- 1Centre for Research on Risk and Crises, Mines Paris, PSL University, Paris, France

- 2Department of Energy, Politecnico di Milano, Milan, Italy

- 3Department of Nuclear Science and Engineering Massachusetts Institute of Technology, Cambridge, MA, United States

- 4Consultant and Independent Researcher, Idaho Falls, ID, United States

- 5Department of Energy, Process and System Engineering, University of Pisa, Pisa, Italy

“We have opinions, we make observations, we change our opinions.” Stephen Senn, Dicing with Death, 2003. The purpose of this review paper is to inform debate and provide snapshot opinions about challenges and solutions for the development of nuclear fission technology. We review the socio-political and techno-economic status of nuclear power technology, which, as almost always during its history, is on an edge from which it may jump to success or fall into the abyss of oblivion. Recent nuclear projects and claims are reviewed in light of lessons learned from the international aircraft and minerals processing industries on manufacturing, construction, and technology maturity. For new nuclear reactor projects and designs, these experiences assist in systematically and objectively quantifying investor risk. We strongly recommend the deployment of nuclear fission for energy production everywhere in the world, depending on the scale and dominant economic factors.

1 Introduction

Nuclear technology and its deployment is inevitably linked to key government and energy policies (COP28, 2023; IAEA Nuclear Energy Summit, 2024; OECD-NEA Role of Economics in, 2024). To facilitate and implement technological solutions, urgent action, rethinking, and redirection beyond a pure reliance on market forces are needed for avoiding “one-off” projects. If we look at the history of nuclear technology, we can see that high capital costs have slowed its development, and what has killed some related concepts are high operational and maintenance (O&M) costs. Nuclear for commercial shipping, old high-temperature gas reactors (HTGRs), and sodium fast reactors (SFRs) are prime examples of this. At the interrelated policy, fiscal, and international levels, what is required are feasible but aggressive timelines and specific goals for nuclear power systems to reduce both capital cash and financial risk in order to achieve the overall goal of enhanced orders and deployments.

There are many claims, studies, and graphics-rich brochures that seek government and/or entrepreneur investment for developing designs, underwriting first-of-a–kind (FOAK) risks (e.g., Google “SMR” to view some 85M results/hits). Cost data collected for 50 different reactor types and 11 studies demonstrate a factor of a two-to-four range in published overnight capital generating cost estimates, but these “…do not consider the construction duration and financing that would be included in the total plant cost” (Jaoude et al., 2024). It is indisputable that there are long development times, high costs, and uncertainty in the development and construction of any new reactor concept (viz. liquid metal cooled reactors), which explain the recent attempts to streamline technology demonstration, minimize costly needed R&D, and simplify licensing (NRC, 2023). Then the question becomes how to ensure that existing and known technology is competitive (e.g., Pioro, 2023), given that the designs needing the least new work are those that can be swiftly “proven” and have to proceed effectively whereas new, more exotic, or innovative reactors are exposed to greater financial and developmental risks.

Analysis of the ideas behind adopting small reactors has led to self-evident statements considering every aspect of energy demand, use, supply, and importantly, market forces (NAS, 2023):

Estimates of the role for advanced nuclear energy in this mix is highly dependent on assumptions… The assumptions with the greatest impact on nuclear deployment were policies and technology cost … The economic challenge that advanced reactor developers face is daunting.

Recent studies even advocate for the conversion of hundreds of closing or redundant coal plant sites, due to aging and national zero-carbon policies, to host small nuclear plants as a means of minimizing local social and economic disruption (EPRI, 2023; Doe, 2023b). In the current context of commercial nuclear power, the purpose of this review is to inform debate and provide snapshot opinions about challenges and solutions for the development of nuclear fission technology. The present approach and opinions differ from the multi-aspect and wide-ranging INPRO assessment methodology (see e.g., Bizmurzin et al., 2023, Industrial decarburization and economic growth on Teesside and beyond, 2024, Miller et al., 2011, Oettingnen, 2021), which focuses on generic sustainability and national energy system considerations. In order to be current and relevant, we consider material from multiple sources, including the latest internet public information and government policy reports, and hence provide new inter-comparisons and data analyses. Therefore, the strategic discussions of issues are in Sections 1–4 in the key logical order of economics, safety and risk, technology maturity, construction times, and cost. Sections 5–7 address potential solutions and future directions, including national directions and new build goals. The opinions and conclusions in Section 8 are also original.

2 Economic factors

The IAEA INPO methodology prioritizes economics: “The first user requirement states that the cost of energy products (CN) from a NES, taking all relevant costs and credits into account, should be competitive with that of alternative energy sources (CA) that are available for a given application in the same time frame and geographical region” (IAEA, 2010). However, major limitations include the following: “One of the main challenges … is insufficient data for the assessment. Vendors remain very cautious in providing technical information on their SMRs” (Ilhan et al., 2023); we now address this issue directly.

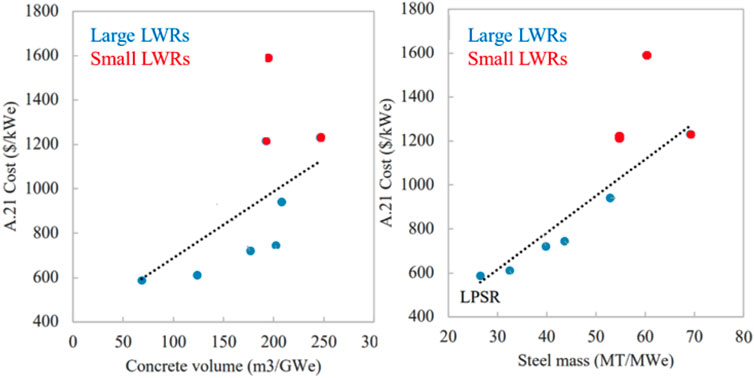

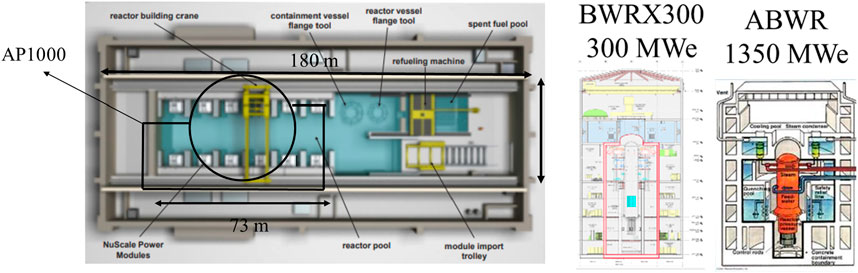

The collapse of the multiple NuScale small reactors in the Carbon Free Project (CFP) (Schlissel, 2023; Reuters et al., 2023) was due to a simple but apparently ignored fact. Despite subsidies and loans, it is challenging to build multiple units, and the NuScale design’s combined risks of a large reactor’s civil construction (Figure 1) with a lack of economy-of-scale for small reactors (>10× smaller power output per reactor) exacerbate this. This made it impossible to execute the project unless NuScale production lines were outputting hundreds of units. In that sense, reported application of the INPRO methodology has also failed, as one exercise resulted in the NuScale reactor being ranked #1 or #2 of the reactor types considered (Ilhan et al., 2023).

