- School of Management, Jinan University, Guangzhou, China

Driven by the prosperity of the online retail market and the success of the agency selling format, dual-channel retailers have engaged extensively in online retailing. However, whether dual-channel retailers act as intermediaries to introduce agency channels for third-party sellers in their online stores has not yet received sufficient attention. To address this problem, we perform game-theoretic analysis of the optimal channel strategy of a dual-channel retailer under three channel structures: No-agency mode, manufacturer-agency mode, and e-tailer-agency mode. Under each structure, the price competition model is studied, with the manufacturer as the Stackelberg leader and the retailer or authorized e-tailer as the follower. We analyze the optimal prices and profits of different structures and study the influence of agency channels. Our analysis shows that when the commission rate is higher than a certain threshold, the dual-channel retailer will introduce an agency channel for the third-party seller, and when the commission rate is high, the dual-channel retailer prefers to introduce an agency channel for the manufacturer rather than an authorized e-tailer. However, higher offline operating cost reduces the willingness of the dual-channel retailer to introduce an agency channel. Furthermore, the manufacturer will always benefit from the agency channel and, because of the mitigation of double marginalization, the manufacturer is most profitable in the manufacturer-agency mode. Finally, introducing an agency channel for the third-party seller can create a “win-win” outcome for the manufacturer and the dual-channel retailer, while the e-tailer-agency mode can increase the dual-channel retailer’s relative channel power under certain conditions.

1 Introduction

The success of online retail has enticed an increasing number of brick-and-mortar retail giants to adopt dual-channel retail, that is, to build their own online stores based on physical stores, such as Walmart, Target, or Staples [1–3]. Most dual-channel retailers operate in a traditional reselling format, where retailers buy products from manufacturers and then resell them to consumers. An increasingly popular online business format is the agency selling format. In this format, retailers only charge commission fees to allow manufacturers or e-tailers to access consumer traffic on the online stores [4–6]. For example, JD.com, as a hybrid online retailer, had more than 270,000 third-party sellers in its online marketplace in 2019.1 In the first quarter of 2019, Amazon’s third-party sales accounted for approximately 53% of total revenue.2

Under these circumstances, some dual-channel retailers began to introduce agency channels to online stores to support the selling activities of third-party sellers. However, dual-channel retailers remain slightly cautious about cooperating with third-party sellers. For example, Walmart has attached importance to third-party sellers since 2016, but had only 35,000 active sellers by 2020, which is insignificant compared to Amazon.3 In order to avoid fake items, Target does not engage in large-scale investment promotion of third-party sellers for online stores, but chooses to cooperate with certain dominant brands, aiming to supplement the current product portfolio.4 In fact, the reason for the slow online progress of dual-channel retailers may be that both manufacturers and dual-channel retailers are concerned that the new channel’s introduction will change the relationships among supply chain members [7–11]. Although the commission fee paid by third-party sellers creates a new source of income, dual-channel retailers may be more worried that online retail will cannibalize the offline market and reduce profits. Moreover, whether upstream manufacturers act as third-party sellers or authorize other e-tailers as third-party sellers to accept the invitation of dual-channel retailers is also uncertain because channel encroachment may aggravate channel conflicts and damage manufacturers’ profits. Although the online market development of dual-channel retailers is an important strategic decision, there is little literature on the relationship between agency channels and the optimal channel strategy of dual-channel retailers.

Motivated by the above practice observations, it is necessary to understand how dual-channel retailers operate online agency channels. This study aimed to answer the following research questions: When should the dual-channel retailer introduce an agency channel for the third-party seller? How should a third-party seller be selected? Should the third-party seller be a manufacturer or an authorized e-tailer? Which channel structure does the manufacturer prefer? What role does the third-party agency channel play in the relationship between the dual-channel retailer and the manufacturer? To address the above questions, we developed a game-theoretic model consisting of a dual-channel retailer, a manufacturer, and an authorized e-tailer. The dual-channel retailer resells the manufacturer’s products through its own physical store and online store simultaneously. On this basis, we examined three modes: 1) No-agency mode (i.e., D mode), where the dual-channel retailer does not introduce the agency channel in the online store; 2) manufacturer-agency mode (i.e., MA mode), where the dual-channel retailer introduces the agency channel for the manufacturer, and the manufacturer sells products directly to consumers by paying a commission fee; 3) e-tailer-agency mode (i.e., TA mode), where the dual-channel retailer introduces the agency channel for the e-tailer, and the e-tailer indirectly resells the manufacturer’s products to consumers by paying a commission fee. The main findings of this study are as follows:

First, we analyzed the optimal channel strategy for the dual-channel retailer. The dual-channel retailer introduces the agency channel for the third-party seller only if the commission rate is higher than a certain threshold. With the increase in commission rate, due to the elimination of the double marginal effect, the dual-channel retailer is more inclined to cooperate with the manufacturer than the e-tailer. The dual-channel retailer’s optimal strategy depends on the trade-off between the advantage of the commission fee and the disadvantage of channel competition.

