- Law School, Dalian Maritime University, Dalian, Liaoning, China

Being the adjustment of the development strategy of the People’s Republic of China (hereinafter referred to as the “PRC”), the new domestic and international dual-cycle development pattern forms the policy framework and target of the PRC’s future shipping industry. By exam the policy innovations taken in the Pilot Free Trade Zones/Free Trade Port and high-level Free Trade Agreements signed by PRC, this paper provides a conceptual research on the path to the construction of a domestic and international dual cycle of the PRC’s shipping industry. It is argued that the internal shipping policy innovations and international agreements has laid the foundation of the path, but resistance such as weak modern shipping service industry, unattractive international shipping system, and myriad of uncertain factors and challenges need to be addressed. It is deemed necessary to optimize the deployment of shipping industry in the logistic system and strengthen the innovation of new development model with combination of digital technologies.

1 Background

In May 2020, developing a new development pattern promoted by a domestic and international dual cycle was first proposed by the Standing Committee of the Political Bureau of the Central Committee. In October 2020, “Accelerating the construction of the domestic cycle as the mainstay and the new development pattern of mutual promotion of the domestic and international dual cycles” was formally included into the Communist Party of China Central Committee’s Fourteenth Five-Year Annual Plan and Proposals for the 2035 Long-term Goals. The new development pattern of the domestic and international dual cycle (hereinafter referred to as ‘dual-cycle development pattern’) is the PRC’s strategic deployment responding to the internal development needs and external trend of counter-globalization and large-scale trade frictions. Its establishment is not only related to the core strategy of the PRC’s economic development during the “14th Five-Year Plan” period, but also forms the PRC’s long-term strategic layout for a new round of higher-level reform and opening-up (Li, 2021).

Since the introduction of the dual-cycle development pattern, the research on its policy background, theoretical basis, strategic implication, and implementation path has rapidly become a heat topic, especially in the PRC, and there are extensive studies conducted in relation to it. At the same time, the impact of the dual-cycle development pattern on certain industries and social governance issues has also been widely analyzed and interpreted, such as the relationship between dual-cycle development pattern and “high-quality development” (Wang et al., 2022), its impact on “rural revitalization” (Wang and Mao, 2021), “digital economy” (Li and Wang, 2021), “scientific and technological innovation” (Lv et al., 2022), “new infrastructure” (Jing and Feng, 2021) and “foreign trade” (Lin et al., 2021).

As for the shipping industry, being a carrier of trade and service circulation, shipping plays an important role in the dual-cycle development pattern, recognized as the “pioneer” that promotes the dual-cycle domestically and abroad (Chang et al., 2021). To match up the development need of the dual-cycle development pattern, some scholars have further proposed that shipping companies should actively integrate into the multimodal transport system, and should establish a logistics system that combines both export-oriented and domestic demand by providing door-to-door logistics services, building integrated logistics suppliers, and promoting the digitalization of the industry both in terms of hardware and software (Xie, 2020). For government, to promote the deepening reform and improvement of the shipping industry in terms of management methods and operating networks, its function is to cultivate and guide the market with policies, regulate the market, and serve the market with information technology (Xu, 2020). Also, attention has been drawn to the construction of Shanghai International Shipping Center under the dual-cycle development pattern, with suggestions to build an efficient shipping logistics network, set up a branded resource allocation system, consolidate a digital shipping governance system, improve the legal environment for shipping participants, and create a high-end shipping talent highland (Zhang, 2021). The above research is enlightening, but also to a large extent fragmented, it does not systematically analyze the basis for the integration of the shipping industry into the dual-cycle development pattern and the suggestions thereof are also raised without comprehensive consideration of the latest trends in the development of the PRC’s shipping industry.

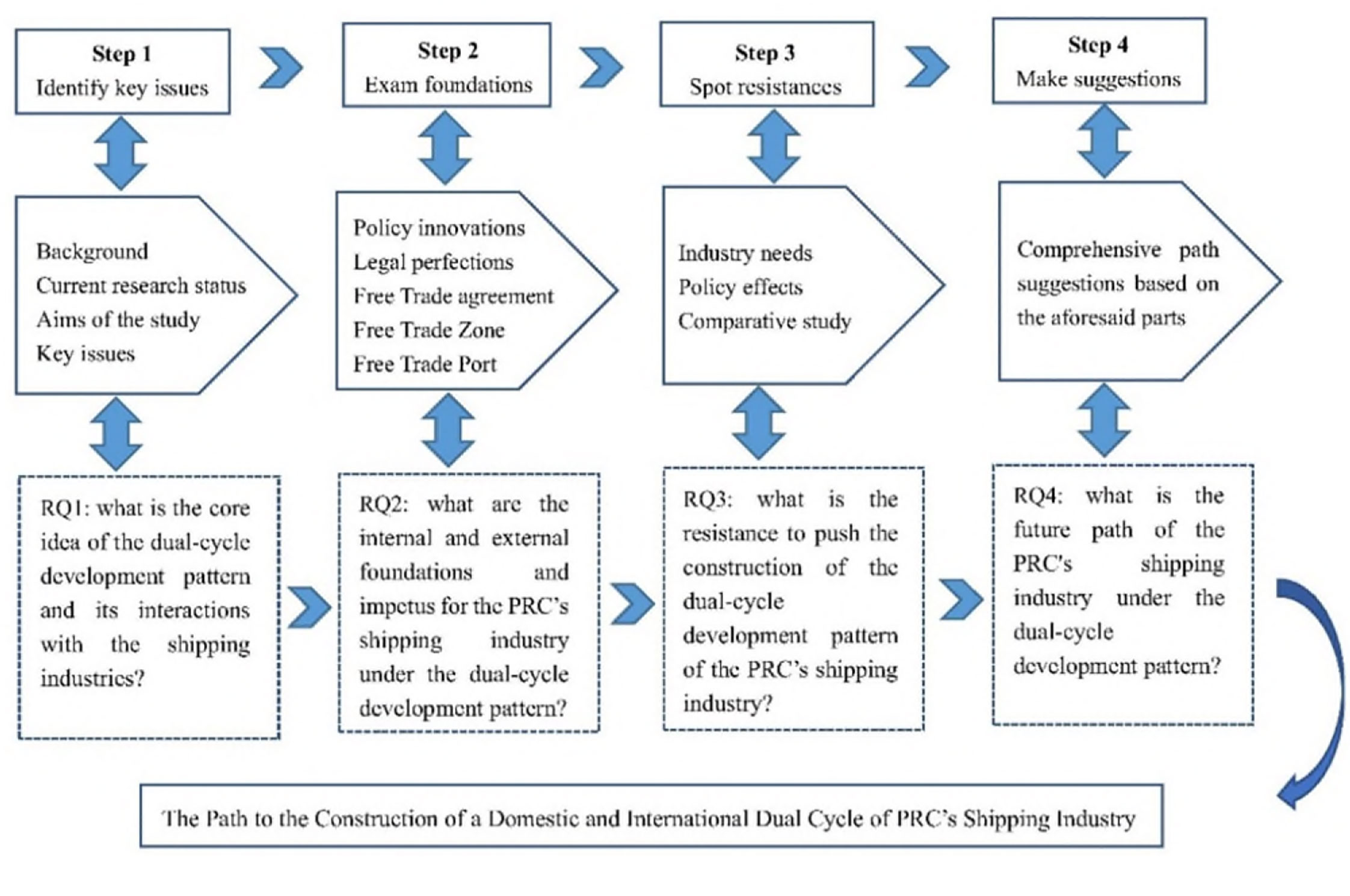

In light of the above context, this paper aims to fill the research gap in analysing the path to the construction of a domestic and international dual cycle of China’s shipping industry in a systematic way. To contribute to this research gap, four questions are raised hereby. First, what is the core idea of the dual-cycle development pattern and its interactions with the shipping industries? Second, what are the internal and external foundations and impetus for the PRC’s shipping industry under the dual-cycle development pattern? Third, what are the resistance to push the construction of the dual-cycle development pattern of the PRC’s shipping industry? Four, in light of the above, what is the future path of the PRC’s shipping industry under the dual-cycle development pattern? To address the above questions, the discussions and contributions of this paper will be organized in the form of a conceptual article. Under this format, each of the four specific academic questions will be analysed based on the detailed collection and analysing of the latest development direction and foundation of the PRC’s shipping industry. The conceptual research design of this paper can be illustrated in Figure 1 below.

