- 1Institute of Marine Development, Ocean University of China, Qingdao, China

- 2Key Laboratory of Coastal Science and Integrated Management, First Institute of Oceanography, Ministry of Natural Resources, Qingdao, China

- 3Water Resources Department, Swedish Environmental Research Institute (IVL), Stockholm, Sweden

- 4Institute for Environmental and Climate Research, Jinan University, Guangzhou, China

Promoting the inclusion of blue carbon in market trading is crucial for recognizing its value and protecting the marine ecological environment. However, China currently does not have an internationally influential blue carbon market trading platform, which hampers the transmission of supply and demand in the blue carbon market and prevents the realization of blue carbon value. In this study, we analyze the feasibility and necessity of establishing a trading mode for the blue carbon market in China. The introduction of futures trading in the blue carbon market’s trading mode allows for the use of futures pricing methods and multiple financial instruments to address the challenges of income cost mismatch in blue carbon project development. The paper also discusses key strategies for the development of China’s blue carbon market, including the creation of a blue carbon trading methodology, the improvement of preservation and appreciation mechanisms, and the establishment of a unified trading platform. These strategies aim to provide intellectual support and decision-making reference for the construction of the market.

1 Introduction

Excessive greenhouse gas emissions pose a serious threat to human survival and development due to global warming (Davis et al., 2022). As the global economy recovers from the Corona Virus Disease 2019 crisis, carbon dioxide emissions have reached a record high of 34.9 billion tons in 2021. China alone accounted for 30% of the global total, with carbon dioxide emissions exceeding 10.47 billion tons (Liu et al., 2022b). Chinese President Xi Jinping addressed the global issue of climate change and China’s environmental challenges at the 75th United Nations General Assembly in September 2020. He announced that China will strengthen its nationally determined contributions and implement more powerful policies and measures to aim for a peak in carbon dioxide emissions before 2030 and achieve carbon neutrality before 2060.

The “Global Carbon Budget 2020” report from the Global Carbon Project reveals that the ocean is the largest carbon reservoir on Earth. The oceanic carbon reservoir has a carbon storage capacity 20 times greater than that of the land-based carbon reservoir and 50 times greater than that of the atmospheric carbon reservoir. It has a high capacity for carbon sequestration and serves as a significant carbon sink, playing a crucial role in mitigating climate change (Friedlingstein et al., 2020; Duarte de Paula Costa and Macreadie, 2022). Ocean carbon sinks, also known as “Blue Carbon,” refer to the carbon captured from the atmosphere and stored in marine and coastal ecosystems such as seagrass meadows, mangroves, and tidal marshes (Nellemann et al., 2009). These ecosystems are highly effective at removing carbon, storing up to 5 times more carbon per area than tropical forests and absorbing it from the atmosphere about 3 times faster as well. Blue carbon ecosystems, despite covering a small fraction of the global ocean area (0.2%), play a significant role in carbon burial in marine sediments. They may account for over 50% of all carbon buried, as supported by studies conducted by Duarte et al. (2013); Macreadie et al. (2021), and Mcleod et al. (2011). Coastal areas in China, serving as the country’s gateway to the outside world, have undergone rapid industrialization and urbanization. This has led to a growing development pressure on both the coastal zone and offshore areas (Kazemi et al., 2021). China’s blue carbon ecosystem is being threatened by the “coastal squeeze” caused by climate-driven impacts such as sea level rise and extreme weather events, as well as coastal development (Xu et al., 2018; Cheng et al., 2022). The value of blue carbon sinks can be realized by establishing a long-term mechanism to transform the value of blue carbon ecological products into economic value. This mechanism can promote the protection and restoration of blue carbon ecosystems, preventing their continuous degradation and transformation into carbon emission sources (Zang, 2019; Friess et al., 2022).

Blue carbon possesses both use value and exchange value, making it a valuable commodity. Building a blue carbon trading mode is beneficial for achieving emission reduction targets and can also serve as a market mechanism for value discovery. It can create a new economic growth point and promote the protection and restoration of the marine ecological environment (Jiao et al., 2018; Jiao et al., 2021). However, there have been limited advancements in blue carbon trading. Numerous studies have examined the economic value of blue carbon. Liu et al. (2019) and Bai and Hu (2021) proposed calculating the economic value of blue carbon using the ecosystem service payment theory and the natural resource asset property rights system. Shen et al. (2020) examined the role of blue carbon in ecological compensation mechanisms and proposed the use of a pricing mechanism to encourage market participants to engage in ecosystem protection and management. This would involve paying for blue carbon ecosystem carbon storage and carbon sequestration. Bertram et al. (2021) assessed the economic value of carbon sequestration and storage in global blue carbon ecosystems, as well as in different countries. They used shadow prices to calculate the contribution and redistribution of each country in the overall global blue carbon value creation. Siikamäki et al. (2012) developed marginal cost curves for carbon reduction in various regions and globally. They discovered that the cost of preventing mangrove deforestation is lower than the economic cost of CO2 emissions. Jakovac et al. (2020) conducted a separate calculation to determine the carbon sequestration potential of protecting and restoring mangroves, as well as the breakeven point when using an ecosystem service payment mechanism. Additionally, recent studies have also focused on the implementation of blue carbon trading. Ullman et al. (2013) argue that the most effective blue carbon market mechanism is a government-regulated “cap and trade” system and propose integrating blue carbon into market-based climate policies. Vanderklift et al. (2019) examined the limitations and opportunities of financial instruments in restoring and protecting blue carbon ecosystems. They suggest that creating successful demonstration and pilot projects can address gaps in this field, attract investor interest, and build practical experience. Yang et al. (2021) proposed that the blue carbon market should prioritize compliance and voluntary markets. They recommended implementing established methodologies and certification standards for ocean carbon sinks and actively exploring financial innovations in blue carbon. Additionally, scholars have explored various issues related to blue carbon, including its necessity (Sutton-Grier and Howard, 2018), the potential for developing blue carbon sinks (Macreadie et al., 2019; Zeng et al., 2021; Gao et al., 2022), development models (Cisneros-Montemayor et al., 2021; Yu and Wang, 2023), trading mechanisms (Cao et al., 2022; Wang et al., 2022; He et al., 2023), and development strategies (Herr et al., 2017; Jiao et al., 2018; Wan et al., 2021).

Existing studies have examined the economic value of blue carbon using various valuation methods, investigated the mechanisms and pathways of blue carbon market trading, and emphasized the significance of financial tools in realizing its economic value. However, there are three shortcomings in China’s current blue carbon trading system. Firstly, there is a problem with the supply of blue carbon products. Many developed blue carbon projects are unable to cover their development costs, which leads to a lack of motivation for further development. Secondly, there is a lack of financial innovation in the demand for blue carbon products, resulting in a shortage of these products and an inability to meet market demand. Lastly, China does not have a blue carbon trading platform, making it difficult to connect suppliers and buyers and causing inefficiencies in the transmission of supply and demand. This study examines the feasibility and necessity of establishing a blue carbon market trading model in China, taking into account the current conditions and domestic demand for blue carbon trading. Guided by the theory of ecological resource capitalization, this study proposes a blue carbon market trading mode dominated by futures trading, which involves derivative financial instruments. It aims to address the issue of cost-benefit mismatch in project development, as well as the preservation and appreciation of capital. This paper consists of five parts. The first part provides an introduction to the background of China’s blue carbon trading. The second part discusses the current situation and internal demands of blue carbon market trading in China. The third part explores the construction of the blue carbon market trading mode. The fourth part offers policy recommendations. Finally, the last part concludes the article.

