- Department of Physics and Energy Engineering, Amirkabir University of Technology (Tehran Polytechnic), Tehran, Iran

The stock price data are sampled at discrete times (e.g., hourly, daily, weekly, etc). When data are sampled at discrete times, they appear as a sequence of discontinuous jump events, even if they have been sampled from a continuous process. On the other hand, distinguishing between discontinuities due to finite sampling of the continuous stochastic process and real jump discontinuities in the sample path is often a challenging task. Such considerations, led us to the question: Can discrete data (e.g., stock price) be modeled using only jump-drift processes, regardless of whether the sampled time series originally belongs to the class of continuous processes or discontinuous processes? To answer this question, we built a stochastic dynamical equation in the general form

1 Introduction

The stock price is known as a highly volatile variable in a stock market. Price fluctuations, which occur randomly and frequently and sometimes include sudden jumps, increase investment risk and cause concern for investors and company owners who want to increase their capital. Therefore, researchers are propelled to study the fluctuating behavior of the market to find a way to model prices (or improve existing models) to advise investors looking for the best investments [1–5]. So far, significant progress has been made in this field, the most important of which is stock price modeling via continuous stochastic processes and discontinuous jump processes. The “arithmetic Brownian motion” model was the first mathematical model of stock prices, presented by Louis Bachelier in [6]. In his proposed model, Bachelier assumed that the discount rate is zero and the stochastic differential equation (SDE) governing the stock price is as follows:

where

where

The main shortcoming of Bachelier’s model is that it assumes that the future value of the assets follows a normal distribution. Based on this assumption, Eq. 2 can lead to a negative stock price with a positive probability, which is not possible in reality. In [7] Osborn demonstrated that the future value of the stock should follow a log-normal distribution, but the log-return of the stock follows a normal distribution. Shortly, the Bachelier model was modified by Samuelson in [8], where he introduced the “geometric Brownian motion” model (also known as Black-Sholes model). In this model, it is assumed that the price of the risky stock evolves according to the following SDE:

where µ and

Integration of Eq. 4 over (

where

In turn, the stock price can be determined from Eq. 5 as:

Eq. 6 enables one to simulate the possible stock price trajectories with time step

where

once

The main disadvantage of the Black-Scholes model is its constant volatility assumption, while it is widely believed and empirically confirmed that stock prices do not have constant volatility, rather it varies during time [13–15]. This shortcoming and unsatisfactory performance of the Black-Scholes model caused researchers look for better alternatives and improve the classic Black-Scholes model in two directions:

1- Adding a term with jumpy behavior to the Black-Scholes equation to allow for random jumps in the stock price process (jump-diffusion model e.g., Merton model [16])

2- Considering stochastic volatility for the stock price (e.g., Heston model [17] or GARCH model [18]).

Here we only focus on the first option and describe the jump-diffusion model. Merton in [16] presented one of the first models in which jump processes were used in financial modeling. To take into account price discontinuities, Merton added a Poisson jump process to the log-price while preserving the independence and stationarity of log-returns. A jump-diffusion equation is generally written as:

where

Integration of Eq. 8 over (

here

In turn, the stock price can be determined from Eq. 9 as:

Eq. 10 enables one to simulate the possible stock price trajectories with time step

where

once

The main shortcoming of the jump-diffusion model is that the jumps reconstructed by the model have larger amplitudes than the jumps in the actual data. Let us demonstrate how this problem occurs. Suppose we want to model the daily prices of a stock via jump-diffusion model. As mentioned, first we need to determine the parameters

If

If

As can be seen from Eqs 12, 13, the diffusion term

where

If

If

With this modification, the shortcoming of the jump-diffusion model can be solved. In this model, we assume that

2 Model description

In [22] we have introduced a general dynamical stochastic equation as follows, which includes a deterministic drift term (

where

2.1 Jump-drift modeling

In the first step, we consider Eq. 14 in its simplest form including a drift term and a stochastic term with jumpy behavior, and show that it can be used to reconstruct prices data of the diffusion markets (e.g., Black-Scholes markets). The general form of a jump-drift equation is as follows:

where

Integration of Eq. 15 over (

where

In turn, the stock price can be determined as:

To reconstruct prices data with the above relation, we must find three parameters

where

According to the first relation in Eq. 17, the mean of log-returns (

We claim that the proposed jump-drift dynamics enable us to model diffusion processes such as the Black-Scholes process. We will check the validity of this claim by reconstructing a Black-Scholes process via the new dynamics using the parameters determined from Eq. 18. But before that, let us provide the following two criteria for evaluating the reconstructed process:

1) We know from Wick’s theorem that for the time series of the Black-Scholes process, the statistical moments of the data satisfy the relation

2) In continuation of the previous point, we find the ratio

by comparing this relation with Wick’s relation, i.e.,

this is while, the second moment in original Black-Scholes process is

In the following, we reconstruct a Black-Scholes process with known drift and volatility parameters via the jump-drift equation, and then evaluate the reconstructed data.