To follow the conceptual framework above, this paper first provides an in-depth interpretation of the dual-cycle development pattern and its interaction with the shipping industry in section 2. Section 3 and Section 4 summarize the PRC’s latest development directions of the PRC’s shipping industry from the internal and external perspectives, which in authors’ view, are also the foundations of the PRC’s path to the construction of the dual-cycle of shipping industry. Section 5 sheds light on the future direction of the PRC’s shipping industry under the new dual-cycle development pattern based on the identification of the resistance. Section 6 concludes the research of this article. Admittedly, although this article endeavours to summarize and present the latest practical development and shortcomings as comprehensively as possible when sorting out the development foundation and path of the PRC’s shipping industry in the dual-cycle development pattern, the sorting is by no means exhaustive and there are still gaps remaining inevitably. This article is in essence more about a macroscopic discussion of the future development path of the PRC’s shipping law under the dual-cycle development model, and the detailed discussion of future improvement measures is not considered the most prominent part of this article.

2 Interpretation of the dual-cycle development pattern and its interaction with the shipping industry

2.1 Interpretation of the dual-cycle development pattern

To explore the impact of the dual-cycle development pattern on the shipping industry, it is essential to first accurately interpret the background and goals of the development strategy. The development path of the shipping industry under the dual-cycle development pattern needs to be based on the development direction of the development strategy.

The dual-cycle development pattern is proposed based on the domestic economic conditions and the international economic environment. It is a strategic move in the process of realizing industrialization based on domestic development needs and changes in the international situation (Dong and Li, 2020). Due to the fact that the PRC had rich labour force in the early stage of reform and opening up but with limited capital and technology capacity, exporting labour-intensive products, importing advanced equipment, raw materials, and introducing capital and technology became inevitable, which made the PRC gradually form an export-oriented pattern of economic development. However, in the recent 10 years, the net growth of the PRC’s labour force has changed from slow to stagnant and then declined, the investment capacity has continued to grow rapidly, the domestic market has expanded, and the constant international economic and trade frictions have made the construction of domestic economic cycle more urgent. Thus, the dual-cycle development pattern with the internal cycle as the main driving force and the external cycle as empowerment is proposed (Wang and Meng, 2021).

The dual-cycle development pattern is based on the PRC’s reliance on the international cycle since the reform and opening up 30 years ago, which has led to greater risks in economic development. It is widely recognized that the unbalanced development of consumption, investment and exports of the PRC has led to insufficient economic development momentum; the industrial chain of the PRC is relatively in the middle and lower reaches of the value chain, which makes its economic development vulnerable. Accordingly, the goal of dual-cycle development pattern is to promote the coordinated development of internal cycle by adjusting the regional economic layout, drive the rapid development of economic internal cycle through industrial upgrading, and promote domestic and international linkage and actively participate in global economic governance (Guo, 2020). Under the dual-cycle development pattern, on the one hand, it is deemed necessary to focus on smoothing the domestic cycle, focusing on supply-side structural reforms to promote the fully balanced development of the domestic economy; on the other hand, it is also necessary to steadily promote the international cycle, constructing a higher-level open economy with a focus on rules-based opening up (Dong and Li, 2020).

On the above basis, the dual-cycle development pattern can also be summed up as one kind of domestic demand-driven globalization, that is, to comprehensively expand the domestic consumer market, support the PRC’s industry upgrade, and first match domestic supply and demand through internal cycles while upgrading, and then through the external circulation to open up the exchange of global production factors, stimulate the potential of economic growth and drive a new round of globalization process (Wang and Liao, 2022). Overall, the dual-cycle development pattern is a development strategy adjustment based on the historical period in which the PRC is currently developing. This adjustment is not a denial of the PRC’s past development model, but a further emphasis on future development priorities on basis of past practices, and its key is to improve the quality of development through reforms and innovations.

2.2 The interaction between the dual-cycle development pattern and the shipping industry

The dual-cycle development pattern needs to be promoted from the perspectives of smooth flow of production, distribution, circulation, and consumption. Among them, speeding up circulation and improving overall resource allocation efficiency are considered pivotal. As an important carrier of circulation, shipping is an important link connecting production, distribution, circulation, and consumption, which facilitates international trade and plays an important role in the growth and development of the local economy (Gani, 2017). To ensure that the development of the shipping industry can keep up with the needs of the dual-cycle development pattern for the circulation field is crucial to achieving the strategic goals of the dual-cycle development pattern.

At the same time, the dual-cycle development pattern also clarifies the direction for the future development of the PRC’s shipping industry: on the one hand, the dual-cycle development pattern adjusts the PRC’s development strategy in a holistic manner, and its in-depth exploration of domestic and international dual-cycle development will also provide the shipping industry with new opportunities; on the other hand, the dual-cycle development pattern’s emphasis on high-quality development and the transition from cost and scale-driven to innovation-driven are also in line with the needs of the PRC’s shipping industry.

2.3 The foundation of the path of the dual-cycle of the PRC’s shipping industry

The adoption of a dual-cycle development pattern for the PRC is not without foundation. To understand the dual-cycle development pattern and deploy the opportunities it brings for the shipping industry, it is necessary to examine the existing practice, summarizing the development needs and direction from the latest practice. Particularly, reform, opening up and innovation are regarded as the key driving forces for the dual-cycle development pattern (Zhou, 2021), the latest practices in pursuing those aspects are considered of key importance, which lays the foundation and enlightens the future of the path of the PRC’s shipping industry under the dual-cycle development pattern. In this regard, sorting through the latest developments of the PRC’s shipping industry domestically and internationally is necessary and is carried out in the following sections.

When examining the domestic foundation of the PRC’s shipping industry under the dual-cycle development pattern, the policy innovations in the Pilot Free Trade Zones/Free Trade Port (hereinafter referred to as ‘FTZs/FTP’) is the key in understanding the development directions of the PRC’s shipping. Different from the traditional domestic FTZ whose purpose is to develop international trade, the core function of the PRC’s construction of the FTZs/FTP is to reform the existing system and promote the transformation of government functions and create the “second season” of the PRC’s open economy (Li and Liu, 2014). It is more a trial zone for the PRC’s new opening and reform strategy (Yao and Whalley, 2015). Attributing to the functions China’s invested in the FTZs/FTP, most shipping innovations during the last decade originated in the trials carried out in the FTZs/FTP. Thus, the FTZs/FTP have become the most important carrier for the internal innovation of the PRC’s shipping industry, with the role not only to optimize the business environment of the domestic shipping market and promote the domestic shipping cycle, but also to better integrate with the international shipping cycle.

