- School of Economics, Ocean University of China, Qingdao, China

As a new mode of marine industry, marine ranching is gradually becoming an important means to promote the high-quality development of marine economy. Meanwhile, the technological innovation of marine ranching enterprises (MREs) can enhance the economic and ecological functions of marine ranching. This paper builds an evolutionary game model including MREs, government and consumers to analyze strategic choices. The results show that: (1) The government’s incentive policies play a key role in the initial period of MREs, while the government can gradually eliminate the policies in the mature period of MREs. (2) Government’s incentive policies consist of subsidy and tax policies. The subsidy amount should be moderate in order to avoid financial burdens, and the tax policy should be adaptation to different types of MREs. (3) Consumers’ preference significantly affects the strategy of MREs innovation. Government subsidies for consumers with different preferences can guide market demand and provide market signals for MREs. This study provides an important reference for MREs to formulate technological innovation strategy and the government to formulate relevant policies

1 Introduction

The ocean is a strategic place for sustainable development and can provide huge economic benefits. However, with the deepening of industrialization, the overfishing of marine resources and the intensification of climate change, a series of prominent problems such as marine pollution, resource shortage and ecological imbalance have appeared (Ramírez et al., 2022; Lincoln et al., 2023; Ullah et al., 2023). In 2015, the United Nations (UN) listed the sustainability of marine resources as one of the key development goals. In this context, as an important tool for resource enhancement and ecological sustainable development, marine ranching has emerged as a new industry (Yu and Zhang, 2020), and many countries began to explore the development path of marine ranching (Chen et al., 2019).

The construction of marine ranching is a complex system project containing multi-disciplines and multi-agents (Zhang et al., 2023), which is highly dependent on marine technology (Qin et al., 2021; Hou and Zhan, 2023). With the in-depth research on the development path of marine ranching, many problems still exist in the construction process, such as long return cycle, bottleneck of key technologies, the lack of the coordination among diverse participants, inadequate innovation ability, and insufficient supervision (Yu and Zhang, 2020; Qin et al., 2022; Jin and Quan, 2023), which puts forward more urgent and strict requirements for technological innovation in marine ranching. As an important subject and active promoter of technological innovation, marine ranching enterprises (MREs) are the key forces to realize the ecological, economic and social benefits of marine ranching (Sun et al., 2024). Through advanced environmental protection technology, enterprises can reduce the negative impact of aquaculture activities on marine ecology and achieve sustainable development (Anthony et al., 2023; Zhang et al., 2024). Secondly, with the help of intelligent aquaculture equipment and management system, enterprises can realize accurate monitoring and scientific management of fishery resources, so as to improve the production efficiency and economic benefits of fishery resources (Fan et al., 2023; Zhang et al., 2024). In addition, the development of virtual reality technology and the construction of an interactive marine science education platform can enhance consumers’ awareness of marine environmental protection (Yuen et al., 2022; Koh et al., 2023). Therefore, the technological innovation of MRE is not only an inevitable requirement to cope with environmental challenges and improve production efficiency, but also a key measure to promote the sustainable and healthy development of enterprises.

For MREs, even if it needs to bear social responsibility, it does not come at the expense of economic benefits (Shi et al., 2023). The government plays a key role in MRE technological innovation process. With positive and negative incentive measures, the government can guide the enterprise to choose innovation decision. Additionally, the enterprise’s choice is also closely related to consumer’s preference. Research shows that consumer preferences will significantly affect market demand and ultimately affect corporate decision-making and profits (Zhang et al., 2019; Meng et al., 2021; Chaudhuri et al., 2024). Today, consumers’ awareness of environmental protection is increasingly strengthened and their preferences are increasingly diversified, which puts forward higher requirements for the product quality, service experience and environmental friendliness of enterprises (Biswas et al., 2023; Fesenfeld et al., 2024). Traditional research on technological innovation mostly focuses on internal resources, technological capability and market environment, but neglects the profound influence of consumer’s preference on technological innovation strategy. In fact, consumer’s preference not only directly determines market demand and product structure, but also indirectly affects the direction of technological innovation and investment intensity of enterprises (Ploll et al., 2023; Barrientos et al., 2024; Cui et al., 2024). The efficient operation of marine ranching industrial ecosystem requires stakeholders to give full play to their own advantages and actively create value (Shi et al., 2023; Zhang et al., 2023). Therefore, in the process of technological innovation, MREs must fully consider consumer’s preferences, oriented to meet market demand, and enhance product added value and competitiveness. Therefore, it is necessary to discuss how government’s incentive policies and consumer’s preference affect technology innovation strategies of MREs.

Evolutionary game theory provides an effective tool for analyzing MRE technology innovation strategy. By constructing an evolutionary game model, it can reveal the strategy selection and evolution rules of enterprises in the process of technological innovation (Luo et al., 2023; Qian et al., 2023; Chen et al., 2024, 2024; Zheng and Wu, 2024; Zhou et al., 2024). In current researches considering consumer’s preference, evolutionary game analysis is also actively used to reveal the impact and evolutionary trend of different strategies (Qiao and Yin, 2021; Shi and Cheng, 2023; Chen et al., 2024; Yue et al., 2024). The application of evolutionary game in marine ranching mainly focuses on digital transformation, safety supervision, ecological development, blue carbon trading (Du et al., 2022; Sun et al., 2024; Wang et al., 2024; Zheng and Zhang, 2024), but there are few studies on technological innovation of marine ranching, and even fewer studies on the technological innovation strategies that combine consumer’s preference and government policies.

This paper constructs an evolutionary game model to simulate the evolution of MRE’s technological innovation strategy considering government’s incentive policies and consumer’s preference, and deeply analyzes the evolution process and influencing factors of technological innovation strategy. At the same time, the applicability and validity of the model are verified by combining case studies and the situation of the complex market, so as to provide theoretical support and policy suggestions for MRE’s technological innovation. The remainder of the paper is organized as follows. Section 2 presents the model developed in this study. Section 3 presents the evolutionary game process and the stability analysis. Section 4 presents the numerical simulations. Section 5 provides a brief conclusion and recommendations.

2 Construction of the evolutionary game model

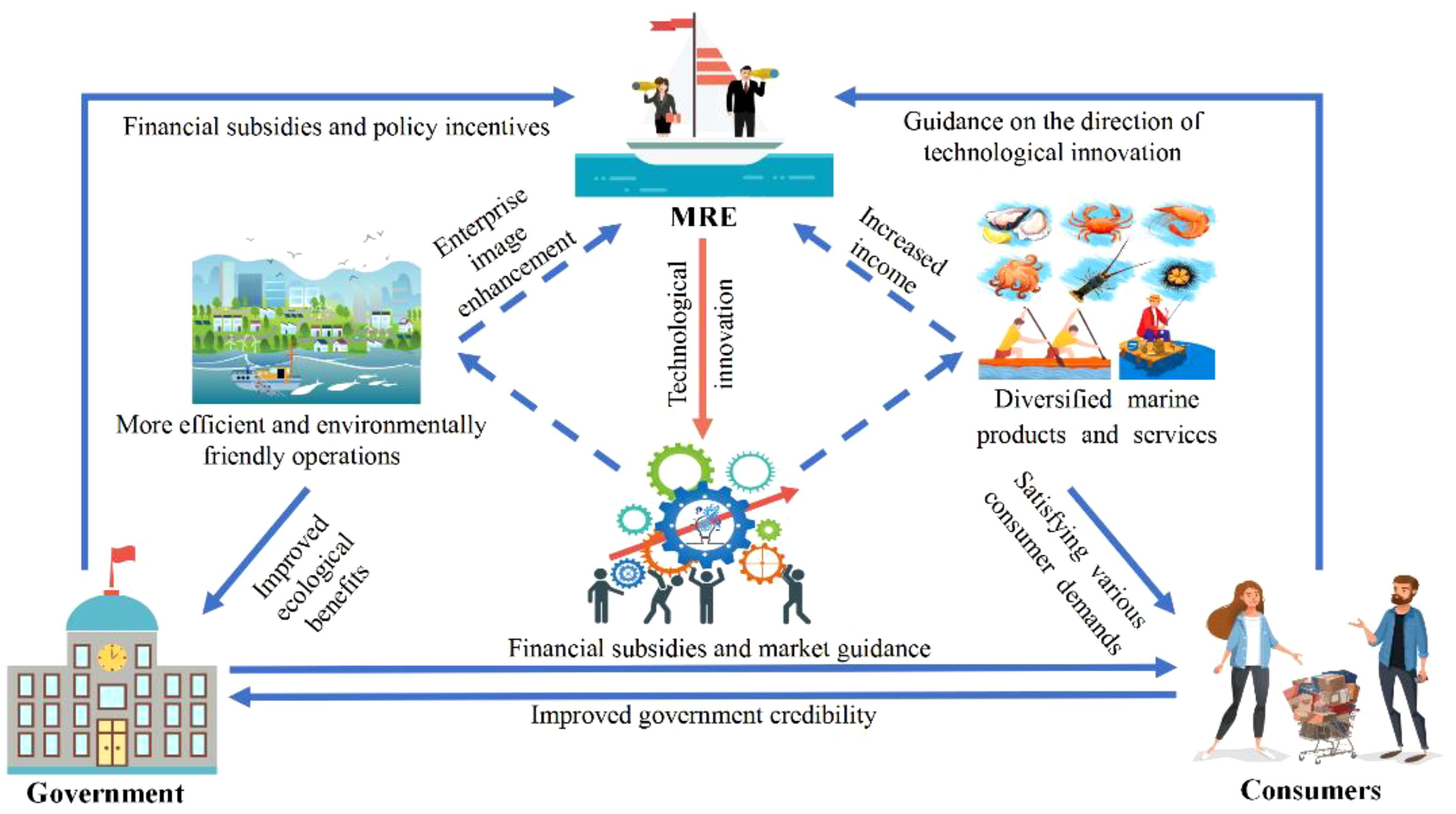

2.1 Participants and their behavioral logic analysis

Firstly, the government plays an important role in the development of marine ranching. The government encourages and supports the development of MREs through the implementation of incentive policies. The policies include capital subsidies, tax incentives, technical support and other forms, and the target of the subsidy is usually the enterprise, aiming to reduce the operating costs of the enterprise and improve its market competitiveness. At the same time, the target of subsidies can also be consumers, through government subsidies to reduce the price of products or services, giving consumers purchase concessions. In addition, the government also regulates the operating behavior of MREs, protects the rights and interests of consumers, and maintains fair competition in the market by formulating relevant regulations and policies. All these efforts will enable the government to obtain different degrees of performance benefits, such as improvement of the ecological environment and increase in social credibility.

Secondly, MREs, as the main undertakers of marine ranching construction, bear important economic and social responsibilities, and are the backbone of promoting the technological progress and industrial upgrading of marine ranching. While carrying out the construction and operation of marine ranching, enterprises can make use of government subsidies and preferential policies, invest capital and technology, carry out scientific breeding management and technological innovation, improve the yield and quality of marine products, expand the functions of fisheries, and create diversified eco-products to meet the diversified needs of consumers. At the same time, technological innovation can also better ensure the rational utilization of marine resources and the protection of the ecological environment, create more ecological benefits and establish a more positive corporate image.