Second, we analyzed the impact of introducing an agency channel. Under the agency mode, the dual-channel retailer lowers the retail price, but only achieves higher demand when the offline operating cost is low. Interestingly, the manufacturer lowers the wholesale price but always benefits from the agency channel expansion. The key driver for the manufacturer is the trade-off between the limited wholesale revenue from the dual-channel retailer and the improved sales profit from the direct agency channel or the improved wholesale revenue from the indirect agency channel. Furthermore, the manufacturer prefers the direct agency channel of the manufacturer to the indirect agency channel of the e-tailer, because the manufacturer can flexibly set the retail price and avoid double marginalization.

Finally, under certain conditions, the introduction of the agency channel can create a “win-win” outcome for the dual-channel retailer and the manufacturer. The agency channel can be regarded as the external choice of the dual-channel retailer in competition with the manufacturer, and providing the agency channel for the e-tailer can increase the relative channel power of the dual-channel retailer.

The main contributions of this study are as follows: First, it contributes to retailers’ online channel management by considering online sales formats. We considered a hybrid online store operated by a dual-channel retailer, where the retailer not only resells the manufacturer’s products online and offline, but also acts as an intermediary for the third-party seller and charges a commission fee. The results show that the dual-channel retailer can obtain higher profits by introducing an agency channel in addition to a reselling channel. This provides a reasonable explanation for dual-channel retailers expanding online stores to merchants in practice. Second, our work enriches the competitive structure of the agency selling format. We analyze the manufacturer’s agency mode and the authorized e-tailer’s agency mode. The results show that the manufacturer has an incentive to enter the retailer’s online store through self-operating or authorizing the e-tailer, and the retailer may benefit from the competitor’s market entry. Finally, our work sheds light on the strategic value of agency channels. In addition to increasing profits, as an external choice to compete with the manufacturer, introducing an agency channel for authorized e-tailers can increase the retailer’s relative channel power. Our results provide some interesting management insights and directions for retailers and manufacturers engaged in multichannel retailing.

The remainder of this paper is organized as follows. Section 2 presents the relevant literature. Section 3 describes the model setting and key assumptions. Section 4 presents the derivation of the optimal solutions. Section 5 compares the optimal decisions and profits across modes. Section 6 presents an extended analysis of the results. Section 7 summarizes the conclusions and provides directions for future research. All proofs are provided in the “Supplementary Appendix S1”

2 Literature Review

The findings of this study contribute to the following two research streams: Channel management and online retail formats. Next, we review the above topics in the literature and clarify the novelty of our study.

2.1 Online Channel Introduction

Researchers have paid great attention to the effects of online channel introduction and endogenous channel selection decisions. Common strategic benefits for manufacturers introducing online channels are more sales, better fulfillment services, higher shareholder values, and competitive advantages in the marketplace [12–15]. The same decisions pertain to brick-and-mortar retailers and e-tailers, which are more relevant to our work. Yoo and Lee [10] found that an independent retailer may reduce profit after adding an online channel, and proposed a framework composed of five key strategic factors to explain the impacts of online channel expansion. Karray and Sigué [16] discussed the feasibility of an offline retailer using an online expansion and pricing strategy to deal with the manufacturer’s channel encroachment. Cao et al. [17] found that lower platform commissions and more generous offline return strategies both motivate offline retailers to enter the online market. Extending the research to duopoly competition, Karray and Sigué [18] show that two offline retailers may be trapped in a prisoner’s dilemma by losing their relative competitive advantage by simultaneously adopting multi-channel retailing. Titiyal et al. [19] used a hybrid MCDM model to prioritize e-retailers’ distribution strategies based on performance and products, providing support for online distribution strategy selection. Chen et al. [20] found that e-tailers prefer to introduce online channels as decision-making followers, but become less inclined to introduce online channels as risk aversion increases.

Previous work mainly studied the introduction of online channels by the manufacturer or the retailer for their own sales, but ignored channel interactions of the dual-channel retailer and the distinction between channel sales formats. In contrast to the above research, we make contributions by considering the dual-channel retailer introducing an agency channel for the third-party seller. The dual-channel retailer not only sells the manufacturer’s products online and offline, but also introduces an agency channel for a third-party seller who sells the same manufacturer’s products.

2.2 Online Retail Format

Many studies have focused on revealing the comparison between the reselling format and the agency selling format. Hagiu and Wright [5] found that the key to the choice between the two formats lies in the relative information held by intermediaries or independent suppliers. Tian et al. [21] provided insights showing that upstream competition weakens the advantages of the agency selling format, and the trade-off between the transfer of pricing power and the responsibility of order fulfillment determines the equilibrium strategy. Wei et al. [22] focused on the online retail format selection of competing manufacturers under the influence of the leader-follower relationship. Other works on online retail formats have examined the interaction with business operation decisions. For example, Wang et al. [23] explored whether the intermediary shares information voluntarily in a hybrid online market, where the intensity of channel competition and proportional fee are considered. Guo et al. [24] investigated how the e-tailer determines the product bundling strategy when providing an agency selling format for two independent suppliers at the same time. Chen et al. [25] studied the interaction between return-freight insurance and the online retail format and verified that the agency selling format needs a more flexible return strategy than the reselling format.

