- 1Wageningen Economic Research, The Hague, Netherlands

- 2Wageningen Environmental Research, Wageningen, Netherlands

- 3Business Models Inc., Amsterdam, Netherlands

- 4MaREI Environmental Research Institute, University College Cork, Cork, Ireland

The European Union's Blue Growth Strategy is a long term strategy to support sustainable growth in the marine and maritime sectors, aiming to contribute to innovation and economic growth (European Commission, 2012). The EU sees the financial sector as a key partner to bring about transition to sustainable consumption and production. However, knowledge about investment behavior, experience with working with these investors, and ways to engage investors in the Blue Growth sectors is lacking. This paper examines this knowledge gap. It characterizes investors and identifies investor behavior, investors' motives, and conditions and criteria relevant for investors to invest in Blue Growth sectors. The presented results are derived from a literature study on investors and investment behavior, an electronic survey and in-depth interviews. Stereotypical images of private equity bankers or wealthy individuals do not do justice to the diversity of investors involved in the Blue Growth sectors. These sectors are still in development and various risks reduce the willingness to invest. Risk mitigation should be seen as a shared responsibility of entrepreneurs, investors and governments. Government support must go further than financial support for research and development or technological demonstration projects. Proven technologies get stuck in the Valley of Death as investors alone are not willing to take the risk associated with upscaling of promising technologies. Tied in a reciprocal relationship, governments need to attract private investors—their capital, knowledge, and networks—to further grow of the Blue Growth sectors while investors need stable, predictable, and effective government support schemes to mitigate their financial risks.

Introduction

The Limassol declaration on a Maritime Agenda for Growth and jobs, endorsed in October 2012 by European Ministers for Maritime Affairs, aims at creating sustainable economic growth, and employment in the marine and maritime economy to facilitate Europe's economic recovery1. The European Blue Growth Strategy is presented as a long term strategy to support sustainable growth in the marine and maritime sectors as a whole and recognizes that seas and oceans are drivers for the European economy with great potential for innovation and growth (European Commission, 2012). It seeks to stimulate smart, sustainable, and inclusive economic and employment growth from the oceans, seas, and coasts.

As mankind exceeds some of Earth's planetary boundaries, human impact threatens to push Earth into a new state (Steffen et al., 2015). Climate change, biodiversity loss, and deteriorating ecosystems are only some of the reasons why a change to sustainable consumption and production is necessary. Increasingly, policy-makers and civil society turn to the financial sector as a key factor in bringing about this change. This is not only the case in the maritime domain but also in protection of nature (Belt and Blake, 2015; Dalal et al., 2015) and climate change policies (Clapp et al., 2015; Demertzidis et al., 2015; Lee et al., 2015).

Blue growth represents a new and ambitious vision and strategy for more and better investments in the ocean economy. It is propagated by the European Commission (European Commission, 2012) and has found its way into the international arena (see for example OECD, 2016)2. The underlying promise of Blue Growth is that it stimulates economic development—increasing jobs and incomes—while securing sustainable management of the marine resources (European Commission, 2014).

Currently, the “blue” economy represents 5.4 million jobs and a gross added value of just under € 500 billion a year (European Commission, 2012). The “Blue Growth” initiative aims to expand the maritime dimension of the Europe 2020 strategy. The Blue Growth strategy recognizes the importance of existing economic sectors such as shipbuilding & repair, transport, fisheries, and offshore oil & gas. At the same time, Blue Growth points to the potential of five emergent economic activities: aquaculture, coastal, and maritime tourism, marine biotechnology, ocean energy, and sea bed mining (European Commission, 2012, 2014).

Bringing about Blue Growth requires major changes in the way both public and private act regarding these ambitions. It requires new ideas, concepts, policies, technologies, and business models. To this end, various governance strategies have been deployed, with emphasis on knowledge generation—through the Horizon 2020 Blue Growth calls—and networking (Hartley et al., 2013; Stuiver et al., 2016).

Fulfilling the potential of Blue Growth requires the upscaling of innovative practices to full commercial scale as well as growth to mature economic sectors. This requires more than knowledge and networks, it also requires financial impulses by investors. Attracting private investors is therefore of paramount importance to implementation of the new Blue Growth strategy. Public investments in research and start-ups are not sufficient in this new road to a sustainable future, with new ideas easily ending up in de Valley of Death (Osawa and Miyazaki, 2006; McIntyre, 2014). In the Valley of Death, start-up firms die off because private investors are not willing to invest in companies without a steady stream of revenues.

The EU is beginning to gather experience how to actually make this work, through for instance the Coordination and Support Actions, Blue Growth Business summits3 and other networking events. A match between the public ambitions and private investors their needs and concerns is necessary to make this work. The framing of Blue Growth—its storyline with concepts, contexts, and issues—however still leans on a public rationale, drive, and support (Børresen, 2013. Pinto et al., 2015).

The main question addressed in this article is how investors—a key private actor for realizing Blue Growth—can be engaged in the development of the Blue Growth sectors. The following sub-questions are addressed:

• Who are the investors in Blue Growth?

• What explains their investor behavior?

• What are relevant risks and barriers to investment in Blue Growth?

• How to involve investors to secure financing for the development of the Blue Growth sectors?

