- School of Finance, Shandong Technology and Business University, Yantai, China

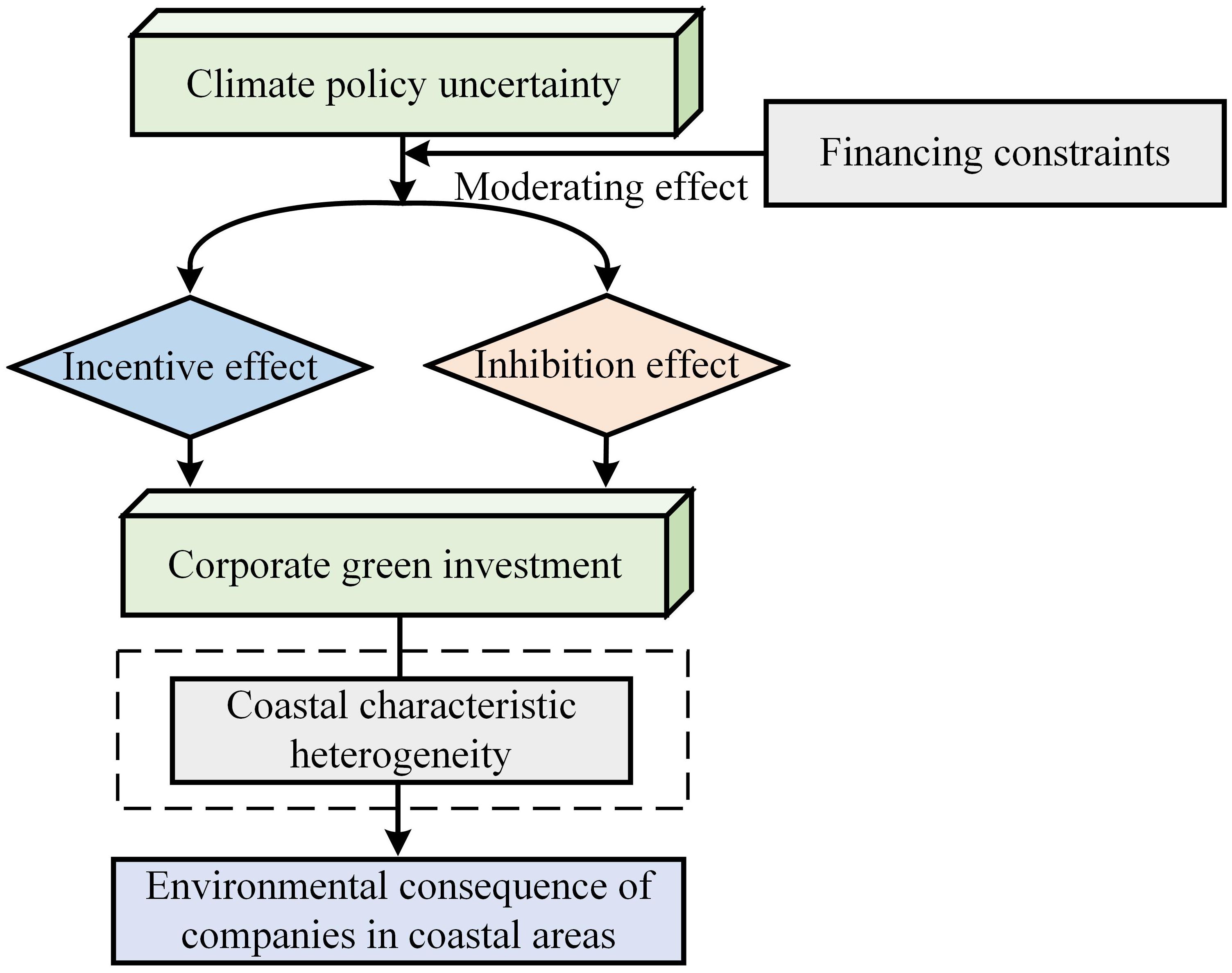

Corporate green investment is the key driver for achieving low-carbon transition and sustainable marine economy. Existing literature has identified several influencing factors of corporate green investment, but there is still limited research on the relationship between climate policy uncertainty and corporate green investment. To fill this gap, this paper innovatively explores the nonlinear impact of climate policy uncertainty on corporate green investment, simultaneously focuses on the moderating role of corporate financing constraints and analyzes the coastal characteristic heterogeneity. Using the sample of listed companies in China from 2014-2020, we find that climate policy uncertainty has an inverted U-shaped impact on corporate green investment. From the perspective of heterogeneity, the inverted U-shaped effect is more significant in coastal areas. Moderating effect test indicates that corporate financing constraints strengthen the inverted U-shaped relationship and shift the turning point of curve to the left. Additionally, we further find that climate policy uncertainty has an inverted U-shaped impact on environmental performance of companies in coastal areas through green investment. Our research will provide some potential insights for China’s climate policy making and corporate green transformation, so as to contribute to sustainable marine development.

1 Introduction

In recent years, frequent environmental problems and climate events have not only put significant pressure on ecosystems, but posed major threat to sustainable economic development and marine management. As a responsible developing country, with global warming and ocean temperatures rising, China attaches great importance to climate change and has successively introduced various climate policies. However, frequent announcements and adjustments of climate policies will cause the increase in China’s climate policy uncertainty, which inevitably affects corporate behavioral decisions. On the one hand, the increasing uncertainty of climate policy will increase the financial risks and operational costs of companies (Ren et al., 2022, 2024). On the other hand, companies can gain new development opportunities from policy fluctuation and then adjust strategic decisions (Bai et al., 2023). Therefore, exploring the potential impact of climate policy uncertainty on corporate behavior has become a new hot topic (Bai et al., 2023; Huang and Sun, 2023; Mo and Liu, 2023; Zhang and Ge, 2024).

As a special corporate activity with environmental benefits, green investment reflects the harmonious development among economy, society and ecology, presenting a strong public product attribute (Liu et al., 2023). Companies are the main role of economic growth and environmental issues (Song and Liu, 2019; Bendell, 2022), and increasing their green investment contributes to China’s environmental quality and green financial system. Meanwhile, promoting the green investment of companies is also of great significance for reducing pressure on marine ecosystems and achieving high-quality development of China’s marine economy. However, the enthusiasm of Chinese companies to carry out green investment activities remains low, and the scale of green investment is generally inadequate (Huang and Lei, 2021). Existing literature has studied the factors that affect green investment from the perspective of policy and uncertainty (Gao and Zheng, 2017; Dalby et al., 2018; Hu et al., 2023; Ma et al., 2024; Zhang et al., 2024). However, as a new measure of climate policy change at the macro level (Huang and Sun, 2023; Shang et al., 2022), the relationship between climate policy uncertainty and corporate green investment has hardly been analyzed. Then, how does climate policy uncertainty affect corporate green investment? What does the relationship between the two differ when the coastal characteristic is different? What environmental consequence can the two bring for companies in coastal areas? These are key issues that need to be analyzed and studied.

In addition, capital is the cornerstone of companies. However, there is no perfect capital market in reality, where information asymmetry and agency problems often cause a certain difference between the costs of internal and external financing (Kaplan and Zingales, 1997). Therefore, financing constraints are the common reality for companies and the important factor affecting their investment behavior (Guariglia and Yang, 2016; Liu and Lin, 2018). Numerous scholars have focused on the role of financing constraints in corporate environmental behavior. One is the direct impact of corporate finance constraints (Tian and Lin, 2019; Yu et al., 2022). Another is taking financing constraints as moderating or mediating variables to explore the role (Tang et al., 2023; Wang et al., 2023). However, existing research has not yet answered the important question of how corporate financing constraints affect the relationship between climate policy uncertainty and corporate green investment.

