94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

BRIEF RESEARCH REPORT article

Front. Phys. , 31 July 2020

Sec. Social Physics

Volume 8 - 2020 | https://doi.org/10.3389/fphy.2020.00296

This article is part of the Research Topic From Physics to Econophysics and Back: Methods and Insights View all 31 articles

Bitcoin being a safe-haven asset is one of the traditional stories in the cryptocurrency community. However, during its existence and relevant presence, i.e., approximately since 2013, there has been no severe situation on the financial markets globally to prove or disprove this story until the COVID-19 pandemic. We study the quantile correlations of Bitcoin and two benchmarks—the S&P 500 and VIX—and make comparison with gold as the traditional safe-haven asset. The Bitcoin safe haven story is shown and discussed to be unsubstantiated and far-fetched, while gold comes out as a clear winner in this contest even when a broader cryptocurrency index (CRIX) is considered.

The history of Bitcoin is tightly connected to its detachment and independence from the standard financial markets and the proclaimed properties that should make it serve as “digital gold” [1]. An important implication of such status is Bitcoin potentially being a safe-haven asset either in addition to or as a replacement of gold itself, which has served as such for decades [2]. A safe-haven asset is an asset in which capital can take refuge when other assets are in distress. The distress situation of the other assets is a clear distinction from being a good diversifier, which traditionally leads to a low or even negative correlation with other assets in the Markowitz portfolio construction logic [3]. An asset might be considered a safe haven if its correlation with other assets during turbulent periods is lower (or at least not higher) than during calm periods [4–7].

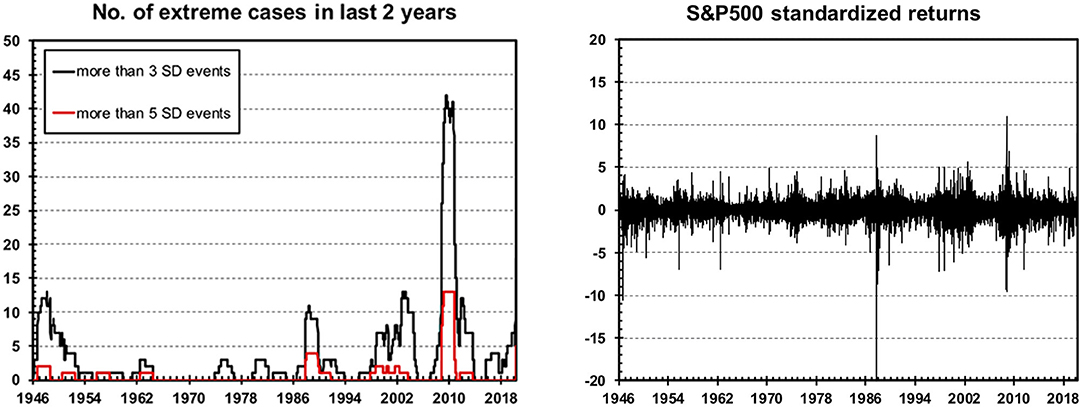

The safe-haven status of Bitcoin is one of its cornerstones and narratives in the financial part of the crypto-community, and lately, it has been a popular topic in the scientific literature as well [8–12]. However, its validity had been, by definition, very difficult to properly discuss and test, as empirical tests had lacked the essential part of the safe-haven definition—financial markets in distress. As Bitcoin was developed in 2008 and 2009 [13], its first legendary pizza transaction took place in March 2010, and it gained larger public attention only by 2013, still mostly due to its controversial aspects (such as the Mt. Gox collapse, the darknet, and the Silk Road), it avoided the most turbulent times of the global financial crisis. Further, it took until the middle of 2016 for the Bitcoin markets to reach a stable daily traded volume of more than $100 million. To illustrate the historical perspective, Figure 1 shows the S&P 500 standardized daily logarithmic returns back to the beginning of 1946 where we find critical historical events with episodes of numerous negative returns of more than five historical standard deviations (the series is demeaned and standardized by the historical mean and standard deviation of the dataset between January 1, 1946, and April 17, 2020). To put the extreme events into a better perspective, the right panel of Figure 1 shows a number of extreme events above three and five standard deviations on a sliding window of two trading years (500 trading days). There, we see that since 1987, there have been only a few periods of time without these 5-SD critical events. Yet, one of these periods has taken place between 2013 and 2020, i.e., the period of Bitcoin's existence with some palpable trading volume and usage. Only in the days of March 2020 did the financial markets experience severe losses due to fear and uncertainty connected with the COVID-19 (coronavirus disease 2019, caused by the SARS-CoV-2 virus) pandemic, which rapidly spread globally.