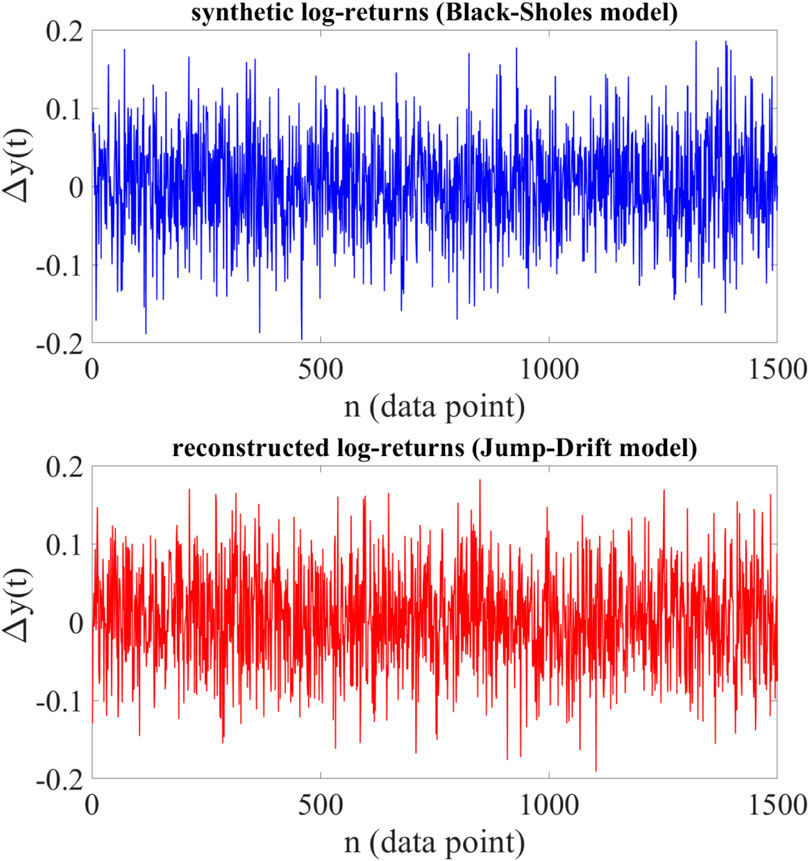

Example 1. First, we generate a synthetic time series

Figure 1. Upper panel: A sample path of synthetic log-returns generated via Black-Scholes dynamics using the preset parameters

Statistical moments determined from generated data:

Required parameters for new modeling:

In the second step, we reconstruct a time series

Statistical moments of reconstructed data:

As can be seen, the reconstructed data are statistically similar to original data with high accuracy, and there is a very good agreement between these results and the theory.

2.2 Jump-jump-drift modeling

In the previous section we modeled a continuous diffusion process through the jump-drift equation. Since real markets are usually jump-diffusion markets, the generalizing of jump-drift modeling to a jump-jump-drift modeling improves the characterization of real markets dynamics beyond a continuous process. The general form of a jump-jump-drift equation is as follows:

where

Integration of Eq. 19 over (

Furthermore, the stock price can be determined from Eq. 20 as:

In modeling the stock price via Eq. 21, we also assume that two jumps do not occur simultaneously, which means that in the time interval

According to this condition, we can discard one of the jump events at each time step, and reconstruct the corresponding data point by another jump event.

To model the stock prices via Eq. 20, we must find the five unknown parameters

By using the relations

To find the five unknowns

Having the statistical moments

We claim that the proposed dynamics enables us to model time series with jump discontinuities more accurately than the classic jump-diffusion dynamics. We will check the validity of this claim by reconstructing a jump-diffusion process via the jump-jump-drift equation. But before that, let us prove this claim by showing that the new relations in Eq. 23 are generalizations of the old jump-diffusion relations in Eq. 11. For this purpose, we consider the case in which

As can be seen, these relations are similar to relations of jump-diffusion model (Eq. 11), so that

In the following, to demonstrate the reliability of the new model, we test it on synthetic data. Furthermore, to ensure the effectiveness of the proposed approach in different conditions, we test the model with different synthetic data.

