- School of International Law, East China University of Political Science and Law, Shanghai, China

The Five-Year Plans are China’s most important macroeconomic and social management tool, setting goals and directions for the national economic and social development vision. To date, China has implemented 13 periods of Five-Year Plans. On March 12, 2021, the Chinese government adopted its 14th Five-Year Plan, which requires breakthrough the key core technologies of marine engineering and cultivating and expanding the marine engineering equipment industry. This research conducts a policy analysis to comprehensively examine the development plans for the marine engineering equipment industry in these 14th Five-Year Plans issued by China’s central level and local level governments. By summarizing and analyzing these policies pertaining to the marine engineering equipment industry, it aims to show a holistic picture for the new policy developments in China’s new five-year period. This paper also highlights the challenges and pressures that might be faced by the Chinese authorities in the policy implementation stage.

Introduction

The marine engineering equipment (MEE) industry is an important part of the global maritime supply chain and an important catalyst for engineering the growth of the marine economy (Kildow and Mcllgorm, 2010). As the development of the MEE industry determines a country’s capability to utilize marine resources, various countries are actively developing their MEE industry and enhancing its international competitiveness. Since 2010, China has listed the MEE industry as one of its strategic emerging industries and enacted intensive laws and policies to boost its rapid development. China’s policy system has played an important role in the development of the MEE industry, providing important “institutional incentives” for the multiple stakeholders embedded in the MEE industrial chain, including MEE enterprises, upstream and downstream enterprises, and central and local government officials, to jointly promote the prosperity and development of the industry.

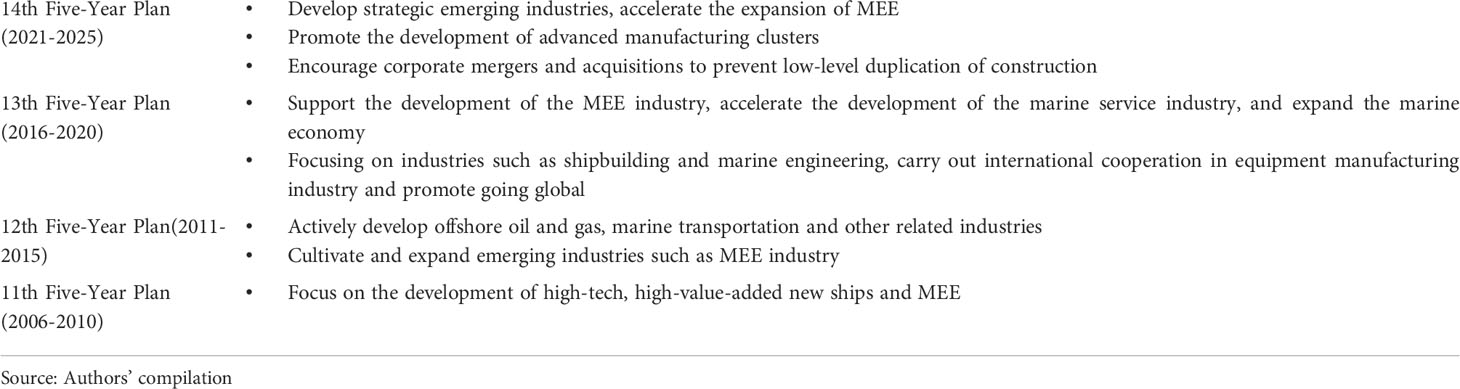

Among China’s policy frameworks, one of the most influential is the five-year plans for national economic and social development. These Five-Year Plans are issued by the central and local governments at all levels in a top-down manner and have become the most important institutional architecture for China’s MEE industry, determining the development orientations of the whole MEE industry. The Five-Year Plans are China’s most important macroeconomic and social management tool. Each plan constitutes a medium- and long-term plan for China’s national economic and social development and includes plans for major national construction projects, productivity distribution, important proportional relationships in the national economy, and social undertakings. Although China has undergone a tremendous transformation from a planned economy to a socialist market economic system in the more than 70 years of development since the founding of the People’s Republic of China, it has always adhered to the formulation and implementation of the Five-Year Plans. It had implemented 13 periods of Five-Year Plans and has now entered the 14th Five-Year Plan stage (Figure 1). Since the 12th Five-Year Plan, China has emphasized the need to promote the development of the MEE industry (Du et al., 2013; Guo et al., 2022).

Figure 1 China’s Five-Year Plans. Source: Authors’ compilation based on data from the website of the history of the People’s Republic of China.

Since the 12th Five-Year Plan period, the MEE industry has become the strategic pillar industry for coastal provinces. The marine economy is one of the five major new economic industries targeted in the 14th Five-Year Plan (Yuan and Zhao, 2020). In the 14th Five-Year Plan for National Economic and Social Development and the Long-Range Objectives through the Year 2035 endorsed by the National People’s Congress, China’s top-level policy maker, a special chapter is incorporated to put forward requirements for the development of the marine economy. It has put forward a series of new directions and requirements for the development of the MEE industry, such as breaking through the key technologies bottleneck for the industry, cultivating and expanding the industry, and guiding it towards high-end directions, which could have a profound impact for the future development of the MEE industry in China (NPC, 2021). Under the guidance of the central government’s 14th Five-Year Plan, the relevant ministries have issued their own specific plans for the implementation of the 14th Five-Year Plan and the local governments in China’s coastal regions that have the ability to develop the MEE industry have also formulated their own road map to achieve what has been laid out in 14th Five-Year Plan respectively.

In China’s 14th Five-Year Plans, there are important planning and arrangements for the MEE industry. Thus, through a policy analysis approach, this study uses the lens of the MEE industry to:

● Summarize and analyze the regulations on the MEE industry in the 14th Five-Year Plan of the Central Government of China.

● Summarize and analyze the situation in all regions that formulated detailed planning and implementation strategies for the MEE industry based on their own conditions during the 14th Five-Year Plan period.

● Explore the challenges that might be faced by the Chinese central and local governments in the planning of the MEE industry during the 14th Five-Year period.

By examining the MEE industry related policies in China’s newly released 14th Five-Year Plans at both the central and local levels, this study unravels the development priorities and orientations in China’s new five-year period, showing how these policy development could provide institutional incentive for the development of the MEE industry in China. This study also identifies the potential challenges that the industry might face in the implementation of these policies, hoping to provide a richer understanding of the institutional framework that regulates the MEE industry and the industrial policy architecture that supports the state’s marine economy.

Literature review and analytical framework

Literature review

The MEE industry is an important part for a country’s development in the marine economy and the high-end equipment. The European Commission has assessed and planned the development of its MEE industry since 2000 (Balance Technology Consulting, 2020). In 2017, a focus on deep-sea mining became one of the new trends in the Japanese economy (Carver et al., 2020).Since 2010, as part of the marine industry, the marine renewable energy industry has received policy support from governments across China (Yang et al., 2018; Li et al., 2020), and emerging marine industries now account for a much larger portion of marine industries than traditional marine industries (Ding et al., 2014). The Chinese central government and local governments have also created planning guidelines for the development of strategic marine industries (Du et al., 2013), especially in the scope of the Made in China 2025 campaign, of which the MEE industry is an important component (State Council, 2015), as are oceanic industrial strategies (Kenderdine, 2017). At present, China’s MEE industry faces transformation and upgrading (Song et al., 2017) and is becoming technology intensive (Wang and Wang, 2019). Enterprises’ operational and technical capabilities are the most critical factors in this transformation (Li et al., 2020). There exists a significant relation between government support and technology innovation (Li et al., 2021b). There is also literature that examines China’s policies regulating the MEE industry by using a symmetric analysis approach and identifies the problems in the policy formulation and development process such as imperfect regulation, limited cooperation network, lack of policy unified management (Ren and Ge, 2022).

When formulating the 14th Five-Year Plan, some scholars have published articles suggesting that institutions formulating the 14th Five-Year Plan should pay attention to the development and utilization of marine resources (Huo et al., 2020) and on the relationship between economic development and energy demand (Li et al., 2019). They also proposed increasing cooperation with other countries in marine development (Hu and Jin, 2021) and promoting emerging marine industries (Hu and Gao, 2021). Other scholars believe that China’s MEE industry faces unbalanced regional development (Li et al., 2021b) and presents low agglomeration benefits (Xie, 2017). The 14th Five-Year Plan includes proposals to fix these problems. After the promulgation and implementation of the 14th Five-Year Plan, scholars studied marine ranching and conducted a comparative study across ten coastal provinces in China; then, they made suggestions for balancing development (Xu et al., 2021). The 14th Five-Year Plan includes detailed guidelines for the development of science and technology (Poo, 2021). Some scholars found that under the 14th Five-Year Plan, China has faced technical bottlenecks in deep-sea development (Chen et al., 2021). Thus, there is an urgent need to speed up the innovation and development of MEE and technologies such as those used in deep-sea exploration and mining. The 14th Five-Year Plan has significantly improved output (Wu et al., 2019), and the implementation of the relevant policies included in the plan will also have a profound impact on equipment manufacturing companies in Taiwan, China, showing that it is necessary to seize the opportunities created by China’s policies (Chen, 2018).

The above research shows that the MEE occupies an increasingly important position in the marine economy and has become an important part of the development of that economy in various coastal countries and regions. China’s 14th Five-Year Plan has established a special chapter to make provisions for actively expanding the space for marine economic development. Regarding the development of China’s MEE industry during the 14th Five-Year Plan, although some scholars have pointed to problems in China’s development of the MEE industry, there has been no interpretation and assessment of the specific plans put forth by the Chinese central government and local governments regarding the MEE industry within the plan (Li et al., 2021a; Xu et al., 2021; Chen et al., 2021). Therefore, there is a lack of research on the specific policies and the specific implementation plans of local governments related to MEE in the 14th Five-Year Plan. The five-year plan is an important component of China’s industrial policies, and an analysis of the new five-year plan can provide a lens through which to deepen the understanding of the development of China’s industrial policies. Some scholars, such as Fan have analyzed the specific content of the five-year plan from the perspective of different industries, including an analysis of the industrial goals of China’s latest five-year plan (Fan, 2013), the dynamic relationship between environmental regulation and foreign trade exports (Shi and Xu, 2018), the new development of information and communications technology industrial policies (Hong, 2017), and China’s ultra-challenges and development trends in deep well drilling technology (Wang et al., 2017). Based on the policy guidelines included in the 14th Five-Year Plan for the MEE industry, this paper analyzes and evaluates the latest policy developments related to the marine industry in the 14th Five-Year Plan to examine its impact on China’s MEE industry.