Methodology

The results presented are derived from a four step approach.

1. In the first step, a database of investors was developed and analyzed.

2. Parallel to that, key literature on investors, and investment behavior was studied.

3. Subsequently, an electronic survey was developed and send out to the identified investors and the results obtained from this were used.

4. Lastly, in order to enrich the questions of the survey, in-depth interviews with a selected number of investors were held to acquire more detailed insights into the motives of investors.

Relatively low response rates in steps (3) and (4), despite the fact that considerable energy was put into reaching out to investor, not only mean careful analysis. It also illustrates the major differences between scientific and investment community, e.g., when it comes to sharing information and issues of confidentiality.

Identification and Characterization of Investors

The objective of the investor database was to provide a detailed overview of investors inside and outside the EU who have an interest in the Blue Growth sectors. The database was designed in interaction with project partners, after discussing what metadata is important given the purpose of the database. This resulted in a database, allowing to record the following multiple characteristics of respondents. The most important characteristics are:

• Type of investor.

• Financial information.

• Basins in which investors are active.

• Blue Growth sectors in which they invest.

• Contact details.

Investors were classified as: business angel, venture capital, and private equity, national government, internal investor, bank, professional services, public fund, or other. Financial information consisted of the annual turnover of an investors and the number of employees. The basins in which investors are active were classified as Atlantic, Baltic, Caribbean, Mediterranean, and multiple basins. These basins have been selected based upon the priorities as defined in the Maribe project. The Blue Growth sectors consisted of aquaculture, seabed mining, ocean energy, and/or marine biotechnology. Coastal tourism, a sector that is part of the Commission's strategy on Blue Growth, was excluded due to priorities in the Maribe project. Contact details consisted of information such as telephone and email addresses. The data for these characteristics has been collected via Internet. For every investor the appropriate website and digitalized annual reports were screened to characterize investors and find the relevant information.

Survey

An online survey was designed and sent out to all investors identified in the database. The objective of the survey was 3-fold:

1. To improve understanding of investor and their investments in Blue Growth sectors.

2. To understand the conditions and criteria relevant for investors.

3. To increase understanding of how to engage investors in the Blue Growth ambitions.

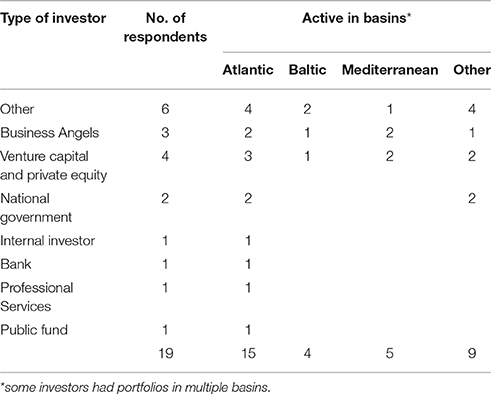

The online survey was programmed in EU Survey4 and consisted of a limited number of closed questions. Respondents were given the possibility to remain anonymous and the survey did not ask for particular investments, focusing on the investors' concerns in general. After sending out the survey to the 200+ investors, a total of 19 responses was received. Reasons for non-response could not be investigated further. The survey respondents come from different organizations (see Table 1). Many investors are active in multiple regions, explaining why the sum adds up to more than 19. Overlooking all response, it is noteworthy that 15 out of 19 investors are active in the Atlantic basin. An explanation could be that the project task leaders were EU based and therefore had an EU bias on investors knowledge.

In-Depth Interviews

The objective of the interviews was to add in-depth knowledge to the survey to better understand results. To this end, semi-structured interviews were designed, with a limited number of generic questions so that investors can share their story. The scheduled time for an interview was 90 min. All interviews were thoroughly prepared by getting acquainted with the investor and his/her company (studying LinkedIn, website, Annual Report, news coverage in advance) and the investments already done in Blue Growth. The agenda and questions of the interview were send to the investor beforehand. Identification of the respondents was based on the database. The database provided 70 names with complete contact details. We both called and mailed these 70 names. Five responded positively to join us for an interview. The main reasons for non-participation mentioned included lack of time and a reluctance to share ideas and information with science. These interviews were performed in September 2015. All interviews are treated confidentially.

Investor Behavior Theories

Although there is a significant amount of knowledge on investors and investors behavior reported in scientific magazines such as the Journal of Finance and the Journal of Business Venturing, research on marine developments have generally paid little attention to these actors. Recently, research on the sustainable energy market have recognized the importance of investors (see e.g., Karltorp, 2016; Shiau and Chuen-Yu, 2016). Wüstenhagen and Menichetti (2012, 2013) and Helms et al. (2015) question who the key investors are and which motives drive their investment decisions.

Different Types of Investors

The first question is how to define an investor. In generic terms an investor can be described as any person and/or group who commits capital with the expectation of financial returns5. According to Investopedia, investors utilize investments in order to grow their money and/or provide an income during retirement, such as with an annuity. A wide variety of investment vehicles exist including (but not limited to) stocks, bonds, commodities, mutual funds, exchange-traded funds (ETFs), options, futures, foreign exchange, gold, silver, retirement plans, and real estate. The act of utilizing investments to grow money is not restricted to private investors. On the contrary, a wide range of actors is active in investing money to gain return, from households who save money to governments, banks, and wealthy individuals.