Figure 1. Historical extreme events of the S&P 500. (Left) Logarithmic returns of the S&P 500 between January 1, 1946, and April 17, 2020, demeaned and standardized by the historical mean and standard deviation over the whole examination period. (Right) Number of extreme returns over 3 or 5 standard deviations. Cumulative count on a rolling window of 500 days is shown.

Even though the spread of the virus had been assumed possibly to be locally contained, its unprecedented spread caused pervasive panic in global society, which quickly translated to sell-outs and havoc on the financial markets. Purely statistically (and perhaps cynically) speaking, this creates a unique opportunity to test the safe-haven properties of Bitcoin and compare it with gold as the traditional safe haven of choice.

We study the interconnection between Bitcoin (BTC) and two benchmarks—the Standard & Poor's 500 (S&P 500) index as a representative of the global financial markets and the CBOE Volatility Index (VIX) as a measure of market uncertainty. We use publicly available data from Yahoo Finance, and we also utilize the Bitcoin prices provided there (these reflect CoinMarkepCap.com data), which restricts the analysis to start from September 16, 2014. The ending is April 17, 2020. As Bitcoin is traded on a 24/7 basis and stocks are not, we use the close-close logarithmic returns1 (rather than open-close) to include the weekend movements of Bitcoin. This gives us 1,405 daily observations.

As the safe-haven property is similar to being a diversifier, i.e., having a low correlation with other assets, but only during critical times, we approach it from a simple perspective of examining correlations between Bitcoin and the other two assets—the S&P 500 and VIX—during critical events. We treat the critical events as rarely occurring, negative events, i.e., events in the (very) low quantiles of the distribution of the baseline asset. For this purpose, we utilize the quantile correlation [14]. For statistical validity, we estimate the quantile correlation coefficient on 1,000 bootstrapped samples (resampling the time index with a replacement) so that we can present not only a point estimate but also confidence intervals.