Finally, the profits generated by the sale of marine products and services are an important guarantee for the sustainable development of the enterprise, and the source of these profits is largely dependent on the purchasing behavior of consumers. Consumer demand and purchasing behavior for marine products and services directly affects MRE’s sales revenue and profit level. Consumers will weigh the quality, price, safety and other factors of the product and choose the product that meets their preferences, and different products bring different utility to consumers. For enterprises, consumers’ choice of strategy is the direction and extent of technological innovation. Producers will decide whether and how to innovate technologically based on market demand, technical feasibility, and other factors. In addition, when the government implements a subsidy policy for consumers, consumers may enjoy lower prices for marine products and services, thus increasing their purchasing power. Enterprises may also organize publicity and educational activities to increase consumer awareness and trust in marine products and services, further promoting the growth of market demand. In the process of evolutionary games, the strategic choices between consumers and MREs will be continuously adjusted and evolved. Changes in consumer preferences will lead producers to make technological innovations, which in turn will influence consumer preferences. This process of mutual influence and adaptation promotes the continuous innovation and development of MRE technology. The relationship between the three parties are show in Figure 1.

2.2 Model hypotheses

Based on the above analysis, in order to establish the three-party evolutionary game model of MRE, government and consumers, this paper puts forward the following hypotheses:

H1: MRE, government and consumers are all finite rationality. The strategy choice of the game parties is based on the consideration of maximizing their own interests to make the corresponding strategy choice.

H2: The strategy set of MRE is {innovate, not innovate}, in which the probability of enterprises choosing technological innovation is x, and the probability of no technological innovation is . The prices of products and services corresponding to the two strategies are , ; and the costs are , , respectively. The investment cost paid by enterprises for technological innovation is I. The additional benefit obtained is , and the part of the enhanced ecological and environmental benefits in indirectly affects the governance effect of the government, and the feedback factor is m, 0<m<1 (Gao et al., 2022).

H3: The government’s strategy set is {support, not support}{supportive, Unsupported}, where the probability that the government supports the technological innovation is y, and the probability that it does not support it is . When the government supports it will provide subsidies, where the subsidy to enterprises is , the subsidy to strong preference consumers is , and the subsidy to weak preference consumers is . At the same time the government will also receive an additional benefit . When the government chooses not to support it will not provide a subsidy and only enjoys the base benefit . The government tax on technologically innovative enterprises is and the tax on traditional enterprises is , with <.

H4: Consumers in the market have different preferences, the preference set is {strong preference, weak preference}, the probability of strong preference consumers is z, and the probability of weak preference consumers is . Strong and weak preferences affect consumers’ price sensitivity to products and services. Strong preference consumers are more inclined to choose products and services that meet marine ecological standards and have little impact on the environment, and they are more interested in diversified products and services after technological innovation of enterprises, so they are less price sensitive and show stronger willingness to buy, with a sensitivity coefficient of . While weak preference consumers are less interested in products and services with new and diversified products and services, and it is harder for them to accept the premium, so they are more price sensitive, and the sensitivity coefficient is , <. Different products and services have different utility to consumers, the utility to consumers of new products and services produced by technologically innovative enterprises is , and the utility to consumers of traditional products and services is , > .

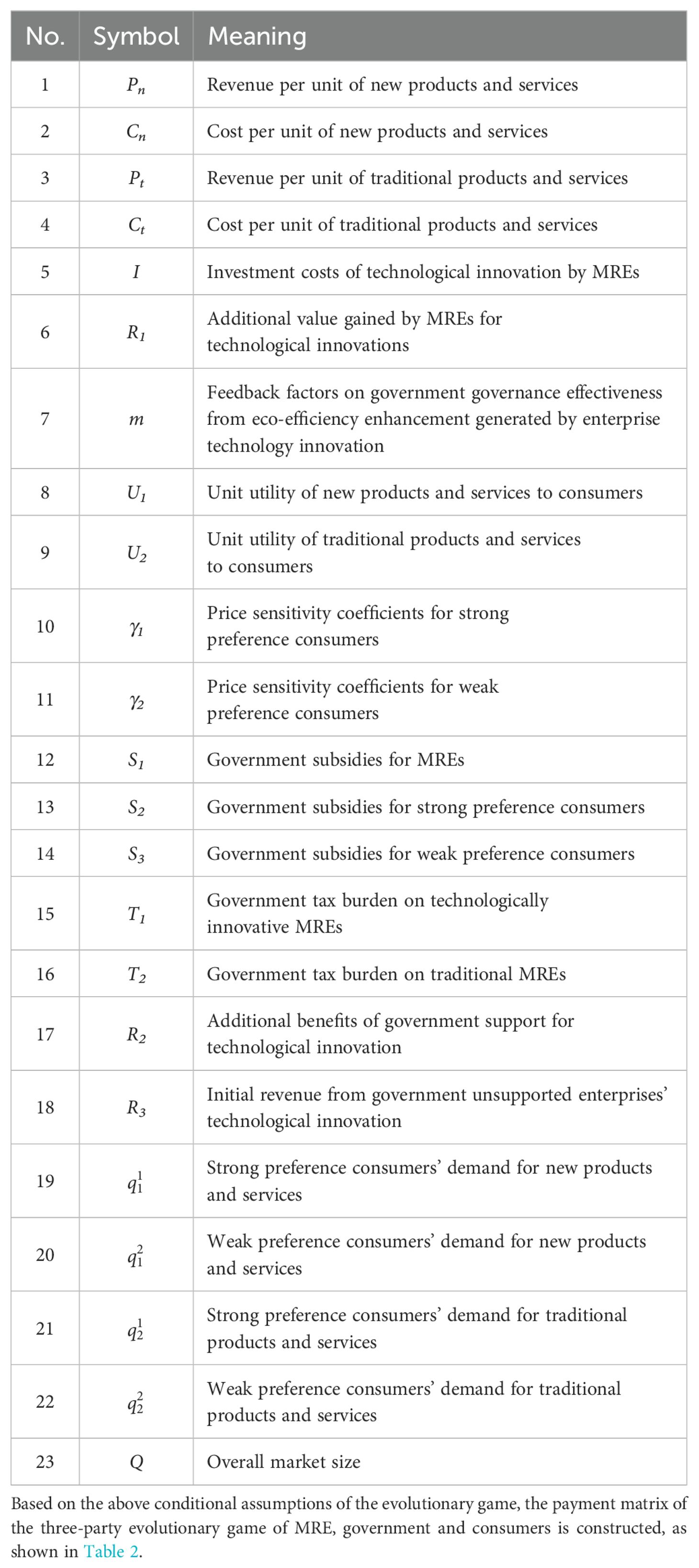

H5: To simplify the calculation, referring to Zheng and Yu, 2022; Guo et al., 2024; Jie and Xin, 2024; Wang et al., 2024, we define the demand for different products by consumers with different preferences as: , , , , where , represent the demand of strong preference and weak preference consumers for new products and services; , represent the demand of strong preference and weak preference consumers for traditional products and services, and Q is the maximum market size. Based on the above analysis, the parameter setting table is obtained, as shown in Table 1.

3 Stability analysis

3.1 The process of evolution

According to Table 2, the expected benefit for the MRE when choosing technological innovations is represented as , while the expected benefit when choosing no technological innovations is . The average benefit, calculated based on these two scenarios, is .

Substituting Equations 1 and 2 in Equation 3, we can obtain the replication dynamic equation for the MRE. Also we can get its first derivative with respect to x:

The expected benefit of supportive strategy and unsupported strategy of the government , and the average benefit are, respectively:

Substituting Equations 6 and 7 in Equation 8, we can obtain the replication dynamic equation for the government. Also we can get its first derivative with respect to y:

The expected benefit for strong preference consumers is , while the expected benefit for weak preference consumers is . The average benefit, calculated based on these two scenarios, is .

Substituting Equations 11 and 12 in Equation 13, we can obtain the replication dynamic equation for the consumers. Also we can get its first derivative with respect to z:

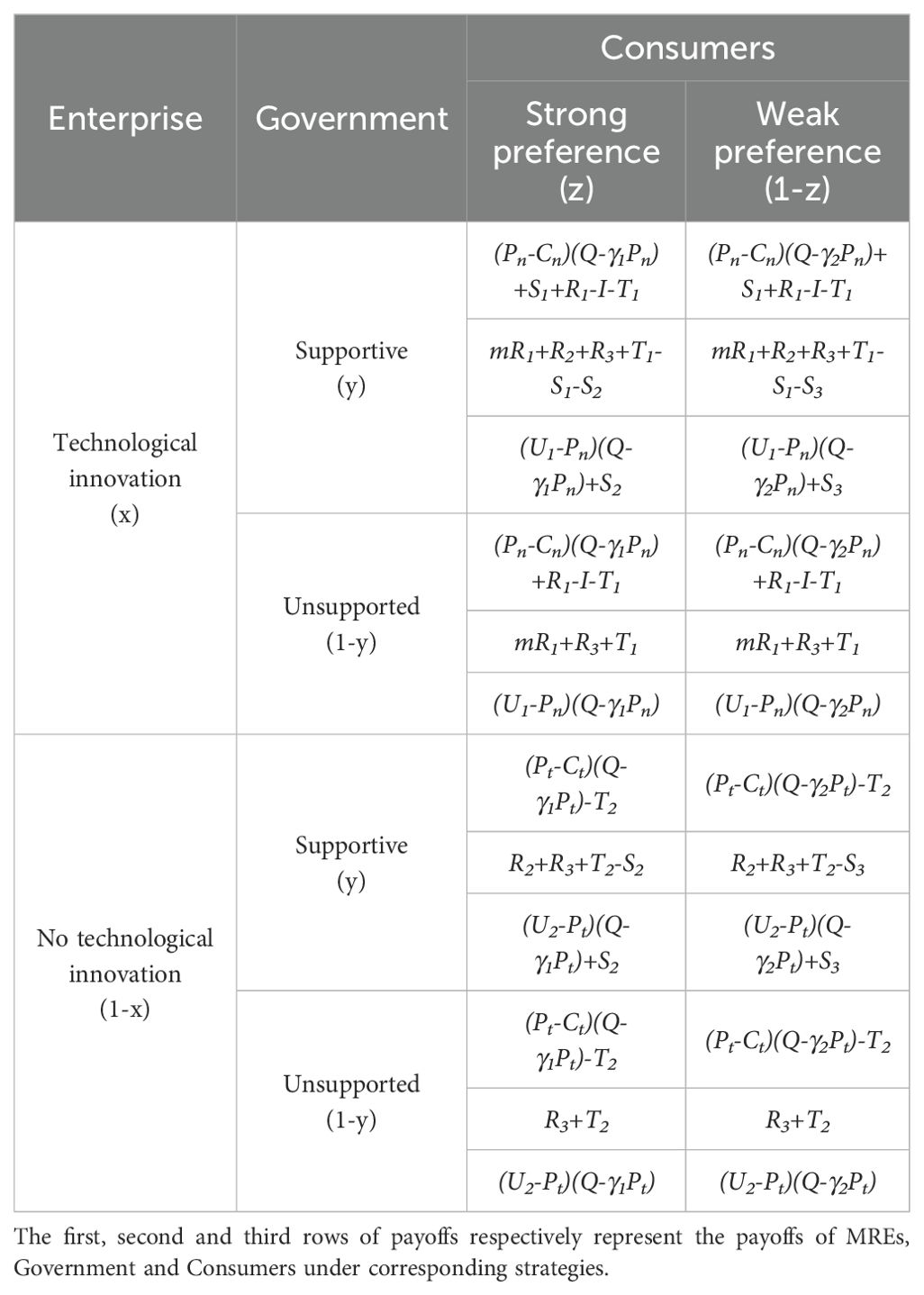

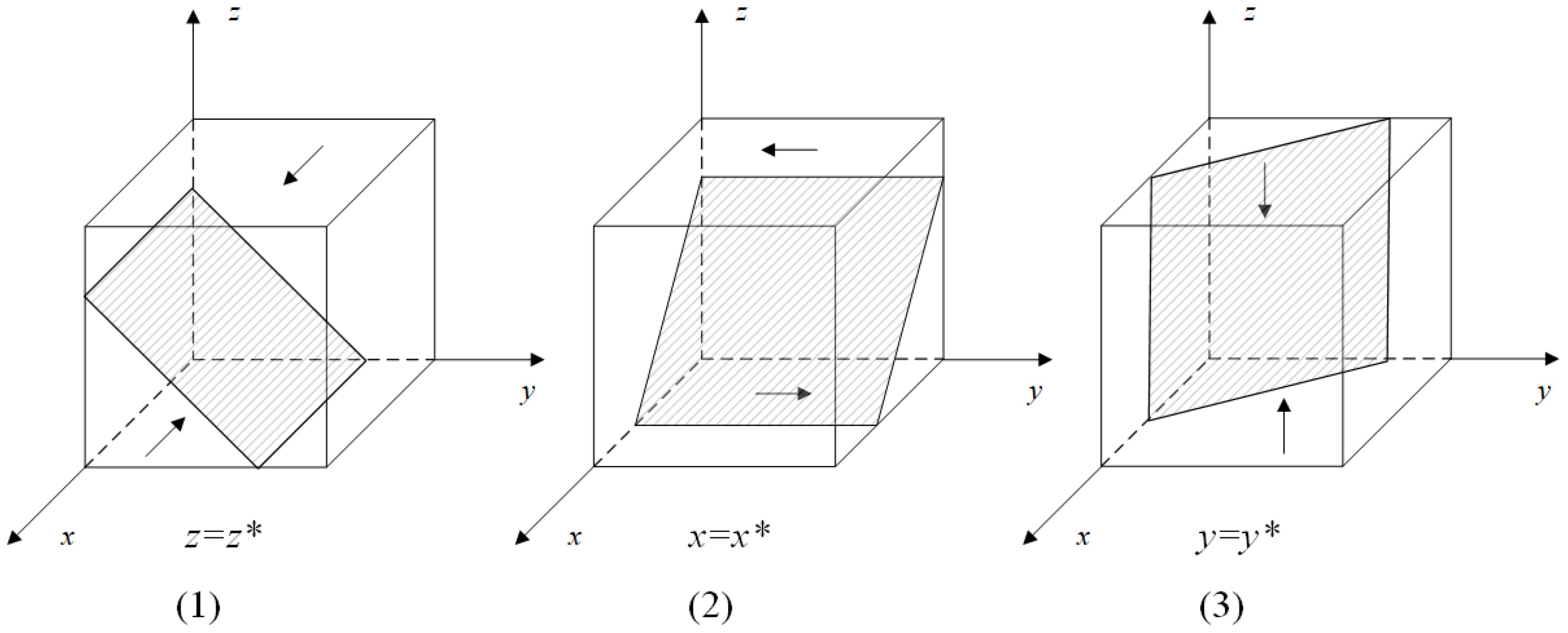

According to the stability theorem of the differential equation of evolutionary game, in order to keep a certain strategy in a stable state, the probabilities x, y and z of MRE, government and consumers choosing this strategy must be satisfied respectively: , ; , ; , . Based on the above analysis, according to Equations 5, 10 and 15, when , at this point, , and the strategy chosen by the MRE is not stable. However, when , , and x = 0 is the evolutionary stable point for the MRE. Conversely, when , , and x = 1 is the evolutionary stable point.

For the government, when , at this point, , and the government’s strategy is not a stable strategy. Nevertheless, when , , and y = 1 is the evolutionary stable point for the government. In contrast, when x , , and y = 0 is the evolutionary stable point.

For the consumers, when y , at this point, , and the consumers cannot determine a stable strategy. But when , , and z = 0 is the evolutionary stable point for the consumers. On the contrary, when , , and z = 1 is regarded as a stable strategy for consumers. The phase diagram of the replication dynamics for the MRE, government, and consumer parties is shown in Figure 2.

3.2 Equilibrium point stability analysis

According to , , , the equilibrium points of the three- party evolutionary game can be obtained from Equations 4, 9, and 14. The Jacobian matrix of the replicated dynamic equation system is shown below.

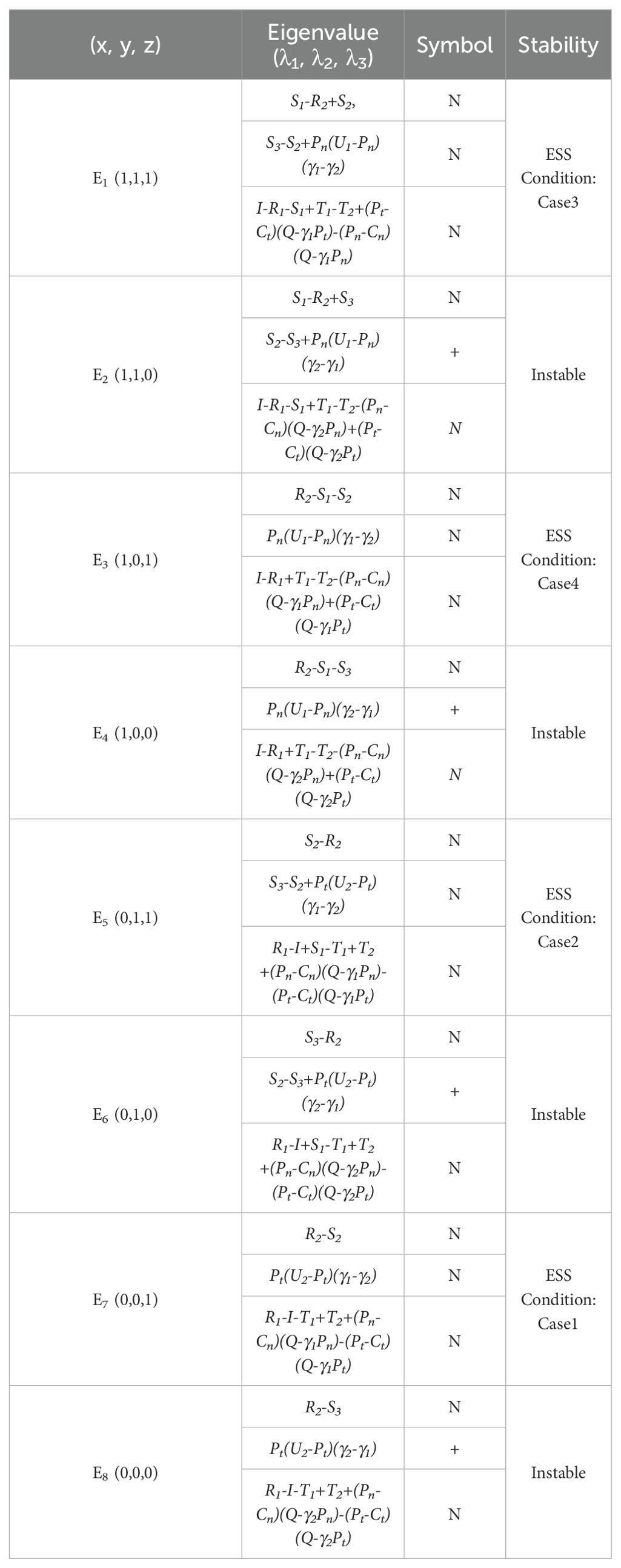

Since the equilibrium of the three- party evolutionary game must be a strict Nash equilibrium, eight pure strategy points can be derived, and substituting them into the Equation 16 yields the eigenvalues of the different strategies as shown in Table 3, and the stable point represents the evolutionary stable strategy (ESS) when all the eigenvalues are negative.

Without loss of generality, assuming that >>0, >>0, >>0, >>0, >>0, it can be concluded that E2(1,1,0), E4(1,0,0), E6(1,0,0) and E8(0,0,0) are the unstable points based on the above assumptions. The remaining four cases are further analyzed below.

Case 1: and

For consumers with different preferences, the benefits of MRE are different. According to the assumption conditions, facing the same products and services, the strong preference consumers bring more benefits to the MRE than the weak preference consumers bring to the MRE, which has nothing to do with whether the MRE carries out technological innovation or not, and such a conclusion is consistent with the reality. In other words, , . Regardless of consumer preferences, when the benefits to MREs from technological innovation are smaller than those from traditional operations, and the government subsidy to MRE technological innovation is not sufficient to make up the difference, then MREs will choose not to engage in technological innovation. Similarly, when , it is easy to know that , and the government will choose not to support technological innovation when the additional benefit gained from government support for MRE technological innovation is less than the cost of government subsidies to the outsiders. Purchase of products can bring additional utility to consumers, strong preference consumers purchase more than weak preference consumers, the former get more utility naturally, weak preference consumers will shift towards strong preference consumers. At this point E7 (0,0,1) is the stabilization point. In this equilibrium, MRE chooses no technological innovation strategy, the government chooses no unsupported strategy, and the consumers are strong preference consumers.

Case 2: and

This case is similar to Case 1, for either type of consumer, when the benefits to the MRE from technological innovation are less than the benefits from traditional operations, and the government’s subsidy to the MRE’s technological innovation is not sufficient to make up the difference, the MRE will choose not to engage in technological innovation at this point. It is worth noting that when , the government will choose to support technological innovation when the additional benefits gained from government support for MRE technological innovation are greater than the cost of government subsidies to MREs and consumers. At this time, E5 (0,1,1) is the stabilization point. In this equilibrium, MRE chooses the no technological innovation strategy, the government chooses the support strategy, and consumers are the strong preference consumers.