Methods, materials and analytical framework

Five-year plans are almost the most important part in China’s policy system, playing a guiding role in the development of China’s national economy in the next five years and is an important national economic policy in China. Therefore, this research uses policy analysis methodology. To ensure the comprehensiveness and accuracy of the policies on which this research is based, all specific policies in 14th Five-Year Plans which focused on the MEE industry are collected from the official websites of the State Council of China and its ministries and commissions; at the same time, relevant policies for the MEE industry are collected when local governments have formulated their own regional 14th Five-Year Plans that contain MEE related content.

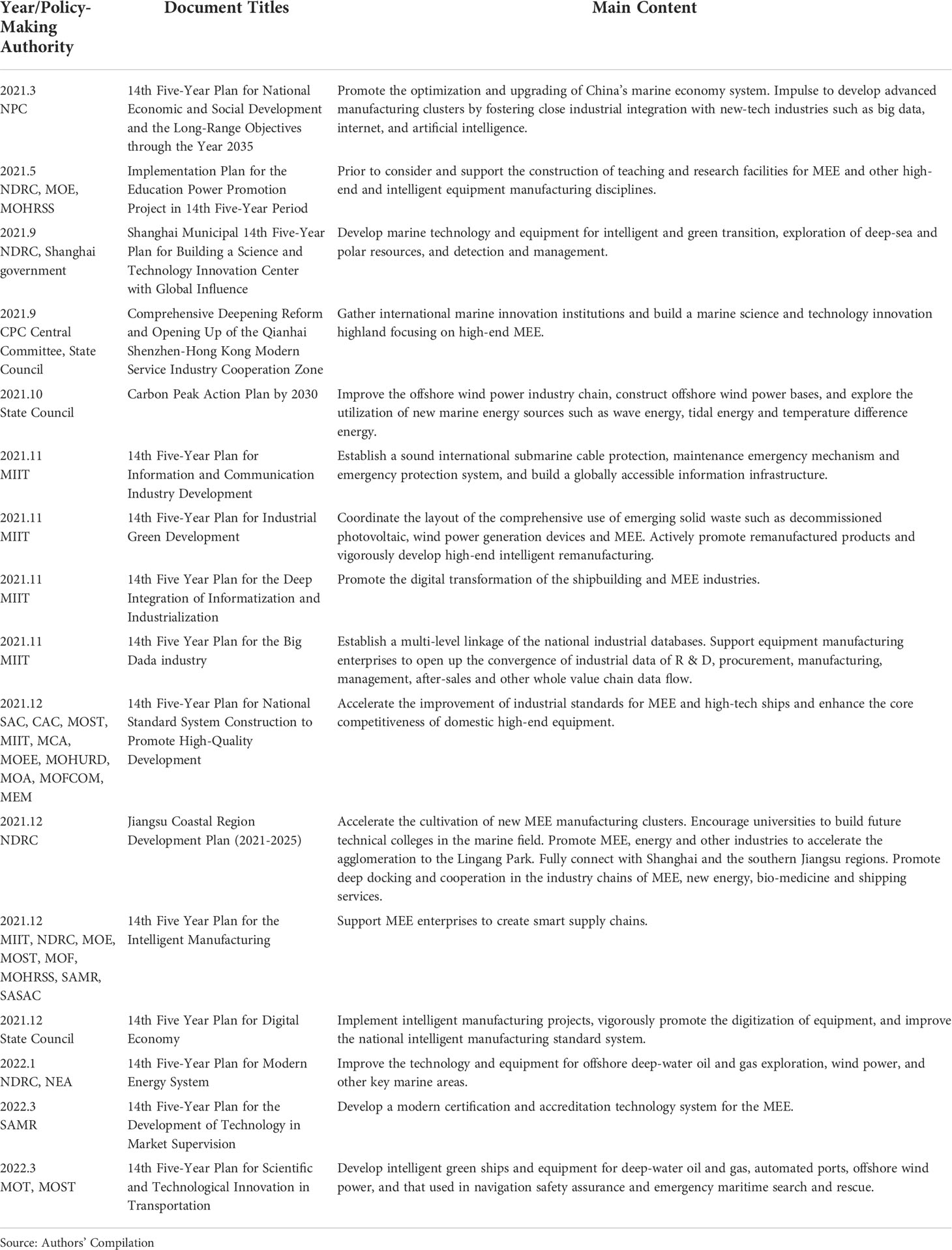

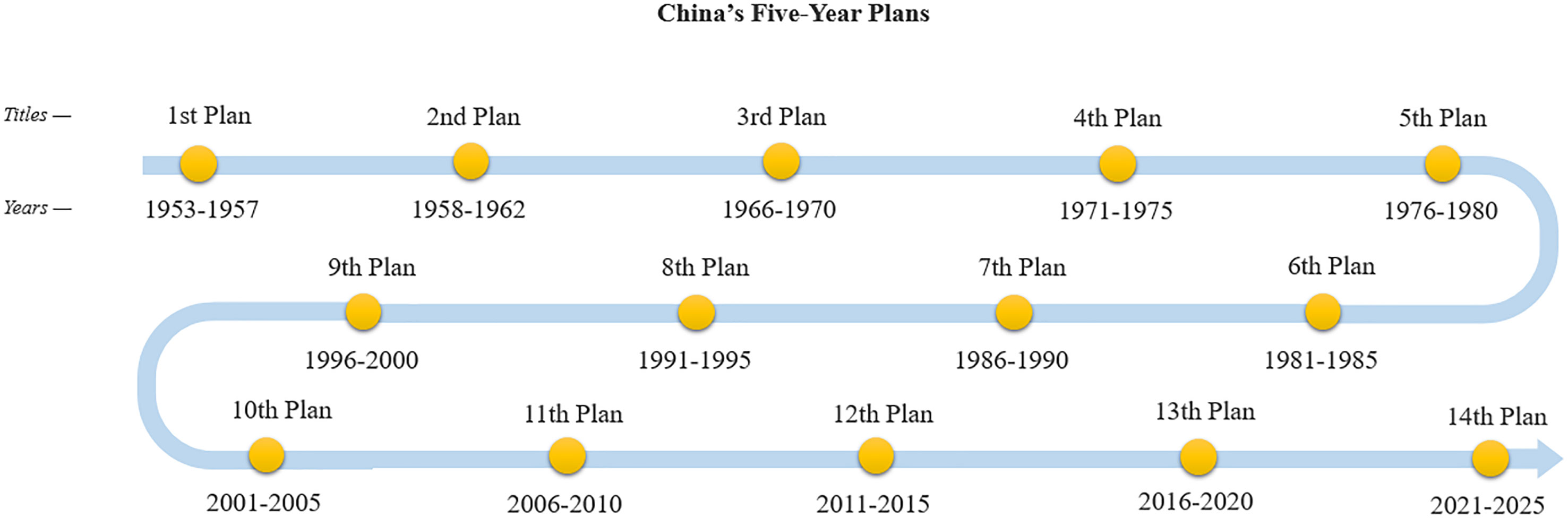

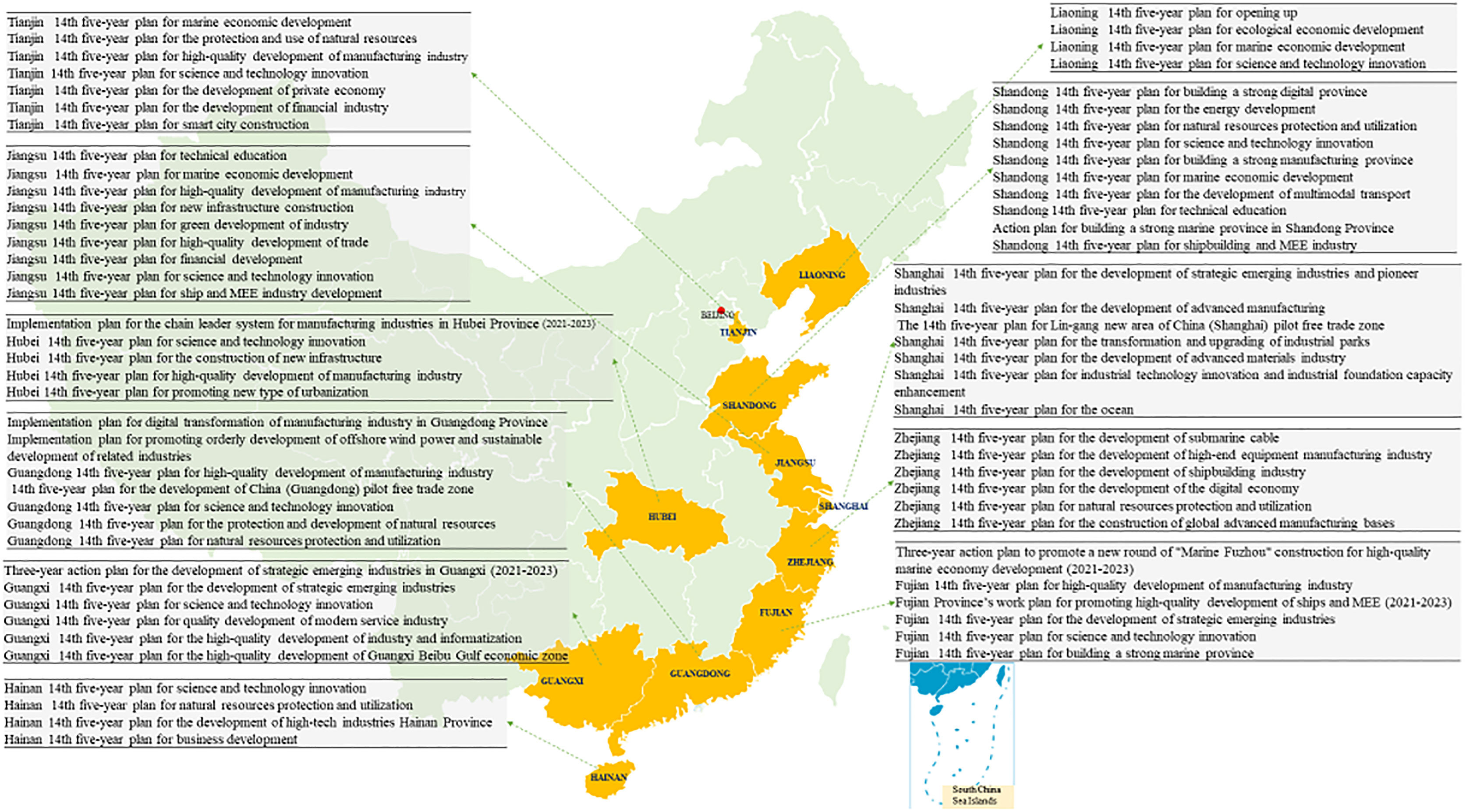

This study is divided into three levels of analysis. First, the study interprets and analyzes the policies pertaining to the MEE industry within the 14th Five-Year Plans of the Chinese central government, mainly including China’s National People’s Congress and the State Council. Second, this study interprets and analyzes the policies issued by the ministries and commissions within the State Council that are specifically tasked with implementing and developing the MEE industrial plans during the 14th five year plan period (Figure 2 and Table 2). Third, many local level governments in China have issued their own regional 14th Five-Year Plans (Figure 3). This study also interprets and analyzes the relevant policies enacted in all local provinces in China, which can formulate their own regional 14th Five-Year Plans to meet their development needs based on their own development advantages and industrial conditions.