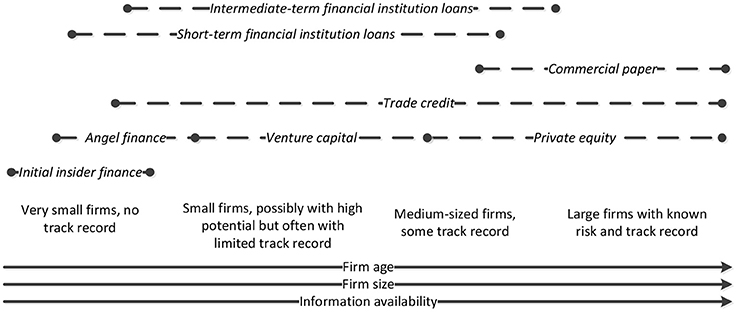

Berger and Udell (1998), among others, have illustrated that there is a great diversity of investors that serve different markets. Start-ups generally acquire capital from friends, family, and angel investors. Venture capital support small sized companies with potential and some track record whereas private equity investor generally invest in more developed companies with a larger track record. Both venture capital and private equity investors can play a significant role in the management and operations of companies. While the media often focus on the negative effects of private investors, there is also significant evidence on the positive effects of investor activism, on corporate performance (Brav et al., 2015). Banks, pension funds, and the like only enter the stage once companies have a greater track record. This relation between types of investor and developmental stage of companies can be visualized in the financing playing field (see Figure 1).

Figure 1. Firm continuum and sources of finance (adapted from Berger and Udell, 1998).

In addition to these different types of private investors there are various governmental investors, or public investors, who invest in corporate activities for a range of reasons. The European Commission and national governments invest in development of marine sectors by providing funding to research and development, for example from the European Maritime and Fisheries Fund (EMFF) or the Horizon 2020 SME Instruments. Of comparable nature are the investments of national government in maritime business development. Regional governments—provinces and states—also have a track record of investing in start-ups for whom it is hard to attract venture capital (Stuart and Abetti, 1987; Cumming, 2007). Government investors also expect a financial return and sometimes support the lending company with information, networks, and knowledge.

Public and private investments are not mutually exclusive. In reality companies can attract finance from both public and private investments, where availability of government venture capital can help to access private venture capital (as is the objective of e.g., the Dutch National Green Fund6 and the European Investment Bank7). Bertoni and Tykvova (2012) studied public and private investments and conclude that this type of financing is most supportive for innovation and that the most supportive form is a heterogeneous syndicate (i.e., consisting of both types of venture capital investors) led by a private investor.

A significant amount of investments comes from companies themselves who spend time and resources on research and development. An internal investor is defined as a company that is using its own (human, financial, technological etc.) resources with the aim of doing business in sectors such as aquaculture, seabed mining, ocean energy, and/or marine biotechnology. This internal investment accounts for a large part of investment in techniques and products (Asker et al., 2015).

A relatively new type of investment is crowdfunding. In this case external financing is provided by a large audience (the “crowd”) instead of small group of sophisticated investors (Belleflamme et al., 2014; Mollick, 2014). At the time of writing, this type of investment was not encountered in relation to Blue Growth sectors.

Drivers of Investor Behavior

Scientific literature on investor behavior generally falls within one of the following three research traditions.

The first school of thought focus on rationalized behavior of investors to identify their motivations and considerations. The behavior of investors is explained by focusing on rational considerations such as expected return of investment, risk reduction, and portfolio management (see for example Bhattacharya and Kojima, 2012; Fich et al., 2015; Moodley et al., 2017). As early as in 1952, Markowitz argued that risks are crucial for understanding investors' decisions and to manage their portfolio of investments to reduce risks. He argued that a rational investor will not invest in a portfolio if a second portfolio exists with a more favorable risk-expected return profile—i.e., if for that level of risk an alternative portfolio exists that has better expected returns. Swensen (2009) elaborated the concept of portfolio management, arguing that investors do best if they build up a portfolio of investments, spread out over various businesses to reduce risks. For this purpose, various computer-based models for portfolio management have been developed (e.g., Aouni et al., 2014; Bennett et al., 2016).

A second school of research has emphasized that the rational approach to investor behavior neglects the irrationality that is part of investors decision-making process. Among others, Barberis et al. (1998) observed regularities in the behavior of investors who reacted strongly to a series of good or bad news and showed less reaction to earnings announcements. Barberis et al. concluded that investor sentiment are of pivotal importance in decision-making. Phenomena such as nervous market participants or complex financial products or decisions are not fully addressed by classical finance theory which too easily assumes that investors behave rationally. Consequently, there is increased attention for behavioral approaches to analyse capital market phenomena which classical finance theory cannot explain. The behavioral finance approach recognizes that individuals are not able to process information at the same time and often do not evaluate information systematically either. For instance, individuals allow their decisions to be swayed by irrelevant details and often make their investment decisions with the help of rules of thumb. An example is that such individuals frequently tend toward naïve diversification, where portfolio composition is not based on fully rational considerations but is more or less arbitrary (Kirby and Ostdiek, 2012). On financial markets investors frequently mimic one another, behavior which classical finance theory cannot explain. This is described as herding, or herding behavior (Raddatz and Schmukler, 2013; Iihara et al., 2016).

