- Aarhus University, School of Culture and Society, Department of Archeology and Heritage Studies, Aarhus, Denmark

Introduction: This paper investigates whether the introduction of coinage in Europe fundamentally changed pre-existing monetary circulation patterns. By analysing the statistical properties of bronze money before and after the advent of coinage (c. 1500–27 BCE), it challenges the prevailing assumption that coinage revolutionized the use and exchange of money. The research engages with longstanding academic debates between competing theories, which posit that money is either market-driven or state-imposed.

Methods: Using a combination of archaeological data and quantitative analysis, the study examines large datasets of pre-coinage money and early coinage, focusing on weight-based regulation and the log-normal distribution of mass values as key indicators of monetary behaviour.

Results: The findings reveal that pre-coinage bronze money, consisting of weighed metal fragments, circulated in a manner similar to early coinage. Both forms of money complied with weight-based systems and exhibited log-normal distribution patterns, reflecting structured economic behaviours. The analysis suggests that the introduction of coinage did not lead to a fundamental transformation in how money circulated but rather continued pre-existing patterns.

Discussion: These results challenge the assumption that state-issued coinage marked a watershed moment in the history of monetary economies. The paper proposes that the beginning of coinage introduced a minor technological improvement rather than a revolutionary change in monetary circulation, offering a new perspective on the continuity between pre-coinage and coinage-based economies in ancient Europe.

1 Introduction

In this article, I explore whether the introduction of coinage in Europe fundamentally changed the way money circulated. I specifically address the development of bronze currencies in an area of Continental Europe roughly comprised between Southern Italy and northern Germany. In this region of Western Eurasia, a monetary system based on weight-regulated bronze fragments developed in the Middle and Late Bronze Age (c. 1500–800 BCE) (Ialongo and Lago, 2024). After the end of the Bronze Age, the circulation of ‘hackbronze’ did not cease, but was accompanied by other forms of non-coined metallic money (e.g., Bertol and Farac, 2012; Milcent, 2017; Hiriart and Genechesi, 2021), and eventually by coins. The earliest coins, in turn, tend to be produced mostly with precious metals, until the mass-production of bronze coinage began under the Roman Republic (Crawford, 1985; e.g., Kemmers, 2016; Yarrow, 2021). While limited to a specific region of the Ancient World, this case study offers the opportunity to address both peculiar historical developments and overarching questions about the origin and development of money in pre-modern economies.

Research on the origin of money is mostly theoretical. For the last two and a half millennia, the origin of money has been the subject of a galaxy of competing schools of thought. This diverse array of approaches is commonly represented as a binary contest: e.g., metallists vs. chartalists, orthodox vs. heterodox, formalists vs. substantivists. To simplify an overly complex question to its core, metallist/orthodox/formalist approaches predict that money emerges from the market, while chartalist/heterodox/substantivist theories state that money is created by the state. Following a renewed interest in the spread of money in pre-state societies, this debate is gaining unprecedented traction in the archaeological domain (Baron and Millhauser, 2021; Blanton and Feinman, 2024; Ialongo and Lago, 2024; Rosenswig, 2024b). One way or the other, the point at stake is clear: if money is created by the state, then before the state money cannot exist; if money does exist before the state, then the state cannot have created it.

Whether the theoretical role of the state in the origin of money may or may not be the point, there is no denying that, for a substantial part of recorded history, money has been an instrument of governments. What is somehow surprising, however, is how little empirical research has been devoted to identify and understand those monies that may or may not have existed before governments established their monopoly over them, or before the state even began. The question, then, is not anymore whether or not money is theoretically possible before the state, but whether or not the archaeological evidence supports the existence of money before the state. If it does, then the theory must account for it, and a role for money before the state needs to be created.

In this line of though, coinage is usually considered a watershed between ‘primitive’ and ‘modern money.’ There is no question that the invention of coinage had long-lasting consequences on the political economy of money, but did it fundamentally change how money circulated among common people? Academic views on early coinage are influenced by historical accounts of economies that developed over a millennium after coinage’s invention. As far as Western Eurasia is concerned, the economy of Early and Middle Bronze Age Mesopotamia (c. 3,000–1700 BCE) is by far the best documented one in ancient history; it had neither coinage nor any form of state-controlled money, and yet money was widespread (Powell, 1996; Peyronel, 2010; Rahmstorf, 2016; Dercksen, 2021). Before finding a comparably well-documented coinage-based economy, one has to wait until the Middle Ages. This means that the early history of coinage – say, between c. 700–27 BCE, from the first coins in western Anatolia until the end of the Roman Republic – relies only on sparse direct accounts, and largely on analogies with later, better documented economies (Kemmers and Myrberg, 2011; Rahmstorf, 2016; van Alfen, 2018; Heymans, 2021). A similar problem holds true for pre-coinage economies that did not leave written accounts. The history of pre-coinage money in prehistoric Europe can only rely on indirect analogies with the better documented economy of Mesopotamian states, and on very few later, indirect accounts of archaic and classical sources. The pre-literate nature of prehistoric Europe, in turn, has determined the widely generalised attitude of mistaking absence of proof for proof of absence. However, written records are not the only source of evidence for money, and neither are they necessarily the most reliable. The physical aspects of money are only now beginning to be explored. For a long time, all we knew of the material differences between pre-coinage money and coins in Europe was that they looked different (Primas, 1986; Sommerfeld, 1994; Lenerz-de Wilde, 1995, 2002): Coins follow recognisable aesthetic patterns, while pre-coinage money consisted of shapeless metal scraps. Such a difference contributed to the long-standing belief in their fundamental otherness.

The inherent bias of ancient sources is a further issue that has been traditionally overlooked. At least until the verge of the Common Era, written sources are always left by the economic elite or their entourage, whether they are state officials, philosophers, or professional merchants, and it is no surprise that these accounts are skewed towards the political economy of money (e.g., Bresson, 2012; Dale, 2021; Lambourn, 2021). But the vast majority of money users were ‘commoners,’ most of whom had neither the skills nor the need to leave written accounts of their transactions. Hence, in order to understand how the majority of people used money, one must inevitably turn to archaeology.

This article comprises three main sections. In section 2, I examine the relationship between money, coinage, and state authority through the lenses of four different methodological approaches, spanning archaeology, anthropology and theoretical economics. All such approaches are not necessarily fully incompatible with one another, and all present challenges when it comes to their consistency with the archaeological evidence. In particular, the comparison shows that the idea that coinage fundamentally changed money is an almost unanimously shared belief outside theoretical economics.

Section 3 discusses why money has value by contrasting the chartalist and metallist perspectives, highlighting reciprocal objections, and testing them against qualitative archaeological evidence for pre- and early coinage money. It also explores the limitations of both perspectives, considering utility, trust, and subjective value as central concepts in understanding how money gains and maintains its value in different historical contexts, regardless of political authorities.

In section 4, I introduce recent quantitative research on pre-coinage money in Europe, and discuss its relevance in understanding the circulation patterns of money in economies that did not leave written accounts. I then extend the analysis to later forms of metallic money, including early coinage, with the aim of assessing whether or not there is any empirical ground to conclude that the circulation patterns of pre-coinage money were fundamentally different from those of coins. The analysis addresses large datasets of pre-coinage money and coins, mostly distributed between Italy and Central Europe between c. 1500–31 BCE. The data support a model of widespread monetary patterns of exchange in an economy that was at least partly regulated by the equilibrium of supply and demand, starting the Middle Bronze Age. Such a pattern did not change with the introduction of coinage, and remained stable for several centuries.

2 Money and the state

2.1 Culture-historical approach

In the prevailing culture-historical perspective of European archaeology, Bronze Age Europe and Republican Rome are epitomes of, respectively, the last fully pre-state civilisation and the first fully-fledged state west of Greece. They are the opposite ends of a complex, nuanced, and archaeologically-fuzzy process that saw the transformation of fully prehistoric societies into the ‘canonical’ state of Classical Antiquity (e.g., Pacciarelli, 2001; Peroni, 2004; Terrenato, 2010; Cardarelli, 2018; Stoddart et al., 2020; Zamboni et al., 2020).

The Roman Republic is one of the archaeological benchmarks for ancient states together with other paradigmatic states of ancient Eurasia, such as Ancient Egypt, the kingdoms of Bronze Age Mesopotamia, and the Athenian Democracy. It checks all the boxes: strong authority, decentralised administration, an army of conscripts, written laws, taxes, fines, public infrastructures, elected officials, bureaucracy, and of course, coins. Between the end of the Bronze Age and the mature phase of the Roman Republic there is alternate evidence for some of these features in the study area. Bronze Age Europe provides conclusive evidence of none. Up until c. 800 BCE, the political landscape of Europe (west of Greece) was splintered into a myriad of small polities, whose elites could not extend their control much further away their immediate surroundings (Harding, 2000; Cardarelli, 2018; Kristiansen, 2018). The process that unfolds in between is then key to understand the outcome, with researchers trying to pinpoint the earliest archaeological correlate of this or that of the many traits that would eventually define the paradigmatic state of ancient Rome.