Figure 2 The central government’s 14th Five-Year Plans for the MEE industry. Source: Authors’ compilation.

Figure 3 Regional governments’ 14th Five-Year Plans for the MEE industry. Source: Authors’ compilation.

The remaining part of this research is organized as follows. Section 3 analyzes the central government’s 14th Five-Year Plans regulating the MEE industry. Section 4 analyzes local governments’ 14th Five-Year Plans regulating the MEE industry. Section 5 discusses the potential challenges that might be faced in the implementation of these MEE industrial policies.

The central government’s 14th five-year plans for the MEE industry

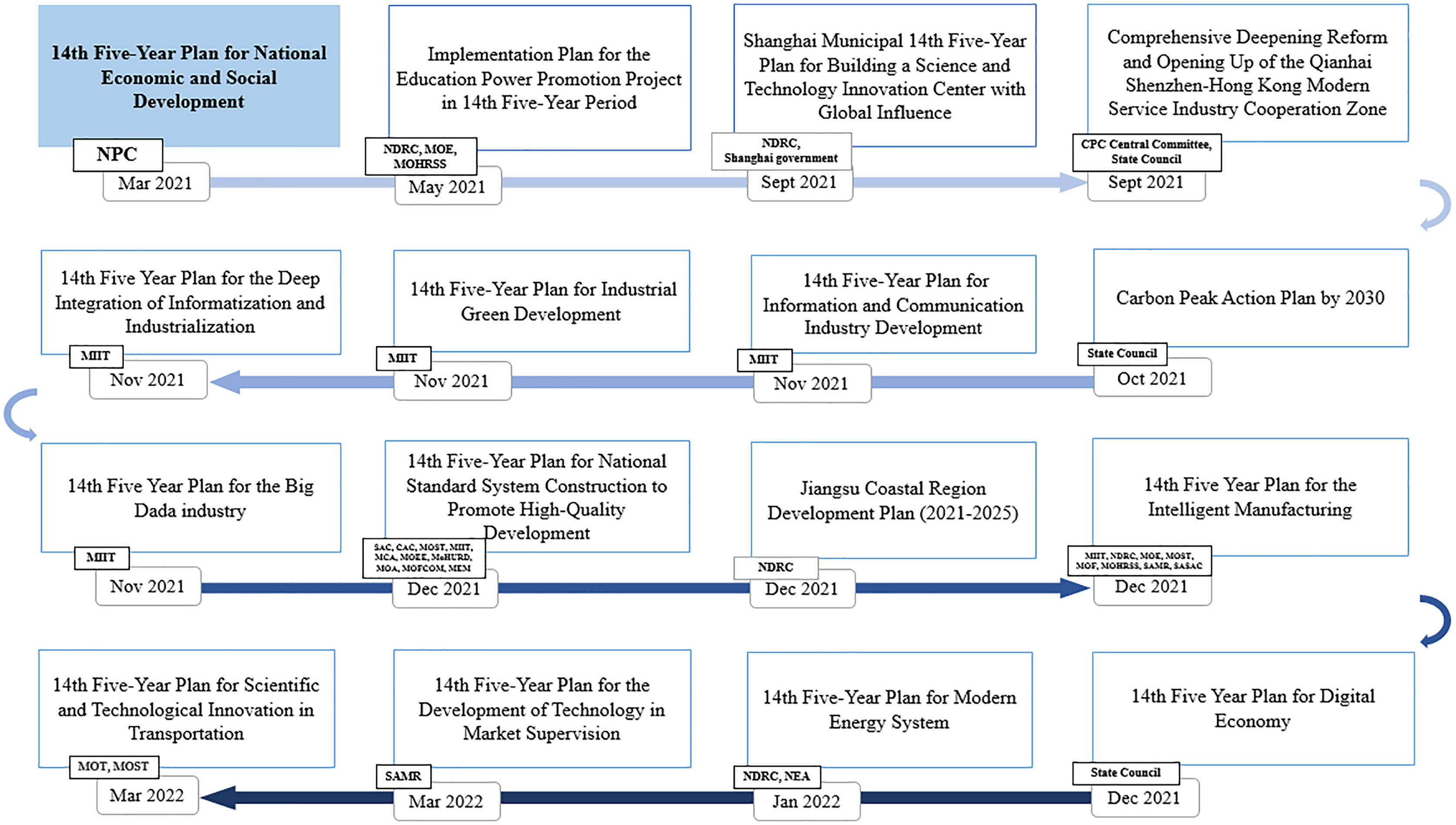

The National People’s Congress (NPC), China’s top level policy maker, has attached great importance to the development of the MEE industry in its Five-Year Plans for national economic and social development over the past decade (Table 1). China has taken manufacturing as a focal point, highlighted the development of the MEE industry, and gradually built and improved China’s MEE industry chain. The development of strategic new industries such as the MEE is an important action to accelerate the development of China’s modern industrial system under the NPC’s 14th Five-Year Plan for National Economic and Social Development and the Long-Range Objectives through the Year 2035 and promote the optimization and upgrading of China’s marine economy system. Particularly influenced by the trend in industrial intelligence and green development, the NPC’s 14th Five-Year Plan highlights promoting the transformation of traditional MEE to advanced high-end MEE and fostering its close industrial integration with new-tech industries such as big data, internet, and artificial intelligence (NPC, 2021).

Guided by the 14th Five-Year Plan enacted by the NPC, the State Council and central cabinets and commissions, including the Ministry of Industry and Information Technology (MIIT), the National Development and Reform Commission (NDRC), the Ministry of Science and Technology (MOST), the Ministry of Transport (MOT), the National Energy Administration (NEA), and the Ministry of Ecology and Environment (MOEE), have enacted a series of 14th Five Year Plans. These plans cover various aspects of the MEE industry, ranging from scientific and technological innovation and development, equipment manufacturing, MEE-related marine environmental protection, renewable resource MEE to regional special MEE projects, as shown in Table 2. These 14th Five-Year Plans involving the MEE industry mainly include the following aspects:

First, the central cabinets have formulated several 14th Five Year Plans to promote the development of the MEE industry toward digitization, artificial intelligence, and automation orientations. For example, the 14th Five Year Plan for the Deep Integration of Informatization and Industrialization issued by the MIIT proposes to promote the digital transformation of the shipbuilding and MEE industries, build digital workshops and smart factories, promote the large-scale application of model-based systems engineering, and rely on the industrial internet platform to achieve predictive equipment maintenance (MIIT, 2021a). The 14th Five-Year Plan for Scientific and Technological Innovation in Transportation issued by the MOT and MOST emphasizes the research and development of equipment used in deep-sea engineering operations and automated port operations (MOT and MOST, 2022). The 14th Five-Year Plan for the Development of Intelligent Manufacturing, which was jointly issued by the MIIT, NDRC, MOST and five other central cabinets, proposes to support leading MEE enterprises to create smart supply chains with data interconnection, credible information interaction, deep production coordination, and flexible resource allocation (MIIT et al., 2021).

Second, central ministerial plans also focus on promoting the development and manufacturing of MEE for the exploitation and utilization of renewable and nonrenewable offshore energy. In the 14th Five-Year Plan for Scientific and Technological Innovation in Transportation issued by the MOT and MOST, China not only proposes to build a number of innovative pilot projects in the field of efficient exploration and exploitation of deep-water oil and gas but also emphasizes promoting the development of MEE in offshore wind power development, seawater energy storage, and large-scale development and utilization of ocean energy (MOT and MOST, 2022). In the 14th Five-Year Plan for Modern Energy System issued by the NDRC and NEA, China more concretely proposes planning for the utilization of renewable and nonrenewable offshore energy related to MEE, including (1) improving the technology and equipment for offshore deep water oil and gas exploration and exploitation and strengthening the geological survey and exploration of oil and gas in key marine areas; (2) encouraging the construction of offshore wind power bases, promoting the distribution of offshore wind power to deep-water and far-shore areas, and promoting the development of large-capacity offshore wind power transmission technology and equipment; (3) promoting technological breakthroughs for offshore floating nuclear power platforms; and (4) promoting the application of ocean energy power generation in offshore island power supply (NDRC and NEA, 2022).

Third, central ministerial plans are committed to promoting the development of MEE used in navigation safety assurance and emergency maritime search and rescue. In the 14th Five-Year Plan for Scientific and Technological Innovation in Transportation, a series of MEE-related developmental plans have been proposed, including (1)promoting research and development in deep-sea navigation safety assurance equipment, maritime emergency search and rescue equipment, and rescue aircraft; (2) promoting the innovative application of the Beidou satellite system in navigation safety assurance services, as well as researching its technical application in port automation services; and (3) breaking through research and development and manufacturing of several key equipment, such as large-depth saturation diving application equipment, large-tonnage deep-water rescue and salvage equipment, three-dimensional search and observation equipment for objects in distress at sea, emergency response equipment for maritime hazardous chemicals transportation accidents, and large ro-ro passenger ship accident disposal equipment (MOT and MOST, 2022).

Fourth, the State Council and some central ministerial plans are also devoted to the pursuit of green development in the MEE industry. The State Council’s Carbon Peak Action Plan by 2030 proposes accelerating the renovation of old ships, developing electric and liquefied natural gas-powered ships, further promoting the use of shore power by ships at ports, improving the offshore wind power industry chain, encouraging the construction of offshore wind power bases, and developing equipment for the efficient utilization of new marine energy such as wave energy, tidal energy, and temperature difference energy (State Council, 2021). Moreover, as mentioned above, several 14th Five-Year Plans have proposed promoting the development of renewable offshore energy equipment such as green smart vessels and offshore wind power equipment. In particular, the 14th Five-Year Plan for Industrial Green Development issued by the MIIT highlights the reutilization of waste equipment and requires an overall arrangement for the comprehensive utilization of decommissioned wind power equipment and MEE (MIIT, 2021b). The 14th Five-Year Plan for Scientific and Technological Innovation in Transportation also advocates for breaking through technical bottlenecks in the MEE industry, such as dual-fuel engines and the design of intelligent green ships (MOT and MOST, 2022).

