i.e.,

(b) There exists a threshold

(c) The B strategy increases the profits of both the e-commerce platform and the manufacturer, i.e.,

Conclusion 1 indicates that when the manufacturer and the e-commerce platform both act as online retailers, recommendations can increase the profits of the recommended party because it increases their market demand. As a result, the e-commerce platform or the manufacturer as the recommended party can directly benefit from the increased sales profit derived from the demand of recommended consumers. Secondly, recommendations do not necessarily reduce the profits of non-recommended parties. The manufacturer, as a non-recommended party, can benefit from the E strategy, while the e-commerce platform may suffer in the M strategy. This is because when the e-commerce platform or the manufacturer act as a non-recommended party, although sales profits may decrease due to reduced traditional market demand, both parties can indirectly gain higher returns through the commission fee or the wholesale contract resulting from an increase in each other’s demands. Balancing these two sources of profit reveals that for the manufacturer acting as the supply chain leader in the E strategy, an increase in wholesale income outweighs any loss in sales profit; whereas for the e-commerce platform in the M strategy only with a certain scale of recommended market will an increase in the commission fee compensate for any loss in sales profit. This outcome demonstrates that there exists a conflict of recommendation preference between the e-commerce platform and the manufacturer. The former hopes to receive the direct recommendation from the manufacturer which would be beneficial for all stakeholders involved.

4.3 Optimal recommendation strategy

The manufacturer determines the recommendation strategy based on its own profit level, choosing the most profitable recommendation method as the optimal recommendation strategy. The results are summarized in Proposition 2.

Proposition 2. In a dual-channel EM structure, the optimal recommendation strategy for the manufacturer is:

(a) When

(b) When

Proposition 2 indicates that the optimal recommendation strategy of the manufacturer is not only related to the relative size of the recommendation market, but also closely related to the commission rate. If the commission rate is low, the manufacturer will choose indifferent recommendation for resale channels and direct sales channels; if the commission rate is high, the manufacturer will choose only direct sales recommendation when the relative size of the recommendation market is low, and indifferent recommendation when the relative size of the recommendation market is high. This is because compared with recommending only direct sales channels, directing all consumers to resale channels will result in higher efficiency loss due to double marginal effects. Not recommending any products or services at all will result in a reduction in market demand by losing potential consumers, therefore, the E strategy and N strategy are strictly inferior to the M strategy. When the commission rate is low or the relative size of the recommendation market is high, the manufacturer can obtain higher profits from the sales revenue of direct sales channels or the wholesale revenue of resale channels. Therefore, indiscriminately promoting products or services is better than targeted promotion. However, when the commission rate is high and the relative size of the recommendation market is low, the manufacturer is at a disadvantage on the e-commerce platform, and the small-scale recommended market will lead to more intense competition between the two parties to attract customers. Therefore, the manufacturer can only enhance its channel control power and achieve higher sales revenue by promoting its products through direct sales channels. It can be seen that under the dual-channel EM structure, in order to expand market demand while avoiding profit loss due to weakened channel control, not recommending or only recommending the distribution channel will not become the optimal recommendation strategy for the manufacturer. Regardless of the relative size of the recommended market, the manufacturer will always take recommended measures and recommend the direct sales channel.

Proposition 2 explains why in reality manufacturers always recommend direct sales channels rather than self-owned channels of e-commerce platforms. For example, Huawei, Xiaomi, etc., the main mobile phone is a digital product commission rate is relatively high, considering the price comparison behavior between consumers in different e-commerce malls, the recommended market size is relatively small, so they always choose only to recommend their own official website mall.

Theorem 1. Let

Theorem 1 indicates that the higher the level of channel competition, the more severe market imbalance will result from only recommending the direct sales channel, therefore relaxing the conditions for the manufacturer to choose indiscriminate recommendation. The higher the commission rate, the stronger the desire of the manufacturer to increase sales profit through direct sales channel by recommending consumers, hence leading to stricter conditions for the manufacturer to choose indiscriminate recommendation. Additionally, reducing the commission ratio can also be seen as potential payment for the e-commerce platform in order to obtain the recommendation.

5 Dual-channel ET structure

For the dual-channel ET composed of the e-commerce platform and the third-party retailer, both the e-commerce platform and the third-party retailer wholesale products from the manufacturer, operate their own authorized stores for online sales. The third-party retailer pays sales commission to the e-commerce platform. Using non-recommendation as the baseline model (denoted as N strategy), the manufacturer can choose to only recommend the e-commerce platform (denoted as E strategy) or the third-party retailer (denoted as T strategy), or it can choose to simultaneously recommend both the e-commerce platform and the third-party retailer (denoted as B strategy). The game sequence is as follows. First, the manufacturer decides whether to recommend and chooses a recommendation strategy. Secondly, the manufacturer determines wholesale prices

The profit of the e-commerce platform is composed of the sales profit from the e-commerce’s distribution channel and the commission fees from the third-party retailer’s distribution channel. The manufacturer’s profit is composed of the wholesale income from the e-commerce’s distribution channel and the third-party retailer’s distribution channel.