2 The realistic foundation and internal demands of the blue carbon market trading in China

2.1 Policy support

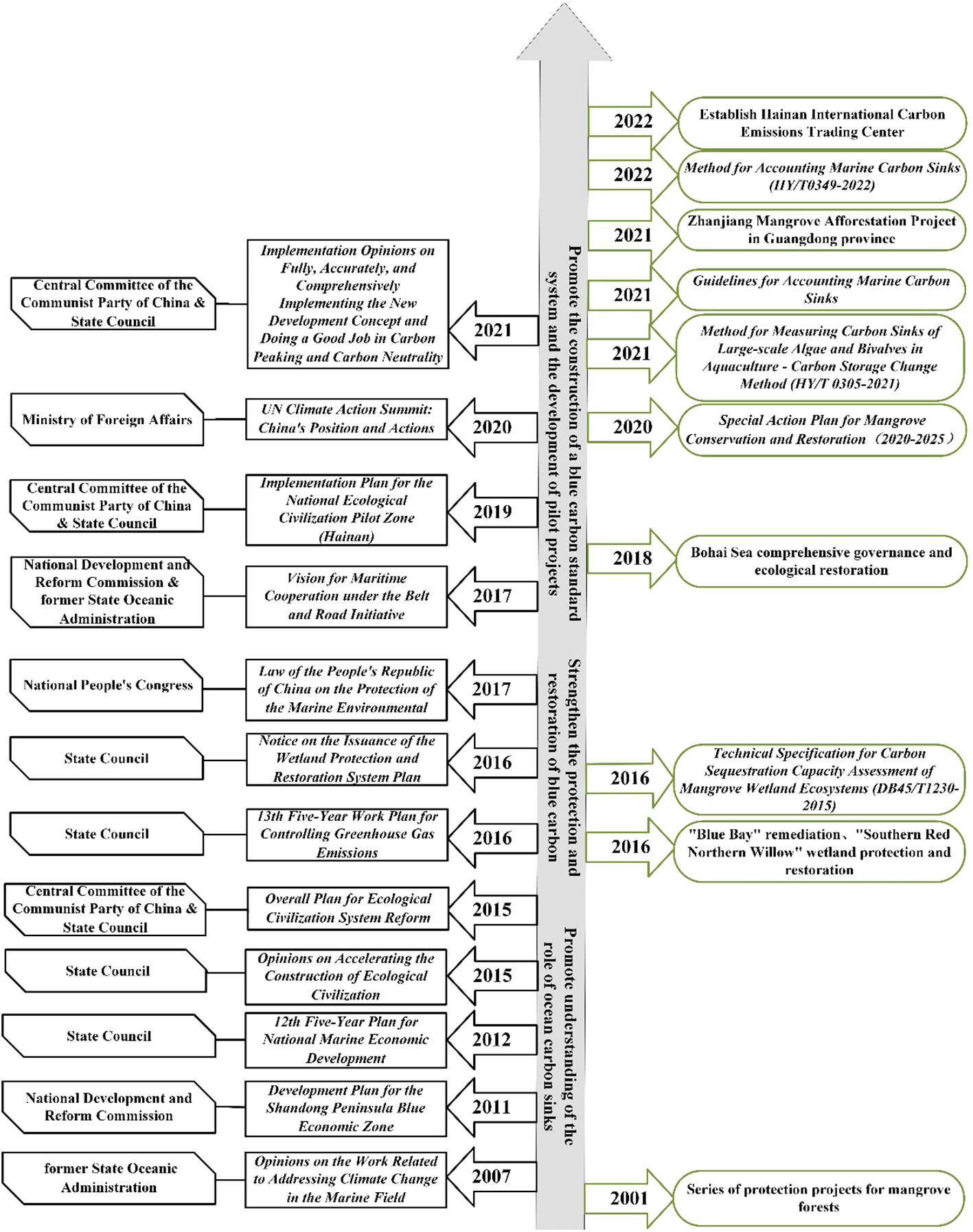

China’s government has implemented various blue carbon policies, as depicted in Figure 1, to safeguard blue carbon resources and encourage blue carbon market trading. The initial blue carbon policies proposed recognizing the functional role of blue carbon sinks and clarifying their important role in responding to climate change. Blue carbon policies have been developed to protect and restore blue carbon resources, based on a growing understanding of their importance. Additionally, China has also explored blue carbon trading mechanisms and pilots. The blue carbon policy evolution in China can be divided into three stages.

Figure 1 Blue carbon policies and practice exploration in China (In order to distinguish between the types of practices, the practices of blue carbon standard construction are represented in italics, and the practices of conservation projects are represented in Orthotype).

The importance of ocean carbon sinks was gradually recognized in the initial stage. The former State Oceanic Administration formulated the “Opinions on the Work Related to Addressing Climate Change in the Marine Field” as early as 2007, highlighting the crucial importance of addressing climate change in the oceanic domain. The “Development Plan for the Shandong Peninsula Blue Economic Zone” and the “12th Five-Year Plan for National Marine Economic Development” were issued to promote the use of blue carbon sinks and achieve a balance between economic, social, and ecological benefits. In 2015, the Central Committee of the Communist Party of China and the State Council issued the “Opinions on Accelerating the Construction of Ecological Civilization” and the “Overall Plan for Ecological Civilization System Reform.” These documents highlighted the importance of increasing ocean carbon sinks as an effective method for controlling greenhouse gas emissions. Ocean carbon sinks were officially incorporated into China’s policies and plans for addressing climate change and promoting economic and social development.

The second stage involved the gradual implementation of measures to protect and restore blue carbon ecosystems. The “13th Five-Year Work Plan for Controlling Greenhouse Gas Emissions,” the “Notice on the Issuance of the Wetland Protection and Restoration System Plan,” the “Guiding Opinions on Strengthening the Management and Protection of Coastal Wetlands,” and the “Notice on Central Financial Support for the Implementation of the Blue Bay Remediation Action” all propose measures to strengthen wetland protection and restoration and enhance the carbon sequestration capacity of wetlands. The 2017 revision of the “Law of the People’s Republic of China on the Protection of the Marine Environment” mandated that governments at all levels must implement effective measures to safeguard marine ecosystems. It also recognized the significance of protecting and restoring blue carbon resources by elevating it to a legal requirement.

The blue carbon standard system and pilot projects were conducted in the third stage. In 2017, the National Development and Reform Commission and the former State Oceanic Administration released the “Vision for Maritime Cooperation under the Belt and Road Initiative.” This document proposed collaborative efforts with countries along the Belt and Road to conduct research on blue carbon ecosystems, including monitoring, standardization, and carbon sequestration. It also aimed to establish an international blue carbon forum and cooperation mechanism. The “Implementation Plan for the National Ecological Civilization Pilot Zone (Hainan)” was later issued, which mandates the initiation of carbon sequestration pilot projects in Hainan Province. It also calls for research on the blue carbon standard system and trading mechanism, as well as the exploration of an international carbon emission trading venue. The “UN Climate Action Summit: China’s Position and Actions” report, released by the Ministry of Foreign Affairs in 2020, highlights China’s commitment to conducting sea level monitoring and assessment, blue carbon research and pilot projects, and marine ecological restoration. The “Implementation Opinions on Implementing the New Development Concept and Achieving Carbon Peaking and Carbon Neutrality” issued by the Central Committee of the Communist Party of China and the State Council in 2021 proposed the inclusion of carbon sequestration trading in the national carbon emission trading market.

2.2 Practice exploration

China’s government began implementing protection projects for mangrove forests as early as 2001 and later expedited the implementation of special actions. Related actions include the remediation of “Blue Bay,” the protection and restoration of the “Southern Red Northern Willow” wetlands, and the comprehensive governance and ecological restoration of the Bohai Sea. In the field of wetland protection and restoration, relevant departments have made continuous improvements to technical standards regarding the protection, restoration, property rights, utilization, and ecological function assessment of blue carbon resources. A series of systems have been developed to enhance the protection and management of blue carbon ecosystems, such as the implementation of wetland area control and ecological benefit compensation systems.

The “Technical Specification for Carbon Sequestration Capacity Assessment of Mangrove Wetland Ecosystems (DB45/T1230-2015)” was implemented in 2016 in Guangxi Zhuang Autonomous Region as the standard for constructing the blue carbon standard. The standard assessed the current status and potential of carbon sequestration, as well as the ecological value of mangrove wetlands. In 2021, the Dapeng New District of Shenzhen issued China’s first “Guidelines for Accounting Marine Carbon Sinks.” These guidelines established an accounting system to measure the total amount of carbon sinks from marine organisms and coastal wetlands. The “Method for Measuring Carbon Sinks of Large-scale Algae and Bivalves in Aquaculture - Carbon Storage Change Method (HY/T 0305-2021)” calculates the carbon sinks of large-scale algae in aquaculture using conversion coefficients derived from the carbon storage change method. The “Method for Accounting Marine Carbon Sinks (HY/T0349-2022)” offers a detailed plan for calculating the economic value of China’s marine carbon sinks. This method is China’s first comprehensive standard for accounting marine carbon sinks.

China has made significant progress in developing blue carbon projects, specifically in carbon sequestration in blue carbon ecosystems and seawater aquaculture. In April 2021, the Zhanjiang Mangrove Afforestation Project in Guangdong Province became China’s first mangrove carbon sequestration project to be registered and approved by the Verra organization. This project meets the requirements of both the Verified Carbon Standard (VCS) and the Climate, Community, and Biodiversity Standards (CCB). In June of the same year, China successfully completed its first project for mangrove carbon sequestration, resulting in a reduction of 5880 tons of carbon dioxide emissions. In July 2021, Xiamen became the first city in China to establish an ocean carbon trading platform. It successfully completed the first carbon sequestration transaction, resulting in a reduction of 2000 tons of carbon dioxide emissions. The Hainan International Carbon Emissions Trading Center was established in Sanya, Hainan Province in July 2022. On December 30, the first cross-border carbon transaction was completed using Verified Carbon Units (VCUs) under the Verified Carbon Standard (VCS), a globally recognized trading product. The project originated in India, a participant in the “Belt and Road” initiative, with a transaction volume of 10,185 tons. On February 28, 2023, the first-ever blue carbon transaction auction took place in Ningbo, Zhejiang Province.

2.3 Advantages of blue carbon products

China has a coastline that spans over 32,600 kilometers and is home to three types of blue carbon ecosystems: mangroves, salt marshes, and seagrass beds. China, consistently the world’s top producer in aquaculture, is uniquely positioned to develop blue carbon trading. China’s blue carbon products can be categorized into two types: blue carbon ecosystem carbon sinks and aquaculture carbon sinks.