Turning to the international foundation of the PRC’s shipping industry under the dual-cycle development pattern, high-level FTAs will be key external imputes. Although unclear international economic and trade situation impacted the development foundation of the shipping industry, China’s positive attitude in strengthen the economic and trade relationship with other countries remain unchanged. This is also in line with the interpretation that the dual-circulation development pattern does not mean closing the door to opening up, but means a much deeper and broader scope of reform (Lin and Wang, 2021). Particularly, in the last decade, the PRC has become much more active in the pursuit of a trade strategy which aims to strengthen economic relations with major trade partners and emerging markets with a gradualist approach (Sampson, 2021). The signing of high-level FTAs has demonstrated the PRC’s firm stance and determination to promote economic globalization and trade liberalization, and to force reforms through openness. Considering its inherent international nature and close relationship with international trade, the PRC’s shipping industry will certainly benefit from the high-level FTAs, for their value in improving the total cargo volume of shipping and shipping circulation efficiency, reducing shipping enterprise costs, and promoting the high-quality development of shipping.

The following two parts will exam and comb through such internal and external foundations of the path to the construction of PRC’s dual-cycle of shipping industry in detail.

3 Policy innovations in the FTZs/FTP providing internal opportunities for the dual-cycle of the shipping industry

3.1 Opening of the shipping market

Market opening policy is a key element in the reform of FTZ, which can be evidenced in multi-faceted aspects, such as for the first time in China, a “negative list” approach is being used (Palmioli and Heal, 2014). As an important sector for the operations of the FTZs/FTP, the opening of shipping market is also promoted to a new level, which includes measures as follows.

3.1.1 Relaxation of restrictions on foreign investment

Before the reform of the FTZ, for Sino-foreign joint or cooperative ventures in international shipping industry, the PRC’s legislation required the proportion of foreign investment should not exceed 49%1. On 21 December 2013, the State Council passed the Decision on Suspension of the Implementation of Relevant Laws and Regulations in the Shanghai Free Trade Zone, relaxed the restrictions on foreign equity in Sino-foreign joint and cooperative international shipping companies, and allowed the establishment of wholly foreign-owned international ship management enterprises. In 2015, this policy was further expanded and opened to other free trade zones2. In 2017, the restrictions on foreign investment in the shipping industry were further relaxed, allowing the establishment of wholly foreign-owned international marine transportation, ship management, cargo handling, container stations and yard enterprises3. The aforementioned liberalization measures have also been confirmed in legislations: during the revision of the Regulation on International Ocean Shipping in 2019, the aforementioned restrictions on foreign investment have been deleted.

Allowing foreign investment to invest the PRC’s shipping-related industries with less restrictions will help to attract more funds for the development of the PRC’s shipping industry and enhance service quality and capabilities through intensified competition. Deservedly, it is also conducive to the business layout of foreign shipping companies in the PRC and strengthen their ability and competitiveness in providing whole legs of multimodal transport services in the PRC.

3.1.2 Pilot opening of cabotage

The concept of cabotage is an old one, yet still adopted widely worldwide. Strict cabotage policies imply that ownership control, vessel registration, crewing and shipbuilding and repair activities are in the hands of nationals (Casaca and Lyridis, 2021). The PRC used to be known for implementing strict cabotage policies. Article 4 of the Chinese Maritime Code clearly stipulates: “Maritime transportation and towage between ports of the PRC shall be operated by ships flying the flag of the PRC.” Article 37 of the PRC’s International Shipping Regulations also expressly prohibits foreign ship transport operators operate ship transport business between Chinese ports, or use chartered Chinese ships and spaces, and exchange spaces, etc., to operate ship transport business between Chinese ports.

The practice of granting cabotage only to the domestic fleet is essentially a reservation to the domestic shipping market. Although it is a common practice in various countries, it inevitably results in a waste of capacity of foreign international sailing ships on the flipside. In order to increase the utilization rate of ships, the “China (Shanghai) Pilot Free Trade Zone Overall Plan” issued by the State Council in 2013 started the reform to allow ships flying foreign flags but owned or controlled by Chinese-funded companies to try the coastal piggyback business of foreign trade import and export containers between domestic coastal ports and Shanghai Port. Since then, the coastal piggyback policy has gradually been replicated and promoted in other FTZs. Although the preliminary pilot of the coastal piggybacking business is not essentially open to the foreign capital market, in November 2021, the State Council announced a decision to suspend the application of the above Article of the Regulations on International Shipping in the Lingang new area of China (Shanghai) Pilot Free Trade Zone, allowing eligible foreign (as well as Hongkong and Macao special administrative region based) liner companies to use their non-five-star flag ships to carried out coastal piggybacking business trial between Dalian, Tianjin, Qingdao and Shanghai Yangshan Port for foreign trade containers, which using Yangshan port area as the international transshipment port4. This new policy brought new chances for foreign container operators, providing them opportunities to enjoy a more efficient arrangement of the shipping routes, which demonstrates the PRC’s determination to build a higher-level open economic system and the PRC’s will to drive the reform and upgrade of the domestic shipping industry (Cao and Chang, 2022).

3.2 Improving the level of shipping facilitation

In the construction of the FTZs/FTP, the facilitation of customs clearance is one of the core components. Through the optimization of the ship and cargo supervision system, the level of shipping facilitation in the PRC has been significantly improved.

3.2.1 Facilitation of customs clearance under the construction of single window

Maritime transport involves a lot of procedures, stakeholders and data that need to be exchanged (Tijan et al., 2019), and establishment of a single window has long been recommended as an efficiency facilitator whereby trade-related information and/or documents need only be submitted once at a single entry point to fulfil all import, export, and transit-related regulatory requirements5. Construction of single window is one of the key missions of the PRC’s FTZ. Through the establishment of a cross-departmental integrated management service platform for customs, foreign exchange, taxation and commerce, the efficient and smooth exchange of information, mutual recognition of supervision and mutual assistance in law enforcement between various supervisory authorities is largely achieved. As of the end of 2016, 95% of cargo declarations and all ship declarations at Shanghai Port were handled through the “single window” of international trade6. Article 45 of the Regulations on Optimizing the Business Environment, which came into effect in January 2020, further settles the practice of single window as a legal requirement, which stipulates that those relevant businesses in the field of ports and international trade should be handled centralized through the “single window” of international trade. Undoubtedly, the construction of the single window has greatly simplified the customs clearance procedures for ships and cargo, and has brought a huge boost to the improvement of shipping efficiency. According to the report of the General Administration of Customs, by promoting the electronic circulation and online processing of relevant logistics documents, the data of international voyage ships entering the port can be reused and shared between the upper and lower ports, and the time for enterprises to declare at the port has been reduced from more than one hour to within five minutes.7

3.2.2 Innovation of international ship registration system

Like many other counties, the PRC traditionally adopts a strict registration policy, whereby the registration of foreign-funded ships in the PRC needs to meet the condition that the capital contribution of the Chinese investor shall not be less than 50%8. For operational costs saving considerations, flagging out has become a common operation strategy for shipowners in the PRC. In facilitating the development of a maritime cluster, the PRC considered the increase in ship registration as a core measure to collaterally promote the development of shipping industries such as port logistics, ship maintenance, ship insurance, ship financial leasing and ship agency. Although the initial attempt of introducing a special tax-free ship registration policy applied to state owned foreign ships started from 2007 is not successful (Chen et al., 2017), many FTZs/FTP have now launched an international ship registration system to attract vessels back to their national flags, as shown by the success of many countries (Yin et al., 2018). The key innovation under the international ship registration system is that shipping companies are now not subject to the aforementioned restriction that the capital contribution of the Chinese investor must not be less than 50%.

