- Chaohu University, Chaohu, Anhui Province, China

This paper presents a more general cobweb model that incorporates the Hilfer fractional derivative in either the demand or supply function or Markov process. The main contributions of this study include deriving the analytical solution for the general model, analyzing the stability of the solution, introducing the equilibrium position using Mittag–Leffler functions, and providing detailed graphical illustrations to validate the effectiveness of the proposed model. The outcomes generalize some known results.

1 Introduction

In 1695, L’Hospital raised the question “dny/dxn if n = 1/2”? That is, “What if n is a fraction”? “This is an apparent paradox from which, one day, useful consequences will be drawn,” Leibniz replied [1]. Since then, the study of fractional derivatives gradually increased. Because the differential operator and the integral operator are inverse to each other, the fractional integral comes in. In short, the fractional integral is the extension of the ordinary integral, which changes the integral order into any real or complex order [2–4],. In the past decades, a large number of facts have proved that the fractional integral can be better prepared than the ordinary integral to simulate real-world phenomena, such as in physics [5–8] and in fluids mechanics[9,10], and more and more researchers like to use fractional integration for mathematical modeling [11–13, 14].

Fractional differential equations can simulate real-life situations better than ordinary differential equations [15]. There exist many different forms of fractional derivatives, namely, the Riemann–Liouville (R–L) fractional derivative[16,17], the Atangana–Baleanu fractional derivative[11,18,19], the Caputo–Fabrizio fractional derivative [20], the Caputo–Liouville (C–L) fractional derivative[16,17], the conformable fractional derivative[21,22], and so on. In the various types of fractional derivatives mentioned previously, the notation of the R–L fractional integral with order μ(0 < μ < 1) is fundamental [3,23–29].

Fractional derivatives play a significant role in economic modeling by providing a more accurate representation of real-world economic phenomena. Unlike traditional integer-order derivatives, fractional derivatives allow for the incorporation of memory effects and long-range dependencies, which are often observed in economic time series data [30–32]. Fractional derivatives capture these characteristics by accounting for the non-Markovian nature of economic processes, where past events and interactions can have a lasting impact on future outcomes. This is particularly relevant in financial markets, where the memory of past price movements and trading behaviors can influence future market dynamics [33–35]. One of the most significant models in economic dynamics, the cobweb economic model, defines the equilibrium price between supply and demand in a market over time [21,36,37]. In the case of pork, for instance, fewer people raised pigs last season due to some factor (such as the epidemic of disease or the increase in the price of pig feed), so this season’s pork production is bound to be low while the market demand remains the same. As a result, the market price of pork is bound to increase. After seeing increasing pork prices this season, more people decided to start raising pigs, which resulted in a substantially bigger supply of pork the following year. When supply outpaces demand and market demand stays the same, pork prices fall as a direct result. The farmers suffer from lower pork prices. As a result, fewer people raised pigs last season. Farmers are frequently powerless in the face of this, and the list goes on. Kaldor [38] examined this phenomenon and discovered that the prices of pork fluctuate like a spider’s web. He then provided a theoretical explanation of this economic event and used the term “cobweb theorem” to describe all economic occurrences that share this characteristic. The “cobweb theorem” was improved and expanded further in [39]. Later, Gandolfo [37] integrated the findings of earlier studies with his own to create a monograph that has since been the standard reference for scientists working on dynamical models.

Following closely in the footsteps of [40], this work deals with a more general cobweb economic model while taking the Hilfer fractional derivative into consideration. We provide the general model’s analytical solution and evaluate its stability. The present outcomes generalize the results of [41] and [40].

The remainder of this work is structured as follows: In Sections 2, 3, some fundamental concepts and theorems on the fractional derivative and cobweb theory are provided. The solution to this model is presented in Section 4, after which its stability is examined and the equilibrium point is calculated. One numerical example and comprehensive descriptions of graphical representations based on the concept are given in Section 5. Some findings are provided in Section 6.

2 Preliminaries on fractional derivatives

We recall the basic definitions and properties of the fractional integrals and the fractional derivatives which will be needed in the following.

Definition 2.1. [2,3,42,43] Let

The right R–L fractional integral of order μ (0 < μ < 1) has the following form:

The right R–L fractional derivative of order μ

The right C–L fractional derivative of order μ

where [μ] denotes the largest integer that do not exceed μ, so

Definition 2.2. [2,3,42,43] Let

The left R–L fractional integral of order μ (0 < μ < 1) has the following form:

The left R–L fractional derivative of order μ

The left C–L fractional derivative of order μ

The generalized R–L fractional derivative, also called the Hilfer fractional derivative [1,40], is defined as follows:

Definition 2.3. [1,15,44]

and

are called the right-sided and left-sided Hilfer fractional derivatives, where

From Definition 2.3, we can find that if ν = 0,

and it turns into the R–L fractional derivative of order μ [(2) and (5)].

Moreover, if ν = 1,

and it turns into the C–L fractional derivative of order μ [ (3) and (6)]. More applications of

In order to obtain the analytical solution of the model with the Hilfer fractional derivative, we use the Mittag–Leffler function given by Definition 2.4.