5.1 Equilibrium results

Using inverse induction method, the equilibrium of each recommendation strategy is solved. First, for given

Proposition 3. In the dual-channel ET structure, the optimal wholesale and retail prices for the four recommendation strategies are as follows:

(a) No recommendation (N strategy)

(b) Only recommend e-commerce platform (E strategy)

(c) Only recommend third-party retailer (strategy T)

(d) Simultaneously recommend e-commerce platform and third-party retailer (strategy B)

5.2 Comparative analysis

Examining the impact of different recommendation strategies on the profits of the e-commerce platform and the third-party retailer, the results are as follows.

Conclusion 2. In the dual-channel ET structure, comparing recommendation strategy

(a) Only when

(b) Only when

(c) Only when

Conclusion 2 provides the impact of recommended strategies on the profits of the recommended and non-recommended party in the dual-channel ET structure. A significant difference from the dual-channel EM structure is that recommendations do not necessarily increase the profit of the recommended party. When the manufacturer only recommends the e-commerce channel, although there is an increase in market demand for the e-commerce platform, if the relative size of the recommended market is small, both the e-commerce platform and the third-party retailer may engage in price competition to attract consumers. The non-recommended third-party retail channel may suffer more severe losses due to double marginal effects, making it difficult for the e-commerce platform to compensate for sales and commission losses in traditional markets with increased revenue from recommended markets. Therefore, the e-commerce platform that consider both self-sales profits and third-party retailer commissions can only achieve higher profits from recommendations when the relative size of the recommended market is high. When the manufacturer exclusively recommends the third-party retailer, exclusive recommendation always benefits the third-party retailer by bringing about market increments without considering whether the e-commerce platform is profitable or not. However, when the manufacturer simultaneously recommends both the third-party retailer and the e-commerce platform under equal conditions, compared to exclusive recommendation, the third-party retailer receive a smaller market increment from recommendations; thus, avoiding loss due to price competition and increasing profits only when market scale is relatively high. Furthermore, recommendations may also increase non-recommended party’s profits because when a relative large-scale recommendation occurs as a result of their competitive advantage leading them to raise retail prices which benefits non-recommended parties through reduced market competition levels resulting in greater profit gains. Additionally, as a non-recommended party, the e-commerce platform can also benefit from increased commission fees derived from the increased demand at the third-party retailer.

5.3 Optimal recommendation strategy

Proposition 4. In the dual-channel ET structure, the manufacturer’s optimal recommendation strategy is as follows: when

Proposition 4 indicates that the manufacturer’s optimal recommendation strategy depends on the relative size of the recommended market. If the relative size of the recommended market is low, then the manufacturer chooses not to recommend; conversely, if the relative size of the recommended market is high, then the manufacturer chooses to indiscriminately recommend both e-commerce and retail channels. The reason for this lies in several factors: On one hand, compared to indiscriminate recommendation, recommending only one channel (e-commerce platform or third-party retailer) causes an imbalance in the market which reduces non-recommended party’s market increment. This leads to lower retail prices and wholesale prices for non-recommended parties (

6 Dual-channel MT structure

For the dual-channel MT consisting of the manufacturer and third-party retailer, the manufacturer wholesales products to the third-party retailer, and the third-party retailer and manufacturer respectively operate the third-party authorized store and official flagship store. The e-commerce platform does not participate in product sales and only provides a platform to collect transaction fees. Taking non-recommendation as the benchmark model (referred to as N strategy), the manufacturer can choose to only recommend the manufacturer (referred to as M strategy) or the third-party retailer (referred to as T strategy) or choose to recommend both the manufacturer and the third-party retailer (referred to as B strategy) simultaneously. The game order is as follows. First, the manufacturer decides whether to recommend and chooses the recommended strategy. Second, the manufacturer decides the wholesale price

The profit of the e-commerce platform is composed of the commission fees from the manufacturer’s direct sales channel and the retailer’s distribution channel. The manufacturer’s profit is composed of the sales profit from the direct sales channel and the wholesale income from the retailer’s distribution channel.