The Hainan Free Trade Port International Ship Regulations passed on 1 June 2021 further draws on the experience of ship registration service management in Hong Kong, Singapore and other places, and legislates several supporting measures for the international ship registration system. First, foreign ship inspection agencies that have obtained statutory inspection authorization can carry out international ship statutory inspections and classification inspections9. Second, relaxation of the restrictions on ship names and allowing the use of English ship names10. Third, expanding the scope of disclosure of ship registration information to allow units and individuals in need to inquire and copy international ship registration information11. Fourth, giving confirmation to the official legal status of the electronic ship certificate so that the ship registration business can be handled online12. Fifth, establishing a temporary ship registration system, so that when the original ship registration application materials are not complete to be submitted to the ship registration agency in the first time, temporary ship registration can be applied to avoid the suspension of flag transfer for imported ships and meet shipowner’s need for fast financing13.

3.3 Introducing shipping related tax innovative measures

Compared with flag-of-convenience countries, the PRC’s heavier shipping tax burden is perceived one of key reasons why many domestic shipping companies or capital choose to register ships and companies abroad, which also brings a heavier burden to the PRC’s shipping companies to participate in international competition. In the construction of the FTZs/FTP, taxation reforms and innovations in various links are expected to enhance the attractiveness of the mainland of the PRC to develop the maritime cluster.

First, the protective tariff policy in the ship supply market. The most successful practice in this regard is the protective tariff fuel bunkering policy for ships on international voyages, for which during 2020, more than 16.8 million tons of protective tariff fuel were provided14. The protective tariff fuel bunkering policy, on the one hand, gives ships tangible benefits, on the other hand, generates the effect of shipping fund gathering and contribute to the local shipping financial industry. In addition, Hainan FTP and some FTZs are also actively carrying out the policy of protective tariff on imported ship parts required for repair and construction in the special customs supervision area to support the forming of trading market of ship parts.

Second, tax relief for specific shipping transactions. For example, insurance companies registered in Guangzhou is exempted from Value-Added Tax on the income from providing international shipping insurance services to companies in the Nansha FTZ15. Another example is that Hainan provides export tax rebates for domestically built ships registered in the “China Yangpu Port” and engaged in international transportation16.

Third, the exploration and implementation of the tax refund policy at the port of departure. In October 2020, container cargo departing from Guangzhou Nansha Bonded Port Area and Shenzhen Qianhai Bonded Port Area (hereinafter referred to as “departure ports”) can implement the port of departure tax refund policy if the conditions are met17. Since then, the policy has been implemented in Hainan and other places. This policy aims to advance the export tax rebate time from the time of export port to the time of port of departure, shortens the tax rebate cycle of enterprises, which is expected to improve the enterprises’ ability to collect goods and capital turnover.

3.4 Summary

Started in 2013, the construction of the PRC’s FTZs has been expanding continuously18, and the construction of the Hainan FTP is also in full swing. The FTZs/FTP have become the hub of the dual circulation domestically and abroad, playing the role of the link node of the dual circulation inside and outside (Zhang, 2020). In the construction and development of coastal FTZs/FTP in various places, shipping is an important module. The policy innovations targeted at improving the efficiency of shipping circulation, reducing the burden on shipping companies, and optimizing the shipping supervision mechanism have achieved sound results in practice. Taking Hainan as an example, from June 2020 to June 2022, there has been an increase of more than 400 new shipping companies in Hainan, with a new shipping capacity of 10.03 million dwt. At present, there are 33 international ships registered as “China Yangpu Port”, with a total deadweight of more than 5.1 million tons, and the total tonnage of international ships in Hainan ranks second among provinces in the PRC.19 Thus, with the inherent requirement that the successful FTZ policy innovations shall be replicated and promoted, those shipping policy innovations constitute an important driving force for the optimization of the business environment in the PRC’s shipping market.

4 FTAs providing external traction for the dual-cycle of the shipping industry

4.1 Integration and optimization goods and services trade to indirectly promote the development of the shipping industry

One of the key objectives of the FTAs is to promote bilateral or regional industrial chain integration and international economic and trade exchanges. FTAs provide the contracting parties the access to the markets of its partners which would otherwise be blocked or restricted (Basu et al., 2005; Siriwardana and Yang, 2008). Research shows that signing FTAs have brought significant trade creation effect for China and its trade partners (Wei et al., 2021).

Specifically, in terms of trade in goods, according to the FTAs and preferential trade arrangements signed, reduced tax rates are implemented between China and many states according to relevant FTAs. It is also worth noting that the China-Cambodia FTA is the first FTA signed between PRC and the least developed countries, where China and Cambodia have mutually granted 97.5% and 90% of the tariff items of zero-tariff products in trade of goods to each other, which is the highest level in all FTAs negotiated so far (Shen and Liu, 2021). Regarding service trade, parties under the FTAs have further opened up their domestic markets and made promises of a higher level of openness. Particularly, the promise in the openness of transportation related service sections will contribute the shipping industry to a better development of the multimode transportation and upgrading the shipping service. For example, owing to the Supplementary Agreement on trade in service of the FTA between PRC and Chile, Chinese transportation service providers can carry out road and pipeline transportation services, tally, warehousing and freight forwarding services in Chile, enjoying the same treatment as local Chilean enterprises (Ministry of Commerce, 2017).

Meanwhile, E-commerce rules have been produced in the FTAs to coordinate the legal frameworks governing electronic transactions and minimize the regulatory burden on electronic commerce to ensure that regulatory frameworks support industry-led development of electronic commerce.20 By working towards the mutual recognition of digital certificates and electronic signatures, accepting trade administration documents submitted electronically as the legal equivalent of the paper version of those documents, and assisting small and medium-sized enterprises to overcome obstacles to the use of electronic commerce, a wider use of e-commerce will be encouraged, which will inevitably contribute to the time and cost saving of the shipping industry as well.

4.2 Clarification of customs and trade facilitation related regulations to directly promote the development of the shipping industry

Predictability, transparency, convenience and speed of customs procedures are core targets in the new generation of the PRC’s FTAs. These targets are explicitly stated in the relevant customs part of the FTAs. For example, in the Protocol to Upgrade the FTA between the PRC and Singapore, it is agreed that each party shall ensure that its customs procedures and practices are predictable, consistent, transparent and trade facilitating while maintaining appropriate customs controls21. What’s more, considering the high-quality experience of Singapore’s single window construction and the willingness of cooperation, the protocol pledged to establish and jointly strengthen the single window construction of both sides. This is the first time that the PRC gives its commitment on this issue in FTAs (Ministry of Commerce, 2018).

To be specific, predictability is reflected in the requirement of ensuring the customs procedures conform to international standards and recommended practices established by the World Customs Organization and avoid arbitrary and unwarranted procedural obstacles.22 Transparency is embodied in the fact that parties should promptly publish relevant information on the Internet to the extent possible in a non-discriminatory and easily accessible way, so that governments, traders and other stakeholders can be aware of the information.23 Parties are required make efforts to make the electronic version of its trade management documents available to the public.24 Convenience is pursued by agreement on the employment of information technology to support customs operations, including sharing of best practices for the purposes of improving their customs procedures, particularly in the paperless trading context25. Controls, formalities and the number of documents required in the context of trade in goods are required to be limited to those necessary to ensure compliance with legal requirements26. In terms of speed, procedures allowing for submission of import documentations and other required information shall be adopted or maintained in order to begin processing prior to the arrival of goods with a view to expediting the release of goods upon arrival27, and release of goods shall be achieved within a period of time no greater than that required to ensure compliance with its customs law, and to the extent possible, within 48 hours of goods’ arrival, provided all necessary regulatory and examination requirements have been met28.