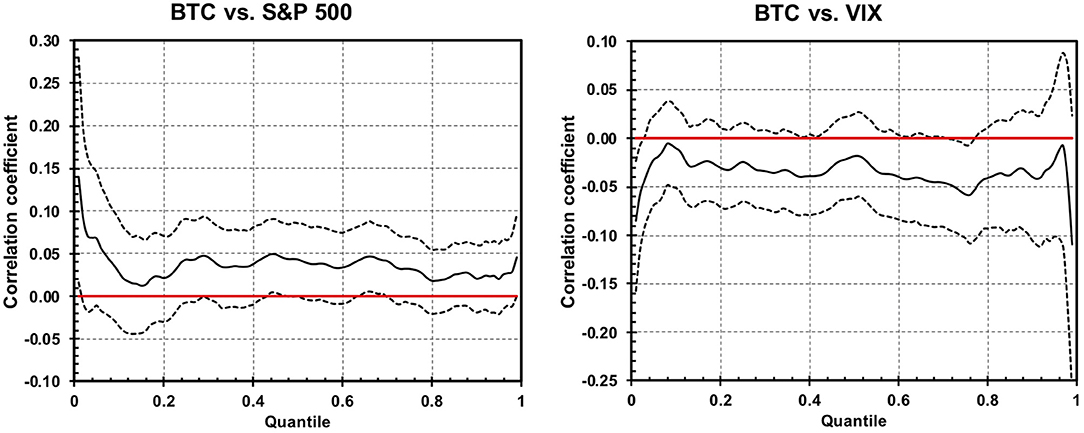

In Figure 2, we see the quantile correlations between BTC and the S&P 500 (left) and between BTC and the VIX (right). The quantile here represents the conditional quantile of the latter asset in the pair, i.e., either the S&P 500 or the VIX. We find that BTC is a good diversifier with respect to the S&P 500 in calm and bullish times, i.e., in the bulk of the distribution and more generally from quantile 0.2 upwards, with correlations very close to zero and the 90 % confidence intervals including the zero correlation. For the very low quantiles below 0.1, the correlation increases up to more than 0.1, precisely to 0.13 for the lowest analyzed quantile of 0.01. The combination of low quantiles of the S&P 500 and a positive correlation signals that BTC drops together with the stock market if the situation is critical. Note that the size of the correlation is still quite low but is well above the levels during the calmer periods and significantly different from zero for the lowest quantiles. For the VIX, which represents the overall mood on the market and expected future uncertainty, we need to look at the high quantiles, as it holds that the higher the VIX is, the higher the uncertainty. For a safe-haven asset, we would expect a low or positive correlation, at least in these high quantiles, or ideally positive correlations for all quantiles. We observe a similar picture as for the S&P 500 case, as the correlation is very close to zero for most situations, but it drops markedly for the times of high uncertainty, which is not a desirable sign for a safe haven.

Figure 2. Quantile correlations for Bitcoin. (Left) Quantile correlations between Bitcoin and the S&P 500 index. The quantiles on the x-axis are with respect to the S&P 500 index. The low quantiles show the extreme negative events. Black bold curve shows the mean value of 1,000 bootstrapped estimates. The dashed curves show the 90 % confidence intervals based on the bootstrapped estimates. (Right) Quantile correlations between Bitcoin and the VIX index. The quantiles on the x-axis are with respect to the VIX index. The high quantiles show the periods of high uncertainty. The other notation holds.

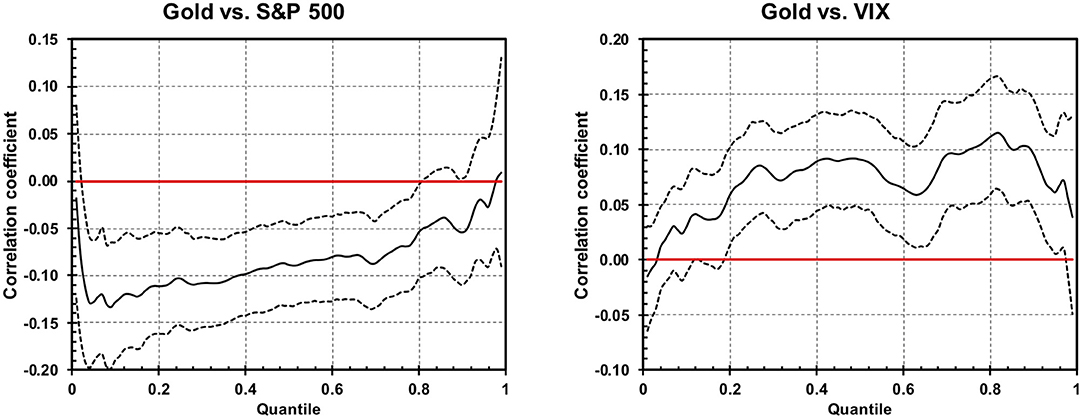

Comparing the results to the traditional safe haven of gold (Figure 3), we see a different picture. In the bulk of the distribution, gold is negatively correlated with the S&P 500, and even though its correlation increases during extreme negative events, its estimate still remains below the zero correlation (statistically speaking not different from zero). With respect to the VIX, gold is positively correlated with it in the bulk of the distribution, and even though its correlation decreases for the most uncertain periods, it still remains above zero. Both of these attributes are the ones we would expect for a safe haven asset, albeit ideally in a more pronounced manner.

