94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Hum. Dyn. , 06 March 2025

Sec. Digital Impacts

Volume 7 - 2025 | https://doi.org/10.3389/fhumd.2025.1485401

In recent years, the digital economy has developed rapidly. The following question arises: how do digital talents contribute to economic development? This study explores the role of digital talents from the perspective of corporate executives’ educational background in the digital economy. Based on the data of listed companies in the Shanghai and Shenzhen A-share markets from 2002 to 2020, this study examines the impact of corporate executives’ educational background in the digital economy on corporate innovation. The findings indicate that corporate executives’ educational background in the digital economy is positively related to corporate innovation. The results suggest that this effect occurs as a result of executives promoting digital transformation, understanding how to translate digital transformation into company innovation, and ultimately achieving improved productivity. The empirical conclusions contribute to the research on corporate executives and innovation, as well as providing a basis for government departments to formulate relevant policies to promote talent education.

Since the reform and opening up policy was introduced in 1978, China has made significant efforts to improve its technological capabilities and accelerate corporate innovation, achieving remarkable results. The period from 2008 to 2018 was a turning point in the development of Chinese enterprises. Prior to this, due to the limited cultural level of entrepreneurs, as well as the imperfect economic development policies and immature laws and regulations at the time, Chinese enterprises chose to imitate foreign brands and pursue “follow-up innovation” (Hua and Yue, 2025). After 2008, corporate innovation ushered in a new trend. Benefiting from the landmark policy of reform and opening up, the production capacity of enterprises greatly improved, transitioning from the previous shortage of supply to oversupply, and market competition became increasingly fierce (Lin et al., 1998; Zhu et al., 2021). Enterprises operating in the traditional mode were likely to be eliminated by the market. Therefore, various enterprises began to seek innovative transformation one after another. In addition, with the continuous advancements in science and technology, the internet has injected new momentum into corporate innovation. Against the backdrop of the establishment of internet companies such as Alibaba and Tencent, enterprises began to learn and apply internet technology to enhance their competitive advantage. Learning about the digital economy and even receiving academic education has become an important development for entrepreneurs to lead their companies to innovate in a way that was not the case in the pre-digital economy era (Cui et al., 2024).

When Chinese enterprises formulate their innovation strategy, they often consider policy factors. The innovation process, especially digital innovation, is inevitably influenced by policies related to talent education and innovation incentives. Scholars have also highlighted that education and human capital are important factors affecting corporate innovation, as they can promote technological progress and economic growth (Song et al., 2023). However, these studies have not considered the impact of senior executives’ educational background in the digital economy (Rothberg and Erickson, 2017; Verhoef et al., 2021). Teece (2018) suggested that executives’ academic backgrounds can help companies innovate more efficiently and that female executives, with their stronger risk-aversion awareness, promote innovation through increased investment. However, the executives’ past work experience, unlike innate characteristics such as gender and personality, is a trait that develops over time. This not only equips them with professional knowledge and capabilities, but also helps them develop a unique decision-making style and can even influence their cognitive patterns and mindsets (Li and He, 2023). The educational background of senior executives in the digital economy (such as through study of the digital economy itself, data science and big data technology, and artificial intelligence) is also an acquired trait that can increase their professional knowledge in the digital economy and enable them to master relevant digital technologies. This may impact the company’s innovation (Malmendier et al., 2011; Schlegel et al., 2021).

Based on this context, this paper examines the relationship between senior executives’ educational background in the digital economy and corporate innovation, as well as the heterogeneity of this relationship, using Chinese A-share listed companies from 2002 to 2020 as the research sample. It also analyses the potential economic consequences of this relationship.

The upper echelons theory suggests that the top management team is primarily responsible for formulating and implementing the company’s strategy (Zhu et al., 2021). Senior executives’ cognitive level and personal background directly influence the company’s strategic decision-making, which in turn affects the company’s innovation performance (Hambrick and Mason, 1984). Relatively comprehensive research has been conducted on the relationship between executive heterogeneity and corporate innovation performance, mainly focusing on investigating executive characteristics such as gender, work experience, overseas study background, and IT technical background (Klassen and Mclaughlin, 1996; Schlegel et al., 2021).

The first research stream examines the relationship between executive heterogeneity and corporate innovation. First, functional heterogeneity within the top management team is detrimental to improvement in firm performance (Klassen and Mclaughlin, 1996). Based on the heterogeneity of executive gender, it has been found that the participation of female executives can improve firm performance. A measure of the richness of executives’ professional experience can be constructed (Lin et al., 1998). Furthermore, a study from the perspective of executive team military experience found no significant relationship between military background and firm performance (Benmelech and Frydman, 2015). Regarding the relationship between executives’ academic educational background and corporate innovation, while many scholars believe that executives’ learning experiences can help improve their company’s innovation performance, some scholars still hold the opposite view. In general, enterprise executives with certain academic experience can better lead and supervise the various management levels and their company’s operations (Audretsch and Lehmann, 2006). Executives with academic experience can provide professional perspectives to analyze problems presented to the board of directors due to their professional knowledge reserves. At the same time, executives with academic experience can provide professional advice to the board of directors, improving the overall efficiency of the top management team and the company (Malmendier et al., 2011).

The second research stream is on the relationship between talent education and corporate innovation. Currently, most of the research on corporate innovation focuses on capital factors (Hsu et al., 2014), institutional factors (Homroy and Slechten, 2019), and product market characteristics (Aghion et al., 2005), with less attention paid to the role of talent factors and the education received by talented individuals in innovation. Based on the difference-in-differences (DID) and two-stage-least-square (2SLS) identification strategies, it is shown that the current basic research in Chinese universities may have a “disconnection” effect on corporate innovation activities (Newell and Marabelli, 2015). The research achievements of universities cannot be transformed into the foundation for corporate innovation (Rothberg and Erickson, 2017). To unblock the “last mile” of the transformation of university scientific and technological achievements, it is necessary to improve the mechanism of technology transfer offices, and universities need to coordinate the allocation of technology transfer resources both inside and outside the campus (Teece, 2018). Using mixed cross-sectional data, the operating efficiency of incubators has been found to have a positive promotion effect on the innovation capability and innovation performance of enterprises (Unger et al., 2011). Incubators can concentrate resources to promote the transformation of scientific and technological achievements, as well as cultivating entrepreneurs or senior management personnel with relevant professional knowledge reserves. The impact of education on corporate innovation is also reflected in its influence on the location of enterprises. Higher education can positively impact the agglomeration of enterprises within a region, thereby promoting enterprise innovation (Schlegel et al., 2021). Industry-university-research collaboration can effectively improve the overall innovation input and output level of the region. Furthermore, in the process of collaborative innovation, the connection between enterprises and universities, as well as the connection between enterprises and research institutions, has a significantly positive impact on regional innovation performance (Waldman et al., 2001; Wu and Parker, 2013).

Existing literature has focused on studying the relationship between top executives and corporate innovation. However, there is still a lack of depth in the literature in terms of specific traits of top executives. Current research has only examined the impact of certain traits such as gender differences and military experience on corporate innovation, while traits like digital economy education have received less attention (Chamorro-Premuzic et al., 2008; Murray et al., 1990). That is, this paper could make a contribution to understanding how specific traits of top executives influence corporate innovation. Specifically, this study aims to broaden the research scope on the influencing factors of corporate innovation. Many scholars have examined the characteristics of management teams from different perspectives, such as the average age, proportion of female executives, and professional backgrounds, and their impact on corporate decision-making or innovation performance (Dooley et al., 2022; Zhang and Li, 2023). However, there is limited empirical research on the influence mechanism of executives’ educational background, especially their education in the digital economy, on corporate innovation. This study could open up a new perspective by focusing on the impact of executives’ educational background on corporate innovation, further distinguishing between digital economy-related and non-digital economy-related educational backgrounds, thereby expanding the research on the influencing factors of corporate innovation. Based on the upper echelons theory, this paper analyses the inherent relationship between executives’ educational background in the digital economy and companies’ efficient innovation, thereby supplementing existing research. Such research helps to demonstrate the value of digital upskilling and has the potential to inform recruitment of executive talent in Chinese companies.