It is also worth to note that FTA’s clarification on certain trade facilitation related issues will increase its certainty to the shipping industry. One of the examples is the rules of origin. In RCEP, it is clarified that the origin of the goods will not be changed if the good has been transported through one or more parties other than the exporting party and the importing party or non-parties, provided that the good has not undergone any further processing in the intermediate parties or the non-parties, except for logistics activities, and remains under the control of the customs authority29. This greatly facilitates the use of intermodal and transit transportation to improve transportation routes and efficiency.

Besides, specific commitments on shipping services stipulated in the FTAs is also upgrading, relaxation of restrictions can be evidenced from the development of the promises in the FTAs. For example, restriction on the proportion of foreign investment in the joint venture in marine section stipulated in the China’s Schedule of Specific Commitments on Services of the China-Singapore FTA, is removed from that of the RCEP.

4.3 Summary

The signing of high-level FTAs has laid the external foundation for the new round of openness. For example, RCEP covers about 30% of global GDP and accounts for about 30% of the world’s population. According to the predication by Peterson Institute for International Economics, RCEP could add $209 billion annually to world incomes, and $500 billion to the world trade by 2030 (Petri and Plummer, 2020). More importantly, because RCEP members are spread across some of the world’s larger economies, its influence will extend far beyond the Asia-Pacific region (Gao and Shaffer, 2021). For the shipping industry, FTAs plays an active role in optimizing customs procedures and clarifying shipping related trade rules, which will improve shipping efficiency and be cost-saving to shipping companies as a direct result.

Meanwhile, in order to comply with the FTAs and to enhance the PRC’s trade competitiveness, the Chinese government has accelerated the promotion of openness and transparency of port and custom procedures. The Global Doing Business Report 2020 also listed the PRC as one of top ten countries in the ease of doing business after implementing regulatory reforms with most notable improvement in reducing burdensome regulations. Notably, the import documents and border compliance time have been reduced respectively by 45.8 and 25.0%, the border compliance costs of exports and imports were reduced by 18.5 and 26.1%, respectively (The World Bank, 2020).

5 The future path of the PRC’s shipping industry under the dual-cycle development pattern

Driven by the internal reform of the FTZs/FTP shipping innovation and the external promotion of high-level FTAs, the future path of the PRC’s shipping industry under the dual-cycle development pattern is rather clear, that is to build a domestic and international complementary and integrated shipping market, pursuing the goal of freedom, openness, efficiency and convenience.

5.1 The resistance faced by the PRC’s shipping industry under the dual-cycle development pattern

Although the future path of the PRC’s shipping industry under the dual-cycle development pattern is relatively clear, and the foundation is good considering that the PRC has already ranked among the world’s front in many aspects, such as port cargo throughput30, ship construction capacity31, and fleet capacity32. However, resistance still exist as the PRC’s shipping industry also faces structural problems, its core competitiveness still needs to be improved.

First, the PRC’s development foundation of the modern shipping service industry is weak, which can be observed in maritime arbitration, shipping finance, shipping insurance, shipping brokerage and so on. Although the PRC does pay attention to the importance and take measures to accelerate the development of modern shipping service for a long time, the development of modern shipping service industry has its own course and depends on many factors that cannot be fostered in a short period. For example, in terms of maritime arbitration, despite the effort taken by the PRC’s maritime arbitration community, its caseload is far behind that of UK as statistics from two leading maritime arbitration organizations (China Maritime Arbitration Commission and London Maritime Arbitrator Association) shows in the Table 1 below. A significant portion of the shipping disputes involved Chinese interests are referred to arbitration outside the PRC. This is not a preferred situation as alternative dispute resolutions are not only an important part of the modern shipping services, which will contribute to the maritime cluster as whole, but also an important for the interest of the PRC’s shipping interest, as foreign arbitration or litigation will generally be more costly and challenging. It is therefore necessary to set a long-term plan and more efforts are needed to attract and gather elements of the modern shipping service.

Second, an attractive international shipping system has not yet been fully established. Unattractive ship registration system, imperfect ship financing environment, shipping legal system not in line with international standards, and high level of shipping taxes are all considered as bottlenecks in the openness, freedom and facilitation of the PRC’s shipping market mechanism and industry rules (Liu et al., 2020). Although policy innovations have been introduced in the FTZs/FPZ as mentioned above, many have achieved limited influence in practice due to fact that they have not torched the crux of the bottlenecks of the existing system. For example, although many FTZs and Hainan FPZ have introduced an international ship registration system, the number of foreign vessels attracted by such registration in practice is not significant. The core reason behind this situation is simply that despite all the efforts taken to facilitate the registration of ships, the foremost element in choice of flag for shipowners remain unchanged for the PRC’s ship registration system: tax. In the PRC, shipping companies are subject to a 25% corporate income tax, which is significantly higher than many countries, considering that many FOC countries do not charge corporate income tax to shipping companies at all (Cao and Chang, 2022).

Third, the development of the PRC’s shipping industry is also in face of a myriad of uncertain factors and challenges, including the uncertainty of the global economic and trade situation, and the fierce competition between domestic and foreign shipping companies (Anwar, 2019; Huang et al., 2020). Particularly, various trade protection measures implemented under the pretext of “fair trade” has brought huge challenges to the shipping industry. One example of the trade friction’s impact on the PRC’s shipping is that China-Australia trade friction caused a large number of ships to be stranded in Chinese ports at the end of 2020, and a large number of shipping disputes have arisen from this33.

5.2 Reform and opening up as an important driving force

The above structural issues and challenges need to be addressed through a new round of innovation by market players and government departments. Especially from the governance perspective of government departments, one of the important opportunities of the dual-cycle development pattern for the shipping industry is to promote government departments to reform the management model, stimulate the vitality of internal and external markets (Xu, 2020). To this end, the process of shipping reform and opening up shall be persisted in terms of both breadth and depth, deploying policy innovations of the FTZs/FTP and legal instruments of FTAs as the two most important driving forces to introduce more capital and technology, reduce the burden on shipping companies, and improve regulatory efficiency and service levels.

Specifically, it is necessary to adhere to the reform of “streamline administration, delegate powers, and improve regulation and services” in the shipping governance field, continue the reform trial of the government’s management mechanism and management methods of ports, ships, crews, and shipping markets in the FTZs/FTP, and expand the successful experience gradually. During this process, the role of legislation shall not be overlooked. Unattractive legal regime can perform as an ultimate barrier for the development of shipping industry, which is fully aware of during the construction of FTZs/FTP. By suspending the implementation of certain laws in the FTZs/FTP, formulating special FTZs/FTP laws or local regulations, and issuing flexible policy documents, a new legal regime for shipping innovation applied in FTZs/FTP is actually being formed gradually, but such approach is to some extent fragmented, and its process shall be reinforced further. New legislations and legislative amendments shall be carried out to confirm and guarantee reforms, creating a better rule of law-based business environment of the shipping market.

On the other hand, facing with the challenges brought by the self-reliant ideology (Wang and Sharma, 2021), the network of high-level FTAs shall be expanded further. Not only PRC shall commit itself to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, but also start or keep strategic discussion with other major trade powers such as USA, EU and UK regarding the possibilities of establishing FTAs, promoting the construction of free trade zones among the “Belt and Road” countries, exploring the possibilities of free trade areas with countries in South America, Central and Eastern Europe, Central Asia, and Africa34. Meanwhile, the commitments in the FTAs shall be kept and performed in a faithful way, where closer bilateral and multilateral cooperation are needed. For example, the latest innovation of coastal piggyback policy eligible for foreign container companies in the FTZs requires the principle of reciprocity to be followed, that is, countries or regions where the actual controller of the foreign container liner company is located, where the foreign container liner company actually register and operate business, and where the operating ship is registered, shall all have opened their coastal piggybacking business to Chinese enterprises. Such relationship of reciprocity shall be proven by legal documents of the above countries or other means. It will be much easier for carriers to fulfill the burden of proof if such mutual opening of piggybacking business can be communicated and cooperated between governments on a bilateral or even regional level.