2.3.1 Blue carbon ecosystem carbon sinks

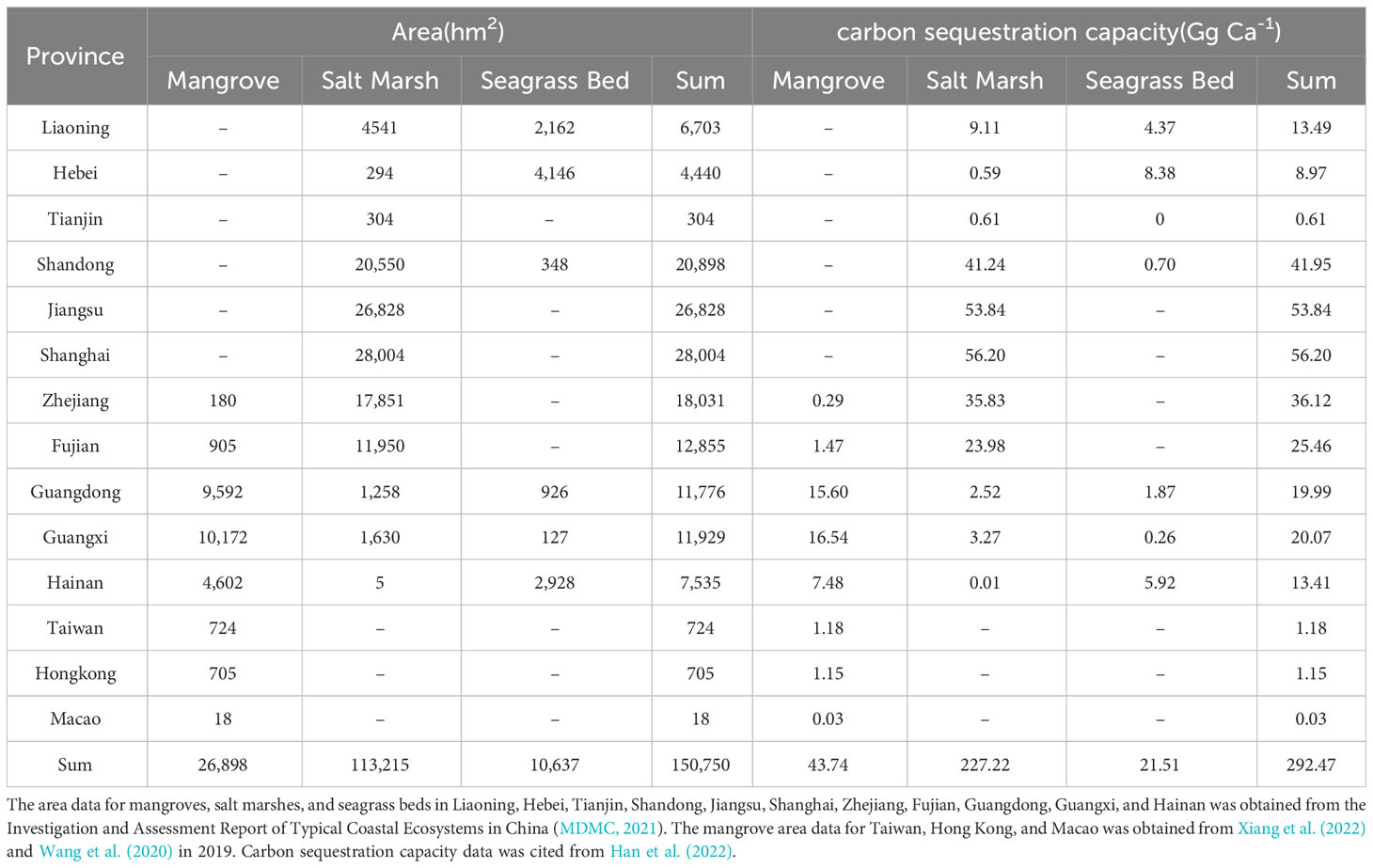

Blue carbon ecosystems, such as mangroves, salt marshes, and seagrass beds, are essential for the carbon cycle between land and sea. These ecosystems have strong photosynthetic capacity, slow decomposition rates, and high productivity, which makes them efficient at storing carbon per unit area. They have become a significant solution for addressing natural climate issues (Tang et al., 2018). According to estimates, the total habitat area of blue carbon ecosystems in China’s coastal zone was 150,750 hectares in 2020, with an annual carbon burial capacity of 292.47 GgC·a-1.

Coastal provinces and regions in China are home to blue carbon ecosystems, which have been increasing in both spatial distribution and area over the years. In China, the majority of mangroves (over 95%) are found along the coasts of Guangdong, Guangxi, and Hainan. Mangroves are also present in Zhejiang, Fujian, Hong Kong, Macau, and Taiwan. The area of mangroves decreased from 48,801 hectares to 20,671 hectares between 1973 and 2000, resulting in a loss rate of 57.6% due to human activities. The decline in mangroves was especially notable in provinces like Guangdong, Fujian, and Hainan, with a sharp decrease in their total area (Jia et al., 2021). Since 2000, there has been a considerable effort to protect and restore mangroves, yielding significant results. According to the Investigation and Assessment Report of Typical Coastal Ecosystems in China (MDMC, 2021), the mangrove area in China has been restored to 26,898 hectares, showing a net increase of 30.1% since 2000. Salt marshes are vital ecosystems along the Chinese coast and are found in coastal provinces. The salt marsh areas in Shandong, Jiangsu, Zhejiang, and Shandong provinces make up 85% of the total area in the country. China’s salt marsh area has declined by over 59% from the 1980s to the 2010s (Gu et al., 2018). As of 2020, China’s salt marshes cover a total area of 113,215 hectares (MDMC, 2021). The most common salt marsh vegetation in China includes Suaeda glauca, Phragmites australis, Spartina alterniflora, Bolboschoenoplectus mariqueter, and Tamarix chinensis (Hu et al., 2021; SKLEC, 2023). According to the Global Distribution of Seagrass Data Set (UNEP-WCMC, Short FT, 2017), seagrass beds in China are mainly found in the South China Sea. Extensive seagrass beds have been recently discovered in temperate waters, such as Yantai and Tangshan (Zhou et al., 2019; Yue et al., 2021). Since the 1970s, over 80% of seagrass beds in China’s coastal waters have vanished. Significant progress has been made in the protection of seagrass bed ecosystems in China through large-scale restoration projects. However, efforts to reverse the trend of degradation have not been successful (Xiang et al., 2022; Du et al., 2023). According to Zheng et al. (2013), the total area of seagrass beds in China in 2013 was 8,775 hectares. As of 2020, China had approximately 10,637 hectares of seagrass beds (MDMC, 2021).

The carbon sequestration effects of China’s three major blue carbon ecosystems are significant from the perspective of carbon sequestration in these ecosystems. The annual amount of carbon sequestration has been increasing steadily as the areas where it occurs continue to expand. The average burial rates of soil organic carbon in China’s coastal salt marshes, mangroves, and seagrass beds are 200.7, 162.6, and 202.2 g C·m–2·a–1, respectively. These rates are comparable to the average burial rates in blue carbon habitats worldwide (Zhou et al., 2016; Han et al., 2022). The estimated annual carbon sequestration amount in 2020 was 292.47 Gg C·a-1, based on the areas and carbon sequestration rates of the three major blue carbon ecosystems (Table 1).

Table 1 Distribution of blue carbon ecosystems and estimation of carbon sequestration capacity in coastal provinces of China in 2020.

2.3.2 Marine aquaculture carbon sinks

According to the “China Fisheries Statistical Yearbook 2021,” China’s marine aquaculture output reached 21.3531 million tons in 2020. The aquaculture output of filter-feeding shellfish was 14.9871 million tons, while the output of macroalgae with carbon sequestration capacity was 2.6214 million tons. However, the scale and diversity of shellfish and algae aquaculture vary among provinces due to differences in natural geographical environment and seawater resources. There is a significant spatial disparity in the carbon sequestration capacity of shellfish and algae aquaculture across provinces (Lai et al., 2022; Liu et al., 2022a). Figure 2 displays the calculated carbon sink capacity of marine aquaculture, considering the carbon sources in shellfish bodies, as well as the POC (particulate organic carbon) and DOC (dissolved organic carbon) produced during the growth of shellfish and algae (Yang et al., 2022). The results indicate that the carbon sink capacity of coastal provinces’ marine aquaculture has been steadily increasing over time. The carbon sink capacity increased from 2.1333 million tons/year in 2006 to 3.0263 million tons/year in 2020, showing a growth of 41.85%. The annual growth rate is around 2.53%. Shandong, Liaoning, Fujian, and Guangdong are four provinces with significant aquaculture production of shellfish and algae. These provinces also contribute to over 80% of the national annual carbon sink capacity of marine aquaculture.

Figure 2 Marine aquaculture carbon sink capacity in coastal provinces in China from 2006 to 2020 (10,000 tons/year). The data originated from Yang (Yang et al., 2022).

2.4 The feasibility of blue carbon trading

As the United Nations’ definition of carbon credits, as well as the principles and rules of carbon trading at both domestic and international levels, only the net increase in carbon emissions resulting from projects implemented with approved methodologies can be traded. This requirement is referred to as “additionality”. The “Measures for the Administration of Voluntary Greenhouse Gas Emission Reduction Trading (for Trial Implementation)” were issued by the Ministry of Ecology and Environment of the People’s Republic of China. “Additionality” refers to voluntary projects that reduce greenhouse gas emissions beyond what would have occurred in the baseline scenario determined by the relevant project methodology. In simpler terms, the project’s greenhouse gas emissions are lower than the baseline emissions, or the greenhouse gas removals are higher than the baseline removals. Not all increases can be traded, even though carbon credits represent an increase. Determining “additionality” is crucial for determining the eligibility of carbon credits for carbon trading. China currently possesses the necessary conditions to evaluate the “additionality” of blue carbon in terms of technology, theory, practice, and auditing.