Definition 2.4. [3,40,42,46] The Mittag–Leffler functions Eα(z) and Eα,β(z) are given as follows:

Hence,

Next, we present some properties of Mittag–Leffler functions proved in some existing literature.

Lemma 2.1. [47] Let

Lemma 2.2. [48] If 0 < α, β < 2, αβ < 2 and

Lemma 2.3. [40] When z → ∞, then the results of Lemma 2.1 and Lemma 2.2 reduce to 0; that is,

and

Lemma 2.4. [1,3,44] The Laplace transform of the Hilfer fractional derivative of g(t) satisfies

where

and

and

with

3 Cobweb economic model

In this section, we give some definitions and theorems of cobweb models.

Gandolfo [37] studied the cobweb models with (13) and (14) (see also in [41,49]).

where p(t) is the market price at time t and p (t + 1) is the market price at time t + 1. D(t), S(t) is the market demand and market supply at time t, respectively.

where p(t) + cp′t) denotes the expected price at time t; that is, the price that producers anticipate will remain stable after output is realized at the time of production is initiated. The commonly used form of p(t) + cp′t) is p(t) + c (p (t + 1) − p(t)) [49], and c > 0 measures the consumer’s price sensitivity to the price difference. The implications behind (13) and (14) are described as follows. In the demand function, a is the market potential and b is the consumer’s price sensitivity coefficient. The larger b means the more sensitive consumers, and a small piece price drop may attract a large portion of consumers to make the consumption. To make the analysis realistic, we assume that a > 0, b < 0. In reality, as prices increase, supply increases throughout the supply curve, and as prices decline, supply decreases along the supply curve, so we set a1 > 0, b1 > 0 in the supply function to make the analysis realistic. Both functions (13) and (14) are linear; the output from the beginning of the period appears at the conclusion of each period, and the market sets its price. When production manifests after a period, the price used to determine it is undoubtedly the price from the previous period. Supply responds to price with a one-period lag, whereas demand is dependent on the current price. In each period, the price is set by the market so that demand consumes exactly the amount that is supplied, leaving no producer with unsold product and no consumer with unmet need (i.e., D(t) = S(t)).

Based on (13), Gandolfo [37] improved the model by taking the following form:

Lemma 3.1. [40,41]The solutions of (13), (14), and (15) are

respectively, where

It can be verified that only when

Chen et al. [41] considered the basic cobweb model [(14) and (15)] with the C–L fractional derivative as follows:

where

Chen et al. [41] obtained the main results of (16) and studied the stability of the solution. Srivastava et al. [40] generalized Chen et al.’s [41] conclusion, and they considered the fractional derivatives as follows:

where

In this paper, we consider the cobweb model (17) with the Hilfer fractional derivative

where

Our model generalizes some known models such as those in [41] and [40]. Specifically, when θ = 0, ν = 1, (18) reduces to the first half of (16); when θ1 = 0, ν = 1, (18) reduces to the last half of (16); when θ1 = 0, θ = 1, (18) turns into the first half of (17); and when θ = 0, (18) turns into the last half of (17).

4 Cobweb model with the Hilfer fractional derivative

In this section, we calculate the solution of the cobweb model (18) and study the stability of the solution.

Theorem 4.1. The following equation solves the cobweb model (18):

where

and

Proof: By simplifying the model (18), we obtain

so

If bθ − b1θ1 ≠ 0, we have

Letting

Taking the Laplace transform of (20), we have

Using the Laplace transform formula (10) for the Hilfer fractional derivative, we have

Merging items of the same type, we have

and then,

Setting

Using the application of Eqs (11), (12), we have

and

where μ − γ = ν(μ − 1), so γ = μ + ν − μν, and we arrive at

Finally, by employing the inverse Laplace transform of (21), it can be found that

where γ = μ + ν − μν.

Theorem 4.2. When θ > 0, θ1 > 0, the solution of (18) converges to the equilibrium value pe, which satisfies

Proof: In model (18), we assume a > 0, b < 0, a1 > 0, b1 > 0 to make our analysis in line with reality. From Theorem 4.1, we know that

When θ > 0, θ1 > 0, then λ < 0. Since 0 < μ ≤ 1, λtμ → −∞ (t → ∞), and in light of Lemma 2.3, when λtu → −∞, we have

Hence

Since γ = −(1 − μ)(1 − ν) + 1, γ ∈ (0, 1], and we make the analysis from two aspects:

i) When γ = 1, from (22), we have

Hence, we obtain

ii) When 0 < γ < 1, tγ−1 → 0 (t → ∞) and λtμ → −∞ (t → ∞). In light of Lemma 2.3,

Hence, we obtain

Overall,

which completes the proof of Theorem 2.2.

The stability conditions θ > 0 and θ1 > 0 play a crucial role in determining the stability of the equilibrium price (pe) in a market. We provide the explanation as follows.