To an external observer, the culture-historical approach may seem evolutionary, but it is, in fact, fundamentally different. The key difference is that ‘the state’ here does not require a universal definition; it is seen as an objectified historical subject, with unique characteristics that are not necessarily universal. Thus, the Roman Republic is a ‘state’ by definition, and all the intermediate forms that lie between it and prehistoric societies are not seen as inevitable stages of linear progress but as unique, unrepeatable circumstances that eventually lead to the formation of a historical singularity. Still, the ultimate outcome is not necessarily equal to the sum of its parts, and individual traits emerging along the trajectory are not necessarily equivalent to their ultimate incarnations. This is the case for money. It is now widely accepted that some ‘stuffs’ that performed monetary functions existed in Europe well before the appearance of coinage. These ‘money-stuffs’ (to use a term popularised by Dalton, 1965) are variably labelled with cautionary prefixes, such as ‘pre-money,’ ‘proto-money,’ ‘utensil-money,’ ‘commodity-money,’ ‘ring-money,’ and ‘primitive-money’ (Sommerfeld, 1994; Primas, 1997; Peroni, 1998; Pare, 2013; e.g., Fontijn, 2019). It is never fully clear in what exactly all these money-stuffs are different from one another, nor in what they would differ from coins, except in shape. What is most clear is that coin-money is the first ‘proper money’, and is invariably issued by ‘the state.’

2.2 Substantivist approach

The idea that money already existed well before coinage, but was fundamentally different from what it became after coinage was introduced, has also been a common tenet in economic anthropology. Substantivist theory, dominant in the 20th century, argued that pre-modern societies operated by different rules than modern economies, lacking self-interested financial calculation. Scholars like Polanyi (1957), Bohannan (1959), and Dalton (1965) emphasised the distinction between ‘primitive’ and ‘modern’ money, where primitive money was embedded in social relationships and had limited functions. However, later critics argued that this division overlooks the social relationships influencing modern economies (Bourdieu, 1977, pp. 183–197; Granovetter, 1985; Appadurai, 1986; Bloch and Parry, 1989) and the limited, context-dependent roles of modern money (Zelizer, 1989; Frank, 1990; Pickles, 2020). They highlighted that modern monetary transactions are also shaped by social factors like trust and status, and different money forms (coins, paper, bank transfers) perform distinct functions (Melitz, 1970; Beckert, 2011). This critique undermines the dichotomy between primitive and modern money, showing that both types operate within both social and market systems.

In summary, up until the 1970s, the mainstream Polanyian perspective created a dichotomy: modern money is seen as purely financial, while primitive money is deeply embedded in social relationships, making them fundamentally different. The post-Polanyian approach demonstrated that modern money is as much embedded in social relationships as only primitive money was supposed to be, hence disproving the dichotomy (Carrier, 1997; Hart, 2005; Wray, 2014).

With a delay of a few decades, it is only very recently that a debate around this question is taking shape in the archaeological domain, with opposing positions not having substantially changed. Polanyian approaches have traditionally formed the bedrock of the mainstream discourse until very recently, and the prehistoric economy of Europe has generally been modelled as a complex system of ritual norms, symbolic meaning, hierarchy and social relationships with barely any mention of markets and money and little space for quantitative research (e.g., Bruck, 2016; Fontijn, 2019; Jung, 2021). Recent contributions that oppose this paradigm are rooted in post-Polanyian arguments and frame them within a more conscious appraisal of the archaeological evidence, pointing out that there is actually little data in support of the alleged primitiveness of prehistoric economies (Baron and Millhauser, 2021; Blanton and Feinman, 2024; Ialongo and Lago, 2024). In addition, Dalton’s argument of a substantial difference between modern (i.e., general-purpose) and primitive (i.e., special-purpose) money has been recently revived.

Drawing form classic substantivist literature, Rosenswig (2024b) re-labels ‘primitive’ and ‘modern’ money into, respectively, ‘social’ and ‘financial’ money. ‘Social money’ is an ‘accounting system of social relationships’; ‘financial money’ is not explicitly defined, but one can derive from the context that it is an accounting system for purely financial operations. Rosenswig identifies ‘the state’ as the watershed between social/primitive and financial/modern money, fully in line with the chartalist approach of the beginning of the 20th century (Knapp, 2018 [1918]): ‘state law brought a financial monetary system of accounting into existence when it specified how debts owed to government authorities could be settled.’ Admittedly, Rosenswig’s definition of ‘the state’ is rather lax, encompassing any ‘governing body of a hierarchically organized polity: be it a complex chiefdom, kingdom, fiefdom, city-state, empire, or whatever’ (Rosenswig, 2024a). The problem with this generic definition is that it clashes with the axiomatically binary nature that the state is granted by the model: the state either exists, or it does not, and so does (financial) money. But then, if the state is literally ‘whatever,’ objective difficulties arise when one tries to frame the model in an archaeological perspective.

2.3 Neo-chartalist approach

A third, more nuanced approach addresses the concept of ‘the state’ in monetary matters with some caution, noting the complex and diverse meanings it has across different disciplines (Green et al., 2024). The authors suggest that ‘the state’ often refers to a political paradigm that attempts to monopolise authority, though this centralization can vary widely in its effectiveness. They critique the term ‘state’ as a ‘stop-think’ word in academic discourse—one that can obscure critical analysis if used uncritically or rigidly. Instead, they advocate for more precise language to describe the structures and dynamics being studied, emphasising the need to avoid simplistic definitions that might overlook the diverse and fluid nature of political authority in ancient societies. In their view, not all social structures evolve toward state-like formations, nor do they need to meet specific hierarchical criteria to function effectively as societies. In this respect, they do not diverge substantially from the culture-historical approach.

In contrast to standard models that emphasise hierarchy, advanced forms of governance, which one might term ‘state,’ can also arise non-linearly from cooperative mechanisms. In this model, central authorities actively foster economic innovation through consensus-driven collective action, rather than by enforcing strictly top-down control (Blanton and Fargher, 2008; Mazzucato, 2014; Feinman and Carballo, 2018). Along the same line, Green et al. (2024) challenge the assumption that currency systems necessarily originated in hierarchical or state contexts. Instead, they suggest that even egalitarian societies, though not highly centralised, implemented forms of governance to coordinate labour and goods for collective needs. Early forms of money were then systems of governance—tools to manage labour and resources in emerging urban settings. Furthermore, they endorse David Graeber’s arguments on credit and debt as fundamental economic relations preceding coinage and commodity exchange (Green et al., 2024, pp. 201–206). In conclusion, although not initiated by hierarchical states, money eventually allowed elites to accumulate resources without directly imposing control, fostering economic networks beyond single polities. When it comes to coinage, this approach is remarkably similar to more traditional ones, in that the introduction of coin-money is seen as a ‘structural innovation’ that had a ‘revolutionary impact’ on the ancient world. In line with the substantivist tradition, coinage is then a vehicle for the transformation of economic relationships from ‘personal’ to ‘impersonal.’

2.4 Theoretical economics

The predominant models in archaeology and economic anthropology put variable emphasis on the role of official authorities in the origin of money, but they tend to converge in identifying coinage as a transformative force for the nature of money, and in acknowledging the decisive role of ‘the state’ in its creation. Theoretical economists adopt a substantially different perspective. In standard economic theory money has no defined role. Economists use a simplified framework that assumes agents making rational choices based on their knowledge of market prices, on which they have no control. They only control what to produce and consume based on what is more convenient for them, which implies making sure that prices are such that supply and demand are in balance (e.g., Mankiw, 2001). Whether or not standards of value or media of exchange are used in the process makes no difference. Simply put, economic theory works even without money, but since money exists then a role had to be created for it (Velde, 2021).

Economists assume that money emerges from the bottom-up without the intervention of, and even in spite of central authorities (Jones, 1976). Notably, economists make no difference between coins and other forms of currencies. Money emerges since the only alternative – barter – simply does not work. The reason is simple: I cannot obtain anything through barter, if the person who has what I want does not want whatever it is that I can give in exchange. Jevons (1875) coined the term ‘Double Coincidence of Wants’ to describe the necessary condition for a transaction to take place: If this condition is not met, exchange cannot happen. Hence, in order to obtain what I want, I would better hold a reserve of something that everyone else wants; that thing is what economists call money. The inefficiency of barter is all the more a problem in small markets, where the limitations of exchange ‘in kind’ make it almost impossible to ‘fulfil excess demand’ (Feldman, 1973; Jones, 1976), meaning that even if there is enough wealth to sell and purchase commodities at equilibrium prices, practical limitations are such that many transactions cannot even take place.