6.1 Equilibrium results

Using the method of backward induction to solve for the equilibrium of each recommended strategy. First, for a given

Proposition 5. In the dual-channel MT, the optimal wholesale and retail prices for the four recommended strategies are as follows:

(a) Non-recommendation (N strategy)

(b) Only recommend manufacturer (M strategy)

(c) Only recommend third-party retailer (T strategy)

(d) Simultaneously recommend e-commerce platform and third-party retailer (strategy B)

6.2 Comparative analysis

Examination of the impact of different recommended strategies on the profits of the e-commerce platform, manufacturer, and third-party retailer yields the following results. Substituting Proposition 5 into Equations 6–8 yields Conclusion 3.

Conclusion 3. In a dual-channel MT structure, comparing recommended strategies

(a) The M strategy increases the profits of the e-commerce platform and manufacturer while decreasing the profit for the third-party retailer, i.e.,

(b) The T strategy increases the profit for the e-commerce platform. There exists a threshold

(c) The B strategy increases profits for the e-commerce platform, manufacturer, and third-party retailer, i.e.,

Comparing Conclusion 2 and Conclusion 3, it is similar to the dual-channel ET structure in that recommendations do not necessarily increase the profits of the recommended party. However, there is a slight difference from intuition: in the ET structure, weaker third-party retailers can unconditionally benefit from differential recommendations, while in the MT structure, stronger the manufacturer can unconditionally benefit from differential recommendations. From Conclusion 3, we can infer that firstly, the manufacturer adopting recommended strategies always increase e-commerce platform profits. Any party entering the recommended market can improve commission fees paid to the e-commerce platform by serving more consumers. Secondly, due to channel efficiency advantages, the manufacturer recommending only direct sales channels increases demand for direct sales channels and reduces demand for resale channels. Therefore, the manufacturer gains higher sales profits due to increased demand while the third-party retailer suffer due to reduced demand. The manufacturer recommending only resale channels increases demand for these channels; however, because of double marginalization weakening recommendation effects unless the relative size of the recommended market is high enough to compensate for traditional market demand reduction losses. Finally, the manufacturer’s indiscriminate recommendation of both direct sales and distribution channels can increase demand for each channel. Therefore, both the manufacturer and the third-party retailer can profit from the expansion of market demand.

6.3 Optimal recommendation strategy

Proposition 6. In the dual-channel MT structure, the M strategy is optimal, i.e.,

In the dual-channel MT structure, the manufacturer chooses indiscriminate recommendation for both direct sales channels and resale channels. The reason is that recommending only the direct sales channel will lead to a decrease in traditional market demand for the non-recommended party, while recommending only the resale channel will result in a loss of channel efficiency due to double marginalization. Both differentiated recommendations and indiscriminate recommendations reduce the manufacturer’s wholesale revenue but fail to achieve higher sales profits. Therefore, differentiated recommendations are inferior to indiscriminate recommendations. Combining Proposition 3, indiscriminate recommendations can not only reduce the loss of channel efficiency but also meet higher market demand, and the manufacturer will benefit from serving more traditional consumers and recommending consumers.

Combining Proposition 2 and Proposition 6, the manufacturer will prioritize recommending direct sales channels in any channel structure, and for resale channels with different competitive positions, the manufacturer will adopt different recommendation strategies. When direct sales channels coexist with dominant resale channels (e-commerce platform channels), the manufacturer may only recommend direct sales channels to obtain additional competitive advantages; When direct sales channels coexist with weak resale channels (third-party retailer channels), the manufacturer’s indiscriminate recommendation strictly superior to differentiated recommendation to improve channel efficiency. In practice, the manufacturer often neglects to attract customers to the e-commerce platform and the third-party retailer due to concerns about customer loss. The above analysis indicates that even if manufacturers cannot directly serve consumers, they can still benefit indirectly through wholesale agreements or channel coordination. Furthermore, in most cases, recommending online retailers is advantageous for manufacturers.

7 Numerical simulation

To further analyze the optimal decisions in different dual-channel structures, this section combines numerical examples for analysis. Under the premise of meeting parameter assumptions, taking