High-level theories suggest that top executives in organizations develop different traits as a result of their education and work experiences. These traits can influence their focus, cognitive abilities, and decision-making processes, leading to different choices when analyzing the company’s situation and formulating strategic decisions. Ultimately, these choices impact the firm’s behavioral decisions and innovation performance (Hambrick and Mason, 1984). These traits provide decision-makers with thinking styles that can be applied when facing problems, as well as a repository of past solutions that can be matched with current issues (Frynas et al., 2018). This results in repetitive and familiar behavioral tendencies or cognitive biases, causing decision-makers to categorize and consider problems in habitual ways and prefer choices that align with their experiences. Similarly, top executives with an educational background in the digital economy are more likely to focus on efficient innovation within the context of digital economy development. They can contribute their ideas and insights to the company, pointing out new directions and pathways for innovative transformation, and subsequently engaging in corresponding innovative actions. Executives with digital economy education often invest significant effort in addressing innovation-related issues and exploring the economic benefits that innovation brings to the company. The greater the investment in human and financial resources in these areas, the lower the likelihood of losing control. Existing research has already demonstrated the crucial role of executive attention in organizations as a key driver of innovation, accelerating the entry of firms into new technology markets (Eggers and Kaplan, 2009).

Executives with an educational background in the digital economy possess knowledge reserves in the digital economy field. They are more familiar with and understand the principles and professional knowledge related to innovation in the context of the digital economy, and they can reasonably predict the consequences of certain innovation decisions. Does this benefit the company or bring difficulties to it? Executives with similar educational backgrounds can comprehensively evaluate and reduce risks. A favorable business environment is crucial for a company to establish itself in the market. Different companies allocate financial expenses differently during their operations. In this situation, acquiring resources and information is particularly important for the company (Homroy and Slechten, 2019). Executives with an educational background in the digital economy have a comprehensive understanding of their company’s overall financial situation and can evaluate whether it is suitable for innovation at a given time. They can make decisions to ensure a steady progression of innovation for the company. Based on the above, the following hypothesis is proposed in this study:

H1: Corporate executives’ educational background in the digital economy will be positively related to corporate innovation.

With the deep integration of the digital economy and the physical economy, digital transformation has become an inevitable choice for companies to adapt to the development of the digital economy era. Digital transformation refers to the comprehensive reconstruction and transformation of business processes, organizational structures, value-creation methods, and customer experiences through the use of digital technology and information, in order to adapt to the changes and competitive environment of the digital economy era. The goal of digital transformation is to achieve digitization, intelligence, and innovation of business operations, in order to improve efficiency, enhance competitiveness, and create more value. It is not simply about migrating traditional business to internet platforms, but rather involves integrating various digital technologies and data resources, as well as redesigning organizational culture and processes, to achieve a high-level transformation of business models and operating methods. The transformation process involves the application of digital intelligent technologies such as cloud computing, algorithms, blockchain, and big data analytics, which are applied to various aspects of enterprise activities, including production operations, daily management, and research and development innovation. By capturing digital opportunities and creating digital value, companies can ultimately generate economic benefits and non-economic effects (Verhoef et al., 2021; Van Tonder et al., 2020).

The formulation and implementation of digital transformation strategies in companies fundamentally rely on the top management team. To a certain extent, the decision-making logic, decision-making styles, and risk preferences of strategic decisions have a decisive impact on the effectiveness of corporate strategic decisions. Building upon the high-level team theory mentioned earlier, traits such as gender, age, educational background, and personal experiences of the executive team have a profound influence on corporate strategic decision-making, including digital transformation strategies (Hambrick and Mason, 1984). According to the imprinting theory, during a specific sensitive period, the external environment in which individuals find themselves leaves an “imprint” on them. This “imprint” silently influences their personality traits and continues to impact their cognitive structures and values, profoundly affecting their management decisions (Marquis and Tilcsik, 2013). The educational background of executives enables them to develop cognitive imprints related to digital transformation, providing them with a comprehensive and concrete understanding of the digital economy and digital practices. This assists companies in adopting digital transformation strategies in their production and management processes. Simultaneously, companies are motivated to develop digital technology applications and integrate them into their operational management (Dyck et al., 2019). Executives’ educational background in the digital economy also enables them to develop competency imprints related to digital transformation. These competencies include problem identification, situation analysis, and teamwork, which are reflected in their participation in major strategic decision-making and implementation processes. Digital transformation in companies requires the construction of a digital cognitive system through the integration of digital intelligent technologies. This involves incorporating digital technologies into various aspects of production, management, and sales processes, while continuously exploring further technological innovations. To achieve this, executive teams need to possess the knowledge and skills necessary for digesting and applying digital transformation, ultimately influencing the effectiveness of digital transformation in companies. Based on this, this study proposes the following hypothesis:

H2: Executives with a background in digital education are more adept at assisting companies with digital transformation, which ultimately shows a positive correlation with the firms’ innovation performance.

Total Factor Productivity (TFP) is an indicator that measures the overall production efficiency of an economy or production unit. It reflects the efficiency level at which an economy or production unit utilizes and combines production factors to generate output, given a certain input of production factors. Traditional productivity measures typically consider the relationship between inputs and outputs of labor or capital, while TFP takes into account the comprehensive impact of all production factors, such as labor, capital, and technology. It measures the overall effectiveness of production factors, including the influence of factors such as factor allocation, combination, technological innovation, and management on production efficiency. The calculation of TFP is typically done using the production function approach, comparing actual output with the theoretical maximum output (Duran et al., 2016). TFP is of great significance to economic development. When the TFP growth rate of an economy or production unit exceeds the growth rate of factor inputs, it means that it is able to achieve higher output with the same level of resource inputs, thereby enhancing economic efficiency and competitiveness. From the perspective of efficiency improvement, existing research has shown that resource allocation efficiency has a significant impact on the TFP of companies.

As decision-makers of companies, corporate executives have a significant influence on the allocation of all resources, and the extent of this influence depends on the level of human capital they possess. Executives with an educational background in the digital economy, due to their exposure to digital economy-related education or relevant training, are able to enhance their own human capital. Moreover, their educational background in the digital economy enhances their professional cognitive level, improves their ability to grasp opportunities when faced with them, and helps companies make more appropriate decisions in areas such as investment, financing, and technological research and development. Therefore, when executives who have received digital economy-related education at universities or have undergone relevant training in this field join a company, their educational background can assist the management in making decisions that are more conducive to the development of the company. They can introduce and adhere to stricter corporate governance guidelines and improve the efficiency of resource allocation in the company (Giannetti et al., 2015). This study proposes the following hypothesis:

H3: Corporate executives’ educational background in the digital economy can promote innovation within the company through enhancing production efficiency. Executives with a background in digital education contribute to enhancing production efficiency for companies in the digital economy era, which ultimately shows a positive correlation with the firms’ innovation performance.

