- 1Business School, Qingdao University of Technology, Qingdao, China

- 2Business School, Nanjing Normal University, Nanjing, China

- 3Tianjin Academy of Social Sciences, Institute of Marine Economy and Port Economics, Tianjin, China

- 4School of Economics, Ocean University of China, Qingdao, China

Achieving carbon peak and neutral as scheduled requires joint efforts to reduce emissions and increase sinks. But in the long term, mitigating climate change requires the latter to play a greater role, in which achieving economic and environmental benefits through ocean carbon sink trading is an indispensable and important measure. Around the ocean carbon sink trading, this paper constructs an ‘Economic-Financial-Environmental’ analytical framework through the BGG-DICE-DSGE model, explores the heterogeneous impact of ocean carbon sink trading on macroeconomics and climate change by impulse response, examines the influencing factors by sensitivity analysis, and uses welfare analysis to explore further performance in financial markets. It is discovered that: (1) ocean carbon sink trading can mitigate climate change, boost social welfare, and reinforce even more under active fiscal and monetary policies and higher ocean output percentage. (2) As the main body of carbon sink trading, firms have a more active impact on economic and environmental systems than government. (3) The proportion of marine output value significantly impacts dual benefits. The efficiency of ocean carbon sinks has a significant impact on environmental benefits, while the related impact of carbon sink prices is weak. (4) Due to the financial accelerator effect, any decrease in output caused by exogenous shocks in the financial market compounds the loss of social welfare. This paper theoretically explains the strategic significance of ocean carbon sink trading, and provides necessary experience and reference for the establishment of ocean carbon sink trading market in the future.

1 Introduction

The increasing climate problem has seriously affected the sustainable development of the earth. Theoretically, achieving carbon peak, carbon neutral, and mitigating climate change as scheduled requires coordinated efforts in emission reduction and negative emissions. Reality shows that governments and international organizations make policies and implement specific practices mainly around emission reduction (Xiao and Xu, 2024). After the promulgation of the United Nations Framework Convention on Climate Change (UNFCCC) in 1992, emission reduction mechanisms based on the Clean Development Mechanism (CDM), International Emissions Trading (IET) and Joint Implementation (JI) were successively established. There is no doubt that it’s necessary to control source of the carbon footprint generated by human activities, and also convenient for policy operations to limit the total amount of carbon emissions (Xu et al., 2024a, b). However, there are also some problems behind it. First, the current mandatory emission reduction mechanism does not cover the entire industry. European Union (EU) Emission Trading Scheme (ETS) covers three sectors (power, industry and aviation) and 39% of total emissions. China national ETS covers only power sector and 44% of total emissions. This ‘membership system’ is exclusive and is not conducive to carbon inclusion. Second, although the global carbon quota trading volume has gradually increased, transaction prices have also risen steadily, the real amount of emission reductions is still unknown. Third, under the constraints of emission reduction, the economic interests of enterprises are damaged, which increases the burden, dampens production enthusiasm, and is not conducive to the green transition of society.

It’s necessary and effective to establish a negative-emission social operating mechanism around carbon sink trading. The ‘Stern Report’ pointed out that since the industrial revolution, excessive carbon emissions produced by human activities have broken the original carbon balance, and the damage to biodiversity caused by rising temperatures has become irreversible. Even if all countries achieve carbon neutrality by 2060, global temperature control will exceed the 1.5 degrees Celsius stipulated in the Paris Agreement. It means that excess man-made carbon emissions left over from history must be neutralized through negative emissions. Academia and government departments have mainly focused on emission reduction paths in public resources and system design to achieve the ‘double carbon’ goal, apparently ignoring negative emissions. In theory, if technological progress can fully achieve negative emissions, there is no need to constrain the carbon emissions generated by human economic activities overly.

Research shows that negative emissions are broadly divided into Carbon Capture, Utilization and Storage (CCUS) and carbon sinks. As a strategic reserve technology to achieve low-carbon utilization of fossil energy, CCUS has attracted much attention recently. However, limited by objective reasons such as high storage costs, potential leakage risks, and lack of business models, the development of CCUS has stagnated. According to estimation from the ‘China Carbon Dioxide Capture, Utilization and Storage Annual Report (2023)’, the globally developed CCUS project capacity is about 150 million tons/year, accounting for only 0.3% of total global carbon emissions. China has about 100 CCUS demonstration projects in operation or under construction, with a capture capacity of 4 million tons/year. Obviously, under current conditions, CCUS is not the ultimate and effective way to achieve carbon neutrality. For carbon sinks, it mainly consists of forest carbon sinks and ocean carbon sinks. The former absorbs and sequesters carbon dioxide through photosynthesis. Due to the wide forest coverage and easy monitoring, its methodology and project development are relatively mature. However, its development has also encountered some bottlenecks. First, the devastating damage caused by humans has caused the forest coverage area to decline yearly, and its carbon sequestration capacity has decreased. Second, the land use area is limited, which restricts the carbon sink function of forests. Especially in recent years, the land shortage and food crisis in the urbanization process are objectively not beneficial to its further development.

In comparison, the role of marine ecosystems in global climate change and the carbon cycle has steadily grown since the United Nations Environment Programme (UNEP) originally proposed ‘blue carbon.’ Existing research on ocean carbon sinks has focused on the following aspects: (1) Carbon sequestration mechanism. Biological pumps, micro-biological carbon pumps, and carbonate pumps are the key carbon fixation mechanisms and unique natural advantages of the ocean carbon sink. Based on the synergistic effect of ‘three-pump synthesis’, the capture, adsorption, sinking and storage of atmospheric carbon dioxide can be effectively achieved (Jiao et al., 2010; Krause-Jensen et al., 2018; Taillardat et al., 2018; Gruber et al., 2019a). (2) Carbon sink capacity accounting and assessment. Early, due to lack of data and imperfect research methods, most studies used carbon sequestration fisheries or specific sea areas as examples for measurement. Recently, with the continuous maturation and application of remote sensing technology, the academic community’s understanding of ocean carbon sinks has become clearer. Research pointed out that the total amount of carbon stored in the ocean is about 3.9×1013 tons (Krause-Jensen and Duarte, 2016; Tréguer et al., 2018), accounting for 93% of the global carbon. About 55% of the biological carbon in the ecosystem is captured by marine organisms (Fan et al., 2016). Compared with terrestrial carbon sinks, ocean carbon sinks have the advantages of long-lasting carbon sequestration. (3) Top-level design and institutional construction, including the overall framework, theoretical basis and legal path of the carbon sink trading market. Gruber et al. (2019b) believe that accelerating the construction of the blue carbon market can effectively solve the long-standing problems of low efficiency, capital misplacement and financing constraints in the resource protection and utilization field. Weiss et al. (2021) pointed out that improving the carbon sink capacity of the ecosystem and establishing an effective verification system and trading platform are key links in improving the construction of the carbon market. From a legal perspective, Dong et al. (2018) believed that the blue carbon market, as a useful supplement to the unified carbon market, should adopt a multi-dimensional legislative model to coordinate domestic legislation with international environmental treaties, and focus on improving key institutional arrangements.

Existing research has the following shortcomings: First, most literature focuses on natural ocean carbon sinks, ignores the role of carbon sink trading, and fails to elaborate on its strategic significance for achieving the ‘double carbon’ goal and mitigating climate change. The essence of the climate problem is the negative externality of human economic activities. Human factors and costs must be considered to internalize the external behavior of carbon emissions. Ocean carbon sequestration based on natural processes is important to the global carbon cycle, which maintains the carbon balance of nature. While it cannot be regarded as humankind’s contribution to emission reduction and climate warming mitigation. Studies have clarified the carbon sequestration mechanism of ocean carbon sinks and affirmed the carbon sequestration potential. However, in practice, the protection and restoration effect of blue carbon resources has always been restricted by the slow capitalization process of ecological resources. It has long relied on the ecological compensation mechanism led by public finance (Iida et al., 2021) and is difficult to transform the natural advantages of ocean carbon sink resources into effective blue carbon capital through activities such as property rights confirmation, value accounting, and market transactions. Second, existing literature lacks comprehensive quantitative research on ocean carbon sink trading. Although some studies have elaborated on regional carbon sink trading and proposed policy suggestions for establishing a blue carbon market from a theoretical perspective, few researches have conducted empirical tests based on an overall perspective, and not provided specific empirical methods and results, which is not conducive to the implementation of the blue carbon market in the future (Chan, 2022; Mu et al., 2022).

Based on this, the paper contributes to the following aspects: (1) Theoretically, it explains the importance of ocean carbon sink trading rather than natural carbon sinks. We emphasize that although the top priority is to quickly achieve carbon peak and carbon neutral by controlling carbon emissions, from a longer-term perspective, sustainable development requires a negative-emission economic and social operating mechanism, of which ocean carbon sink trading is an indispensable and important part. (2) Methodology, the article combines the Dynamic Stochastic General Equilibrium (DSGE) model, Dynamic Integrated Model of Climate and the Economy (DICE) and financial accelerators to build an “environmental-economic-finance” system framework around the key mechanisms (transactions, risks, financing mechanisms) in the ocean carbon sink market. Specifically, we studied the impact of the heterogeneous behavior of market entities (enterprises, governments and financial markets) on the environment and economy. We found that market transaction entities’ impact is greater than government decisions. In addition, we also explored potential influencing factors and found that the proportion of ocean production value has the greatest impact, followed by ocean carbon sink efficiency and transaction price. Finally, we added a financial accelerator mechanism to examine further impacts on financial markets.

The innovations are as follows: First, we explain the necessity and strategic significance of ocean carbon sink trading from a theoretical level, providing a new logical inspiration for the sustainable development of the ocean and the mitigation of climate warming. Developing and improving blue carbon market transactions fully mobilizes the whole society’s enthusiasm for carbon reduction through incentive mechanisms, and attracts more entities to achieve national emission reduction around carbon footprints and truly achieve inclusive carbon benefits. In addition, social capital is encouraged to participate in the construction of carbon sink projects, which will substantially promote the capitalization process of ocean carbon sinks, effectively solve the long-standing problems of capital misplacement and financing constraints, and achieve a win-win situation for the economy and the environment. Moreover, accelerating negative emissions is significant in the long run to achieve the ‘double carbon’ goal as scheduled. Based on the above theoretical framework, it not only helps to form an effective negative emissions mechanism, but also lays the logical foundation for understanding the concept of a community with a shared future for mankind based on climate change. Second, it empirically tests the effectiveness of ocean carbon sink trading, the key influencing factors of market operation and the supporting role of the financial market, and provides practical suggestions for the future construction of the ocean carbon sink market. Third, we enrich and expand the environment DSGE model. Little literature on DSGE considers ocean carbon sinks. and we have expanded the model construction of DSGE and built a complete analysis framework of ‘economics-environment-finance’ around marine carbon sinks. It is an effective innovation of the traditional environmental DSGE model and provides a new perspective for the value realization of ocean carbon sinks and sustainable ocean development.

The paper is organized as follows: the second chapter is model setting, the third chapter is parameter calibration, the fourth chapter is empirical testing, and the fifth chapter is conclusion and policy recommendations.

