- International Law School, China University of Political Science and Law, Beijing, China

The international shipping industry is unique and important. The negative list related to the opening up of the shipping industry is an important part of the reform and innovation of China’s pilot free trade zones. In recent years, as countries around the world continue to promote the process of opening up in the fields of trade and services, the negative list system has been used more in international investment and trade agreements. In the field of International Shipping, how to correctly grasp and apply the negative list system is an important topic. Starting with the general concept of the negative list system of shipping market access, this paper reviews and summarizes the developmental processes of the negative list of foreign capital market access in the shipping field since the establishment of Shanghai Pilot Free Trade Zone. It compares and analyzes the international contracting practice of the European Union and the United States as reflected in the negative list of shipping market access. It equally points out that the system connection between the negative list still existing in China’s shipping field and the international high standard negative list is not enough. It argues that the transparency of the negative list still needs to be further strengthened, as the rules behind the list and the awareness of its risk prevention are weak. In view of these hitches, this paper makes some suggestions that are tilted towards improving the negative list system of China’s shipping market access. It also continues the optimization of the negative list of shipping market access and the improvement of a conscious awareness aimed at avoiding the possible risks of the negative list. Finally, it makes a strong argument for a continuous improvement of China’s international shipping competitiveness.

1 Introduction

The negative list system, an investment access policy that is adopted widely and internationally, is characterized by a natural inclination towards the service industry. It effectively reduces barriers to trade and services (Tan et al, 2019). The shipping industry is a high-end service industry. Under the current background of global economic integration, technological progress has promoted the further expansion of the production and operation activities of international enterprises worldwide. It has also helped the steady growth of international trade and the rising demand for international transportation.

The international shipping industry has particularity and a unique importance. Statistics from the United Nations Conference on Trade and Development (UNCTAD) show that in the past few decades, maritime trade has made significant development. Calculated by weight, seaborne trade accounts for 80%–90% of global trade volume, especially in developing countries. This advantage is even more prominent when calculated by commodity value. This makes the seaborne trade volume account for 60%–70% of global trade volume. With time, trade export has become a key prerogative of developing countries (UNCTAD, 1968–2018). It is also evident that international shipping is increasingly playing important roles in today’s international trade. About 80% of the world’s total international trade volume is completed by sea transportation, and this percentage is nearly 90% in China. Since international shipping is closely related to a country’s economy, the development of the shipping industry plays an important role in promoting a country’s economic development.

According to Review of Maritime Transport 2022, rarely has the importance of maritime logistics for trade and development been more evident than during the last year. Historically high and volatile freight rates, congestion, closed ports, and new demands for shipping following the coronavirus disease 2019 (COVID-19) and the war in Ukraine have all had measurable impacts on people’s lives. With ships carrying over 80% of volume of global trade, higher shipping costs and lower maritime connectivity lead to higher inflation, shortages of food, and interruptions of supply chains—all of which are among the features of the current global crisis (UNCTAD, 2022). Although maritime trade recovered in 2021, 2022 also faces a complex operating environment fraught with risk and uncertainty. For 2022, UNCTAD projects maritime trade growth to moderate to 1.4%, and for the period 2023–2027 to expand at an annual average of 2.1%, a slower rate than the previous three-decade average of 3.3% (UNCTAD, 2022). Facing the increasingly severe international environment, all countries in the world should unite, cooperate, and ensure the stable development of manufacturing, logistics, and supply chain.

The development of China’s shipping industry is closely related to the world economy and trade. The improvement of China’s international shipping competitiveness will promote the development of world economy and trade. It also has a positive impact on the shipping trade development of other countries. On the one hand, China is a major shipping country. After continuous development in recent years, China, as the largest port country and the second largest shipowner country, is closely connected with the world economy, forming a relatively complete global resource trade system. China’s import and export trade spreads all over the world, and the world cannot do without China, and China also cannot do without the world. On the other hand, international shipping is an important index of the world economy. Countries rely on international shipping to further strengthen their own economic system, foreign relations, and foreign trade and thus enhance their comprehensive strength. Maritime shipping is a backbone of international trade and, thus, the world economy. Cargo-loaded vessels travel from one country’s port to another via an underlying port-to-port transport network, contributing to international trade values of countries en route (Xu et al., 2020).

General Secretary Xi Jinping once pointed out during an inspection in Shanghai that “An economic power must be a maritime power and a shipping power” (Xinhuanet, 2018). Shipping has an inseparable relationship with the national economy and national strategy. Article (7) of the “Overall Plan for the Lin-gang New Area of the China (Shanghai) Pilot Free Trade Zone,” announced by the State Council on 6 August 2019, opines that this relationship will “implement a highly open international transportation management.” Article (16) says that the relationship is tantamount to “building a high-energy global shipping hub.”

In July 2021, the Shanghai Municipal People’s Government issued the Fourteenth Five-Year Plan for the Construction of Shanghai International Shipping Center, pointing out that, “except for domestic waterway transportation business, other shipping businesses have been opened to the outside world, and the business environment of the shipping market has been significantly optimized.” In August 2019, the Shanghai Municipal People’s Government announced “Several Measures for Shanghai’s New Round of Service Industry Expansion and Opening-up,” stating that they would “strengthen the external radiation capabilities of the modern shipping service industry, and enhance the ability of global shipping to freely allocate.” In totality, there are 40 measures for the expansion of the opening up of the service industry in Shanghai. Of these measures, seven involve the shipping sector. As one of the important areas for expansion and opening up, the shipping service sector that will further deepen the reform and opening up of Shanghai’s service industry is of great significance. On the 26th of the same month, the State Council announced the “Notice on the Overall Plan for the Establishment of Six New Pilot Free Trade Zones,” which once again, when clarified, will “fully implement the pre-foreign investment national treatment plus negative list management system.” The enhancement of shipping service capabilities involves innovations in shipping fields. The policy is mentioned in the overall plan of the Shandong, Jiangsu, Guangxi, Hebei, Yunnan, and Heilongjiang zones of the free trade pilot zones. On 21 September 2020, China, once again, added three pilot free trade zones to Beijing, Hunan, and Anhui. As a result, the pilot free trade zones in various parts of China have combined their own characteristics and advantages to implement shipping innovation policies and promote them to varying degrees.

In summary, China is facing new situations and challenges at this stage. The construction of Hainan Free Trade Port, the Shanghai Free Trade Zone’s Lin-gang New Area, and the establishment of nine new pilot free trade zones undoubtedly demonstrate China’s perseverance and determination to further open up to the outside world. Under the current complex and volatile international environment, it brings new impetus to China’s shipping industry.

2 Literature review

In recent years, some scholars have conducted about the negative list management system from different perspectives. For example, some scholars inferred that international experience in the implementation of negative list management at the international, multilateral, and bilateral levels must be objective. They opine that Hong Kong and Singapore’s free trade ports and those of developing countries have concluded on the need for caution and carefulness in building pilot free trade zones and free trade ports. They equally pontificate on the need for focus in pushing the derivative effects of negative lists and balance between macroeconomic management and microeconomics (Huang and Yuan, 2018). The Negative List Approach is an incremental step towards equal treatment for foreign-invested enterprises in China (Wang, 2016). In addition, it focuses on the analysis of the changes in the negative list of the pilot free trade zones in recent years.”“ It further clarifies the direction of improvement of the negative list under the new situation (Shi, 2018). China must address existing laws and regulations that are incompatible with the new regime, clarify key issues that the new law fails to address, issue clearer guidance on national security, shorten its ‘negative list’, promote opening up and enhance regulatory transparency (Zhang, 2022). There are still important differences in institutional effects between China’s current negative list system of foreign investment management and the international investment agreement based on the negative list model. Therefore, it is of great significance for China to sign into a new economic system and promote the opening-up of overseas enterprises as soon as possible (Ma et al., 2021).