Figure 1. Left: overlay of AP1000 safety and seismic structure footprint over NuScale 12-module reactor building (NuScale design features of other safety and seismic structures including control and waste management buildings not shown). Right: comparison of BWRX300 and ABWR reactor buildings.

Such shortfalls, while pronounced in the case of the NuScale design, show up in other leading vendor concepts. The BWRX-300 design still publicly advertises a $2000/kW cost, which is unattainable since the ABWR, with a smaller reactor building, while producing 4.5 times the power level and being built in a record 40 months by leveraging expansive modularization and experience, never achieved less than $3,000/kW in Japan at the Kashiwazaki-Kariwa site (Matsuo and Hisanori, 2019). For small reactors, the biggest attraction lies in minimizing financial risk exposure and faster payback not in the unbelievable claims reported by the US National Academies of Science (NAS) of the 50% lower overnight capital cost (NAS, 2023, p. 75). The reality has turned out to be four times that initially promised and is blamed on rising inflation and materials, not on possibly incorrect analyses, misleading methodologies, and inadequate margins. Assuming best in-class multi-unit large water reactor operation and maintenance (O&M) and fuel cost for small modular reactors such as NuScale is highly misleading. For example, the CFP project was green-field, and no matter how much simplification in systems and components has been implemented in the NuScale project, it is impossible to operate six reactors (6 × 77 = 462MWe) in a green-field site with the same variable cost as a 2 × 1250 MWe reactor site. The same is true of some MWe microreactors which can only afford only one full-time-equivalent (FTE) staff who cannot work 24/7 shifts while simultaneously acting as a security/operator/maintenance worker or receiving minimum pay in order to make the proposition economical. This pushes the microreactors to needed applications in more expensive remote grids, mines, and communities that do not, however, directly address climate change concerns.

The NAS report itself warned about the risk of failure (NAS, 2023) (p86):

The credibility of a technology option is a function of a hard-nosed assessment of costs and markets, the historical deployment record, technological readiness, and the magnitude and impacts of uncertainties. In this respect, advanced technologies are, by definition, riskier bets than established ones and elaborates on the challenges.

The biggest portions of the cost of nuclear power plants, big and small, are the same and are known to everyone (NAS, 2023, p74). The nuclear “island” equipment itself is only 10%–20% of the total cost for large reactors whereas the majority of the cost is due to installation and construction work (Stewart and Shirvan, 2022). This means that the nth-of-a-kind (NOAK) cost for large reactors approaches the cost of their plant equipment, since most learning and cost reductions are realized through rapid project execution and streamlining on-site construction. When deploying smaller and/or higher temperature units, nuclear island equipment and civil infrastructure constitute a larger portion of the total cost, jeopardizing nuclear energy NOAK potential.

We do not know all the answers as to why these other costs are so high for nuclear technology, but observe the following:

1) Excessive construction times and widespread use of steel, concrete, rebar, and shear engineering, even in factory module builds; the proposed SMR designs trend in the opposite direction (Figure 2).

2) Lack of value for baseload generation challenges any high capex electricity source, where timely recovery of its capital is critical for the private sector. On the one hand, nuclear power plants must attain high-capacity factors to recover cost; on the other hand, the 24/7 dispatched commodity is continuously being devalued in a low-carbon world. Regardless, achieving high-capacity factors can only be attained for nuclear technologies with significant prior experience: this has been proven over and over again, with low-capacity factors achieved by fast and high-temperature reactors.

3) High-interest payments and financing costs require some power price guarantee or purchase agreement to assure returns on investment, despite the reduced negative cash flow for smaller units (Duffey, 2018). This is also seen as a main barrier to the deployment of unsubsidized solar thermal plants or offshore wind projects as high capex technologies are heavily penalized in today’s market.

4) Overly complex national safety cases and protracted licensing risks are based on rules, guides, regulations, and laws that are clearly obsolete, let alone unobtrusive. For instance, despite operating in the Republic of Korea (ROK) and United Arab Emirates (UAE) as well as obtaining design certification for the US NRC, the APR1400 design for the entire EU market is drastically changed with the adoption and addition of double containment and core catcher.

5) Minimal market competitiveness against natural gas and subsidized wind and solar, with unproven suggestions that new plants can somehow replace old or forced-closure coal units to retain their communities and recycle some staff (EPRI, 2023; DOE, 2023b) while incidentally gaining local political support. In particular, these sites host economically suppressed regions of a country with no means of executing multi-billion dollar mega-projects such as a nuclear without full guarantees and recovery insurance on the project’s execution performance.

6) Lack of proven technological experience and insufficient depth of technical and real project completion expertise, leading to excessive optimism and unrestrained aggressive marketing with sweeping claims regarding costs, safety, feasibility, fuel cycles, and waste reduction.

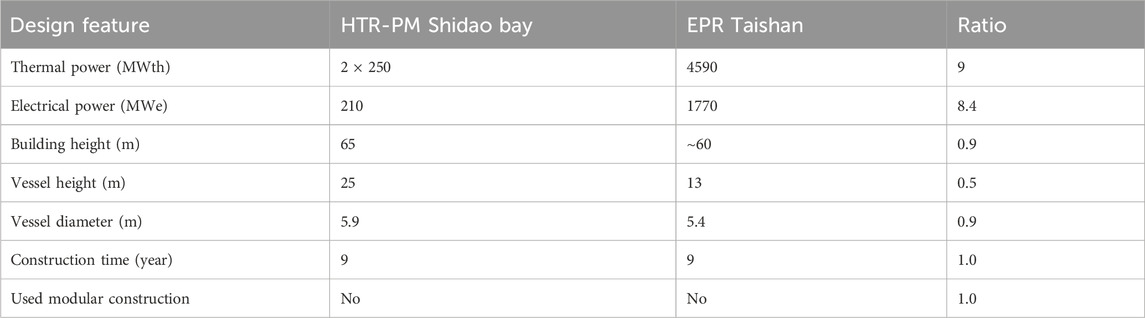

7) A plethora of speculative initiatives, projects, and partnerships seeking government funding and political support to reduce FOAK risks and costs and pursue innovative funding mechanisms from entrepreneurs and special entities. “SMR”, “Generation IV”, or “advanced reactors” are misnomers for legacy stick-built technologies, as exemplified by HTR-PM (Table 1), which has only realized a 1% capacity factor since connecting to the grid 2 years ago. The exact same technology—components, layout, fuels, and operation—is planned to be built in the USA for a chemical company where reliability is the first priority, followed by the ability for the grid to buy the excess generated power through an n+2 operation mode. Other noteworthy examples where legacy approaches, like HTR-PM, also dating back 50 years, are being pursued despite initially “innovative” thinking are:

7.1 Innovation: A traveling wave reactor where high burnups are achieved by deep breeding in a SFR by Terrapower, where 10 years of development led to the Natrium concept that features conventional US SFR with the same fuel as the EBR-II sodium reactor that reached criticality in 1965.