Our work is most closely related to Mantin et al. [26] and Zheng et al. [27], who analyzed the impact of a third-party seller’s agency channel on manufacturers and retailers. Our work differs from these studies in the following three ways. First, Mantin et al. [26] and Zheng et al. [27] targeted a situation, in which the retailer provides the e-tailer with an agency channel, while ignoring the possibility of the manufacturer as a third-party seller choosing the agency channel. In our work, the manufacturer’s agency channel and the e-tailer’s agency channel are equally important and considered. Second, Mantin et al. [26] and Zheng et al. [27] considered an independent third-party e-tailer; that is, the cost of the e-tailer is exogenous rather than determined by the manufacturer. In our work, we consider authorized third-party e-tailers who wholesale products from the manufacturer and then resell them to consumers. Third, Mantin et al. [26] found that the agency channel can increase the retailer’s ability to bargain with the manufacturer. Zheng et al. [27] found that the agency channel can alleviate the double marginal effect of a retailer’s channel. However, we find that the e-tailer’s agency channel increases the relative channel power of the retailer, while the manufacturer’s agency channel does not have such a strategic role.

3 The Model

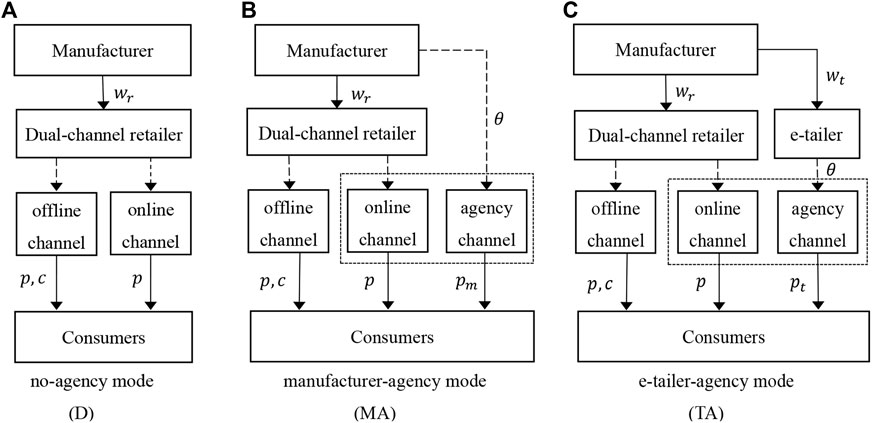

We consider a decentralized supply chain consisting of a manufacturer, a dual-channel retailer (called retailer), and an authorized e-tailer (called e-tailer). The manufacturer sells products to the retailer, who then resells them in a physical store and an online store. The retailer considers providing the manufacturer or the e-tailer with an agency channel that can directly access consumers in an online store. The retailer also charges a commission fee to the manufacturer or the e-tailer. We define the retailer’s online store as a hybrid store that adopts a reselling format and agency selling format. We also assume that the commission rate is exogenous and fixed within 50% [21, 28]. The following three channel structures are explored: No-agency mode (i.e., D), manufacturer-agency mode (i.e., MA), and e-tailer-agency mode (i.e., TA). These results are depicted in Figure 1.

FIGURE 1. Channel structure of different mode: (A) no-agency mode; (B) manufacturer-agency mode; (C) e-tailer-agency mode.

Three alternative modes evaluated are as follows:

• No-agency mode (D): Under the D mode, the retailer does not introduce an agency channel and resells products through its own physical store and online store. The retailer implements an equal online and offline pricing strategy. The manufacturer starts by offering a wholesale price to the retailer, which, in turn, sets a retail price for consumers.

• Manufacturer-agency mode (MA): Under the MA mode, the retailer introduces an agency channel for the manufacturer, and the manufacturer pays a commission fee to sell in an online store. In addition to setting the wholesale price, the manufacturer must independently decide the retail price of the agency channel. The retailer acts as a distributor and intermediary for the manufacturer.

• E-tailer-agency mode (TA): Under the TA mode, the retailer introduces an agency channel for the e-tailer, which pays a commission fee to sell in the online store. The manufacturer determines the wholesale prices for the retailer and e-tailer, and then the two merchants set retail prices for their own selling channels. The retailer acts as an intermediary for the e-tailer, while still acting as a distributor for the manufacturer.

Linear demand functions effectively characterize price competition across multiple channels and have been widely adopted in the marketing and operations literature [6, 13, 15, 20, 27, 29, 30]. Specifically, they can be written as follows:

The retailer’s offline channel, retailer’s online channel, manufacturer’s agency channel, and e-tailer’s agency channel are indexed by

Supply chain members play a sequential game of complete information and make decisions based on the principle of profit maximization. Next, we analyze the optimal decisions of the supply chain members.

4 Equilibrium Analysis

In this section, we first describe the benchmark, that is, a situation where there is no agency channel. Next, we consider the situation, in which the retailer introduces an agency channel for the manufacturer. Finally, we investigate the situation, in which the retailer introduces an agency channel for the e-tailer. The latter two are collectively referred to as agency mode.