First, the condition θ > 0 is related to the price elasticity of demand. It indicates that the demand function is negatively sloped, meaning that as the price increases, the quantity demanded decreases. This condition ensures that the market is responsive to changes in price, and it reflects the typical behavior observed in most markets. When θ > 0, it implies that an increase in price will lead to a decrease in demand, which helps maintain stability in the market. If θ were to be negative, it would imply an upward-sloping demand curve, which could lead to instability and oscillations in the market. Second, the condition θ1 > 0 is associated with the price elasticity of supply. It signifies that the supply function is positively sloped, indicating that as the price increases, the quantity supplied also increases. This condition ensures that suppliers are willing to increase their production in response to higher prices, maintaining stability in the market. If θ1 were negative, it would imply a downward-sloping supply curve, which could lead to instability and fluctuations in the market.

In terms of market stability, when both θ > 0 and θ1 > 0 hold, the market tends to reach a stable equilibrium price where demand and supply are balanced. In this scenario, any temporary imbalances between demand and supply will be corrected through price adjustments, ensuring market stability.

To compare the difference between integer derivatives and fractional derivatives, we consider the basic cobweb model with integer derivatives in supply and demand function together as the following form:

where

Theorem 4.3. assume that

where

Proof: By simplifying (23), we obtain

and then,

If bθ − b1θ1 ≠ 0, we have

and letting

and for ordinary differential equation p′t) = λp(t), we have p(t) = heλt, where h is a constant. Applying the constant variation method, the solution of (24) is

where h1 is a constant.

Taking initial condition p (0) = p0 into account, we obtain

Letting

5 Numerical analysis

In this section, we make the numerical analysis to implement the aforementioned outcomes.

Example 1. We consider the following cobweb model:

where

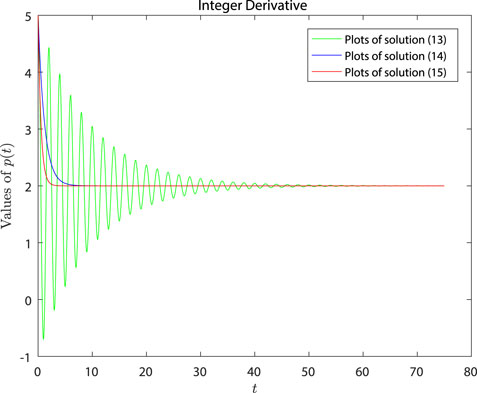

To solve Example 1, we apply the outcomes of Theorem 4.3. In the line with [41] and [40], we set a = 40, b = −10, θ = 2.5, a1 = 2, b1 = 9, θ1 = 3.3 in model (23), and we obtain

It is clear that the stability condition θ > 0, θ1 > 0 is satisfied, so

where

Srivastava et al. [40] examined how different types of fractional derivatives of the same order affected p(t). As a supplement, we look into how various fractional derivative types affect the cobweb model. Additionally, we take into account how the initial price p0 may have an impact on the outcomes.