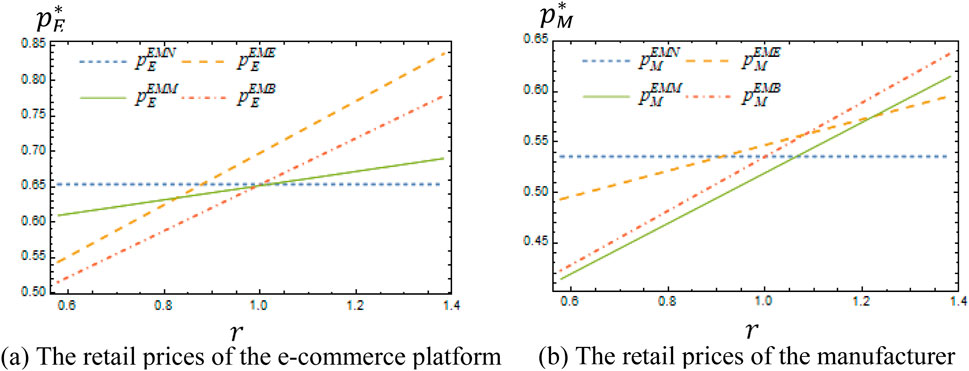

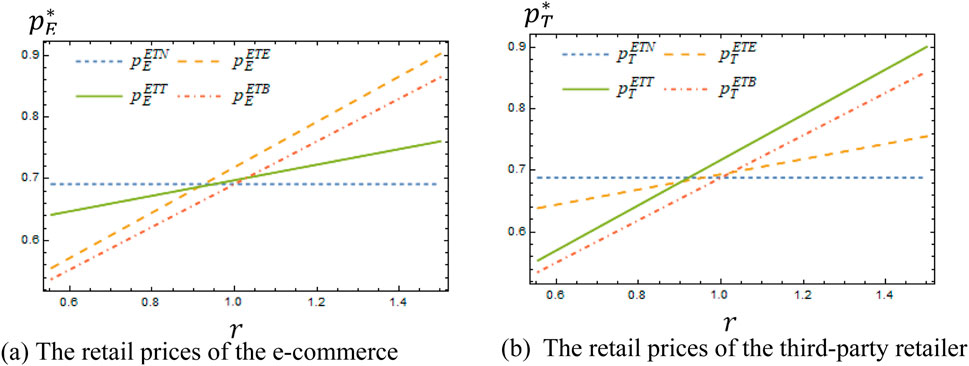

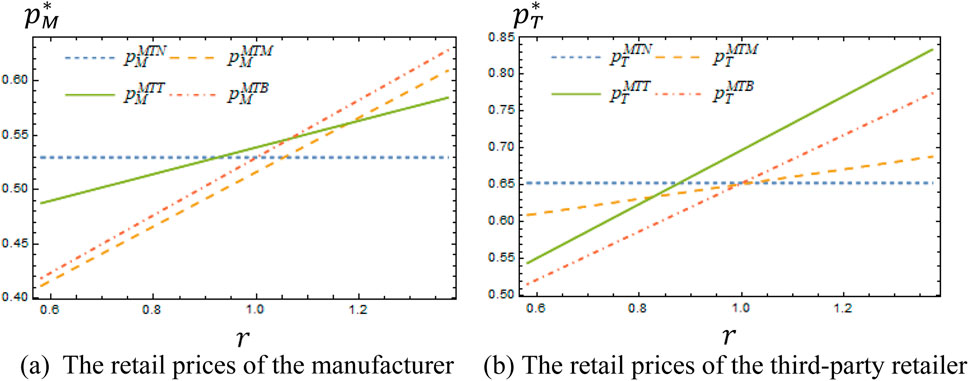

7.1 Retail prices

Figures 2–4 show the retail prices of e-commerce platforms, manufacturers, and third-party retailers under different dual-channel structures. The results indicate that in any dual-channel structure, when the recommended market relative scale is small, the retail prices under recommendation are lower than those without recommendation. The recommended businesses will lower their prices to attract recommended consumers. However, when the recommended market relative scale is large, the retail prices under recommendation are higher than those without recommendation. From the perspective of the recommended party, although recommended consumers give them a demand advantage in the market which gives them an incentive to raise prices; increasing retail prices will reduce traditional market demand. Therefore, only when the relative scale of the recommended market is high and the benefit from increased demand outweighs losses from reduced traditional market demand would they increase retail prices. From the perspective of non-recommended parties, price reductions by recommended parties will lead to more intense market competition. Non-recommended parties are at a disadvantage as they cannot access recommended consumers and ultimately have to follow suit with price reductions to retain traditional market consumers. Raising prices by non-recommended parties will ease market competition and following suit with price increases will improve sales profits.

Figure 2. Retail prices for the dual-channel EM model. (A) The retail prices of the e-commerce platform. (B) The retail prices of the manufacturer.

Figure 3. Retail prices for the dual-channel ET model. (A) The retail prices of the e-commerce platform. (B) The retail prices of the third-party retailer.

Figure 4. Retail prices for the dual-channel MT model. (A) The retail prices of the manufacturer. (B) The retail prices of the third-party retailer.