In the field of market access and free trade agreements, some international scholars inferred that properly designed markets allocate resources efficiently. However, in many circumstances, markets are not feasible, it is necessary to design a host of market-like mechanisms (Holzer and McConnell, 2016). It provides that greater market access means preferential trade liberalization, which further deepens economic integration between the investment host and investment source countries (Blanchard and Matschke, 2015). And it points that after a quarter-century of unprecedented trade integration, the world may be taking a momentary pause to re-evaluate the economic impact of free trade agreements (Baier et al., 2019a). It is important to summarize the framework and highlights of the free trade agreements, to measure the extent of tariff reduction from various perspectives.And it is also necessary to make a quantitative assessment of the level of service trade liberalization of the member states (Sheng and Jin, 2022). It also discusses the moral limits of market-based mechanisms under by using the international maritime transport sector (Monios, 2022).

In the field of Shipping, there are not many studies on the negative list of shipping market access in particular. Market access to coastal shipping services is often severely restricted. (R.Brooks, 2014). At present, we can see it is important to analyze the strategic significance and advantages of the development of international shipping services in the pilot free trade zones. It focuses on assessing the progress of innovative international shipping services in the Shanghai Pilot Free Trade Zone. This focus is necessary as the operation of the Pilot Free Trade Zone since its more than a year’s existence is significant, and helps in putting forward suggestions needed to promote the construction of China’s shipping power (Li, 2015). After relaxing the restrictions on foreign ownership of ship management in the Pilot Free Trade Zone, the relevant operations and problems existing in the operations of foreign ship management enterprises introduced, and explored corresponding solutions (Shi, 2016). The construction of Shanghai International Shipping Center is currently at a critical period of strategic transition. In his opinion, the construction of Shanghai International Shipping Center should have a long-term strategic thinking (Boke, 2018). It is necessary to further strengthen the role of Shanghai International Shipping Center and the International Financial Center in serving the, “Belt and Road”. This helps the coordination mechanism construction dynamics.

From this review, it is evident that the research efforts related to the negative list of shipping market access need to be carried out thoroughly. Consequently, this article hopes to analyze the contents of the negative list of shipping in the current typical bilateral and multilateral investment agreements in the world. It also hopes to point out the shortcomings in China’s negative list of shipping market access, and further put forward suggestions for its development.

3 International shipping market access and China’s negative list system: The growth index

3.1 The general theory of international trade and investment agreements

Although international trade and investment are usually thought of two sides of the same coin, in fact, this relationship is complicated and has changed over time. The conclusion of bilateral and multilateral trade and investment agreements among member countries is an important measure to promote economic globalization, which is usually beneficial to all participating countries. In recent years, the number of Bilateral Investment Treaties (BITs) has gradually decreased. On the one hand, there is a limitation between the two countries. On the other hand, it is too narrow to meet the demands of regional economic development and cooperation. The United States formulated a BIT model in 2004 and revised it in 2012 to strengthen fair competition and transparency. The rise of regional agreements, namely Free Trade Agreements (FTAs), make up for the deficiency of BITs.FTAs cover a wide range of contents with a high degree of liberalization. FTAs include both trade and investment, some clauses are gradually included in the agreement, such as trade in services, facilitation measures, dispute settlement mechanism, etc. It has a more positive impact on FTAs member countries. Almost all WTO members have joined in one or more regional trade agreements.Some scholar has referred that the United States has completed numerous FTAs,but the pattern of these agreements defies conventional explanations (Hundt, 2015).

3.2 The general theory of the negative list of shipping market access

Market access can first be seen in the international, bilateral and multilateral investment agreements signed in the 1970s. In China, the concept of market access was first introduced when China participated in the negotiation of the General Agreement on Tariffs and Trade (GATT). It is most commonly used as a concept in international law.In international trade and investment negotiations, Positive List and Negative List systems are major technics that state parties choose to attract foreign investment or to inscribe their commitments or exceptions. Positive List means that the host country lists the items that allow foreign investment one by one, and the items that are not listed will not be opened; Negative List is a concept opposite to Positive List, which lists the items that prohibit foreign investment one by one, while the items that are not in the list are allowed to enter.Specifically,Negative List refers to the practice of clearly enumerating all restrictions and prohibitions in the process of foreign investment in the form of a list (Guo, 2019). It embodies the idea of “nothing is prohibited by law”, and it follows the logic of, “unless prohibited by law, otherwise it is permitted by law” (Gong, 2016).

The change from Positive List to Negative List has profound significance, which represents a higher level of foreign capital market access mode. The host country can increase or decrease the Negative List items according to the development status of different industries in its own country.It is helpful to control the opening degree of different industries and further realize the purposes of opening to the outside world, protecting domestic industries and international security. Negative List follows the principle of freedom of investment in the field of legal reservations. And it is not only an effective guarantee for the rights of market subjects, but also an important measure to promote investment liberalization.

Internationally, there are roughly three models of Negative List. The first is a type of Negative List independently developed by the host country, representing countries such as South Korea, and the Philippines. The second is in the form of an annex to a bilateral or multilateral investment agreement. Most countries in Asia and North America adopt this form. The third is not strictly a list text. The industries that prohibit or restrict foreign investment and restrictive measures are scattered in the constitutions, laws, and administrative regulations of various countries. Most of the negative lists of European and Oceanian countries are like this (Ge, 2018). The negative list of Pilot Free Trade Zones and the National Negative List that China has successively announced belong to the negative lists independently formulated by China.

Some scholars believe that the Market Access Negative List System refers to a series of institutional arrangements in which the State Council clearly lists the industries, fields, businesses and the like that are prohibited and restricted from investment and operation in China. In line with this, governments at all levels adopt corresponding management measures in accordance with the law. The Market Access Negative List includes prohibited access and restricted access (Li, 2016). The negative list of China’s shipping market access discussed in this article is, to be precise, a negative list of shipping market access specifically for foreign investment. By this, the State Council clearly lists the shipping field prohibitions and restrictions in China in the form of a list. Governments at all levels have adopted a series of corresponding management measures in accordance with the laws in industries, fields, and businesses that foreign investment and operations are engaging. The latter refers to non-conforming measures or reservation clauses in the shipping field.

As an important part of the modern high-end service industry, the shipping service industry is an important area for the market to optimize the allocation of resources. It plays an important role in promoting China’s economic development. At the same time, it faces many new situations and problems. Therefore, in bilateral and multilateral investment agreements, countries generally adopt a cautious approach to the shipping service industry. With the inclusion of the U.S. Bilateral Investment Treaty (BIT), U.S-Korea Free Trade Agreement (KORUS), and the newly signed U.S-Canada-Mexico Trade Agreement; the United States-Mexico-Canada Agreement’s (USMCA) document equally contains specific provisions on the contents of the shipping negative list. This is elaborated below.