Table 1 summarizes the main relevant studies. It can be observed that the impact of climate policy uncertainty on corporate green investment has not been widely explored, and there is little literature focusing on the role of corporate financing constraints and coastal characteristic in this process. To fill the above gaps, this paper takes the listed companies in China from 2014 to 2020 as the research sample to empirically analyze. The potential marginal contributions of this paper are mainly reflected in the following four aspects:

Firstly, compared with existing studies (Syed et al., 2023; Borozan and Pirgaip, 2024; Zhang and Ge, 2024), we focus on the nonlinear relationship between climate policy uncertainty and corporate green investment. Taking the perspective of macro-policy changes’ impacts on corporate micro-behavior, this paper contributes the literature on climate policy uncertainty, as well as provides a new perspective for the study of corporate green investment. Secondly, we incorporate corporate financing constraints into research framework, clarifying its moderating role. This paper provides evidence for the boundary condition of climate policy uncertainty and corporate green investment. Thirdly, considering the differences in coastal characteristic, this paper investigates the different effects of climate policy uncertainty in non-coastal and coastal areas. We expand the research scenario mechanism, enrich the studies about coastal characteristic heterogeneity (Li and Li, 2022; Li et al., 2023). Our research also helps to make targeted climate policies. Fourthly, we extend the analysis of the environmental consequence of companies in coastal areas brought by climate policy volatility through green investment. This paper supplements the relevant literature on the environmental management of companies in coastal areas (Shi et al., 2019; Chen et al., 2020) and is of great significance for sustainable economic development and ecological environment protection in coastal areas. Our conclusions provide certain references for formulating climate policies, simultaneously form a valuable complement for reducing the pollution of marine ecosystems and promoting the sustainable development of ocean economy.

The rest sections are organized as follows. Section 2 is the theory and hypothesis. Section 3 presents the research design. Section 4 shows the detailed empirical results analysis. Section 5 is further analysis. Section 6 gives the conclusions and policy implications based on the results we obtained. Section 7 presents the limitations and future research directions.

2 Theoretical analysis and research hypothesis

2.1 Climate policy uncertainty and corporate green investment

On the one hand, a certain range of climate policy uncertainty may incentivize corporate green investment behavior. Increased policy uncertainty may have some incentive and selection effects on companies (Bai et al., 2023). When companies face climate policy announcements and adjustments within an acceptable range, they tend to consider profit opportunities to adjust their company strategies. Companies will make policy-oriented decisions to gain acceptance from investors and society, thus increasing profitability.

Meanwhile, from the signal transmission perspective (Tong et al., 2021; Li et al., 2024), the release of climate policies signals to the public that environmental sustainability is valued, bringing compliance pressure on companies while guiding their green transformation. After receiving signals on climate issues, companies may consider whether their behavior is in line with the upcoming policy regulations. Companies may then change their strategies and increase green investment to enhance their behavioral compliance. Furthermore, with the increasing uncertainty of regional climate policy, corporate behavior will further receive attention from society and investors, facing greater public opinion and reputation pressure. Corporate reputation determines the business performance to a certain extent. Therefore, considering their image, companies may increase green investment.

On the other hand, as climate policy uncertainty increases to a certain level, the effect on corporate green investment behavior may be reversed, from incentive to inhibition. At first, according to the real options theory, companies may choose to delay their investment in situations of higher external environmental uncertainty (Gulen and Ion, 2016). Green project is viewed as an option, and whether to invest is the result of a trade-off between current investment return and future return. Companies will choose to invest only if the net present value of the current investment return is higher than the sum of investment cost and real option’s value. With the frequent changes in climate policy, it is difficult for companies to accurately predict the direction of future policies. And green investment involves significant capital input and sunk cost. Therefore, when the uncertainty of climate policy is too high, companies prefer to invest in the future to gain a higher value.

Secondly, most decision-making participants will exhibit avoidance behavior when facing higher uncertainty (Wen et al., 2021). As rational market individuals, profit maximization is the core objective of companies. Systemic risk brought by excessive climate policy uncertainty implies the unstable investment environment. Reducing green investment is considered as a conservative investment strategy to minimize possible losses and maintain business stability.

Additionally, different from other investment activities, corporate green investment is characterized by longer return cycle and uncertain short-term return. From the cost-benefit perspective, companies are more inclined to invest in projects with shorter payback cycles and higher short-term returns when facing highly uncertain external environment. This helps to better maintain cash flow and profitability to hedge against the risks associated with policy volatility. Excessive climate policy volatility exacerbates the uncertainty of green investment returns, and companies may reduce the level of green investment as a result. Also, green investment usually requires large amounts of capital and resources. Higher climate policy uncertainty may cause the volatility of financial markets, which in turn causes companies to reduce their green investment behavior due to the capital costs.

Summarizing the above analysis, different levels of climate policy uncertainty may have different impacts on corporate green investment. Within a certain range, climate policy uncertainty will promote corporate green investment behavior due to incentive effect. However, when climate policy uncertainty exceeds the a certain level, its impact on corporate green investment may be reversed, which means that corporate green investment level decreases with the increase of climate policy uncertainty. Based on this, we propose hypothesis 1:

Hypothesis 1(H1): Climate policy uncertainty has an inverted U-shaped impact on corporate green investment.

2.2 The moderating effect of financing constraints

Initially, when companies face financing constraints, if external environmental changes are within acceptable limits, the companies will consider potential opportunities with a view to alleviating and breaking out of their financing and operational difficulties. Thus, when companies with financing constraints are faced with an acceptable range of climate policy fluctuation, they will actively increase their green investment. It is beneficial to build better corporate image, release compliance information and alleviate the financing dilemma.

However, as a high-cost investment activity, corporate green investment requires vast capital sources and diversified financing channels (Ding et al., 2023). High climate policy uncertainty can lead to a shift in corporate decision makers’ attitudes, from believing in potential profit opportunities to worrying about the policy environment and financial situations. At this point, higher financial pressure can make corporate green investment behavior more sensitive to excessive climate policy uncertainty. Simultaneously, financing constraints make companies pay more attention to investment projects’ returns, especially short-term profits. Compared with companies with lower degree of financing constraints, the managers of financially struggling companies will pay more attention to investment returns and potential external risks. Climate policy uncertainty can lead to high unpredictability of returns, and companies with higher level of financing constraints may reduce green investment to a greater extent due to risk aversion.

To summarize, financing constraints may make the impact of climate policy uncertainty on corporate green investment more sensitive. Based on this, this paper proposes hypothesis 2:

Hypothesis 2(H2): The increasing degree of corporate financing constraints can strengthen the inverted U-shaped relationship between climate policy uncertainty and green investment.

2.3 Coastal characteristic heterogeneity

Companies in coastal areas are more likely to be exposed to the direct threats from climate change such as sea level rise and storm surges, whilst often being the focus of national and regional policies (Cui et al., 2024). Firstly, as coastal areas are the forefront of economic development, local companies are increasingly concerned with the development of green and marine economy, thus having the greater sensitivity to climate policies. When climate policies fluctuate, companies in coastal areas usually receive policy signals more quickly and adjust accordingly. Secondly, companies in coastal areas tend to be in highly competitive markets with more export-oriented companies. International markets are increasingly concerned about the environmental standards and climate change, climate policy uncertainty may bring market opportunities or challenges. As a result, companies need to constantly adapt their strategies to gain a favorable position in the market.

Given the above, there is coastal characteristic heterogeneity in the effect of climate policy uncertainty. Therefore, we propose hypothesis 3:

Hypothesis 3(H3): The impact of climate policy uncertainty on corporate green investment is more significant in coastal areas.

2.4 Environmental consequence of companies in coastal areas

Coastal areas are usually the economic engines and trade hubs of country, with a large number of industries and port facilities. The production activities of companies in coastal areas have significant impact on the surrounding environment and the whole ecosystem. As green investment increase, companies could reduce energy waste and improve resource utilization by investing in green projects (Zhu et al., 2020). Industries in coastal areas are well developed, and corporate green investment incentivized by climate policy uncertainty can directly reduce the pollutant emissions of companies in coastal areas, which in turn improves environmental performance. On the contrary, the environmental performance of companies in coastal areas is negatively affected. Meanwhile, environmental issues in coastal areas have received focused policy attention. Companies in coastal areas can gradually increase their environmental awareness in the process of making green investment. It helps companies to establish the sense of social responsibility and improve environmental performance on their own.

Considering the above analysis, climate policy uncertainty may further affect the environmental performance of companies in coastal areas through green investment. Accordingly, this paper proposes hypothesis 4:

Hypothesis 4(H4): Climate policy uncertainty has an inverted U-shaped effect on environmental performance of companies in coastal areas through corporate green investment.

Based on the above analysis, the theoretical framework diagram of this paper is shown in Figure 1.

3 Research design

3.1 Empirical methodology

Most studies on the consequences of climate policy uncertainty and the factors of corporate green investment adopted linear models (Bai et al., 2023; Huang and Sun, 2023; Liu et al., 2023; Xi et al., 2023; Borozan and Pirgaip, 2024), providing positive, negative or neutral relationships. However, the relationship between climate policy uncertainty and corporate green investment may be complex. Therefore, we use nonlinear model which can describe the complex relationship between variables more accurately and determine the optimal level of climate policy uncertainty that maximizes corporate green investment (Haans et al., 2016; Ben Lahouel et al., 2022). To test the nonlinear impact of climate policy uncertainty on corporate green investment, we construct Equation 1:

Where i represents the company, t represents the year; is the dependent variable of this paper, representing corporate green investment; is the core independent variable of our interest, representing climate policy uncertainty; is the squared term of climate policy uncertainty; denotes the control variables; denotes year-level fixed effect; is individual-level fixed effect; and is the random error term. If is significantly positive and is significantly negative, then hypothesis 1 holds.

