- 1School of Statistics and Mathematics, Zhejiang Gongshang University, Hangzhou, China

- 2Collaborative Innovation Center of Statistical Data Engineering, Technology and Application, Zhejiang Gongshang University, Hangzhou, China

- 3College of Information Science and Technology, Donghua University, Shanghai, China

- 4Department of Statistics, Donghua University, Shanghai, China

In this paper, the exponential stability of stochastic differential equations driven by multiplicative fractional Brownian motion (fBm) with Markovian switching is investigated. The quasi-linear cases with the Hurst parameter H ∈ (1/2, 1) and linear cases with H ∈ (0, 1/2) and H ∈ (1/2, 1) are all studied in this work. An example is presented as a demonstration.

1 Introduction

In the natural world, it is a common phenomena that many practical systems may face random abrupt changes in their structures and parameters, such as environmental variance, changing of subsystem interconnections and so on. To deal with these abrupt changes, Markovian switching systems, a particular class of hybrid systems, are investigated and widely used [1, 2]. Especially in signal processing, financial engineering, queueing networks, wireless communications and so on (see, e.g. [1, 3]).

In recent years, much attention has been paid to the stability of stochastic hybrid systems. For example, Mao [4] considers the exponential stability of general nonlinear stochastic hybrid systems. In [5], the criteria of moment exponential stability are obtained for stochastic hybrid delayed systems with Lévy noise in mean square. Zhou [6] investigates the pth moment exponential stability of the same systems. Some sufficient conditions for asymptotic stability in distribution of SDEs with Markovian switching are reported in [7]. See also [8, 9] for more results about Markovian switching.

On the other hand, it is generally known that if H ∈ (0, 1/2) and H ∈ (1/2, 1),

then

The main purpose of this paper is to discuss the exponential stability of a risky asset, with price dynamics:

where g(Xt, t, rt) = σ(t, rt)Xt,

Equation 1 can be regarded as the result of the following N fractional stochastic differential equations:

switching from one to another according to the movement of

Throughout this paper, unless otherwise specified, we let C denote a general constant and p denote a non-negative constant. Let

This paper is organized as follows. For the convenience of the reader, we briefly recall some of the basic results in Section 2. In Section 3, we investigate the solution and an extended Itô’s Formula for the general hybrid fractional stochastic differential Equation 1. Section 3 is devoted to the linear cases. In this section the moment exponential stability and almost sure exponential stability are discussed respectively. In Section 4, some useful criteria for the exponential stability with respect to quasi-linear cases are presented. Finally, a numerical example and graphical illustration are presented in Section 6.

2 Preliminaries

2.1 Markov Chain

Let

where △ > 0.

Here qij is the transition rate from i to j if i ≠ j. According to [22, 23], a continuous-time Markov chain

with initial condition r0 = i0, where ν(dt × dy) is a Poisson random measure with intensity dt × m(dy). Here m(⋅) is the Lebesgue measure on

Throughout this paper, unless otherwise specified, the Markov chain

2.2 Fractional Brownian Motion and Wick Product

We recall some of the basic results of fBm briefly, which will be needed throughout this paper. For more details about fBm we refer the reader to [16, 17, 27, 28]. If H ∈ (0, 1/2) ∪ (1/2, 1), then the (standard) fractional Brownian motion with Hurst parameter H is a continuous centered Gaussian process

To simplify the representation, it is always assumed that

Besides,

where

in which

Let

Define the Hermite polynomials:

and Hermite functions:

Let

the product of Hermite polynomials. Consider a square integrable random variable

According to [17, 29], every F(ω) has a unique representation:

besides,

Definition 2.1. (Wick Product) For

2.3 Malliavin Derivative

Let

and let

where ϕ(s, t) = H(2H − 1)|s − t|2H−2.

Definition 2.2. The ϕ-derivative of F ∈ Lp in the direction of Φg is defined by

if the limit exists in Lp. Moreover if there exists a process

for all

and

as n → ∞. Here

Definition 2.3. Let

where |π| = maxi∈{0,1,…,n−1}{ti+1 − ti}.

Remark 2.1.: According to Theorem 3.6.1 in [16], if

What’s more, according to Definition 3.4.1 in [16], the stochastic integral can be extended by

where

3 Hybrid Fractional Systems

In this section, firstly, we consider the existence and uniqueness of solution for Eq. 1. Then, an extended Itô’s Formula is presented.

3.1 Existence and Uniqueness

To ensure the existence and uniqueness, we impose the following assumptions.