Anthropologists object that such a solution poses more questions than it answers: If barter is unfeasible, how could exchange even be possible before money existed? Looking at the ethnographic record, there is no evidence that a moneyless barter economy ever existed, let alone that money originated from it (Chapman, 1980; Humphrey, 1985; Heady, 2005). At the same time, the evidence for pure barter is often even more compelling in contemporary Western economies than in supposedly primitive ones (Appadurai, 1986; Powell, 2002; Graeber, 2011), which in turn poses a serious challenge to the genealogical model: If money emerges to overcome the unfeasibility of barter, how come barter still thrives in monetary economies? As a matter of fact, not a single case study exists – ancient or modern – documenting the autonomous transformation of a ‘barter economy’ into a ‘monetary’ one. There are indeed many documented cases of so-called ‘traditional’ societies that started using western currencies at some point, but very few of these societies did not already have their own monetary patterns of exchange (Bohannan, 1959; Dalton, 1965; Einzig, 1966; Pryor, 1977). The idea of a barter economy before money, then, is today widely regarded as a ‘myth’, a simplistic origin story with no roots in facts (Gilbert, 2005; Hart, 2005; Maurer, 2006; Graeber, 2011).

Building on Graeber’s influential work (2011), contemporary economic anthropologists often dismiss theoretical economists too quickly due to perceived inconsistencies, inadvertently overlooking valuable contributions theoretical economics offers to the study of money. Such a dismissal, however, is largely rooted in a misunderstanding of the role that barter actually plays in economic models. Graeber is particularly concerned about the pervasive and often uncritical acceptance of the ‘myth of barter’ as a historical fact in some scientific works, popular culture and even school books, for which he generically blames ‘the economists.’ While his concerns are entirely relatable, the blame is perhaps unfairly directed. After Adam Smith – who candidly wrote about a pristine world of bartering ‘savages’ (Smith, 1976, pp. 21–32 [1776]) – the idea of a pre-monetary economy based on pure barter has been more and more framed by economists as a thought experiment, providing the logical starting point for mathematical models, rather than a historical fact (e.g., Feldman, 1973; Jones, 1976; Moran et al., 2013). More than a decade before Graeber, Ludwig von Mises – an economist and a sociologist – observed that whether or not such an economic system really ever existed is not even relevant from the economist’s perspective: as long as the logic is rigorous and the math works, the model provides a satisfactory explanation of an event that may or may not have happened so far back in time – or so many times over – that we might never be able to precisely pinpoint (Von Mises, 1996, pp. 405–408). The ‘myth of barter’, then, becomes a paradox, a useful device to solve an academic problem: it does not really explain why money came to be, but rather why the economy cannot work without money, hence standing itself as a strong argument that a pure barter economy never actually existed.

3 The value of money

3.1 Chartalism vs. metallism

A crucial question that underlies all the different stances on the ‘origin of money’ is why money has value. In this section, I will approach this question through a simplified account of the ‘chartalist vs. metallist’ controversy, and by examining how these opposite schools of thought measure up to the archaeological evidence.

The question of why money has value is one of the most debated topics in economic history (Wray, 2014; Ehnts, 2019). Since the late 19th century, the debate has seen the opposition of two approaches (Frankel, 1978). The so-called ‘metallist’ or ‘orthodox’ approach holds that money’s value depends on the market value of the substance of which it is made (Menger, 1892). The approach is based on the assumption that the value of money relies on an implicit agreement among all the agents in a given market in which money circulates, hence money is both ‘fiduciary’ and ‘commodity’ at the same time (Simmel, 2004 [1900]).

According to the ‘chartalist approach,’ money has value because the state establishes by decree that it does. It issues ‘fiat money’ which, in the case of metal coins, is at the same time ‘commodity money’ and ‘token money’ (Schumpeter, 1954, pp. 50–65; Knapp, 2018 [1918]). The state dictates that taxes and fines be paid in the state’s own currency; in doing so, it establishes a number of liabilities and fixes the amount of currency due in payment, hence directly or indirectly establishing prices (Innes, 1914). Transposed into a historical narrative, this implies that money could not exist before the state, and especially before the state started issuing its officially currencies, which in turn implies that money only began with coins (Laum, 2016 [1923]). This approach is often called ‘heterodox,’ due to its initially minoritarian position. Over time, however, its popularity has grown to a point that it has now become itself a form of orthodoxy (Lavoie, 2013; Palley, 2015; Skre, 2015).

3.2 The ‘Hahn problem’ and the archaeological evidence

Probably even more insightful than their respective assumptions are the objections that each approach moves against the other. Chartalists object that without official regulation it is difficult to determine the purity and value of metal. Therefore, people ‘trust’ money not because of an implicit agreement, but because of an explicit sanction from a trusted authority (Bridel, 2014). To which the metallist would reply that the state cannot simply print money, as if it did, that money would rapidly loose value due to inflation (Velde, 2021). In contemporary theoretical economics, this controversy is commonly known as the ‘Hahn problem’, after a seminal article that formulated the problem as a question to be answered through mathematical models (Hahn, 1966): How is it possible that something that can be worthless (e.g., paper bills) has a positive value in economic transactions? While the question is still unanswered, it is nonetheless useful for the scope of this paper to explore whether or not the Hahn problem also applies to ancient money.

As far as the origin of coinage is concerned, the chartalist approach is today considered problematic, as it is not supported by archaeological evidence. While coinage is still credited with triggering a process that eventually resulted in the establishment of state monopoly over money, it is now widely recognised that such a process was not instant, but rather stretched out over many centuries (Andreau, 2001; Kemmers, 2016; Rahmstorf, 2016; van Alfen, 2020; Heymans, 2021, pp. 38–52). For a large part of the 1st millennium BCE, coins were not necessarily issued by political authorities, and minted coins circulated along with several forms of pre-coinage monies. In the Archaic Period (c. 700–500 BCE), for example, electrum coins issued by royal authorities in Lydia and by democratic institutions in Athens coexisted with coins minted by aristocratic individuals who were neither royal persons nor necessarily acting on behalf of the Polis (van Alfen, 2012). In the same period in Lycia, silver coins were not produced by central authorities at all, but rather by a multitude of individual dynasts (Vismara et al., 1989).

Similar situations persisted well into the late 1st millennium BCE. In the Republican period, the senate – i.e., the central governing body of the Roman state – only established legal monopoly over silver coins and never on bronze issues, meaning that non-public subjects were authorised or compelled to produce bronze coinage to meet their immediate needs. The Roman Republic began issuing bronze coins during the Pyrrhic War, c. 280–275 BCE, effectively stopping between the time of Sulla and Caesar, with some fluctuations in coinage production in the 80s BCE (Crawford, 1985; Yarrow, 2021). During this period, bronze coinage was also produced by non-public entities. Various local authorities, cities, and even private individuals minted bronze coinage. For example, certain military leaders minted bronze coins during the Pyrrhic and Punic Wars to meet contingent demand, e.g., to pay the troops salaries. The minting of bronze coins persisted after the Roman state discontinued their production. Between 80 BCE and 30 BCE, the production of bronze coinage in Italy was carried out by different local subjects. Two notable examples include Paestum and Velia, both in the region Campania, where bronze coinage continued until the time of Caesar.

The circulation of bronze coinage in Campania was the subject of extensive research (Stannard, 2018, 2021). Stannard noted that, from the 4th to the 1st century BCE, the vast majority of bronze coins was minted by several local ‘informal mints’ – unauthorised or semi-official minting activities carried out under special circumstances, particularly during periods of military campaigns or local crises – or imported from foreign polities, mostly Ebusus (Ibiza) and Massalia (Marseiile), respectively Punic and Greek. Stannard makes a compelling case which, although limited to a specific historical and geographical context, has broad implications. On the one hand, local subjects, whether or not bestowed with varying degrees of ‘authority,’ issue coins because the local demand for money is not satisfied by the central state. On the other, large quantities of foreign coins issued by institutions that have no authority in Campania somehow find their way in the local economy to fill the void left by ‘the state.’ Stannard concludes that in Campania the chronic shortage of state-issued small change led to the widespread adoption of foreign and informal coins, all valued based on their ‘utility’ rather than intrinsic or state-backed fiat.

‘Hackmetal’ currencies, on the other hand, always thrived in the absence of monopoly. In the Ancient Near East – roughly two millennia before the invention of coinage – silver (together with copper, tin, gold and even barley) was widely used as medium of exchange, standard of value, reserve of value, and means of deferred payment (Garfinkle, 2004; Steinkeller, 2004; Englund, 2012; Dercksen, 2021), even though it was never officially adopted, let alone ‘issued’ by any central authority (Powell, 1996; Peyronel, 2010; Rahmstorf, 2016). Likewise, in ancient Italy, legal texts from the 5th century BCE report that fines were to be paid in unshaped lumps and fragments of bronze (aes) over which the political authority had no direct control (Thomsen, 1957, pp. 19–48; Kunkel and Wittmann, 1995). The existence of a state is not even a requirement for money to have value. In Bronze Age Europe (c. 1500–800 BCE), where no form of state institution existed, bronze circulated in a monetary fashion in the form of weighed fragments, and following consumption patterns that are indistinguishable from modern ones (Ialongo and Lago, 2024). The circulation of pre-coinage money does not seem to be hindered by the spread of coinage either. In the early 1st century BCE, in Croatia – a Roman protectorate since the 2nd century BCE – a particular type of hoard is widely attested, mixing high quantities of aes and imported coins. These hoards are referred to as Mazin-type, after their most notable example (Mirnik, 1982; Bertol, 2014). The Mazin hoard contains c. 100 kg of aes (574 pieces) and 898 coins, all made of bronze, 877 of which (98%) come from Northern Africa (Bertol and Farac, 2012).