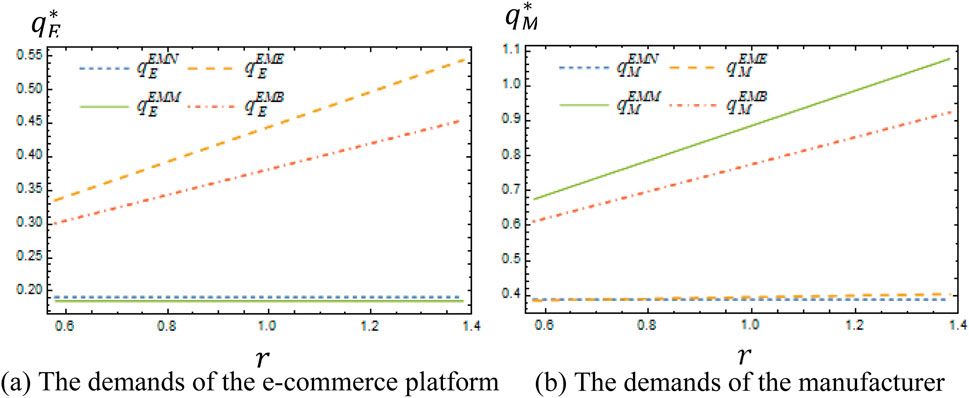

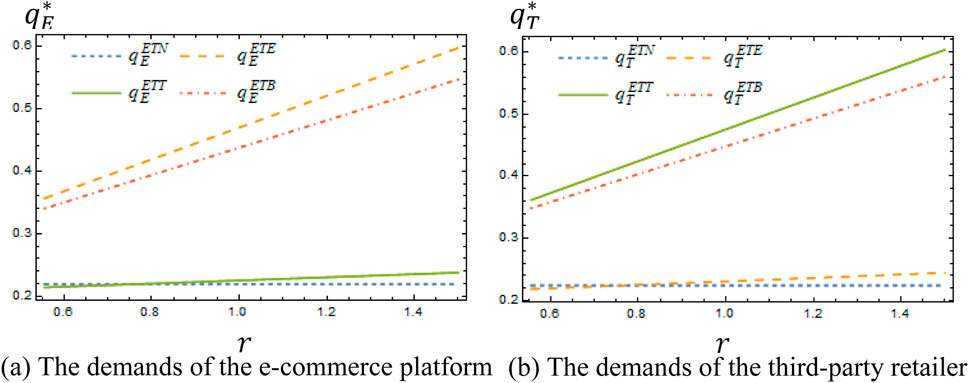

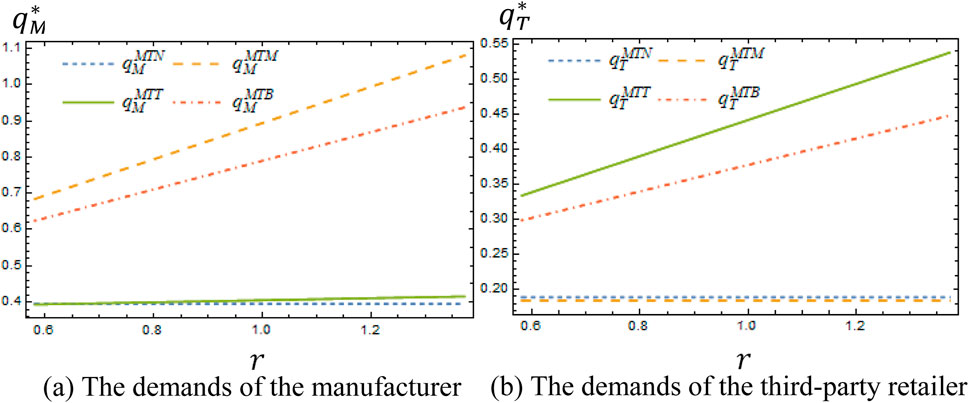

7.2 Market demands

Figures 5–7 show the demand for e-commerce platforms, manufacturers, and third-party retailers under different dual-channel structures. It can be observed that in any dual-channel structure, both differentiated recommendation and indiscriminate recommendation can attract recommended consumers to e-commerce platforms, increasing the demand for the recommended party compared to the non-recommended scenario. Additionally, under differentiated recommendation, there is a greater increase in demand, indicating that competition in the recommended market does not favor an expansion of market demand. In dual channels EM and MT, recommending only the direct sales channel (i.e., manufacturer’s channel) will reduce the demand for non-recommended parties due to the elimination of double marginalization effects; thus, expanding direct sales channels will erode resale channels. In differentiated recommendations between e-commerce platforms and third-party retailers if the relative scale of the recommended market is small, to attract exclusive consumers, there is a higher relative intensity of price reduction by recommended parties compared to non-recommended parties. This attracts traditional market consumers to more favorable recommended channels. If the relative scale of the recommended market is large because of exclusive consumer advantages; there is a higher relative intensity of price increases by recommended parties compared to non-recommended ones as traditional market consumers, then turn towards better value non-recommended channels. Under necessary conditions, it may be necessary for recommended parties to abandon traditional market consumers and rely on increased demand brought by recommended consumers in order to enhance overall profits.