Assumption 3.1. Let

1) For each fixed

2) For each fixed

3) For each fixed

Assumption 3.2. Let

1) For each fixed

2) For each fixed

Lemma 3.1.: Let Assumptions 3.1, 3.2 hold. Then Eq. 1 has a unique solution.

Proof: The existence and uniqueness can be proved similar to that for Theorem 2.6 in [31], so we omit it here.

3.2 The Itô Formula

Next, we first review the results in [16, 30] on the Itô formula with respect to fBm. Then we extend it to SDEs driven by fBm with Markovian switching.

Lemma 3.2. [16] (The Itô Formula) Let (Fu, 0 ≤ u ≤ T) be a stochastic process in

where |u − v| ≤ δ for some δ > 0 and

Let sup0≤s≤T|Gs| < ∞ and

Here

Formally,

Let

Substituting Eq. 3 into Eq. 2, we get

In the sequel of this paper, unless otherwise specified, we let the coefficients of Eq. 1 satisfy the conditions in Lemma 3.2, for each fixed

Lemma 3.3. If

where

Proof: This result can be obtained similarly to that in [31] and we therefore omit it. For further details we also refer to [2, 23].

4 Linear Hybrid Fractional Systems

There are many models for financial markets with fBm (see, e.g. [16]). The simplest nontrivial type of market is the fBm version of the classical Black Scholes market, in which linear fractional SDEs is used. Thus, we would like to give some new criteria for switching linear fractional SDEs with

Definition 4.1. Let H ∈ (0, 1). The operator M is defined on functions

where

Here Γ(⋅) denotes the classical Gamma function.According to [16], Eq. 6 can be restated as follows.For H ∈ (0, 1/2), we have

For H = 1/2, we have

For H ∈ (1/2, 1), we have

Lemma 4.1. Let

Then there exists constants C, c > 0 such that:

for any initial condition r0 and every t ≥ 0.

Proof: It is a consequence of Perron-Frobenius theorem and the study of eigenvalues. See Proposition 4.1 in [25], Proposition 4.2 in [25], and Lemma 2.7 in [26], for further details.In Eq. 1, let us consider the case g(x, t, rt) = σ(t, rt)x = thb(rt)x, f(x, t, rt) = α(rt)x, where α(i) and b(i) are constants for each

Set

4.1 pth Moment Exponential Stability

Theorem 4.1. Let

1) If

2) If

Proof. According to [16], without too many calculations, we obtain that

where Ms is the operator M acting on the variable s. Let x0 ≠ 0. It follows from Eq. 8 that

We then see from Eq. 9 that

where

Noting that ζt is the solution to the equation

with initial value ζ0 = |x0|p. Thus

which yields

Substituting Eq. 11 into Eq. 10 gives

Note that

Consequently, by Definition 4.1 and [16], one has

Making use of Eqs 12, 13, we obtain that

Therefore, by Lemma 4.1 and Eq. 12, the required assertions follow. The proof is complete.

Theorem 4.2. Let

1) If

2) If

Proof: Similar to Theorem 4.1, we write the solution as follows.

Note that Ms is the operator M acting on the variable s, where

According to [16], we also have that

Consequently, by Lemma 4.1, the result follows. The proof is complete.

Remark 4.1. In the above Theorems 4.1, 4.2, the parameter h is supposed to be H − 1/2. Noting that by Eqs 13, 15 and together with the Definition 4.1, the stability of solution for Eq. 7 with h < 1/2 − H or h > 1/2 − H can be deduced respectively without too many difficulties.

Remark 4.2. Take H = 1/2. It’s easy to show that if

4.2 Almost Sure Exponential Stability

To proceed, we need to introduce the definition of almost sure stability and a useful lemma.

Definition 4.2. The equilibrium point x = 0 is said to be almost surely exponential stable if

for any

Lemma 4.2. (Law of the iterated logarithm) For a standard fBm

where CH > 0 is a suitable constant.

Proof: By [33], we have

where cH is a suitable constant. Then the thesis follows by the self-similarity of fBm and a change of variable t → 1/t.For the sake of clarity, we firstly set h = 0. Namely, let us consider

Noting that Eq. 17 is exactly the geometry fBm with Markovian Switching. We proceed to discuss the almost sure exponential stability about it.

Theorem 4.3. 1) If 0 < H < 1/2, the equilibrium point x = 0 of the system Eq. 17 is almost surely exponential stable when

Proof: Define

By Definition 4.1 and [16], one has

Making use of Eq. 18, we get

Especially, when H = 1/2, we have that

Therefore, the required results follows. The proof is complete.

Remark 4.3. Making use of Eq. 18, one can discuss the almost sure exponential stability for Eq. 7 with h ≠ 0. The proofs are similar to Theorem 4.3 and are omitted.