3.3 China’s shipping market access and the development of the negative list

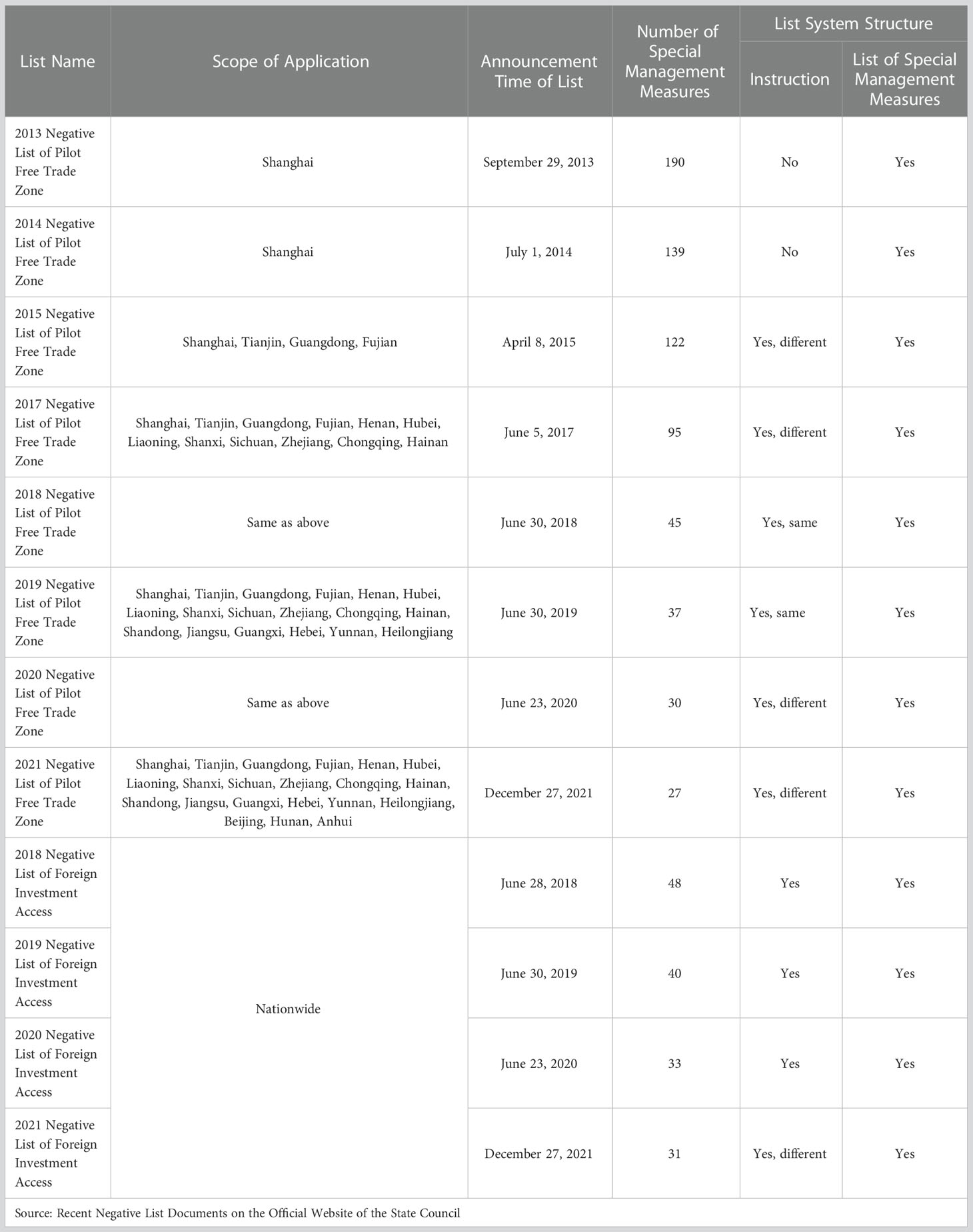

Looking back at the development of China’s negative list management system since the establishment of the Shanghai Pilot Free Trade Zone in September 2013, eight versions of the negative list have been updated for the Pilot Free Trade Zone. In addition, four versions of the national negative list for foreign investment access have also been updated.Furthermore, Hainan Free Trade Port has successively issued the Special Administrative Measures for foreign investment access of Hainan Free Trade Port (negative list: 2020 version). This also affects the Special Administrative Measures for cross-border service trade of Hainan Free Trade Port (negative list: 2021 version). During these seven years, the negative list system has been gradually advanced and breakthroughs have been made. It is mainly reflected in the items of special management measures which are continuously reduced and clarified. The breakthrough equally applies to the time and structure of the list announcement which tends to be stable. This also applies to the scope of application of the negative list which has changed from the Pilot Free Trade Zone to 2018 as a new version. The national version of the negative list of foreign investment access which has been announced will be applicable nationwide as from 2010 (See Table 1). More importantly, the “Foreign Investment Law” of March 15, 2019 clearly aligns with the provisions of the pre-entry national treatment, and the negative list management system. The negative list system was fixed in the form of law for the first time (Shi, 2019). It is a milestone in the development of China’s foreign investment management system.

Table 1 Changes in the Scope of the Application of the Pilot Free Trade Zones and the National Versions of the Negative List of Foreign Investment Access (2013-2021).

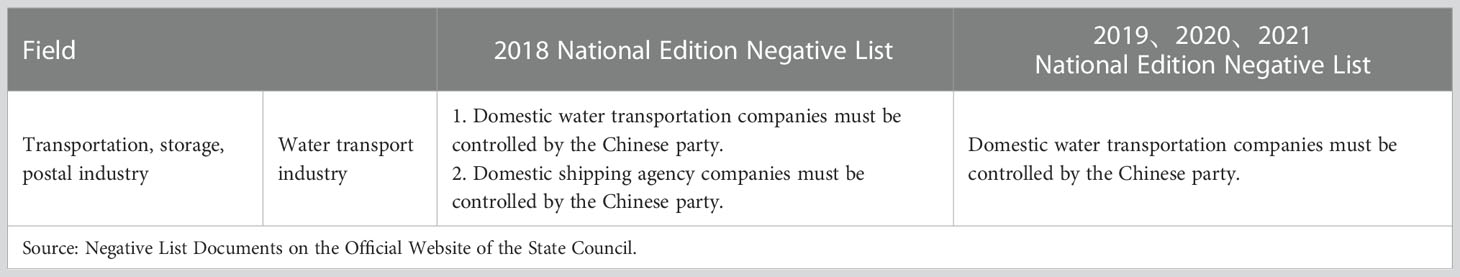

In the eight versions of the negative list of the pilot free trade zones and the four national versions of the negative list, special management measures in the shipping sector account for a certain percentage. Taking the 2020 Negative List of Pilot Free Trade Zone and the 2021 National Negative List as examples, the special management measures in the shipping field are all listed in the, “VI: Transportation, warehousing and postal industry” categories. However, the contents of the shipping field are basically the same. Both the 2020 Negative List of Pilot Free Trade Zone and the 2021 National Negative List include only one special management measure in the shipping field. This means that the domestic water transportation companies must be controlled by the Chinese party. The contents of the 2018-2021 National Edition Negative List in the shipping field are shown in Table 2 below:

Table 2 Negative list of foreign investment access in the shipping field (National edition: 2018-2021).

From the text analysis of the Negative List of Shipping Market Access in the Pilot Free Trade Zones (2013-2021), and the National Version of the Negative List of Shipping Market Foreign Investment Access, the author summarized the following aspects:

First, except for the Negative Lists of the 2013 and 2014 Pilot Free Trade Zones, each version of the Negative List basically follows the same style. It is composed of “Explanation” + “Special Management Measures List”. The “Explanation” section clearly states the content reflecting the negative list of the 2015 Pilot Free Trade Zone Edition. The explanatory part of the 2021 Pilot Free Trade Zone Edition and the negative list of the National Edition are consistent with the contents of the 2020 Pilot Free Trade Zone Edition, and the negative list of the National Edition. Similarly, the negative list of the 2015 Pilot Free Trade Zone, and the “Special Management Measures List,” have been classified in the order of “Serial Number, Field, and Special Management Measures.” This was the order until the 2019 Pilot Free Trade Zone version and the national version of the negative list. Delete “Field” has become “Serial Number + Special Management Measures” – quite concise and clear.

Second, in the negative lists of several versions of the Pilot Free Trade Zone, special management measures in the shipping service field account for a certain proportion. These measures are all classified into the two major categories of “manufacturing” and “transportation, storage and postal industry.” Interestingly, shipbuilding and water transportation are the main industries. In the negative list of the 2018 Pilot Free Trade Zone, “the repair, design and manufacturing of ships (including subsections) must be controlled by Chinese parties.” The deletion means that restrictions on foreign investment have been completely removed in the field of shipbuilding.