The evidence would seem to support the metallist argument, hence ruling out the Hahn problem for pre-coinage and early coinage money: if ‘the state’ or other forms of political authority did not play a predominant role, or played no role at all, then one might be tempted to argue that the value of money in the ancient world – at least until sometime after the invention of coinage – was only dependant on the market value of the substance of which money was made. Such a superficial outlook, however, entails the risk of overlooking what those substances were really made of. Especially when it comes to metals, it is crucial to consider that what we call ‘silver’ or ‘bronze’ actually came in a wide variety of different alloys. The metallist argument fails to explain how it is possible that different alloys that looked the same, but in fact were not, could have had the same value in a monetary transaction. For example, throughout the 2nd and the early 1st millennium BCE, hacksilver in the Levant was regularly alloyed with copper (Eshel et al., 2021), aes in Iron Age Italy had high contents of lead and iron (Ingo et al., 2004; Baldassarri et al., 2007), and Bronze Age fragments contained highly variable proportions of copper, tin and lead, all coming from different sources (Radivojević et al., 2019; Nørgaard et al., 2021). In all cases, there is neither evidence that the monetary circulation of pure metals was any different than that of cheaper alloys, nor that political authorities, where they existed, made any distinction. Not to mention that, arguably, casual users did not even have the means to measure exactly how much ‘cheap material’ was contained in their metallic monies, let alone separating them.

3.3 Utility and the subjective theory of value

The evidence shows that the value of money in ancient economies is as much of a puzzle as it is in modern ones. Even though the chartalist argument cannot hold before monopolies were established, its objection to the metallist argument is still valid: if the substance of money cannot be determined by its users, then its value cannot be entirely determined by what money is made of. Note that the point of contention has never been whether or not money has value. That a given substance has monetary value becomes implied the moment we identify it as money, regardless of where that value comes from. Hence, acknowledging that a substance is not precious, useful, or backed by political authorities is no obstacle for its identification as ‘proper money,’ in modern as well as in prehistoric economies.

As the Hahn problem will likely remain unsolved for the foreseeable future (Bridel, 2014), new approaches going by the name of New Monetarist Economics are finding workarounds, by introducing a subtle albeit substantial change of perspective. The question is not anymore why money has value, but rather why money enters people’s preferences when they are given the (theoretical) choice not to use it (Nosal and Rocheteau, 2012, pp. 1–12; Gu et al., 2019). Utility is a central concept. In economic jargon, ‘utility’ is the measure of the satisfaction a person derives from a transaction. To say that something has utility means that a person perceives that they are better off after they sell or purchase that thing. Hence, money has utility not because it is precious or because the political authority says so, but because people believe that by using money in a transaction, they will be marginally better off than they would if they did not use it, whether it is because it circumvents the hurdles of pure barter or because it makes it easier to quantify debts. Simply put, ‘if people believe that money has value, it does’ (Velde, 2021).

This approach has a remarkable parallel in modern economic anthropology. Rooted in the same Subjective Theory of Value that forms the foundations of the metallist approach (e.g., Simmel, 2004 [1900]), anthropologists today see value not as an ‘inherent property of objects,’ but rather as ‘a judgement made about them by subjects’ (Appadurai, 1986). In this perspective, ‘commodities,’ ‘gifts,’ and ‘money’ are not objective, mutually exclusive categories to which things are naturally bound, but mere academic concepts that we use to describe different states in the fluid continuity that is every object’s life (Bourdieu, 1977, p. 171; Hart, 1982; Kopytoff, 1986). What ultimately determines the value of things is the particular state in which people perceive things to be when they make a judgement about them. This perspective allows one to momentarily set aside the ‘authority vs. commodity’ dilemma: any form of money neither has value (entirely) because it is precious nor (entirely) because the state says so, but because it has ‘utility,’ i.e., because people trust that their money will be accepted by everyone else.

4 Quantitative analysis of monetary patterns before and after the introduction of coinage

4.1 Premise

In this section, I will test the hypothesis that the introduction of coinage fundamentally changed how money circulated, based on the quantitative analysis of a large sample of archaeological data. I am neither concerned with defining what money is, nor with looking for its origins. I simply start from a point in time and space for which there is strong evidence that a substance that performed the functions of money actually existed, explore its statistical properties, and follow its development until a few centuries into the spread of coinage. The point in time and space is Bronze Age Europe, and the substance is bronze. For roughly 1,500 years, bronze served as the small change of European economies, an affordable material that circulated as everyday currency across all levels of society, first as weighed scraps and then as coins. The question is whether there was a fundamental difference in the circulation patterns of bronze money before and after the state began minting coins. My working definition of ‘state’ coincides with the Roman Republic, in line with the culture-historical approach illustrated in section 2.

So far, I have illustrated and discussed qualitative evidence on pre- and post-coinage money drawn from archaeological and historical sources. From a qualitative point of view, the resulting picture does not support the hypothesis that money began with the state, nor that the introduction of coins produced any revolution. A moneyless economy is unlikely, while money has value regardless of whether or not the state issues or acknowledges it, and whether or not the state even exists. However, this still does not clarify if coinage substantially changed the way people used money. Here, I will address this problem quantitatively as an experimental test of two alternative hypotheses: a null-hypothesis (H 0 ) that the introduction of coinage produces no substantial effect on the materiality of money, and an alternative hypothesis (H 1 ) that coinage – i.e., state-defined currency – fundamentally changed money.

My intent is to take two radically different extremes – the fully-prehistoric, state-free Bronze Age, and the fully-fledged state of the Roman Republic – and directly compare them on empirical basis, while skipping the complex, nuanced, and archaeologically fuzzy process that unfolded in between and elsewhere. The units of analysis, then, are not two geographical regions, but two economies that existed in two broadly-defined periods of European pre/history roughly in the same region. The circulation of money in prehistoric Europe was already addressed in detail in recent research (Ialongo and Lago, 2024), whereas here I focus on new data from the late Roman Republic. Here, I compare a sample of Bronze Age fragments dating to c. 1500–800 BCE, a sample of aes from the Mazin hoard in Croatia (c. 90 BCE), and a sample of Republican bronze coins from Italy (c. 275–31 BCE).

My goal is to provide a straightforward analytical framework to test hypotheses that nuanced theoretical models have already formulated, but could not prove empirically. To achieve this goal, I use simple statistics designed to answer yes-or-no questions, and I consequently simplify the archaeological and anthropological question to adapt to this logic.

4.2 Materials

4.2.1 Bronze Age fragments

The sample includes 6,485 fragments from 471 hoards evenly distributed across Italy, Switzerland, Austria, Slovenia and Germany (Figure 1). The sample is divided into two chronological subsets: objects dating to the Middle Bronze Age (MBA), c. 1500–1200 BCE (n = 3,339), and objects dated to the Late bronze Age (LBA), c. 1,200–800 BCE (n = 3,145). The complete dataset is freely available as downloadable supplementary material in the original publication (Ialongo and Lago, 2024).

Figure 1. Distribution map of the analysed bronze objects. The darker grey area indicates the portion of the study area from which the analysed coin sample comes from.

4.2.2 Aes

The sample analysed here includes 574 pieces of aes of different types for a total mass of c. 100 kg, all coming from the Mazin hoard, in Croatia, dated to c. 90 BCE (Bertol and Farac, 2012). Other than the pieces of aes, the Mazin hoard contains 963 bronze coins from different regions of the western Mediterranean. The Mazin hoard is a commendable unique case in which a large quantity of aes is published in detail, complete with the mass value of each object. Despite being largely contemporary, occurring in the same contexts, and allegedly performing the same function, aes is incomparably less researched than coins. Chemical analyses show that these objects are made of copper alloys with high iron and lead content (up to c. 50%), which definitely rules out their potential use as ingots, and reinforces the hypothesis that they circulated as money (Ingo et al., 2004; Baldassarri et al., 2007).