Meanwhile, in order to explore the moderating effect of financing constraints, this paper constructs Equation 2:

Where is the moderating variable, representing corporate financing constraints; denotes the interaction term between climate policy uncertainty and corporate financing constraints; is the interaction term between squared term of climate policy uncertainty and corporate financing constraints. The others are the same as Equation 1.

3.2 Variables

(1) Dependent variable: corporate green investment (GI). Referring to the studies of Jiang et al. (2022); Zhao and Yuan (2024), this paper manually screens and collects the expenditures related to environmental protection and green governance in the construction in progress subject of listed companies, and sums them up to get the total amount of corporate green investment in the year. Then we measure the corporate green investment level using the ratio of green investment amount to total assets.

(2) Core independent variable: climate policy uncertainty (CPU). The measurement of climate policy uncertainty has attracted wide discussion among scholars. Gavriilidis (2021) searched for articles in eight leading US newspapers containing terms, constructed the macro-level climate policy uncertainty index. Xu et al. (2023) measured the macro-level climate policy uncertainty index in China based on Chinese news data. However, there are significant differences in climate conditions and policy implementation among different regions. Ma et al. (2023) used a deep learning algorithm—the MacBERT model to construct climate policy uncertainty index at various levels in China. In this paper, we adopt the provincial level results of Ma et al. (2023) as the measure of climate policy uncertainty.

(3) Moderating variable: financing constraints (KZ). In this paper, KZ index is used to measure the corporate financing constraints degree (Liu et al., 2022; Yao et al., 2022). The larger the KZ, the more serious the financing constraints.

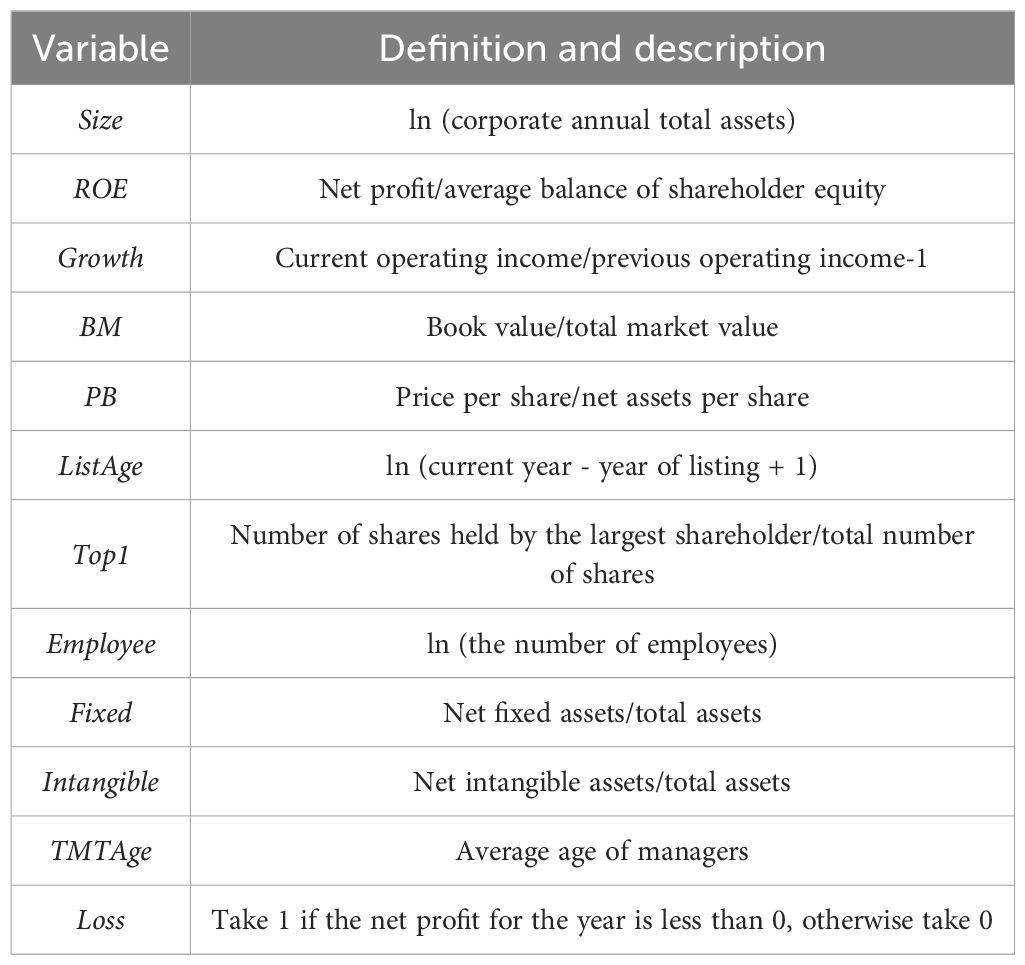

(4) Control variables: to exclude other factors’ influence on regression results, this paper selects the following control variables: corporate size (Size), return on equity (ROE), growth rate of operating income (Growth), book-to-market ratio (BM), price-to-book ratio (PB), years of listing (ListAge), proportion of shares held by the first largest shareholder (Top1), number of employees (Employee), fixed assets proportion(Fixed), intangible assets proportion (Intangible), average age of management (TMTAge) and loss or not (Loss). Specific descriptions are shown in Table 2.

3.3 Sample selection and data sources

This paper selects the data of Chinese A-share listed companies from 2014 to 2020 as the initial sample. We process the data as follows: (1) Samples of listed companies in the financial industry are excluded; (2) Samples of ST, *ST and PT companies are excluded; (3) Samples with missing main variables are excluded; (4) The variables are winsorized by 1% each before and after. Finally, 3641samples are obtained as observations.

The relevant data on the climate policy uncertainty are from the China’s provincial climate policy uncertainty index constructed by Ma et al. (2023). Data on corporate green investment are manually collected through the listed corporate annual reports, social responsibility reports, official websites, and so on. Other data are obtained from CSMAR database, Wind database, CNRDS database and National Bureau of Statistics of China.