Figure 5. The demands for the dual-channel EM model. (A) The demands of the e-commerce platform. (B) The demands of the manufacturer.

Figure 6. The demands for the dual-channel ET model. (A) The demands of the e-commerce platform. (B) The demands of the third-party retailer.

Figure 7. The demands for the dual-channel MT model. (A) The demands of the manufacturer. (B) The demands of the third-party retailer.

7.3 Supply chain profits

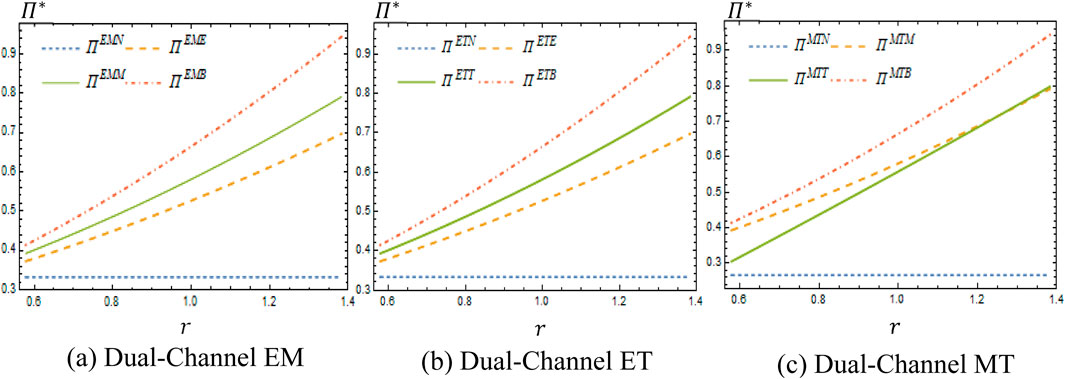

Let

Figure 8. The profits of the supply chain. (A) Dual-Channel EM. (B) Dual-Channel ET. (C) Dual-Channel MT.

Figure 8 illustrates that the adoption of recommendation strategies by manufacturers can increase the overall profit level of the supply chain due to purchases made by recommended consumers. Among the three channel structures, supply chain profits are highest under indiscriminate recommendation. Comparing the supply chain profits under different recommendation strategies, in dual-channel EM and ET, supply chain profits are lowest under strategy E; in dual-channel MT, when the relative scale of the recommended market is small, supply chain profits are lowest under strategy T, and when it is large, they are lowest under strategy M. The maximization of overall supply chain profit does not completely align with maximizing manufacturer’s profit; therefore, a manufacturer’s recommendation strategy may not be optimal for the entire supply chain system.

8 Conclusion and implication

This study focuses on the phenomenon of manufacturers engaging in multi-channel sales through e-commerce platforms, examining channel management measures by manufacturers to guide consumer behavior through recommendation strategies. For the three dual-channel structures composed of e-commerce platforms, manufacturers, and third-party retailers, game models were constructed for manufacturer’s non-recommendation, differentiated recommendation, and indiscriminate recommendation. The impact of channel structure and recommendation strategy on recommended parties and non-recommended parties was compared. The optimal recommendation strategy for manufacturers was discussed along with numerical simulation analysis of differences in optimal prices, market demand, and supply chain profits.

The research findings are as follows:

(1) Under different channel structures, recommendations do not necessarily increase the profit of the recommended party or decrease the profit of the non-recommended party. In most cases, a higher relative scale in the recommended market is needed to increase profits for both parties while avoiding low-price competition to attract a small number of recommended consumers.

(2) The optimal recommendation strategy for manufacturers is closely related to channel structure, commission rates, and relative scale in the recommended market. In dual-channel EM structure when commission rates are high and relative scale in the recommended market is low; manufacturers choose only to recommend their own channels; otherwise, they opt for indiscriminate recommendations. In dual-channel ET structure when relative scale in the recommended market is low; manufacturers will not use a recommendation strategy; otherwise, they choose indiscriminate recommendations. In dual-channel MT structure; choosing indiscriminate recommendations allows manufacturers to obtain maximum profit.

(3) Numerical simulation results show that retail prices, total market demand, and supply chain profits increase with an expansion in relative scale within the recommended market. Compared to scenarios without recommendations: when relative scale within the recommended market is small-retail prices under recommendation are lower than those without recommendations, when it's large-retail prices under recommendation are higher than those without recommendations. Differentiated recommendations and indiscriminate recommendations can both increase demand for recommended parties as well as supply chain profits but differentiated recommendations lead to greater increases in demand while indiscriminate recommendations result in larger increases in supply chain profits.