2.4.1 Technical support

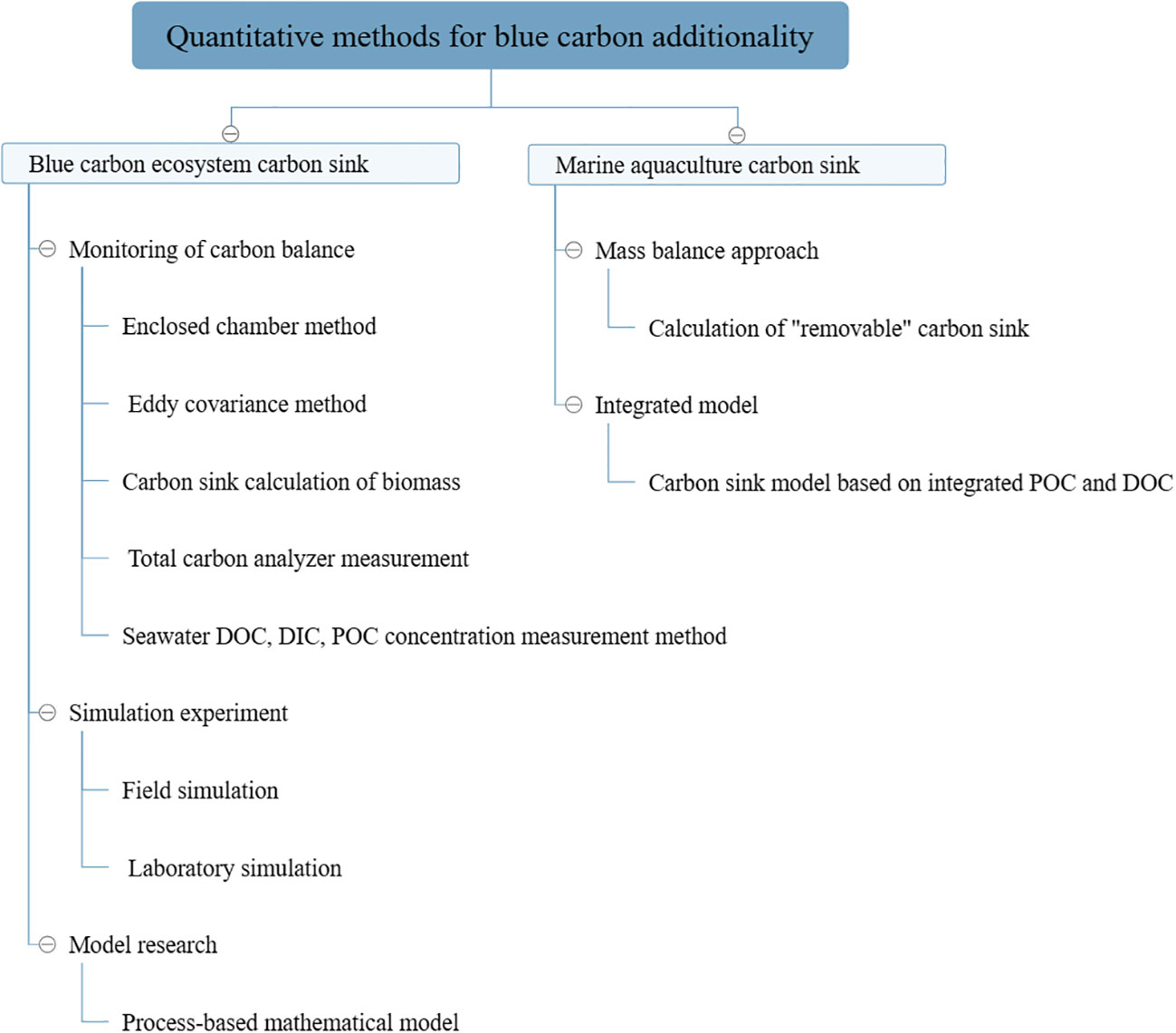

Current quantitative research methods for blue carbon ecosystems include carbon balance monitoring, simulation experiments, and modeling research. Carbon monitoring involves tracking carbon fluxes and storage. Flux measurements of vertical carbon fluxes are conducted using the enclosed chamber method and eddy covariance method. Water flow and the concentrations of dissolved organic carbon (DOC), dissolved inorganic carbon (DIC), and particulate organic carbon (POC) are measured in estuaries or tidal creeks to evaluate horizontal carbon fluxes (Tang et al., 2018). Various measurement methods are utilized for different carbon reservoirs (Zhang and Guo, 2013). The biomass carbon sink can be determined by multiplying the dry weight of vegetation’s above- and below-ground parts by the corresponding carbon conversion factor. Soil carbon content can be measured using a total carbon analyzer (Armentano and Woodwell, 1975). Simulation experiments can be classified as field or laboratory simulations. The carbon sink of blue carbon ecosystems can be measured through field sampling and laboratory estimation, which provides the default value. Model research involves the development of process-based mathematical models through long-term observation and simulation studies on blue carbon ecosystems. These models are utilized to forecast and assess the carbon absorption capacity of these ecosystems (Siikamäki et al., 2012; Jardine and Siikamäki, 2014).

The measurement of marine aquaculture activities primarily relies on the concept and model calculation of the “removable carbon sink.” Existing research methods for estimating carbon sinks include the mass balance approach (Zhang et al., 2017), which calculates the annual carbon sink capacity of marine aquaculture based on production output. With advancements in scientific knowledge and assessment methods, there is growing interest in modeling carbon sinks formed by particulate organic carbon (POC) and dissolved organic carbon (DOC) comprehensively (Zhou et al., 2019; Yue et al., 2021; Yang et al., 2022). Figure 3 illustrates the quantitative measurement methods employed to assess the “additionality” of blue carbon.

2.4.2 Theoretical and practical support

Strict methodology, approval procedures, and rigorous review of project emissions reductions are the three conditions that guarantee additionality. The development of blue carbon methodology has provided a preliminary theoretical foundation for determining additionality. The pilot work of carbon emission trading in China and the development of Chinese Certified Emission Reduction (CCER) trading have provided valuable experience for blue carbon trading, particularly in project and project emission reduction reviews.

In the field of carbon sequestration, methodologies for ocean carbon sequestration can be categorized into national greenhouse gas inventory compilation, carbon storage survey and monitoring, and carbon trading, depending on the specific focus (Zhao et al., 2021). “IPCC Guidelines for National Greenhouse Gas Inventories: Wetlands” outlines the method for compiling greenhouse gas inventories for three important blue carbon ecosystems: seagrass beds, mangroves, and coastal marshes. The “Coastal Blue Carbon Methods” publication by the Blue Carbon Initiative working group introduces a scheme for field investigations of carbon storage in three major blue carbon ecosystems. This involves surveys and analysis of sediment carbon pools, biomass carbon pools, carbon storage, and annual carbon fixation rates. The carbon trading market methodologies “AR-AM0014 Afforestation and reforestation of degraded mangrove habitat” and “AR-AMS0003 Simplified baseline and monitoring methodology for small-scale CDM afforestation and reforestation project activities implemented on wetlands” are included in the Clean Development Mechanism (CDM) methodology system. These methodologies can also be applied to Joint Implementation (JI) and Verified Carbon Standard (VCS) project development, particularly for mangrove projects. The “REDD+ Methodological Framework,” “VM0024 Methodology for Coastal Wetland Creation,” and “VM0033 Methodology for Tidal Wetland and Seagrass Restoration” are components of the VCS methodology system. These methodologies outline the requirements for developing wetland carbon sink projects, including those that involve mangroves. The methodology for peatlands can also be applied to carbon sink projects in mangroves and salt marshes (Chen et al., 2022). The carbon sequestration methodology for kelp farming was released at the International Forum on Marine Ecological Economy held in Nanhai New Area, Weihai in 2019. This methodology is China’s first approach to ocean carbon sequestration.

2.4.3 Third-party auditing

The third-party auditing that determines the “additionality” of blue carbon sinks is crucial for the implementation of blue carbon trading. As of 2017, China has approved 12 third-party certification and verification agencies to assess voluntary greenhouse gas reduction projects. Third-party organizations, like the China Quality Certification Center (CQC), can professionally review the boundaries, additionality, sustainable management, and community improvement of blue carbon projects using blue carbon methodologies.