4.2.3 Coins

The sample analysed here includes 1,335 coins preserved at the British Museum, whose data were extracted from the Museum’s online database (British Museum Collection, 2024). The selection includes all copper alloy coins dating to the Roman Republic contained in the database. The dataset used in this article can be obtained directly from the database by using the following keywords: Object name – coin, Culture/period/dynasty – Roman Republican; Material – copper alloy. Cast coins were filtered out to include only struck coins, in order to insure internal consistency of mass values. According to the entry descriptions, the coins chronology ranges between 275 to 31 BCE. 1,211 coins (91%) bear the inscription ‘ROMA,’ indicating that they were issued by, or on behalf of the senate. This dataset offers an excellent sample for testing potential analogies with Bronze Age metallic money. It includes entries from a wide range of provenances, randomly collected between 1799 and 2002. This randomness makes the dataset particularly well-suited for statistical analysis. The database does not indicate find spots, but provide information about where the coins where minted. According to the database, most of the coins in the sample were minted in Rome (n = 1,049). The remaining ones were struck in Southern Italy (97), Central Italy (58), Sicily (54), and Sardinia (25). In addition, 24 coins were produced generically in the ‘Roman Republic,’ and 16 generically in ‘Italy.’

There is widespread agreement that all these different forms of physical objects are, in one way or another, money. What is debated is whether or not the forms of money that existed before the state began to issue coinage performed exactly the same functions of coins, i.e., if they were used to sell and purchase things and services in a market fashion (Baron and Millhauser, 2021; Blanton and Feinman, 2024; Ialongo and Lago, 2024; Rosenswig, 2024b). Out of the three monies addressed in this article, Bronze Age scrap and aes were never issued by official authorities, and coins were often, but not always. Here, I address the supposed otherness of coinage as a hypothesis to be tested, rather than as a self-evident axiom.

The key statistical properties of pre-coinage metal-scrap money in Bronze Age Europe (c. 1500–800 BCE) were the focus of recently published research, in which the Bronze Age sample, its cultural setting, and the complete analytical methodology are described in detail (Ialongo and Lago, 2024; Lago et al., 2024). Here, I will use the same methodology to analyse new samples of later forms of metallic money in circulation under the Roman Republic – namely, aes and bronze coins – and compare the results. My objective is to assess whether or not there is a significant difference in the statistical properties of the three samples. I will focus on two quantitative indicators, both reflecting behavioural patterns that underly the use and circulation patterns of metallic money: weight-based regulation and logarithmic density distribution of mass values. The former provides information on the use of bronze as medium of exchange and its compliance with prices, while the latter is a proxy of the distribution of consumption, intended as the total distribution of transaction values in which households engage in a given period of time.

4.3 Weight-based regulation and the compliance with prices

Weight-based regulation is a constant feature of metallic money, from the inception of weighing technology until modern days (Velde, 2007). The practice of breaking down metal objects in order for the resulting fragments to comply with weight systems is archaeologically attested in Bronze Age Mesopotamia by c. 2000–1700 BCE (Ialongo et al., 2018), and in Europe by c. 1500–1350 BCE (Ialongo and Lago, 2024). The old hypothesis that these fragments circulated as weighed currency (e.g., De Rossi, 1886; von Brunn, 1947; Peroni, 1966) was recently confirmed by statistical tests, showing that, starting c. 1500 BCE, bronze fragments systematically comply with the European weight unit of c. 10 g (Ialongo and Lago, 2021, 2024). Data show that the c. 50% of all transactions had the equivalent value of up to 25 g of bronze. As a reference, bronze axes – by far the most attested tool of everyday use in the European Bronze Age – weighed on average c. 400 g. This is to say that the value of most monetary transactions was smaller than 1/16 of the value of the most commonly owned tool. The evidence suggests that, just like bronze coins in the Roman Republic, Bronze Age weighed scrap was mostly used in petty transactions in local markets. If prices were quantified in weight, it follows that this practice is a direct correlate of the practice of negotiating prices according to a shared index of value, paying what is due, and concluding a transaction. It is, in other words, a direct proxy of emergent economic behaviour that leaves clearly readable traces in the archaeological record.

4.3.1 Test: cosine quantogram analysis

Cosine Quantogram Analaysis (CQA) is the standard statistical technique used in ancient metrology to detect if the mass values of all the objects in a sample tend to be multiples of a given basic value, i.e., a unit of measurement (Kendall, 1974; Petruso, 1992; Rahmstorf, 2010; Pakkanen, 2011; Hafford, 2012; Ialongo, 2019). The test statistic is usually called φ(q), and is a measure of how well a pre-defined value – i.e., a quantum – fits all the measurement in a sample.

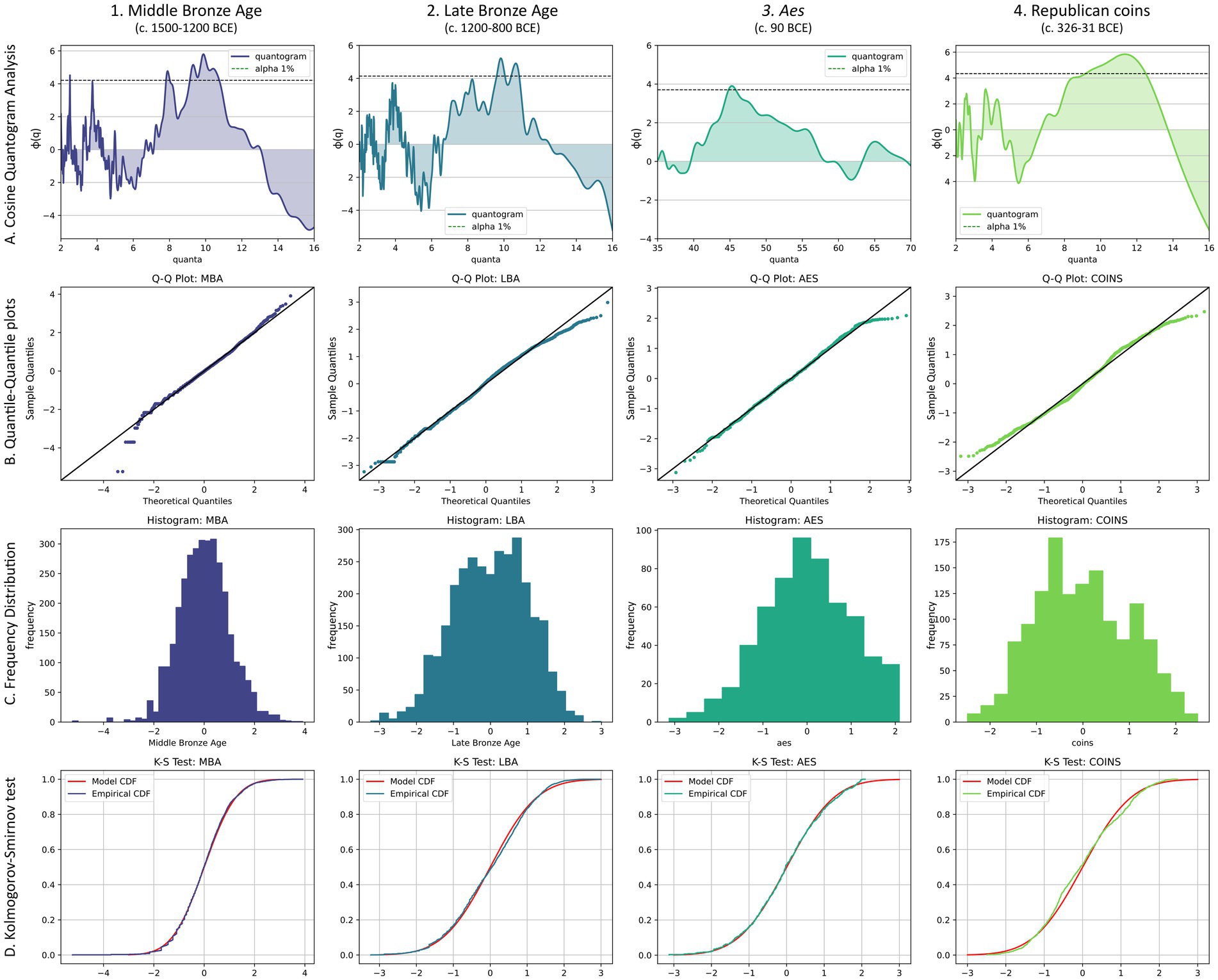

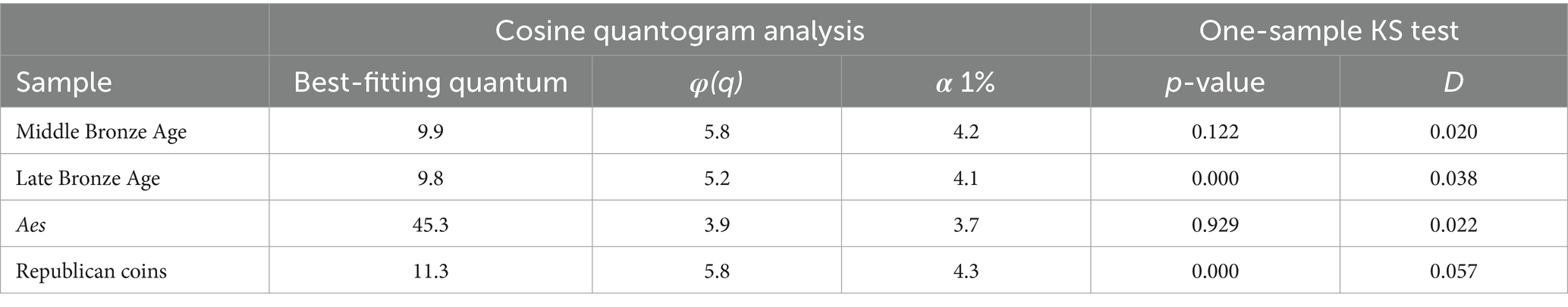

The results of CQA are visualised in a graph, called ‘quantogram’; if analysis finds a quantum that fits the sample particularly well, the quantogram shows a high peak around that value. When this happens, the sample is said to be ‘quantally-configured’, and the peak value likely corresponds to a unit of measurement or one of its multiples or fractions (Figures 2A1–4).