Case 3: and

This case builds on Case2 by changing the MRE’s strategy. Regardless of the type of consumer, when the benefits of technological innovation by the MRE are greater than the benefits of traditional operations, the MRE will choose to engage in technological innovation. When , the government will choose to support technological innovation when the additional benefits gained from government support for MRE technological innovation are greater than the cost of government subsidies to MREs and consumers. At this time E1 (1,1,1) is the stabilization point. In this equilibrium, MRE chooses the technological innovation strategy, the government chooses the support strategy, and the consumers are the strong preference consumers.

Case 4: and

This case is based on Case3 and changes the government’s strategy. Similarly, for either preference consumer, when the benefits of MRE to carry out technological innovation are greater than the benefits of traditional business, MRE will choose technological innovation strategy. However, when , it is known easily that , the government will choose not to support technological innovation when the additional benefits gained from government support for MRE technological innovation are less than the cost of government subsidies to the outsiders. At this point E3 (1,0,1) is the stabilization point. It is important to note that in this equilibrium condition, the government chooses the unsupported strategy, and in the absence of government subsidies, MRE still chooses the technological innovation strategy, the consumers are strong preference consumers, and the interests between the enterprises and the consumers achieve a good market-oriented cycle, which is a kind of ideal state of market maturity.

4 Numerical simulation

4.1 Simulation of the cases

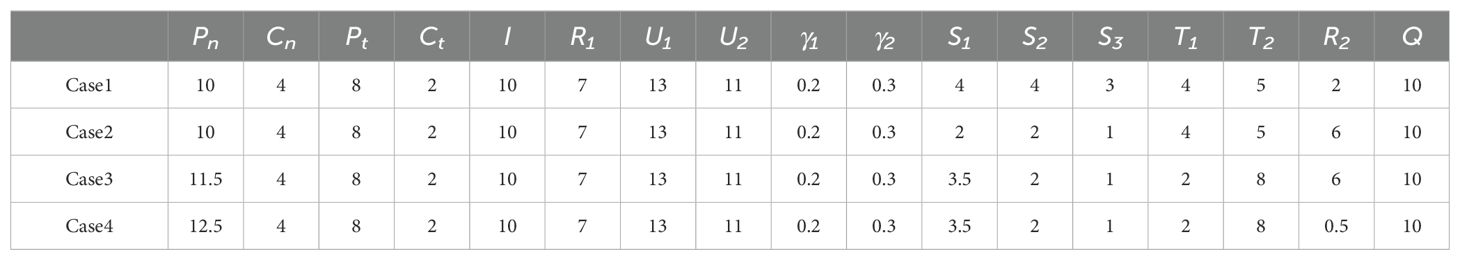

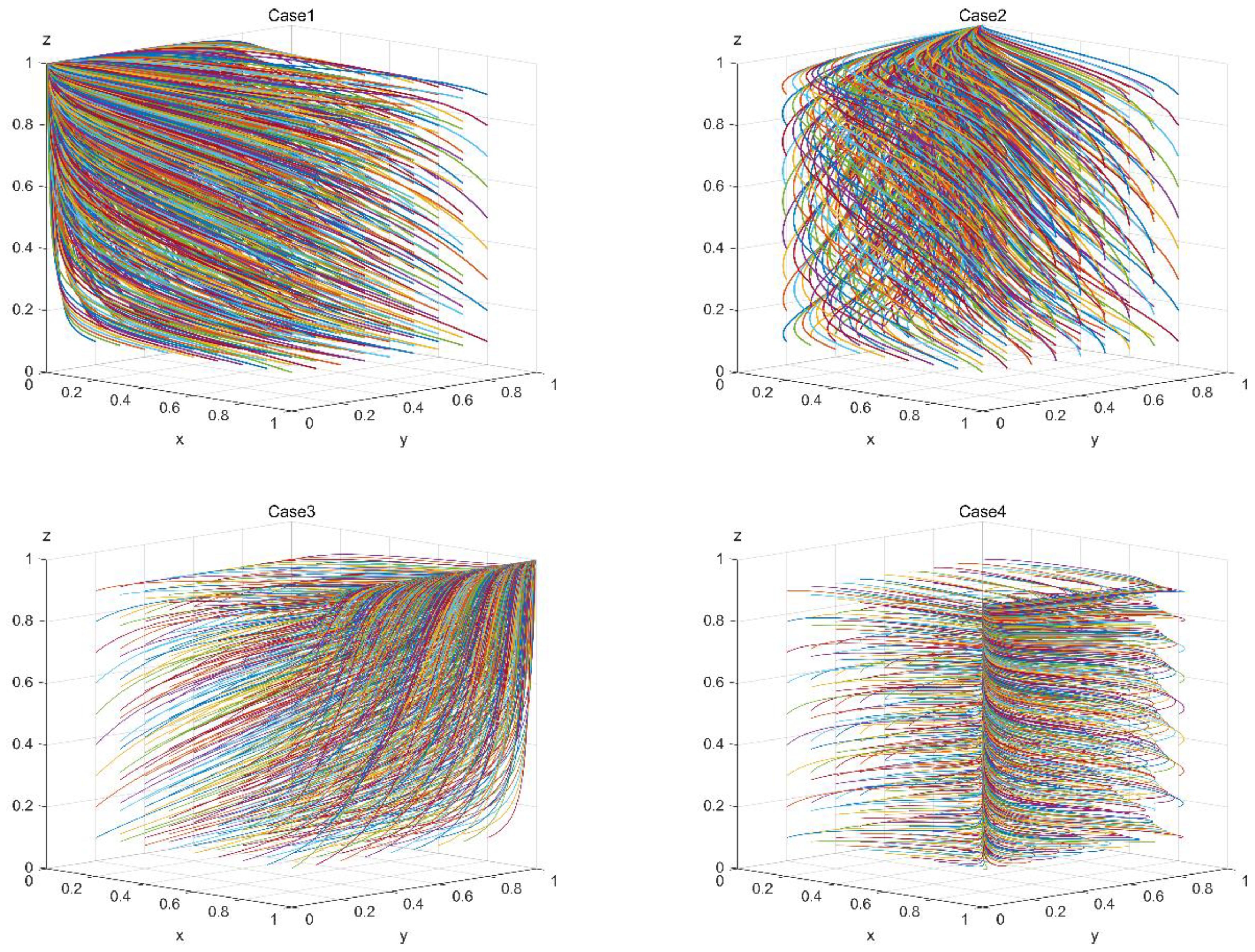

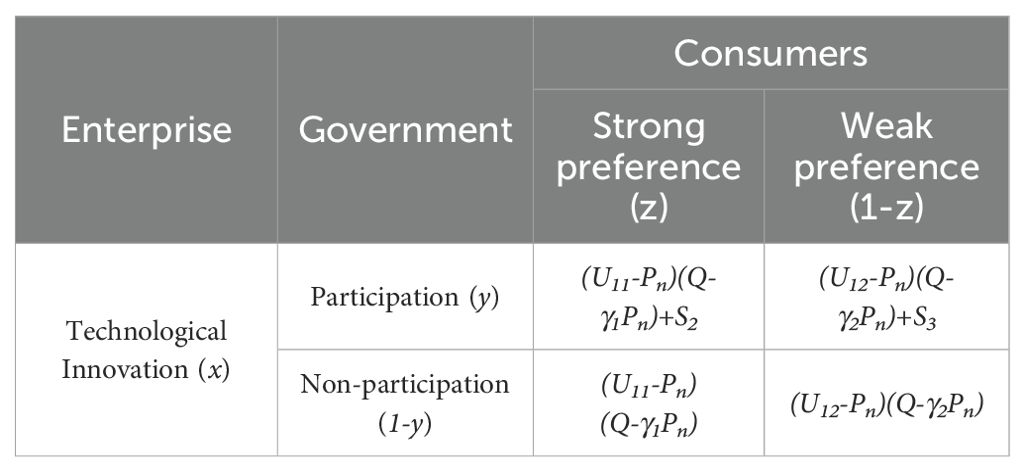

To confirm the above constructed evolutionary game model and derive the results, the model and its parameters were simulated and analyzed using MATLAB software. Referring to the research of Wan et al., 2021; Sun et al., 2024; Wang et al., 2024 and combining with the actual situation, while considering the overall equilibrium of the system and the basic assumptions based on the evolutionary game, the initial assignments of specific parameters are shown in Table 4.

As a new industry, Marine ranching industry also follows the basic laws of life cycle theory, including introduction period, growth period, maturity period and decline period. At different stages of development, the Marine ranching industry is facing different market environments and challenges. Introduction period: immature technology, low market awareness, need a lot of research and development and government support; Growth period: gradually mature technology, market awareness, rapid development of the industry; Maturity stage: Market saturation, fierce competition, need product differentiation and service innovation to maintain advantages; Recession period: The industry is declining, and it needs to transform and upgrade, find new growth points or consider quitting. The application of life cycle theory to Marine ranching industry is helpful to promote the sustainable development of Marine ranching industry.

Based on the life cycle theory, technological innovation in MRE can be simplified into three stages (Yang et al., 2021; Piila et al., 2022; Pan et al., 2023), the initial stage - governmental guidance and assistance, the development stage - the enterprise independent R&D and innovation practice, and mature stage - market maturity and self-driven. These three stages can correspond to each of the four cases analyzed above. In order to simplify the analysis, we will change certain values on the basis of one case to show the evolution process between the cases.