Example 2:. First, we test the model with data generated through the Black-Scholes process in Example 1. By obtaining the statistical moments

The value of

By obtaining the statistical moments

Case1:. Preset parameters:

Estimated parameters via jump-diffusion model:

Estimated parameters via jump-jump-drift model:

Case2:. Preset parameters:

Estimated parameters via jump-diffusion model:

Estimated parameters via jump-jump-drift model:

The above results show that in the first case, both models lead to almost the same results, but in the second case, the proposed model leads to more accurate results (note that in the new model,

3 Data and methodology

Our dataset comprises the daily closing prices of the Apple and IBM stocks, as well as gold prices with two different time horizons (weekly and hourly). For Apple and IBM stocks, the historical data that will be used are daily closing prices from 1 June 2020 to 1 June 2023, which are obtained from Yahoo Finance source. For gold, the historical data that will be used are weekly gold prices from 5 January 2004 to 3 January 2022, as well as hourly gold prices from 11 March 2022 to 11 November 2022, which are obtained from dukascopy historical data source.

For each of the collected data, we will obtain log-returns time series

where

where

In addition, we will use the following equation to forecast prices for several time steps after the chosen historical period:

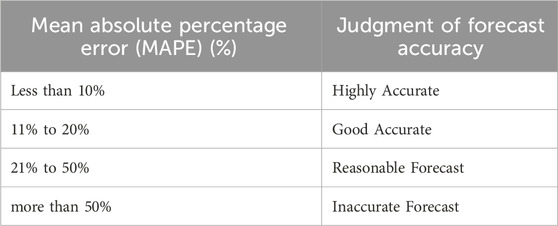

To determine the forecasts accuracy, we will use “Mean Absolute Percentage Error” (MAPE) calculation as follows:

where

3.1 Research output and discussion

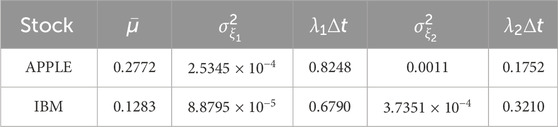

In the following, considering the elements described in the methodology, we first model Apple and IBM stocks and predict their prices for a period of 30 days. Historical data used are daily closing stock prices from 1 June 2020 to 1 June 2023. For daily prices, the trading period is

Table 2. values of the drift, jump amplitudes, and jump rates obtained from historical daily prices of Apple and IBM stocks using the jump-jump-drift modeling.

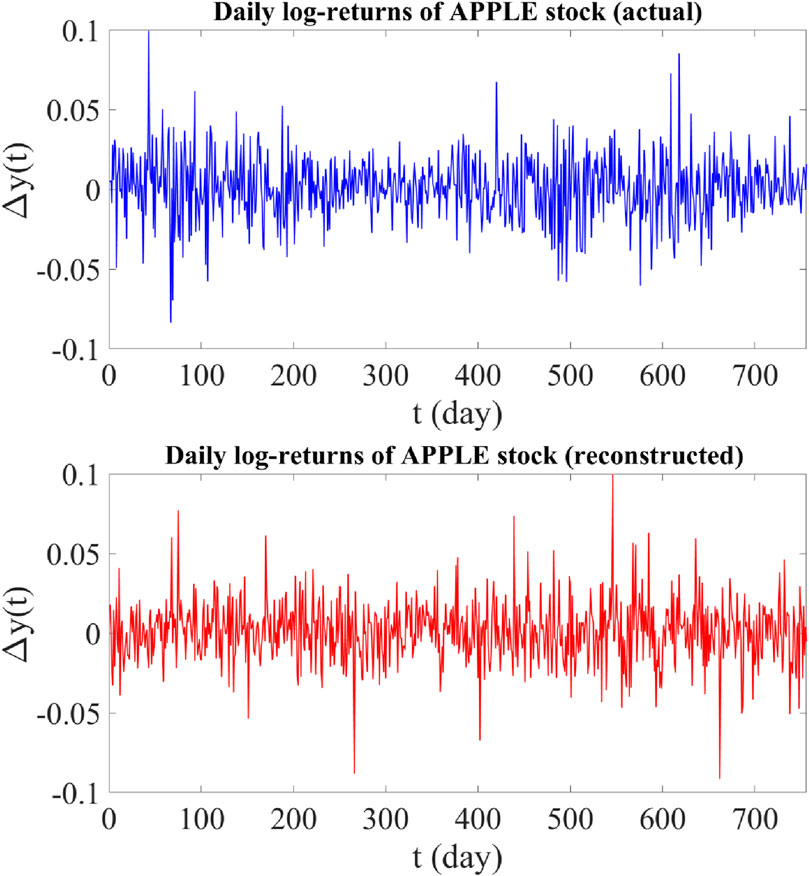

To reconstruct log-return data through proposed model, we use the equation

Figure 2. Upper panel: Time plot of actual daily log-returns of Apple stock from 1 June 2020 to 1 June 2023 (756 data points). Lower panel: Time plot of reconstructed daily log-returns of Apple stock using the proposed jump-jump-drift model.