Fifth, aiming to enhance the international competitiveness of China’s MEE industry, certain central ministerial plans are particularly involved in improving and normalizing that industry’s standards. For example, as shown in Table 2, the 14th Five-Year Plan for National Standard System Construction to Promote High-Quality Development, jointly issued by the Standardization Administration of China (SAC), MIIT, MOST and seven other cabinets and departments, proposes accelerating the improvement of industrial standards for MEE and high-tech ships and enhancing the core competitiveness of domestic high-end equipment (SAC et al., 2021). The State Administration for Market Supervision (SAMR) plans to develop a modern certification and accreditation technology system for the MEE, ensuring its consistency with international standards and certification requirements (SAMR, 2022). The Chinese government hopes to expand the MEE talents team and their ability to overcome the technical bottleneck of MEE through targeted investment in education and scientific research.

Local governments’ 14th five-year plans for the MEE industry

The Five-Year Plans of the central government guide the formulation of more detailed and practical local implementation policies for the MEE industry. To date, among the 31 provincial administrative regions in mainland China, 11 regions, including Liaoning, Tianjin, Shandong, Jiangsu, Hubei, Shanghai, Zhejiang, Fujian, Guangdong, Guangxi, and Hainan, have enacted their own regional 14th Five-Year Plans to promote the development of the MEE industry while taking into account regional development characteristics (Figure 3).

Liaoning province

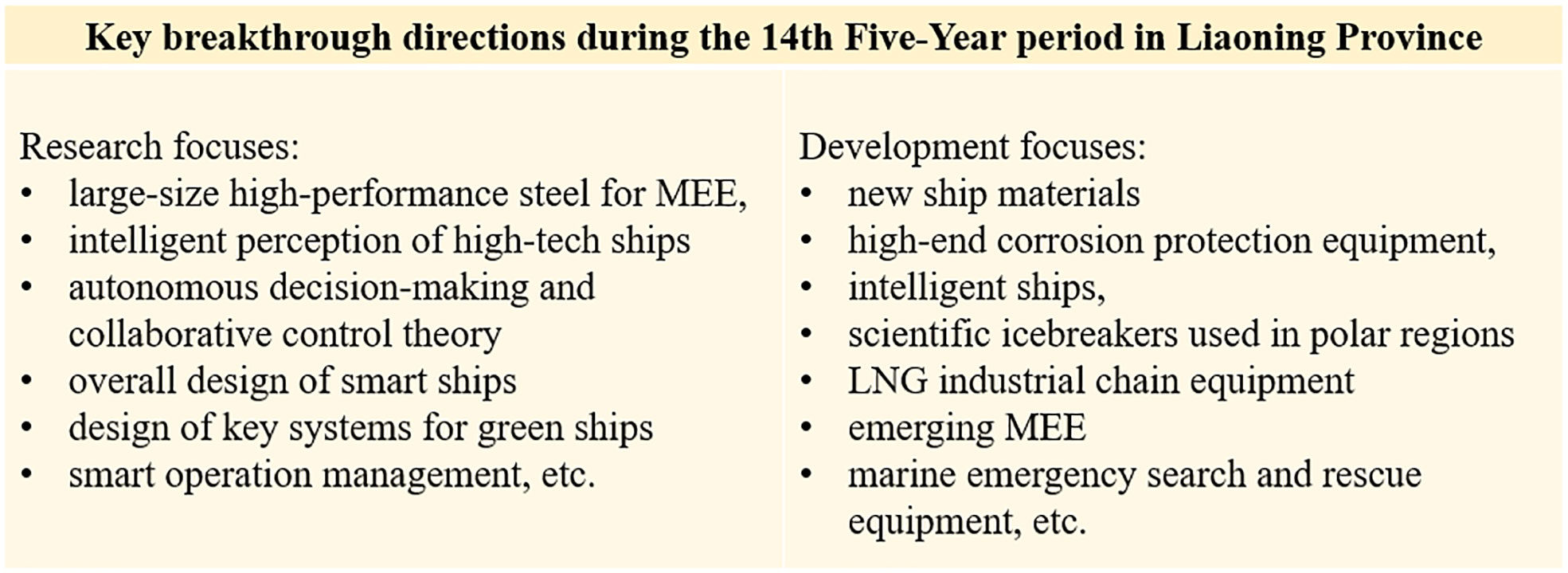

Located on China’s northeast coast and adjacent to the Bohai Sea and the Yellow Sea, Liaoning Province has evolved to be an important production base for China’s shipbuilding and MEE industries. According to the 14th Five-Year Plan for Marine Economy Development of Liaoning Province, during the 14th Five-Year Plan period, Liaoning proposes promoting the development of high-end and intelligent MEE. In terms of traditional ships such as bulk carriers, container ships and oil tankers, it proposes strengthening the design of energy-saving, environmentally sound, safe, and intelligent ship types. It also encourages the development of hydrogen energy ships, large liquefied natural gas (LNG) carriers, large ethane carriers, LNG bunkering ships and small and medium-sized gas carriers. In addition, Liaoning also proposes developing special ships such as large and medium-sized engineering ships, high-performance law enforcement ships, unmanned ships, and scientific research ships to promote the development of a high-end MEE industry oriented toward deep seas and polar areas. In terms of offshore platforms, Liaoning proposes the development of jack-up and semisubmersible drilling platforms, floating oil storage devices, and civil marine nuclear power platforms. It also proposes cultivating the production of intelligent MEE, such as underwater robots, underwater intelligent equipment, and deep-water exploration equipment (Figure 4) (Liaoning Provincial People’s Government, 2022).

Figure 4 Key breakthrough directions during the 14th Five-Year period in Liaoning Province. Source: Authors’ compilation based on MEE policies in Liaoning Province’s 14th Five-Year Plans.

Furthermore, Liaoning is expected to invest in a series of marine engineering construction projects pertaining to offshore oil and gas transportation and storage during the 14th Five-Year Plan period, including the construction of the Dalian LNG terminal and the Huludao Suizhong LNG terminal to promote the green, intensive and efficient development of the region’s petrochemical industry and the construction of a national marine fine chemical base (Liaoning Provincial People’s Government, 2022).

Additionally, Liaoning also focuses on the development of equipment for the utilization of marine renewable energy during the 14th Five-Year Plan period, including (1) accelerating the construction of Dalian offshore wind power plants and carrying out research on technological innovation in the utilization of wind power in far sea areas; (2) promoting the development and utilization of seawater hydrogen energy, accelerating the construction of hydrogen energy industry bases, and building hydrogen energy industry application demonstration areas; and (3) expanding the large-scale application of seawater desalination and supporting large-scale seawater desalination projects (Liaoning Provincial People’s Government, 2022).

During the 14th Five-Year Plan period, Liaoning plans to establish two MEE industrial clusters. One is the large-scale shipbuilding and MEE industrial cluster and other is the small and medium-sized ship and auxiliary MEE manufacturing industrial cluster, which optimizes the allocation of regional resources and promotes the coordinated development of the upstream and downstream subsectors in shipbuilding and MEE industries (Liaoning Provincial People’s Government, 2022).

Tianjin municipality

Tianjin has already established an MEE base with several leading MEE enterprises within the region. Its market shares in international shipping vessels and offshore platform leasing business account for more than 80% of the national total. During the 14th Five-Year Plan period, Tianjin plans to focus on five major subsectors to promote the development of the MEE industry and plans to create an industrial cluster with an industrial scale of more than RMB 60 billion yuan by 2025 (Tianjin Municipal People’s Government, 2021). (1) In the field of offshore oil and gas equipment, Tianjin proposes to focus on the development of offshore oil and gas exploration and exploitation equipment, such as shallow-sea drilling platforms, high-end geophysical ships, deep-water semisubmersible oil storage and offloading equipment, etc., to enhance offshore oil and gas exploration and exploitation capabilities. (2) In the field of port and channel engineering equipment, Tianjin proposes the development of a series of large-scale port and waterway machinery and equipment and relevant auxiliary equipment, such as multifunctional anchor boats, self-propelled rakes, large cranes, offshore construction vessels, offshore cranes, ship loaders, etc. (3) In the field of seawater desalination equipment, Tianjin focuses on the development of large-scale membrane/thermal seawater desalination equipment, small- and medium-sized serialized seawater desalination devices and modular seawater desalination devices and plans to accelerate the development of environmental protection equipment for desalination wastewater disposal. Tianjin also aims to cultivate leading enterprises with international influence that are engaged in seawater desalination projects and promote these enterprises’ participation in seawater comprehensive utilization projects in the Belt and Road countries. (4) In the field of marine environment detection equipment, Tianjin promotes the clustering of marine environment detection equipment subsectors, focusing on the development of low-cost wave energy gliders, unmanned boats, underwater gliders, Argo and other mobile autonomous detection platforms, and marine detection sensors. (5) In the field of offshore wind power equipment, Tianjin plans to promote the development of high-efficiency wind turbines, improve the manufacturing capabilities of key components such as high-quality bearings, gearboxes, control systems and high-voltage cables for offshore wind turbines, break through the self-installation technology of offshore wind power, and improve the development of offshore wind power toward artificial intelligence and high-end orientations (Tianjin Municipal People’s Government, 2021).