A third approach to investor behavior focusses on the rise of social responsible investment (SRI). As investors are scrutinized for a one-sided focus on the financials, SRI enables them to take a multi-criteria approach to make investment decisions, not only focusing on short- and long-term profits but also on the impact of their investment on society. In SRI, both financial and social objectives are pursued (Renneboog et al., 2008; Ballestero et al., 2012).

Characterisation of Investors

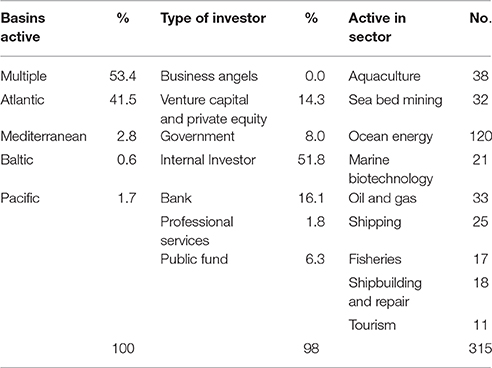

The inventory of investors in Blue Growth collated by the Maribe project contained 244 entries. Each of these entries was categorized by the project team. At times, characterization was hampered by lack of knowledge. It is for example easier to know in which basin an investor is active—based on press release or literature—but difficult to exclude they are active in another basin as well. The characterization of investors in Table 2 is based on publically availably websites and literature.

The calculations in Table 2 were conducted as follows. The percentage of investors that are active in one or more basins was calculated by cumulating the number of investors active in each type of basins, divided by the total sum of investors (244). The percentage of types of investors was calculated by cumulating the number investors for each investor type, divided by the total sum of investors. The number of investors active in each sector was calculated by cumulating the number of investors for each specific sector.

A large group of the investors in the database have their headquarters in the UK (31%). The United States and the Netherlands are also home to a large part of investors (respectively 14 and 13%). The remainder of investors originate from various countries and continents.

The first result that emerges from analysis of the investor database is that the sample of investors are generally not restricted to operating in one particular basin. The Atlantic basis is the most relevant basis for investors. More than half of the identified investors in the database are active in more than one basin (53%).

A large part of the identified investors are “internal investors,” working for companies that are already active in the maritime domain and make capital available for research and development to support and grow business. Ocean energy is by far the largest sectors for the identified investors in the sample, and it is acknowledged that this uneven sample bias is due to the majority of investor sources used were in the knowledgeable. All Blue Growth sectors attract investors, and further expansion of the investor database will be required to cover all sectors evenly.

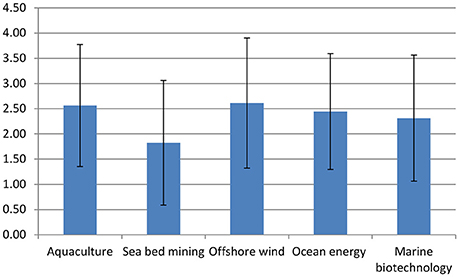

In the survey, investors where asked which of the Blue Growth sectors is the most important to them. Results show that most Blue Growth sectors are more or less equally important with the noticeable exception of sea bed mining which scores lower (see Figure 2). This can be explained. Sea bed mining is still in its infancy and the main projects are currently carried out in the Gulf of Mexico and South Pacific8.

Figure 2. Importance of Blue Growth sectors for investor on 1 (low)-4 (high) scale. Error bars represent standard deviation.

Understanding Blue Growth Investors' Behavior

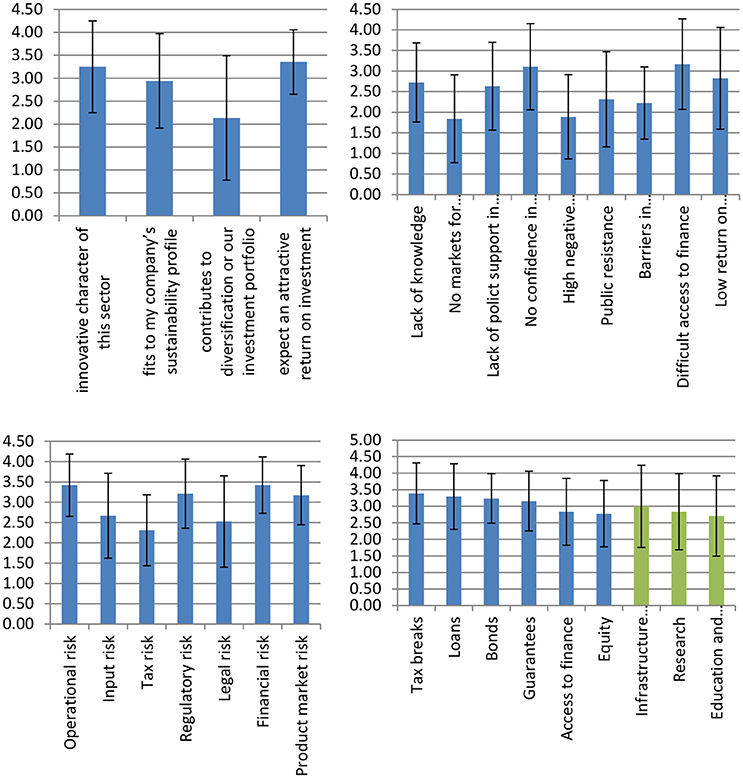

Below, the results of the survey and interviews are discussed. First, the motivation of investors to invest in particular sectors and/or companies is analyzed, followed by analysis of main risks and barriers. The analysis ends with a discussion on government regulation. Results from the survey are graphically presented in Figure 3 below.