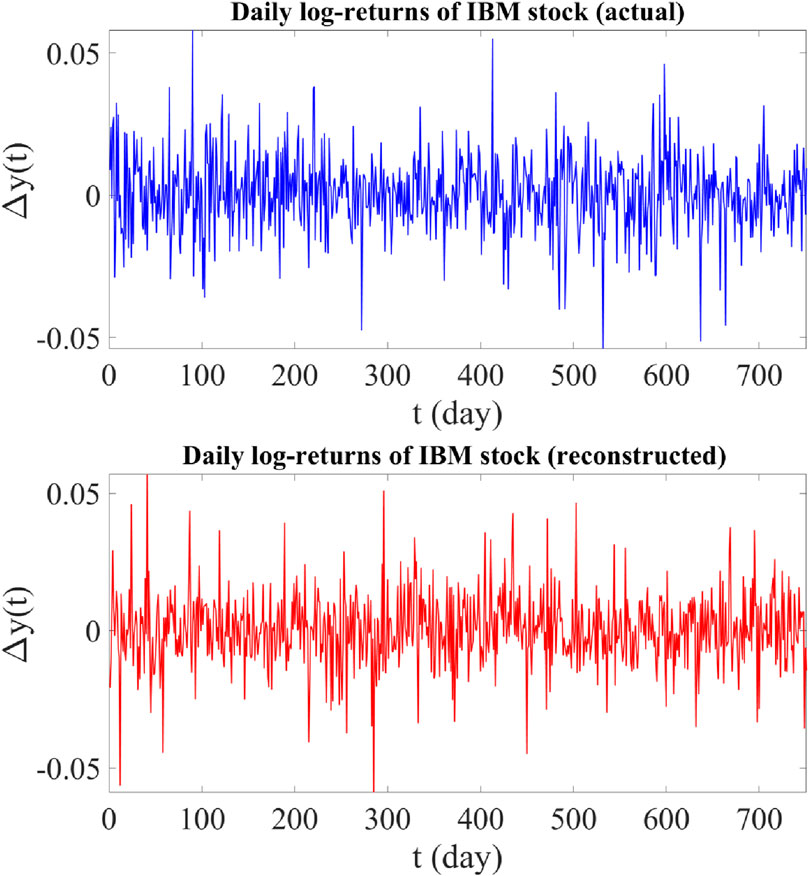

Figure 3. Upper panel: Time plot of actual daily log-returns of IBM stock from 1 June 2020 to 1 June 2023 (756 data points). Lower panel: Time plot of reconstructed daily log-returns of IBM stock using the proposed jump-jump-drift model.