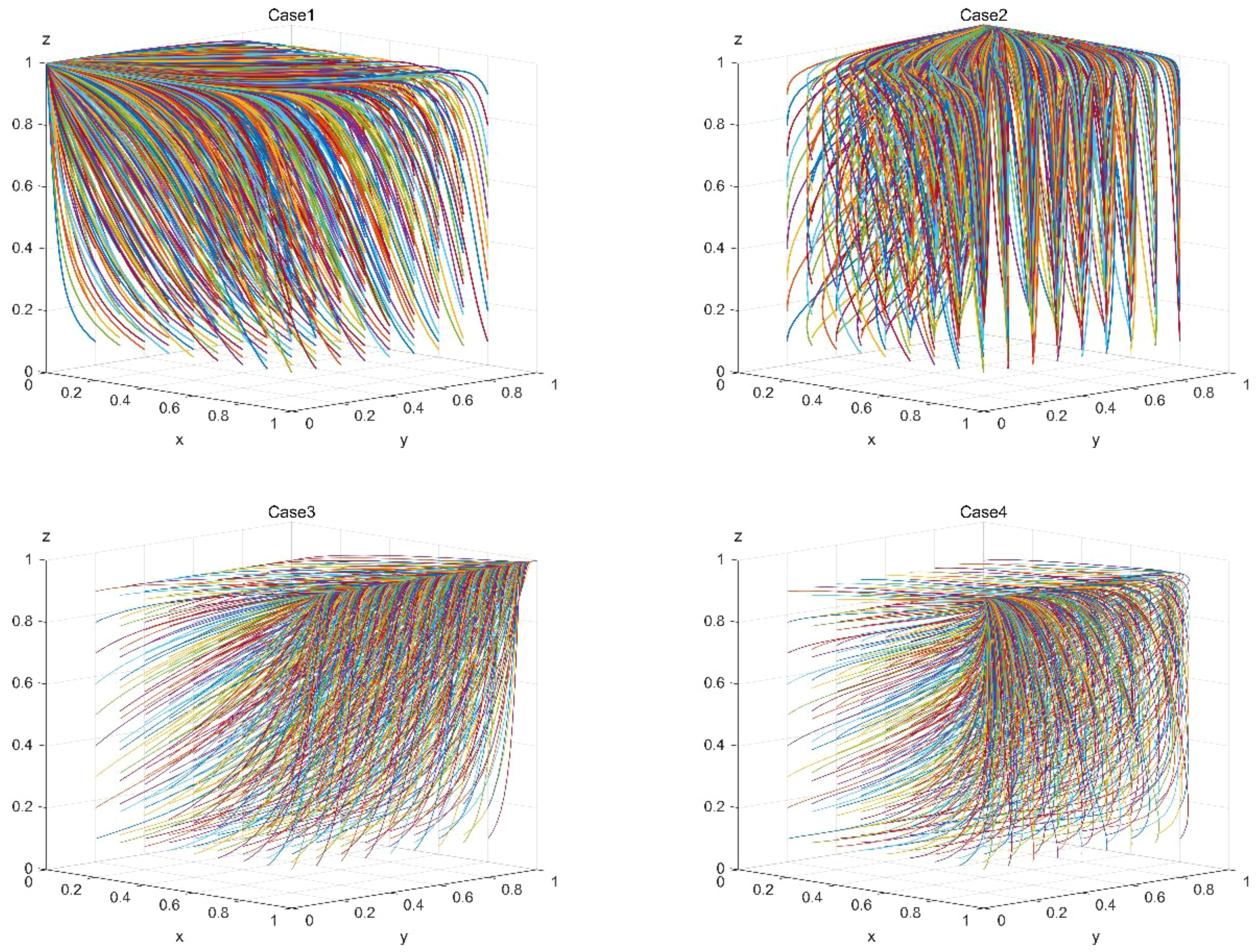

According to the set parameter values, the simulation of each of the above four cases is carried out, and the results are shown in Figure 3. Case1 is analyzed as the initial stage, when the parameter values of the cases satisfy the conditions and , E7 (0,0,1) is the ESS, which is in consistent with the above analysis, and further verifies the stability of the analysis is correct. In the early stage of the market, consumers are solid advocates of traditional products and services.

Keeping other values unchanged, set S1=S2 = 2, S3 = 1, R2 = 6 on the basis of Case1. That is, the government’s external subsidy cost is reduced, and the additional income obtained by the government in supporting technological innovation is increased. At this time, the government’s choice of support for technological innovation is profitable, and the ESS transfers from E7 (0,0,1) to E5 (0,1,1). Despite government support for enterprise technological innovation, in the early stages of the market, consumers’ embrace of traditional products and services makes the revenue generated by new products and services insufficient for enterprises to engage in technological innovation.

On the basis of Case2, set Pn=11.5, S1 = 3.5, T1 = 2, T2 = 8. In order to support MREs to make technological innovations, the government reduces the innovation cost of enterprises by increasing the subsidies to MREs and reducing the tax. At the same time, it induces technological innovation in traditional MREs by imposing a higher tax burden on them. Higher prices for new types of products and services can bring more revenue to enterprises, further pushing them to choose technological innovation strategies. The case transforms from Case2 to Case3, and the ESS transforms from E5 (0,1,1) to E1 (1,1,1). This phase is the development stage, when the government’s support for technological innovation of enterprises is increasing, and consumers’ acceptance of new products and services is increasing, MREs will carry out technological innovation to gain more benefits.

On the basis of Case3, set Pn=12.5, R2 = 0.5. In this case, the government’s choice of technological innovation strategy is a loss, if the condition is met, the government’s stability strategy is not to support technological innovation. With the withdrawal of the government from the partnership, the maturity of the market allows MRE to offset the loss of government subsidies by increasing the price of new products and services to increase profits. The case changes from Case3 to Case4, and the ESS transforms from E1 (1,1,1) to E3 (1,0,1). This stage is the mature stage, and MRE and consumers have formed a good marketization relationship, which is the most ideal state of evolutionary game.

Finding 1: The government plays an important role in the growth period of MREs. The government encourages enterprises to carry out technological innovation activities through positive and negative incentives. The government’s incentive policies play a key role in the growth period of MREs, while the government can gradually eliminate the policies in the mature period of MREs.

Finding 2: In the mature period of MREs, the government can gradually eliminate the incentive policies since MRE can offset the impact of reduced government subsidies by increasing the prices of products and services.

4.2 Relaxation of the hypothesis

4.2.1 Analysis of consumer maturity

In the above hypothesis, the utility of the products and services of marine ranch is greater than the cost that consumers pay for them, so there is no doubt that consumers will choose to purchase them. But in reality, there will be a more complicated market situation. The performance brought by new products is closely related to the market system and environment (Ding and Ding, 2022). New products often require consumers to have a certain understanding and cognition of new concepts, technologies or functions. Being able to identify the value of innovative products is the performance of mature consumers (Edler et al., 2011). However, in the initial stage, consumers may hold a conservative attitude towards MRE’s new products and services, so they need time to transform from immature to mature.

Therefore, we relax our hypothesis by assuming that the strong preference consumers in the market are mature consumers for whom the utility of the new products and services U11 is still greater than the cost of purchase by the consumers Pn, while the weak preference consumers are immature consumers for whom the utility of the new products and services U12 is less than the cost of purchase by the consumers Pn. In this case, the consumer’s benefit matrix when enterprises provide the new products and services is as shown in Table 5 shows.

At this point the consumer’s replication dynamic equation is:

Set U11 = 11, U12 = 9, and the other parameters remain unchanged as shown in Table 4. Based on Equations 17 and 18, we can obtain the results as shown in Figure 4. Compared with the results in Figure 3, it can be found that the evolutionary stable points of the four cases have not changed, and the stable points of Case1 to Case4 are E7 (0,0,1), E5 (0,1,1), E1 (1,1,1), E3 (1,0,1) respectively. The government plays a key role in the technological innovation of enterprises, and is an important promoter and guarantor of the development of technological innovation. Case2 is taken as the initial scenario below to provide an in-depth analysis of the role of government in the evolution of the cases.

4.2.2 The impact of government subsidies

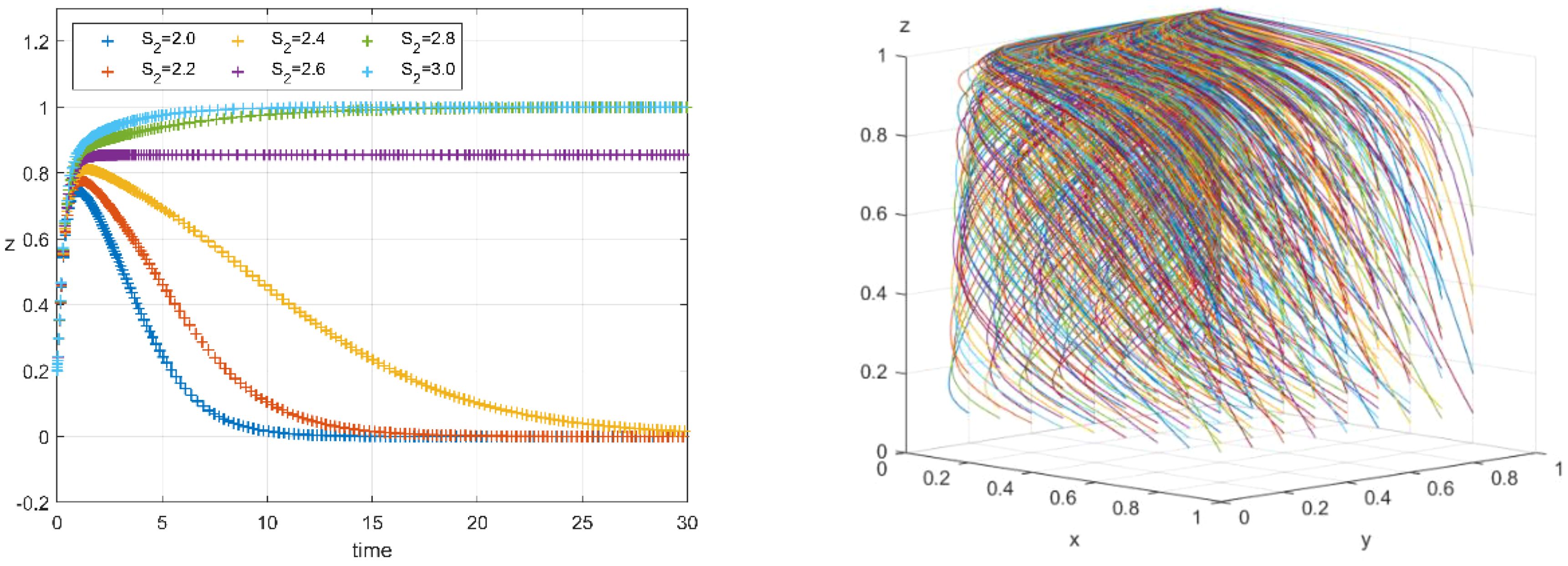

Based on the analysis in the previous subsection, this section explores the impact of government subsidies on the behavior of other subjects after relaxing the assumptions, setting S1 = 2, S2 = 2, S3 = 5. Firstly, a sensitivity analysis is conducted on the subsidy S2 given by the government to strong preference consumers. In order to be more in line with the initial market situation, the initial willingness of strong preference consumers is set to 0.2, that of the weak preference consumers is set to 0.8, and the initial willingness of both MREs and the government is set to 0.5. The simulation results are shown in Figure 5.

From the simulation results in the left figure, it can be seen that the change in S2 can change the evolutionary direction of consumers, and as S2 increases, the evolutionary direction of consumers changes from 0 to 1, where 2.6 is a key threshold value. When S2 is smaller than the threshold, consumers will eventually transform into weak preference consumers, and when S2 is larger than the threshold, consumers will eventually transform into strong preference consumers. The government subsidy given to strong preference consumers can promote the transformation of weak preference consumers to strong preference consumers. Set S2 = 3, when ESS is E5(0,1,1).