Figure 3. Survey results on 1 (low)-4 (high) scale. Error bars represent standard deviation. (A) Motivation to invest. (B) Importance of various barriers to invest. (C) Risks. (D) Preferred government support schemes. Errors bars represent standard deviation.

Motivation to Invest

The survey results (see Figure 3A) show that the rational motivation “return on investment” is important to the investors, while “diversification of portfolio”—a strategy to reduce risk—is rated as less important.

The innovative character of a sector is of moderate importance, and this is explained for in the interviews. Investors are not driven by enthusiasm about a particular technology or device. Although it is understood that technology development is needed and takes a long time, this is first and foremost seen as a concern for developers. The interest of investors lies in the potential impact of technologies; they are interested in finding the game-changer, i.e., technology that changes an industry. They do not get involved for a quick or big return but have a long-term view on the developments in sectors—and society as a whole—based on a combination of idealism and realism. This is illustrated by the following quote from an investor in aquaculture: “ you invest in growth potential and the scale of businesses, not the development of technology. The technology is already there, it is about investing in the right companies to continue marketing and thereby change the aquaculture industry in a positive way.” In similar vein, an investor comments: “as private equity investor, we invest in building growth rather than developing technologies.”

To secure impact, many investors work closely with the management team of the company and/or the inventors of the concept and try to understand the character of the company they invested in. They seek to contribute to knowledge development within a sector and gain first-hand understanding of what goes on in a sector “When you are engaged with money in this sector you can learn about the suppliers how they get money, the interests of buyers etc., This knowledge is much more important than the first Return on Investment.”

Particularly early stage investors—i.e., business angels—are interested in digging into the company's future and business models with an eagerness to be involved closely and thereby better understand the potential for growth. Their networks can bring new insights and knowledge about the market and the technology.

Risks and Barriers to Investment in Blue Growth

The most important barriers to investment—according to the respondents—are the lack of confidence in technology and difficulties to access finance (Figure 3B). The most important risks according to the investors consulted are operational and financial risks.

Operational Risks

Blue Growth investors are not dealing with mature technologies or low risk markets. The Blue Growth sectors face uncertainty and risk in the commercialization of the products, regulatory problems), and technologies are still under development. As one respondent signals: “Offshore technologies are still very expensive: new technology is not getting obviously cheaper. In some cases, prices are actually increasing.” Another respondent states that “Aquaculture is still young and there is still much to discover”

For the various Blue Growth sectors, the question is how to move toward a low-risk, mature technology sector, and become more attractive for investors. The involvement of investors in company management—“we always take a strong involvement. We were always take a board and we follow the company very closely”—can help to mitigate market risk as they bring in experience and knowledge and can help to open up new networks for the company they invested in. Investing in a company is more than handing over capital: it includes “connecting and tying together the right parties.”

Investors do not see a role for themselves in technological development. The mitigation of technological risks is part of technology development and remains the responsibility of entrepreneur.

Access to Finance and Financial Risk

Access to finance is a recognized critical issue in the development of the Blue Growth sectors (Blanco, 2009; Kleih et al., 2013). In the case of offshore wind energy, public support is required as “the economic viability is still not there.” Among the respondents, the most preferred governmental support schemes are tax breaks, loans, bonds and guarantees, although differences are small and all are relatively important (Figure 3D). The four most favored support schemes all relate to financing of companies and help to increase access to finance through stable, long-term support schemes. Direct financial support—whether through a subsidy of government participation—is less certain as it can be repudiated more easily. Government support for non-financial support (green in Figure 3D) such as infrastructure and research and education—of which the eventual impact is less quantifiable—receive lower scores.

Yet, poor-designed government support schemes are a risk to the development of Blue Growth sectors: “There have been oversized or poorly designed subsidy schemes, leading to often ill-timed repudiation. These things are improving. There are improved tariff and incentives structures now and also auctioning processes help.”

Government Regulatory Frameworks

The attitude of investors toward regulatory measures is mixed. On the one hand, regulations and frameworks are seen as a burden (“it is complicated to get a permit”), on the other hand investors argue that regulatory frameworks should be more supportive of investing in Blue Growth and provide subsidies or other means of support such as test sites. What binds these two opposing arguments is the desire for a regulatory framework and support-scheme that is predictable, has a long time-span and will not erratically change: “Problems arise when parties pull back from previous commitments. Investors don't like this because there is already enough risk related to power price, wind, technology, and other constraints.” Regulatory frameworks for offshore wind energy development are praised: “Regulatory and permitting process in the Netherlands is smooth. The UK is in a similar position, making things simpler while maintaining competitive tension, which helps the investment climate.”