7.2 Innovation: A commercial-scale (few MWe) heat pipe design with metal fuel by Oklo, where 10 years of development led to the current design that is also identical to EBR-II.

8) Whereas governments can partially bail out the high capex of nuclear technology through legislation, subsidies, and load guarantees, its O&M and fuel costs must also be kept low. High O&M costs have historically been the leading reason behind the following:

• The demise of the nuclear commercial shipping industry in the USA.

• Germany’s and Japan’s lack of penetration of non-water cooled reactors, leading to 97% market-share dominance by water-cooled technology.

• Low longevity of test reactors to enable material R&D.

Table 1. Comparison of a “generation IV advanced SMR” of a high-temperature gas reactor (HTR-PM) to a large pressurized water reactor (EPR), both built in China.

This latter aspect always forces “real” nuclear projects to rely on the already tried and failed legacy approaches and technologies, and is manifested in and by conservative engineering standards and “proven” practices..

9) Adopting technical solutions for items 1-8 above is commonly challenged by the realities of energy market demand projection, which is only firm in a 5-year horizon. However, companies have to freeze design and spend some 10 years on licensing, after which the design has not only been adopted based on legacy concepts (as noted above) but also missed the market demand by 5, years let alone the extraordinary pace of digital technology change. This vicious cycle is the reality of today, and nuclear technology R&D for new systems and components continues to be, on average, on a 15–20 year time frame.

These hurdles are coupled with well-known social and outstanding political issues:

a) Public fear of radiation because of possible dual use in military actions and poor science, technology, engineering, and mathematics (STEM) and social science (SS) education.

b) Lack of internationally accepted standards or processes for licensing.

c) Investor and regulatory pressures for local power companies/entities to show financial returns amid politicians’ short re-election horizons.

d) Continuing lack of long-term strategic international cooperation when not in the national economic and political self-interest.

3 Nuclear safety and risk: what happened after Fukushima and what is happening now?

Safety and the risk of accidents are uppermost in many people’s minds and feature strongly in the current regulatory procedures. Like all such events, the Fukushima catastrophe has been considered by many as preventable, but only as an afterthought. Woefully inadequate tsunami protection led to three reactors melting and exploding live on worldwide media, with its inevitable large and lasting geopolitical, economic, and technological consequences being evident.

At first, there was a negative re-thinking of nuclear energy, evident in extreme cases:

• Japan immediately halted all nuclear production to implement revised licensing and safety rules.

• Program slowdowns and plant closures in Europe.

• New builds dramatically slowed in the USA.

All this occurred under the (unproven) hope that wind and solar sources could supply most electricity, so subsidizing investments for these renewable technologies took priority. This resulted in high energy costs that helped incentivize essential manufacturing to move to China and even more essential energy imports from Russia. However, Japan’s electrical energy production was not sustainable without nuclear energy, and in a few years, 25% of reactors in operation before the Fukushima event were restarted with upgrades, and an additional 25% are being restarted now.

In addition, major world populations in China and India need nuclear energy for sustainable economic expansion with minimum pollution of the environment, which explains their investment in developing domestic nuclear capability, national designs, new concepts, and manufacturing facilities. Dozens of large-size nuclear reactors are in construction, along with about 1 GW(e) per week of high-efficiency supercritical coal-fired plants.

Moreover, Russia has understandably always followed a two-tier strategy; they have created concentrated electrical energy poles by nuclear sources surrounding Europe—Belarus, Turkey, Egypt, and Hungary—while strengthening political and economic links with countries like Egypt, Turkey, Bangladesh, and some South-East Asian and African countries (see also below).

Furthermore, the USA, Canada, South Korea, Taiwan, United Kingdom, and France have experienced novel/weak changes in public opinion and problematic energy politics, with the resulting strategy appearing to be to retain some nuclear energy share (higher in France than in the USA) for electricity production and encourage new builds under the “zero carbon” banner, despite increasing energy independence needs, while having to refurbish or upgrade aging units.

In addition, the strategy of Middle Eastern countries is to invest their enormous and endless oil-revenue stream to start building new nuclear plants and investing in homegrown expertise to secure both electricity production and desalination for clean water. Given the possible shrinking of oil reserves, the status of the projects differs greatly from the United Arab Emirates (very advanced) to Saudi Arabia (at a triggering level), but the wellbeing of their people and energy diversification are strongly improving.

Finally, each country has a different framework or rationale for action or inaction on implementing nuclear technology, and annual reports from the International Atomic Energy Agency (IAEA, 2014) provide insightful details. For instance, in Italy, Spain, Belgium, Switzerland, Argentina, Brazil, Australia, and Mexico, nuclear technology remains in quasi-limbo due to (lack of) political motivation, economic crisis, and competition from different energy sources. Older industrialized countries (United Kingdom, Czechia, Slovakia, Romania, Bulgaria, Poland, Hungary, and Canada) have a proactive predisposition toward nuclear energy but have made small efforts, so they now largely import technology while emerging nations such as South Africa, Nigeria, Ghana, Kenya, Morocco, Kazakhstan, and the Philippines are seriously considering their nuclear technology options for energy production, and calling for feasibility and economic studies.

4 Technological maturity: identifying and reducing investment risk, cost, and project schedule

In our examination of investment risk issues and solutions, of high relevance is the comparison of lessons on the impact of the relative technology maturity on the experience of actual technology deployment in other industries. This need to examine and utilize lessons from other industries is emphasized in the latest political statements from OECD countries (OECD-NEA Role of Economics in, 2024).

What, then, can be learned and used from such good and bad experiences?

A greater cost for deploying new technology is not unexpected, so issues of technology maturity and implementation risks arise. The United Kingdom’s Atkins Report (Atkins, 2016) noted

…a great deal of uncertainty with regards to the economics of the smaller reactors … However it is recognized that SMR is a new technology and there is a substantial risk that these costs will be higher than this if costs accumulate during development or if financing costs are initially higher than they are for large nuclear.

When identifying some 90 SMR and AMR “projects” globally, relative maturity has only been addressed/listed as a “differentiating factor” by using qualitative bar charts (Taleb et al., 2024).

Introducing any new or different technology entails the risk of performance and financial loss. Suggested here are the analogy between the global nuclear and mining industries and how we can inform risk decisions when literally “betting the company” on a new process—in the nuclear case— for producing not minerals but electricity for sale.