4 Experimental results

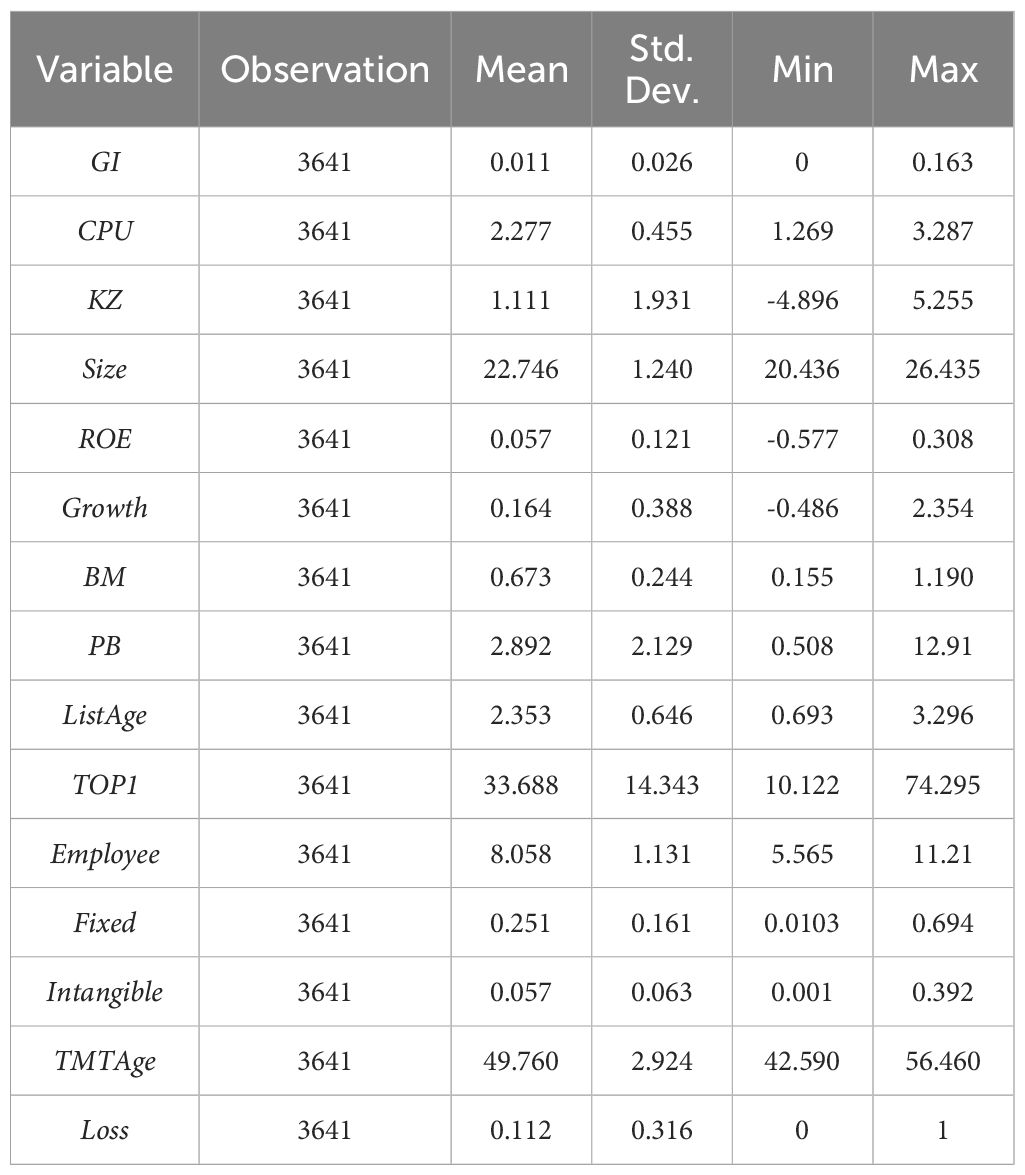

4.1 Descriptive statistics

The descriptive statistics results of the main variables are shown in Table 3. The mean value of GI is 0.011, indicating that the whole level of corporate green investment is not high, which needs to be improved. The maximum value of CPU is 3.287, while the minimum value is 1.269, meaning that the climate policy uncertainty has differences in different places. In addition, the standard deviation of KZ is 1.931, indicating that the degree of financing constraints differs significantly among companies.

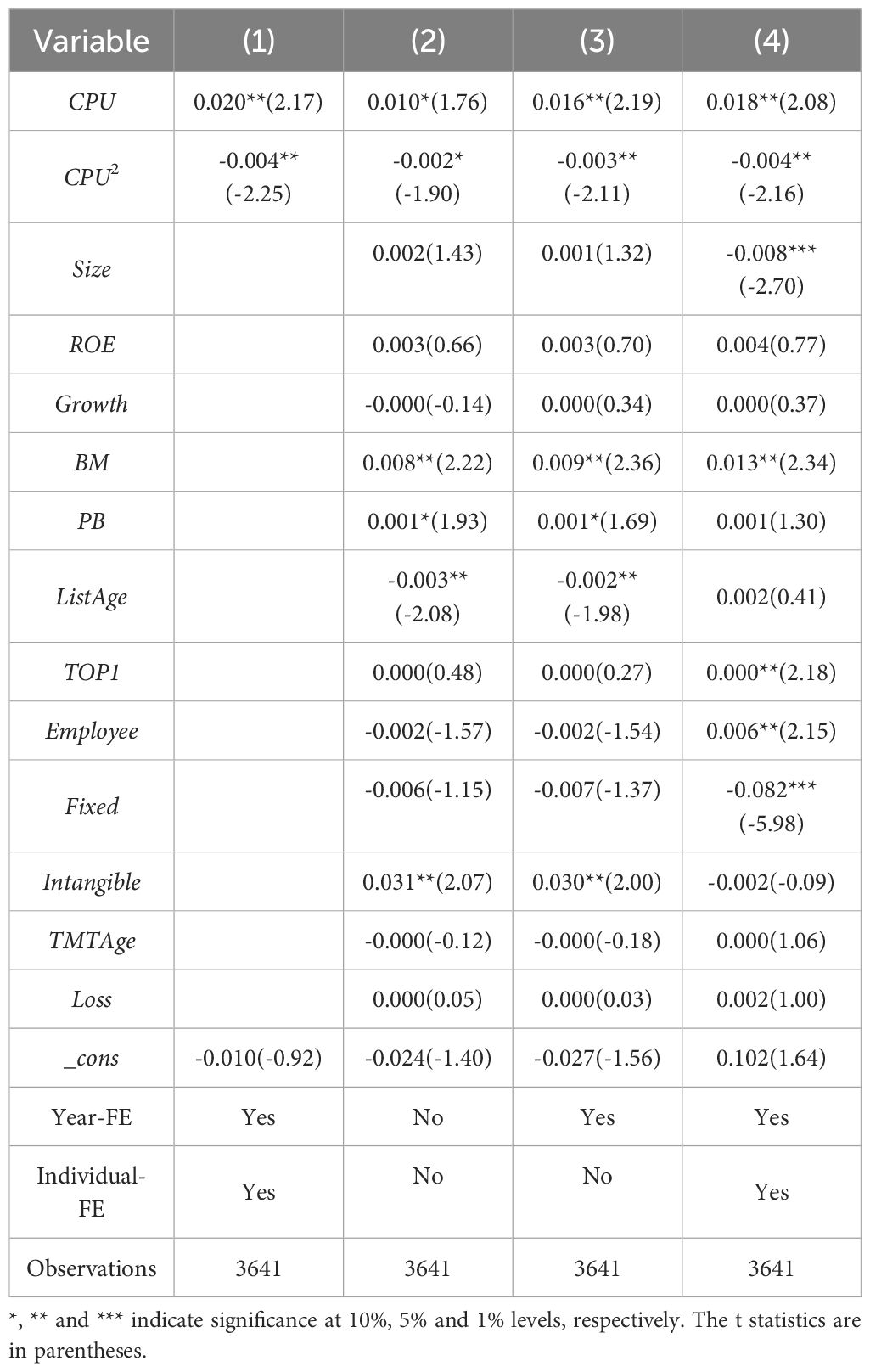

4.2 Analysis of baseline regression results

To test the nonlinear relationship between climate policy uncertainty and corporate green investment, this paper conducts baseline regression based on Equation 1, and the regression results are shown in Table 4. Column (1) only includes the test of the core independent variable climate policy uncertainty and its squared term on corporate green investment. Results show that the coefficient of CPU is 0.020, which is significant at the 5% level, simultaneously the coefficient of is -0.004, which is also significant at the 5% level. Columns (2) to (4) add control variables, and gradually fix time and individual effects for regression. In column (4), the coefficients of CPU and are 0.018 and -0.004, respectively, both are significant at the 5% level. The above results indicate that climate policy uncertainty has a significant inverted U-shaped effect on corporate green investment, and hypothesis 1 is verified. The reason for this phenomenon is that climate policy uncertainty initially generates incentives for companies (Bai et al., 2023), which seek to find opportunities from it. However, as climate policy uncertainty exceeds a certain level, companies may reduce green investment due to the considerations of risk and return. At this point, climate policy uncertainty has a negative impact on companies, which is similar to the findings of Ren et al. (2022); Mo and Liu (2023). In addition, in terms of control variables, book-to-market ratio, proportion of shares held by the first largest shareholder and the number of employees benefit corporate green investment.

To further confirm the inverted U-shaped relationship between climate policy uncertainty and corporate green investment, we also conduct the following work:

Firstly, this paper utilizes the utest test to examine the nonlinear relationship in columns (1) and (4) of Table 4. For column (1), the results show that: (1) On the left side of curve, the slope is 0.010 (p<0.05). On the right side of curve, the slope is -0.008 (p<0.05). (2) The extreme point is 2.404 which is within the valid range of values for climate policy uncertainty. (3) The overall test shows the p-value is 0.020. For column (4), the results show that: (1) The curve is characterized by firstly positive (0.009, p<0.05) and then negative (-0.007, p<0.05). (2) The extreme point of the curve is 2.424, which is within the range of valid values. (3) The p-value of the overall test is 0.025. The above results suggest an inverted U-shaped relationship between climate policy uncertainty and corporate green investment again.

Secondly, we introduce the cubic term of climate policy uncertainty into Equation 1 to test. The results exclude the possibility that the relationship curve of climate policy uncertainty and corporate green investment is S-shaped.