Figure 3. Quantile correlations for gold. (Left) Quantile correlations between gold and the S&P 500 index. (Right) Quantile correlations between gold and the VIX index. The notation from Figure 2 holds.

The COVID-19 pandemic is the first global economic and financial earthquake that has taken place during the existence and actual use and wider knowledge of Bitcoin, which made it possible to put the claims of Bitcoin being a safe-haven asset to an actual empirical examination. We study the quantile correlations between Bitcoin and a pair of global financial benchmarks—the S&P 500 index as the stock market benchmark and the VIX index as a measure of uncertainty and future expectations. What we find is that Bitcoin can easily be considered as a good diversifier, as its correlation with the S&P 500 is close to zero for most of the quantiles. However, its correlation increases markedly during turbulent periods of the S&P 500. The mirror result is observed for its relationship with the VIX index, as the correlation remains close to zero for most quantiles again but drops for the most uncertain times. However, even the extreme-quantile correlations between Bitcoin and either the S&P 500 or the VIX still remain rather low (in absolute terms), and one needs a comparison to fairly comment on its safe-haven properties.

The first comparison is at hand—to gold. This has been presented in the main Results section, but it needs to be stressed that gold shows favorable properties with respect to portfolio diversification utility compared to Bitcoin. It shows negative correlations with the S&P 500 for the bulk of the distribution. The correlations grow for higher quantiles (even though they do not cross to positive ones), i.e., more bullish periods, which is again beneficial. And even though the correlation increases for the lowest quantiles, i.e., the most extreme negative cases, it still collapses to zero, not higher. In addition, we have the connection to the VIX, where gold is again favored in most portfolio-related aspects. We see positive correlations for the bulk of the distribution, i.e., if uncertainty increases, the price of gold increases as well, and for extreme cases, even though the correlation drops, it still remains positive. Therefore, even if we forget about other issues connected to Bitcoin (such as low liquidity, exchange risk, and various legal and accounting/tax issues [15–19]), it does not outperform gold in any important aspect as a safe-haven asset.