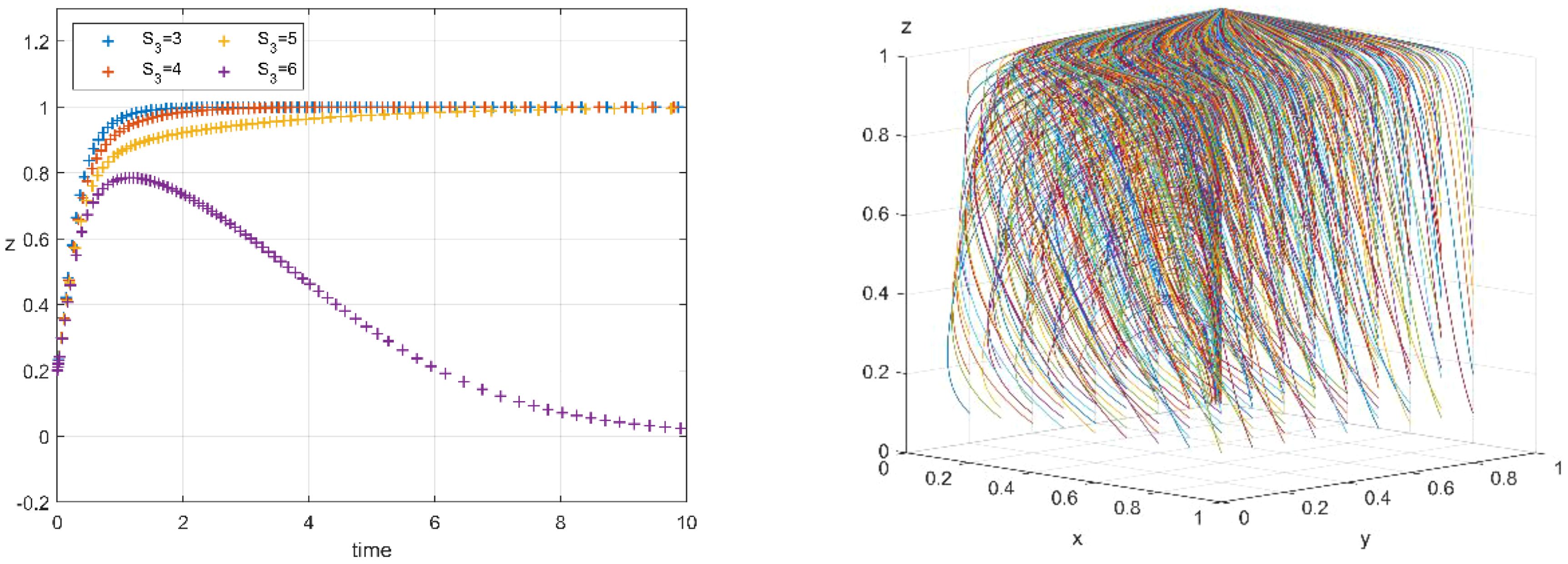

Further, we change the value of S3, and the results are shown in Figure 6. As S3 increases, the rate of consumer evolution to 1 gradually decreases. When S3 exceeds the threshold, the direction of consumer evolution changes from 1 to 0. Setting S3 = 6, ESS changes from E5(0,1,1) to E6(0,1,0). Government subsidies to weak preference consumers will hinder the transformation of weak preference consumers to strong preference consumers, and consumers in the market are still more inclined to accept traditional products and services, which is not conducive to the realization of MRE technological innovation.

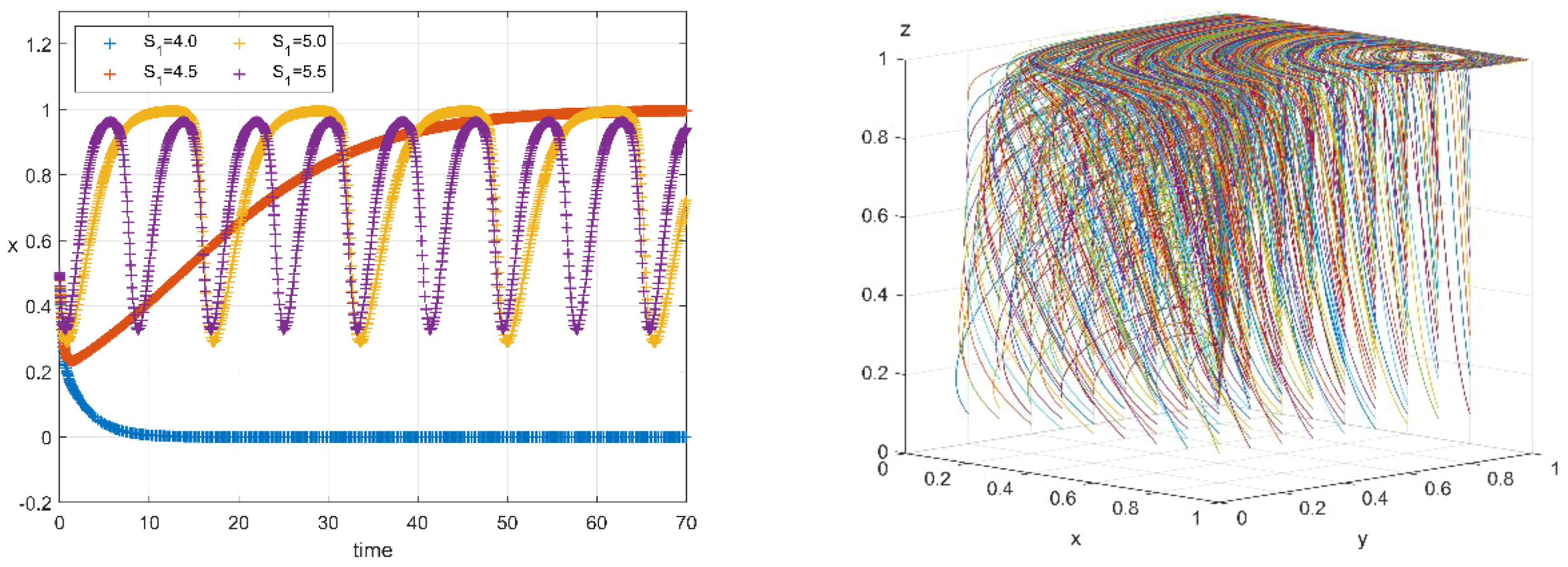

Finally, we explore the situation where the government subsidy S1 given to MREs changes. Varying the value of S1, the results are shown in Figure 7. When S1 = 4 and S1 = 4.5, the evolution direction of MRE is 0 and 1 respectively. However, when the value of S1 continues to increase, the evolution direction of MRE is periodically fluctuating, and the increase of S1 affects the stability of MRE. Government subsidies to MRE technological innovation can increase the enthusiasm of enterprises to carry out technological innovation. However, with the increasing subsidies of government expenditure, the financial pressure on the government will be increasing. When the government grants subsidies to MRE to support its technological innovation, the government will also bear more and more financial pressure. However, benefits such as the improvement of environmental benefits brought by enterprises’ technological innovation and the increase of the public’s credibility to the government are not as large as government subsidies. In other words, when the financial burden brought by subsidies exceeds the additional benefits obtained by the government in scientific and technological innovation, the government will gradually withdraw from cooperation due to the negative benefits of choosing this strategy, and the evolutionary game system will show instability. Set S1 = 5, at this time the evolutionary game has no ESS.

Finding 3: Increasing government subsidies to consumers with strong preferences and reducing subsidies to consumers with weak preferences can guide consumers to change their preferences and create a better customer source environment for MRE technology innovation.

Finding 4: The government subsidy amount should be moderate. Small subsidy cannot effectively motivate MRE technological innovation, while large subsidy will overburden the government and affect the stability of the system’s evolution.

4.2.3 The impact of government taxation

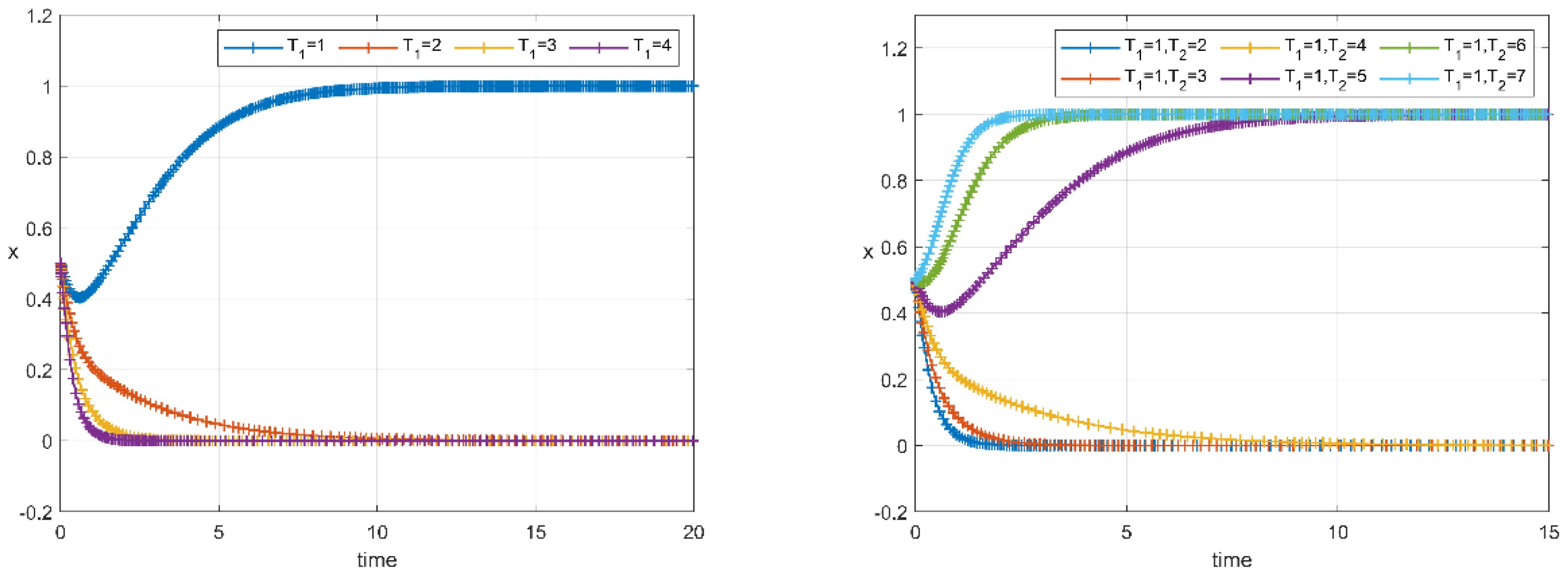

Changing the government’s tax T1 on technology innovation enterprises, the simulation results are shown in Figure 8. With the change of T1, the evolution direction of MRE will also change, and the decrease of T1 will encourage enterprises to choose technology innovation strategy. Set T1 = 1 and change the value of T2 to further study the effect of the difference between the two on the evolution of MRE. As can be seen from Figure 8, the difference between the two parameters has a threshold between 3 and 4. When the difference is less than the threshold, the MRE evolves to 0, otherwise, the MRE evolves to 1. As the difference between T1 and T2 is larger, the MRE evolves to 1 faster. The government gives positive incentives to the MRE of technological innovation and negative incentives to the traditional MRE through taxation. The greater the degree of differentiated taxation is, the more it can promote the MRE to carry out technological innovation.

Finding 5: Differentiated taxation imposed by the government on MRE can promote its technological innovation and the greater the degree of differentiation, the better the incentive effect.