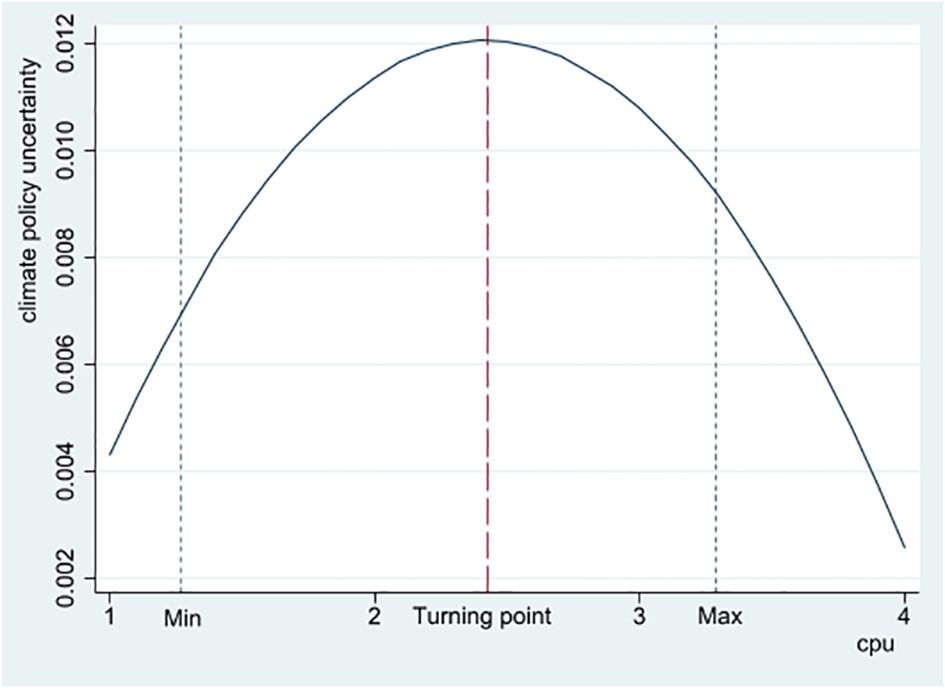

Thirdly, we perform a plotting analysis based on the results of column (4) in Table 4. As shown in Figure 2, with the increasing of climate policy uncertainty, corporate green investment shows an increasing trend firstly. However, after climate policy uncertainty reaching the extreme point (CPU=2.424), its impact on corporate green investment changes from positive to negative. Thus, the inverted U-shaped relationship between climate policy uncertainty and corporate green investment is further clearly shown. In addition, the distribution of CPU samples shows that about 65.6% of the indicator values are situated on the left of extreme point, and about 34.4% of the indicator values are in the right section of inverted U-shaped curve.

4.3 Treatment of endogeneity problem

Empirical results of baseline regression have shown the inverted U-shaped effect of climate policy uncertainty on corporate green investment. However, the relationship between the two may be affected by endogeneity problem. On the one hand, there may be a reverse causality problem between climate policy uncertainty and corporate green investment. On the other hand, the results may also be affected by omitted variables. To overcome endogeneity problem, this paper uses two-stage least square (2SLS) estimations with instrumental variable approach for the test. we choose provincial direct economic losses caused by natural disasters (EL) and its squared term () as instrumental variables. The reasons are: (1) Climate problems can cause natural disasters and then directly bring economic losses (Armal et al., 2020; Li et al., 2022), simultaneously attract the attention of policy makers, resulting in climate policy uncertainty. The fluctuation of climate policy is correlated with the direct economic losses caused by natural disasters, which meets the correlation requirement. (2) The provincial economic losses caused by natural disasters hardly have the impact on corporate investment behavior, and consequently are not directly related to corporate green investment. The instrumental variable meets the exogeneity requirement.

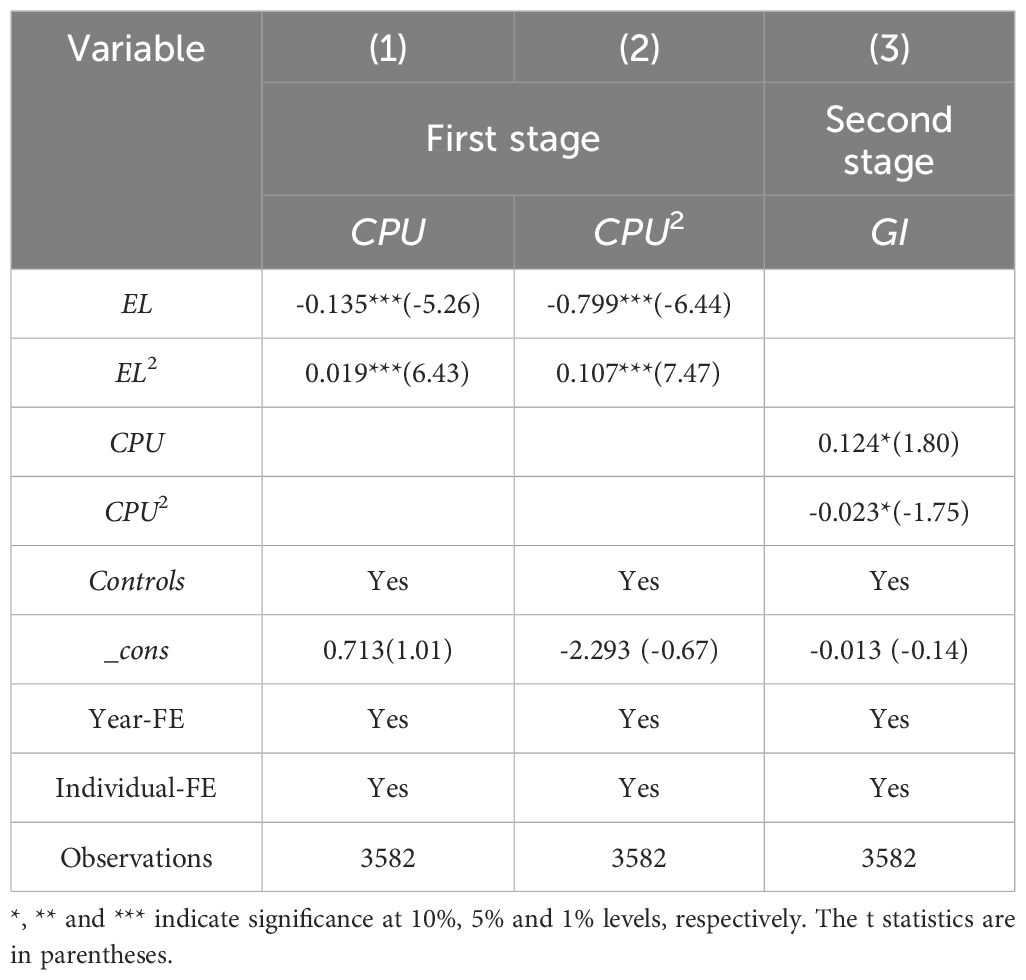

The results are shown in Table 5. According to the first stage regression results in column (1) and column (2), the coefficients of the instrumental variables are significant, indicating that climate policy uncertainty is related to the provincial direct economic losses caused by natural disasters. Meanwhile, the values of F in the first stage are all higher than 10, indicating that the instrumental variables are valid which is as expected. According to the second stage results in column (3), the coefficient of CPU is 0.124, and the coefficient of is -0.023, which are both significant at the 10% level. These further suggest that the conclusion of hypothesis 1 is robust.