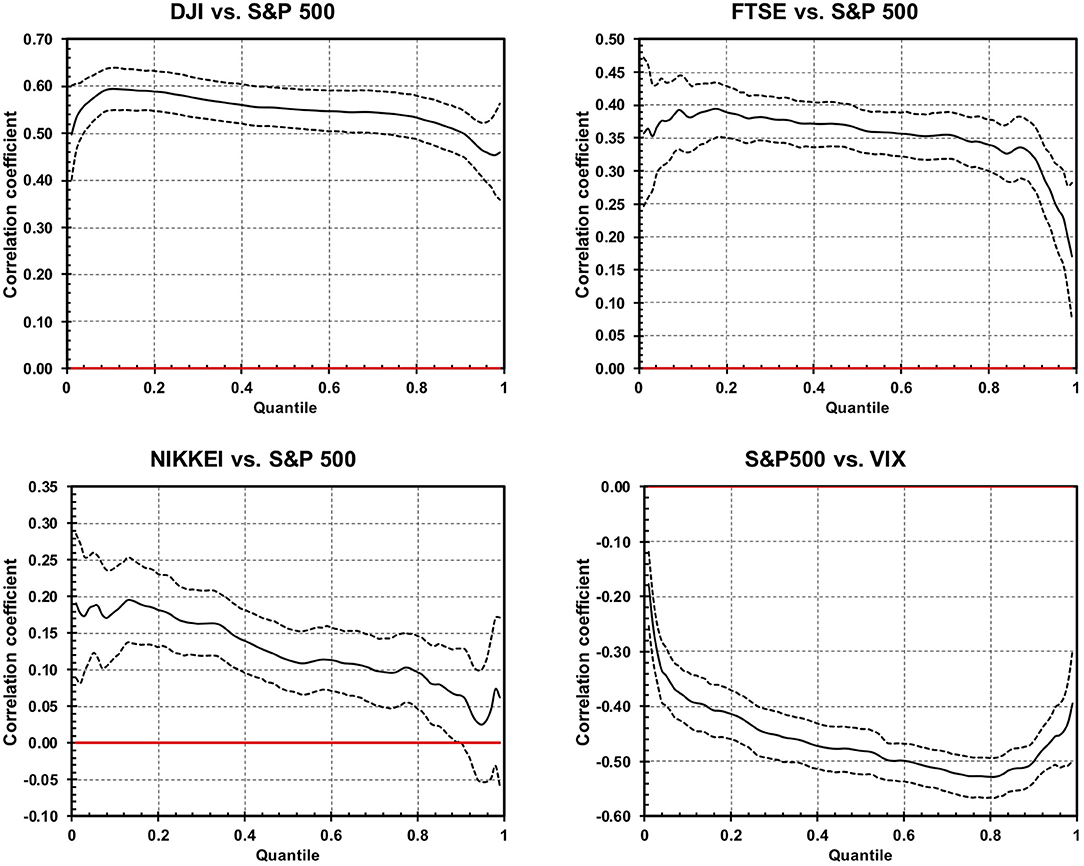

The second comparison is to other stock indices, mostly to get the correct grasp of the scale of the correlations presented above. In Figure 4, we show the quantile correlations of the S&P 500 with the VIX and three other stock indices- the Dow Jones Industrial Average (DJI), Footsie 100 (FTSE), and NIKKEI 225 (NIKKEI)—for the same period of time. There are several interesting observations. First, even for the pair of the S&P 500 and the DJI, the two main US stock indices (in addition to the NASDAQ), the tails correlations are not as strong as one might expect—around 0.5 for both sides of the extreme cases. Second, not surprisingly, the S&P 500 is strongly connected to the VIX. But again, its connection weakens for the extreme cases, more markedly for the calmer periods. Third, the markets are not very correlated during the extremely positive movements of the S&P 500 index, where we find the quantile correlations fall to very low values for both the FTSE and the NIKKEI. And fourth, BTC shows similar properties to the NIKKEI, showing mild correlations for the whole spectrum of quantiles, with slightly higher correlations for the extreme negative movements and practically zero correlation for the extremely positive movements. To be fair, BTC still shows more favorable low-quantile correlations than the NIKKEI does, but not by much.

Figure 4. Quantile correlations of the S&P 500 with other assets. The notation from Figure 2 holds.