4.1 No-Agency Mode (D)

In this subsection, the retailer does not introduce agency channels and distributes the manufacturer’s products through physical and online stores. The manufacturer first quotes the wholesale price

We use the superscript “D” to indicate the equilibrium outcomes of this mode and solve the problem backward. For the given wholesale price

(i) The retailer’s optimal retail price is

(ii) The manufacturer’s optimal wholesale price is

It is easy to see that when the retailer resells products offline and online, 1) the retailer’s optimal retail price has a positive relationship with the product’s market base and the offline operating cost; 2) the manufacturer’s optimal wholesale price and the retailer’s demand have a positive relationship with the product’s market base and a negative relationship with the offline operating cost. Consistent with intuition, the retailer charges consumers high retail prices to balance high offline operating costs, resulting in low demand. To deal with the reduction in the retailer’s marginal profit, the manufacturer would lower the wholesale price to ensure the order quantity. Increased offline operating costs also reduce the profits of retailers and manufacturers. The profit for the retailer under the D mode serves as a base for evaluating whether the retailer should introduce an agency channel for third-party sellers.

4.2 Manufacturer-Agency Mode

In this subsection, the retailer introduces an agency channel for manufacturers. The manufacturer accepts the offer and shares the direct selling revenue with the retailer. The manufacturer plays the role of supplier and retailer, while the retailer plays the role of distributor and intermediary. The game proceeds as follows. In the first stage, the manufacturer decides the wholesale price

We use the superscript “MA” to indicate the equilibrium outcomes of this mode. We solve the above game using backward induction and obtain the optimal decisions of the retailer and the manufacturer, given as follows:

(i) The retailer’s optimal retail price is:

(ii) The manufacturer’s optimal retail price is:

(iii) The manufacturer’s optimal wholesale price is:

4.3 E-Tailer-Agency Mode

In this subsection, we consider the situation, in which the retailer introduces an agency channel for the e-tailer and charges the e-tailer a commission fee. Therefore, the manufacturer first announces wholesale prices

We use the superscript “TA” to indicate the equilibrium outcomes of this mode. Using the backward rule, we obtain the optimal decisions of the retailer, the e-tailer, and the manufacturer, given as follows:

(i) The retailer’s optimal retail price is

(ii) The e-tailer’s optimal retail price is

(iii) The manufacturer’s optimal wholesale price for the retailer is

(iv) The manufacturer’s optimal wholesale price for the e-tailer is

5 Comparison

5.1 Impacts of the Agency Channel

In this subsection, assuming that the channel structure is determined, we identify the impact of introducing an agency channel. According to the optimal solutions of the three modes, we compare the optimal price, demand, and profit to examine the agency channel’s impacts on the retailer and the manufacturer. Specifically, we provide a direct comparison between the agency mode (i.e., MA and TA modes) and the D mode.

5.1.1 Impact on Price

We first shed light on the optimal pricing decisions. We compare the retailer’s optimal retail price and the manufacturer’s optimal wholesale price across the D and agency modes. The results are summarized in Lemma 1.

Lemma 1. Compared to the D mode, under the MA or TA modes, (i) the retailer sets a lower retail price and (ii) the manufacturer sets a lower wholesale price. Mathematically, (i)

5.1.2 Impact on Demand

We study how the introduction of the agency channel affects the demand for dual channels owned by the retailer. Regarding the comparison of the retailer’s demand with and without the agency channel, Lemma 2 is as follows:

Lemma 2. Compared to the D mode, under the MA or TA modes, when the offline operating cost is low, the retailer achieves higher demand; otherwise, the retailer achieves lower demand. Mathematically, (i) when

5.1.3 Impact on Channel Power

Following the settings of Messinger and Narasimhan [31], Kadiyali et al. [32], and Karray and Sigué [16], we define the channel power as the proportion of channel profit obtained by each channel member. Generally speaking, when a channel member earns more profit than other channel members, we say that the channel member has stronger channel power. We compare the relative profits of the retailer and manufacturer under the benchmark and agency modes, and analyze whether the introduction of an agency channel increases the channel power of the retailer relative to the manufacturer. The results are summarized in Proposition 1.

Proposition 1. The retailer earns less profit than the manufacturer in the no-agency and manufacturer-agency modes, and earns more profit than the manufacturer in the e-tailer-agency mode when the commission rate and offline operating cost are both low. Mathematically,

5.2 Channel Structure Choice

In the previous subsection, we assumed that the channel structure was predetermined, in order to determine the impacts of the agency channel. In this subsection, we solve the retailer’s endogenous choice of the channel structure. We assume that the channel structure precedes the pricing decision because the channel structure decision is a longer-term decision than the pricing decision. This setting is in accordance with the modeling related to online channel choices.