Corporate innovation is an activity that requires both foresight and risk-taking. In the context of global technological advancements and digital technologies driving industrial transformation, companies across industries need to innovate and upgrade their technologies to adapt to the current technological environment and enhance their competitiveness. The risk choices made in corporate innovation investment decisions have a significant impact on company development and economic growth. Corporate executives’ educational background in the digital economy makes it easier for them to grasp the current digital technology transformation and engage in innovative activities. In other words, when executives’ educational background aligns with current mainstream technologies, this provides corporate executives with a “foresight” perspective. This makes it easier for them to venture into unexplored frontiers in innovation activities, further enhancing corporate innovation levels. Furthermore, managers with a “venture spirit” are more confident in their decision-making abilities and are likely to actively explore opportunities in high-risk, high-reward areas. Executives with a venture spirit believe that their knowledge aligns well with the future development of the company, allowing them to make accurate judgments on innovative projects. As a result, they exhibit a stronger risk appetite when selecting investment projects, which leads to better risk identification and utilization of valuable investment opportunities. Therefore, from the perspective of risk-taking, having relevant educational background in the digital economy can encourage managers to better identify and utilize valuable investment projects, thereby improving innovation efficiency. In summary, the following hypothesis is proposed in this study:

H4: Corporate executives’ educational background in the digital economy can promote innovation within the company through the “venture spirit” of the executives. Executives with a background in digital education are more inclined to take risks, which ultimately correlates positively with the innovation performance of the firms.

This study primarily uses A-share listed companies from 2002 to 2020 as the research sample. The educational background in the digital economy mentioned in this paper is part of the executives’ educational background, which is the personal trait data of the corporate executives. In the China Stock Market & Accounting Research (CSMAR) database, relevant and relatively complete data regarding their educational background in the digital economy starts from 2002. The personal information data of corporate executives, equity structure data, board structure data, and corporate characteristics data were obtained from the CSMAR database. Data was also collected on research and development investment from the listed company database. After excluding financial companies and newly listed companies in the respective years, a total of 21,613 observations were obtained. To eliminate the influence of outliers, a 1% winsorization process was applied to continuous variables. Additionally, the industry classification of companies was determined based on the two-digit industry codes outlined in the China Securities Regulatory Commission’s “Guidelines for Industry Classification of Listed Companies” (2012 revised edition).

To examine the relationship between corporate executives’ educational background in the digital economy and corporate innovation, the innovation outcomes of companies was measured using the annual number of patent applications. The number of patent applications (Patent) represents the total number of patent projects that a company applies for in a given year. Following the studies conducted by Dosi et al. (2006) and Zhou et al. (2012), the choice of using patent applications as the dependent variable was based on several considerations. First, patent grants require time for examination and are subject to greater uncertainty and instability (Beck et al., 2011). Second, patent applications can be influenced by bureaucratic factors. Therefore, the number of patent applications was selected as the dependent variable to measure the innovation outcomes of companies.

This study aimed to examine the impact of corporate executives’ educational background in the digital economy on corporate innovation. Corporate executives play a crucial role in companies and have the ability to influence strategic decision-making. The educational background of executives refers to their learning experiences in higher education during their diploma or undergraduate studies. With the rapid development of the digital economy, companies face new challenges in innovation, and traditional business models or strategic approaches may no longer meet the demands of market competition. The educational background of executives, especially in the field of digital economy, has gradually become a key factor influencing corporate innovation. Therefore, in this study, the digital economy educational background of the corporate executives included disciplines such as information management, artificial intelligence, automation, computer science and technology, and big data technology. If corporate executives had an educational background in the digital economy, they were assigned a value of 1; otherwise, they were assigned a value of 0.

This study adopted the research methodology of existing literature (Eccles and Serafeim, 2013; Amore and Bennedsen, 2015), controlling for the following variables: firm age (FirmAge), firm size (Size), leverage ratio (Lev), proportion of independent directors (Indir), proportion of shares held by the largest shareholder (Top1), operating cashflow ratio (Cashflow), executive salary level (Salary), proportion of R&D personnel (Rdpersonratio), R&D expenditure as a percentage of operating income (Rdspendsumratio), and enterprise digitization level (Digital).

Control variables were mainly selected at the firm level, including firm age (Fage) and firm size (Size). Differences in these variables may impact innovation investment activities. For example, older firms that have been established for a longer period of time may become more rigid and less inclined to engage in innovation. Additionally, variables such as leverage ratio (Lev), return on assets (ROA), and firm growth (Growth) reflect the overall business performance and the level of available innovation resources. At the corporate governance level, variables such as CEO and Chairman duality (Dual) and executive shareholding (ESH) were considered. These variables capture the magnitude of decision-making power of top executives and may influence the decision-making process regarding innovation investments. Furthermore, family-related variables were included, such as family shareholding (FSH), which represents the proportion of shares held by all family members. A higher value indicates stronger family control, which may make family firms more conservative and less inclined to invest in innovation. Considering the potential influence of macroeconomic and industry factors on innovation, this study incorporated annual (Year) and industry (Industry) dummy variables in the model.

The definitions and measurements of the main variables in this study are shown in Table 1.

In order to examine the impact of executives’ educational background in the field of digital economy on corporate innovation, this study established the following Equation 1:

The variable Patent represents the number of annual patent applications made by the company, which serves as a proxy for the level of innovation. The explanatory variable Major specifically refers to the educational background of executives in the field of digital economy. If the executives have such an educational background, they were assigned a value of 1; otherwise, they were assigned a value of 0. Zi represents the control variables, which include variables such as leverage ratio (Lev), proportion of independent directors (Indir), proportion of shares held by the largest shareholder (Top1), operating cashflow ratio (Cashflow), executive salary level (Salary), enterprise digitization level (Digital) and others. δyear represents year fixed effects, δindustry represents industry fixed effects, and εi represents other disturbance terms.

Table 2 presents the descriptive statistics of the variables. From the table, it can be observed that the dependent variable, the number of patent applications Patent, ranges from a minimum value of 0 to a maximum value of 9.702, indicating significant variation in innovation outcomes across different companies. The standard deviation of 1.288 and mean of 3.375 suggest that the overall level of innovation in Chinese companies is slightly lower. The mean value of the variable representing a digital economy educational background (Major) is 0.044, indicating that less than 10% of executives in the sample have received education in this field. The mean value of leverage ratio (Lev) is 0.385, indicating that a majority of firms still maintain a relatively conservative capital structure policy. The maximum value of the operating cashflow ratio (Cashflow) is 0.661, while the minimum value is −0.587, indicating significant differences in operational capabilities among companies. The maximum value of the proportion of independent directors (Indir) is 8, the minimum value is 0, and the mean value is 3.049, suggesting that most companies tend to appoint independent directors. The wide range and standard deviation of the variable representing the proportion of shares held by the largest shareholder (Top1) indicate significant variations in shareholding among the largest shareholders of different companies. Some companies have a stake of over 50%, which may have an impact on their strategic decisions, including innovation. Both firm age (FirmAge) and firm size (Size) exhibit large ranges, indicating significant differences among companies in different industries. The large range of the variables representing the proportion of R&D personnel (Rdpersonratio) and R&D expenditure as a percentage of operating income (Rdspendsumratio) reflects the substantial variation in company sizes, which is a common phenomenon.