Third, the changes in the field of “shipbuilding” are mainly manifested in the 2013 and 2014 Free Trade Pilot Zone version of the negative list. The caption of the field therein is, “Railway, Shipbuilding, Aerospace and other Transportation Equipment Manufacturing”. Since 2015, the domain’s name has been, “Shipbuilding”. In the 2013 and 2014 Pilot Free Trade Zone versions of the negative list, there are four special management measures while the 2015 version has three special management measures. Items 51 and 53 of the 2014 version of the negative list are deleted. Item 51 of the 2014 Negative List of the Pilot Free Trade Zones is structured to, “invest in the design of low- and medium-speed diesel engines and their parts for ships, and the manufacturing of yachts must be joint venture or cooperative.” Item 53 is to, “invest in the manufacturing of ship cabin machinery. The Chinese party must have a relatively controlling stake.” At the same time, the “designing, manufacturing, and repairing of restricted investment ships (including subsections, with Chinese party as the controlling shareholder)” in Item 54 are changed. Similarly, the “repairing, designing, and manufacturing of ships (including subsections) are restricted, and it must be the Chinese party that shall hold the majority of shares.” This will further optimize the content of the field. The 2017 special management measures are found in Article 13 which spells that, “the repair, design and manufacturing of ships (including subsections) must be controlled by Chinese parties.” In 2018, it was stated that foreign investment restrictions in the field of shipbuilding would be fully lifted. It is obvious this is a gradual opening process.

Furthermore, the International Ship Management was fully opened to foreign investment in the Pilot Free Trade Zone because international ships were not included in the negative list of the 2013 Pilot Free Trade Zone. This is an observation evident in the field of International Ship Management after the establishment of the Shanghai Pilot Free Trade Zone. The content of the management field is deemed to be open if it is not specified. The field of International Shipping Agency, the 2018 Pilot Free Trade Zone, and the national version of the negative list do not specify: International shipping agency, foreign equity ratio not exceeding 51%, and if there is no provision, it is open. This means that from 2018, it is allowed to completely loosen the restrictions on foreign investment in the field of international shipping agency. The restrictions on foreign investment in the field of international shipping agencies have gone through the process of “Chinese holding-equity ratio not exceeding 51%-fully open”.

Investing in the business areas of international cargo maritime, and the international maritime container stations and depots, which are not stipulated in the negative list of the 2014 Free Trade Zone means that the fields were completely opened to foreign investors in the pilot free trade zone as from 2014. Until it is promoted for the whole country in terms of investment in foreign shipping tally, there are no restrictive regulations in the negative list of the 2015 Pilot Free Trade Zone. This means that the field was fully opened to foreign investors in the pilot free trade zone as from 2015 until it would be extended to the whole country.

In the field of domestic shipping, the 2019 Pilot Free Trade Zone and the national version of the Negative List do not stipulate that, “domestic shipping companies must be controlled by Chinese parties.” If there is no stipulation, it is open. This means that foreign investors have been allowed to fully liberalize in China as from 2019. This is notwithstanding any investment restrictions in the shipping agency market they may encounter. Foreign investment restrictions in the field of domestic shipping have also gone through the process of “Chinese holding-equity ratio not exceeding 51%-fully open”.

In addition, it should be noted that in the process of enabling changes in the, “water transport industry”, it is necessary to avoid the phenomenon of inconsistent names. The field name in the negative list of the 2013 and 2014 Pilot Free Trade Zone is “Water Transportation Industry” while that of the 2015 and 2017 Pilot Free Trade Zone is “Water Transportation”. The 2018 Pilot Free Trade Zone, and the national version of the negative list were changed to, “Water Transportation Industry”. There was no, “field” in the 2019 Pilot Free Trade Zone, and the national version of the negative list. The author believes that the name should not be changed. It is also the opinion of the author that the accuracy and stability of the name should be guaranteed.

Generally, it can be seen from the 2019 and 2021 Pilot Free Trade Zones and the national versions of the negative list that except for the domestic water transportation imperative which needs to be controlled by the Chinese side, the rest of China’s international shipping market is currently fully open to foreign capital. This is with a greater degree of openness for the international shipping market. The opening of various fields of the international shipping market is a gradual process.

4 Interrogating the negative list: The EU and US shipping market access as an exemplar

4.1 The negative list of the EU’s shipping market access

The number of international investment agreements signed by the EU accounts for about half of the existing agreements that have entered into force in the world. However, the implementation of the negative list of international trade negotiations started late. Before 2009, it mainly adopted the positive list model, and was less involved in the national treatment before investment access (Hao, 2016).

In 2016, the EU and Canada signed the comprehensive economic and trade agreement (Here in referred to as CETA), which became the first free trade agreement with investment rules and negative list signed by The EU.CETA is certainly the most complex FTA ever negotiated by Canada and arguably the most far-reaching ever negotiated by the EU. Like North American Free Trade Agreement 1994 before it, CETA may well become a model for future mega-regional FTAs (de Mestral, 2015). It means the establishment of investment rules between two developed economies, which is of great significance to the development of the international investment legal system (Broschek and Goff, 2022). On the one hand, CETA is the first comprehensive economic and trade agreement signed by the EU with an investment chapter since the Lisbon Treaty was gained the right to make foreign investment policies. And it has actually established the embryonic form of the Negative List of EU (Hubner et al., 2017); On the other hand, the reconstruction of global economic and trade rules is equally accelerating, and the signing of CETA means that the EU is trying to establish new standards for its global trade activities through a new round of trade negotiations (Yang and Jia, 2018).

At present, the international situation is complex but changeable. Interestingly, the signing of CETA means that it is a certain reference significance for China’s ongoing China-EU bilateral investment agreement negotiation (Herein referred to as “China EU-bit”). It would also bring some enlightenment to China in other bilateral and multilateral international trade negotiations.

In CETA, the requirements of EU countries are slightly different from those of the central level of EU.Yet, European Parliaments have recently taken on a very active role in various international negotiations (Roederer-Rynning, 2017). In addition to the two principles of market access and national treatment, EU countries also put forward more restrictions on the requirements of Canadian investors and their investments in their own country’s executives and boards of directors.At the same time, although EU member states currently have no performance requirements for foreign investment in Canada, most member states have reserved the policy space for further restrictive measures (Fernandez-Pons et al., 2017).

Under Section E,”Reservations and Exceptions,” of Chapter VIII’s “investment” of CETA, it is stipulated that the EU and Canada can take specific non-compliance measures against performance requirements, national treatment, most favored nation treatment, senior managers, and obligations under the board of directors. CETA’s negative list includes Annex I and Annex II. Annex I is the existing non-conformity measures stipulated by the central or local governments of both parties. Annex II contains the reserved rights listed by both parties referring to the non-conformity measures that can be restricted in the future. The list consists of, “department (sub-department) + industrial classification + retention type + government level + legal basis + specific description”. For the EU, some inconsistent measures are implemented only in an EU Member State, while some are implemented in all EU Member States. There are several measures inconsistent with the provisions of Annex I, not only for the Canadian government, but also for other places. Canada has set up its own unique negative list for the different economic development regions. This is conducive for the better implementation of foreign capital opening and foreign capital supervision.

In the negative list of CETA’s investment, it is not only the industries concerned by the EU and Canada that are different. Among the EU Member States, the inconsistent measures in various fields on the list retain the respective characteristics of the member states. In the field of International Shipping, Chapter 14 of CETA provides specific provisions on international maritime transport services. This chapter establishes a framework for regulating the maritime transport market between The EU and Canada. It includes inconsistent measures established to ensure that commercial ships have fair and equal access to port services. Canada pays more attention to the field of transport services, and clearly explains the inconsistent measures for foreign investment access to all industries. The EU lists few existing non-compliance measures. It reserves foreign investment access in water transportation, aviation, and multimodal transport in the field of transport services. EU countries have imposed restrictions on transport services and commercial services in Annex I. This includes 46 retention measures related to transport services. It also involves inland shipping, maritime transportation, fishing boat transportation, railway, and other fields. Annex II refers to the nonconformance measures that can be restricted in the future. The EU also reserves the right to impose restrictions on the field of transport services in the future.