5.2.1 Optimal Channel Strategy

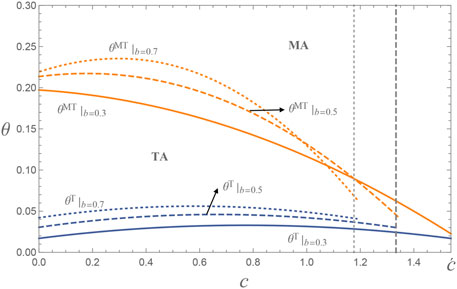

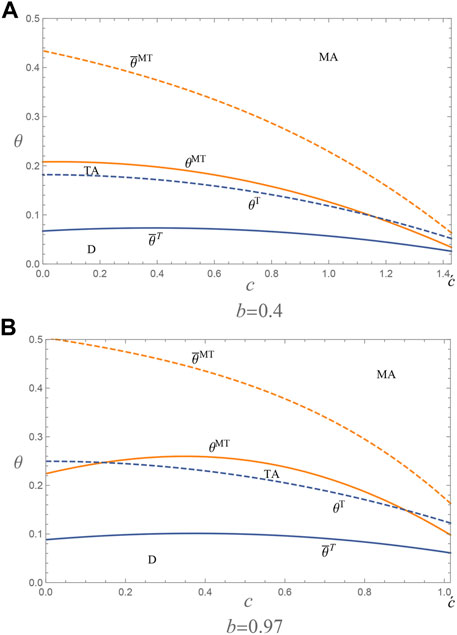

A key question facing the retailer is: How can the retailer choose third-party sellers for profitability? To answer this question, we compared the retailer’s profits under the three channel structures. The results of the retailer’s optimal channel strategy are summarized in Proposition 2 and Figure 2.

Proposition 2. Commission rate threshold

(i) If

(ii) If

(iii) If

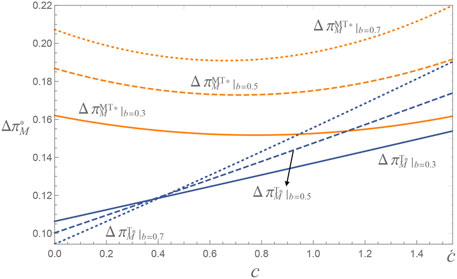

5.2.2 Manufacturer’s Preference

After answering the retailer’s optimal channel strategy, another question emerges: Is the manufacturer’s preference for the online channel structure consistent with the retailer’s preference? To answer this question, we compared the profits of the manufacturer under the agency channel structures, and the results are shown in Proposition 3 and Figure 3. It should be noted that there are

Proposition 3. The manufacturer is always more profitable in the manufacturer-agency mode than in the e-tailer-agency mode. Mathematically,

6 Extension

In this section, we extend our basic model in three ways: Unequal pricing, dominant retailer, and asymmetric channel competition.

6.1 Unequal Pricing

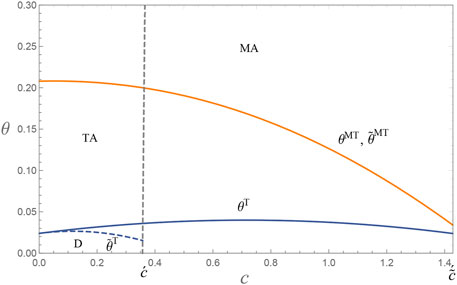

The previous analysis is based on the fact that the retailer adopts equal pricing for online and offline channels, because this setting can avoid internal channel conflict. However, in practice, the retailer will also use unequal pricing as a price discrimination tool for obtaining higher profits. Therefore, in this subsection, we focus on the potential impact of unequal pricing. We use the top mark symbol “

Proposition 4. 1) Compared with the equal pricing strategy, the retailer introduces agency channels to third-party sellers more easily under the unequal pricing strategy. 2) Comparing the manufacturer-agency and e-tailer-agency modes, the retailer’s preference is indifferent under equal pricing and unequal pricing. Mathematically,

6.2 Dominant Retailer

In line with the general model setting, our basic model regards the manufacturer as the supply chain leader; that is, the manufacturer first determines the wholesale price, and then the retailer determines the retail price. One may argue that retailers who can run online stores and introduce agency channels for third-party sellers are often large offline supermarkets, and they may have stronger bargaining power than manufacturers. This subsection fills this gap by investigating the role of the retailer as the leader of the supply chain.

We use

FIGURE 5. Optimal channel strategy in dominant manufacturer and dominant retailer in different case: (A) a = 1, b = 0.4; (B) a = 1, b = 0.97.