The regression results for the relationship between executives’ educational background in the digital economy and the number of annual patent applications are presented in Table 3. In Column (1) of Table 3, the number of patent applications is taken as the dependent variable, and executives’ educational background in the digital economy is the independent variable. The regression coefficient is reported as 0.1814, which is significant at the 1% level. This suggests that executives’ educational background in the digital economy has a positive and significant effect on promoting corporate innovation, providing support for hypothesis H1. In order to further confirm the relationship between the two variables, a truncation procedure was employed by replacing values below the 1st percentile with the value at the 1st percentile, and values above the 99th percentile with the value at the 99th percentile. This was done directly without creating new variables, and the results are shown in Column (2).

In terms of control variables, the proportion of shares held by the largest shareholder, leverage ratio, and operating cashflow ratio show a negative correlation with the number of patent applications. This suggests that as the ownership of shares becomes more concentrated, companies are more likely to be influenced by conservative decisions made by the largest shareholder. This also leads to higher levels of debt, as executives may be less willing to invest in long-term, risky innovation projects. Additionally, a higher operating cashflow ratio indicates that the company’s focus is more on operational activities, resulting in reduced investment in innovation. This suggests that companies with lower operational pressure and a primary focus on innovation tend to achieve better innovation outcomes. When the proportion of shares held by directors is at a relatively balanced level, it facilitates a more collaborative decision-making process, reducing the likelihood of one-sided decision-making. Furthermore, the proportion of R&D personnel, R&D expenditure as a percentage of operating income, and the number of patent applications show a consistently positive correlation. This indicates that the more resources and personnel a company allocates to innovation, the more likely it is to achieve innovative outcomes. This further confirms the previous statement that companies that prioritize day-to-day operations tend to have a lower emphasis on innovation.

The regression method used in this study, as mentioned earlier, is ordinary least squares regression. However, the panel Poisson fixed effects model can be employed to control for individual fixed effects, allowing for the control of the impact of individual characteristics on the dependent variable. This control helps to mitigate individual heterogeneity and reduces endogeneity issues arising from changes in individual characteristics. Moreover, the panel Poisson fixed effects model is suitable for panel data, which includes both cross-sectional and time dimensions. This model can better utilize the information in panel data, providing more comprehensive and accurate analytical results. In Table 4, the Column (1) results present the examination of the relationship between executives’ educational background in the digital economy and corporate innovation using the panel Poisson fixed effects model. From the table, it can be observed that the regression coefficient for executives’ educational background in the digital economy and the number of patent applications is reported as 0.0685, which is significant at the 1% level. This indicates that hypothesis H1 is supported, suggesting a positive relationship between executives’ educational background in the digital economy and the number of patent applications.

The problem that may be caused by setting the explained variable as the number of annual applications of the enterprise is that it only pays attention to the number of declarations of the enterprise, and does not pay attention to whether there is any misstatement in the application profession. Therefore, the explained variable was replaced by the number of granted patents, and the correlation was re-examined. The results obtained are shown in Table 4, Column (2). The regression coefficient between the professional education of senior executives in digital economy and the number of patents granted by enterprises is 0.1988, which is significant at the 1% level, indicating that hypothesis H1 is valid.

To enhance the reliability of the research conclusions, this study also adopted patent quality as an alternative dependent variable for regression analysis. Specifically, patent quality was used for measuring the quality of corporate innovation. It was done by reflecting the knowledge breadth of patents through the diversity of the large group classification numbers contained in the patents, based on the IPC classification (International Patent Classification) used in patent documents from the China National Intellectual Property Administration. This study adopted a weighted approach similar to the Herfindahl index, with the specific formula defined as: Qualityit=1−∑α2 , where 𝛼 represents the proportion of each large group in the IPC classification. In this context, greater differences among the large groups in the IPC classification of patents lead to a higher Qualityit indicating better quality of corporate innovation output. The Column (3) of Table 4 presents the regression results of the impact of corporate executives’ digital education background on patent quality. The results indicate that, the professional education of senior executives in digital economy and the number of patents granted by enterprises is 0.1853, which is significant at the 5% level.

As the corporate executives’ digital education background is a core explanatory variable of this study, this paper re-measured it by using the proportion of executives with a digital education background. The robustness check for the core explanatory variable is shown in Table 4, Column (4). The regression coefficient between the professional education of senior executives in digital economy and the number of patents granted by enterprises is 13.2939, which is significant at the 1% level, indicating that hypothesis H1 is valid.

The development of internet education in higher education institutions can be summarized in several stages. The 1990s to the early 2000s marked the early experimental phase; internet education in higher education started in the 1990s with distance education as the primary form. Schools began to explore the use of internet technology to provide distance learning courses, primarily through email and online forums for teacher–student communication and sharing of teaching resources. However, due to technological limitations and immature network conditions at the time, the overall development was relatively limited. From the mid-2000s to the 2010s, with the rapid development of internet technology and network infrastructure, internet education in higher education institutions entered a phase of rapid growth. In 2002, internet education became widely implemented in higher education institutions, with many universities establishing online learning platforms to offer online courses and learning resources. During this stage, internet education gradually transitioned from distance education to online education, adopting various teaching methods such as online video courses, virtual laboratories, and online discussions. This provided learners with more flexible and convenient learning opportunities. In the mid-2010s, higher education institutions officially entered the stage of integrating “Internet + Education,” further merging internet education with the concept of Internet+. Schools began actively exploring innovative teaching models such as blended learning and flipped classrooms, combining online and offline teaching resources to provide a more diverse and personalized learning experience. Additionally, more online education platforms and resource providers emerged, offering higher education institutions increased educational technology support and services. For the selected sample period in this study, the condition was set to include only executives whose graduation year was after 2006. The results are shown in Table 4, Column (5) and the regression coefficient is 1.0361, which is significant at the 1% level. Hypothesis H1 is valid.

To mitigate the potential impact of other factors on the empirical research, this study considered incorporating fixed effects for the industry to which the enterprises belong in the baseline empirical equation. This approach aims to provide a more accurate estimation of the relationship between the digital education background of corporate executives and its impact on enterprise innovation. The results obtained are shown in Table 4, Column (6). The regression coefficient between the professional education of senior executives in digital economy and the number of patents granted by enterprises is 0.1389, which is significant at the 1% level, indicating that hypothesis H1 is valid.

Based on the availability of data on corporate innovation and considering the time lag from innovation input to patent application, this study followed the approach of Benmelech and Frydman (2015), opting to lag all control variables by one period. The lagged control variables were assigned the maximum weight to examine the factors influencing corporate innovation. This approach helped to mitigate issues such as multicollinearity, reverse causality, and omitted variables. Based on the results presented in Column (7) of Table 4, it is observed that all variables, including both independent and control variables, maintain significant correlations even after being lagged by one period. The regression coefficient for lmajor and patent_apply is reported as 0.3385, which is significant at the 1% level.

The above four robustness tests show that enterprise executives’ educational background in the digital economy can indeed promote enterprise innovation. Therefore, hypothesis H1 is supported with high confidence and the conclusion is relatively robust.