There is also an internal linkage between the policy innovations of the FTZs/FTP and legal instruments of the FTAs. The former lays the foundations of the PRC’s confidence in making high-level commitments to the outside world, being an important carrier for the compliance of those commitments, while the later will have the effect of accelerating the PRC’s shipping reform and opening up, providing external impetus for the reform and innovation of the FTZs/FTP. It can be exemplified that, based on the existing practice of liberalizing foreign investment restrictions in the FTZs/FTP, the PRC is able to make investment opening commitments in the field of international shipping in the China-Eu Comprehensive Agreement on Investment: China will not only open up international maritime cargo and passenger transportation, but also allow investment in related land-based auxiliary activities, enabling EU companies to invest in maritime customs clearance services, cargo handling, container yards and stations, and maritime agency services without restrictions35.

5.4 Optimizing the deployment of the shipping industry in the logistics system

First, optimizing the deployment of domestic shipping industry in the PRC’s logistic system. This is not only the internal requirement for a balanced domestic and international shipping network under the dual-cycle development pattern of the shipping industry, but a general requirement for the optimization of the logistic system. Although the PRC’s domestic waterway transportation is showing an overall steady growth trend, its proportion is relatively small, accounting for less than 20% of the total domestic freight36.Waterway transportation as a low-cost transportation method has not received enough attention. For example, Yangtze River, the most important inland waterway of the PRC, has long suffered from the spree of port infrastructure construction, and a serious excess of terminals (Ye et al., 2020). The Guiding Opinions of the Ministry of Transport on the Establishment of a New Development Pattern of Services issued in January 2021 put forward the requirements for optimizing the PRC’s transportation structure, in which the importance of domestic waterway transportation is highly evaluated with the policy of “maximizing the deployment of waterway”, return the road transportation of bulk cargo and medium and long-distance cargo to waterway transportation. Domestic waterway transportation can perform as an important link between the international shipping and domestic transportation.

Second, promoting the development of multimodal transportation. The development of multimodal transport is deemed necessary to connect the domestic market and the international market and the PRC also regards multimodal transport as the core task of improving the global shipping network, and vigorously develops rail-water combined transport and river-sea combined transport.37 However, one of the current obstacles to the development of multimodal transport is the inconsistency of transport documents, that is, each transport leg issues and approves its own transport documents, which greatly affects the efficiency of handover of goods under multimodal transport, and leads to fragmentation of transport information. Although some FTZs in the PRC are pursuing the reform of the “single document system”, that is, only one transport document is issued to cover the entire transportation under multimodal transport. However, one of the legal challenges faced by the current practice of “single document system” is that there is currently a gap in the legislation on multimodal transport documents, at both the international and domestic levels.

At the level of domestic law, because the provisions of the Chinese Maritime Code on bills of lading are stipulated in the chapter “Contract for Carriage of Goods by Sea”, the provisions on bills of lading in the Chinese Maritime Code only apply to bills of lading issued under the contract of carriage of goods by sea. However, the provisions of the Civil Code on multimodal transport contracts do not provide for multimodal transport documents or bills of lading. At the level of international law, conventions applicable to multimodal transportation such as United Nations Convention on International Multimodal Transportation of Goods adopted in 1980, and United Nations Convention on Contracts for the International Carriage of Goods Wholly or Partly by Sea adopted in 2008, has not came into effect yet, and the PRC is not a party to either of the convention as well. Therefore, at the legislative level, there is a certain gap in the legislation of multimodal transport documents. The gap at the legislative level will have an important impact on the practice of multimodal transport documents: that is, in the absence of legislation to confirm the legal functions of multimodal transport documents, whether holding a multimodal transport bill of lading has the legal right to pick up the goods, and then whether it has a function similar to “document of title” will be questioned. This makes it difficult for the multimodal bill of lading to become a negotiable document like the ocean bill of lading. The current practice of the “single document system” mainly realizes the delivery function of the documents through the agreement between the parties, that is, the parties agree to use the specific documents under the “single document system” as the proof of delivery of the goods. As a contractual obligation, this kind of agreement should be performed by the parties, but due to the lack of legislative confirmation, there is a legal risk in the implementation of this kind of agreement: if the legislation or practice of other countries adopts other documents or methods in practice, then the contractual agreement will conflict with legislation or practice. At such time, the enforceability of the agreement will cause disputes, which will affect its effectiveness as a delivery certificate of goods. For this reason, it is necessary to accelerate the establishment of a legal system conducive to the development of multimodal transport at the international and domestic legislative levels.

5.4 Integrating into the digital age

One of the important growth points of the shipping industry and the entire logistics industry in the future lies in being more closely related to supply chain management and new retail, through the integration of shipping logistics, information flow, capital flow, and business flow, realizing the application scenario innovation and chain reconstruction of the shipping industry. In March 2021, the Ministry of Commerce and other six departments jointly expanded the cross-border e-commerce retail import pilots to all cities (and regions) where all FTZs are located38, which brought new business growth point and model to the shipping industry. These new formats, of cause, also come up with higher requirement on the rate of digitalization, requiring shipping and port companies to accelerate digital transformation and accelerate the integration of shipping business with platform economy and digital economy. Shipping and maritime logistics would also largely benefit from the positive effects of digitization with respect to efficiency, safety and energy saving (Abdirad and Krishnan, 2021). Presented by the recent wide spectrum application of blockchain technology in the maritime industry (Zhou et al., 2020), the development of “smart shipping” through new technologies shall be pursued further in the construction of the PRC’s FTZs/FTP, using big data and the increase in data processing to prevent the waste of carrying capacity, realize port automation and improve the capabilities of shipping resource allocation (Alop, 2019).

6 Conclusion

The dual-cycle development pattern is a new strategy that meets for current problems and challenges of the PRC’s shipping industry, but its path is not brand new: the construction of the FTZs/FTP and the signing of high-level FTAs shall continue to be the key components of the PRC’s strategy in providing endogenous and external driving forces in promoting the shipping industry. It is therefore necessary to continue the path to promote deeper international cooperation for the PRC’s shipping industry by a deeper and wider network of FTAs, deepen the PRC’s shipping reform and opening up through the FTZs/FTP policy innovations for purpose of accelerating the development of domestic shipping, and give full play to the leading role of international shipping in domestic shipping. Meanwhile, development of modern shipping service industry and innovation of new technologies and new formats, are all necessary to lay the foundation of the dual-cycle development pattern of the shipping industry. In this process, it is perceived vital to keep a close interaction between the policy innovations and legal instruments. Legal instruments shall aim to provide better legal framework and clear guidance for policy innovations, confirming the effective policy by legislation timely, and as the practice has evidenced, certain legislations can be suspended in FTZs/FTP for trial of policy innovations, which means policy innovations shall also lead the reform of legislations.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material. Further inquiries can be directed to the corresponding author.

Author contributions

XC: original idea and writing up. XZ: partial writing, translation, proofreading. Y-CC: proofreading and supervision. All authors contributed to the article and approved the submitted version.