4.2 Negative list of US shipping market access

In the practice of signing Free Trade Agreement (FTA), like in the case of the BIT, USMCA, and similar agreements between The United States, and other countries, the negative list mode is usually adopted. The clauses listed in the negative list are called, “non-conforming measures”, which allow the contracting parties to take or maintain any measure that is inconsistent with the obligations of the Market Access Treaty. Interestingly, these non-conforming measures are allowed to be continued or updated in time or revised without expanding the scope.

The author mainly studies the content of bit protocol based on the 2004 version. The 2012 bit agreement between The United States and Uruguay and the 2012 bit agreement between the United States and Rwanda are all signed based on the contents of the 2004 version of the bit agreement. The main contents include the text of the agreement and annexes I, II, and III. Each annex’s list includes explanatory notes, and entries in the negative list of states. The entries also include notes in the negative list of the United States. In the text of the agreement, Annex I contains the existing non-conformity measures, which include the non-conformity measures that the host country wishes to retain after the agreement becomes active. Annex II contains new, nonconformance measures for the future. Annex III is specific to the field of financial services, which can include existing measures or inconsistent measures taken in the future (Qian, 2015). Each item in the annex list usually consists of the five elements: “department + related obligations + government level + measure basis + description”. In the “explanatory notes” of each annex, there are specific explanations on these five elements.

In the FTA contracting practice of the US, the contents related to the shipping field are usually listed for explanation in the Negative List, Annex List 1 and Annex List 2 under the specific departments.Since the United States promulgated the, “U.S.-Chile Free Trade Agreement (FTA)” in 2004, the market access exceptions for maritime transportation services have been basically consistent content-wise. This shows the continuity and consistency of the FTA content of The US.

There are 24 chapters in the “United States-Korea 2012FTA”, including national treatment and market access for goods, customs procedures and trade facilitation, trade remedy, investment, financial services, government procurement, transparency and dispute settlement and so on. Among them, the Negative List system is adopted in three chapters: investment, trade in services and financial services (Russ and Swenson, 2019). Through the Negative List system, the US has effectively protected its own specific industries (Leung, 2016).In the “United States-Korea 2012FTA” Annex I belonging to the United States’ list, the US retains the two obligations of, “national treatment and local ingredients” under “Transportation Services-Customs Brokers.” In the agreements forged on behalf of the “U.S.-Uruguay 2012BIT” and “U.S.-Rwanda 2012BIT”, the contents of the United States’ list in Annex I of the two are the same. The United States only retains the national treatment obligation for this item. There is no reservation of, “local presence”.

Be that as it may, reservations on “international maritime cargo transport and auxiliary business” have been made with respect to Annex I of the South Korean list of the “United States-South Korea 2012 FTA”. On the other hand, Annex II of the South Korean list has made two reservations on “internal waterway transport services, space transport services, and storage and warehousing services”. In this regard, the author summarizes the following characteristics: (1) South Korea has a relatively complete set of shipping laws and regulations. In Annex I of the negative list of treaties, the ROK has clearly specified the relevant obligations of reservations and the domestic legal basis for non-compliance measures. The negative list is highly transparent. (2) South Korea has implemented strict reservation measures for domestic internal waterway transportation and space transportation services. According to this item, foreign capital can be completely prohibited from entering the service fields of internal waterway transportation and space transportation in South Korea. (3) South Korea has strict treaty reservations on any storage and warehousing services related to rice. In a word, through the Negative List system, the forbidden zones of related industries have been defined between the two countries. Countries will be bound to a certain extent when implementing their related measures, but they also have some flexibility (Wei et al., 2019).

In addition, the author found some characteristics in the process of the Central American Free Trade Agreement (CAFTA-DR) signed by the United States and the five Central American countries – Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua – and the Dominican Republic in 2004. Firstly, Costa Rica, Dominica, Honduras, and Nicaragua’s Negative List’s Annex I involves, “maritime” content. Among these countries are Costa Rica’s reserved department – “Maritime and Specialty Air Services”, the reserved department of Dominican “Maritime Transportation”, the reserved department of Honduras’ “Maritime Transportation-Coastal Navigation”, and the two reserved departments related to shipping in Nicaragua, namely “Maritime Transportation”, and “Port”. However, neither El Salvador nor Guatemala’s Annex 1 mentions the regulations on maritime transport. There is no reservation clause for the sector. In the item tagged, “Government level”, Costa Rica and Honduras have regulations that are “central”. Dominica and Nicaragua do not list “Government level”. In the item labelled, “Description”, the Dominican Republic has the most specific provisions for the description of measures. Indeed, the content has the most restrictions.

Above all, it can be seen from the above examples that the United States and its contracting parties attach great importance to the content of the negative list of market access for “maritime services and ancillary industries”. It is also reflected in Annex II with greater flexibility for the party adopting new non-conforming measures in the future. There are specific manifestations. The first has to do with the contents of the non-conformance measures in the negative list of shipping market access evident in international treaties. The contents include government-level regulations. The provisions on the contents of the negative list of shipping market access are basically included at the level of the central government. Another content is the restriction on board members. Although, the content stipulated by the parties in the, “description” part of the list of non-conformance measures is different and has its own characteristics, there are still some common features. For instance, the negative list of agreements signed by developed countries has fewer items of non-conformance measures involving shipping and restricted contents. Singapore and Australia are quick examples. The negative list of agreements signed by developing countries, on the other hand, involves more shipping non-conformance measures and many restrictions. Quick targets are countries like Uruguay, Rwanda, and the like. Finally, comparing the contents of the negative list of shipping market access in the United States with BIT and FTA, it can be seen that the contents of the negative list in the United States under BIT and FTA are not too different.

5 The negative list of China’s shipping market access: Growth and deficiencies

With the development of the negative list of shipping market access, the openness of China’s international shipping market has been expanding continuously. The transparency of the negative list has equally been gaining continuous strength. However, the comprehensive development of the negative list of shipping market access needs to be further improved. There are still gaps and deficiencies hindering its attainment of the highest international standards.

5.1 China’s negative list and the international high standard negative list: The insufficiency of the system connection

The system connection between China’s negative list and the international high standard negative list is not enough. The structure and the content of the negative list have obvious need for further optimization. From its structure and content, it is imperative that the international treaties involve national treatment, local presence, market access, most favored nation treatment, senior managers, and board of directors. Howbeit, there are few restrictions on relevant obligations in the provisions of China’s negative list of shipping – this is excluding local presence, most favored nation treatment, and the like. Again, in terms of the classification of measures, other countries basically include the idea of maintaining the existing and possible new inconsistent measures in the future. Because China’s negative list is unilateral and open, it only includes the existing inconsistent measures and has no provisions on the possible inconsistent measures in the future.

On the other hand, China seldom adopts the negative list in international trade negotiations. At present, high standard bilateral or multilateral international investment agreements mostly adopt the negative list model. Markets with high openness and large economic volume conclude agreements in the negative list model. To some extent, the negative list system represents the inevitable developmental trend of international investment, and trade agreement negotiation for the future. At this stage, therefore, China has applied to join the CPTPP agreement, which represents a high level of global investment and trade rules. The degree of market access therein is higher. To achieve a new pattern of opening-up at a higher level, China should try to adopt the negative list model for high-standard free trade negotiations. China should also strengthen the institutional connection between China’s domestic negative list and the negative list adopted in high-standard international investment agreements.