Shandong province

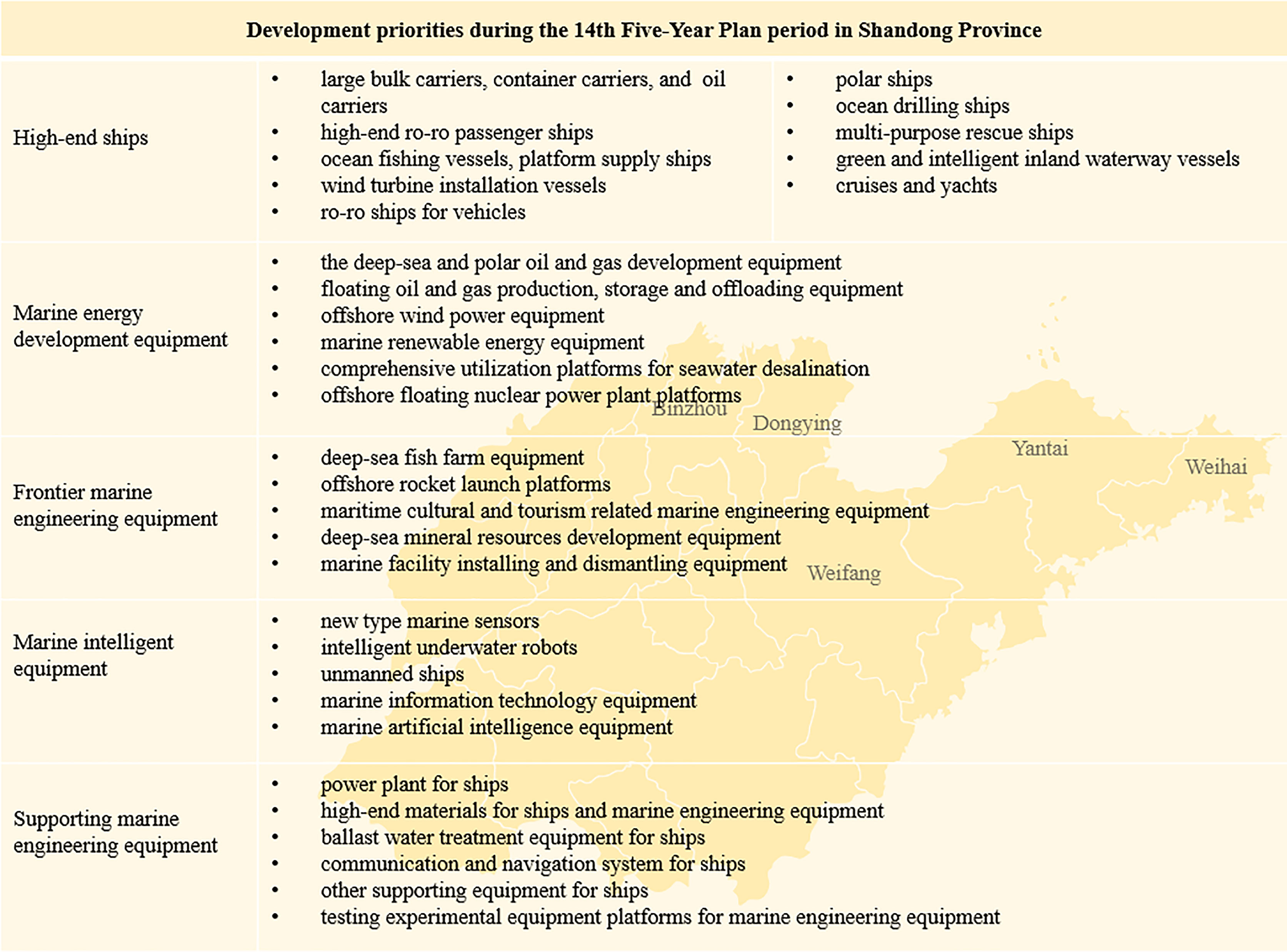

Shandong Province is one of the largest MEE provinces in China, occupying 78% of the country’s total market shares for deep-water semisubmersible drilling platforms. Shandong has also made great progress in developing a new type of MEE and has built iconic deep-sea fishery equipment, the country’s first comprehensive modern ecological marine ranch platform Genghai No. 1, and the first domestic marine space launch platform. The three major shipbuilding and MEE manufacturing bases in Qingdao, Yantai and Weihai have undergone rapid development.

According to the 14th Five-Year Plan for the Development of Shipbuilding and MEE Industry of Shandong Province, during the 14th Five-Year Plan period, the MEE industry development priorities in Shandong Province mainly include the following aspects (Figure 5). (1) High-end ships. Shandong plans to upgrade the products for which it has comparative advantages, such as large bulk carriers, high-end ro-ro passenger ships, platform supply ships and high-performance law enforcement ships, accelerate the development of large gas carriers, large container ships, semisubmersible ships, multipurpose rescue ships, unmanned ships, etc., and make breakthroughs in the development of polar ships, ocean drilling ships and multipurpose medical ships. (2) Marine energy development equipment. Shandong will promote the development of traditional offshore oil and gas development equipment, including deep-sea and polar drilling equipment, deep-water semisubmersible drilling platforms, floating liquefied natural gas (FLNG) storage and floating oil and gas production and storage devices (FPSOs). It also plans to vigorously develop offshore wind power equipment, marine renewable energy equipment, comprehensive utilization platforms for seawater desalination, offshore wind power hydrogen production equipment, deep-water natural gas hydrate development equipment, offshore carbon capture and storage equipment, clean energy floating islands and offshore floating nuclear power plant platforms. (3) Frontier MEE. Shandong proposes to actively carry out research and development in cutting-edge technologies for frontier MEE, including the development of ocean drilling vessels, offshore rocket launch platforms, deep-sea intelligent mining equipment, polar floating mineral development vessels, deep-sea aquaculture equipment, etc. (4) Marine intelligent equipment. Shandong plans to strengthen the development of new types of marine sensors, underwater unmanned ships and intelligent underwater robots and improve the overall design of intelligent systems in ships. (5) Supporting MEE. Shandong plans to promote the research and development of MEE-related new materials and fuels, including new energy resources such as methanol, ammonia fuel, hydrogen fuel, and biofuels, and the development of ultrahigh-strength steel, ultralow temperature structural steel, and high-performance steel (Shandong Provincial Department of Industry and Information Technology, 2022).

Figure 5 Development priorities during the 14th Five-Year Plan period in Shandong Province. Source: Authors’ compilation based on MEE policies in Shandong Province’s 14th Five-Year Plans.

In terms of geographical layout, five cities, Yantai, Weifang, Weihai, Dongying and Binzhou are allowed to use their respective advantages to develop marine fishery equipment, marine wind power equipment, marine new energy equipment, and MEE manufacturing and high-end MEE and become manufacturing bases, wind power equipment industrial bases, and pilot zones for the transformation and development of the marine economy (Shandong Provincial People’s Government, 2021a; Shandong Provincial People’s Government, 2021b; Shandong Provincial People’s Government, 2021c; Shandong Provincial People’s Government, 2021d).

Jiangsu province

The MEE industrial scale and speed of development in Jiangsu Province have been at the forefront of China for the past ten years. During the 14th Five-Year Plan period, Jiangsu Province plans to maintain its nationwide lead in the industry (Jiangsu Provincial Department of Natural Resources and Jiangsu Provincial Development and Reform Commission, 2021)

Jiangsu proposes to break through some key MEE technologies. For example, (1) Deep-sea equipment technology and deep-sea scientific monitoring technology, including deep-sea environmental monitoring technology, deep-sea scientific research vessel equipment technology, deep-sea manned submersible equipment technology, deep-sea unmanned submersible equipment technology, etc. (2) Deep-sea oil and gas development equipment technology, including deep-water underwater oil and gas production system equipment technology, deep-water floating oil and gas production and development equipment technology, deep-water underwater drilling equipment technology, etc. (3) Deep-sea mining equipment technology, including seabed mineral exploration, mining, transportation equipment technology, key technology of the underwater Internet of Things for deep-sea mining systems, deep-sea mining surface support mother ship equipment technology and deep-sea mining equipment test facilities. (4) Polar equipment technology (Jiangsu Provincial Department of Industry and Information Technology, 2022).

Jiangsu also plans to improve the competitiveness of the entire MEE industrial chain by mastering the design and production capabilities of mainstream semisubmersible platforms, jack-up platforms, FPSOs, offshore auxiliary ships, etc. (Jiangsu Provincial Department of Industry and Information Technology, 2022).

To achieve the aim of building a world-class MEE manufacturing base, it selects Nantong as its main production base, focus on the development of FLNG and FPSO, ultra deep water oil and gas platforms, offshore wind power development equipment, offshore natural gas (hydrate) exploitation equipment and other high-end MEE, expand offshore resource development and wind farm maintenance equipment such as marine wind power resources and fishery resources, realize a marine resource development equipment product system that reaches from offshore to deep sea, and create a marine resource integrated research and development, design and high-end manufacturing base (Jiangsu Provincial Department of Industry and Information Technology, 2022).

Hubei province

Hubei Province will continue to consolidate its status as a national-level MEE research and development base and rely on this base to accelerate the construction of innovative platforms such as the Hubei Provincial MEE Research Center. First, Hubei’s plan focuses on the development of deep-sea fisheries and their support platform equipment, offshore floating nuclear power equipment, jack-up rigs, floating production storage and offloading and other series of products, marine environment monitoring equipment and other MEE (Hubei Provincial People’s Government, 2021a). Second, aiming at the major needs for future ocean development, Hubei has accelerated the development of deep-sea mineral exploration equipment, natural gas hydrate mining, underwater oil and gas production systems, and deep-sea underwater emergency operations (Hubei Provincial People’s Government, 2021b). Third, Hubei will build a national-level high-tech ship research and development base and focus on the development of a series of multifunctional offshore platform work vessels, geophysical exploration vessels, deep-sea large-scale lifting and pipe-laying vessels, multifunctional semisubmersible engineering vessels and other marine engineering operation support vessels (Hubei Provincial People’s Government, 2021b).

Shanghai municipality

The development of the MEE industry in Shanghai during the 14th Five-Year Plan period has five key directions. (1) Intelligent and green MEE, research and manufacturing for underwater equipment for robots capable of deep-sea operations (underwater exploration, mineral development), thin-film LNG containment systems, installation and dismantling operations for large-scale offshore marine projects, installation and maintenance of high-power offshore fans, and deep-sea drilling. (2) The exploitation and utilization of deep-sea resources and the development of core key products such as environmentally friendly submarine mining. (3) The exploration, observation and integral management of the marine environment, overcoming the key technologies of the marine comprehensive test site, the all-weather jack-up platform, and the deep-sea resident floating research facility platform. (4) The exploration of marine biological resources, carrying out of research on key technologies of deep-sea aquaculture equipment and supporting facilities. (5) Polar science and technology, carrying out research and development in technologies and equipment used for polar environment and space observation, polar geophysical comprehensive detection, polar waterway, and biological and space resource utilization, which will improve the independent research and development capabilities and environmental protection capabilities of polar observation and detection equipment in China (NDRC and Shanghai Municipal People’s Government, 2021).

In the Lin-gang Special Area, a group of high-end marine equipment technology-innovative enterprises and projects will be gathered and cultivated (Shanghai Municipal People’s Government, 2021a), and an industrial chain including full links of technology research and development, comprehensive testing, and business incubation capabilities will be built with the main focus on “marine + intelligent manufacturing” (Shanghai Municipal Economy and Information Technology Commission, 2021; Shanghai Municipal People’s Government, 2021b). This hub will mainly focus on the frontier fields of marine science and technology development, such as seabed detection and development and marine intelligent equipment (Shanghai Municipal People’s Government, 2021b). Apart from Lin-gang, Changxing Island relies on its large-scale deep-sea platform for heavy-duty operations to serve the construction of a modern marine equipment research center in Shanghai, as well as to continuously improve the research and development capabilities of common basic technologies, core technologies, and forward-looking technologies in the field of MEE (Shanghai Municipal People’s Government, 2021b).