Obtaining competitive advantage (however defined in price, quality, capability, etc.) is key, and the degree of risk and failure must be estimated. Although apparently unknown to the nuclear industry, the risk for the massive and highly competitive global mining industry of lost production due to processing technology change has been directly addressed and systematically characterized using actual data on production costs and schedules, resulting in a clearly defined series of four “McNulty curves” (McNulty, 1998; Canadian Institute of Mining CIM, 2019; Lotter et al., 2018). The dynamic relative percentage loss or production shortfall magnitudes or equivalent project delays have been quantified, and the curves are quite literally the “gold standard” for judging new technology risk; unsurprisingly, they are actually technology learning curves in disguise (Duffey, 2020). The mining investment community openly adds a fifth series, the “Promoters Curve,” which is overly optimistic in both production and timing and is not based on any prior data (Flannery, 2016).

By applying this thinking and knowledge from this major industry to nuclear technology in competitive electricity energy markets, we can better match the actual production goals or aspirations to the achievable expectation of the desired or planned project values.

Series 1: The fastest, most mature, proven, and best production baseline (= existing Gen III LWRs and HWRs).

Series 2: Less production because of being a prototype and having limited field experience or testing (= new design variants of existing LWR designs like EPR, AP1000, VVER1400, etc.).

Series 3: Even slower and with little variability experience (= any water-cooled new SMRs, such as AP300, BWRX-300, SMR160, or other Gen IV types).

Series 4: The slowest, with more complex or new processes that are pioneering, novel, or unproven (=all other advanced types of SMR, such as molten salt, fast reactors, gas-cooled reactors, Gen IV concepts, and any hypothetical SMRs)

We need to know or at least objectively assess the order-of-magnitude baseline and realistic expectations/goals for equivalent nuclear power plant technology. Supplementary Table S1 provides the relative maturity suggested by allocation of actual nuclear projects/concepts to the above McNulty series correspondence, including first-of-a-kind (FOAK) or demonstration- (DOAK) projects and any undisclosed financing/subsidies; this is solely based on published results and claims available as of 2024 for relative project costs and duration. The range of the known cost increase multipliers (i.e., project financial risk) illustrates the impacts of technological change and clearly supports using existing technology as far as possible. The series 4 claims actually seem to correspond to Flannery’s fifth or “promoter’s curve” that, by definition, always has a lower cost, faster schedule, higher output and, hence, less risk exposure, although obviously not based on any empirical evidence.

5 Reducing nuclear plant construction times and costs

Recent nuclear plant builds outside of China have usually overrun their construction schedule by many years, and hence by billions of dollars, in Finland, France, the ROK, Turkey, and the USA. Many vendor companies have faced financial difficulties as a result because of the added interest in any loans, extra labor costs (for the 3,000 or so workers on site), contract penalty clauses, and resulting cash flow issues. This is an additional financial risk for investors: in the absence of subsidies and required portfolios, the nuclear “market share” is determined by the competitive generating cost advantage (the differential) below other local sources (gas, coal, oil) and is exponentially dependent rather than linear.

Why, then, can China build series 2 at the same time as series 1?

Contributory factors include the following commitments.

• A major national construction plan going forward (as had occurred before in Japan and France): building multiple units that have first deliberately assimilated (“digested”) the technology of foreign imports while simultaneously developing and deploying their own designs.

• “Learning by doing”, with almost complete control over the workforce and project management and with government control (even if sometimes indirect) of the financing, construction, and power partners.

• Relatively rapid licensing processes once national policy and planning decisions on safety, siting, and financing have been made, subject to strict oversight.

• Having an indigenous design and domestic build capability, with multiple factories for fuel, major components, and plant modules.

It is unlikely that these social and political forces can all be fully duplicated outside of China, where the government directly or indirectly controls the program via set targets, workforce, and ownership. The closest model was the successful large build program in France, where the developer and technologist (CEA), the designer and contractor (AREVA), and the operator utility (EdF) were and are all government-owned in a vertically integrated structure and compliant with political demands. Internationally, licensing processes are also firmly rooted in existing water-reactor technology and past practices. It is thus essential to examine the major “technology neutral” and societal costs, as well as the safety objectives, items that evidently lie outside the nuclear island itself, and the national objective and government role.

For series 2, construction complexity may offset the progressively increasing power outputs designed to reduce specific generating costs($/MWh), while retaining tried-and-trusted configurations by adding additional loops, cabling, heat exchangers, and pipework to an existing layout. The challenge is to avoid more complex project management, task breakdown structure, worksite, quality assurance (QA), workforce, and project schedule, which may contribute to “cost plus” engineering contract delays.

The following are suggestions for discussion purposes, some more controversial than others, with estimates of the potential goals, impacts, and resulting issues.

So-called “standard designs” have been built and touted for some time and are inherent in some current large plant offerings. There are three known advantages:

a) Costs and time reduce with replicated designs and with learning, so that after about 10 identical units, a decline of 10%–20% is typically expected. Series build for multiple units should allow repetition of computerized designs and “module” construction lines.

Aim: achieve orders for multiple units as per the Boeing–Airbus aircraft business model, with discounts for bulk orders and establishment of factory production lines.

b) Licensing is nominally quicker and simpler once the “reference” design has been reviewed and approved. Having a combined licensing process (COL) does not seem to reduce licensing times, as they are still five or more years, even for designs already licensed in other countries (e.g., the ABWR or EPR), so some design changes are inevitable as materials, knowledge, customers, and technology change.

Aim: develop a means of continuously updating and customizing the reference design without restarting or opening up the whole design and licensing process.

c)Uncertainty is reduced, especially if a FOAK or some prototype or DOAK has already been committed and the concept “proven,” reducing financing risk.

Aim: a prototype capability underwritten by national funding, as is underway now in China and India, for demonstrating new technology, materials, concepts, and processes and international collaboration on deployment and funding of FOAK or DOAK units (e.g., for series 3 and 4 Gen IV, SMR, and other concepts).

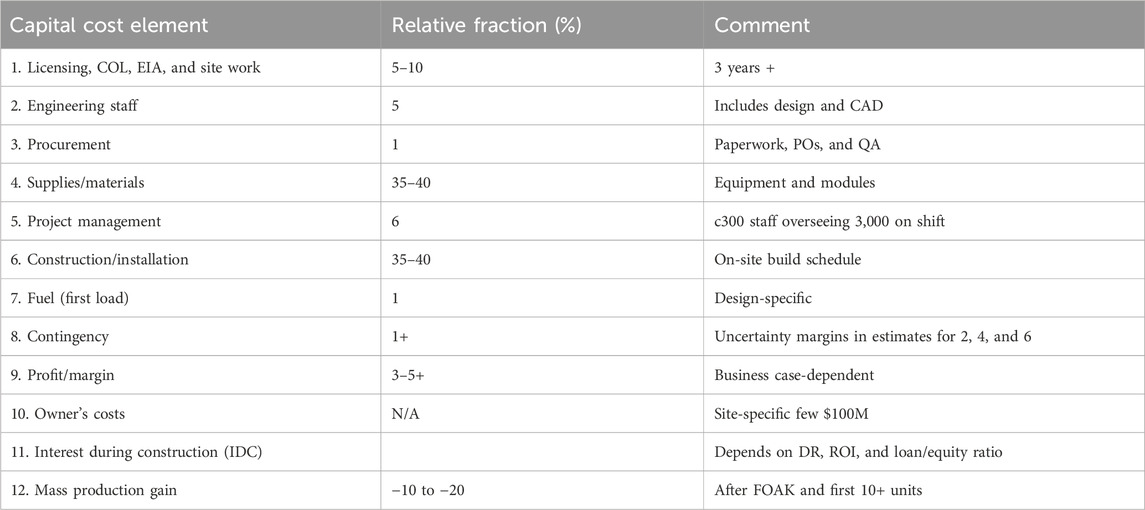

Given the cost elements in Table 2, how can we introduce new technology and minimize the now known project schedule and financial risks?