2 Materials and methods

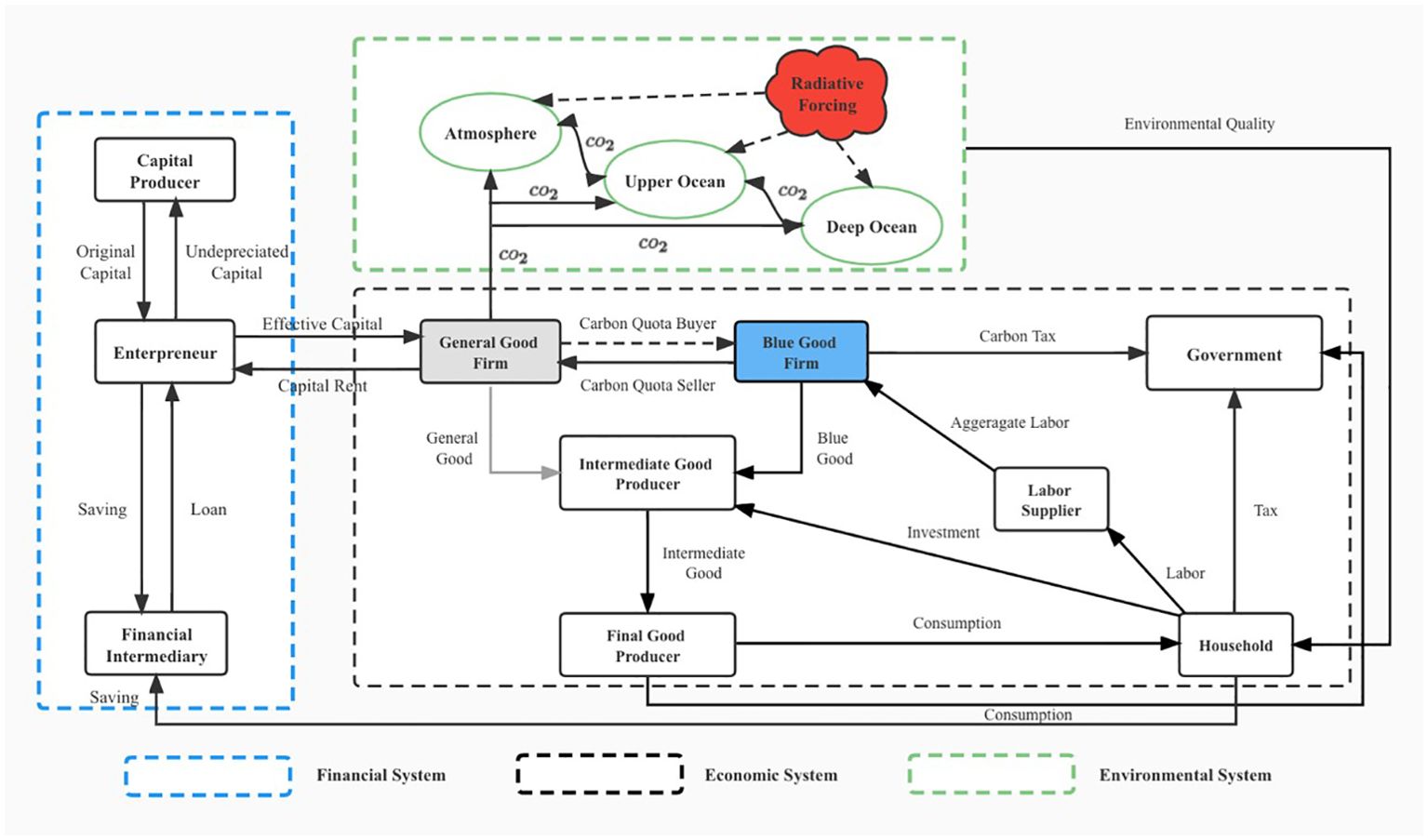

A perfect trading market has three major elements: trading subjects, trading objects and trading media. Carbon sink trading is a market-based means of converting ecological products that can generate carbon sinks into greenhouse gas emission rights through carbon credits, thereby obtaining ecological compensation. The trading subjects include carbon sink suppliers (sellers), demanders (buyers) and other participants. Suppliers obtain income by selling marine carbon sinks, have the right to receive returns and assume the obligation to deliver carbon sink products. Demanders purchase marine carbon sinks by paying fees, have ownership of carbon sink products and the obligation to pay costs. The activities of both parties are realized through trading media. As sellers of marine carbon sinks, suppliers can have a wide range, including suppliers who do not have emission reduction obligations but have marine carbon sink quotas, and suppliers who have both emission reduction obligations and marine carbon sink quotas. In addition, there are market investors who buy marine carbon sinks from savers and sell them to demanders. Demanders as buyers in the market can be organizations that implement mandatory emission reductions [International Civil Aviation Organization (ICAO)], companies and market investors that voluntarily participate in emission reductions. In addition, there are other participants in the transaction process, such as governments, marine carbon sink intermediaries and third-party institutions. From the government’s perspective, it should actively encourage the storage of marine carbon sinks, provide funds, technology, policies and guidance, regulate market transactions, and ensure the stable development of the trading market. Intermediaries with market influence can actively and proactively find reliable buyers to promote the high-quality development of the market. Third-party institutions are also an important part of the marine carbon sink market. For example, consulting agencies can provide market transaction information, predict risks and future development trends for both supply and demand parties. The marine carbon sink trading market structure is shown in Figure 1.

Due to the outstanding contributions of scholars such as Annicchiarico and Diluiso (2019) and Junior and Garcia-Cintado (2021), the DSGE model has been extended to the environmental field recently. They added pollutant emissions and environmental systems to the traditional DSGE model and examined the impact of environmental protection policies (Zhao et al., 2020), such as emission caps (Wang and Yi, 2022), emission intensity (Bernanke et al., 1999), and carbon taxes (Amiri et al., 2021). The DSGE model describes the behavioral decisions of multi-sector entities based on a dynamic perspective, characterizes the optimal behavior under market clearing conditions, and can well simulate the operation of the marine carbon sink market. The traditional environmental DSGE model depicts the impact of exogenous environmental shocks and policies. This paper attempts to expand in the following four aspects: (1) Trading mechanism. Producers of intermediate products are separated into general type and blue carbon type. The general firm purchases carbon permits due to excessive carbon emission, while the blue carbon type becomes a seller in the trading market because of the carbon sink effect. (2) Risk mechanism. The potential risks of carbon sink trading include ecosystem risks caused by extreme weather and natural disasters, uncertainties caused by policy evolution and revision of laws, as well as differences of stakeholders’ willingness to pay and transaction motives. Considering the exogenous disaster risk mechanism, this paper describes the impact of disaster risk through the changes of capital stock and total factor productivity with reference to the research of Gourio (2012). (3) Investment and financing mechanism. The blue carbon trading requires the strong support of the financial market. To further improve the framework of carbon finance, this paper refers to Bernanke, Gertler and Gilchfist (BGG) model and introduces capital producers, entrepreneurs, financial intermediaries, and other departments. (4) Carbon cycle mechanism. The DICE of Nordhaus (2018) is used in this paper to simulate the carbon cycle systems, which include land, offshore, deep ocean systems, the thermal radiation system of the atmosphere, and temperature measurement. The framework of the BGG-DICE-DSGE model is shown in Figure 2.

2.1 Economic system

2.1.1 Consumer

The consumer utility maximization problem is as follows:

The budget constraint equation is:

where represents the nominal deposit of the financial intermediary. represents notional government bonds. and represent the nominal interest rate and the total return, respectively. , and are labor tax, real wages and capital tax, respectively. , , and denote one-time transfer payments from financial institutions, total corporate profits, net transfer of entrepreneurs, Lagrange multiplier, respectively.

2.1.2 Firms

The demand function of the intermediate product can be expressed as , and we get the expression for the total price level . According to Calvo’s price sticky pricing principle, the final product price is as follows:

Intermediate product manufacturers are divided into marine carbon sinks and carbon emissions. The former uses marine carbon sinks as a production factor, combines it with labor and capital, follows relevant certification methods and standards, and develops carbon credits through economic activities such as ecological development, restoration and conservation (mangroves, seagrass beds, salt marshes, etc.), achieves positive environmental externalities, and then realizes value conversion through voluntary emission reduction market transactions. The latter emits greenhouse gases excessively and cannot achieve the expected goals through its own emission reduction methods. It can offset its emissions by purchasing carbon sinks in the voluntary market. Additionally, the loss function proposed by Nordhaus (2018) is introduced to describe the negative impact of carbon emissions. Relative expressions are shown in Equations 4–7.

and are the total output of blue carbon firms and general firms, respectively. and , represent the capital and labor input of blue carbon firms, respectively. and represent the capital and labor input of general firms, respectively. and denote the share of capital and labor in total output. and are the loss function and carbon sink efficiency of the ocean. is carbon emission intensity, which measures the carbon emissions per unit output of intermediate product firms. is the emission reduction rate, which measures the firm’s emission reduction willingness. , and represent blue firm total factor productivity (TFP), general firm TFP and environmental protection technology, respectively, which follow the AR(1) process:

This paper introduces the disaster risk shock (Barro, 2006; Gourio, 2012), which describes how blue carbon investment projects fluctuate due to climate disasters, policy changes, and project investment uncertainty. is the probability of disaster risk occurrence. is the persistence parameter. and are the magnitude of the decline in production technology under the disaster shock. The equation is as follows:

Due to the negative externality of carbon emissions, both firms are affected by the same environmental impact, thus the subscript i is omitted.

This paper divides traditional firm costs into four categories: The first category is the cost of production, including labor and capital . The second is the emission reduction cost, expressed as a function of output and emission reduction rate, and the expression is . The third is the emission fee . The fourth is the cost of carbon sinks . The relevant expressions are as follows:

Given input prices and , blue carbon firms minimize costs by selecting labor input and capital input . It turns into a seller in the carbon quota market because of carbon sink effect. The expression is as follows:

Intermediate firms produce differentiated products by linearly summing blue carbon products and general products applying the CES production function, as shown in Equation 15.

is the output ratio of blue carbon firms, and is the substitution elasticity of the two products.

2.1.3 Government

This paper refers to the classic Taylor rule to describe monetary policy. The rules are as follows:

Here is the interest rate smoothing coefficient. and measure the response coefficient of the interest rate rule to the output gap and the inflation gap, respectively. The budget constraint equation for fiscal policy is as follows:

Tax revenue consists of consumption tax, labor tax and capital tax:

2.2 Financial system

2.2.1 Capital goods producer

The capital evolution equation is:

and are the capital invested and new investment in the current period, respectively. The economic problem for the supplier of capital goods is ( is the capital price for the current period):

2.2.2 Entrepreneurs in need of loans

Entrepreneurs’ asset composition is , where and represent the net worth and the newly purchased asset, respectively. Therefore, in equilibrium, the total income from both successful and failed lending by financial intermediaries is equal to the cost of holding funds:

2.3 Environmental system

2.3.1 Carbon cycle

Based on DICE model, the global carbon cycle system are shown as follows:

where , and represent the carbon content in the atmosphere, the carbon content in the surface layer and the carbon storage in the deep ocean layer, respectively. measures the flow coefficient.

2.3.2 Climate change

Due to the excessive emissions of greenhouse gases in recent years, port pollution and the ocean environmental issues such as the ocean ice melting, seawater warming, and ocean acidification have weakened its carbon sink capacity, changed the balance of biogeochemical carbonate, and further affected the ocean circulation and global temperature (Fernández et al., 2024; Shi et al., 2024; Xiao et al., 2024). It’s essential to evaluate the relationship between carbon dioxide and climate change. Thus we use DICE model to create a condensed climate equation, which is represented as follows:

measures the total thermal radiation change, and it consists of two parts: carbon dioxide-dominated greenhouse gas change since 1750 ( represents the carbon emission in 1750), and the other is the exogenous radiation shock . A simplified two-level model is expressed as follows:

2.3.3 Environmental quality

The paper dynamically describes the environmental quality:

The evolution process of environmental quality consists of the following parts: The first part is the initial state , and is the smoothing coefficient of ecological quality; The second is ecological quality of the previous period ; The third is current carbon emission ; The fourth is the amount of carbon sequestered by the ocean carbon sink ; The fifth is the effect of government environmental governance, and is the conversion rate of governance effect. The resource constraint equation in the entire system is:

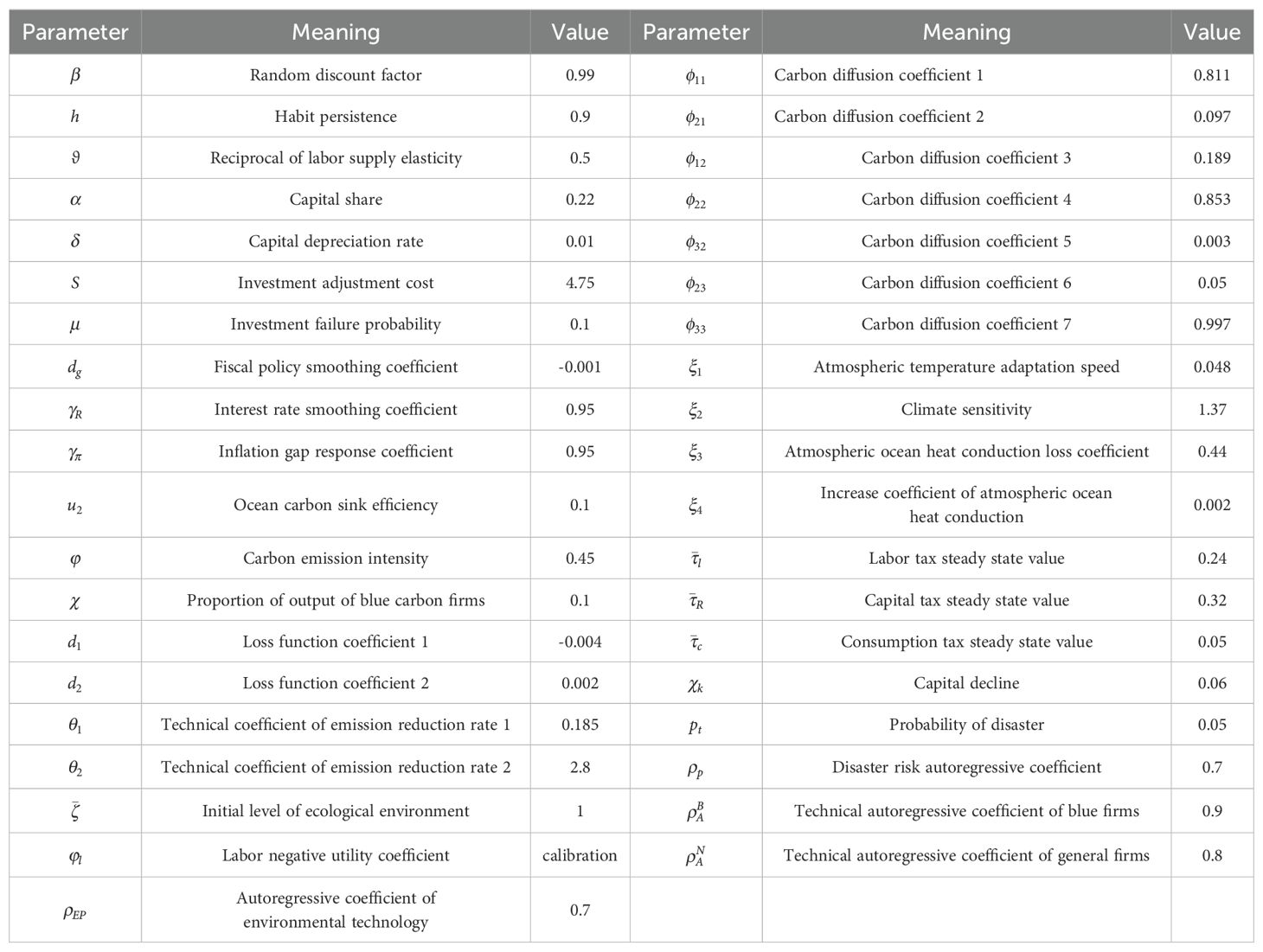

3 Parameter calibration

The parameters in the theoretical model are determined by the combination of calibration and estimation. We use matlab for numerical simulation.

Parameters on economic system. For random discount factor , consumption habits h, and labor substitution elasticity , the values in existing studies are basically consistent. We refer to the study of Amiri et al. (2021); Fernández-Villaverde and Guerrón-Quintana (2021); Liu and He (2021); Cardani et al. (2022), and calibrated them to 0.99, 0.9, and 0.5, respectively. Labor negative utility coefficient , we calibrate it based on the steady-state values of the model. Based on China’s actual economic data, using annual data from the National Bureau of Statistics (NBS) from 2013 to 2023, we calculated the consumption effective tax rate, labor effective tax rate, and capital effective tax rate separately. Then, we took the average of these rates as the steady-state tax rate values, respectively. The model calibrates the steady-state values of consumption tax , labor income tax , and capital value-added tax to 0.05, 0.24, and 0.32, respectively. For capital share , we referred to relevant research by Chinese scholars. Niu et al. (2018) and Sobieraj and Metelski (2021) measured the share of China’s labor and capital in total output and calculated it as 0.22 and 0.78 respectively. For carbon emission intensity , we referred to Chan (2020) and Wang (2021) and calibrated it as 0.45. Regarding the proportion of marine output in total output , we consulted the ‘China Marine Economy Statistical Yearbook’ and found that the proportion of gross marine product in GDP in the past two years was 9.3% and 9.06%. For the convenience of calculation, the paper calibrated it to 10%. For ocean carbon sink efficiency , the blue carbon sector regards ocean carbon sinks as a production factor, combined with labor and capital, and follows relevant certification methods and standards to develop carbon credits through economic activities such as ecological development, restoration, and conservation, thereby achieving value conversion through voluntary emission reduction market transactions. We referred to the mariculture data in the ‘China Fisheries Statistical Yearbook’ and calculated that the marine carbon sink efficiency of coastal provinces is 0.1. Referring to Jerow and Wolff (2022) and Iwasaki et al. (2021), we set the interest rate smoothing coefficient , inflation gap response coefficient as 0.95.

Parameters on financial system. Referring to Chiarini et al. (2020); Abdo and Mougoué (2021) and Zhao et al. (2022), we calibrate the capital depreciation rate, investment adjustment cost, and enterprise survival rate to 0.01, 4.75, and 0.975, respectively.

Parameters on environment system. For carbon diffusion coefficient, atmospheric temperature adaptation speed, climate sensitivity, atmospheric ocean heat conduction loss coefficient, increase coefficient of atmospheric ocean heat conduction, and loss function coefficient, we referred to Nordhaus’s DICE model and calibrated relevant parameters. For probability of disaster , we refer to Gourio (2012) and set it as 0.05. The parameters are shown in Table 1.

4 Results

4.1 Impulse response of firms and governments

According to the model settings and parameters above, this chapter conducts impulse response analysis of the baseline model to explore how different behaviors of firms and governments affect the economic and environmental system in the ocean carbon sink transaction.

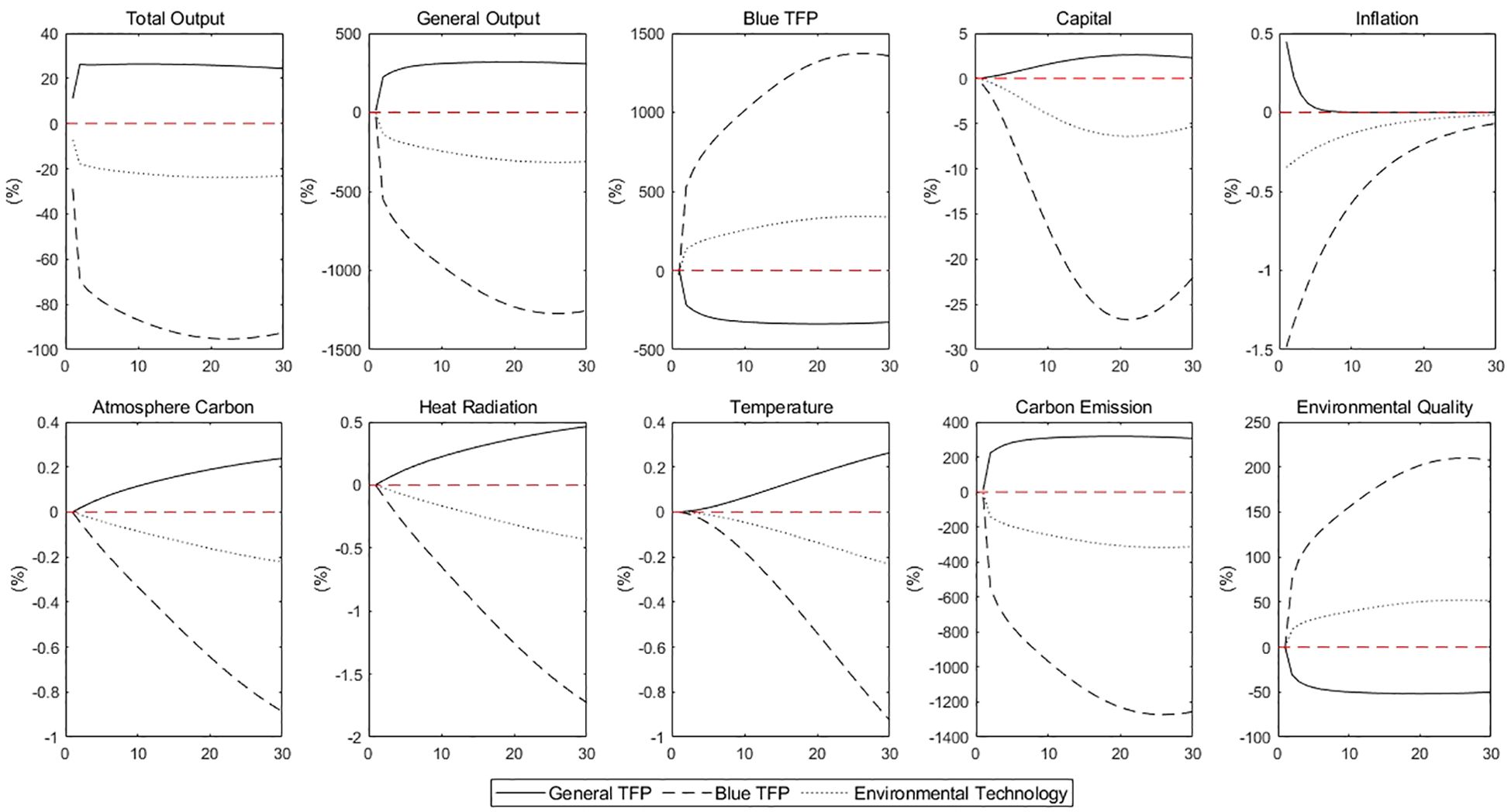

4.1.1 Firms’ shock

Figure 3 shows the impulse response of three firms’ technology shocks. It is evident that different technology shocks have various effects on the economy and environment. The economic benefits of general firms TFP are considerable, but it also causes negative externalities to the environment. Blue carbon firms TFP and environmental technology have obvious effects on climate improvement, and the former is more prominent. Two kinds of technological progress can make up for the negative externalities caused by general firms. It can be clearly seen that through coordination and cooperation with heterogeneous technology shocks, climate change can be effectively improved to achieve a win-win situation for economy and environment under ocean carbon sink trading.

Specifically, general firms gain economical profits from the TFP shock, however, they have a negative impact on the climate due to their high carbon emissions. In terms of economic system, Under the impact of general firms’ technology, due to the existence of capital adjustment cost and the gradual slowdown of exogenous AR (1) shock, both capital and inflation increased slightly. In terms of environmental system, the growth of output also exerts continuous pressure on the environment, and the inevitable growth of carbon emissions has been significantly increased and continued for some time. Under the mechanism of atmospheric and oceanic carbon cycle, atmospheric carbon content and thermal radiation show a linear growth trend compared with the same period last year, and environmental quality continues to deteriorate as the temperature rises. In sum, ocean carbon trading has increased the marginal cost for general firms, but it hasn’t altered the long-term trend of economic expansion or carbon emissions.

The impact of blue carbon firms’ TFP shock is opposite. It has significantly improved the ecological quality and increased the blue carbon output. However, due to the low economic proportion, the total output did not increase. Specifically, blue carbon output has grown continually and reached a peak around Phase 30. The mechanism shows that the blue carbon TFP has improved the output efficiency, which has brought additional benefits to the ocean carbon department through carbon sink trading. On the other hand, the cost of general firm has increased, the profit has declined, and the output was down. While their proportion in the total output is far higher than that of the ocean carbon department, the total output under blue carbon TFP has declined, showing a U-shaped trend and continues to weaken. In terms of environment, it can be seen from the environmental quality evolution formula that under ocean carbon firms TFP’s shock, the amount of ocean carbon sink increases, effectively improving the environmental quality. The figure shows that unit blue carbon TFP can compensate for the environmental loss caused by the unit TFP of general firms, which implies positive environmental impact. Meanwhile, general firms under cost pressure focus on transformation and upgrading, reduce carbon emissions, and lower the damage to the environment. Through the incentive mechanism for blue carbon firms to actively increase ‘negative emissions’ and the punishment mechanism for general firms to passively reduce emissions, the environmental benefits have been improved.

In addition, the impulse response of environmental technology impact shows that the trend of economic and environmental variables is basically consistent with the impact of blue carbon TFP shock, but the fluctuation range is significantly narrowed. Compared with the carbon sink increase effect brought by blue carbon firms’ TFP, the impact of environmental technology on economy and environment system is weakened. Due to the introduction of environmental protection equipment and talents, the marginal cost of general forms in the current period increased, the total output decreased in the current period and continued to decline before the 20th phase and increased marginally, showing a U-shaped trend. In terms of environment, the carbon emissions under the impact of environmental technology have decreased significantly, and with the atmospheric carbon cycle, the carbon content of each ecological layer has decreased, mitigating climate warming and effectively improving environmental quality.