The results from interviews and survey presented above are re-affirmed by recent research on the behavior of investors in renewable energy investments. Bürer and Wüstenhagen (2009) studied which energy policy is favored by venture capitalists and conclude that particularly feed-in tariffs are effective to arouse interest of investors. Transcending the comparison of specific policy instruments, Bürer and Wüstenhagen conclude that the policy support should take a two-sided approach with a focus on technology-push policies and stimulating the market by market-pull policies. Renewable energy investment come with significant risks, which hamper mobilization of capital (Karltorp, 2016). Leete et al. (2013) studied investor behavior concerning marine renewable energy in the UK and identified a number of barriers to investment. They conclude that future private investment of marine renewable energy is hindered by investors' greater understanding of the scale, unpredictability of the costs and the length of time required to develop these technologies.

Conclusion and Discussion

The objective of this paper is to identify investors in Blue Growth, to gain understanding about their motives and concerns when it comes to investing in the Blue Growth sectors. This knowledge serves a purpose; it is necessary to understand how public actors can involve private actors in development of the Blue Growth sectors.

There is not one type of “Blue Growth investor.” Stereotypical images of private equity banker or wealthy individuals do not do justice to the diversity of investors that can potentially be involved in the Blue Growth sectors. There is a large variation in investors; large and small, private or public, low- or high-risk taking, ideological, or conservative.

Theories suggest that that the behavior of investors is dependent on many different variables. Part of the decision-making process is based on rational and calculated choices, including those on risk taking and return on investment. Another part is based on less rational decisions such as trust in the companies, personal interests, mimicking other investors. Both views on investor behavior are affirmed when studying the sample of Blue Growth investors in the survey and interviews. The financial revenues—including the return on investment—and risk management are part the full spectrum of investor decision making. Investors also aim for impact by contributing to the development of new sectors with positive benefits to society. For many investors, investing is more than simply providing capital; it often means the investor is actively involved in managing the company and expanding its network to increase impact and revenues.

A key insight is that investment in Blue Growth are seldom the outcome of one-on-one contact by a company and an investors. Investments in the Blue Growth sectors come about when different investors—public and/or private investors—are brought together to raise the capital required. Investing as partner of a consortium of investors is a way to spread risks and allows investors to invest in multiple companies.

The final question this paper addresses is how investors engagement in the Blue Growth agenda can be stimulated. Notwithstanding their potential, the Blue Growth sectors are still in development and there are various risks for investors that reduce willingness to invest. Risk mitigation should be seen as a shared responsibility of entrepreneurs, investors, and governments. Technology developers are in the lead to reduce technological risks. Many investors are supportive to start-up or young companies and actively participate, mitigating management, and market risk. It is in mitigation of the financial risk where governments have an important role to play.

Public involvement justifiable because of the economic, social and environmental benefits that can be realized by growing the Blue Growth sectors but government support must go further than financial support for research and development or technological demonstration projects. Proven technologies get stuck in the Valley of Death as investors alone are not willing to take the risk associated with upscaling of promising technologies. Tied in a reciprocal relationship, government need to attract private investor—their capital, knowledge and networks—to further growth the Blue Growth sectors while investors need stable, predictable and effective government support schemes to mitigate their financial risks.

Author Contributions

Sv, MS, BB, RW, and GD designed the study. Sv, MS, BB, and RW contributed to the inventory of investors. TS and Sv conducted the literature review. Sv and BB designed and analyzed the survey. MS and RW conducted and analyzed the interviews. All authors were involved in drafting this article. GD reviewed the article. All authors approved the final version for publication.

Funding

This work was carried out under the Maribe project. This project has received funding from the European Union's Horizon 2020 research and innovation program under grant agreement No 652629.

Conflict of Interest Statement

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Footnotes

1. ^http://ec.europa.eu/maritimeaffairs/policy/documents/limassol_en.pdf (last accessed 05-10-2016).

2. ^See also http://www.fao.org/asiapacific/perspectives/blue-growth/en (last accessed 06-10-2016).

3. ^http://ec.europa.eu/newsroom/mare/itemdetail.cfm?subweb=342&lang=en&item_id=31238 (last accessed 05-10-2016).

4. ^https://ec.europa.eu/eusurvey/ (last accessed 05-10-2016).

5. ^http://www.investopedia.com/terms/i/investor.asp (last accessed 05-10-2016).

6. ^http://www.nationaalgroenfonds.nl/ (last accessed 05-10-2016).

7. ^http://www.eib.org/ (last accessed 05-10-2016).

8. ^http://www.nautilusminerals.com/IRM/content/default.aspx (last accessed 05-10-2016).