4.2.4 Analysis of mature markets

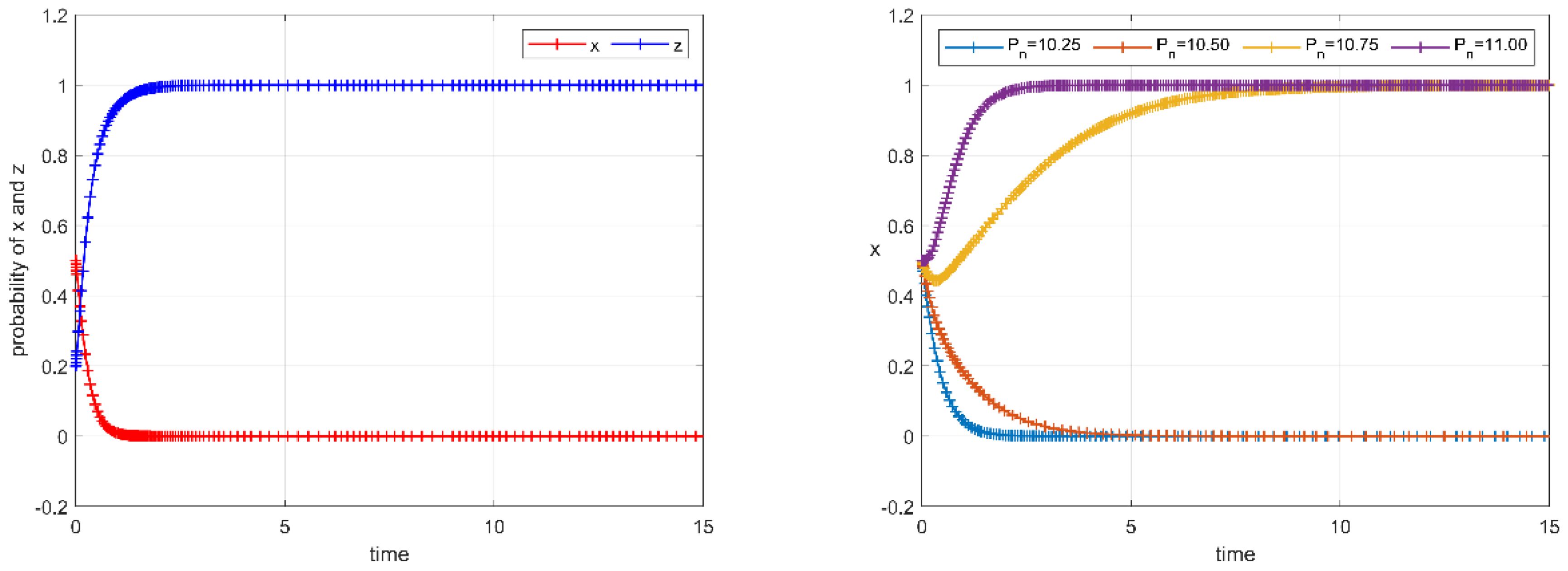

The most ideal state of the three-party evolutionary game between the government, MREs and consumers is the stage of market maturity and self-driven. In this stage, the government gradually withdraws from the role of direct guidance, and a good market relationship is formed between enterprises and consumers. Based on the hypothesis of relaxation, set S1=S2=S3=R2 = 0, simulate the scenario of the government’s gradual withdrawal, and the simulation results are shown in Figure 9.

When the government withdraws, the direction of MRE evolution is 0, and the direction of consumer evolution is 1. It is important to note that the relaxation of the hypothetical conditions does not change the amount of consumer utility for traditional MRE products and services U2, which means that the net utility of consumers is still positive when they purchase traditional products and services, so ultimately, consumers are transformed to strong preference consumers in order to obtain more net utility. Changing the value of Pn can change the direction of MRE evolution stabilization, the larger the value of Pn, the faster the evolution of MRE to 1, indicating that the enterprise can increase the price of new products and services to obtain more profits, as a response to the reduction of government subsidies, relaxing the hypothesis that Finding2 is still valid under the complex market.

Setting Pn=10.5, the sensitivity analysis of and are made respectively, and the results are shown in Figure 10. Compared with the sensitivity of weak preference consumers to price, the strategy choice of MRE is more easily affected by the sensitivity of strong preference consumers to price. When the strong preference consumers’ sensitivity to price decreases to 0.1, the evolution direction of MRE changes from 0 to 1. The lower the sensitivity coefficient, the faster the evolution stabilization. Changing the sensitivity coefficient of weak preference consumers to price does not have a great impact on the evolution direction and rate of MRE. When enterprises are developing technological innovation strategies, they are more likely to be influenced by strong preference consumers because these consumers provide enterprises with greater profit margins and the potential for market share growth.

Finding 6: The purchasing behavior and price sensitivity of strong preference consumers provide enterprises with greater innovation motivation and market opportunities.

5 Conclusions and policy implications

5.1 Conclusions

This paper constructs a tripartite evolutionary game model including MREs, government and consumers and systematically analyzes the stability of the model. Using numerical simulation the evolution of the four scenarios of Case 1-Case 4 using MATLAB software and considers the validity of the conclusions after the hypothesis is relaxed. Finally, it further analyzes the scenario of the mature market under the withdrawal of government from the market and the cancellation of subsidies. The study found that:

(1) The government’s incentive policies play a key role in the initial period of MREs. In the mature period of MREs, since the enterprises can self-adjust the benefit of innovation strategy, the government can gradually eliminate the incentive policies.

(2) Government’s incentive policies consist of subsidy and tax policies. The subsidy amount should be finely designed so as to effectively stimulate technological innovation and avoid excessive financial burden. At the same time, the implementation of differentiated tax policies can encourage MREs to carry out technological innovation. Furthermore, a higher degree of differentiation leads to a more significant the incentive effect.

(3) Consumers’ preference significantly affects the strategy of MREs innovation. Furthermore, MRE’s strategy choice is more sensitive to the behavior of consumers with strong preferences. Government subsidies for consumers with different preferences can guide market demand and provide market signals for MREs.

5.2 Policy implications

Based on the above conclusions, we make the following suggestions:

(1) The government should investigate and assess the stage of MREs. In the initial stage of enterprise, the government can use positive incentive measures, such as setting up innovation funds, as well as negative incentive measures, such as increasing penalties for old fashioned technologies, to stimulate technological innovation of enterprises. In the mature stage of enterprise, the government should gradually reduce direct subsidies to enterprises. At the same time, the government should guide enterprises to establish a more market-oriented pricing mechanism, ensure the transparency of policy adjustment, and enable enterprises to adjust their strategies in time.

(2) The government should design subsidies and tax policies finely to promote the balance between technological innovation and fiscal sustainability. Besides, the government should establish the evaluation and feedback mechanism of the policies. Based on on-site investigations, the subsidy amount should be flexibly adjusted according to the actual demand of enterprises’ technological innovation. At the same time, differentiated tax policies will be implemented to give tax exemptions to enterprises with high R&D investment and remarkable innovation achievements, so as to encourage enterprises to continuously increase investment in technological innovation.

(3) The government should lead the consumer’s preference towards innovative marine product and then create a favorable market environment for technological innovation. The government can adjust the subsidy strategy for consumers with different preferences, strengthen the education of consumers’ environmental awareness and propagate the benefits of marine ecological products to improve consumers’ awareness and acceptance of new products and services. In addition, enterprises should actively carry out market research and product testing based on consumer demand, and adjust technological innovation direction according to consumer feedback.

5.3 Limitations and prospects

The research in this paper still has some limitations. Although the conclusions drawn can provide scientific basis and theoretical support to a certain extent, the core lies in the construction of the model and the setting of parameters, which are often based on a series of assumptions and simplifications. In the subsequent in-depth research, we will continue to improve the research hypothesis and increase parameters to make the evolutionary logic more realistic. For example, under different strategies, the feedback factor m is introduced into the model as a variable rather than a quantitative one, and real cases are introduced as analysis objects. Through the combination of qualitative research methods (such as interviews and observation) and quantitative research methods (such as questionnaire survey and statistical analysis), richer and more specific data information can be provided, which helps to verify and modify the simulation model, improve the practicability and credibility of research, and contribute more valuable insights and results to the development of related fields.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material. Further inquiries can be directed to the corresponding author.

Author contributions

HL: Conceptualization, Writing – original draft. QW: Data curation, Writing – original draft.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This research is supported by National Science Foundation of China (No. 12201593).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Allman K., Edler J., Georghiou L., Jones B., Miles I., Omidvar O., Ramlogan R., et al. (2011). Measuring Wider Framework Conditions for successful innovation: A system’s review of UK and international innovation data. (Londres, Nesta: Index Report). doi: 10.13140/RG.2.2.16508.13444

Anthony D., Siriwardana H., Ashvini S., Pallewatta S., Samarasekara S. M., Edirisinghe S., et al. (2023). Trends in marine pollution mitigation technologies: Scientometric analysis of published literature, (1990-2022). Reg. Stud. Mar. Sci. 66, 103156. doi: 10.1016/j.rsma.2023.103156

Barrientos M., Vásquez Lavín F., Ponce Oliva R. D., Nayga R. M., Gelcich S. (2024). Microplastics in seafood: Consumer preferences and valuation for mitigation technologies. Food Res. Int. 187, 114342. doi: 10.1016/j.foodres.2024.114342

Biswas D., Jalali H., Ansaripoor A. H., De Giovanni P. (2023). Traceability vs. sustainability in supply chains: The implications of blockchain. Eur. J. Operation. Res. 305, 128–147. doi: 10.1016/j.ejor.2022.05.034

Chaudhuri N., Gupta G., Sharma S. K. (2024). Outpacing choices: Examining dynamic consumer preferences across multi-generational information-intensive digital products. Int. J. Inf. Manage. 77, 102784. doi: 10.1016/j.ijinfomgt.2024.102784

Chen F., Wu B., Lou W.-q., Zhu B.-w. (2024). Impact of dual-credit policy on diffusion of technology R & D among automakers: Based on an evolutionary game model with technology-spillover in complex network. Energy 303, 132019. doi: 10.1016/j.energy.2024.132019

Chen G., Lim M. K., Tseng M.-L. (2024). Green credit and transformation to enhance the plastic supply chain in China: A three-player evolutionary game perspective approach under dynamic green awareness. J. Clean. Prod. 448, 141416. doi: 10.1016/j.jclepro.2024.141416

Chen P., Shu L., Yuan H., Feng X., Tong F., Chen Q., et al. (2019). Review on development, definition and classification of marine ranching in domestic and overseas. J. fish. China 43, 1851–1869. doi: 10.11964/jfc.20190711887

Chen Y., Sun Z., Zhou Y., Yang W., Ma Y. (2024). The future of sustainable farming: An evolutionary game framework for the promotion of agricultural green production technologies. J. Clean. Prod. 460, 142606. doi: 10.1016/j.jclepro.2024.142606