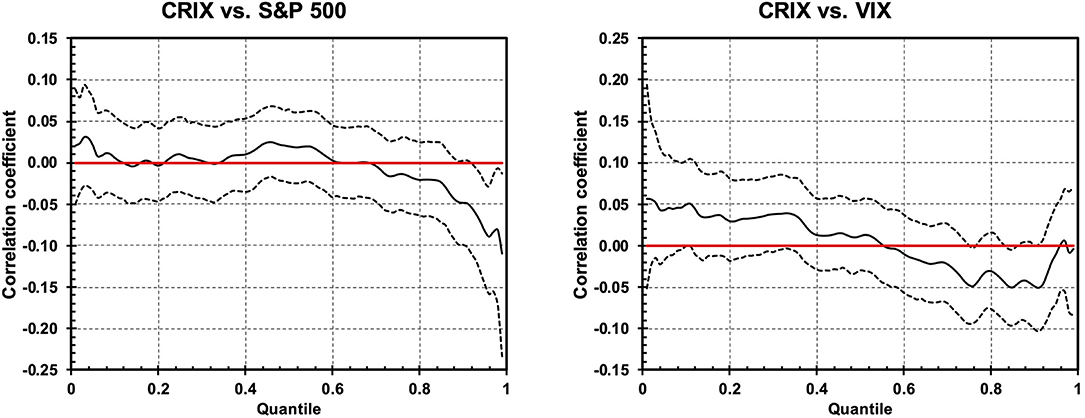

The last perspective and comparison we provide is to a more general cryptocurrency index. Here, we utilize the CRIX index2, which is constructed as a capitalization-weighted price index [20]. Currently (mid-2020), it contains around 70% Bitcoin, 10% Ethereum, 5% Ripple, 2.5% Bitcoin Cash and Tether, between 1 and 2% Bitcoin SV, Litecoin, Binance Coin, and EOS, and below 1% OKB (OKEx exchange coin). The quantile correlations between the logarithmic returns of the CRIX index and the two baseline series—the S&P 500 and VIX—are shown in Figure 5. Even though the index is majorly formed by Bitcoin, the connection to the stock markets is quite distinct. For the S&P 500 index, we find quantile correlations of practically zero ranging from the lowest quantiles up to around quantile 0.7, where the correlation starts decreasing, and it reaches around −0.1 for the highest quantiles. The diversified cryptocurrency index thus does not follow the stock market index in negative events, which is a good sign for the identification as a safe haven (even though it actually goes against the stock market in the extreme positive events). These results are mostly confirmed for the dynamics between the CRIX and VIX indices, where we observe mildly positive correlations for the lowest quantiles of the VIX (calm periods) that decrease with increasing quantile. Above quantile 0.7, the quantile correlations are of a similar level (around −0.05) as for the relationship between Bitcoin and the VIX index. However, for the most extreme cases, the quantile correlation between CRIX and VIX grows to zero, whereas for Bitcoin, we found a rather sharp drop to negative correlations. The results for the CRIX index are thus more favorable for the safe-haven label when compared to Bitcoin alone. A diversified portfolio of cryptocurrencies has more desirable properties, both as a diversifier (generally lower correlations for all quantiles compared to Bitcoin alone) and as a safe haven (lower correlations with the stock index in the lowest quantiles and correlations closer to zero for the turbulent periods measured by the VIX index). Nevertheless, both of these features are more profoundly represented by gold even compared to the CRIX index.

Figure 5. Quantile correlations for CRIX with the S&P 500 (left) and the VIX (right). The notation from Figure 2 holds.

Overall, we argue that the claim of Bitcoin being a safe haven and an alternative to gold or even being the “digital gold” seems unsubstantiated and far-fetched. This is true even if a broader cryptocurrency index is considered. We do not, however, want to discredit Bitcoin in this aspect completely, as the COVID-19 pandemic and the financial market turmoil induced by it are only the first real tests to its status. In addition, the potential safe-haven properties of Bitcoin and cryptocurrencies in general are certainly not the only factor making cryptocurrencies attractive and sought after. Nevertheless, at this point and with respect to the safe haven contest, gold emerges as a clear winner.

The datasets analyzed in this study are publicly available at Yahoo Finance and the CRIX-VCRIX website.

LK contributed to all parts of the presented research.

This work was supported from the Charles University PRIMUS program (project PRIMUS/19/HUM/17) and the Czech Science Foundation (project 20-17295S) was highly appreciated.

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

1. ^It is certainly up for discussion whether to use returns for the VIX as well. We considered this possible issue and performed the analysis on both the levels and returns of the VIX index. The results are qualitatively the same. Note that the distinction between logarithmic and original series plays no role here, as we apply a quantile-based method (and logarithm is a monotonous transformation).

2. ^The index is described in detail at http://thecrix.de. The volatility CRIX index (VCRIX), in a way parallel to the VIX index, is also available there.

1. Courtois NT, Grajek M, Naik R. Optimizing SHA256 in Bitcoin mining. In: Kotulski Z, Kdiezopolski B, Mazur K, editors. Cryptography and Security Systems. Lublin: Springer (2014). p. 131–44. doi: 10.1007/978-3-662-44893-9_12

2. O'Connor FA, Lucey BM, Batten JA, Baur DB. The financial economics of gold–a survey. Int Rev Financ Anal. (2015) 41:186–205. doi: 10.1016/j.irfa.2015.07.005

3. Markowitz HM. Portfolio selection. J Finance. (1952) 7:77–91. doi: 10.1111/j.1540-6261.1952.tb01525.x

4. Baur DG, Lucey BM. Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financ Rev. (2010) 45:217–29. doi: 10.1111/j.1540-6288.2010.00244.x