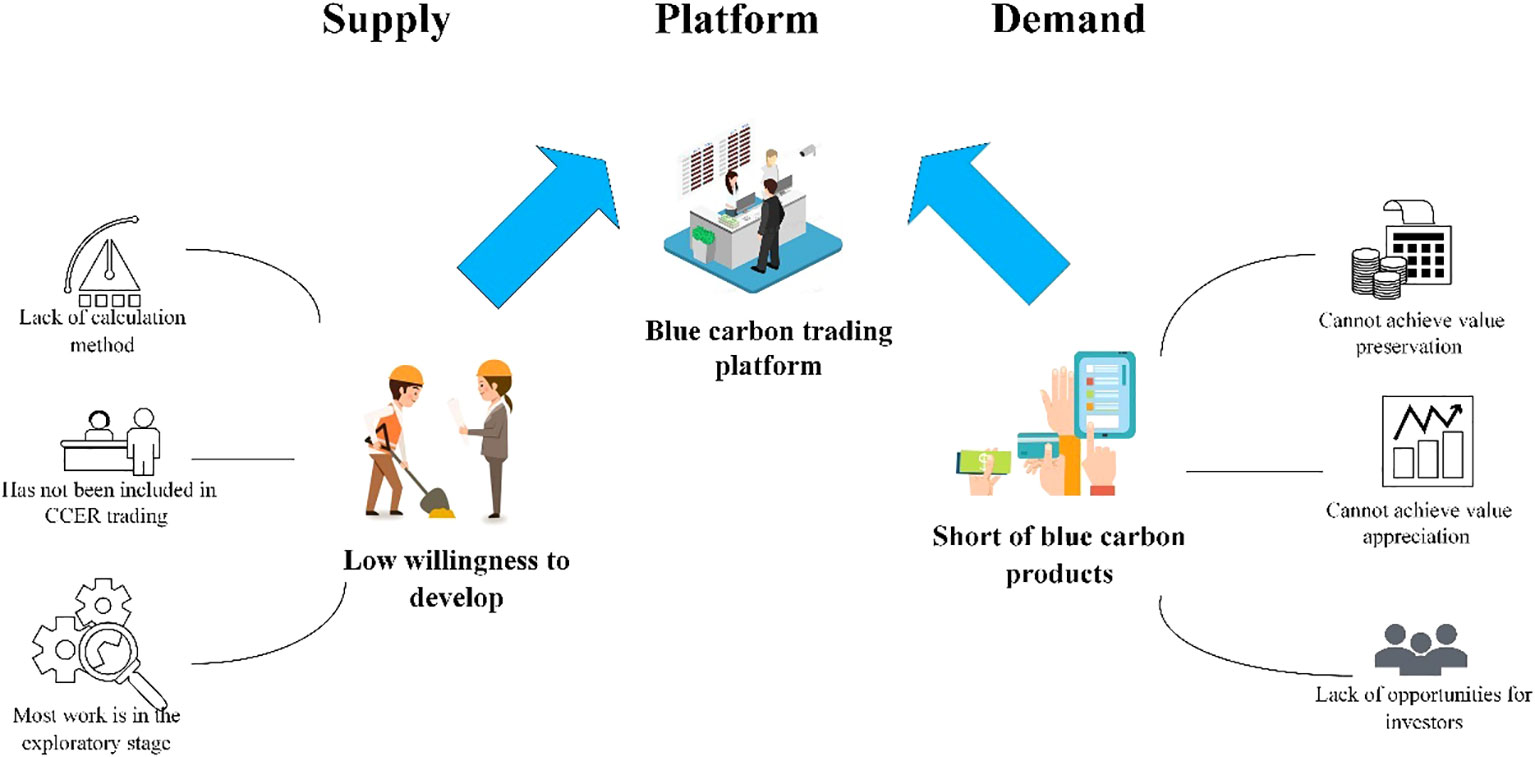

2.5 Internal demands

Based on the analysis of China’s blue carbon market trading, it is evident that implementing blue carbon trading is feasible. However, there are still some issues with China’s blue carbon market: (1) From the perspective of blue carbon product supply, currently developed projects face the challenge of insufficient benefits to cover development costs, leading to a low motivation for further development. The primary reason for the low revenue of blue carbon projects is the inadequate calculation of blue carbon value. The current methods, such as cost-plus pricing or market value, do not consider the scarcity of blue carbon resources. Blue carbon has not been included in CCER trading, resulting in its market value not being publicly recognized. The current value of blue carbon is underestimated. The high cost of developing blue carbon projects is due to the ongoing exploration of protection, restoration, monitoring, evaluation, measurement, and verification work for these projects. Standard methodologies have not been established, resulting in high initial expenses. (2) The lack of financial innovation in the blue carbon market leads to a shortage of products, preventing the demand from being met. This slow process of capitalizing on blue carbon resources hinders the preservation and appreciation of blue carbon capital, limiting the sustainable development of blue carbon capital operation. Currently, blue carbon trading projects are the most common form of over-the-counter spot trading in financial transactions. However, these projects lack hedging or insurance measures, and the risks associated with project development are relatively high. It becomes challenging to preserve capital. The current pricing mechanism and trading mode do not consider the time value of money and investor expectations, and do not support the appreciation of blue carbon capital. Relying solely on a single investment method restricts the ability of investors driven by value appreciation and speculation to engage in trading. This results in an excessive dependence on the ecological compensation mechanism, which is funded by public finance, for the protection and restoration of blue carbon resources. Consequently, there is a lack of internal incentives and long-term mechanisms. (3) China currently lacks a globally recognized blue carbon trading platform and a means of connecting suppliers with demanders. Consequently, there is limited transmission of supply and demand, and a lack of pricing autonomy for blue carbon. This vulnerability exposes organizations to the impact of the international market. The accurate reflection of true market supply and demand is hindered, which prevents investors from making correct investment decisions, as depicted in Figure 4.

This study proposes a trading mode for the blue carbon market to address the mentioned problems. The aim is to find a scientifically reasonable method for valuing the market and to resolve the issue of income and cost mismatch. By offering a variety of financial instruments to attract more traders, we can establish a strong blue carbon trading market. This platform will make blue carbon market transactions more accessible, ultimately helping to preserve and increase blue carbon capital.

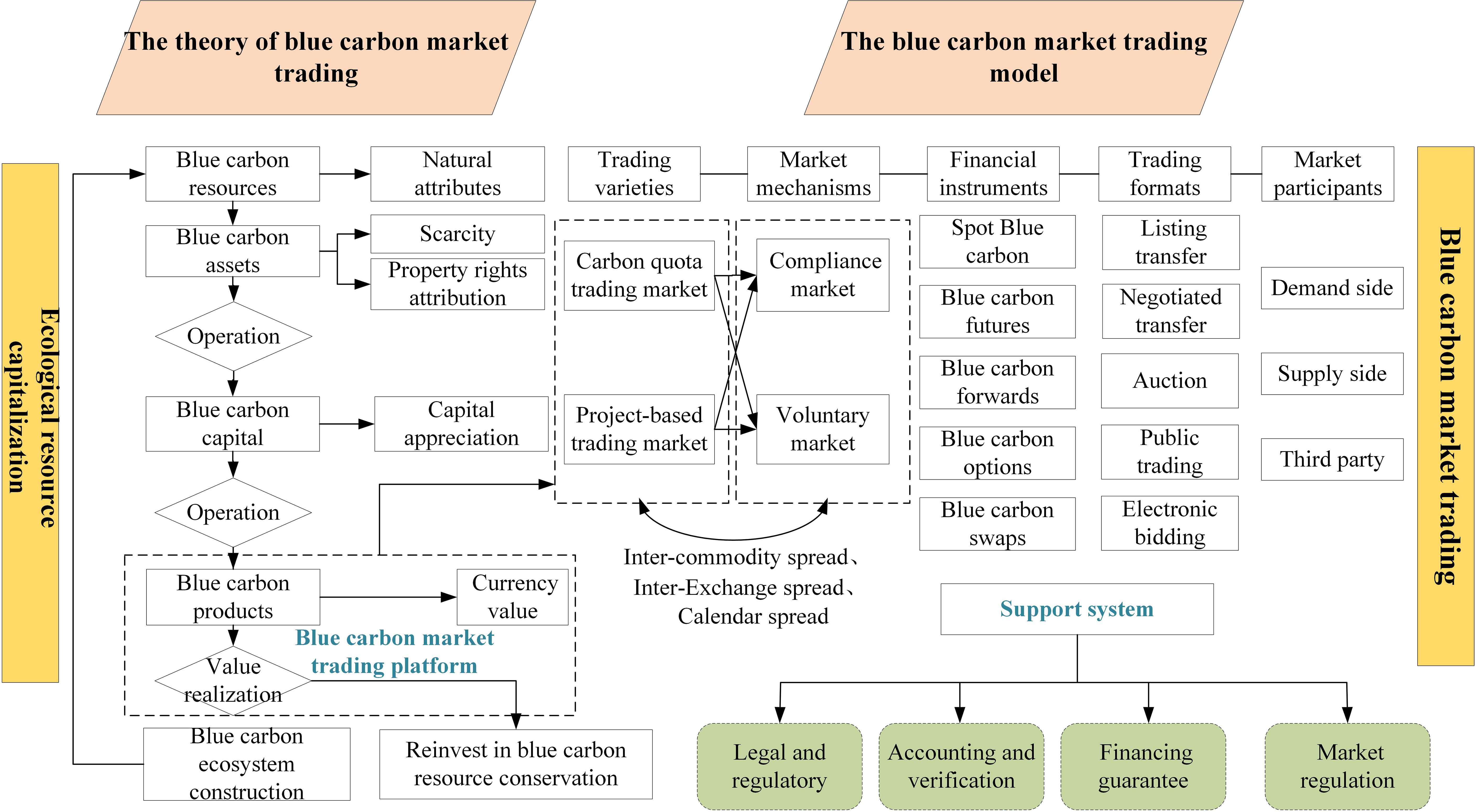

3 Constructing a trading mode for the blue carbon market

The construction of a blue carbon market trading platform is a complex system project that requires a strong theoretical foundation. This study applies the theory of ecological resource capitalization to develop a blue carbon market trading platform. The platform is constructed based on five key aspects: trading varieties, market mechanisms, financial instruments, trading formats, and market participants. And establish a comprehensive support system from four perspectives: legal and regulatory, accounting and auditing, financing guarantee, and market regulation (see Figure 5).

3.1 The theoretical basis of blue carbon market trading

This article proposes a trading mode for the blue carbon market based on the theory of ecological resource capitalization. Ecological resource capitalization refers to the process of increasing the value of scarce ecological resources by establishing clear property rights and utilizing market-based capital operations. This process follows the evolutionary logic of “ecological resources-ecological assets-ecological capital-ecological products” (Zhang and Zhang, 2019). The construction of the blue carbon market trading mode promotes the formation of a closed loop for capitalizing on blue carbon resources. In order to establish the trading mode of the blue carbon market and facilitate the transformation of blue carbon from ecological resources to ecological products, it is crucial to follow the entire evolutionary process of “blue carbon resources-blue carbon assets-blue carbon capital-blue carbon products” (Yang et al., 2021).

The process of assetizing blue carbon resources involves converting blue carbon from a natural resource with ecological attributes into a blue carbon asset with associated property rights (Gao et al., 2016). By establishing a comprehensive institutional framework that clearly defines the rights and ownership of blue carbon resources, including ownership, possession, control, use, income, and disposal rights, a market mechanism can be implemented to realize the value of these resources. Market pricing and trading can only incentivize and regulate blue carbon developers and operators if ownership of blue carbon resources is established.