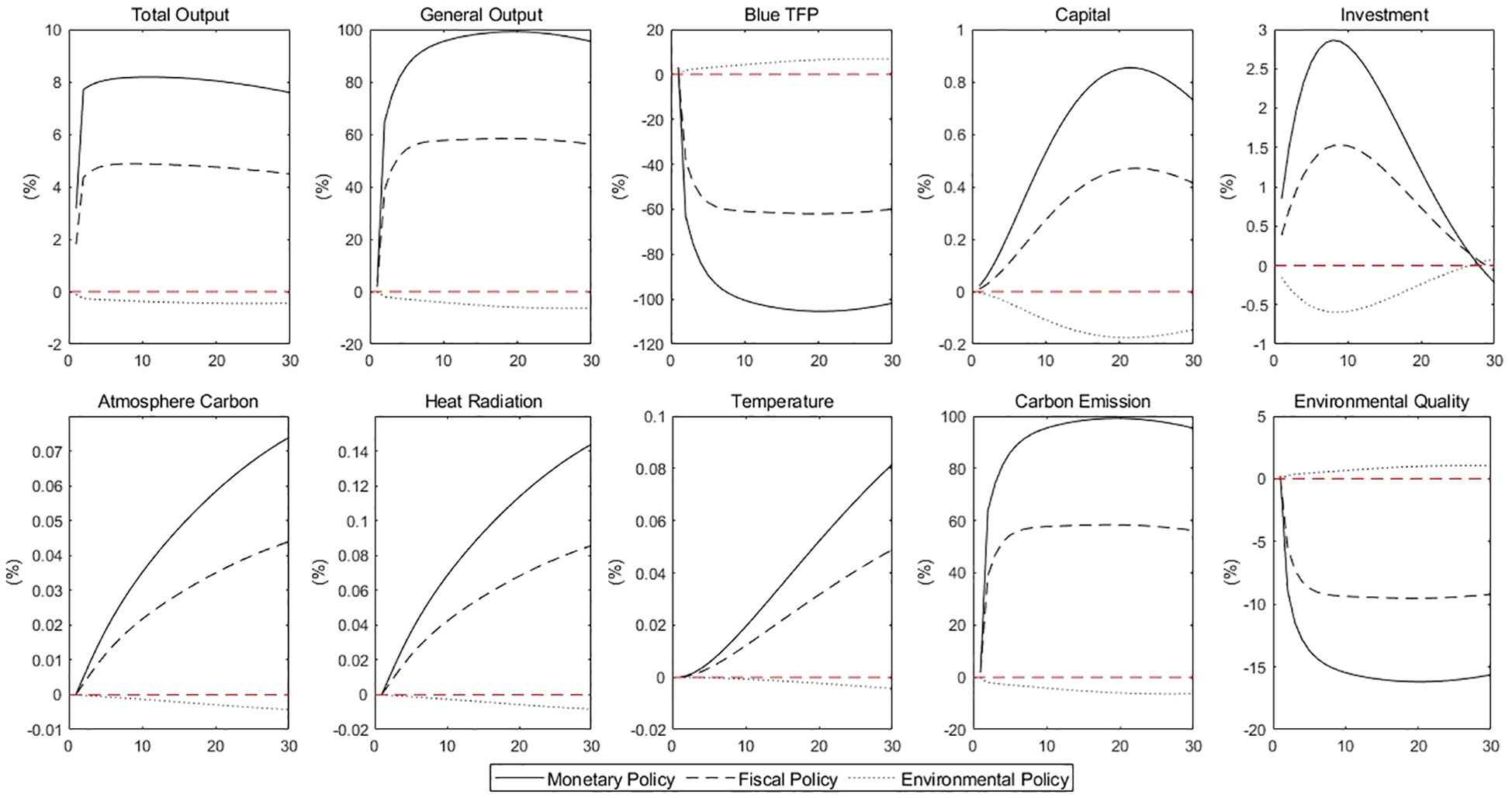

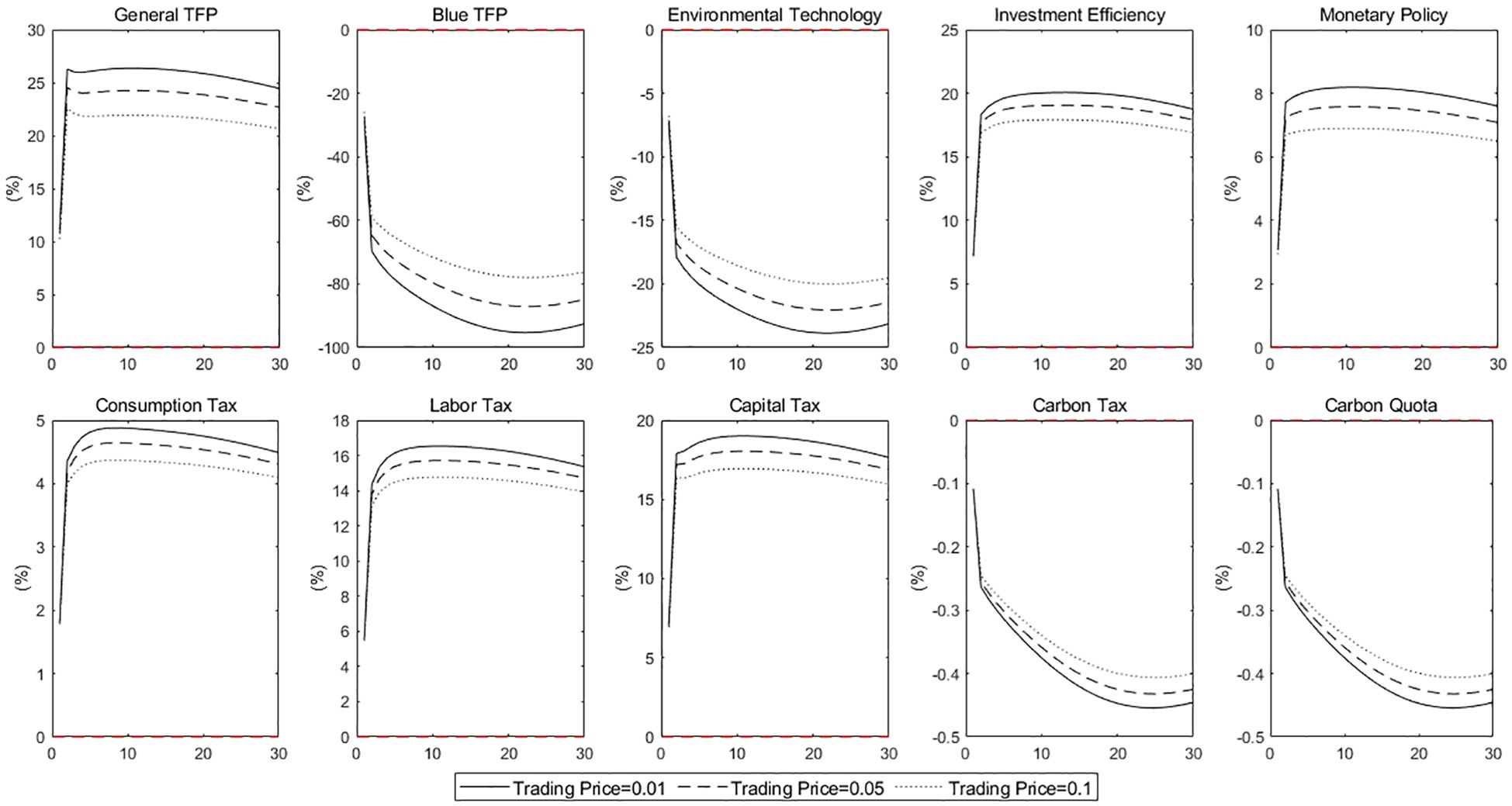

4.1.2 Government policy shock

Figure 4 shows the impulse response of three kinds of government policies. Monetary policy is represented by the classic Taylor rule, fiscal policy is measured by three kinds of tax policies, and environmental policy is represented by carbon tax and license trading. Compared with Figure 3, we find that: First, the fluctuation of the impulse response in Figure 4 is less than that of in Figure 3, which means that in ocean carbon sink trading, the impact of firms’ behavior on the economic and environmental systems is higher than that of the government; Secondly, compared with environmental policies, positive monetary and fiscal policies can achieve significant economic benefits, which indicates that the development of the ocean carbon sink market needs strong support from the government.

As can be seen from the graph, under the impact of a unit interest rate, investment is active and capital stock increases, especially the output growth of general firms, which drives the overall economic growth. Positive fiscal policy impact means more adequate government expenditure and transfer payment, which also has a positive incentive effect on the two types of firms. While effectively stimulating firms’ output and promoting economic growth, two policies inevitably produce excessive carbon emissions, which affect ecosystem through the circulation between the atmosphere and deep ocean, exacerbating the global climate change problem. In addition, the fluctuation range of the main variables under the effect of environmental protection policies was weak and basically maintained at the steady level.

4.2 Sensitivity analysis around ocean carbon sinks

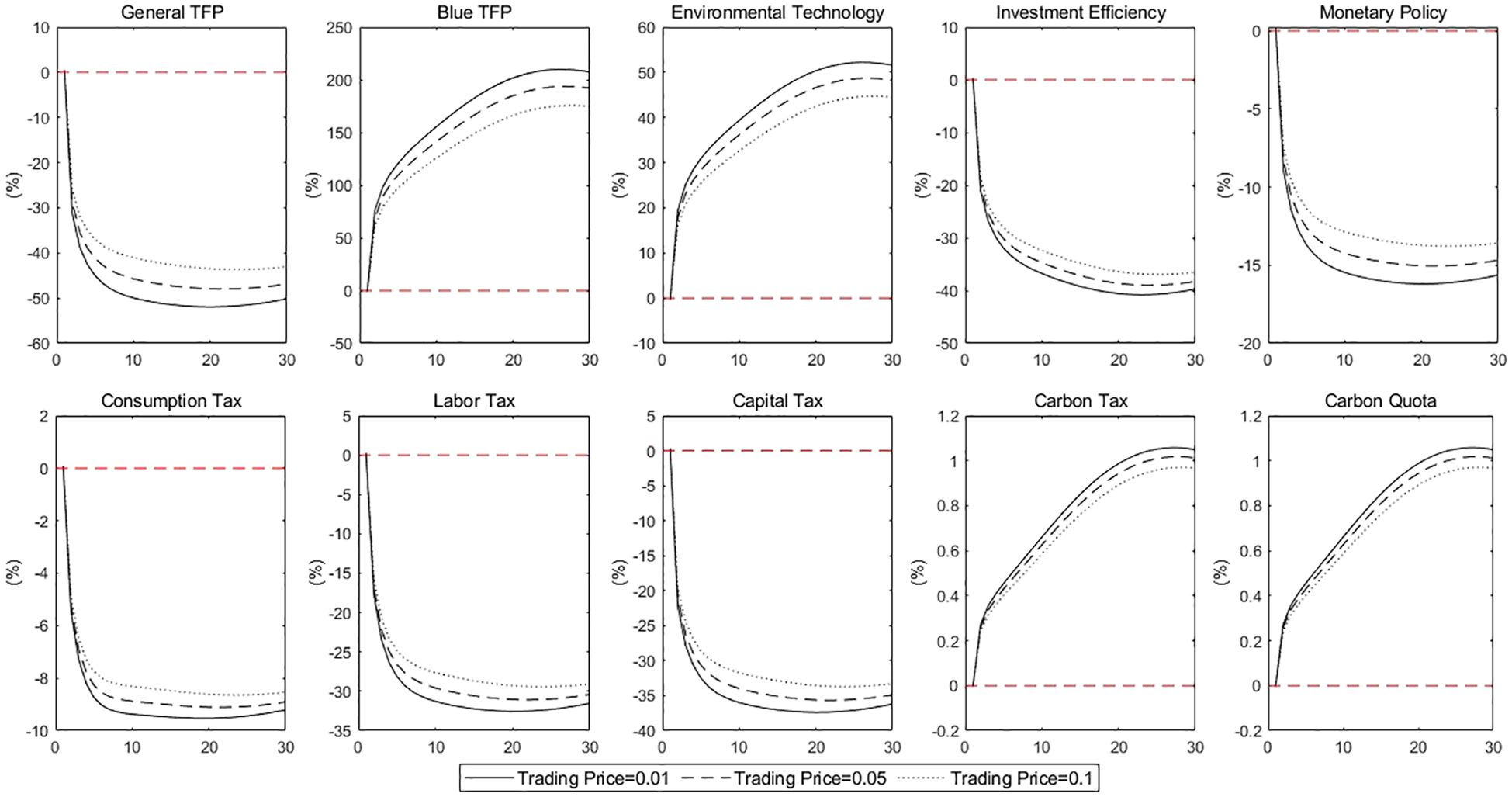

We have examined the impact on output and the environment of major exogenous shocks in ocean carbon sink trading. Additionally, we wonder how to optimize the mechanism around ocean carbon sink to improve climate change and maximize the value of ocean carbon sink trading. Specifically, we alter the ocean output proportion, the efficiency of ocean carbon sinks, and transaction prices while conducting sensitivity analysis under exogenous shocks. Due to space constraints, we quantify the economic benefits of carbon sink trading using total output and the environmental benefits using environmental quality.