Figure 2. Statistical analyses of the samples of Bronze Age fragments (1–2), aes (3), and Republican coins (4). (A) Cosine Quantogram Analysis, the horizontal dashed lines represent the α-level (1%) calculated through Monte Carlo simulations. (B) Quantile-Quantile plots. (C) Binned Frequency Distribution. (D) Results of the one-sample Kolmogorov–Smirnov test.

A Monte Carlo Simulation is then executed to assess the statistical significance of the results. The simulation generates 1,000 samples of random numbers with similar distribution to the observed archaeological data, and checks the likelihood that random data can give higher peaks than the real data. If the simulated data give higher peaks in fewer than 1% of the iterations, then it can be excluded that the peak of the real data is simply due to chance. The 1% threshold is displayed as a horizontal line on the graphs (Figures 2A1–4). The parameters of the simulation are the same described in detail in Lago et al. (2024). A spreadsheet for the execution of the CQA (Ialongo, 2019) and a python script for CQA and Monte Carlo Simulation (Lago, 2024; Lago et al., 2024) are freely available online.

When applied to Middle and Late Bronze Age fragments in Europe, CQA consistently gives a high significant value that accurately corresponds to the Pan-European unit of c. 10 g (Figures 2A1,2). The same analysis gives consistent results for the samples of Republican coins and aes (Figures 2A3,4). The best-fitting quanta are different, but the samples are always quantally-configured (Table 1). The coin sample shows a best-fitting quantum that is only slightly higher than the ones of the Bronze Age samples (Table 1). The aes sample, on the other hand, shows a substantially higher one (45.3 g). As shown by previous research, the best-fitting quanta of quantally-configured samples do not necessarily correspond to a unit of measurement, and can just indicate common fraction and multiples (Ialongo, 2019). The similarities and differences between the highlighted best-fitting quanta, then, require further investigation, and do not support per se the existence of different units of measurement. For the purposes of this article, it is only significant that all the samples are quantally configured, providing strong support for the weight-regulation hypothesis across all forms of money. In conclusion, this first test does not highlight substantial differences between pre-coinage money and coins.

Table 1. Detailed breakdown of the results of Cosine Quantogram Analysis and one-sample Kolmogorov–Smirnov test for normality for all samples.

4.4 Log-normality and the distribution of consumption

The log-normal distribution is a recently-discovered property of pre-coinage weight-based metallic money (Ialongo and Lago, 2024). It can be easily demonstrated that the logarithm of the mass values of Bronze Age weight-regulated fragments tends to be normally-distributed. The significance of this phenomenon lies in the observation that the mass values of Bronze Age scraps align with the statistical distribution of modern consumption, i.e., the values of all the transactions in which individuals and households engage in a given period of time. Since the mass of metal fragments is a proxy of transaction prices, one can derive that their statistical distribution is a proxy of how much was spent in a given period of time, i.e., consumption. And since it can be demonstrated that the observed log-normal distribution of the mass values of fragmented metal objects cannot be the outcome of a random process, it follows that such a pattern must derive from a widespread form of structured behaviour. Based on simulations, the best-fitting scenario is weight-based fragmentation aimed at monetary circulation in local markets with log-normally distributed supply.

The lognormal distribution of consumption is widely studied in contemporary economics, and reflects the unequally distributed spending habits of individuals and households with unequally-distributed income (Battistin et al., 2009). Simply put, households with an average income are at the same time much fewer than households with a very high income and moderately more numerous than households with a very low income, and their expenses are distributed accordingly. Moreover, the distribution of income and consumption are closely correlated to those of supply and demand (Becker and Tomes, 1979; Possen, 1979; Sutton, 1997). In conclusion, the fact that the distribution of Bronze Age proxies of consumption – i.e., money – is the same as in modern economies strongly suggest that the respective economic behaviours were not substantially different.

4.4.1 Test: goodness-of-fit

The binned Frequency Distribution of the standardised logarithm of each dataset is displayed in histograms in Figures 2C1–4. The Quantile-Quantile (Q-Q) plots provide a visual assessment of the goodness of fit of the observed data with the normal distribution model (Figures 2B1–4). The logarithm of the mass values of the money datasets is tested for normality using the one-sampled Kolmogorov–Smirnov (KS) test. The KS test is a non-parametric test that compares the Cumulative Distribution Function (CDF) of an observed dataset to the CDF of an ideal normal-distribution. The interpretation of the test is based on two values. The p-value is a standard measurement of statistical significance; if the p-value is greater than the chosen confidence level (in this case 0.05), then it cannot be excluded that the observed data are randomly drawn from a normally-distributed population. The test statistic D is the effect size, a measure of the ‘distance’ between the observed distribution and the model; distances below 0.2 are considered negligible (Cohen, 1994, 2009; Sullivan and Feinn, 2012). The interpretation of the test must take into account both values. In particular, a p-value lower than 0.05 does not imply that the sample is not normally distributed if D is negligible; in this case, the interpretation is that the observed data are not different enough from the normal distribution to invalidate modelling based on the assumption that they are normally-distributed.

The results of the KS test confirm that the logarithms of all samples are either normally distributed at α = 0.05 (Middle Bronze Age fragments and aes), or their effect size D is so small that it can be practically assumed that they are log-normally distributed (Late Bronze Age fragments and coins) (Figures 2D1–4 and Table 1). In line with the CQA test, the statistical distribution of the mass values of pre-coinage money and coins does not highlight fundamental differences.

4.5 Discussion

Based on the available datasets, the results of the analyses reject the hypothesis that coinage fundamentally changed the circulation patterns of bronze money (H 1 ). Therefore, the null-hypothesis – i.e., that no fundamental change occurred – remains the most likely explanation, at least until proven otherwise by a new experiment. In this respect, it must be considered that the evidence presented here mostly concerns ‘cheap’ money with widespread circulation among ‘common’ people. It is possible that the monetary circulation of precious-metals might reveal different patterns, especially in view of the fact that there is no conclusive evidence yet that they circulated as money in prehistoric Europe (Rahmstorf, 2019; Hermann, 2022). As far as bronze money is concerned, pre- and post-coinage data can be explained by modern economic behaviour, provided we acknowledge that it is shaped by both market forces and social institutions.

Results show that measurable proxies of monetary circulation of bronze money in the study area (roughly between southern Italy and Northern Germany) do not seem to change with the introduction of coinage. The compliance with weight systems and the log-normal distribution of mass values provide strong indications about how bronze money was used: the former is a proxy of how people used money in everyday transactions when they negotiate prices, the latter is a measure of what people spent their money on. The rationale is that, if coinage is really a watershed in monetary patterns of exchange, then a substantial transformation should be visible in the material correlates of such patterns. Since the outcomes are substantially the same, one can conclude that there is no evidence that a substantial difference existed in how pre-coinage money and coins circulated.

As long as measurable proxies of circulation patters are concerned, early bronze coins faithfully replicate the statistical properties of Bronze Age money. This observation is particularly significant, as the two phenomena are the outcome of two opposite processes: if the weight-based regulation and log-normal distribution of metal fragments are entirely produced by emergent behaviour, when it comes to coins, they must be the outcome of predetermined regulation. Interestingly, in the republican period, bottom-up weight-based fragmentation coexisted with top-down weight-based regulation. The fact that, from an analytical perspective, the two outcomes are indistinguishable suggests that the production of early coinage was the result of rational planning aimed at fitting pre-existing monetary patterns, already widespread among the population for more than a millennium.