Because of the arbitrariness of

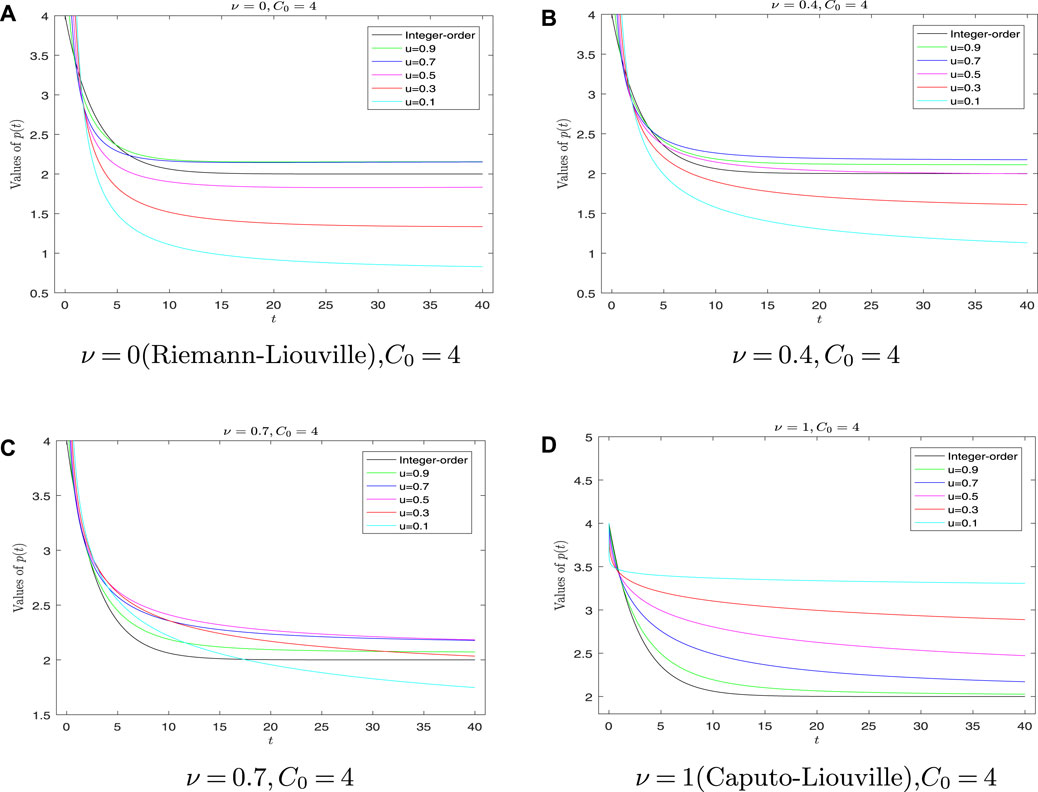

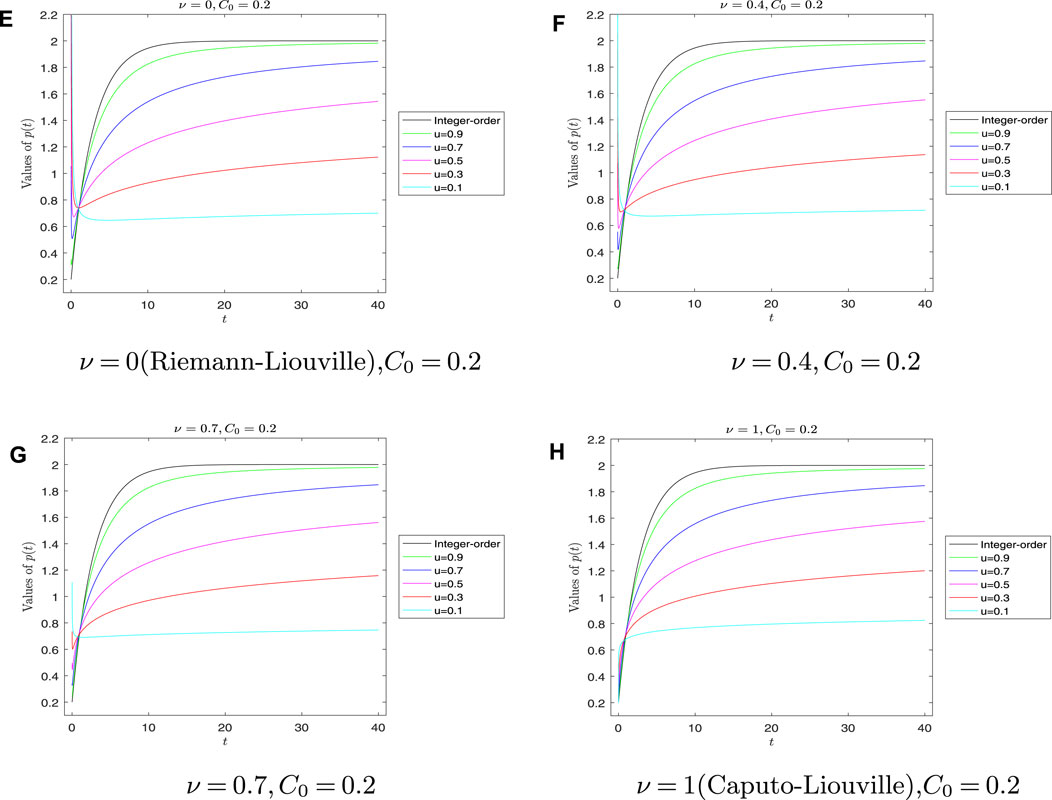

Case 1: Let ν be the fixed type of fractional derivative in this case. We discuss different fractional orders μ of p(t) by means of Figure 2 and Figure 3 to explicate C0 > pe and C0 < pe, respectively.

FIGURE 2. Graph of p(t) for different values of fractional-order μ with C0> pe. (A) Graph of p(t) with v = 0 (Riemann-Liouville), C0 = 4. (B) Graph of p(t) with v = 0.4, C0 = 4. (C) Graph of p(t) with v = 0.7, C0 = 4. (D) Graph of p(t) with v = 1 (Caputo-Liouville), C0 = 4.

FIGURE 3. Graph of p(t) for different values of fractional-order μ with C0< pe. (E) Graph of p(t) with v = 0 (Riemann-Liouville), C0 = 0.2. (F) Graph of p(t) with v = 0.4, C0 = 0.2. (G) Graph of p(t) with v = 0.7, C0 = 0.2. (H) Graph of p(t) with v = 1 (Caputo-Liouville), C0 = 0.2.

After some calculation, it can be verified that when C0 > pe, p(t) has the memoryless property or Markov property. First, the graphs in Figure 2 concerning the R–L fractional derivative (ν = 0) and the families of Hilfer fractional derivative with types ν for which 0 < ν < 1 are divergent and unstable at the beginning t0 by observing Figure 2 and Figure 3. Under the condition of C0 > pe, the curve of p(t) goes down very fast at the initial time t0 and then p(t) becomes stable along with the increase in t; finally, p(t) converges to the equilibrium point pe decreasingly. On the other hand, the value of p(t) drops rapidly in the case of C0 < pe in a very short period of time near t0. However, the curve of p(t) increases again and becomes stable with the increase in t. In the end, it converges to the equilibrium pe increasingly. Second, the smaller the μ of the fractional order is, the slower the p(t) converges to pe. Third, the image of the C–L fractional derivative (ν = 1) is different from that of the R–L fractional derivative (ν = 0) and the families of Hilfer fractional derivative with types 0 < ν < 1, which seems to be more consistent with the derivative of integral order.