Cui X., Zhu Z., Liu L., Zhou Q., Liu Q. (2024). Anomaly detection in consumer review analytics for idea generation in product innovation: Comparing machine learning and deep learning techniques. Technovation 134, 103028. doi: 10.1016/j.technovation.2024.103028

Ding W., Ding J. (2022). New venture’s product innovativeness strategy, institutional environment and new product performance. Technol. Forecast. Soc. Change 174, 121211. doi: 10.1016/j.techfore.2021.121211

Du Y. W., Sun H.-R., Wan X.-L. (2022). Tripartite supervision mechanism and evolutionary strategies for marine ranching ecological security: Policy tools perspective. Reg. Stud. Mar. Sci. 50, 102125. doi: 10.1016/j.rsma.2021.102125

Fan Q., Fan L., Quach W.-M., Zhang R., Duan J., Sand W. (2023). Application of microbial mineralization technology for marine concrete crack repair: A review. J. Build. Eng. 69, 106299. doi: 10.1016/j.jobe.2023.106299

Fesenfeld L. P., Zeiske N., Maier M., Rachelle Gallmann M., van der Werff E., Steg L. (2024). Tasting and labeling meat substitute products can affect consumers’ product evaluations and preferences. Food Qual. Preference 118, 105184. doi: 10.1016/j.foodqual.2024.105184

Gao L., Yan A., Yin Q. (2022). An evolutionary game study of environmental regulation strategies for marine ecological governance in China. Front. Mar. Sci. 9. doi: 10.3389/fmars.2022.1048034

Guo L., Zhang Q., Wu J., Santibanez Gonzalez E. D. R. (2024). An evolutionary game model of manufacturers and consumers’ behavior strategies for green technology and government subsidy in supply chain platform. Comput. Ind. Eng. 189, 109918. doi: 10.1016/j.cie.2024.109918

Hou G., Zhan B. (2023). Relationship among marine pollution, outdoor activities, and climate change: Fresh evidence from panel threshold regression analysis from coastal regions of China. Environ. Res. 236, 116668. doi: 10.1016/j.envres.2023.116668

Jin J., Quan Y. (2023). Assessment of marine ranching ecological development using DPSIR-TOPSIS and obstacle degree analysis: A case study of Zhoushan. Ocean Coast. Manage. 244, 106821. doi: 10.1016/j.ocecoaman.2023.106821

Koh L. Y., Wu M., Wang X., Yuen K. F. (2023). Willingness to participate in virtual reality technologies: Public adoption and policy perspectives for marine conservation. J. Environ. Manage. 334, 117480. doi: 10.1016/j.jenvman.2023.117480

Lincoln S., Chowdhury P., Posen P. E., Robin R. S., Ramachandran P., Ajith N., et al. (2023). Interaction of climate change and marine pollution in Southern India: Implications for coastal zone management practices and policies. Sci. Total Environ. 902, 166061. doi: 10.1016/j.scitotenv.2023.166061

Luo J., Hu M., Huang M., Bai Y. (2023). How does innovation consortium promote low-carbon agricultural technology innovation: An evolutionary game analysis. J. Clean. Prod. 384, 135564. doi: 10.1016/j.jclepro.2022.135564

Leng J, Qi X. (2024). A differential game model for marine ranching development decisions between government and marine ranching enterprises considering myopic behavior. Mar. Dev. 2(1), 11. doi: 10.1007/s44312-024-00022-5

Meng Q., Li M., Liu W., Li Z., Zhang J. (2021). Pricing policies of dual-channel green supply chain: Considering government subsidies and consumers’ dual preferences. Sustain. Prod. Consumpt. 26, 1021–1030. doi: 10.1016/j.spc.2021.01.012

Pan X., Shen Z., Song M., Shu Y. (2023). Enhancing green technology innovation through enterprise environmental governance: A life cycle perspective with moderator analysis of dynamic innovation capability. Energy Policy 182, 113773. doi: 10.1016/j.enpol.2023.113773

Piila N., Sarja M., Onkila T., Mäkelä M. (2022). Organisational drivers and challenges in circular economy implementation: an issue life cycle approach. Organ. Environ. 35, 523–550. doi: 10.1177/10860266221099658

Ploll U., Weingarten N., Hartmann M. (2023). Frame by frame, attitude by attitude – The effect of information framing in videos on consumers’ acceptance of sustainable food production innovations. J. Environ. Psychol. 92, 102185. doi: 10.1016/j.jenvp.2023.102185

Qian Y., Yu X. A., Chen X., Song M. (2023). Research on stability of major engineering technology innovation consortia based on evolutionary game theory. Comput. Ind. Eng. 186, 109734. doi: 10.1016/j.cie.2023.109734

Qiao W., Yin X. (2021). Understanding the impact on energy transition of consumer behavior and enterprise decisions through evolutionary game analysis. Sustain. Prod. Consumpt. 28, 231–240. doi: 10.1016/j.spc.2021.04.015

Qin M., Wang X., Du Y. (2022). Factors affecting marine ranching risk in China and their hierarchical relationships based on DEMATEL, ISM, and BN. Aquaculture 549, 737802. doi: 10.1016/j.aquaculture.2021.737802

Qin M., Wang X., Du Y., Wan X. (2021). Influencing factors of spatial variation of national marine ranching in China. Ocean Coast. Manage. 199, 105407. doi: 10.1016/j.ocecoaman.2020.105407

Ramírez F., Shannon L. J., Angelini R., Steenbeek J., Coll M. (2022). Overfishing species on the move may burden seafood provision in the low-latitude Atlantic Ocean. Sci. Total Environ. 836, 155480. doi: 10.1016/j.scitotenv.2022.155480

Shi X., Wang T., Luo K., Wang J., Gu X. (2023). The mechanism of constructing marine ranching industrial ecosystem based on grounded theory: A case study of Yantai, China. Reg. Stud. Mar. Sci. 68, 103214. doi: 10.1016/j.rsma.2023.103214

Shi Z., Cheng J. (2023). How do government subsidies and consumers’ low-carbon preference promote new energy vehicle diffusion? A tripartite evolutionary game based on energy vehicle manufacturers, the government and consumers. Heliyon 9, e14327. doi: 10.1016/j.heliyon.2023.e14327

Sun Y. L., Du Y. W., Wang Y. C. (2024). Ecodevelopment strategy selection and case simulation of marine ranching enterprises based on evolutionary games. Reg. Stud. Mar. Sci. 69, 103336. doi: 10.1016/j.rsma.2023.103336

Ullah I., Nuta F. M., Levente D., Yiyu B., Yihan Z., Yi C., et al. (2023). Nexus between trade, industrialization, and marine pollution: A quantile regression approach. Ecol. Indic. 155, 110992. doi: 10.1016/j.ecolind.2023.110992

Wan X., Li Q., Qiu L., Du Y. (2021). How do carbon trading platform participation and government subsidy motivate blue carbon trading of marine ranching? A study based on evolutionary equilibrium strategy method. Mar. Policy 130, 104567. doi: 10.1016/j.marpol.2021.104567

Wang W., Wang M., Zhong L., Zhang L. (2024). Research on sustainable development of marine ranching based on blue carbon trading. Ocean Coast. Manage. 249, 106988. doi: 10.1016/j.ocecoaman.2023.106988

Yang L., Qin H., Xia W., Gan Q., Li L., Su J., et al. (2021). Resource slack, environmental management maturity and enterprise environmental protection investment: An enterprise life cycle adjustment perspective. J. Clean. Prod. 309, 127339. doi: 10.1016/j.jclepro.2021.127339

Yu J., Zhang L. (2020). Evolution of marine ranching policies in China: Review, performance and prospects. Sci. Total Environ. 737, 139782. doi: 10.1016/j.scitotenv.2020.139782

Yue R., Xu X., Li Z., Bai Q. (2024). Reusable packaging adoption in e-commerce markets with green consumers: An evolutionary game analysis. J. Retail. Consum. Serv. 81, 103818. doi: 10.1016/j.jretconser.2024.103818

Yuen K. F., Chua J., Li K. X., Wang X. (2022). Consumer’s adoption of virtual reality technologies for marine conservation: Motivational and technology acceptance perspectives. Technol. forecast. Soc. Change 182, 121891. doi: 10.1016/j.techfore.2022.121891

Zhang L., Zhou H., Liu Y., Lu R. (2019). Optimal environmental quality and price with consumer environmental awareness and retailer’s fairness concerns in supply chain. J. Clean. Prod. 213, 1063–1079. doi: 10.1016/j.jclepro.2018.12.187

Zhang W., Ye Z., Qu P., Li D., Gao H., Liang Y., et al. (2024). Using solid phase adsorption toxin tracking and extended local similarity analysis to monitor lipophilic shellfish toxins in a mussel culture ranch in the Yangtze River Estuary. Mar. pollut. Bull. 199, 116027. doi: 10.1016/j.marpolbul.2024.116027

Zhang X., Cheng J., Zheng S. (2023). Can multi-agent cooperation promote the ecological value realization of blue carbon in marine ranching? Heliyon 9, e18572. doi: 10.1016/j.heliyon.2023.e18572

Zhang Y., Ou Z., Tweedley J. R., Loneragan N. R., Zhang X., Tian T., et al. (2024). Evaluating the effectiveness of baited video and traps for quantifying the mobile fauna on artificial reefs in northern China. J. Exp. Mar. Biol. Ecol. 573, 152001. doi: 10.1016/j.jembe.2024.152001

Zheng Y., Wu X. (2024). Fostering fintech innovation: A tripartite evolutionary game analysis of regulatory sandbox experiments. Int. Rev. Econ. Finance 92, 1302–1320. doi: 10.1016/j.iref.2024.02.060

Zheng S., Yu L. (2022). The government’s subsidy strategy of carbon-sink fishery based on evolutionary game. Energy 254, 124282. doi: 10.1016/j.energy.2022.124282

Zheng S., Zhang Y. (2024). Analyzing the evolutionary game of subsidies’ strategy in the digitization of marine ranch: a theoretical framework [Original Research]. Front. Mar. Sci. 11. doi: 10.3389/fmars.2024.1376256

Keywords: marine ranching, technological innovation strategy, evolutionary game, numerical simulations, consumer preferences

Citation: Liu H and Wu Q (2024) Evolutionary game analysis on technological innovation strategies of marine ranching enterprises considering government’s incentive policies and consumer preferences. Front. Mar. Sci. 11:1470846. doi: 10.3389/fmars.2024.1470846

Received: 26 July 2024; Accepted: 16 August 2024;

Published: 30 August 2024.

Edited by:

Song Ding, Zhejiang University of Finance and Economics, ChinaReviewed by:

Zhipeng Li, Qufu Normal University, ChinaCheng Hu, Shandong Normal University, China

Xiaole Xue, Shandong University, China

Copyright © 2024 Liu and Wu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Haodong Liu, bGl1aGFvZG9uZ0BvdWMuZWR1LmNu

Haodong Liu

Haodong Liu Qian Wu

Qian Wu