Table 2. Illustrative cost contributions for building a nuclear plant (rounded typical ranges so total not exactly 100% and actual project-dependent and excludes development).

In the commercial aviation industry, this problem is addressed by having at least one prototype of the new aircraft built and tested before setting up a full production line and simultaneously developing an “order book” (sometimes for hundreds of units). The purpose is to enable a fair return and pricing to be established that, as for the mass production of automobiles or medicines, spreads the initial development, design, production line set-up, and regulatory and marketing costs over many units.

In what is called the “technology learning curve,” it typically takes building about 10 units to reduce the initial costs significantly and/or to reduce the manufacturing time, even after a prototype or FOAK has been demonstrated and committed. For the AP1000 in the United Kingdom, a reduction of some 20% in levelized unit electricity cost (LUEC) was claimed or estimated to be achievable by building just five units (see Figure 1, square points labeled “AP1000”).

In practice, increased modularization alone does not reduce overall costs (Figure 2; Table 1), and the manufacturing costs (capital costs are about 60% of the final total generating cost—LUEC) are significantly more expensive for the first few units. The costs of the factories and field experience have to be “amortized” or written off over a certain build number. The only way to reduce the penalty is to shorten construction times by a suitable amount. Otherwise, the first few units cost more.

Despite this, the need for the USA is recognized as “a committed order book”, such as signed contracts for 5–10 deployments of at least one reactor design by 2025 being required to catalyze commercial liftoff but with just ±20% uncertainty in cost and schedule for “advanced reactors” (DOE, 2023a) —type Series 2 builds. In addition, without any build experience, the US Department of Energy (DOE) boldly states by that “SMRs can provide more certainty of hitting a predicted cost target” (DOE, 2023a), despite the actual experience (Jaoude et al., 2024; Schlissel, 2023; Reuters et al., 2023; also Table 2). As of 2024, these “paths” lack the necessary commercial and power market commitments of suitable scale without government financing guarantees, production credits, zero-carbon offsets, and low interest rate subsidies.

Now, modularization is also meant to speed up construction. Because of the interest accrued (IDC), there is a linear relation between cost and construction time, so any change or delay raises a proportionate change in LUEC. Hence, reducing the construction/on-site time from 72 to 36 months reduces the LUEC by nearly 50%.

6 Alternate approaches to reducing risk and increasing licensing/build efficiency

We now can define the necessary pathways to the future that respond to the challenges discussed so far. Large units (1,400–1800MWe) are possibly just too difficult and expensive to build in a timely manner, and hence for some they constitute excessive financial risk exposure (e.g., Duffey, 2018; Georgia Public Service Commission, 2021). To offset the risk and open-market capital requirements requires a government-backed loan or guarantee plus a forward power purchase agreement (PPA) for some 20 years at very high consumer rates, as used in the United Kingdom and Turkey. The traditional reduction in LUEC with increasing unit size still holds in principle, but capital exposure increases. Even existing units need a legislated subsidy or offset of some kind (e.g., from carbon emissions credits) to be able to compete with natural gas units. This credit or subsidy has been offered for new plants only in the latest proposed regulations and COP “statements” regarding power plant emissions and carbon fuel reductions (COP28, 2023; IAEA Nuclear Energy Summit, 2024).

Here is a list of seven possible alternative approaches that have featured in various concepts and discussions:

• Decreased time scales reduce risk for licensing, site selection, and review

The various procedural, legal, regulatory, and business steps prior to even agreeing on a contract to build a nuclear plant are very unattractive compared to, say, a combined-cycle gas turbine (CCGT) unit, which can be committed, built, and operational in 36 months or less. Because of subsequent licensing and ordering delays after the accident at Three Mile Island, a Combined Construction and Operating License (COL) process has been offered under 10.CFR.Part 52 by the US NRC, where a “standard” (certified) plant design can be pre-approved for an early site permit, subject to subsequent verification (the so-called “interim test and acceptance criteria” or ITAACS). But licensing a plant design for the US that is already approved and perhaps built elsewhere does take several years to be certified, even prior to this process.

Whereas no plant has actually outrightly been refused a license, the formal review processes have raised many diverse questions by the NRC and other regulators in the United Kingdom, Japan, EU, and Finland. These include the degree of foreign ownership permitted, and the safety and control system wiring layouts (EPR); the level of design and layout detail needed prior to actual final design (ESBWR); the completeness and level of detail of the probabilistic safety assessment, PSA (ABWR); the potential for having to change regulations and standards for permitting different concepts (CANDU and NuScale); the degree of upgrading and robustness needed in the light of the Fukushima–Daiichi events (PWR and ABWR). The cost of obtaining a license to build is in the range of $300M to $1B and is so large that it has been subsidized by special licensing assistance funding from the DOE Nuclear Energy Programs to the designer/license—in effect, one part of the government is paying another.

It would seem reasonable to consider adopting the standardized licensing approach for aircraft, where a “type certification” is issued, valid internationally, which is then suitably amended later by bulletins, alerts, and notices from the manufacturer(s) and the regulator. An internationally agreed target suitable for this process is approximately 24 months for a new build, rather than 60, assuming that a type certification process is feasible and adopted.

• Lower up-front risk and initial capital investment to produce earlier return on investment (ROI).

This means not only reducing what are essentially over-engineered design and licensing requirements, many of which have been layered on over the years but also a required radical overhaul of both licensing processes and applicable engineering standards.

In addition, as noted by the NRC’s own Fukushima Task Force (Duffey, 2020), the present collection of safety analysis requirements and approaches

…is largely the product of history … It was developed for the purpose of reactor licensing in the 1960s and 1970s and supplemented as necessary to address significant events or new issues. This evolution has resulted in a patchwork regulatory approach… [steps are needed toward] …establishing a logical, systematic, and coherent regulatory framework for adequate protection that appropriately balances defense-in-depth and risk considerations.

This continues with the new rules proposed and under the banners and buzzwords of being “risk informed”, “technology neutral”, and “performance-based” (NRC, 2023) while still excluding investor risks.