Zhejiang province

Zhejiang will aggressively cultivate and develop MEE manufacturing industries, support the development of large-scale petrochemical, wind power equipment, and coal chemical equipment manufacturing industries, promote the development of marine space utilization equipment, and accelerate the technology and product development of submarine cables (Zhejiang Provincial People’s Government, 2021a). The first step will be to conquer key technologies in cultivating large-scale MEE, such as marine drilling platforms, marine production and life platforms, floating production storage and unloading units, and FLNG storage units (Zhejiang Provincial People’s Government, 2021a; Zhejiang Provincial Department of Economy and Information Technology, 2021a). Meanwhile, mining equipment for mineral resources, natural gas hydrate and other marine resources, industrialization equipment for seawater desalination, and large-scale deep-sea fishery equipment will also be developed (Zhejiang Provincial Department of Economy and Information Technology, 2021a; Zhejiang Provincial People’s Government, 2021a).Beyond that focus, devices for offshore wind power generation and series products for utilizing wave energy, tidal energy and other marine renewable resources are also included in the development plan (Zhejiang Provincial Department of Economy and Information Technology, 2021a; Zhejiang Economy and Information Technology Department, 2021b).

Second, the offshore utilization and safety protection equipment of islands and reefs is another type of MEE that Zhejiang seeks to develop. These infrastructures are not limited to large or super large floating support bases, extremely large floating air harbors, medium-sized floating platforms on islands and reefs, and construction devices for offshore islands and reefs. Indeed, they also include large-scale intelligent equipment for deep-sea ranches (Zhejiang Provincial Department of Economy and Information Technology, 2021a).

The third step in the plan is to research and develop an MEE for submarine cables and perfect the space management and control of the sea used for submarine cables and pipelines by optimizing the spatial layout, reserving development space, utilizing abandoned space, and developing the three-dimensional use of sea space and other sea use strategies (Zhejiang Provincial Department of Natural Resources, 2021).

Last but not least, Zhejiang plans to plot the industrial chain composed of new marine materials, the manufacturing of MEE’s key components and high-end MEE (Zhejiang Provincial People’s Government, 2021a). The clusters included in the plans are of two types: new marine materials industries (Zhejiang Provincial People’s Government, 2021a) and manufacturing industries for gradual implementation of industrial clusters (Zhejiang Provincial Department of Economy and Information Technology, 2021a).

Fujian province

The Fujian provincial government will mainly make deployments on two major items in the technology and industrial chain during the 14th five-year period and under special plans for offshore wind power equipment.

From the perspective of the technical development of the MEE, the first step is to develop major marine equipment for seabed mining, underwater salvage, marine rescue, hydrographic surveys, port and channel construction, deep water surveys, marine engineering assistance, submarine cable construction, etc. (Fujian Provincial People’s Government, 2021a; Fujian Provincial Department of Industry and Technology Department, 2021). Second, advanced equipment for deep-sea oil and gas and other submarine energy mining, as well as deep-water platforms and large-scale coastal engineering will be researched and developed (Fujian Provincial People’s Government, 2021b). Third, in light of the development needs of the local aquaculture industry, Fujian proposes strengthening the research and development of deep-sea aquaculture equipment and fostering breakthroughs in key technologies to improve the development of deep-sea aquaculture equipment such as fisheries and abalone breeding platforms (Fujian Provincial People’s Government, 2021c).

In terms of the MEE’s industrial chain, Fujian intends to extend the manufacturing industrial chain that integrates equipment design, integration, manufacturing, and basic materials supporting services (Fujian Provincial People’s Government, 2021c).It also plans to build a complete technical chain of high-end MEE, from design to manufacturing, testing and finalization assessment (Fujian Provincial People’s Government, 2021d).

Furthermore, large and powerful enterprises, especially those manufacturing offshore wind power equipment, are encouraged to develop offshore wind power equipment and other MEE projects in Fujian to expand the offshore wind industrial chain (Fujian Provincial People’s Government, 2021e).

Fujian also focuses on developing large-capacity wind turbines, steel structures, operation and maintenance ships and other offshore wind equipment products to achieve an output value of 40 billion yuan by 2023 (Fujian Provincial People’s Government, 2021e; Fujian Provincial Department of Industry and Information Technology, 2021).

Guangdong province

During the 14th Five-Year Plan period, Guangdong will particularly develop offshore oil and gas storage and transportation facilities, marine drilling and production equipment and other MEE used for deep-sea oil and gas resource exploration and development and accelerate the development of emerging MEE used in the construction, operation and maintenance of offshore wind farms, deep-sea large-scale aquaculture, deep-sea mining, seawater desalination, marine tourism and leisure, etc. (Guangdong Provincial People’s Government, 2021a).

To establish an offshore wind industrial base and research and development center in Guangdong, specific arrangements, namely, local Five-Year Plans and the Implementation Plan for Promoting Orderly Development of Offshore Wind Power and Sustainable Development of Related Industries, have been made to form an internationally competitive system that integrates the research and development, manufacturing, design, installation, operation and maintenance of offshore wind power equipment. This system is planned to achieve an annual manufacturing output of 900 sets of complete offshore wind power machines by 2025 (Guangdong Provincial People’s Government, 2021c). Because of its geographical location, Shantou is supposed to develop the design, processing, manufacturing, construction, installation of offshore wind power equipment, and operation and maintenance of wind farms. Yangjiang focuses on the development of high-end wind power equipment as part of an economical and compact MEE. Shanwei focuses on the development of equipment for offshore large-megawatt fan blades (Guangdong Provincial People’s Government, 2021b). Led by the offshore wind power industry, Guangdong is supposed to set specific funding for enterprises to support the research and development, technological transformation and breakthroughs in the MEE (Guangdong Provincial People’s Government, 2021a).

In addition, Guangdong promotes the digital, intelligent and green transformation of the MEE industry and plans to enhance the research, development, design and construction capabilities of high-end MEE equipment (Guangdong Provincial People’s Government, 2021a; Guangdong Provincial People’s Government, 2021c).

Guangxi province

Led by its offshore wind power equipment manufacturing industry, the Beibu Gulf Economic Zone in Guangxi, which plans to elevate the value of its high-end equipment manufacturing output to 200 billion yuan by 2025 (Guangxi Provincial People’s Government, 2021a), benefits from its geographical coastal location to actively promote the development of the MEE industry (Guangxi Provincial People’s Government, 2021a; Guangxi Provincial People’s Government, 2021b; Guangxi Provincial People’s Government, 2021c; Guangxi Provincial People’s Government, 2021d). During the 14th Five-Year Plan period, Guangxi intends to build an industrial cluster for equipment manufacturing, an innovation platform for the wind power equipment industry in the Beibu Gulf, and a huge offshore wind power base covering the core elements of the marine wind industry, such as the research, development and design, core manufacturing of key equipment, final assembly, shipment, offshore installation, operation and maintenance (Guangxi Provincial People’s Government, 2021d; Guangxi Provincial People’s Government, 2021e). In addition, Guangxi is exploring relay development from the Beibu Gulf of Guangxi to the South China Sea. Emerging MEE, such as marine ranch pilot projects, have been put on the agenda and include the development of marine fishing equipment, aquaculture vessels, and large-scale deep-water intelligent cages to meet the needs of deep-sea aquaculture (Guangxi Provincial People’s Government, 2021d).

Hainan province

Compared with other provinces, Hainan Province is a region with less comparative advantages in advanced scientific and technology research capacities and therefore lacks advantages in high-end MEE products. However, it can be seen from Hainan’s regional plans that it will effectively take advantage of central government’s support for the construction of the Hainan Free Trade Port to promote foreign cooperation in a targeted manner, especially cooperation with ASEAN countries.

Hainan’s MEE development plans focus for deep-sea resource exploitation equipment, offshore wind power equipment and international MEE cooperation. First, Hainan plans to take advantage of its deep-sea access and actively undertaken the construction of the operation, maintenance and support base for a “deep-sea space station,” a national major science and technology innovation 2030 project that mainly focuses on marine oil and gas and other deep-sea resource exploration, development and utilization (Hainan Provincial People’s Government, 2021a; Hainan Provincial People’s Government, 2021b; Hainan Provincial Department of Natural Resources and Planning, 2021). The emphasis is also on developing offshore platforms, submarine pipeline installation, submarine cable laying, and on the testing, maintenance and repair services of instruments and equipment (Hainan Provincial People’s Government, 2021b). Second, Hainan intends to create an industrial chain for the manufacturing of offshore wind power and other new energy equipment with independent intellectual property rights of MEE’s core technologies (Hainan Provincial People’s Government, 2021b). Last, in terms of external exchanges and cooperation, Hainan actively encourages local enterprises to (1) deepen cooperation with enterprises in Guangdong, Hong Kong and Macao in the MEE for deep-sea exploration and other marine resources projects to extend and improve the local industrial chain (Hainan Provincial People’s Government, 2021b) and (2) carry out scientific and technological cooperation for the MEE with enterprises in Guangdong and Hunan (Hainan Provincial People’s Government, 2021a). In addition, Hainan will introduce enterprises from ASEAN countries such as Singapore to participate in the construction of marine engineering oil and gas service cooperation projects (Hainan Provincial Department of Commerce, 2021). Taking advantage of preferential policies in the Hainan Free Trade Port, Hainan will also greatly increase the proportion of MEE industry trade and vigorously promote the development of bonded repair and remanufacturing of MEE (Hainan Provincial Department of Commerce, 2021).

Challenges facing China’s MEE industrial policy

Gradual policy innovations have promoted the rapid development of China’s MEE industry in recent years, and the newly issued 14th Five Year Plans have put forward new orientations for the MEE industry in the next five years, stimulating the potential for further development in the industry. At present, China’s 14th Five-Year Plans have been implemented in a top-down manner. The NPC, the State Council and its cabinets and commissions, and local governments have successively issued implementation plans to promote the development of the MEE industry and the marine economy for the duration of the 14th Five-Year Plan. Nevertheless, China’s MEE developmental plans and industrial policy and their implementation in practice still face a series of challenges.

Complexity and vagueness in the industrial policy system

China’s MEE industrial policy system, an important component of which is central and local planning, has a rather complicated structure. It consists of a series of policy documents issued by both the central and local governments. A complicated industrial policy system has provided important “institutional incentives” for the multiple stakeholders embedded in the MEE industrial chain, including inter alia, MEE enterprises, upstream and downstream enterprises, and central and local government officials, to jointly promote prosperity and development in the industry. However, due to the lack of effective coordination among policies issued by the various departments and regions, such a complicated industrial policy system governing the MEE industry inevitably faces problems of “sectoral fragmentation,” “regional fragmentation” and “resource wastage” which could impede further development in the MEE industry (Chang and Wang, 2017; Chen et al., 2019; Li et al., 2021b; Zhang and Wang, 2022b).