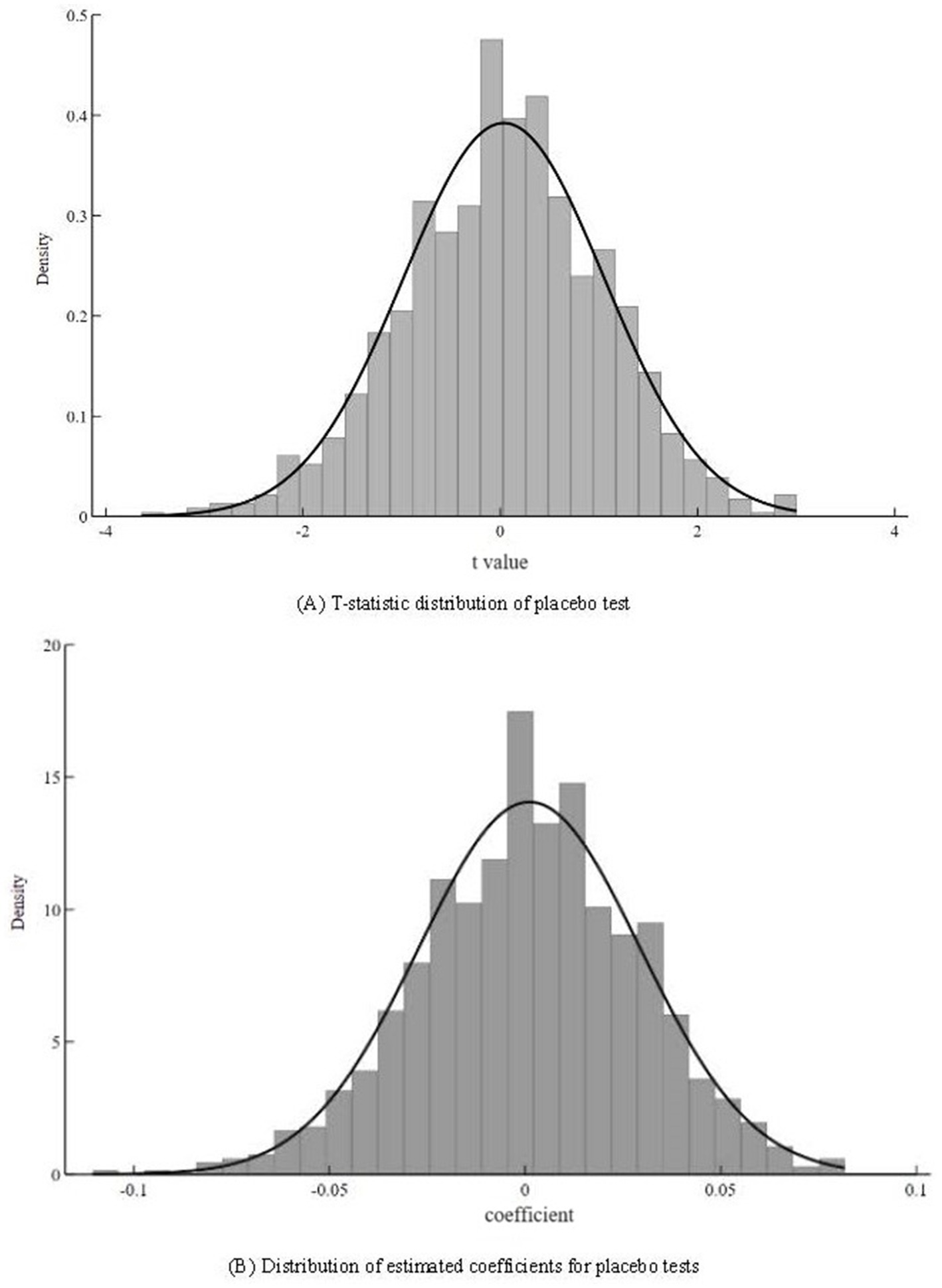

To mitigate the potential influence of unobservable random factors on the regression results regarding the impact of executives’ educational background in the digital economy on corporate innovation, a placebo test was also conducted. First, for the listed companies in the research sample, a treatment group was randomly generated and educational backgrounds in the digital economy were assigned to their executives. A total of 1,000 repeated regressions were performed using this randomly assigned data. After 1,000 repetitions of random assignment and regression, the regression coefficients were found to be concentrated around zero, significantly smaller than the coefficient of 0.18 in the baseline regression. Figure 1, specifically (a), presents the distribution of coefficient values from the 1,000 random regressions, while (b) presents the distribution of t-statistics from the 1,000 random regressions. From the values of the t-statistics, it can be observed that they are centered around zero, with only a few regressions having absolute t-values greater than 2. This indicates that the results from the random assignment and 1,000 regressions are not statistically significant. This further suggests that even when considering the interference of unobservable random factors, the impact of executives’ educational backgrounds in the digital economy on corporate innovation remains robust.

Figure 1. Comparison of digital patent and high-value patent ownership between China and foreign countries. (A) T-statistic distribution of placebo test. (B) Distribution of estimated coefficients for placebo test.

To further explore the causal relationship between executives’ educational background and corporate innovation while controlling for other firm characteristics, this study employed the propensity score matching (PSM) method for robustness checks, following the approach of Fan et al. (2023). For each company with executives graduating in digital economy, the control variables mentioned earlier were used as matching variables. In this approach, a matching company is identified that is similar in all other aspects but does not have executives with an educational background in the digital economy. By comparing the innovation performance of these two “similar” companies, one with executives educated in digital economy and the other without, the impact of executives’ educational background can be assessed. A Logit model was used to estimate the propensity scores, and a 1:1 nearest neighbor matching method was applied. Table 5 presents the results of the matched sample, showing no significant differences in covariates after matching. Based on the PSM method and the matched sample, the robustness check regression results are shown in Table 5, Column (1). The regression results indicate that digitalization of the firm still significantly improves innovation efficiency at the 1% level, validating the robustness of the findings.

To address potential endogeneity issues that may arise from reverse causality, this study also employed the instrumental variable (IV) approach. Specifically, instrumental variables were constructed using the heteroscedasticity-based IV method. According to Lewbel (2012), constructing instrumental variables based on the residuals from regressing the core explanatory variable on other exogenous variables in the model can provide strong instrument relevance and a high correlation with the core explanatory variable. Following the approach of Lewbel (2012), the product of these residuals and the de-meaned exogenous variable was used as the instrumental variable. The 2SLS method was then applied to estimate the regression, and the results are shown in Columns (2) and (3) of Table 5.

The Heckman two-step method was employed to address the issue of sample selection and to respecify the regression model. Specifically, in the first stage of this process, a binary selection model was used to regress the dummy variable indicating the decision of executives to choose a digital economy major. In the first stage of the Heckman model, it is necessary to introduce exclusive constraint control variables. Following the approach, the executives’ household registration attribute was included in the model. The rationale behind this is that individuals with rural household registration and those with urban hukou may differ in whether they choose to study digital economy majors, as individuals born and raised in urban areas are more likely to be exposed to cutting-edge technologies. On the other hand, the household registration attribute of executives does not directly affect corporate innovation. Therefore, this study introduced whether an executive has an agricultural household registration as an exclusive constraint control variable in the first stage of the Heckman model and regressed it using a Probit model, with the executives’ educational background in the digital economy as the dependent variable. The corresponding “Inverse Mills Ratio” (IMR) was then calculated. In the second stage of the regression, the calculated IMR was included in the baseline equation, and its significance was used to determine whether the estimation bias caused by non-random sample is effectively addressed. Based on the aforementioned research approach, the final regression results are shown in Columns (4) and (5) of Table 5. The results of the second stage regression indicate that the coefficient of the IMR is significant, and the coefficient of the main explanatory variable is larger than in the baseline regression. Additionally, the VIF test value is 5.23, which is far below 10, indicating that the regression results using the Heckman two-step method are not affected by multicollinearity. These results suggest that even after considering the sample of firms that have not undergone digital transformation, the regression results remain significantly positive at the 1% level, confirming the positive impact of executives’ educational background in the digital economy on corporate innovation.