Since IDC added by licensing issues can be significant, optimizing and reducing system cost and schedule uncertainty is important, especially in competitive energy markets where nuclear must compete with cheap gas in the foreseeable future. The target capital cost reduction required to compete directly is a factor of four or five and can only be achieved through radical innovations.

• Shorten engineering and construction times

The engineering aspect here includes all the necessary detailed project design, layout, schedule, and construction sequencing, and is a very significant cost contributor (see items 2 to 6 in Table 1) .

Advances are needed to approach the challenging goals of

- 48 or fewer months from first concrete to completion

- Designs requiring less than a few million hours of engineering

- Construction site staff numbering less than 3,000

Contributions could come from streamlining designs for “constructability”, implementing new modern materials and techniques (less rebar and concrete), and integrating modern wiring and CAD techniques into the construction schedule. The use of heavy single-large-lift cranes and “open top” construction techniques have simplified access to and sped up the assembly of major items into the containment building. In principle, as suggested by Russian concepts, the entire reactor island can be literally shipped to the site. Requiring less staff and contractors on site is also a challenge because the required crafts and technicians are on contract to sub-contractors and often use cost-plus terms and conditions.

• Add small increments of power as demand requires and cash flow allows rather than just committing to large units.

This is the SMR or “module” idea, but it must overcome the penalty (of the order 30%) produced by the overhead of the overall site security, staffing, and site requirements. The business model is to minimize, level, or spread out the up-front cost of module “factories” and licensing (approximately 5 years and over $300M per design/unit).

• Sharing of common facilities and site infrastructure to basically promote “nuclear parks” or “energy centers”.

This is not a new concept but a logical approach that consolidates the needed expertise, site suitability, and appropriate security, and the necessary infrastructure costs and requirements are simplified. Meneley et al. (1999) stated:

An integrated energy park makes it easy to meet the security (safeguards) requirements that the world justly demands of this technology. Such a park need not be huge; its main requirement is that it be integrated, with no justifiable movement of isolated fissile material across its defined boundary …These plants could serve as producers of electricity, hydrogen, process heat, and manufactured fossil fuels such as methanol. Greenhouse gas emissions from these facilities could be reduced dramatically.

This theme is being re-discovered and re-reinvented today (WNN, 2024). What type or class of reactor would be best suited to such parks is, then, entirely site- and park-size-specific and requires further analysis. The risk assessment is made more complicated because of potential unit-to-unit interactions and common cause failures (CCF), especially for “external” events and threats; however, the overall approach avoids the excessive fragmentation of valuable resources, consolidates safety and emergency plans, allows more integration of capability, and reduces owner’s site costs.

• Address key social concerns by eliminating core melt by design and avoiding emergency evacuation requirements.

This elimination cannot be excluded from extreme events like, say, abnormal events, nuclear warfare, or a meteor strike, which would also have enormous additional societal impacts. However, the public generally accepts assurances of low risk due to reactor accidents, and no core melt is postulated as attainable for some new concepts with additional design features (Pioro, 2023).

This objective is completely in line with GIF goals, and it also addresses the huge societal impacts and concerns raised by even minor nuclear incidents and more so by major accidents that involve radioactivity and/or core damage. This requires a substantial realignment of safety and design goals for new units (because some low frequency of core melt is no longer “acceptable”), achieving reduction and acceptance of the perceived risk, and effective public communication and outreach, especially in regions or beliefs where even the word “nuclear” is anathema.

• Implement a new national and industrial research agenda that directly addresses the new national and international requirements and re-aligns existing efforts and traditional thinking.

This may mean eliminating some existing efforts, but it also requires new ones with a long-term commitment to innovative research, higher risk efforts, and FOAK prototype deployment.

7 Doubling down on tripling: why is nuclear technology on an edge?

The thrust and theme for many political and environmental initiatives is to reduce the energy “carbon footprint” and atmospheric emissions by achieving carbon net-zero or carbon neutral societal ideals by about 2050, in time to counter the projections of growing global energy needs and economic uses (e.g., Taleb et al., 2024; Stein et al., 2022; X_Energy, 2023; Miller and Duffey, 2009). One positive aspect is the significant key declaration by 23 countries1 at COP 28 (COP28, 2023) to triple nuclear capacity by 2050, thus assisting the global “net-zero emissions goal. Already accounting for some 270 large water-cooled reactors out of the 450 global total but not including China (c 70), India (c 23), and Russia (c 30), this declaration boldly pledges to add some 1,000 new large units (or over 3000 SMR-types), but this still falls short of the conflicting needs of global energy growth and environmental emissions reduction (Miller and Duffey, 2009; NuScale, 2024). A doubling of the pledge would be highly desirable and, while not politically and socially achievable in the short term, is a relevant aspirational goal.

8 Conclusion and opinions

In light of the above discussions, the following conclusions are based on our opinions on the discussions in the previous sections. Furthermore, the subjective evaluations provided are based on judgment and experience and are intended to promote a science-based debate to lead to informed decisions. These topics and additional opinions and conclusions are also reflected in and provide technical support to ongoing evolving major discussion in global financial circles (Coen et al., 2024).

The challenges mentioned in the introduction may have (simple) explanations and origins.

- Dual use of nuclear: this is disconnected from energy production but not from international politics and business dealings.

- Unlimited energy: this is a massive benefit given the potential for an inexhaustible energy supply using thorium and plutonium recycling.

- Accidents: nuclear technology is not immune, but “consequences” are mainly economic per unit benefits, and actual catastrophes are the fault of humans themselves either at the operational level or due to inadequate design.

- Radiation: people accept risks if they are not close to a source, but nuclear terminology uses terms such as “becquerels,” “grays”, “roentgens”, “curies”, and “sieverts”, which communicate nothing and require a clearer explanation of nuclear applications and radiation effects to the public

- Uncontainable waste: nuclear waste is in fact an energy resource rather than a million-year problem, so much so that uranium and thorium should never be “sold” but leased.

The nuclear technology skills acquired during past decades resulted in the safe design of large reactors. Ironically, while enough competencies were acquired at the end of the last century, these risk being buried by the dust of oblivion2.

Several opinions based on expert judgment arise.

Opinion: The larger cost of the nuclear option compared with alternative energies should be connected with the necessary evolution of human civilization and the benefit of mankind globally.

Opinion: Having zero accidents with major radioactivity releases when thousands of reactors are running is an illusion. A sustainable deployment of nuclear technology requires an aware public that accepts emergencies (residual risk) and, above all, governments capable of managing and paying for the consequences of such emergencies.

Opinion: Independent assessment, or a principle of nuclear reactor safety, has become a weakness in current plants due to their complexity3 and because the immaturity and proprietary nature of many concepts hides key data and design information.

Opinion: If one considers the recovery times of invested capital, nuclear technology is inconsistent with the lifetime of governments in democracies, at least in situations where power and opposition are strongly divided; recovery occurs four to five government periods after the government that authorized the investment, possibly causing a benefit to the opposition.