The results show that after increasing the ocean output proportion and the ocean carbon sink efficiency, the effect of improving climate change is more obvious. The former mitigates the negative environmental impact of exogenous shocks, while the latter strengthens the positive impact. However, after changing the carbon sink trading price, the impulse response doesn’t change significantly, indicating that the current trading price couldn’t produce significant environmental benefits.

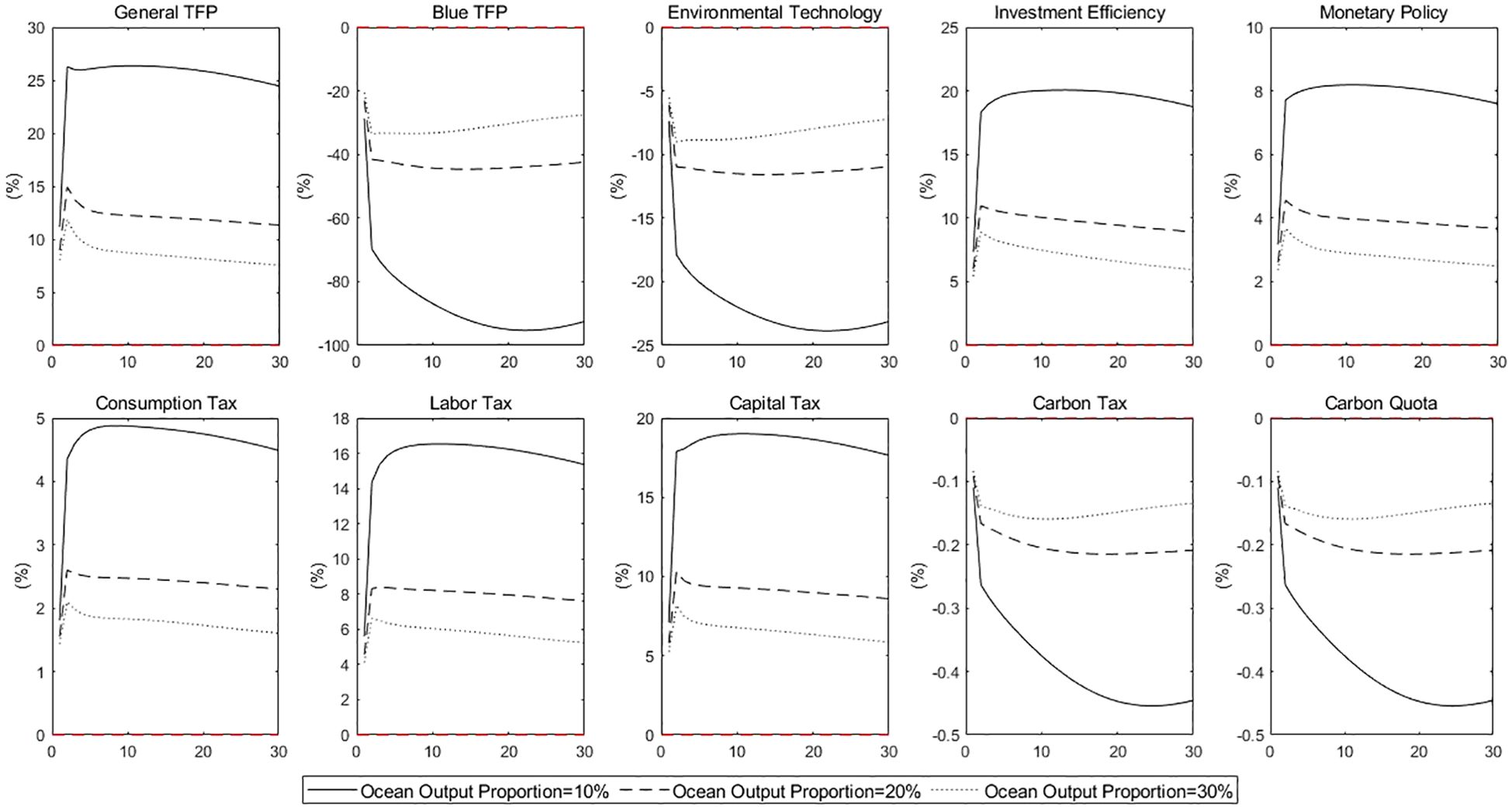

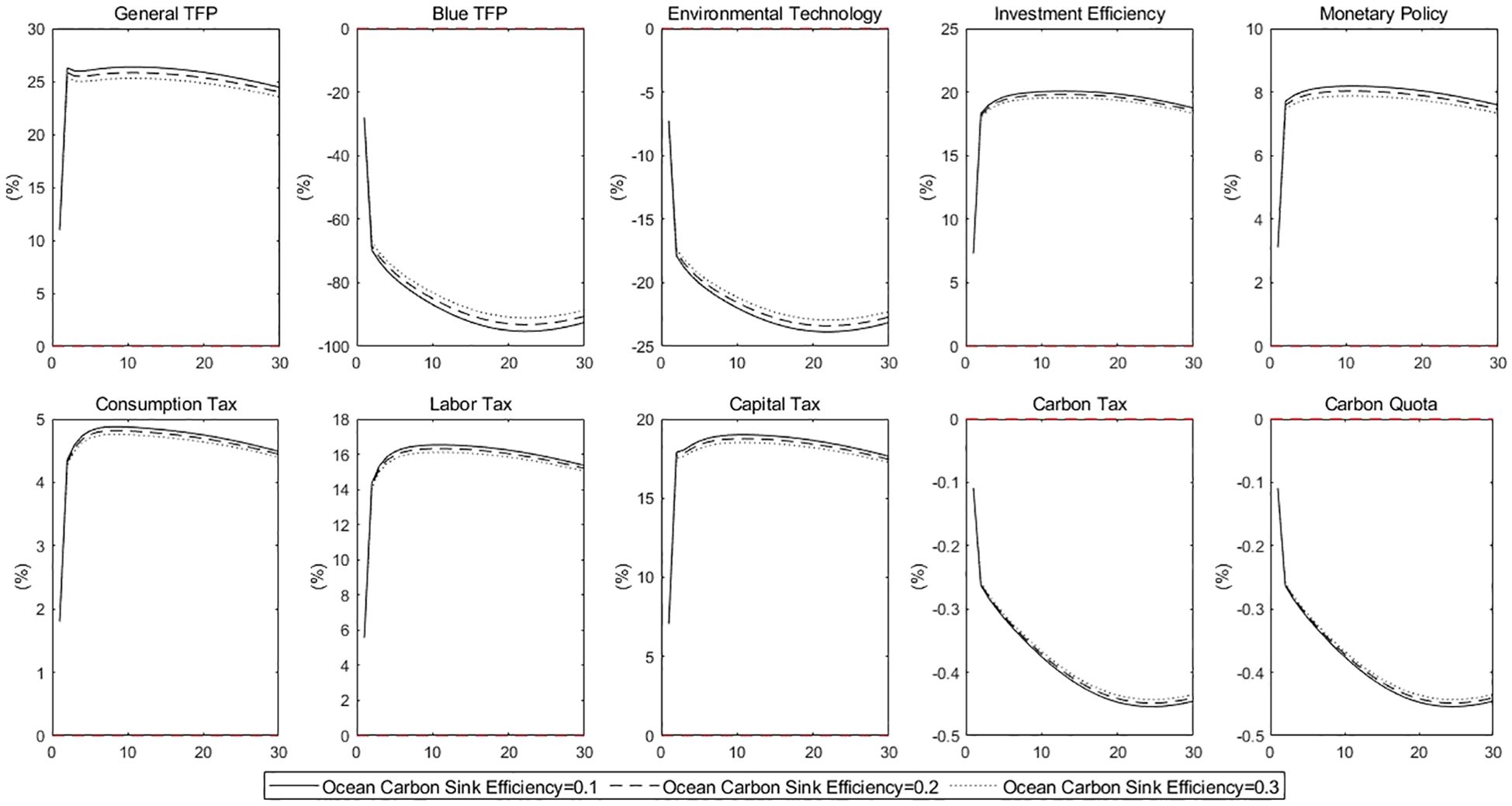

4.2.1 Ocean output proportion

Figures 5 and 6 illustrate how each exogenous shock’s economic and environmental benefits vary after adjusting ocean output proportion. We find that as the proportion of ocean output increases, the economic and environmental fluctuations gradually converge, especially the negative environmental shocks. This demonstrates that it is reasonable and necessary to continuously improve the strategic position of the ocean and lessen the negative impact of exogenous shocks on the environment.

The increase in ocean output under the progress of ocean carbon technology and the increase in the ocean output proportion superimpose the increase in total output year-on-year. At the same time, changes in production modes have also affected output and led to a decrease in the proportion of certain parts of the total output value (Xu et al., 2023), thereby weakening the production stimulating effect and investment efficiency of traditional technologies. The graphics demonstrate that the percentage of output that deviates from the steady state has dropped to varying degrees, but it has also lessened the environmental impact of human activity. The impact of environmental protection technology and the rise in marine output value have led to a significant decrease in carbon emissions, which has also sped up the upgrading and transformation of traditional firms. As a result, the firm’s own emission reduction costs and carbon emission costs are lower, and output has increased year over year. The ecological improvement effect of environmental protection technology has steadily diminished due to the decline in the share of traditional manufacturers, displaying a marginal falling state, although it is still significantly positive.

The impulse response to the monetary policy shock is not very variable, with output rising significantly by about 8% in the period and continuing to grow, and the corresponding environmental quality deteriorating in the period and persisting for a long time. The year-over-year increase in output under the three tax policy shocks narrowed significantly, and the impulse response trend of the two environmental policies began to converge. Due to the increase in the proportion of ocean output, the industrial structure is gradually rationalized, and the effect of technology shocks and government regulation by enterprises is more moderate.

4.2.2 Ocean carbon sink efficiency

In reality, the following practices are being used to improve the ocean’s carbon sink capacity: (1) Negative emission ecological engineering for coordinated land and sea. Through scientific fertilization, the use of inorganic fertilizers such as nitrogen and phosphorus in farmland is reduced, thereby reducing the amount of nutrients entering the sea from rivers and alleviating offshore eutrophication. In addition, through large-scale seaweed farming, the absorption of carbon by photosynthesis is also an effective way to alleviate offshore eutrophication and increase marine carbon sinks. (2) Marine aquaculture foundation and marine ranches. Artificial upwelling driven by clean energy brings the nutrient-rich salt water at the bottom of the aquaculture area to the upper layer, providing the nutrients needed for photosynthesis of aquaculture seaweed, fish, shellfish, etc. (3) Sewage alkalization to increase carbon sinks. Add alkaline substances (such as alkaline minerals such as olivine) before discharging water into the sea to achieve alkalinization of the tailwater from the sewage treatment plant and discharge it into the sea, thereby increasing carbon sinks.