The capitalization of blue carbon assets involves consolidating dispersed assets, selecting suitable financial instruments, and coordinating the capitalization process (Yan et al., 2009). Blue carbon capital can be preserved and increased through market investments and capital circulation. Blue carbon capital refers to a type of asset that has the potential to generate future cash flows and increase in value over time through circulation. It can create greater value than its initial worth. Financial instruments are essential for converting blue carbon assets into blue carbon capital. They provide investment opportunities and facilitate the movement of funds and capital.

The monetization of blue carbon products involves creating financial mechanisms and trading these products in the open market (Lan et al., 2020). By utilizing advanced pricing models in financial mechanisms, the issue of cost-benefit mismatch in blue carbon project development can be addressed. The monetization of blue carbon products is crucial for realizing the economic benefits of blue carbon resources and is the most critical step in capitalizing on these resources.

3.2 Blue carbon market trading platform

The blue carbon market trading platform is a platform that sells standardized financial products in the form of blue carbon products. The platform uses financial instruments to transform blue carbon assets into blue carbon capital, with the goal of preserving and increasing their value. The design of the blue carbon market trading platform should learn from well-established international and domestic carbon emission trading platforms in China. The security management should also include the integration of blue carbon products, both in the form of spot products and as derivatives. The construction of the blue carbon market trading platform includes five main aspects: trading varieties, market mechanisms, financial tools, trading formats, and market participants.

3.2.1 Trading varieties and market mechanisms

Clarifying the trading options and market mechanisms for the blue carbon market trading platform is essential to ensure that blue carbon project development meets delivery standards and is eligible for trading. Blue carbon is part of a project-based trading market that complements the carbon quota trading market. The market size and price fluctuations of blue carbon are influenced by both the carbon quota trading market and other carbon sequestration project trading markets. Traders have the opportunity to participate in both the carbon quota trading market and the project trading market. The trading varieties in the blue carbon market primarily depend on the carbon sequestration volume generated by blue carbon projects, based on market connectivity and transaction convenience. Additionally, they provide trading options such as inter-commodity spread, inter-exchange spread, and calendar spread between the carbon quota trading market and other carbon sequestration project trading markets. The blue carbon market trading platform operates through two mechanisms: the compliance market and the voluntary market. Blue carbon trading is applicable in the compliance market through methods like the Clean Development Mechanism (CDM) and Joint Implementation (JI). Blue carbon trading in the voluntary market is implemented through methods such as the Verified Carbon Standard (VCS) and Gold Standard (GS).

3.2.2 Financial instruments and trading formats

The choice of financial instruments determines the financial mechanism for blue carbon products. The blue carbon market trading platform should utilize derivative financial instruments, such as futures contracts. Futures pricing is advantageous because it can consider both the development cost of blue carbon projects and the time value of funds, while also providing a more accurate representation of the expected scarcity of blue carbon. Additionally, futures contracts can meet the trading needs of multiple parties and attract a larger number of traders. Developers of blue carbon projects can use blue carbon futures to engage in spot-futures arbitrage, which involves holding spot positions to achieve risk hedging and risk transfer. Carbon purchasing enterprises can mitigate losses resulting from sudden price fluctuations near the delivery date by purchasing blue carbon futures in advance. Speculators can profit from price fluctuations by engaging in cross-period arbitrage and one-sided trading of blue carbon futures. However, they must also be willing to accept the associated risks. The blue carbon market trading platform provides a range of financial instruments, including spot, forwards, options, swaps, and others, to meet the diverse trading needs of market participants.

Blue carbon futures are traded through listing transfer and negotiated transfer. Listing transfers can be divided into public bidding and direct sales. Public bidding involves multiple interested parties who publicly bid, and the transfer is made to the highest bidder as determined by the auction. Direct sales are sold at either the commission price or the reference price. A negotiated transfer is a transfer that occurs at a price that is equal to or higher than the reference benchmark, following negotiations between the two parties. Other financial instruments derived from blue carbon can be traded through various methods such as auctions, public trading, electronic bidding, and other flexible approaches.

3.2.3 Blue carbon market participants

According to the theory of supply and demand in economics, participants in the blue carbon market include those on the demand-side, supply-side, and other market participants (MEE, 2019; Sankar, 2020). The demand-side consists of compliance buyers, voluntary buyers, and other organizations, institutions, and individuals who adhere to regulations. The supply side of blue carbon projects typically includes developers and owners, such as state-owned, collective, and individual entities. Other market participants include third-party certification bodies and brokers. The trading behavior of demand-side and supply-side participants in the blue carbon market helps to unlock the value of blue carbon products. Other market participants play a role in facilitating transaction completion through services such as measurement and certification, approval, guarantee, feasibility studies, and brokerage services.

3.3 The supporting system for blue carbon market trading

The blue carbon market trading platform serves as a public venue for trading blue carbon. However, it still requires support and alignment in terms of legal regulations, accounting and verification, financing guarantees, and market regulation to ensure the orderly and standardized operation of the platform.

3.3.1 Legal and regulatory framework

A robust legal framework is essential for regulating market transactions, defining trading behavior prohibitions, and ensuring the smooth operation of the blue carbon market. In selecting the legal framework for the blue carbon market, a combination of the “top-down” integrated legislative model, the specialized legislative model, and the “bottom-up” local legislative model should be adopted. The integrated legislative model promotes the integration of the blue carbon market with national-level carbon emission legislation, facilitating a unified process. The special legislative model involves the formulation of supportive laws, regulations, and market supervision rules for blue carbon financial transactions under the leadership of government departments. Local coastal provinces are promoting local legislation to advance the development and market construction of blue carbon resources, based on their specific types and foundations (Pan, 2018).

3.3.2 Accounting and verification

An effective blue carbon accounting and verification system ensures that carbon offsets generated by blue carbon projects meet requirements for additionality, authenticity, and measurability. Only verified and accounted for blue carbon projects are eligible for trading on the platform. The development and verification process of Chinese blue carbon projects can follow the implementation process of CCER projects, which consists of six steps: preparing project design documents, project approval, project filing, project implementation and monitoring, emission reduction verification, and emission reduction filing and issuance.

3.3.3 Financing guarantee

The blue carbon financing guarantee mechanism includes various financial instruments such as blue carbon bonds, commercial loans, funds, trusts, insurance, and other forms of capital financing and risk mitigation. Capital financing can help attract private capital to blue carbon development projects. This approach reduces reliance on public funding for blue carbon protection and restoration, while creating internal incentives and long-term mechanisms that are sustained by carbon revenue. These mechanisms aim to encourage early-stage investment. Blue carbon insurance enables risk transfer and capital supplementation, offering protection for the development of blue carbon projects and promoting their sustainable operation.

3.3.4 Market regulation

The establishment of a three-tier regulatory system, which includes government regulatory departments, market regulatory agencies, and trading platforms, is necessary. Government departments play a crucial role in regulating and overseeing various aspects of society. They establish laws, regulations, and standards at a macro and policy level, and also engage in management, regulation, and supervision. The regulatory agency for the blue carbon market formulates industry rules and implementation details for trading blue carbon. The responsibility of blue carbon accounting and verification, supervision and inspection, and information disclosure falls under its purview. The trading platform internally supervises and manages trading, delivery, settlement, and default processing. The blue carbon market reduces risks such as carbon reversal, abnormal price fluctuations, and imperfect carbon accounting and certification technologies through a three-tier regulatory system. This ensures that the market operates in an organized and transparent manner.

4 Policy recommendations for establishing blue carbon market trading modes

4.1 Developing blue carbon trading methodology

Developing a pricing model for blue carbon derivatives, with a futures pricing mechanism at its core, is crucial for addressing the issue of mismatched costs and benefits in blue carbon project development. It is crucial to establish and improve a comprehensive blue carbon trading methodology system that includes all types of blue carbon resources. This will establish a standardized and widely recognized system for accounting and verifying blue carbon projects, which will greatly support the development of a unified blue carbon market trading platform. It is crucial to expedite the inclusion of blue carbon in CCER trading. This will attract more participants to the blue carbon market, improve market liquidity, and accelerate the realization of the value of blue carbon resources.

4.2 Establishing blue carbon hedging and value-added mechanism

Accelerating the development of the blue carbon property rights system and overcoming institutional barriers are crucial for successfully capitalizing on and operating blue carbon resources. By clarifying the legal rights associated with blue carbon, distinguishing between public and private interests, and specifying liability responsibilities, institutional barriers to blue carbon financial innovation can be overcome. It is important to fully utilize the risk hedging and hedging functions of derivatives, such as futures. A wide variety of financial instruments, such as bonds, credit, and funds, should be used to diversify financing options. By maximizing the value and potential of blue carbon resources, we can attract greater private investment in the preservation and restoration of blue carbon ecosystems. This will help reduce the financial burden currently experienced by blue carbon development projects. By promoting the concept of “resource utilization” to enhance “blue carbon protection,” we can establish a positive feedback loop of protection and restoration. This will lead to the accumulation and appreciation of blue carbon capital.

4.3 Building a unified blue carbon market trading platform

Building a unified blue carbon market trading platform with international influence is crucial for connecting buyers and sellers of blue carbon products and gaining pricing power in the market. China’s blue carbon market trading platform should ease market access conditions to attract more domestic and international participants. At the same time, it is necessary to gradually reduce the total amount of domestic carbon emission quotas, decrease the proportion of free allocation, increase the proportion of auction quotas, and enhance market liquidity. It is crucial to establish an international mutual recognition mechanism to facilitate trading across markets, products, and time periods. This will enhance trading activity and increase the global influence of the blue carbon market. Additionally, it will enable us to proactively address future carbon tariffs and international trade issues.