5.2 The negative list of shipping market access and the need for a strengthened transparency

The term, “transparency” has a richer meaning that exists uniquely and independently of the technical sense of the word. From its semantic perspective, transparency could be said to mean that a rule and law should be open to the public, so that the public can easily see, find, and obtain it. From the perspective of management, however, transparency suggests that in the actual management process, there is the need for managers to strengthen the timely disclosure, clarity, and accuracy of information when facing stakeholders. This will help to better realize efficient and transparent management (Schnackenberg and Tomlinson, 2016). Some international organizations have also defined transparency. The OECD defines transparency in two ways. On the one hand, transparency can be defined as, “rule transparency”. This means that under the condition of the rule of law, the regulated entities have the possibility of identifying and understanding their obligations.

On the other hand, transparency requires the government to further strengthen, “information transparency”. Information transparency includes the hearing of stakeholders, the practice of controlling the alienation of rules through transparent procedures, and the establishment of appeal procedures (Quan, 2010). In fact, the international standard of transparency is summarized from the legislation, practice, and scholars’ interpretation in different fields of international law. However, the United States is presently the founder of the negative list, and it has established transparency in investment agreements in the first generation bit model (1983 model).Therefore, the development of transparency in IIAs is largely reflected in the development of The US’ bit model.

The transparency of the negative list of international shipping market access is specifically reflected in the shipping field. Since the release of the 2018 version of the Pilot Free Trade Zone and the national version of the negative list of foreign investment, the transparency of the list has been greatly improved. On the one hand, compared with the 2018 version, the 2019 version of the negative list of foreign investment in the Pilot Free Trade Zone, and the national version have deleted the classification of “field”. The contents listed in the list are clearer and better. In addition, the 2018 and 2019 negative lists have specific provisions on the transition period in the description part. On the other hand, the list continues to maintain high international standards. It does not only clearly list the proportion of equity, it also has a series of special management measures such as national treatment in the field of shipping. All these reflect the improvement of the transparency of China’s negative list of international shipping market access. However, by understanding the practice of countries’ negative lists in transparency, we find that transparency still needs to be improved in the three stages of, “notification before formulation, participation in formulation and evaluation after formulation”. This will help to protect the right to know of stakeholders. In addition, the international high standard negative list also covers MFN treatment, performance requirements, senior management and board of directors, and other restrictions. The transparency of the negative list of China’s shipping market access needs to be further strengthened.

5.3 Weak awareness of rules and risk prevention behind the list

The negative list is quite important as it represents a high degree of standard, and transparent foreign investment management model despite the length (Guan, 2017). At the same time, it is also an exploration process for promoting the modernization and reform of the national governance system. The negative list itself is only an annex to the whole management system. Its implementation mainly relies on the unified and transparent management system, and the legal system behind the list. The high standard negative list usually lists the legal provisions on which it is based. It is even specific to the relevant legal provisions, which have strong operability. However, at present, the rules behind the negative list of China’s international shipping market access have not been fully straightened out. Rigorous management system and perfect supporting shipping laws and regulations are the powerful guarantee for the smooth implementation of the negative list. At the same time, the negative list of international shipping market access puts forward higher requirements for the risk control ability of Chinese government’s departments. China’s risk prevention awareness for foreign capital access is weak at the moment. Therefore, while comprehensively deepening reforms, and opening up, the bottom line of national security must be firmly grasped. The government should strictly restrict access to areas involving national security – areas that are of social, and public interests.

6 Perfecting the progress of the negative list: Suggestions for a better shipping market access in China

6.1 Continuing the optimization of the negative list of shipping market access

Internationally, many countries are yet to form a unified practice in signing international investment treaties or formulating and implementing the negative list of domestic legislation. Developed countries and developing countries have different views on foreign investment. The former hold an open attitude towards foreign investment. This helps them to often list their restrictions and prohibitions on foreign investment access in the annex of the agreement text through bilateral and multilateral trade negotiations. They do this because the latter are usually subject to the level of domestic economic development they have. Hence, they mostly adjust foreign investment access and business activities with special domestic legislation (Tao, 2018).

The reform idea of China’s negative list tends to be a national “one list” as it emphasizes the full coverage and institutional unity of the list. However, China’s economy is huge, and the differences between regions in terms of resource elements cannot be ignored. How to find a balance between maintaining the unity of the system, and the differences of regional development is another important challenge for China. It is a challenge as China would naturally want to continue to promote the pre-access national treatment, and the negative list system. At the same time, the global trade environment, and the rules on economic and trade imperatives are constantly changing. Also, the formulation and improvement of China’s negative list cannot be “finalized” or “changed day and night”. Therefore, China should not only promote the negative development of the national treatment system, but also adapt to the international trend step by step in the process of holistic implementation.

6.2 Improving and supporting the legal framework of the shipping market

The competition in the international shipping market is also a competition of rules and standards. From international treaties, we can find that specific areas involved in the negative list text have specific and clear domestic laws and regulations. The rules which are highly transparent serve as a support system. However, the text of China’s negative list is single. It has a low transparency impression, and lacks support laws. The latter is largely related to the imperfect shipping laws and regulations, the complex revision process, and many uncertain factors. China’s establishment of Pilot Free Trade Zone, New Port Area of Shanghai Free Trade Zone, and the construction of Hainan Free Trade Port is strategic. The ports and zones are established to continuously improve the process of investment liberalization, attract more foreign capital to enter the domestic market, and boost China’s further opening-up and economic development, transformation, and upgrading. Presently, the provisions of non-compliance measures in the negative list are reduced, and the market opening is strengthened. It is urgent for China to continuously improve the supervision system. That would ensure a better operation of the system. In the field of shipping services, it is particularly important to improve the supporting shipping laws and regulations. It is, indeed, necessary to establish and improve a risk monitoring and supervision mechanism that corresponds to the negative list of shipping market access. The latter would require the improvement and construction of a series of support shipping laws and regulations as soon as possible.

At this stage, China’s laws in the field of shipping mainly include maritime law, maritime procedure law, port law, and maritime traffic safety law. The legal system in the field of international shipping market dominated by anti-monopoly law, and international shipping regulations is not perfect. On the one hand, as a general law, the provisions of the anti-monopoly law are more principled. They fail to fully take into account the particularity of the international shipping industry. With the deepening of the reform of China’s international shipping management system, the international shipping regulations lack the provisions on in-process and post-event supervision means. They also do not factor in how to supervise new formats such as digital shipping, and the increasing problem of low legal effectiveness. Therefore, China should speed up the construction of the legal framework of the international shipping market with Chinese characteristics and promote the promulgation of the shipping laws of the People’s Republic of China.

6.3 Strengthening risk awareness in the avoidance list

Some people believe that with the increasing openness of various fields of the shipping market, the adoption of the negative list may lead to insufficient supervision and possible risks. In fact, the negative list does not represent laissez faire, but a higher level and more secure system. Nowadays, one of the important significance of implementing the negative list system in China is the transformation of the focus of government supervision. Government functional departments should change from the pre-examination and approval method to the in-process and post-supervision methods. This is necessary as the awareness of the transformation of government functions is gradually strengthening. The negative list system puts forward higher requirements for the top-level design and supervision ability of Chinese government. Through reasonable institutional design and regulatory institutional arrangements, the negative list cannot only effectively prevent and avoid risks, but also reserve some space for China’s future policy-making.

Similarly, in the process of international trade negotiations, China should make full use of the negative list system to avoid possible risks. When it comes to shipping, China should fully consider the needs of China’s economic development, national sovereignty and security, and add the areas that are not suitable for opening at this stage to the negative list. On the premise that it is impossible to predict the future development of some shipping industries, China should reserve a policy room for future non-compliance measures. It should also set aside separate non-compliance measures that can be retained in the future in the negative list. The latter will help to predict the possible threats or vicious competition in the future, and further maintain the safe and efficient operation of the international shipping market. It would also ensure the prevention and resolution of risks while expanding the opening-up, and effectively ensuring the stable development of the international shipping market.