The log-normal distribution of coins, in particular, offers hints for future research, as it would imply that coin-issuing subjects, whether public or private, were possibly aware of the overall spending habits of coin users – meaning that they were aware of the distribution of money demand – and planned production accordingly, as Stannard (2018, 2021) already suggested. Why they did it remains an open question that the analyses illustrated here cannot fully answer. Through a framework focussed on power, aligning their coins to pre-existing monetary patterns might have facilitated political authorities in asserting control and legitimacy over the new currency and maximising tax collection (Green et al., 2024; Rosenswig, 2024b). This can explain why ‘the state’ issued coins, but not why coins were issued also by subjects with varying degrees of ‘authority,’ all operating within the same ‘state,’ many of which did not collect taxes and were not necessarily interested in asserting any form of direct control over the circulation of money (Stannard, 2021; Yarrow, 2021). The same argument would also hardly explain the wide circulation of foreign currencies. For the time being, all the available evidence allows one to conclude is that different subjects, either public or private, started issuing coins because there was a demand for money that was not fulfilled by pre-coinage forms of currency, and continued to do so because that demand never ceased. In other words, the introduction of coinage did not fundamentally change how money circulated, and those responsible for it might not have even intended to bring about such a change in the first place.

From a quantitative point of view, it appears that no measurable difference exists between pre-coinage money and early coins in the study area. Technically speaking, metallic money has remained a quantally-configured, log-normally distributed array of metal objects for roughly 1,500 years, since the inception of weighing technology. When money became coinage, these properties did not fundamentally change. Both the quantal configuration and the log-normal distribution of metallic money are a consequence of, and not a cause for how money was used, and both are correlated to the distribution of income, consumption, supply and demand. In conclusion, the monetary patterns of exchange that were widespread for millennia did not change during the first centuries of coin circulation. Hence, state-issued money did not substantially change the nature of money. These observations suggest that the invention of coinage was a relatively minor technological innovation that produced major political economic effects in the long run, but that does not appear to have had a substantial effect on the economic behaviour of Europeans during its first few centuries. In a way, the introduction of coinage seems to change the scholarly perception of money more than it changed how money actually circulated.

5 Conclusion

The theses illustrated in this article largely rely on empirical observations on data that come from a specific region of Europe with its own peculiar socio-political setting, and should not be taken as reflections of universally valid mechanics. Each region of the world has its own specific history, and dynamics can change, as well as their outcomes. Yet, the case study offers evidence in support of a largely seamless continuity in monetary patterns of exchange before and after coinage, and a general theory of money must account for this evidence. The common assumption that pre-coinage and pre-state money, along with the economies they operated within, were inherently primitive is not a self-evident fact but rather a hypothesis that requires testing. At least since Polanyi, it has been a common pitfall to overestimate the supposed ‘impersonal nature’ of modern monies as opposed to the ‘embedded nature’ of primitive ones, while there is in fact no real empirical ground to assume that modern monies are in any substantial way more ‘impersonal’ than primitive money is supposed to be. By the same token, pre-coinage monies might have been just as ‘impersonal’ as post-coinage ones.

The idea that the invention of coinage ushered an era of impersonal economic transactions, then, is a legitimate but untested assumption that is mostly based on old stereotypes. The archaeological evidence illustrated in this article suggests that coinage did not usher a revolution, as it took many centuries after its invention before it completely replaced older forms of money, which in turn happened long after the state started issuing coins. The quantitative metrics explored in the last section further confirm the qualitative observations, showing that coins seamlessly blend with preexisting monetary patterns of exchange that had already been widespread in European economies at least since c. 1500 BCE.

The debunked myth of a pre-monetary barter economy stands as a warning that the ‘origin of money’ might be itself a myth. While a barter economy never existed, the ‘myth of barter’ still serves as a powerful paradox, illustrating that the origin of money is not a concrete historical event but rather an abstract academic concept, a construct that frames variable outcomes of complex economic behaviour rather than a milestone in cultural evolution. In the same way, the distinction between ‘primitive’ and ‘modern’ money is also more academic than practical; these terms merely describe different aspects of monetary exchange patterns that overlap in both modern and so-called primitive economies. The key to understanding economic transformations in ancient history, then, might not lie in mutually-exclusive oppositions, but rather in how much each of such different aspects contributed to the general picture.

Trust is central to money’s function. Whether state-issued or market-driven, money holds value because people collectively agree that it does. This shared belief system is crucial to understanding why money works, regardless of its form or origin. Perhaps, money should not be viewed as a thing but rather as a way of exchanging things. Different anthropological approaches are right in identifying the origin of money in social relationships; their oversight lies in baselessly assuming that this changed at some point along the path to modernity. As economists and anthropologists alike always maintained – although from different starting points – the true origin of money lies in human behavioural patterns that become manifest when opportunities for exchange become quantitatively relevant. Determining the exact point at which these behaviours technically qualify as ‘money’ is a matter of academic finesse rather than a fixed historical threshold. This perspective shifts the focus from money as a physical entity to money as a social and economic process, rooted in the patterns of human interaction – today like thousands of years ago.

The invention of coinage is often celebrated as a major milestone in the history of money, but it is only one of several technical improvements. The invention of weighing technology in Bronze Age Western Eurasia, for instance, is an era-defining innovation that was at least as significant as the later advent of coinage, and its impact on monetary systems lasted for much longer. At the same time, the spread of weight-based metallic money did not fundamentally alter economic behaviour; rather, it made visible a pre-existing way of exchanging goods that had been in practice long before it became archaeologically detectable. This evidence challenges the notion of a stark divide between primitive and modern economies, suggesting instead that the fundamental principles of economic exchange have deep roots that extend far back into history. By incorporating these principles into a theory of money, one can better understand its nature and evolution, not as a singular invention but as a reflection of enduring human behaviour.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: https://static-content.springer.com/esm/art%3A10.1038%2Fs41562-024-01926-4/MediaObjects/41562_2024_1926_MOESM3_ESM.xlsx.

Author contributions

NI: Writing – original draft, Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Acknowledgments

I would like to express my sincere gratitude to Giancarlo Lago, Julius Roch and Clive Stannard for their thoughtful feedback on the early version of this manuscript. I am also deeply thankful to Eleonore Pape for her insightful feedback and constructive comments, which greatly improved the quality of this work. My gratitude also goes to the reviewers, whose valuable insights greatly contributed to the improvement of the original manuscript.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Andreau, J. (2001). La monnaie et les « monnaies frappées », conclusions de la Table ronde du 15 janvier 2000. Revue numismatique 6, 163–172. doi: 10.3406/numi.2001.2325

Appadurai, A. (ed.). (1986). “Introduction: commodities and the politics of value” in The social life of things (Cambridge: Cambridge University Press), 3–63.

Baldassarri, M., Cristoforetti, G., Fantozzi, I., Firmati, M., Legnaioli, S., Palleschi, V., et al. (2007). “Analisi LIBS di esemplari di aes rude proveniente dall’abitato etrusco di Ghiaccio Forte (Scansano, GR)” in Atti del IV Congresso Nazionale di Archeometria (Pisa, 1–3 febbraio 2006). ed. C. D’Amico (Bologna: Pàtron), 561–573.

Baron, J., and Millhauser, J. (2021). A place for archaeology in the study of money, finance, and debt. J. Anthropol. Archaeol. 62:101278. doi: 10.1016/j.jaa.2021.101278

Battistin, E., Blundell, R., and Lewbel, A. (2009). Why is consumption more log Normal than income? Gibrat’s law revisited. J. Polit. Econ. 117, 1140–1154. doi: 10.1086/648995

Becker, G. S., and Tomes, N. (1979). An equilibrium theory of the distribution of income and intergenerational mobility. J. Polit. Econ. 87, 1153–1189. doi: 10.1086/260831

Beckert, J. (2011). Where do prices come from? Sociological approaches to Price formation. Max-Planck-Institut für Gesellschaftsforschung Discussion Paper 11, 1–26. doi: 10.1093/ser/mwr012

Bertol, A. (2014). “Individual finds or a coin hoard: analysis of the Mazin-type material from the Sveta Trojica hill-fort near Starigrad Paklenica” in Miscellanea historiae antiquitatis: Proceedings of the first Croatian-Hungarian PhD conference on ancient history. eds. G. Németh and D. Bajnok (Budapest: Eötvös Lorand University), 111–142.

Bertol, A., and Farac, K. (2012). Aes rude and aes formatum – a new typology based on the revised Mazin hoard. Vjesnik Arheološkog muzeja u Zagrebu 45, 93–113.

Blanton, R., and Fargher, L. (2008). Collective action in the formation of pre-modern states. New York, NY: Springer New York.

Blanton, R. E., and Feinman, G. M. (2024). New views on price-making markets and the capitalist impulse: beyond Polanyi. Front. Hum. Dyn. 6:1339903. doi: 10.3389/fhumd.2024.1339903

Bloch, M., and Parry, J. (1989). “Introduction: money and the morality of exchange” in Money and the morality of exchange. eds. J. Parry and M. Bloch (Cambridge: University Press), 1–32.

Bohannan, P. (1959). The impact of money on an African subsistence economy. J. Eco. History 19, 491–503. doi: 10.1017/S0022050700085946

Bresson, A. (2012). “Le marché des philosophes: Platon, Aristote et la monnaie” in Tout vendre, tout acheter. Structures et équipements des marchés antiques. eds. V. Chankowski and P. Karvonis (Bordeaux: Ausonius éditions), 365–384.