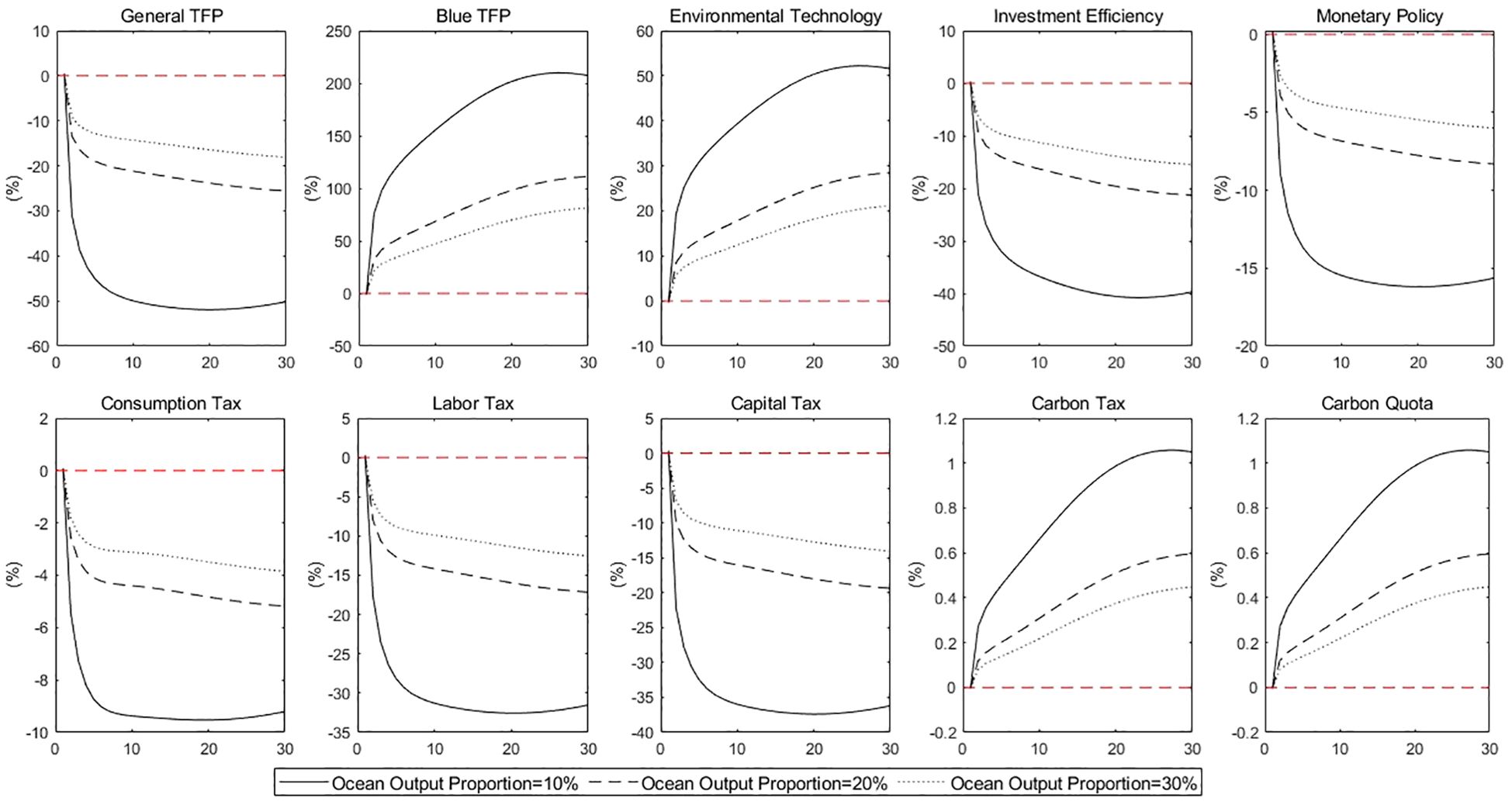

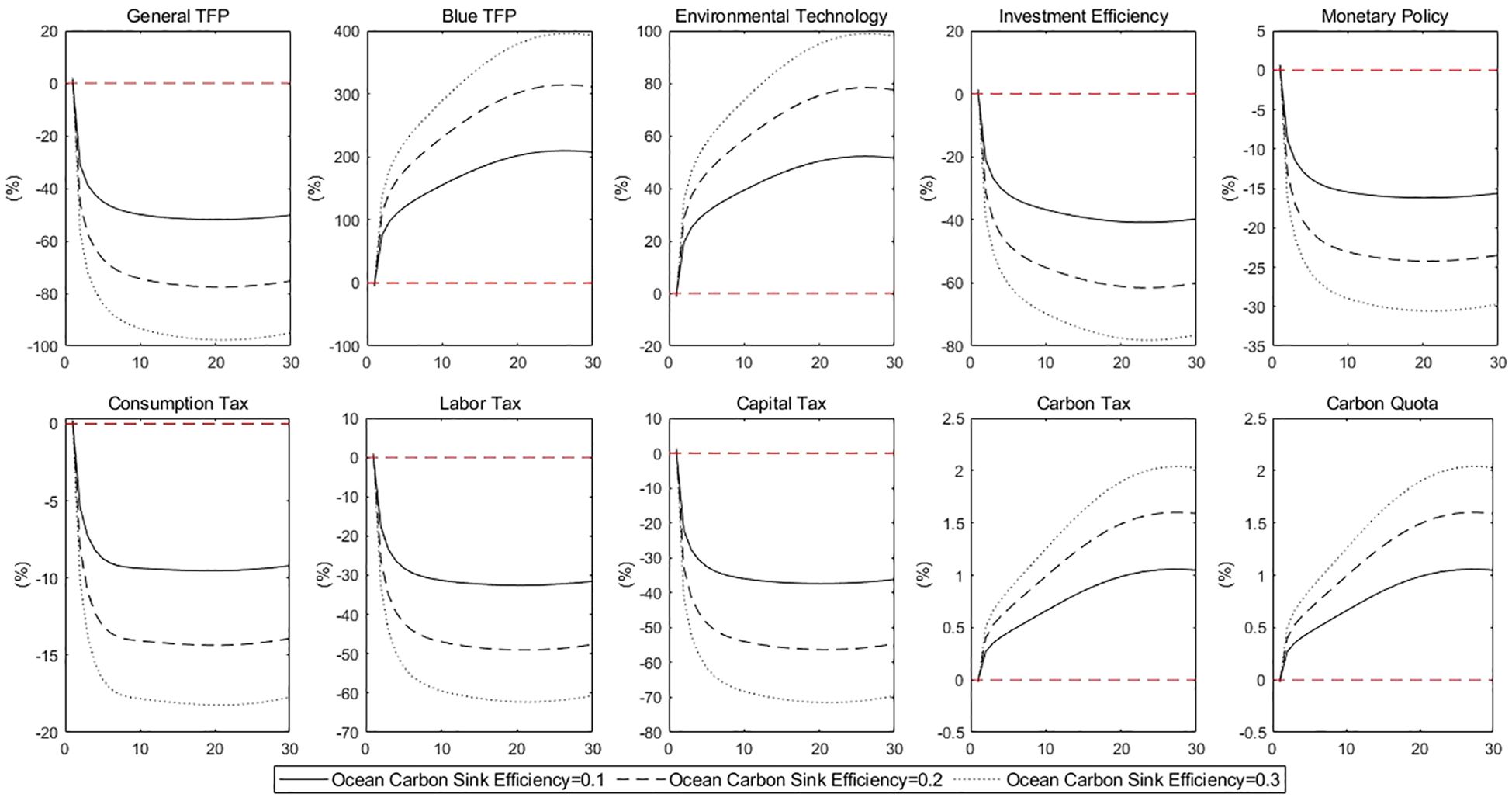

The output and environment fluctuations under heterogeneous shocks are depicted in Figures 7 and 8 after the ocean carbon sink efficiency has been changed to 0.2 and 0.3, respectively. Unlike Figures 5 and 6, the environmental trends under exogenous shocks in Figure 8 are more divergent rather than convergent, suggesting that the increase in ocean carbon sink efficiency has more significant environmental benefits, especially under blue TFP and environmental technology. The previous analysis has confirmed the importance of firms’ impact. After improving the carbon sink efficiency, it can fully enhance the ecological improvement effect of blue carbon firms’ TFP and environmental technology shock.

The mechanism demonstrates that, an improvement in the ocean carbon sink efficiency will result in an increase in the additional revenue for blue carbon firms. The output will marginally grow as blue carbon technology progresses. We refer to Li et al. (2024) and conclude that carbon sink intensity effect and consumer demand effect are important factors that inhibit and promote carbon sink growth, respectively. And the expansion of carbon sinks will significantly raise environmental quality. The continuous effects of environmental technology have decreased carbon emissions and, through the carbon cycle system, lowered atmospheric temperature, effectively reducing climate warming, decreasing output loss and slightly promoting overall production. The two impacts achieve a win-win situation for both economy and ecology through two channels: emission reduction and sink enhancement.

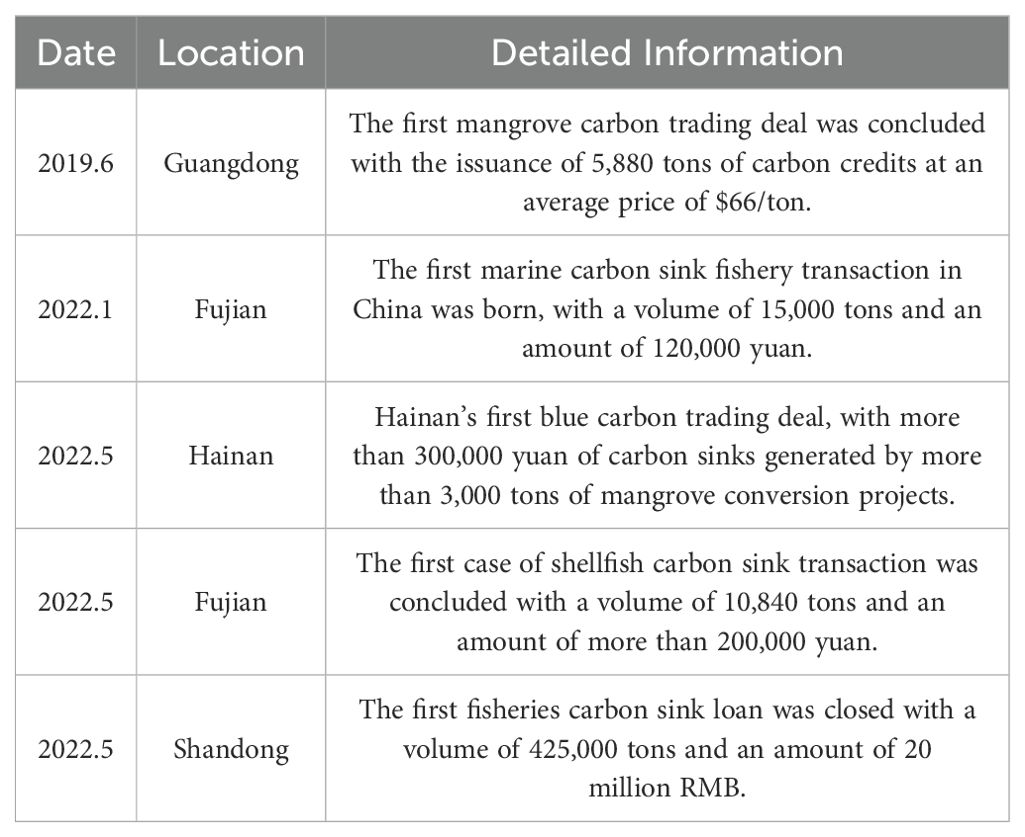

4.2.3 Ocean carbon sink trading price

To explore the potential impact of ocean carbon sink trading price fluctuations on the economic and environmental system, the article refers to the existing ocean carbon sink prices for sensitivity analysis (Figures 9, 10). Table 2 shows the transaction status of China’s ocean carbon sink trading pilot. The images show that the fluctuations of economic and environmental variables are largely stable under heterogeneous shocks, which also means that in the current ocean carbon sink trading, the price cannot guide the production decision-making of firms and reasonably allocate the ocean carbon sink resources. According to theoretical mechanism analysis, the price rise boosts blue carbon revenue and reinforces the economic benefits of technological advancements related to blue carbon. Meanwhile the cost of traditional manufacturers also rises, which reduces the economic gains from overall investment and technology progress. In terms of environmental impact, corresponding to economic benefits, general firms began to actively reduce emissions due to cost pressures, investment efficiency and the impact of general TFP on environmental damage converged, and the environmental benefit curve moved upward. The possible reason is that due to the low proportion of ocean output value, ocean carbon sink trading has not formed scale effect, thus it can’t play the role of price signal transmission and resource allocation.

4.3 Further thoughts on financial markets

The carbon market originates as a direct exchange of carbon allowances between buyers and sellers. With the development of the carbon market and the application of financial tools, more capital will be invested in the ocean carbon sink market. Therefore, we add capital goods producers, banks and entrepreneurs to the ocean carbon sinks market. Entrepreneurs purchase virgin capital from capital goods manufacturers by using bank loans and their own funds, undergo heterogeneous uncertainty shocks to turn it into efficient capital, and then lease it to enterprises for capital gains. After the production completion, the entrepreneur recovers the undepreciated capital and sells it to the capital goods producer, and the entrepreneur defaults on debt repayment or insolvency.