4.4 Robustness tests

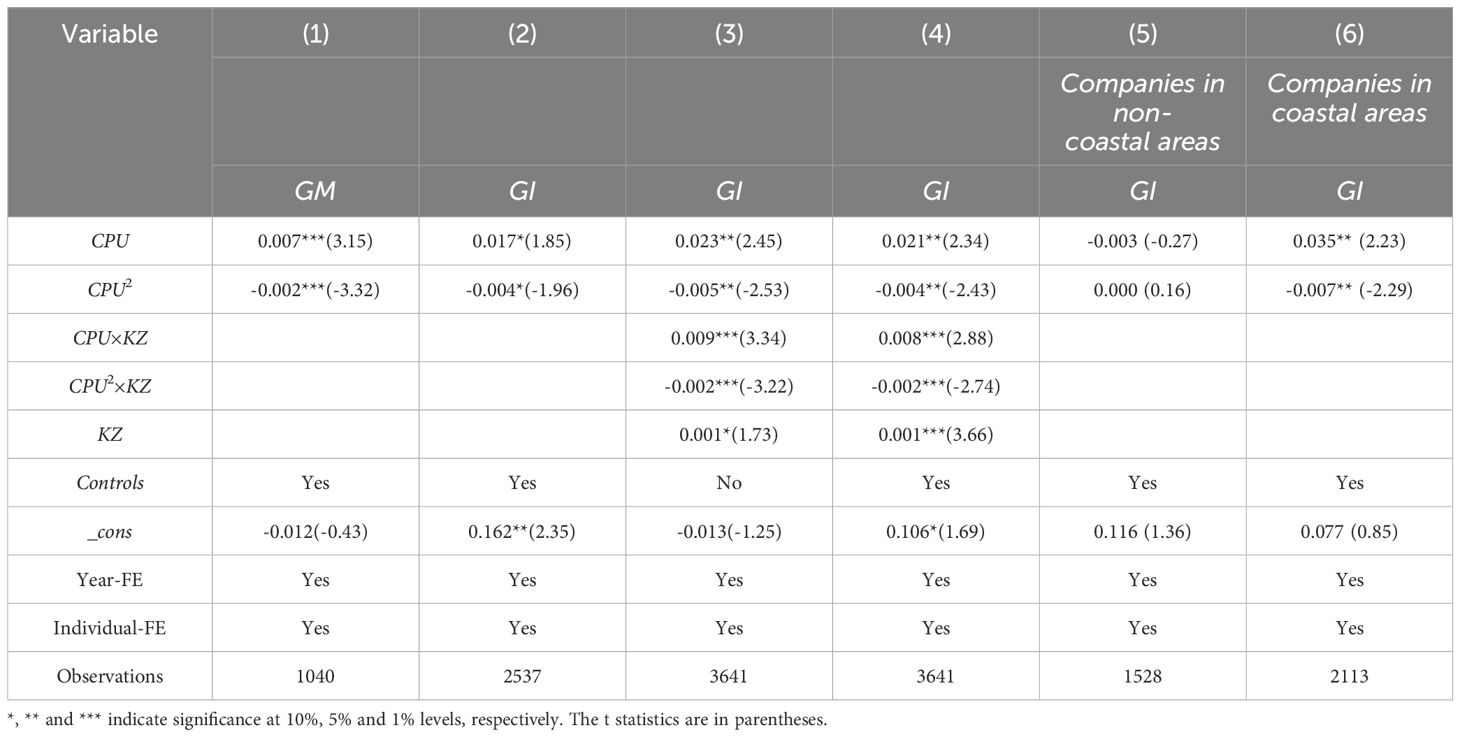

(1) Replacing dependent variable. This paper uses the ratio of corporate green management expenses to operating revenue (GM) to replace the dependent variable GI. The results are presented in column (1) of Table 6. The coefficients of CPU and are 0.007 and -0.002, respectively, and both of them are significant at the 1% level. These indicate that there is an inverted U-shaped relationship between climate policy uncertainty and corporate green investment, and the conclusion of the baseline regression is robust.

(2) Sample size adjustment. Manufacturing industry is the core of real economy, and its environmental management is crucial in China’s green transition. Thus, we narrow down the study scope to manufacturing companies and test again based on Equation 1. As shown in column (2) of Table 6, the coefficient of CPU is significantly positive, and the coefficient of is significantly negative, which are consistent with the baseline regression results.

4.5 Moderating effect test

In order to test the moderating role of corporate financing constraints in the inverted U-shaped relationship between climate policy uncertainty and green investment, this paper conducts regression analysis based on Equation 2, and the results are shown in columns (3) and (4) of Table 6. Among them, column (3) does not contain control variables and column (4) adds control variables. The coefficients of in columns (3) and (4) are significant, which indicates that there is a moderating role of corporate financing constraints in the inverted U-shaped impact of climate policy uncertainty on green investment.

Specifically, first of all, referring to the study of Haans et al. (2016), based on the Equation 2, we set the first derivative with respect to CPU to zero, and then obtain Equation 3. To show how the turning point changes as KZ changes, we then take the derivative with respect to KZ, and get Equation 4. The movement of curve turning point depends on the sign of . If is less than 0, the turning point will shift to the left; if it is greater than 0, the turning point will shift to the right. According to the results of column (4) in Table 6, the value of is 0.021, the value of is -0.004, the value of is 0.008, and the value of is -0.002. We can calculate that <0, which indicates that the increase in corporate financing constraints can shift the curve turning point to the left.

Secondly, the coefficients of and are both significantly negative in column (4) of Table 6, indicating that the increasing of corporate financing constraints can strengthen the inverted U-shaped relationship between climate policy uncertainty and corporate green investment, as well as hypothesis 2 is verified. This means that the inverted U-shaped relationship curve becomes steeper and corporate green investment is more sensitive to climate policy uncertainty as corporate financing constraints increase. Accordingly, it is necessary to alleviate corporate financing constraints to mitigate the negative impact of excessive climate policy uncertainty on corporate green investment.

4.6 Heterogeneity analysis

Considering the impact of coastal characteristic on companies, we divide the samples into companies in non-coastal areas and coastal areas based on the geographic location of provinces, and then test based on Equation 1. Referring to the studies of Shao et al. (2021) and Wang et al. (2024), the sample contains the majority of coastal provinces (municipalities) in China, including Tianjin, Shanghai, Hebei, Liaoning, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, Guangxi and Hainan.

The results are reported in columns (5) and (6) of Table 6. Columns (5) and (6) show the regression results for companies in non-coastal areas and coastal areas, respectively. It can be seen that the regression results of CPU and in column (5) are not significant. In contrast, in column (6), the coefficient of CPU is 0.035 and the coefficient of is-0.007, both of which are significant at the 5% level. Meanwhile, the utest test results of the nonlinear relationship for companies in coastal areas show that: (1) The extreme point of the curve is 2.472. (2) The slope of left curve is 0.017 (p<0.05), and the slope of right curve is -0.011 (p<0.05). (3) The p-value of the overall test is 0.016. In summary, climate policy uncertainty has an inverted U-shaped effect on the green investment of companies in coastal areas, while it has no significant effect on companies in non-coastal areas. Hypothesis 3 of this paper is proved. It can be seen that coastal characteristic do have the impact on policy effectiveness (Li and Li, 2022). From this point, government should recognize the impact of climate policy fluctuation on companies in coastal areas and formulate the reasonable climate policy.

5 Further analysis

To test the mediating role of green investment in climate policy uncertainty and environmental performance of companies in coastal areas, this paper constructs Equation 5, which together with Equation 1 constitutes the mediating effect testing process.

Where, represents the environmental performance of companies in coastal areas. If companies perform any of the following behaviors, EP is assigned the value of 1, otherwise it is 0: (1) Environmental certification; (2) Environmental recognition; (3) Measures to reduce emissions of waste gas, waste water, waste residue and greenhouse gas; (4) Environmentally friendly products; (5) Circular economy; (6) Energy conservation. The others are the same as Equations 1 and 2.

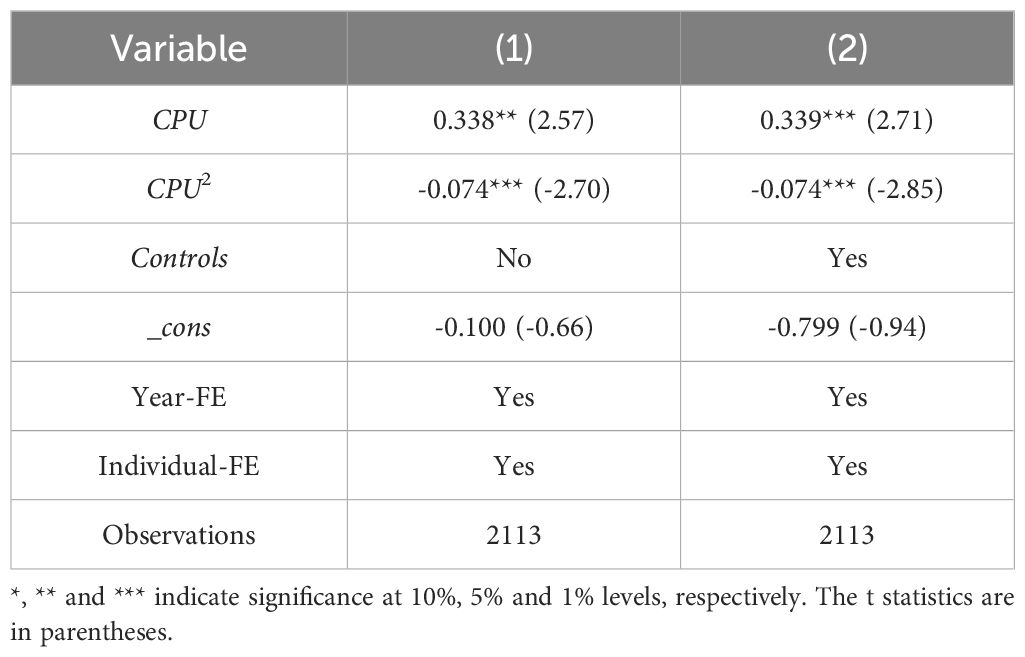

The results of Equation 5 are shown in Table 7. Column (1) includes no control variables, showing the coefficient of CPU is significantly positive and the coefficient of is significantly negative. Column (2) adds control variables on the basis of column (1), the coefficients of CPU and are 0.339 and-0.074, which are both significant at the 1%. And there is a notable link between green investment and environmental performance of companies in coastal areas. The above analysis reveals that climate policy uncertainty has an inverted U-shaped effect on environmental performance of companies in coastal areas through influencing green investment, and the hypothesis 4 is supported.