Proposition 5. If the retailer is the leader of the supply chain, (i) it is more difficult for the retailer to introduce agency channels for third-party sellers, and (ii) there exist

6.3 Asymmetric Channel Competition

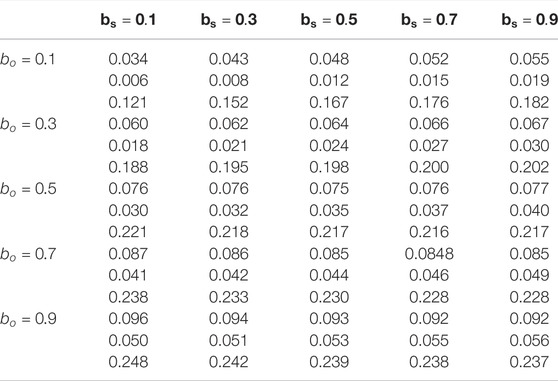

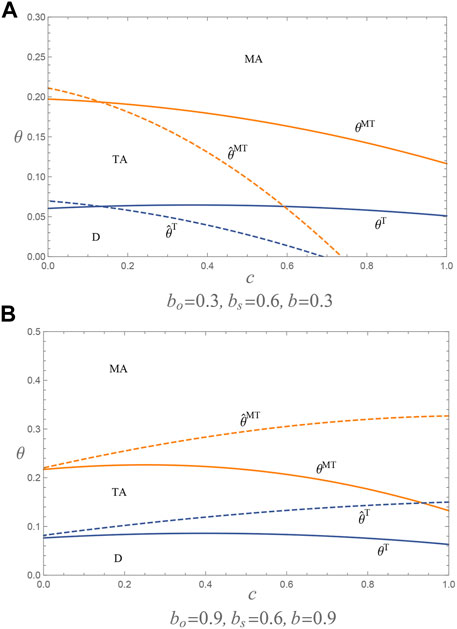

For conciseness and tractability, our basic model assumes that the degree of cross-channel competition is symmetric. In fact, due to channel characteristics, such as services, advertising, and convenience, the degree of cross-channel competition may be asymmetric. To be more realistic, we assume an asymmetric channel competition degree, where

Owing to the complexity of the optimal solutions, we used numerical and graphical methods to verify the impact of asymmetric channel competition. Supposing

FIGURE 6. Optimal channel strategy in symmetric and asymmetric in different case: (A) a = 1, bo = 0.3, bs = 0.6, b = 0.3; (B) a = 1, bo = 0.9, bs = 0.6, b = 0.9.

In each grid in Table 1, the three values represent the lowest threshold of

We discuss the retailer’s equilibrium strategy under asymmetric channel competition. It can be seen from Table 1 and Figure 6 that, given

7 Conclusion

Offline retailers are increasingly entering the online market through self-built online stores to become dual-channel retailers. The success of online retail is inseparable from the application of the agency selling format, so it is particularly important for dual-channel retailers to consider the question of whether to introduce agency channels for third-party sellers in online stores and how to select third-party sellers. To investigate the online channel strategy of the dual-channel retailer, we develop three channel structure modes: 1) No-agency mode, in which the retailer does not introduce an agency channel; 2) manufacturer-agency mode, in which the retailer introduces an agency channel for the manufacturer; 3) e-tailer-agency mode, in which the retailer introduces an agency channel for the authorized e-tailer. We focus on the channel structure that is most beneficial to the dual-channel retailer and how the commission rate affects the channel strategies of the dual-channel retailer.

7.1 Theoretical Implications

The main three theoretical implication are as follows.

First, we find that it is not desirable for the dual-channel retailer to introduce an agency channel for the third-party seller when the commission rate is below a certain threshold. This is because the retailer faces a trade-off between the gain in channel expansion and the loss of channel competition. Specifically, the introduction of the agency channel intensifies channel competition and reduces the retail price of the retailer, but the commission fee of the agency channel increases the sources of the retailer’s income. Therefore, the retailer can benefit from the agency channel only when the commission fee of channel expansion compensates for the loss of channel competition. Furthermore, given the commission rate, as the offline operating cost increases, the retailer’s willingness to introduce the agency channel first weakens and then strengthens. In addition, when the commission rate is moderate, the retailer prefers to introduce the agency channel for the e-tailer, while when the commission rate is high, the retailer prefers to introduce the agency channel for the manufacturer. This is because the elimination of double marginalization in the manufacturer’s agency channel leads to more intense channel competition, so the retailer needs to set a higher commission rate to compensate for the loss. In addition, under certain conditions, the retailer that introduces the e-tailer to the agency channel can obtain higher relative channel power than the manufacturer, which can be regarded as one of the strategic significances of agency channel expansion.

Second, we find that the manufacturer always benefits from the introduction of an agency channel. Although channel competition reduces the manufacturer’s wholesale price to the retailer, the manufacturer can obtain higher self-operating sales profits from the direct agency channel or higher e-tailer’s wholesale revenue from the indirect agency channel. In addition, for the manufacturer, the manufacturer-agency mode is always more profitable than the e-tailer-agency mode because the elimination of double marginalization makes the manufacturer’s agency channel more efficient. This also shows that the interests of the manufacturer and retailer for the channel structure are sometimes inconsistent.

Finally, we also consider three extensions (unequal pricing, dominant retail, and asymmetric channel competition) and find that our results roughly hold qualitatively. Unequal pricing allows the retailer to set discriminatory prices to differentiate between online and offline consumers, which ultimately leads to the shrinkage of the no-agency mode’s equilibrium area and the expansion of the e-tailer-agency mode’s equilibrium area. The dominant retailer can force the manufacturer to lower the wholesale price to obtain a higher profit margin, which ultimately leads to the boundary line between the no-agency and e-tailer-agency modes, and between the e-tailer-agency and manufacturer-agency modes moving up. Under asymmetric channel competition, as the commission rate increases, the retailer’s preference changes from no-agency mode to e-tailer-agency, and finally to manufacturer-agency mode. The equilibrium area may move downward or upward with a combination of specific channel competition.