Looking at the future.

✓ Applications for the conquest of space and for controlling the pollution of the environment widen the prospects for the use of nuclear energy but only based on terrestrial knowledge.

✓ Limited uranium resources (whatever they are) require that we consider breeding technologies, thorium, and plutonium (and nuclear waste).

✓ The increase in the number and types of nuclear reactor designs inevitably heralds unexpected types of accidents: a single catastrophic accident may drive the overall technology into the abyss.

✓ Flexibility in licensing rules is being pursued to enhance international competition for market share and to justify research investments aimed at the employment of scientists rather than the needs of people.

✓ Communication is overshadowing and controlling technological progress: it drives the future of nuclear technology to tactical successes but casts a shadow on sustainable strategies (as proclaimed at COP28)

✓ Our hope and recommendation is to maintain the competencies for the design and operation of large reactors: this ensures (overcoming the issue of independent assessment) a robust and reliable technology ready to incorporate SMR and micro-reactors which are more suitable than large reactors for transportation, hydrogen production, desalination, and local chemical industry needs.

We strongly recommend the deployment of nuclear fission for energy production everywhere in the world. Large reactors, whenever possible, should contribute to energy security, financial stability, and technological development. The small reactors may contribute to areas that directly impact the reduction of pollution, such as naval transportation, hydrogen production, and remote-area energy powering.

Author contributions

EZ: Writing–original draft, Writing–review and editing. KS: Writing–original draft, Writing–review and editing. RD: Writing–original draft, Writing–review and editing. FD’A: Writing–original draft, Writing–review and editing.

Funding

The authors declare that no financial support was received for the research, authorship, and/or publication of this article.

Acknowledgments

The authors thank Prof. Koroush Shirvan for his contributions to the discussion, reflections, and opinions.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fnuen.2025.1501247/full#supplementary-material

SUPPLEMENTARY TABLE S1 | Series classification of relative nuclear technology maturity together with actual and claimed fractional project cost increases and project/development durations from published data and Reuters (2023), NuScale (2024), and Oettingnen (2021).

Footnotes

1Signed at COP28 by the United States, Bulgaria, Canada, Czech Republic, Finland, France, Ghana, Hungary, Japan, Republic of Korea, Moldova, Mongolia, Morocco, Netherlands, Poland, Romania, Slovakia, Slovenia, Sweden, Ukraine, the United Arab Emirates, and the United Kingdom.

2As an example, if one compares the topics and the database of nuclear thermal-hydraulics and generation IV designs discussed in recently published major handbooks (Pioro, 2023; D’Auria and Hassan, 2024), where the target is to summarize 40 years of research, one finds the acquired basic knowledge risks disappearing, which is a major reason for their production.

References

Atkins (2016). SMR techno-economic assessment project 1: comprehensive analysis and assessment techno-economic assessment, final report, volume 1, for the UK department of energy and climate change. Available at: https://assets.publishing.service.gov.uk/government/uploads/.

Bizmurzin, R., Scherer, C., and Boyer, B. (2023). “Using INPRO methodology for a sustainability assessment of advanced and innovative small modular reactors,” in Proc INMM &ESARDA joint annual meeting. Vienna, 21–25. Available at: https://resources.inmm.org/sites/default/files/2023-07/finalpaper_486_0524010228.pdf.

Canadian Institute of Mining (CIM) (2019). CIM estimation of mineral resources and mineral reserves best practices guidelines, Westmount, Quebec, Canada, November. Available at: https://atmrmr.cim.org/media/1146/cim-mrmr-bp-guidelines_2019_may2022.pdf.74pp

Coen, B. C., Kanwar, S., Kemene, E., Stenson, C., and Tladi, T. (2024). “A collaborative framework for accelerating advanced nuclear,” in Small modular reactor deployment, white paper. Geneva, Switzerland: World Economic Forum. Available at: https://www.weforum.org/publications/a-collaborative-framework-for-accelerating-advanced-nuclear-and-small-modular-reactor-deployment/.(Accessed November 7, 2024).

COP28 (2023). World climate action Summit of the 28th conference of the parties to the U.N. Framework convention on climate change, declaration to triple nuclear. Energy. Available at: https://www.energy.gov/articles/cop28-countries-launch-declaration-triple-nuclear-energy-capacity-2050-recognizingkey.

F. D’Auria, and Y. Hassan (2024). Handbook of thermal hydraulics in water cooled nuclear reactors (Woodhead). Available at: https://www.elsevier.com/books/handbook-on-thermal-hydraulics-in-water-cooled-nuclear-reactors/dauria/978-0-323-8560.

DOE (2023a). Pathways to commercial liftoff: advanced nuclear, vPUB-0329. Washington, DC: Publication. Available at: https://liftoff.energy.gov/wp-content/uploads/2023/03/20230320-Liftoff-Advanced-Nuclear-vPUB-0329-Update.pdf.

DOE (2023b). “Coal-to-Nuclear transitions: an information guide, US dept of energy, office of nuclear energy,”. Washington, DC. Available at: https://www.energy.gov/ne/articles/coal-nuclear-transitions-information-guide.

Duffey, R. B. (2018). “Size and cost optimization of nuclear reactors in energy markets: the need for new approaches and advances,” in Proc first international conference on generation IV and small reactors. CNS, Ottawa, ON, Canada. Available at: https://www.g4sr.org/proc/html_files/4427.html.

EPRI (2023). From coal to nuclear: a practical guide for developing nuclear energy facilities in coal plant communities. Palo Alto, CA: Electric Power Research Institute, 124pp. Available at: https://www.epri.com/research/products/000000003002026517.

Flannery, W. (2016). A banker’s perspective on feasibility. Toronto, Canada: Institute Canadien des Mines, de la Metallurgie et du Petrole CIM ICM. Available at: https://www.cimmes.org/wp-content/uploads/2016/05/4-A-Banker’s-Perspective-on-Feasibility-Warren-Flannery.pdf.

Georgia Public Service Commission (2021). In the matter of: Georgia Power Company’s twenty-fifth semi-annual Vogtle construction monitoring. Available at: https://psc.ga.gov/search/facts-docket/?docketId=2984,GeorgiaPowerCompany`sVogtleUnits3and4ConstructionMonitoring.22pp

IAEA (2010). “Introduction to the use of the INPRO methodology in a nuclear energy system assessment/a report of the International Project on Innovative Nuclear Reactors,” in Fuel cycles (INPRO). Vienna: International Atomic Energy Agency.

IAEA (2014). INPRO methodology for sustainability assessment of nuclear energy systems: economics. Vienna: International Atomic Energy Agency.30 (IAEA nuclear energy series). STI/PUB/1653, 978–92–0–102714–6

IAEA nuclear energy Summit, Brussels declaration, (2024). Available at: https://www.iaea.org/newscenter/news/a-turning-point-first-ever-nuclear-energy-summit-concludes-in-brusselswww.ans.org/news/article-5892/nuclear-energy-declaration-adopted-at-brussels-summit/.