6 Conclusions and policy implications

6.1 Conclusions

Climate policy uncertainty has become an important factor affecting corporate environmental management behavior. Exploring the relationship between climate policy uncertainty and corporate green investment is not only related to the potential impacts and formulation strategies of climate policies, but also a major strategic issue about corporate green transformation and the efficient utilization of marine resources. This paper focuses on A-share listed companies in China from 2014 to 2020, innovatively examines the micro impact of climate policy uncertainty on corporate green investment, and specially analyzes the role of corporate financing constraints and coastal characteristic. The empirical results show that:

(1) There is an inverted U-shaped relationship between climate policy uncertainty and corporate green investment. Climate policy uncertainty initially motivates corporate green investment, but when it exceeds extreme point, green investment will be inhibited. The conclusion still holds after considering endogeneity problem and robustness tests such as instrumental variable approach, replacing dependent variable and sample size adjustment. (2) As the unignorable factor in corporate investment decisions, the increasing of corporate financing constraints strengthens the inverted U-shaped relationship between climate policy uncertainty and corporate green investment. Higher financing constraints can make the curve steeper, and simultaneously shift the turning point of the curve to left. (3) The inverted U-shaped impact of climate policy uncertainty on corporate green investment differs in different scenarios, with greater significance in coastal areas. (4) Climate policy uncertainty has an inverted U-shaped effect on environmental performance of companies in coastal areas through green investment.

6.2 Policy implications

The empirical results of this paper have the following policy implications: firstly, appropriate and stable climate policies should be formulated. When formulating climate policies to address climate issues, government should recognize the different impacts of varying climate policy fluctuations. On the one hand, the government should timely send incentive signals through climate policies to lead companies to make green investment, so as to promote the sustainable development of economy and society. On the other hand, policy makers should also be aware of the adverse impact of excessive climate policy uncertainty on corporate behavior. Government should focus on the consistency and predictability of policies to provide a stable and favorable external policy environment for corporate green investment. Secondly, climate policies should be formulated according to the characteristics of regions and companies. Policy makers should focus on the climate policy formulation of companies in coastal areas. And this “tailor-made” approach to guide green investment will ultimately promote high-quality economic development and realize the harmonious coexistence of human beings and nature. Thirdly, the degree of corporate financing constraints should be eased. Government and society should note financing constraints’ moderating role in the process of external environmental affecting corporate behavior. We ought to improve the market mechanisms and increase the financing channels to reduce the pressure on corporate financing.

7 Limitations and future research directions

This paper may have some limitations that offer potential for future research. Firstly, this paper has used provincial climate policy index, which effectively reflects the regional climate policy uncertainty. However, the impact of climate policy uncertainty on each company is different. Future research could try to construct a firm-level index system to more accurately assess its complex impacts. Secondly, this paper has only explored the impact of climate policy uncertainty on corporate green investment, but does not further examine its channels. Specific channel mechanisms could be explored to reveal the detailed paths of how climate policy uncertainty affects corporate green investment, so as to provide more precise policy implications for green transformation and marine economic management. Thirdly, we have conducted partial analysis of the coastal characteristic of companies. Future research could conduct more in-depth studies on marine-related companies based on more classification criteria.

Data availability statement

The data sources are mentioned in the article. Further inquiries can be directed to the corresponding author.

Author contributions

YS: Conceptualization, Visualization, Writing – original draft, Writing – review & editing. JD: Formal analysis, Methodology, Software, Writing – original draft, Writing – review & editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This research was supported by the Shandong Province Philosophy and Social Sciences Youth Talent Team Project (No. 2023-015), Shandong Province Social Science Planning Project (key item No. 23BKRJ02), Shandong Province Humanities and Social Sciences Project (No. 2023-2k2d-015) and Wealth Management Projects of Shandong Technology and Business University (No. 2022ZA01, 2022YB17).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Armal S., Porter J. R., Lingle B., Chu Z. Y., Marston M. L., Wing O. E. J. (2020). Assessing property level economic impacts of climate in the US, new insights and evidence from a comprehensive flood risk assessment tool. Climate 8, 116. doi: 10.3390/cli8100116

Bai D. B., Du L. Z., Xu Y., Abbas S. (2023). Climate policy uncertainty and corporate green innovation: Evidence from Chinese A-share listed industrial corporations. Energy Econ. 127, 107020. doi: 10.1016/j.eneco.2023.107020

Bendell B. L. (2022). Environmental investment decisions of family firms—An analysis of competitor and government influence. Bus. Strateg. Environ. 31, 1–14. doi: 10.1002/bse.2870

Ben Lahouel B., Ben Zaied Y., Managi S., Taleb L. (2022). Re-thinking about U: The relevance of regime-switching model in the relationship between environmental corporate social responsibility and financial performance. J. Bus. Res. 140, 498–519. doi: 10.1016/j.jbusres.2021.11.019

Borozan D., Pirgaip B. (2024). Climate policy uncertainty and firm-level carbon dioxide emissions: Assessing the impact in the US market. Bus. Strateg. Environ. 1–19. doi: 10.1002/bse.3784

Chen Z., Chen H., Wang L., Guo W. (2020). Factors of enterprise carbon performance: an empirical study of public shipping company in coastal regions of China. J. Coast. Res. 107, 268–272. doi: 10.2112/JCR-SI107-066.1

Cui Y. H., Xu H. X., An D., Yang L. (2024). Evaluation of marine economic development demonstration zone policy on marine industrial structure optimization: a case study of Zhejiang, China. Front. Mar. Sci. 11. doi: 10.3389/fmars.2024.1403347

Dalby P. A. O., Gillerhaugen G. R., Hagspiel V., Leth-Olsen T., Thijssen J. J. J. (2018). Green investment under policy uncertainty and Bayesian learning. Energy 161, 1262–1281. doi: 10.1016/j.energy.2018.07.137

Ding Q., Huang J. B., Chen J. Y. (2023). Does digital finance matter for corporate green investment? Evidence from heavily polluting industries in China. Energy Econ. 117, 106476. doi: 10.1016/j.eneco.2022.106476

Gao X. X., Zheng H. D. (2017). Environmental concerns, environmental policy and green investment. Int. J. Environ. Res. Public Health 14, 1570. doi: 10.3390/ijerph14121570

Gavriilidis K. (2021). Measuring climate policy uncertainty. SSRN, 3847388. doi: 10.2139/ssrn.3847388

Guariglia A., Yang J. H. (2016). A balancing act: Managing financial constraints and agency costs to minimize investment inefficiency in the Chinese market. J. Corp. Financ. 36, 111–130. doi: 10.1016/j.jcorpfin.2015.10.006

Gulen H., Ion M. (2016). Policy uncertainty and corporate investment. Rev. Financ. Stud. 29, 523–564. doi: 10.1093/rfs/hhv050

Haans R. F. J., Pieters C., He Z. L. (2016). Thinking about U: Theorizing and testing u- and inverted u-shaped relationships in strategy research. Strateg. Manag. J. 37, 1177–1195. doi: 10.1002/smj.2399

Hu Y. D., Bai W. S., Farrukh M. (2023). How does environmental policy uncertainty influence corporate green investments? Technol. Forecast. Soc. Change 189, 122330. doi: 10.1016/j.techfore.2023.122330

Huang L. Y., Lei Z. J. (2021). How environmental regulation affect corporate green investment: Evidence from China. J. Clean. Prod. 279, 123560. doi: 10.1016/j.jclepro.2020.123560

Huang T., Sun Z. Y. (2023). Climate policy uncertainty and firm investment. Int. J. Financ. Econ. 1–14. doi: 10.1002/ijfe.2881