References

Aouni, B., Colapinto, C., and La Torre, D. (2014). Financial portfolio management through the goal programming model: current state-of-the-art. Eur. J. Oper. Res. 234, 536–545. doi: 10.1016/j.ejor.2013.09.040

Asker, J., Farre-Mensa, J., and Ljungqvist, A. (2015). Corporate investment and stock market listing: a puzzle? Rev. Financ. Stud. 28, 342–390. doi: 10.1093/rfs/hhu077

Ballestero, E., Bravo, M., Pérez-Gladish, B., Arenas-Parra, M., and Plà-Santamaria, D. (2012). Socially responsible investment: a multicriteria approach to portfolio selection combining ethical and financial objectives. Eur. J. Oper. Res. 216, 487–494. doi: 10.1016/j.ejor.2011.07.011

Barberis, N., Shleifer, A., and Vishny, R. (1998). A model of investor sentiment. J. Financ. Econ. 49, 307–343. doi: 10.1016/S0304-405X(98)00027-0

Belleflamme, P., Lambert, T., and Schwienbacher, A. (2014). Crowdfunding: tapping the right crowd. J. Bus. Ventur. 29, 585–609. doi: 10.1016/j.jbusvent.2013.07.003

Belt, M., and Blake, D. (2015). Investing in natural capital and getting returns: an ecosystem service approach. Bus. Strategy Environ. 24, 667–677. doi: 10.1002/bse.1895

Bennett, S., Gallagher, D. R., Harman, G., Warren, G. J., and Xi, L. (2016). Alpha generation in portfolio management: long-run Australian equity fund evidence. Aust. J. Manage. 41, 107–140. doi: 10.1177/0312896214539815

Berger, A. N., and Udell, G. F. (1998). The economics of small business finance: the roles of private equity and debt markets in the financial growth cycle. J. Bank. Financ. 22, 613–673. doi: 10.1016/S0378-4266(98)00038-7

Bertoni, F., and Tykvova, T. (2012). Which Form of Venture Capital is Most Supportive of Innovation? (2012). ZEW- Centre for European Economic Research Discussion, Paper No. 12-018. Available online at: http://ssrn.com/abstract=2018770

Bhattacharya, A., and Kojima, S. (2012). Power sector investment risk and renewable energy: a Japanese case study using portfolio risk optimization method. Energy Policy 40, 69–80. doi: 10.1016/j.enpol.2010.09.031

Blanco, M. I. (2009). The economics of wind energy. Renew. Sus. Energy Rev. 13, 1372–1382. doi: 10.1016/j.rser.2008.09.004

Børresen, T. (2013). Blue growth opportunities in sustainable marine and maritime sectors. J. Aquat. Food Prod. Technol. 22, 217–218. doi: 10.1080/10498850.2013.783748

Brav, A., Jiang, W., and Kim, H. (2015). The real effects of hedge fund activism: productivity, asset allocation, and labor outcomes. Rev. Financ. Stud. 28, 2723–2769. doi: 10.1093/rfs/hhv037

Bürer, M. J., and Wüstenhagen, R. (2009). Which renewable energy policy is a venture capitalist's best friend? Empir. Evid. Surv. Int. Cleantech Invest. Energy Policy 37, 4997–5006. doi: 10.1016/j.enpol.2009.06.071

Clapp, C. S., Alfsen, K. H., Torvanger, A., and Lund, H. F. (2015). Influence of climate science on financial decisions. Nat. Clim. Chang. 5, 84–85. doi: 10.1038/nclimate2495

Cumming, D. (2007). Government policy towards entrepreneurial finance: innovation investment funds. J. Bus. Ventur. 22, 193–235. doi: 10.1016/j.jbusvent.2005.12.002

Dalal, S. P., Bonham, C., and Silvani, A. (2015). “An investigation on ecosystem services, the role of investment banks, and investment products to foster conservation,” in Responsible Investment Banking, ed K. Wendt (Cham: Springer International Publishing), 285–300.

Demertzidis, N., Tsalis, T. A., Loupa, G., and Nikolaou, I. E. (2015). A benchmarking framework to evaluate business climate change risks: a practical tool suitable for investors decision-making process. Clim. Risk Manag. 10, 95–105. doi: 10.1016/j.crm.2015.09.002

European Commission (2012). Blue Growth – Opportunities for Marine and Maritime Sustainable Growth – Communication from the Commission to the European Parliament, the Council, the European Economq1ic and Social Committee and the Committee of the Regions. Luxembourg: Publications Office of the European Union.

European Commission (2014). Innovation in the Blue Economy: Realising the Potential of our Seas and Oceans for Jobs and Growth. Brussels: European Commission.

Fich, E. M., Harford, J., and Tran, A. L. (2015). Motivated monitors: the importance of institutional investors's portfolio weights. J. Financ. Econ. 118, 21–48. doi: 10.1016/j.jfineco.2015.06.014

Hartley, J., Sørensen, E., and Torfing, J. (2013). Collaborative innovation: a viable alternative to market competition and organizational entrepreneurship. Public Adm. Rev. 73, 821–830. doi: 10.1111/puar.12136

Helms, T., Salm, S., and Wüstenhagen, R. (2015). “Investor-specific cost of capital and renewable energy investment decisions,” in Renewable Energy Finance: Powering the Future, ed C. W. Donovan (London: Imperial College Press).

Iihara, Y., Kato, H., and Tokunaga, T. (2016). “Investors” herding on the Tokyo Stock Exchange,” in Behavioral Economics of Preferences, Choices, and Happiness, eds S. Ikeda, H. K. Kato, F. Ohtake, and Y. Tsutsui (Tokyo: Springer Japan), 639–666.