Based on these conclusions following managerial implications can be drawn.

(1) When using referral methods Manufacturers should focus on predicting referral consumer numbers such as incorporating official website link clicks into forecast planning regarding referral consumer numbers estimating consumption volume driven by official websites which could be used alongside brand promotion methods enhancing manufacturer reputation attracting more consumers via official website guidance then adjusting referral strategies based on predicted referral consumer numbers accordingly.

(2) Manufacturers should not blindly direct consumers solely towards their direct sales channels combining this with channel structure and commission rates directing consumers towards e-commerce platform channels or third-party retailer channels remains beneficial helping leverage synergies between different channels.

(3) E-commerce platforms and third-party retailers should actively monitor changes at manufacturer’s official websites utilizing this information timely adjusting pricing strategies also adjusting commission fees inducing manufacturer referrals through adjustments made by e-commerce platforms.

There are some shortcomings in the research. First of all, this paper assumes that the competition between the traditional market and the recommendation market is symmetrical, and future work can consider the heterogeneity of consumers and incorporate consumer channel preferences into the consideration of recommendation strategies. Secondly, this paper focuses on mathematical modeling method, and does not use actual data for empirical test, so further consideration of empirical method research is needed in the future. Finally, this paper does not integrate artificial intelligence technology, and deep learning can be integrated in the future to improve the accuracy of manufacturer recommendation strategies.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

YW: Writing–original draft, Writing–review and editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This research is supported by funding from the New Talent Research Initiation Project of Guangzhou Railway Polytechnic (GTXYR2310).

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

1. Mantin B, Krishnan H, Dhar T. The strategic role of third-party marketplaces in retailing. Prod Operations Manag (2014) 23(11):1937–49. doi:10.1111/poms.12203

2. Chen SZ, Xiong ZK, Li GD, Wen HH. Research on the coordination mechanism of dual-channel supply chain considering innovation compensation. J Ind Eng Manag (2011) 25(02):45–52+7. doi:10.3969/j.issn.1004-6062.2011.02.007

3. Dai JS, Qin KD. Optimal buyback contract for supply chain with risk-averse retailer. Chin J Manag Sci (2016) 24(07):72–81. doi:10.16381/j.cnki.issn1003-207x.2016.07.009

4. Wu H, Cai G, Chen J, Sheu C. Online manufacturer referral to heterogeneous retailers. Prod Operations Manag (2015) 24(11):1768–82. doi:10.1111/poms.12363

5. Duan YR, Yin J. Consumer recommendation reward and advertising investment dynamic pricing decision based on Bass model. Chin J Manag Sci (2020) 28(08):65–75. doi:10.16381/j.cnki.issn1003-207x.2020.08.006

6. Lobel I, Sadler E, Varshney LR. Customer referral incentives and social media. Manag Sci (2017) 63(10):3514–29. doi:10.1287/mnsc.2016.2476

7. Yang DH, Gao X. Online retailer recommender systems: a competitive analysis. Int J Prod Res (2017) 55(14):4089–109. doi:10.1080/00207543.2016.1253888

8. Blanchard SJ, Hada M, Carlson KA. Specialist competitor referrals: how salespeople can use competitor referrals for nonfocal products to increase focal product sales. J Marketing (2018) 82(4):127–45. doi:10.1509/jm.16.0269

9. Arbatskaya M, Konishi H. Referrals in search markets. Int J Ind Organ (2012) 30(1):89–101. doi:10.1016/j.ijindorg.2011.06.002

10. Zhang J, Liu Z, Rao RS. Flirting with the enemy: online competitor referral and entry-deterrence. Quantitative Marketing Econ (2018) 16(2):209–49. doi:10.1007/s11129-017-9196-7

11. Ghose A, Mukhopadhyay T, Rajan U. The impact of Internet referral services on a supply chain. Inf Syst Res (2007) 18(3):300–19. doi:10.1287/isre.1070.0130

12. Li ZL, Guo Q, Nie J. Research on online referral strategy of dual-channel manufacturers based on risk aversion. China Manag Sci (2020) 28(07):112–21. doi:10.16381/j.cnki.issn1003-207x.2020.07.011

13. Zhang Q, Lu J, Jin Y. Artificial intelligence in recommender systems. Complex and Intell Syst (2021) 7(1):439–57. doi:10.1007/s40747-020-00212-w

14. Yu D, Zhou Y, Zhang S, Li W, Small M, Shang K. Information cascade prediction of complex networks based on physics-informed graph convolutional network. New J Phys (2024) 26(1):013031. doi:10.1088/1367-2630/ad1b29