Moreover, although China introduced a series of new policies to stimulate the development of the MEE industry in the 14th Five-Year Plan period, the vagueness of these policies on many important issues may not be conducive to truly promoting the long-term development of China’s MEE industry. For example, the issue of governmental subsidies and financial support for the MEE industry remains vague. The development of many subsectors of the MEE industry is inseparable from governmental subsidies and financial support, especially for those high-end and advanced subsectors with high research and development costs. However, in the latest central policies established in the 14th Five Year Plans, subsidies for MEE-related sectors are rarely mentioned. Due to a lack of unified central guiding standards and procedures, inconsistencies or even chaos may inevitably arise among local subsidies and supportive policies. The vaguely targeted government subsidies may lead to problems such as “incomplete standards,” “construction-oriented subsidy mechanisms” and “significant regional disparity” (Yin et al., 2020). For example, as Yin et al. found in a study on Chinese offshore shore power equipment, “despite the preferential policies and strong subsidies rolled out in Shenzhen and Shanghai, the different focuses on pollution prevention and treatment and the importance attached to ship emissions in different places have led to significant regional disparity in shore power promotion” (Yin et al., 2020).

Divergence between policy in the paper and its implementation

The effect of a policy lies in its implementation (Pound, 1910). Without effective implementation, policies may stall on paper. Although the 14th Five-Year Plans propose many institutional innovations to stimulate the development of the MEE industry, whether these innovative policies that exist on paper can be effectively enforced in practice and promote the upgrading of the MEE industry as expected is not without doubt.

First, the potential conflicts between the central government’s policies with long-term industrial upgrade orientations and the local governments’ focus on GDP-oriented short-term industrial development may lead to deviations in the implementation of the central government’s policies at the local level. As shown in Table 2, relevant MEE industrial policies issued by the central government are more focused on the long-term development of the industry and advocate the development of high-tech, high-end, forward-looking and environmentally friendly subsectors such as intelligent MEE, green MEE, and deep-sea resource utilization-related MEE. However, at the local level, the MEE policies in some regions do not completely implement the central government’s industrial upgrade oriented policies but remain focused on certain subsectors that consume a lot of energy and pollute a lot but that may bring short-term economic benefits (Ding et al., 2014). For example, in its 14th Five-Year Plan, Liaoning Province emphasizes the need to deepen offshore oil and gas development and accelerate oil and gas infrastructure construction and equipment manufacturing (Liaoning Provincial People’s Government, 2022).Zhejiang Province focuses on the development of both renewable resource MEE, such as offshore wind power generation equipment and wave and tidal energy utilization equipment, and the development of equipment for exploiting offshore oil and gas resources (Zhejiang Economy and Information Technology Department, 2021b). Because of official promotional incentives and to protect local interests, local officials often tend to invest in MEE projects that can bring greater economic benefits in the short term rather than MEE projects with long research and development cycles. Moreover, constrained by political and economic interests, local governments may implement selective environmental monitoring and enforcement for MEE projects (Ren and Ji, 2021). This may inevitably cause implementation deviations during the implementation process of central policies at the local level (Yang, 2016). Research by Kostka and Hobbs has shown that local government officials are often reluctant to rigorously enforce policies that do not bring significant local economic benefits and even seek loopholes in policy implementation (Kostka and Hobbs, 2012). The long-standing problem of central-local conflicts between the overall layout and long-term planning of the central government and the inclinations to engage in local protectionism and GDP-oriented short-term economic policies of the local government, which has been bordering policy implementation in China, is also evident in the MEE industry (Li, 2020).

Second, most of the MEE industrial policies are largely declarative and lack sufficient enforcement mechanisms to effectively take policies from paper to practice. For instance, the overall layout of the14th Five-Year Plan for Economic and Social Development of the People’s Republic of China (2021-2025) issued by the NPC proposes to develop strategic emerging industries and promote the expansion and accelerated development of the MEE industry (NPC, 2021). However, there are no practical procedures for how this policy is to be implemented or for accountability mechanisms in the event governmental officials fail to implement it. Similarly, the NDRC and NEA’s efforts at enhancing the capabilities of technological innovation for renewable resource in MEE lack accountability or mandatory enforcement mechanisms (NDRC and NEA, 2022). Additionally, the problem of “multitask regulators” may make the policy implementation process cumbersome and slow. For example, when an offshore project threatens the marine environment, the State Oceanic Administration (SOA), the Coast Guard (CCG), and the Maritime Safety Administration all have jurisdiction over the regulation of marine pollution, which leads to the potential problem of “fragmentated regulations” (Chang and Wang, 2015).

Third, the divergence between policy prescriptions on paper and practical implementation by companies may further exacerbate the problem of policy implementation. The MEE industrial policies covered in the 14th Five-Year Plans advocate relevant MEE enterprises carrying out technology innovation and investing in high-end and forward-looking MEE. However, this also implies higher research and development and production costs for MEE enterprises, which may sometimes conflict with the profit-earning objectives of these companies (Collins et al., 2020; Chen and Qian, 2020). Whether the divergence between governmental policy objectives and the profit orientation of corporate practice can be resolved and render MEE enterprises more willing to invest in high-end technology research and development remains uncertain (Li et al., 2020).

Potential conflicts between industrial policies and fair market competition policies

Plans and initiatives to engineer the growth of the MEE industry are among the important components of China’s industrial policy system in that industry. These industrial policies carried out by governments attempt to “shape the sectoral structure of the economy through channeling resources into selected strategic industries” (Heilmann and Shih, 2013) and are expected to “offer better growth than would occur in the (noninterventionist) market equilibrium” (Naughton, 2021). However, the problem is that some industrial policies may conflict with fair market competition policies, as their interventionist nature may be deemed a distortion of market competition (Bush and Yue, 2011; Zhang, 2014; Sokol, 2015).

For example, in the MEE industry, China’s industrial policies in recent years have been aimed at promoting resource integration and industrial alliances among state-owned MEE enterprises to enhance their global influence (MIIT, 2012). In 2019, the merger between two state-owned shipbuilding enterprises formed China’s largest shipbuilding giant and made it globally competitive under the name of China State Shipbuilding Corporation (CSSC). In 2022, ten leading Chinese state-owned MEE enterprises, including CSSC, China International Marine Containers Group, China National Petroleum Corporation, Sinopec Group, China National Offshore Oil Corporation, China COSCO Shipping Corporation, China Communications Construction Group, etc., came together to establish the China Marine Engineering Equipment Technology Development Corporation, attempting to integrate China’s marine equipment construction capabilities and build the world’s largest MEE manufacturer. The government-supported consolidation of state-owned enterprises (SOEs) engaged in the MEE industry is likely to help SOEs gain greater market power (Kovacic, 2017).

However, from the perspective of competition policy, as Hong Yu commented, mega-merger-oriented policies make it “more difficult for other domestic and foreign firms to enter the industrial sectors dominated by SOEs, or to engage in fair competition with them” (Yu, 2019).Influenced by mega-merger-oriented policies, China’s fair competition regulatory authorities are often inclined to green light mergers and acquisitions among large state-owned MEE enterprises but impose stricter scrutiny over mergers that include foreign-funded MEE companies. For instance, although the Chinese antitrust enforcers approved the acquisition of the activities of the TTS Group ASA by Cargotec – a European major port machinery giant– it attached strict restrictions to the deal (SAMR, 2019). The literature on the influence of industrial policy on mergers in China has shown that the merger review process is shaped by the desire to cultivate domestic firms, especially in those industries China views as strategic. The antitrust enforcement agency is more sympathetic toward domestic firms when such firms face increased competition from foreign competitors (Sokol, 2013). Therefore, the policies pertaining to government-supported consolidation among MEE SOEs that seeks to integrate industrial resources and enhance global competitiveness will inevitably conflict with sound pro-competitive competition policies, raising the question of a neutral competitive environment.

Homogeneous competition induced by homogeneous policies

Many coastal provinces in China have issued 14th Five-Year Plans to promote the development of their respective MEE industries, as shown in Figure 2. Although some of these regional MEE policies are formulated by taking regional resource endowments into consideration (Ding et al., 2014), in the absence of effective cross-regional policy coordination, it is difficult to avoid the problems of homogeneous competition and overcapacity induced by homogeneous policies (An et al., 2022).

One example is the homogenous policies issued by various regions that emphasize the development of high-end MEE. For instance, Shandong province has proposed to promote the independent research and production of core high-end MEE (Shandong Provincial Department of Industry and Information Technology, 2022); Jiangsu province has proposed to strengthen key technology research for high-end shipbuilding equipment and MEE (Jiangsu Provincial Department of Natural Resources and Jiangsu Provincial Development and Reform Commission, 2021); and Guangdong province has proposed to enhance the research and development, design and construction capabilities of high-end MEE and accelerate the transformation of mid-to-high-end marine engineering projects (Guangdong Provincial People’s Government, 2021d). However, the high-end MEE subsector is characterized by capital and technology intensiveness. Under such homogenous policies, the upcoming investment boom in the development of high-end MEE manufacturing will easily lead to duplicate construction, homogeneous competition and overcapacity problems.

Another example is the homogeneous policies that several regions have implemented in an attempt to establish MEE industrial clusters and entire MEE industrial chains there. For instance, Jiangsu Province’s14th Five-Year Plan for Marine Economy Development has proposed cultivating an entire high-end MEE industrial chain that would stretch from high-end marine materials to high-tech marine equipment (Jiangsu Provincial Department of Natural Resources and Jiangsu Provincial Development and Reform Commission, 2021). Liaoning, Shandong and Zhejiang provinces have proposed the formation of an entire MEE industrial system encompassing scientific research and development, assembly and construction, equipment supply, and technical services within these provinces (Shandong Provincial People’s Government, 2021a; Zhejiang Provincial Department of Economy and Information Technology, 2021a; Liaoning Provincial People’s Government, 2022).Guided by such policies, many regions have rushed to start the construction of MEE and ship construction bases (Li and Luo, 2020; Li et al., 2021b). However, homogeneous policies aiming to establish entire MEE industrial chains within each region may not only make regions invest in areas where they do not have factor endowments but also lead to problems of homogeneous competition, redundant construction and overcapacity.

For O’Brien and Li, policy implementation in China sometimes may turn a well-liked policy into a “harmful local policy that justifies wasteful investment and more extraction” (O’Brien and Li, 1999).China’s MEE industry has long faced the problem of unbalanced regional distribution (Xie, 2017).It calls for effective cross-regional coordination mechanisms to reasonably allocate resources among regions, coordinate upstream and downstream production capacity, and realize the coordinated development of the MEE industrial chain nationwide.”

Insufficient marine environmental protection in local policies

China’s policies to promote the development of the MEE industry have inspired a large number of marine engineering construction projects, which may exacerbate the contradiction between the rapid development of the MEE industry and marine environmental protection (Ding et al., 2014; Zheng et al., 2020; Gomez-Banderas, 2022; Zhang and Wang, 2022a).