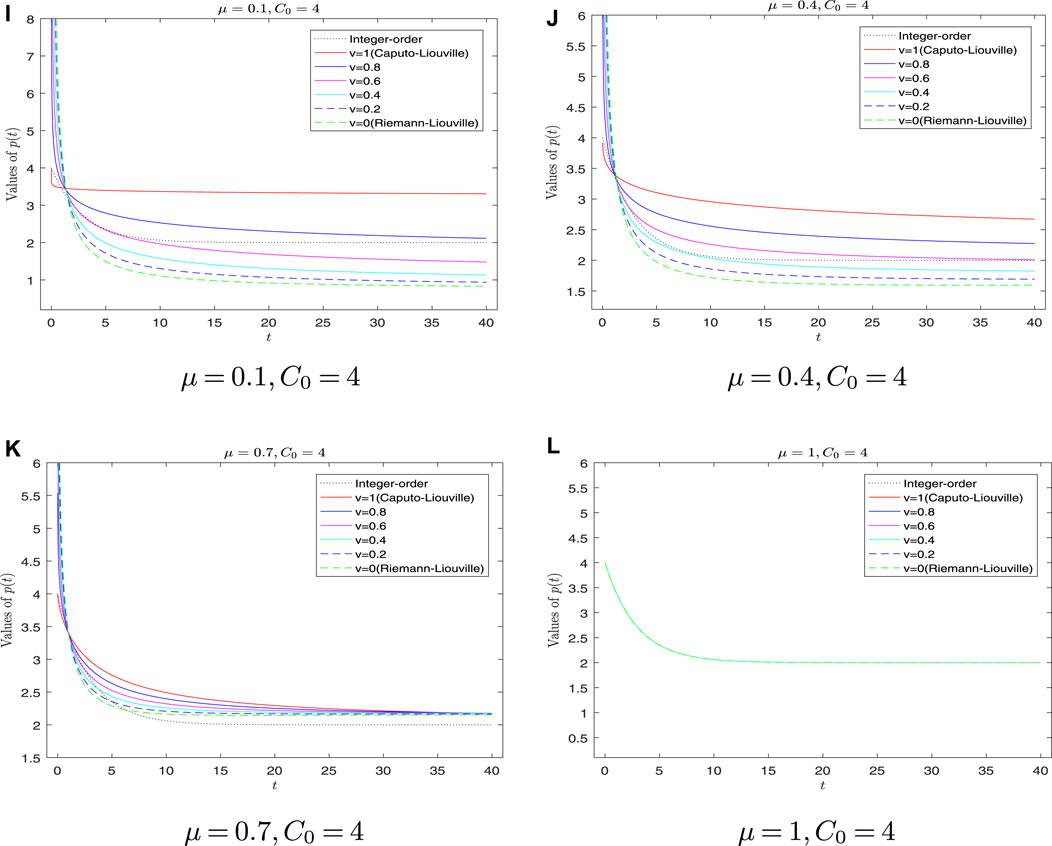

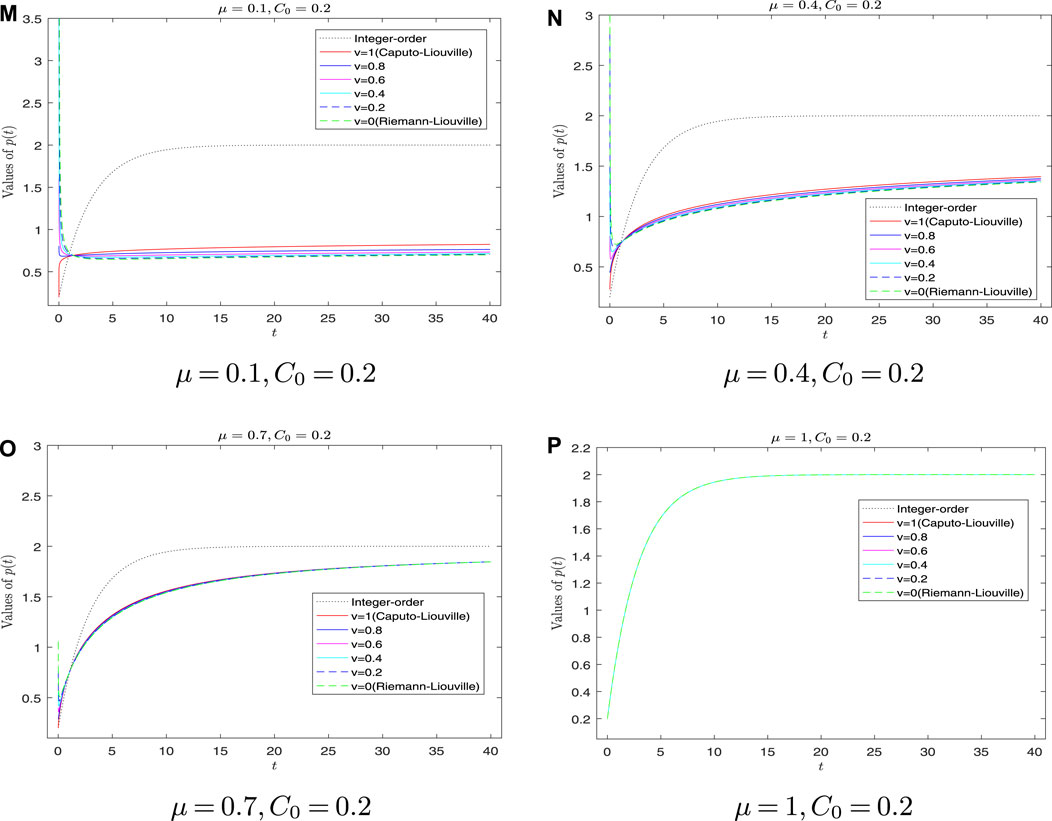

Case 2: This case discusses different types of fractional derivatives of p(t). We let the fractional-order μ be fixed first, such as setting μ = 0.1, 0.4, 0.7, 1 and C0 = 4, 0.2 remain unchanged as previously mentioned. The case of C0 = 4 > pe is shown in Figure 4. The case of C0 = 0.2 < pe is shown in Figure 5.

FIGURE 4. Graph of p(t) for different types of fractional derivatives with C0> pe. (I) Graph of p(t) with μ = 0.1, C0 = 4. (J) Graph of p(t) with μ = 0.4, C0 = 4. (K) Graph of p(t) with μ = 0.7, C0 = 4. (L) Graph of p(t) with μ = 1, C0 = 4.

FIGURE 5. Graph of p(t) for different types of fractional derivatives with C0< pe. (M) Graph of p(t) with μ = 0.1, C0 = 0.2. (N) Graph of p(t) with μ = 0.4, C0 = 0.2. (O) Graph of p(t) with μ = 0.7, C0 = 0.2. (P) Graph of p(t) with μ = 1, C0 = 0.2.

Before the discussion, we give two forms of

If μ = 0, model (18) turns into

It can be found that

From Figure 4 and Figure 5, we can find that, as μ decreases (μ → 0), the curves of p(t) with C–L fractional derivative become more vertical, which is consistent with model (25). Second, if μ = 1, the fractional derivative turns into the ordinary derivative, so the curves (integer-order and types ν for which ν = 0, 0.2, 0.4, 0.6, 0.8, 1) in Figure 4 and Figure 5D coincide with each other, which ensures the compatibility of our model. Third, Figures 4B, C, and Figures 5B, C show that the higher the fractional derivative order μ, the faster the p(t) converges to pe. Finally, we can also verify Case 1 from Figure 5A of Case 2.

6 Conclusion

This study focuses on exploring the solution of the cobweb economic model by integrating the Hilfer fractional derivative

The results of our investigation demonstrate that the C–L fractional derivative, when compared to the R–L fractional derivative and the families of Hilfer fractional derivatives with types 0 < ν < 1, displays a high level of practical robustness and retains a significant number of desirable properties that are characteristic