Funding

The fieldwork is supported by the following project: The National Social Science Project, China (Grant No.17BFX090). The Fundamental Research Funds for the Central Universities (3132022638).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

- ^ Article 29 of Regulation on International Ocean Shipping of PRC (2013 version)

- ^ Announcement of the Ministry of Transport on Policies for the Pilot Programs of Maritime Transportation in National Free Trade Zones.

- ^ Decision of the State Council to Temporarily Adjust the Provisions of Relevant Administrative Regulations, Documents of the State Council, and Departmental Rules Approved by the State Council in Pilot Free Trade Zones.

- ^ Reply of the State Council on Approving the Suspension of certain Regulations in the Lingang New Area of China (Shanghai) Pilot Free Trade Zone.

- ^ UNECE and UN/CEFACT Recommendation NO.33, Recommendation and Guidelines on establishing a Single Window, 2004.

- ^ Shanghai FTZ Implements the Highest Standard Single Window Construction. Available online at: https://www.sohu.com/a/133949699_468610 (accessed 2 October 2021) (in Chinese).

- ^ International trade "single window" builds a public information platform for the majority of import and export enterprise. Available online at: http://www.gov.cn/xinwen/2021-07/29/content_5628204.htm (accessed 16 November 2022) (in Chinese).

- ^ Article 2 of the Ship Registration Regulations of PRC.

- ^ Article 7 of Hainan Free Trade Port International Ship Regulations.

- ^ Ibid art 10.

- ^ Ibid art 21.

- ^ Ibid art 22.

- ^ Ibid art 18, 19.

- ^ The Intensification of China's Protective Tariff Fuel Bunkering Ports Increased with New Policy’s Pushing. Available online at: http://www.chinaports.com/portlspnews/7371 (accessed 11 October 2021) (in Chinese).

- ^ Notice by the Ministry of Finance, the General Administration of Customs and the State Taxation Administration of Implementing Relevant Value-Added Tax Policies in the Guangdong-Hong Kong-Macao Greater Bay Area.

- ^ General Plan for the Construction of Hainan Free Trade Port.

- ^ Notice by the Ministry of Finance, the General Administration of Customs and the State Taxation Administration of Implementing Relevant Value-Added Tax Policies in the Guangdong-Hong Kong-Macao Greater Bay Area.

- ^ Currently, there are 21 FTZs in total in China, namely the FTZ of Shanghai, Guangdong, Tianjin, Fujian, Liaoning, Zhejiang, Henan, Hubei, Chongqing, Sichuan, Shanxi, Hainan, Shandong, Jiangsu, Guangxi, Hebei, Yunnan, Heilongjiang, Hunan, Anhui and Beijing.

- ^ Positive progress has been made in the shipping industry of Hainan Free Trade Port. Available online at: https://www.ndrc.gov.cn/fzggw/jgsj/dqs/sjdt/202207/t20220729_1332348.html?code=&state=123 (accessed 11 October 2021) (in Chinese).

- ^ Such as Chapter 15 of China-Singapore FTA, Chapter 12 of China-Australia FTA, Chapter 12 of RCEP.

- ^ Article 4 of the Chapter 5 of the China-Singapore FTA.

- ^ Article 4.3 of the Chapter 4 of China-Australia FTA.

- ^ Article 5, Para 1 of the Chapter 4 of the RCEP.

- ^ Ibid art 12, Para 3.

- ^ Article 5 of the Chapter 5 of the China-Singapore FTA.

- ^ Ibid art 4, Para 4.

- ^ Ibid art 14,

- ^ Ibid art 15, Para 2.

- ^ Ibid art 15 of Chapter 3 ‘Rules of Origin’.

- ^ China Has 7 of World’s Top 10 Ports by Cargo, Container Throughput. Available online at: https://www.hellenicshippingnews.com/china-has-7-of-worlds-top-10-ports-by-cargo-container-throughput/ (accessed 15 October 2021).

- ^ China Regains Title of World’s No.1 Shipbuilding Nation, As It Surpasses South Korea. Available online at: https://www.marineinsight.com/shipping-news/china-regains-title-of-worlds-no-1-shipbuilding-nation-as-it-surpasses-south-korea/ (accessed 11 October 2021).

- ^ China ranks the 3rd place in terms of Ownership of world fleet, ranked by carrying capacity in dead-weight tons, 2020. See UNCTAD, Review of Marine Transportation 2020, p.41.

- ^ China Blacklist Strands More Than 50 Australia Coal Cargoes. Available online at: https://www.bloomberg.com/news/articles/2020-11-24/there-s-500-million-of-coal-on-anchored-ships-off-china-s-coast (accessed 11 October 2021).

- ^ Free trade zone promotion strategy: speed up again from a new starting point. Available online at: http://fta.mofcom.gov.cn/article/fzdongtai/202104/44844_1.html (accessed 21 September 2021) (in Chinese).

- ^ See the transport service part of China’s schedule of commitments and reservations of the China-Eu Comprehensive Agreement on Investment. Available online at: https://trade.ec.europa.eu/doclib/docs/2021/march/tradoc_159483.pdf (accessed 5 October 2021).

- ^ China’s Industrial Development Status Quo and Future of Waterway Transportation 2019. Available online at: https://www.chyxx.com/industry/202005/863556.html (accessed 11 November 2021) (in Chinese).

- ^ “Several Opinions of the State Council on Promoting the Healthy Development of the Maritime Industry”. Available online at: http://www.gov.cn/zhengce/content/2014-09/03/content_9062.htm (accessed 11 November 2022) (in Chinese).

- ^ Notice on Expanding Cross-border E-commerce Retail Import Pilots and Strictly Implementing Regulatory Requirements.

References

Abdirad M., Krishnan K. (2021). Industry 4.0 in logistics and supply chain management: A systematic literature review. Eng. Manage. J. 33 (3), 187–201. doi: 10.1080/10429247.2020.1783935

Alop A. (2019). The main challenges and barriers to the successful smart shipping. Int. J. Mar. Navigation Saf. Sea Transportation 13, 521–528. doi: 10.12716/1001.13.03.05

Anwar S. T. (2019). Global strategy gone astray: Maersk’s big box boats and the world shipping industry. Thunderbird Int. Business Rev. 62 (2), 183–196. doi: 10.1002/tie.22115

Basu P. K., Hicks J., Sappey R. B. (2005). Chinese Attitudes to trade agreements in the context of the proposed Australia-China free trade agreement. Economic Papers 24 (4), 294–308. doi: 10.1111/j.1759-3441.2005.tb01004.x

Cao X., Chang Y. (2022). The opening of cabotage: China’s trials and challenges. Mar. Policy 143, 105174. doi: 10.1016/j.marpol.2022.105174

Casaca A., Lyridis D. (2021). The reasons and the policy instruments behind cabotage policies. Maritime Policy Manage. 48 (3), 391–418. doi: 10.1080/03088839.2020.1791992

Chang Y-C., Liu X. (2021). Taking transportation as the pioneer in promoting the dual-cycle. Transportation Construction Manage. 1, 56–59.

Chen J., Li K. X., Liu X., Li H. (2017). The development of ship registration policy in China: Response to flags of convenience. Mar. Policy 83, 22–28. doi: 10.1016/j.marpol.2017.05.020

Dong Z., Li C. (2020). New development pattern of domestic and international dual-cycle: Historical source, logical interpretation and policy guidance. J. Party School CPC Cent. Committee 5, 47.

Gani A. (2017). The logistics performance effect in international trade. Asian J. Shipping Logistics 33, (4) 279–288. doi: 10.1016/j.ajsl.2017.12.012

Gao H., Shaffer G. (2021) The RCEP: Great power competition and cooperation over trade. Available at: https://ssrn.com/abstract=3777604 (Accessed 11 October 2021).