7.2 Managerial Implications

Our findings provide actionable management insights for dual-channel retailers to dig into the online market. Retailers can cooperate with different third-party sellers in different categories according to their commission rate levels. For example, retailers can self-operate products with a low commission rate, allow e-tailers to trade products with a moderate commission rate, and invite manufacturers to sell products with a high commission rate. Moreover, in terms of encouraging third-party sellers to settle in, retailers can provide authorized e-tailers with more favorable commission rates than those provided to manufacturers, which can also increase channel power at a strategic level under certain conditions.

7.3 Limitations and Future Research

There are several potential directions for future research. First, third-party sellers may have external options, such as self-built direct sales channels or sales through pure e-tailers. In practice, dual-channel retailers inevitably compete with e-commerce platforms and other channels. It could be of interest to understand the retailer’s optimal channel strategy under competing online stores. Second, in addition to the wholesale price contract, the manufacturer may use different contracts with supply chain partners, such as quantity discounts and revenue sharing. It may be more informative to understand the optimal online channel strategy of dual-channel retailers under different contracts. Finally, in reality, consumers may have fixed and differentiated preferences for online and offline channels. Heterogeneous consumers may react differently to the pricing strategy, which could affect the dual-channel retailer’s choice of online channel strategy.

Data Availability Statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author Contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Conflict of Interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Acknowledgments

The authors would like to thank Editage(www.editage.com) for English language editing.

Supplementary Material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fphy.2022.895770/full#supplementary-material

Footnotes

1https://ir.jd.com/static-files/fc93d5dd-9437-4141-9191-f960ba46874b.

2https://www.Statista.com/statistics/259782/third-party-seller-share-of-amazon-platform.

3https://www.marketplacepulse.com/articles/walmart-surpasses-100000-marketplace-sellers.

4https://www.marketplacepulse.com/articles/targets-marketplace-still-tiny-two-years-later.

References

1. Thaichon P, Phau I, Weaven S. Moving from Multi-Channel to Omni-Channel Retailing: Special Issue Introduction. J Retailing Consumer Serv (2022) 65:102311. doi:10.1016/j.jretconser.2020.102311

2. Wang W, Li G, Cheng TCE. Channel Selection in a Supply Chain with a Multi-Channel Retailer: The Role of Channel Operating Costs. Int J Prod Econ (2016) 173:54–65. doi:10.1016/j.ijpe.2015.12.004

3. Verhoef PC, Kannan PK, Inman JJ. From Multi-Channel Retailing to Omni-Channel Retailing. J Retailing (2015) 91(2):174–81. doi:10.1016/j.jretai.2015.02.005

4. Abhishek V, Jerath K, Zhang ZJ. Agency Selling or Reselling? Channel Structures in Electronic Retailing. Manage Sci (2016) 62(8):2259–80. doi:10.1287/mnsc.2015.2230

5. Hagiu A, Wright J. Marketplace or Reseller? Manage Sci (2015) 61(1):184–203. doi:10.1287/mnsc.2014.2042

6. Jiang B, Jerath K, Srinivasan K. Firm Strategies in the "Mid Tail" of Platform-Based Retailing. Marketing Sci (2011) 30(5):757–75. doi:10.1287/mksc.1110.0656

7. Kim J-C, Chun S-H. Cannibalization and Competition Effects on a Manufacturer's Retail Channel Strategies: Implications on an Omni-Channel Business Model. Decis Support Syst (2018) 109:5–14. doi:10.1016/j.dss.2018.01.007

8. Ryan JK, Sun D, Zhao X. Competition and Coordination in Online Marketplaces. Prod Oper Manag (2012) 21(6):997–1014. doi:10.1111/j.1937-5956.2012.01332.x

9. Tsay AA, Agrawal N. Channel Conflict and Coordination in the E-Commerce Age. Prod Oper Manag (2004) 13(1):93–110. doi:10.1111/j.1937-5956.2004.tb00147.x

10. Yoo WS, Lee E. Internet Channel Entry: A Strategic Analysis of Mixed Channel Structures. Marketing Sci (2011) 30(1):29–41. doi:10.1287/mksc.1100.0586

11. Zhang P, He Y, Shi C. Retailer's Channel Structure Choice: Online Channel, Offline Channel, or Dual Channels? Int J Prod Econ (2017) 191:37–50. doi:10.1016/j.ijpe.2017.05.013

12. Cai G. Channel Selection and Coordination in Dual-Channel Supply Chains. J Retailing (2010) 86(1):22–36. doi:10.1016/j.jretai.2009.11.002

13. Cao K, Xu Y, Wu Q, Wang J, Liu C. Optimal Channel and Logistics Service Selection Strategies in the E-Commerce Context. Electron Commerce Res Appl (2021) 48:101070. doi:10.1016/j.elerap.2021.101070