5 Conclusions

Carbon trading is a market mechanism that aims to assign value to carbon products. It encourages increased private investment in blue carbon resource protection and restoration. This paper examines the prerequisites for China to participate in blue carbon trading, the current issues in China’s blue carbon trading system and then proposes a theoretical basis and framework for constructing a blue carbon market trading model in China. Additionally, it examines the creation of carbon trading platforms and support systems. The main findings are as follows:

(1) China is well-positioned to participate in the blue carbon market trading, which presents promising market opportunities.

(2) Building a blue carbon market trading mode dominated by financial derivatives, such as futures, can maximize the benefits of futures pricing mechanisms and address issues like the misalignment between project benefits and costs. At the same time, it can offer market participants a variety of financial tools, which promotes the preservation and growth of blue carbon capital.

(3) Currently, there are still obstacles to realizing the value of China’s blue carbon products. Measures need to be taken to remove institutional and systemic barriers that hinder their value realization. China should focus on developing a blue carbon trading methodology, establishing a blue carbon hedging and value-added mechanism, and creating a unified blue carbon market trading platform.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material. Further inquiries can be directed to the corresponding authors.

Ethics statement

The manuscript presents research on animals that do not require ethical approval for their study.

Author contributions

PL: Writing – original draft. DL: Writing – original draft. CL: Writing – original draft. XL: Writing – review & editing. ZL: Writing – review & editing. YZ: Writing – review & editing. BP: Writing – review & editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This work was supported in part by the 2023 Marine Economy Development Six Industries Special Key Project Founding of Guangdong Province (Grant Nos. GDNRC [2023]41) and the Ministry of Natural Resources High-level Science and Technological Innovation Talent Project Founding (Grant No. 121106000000180039-2022).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Armentano T. V., Woodwell G. M. (1975). Sedimentation rates in a Long Island marsh determined by 210Pb dating1. Limnology Oceanography. 20, 452–456. doi: 10.4319/lo.1975.20.3.0452

Bai Y., Hu F. (2021). Research on China's marine blue carbon trading mechanism and its institutional innovation. Sci. Technol. Manage. Res. 41, 187–193. doi: 10.3969/j.issn.1000-7695.2021.03.026

Bertram C., Quaas M., Reusch T. B. H., Vafeidis A. T., Wolff C., Rickels W. (2021). The blue carbon wealth of nations. Nat. Climate Change. 11, 704–709. doi: 10.1038/s41558-021-01089-4

Cao Y., Kang Z., Bai J., Cui Y., Chang I. S., Wu J. (2022). How to build an efficient blue carbon trading market in China? - A study based on evolutionary game theory. J. Cleaner Production. 367, 132867. doi: 10.1016/j.jclepro.2022.132867

Chen G., Wang J., Xu F., Yang Y., Fan M. (2022). Progress of coastal wetland blue carbon projects in carbon market and advice on facilitating the development of blue carbon projects in China. J. Appl. Oceanography. 41, 177–184. doi: 10.3969/J.ISSN.2095-4972.2022.02.001

Cheng P., Dong Y., Wang Z., Tang H., Jiang P., Liu Y. (2022). What are the impacts of livelihood capital and distance effect on farmers' willingness to pay for coastal zone ecological protection? Empirical analysis from the Beibu Gulf of China. Ecol. Indicators. 140, 109053. doi: 10.1016/j.ecolind.2022.109053

Cisneros-Montemayor A. M., Moreno-Báez M., Reygondeau G., Cheung W. W. L., Crosman K. M., González-Espinosa P. C., et al. (2021). Enabling conditions for an equitable and sustainable blue economy. Nature. 591, 396–401. doi: 10.1038/s41586-021-03327-3

Davis S. J., Liu Z., Deng Z., Zhu B., Ke P., Sun T., et al. (2022). Emissions rebound from the COVID-19 pandemic. Nat. Climate Change. 12, 412–414. doi: 10.1038/s41558-022-01332-6

Du J., Chen B., Nagelkerken I., Chen S., Hu W. (2023). Protect seagrass meadows in China's waters. Science. 379, 447–447. doi: 10.1126/science.adg2926

Duarte C. M., Losada I. J., Hendriks I. E., Mazarrasa I., Marbà N. (2013). The role of coastal plant communities for climate change mitigation and adaptation. Nat. Climate Change. 3, 961–968. doi: 10.1038/nclimate1970

Duarte de Paula Costa M., Macreadie P. I. (2022). The evolution of blue carbon science. Wetlands. 42, 109. doi: 10.1007/s13157-022-01628-5

Friedlingstein P., O’Sullivan M., Jones M. W., Andrew R. M., Hauck J., Olsen A., et al. (2020). Global carbon budget. Earth System. Sci. Data 12 (4), 3269–3340. doi: 10.5194/essd-12-3269-2020

Friess D. A., Howard J. F., Huxham M., Macreadie P. I., Ross F. (2022). Capitalizing on the global financial interest in blue carbon. PloS Climate 1 (8), e0000061. doi: 10.1371/journal.pclm.0000061

Gao G., Beardall J., Jin P., Gao L., Xie S., Gao K. (2022). A review of existing and potential blue carbon contributions to climate change mitigation in the Anthropocene. J. Appl. Ecology. 59, 1686–1699. doi: 10.1111/1365-2664.14173

Gao J., Li H., Tian M. (2016). Concept and significance of ecological assets capitalization. J. Ecol. Rural Environment. 32, 41–46. doi: 10.11934/j.issn.1673-4831.2016.01.008

Gu J., Luo M., Zhang X., Christakos G., Agusti S., Duarte C. M., et al. (2018). Losses of salt marsh in China: Trends, threats and management. Estuarine Coast. Shelf Science. 214, 98–109. doi: 10.1016/j.ecss.2018.09.015

Han G., Wang F., Ma J., Xiao L., Chu X., Zhao M. (2022). Blue carbon sink function, formation mechanism and sequestration potential of coastal salt marshes. Chin. J. Plant Ecology. 46, 373–382. doi: 10.17521/cjpe.2021.0264

He Y., Zhang F., Wang Y. (2023). How to facilitate efficient blue carbon trading? A simulation study using the game theory to find the optimal strategy for each participant. Energy 276 (4), 127521. doi: 10.1016/j.energy.2023.127521

Herr D., Mv U., Laffoley D., McGivern A. (2017). Pathways for implementation of blue carbon initiatives. Aquat. Conservation-marine Freshw. Ecosystems. 27, 116–129. doi: 10.1002/AQC.2793

Hu Y., Tian B., Yuan L., Li X., Huang Y., Shi R., et al. (2021). Mapping coastal salt marshes in China using time series of Sentinel-1 SAR. ISPRS J. Photogrammetry Remote Sensing. 173, 122–134. doi: 10.1016/j.isprsjprs.2021.01.003

Jakovac C. C., Latawiec A. E., Lacerda E., Leite Lucas I., Korys K. A., Iribarrem A., et al. (2020). Costs and carbon benefits of mangrove conservation and restoration: A global analysis. Ecol. Economics. 176, 106758. doi: 10.1016/j.ecolecon.2020.106758

Jardine S. L., Siikamäki J. V. (2014). A global predictive model of carbon in mangrove soils. Environ. Res. Letters. 9, 104013. doi: 10.1088/1748-9326/9/10/104013

Jia M., Wang Z., Mao D., Huang C., Lu C. (2021). Spatial-temporal changes of China’s mangrove forests over the past 50 years: An analysis towards the Sustainable Development Goals (SDGs) (in Chinese). Chin. Sci. Bull. 66, 3886–3901. doi: 10.1360/TB-2020-1412

Jiao N., Liu J., Shi T., Zhang C., Zhang Y. (2021). Deploying ocean negative carbon emissions to implement the carbon neutrality strategy (in Chinese). Scientia Sin. Terrae. 51, 632–643. doi: 10.1360/SSTe-2020-0358

Jiao N., Wang H., Xu G., Aricò S. (2018). Blue carbon on the rise: challenges and opportunities. Natl. Sci. Review. 5, 464–468. doi: 10.1093/nsr/nwy030

Kazemi A., Castillo L., Curet O. M. (2021). Mangrove roots model suggest an optimal porosity to prevent erosion. Sci. Rep. 11, 9969. doi: 10.1038/s41598-021-88119-5

Lai Q., Ma J., He F., Zhang A., Pei D., Yu M. (2022). Current and future potential of shellfish and algae mariculture carbon sinks in China. Int. J. Environ. Res. Public Health 19, 8873. doi: 10.3390/ijerph19148873

Lan J., Liu K., Zhu X. (2020). The evolutionary logic, practical exploration and strategic orientation of ecological resource capitalization. Zhejiang Agric. Sci. 61, 2450–2455. doi: 10.16178/j.issn.0528-9017.20201205

Liu Z., Deng Z., Davis S. J., Giron C., Ciais P. (2022b). Monitoring global carbon emissions in 2021. Nat. Rev. Earth Environment. 3, 217–219. doi: 10.1038/s43017-022-00285-w

Liu C., Liu G., Casazza M., Yan N., Xu L., Hao Y., et al. (2022a). Current status and potential assessment of China’s ocean carbon sinks. Environ. Sci. Technology. 56, 6584–6595. doi: 10.1021/acs.est.1c08106

Liu F., Liu D., Guo Z. (2019). Study on economic value accounting of ocean carbon sink. Mar. Sci. Bulletin. 38, 8–13. doi: 10.11840/j.issn.1001-6392.2019.01.002

Macreadie P. I., Anton A., Raven J. A., Beaumont N. J., Connolly R. M., Friess D. A., et al. (2019). The future of Blue Carbon science. Nat. Commun. 10 (2019), 3998. doi: 10.1038/s41467-019-11693-w

Macreadie P. I., Costa M. D. P., Atwood T. B., Friess D. A., Kelleway J. J., Kennedy H., et al. (2021). Blue carbon as a natural climate solution. Nat. Rev. Earth Environment. 2, 826–839. doi: 10.1038/s43017-021-00224-1

Mcleod E., Chmura G. L., Bouillon S., Salm R., Björk M., Duarte C. M., et al. (2011). A blueprint for blue carbon: Toward an improved understanding of the role of vegetated coastal habitats in sequestering CO2. Front. Ecol. Environment. 7, 362–370. doi: 10.1890/070211

MDMC, Marine Disaster Mitigation Center, Ministry of Natural Resources, PRC. (2021). Investigation and assessment report of typical coastal ecosystems in China.