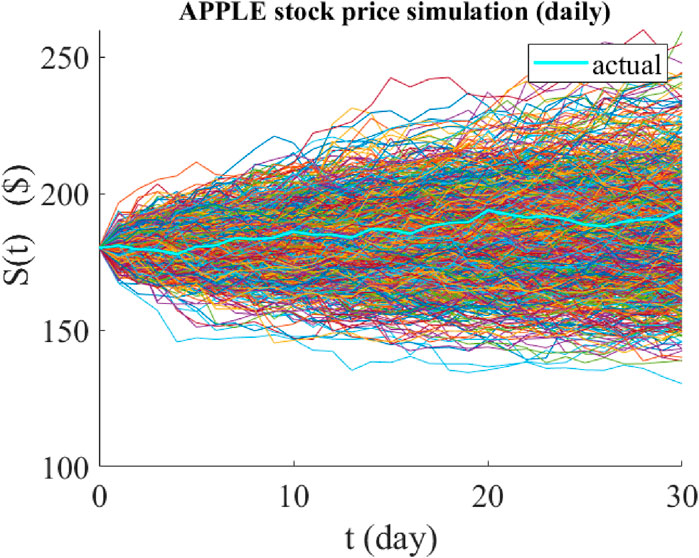

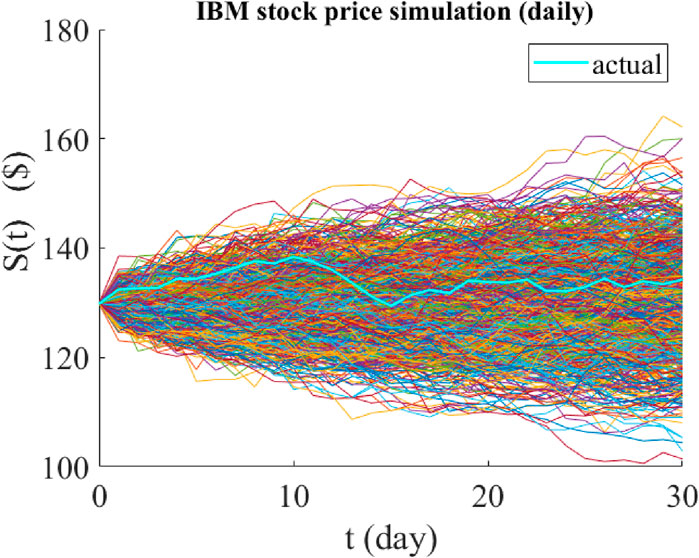

To predict stock prices, we use parameters estimated from historical data. The forecast period is 30 days and is related to the days after the selected historical period. Simulation of predictions is done by 1,000 realization of the trajectory. Each trajectory is realized using the equation

Figure 4. Graphical representation of the predicted paths of the daily price of Apple stock using jump-jump-drift modeling. The time period of all predictions is 30 days and their starting point is 1 June 2023. The cyan graph is the actual price path realized over the same 30 days, and the colored graphs are the 1,000 possible paths predicted by the model.

Figure 5. Graphical representation of the predicted paths of the daily price of IBM stock using jump-jump-drift modeling. The time period of all predictions is 30 days and their starting point is 1 June 2023. The cyan graph is the actual price path realized over the same 30 days, and the colored graphs are the 1,000 possible paths predicted by the model.

The smallest MAPE = 1.51%, the largest MAPE = 24.3%, and the average MAPE = 6.32%. These results show that the jump-jump-drift model has a better performance than the jump-diffusion model, and if the time period of the forecasts becomes larger (e.g., in annual forecasts), the difference between the forecasts of the two models becomes more visible.

The results of IBM stock price predictions are even more surprising than Apple stock. Analysis of IBM stock simulation outputs shows that all 1,000 predicted trajectories have MAPE values less than 15% (with the smallest MAPE = 1.22%, the largest MAPE = 14.02% and the average MAPE = 4.62%), indicating good accuracy of the model predictions. The corresponding values obtained through jump-diffusion model are as follows:

The smallest MAPE = 1.62%, the largest MAPE = 20.7%, and the average MAPE = 5.12%.