Ilhan, G., Scherer, C., and Boyer, B. (2023). “Recent applications of the INPRO methodology for innovative and advanced nuclear energy systems,” in Proc IMMm &ESARDA joint annual meeting. Vienna, 21–25. Available at: https://inmm.org/sites/default/files/2023-07/finalpaper_492_0519075523.-190523docx.pdf.(Accessed November 7, 2024).

Industrial decarburization and economic growth on Teesside and beyond (2024). X-Energy UK holdings, 17pp. LLC. Available at: https://static1.squarespace.com/static/5e13e7e8e3a0d42924a7e3e9/t/65706c21444b0730f5fec7f8/1701867195576/beyondelectricityuk.

Jaoude, A., Larsen, L. M., Guaita, N., Trivedi, I., Joseck, F., Lohgse, C., et al. (2024). Meta analysis of advanced nuclear reactor cost estimations, INL RPT24-77048, US DoE. Idaho National Laboratory.

Lotter, N. O., Baum, W., Reeves, S., Arrue, C., and Bradshaw, D. J. (2018). The business value of best practice process mineralogy. Miner. Eng. 116, 226–238. doi:10.1016/j.mineng.2017.05.008

Matsuo, Y., and Hisanori, N. (2019). An analysis of the historical trends in nuclear power plant construction costs: the Japanese experience. Energy Policy Vo 124, 180–198. doi:10.1016/j.enpol.2018.08.067

Meneley, D. A., Duffey, R. B., and Pendergast, D. R. (1999). CANDU co-generation opportunities, IAEA TECDOC 1184. Beijing,: International Atomic Energy Agency–30. Available at: https://inis.iaea.org/collection/NCLCollectionStore/Public/32/001/32001525.

Miller, A. I., and Duffey, R. B. (2009). Sustainable supply of global energy needs and greenhouse gas reductions. Trans. Can. Soc. Mech. Eng. 33 (1), 1–10. paper 09-CSME-06. doi:10.1139/tcsme-2009-0002

Miller, C., Cubbage, A., Dorman, D., Grobe, J., Holahan, G., and Sanfilippo, N. (2011). “Recommendations for enhancing nuclear safety in the 21st century,” in Fukushima task force review of insights. NRC, Washington, DC.

NAS (2023). National Academies of sciences, engineering, and medicine, 2023, laying the foundation for new and advanced nuclear reactors in the United States. Washington, DC: The National Academies Press. doi:10.17226/26630300pp

NRC (2023). Nuclear regulatory commission, risk-informed, technology-inclusive regulatory framework for advanced reactors, 10 CFR Part 53 proposed rule, march. Available at: https://www.nrc.gov/reactors/new-reactors/advanced/modernizing/rulemaking-and-guidance/part-53andDocketIDNRC-2019-0062.

NuScale (2024). Investor presentations, february and march 2024, NuScale power LLC, slide 11. Available at: https://www.nuscalepower.com/-/media/nuscale/pdf/investors/2023/investor-presentation.pdf.(Accessed May 16, 2024).

OECD-NEA role of economics in SMR progress (2024). Workshop, Ottawa. Available at: https://www.oecd-nea.org/jcms/pl_91685/the-role-of-economics-in-smr-progress-and-deployment

Oettingnen, M. (2021). Costs and timeframes of construction of nuclear power plants carried out by potential nuclear technology suppliers for Poland, Pulaski Policy Papers. Warsaw, Poland. Available at: https://www.pulaski.pl/.

I. Pioro (2023). Handbook of generation IV reactors. 2nd edition (Woodhead), 940pp. Available at: https://shop.elsevier.com/books/handbook-of-generation-iv-nuclear-reactors/pioro/978-0-12-820588-4.

Reuters, (2023). NuScale ends Utah project in blow to US nuclear power ambition, T. Gardner, and M. Mishra Available at: https://www.reuters.com/business/energy/nuscale-power-uamps-agree-terminate-nuclear-project-2023-11-08/.

Schlissel, D. (2023). Eye popping new cost estimates released for NuScale SMR, Institute for energy economics and financial analysis. Available at: https://ieefa.org/resources/eye-popping-new-cost-estimates-released-nuscale-small-modular-reactor.

Stein, A., Messenger, J., Wang, S., Lloyd, J., McBride, J., and Franovich, R. (2022). Advancing nuclear energy: evaluating deployment, investment and impact in America’s energy future, Breakthrough Institute. Berkeley, CA, 155pp. Available at: https://thebreakthrough.org/articles/advancing-nuclear-energy-report.

Stewart, R., and Shirvan, K. (2022). Capital cost evaluation of advanced water-cooled reactor designs with consideration of uncertainty and risk, ANP: advanced nuclear power program 194, center for advanced nuclear. Energy Syst. Available at: https://canes.mit.edu/capital-cost-evaluation-advanced-water-cooled-reactor-designs-consideration-uncertainty-and-risk.

Taleb, I., Hadad, J., and Milisavljevic, M.EY- Parthenon (Ernst and Young) (2024). “The true power of small modular reactors on the road to a sustainable energy future: unveiling opportunities and challenges,”. Studio BMC, Paris, France. Available at: https://assets.ey.com/content/dam/ey-sites/ey-com/fr_fr/topics/energy/ey-parthenon-white-paper-smr-amr-20240319.pdf.

WNN (2024). World nuclear news, norsk kjernekraft focuses on off-grid SMR projects. Available at: https://www.world-nuclear-news.org/Articles/Norsk-Kjernekraft-focuses-on-off-grid-SMR-projects.

X-energy (2023). Beyond Electricity: nuclear energy's role in supporting industrial decarbonisation and economic growth on Teesside and beyond. Available online at: https://static1.squarespace.com/static/5e13e7e8e3a0d42924a7e3e9/t/65706c21444b0730f5fec7f8/1701867195576/beyondelectricityuk.

Keywords: nuclear fission, techno-economic comparison, pressurized water reactor, boiling water reactor, small modular reactor

Citation: Zio E, Shirvan K, Duffey RB and D’Auria F (2025) Nuclear power technology: an analysis and informed opinions. Front. Nucl. Eng. 4:1501247. doi: 10.3389/fnuen.2025.1501247

Received: 24 September 2024; Accepted: 29 January 2025;

Published: 14 March 2025.

Edited by:

Walter Villanueva, Bangor University, United KingdomReviewed by:

Evgeny Ivanov, Institut de Radioprotection et de Sûreté Nucléaire, FranceYadukrishnan Sasikumar, Oak Ridge National Laboratory (DOE), United States

Copyright © 2025 Zio, Shirvan, Duffey and D’Auria. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Enrico Zio, ZW5yaWNvLnppb0Bwb2xpbWkuaXQ=

Enrico Zio

Enrico Zio Koroush Shirvan3

Koroush Shirvan3