Based on the theoretical analysis presented above, it was proposed that executives’ educational background in the digital economy can promote corporate innovation by accelerating digital transformation, enhancing production efficiency, and harnessing executives’ entrepreneurial spirit. Considering the potential overuse and misapplication of the stepwise mediation analysis in economic analysis, this study adopted the operational guidelines for mediation analysis. Three intermediate variables that have a significant impact on corporate innovation performance were identified, and an empirical model was established to test the causal relationship between executives’ educational background in the digital economy and these intermediate variables.

In order to test hypothesis H2 that enterprise executives’ educational background in the digital economy can promote enterprise innovation by accelerating enterprise digital transformation, the following empirical model (Equation 2) was established:

where β0 represents the constant term and Digit represents the degree of digital transformation in the company. If its coefficient is significantly positive ( β1>0 ), it indicates that executives’ educational background in the digital economy can help accelerate the company’s digital transformation, thus promoting innovation. Zi represents a series of control variables at the company level, including variables such as leverage ratio, proportion of independent directors, and shareholding proportion of the largest shareholder. δyear represents year fixed effects, δindustry represents industry fixed effects, and εi represents other error terms; the same components are included in the below equation. Regarding the measure of digital transformation, the proportion of intangible assets related to the digital economy in the detailed items of listed companies’ intangible assets was used as a proxy variable. Specifically, when the detailed items of intangible assets include keywords such as “software,” “network,” “client,” “management system,” and “smart platform” that are relevant to digital transformation, these items were labeled as “intangible assets related to digital transformation.” The total value of multiple digital-related assets in the same company for the current year was then summed, and the proportion of this sum to the total value of intangible assets for the current year was calculated as a measure of the company’s digital transformation.

In order to test hypothesis H3, which states that educational background in the digital economy can promote firm innovation by contributing to firm productivity enhancement, the following empirical model (Equation 3) was established:

where TFPit represents the total factor productivity calculated using the Olley-Pakes method. If its coefficient is significantly positive ( β1>0 ), it indicates that digital technology can promote productivity, improve the efficiency of utilizing and combining production factors to generate output, and stimulate innovation activities in companies. In terms of measuring TFP, this study used the Olley-Pakes method for estimation.

In order to test the hypothesis H4 that the educational background of enterprise executives specializing in the digital economy can give executives a “risk-taking spirit,” which further promotes improvement in the level of enterprise innovation, this study established the following empirical model (Equation 4):

With reference to the practices of Zhu et al. (2021), the measurement methods of “risk-taking spirit” in this study were as the following Equation 5:

In the above formula, the lower corner mark i represents the enterprise, t represents the year, N represents the number of enterprises in the same industry, and Adj_ROAit represents the adjusted profit of enterprise i in the t year, which was calculated as the following Equation 6:

That is, adjustments to corporate profits were made using the ratio of corporate profits before tax, interest, depreciation, and amortization to corporate total assets, while taking into account the differences between firms in different industries. In order to remove the effect of industry heterogeneity, this study also used the mean industry profit-asset ratios to make adjustments.

Using the above model, the OLS method was employed to regress the dependent variable, and the regression results are reported in Table 6. Column (1) presents the impact of executives’ educational background in the digital economy on the company’s digital transformation. The results show that an educational background in the digital economy significantly promotes digital transformation at a 1% level of significance, thereby enhancing the company’s innovation capability and confirming hypothesis H2a. Column (2) reports the results of the regression analysis of executives’ educational background in the digital economy on total factor productivity (estimated using the Olley-Pakes method). Under a set of assumptions, the Olley-Pakes method provides consistent estimates of the company-level production function. One of the assumptions is that the proxy variable should exhibit a monotonic relationship with total output. This implies that samples with zero investment cannot be estimated and need to be excluded. In reality, due to the volatility of investments, it is not guaranteed that every year’s investment will yield positive returns, leading to the loss of many company samples during the estimation process. Levinsohn and Petrin (2003) identified this problem and developed a new method for estimating total factor productivity. This method replaces the original investment amount with intermediate input indicators as proxy variables, which are easier to obtain from a data perspective.

In addition, Levinsohn and Petrin (2003) also provide several methods to test the suitability of proxy variables, which greatly expands the range of potential proxy variables. The LP method allows researchers to flexibly select proxy variables based on the characteristics of available data. In this case, a one-unit increase in a digital economy educational background is associated with a 2.68% improvement in productivity. The results in Table 6 demonstrate that a background in the digital economy significantly optimizes the combination of various production factors at a 1% level of significance, thereby increasing productivity and promoting innovation activities in companies, confirming hypothesis H3. Column (3) presents the impact of executives’ educational background in the digital economy on their inclination toward an “entrepreneurial spirit.” The coefficient is slightly lower compared to the previous two mechanisms. However, the results show that executives with an educational background in the digital economy exhibit an entrepreneurial spirit at a 1% level of significance. These executives are more likely to lead companies in exploring new development paths and engaging in innovative activities. A one-unit increase in a digital economy educational background is associated with a 0.32% increase in innovation output for the company.

To examine the specific mechanisms through which executives’ educational background in different majors promotes innovation in companies, all of the executives’ majors were classified into five categories: Optoelectronics, Computer Science, Information Engineering, Digitalization, and Intelligent Management. The regression results are presented in Table 7. The overall results show that executives’ educational background in different majors has a significant positive impact on innovation in companies, effectively promoting innovation. Column (1) of Table 7 indicates that for each one-unit increase in educational background in the specific major, the company’s innovation level improves by 0.3268%. Optoelectronics technology and related industrial capabilities have become important indicators of a country’s comprehensive strength and international competitiveness. Innovation in optoelectronics not only injects new impetus into the development of optoelectronic and intelligent manufacturing industries but also enhances regional industrial capabilities, supporting industrial transformation and innovation upgrades. The optical industry is also a key industry for innovative development. With the continuous maturity of photosensitive imaging device technology and its extensive integration into camera manufacturing, the demand for precision optical components in frontier areas such as human–computer interaction, smart glasses and holographic projection, and intelligent driving in the context of advancing science and technology will continue to increase and maintain high growth rates.

Column (2) of Table 7 shows that for each one-unit increase in educational background in the Computer Science major, the company’s innovation capability improves by 0. 1,035%. Computer technology, in the context of the digital economy, holds great significance for the development of modern enterprises as it enhances their operational efficiency and service quality. Digitalized computer technology is also a major hallmark of modern businesses. First, the application of computer technology provides enterprises with a broader source of data and more efficient data processing capabilities. This enables companies to better understand market demand and consumer behavior, providing robust data support for product development, service innovation, and management innovation. For example, through data analysis, companies can accurately understand consumer preferences, develop products that better meet market needs, and provide more personalized services. Second, the application of computer technology drives the digital transformation of enterprises. In the process of digital transformation, companies can enhance their competitiveness by improving production efficiency, reducing costs, and enhancing decision-making efficiency. For instance, through the application of industrial internet technology, companies can achieve remote monitoring and maintenance of equipment, thereby improving production efficiency and quality. Furthermore, the application of computer technology also promotes management innovation in companies. Through the application of enterprise information technology, businesses can achieve automation and optimization of business processes, thereby improving management efficiency. Additionally, through the application of data analysis and artificial intelligence technology, companies can make more accurate decisions, enhancing decision-making efficiency and quality. The application of computer technology, within the context of the digital economy, provides companies with broader opportunities and stronger support for innovation.

Column (3) of Table 7 shows that for each one-unit increase in educational background in the Information Engineering major, the company experiences a 0.1209% improvement in innovation level.