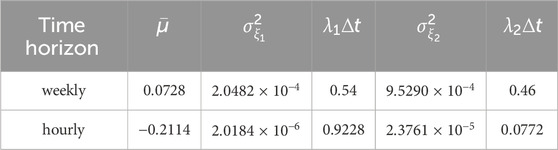

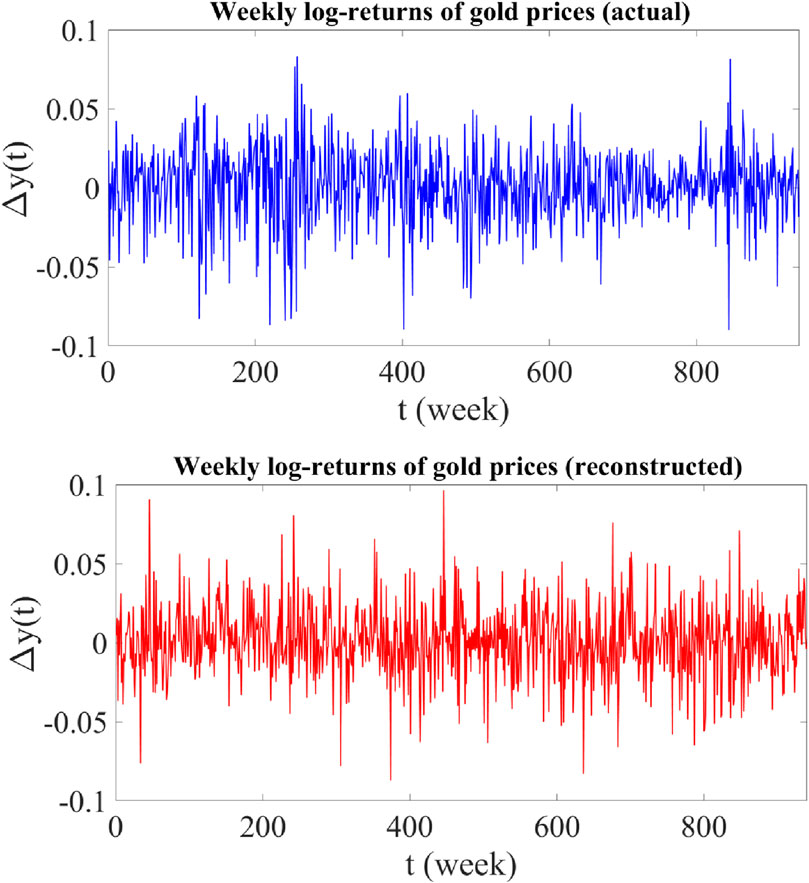

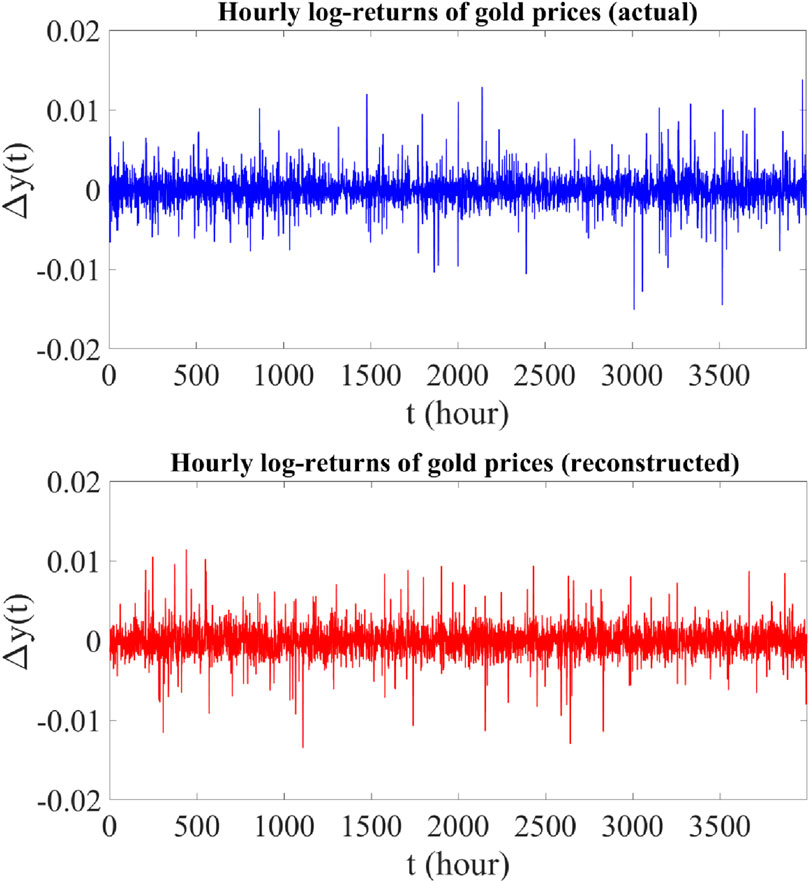

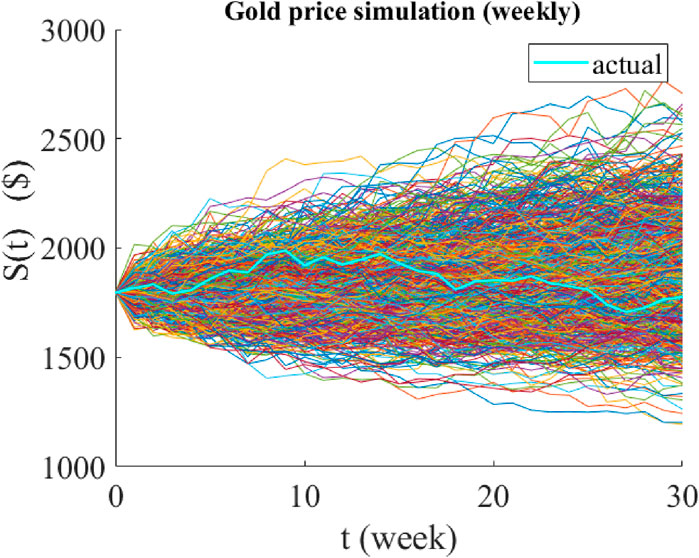

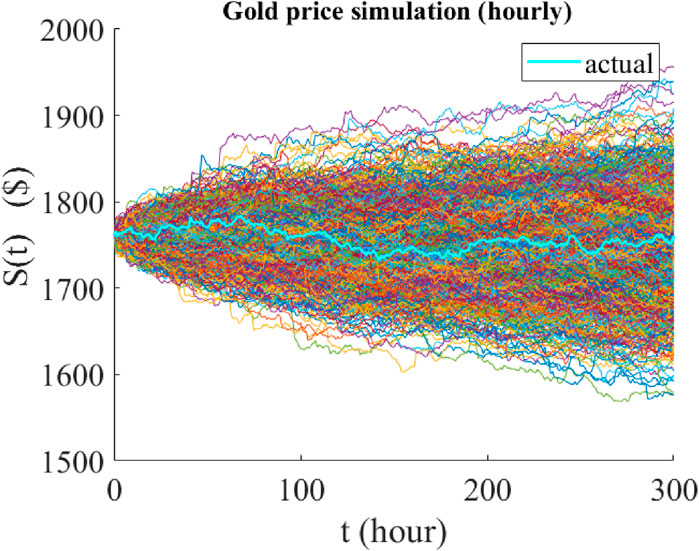

Finally, to see the effectiveness of the proposed approach for different time horizons, we simulate gold prices with two different time horizons. Historical data used are weekly gold price from 5 January 2004 to 3 January 2022, as well as hourly gold prices from 11 March 2022 to 11 November 2022. For weekly prices, the trading period is

Table 3. values of the drift, jump amplitudes, and jump rates obtained from historical gold prices (weekly and hourly) using jump-jump-drift modeling.

To reconstruct log-return data through proposed model, we use the equation

Figure 6. Upper panel: Time plot of actual weekly log-returns of gold prices from 5 January 2004 to 3 January 2022 (940 data points). Lower panel: Time plot of reconstructed weekly log-returns of gold prices using the proposed jump-jump-drift model.

Figure 7. Upper panel: Time plot of actual hourly log-returns of gold prices from 11 March 2022 to 11 November 2022 (3,999 data points). Lower panel: Time plot of reconstructed hourly log-returns of gold prices using the proposed jump-jump-drift model.

To predict gold prices, we use parameters estimated from historical data. The forecast period for weekly price is 30 weeks and for hourly price is 300 h and related to the times after historical periods. Simulation of predictions is done by 1,000 realization of the trajectory. Each trajectory is realized using the equation

Figure 8. Graphical representation of the predicted paths of the weekly price of gold using jump-jump-drift modeling. The time period of all predictions is 30 weeks and their starting point is 3 January 2022. The cyan graph is the actual price path realized over the same 30 weeks, and the colored graphs are the 1,000 possible paths predicted by the model.

Figure 9. Graphical representation of the predicted paths of the hourly price of gold using jump-jump-drift modeling. The time period of all predictions is 300 h and their starting point is 11 November 2022. The cyan graph is the actual price path realized over the same 300 h, and the colored graphs are the 1,000 possible paths predicted by the model.

The smallest MAPE = 2.3%, the largest MPAE = 35.7%, and the average MAPE = 7.85%.