15. Liu B. Based on intelligent advertising recommendation and abnormal advertising monitoring system in the field of machine learning. Int J Comput Sci Inf Technol (2023) 1(1):17–23. doi:10.62051/ijcsit.v1n1.03

16. Danaf M, Becker F, Song X, Atasoy B, Ben-Akiva M. Online discrete choice models: applications in personalized recommendations. Decis Support Syst (2019) 119:35–45. doi:10.1016/j.dss.2019.02.003

17. Guo Z, Yu K, Li Y, Srivastava G, Lin JCW. Deep learning-embedded social internet of things for ambiguity-aware social recommendations. IEEE Trans Netw Sci Eng (2021) 9(3):1067–81. doi:10.1109/tnse.2021.3049262

18. Wolk A, Ebling C. Multi-channel price differentiation: an empirical investigation of existence and causes. Int J Res Marketing (2010) 27(2):142–50. doi:10.1016/j.ijresmar.2010.01.004

19. Boyaci T. Competitive stocking and coordination in a multiple-channel distribution system. IIE Trans (2005) 37(5):407–27. doi:10.1080/07408170590885594

20. Tsay AA, Agrawal N. Channel conflict and coordination in the e-commerce age. Prod operations Manag (2004) 13(1):93–110. doi:10.1111/j.1937-5956.2004.tb00147.x

21. Xiong Z, Li G, Tang YC. Research on channel coordination issues considering dynamic pricing in the network environment. J Ind Eng Manag (2007) 21(3):49–55. doi:10.3969/j.issn.1004-6062.2007.03.011

22. Cao L, Li L. The impact of cross-channel integration on retailers’ sales growth. J Retailing (2015) 91(2):198–216. doi:10.1016/j.jretai.2014.12.005

23. Shen XL, Li YJ, Sun Y, Wang N. Channel integration quality, perceived fluency and omnichannel service usage: the moderating roles of internal and external usage experience. Decis Support Syst (2018) 109:61–73. doi:10.1016/j.dss.2018.01.006

24. Li Y, Liu H, Lim ETK, Goh JM, Yang F, Lee MK. Customer's reaction to cross-channel integration in omnichannel retailing: the mediating roles of retailer uncertainty, identity attractiveness, and switching costs. Decis support Syst (2018) 109:50–60. doi:10.1016/j.dss.2017.12.010

25. Abhishek V, Jerath K, Zhang ZJ. Agency selling or reselling? Channel structures in electronic retailing. Manag Sci (2016) 62(8):2259–80. doi:10.1287/mnsc.2015.2230

26. Zhao J, Liu L, Wang Y. Study on supplier competition and model selection based on e-commerce platform. Syst Eng Theor Pract (2024) 39(8):2058–69. doi:10.12011/1000-6788-2018-1029-12

27. Tian L, Vakharia AJ, Tan Y, Xu Y. Marketplace, reseller, or hybrid: strategic analysis of an emerging E-commerce model. Prod Operations Manag (2018) 27(8):1595–610. doi:10.1111/poms.12885

28. Balachander S, Ghosh B, Stock A. Why bundle discounts can be a profitable alternative to competing on price promotions. Marketing Sci (2010) 29(4):624–38. doi:10.1287/mksc.1090.0540

29. Chen Y, Iyer G, Padmanabhan V. Referral infomediaries. Marketing Sci (2002) 21(4):412–34. doi:10.1287/mksc.21.4.412.135

30. Cai GG, Chen YJ. In-store referrals on the internet. J Retailing (2011) 87(4):563–78. doi:10.1016/j.jretai.2011.09.005

31. Ha AY, Shang W, Wang Y. Manufacturer rebate competition in a supply chain with a common retailer. Prod Operations Manag (2017) 26(11):2122–36. doi:10.1111/poms.12749

32. Jerath K, Zhang ZJ. Store within a store. J Marketing Res (2010) 47(4):748–63. doi:10.1509/jmkr.47.4.748

Keywords: recommendation strategy, channel structure, sales model, e-commerce platform, agency selling

Citation: Wang Y (2024) Research on the recommendation strategy of dual-channel manufacturers for hybrid e-commerce platforms. Front. Phys. 12:1455165. doi: 10.3389/fphy.2024.1455165

Received: 26 June 2024; Accepted: 11 November 2024;

Published: 02 December 2024.

Edited by:

Jianrong Wang, Shanxi University, ChinaCopyright © 2024 Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yang Wang, d2FuZ3lhbmdAZ3R4eS5lZHUuY24=

Yang Wang

Yang Wang