The increase in the number of marine engineering construction projects has placed great pressure on marine environmental protection in recent years (Rayner et al., 2019; Zeng et al., 2022). According to the statistics released by the SOA, 6.3% of marine engineering construction projects make illegal uses of the ocean, which may threaten the sustainable development of the marine environment; such activities include illegal reclamation, construction of dam projects at sea and submarine pipelines, and illegal exploitation of marine resources (SOA, 2011). The media has also revealed that some Chinese MEE enterprises fail to carry out construction projects in accordance with their pre-reported marine environmental impact assessment report (Zhou et al., 2021).

In the face of marine environmental damage and reclamation problems pertaining to MEE manufacture and construction, the Chinese central government has specifically issued the 14th Five-Year Plan for Marine Ecological Environment Protection, in which it proposes to strengthen the prevention and control of marine environmental pollution caused by marine engineering construction projects and the environmental supervision and monitoring over marine engineering construction projects and establish a waste discharge permit system for marine engineering construction projects (MOEE et al., 2022). However, likely because of the pressures emerging from the cadre evaluation system (Edin, 2003) and frequent cadre turnover (Eaton and Kostka, 2014) at the local level, the issue of marine environmental protection is rarely emphasized in the latest 14th Five-Year MEE plans and policies issued by the local governments. An empirical analysis of the MEE-related 14th Five-Year Plans issued by the provincial governments reveals that MEE-related marine environmental protection has been limited to an emphasis on the need to invest in the manufacturing of marine environmental monitoring equipment, while issues that adversely affect the marine environment, such as illegal reclamation and construction and waste dumping into the ocean, are largely overlooked.

Conclusions

By analyzing China’s newly released MEE-related 14th Five-Year Plans at both the central and local levels, this study explores the potential innovations and implications that these new policies may bring to China’s MEE industry. Although gradual policy innovation has provided important “institutional incentives” for the rapid development of China’s MEE industry in recent years, there remain problems and challenges faced by these policies and their implementation in practice. This paper also intends to analyze a series of important challenges that China’s MEE policy implementation may still face in practice, including complexity and vagueness in the industrial policy system, divergences between policy on paper and its implementation, potential conflicts between industrial policies and competition policies, homogeneous competition and overcapacity induced by homogeneous policies, and insufficient local marine environmental protection. It is hoped that this study could provide a richer understanding of the institutional framework that regulates the MEE industry and the architecture that supports a central component of the state’s marine economy development model in China. It is also hoped that this research can help shed light on a series of important issues for future research, including inter alia, the implications of these new policies for potential future upgrades in the MEE industry in China, how China’s MEE industry can better integrate into the global maritime supply chain, and how China’s MEE industrial policies may contribute to the world’s marine economy. China’s 14th Five-Year Plan has put forward requirements for the MEE industry, and local governments have also put forward their own roadmaps to achieve the requirements. If the 14th Five-Year Plan can be implemented in an orderly manner, China’s MEE industry will make significant progress, various international cooperation relating to MEE will also reach a higher level, making great contributions to the development of the global MEE industry.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material. Further inquiries can be directed to the corresponding author.

Author contributions

All authors contributed to the article and approved the submitted version.

Acknowledgements

This study was supported by the National Social Science Foundation of China (Grant No. 19ZDA167 and No. 22AZD108) and the Shanghai Social Science Foundation (Grant No. 2021BFX006).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Abbreviations

CAC, Cyberspace Administration of China; CCG, China Coast Guard; MCA, Ministry of Civil Affairs; MEM, Ministry of Emergency Management; MIIT, Ministry of Industry and Information Technology; MNR, Ministry of Natural Resources; MOA, Ministry of Agriculture and Rural Affairs; MOE, Ministry of Education; MOEE, Ministry of Ecology and Environment; MOF, Ministry of Finance; MOFCOM, Ministry of Commerce; MOHRSS, Ministry of Human Resources and Social Security; MOHURD, Ministry of Housing and Urban-Rural Development; MOST, Ministry of Science and Technology; MOT, Ministry of Transport; NDRC, National Development and Reform Commission; NEA, National Energy Administration; NPC, National People’s Congress; SAC, Standardization Administration; SAMR, State Administration for Market Regulation; SASAC, State-owned Assets Supervision and Administration; SOA, State Oceanic Administration.

References

An D., Shen C. L., Yang L. (2022). Evaluation and temporal-spatial deconstruction for high-quality development of regional marine economy: A case study of China. Front. Mar. Sci. 9, 16662. doi: 10.3389/fmars.2022.916662

Balance Technology Consulting (2020). Competitiveness and benchmarking in the field of marine equipment. Available at: https://ec.europa.eu/docsroom/documents/3290/attachments/1/translations/en/renditions/native (Accessed April 27, 2022).

Bush N., Yue B. (2011). Disentangling industrial policy and competition policy in China. Antitrust Source 10, 1–14.

Carver R., Childs J., Steinberg P., Mabon L., Matsuda H., Squire R., et al. (2020). A critical social perspective on deep sea mining: Lessons from the emergent industry in Japan. Ocean Coast. Management. 193, 105242. doi: 10.1016/j.ocecoaman.2020.105242

Chang Y. C., Wang N. N. (2015). The restructuring of the SOA in China: moving toward a more integrated governance approach. Int. J. Mar. Coast. Law. 30, 795–807. doi: 10.1163/15718085-12341371

Chang Y. C., Wang N. (2017). Legal system for the development of marine renewable energy in China. Renewable Sustain. Energy Rev. 75, 192–196. doi: 10.1016/j.rser.2016.10.063

Chen J. L. (2018). The cases study of “One belt and one road” and “Made in China 2025” impact on the development of taiwan’s machine tool industry. Int. Business Res. 11, 189–196. doi: 10.5539/ibr.v11n2p189

Chen X., Qian W. W. (2020). Effect of marine environmental regulation on the industrial structure adjustment of manufacturing industry: An empirical analysis of china’s eleven coastal provinces. Mar. Policy. 113, 103797. doi: 10.1016/j.marpol.2019.103797

Chen S., Qiu L. P., Sun S. F., Yang J. Y., Meng Q. H., Yang W. B. (2021). Research progress on corrosion of equipment and materials in deep-sea environment. Adv. Civil Eng. 2021, 7803536. doi: 10.1155/2021/7803536

Chen J., Zheng T., Garg A., Xu L., Li S., Fei Y. (2019). Alternative maritime power application as a green port strategy: Barriers in China. J. Cleaner Prod. 213, 825–837. doi: 10.1016/j.jclepro.2018.12.177

Collins J. E., Vanagt T., Huys I., Vieira H. (2020). Marine bioresource development – stakeholder’s challenges, implementable actions, and business models. Front. Mar. Sci. 7, 62. doi: 10.3389/fmars.2020.00062

Ding J., Ge X. Q., Casey R. (2014). Blue competition” in China: Current situation and challenges. Mar. Policy. 44, 351–359. doi: 10.1016/j.marpol.2013.09.028

Du L. N., Luan W. X., Jiang Y. P. (2013). Research on the development potential of china’s strategic marine industries – MEE manufacturing industry. Advanced Materials Res. 694-697, 3626–3631. doi: 10.4028/www.scientific.net/AMR.694-697.3626

Eaton S., Kostka G. (2014). Authoritarian environmentalism undermined? local leaders’ time horizons and environmental policy implementation in China. China Quarterly. 218, 359–380. doi: 10.1017/S0305741014000356

Edin M. (2003). State capacity and local agent control in China: CCP cadre management from a township perspective. China Quarterly. 173, 35–52. doi: 10.1017/S0009443903000044

Fan C. C. (2013). China’s eleventh five-year plan, (2006–2010): From “getting rich first” to “common prosperity”. Eurasian Geogr. Economics 47, 708–723. doi: 10.2747/1538-7216.47.6.708

Fujian Provincial Department of Industry and Information Technology (2021). Fujian province’s work plan for promoting high-quality development of ships and MEE, (2021–2023). Available at: https://swt.fujian.gov.cn/xxgk/flfg/qtx/202109/t20210903_5681387.html (Accessed June 26, 2022).

Fujian Provincial People’s Government (2021a) Fujian 14th five-year plan for the development of strategic emerging industries. Available at: http://www.fujian.gov.cn/zwgk/ghjh/ghxx/202110/t20211029_5752253.html (Accessed June 26, 2022).

Fujian Provincial People’s Government (2021b). Fujian 14th five-year plan for science and technology innovation. Available at: http://www.fujian.gov.cn/zwgk/ghjh/ghxx/202111/t20211105_5768034.html (Accessed June 26, 2022).

Fujian Provincial People’s Government (2021c). Fujian 14th five-year plan for high-quality development of manufacturing industry. Available at: http://www.fujian.gov.cn/zwgk/ghjh/ghxx/202107/t20210706_5641624.html (Accessed June 26, 2022).

Fujian Provincial People’s Government (2021d). Fujian 14th five-year plan for building a strong marine province. Available at: http://www.fujian.gov.cn/zwgk/ztzl/gjcjgxgg/zc/202111/t20211124_5780320.html (Accessed June 26, 2022).

Fujian Provincial People’s Government (2021e). Three-year action plan to promote a new round of “Marine fuzhou” construction for high-quality marine economy development, (2021-2023). Available at: http://www.fujian.gov.cn/zwgk/ztzl/gjcjgxgg/zc/202105/t20210521_5599586.html (Accessed June 26, 2022).

Gomez-Banderas J. (2022). Marine natural products: A promising source of environmentally friendly antifouling agents for the maritime industries. Front. Mar. Sci. 9, 858757. doi: 10.3389/fmars.2022.858757

Guangdong Provincial People’s Government (2021a) Guangdong 14th five-year plan for natural resources protection and utilization. Available at: http://www.gd.gov.cn/zwgk/jhgh/content/post_3718599.html (Accessed June 26, 2022).

Guangdong Provincial People’s Government (2021b) Guangdong 14th five-year plan for high-quality development of manufacturing industry. Available at: http://www.gd.gov.cn/zwgk/gongbao/2021/23/content/post_3496256.html (Accessed June 26, 2022).

Guangdong Provincial People’s Government (2021c) Implementation plan for digital transformation of manufacturing industry in guangdong province. Available at: http://www.gd.gov.cn/zwgk/wjk/qbwj/yfb/content/post_3316639.html (Accessed June 28, 2022).

Guangdong Provincial People’s Government (2021d) Guangdong 14th five-year plan for marine economy development. Available at: http://www.gd.gov.cn/attachment/0/476/476500/3718595.pdf (Accessed July 26, 2022).