Analysis of hourly gold prices shows that all 1,000 predicted paths have MAPE values less than 10% (with the smallest MAPE = 0.51%, the largest MPAE = 7.17% and the average MAPE = 1.82%), indicating very high accuracy of the model predictions for hourly time horizons. The corresponding values obtained by jump-diffusion model are as follows:

The smallest MAPE = 0.8%, the largest MPAE = 10.3%, and the average MAPE = 2.15%.

4 Conclusion

We discussed that when data are sampled at discrete times (e.g., stock prices), they appear as a sequence of discontinuous jump events, even if they have been sampled from a continuous process. This issue gave us the idea to propose a new modeling in which random variations in the sample path of a measured time series are attributed to jump events, even if the time series belongs to the class of diffusion processes. Based on this, we introduced a new dynamical stochastic equation including a deterministic drift term and a combination of several stochastic terms with jumpy behaviors. The general form of this equation is as follows:

In this modeling we also assumed that the jump events do not occur simultaneously so that the jumps have no overlap. We started with the simplest form of equation including a deterministic drift term and a jump process as the stochastic component, and argued that it can be used to describe the discrete-time evolution of a diffusion process, e.g., Black-Scholes process. Afterwards, we extended the equation by considering two jump processes with different distributed sizes, and used it to model assets such as stock prices and gold prices with different time horizons. We also demonstrated that in all cases the proposed model works better than the old jump model. It should be noted that, due to the small number of available price data and the lack of diversity in the amplitudes of jumps, in this article we modeled prices data only by considering two jump processes. However, depending on the number of data points and variation in the amplitudes of fluctuations, more stochastic terms can be kept in the equation to increase the accuracy of the modeling. But on the other hand, the more the number of terms in the equation, the need to solve the system of equations with more unknowns, the cost of which must be paid in the form of longer runtime.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