Jiang Y. L., Guo C., Wu Y. Y. (2022). Does digital finance improve the green investment of Chinese listed heavily polluting companies? The perspective of corporate financialization. Environ. Sci. Pollut. Res. 29, 71047–71063. doi: 10.1007/s11356-022-20803-z

Kaplan S. N., Zingales L. (1997). Do investment-cash flow sensitivities provide useful measures of financing constraints? Q. J. Econ. 112, 169–215. doi: 10.1162/003355397555163

Li Y. J., Chen J. W., Li L., Huang X. J. (2024). Government innovation awards, innovation funds acquisition and enterprise innovation. Econ. Anal. Policy 82, 846–864. doi: 10.1016/j.eap.2024.04.021

Li C., Guo Y., Wang L. P. (2023). Can social organizations help the public actively carry out ecological environment supervision? Environ. Dev. Sustain. 26, 12061–12107. doi: 10.1007/s10668-023-03656-5

Li X. F., Li Z. H. (2022). Does environmental regulation contribute to enterprise green innovation? Empirical data based on the mediation effect from the perspective of executive compensation. Tech. Anal. Strateg. Manag. 36, 1847–1862. doi: 10.1080/09537325.2022.2116571

Li W. P., Wu Y. M., Gao X., Wang W. (2022). Characteristics of disaster losses distribution and disaster reduction risk investment in China from 2010 to 2020. Land 11, 1840. doi: 10.3390/land11101840

Liu X., Li H., Li H. (2022). Analyzing relationship between financing constraints, entrepreneurship, and agricultural company using AI-based decision support system. Sci. Program. 2022, 1634677. doi: 10.1155/2022/1634677

Liu C. L., Lin Y. M. (2018). Do mispricing and financial constraints matter for investment decisions? Appl. Econ. 50, 5877–5892. doi: 10.1080/00036846.2018.1488071

Liu S., Liu H. M., Chen X. Y. (2023). Does environmental regulation promote corporate green investment? Evidence from China’s new environmental protection law. Environ. Dev. Sustain. 26, 12589–12618. doi: 10.1007/s10668-023-03933-3

Ma Y. R., Liu Z. H., Ma D. D., Zhai P. X., Guo K., Zhang D. Y., et al. (2023). A news-based climate policy uncertainty index for China. Sci. Data 10, 881. doi: 10.1038/s41597-023-02817-5

Ma Y. B., Lu L., Cui J. B., Shi X. P. (2024). Can green credit policy stimulate firms’ green investments? Int. Rev. Econ. Financ. 91, 123–137. doi: 10.1016/j.iref.2024.01.009

Mo Y., Liu X. T. (2023). Climate policy uncertainty and digital transformation of enterprise-Evidence from China. Econ. Lett. 233, 111377. doi: 10.1016/j.econlet.2023.111377

Ren X. H., Li W. C., Duan K., Zhang X. R. (2024). Does climate policy uncertainty really affect corporate financialization? Environ. Dev. Sustain. 26, 4705–4723. doi: 10.1007/s10668-023-02905-x

Ren X. H., Zhang X., Yan C., Gozgor G. (2022). Climate policy uncertainty and firm-level total factor productivity: Evidence from China. Energy Econ. 113, 106209. doi: 10.1016/j.eneco.2022.106209

Shang Y. F., Han D., Gozgor G., Mahalik M. K., Sahoo B. K. (2022). The impact of climate policy uncertainty on renewable and non-renewable energy demand in the United States. Renew. Energy 197, 654–667. doi: 10.1016/j.renene.2022.07.159

Shao Q. L., Guo J. J., Kang P. (2021). Environmental response to growth in the marine economy and urbanization: A heterogeneity analysis of 11 Chinese coastal regions using a panel vector autoregressive model. Mar. Policy 124, 104350. doi: 10.1016/j.marpol.2020.104350

Shi P. H., Hu P., Chen X. D., Zhang F. F. (2019). The impact of institutional ownership on corporates’ Environmental responsibility: empirical evidence from coastal public companies in China. J. Coast. Res. 96, 5–11. doi: 10.2112/SI96-002.1

Song Y. J., Liu J. X. (2019). On the influence of ‘strip and block coexistence’ environmental decentralization on technology diffusion of environmental protection. Chin. J. Popul. Resour. Environ. 29, 108–117.

Syed Q. R., Apergis N., Goh S. K. (2023). The dynamic relationship between climate policy uncertainty and renewable energy in the US: Applying the novel Fourier augmented autoregressive distributed lags approach. Energy 275, 127383. doi: 10.1016/j.energy.2023.127383

Tang D. C., Chen W. Y., Zhang Q., Zhang J. Q. (2023). Impact of digital finance on green technology innovation: the mediating effect of financial constraints. Sustainability 15, 3393. doi: 10.3390/su15043393

Tian P., Lin B. Q. (2019). Impact of financing constraints on firm’ s environmental performance: Evidence from China with survey data. J. Clean. Prod. 217, 432–439. doi: 10.1016/j.jclepro.2019.01.209

Tong X. L., Wang Z., Li X. T. (2021). The influence of government subsidy on enterprise innovation: based on Chinese high-tech enterprises. Econ. Res-Ekon. Istraz. 35, 1481–1499. doi: 10.1080/1331677X.2021.1972818

Wang Y. F., Liu J., Yang X. R., Shi M., Ran R. (2023). The mechanism of green finance’s impact on enterprises’ sustainable green innovation. Green Financ. 5, 452–478. doi: 10.3934/GF.2023018

Wang H., Yang J. C., Wu H. S., Niu C. C. (2024). Research on the impact of marine economic development in coastal areas on regional economic resilience: evidence from China. Front. Mar. Sci. 11. doi: 10.3389/fmars.2024.1414663

Wen F. H., Li C., Sha H., Shao L. G. (2021). How does economic policy uncertainty affect corporate risk-taking? Evidence from China. Financ. Res. Lett. 41, 101840. doi: 10.1016/j.frl.2020.101840

Xi Y., Huynh A. N. Q., Jiang Y. S., Hong Y. R. (2023). Energy transition concern: Time-varying effect of climate policy uncertainty on renewables consumption. Technol. Forecast. Soc. Change 192, 122551. doi: 10.1016/j.techfore.2023.122551

Xu X., Huang S. P., Lucey B. M., An H. Z. (2023). The impacts of climate policy uncertainty on stock markets: Comparison between China and the US. Int. Rev. Financ. Anal. 88, 102671. doi: 10.1016/j.irfa.2023.102671

Yao Y. H., Feng J., Yang Q. W. (2022). Impact of financing constraints on firm performance: moderating effect based on firm size. Comput. Intell. Neurosci. 2022, 1954164. doi: 10.1155/2022/1954164

Yu L., Zhang B. B., Yan Z. J., Cao L. J. (2022). How do financing constraints enhance pollutant emissions intensity at enterprises? Evidence from microscopic data at the enterprise level in China. Environ. Impact Assess. Rev. 96, 106811. doi: 10.1016/j.eiar.2022.106811

Zhang Z. X., Ge Z. Y. (2024). Fishing in muddy water? Climate policy uncertainty and corporate greenwashing in environmental, social, and governance. Manage. Decis. Econ. 45, 4191–4207. doi: 10.1002/mde.4254

Zhang W., Ke J. J., Ding Y. G., Chen S. C. (2024). Greening through finance: Green finance policies and firms’ green investment. Energy Econ. 131, 107401. doi: 10.1016/j.eneco.2024.107401

Zhao L. H., Yuan H. A. I. (2024). Digital transformation and the herd effect of corporate green investment. Financ. Res. Lett. 63, 105244. doi: 10.1016/j.frl.2024.105244

Keywords: climate policy uncertainty, corporate green investment, financing constraints, coastal characteristic, environmental performance, inverted U-shaped impact

Citation: Song Y and Dong J (2024) Impact of climate policy uncertainty on corporate green investment: examining the moderating role of financing constraints. Front. Mar. Sci. 11:1456079. doi: 10.3389/fmars.2024.1456079

Received: 27 June 2024; Accepted: 02 August 2024;

Published: 26 August 2024.

Edited by:

Song Ding, Zhejiang University of Finance and Economics, ChinaReviewed by:

Chong Huang, Shandong University of Finance and Economics, ChinaShiwei Zhou, The University of Sydney, Australia

Copyright © 2024 Song and Dong. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jie Dong, MjAyMjQyMDIxN0BzZHRidS5lZHUuY24=

Yingjie Song

Yingjie Song Jie Dong

Jie Dong