MEE, Ministry of Ecology and Environment, People's Republic of China (2019). China’s policies and actions for addressing climate change, (2019). Available at: https://english.mee.gov.cn/Resources/Reports/reports/201912/P020191204495763994956.pdf.

Nellemann C., Corcoran E., Duarte C. M., Valdés L., DeYoung C., Fonseca L. E., et al. (2009). The role of healthy oceans in binding carbon. A rapid response assessment (United Nations Environment Programme, GRID-Arendal). Available at: https://www.researchgate.net/publication/304215852_Blue_carbon_A_UNEP_rapid_response_assessment.

Pan X. (2018). Theoretical isomorphism and legal path in construction of blue carbon market of China. J. Hunan Univ. (Social Sciences). 32, 155–160. doi: 10.16339/j.cnki.hdxbskb.2018.01.022

Sankar G. (2020). Supply and demand evolution in the voluntary carbon credit market (Kleinman Center for Energy Policy). Available at: kleinmanenergy@upenn.edu.https://kleinmanenergy.upenn.edu/wp-content/uploads/2020/11/KCEP-Supply-and-Demand-Evolution-Singles.pdf.

Shen J., Lv J., Liu R. (2020). A study on compensation scheme design of blue carbon sink for marine ranching in China. J. Ocean University China 2020 (03), 68–75. doi: 10.16497/j.cnki.1672-335X.202003007

Siikamäki J., Sanchirico J. N., Jardine S. L. (2012). Global economic potential for reducing carbon dioxide emissions from mangrove loss. Proc. Natl. Acad. Sci. 109, 14369 –14374. doi: 10.1073/pnas.1200519109

SKLEC, The State Key Laboratory of Estuarine and Coastal Research. (2023). Chinese coastal salt marsh data set. Available at: https://coastaldata.ecnu.edu.cn/zh-hans/node/117.

Sutton-Grier A., Howard J. (2018). Coastal wetlands are the best marine carbon sink for climate mitigation. Front. Ecol. Environment. 16, 73–74. doi: 10.1002/fee.1766

Tang J., Ye S., Chen X., Yang H., Sun X. (2018). Coastal blue carbon: Concept, study method, and the application to ecological restoration. Sci. China Earth Sci. 48, 661–670. doi: 10.1007/s11430-017-9181-x

Ullman R., Bilbao-Bastida V., Grimsditch G. (2013). Including Blue Carbon in climate market mechanisms. Ocean Coast. Management. 83, 15–18. doi: 10.1016/j.ocecoaman.2012.02.009

UNEP-WCMC, Short F. T. (2017). Global distribution of seagrasses (version 6.0). Sixth update to the data layer used in Green and Short (2003). Cambridge (UK): UN Environment World Conservation Monitoring Centre). Available at: http://data.unepwcmc.org/datasets/7.

Vanderklift M. A., Marcos-Martinez R., Butler J. R. A., Coleman M., Lawrence A., Prislan H., et al. (2019). Constraints and opportunities for market-based finance for the restoration and protection of blue carbon ecosystems. Mar. Policy. 107, 103429. doi: 10.1016/j.marpol.2019.02.001

Wan X., Li Q., Qiu L., Du Y. (2021). How do carbon trading platform participation and government subsidy motivate blue carbon trading of marine ranching? A study based on evolutionary equilibrium strategy method. Mar. Policy. 130, 104567. doi: 10.1016/j.marpol.2021.104567

Wang Y., Guo T., Cheng T. C. E., Wang N. (2022). Evolution of blue carbon trading of China's marine ranching under the blue carbon special subsidy mechanism. Ocean Coast. Management. 222, 106123. doi: 10.1016/j.ocecoaman.2022.106123

Wang H., Ren G., Wu P., Liu A., Pan L. (2020). Analysis on the remote sensing monitoring and landscape pattern change of mangrove in China from 1990 to 2019. J. Ocean Technology. 39, 1–12. doi: 10.3969/j.issn.1003-2029.2020.05.001

Xiang A., Chuai X., Li J. (2022). Assessment of the status and capacity of blue carbon in China’s coastal provinces. Resour. Science. 44, 1138–1154. doi: 10.18402/resci.2022.06.04

Xu W., Dong Y.-e., Teng X., Zhang P.-p. (2018). Evaluation of the development intensity of China's coastal area. Ocean Coast. Management. 157, 124–129. doi: 10.1016/j.ocecoaman.2018.02.022

Yan L., Tan B., Liu J. (2009). Eco-capitalization: the realization of the value of ecological resources. J. ZhongNan Univ. Economics Law 2010 (05), 3–9. doi: 1003-52309(2010)05-0003-07

Yang Y., Chen L., Xue L. (2021). Top design and strategy selection of blue carbon market construction in China. China Population Resour. Environment. 31, 92–103. doi: 10.12062/cpre.20210835

Yang L., Hao X., Shen C., An D. (2022). Assessment of carbon sink capacity and potential of marine fisheries in China under the carbon neutrality target. Resour. Science. 44, 716–729. doi: 10.18402/resci.2022.04.06

Yu J., Wang Y. (2023). Evolution of blue carbon management policies in China: review, performance and prospects. Climate Policy. 23, 254–267. doi: 10.1080/14693062.2022.2142493

Yue S., Xu S., Zhang Y., Qiao Y., Liu M. (2021). New discovery of larger seagrass beds with area >50 ha in the temperate waters of China: IV; Distribution status and ecological characteristics of seagrass in the coastal waters of Yantai. Mar. Sci. 45, 61–70. doi: 10.11759/hykx20201118003

Zang Z. (2019). Analysis of intrinsic value and estimating losses of “blue carbon” in coastal wetlands: a case study of Yancheng, China. Ecosystem Health Sustainability. 5, 216–225. doi: 10.1080/20964129.2019.1673214

Zeng Y., Friess D. A., Sarira T. V., Siman K., Koh L. P. (2021). Global potential and limits of mangrove blue carbon for climate change mitigation. Curr. Biol. 31, 1737–1743.e3. doi: 10.1016/j.cub.2021.01.070

Zhang L., Guo Z. (2013). Carbon storage and carbon sink of mangrove wetland: Research progress. Chin. J. Appl. Ecology. 24, 1153–1159. doi: 10.13287/j.1001-9332.2013.0272

Zhang W., Zhang X. (2019). The capitalization of ecological resources: an explanatory framework. Reform 2010 (05), 122–131. doi: 1003-7543(2019)01-0122-10

Zhang Y., Zhang J., Liang Y., Li H., Li G., Chen X. (2017). Carbon sequestration processes and mechanisms in coastal mariculture environments in China. Sci. China Earth Sci. 47, 1414–1424. doi: 10.1007/s11430-017-9148-7

Zhao P., Tang Y., Song W., Xu C. (2021). Demands and design for China’s blue carbon standards system. China Acad. J. Electronic Publishing House 17, 68–73. doi: 10.3969/j.issn.1002-5944.2021.17.004

Zheng F., Qiu G., Fan H., Zhang W. (2013). Diversity, distribution and conservation of Chinese seagrass species. Biodiversity Science. 21, 517–526. doi: 10.3724/SP.J.1003.2013.10038

Zhou C., Mao Q., Xu X., Fang C., Luo Y., Li B. (2016). Preliminary analysis of C sequestration potential of blue carbon ecosystems on Chinese coastal zone. Scientia Sin. Vitae. 46, 475–486. doi: 10.1360/N052016-00105

Zhou Y., Xu S., Xu S., Yue S., Gu R. (2019). New discovery of larger seagrass beds with areas >0.50 km2 in temperate waters of China: II. The largest Zostera marina bed in China discovered in the coastal waters of Tangshan in the Bohai Sea by sonar detection technology. Mar. Sci. 43, 50–55. doi: 10.11759/hykx20190318003

Keywords: blue carbon market, value realization, market trading mechanism, financial instruments, blue carbon futures

Citation: Li P, Liu D, Liu C, Li X, Liu Z, Zhu Y and Peng B (2024) Blue carbon development in China: realistic foundation, internal demands, and the construction of blue carbon market trading mode. Front. Mar. Sci. 10:1310261. doi: 10.3389/fmars.2023.1310261

Received: 09 October 2023; Accepted: 11 December 2023;

Published: 04 January 2024.

Edited by:

Françoise Gaill, Centre National de la Recherche Scientifique (CNRS), FranceReviewed by:

Fengxuan Zhang, Zhejiang Ocean University, ChinaChao Fan, Zhejiang Ocean University, China

Kai Xiao, Southern University of Science and Technology, China

Copyright © 2024 Li, Liu, Liu, Li, Liu, Zhu and Peng. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Dahai Liu, liudahai@fio.org.cn; Bo Peng, pengbo@jnu.edu.cn

Ping Li

Ping Li