of integer derivatives. As a result, the C–L fractional derivative emerges as a more appropriate choice for effectively modeling and analyzing the cobweb economic model. Our findings suggest that the C–L fractional derivative can provide more accurate and reliable results, making it a valuable tool for economists and policymakers in understanding the dynamics of economic systems. The outcomes contribute to the ongoing development of fractional calculus and its applications in economic modeling, providing insights into the behavior of complex economic systems.

Overall, this study has made substantial contributions to the field by examining the behavior of the cobweb economic model when influenced by the Hilfer fractional derivative in both the demand and supply functions. The analytical solutions obtained, along with the stability analysis and computation of equilibrium points, have yielded valuable insights into the dynamic nature of the model. Moreover, our findings highlight the numerous advantages offered by the C–L fractional derivative, further emphasizing its practical significance and its ability to preserve key properties commonly associated with traditional, integer derivatives. These findings have important implications for economic modeling and analysis, as they provide economists and policymakers with a more accurate and reliable tool for understanding and predicting the behavior of economic systems. By shedding light on the benefits of the C–L fractional derivative, this study contributes to the advancement of fractional calculus and its applications in the field of economics.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material; further inquiries can be directed to the corresponding author.

Author contributions

XQ: conceptualization, data curation, methodology, resources, and writing–original draft. ZR: conceptualization, data curation, formal analysis, funding acquisition, visualization, and writing–review and editing. WP: conceptualization, data curation, methodology, supervision, and writing–review and editing.