5. Beckmann J, Berger T, Czudaj R. Does gold act as a hedge or a safe haven for stocks? A smooth transition approach. Econ Model. (2015) 48:16–24. doi: 10.1016/j.econmod.2014.10.044

6. Klein T. Dynamic correlation of precious metals and flight-to-quality in developed markets. Finance Res Lett. (2017) 23:283–90. doi: 10.1016/j.frl.2017.05.002

7. Klein T, Pham Thu H, Walther T. Bitcoin is not the new gold–a comparison of volatility, correlation, and portfolio performance. Int Rev Financ Anal. (2018) 59:105–16. doi: 10.1016/j.irfa.2018.07.010

8. Bouri E, Molnar P, Azzi G, Roubaud D, Hagfors LI. On the hedge and safe haven properties of Bitcoin: is it really more than a diversifier? Finance Res Lett. (2017) 20:192–8. doi: 10.1016/j.frl.2016.09.025

9. Wang G, Tang Y, Xie C, Chen S. Is Bitcoin a safe haven or a hedging asset? Evidence from China. J Manag Sci Eng. (2019) 4:173–88. doi: 10.1016/j.jmse.2019.09.001

10. Smales LA. Bitcoin as a safe haven: is it even worth considering? Finance Res Lett. (2019) 63:322–30. doi: 10.2139/ssrn.3204237

11. Selmi R, Mensi W, Hammoudeh S, Bouoiyour J. Is Bitcoin a hedge, a safe haven or a diversifier for oil price movements? A comparison with gold. Energy Econ. (2018) 74:787–801. doi: 10.1016/j.eneco.2018.07.007

12. Urquhart A, Zhang H. Is Bitcoin a hedge or safe haven for currencies? An intraday analysis. Int Rev Financ Anal. (2019) 63:49–57. doi: 10.1016/j.irfa.2019.02.009

13. Nakamoto S. Bitcoin: A Peer-to-Peer Electronic Cash System (2008). Available online at: https://bitcoin.org/bitcoin.pdf

14. Li G, Li Y, Tsai CL. Quantile correlations and quantile autoregressive modeling. J Am Stat Assoc. (2015) 110:246–61. doi: 10.1080/01621459.2014.892007

15. Koutmos D. Liquidity uncertainty and Bitcoin's market microstructure. Econ Lett. (2018) 172:97–101. doi: 10.1016/j.econlet.2018.08.041

16. Gandal N, Hamrick JT, Moore T, Oberman T. Price manipulation in the Bitcoin ecosystem. J Monet Econ. (2018) 95:86–96. doi: 10.1016/j.jmoneco.2017.12.004

17. Schilling L, Uhlig H. Some simple Bitcoin economics. J Monet Econ. (2019) 106:16–26. doi: 10.1016/j.jmoneco.2019.07.002

18. Wu Y, Luo A, Xu D. Identifying suspicious addresses in Bitcoin thefts. Digit Invest. (2019) 31:200895. doi: 10.1016/j.fsidi.2019.200895

19. Al-Yahyaee KH, Mensi W, Ko HU, Yoon SM, Kang SH. Why cryptocurrency markets are inefficient: the impact of liquidity and volatility. North Am J Econ Finance. (2020) 52:101168. doi: 10.1016/j.najef.2020.101168

Keywords: Bitcoin, safe haven, extreme events, COVID-19, coronavirus

Citation: Kristoufek L (2020) Grandpa, Grandpa, Tell Me the One About Bitcoin Being a Safe Haven: New Evidence From the COVID-19 Pandemic. Front. Phys. 8:296. doi: 10.3389/fphy.2020.00296

Received: 22 April 2020; Accepted: 30 June 2020;

Published: 31 July 2020.

Edited by:

Siew Ann Cheong, Nanyang Technological University, SingaporeReviewed by:

Chi Xie, Hunan University, ChinaCopyright © 2020 Kristoufek. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Ladislav Kristoufek, lk@fsv.cuni.cz

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.