5 Quasi-Linear Hybrid Fractional Systems

We now apply the extended Itô Formula in Section 3 to discuss the stability for quasi-linear fractional SDEs with Markovian switching.

Theorem 5.1.: Let Assumptions 3.1, 3.2 hold. If there exists a function

for all

Proof: According to Lemma 3.1, Eq. 1 has a unique solution. Denote it

where

Thus we obtain that

Dividing both sides of Eq. 21 by a1eηt, noting that λa2 − b < 0, we get

Consequently,

Letting T → ∞ gives

and the required assertion follows. The proof is complete.In the sequel of this section, we give another useful criterion and prove it briefly.

Theorem 5.2. Assume that Eq. 1 has a unique solution and there exist a function

and

Then Eq. 1 is pth moment exponential stable.

Proof: Set

By [1], Eq. 22 implies the Poisson equation:

Note that Eq. 23 has the solution

For each

Making use of Eqs 25, 26, we obtain that

Substituting Eq. 24 into Eq. 27, we get

where κ < 0. Making use of Theorem 5.1, the desired criterion follows.On the other hand, we can prove it in another way. Set η > 0 and λ ∈ (η, − κ). Define

Compute

Thus we obtain that

Dividing both sides of Eq. 28 by b1eηt, noting that b2(λ + κ) < 0, we get

Therefore, we obtain the required assertion

The proof is complete.

6 Example

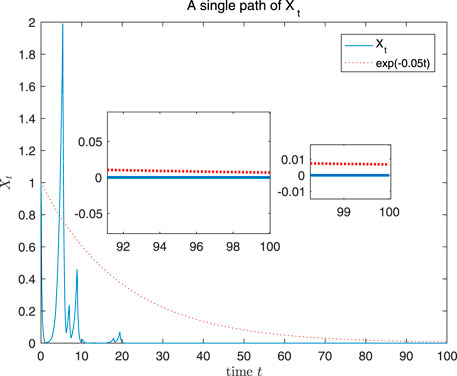

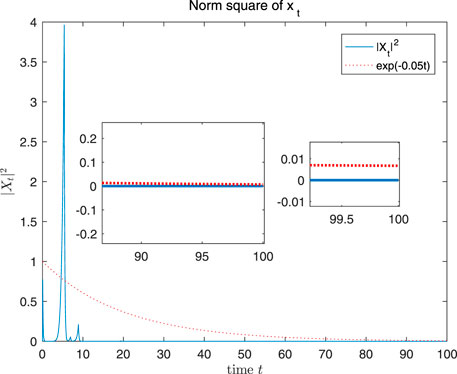

In this section we give a numerical example to illustrate our results.

Example 1. Let

on t ≥ 0. Here we take H = 0.7 and

Note that for all

and

Compute

By Theorem 5.2, it’s clear that the solution of Eq. 29 is second moment exponential stable. Figures 1, 2 show a single path of the solution and the solution’s norm square, respectively.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author Contributions

WP contributed to conception and design of the study. WP wrote the first draft of the manuscript. ZZ and WP wrote sections of the manuscript. All authors contributed to manuscript revision, read, and approved the submitted version.

Funding

The research of WP was supported by the Characteristic and Preponderant Discipline of Key Construction Universities in Zhejiang Province (Zhejiang Gongshang University-Statistics).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Acknowledgments

The authors are grateful to thank the reviewers for careful reading of the paper and for helpful comments that led to improvement of the first version of this paper.

References

1. Yin GG, Zhu C. Hybrid switching diffusions: Properties and applications, Stoch. Model. Appl. Probab. New York: Springer (2010).

2. Mao XR, Yuan CG. Stochastic differential equations with Markovian switching. South Kensington: Imperial College Process (2006).

3. Hamilton JD. A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica (1989) 57:357–84. doi:10.2307/1912559

4. Mao X. Stability of stochastic differential equations with Markovian switching. Stochastic Process their Appl (1999) 79:45–67. doi:10.1016/s0304-4149(98)00070-2

5. Yuan C, Mao X. Stability of stochastic delay hybrid systems with jumps. Eur J Control (2010) 16:595–608. doi:10.3166/ejc.16.595-608

6. Zhou W, Yang J, Yang X, Dai A, Liu H, Fang JA. pth Moment exponential stability of stochastic delayed hybrid systems with Lévy noise. Appl Math Model (2015) 39:5650–8. doi:10.1016/j.apm.2015.01.025