Funding

The authors declare financial support was received for the research, authorship, and/or publication of this article. This research was funded by the university Key Project of Natural Science Foundation of Anhui Province grants 2023AH052106, KJ2021A1032, KJ2019A0683, and KJ2021A1031, Key Project of Natural Science Foundation of Chaohu University grant XLZ-202201, Key Construction Discipline of Chaohu University grants kj22zdjsxk01,kj22yjzx05, and kj22xjzz01.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fphy.2023.1266860/full#supplementary-material

References

2. Samko SG, Kilbas AA, Oleg IM. Fractional integrals and derivatives: theory and applications. Switzerland: Gordon and breach science publishers, Yverdon Yverdon-les-Bains (1993).

3. Kilbas AA, Srivastava HM, Trujillo JJ. Theory and applications of fractional differential equations. Amsterdam, Netherlands: Elsevier (2006).

4. Almeida R, da Cruz AB, Martins N, Monteiro MTT. An epidemiological mseir model described by the caputo fractional derivative. Int J Dyn Control (2019) 7(2):776–84. doi:10.1007/s40435-018-0492-1

5. Hashemi MS, Dumitru B, Parto-Haghighi M, Darvishi E. Solving the time-fractional diffusion equation using a lie group integrator (2015). doi:10.2298/TSCI15S1S77H

6. Hristov J. Transient heat diffusion with a non-singular fading memory: From the cattaneo constitutive equation with jeffrey kernel to the caputo-fabrizio time-fractional derivative. Therm Sci (2016) 20(2):757–62. doi:10.2298/TSCI160112019H

7. Hristov J. Fourth-order fractional diffusion model of thermal grooving: Integral approach to approximate closed form solution of the mullins model. Math Model Nat Phenomena (2018) 13(1):6. doi:10.1051/mmnp/2017080

8. Traore A, Sene N. Model of economic growth in the context of fractional derivative. Alexandria Eng J (2020) 59(6):4843–50. doi:10.1016/j.aej.2020.08.047

9. Sene N. Integral balance methods for Stokes’ first equation described by the left generalized fractional derivative. Physics (2019) 1(1):154–66. doi:10.3390/physics1010015

10. Sene N. Second-grade fluid model with caputo–liouville generalized fractional derivative. Chaos, Solitons and Fractals (2020) 133:109631. doi:10.1016/j.chaos.2020.109631

11. Sene N. Stokes’ first problem for heated flat plate with atangana–baleanu fractional derivative. Chaos, Solitons and Fractals (2018) 117:68–75. doi:10.1016/j.chaos.2018.10.014

12. Avci D, Ozdemir N, Yavuz M. Fractional optimal control of diffusive transport acting on a spherical region. In: Methods of mathematical modelling. Boca Raton, Florida, CRC Press (2019). p. 63–82.

13. Asjad MI, Ullah N, Rehman HU, Gia TN. Novel soliton solutions to the atangana-baleanu fractional system of equations for the isalws. Open Phys (2021) 19(1):770–9. doi:10.1515/phys-2021-0085

14. Jan R, Shah Z, Deebani W, Alzahrani E. Analysis and dynamical behavior of a novel dengue model via fractional calculus. Int J Biomathematics (2022) 15(06):2250036. doi:10.1142/S179352452250036X

15. Hilfer R, Luchko Y, Tomovski Z. Operational method for the solution of fractional differential equations with generalized riemann-liouville fractional derivatives. Fract Calc Appl Anal (2009) 12(3):299–318.

16. Sene N. Exponential form for lyapunov function and stability analysis of the fractional differential equations. J Math Comput Sci (2018) 18(4):388–97. doi:10.22436/jmcs.018.04.01

17. Priyadharsini S. Stability of fractional neutral and integrodifferential systems. J Fract Calc Appl (2016) 7(1):87–102. doi:10.21608/jfca.2016.308374

18. Owolabi KM, Hammouch Z. Mathematical modeling and analysis of two-variable system with noninteger-order derivative. Chaos: Interdiscip J Nonlinear Sci (2019) 29(1):013145. doi:10.1063/1.5086909

19. Sene N. Analytical solutions of hristov diffusion equations with non-singular fractional derivatives. Chaos: Interdiscip J Nonlinear Sci (2019) 29(2):023112. doi:10.1063/1.5082645

20. Abdeljawad T, Mert R, Peterson A. Sturm liouville equations in the frame of fractional operators with exponential kernels and their discrete versions. Quaestiones Mathematicae (2019) 42(9):1271–89. doi:10.2989/16073606.2018.1514540

21. Bohner M, Hatipoğlu VF. Cobweb model with conformable fractional derivatives. Math Methods Appl Sci (2018) 41(18):9010–7. doi:10.1002/mma.4846

22. Bohner M, Hatipoğlu VF. Dynamic cobweb models with conformable fractional derivatives. Nonlinear Anal Hybrid Syst (2019) 32:157–67. doi:10.1016/j.nahs.2018.09.004

23. Bagley RL. On the fractional order initial value problem and its engineering applications. In: International conference proceedings. Tokyo: Mdpi (1990). p. 12–20.

24. Beyer H, Kempfle S. Definition of physically consistent damping laws with fractional derivatives. ZAMM-Journal Appl Maths Mechanics/Zeitschrift für Angew Mathematik Mechanik (1995) 75(8):623–35. doi:10.1002/zamm.19950750820

25. Miller KS, Ross B. An introduction to the fractional calculus and fractional differential equations. Hoboken, New Jersey: Wiley (1993).