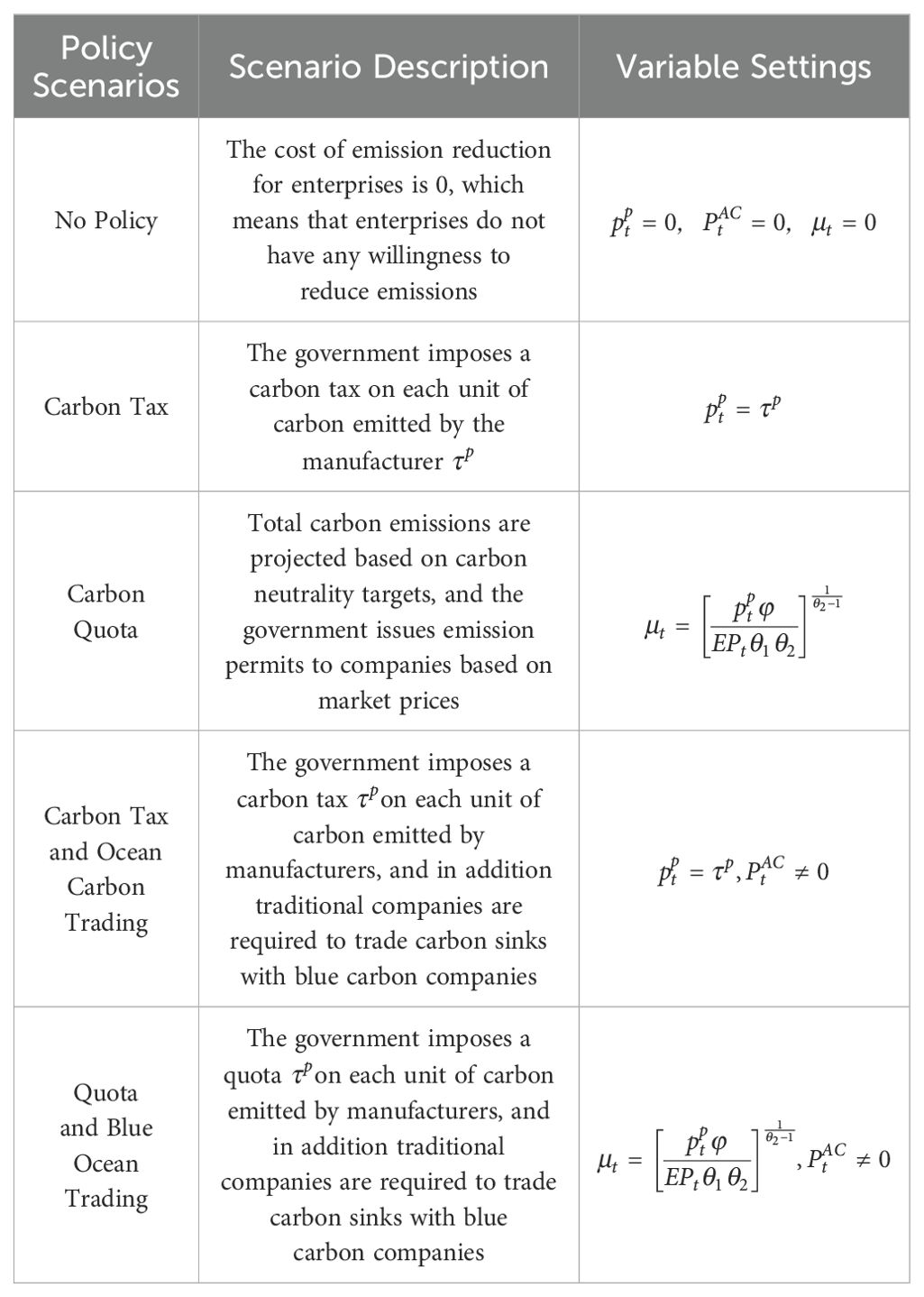

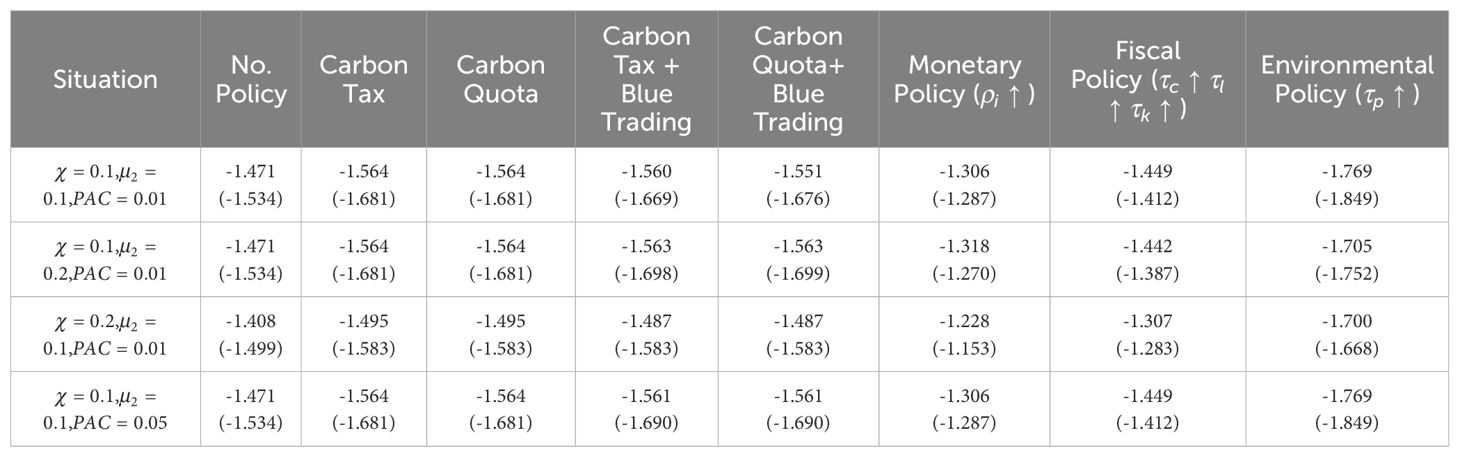

Considering the potential constraints of emission reduction policies, different scenarios need to be set for targeted analysis. Carbon tax and quota act as the main types of emission reduction schemes. With the introduction of ocean carbon sink trading, we give the future carbon trading market the experience and references by naturally combining ‘emission reduction’ and ‘sink growth’. We must strike a balance between the two because it is obviously not appropriate to achieve carbon reduction and climate improvement at the expense of economic growth. Additionally, we refer to Rubio (2020) and Gross and Hansen (2021) to do welfare analysis. Tables 3 and 4 display policy descriptions and welfare loss results, the findings in parenthesis represent welfare losses under financial frictions.

The overall amount of social benefit has decreased since the introduction of the carbon tax and carbon emission permit. This is due to the fact that the obligatory emission reduction program has had a negative impact on overall output, investment, and social consumption. In a cross-sectional comparison, we find a significant increase in welfare levels when ocean carbon sink trading is introduced, suggesting that the capitalization process of ocean carbon sink resources has effectively improved climate change and increased social welfare. The revelation to us is that the ‘carbon peak’ will unavoidably construct a carbon-constrained social and economic operating mechanism to accomplish carbon emission reduction goals. Excessively rigid constraints on carbon emissions for the purpose of sacrificing economic growth will not only fail to achieve ‘carbon neutral’, and also creating uncertainty about the human climate agenda. The fundamental and effective way to achieve the goal of ‘carbon neutrality’ is to establish a social and economic operation mechanism for ‘negative emission’ of the carbon footprint generated by human economic activities through technological progress. For example, biological capture technology has demonstrated that it provides a reliable and cost-effective solution for achieving carbon neutrality (Tiwari et al., 2024). Active monetary and fiscal policy stimulus led to a significant increase in welfare levels due to output growth, while in contrast environmental policies realized environmental benefits but also came at the cost of economic losses and a decline in total welfare levels.

The longitudinal analysis shows that the degree of social welfare has increased when raising the ocean output proportion. Through the sensitivity analysis in the second part, we discover that as the percentage of ocean output changes, economic and environmental fluctuations have narrowed significantly. On the one hand, more and more capital flows into the ocean, which can not only generate positive environmental externalities through efficient carbon sequestration, but also reap profits through market transactions. On the other hand, under the carbon peak limitation, general firms are compelled to transform, reducing carbon emissions and mitigating climate change. As a result, both the welfare level and the social industrial structure are more reasonable. Changes in transaction price and carbon sink efficiency, however, did not dramatically enhance social welfare. The former merely had an impact on the environmental system, whereas the latter did not create a price guiding mechanism and had little effect on carbon sink transactions.

In addition, welfare losses have increased in different scenarios since financial frictions were introduced, which is also consistent with their core element of ‘small shocks, large fluctuations’. There are two reasons behind it: one is the effect of inflation. Generally, TFP shocks, capital efficiency shocks, monetary policy, and fiscal policy are positive economic shocks. They will raise prices in a situation of financial friction in addition to raising aggregate demand and output. Therefore, when debt contracts are denominated at nominal value, an increase in inflation improves the entrepreneur’s balance sheet, which both reduces the entrepreneur’s real debt level and increases the entrepreneur’s net worth. Further loan financing premiums fell and ultimately the ocean carbon investment environment improved. The second is the channel of capital accumulation. Negative economic shocks including blue firms TFP shocks, environmental technology shocks, disaster shocks, and carbon emission policy cause aggregate demand to decline, capital prices to drop, and collateral values to fall. As a result, external financing premiums rise. Credit spreads that are getting wider reduce investment demand and capital accumulation. Investment and output are negatively impacted by this feedback mechanism over the long term, which is not favorable for ocean carbon capital’s investment.

5 Conclusions and policy recommendations

Achieving the carbon neutrality goal requires the joint efforts of emission reduction and sink increase, especially to tap the greater potential of ocean carbon sinks. We construct a BGG-DICE-DSGE model around the ocean carbon sink, which refers to Nordhaus’ framework for climate analysis and the financial friction of Bernanke, and draw the following conclusions.

Firstly, in ocean carbon sink trading, we compare the various effects of firm and governmental actions on the economy and climate change. We find that the impact of firms’ diverse technology advancements on improving the climate is greater than the government’s policy impact, particularly the TFP impact of blue carbon firms. Traditional monetary and fiscal policies only achieve economic benefits, but accelerate climate change, while existing environmental policies are difficult to reverse the trend of climate change.

Secondly, we conduct sensitivity analysis around ocean carbon sink, and compare different trends of exogenous shocks under different ocean output proportion, ocean carbon sink efficiency and trading prices. The results show that after increasing the ocean output proportion and the ocean carbon sink efficiency, the effect of improving climate change is more obvious. The former mitigates the negative environmental impact of exogenous shocks, while the latter strengthens the positive impact. However, after changing the carbon sink trading price, the impulse response doesn’t change significantly, indicating that the current trading price couldn’t produce significant environmental benefits.

Finally, we make a further exploration in the financial market and carry out a welfare analysis. The results show that the social welfare is reduced under the constraint of emission reduction policy, but it is significantly improved under the ocean carbon sink trading, and further improved under more positive government policy shock and higher proportion of ocean output. In addition, since the financial market was established, the output loss caused by the heterogeneity shock has grown due to the financial accelerator effect, which has also accelerated welfare loss.

This article puts forward the following suggestions: First, adhere to the implementation of strategies such as “land and sea coordination,” “maritime power,” and “maritime community with a shared future,” and cultivate and develop high-quality marine high-tech industries and economic development. Deepen the reform of marine science and technology systems and mechanisms, develop and expand emerging marine industries, and build a modern marine industry system. In the future, breakthroughs should continue to be made in areas such as seawater alkalization, artificial upwelling/downflow, ocean fertilization, large-scale seaweed cultivation, and electrochemical sink enhancement, in order to seize the international high ground and discourse power. The second is to improve the investment and financing mechanism by promoting blue carbon climate financial support and financial innovation to form stable and considerable carbon sink transaction prices and investment expectations. Enrich market entities with the help of innovative financial tools such as green funds and green bonds. For example, the trading system can be improved with the help of voluntary markets [certified emission reduction standards, project design standards, Chinese Certified Emission Reduction (CCER)], compliance markets (national and regional carbon trading markets), inclusive markets (carbon inclusive trading), international climate finance mechanisms (bilateral development banks and international financial institutions) and green financial service innovations (green credit, green insurance). The third is to strengthen basic research on marine carbon sinks and conduct methodological research on fishery carbon sink methodology, coastal salt marsh wetland carbon sink methodology, and marine pasture carbon sink methodology with the help of land-sea coordination, artificial upwelling and other means. With the application of the blockchain and remote sensing technology, the efficiency and quality of monitoring, accounting and evaluation of blue carbon projects can be improved. Focus on the progress of ocean remote sensing technology for sea fog, strong convection at sea, and marine ecology. The fourth is to encourage blue carbon trading and explore establishing a regional certified voluntary emission reduction market with blue carbon as the main trading product. The government provides necessary carbon sink funds to solve the “exchange” problem between the marine and current carbon quota markets. Through early government policy guidance, we can drive the enthusiasm of the whole society to participate, improve the market infrastructure and rules and regulations, and provide a good guarantee for later market-oriented operations.