6.4 China’s international shipping competitiveness and the need for a continuous improvement

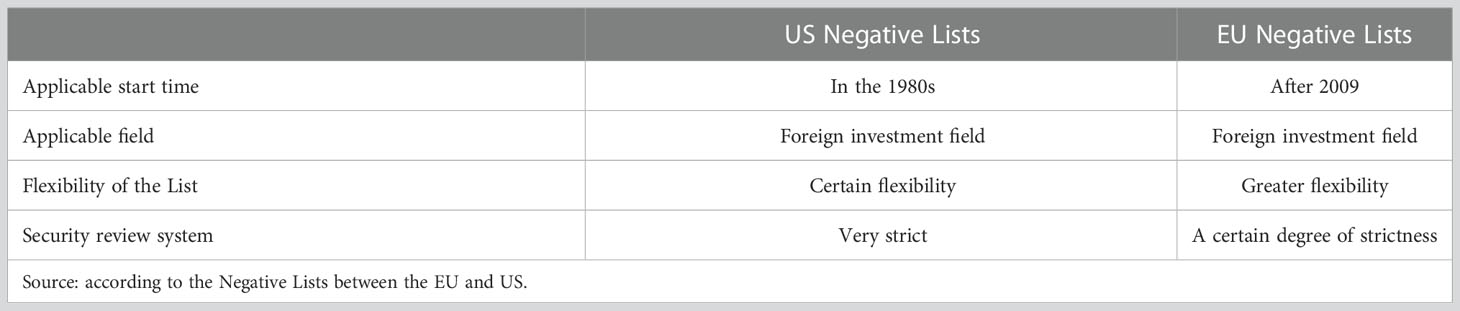

6.4.1. Overall comparison of the negative lists between the EU and US

The US and EU are the most important economies in the world. And they always have strong initiative in formulating international economic and trade rules, both in promoting the development of WTO and the international trade and agreement negotiations. Compared with the EU’s attempt in recent years to include Negative List in international trade and investment agreements, Negative Lists of investment agreements drawn up by the US have accumulated rich practical experience. It has signed more than 40 bilateral investment agreements and 20 free trade agreements with foreign countries, and promoted Negative Lists among its contracting partners (Baier et al., 2019b). The Negative List of the most influential FTAs and BITs in the US has become a typical template for countries to conclude investment treaties.Considering different national conditions, the US and EU have different considerations on the flexibility of Negative Lists. For example, bilateral investment agreements signed by the US and Latin American countries allow Latin American countries to retain preferential treatment for small and medium-sized enterprises,and are not bound by national provisions (Bohigues and Rivas, 2019). The EU supports further liberalization of trade and investment in services. Furthermore, It full opens its market to the least developed countries and applies different and special treatments for developing countries (D'Erman, 2020).

In the security review system, the Negative Lists of the US propose that contracting parties have the right to take the necessary measures to safeguard their security interests. The US imposes direct or indirect restrictions on broadcasting, telecommunications, energy exploitation and other industries.And foreign capitals are explicitly prohibited from entering domestic air transport, inland shipping and other industries. The EU also has certain control over strategic industries. However, “public safety or legitimate public interests” is not clearly defined in the relevant clauses (See Table 3).

6.4.2. Future development of the negative list of China’s shipping market access

Through the comparison of the negative list of typical international investment agreements in the world, It discovers that the structure and the content of the negative list involved in the shipping field are roughly the same. For example, there is basically no difference in the contents of bit and FTA’s negative lists as the shipping market access enabled therein has a certain stability. Therefore, the author believes that China should also maintain a stable and equal openness when signing bilateral or multilateral agreements with other countries in the future. Presently, the international situation is changing rapidly, and the global economic and trade rules are facing great challenges and adjustments. It is likely that a new global economic and trade rule will appear in the near future. China’s economy has shifted from high-speed growth to high-quality development. At the same time, The United States has already paid great attention to the promotion of its own ideas. It has promoted its own economic development goals through the negotiation of bilateral agreements and free trade agreements. In the field of international shipping, China should absorb the policy ideas conducive to the development of its own shipping industry, summarize international experience, and strive to improve the competitiveness of China’s international shipping.

China is a large shipping country, but the current situation is that its international competitiveness in the shipping industry is not strong. Hence, while promoting a series of national strategic development processes such as the Pilot Free Trade Zone, Free Trade Port, and Regional Economic Integration, China should actively maintain its special strategic position in the field of international shipping in international investment agreements and trade negotiations. The posture will enable China lay a foundation for the development of its shipping industry. In the process of multilateral trade negotiations, China will strive for more favorable terms and conditions and improve its influence in international trade negotiations.

7 Conclusion

The negative list system was first adopted from the Shanghai Pilot Free Trade Zone and tried successfully. The perspective behind it is the legal theory of “act without prohibition”. This idea has been implemented in the practice of the rule of law in the Pilot Free Trade Zone. Through replication and promotion, it is conducive to further promote the reform of the rule of law in China. Throughout the world, many countries and regions implement negative lists. However, due to differences in economic development, different countries and regions adopt different strategies when it comes to specific market opening reflecting their actual situation. For example, the EU has only begun to include the negative list in international investment agreements in recent years. This has the characteristics of regional protection. The United States included the negative list in international investment agreements earlier and accumulated rich practical experience from it. In addition, understanding the specific situation of the negative list of international shipping market access in major international investment agreements around the world will help China build pilot free trade zones that would be in line with the highest international standards. It would also promote and help China to master the process of formulating international rules in the field of international shipping as soon as possible.

At present, the revision of China’s negative list is still in a dynamic phase. In the face of the shrinking negative list reality, there should be a support approval mechanism. If the relationship between the two cannot be established in a balanced way, the experimental role of the Pilot Free Trade Zone will be weakened. The latter may also affect the pre-access national treatment, and negative list system and may eventually not achieve the desired results in the process of national implementation, and promotion.

Author contributions

YS participated in conception of research ideas and study design. YS: orginal idea and writing up. YS approved the submitted version.

Funding

This work was supported by the Fundamental Research Found of China(Guangdong) Dongguan Arbitration Commission (Grant No.1031-23621105).

Acknowledgments

Thanks to all the colleagues in International Law School of China University of Political Science and Law for their supports.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Baier S. L., Yotov Y. V., Zylkin T. (2019a). On the widely differing effects of free trade agree ments:Lessons from twenty years of trade integration. J. Int. Economics 116, 206–226. doi: 10.1016/j.jinteco.2018.11.002

Baier S. L., Bergstrand J. H., Bruno J. P. (2019b). Putting Canada in the penalty box: Trade and welfare effects of eliminating north American Free Trade Agreement. World Economy 42 (12), 3488–3514. doi: 10.1111/twec.12870

Blanchard E., Matschke X. (2015). U.S. multinationals and preferential market access. Rev. Economics Stat 97 (4), 839–854. doi: 10.1162/REST_a_00496

Bohigues A., Rivas J. M. (2019). Free trade agreements and regional alliances: support from Latin American legislators. Rev. Bras. Politica Internacional 62 (1), 3. doi: 10.1590/0034-7329201900101

Boke M. (2018). The construction of shanghai international shipping center towards 2035. Transportation Port Shipping 04, 5–12.

Broschek J., Goff P. M. (2022). Explaining Sub-federal variation in trade agreement negotiations: The case of CETA. JCMS-Journal Common Market Stud. 60 (3), 801–820. doi: 10.1111/jcms.13287

CETA. CETA chapter by chapter:Annex I and annex II. Available at: https://ec.europa.eu/trade/policy/in-focus/ceta/ceta-chapter-by-chapter/ (Accessed 2022/5/15).