AM: Conceptualization, Data curation, Formal Analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing–original draft, Writing–review and editing. HN: Conceptualization, Data curation, Formal Analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing–original draft, Writing–review and editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

1. Reddy K, Clinton V. Simulating stock prices using geometric Brownian motion: evidence from Australian companies. Australas Account Business Finance J (2016) 10(3):23–47. doi:10.14453/aabfj.v10i3.3

2. Synowiec D. Jump-diffusion models with constant parameters for financial log-return processes. Comput Math Appl (2008) 56(8):2120–7. doi:10.1016/j.camwa.2008.02.051

3. Azizah M, Irawan M, Putri E. Comparison of stock price prediction using geometric Brownian motion and multilayer perceptron. In: AIP conference proceedings: Depok, Indonesia. AIP Publishing (2020).

4. Mota PP, Esquível ML. Model selection for stock prices data. J Appl Stat (2016) 43(16):2977–87. doi:10.1080/02664763.2016.1155205

5. Benninga S. Financial modeling, fourth edition By Simon Benninga Hardcover. The MIT press (2014).

6. Bachelier L. Théorie de la spéculation. In: Annales scientifiques de l’École normale supérieure (1900).

7. Osborne MF. Brownian motion in the stock market. Operations Res (1959) 7(2):145–73. doi:10.1287/opre.7.2.145

9. Black F, Scholes M. The pricing of options and corporate liabilities. J Polit economy (1973) 81(3):637–54. doi:10.1086/260062

10. Black F, Karasinski P. Bond and option pricing when short rates are lognormal. Financial Analysts J (1991) 47(4):52–9. doi:10.2469/faj.v47.n4.52

12. Bouchaud J-P, Cont R. A Langevin approach to stock market fluctuations and crashes. Eur Phys J B-Condensed Matter Complex Syst (1998) 6:543–50. doi:10.1007/s100510050582

13. Hull J, White A. The pricing of options on assets with stochastic volatilities. J Finance (1987) 42(2):281–300. doi:10.1111/j.1540-6261.1987.tb02568.x

14. Mercurio D, Spokoiny V. Estimation of time dependent volatility via local change point analysis (2005).

15. Goldentayer L, Klebaner F, Liptser RS. Tracking volatility. Probl Inf Transm (2005) 41:212–29. doi:10.1007/s11122-005-0026-2

16. Merton RC. Option pricing when underlying stock returns are discontinuous. J financial Econ (1976) 3(1-2):125–44. doi:10.1016/0304-405x(76)90022-2

17. Heston SL. A closed-form solution for options with stochastic volatility with applications to bond and currency options. Rev financial Stud (1993) 6(2):327–43. doi:10.1093/rfs/6.2.327

18. Nelson DB. ARCH models as diffusion approximations. J Econom (1990) 45(1-2):7–38. doi:10.1016/0304-4076(90)90092-8

19. Anvari M, Tabar MRR, Peinke J, Lehnertz K. Disentangling the stochastic behavior of complex time series. Scientific Rep (2016) 6(1):35435. doi:10.1038/srep35435

20. Tabar R. Analysis and data-based reconstruction of complex nonlinear dynamical systems, 730. Springer (2019).

21. Lehnertz K, Zabawa L, Tabar MRR. Characterizing abrupt transitions in stochastic dynamics. New J Phys (2018) 20(11):113043. doi:10.1088/1367-2630/aaf0d7

22. Movahed AA, Noshad H. Introducing a new approach for modeling a given time series based on attributing any random variation to a jump event: jump-jump modeling. Scientific Rep (2024) 14(1):1234. doi:10.1038/s41598-024-51863-5

Keywords: stock prices modeling, stochastic dynamical equation, Black-Scholes model, poisson jump process, jump-diffusion model, jump-drift process

Citation: Movahed AA and Noshad H (2024) Introducing a new approach for modeling stock market prices using the combination of jump-drift processes. Front. Phys. 12:1402593. doi: 10.3389/fphy.2024.1402593

Received: 17 March 2024; Accepted: 18 June 2024;

Published: 18 July 2024.

Edited by:

Shuvojit Paul, Indian Institute of Science Education and Research Kolkata, IndiaReviewed by:

N. Narinder, Technical University Dresden, GermanyPrasanta Panigrahi, Indian Institute of Science Education and Research Kolkata, India

Copyright © 2024 Movahed and Noshad. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Houshyar Noshad, aG5vc2hhZEBhdXQuYWMuaXI=

Ali Asghar Movahed

Ali Asghar Movahed Houshyar Noshad*

Houshyar Noshad*