Column (4) of Table 7 indicates that for each one-unit increase in educational background in the Digitalization major, the company experiences a significant 1.7557% improvement in innovation level, making it the most significant among the five majors. For companies, the deep development of the digital economy not only brings about a strategic shift in direction but also serves as a tipping point for seeking breakthroughs in independent innovation (Vial, 2019). The educational background of executives in digitalization provides new opportunities and insights for product innovation in companies.

Column (5) of Table 7 shows that for each one-unit increase in educational background in the Intelligent Management major, the company experiences a 0.2048% improvement in innovation capability.

In addition to categorizing executives’ educational backgrounds into different majors, this study also classified companies based on two different perspectives: whether they belong to the digital industry and whether they belong to the high-tech industry. The regression results are presented in Table 8. Overall, the results show that the educational background of executives in digital economy majors has a significant positive impact on innovation in companies across various industries, indicating its effectiveness in promoting innovation. Columns (1) and (2) of Table 8 represent the impact of educational background in digital economy majors on digital and non-digital industries, respectively. From the data in the table, it can be observed that at a 1% significance level, the educational background of executives in digital economy majors can promote innovation development in digital industries, stimulating innovative momentum. However, for non-digital industries, this promotional effect is not particularly evident. Compared to traditional economies, the digital economy, with the help of digital technologies such as big data and blockchain, breaks the geographical limitations of traditional economies and fundamentally changes the current economic development patterns and industrial structure (Bertani et al., 2021). The emergence of the digital economy has accelerated the diffusion and absorption of digital technologies, allowing them to extend to both ends of the industrial chain and value chain (Guan and Ma, 2003), including vertical derivative industry chains and horizontal extended value chains, thereby potentially enhancing companies’ innovation capabilities. To regain market competitiveness, companies actively engage in innovative production organization methods and business model transformations.

Additionally, the digital economy empowers production and operations with digital technologies such as big data and cloud computing, accelerating the digitization process within industries. This compels companies to transition from traditional technologies to intelligent technologies, thereby enhancing their innovation capabilities. The digital economy exhibits synergistic effects, benefiting companies through strengthened collaboration and resource sharing in digital ecosystems. It facilitates the transfer and spillover of information and data elements among enterprises, enhancing the efficiency of knowledge conversion into innovative outcomes. This, in turn, promotes innovation outputs within companies. Furthermore, the digital economy changes the interactive dynamics between supply and demand, compelling companies to break free from the constraints of traditional business models. This enables companies to leverage digital technologies to accurately identify consumer needs, obtain timely product feedback, and align consumer demands with product innovation, thus enhancing their innovation capabilities. For example, companies actively interact with consumers through social media platforms, public accounts, and other mediums to gather insights on product improvements and system development. This allows them to provide personalized services, giving them a competitive advantage throughout the entire competition process. Moreover, the development of the digital economy permeates various production stages within companies, breaking the shackles of traditional factor markets. It provides technological support for companies’ digitalization and intelligent development, facilitating the improvement of production quality and efficiency. The digital economy can effectively enhance a company’s total factor productivity by alleviating financing constraints, improving technological innovation capabilities, and promoting digital transformation, ultimately fostering innovation within companies.

Columns (3) and (4) of Table 8 show the different impacts of educational background in digital economy majors on high-tech and non-high-tech industries. It can be seen from the data in the table that an educational background related to the digital economy has a more significant impact on high-tech industries than non-high-tech industries. At the 1% significance level, business executives’ educational background in digital economy majors has an impact on the innovation development of high-tech industry.

This study also divided companies based on their ownership structure. Table 8, Columns (5) and (6), illustrates the different impacts of educational background in digital economy majors on state-owned enterprises and non-state-owned enterprises. The data clearly shows that, at a significance level of 1%, executives with this educational background have a promoting effect on innovation development in both types of enterprises. However, this effect is more pronounced in non-state-owned enterprises. State-owned enterprises have long been considered a pillar of China’s national economic development and the economic backbone of Chinese socialism. State-owned enterprises generally have advantages in terms of resources, such as talent, technology, capital, and policy support, which are superior to those of private enterprises. They also face fewer constraints in terms of inadequate innovation investment due to financing issues. However, their disadvantages are also significant. Typically, under the control of a single state shareholder, state-owned enterprises often lack the motivation for innovation investment.

Di and Bu (2021) analyzed the nature of state-owned enterprises from an agency perspective, highlighting that state-owned enterprises are collectively owned by the entire nation. The control rights of state-owned enterprises are delegated from hierarchical organizations to the government, which then authorizes the management of the enterprises to have these control rights. However, as a result, ordinary citizens lack the motivation and ability to supervise the managers (Armen, 1965). From this, it can be seen that the lengthy delegation–agency chain can create a dilemma of “absentee owners” for the enterprise, leading to more severe problems of agency in state-owned enterprises (Di and Bu, 2021). Additionally, due to the lack of effective public supervision over the management of most state-owned enterprises, executives are more inclined to consider their own interests and choose stable short-term development instead of engaging in high-risk long-term plans that are beneficial for the company’s growth. Furthermore, both central and local state-owned enterprises are inevitably subject to government intervention, and some governments tend to shift their social responsibilities onto enterprises, such as addressing employment issues, solving fiscal difficulties, and fulfilling social welfare obligations (Lin et al., 1998). The “stability-oriented” nature of government objectives is inconsistent with the profit-centered goals of enterprises. Once the government imposes these social functions that should belong to the government sector onto state-owned enterprises, burdening them with heavy policy obligations, it indirectly changes the business objectives of the enterprises, making them unwilling to undertake high-risk projects and reducing their innovation motivation. In contrast, non-state-owned enterprises are less influenced by the government and are more willing to take on greater risks in their decision-making processes to pursue innovative activities. This also leads to higher levels of innovation in non-state-owned enterprises compared to state-owned enterprises.

This study took a novel approach by focusing on executives’ educational background in digital economy majors, and utilizing data from Chinese A-share listed companies from 2002 to 2020. The research reveals that executives’ educational background (in particular, completing a digital economy major) is significantly correlated with measures of company innovation and measures of company productivity. Furthermore, the study explored how executives with digital economy majors specifically impact innovation within companies. Two channels were identified: Channel 1: Executives’ educational background in digital economy majors facilitates digital transformation within companies, thereby enhancing their innovation capabilities. Channel 2: Executives’ educational background in digital economy majors contributes to productivity enhancement within companies. Total factor productivity reflects the average output level of various input factors in the production process, indicating the overall efficiency of transforming inputs into final output.

The implications of the findings from this study are as follows: First, there is a need to strengthen the construction of a comprehensive innovation system. With the transition from the industrial economy to the digital economy, data has become a critical production factor. Innovating and improving productivity therefore requires leadership from executives who have expertise in digital technology and the digital economy. Government departments can intensify efforts to promote the development of digital economy-related disciplines in universities, providing more talents with digital economy majors for the recruitment market of executives in companies. Besides directly recruiting executives with digital economy majors, companies can also provide professional training to executives who enter the management level without such educational backgrounds. For example, this could involve setting up corresponding educational institutions to conduct digital economy education and training, focusing on providing professional training for executives who lack digital economy majors. Second, companies themselves need to formulate policies and regulations that can incentivize executives to enter the company and work in the field of innovation. Companies should thoroughly assess their own operational level and stage, strengthen professional education and training for the executive team, enhance their innovation awareness, and increase their innovation capabilities, thereby promoting company innovation. Third, from the perspective of executives themselves, they should value the development of their digital economy education. They can pursue professional education, such as studying digital economy and related disciplines in universities, or participating in innovation-related work to enrich their work experience. This not only helps them to gain favor in the talent recruitment market but also enables them to effectively demonstrate their professional expertise when entering companies in the future.