Bridel, P. (2014). Why is there money? Or yet a new attempt at solving the Hahn problem. oeconomia. 4, 623–635. doi: 10.4000/oeconomia.1052

British Museum Collection (2024). Available at: https://www.britishmuseum.org/collection (Accessed June 9, 2024).

Bruck, J. (2016). “Hoards, fragmentation and exchange in the European bronze age” in Raum, Gabe und Erinnerung: Weihgaben und Heiligtümer in prähistorischen und antiken Gesellschaften. Berlin Studies of the Ancient World 38. eds. S. Hansen, D. Neumann, and T. Vachta (Berlin: Edition Topoi), 75–92.

Cardarelli, A. (2018). Before the city: the last villages and proto-urban centres between the Po and Tiber rivers. Origini 42, 359–382.

Carrier, J. G. (1997). “Preface” in Meanings of the market. The free market in Western culture. ed. J. G. Carrier (New York: Berg), vii–xvi.

Chapman, A. (1980). Barter as a universal mode of exchange. L’Homme 20, 33–83. doi: 10.3406/hom.1980.368100

Cohen, J. (1994). The earth is round (p<.05). Am. Psychol. 49, 997–1003. doi: 10.1037/0003-066X.49.12.997

Cohen, J. (2009). Statistical power analysis for the behavioral sciences. 2. ed., reprint Edn. New York, NY: Psychology Press.

Crawford, M. H. (1985). Coinage and money under the Roman republic: Italy and the mediterranean economy. Berkeley Los Angeles: University of California Press.

Dale, G. (2021). “The infinite silver of Xenophon. Money and growth in classical Athens” in Merchants, measures and money. Understanding Technologies of Early Trade in a comparative perspective. eds. L. Rahmstorf, G. Barjamovic, and N. Ialongo (Göttingen: Wachholtz Verlag), 305–316.

De Rossi, M. S. (1886). Pezzi d’aes rude di peso definito e le asce di bronzo adoperate come valore monetale. Dissertazioni della Pontificia Accademia Romana Archeologica 2, 451–470.

Dercksen, J. G. (2021). “Money in the old Assyrian period” in Merchants, measures and money. Understanding Technologies of Early Trade in a comparative perspective. eds. L. Rahmstorf, G. Barjamovic, and N. Ialongo (Wachholtz Verlag), 331–359.

Ehnts, D. H. (2019). Knapp’s state theory of money and its reception in German academic discourse. Berlin School of Economics and Law, Institute for International Political Economy. Available at: https://www.ipe-berlin.org/fileadmin/institut-ipe/Dokumente/Working_Papers/IPE_WP_115.pdf (Accessed February 22, 2022).

Englund, R. (2012). “Equivalency values and the command economy of the Ur III period in Mesopotamia” in The construction of value in the ancient world. eds. J. K. Papadopoulos and G. Urton (Los Angeles: Cotsen Institute of Archaeology Press), 427–458.

Eshel, T., Gilboa, A., Yahalom-Mack, N., Tirosh, O., and Erel, Y. (2021). Debasement of silver throughout the late bronze – Iron age transition in the southern Levant: analytical and cultural implications. J. Archaeol. Sci. 125:105268. doi: 10.1016/j.jas.2020.105268

Feinman, G. M., and Carballo, D. M. (2018). Collaborative and competitive strategies in the variability and resiliency of large-scale societies in Mesoamerica. Econ. Anthropol. 5, 7–19. doi: 10.1002/sea2.12098

Feldman, A. M. (1973). Bilateral trading processes, pairwise optimally, and Pareto optimality. Rev. Econ. Stud. 40, 463–473. doi: 10.2307/2296581

Frank, R. H. (1990). “Rethinking rational choice” in Beyond the marketplace. Rethinking economy and society. eds. R. Friedland and A. F. Robertson (New York: Routledge), 53–88.

Frankel, S. H. (1978). Two philosophies of money: The conflict of trust and authority. New York: St. Martin’s Press.

Garfinkle, J. (2004). Shepherds, merchants, and credit: some observations on lending practices in Ur III Mesopotamia. J. Econ. Soc. Hist. Orient 47, 1–30. doi: 10.1163/156852004323069385

Gilbert, E. (2005). Common cents: situating money in time and place. Econ. Soc. 34, 357–388. doi: 10.1080/03085140500111832

Granovetter, M. (1985). Economic action and social structure: the problem of embeddedness. Am. J. Sociol. 91, 481–510. doi: 10.1086/228311

Green, A. S., Wilkinson, T. C., Wilkinson, D., Highcock, N., and Leppard, T. (2024). Cities and citadels: an archaeology of inequality and economic growth. 1st Edn. London: Routledge.

Gu, C., Han, H., and Wright, R. (2019). “New monetarist economics” in Oxford research encyclopedia of economics and finance (Oxford: Oxford University Press).

Hafford, W. B. (2012). Weighting in Mesopotamia. The balance Pan weights from Ur. Akkadica 133, 21–65.

Hahn, F. H. (1966). “On some problems of proving the existence of an equilibrium in a monetary economy” in The theory of interest rates: Proceedings of a conference held by the International Economic Association. eds. F. H. Hahn and F. P. R. Brechnung (London and Basingstoke: Elsevier), 297–306.

Hart, K. (1982). “On commoditization” in From craft to industry: The ethnography of proto-industrial cloth production. ed. E. N. Goody (Cambridge: Cambridge University Press), 38–49.

Hart, K. (2005). “Money: one anthropologist’s view” in A handbook of economic anthropology. ed. J. G. Carrier (Cheltenham, Northampton: Edward Elgar Publishing), 160–175.

Heady, P. (2005). “Barter” in A handbook of economic anthropology. ed. J. Carrier (Edward Elgar Publishing), 2904.

Hermann, R. (2022). Weight regulation in British bronze age gold objects: a reanalysis and reinterpretation. Antiquity 96, 336–353. doi: 10.15184/aqy.2021.54

Heymans, E. D. (2021). The origins of money in the Iron age Mediterranean world. 1st Edn. Cambridge: Cambridge University Press.

Hiriart, E., and Genechesi, J. (2021). Gold and silver “ingots” across Celtic continental Europe a monetary use? Am. J. Numismatics 33, 49–67.

Ialongo, N. (2019). The earliest balance weights in the west: towards an independent metrology for bronze age Europe. Camb. Archaeol. J. 29, 103–124. doi: 10.1017/S0959774318000392

Ialongo, N., and Lago, G. (2021). A small change revolution. Weight systems and the emergence of the first Pan-European money. J. Archaeol. Sci. 129:105379. doi: 10.1016/j.jas.2021.105379

Ialongo, N., and Lago, G. (2024). Consumption patterns in prehistoric Europe are consistent with modern economic behaviour. Nat. Hum. Behav. 8, 1660–1675. doi: 10.1038/s41562-024-01926-4

Ialongo, N., Vacca, A., and Peyronel, L. (2018). Breaking down the bullion. The compliance of bullion-currencies with official weight-systems in a case-study from the ancient near east. J. Archaeol. Sci. 91, 20–32. doi: 10.1016/j.jas.2018.01.002

Ingo, G. M., de Caro, T., and Bultrini, G. (2004). Microchemical investigation of archaeological copper based artefacts disclosing an ancient witness of the transition from the value of the substance to the value of the appearance. Microchim. Acta 144, 87–95. doi: 10.1007/s00604-003-0097-y

Jones, R. A. (1976). The origin and development of Media of Exchange. J. Polit. Econ. 84, 757–775. doi: 10.1086/260475

Jung, R. (2021). “Uneven and combined: product exchange in the Mediterranean (3rd to 2nd millennium BCE)” in The critique of archaeological economy. eds. S. Gimatzidis and R. Jung (Cham: Springer), 139–162.

Kemmers, F. (2016). “Coin use in the Roman Republic” in Neue Forschungen zur Münzprägung der Römischen Republik (Beiträge zum internationalen Kolloquium im Residenzschloss Dresden 19.–21. Juni 2014). Nomismata 8. eds. F. Haymann, W. Hollstein, and M. Jehne (München: Habelt Verlag), 347–372.

Kemmers, F., and Myrberg, N. (2011). Rethinking numismatics. The archaeology of coins. Arch. Dial. 18, 87–108. doi: 10.1017/S1380203811000146

Kendall, D. B. (1974). Hunting quanta. Philos. Trans. R. Soc. Lond. Ser. A Math. Phys. Sci. 276, 231–266.

Kopytoff, I. (1986). “The cultural biography of things: commoditization as process” in The social life of things. ed. A. Appadurai (Cambridge: Cambridge University Press), 64–91.

Kristiansen, K. (2018). “The rise of bronze age peripheries and the expansion of international trade 1950–1100 BC” in Trade and civilisation. Economic networks and cultural ties, from prehistory to the early modern era. ed. K. Kristiansen (Cambridge: Cambridge University Press), 87–112.