Karltorp, K. (2016). Challenges in mobilising financial resources for renewable energy—The cases of biomass gasification and offshore wind power. Environ. Innov. Soc. Trans. 19, 96–110. doi: 10.1016/j.eist.2015.10.002

Kirby, C., and Ostdiek, B. (2012). It's all in the timing: simple active portfolio strategies that outperform naive diversification. J. Financ. Quant. Anal. 47, 437–467. doi: 10.1017/S0022109012000117

Kleih, U., Linton, J., Marr, A., Mactaggart, M., Naziri, D., and Orchard, J. E. (2013). Financial services for small and medium-scale aquaculture and fisheries producers. Mar. Policy 37, 106–114. doi: 10.1016/j.marpol.2012.04.006

Lee, S. Y., Park, Y. S., and Klassen, R. D. (2015). Market responses to firms' voluntary climate change information disclosure and carbon communication. Corp. Soc. Responsibi. Environ. Manag. 22, 1–12. doi: 10.1002/csr.1321

Leete, S., Xu, J., and Wheeler, D. (2013). Investment barriers and incentives for marine renewable energy in the UK: an analysis of investor preferences. Energy Policy 60, 866–875. doi: 10.1016/j.enpol.2013.05.011

McIntyre, R. (2014). Overcoming “The Valley of Death”. Sci. Prog. 97, 234–248. doi: 10.3184/003685014X14079421402720

Mollick, E. (2014). The dynamics of crowdfunding: an exploratory study. J. Bus. Ventur. 29, 1–16. doi: 10.1016/j.jbusvent.2013.06.005

Moodley, T., Ward, M., and Muller, C. (2017). The relationship between the management of payables and the return to investors. South Afr. J. Account. Res. 31, 35–43. doi: 10.1080/10291954.2015.1105555

Osawa, Y., and Miyazaki, K. (2006). An empirical analysis of the valley of death: large-scale R&D project performance in a Japanese diversified company. Asian J. Technol. Innov. 14, 93–116. doi: 10.1080/19761597.2006.9668620

Pinto, H., Cruz, A. R., and Combe, C. (2015). Cooperation and the emergence of maritime clusters in the Atlantic: analysis and implications of innovation and human capital for blue growth. Mar. Policy 57, 167–177. doi: 10.1016/j.marpol.2015.03.029

Raddatz, C., and Schmukler, S. L. (2013). Deconstructing herding: evidence from pension fund Investment behavior. J. Financ. Serv. Res. 43, 99–126. doi: 10.1007/s10693-012-0155-x

Renneboog, L., Ter Horst, J., and Zhang, C. (2008). Socially responsible investments: institutional aspects, performance, and investor behavior. J. Bank. Financ. 32, 1723–1742. doi: 10.1016/j.jbankfin.2007.12.039

Shiau, T. A., and Chuen-Yu, J. K. (2016). Developing an Indicator System for measuring the social sustainability of offshore wind power farms. Sustainability 8:470. doi: 10.3390/su8050470

Steffen, W., Richardson, K., Rockström, J., Cornell, S. E., Fetzer, I., Bennett, E. M., et al. (2015). Planetary boundaries: guiding human development on a changing planet. Science 347:1259855. doi: 10.1126/science.1259855

Stuart, R., and Abetti, P. A. (1987). Start-up ventures: towards the prediction of initial success. J. Bus. Ventur. 2, 215–230. doi: 10.1016/0883-9026(87)90010-3

Stuiver, M., Soma, K., Koundouri, P., van den Burg, S., Gerritsen, A., Harkamp, T., et al. (2016). The Governance of multi-use platforms at sea for energy production and aquaculture: challenges for policy makers in European seas. Sustainability 8:333. doi: 10.3390/su8040333

Swensen, D. F. (2009). Pioneering Portfolio Management: An Unconventional Approach to Institutional Investment, Fully Revised and Updated. New York, NY: Simon and Schuster.

Wüstenhagen, R., and Menichetti, E. (2012). Strategic choices for renewable energy investment: conceptual framework and opportunities for further research. Energy Policy 40, 1–10. doi: 10.1016/j.enpol.2011.06.050

Keywords: EU policy, blue growth, investors, investment theory, offshore wind, aquaculture

Citation: van den Burg SWK, Stuiver M, Bolman BC, Wijnen R, Selnes T and Dalton G (2017) Mobilizing Investors for Blue Growth. Front. Mar. Sci. 3:291. doi: 10.3389/fmars.2016.00291

Received: 13 October 2016; Accepted: 28 December 2016;

Published: 13 January 2017.

Edited by:

Eugen Victor Cristian Rusu, University of Galati, RomaniaReviewed by:

Zongze Shao, State Oceanic Administration, ChinaMelissa Garren, California State University, Monterey Bay, USA

Copyright © 2017 van den Burg, Stuiver, Bolman, Wijnen, Selnes and Dalton. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) or licensor are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Sander W. K. van den Burg, c2FuZGVyLnZhbmRlbmJ1cmdAd3VyLm5s

Sander W. K. van den Burg

Sander W. K. van den Burg Marian Stuiver

Marian Stuiver Bas C. Bolman1

Bas C. Bolman1 Trond Selnes

Trond Selnes