Finally, this study has important positive implications for higher education institutions. On the one hand, digital education for practitioners can foster an innovative spirit within enterprises, reflected in the improvement and breakthroughs in both the quantity and quality of patents. In the context of the digital economy, higher education institutions can leverage their expertise to offer relevant digital education, enabling students not only to acquire digital knowledge but also to learn how to apply digital technologies for in-depth study, discussion, and innovation in their fields. On the other hand, for corporate executives, it is noteworthy that management personnel in Chinese enterprises often pursue MBA and EMBA programs. Higher education institutions should pay attention to how digital education can be integrated into these programs. For example, such programs could offer courses related to data mining software. The development of the digital economy relies heavily on data and algorithms, and courses in artificial intelligence and machine learning can assist executives in deeply exploring the data and algorithms necessary for future enterprise development, providing guidance and suggestions for further innovation.

The study also has some limitations. As the study is correlational, the observed effects could operate in the reverse direction. That is, companies that are on a trajectory toward increased innovation and productivity may be more likely to attract executive talent with educational background in the digital economy. In an ideal scenario, considering only the relationship between executive educational background and corporate development, the heterogeneity analysis in this paper indicates that high-tech industries are more attractive to executives with digital educational backgrounds. This is because such executives typically possess a digital mindset, a greater awareness of improving production efficiency, and a higher risk-taking spirit. Furthermore, whether there are other factors influencing the relationship between executive educational background and corporate innovation remains to be further explored. This study only selected the number of annual applications of enterprises to measure enterprise innovation, but there are many indicators to measure enterprise innovation, and future research needs to be further expanded. In addition, the research sample in this study is limited to Chinese enterprises. Future research could explore how the results compare across different countries and cultural contexts, and whether the conclusions of this study still hold true. This presents a potential direction for further expansion.

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

YY: Conceptualization, Data curation, Formal analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Validation, Writing – original draft, Writing – review & editing, Supervision.

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This study was funded by the National Social Science Fund of China (Project no: 21CTJ026).

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Aghion, P., Bloom, N., Blundell, R., Griffith, R., and Howitt, P. (2005). Competition and innovation: an inverted-u relationship. Q. J. Econ. 120, 701–728. doi: 10.1093/qje/120.2.701

Amore, M. D., and Bennedsen, M. (2015). Corporate governance and green innovation. J. Environ. Econ. Manag. 75, 54–72. doi: 10.1016/j.jeem.2015.11.003

Armen, A. (1965). The basis of some recent advances in the theory of management of the firm. J. Ind. Econ. 14, 30–41. doi: 10.2307/2097649

Audretsch, D. B., and Lehmann, E. (2006). Entrepreneurial access and absorption of knowledge spillovers: strategic board and managerial composition for competitive advantage. J. Small Bus. Manag. 44, 155–166. doi: 10.1111/j.1540-627X.2006.00161.x

Beck, L., Janssens, W., and Debruyne, M. (2011). A study of the relationships between generation, market orientation, and innovation in family firms. Fam. Bus. Rev. 24, 252–272. doi: 10.1177/0894486511409210

Benmelech, E., and Frydman, C. (2015). Military CEOs. J. Financ. Econ. 117, 43–59. doi: 10.1016/j.jfineco.2014.04.009

Bertani, F., Ponta, L., Raberto, M., Teglio, A., and Cincotti, S. (2021). The complexity of the intangible digital economy: an agent-based model. J. Bus. Res. 129, 527–540. doi: 10.1016/j.jbusres.2020.03.041

Chamorro-Premuzic, T., Furnham, A., Christopher, A. N., Garwood, J., and Martin, G. N. (2008). Birds of a feather: students’ preferences for lecturers’ personalities as predicted by their own personality and learning approaches. Personal. Individ. Differ. 44, 965–976. doi: 10.1016/j.paid.2007.10.032

Cui, L. S., Zhao, J., Zhao, L. J., and Hu, P. (2024). Top executives’ overseas background on corporate green innovation output: the mediating role of risk preference. Economics 18:20220105. doi: 10.1515/econ-2022-0105

Di, L. Y., and Bu, D. L. (2021). Impact of heterogeneous large shareholders on enterprise innovation investment in the mixed ownership reform—a comparative analysis based on state-owned enterprises and non-state-owned enterprises. R&D Manag. 33, 152–168. doi: 10.13581/j.cnki.rdm.20201256

Dooley, L., Barrett, G., and O’Sullivan, D. (2022). SME open innovation: differences within the similar across the R&D intensity spectrum. Int. J. Innov. Manag. 26:2250060. doi: 10.1142/S1363919622500608

Dosi, G., Marengo, L., and Pasquali, C. (2006). How much should society fuel the greed of innovators? On the relations between appropriability, opportunities and rates of innovation. Res. Policy 35, 1110–1121. doi: 10.1016/j.respol.2006.09.003

Duran, P., Kammerlander, N., and Zellweger, T. (2016). Doing more with less: innovation input and output in family firms. Acad. Manag. J. 59, 1224–1264. doi: 10.5465/amj.2014.0424

Dyck, A., Lins, K. V., Roth, L., and Wagner, H. F. (2019). Do institutional investors drive corporate social responsibility? International evidence. J. Financ. Econ. 131, 693–714. doi: 10.1016/j.jfineco.2018.08.013

Eccles, R. G., and Serafeim, G. (2013). The performance frontier: innovating for a sustainable strategy. Harv. Bus. Rev. 91, 50–6, 58, 60, 150

Eggers, J. P., and Kaplan, S. (2009). Cognition and renewal: comparing CEO and organizational effects on incumbent adaptation to technical change. Organ. Sci. 20, 461–477. doi: 10.1287/orsc.1080.0401

Fan, H. J., Wu, T., and He, S. J. (2023). Research on the industrial chain linkage effect of enterprise digitalization. China Indus. Econ. 3, 115–132. doi: 10.19581/j.cnki.ciejournal.2023.03.005

Frynas, J. G., Mol, M. J., and Mellahi, K. (2018). Management innovation made in China: Haier’s rendanheyi. Calif. Manag. Rev. 61, 71–93. doi: 10.1177/0008125618790244

Giannetti, M., Liao, G., and Yu, X. (2015). The brain gain of corporate boards: evidence from China. J. Financ. 70, 1629–1682. doi: 10.1111/jofi.12198

Guan, J., and Ma, N. (2003). Innovative capability and export performance of Chinese firms. Technovation 23, 737–747. doi: 10.1016/S0166-4972(02)00013-5

Hambrick, D. C., and Mason, P. A. (1984). Upper echelons: the organization as a reflection of its top managers. Acad. Manag. Rev. 9, 193–206. doi: 10.2307/258434

Homroy, S., and Slechten, A. (2019). Do board expertise and networked boards affect environmental performance? J. Bus. Ethics 158, 269–292. doi: 10.1007/s10551-017-3769-y

Hsu, P. H., Huang, S., Massa, M., and Zhang, H. (2014). The new lyrics of the old folks: the role of family ownership in corporate innovation. Social science electronic publishing, working paper. Singapore: School of Accountancy at Institutional Knowledge at Singapore Management University. Available at: https://ink.library.smu.edu.sg/soa_research/1299

Hua, T., and Yue, J. (2025). Analysis and prospects for the development of spectral information in China from the perspective of the National Natural Science Foundation of China. Chinese J. Lasers 52:0121001.