Guo Q. (2020). The realistic logic and realization path of the new development pattern of dual-cycle. Seeker 11, 100–107.

Huang L., Lasserre F., Pic P., Chiu Y-Y. (2020). Opening up the Chinese shipping market 1988–2018: The perspective of Chinese shipping companies facing foreign competition. Asian Transport Stud. 6, 1–11. doi: 10.1016/j.eastsj.2020.100004

Jiang X., Meng L. (2021). Higher level dual cycle: International experience and Chinese practice. Manage. World 1, 1–17.

Jing L., Feng M. (2021). The evolutionary game research on the development of new financial services infrastructure under the “Double cycle” development pattern 2021 3rd international. Conf. Mach. Learning Big Data Business Intell. (MLBDBI), 548–552. doi: 10.1109/MLBDBI54094.2021.00109

Li X. (2021). Dual cycles needs higher level of opening-up. J. Nankai Univ. (Philosophy Soc. Sci. edition) 1, 13–17.

Lin G., Guo L., Zhang J. (2021). The effects of dual-cycle on china’s trade development and the countermeasures. Intertrade 4, 22–31.

Lin Y., Wang X. (2021). Dual circulation: A new structural economics view of development. J. Chin. Economic Business Stud. 16, 1–20. doi: 10.1080/14765284.2021.1929793

Liu W., Zhang Y., Hu Z. (2020). The experience of international shipping centre and its enlightenment on shenzhen. Ocean Dev. Manage. 3, 20–21.

Li T., Wang X. (2021). Digital economy empowers china's dual-cycle strategy: Internal logic and practice path. Economist 5, 102–109.

Lv S., Zhao S., Liu H. (2022). Research on the coupling between the double cycle mode and technological innovation systems: Empirical evidence from data envelopment analysis and coupled coordination. Systems. 10 (3), 62. doi: 10.3390/systems10030062

Ministry of Commerce (2017) The interpretation of the director of the international department of the ministry of commerce regarding the upgrade protocol of the China-Chile FTA. Available at: http://www.gov.cn/zhengce/2017-11/12/content_5239022.htm (Accessed 11 October 2021).

Ministry of Commerce (2018) The interpretation of the director of the international department of the ministry of commerce regarding the upgrade protocol of the China-Singapore FTA. Available at: http://fta.mofcom.gov.cn/article/zhengwugk/201811/39339_1.html (Accessed 30 October 2021).

Palmioli G., Heal A. (2014). Structural economic reform in China: The role of the shanghai free trade zone. Trade Insight 3, 1.

Petri P. A., Plummer M. G. (2020) East Asia Decouples from the united states: Trade war, COVID-19, and East asia’s new trade blocs. working paper of Peterson institute for international economics. Available at: https://www.piie.com/system/files/documents/wp20-9.pdf.

Sampson M. (2021). The evolution of china’s regional trade agreements: Power dynamics and the future of the Asia-pacific. Pacific Rev. 34 (2), 259–289. doi: 10.1080/09512748.2019.1660397

Shen C., Liu H. (2021) Facilitating high-quality development with tariff adjustments: Analysis of china's new tariff regulations in 2022. Available at: http://www.xinhuanet.com/2021-12/16/c_1128167388.htm.

Siriwardana M., Yang J. (2008). GTAP model analysis of the economic effects of an Australia-China FTA: Welfare and sectoral aspects. Global Economic Rev. 37 (3), 341–362. doi: 10.1080/12265080802273315

The World Bank (2020) Global doing business report 2020: Comparing business regulation in 190 economies. Available at: https://documents1.worldbank.org/curated/en/688761571934946384/pdf/Doing-Business-2020-Comparing-Business-Regulation-in-190-Economies.pdf (Accessed 11 November 2021).

Tijan E., Jović M., Jardas M., Gulić M. (2019). The single window concept in international trade, transport and seaports. Sci. J. Maritime Res. 33, 130–139. doi: 10.31217/p.33.2.2

Wang Y., Liao H. (2022). Changing ourselves and influencing the world 2.0: China and the world under the background of dual-cycle strategy. J. Xinjiang Normal Univ. (Philosophy Soc. Sci. Edition) 5, 84–94.

Wang B., Mao J. (2021). Integration of the new development pattern of dual-cycle and the rural revitalization strategy. NingXia Soc. Sci. 2, 82–89.

Wang C., Sharma V. (2021). India's RCEP dilemma with China: Beyond the legal texts. Pacific Focus 36 (1), 40–62. doi: 10.1111/pafo.12180

Wang X., Meng L. (2021). Higher Level Dual Cycle: International Experience and Chinese Practice, Management World. 1, 1–17. doi: 10.1111/pafo.12180

Wang F., Wang R., He Z. (2022). Exploring the impact of “Double cycle” and industrial upgrading on sustainable high-quality economic development: Application of spatial and mediation models. Sustainability 14, 2432. doi: 10.3390/su14042432

Wei J., Zhou J., Tang X. (2021). Analysis of the influencing factors of the trade creation effect of china's free trade agreement. Int. Business Res. 22, 89–100.

Xie X. (2020). Accelerating the construction of the modern shipping and logistics system to facilitate domestic and international. Dual-cycle Mar. China 10(2):2.

Xu Z. (2020)How to transform and develop the water transport industry under the new development pattern of dual-cycle. China water transportation 2020-9-20. Available at: http://www.chinaports.com/portlspnews/6000 (Accessed October 10, 2022).

Yao D., Whalley J. (2015) The China (Shanghai) pilot free trade zone: Background, developments and preliminary assessment of initial impacts, NBER working papers. Available at: https://www.nber.org/system/files/working_papers/w20924/w20924.pdf (Accessed 12 November 2021).

Ye S., Qi X., Xu Y. (2020). Analyzing the relative effciency of china’s Yangtze river port system. Maritime Economics Logistics 22, 640–660. doi: 10.1057/s41278-020-00148-5

Yin J., Fan L., Li K. X. (2018). Second ship registry in flag choice mechanism: The implications for China in promoting a maritime cluster policy. Transportation Res. Part A 107, 152–165. doi: 10.1016/j.tra.2017.11.006

Zhang N. (2020). A new round of FTZ expansion strengthening its function as the hub of the dual-cycle. China Dev. Observation 18, 43–48.

Zhang L. (2021). Practice path of high-quality development pattern of shanghai international shipping centre from the perspective of dual-cycle. Pract. Foreign Economic Relations Trade 11, 86–90.

Zhou X. (2021) Efficient routes for building the dual-cycle development pattern, southern daily. Available at: http://www.xinhuanet.com/politics/2021-06/22/c_1127586380.htm (Accessed 12 November 2021).

Keywords: domestic and international dual cycle, shipping industry, free trade zones, free trade agreement, free trade port

Citation: Cao X, Zhang X and Chang Y-C (2023) The path to the construction of a domestic and international dual cycle of China’s shipping industry. Front. Mar. Sci. 9:1077657. doi: 10.3389/fmars.2022.1077657

Received: 23 October 2022; Accepted: 12 December 2022;

Published: 11 January 2023.

Edited by:

Tsz Leung Yip, Hong Kong Polytechnic University, ChinaReviewed by:

Bingying Dong, University of International Business and Economics, ChinaQingji Zhou, Tianjin University, China

Copyright © 2023 Cao, Zhang and Chang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xu Zhang, WHUuWmhhbmdAYWx1bW5pLnVuaW1lbGIuZWR1LmF1

Xingguo Cao

Xingguo Cao Xu Zhang

Xu Zhang Yen-Chiang Chang

Yen-Chiang Chang