D'Erman V. J. (2020). The EU's realist power: public procurement and CETA negotiations with Canada. J. Int. Relations Dev. 23 (1), 1–23. doi: 10.1057/s41268-018-0135-3

de Mestral A. (2015). When does the exception become the rule? conserving regulatory space under CETA. J. Int. Economic Law 18 (3), 641–654. doi: 10.1093/jiel/jgv033

Fernandez-Pons X., Polanco R., Torrent R. (2017). CETA on Investment:The definitive surrender of EU law to gats and NAFTA/BITs. Common Market Law Rev. 54 (5), 1318–1357. doi: 10.000/414375800002

Ge S. Q. (2018). Research on the "Negative list" management model of foreign investment. People's Publishing House 07, 10.

Gong B. H. (2016). China Pilot free trade zone needs to test new thinking on the rule of law. People's Rule Law 12, 14.

Guan J. P. (2017). The evolution trend and reform trend of china's market access legal system—A study based on the negative list system of the free trade zone. Legal Business Res. 11, 51. doi: 10.16390/j.cnki.issn1672-0393.2017.06.008

Guo G. N. (2019). How to recognize and fully implement the market access negative list system. Chin. Administration 01, 6. doi: 10.19735/j.issn.1006-0863.2019.01.01

Hao H. M. (2016). International experience comparison and development trend of negative list management mode. Foreign economic trade Pract. 02, 4–8.

Holzer J., McConnell K. (2016). A model of access in the absence of Markets.The B.E. J. Theor. Economics 16 (1), 367–368. doi: 10.1515/bejte-2015-0026

Huang Q. P., Yuan S. Y. (2018). The future of free trade port: International experience based on negative list management. Economic System Reform 03, 173–178.

Hubner K., Deman A. S., Balik T. (2017). EU And trade policy-making: the contentious case of CETA. J. Eur. Integration 39 (7), 843–857. doi: 10.1080/07036337.2017.1371708

Hundt D. (2015). Free Trade Agreements and US Foreign policy. Pacific Focus 30 (2), 151–172. doi: 10.1111/pafo.12048

Leung J. Y. (2016). Bilateral vertical specialization between the US and its trade partners- before and after the free trade agreements. Int. Rev. Economics&Finance 45, 177–196. doi: 10.1016/j.iref.2016.05.003

Li Q. (2015). The progress, plans and suggestions of international shipping service innovation in shanghai free trade zone. China Circ. Economy 08, 16–25.

Ma Y. M., Lu J. M., Li L. (2021). The signal effect of negative list model international investment agreement and its impact on international direct investment. Economic Res 11, 155–172.

Monios J. (2022). The moral limits of Market-based mechanisms: An application to the international maritime sector. J. Business Ethics 559, 25–27. doi: 10.1007/s10551-022-05256-1

Qian X. P. (2015). Research on the "Negative list" rules of international treaties on "Minority affairs" market access. J. Minzu Univ. China 01, 74. doi: 10.15970/j.cnki.1005-8575.2015.01.011

Quan X. L. (2010). WTO transparency principle: connotation, development and influence. Doctoral Dissertation Jilin Univ 6, 50–74.

R.Brooks M. (2014). The the changing regulation of Coastal Shipping in Australia. Ocean Dev. Int. Law 45, 67–83. doi: 10.1080/00908320.2014.867191

Roederer-Rynning C. (2017). Parliamentary assertion and deep integration: the European parliament in the CETA and TTIP negotiations. Cambridge Rev. Int. Affairs 30 (5-6), 507–526. doi: 10.1080/09557571.2018.1461808

Russ K. N., Swenson D. L. (2019). Trade diversion and trade deficits: The case of the Korea-US free trade agreement. J. Japanese Int. Economics 52, 22–31. doi: 10.1016/j.jjie.2019.02.001

Schnackenberg A. K., Tomlinso E. C. (2016). Organizational transparency: A new perspective on managing trust in organization-stakeholder relationships. J. Manage. 42 (7), 1784–1810. doi: 10.1177/0149206314525202

Shanghai Municipal People's Government Several measures for Shanghai's new round of service industry expansion and opening. Available at: http://tradeinservices.mofcom.gov.cn/article/yanjiu/hangyezk/201909/89666.html (Accessed 2022/2/20).

Sheng B., Jin C. X. (2022). An evaluation of the regional comprehensive economic partnership Agreement:Market access and trading Rules.China &World. Economy 30 (5), 49–74. doi: 10.1111/cwe.12437

Shi G. R. (2016). Analysis of the current situation and policy recommendations of the foreign international ship management industry in shanghai free trade Zone. Transportation Port Shipping 12, 8–11. doi: 10.16487/j.cnki.issn2095-7491.2016.06.003

Shi Y. H. (2018). Discussion on the negative list management model of my country's pilot free trade zones. Foreign Economic Trade Practices 11, 61–64.

Shi Y. H. (2019). Development status, problems and improvement paths of the negative list management system. Foreign Economic Trade Practices 08, 60.

State Council. China (Shanghai) pilot free trade zone Lin-gang new area overall plan. Available at: http://www.gov.cn/gongbao/content/2019/content_5421541.htm (Accessed 2022/1/20).

State Council. (2019) Notice on Issuing the Overall Plan for 6 Pilot Free Trade Zones Available at : http://www.gov.cn/zhengce/content/2019-08/26/content_5424522.htm (Accessed 2022/2/20).

Tan W. J., Cui F., Yang Z. Y. (2019). The impact of the negative list management model on the capital flow of the service industry in the shanghai free trade zone. Macroeconomic Res. 05, 119. doi: 10.16304/j.cnki.11-3952/f.2019.05.012

Tao L. (2018). Benchmarking the implementation path of the free trade zone negative list of the highest international standard—and commenting on the improvement of the 2018 version of the free trade zone negative list. Legal Forum 09, 147.

UNCTAD. (1968-2018). 50 years of review of maritime Transport,1968-2018:Reflecting on the past, exploring the future. Available at: https://unctad.org/en/pages/PublicationWebflyer.aspx?publicationid=2289 (Accessed 2022/3/23).

UNCTAD. (2022). Review of maritime transport 2022. Available at: https://unctad.org/webflyer/review-maritime-transport-2022#tab-4 (Accessed 202212/1).

Wang Z. M. (2016). Negative list in the SHPFTZ and its implications for china's future FDI legal system. J. World trade 50 (1), 117–145. doi: 10.54648/TRAD2016008

Wei D., Chen Z., Rose A. (2019). Estimating economic impacts of the US-south korea fr ee trade agreement. Economic Syst. Res. 31 (3), 305–323. doi: 10.1080/09535314.2018.1506980

Xinhuanet. (2018). Xi jinping visits shanghai. Available at: http://www.xinhuanet.com/politics/2018-11/07/c_1123679389.htm/ (Accessed 2022/1/20).

Xu M., Pan Q., Xia H., Masuda N. (2020). Estimating international trade status of countries from global liner shipping networks. R. Soc. Open Sci. 7 (10), 1–13. doi: 10.1098/rsos.200386

Yang R., Jia R. (2018). Negative list system of EU Canada CETA investment agreement and its enlightenment to China. Int. Economic trade Explor. 12, 107–118.

Keywords: shipping market access, negative list, international treaty, China’s pilot free trade zones, shipping law, government supervision

Citation: Shi Y (2023) International practice analysis of the negative list: Chinese Example of shipping market access. Front. Mar. Sci. 9:1088093. doi: 10.3389/fmars.2022.1088093

Received: 03 November 2022; Accepted: 13 December 2022;

Published: 18 January 2023.

Edited by:

Shih-Ming Kao, National Sun Yat-sen University, TaiwanCopyright © 2023 Shi. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yuanhong Shi, Q1UyMTQwMThAY3VwbC5lZHUuY24=

Yuanhong Shi

Yuanhong Shi