26. Younis M, Hamood UR, Syed Tahir RR, Syed Amer M. Dark and singular optical solitons perturbation with fractional temporal evolution. Superlattices and Microstructures (2017) 104:525–31. doi:10.1016/j.spmi.2017.03.006

27. Jan A, Jan R, Khan H, Zobaer MS, Shah R. Fractional-order dynamics of rift valley fever in ruminant host with vaccination. Commun Math Biol Neurosci (2020).

28. Ur Rehman H, Imran MA, Ullah N, Ali A. On solutions of the newell-whitehead-segel equation and zeldovich equation. Math Methods Appl Sci (2021) 44(8):7134–49. doi:10.1002/mma.7249

29. Rehman HU, Mustafa I, Muhammad IA, Azka H, Qamar M. New soliton solutions for the space-time fractional modified third order korteweg–de vries equation. J Ocean Eng Sci (2022). doi:10.1016/j.joes.2022.05.032

30. Acay B, Bas E, Abdeljawad T. Fractional economic models based on market equilibrium in the frame of different type kernels. Chaos, Solitons and Fractals (2020) 130:109438. doi:10.1016/j.chaos.2019.109438

31. Lin Z, Wang H. Modeling and application of fractional-order economic growth model with time delay. Fractal and Fractional (2021) 5(3):74. doi:10.3390/fractalfract5030074

32. Shah Z, Bonyah E, Alzahrani E, Jan R, Alreshidi NA. Chaotic phenomena and oscillations in dynamical behaviour of financial system via fractional calculus. Complexity (2022) 2022. doi:10.1155/2022/8113760

34. Tang T-Q, Shah Z, Jan R, Alzahrani E. Modeling the dynamics of tumor-immune cells interactions via fractional calculus. The Eur Phys J Plus (2022) 137(3):367. doi:10.1140/epjp/s13360-022-02591-0

35. Yousefpour A, Jahanshahi H, Castillo O. Application of variable-order fractional calculus in neural networks: Where do we stand? Eur Phys J Spec Top (2022) 231(10):1753–6. doi:10.1140/epjs/s11734-022-00625-3

36. Fulford G, Forrester P, Forrester PJ, Jones A. Modelling with differential and difference equations. Cambridge: Cambridge University Press (1997).

38. Kaldor N. A classificatory note on the determinateness of equilibrium. Rev Econ Stud (1934) 1(2):122–36. doi:10.2307/2967618

40. Srivastava HM, Raghavan D, Nagarajan S. A comparative study of the stability of some fractional-order cobweb economic models. Revista de La Real Academia de Ciencias Exactas, Físicas y Naturales Serie A Matemáticas (2022) 116(3):1–20. doi:10.1007/s13398-022-01239-z

41. Chen C, Bohner M, Jia B. Caputo fractional continuous cobweb models. J Comput Appl Maths (2020) 374:112734. doi:10.1016/j.cam.2020.112734

43. Jarad F, Abdeljawad T. A modified laplace transform for certain generalized fractional operators. Results Nonlinear Anal (2018) 1(2):88–98.

44. Tomovski Ž, Hilfer R, Srivastava HM. Fractional and operational calculus with generalized fractional derivative operators and mittag–leffler type functions. Integral Transforms Spec Functions (2010) 21(11):797–814. doi:10.1080/10652461003675737

45. Hilfer R. Experimental evidence for fractional time evolution in glass forming materials. Chem Phys (2002) 284(1-2):399–408. doi:10.1016/S0301-0104(02)00670-5

46. Wright EM. The asymptotic expansion of integral functions defined by taylor series. Philos Trans R Soc Lond Ser A, Math Phys Sci (1940) 238(795):423–51.

47. Gorenflo R, Kilbas AA, Mainardi F, Sergei VR. Mittag-Leffler functions, related topics and applications. Berlin, Germany: Springer (2020).

48. Lavault C. Integral representations and asymptotic behaviour of a mittag-leffler type function of two variables. Adv Operator Theor (2018) 3(2):365–73. doi:10.15352/APT.1705-1167

Keywords: cobweb model, Hilfer fractional derivative, demand and supply functions, Mittag–Leffler function, Markov process

Citation: Qin X, Rui Z and Peng W (2023) Fractional derivative of demand and supply functions in the cobweb economics model and Markov process. Front. Phys. 11:1266860. doi: 10.3389/fphy.2023.1266860

Received: 25 July 2023; Accepted: 12 September 2023;

Published: 02 October 2023.

Edited by:

Olaniyi Samuel Iyiola, Clarkson University, United StatesReviewed by:

Hamood Ur Rehman, University of Okara, PakistanRashid Jan, University of Swabi, Pakistan

Copyright © 2023 Qin, Rui and Peng. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Zhaobiao Rui, cnVpemhhb2JpYW9AY2h1LmVkdS5jbg==

Ximei Qin

Ximei Qin Zhaobiao Rui

Zhaobiao Rui Weicai Peng

Weicai Peng