7. Yuan C, Mao X. Asymptotic stability in distribution of stochastic differential equations with Markovian switching. Stochastic Process their Appl (2003) 103:277–91. doi:10.1016/s0304-4149(02)00230-2

8. Li X, Mao X. A note on almost sure asymptotic stability of neutral stochastic delay differential equations with Markovian switching. Automatica (2012) 48:2329–34. doi:10.1016/j.automatica.2012.06.045

9. Wu H, Sun J. p-Moment stability of stochastic differential equations with impulsive jump and Markovian switching. Automatica (2006) 42:1753–9. doi:10.1016/j.automatica.2006.05.009

10. Hurst HE. Long-term storage capacity in reservoirs. Trans Amer Soc Civil Eng (1951) 116:400–10. doi:10.1061/taceat.0006518

11. Hurst HE. Methods of using long-term storage in reservoirs. Proc Inst Civil Eng (1956) 5:519–43. doi:10.1680/iicep.1956.11503

13. Mandelbrot BB. Fractals and Scaling in Finance: Discontinuity, Concentration, Risk. Berlin: Springer-Verlag (1997).

14. Hu Y, Øksendal B. Fractional white noise calculus and applications to finance. Infin Dimens Anal Quan Probab. Relat. Top. (2003) 06:1–32. doi:10.1142/s0219025703001110

15. Brody DC, Syroka J, Zervos M. Dynamical pricing of weather derivatives. Quantitative Finance (2002) 2:189–98. doi:10.1088/1469-7688/2/3/302

16. Biagini F, Hu YZ, Øksendal B, Zhang TS. Stochastic calculus for fractional Brownian motion and applications. London: Springer-Verlag (2008).

17. Mishura YS. Stochastic calculus for Fractional Brownian Motion and related process. Berlin: Springer-Verlag (2008).

18. Li M. Modified multifractional Gaussian noise and its application. Phys Scr (2021) 96:125002. doi:10.1088/1402-4896/ac1cf6

19. Li M. Generalized fractional Gaussian noise and its application to traffic modeling. Physica A (2021) 579:1236137. doi:10.1016/j.physa.2021.126138

20. Li M. Multi-fractional generalized Cauchy process and its application to teletraffic. Physica A: Stat Mech its Appl (2020) 550:123982. doi:10.1016/j.physa.2019.123982

21. Li M. Fractal time series a tutorial review. Math Probl Eng (2010) 2010:157264. doi:10.1155/2010/157264

22. Ghosh MK, Arapostathis A, Marcus SI. Ergodic control of switching diffusions. SIAM J Control Optim (1997) 35:1952–88. doi:10.1137/s0363012996299302

23. Skorohod AV. Asymptotic Methods in the Theory of Stochastic Differential Equations. US: American Mathematical Society (1989).

25. Bardet JB, Gurin H, Malrieu F. Long time behavior of diffusions with Markov switching. ALEA Lat Am J Probab Math Stat (2010) 7:151–70.

26. Cloez B, Hairer M. Exponential ergodicity for Markov processes with random switching. Bernoulli (2015) 21:505–36. doi:10.3150/13-bej577

27. Alos E, Mazet O, Nualart D. Stochastic calculus with respect to Gaussian processes. Ann Probab (1999) 29:766–801.

28. Nualart D, Răşcanu A. Differential equations driven by fractional Brownian motion. Collect Math (2000) 53:55–81.

29. Holdeb H, Øksendal B, Ubøe J, Zhang T. Stochastic partial differential equations. Boston: Birkhäuser (1996).

30. Duncan TE, Hu Y, Pasik-Duncan B. Stochastic Calculus for Fractional Brownian Motion I. Theory. SIAM J Control Optim (2000) 38:582–612. doi:10.1137/s036301299834171x

31. Yan L, Pei WY, Pei W, Zhang Z. Exponential stability of SDEs driven by fBm with Markovian switching. Discrete Cont Dyn-a (2019) 39:6467–83. doi:10.3934/dcds.2019280

Keywords: stochastic differential equation (SDEs), stability, fractional brownian motion, markovian switching, hybrid system

Citation: Pei W and Zhang Z (2021) Stability of Hybrid SDEs Driven by fBm. Front. Phys. 9:783434. doi: 10.3389/fphy.2021.783434

Received: 26 September 2021; Accepted: 13 October 2021;

Published: 02 November 2021.

Edited by:

Ming Li, Zhejiang University, ChinaCopyright © 2021 Pei and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Wenyi Pei, cGVpd2VueWlAMTYzLmNvbQ==

Wenyi Pei

Wenyi Pei Zhenzhong Zhang4

Zhenzhong Zhang4