14. Homburg C, Vollmayr J, Hahn A. Firm Value Creation through Major Channel Expansions: Evidence from an Event Study in the United States, Germany, and China. J Marketing (2014) 78(3):38–61. doi:10.1509/jm.12.0179

15. Zhang Y, Hezarkhani B. Competition in Dual-Channel Supply Chains: The Manufacturers' Channel Selection. Eur J Oper Res (2021) 291(1):244–62. doi:10.1016/j.ejor.2020.09.031

16. Karray S, Sigué SP. Offline Retailers Expanding Online to Compete with Manufacturers: Strategies and Channel Power. Ind Marketing Manage (2018) 71:203–14. doi:10.1016/j.indmarman.2018.01.004

17. Cao K, Xu Y, Cao J, Xu B, Wang J. Whether a Retailer Should Enter an E‐commerce Platform Taking into Account Consumer Returns. Intl Trans Op Res (2020) 27(6):2878–98. doi:10.1111/itor.12768

18. Karray S, Sigué SP. Multichannel Retailing and price Competition. Intl Trans Op Res (2021) 28(4):2002–32. doi:10.1111/itor.12835

19. Titiyal R, Bhattacharya S, Thakkar JJ. The Distribution Strategy Selection for an E-Tailer Using a Hybrid DANP VIKOR MCDM Model. Benchmarking (2019) 26:395–433. doi:10.1108/BIJ-01-2018-0018

20. Chen H, Hao Y, Yan Y. The Introduction Strategy of the Emerging Online Marketplace Considering Risk Attitude and Channel Power. Int J Gen Syst (2020) 49(5):470–96. doi:10.1080/03081079.2020.1748617

21. Tian L, Vakharia AJ, Tan YR, Xu Y. Marketplace, Reseller, or Hybrid: Strategic Analysis of an Emerging E-Commerce Model. Prod Oper Manag (2018) 27(8):1595–610. doi:10.1111/poms.12885

22. Wei J, Lu J, Zhao J. Interactions of Competing Manufacturers' Leader-Follower Relationship and Sales Format on Online Platforms. Eur J Oper Res (2020) 280(2):508–22. doi:10.1016/j.ejor.2019.07.048

23. Wang T-Y, Li Y-L, Yang H-T, Chin K-S, Wang Z-Q. Information Sharing Strategies in a Hybrid-Format Online Retailing Supply Chain. Int J Prod Res (2021) 59(10):3133–51. doi:10.1080/00207543.2020.1746851

24. Guo X, Zheng S, Yu Y, Zhang F. Optimal Bundling Strategy for a Retail Platform under agency Selling. Prod Oper Manag (2021) 30(7):2273–84. doi:10.1111/poms.13366

25. Chen Z, Fan Z-P, Zhao X. Offering Return-Freight Insurance or Not: Strategic Analysis of an E-Seller's Decisions. Omega (2021) 103:102447. doi:10.1016/j.omega.2021.102447

26. Mantin B, Krishnan H, Dhar T. The Strategic Role of Third-Party Marketplaces in Retailing. Prod Oper Manag (2014) 23(11):1937–49. doi:10.1111/poms.12203

27. Zheng S, Yu Y, Ma B. The Bright Side of Third‐party Marketplaces in Retailing. Intl Trans Op Res (2022) 29(1):442–70. doi:10.1111/itor.12992

28. Jiang B, Tian L. Collaborative Consumption: Strategic and Economic Implications of Product Sharing. Manage Sci (2018) 64(3):1171–88. doi:10.1287/mnsc.2016.2647

29. Li G, Tian L, Zheng H. Information Sharing in an Online Marketplace with Co‐opetitive Sellers. Prod Oper Manag (2021) 30(10):3713–34. doi:10.1111/poms.13460

30. Yan B, Wang T, Liu Y-p., Liu Y. Decision Analysis of Retailer-Dominated Dual-Channel Supply Chain Considering Cost Misreporting. Int J Prod Econ (2016) 178:34–41. doi:10.1016/j.ijpe.2016.04.020

31. Messinger PR, Narasimhan C. Has Power Shifted in the Grocery Channel? Marketing Sci (1995) 14(2):189–223. doi:10.1287/mksc.14.2.189

Keywords: dual-channel retailer, agency channel, channel strategy, online retailing, game theory

Citation: Wang Y (2022) Optimal Channel Strategy for Dual-Channel Retailers: The Bright Side of Introducing Agency Channels. Front. Phys. 10:895770. doi: 10.3389/fphy.2022.895770

Received: 14 March 2022; Accepted: 10 May 2022;

Published: 16 June 2022.

Edited by:

Huijia Li, Beijing University of Posts and Telecommunications (BUPT), ChinaReviewed by:

Benrong Zheng, Huazhong Agricultural University, ChinaJiuchuan Jiang, Nanjing University of Finance and Economics, China

Copyright © 2022 Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yang Wang, MjAxOXdhbmd5YW5nQHN0dTIwMTkuam51LmVkdS5jbg==

Yang Wang

Yang Wang