Of course, this article still has the following improvements: Firstly, it relies on strict model assumptions and mathematical derivations. With the continuous maturity of DSGE models and the enrichment of ocean carbon sink theory in the future, relevant assumptions can be moderately relaxed and more elements related to the ocean field can be added; Secondly, due to space limitations and objective data availability, this article did not consider the regional differences in ocean carbon trading. In the future, discussions can focus on 11 coastal provinces and key cities; Finally, this article focuses more on the systematic performance of the ocean carbon sink market under short-term shocks, lacking further analysis under long-term stable states. In the future, in-depth research can be conducted around the steady-state values of key variables and variance decomposition.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material. Further inquiries can be directed to the corresponding author.

Author contributions

YX: Conceptualization, Methodology, Validation, Writing – original draft, Writing – review & editing. ZW: Software, Validation, Writing – original draft. LX: Writing – review & editing. GZ: Conceptualization, Data curation, Methodology, Software, Writing – original draft, Writing – review & editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This work was supported by the National Natural Science Foundation of China (Grant No.72303124), Natural Science Foundation of Shandong Province (Grant No. ZR2023QG037).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Abbreviations

BGG, Bernanke, Gertler and Gilchfist; CCER, Chinese Certified Emission Reduction; CCUS, Carbon Capture, Utilization and Storage; CDM, Clean Development Mechanism; DICE, Dynamic Integrated Model of Climate and the Economy; DSGE, Dynamic Stochastic General Equilibrium; EU, European Union; ETS, Emission Trading Scheme; ICAO, International Civil Aviation Organization; IET, International Emissions Trading; JI, Joint Implementation; NBS, National Bureau of Statistics; UNEP, United Nations Environment Programme; UNFCCC, United Nations Framework Convention on Climate Change; TFP, Total Factor Productivity.

References

Abdo M. H., Mougoué M. (2021). Financial frictions and macroeconomy during financial crises: A bayesian DSGE assessment. Am. Bus. Rev. 24, 62–69. doi: 10.37625/abr.24.2.62-99

Amiri H., Sayadi M., Mamipour S. (2021). Oil price shocks and macroeconomic outcomes; Fresh evidences from a scenario-based NK-DSGE analysis for oil-exporting countries. Resour. Policy. 74, 102262. doi: 10.1016/j.resourpol.2021.102262

Annicchiarico B., Diluiso F. (2019). International transmission of the business cycle and environmental policy. Resour. Energy. Econ. 58, 101112. doi: 10.1016/j.reseneeco.2019.07.006

Barro R. J. (2006). Rare disasters and asset markets in the twentieth century. Q. J. Econ. 121, 823–866. doi: 10.1162/qjec.121.3.823

Bernanke B. S., Gertler M., Gilchrist S. (1999). The financial accelerator in a quantitative business cycle framework. Handb. Macro. 1, 1341–1393. doi: 10.1016/S1574-0048(99)10034-X

Cardani R., Croitorov O., Giovannini M., Pfeiffer P., Ratto M., Vogel L. (2022). The Euro Area’s pandemic recession: A DSGE-based interpretation. J. Econ. Dyn. Control. 143, 104512. doi: 10.1016/j.jedc.2022.104512

Chan Y. T. (2020). Are macroeconomic policies better in curbing air pollution than environmental policies? A DSGE approach with carbon-dependent fiscal and monetary policies. Energy Policy. 141, 111454. doi: 10.1016/j.enpol.2020.111454

Chan Y. T. (2022). The macroeconomic impacts of the COVID-19 pandemic: A SIR-DSGE model approach. China Econ. Rev. 71, 101725. doi: 10.1016/j.chieco.2021.101725

Chiarini B., Ferrara M., Marzano E. (2020). Tax evasion, investment shocks, and the consumption puzzle: A DSGE analysis with financial frictions. J. Money Credit Bank. 52, 907–932. doi: 10.1111/jmcb.12616

Dong F., Yu B., Hadachin T., Dai Y., Wang Y., Zhang S., et al. (2018). Drivers of carbon emission intensity change in China. Resour. Conserv. Recycl. 129, 187–201. doi: 10.1016/j.resconrec.2017.10.035

Fan Y., Wu J., Xia Y., Liu J. Y. (2016). How will a nationwide carbon market affect regional economies and efficiency of CO2 emission reduction in China? China Econ. Rev. 38, 151–166. doi: 10.1016/j.chieco.2015.12.011

Fernández P. A., Amsler C. D., Hurd C. L., Díaz P. A., Gaitán-Espitia J. D., Macaya E. C., et al. (2024). Diverse inorganic carbon uptake strategies in Antarctic seaweeds: Revealing species-specific responses and implications for Ocean Acidification. Sci. Total Environ. 945, 174006. doi: 10.1016/j.scitotenv.2024.174006

Fernández-Villaverde J., Guerrón-Quintana P. A. (2021). Estimating DSGE models: Recent advances and future challenges. Annu. Rev. Econ. 13, 229–252. doi: 10.1146/annurev-economics-081020-044812

Gourio F. (2012). Disaster risk and business cycles. Am. Econ. Rev. 102, 2734–2766. doi: 10.1257/aer.102.6.2734

Gross I., Hansen J. (2021). Optimal policy design in nonlinear DSGE models: An n-order accurate approximation. Eur. Econ. Rev. 140, 103918. doi: 10.1016/j.euroecorev.2021.103918

Gruber N., Clement D., Carter B. R., Feely R. A., Van Heuven S., Hoppema M., et al. (2019a). The oceanic sink for anthropogenic CO2 from 1994 to 2007. Science 363, 1193–1199. doi: 10.1126/science.aau5153

Gruber N., Landschützer P., Lovenduski N. S. (2019b). The variable Southern Ocean carbon sink. Annu. Rev. Mar. Sci. 11, 159-186. doi: 10.1146/annurev-marine-121916-063407

Iida Y., Takatani Y., Kojima A., Ishii M. (2021). Global trends of ocean CO2 sink and ocean acidification: An observation-based reconstruction of surface ocean inorganic carbon variables. J. Oceanogr. 77, 323–358. doi: 10.1007/s10872-020-00571-5

Iwasaki Y., Muto I., Shintani M. (2021). Missing wage inflation? Estimating the natural rate of unemployment in a nonlinear DSGE model. Eur. Econ. Rev. 132, 103626. doi: 10.1016/j.euroecorev.2020.103626

Jerow S., Wolff J. (2022). Fiscal policy and uncertainty. J. Econ. Dyn. Control. 145, 104559. doi: 10.1016/j.jedc.2022.104559

Jiao N., Herndl G. J., Hansell D. A., Benner R., Kattner G., Wilhelm S. W., et al. (2010). Microbial production of recalcitrant dissolved organic matter: Long-term carbon storage in the global ocean. Nat. Rev. Microbiol. 8, 593–599. doi: 10.1038/nrmicro2386

Junior C. J. C., Garcia-Cintado A. C. (2021). Rent-seeking in an emerging market: A DSGE approach. Econ. Syst. 45, 100775. doi: 10.1016/j.ecosys.2020.100775

Krause-Jensen D., Duarte C. M. (2016). Substantial role of macroalgae in marine carbon sequestration. Nat. Geosci. 9, 737–742. doi: 10.1038/ngeo2790

Krause-Jensen D., Lavery P., Serrano O., Marbà N., Masque P., Duarte C. M. (2018). Sequestration of macroalgal carbon: The elephant in the Blue Carbon room. Biol. Lett. 14, 20180236. doi: 10.1098/rsbl.2018.0236

Li Y., Deng C., Jiang P., Wei Y., Wang K. (2024). Provincial marine carbon sink transfer in China: Structural drivers and key consumption pathways. Front. Mar. Sci. 11. doi: 10.3389/fmars.2024.1438096

Liu L., He L. Y. (2021). Output and welfare effect of green credit in China: Evidence from an estimated DSGE model. J. Clean Prod. 294, 126326. doi: 10.1016/j.jclepro.2021.126326

Mu J., Yan L., Wu S. (2022). Growing with inequality: A DSGE model with heterogeneous human capital and endogenous economic growth. Appl. Econ. 55, 3689-3715. doi: 10.1080/00036846.2022.2117778

Niu T., Yao X., Shao S., Li D., Wang W. (2018). Environmental tax shocks and carbon emissions: An estimated DSGE model. Struct. Change Econ. Dyn. 47, 9–17. doi: 10.1016/j.strueco.2018.06.005

Nordhaus W. (2018). Evolution of modeling of the economics of global warming: changes in the DICE model 1992–2017. Clim. Change. 148, 623–640. doi: 10.1007/s10584-018-2218-y

Rubio M. (2020). Monetary policy, credit markets, and banks: A DSGE perspective. Econ. Lett. 195, 109481. doi: 10.1016/j.econlet.2020.109481

Shi W., Fu X., Han Y., Qin J., Sun J. (2024). Impact of ocean acidification on microzooplankton grazing dynamics. Front. Mar. Sci. 11. doi: 10.3389/fmars.2024.1414932

Sobieraj J., Metelski D. (2021). Application of the bayesian new keynesian DSGE model to polish macroeconomic data. Eng. Econ. 32, 140–153. doi: 10.5755/j01.ee.32.2.27214

Taillardat P., Friess D. A., Lupascu M. (2018). Mangrove blue carbon strategies for climate change mitigation are most effective at the national scale. Biol. Lett. 14, 20180251. doi: 10.1098/rsbl.2018.0251

Tiwari T., Kaur G. A., Singh P. K., Balayan S., Mishra A., Tiwari A. (2024). Emerging bio-capture strategies for greenhouse gas reduction: Navigating challenges towards carbon neutrality. Sci. Total Environ. 929, 172433. doi: 10.1016/j.scitotenv.2024.172433

Tréguer P., Bowler C., Moriceau B., Dutkiewicz S., Gehlen M., Aumont O., et al. (2018). Influence of diatom diversity on the ocean biological carbon pump. Nat. Geosci. 11, 27–37. doi: 10.1038/s41561-017-0028-x

Wang S. L. (2021). Fiscal stimulus in a high-debt economy? A DSGE analysis. Econ Model. 98, 118–135. doi: 10.1016/j.econmod.2021.02.009

Wang S., Yi X. (2022). Can the financial industry ‘anchor’carbon emission reductions? —The mediating and moderating effects of the technology market. Energy Environ. 34, 0958305X2110618. doi: 10.1177/0958305X211061810

Weiss L., Ludwig W., Heussner S., Canals M., Ghiglione J. F., Estournel C., et al. (2021). The missing ocean plastic sink: Gone with the rivers. Science 373, 107–111. doi: 10.1126/science.abe0290

Xiao G., Wang Y., Wu R., Li J., Cai Z. (2024). Sustainable maritime transport: A review of intelligent shipping technology and green port construction applications. J. Mar. Sci. Eng. 12, 1728. doi: 10.3390/jmse12101728

Xiao G., Xu L. (2024). Challenges and opportunities of maritime transport in the Post-Epidemic Era. J. Mar. Sci. Eng. 12, 1685. doi: 10.3390/jmse12091685

Xu L., Shen C., Chen J. (2024b). The impact of the Maritime Silk Road Initiative on the carbon intensity of the participating countries. Marit Econ Logist. 26, 1–19. doi: 10.1057/s41278-024-00295-z

Xu L., Shen C., Chen J., Pan X., Xiao G. (2024a). Efficiency evaluation and improvement pathway of sulfur-oxide emissions in European ports based on Context-dependent SBM-DEA model. Mar. Pollut. Bull. 208, 117002. doi: 10.1016/j.marpolbul.2024.117002

Xu Y., Zhang Y., Ji J., Xu J., Liang Y. (2023). What drives the growth of China’s mariculture production? An empirical analysis of its coastal regions from 1983 to 2019. Environ. Sci. Pollut. Res. 30, 111397–111409. doi: 10.1007/s11356-023-30265-6

Zhao Z., Meenagh D., Minford P. (2022). Should Hong Kong switch to Taylor rule?—Evidence from DSGE model. Appl. Econ. 54, 1–22. doi: 10.1080/00036846.2022.2053655

Keywords: DSGE, DICE, ocean carbon sink, financial friction, climate change

Citation: Xu Y, Wei Z, Xu L and Zhou G (2024) Double effect of ocean carbon sink trading and financial support: analysis based on BGG-DICE-DSGE model. Front. Mar. Sci. 11:1473828. doi: 10.3389/fmars.2024.1473828

Received: 31 July 2024; Accepted: 28 October 2024;

Published: 14 November 2024.

Edited by:

James Scott Maki, Marquette University, United StatesReviewed by:

Huaping Sun, Jiangsu University, ChinaGuangnian Xiao, Shanghai Maritime University, China

Copyright © 2024 Xu, Wei, Xu and Zhou. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Gang Zhou, emhvdWdhbmdAb3VjLmVkdS5jbg==

Yao Xu

Yao Xu Zhenhao Wei3

Zhenhao Wei3 Gang Zhou

Gang Zhou