- Makerere University Business School, Kampala, Uganda

Research problem: In the face of global efforts to combat poverty and enhance the well-being of vulnerable populations, aiming for inclusive growth, the 2024 UNDP trend report casts a shadow with its findings that the world remains off-course for achieving Sustainable Development Goal 1 (SDG1) “No Poverty.” Specifically, in Uganda, despite the integration of poverty eradication measures within national development agendas, the efficacy of such initiatives is critically contingent upon the financial literacy levels among the impoverished targets.

Aim: This study underscores the pivotal role of financial literacy in fostering the empowerment of underserved communities, directing them toward paths of inclusive growth.

Research methods: Adopting a qualitative framework, this investigation spanned 7 parishes across five districts within Uganda’s Busoga region, selected via purposive sampling. Participants included a cross-section of community members—ranging from household heads and local entrepreneurs to SACCO (Savings and Credit Cooperative Organization) members and parish chiefs—all of whom engage with government-led poverty alleviation programs. A semi-structured interview guide facilitated the collection of nuanced data, which was subsequently transcribed and subjected to content analysis to distill key thematic insights.

Results and discussion: The findings illuminate a stark reality: inadequate financial management and literacy significantly thwart the sustainable development of rural communities. Such deficiencies not only hamper economic progress but also stifle the potential for holistic community empowerment.

Conclusion: Investment in financial literacy emerges as a crucial strategy, underscoring the importance of equipping individuals with the knowledge and skills necessary for economic participation and personal growth. This approach aligns with the principles of Amartya Sen’s Capability Approach and the Human Capital Theory, advocating for the prioritization of financial literacy initiatives within rural development strategies. The study accentuates the need for comprehensive financial literacy training, aimed at fulfilling broader policy objectives and catalyzing economic development and poverty reduction efforts.

Introduction

Sustainable economic growth in rural regions poses a significant problem for numerous sub-Saharan African countries, where restricted access to financial services, educational resources, and organized economic possibilities sustains cycles of poverty (United Nations Development Programme, 2017). Uganda, predominantly a rural country, encounters same issues, with substantial segments of its populace marginalized from formal financial systems and deficient in essential financial competencies. The Ugandan government has increasingly prioritized Savings and Credit Cooperatives (SACCOs) to enhance financial inclusion and economic empowerment in rural communities (Uganda Ministry of Finance, Planning and Economic Development, 2012). SACCOs, which offer accessible savings and credit services, considerably enhance rural livelihood sustainability by empowering members to support their families, promote entrepreneurship, and create employment prospects (Moyo and Gasva, 2022). Nonetheless, despite the prospective advantages of SACCOs, operational difficulties, cultural impediments, and insufficient financial literacy among members hinder their efficacy in rural Uganda, necessitating a thorough examination of targeted strategies to enhance their influence on sustainable rural development.

Financial literacy training is recognized as a vital element affecting the efficacy of SACCOs in promoting economic empowerment within rural communities. Studies indicate that individuals possessing elevated financial literacy are more inclined to practice sound financial behaviors, including debt management, savings growth, and investment, thereby enhancing the financial stability of SACCOs and fostering resilience at both individual and community levels (Mwatondo and Wekesa, 2020; Namakula and Kawooya, 2021). In Uganda, financial literacy training is frequently integrated into SACCO programs to enhance the financial management skills of rural entrepreneurs and farmers, hence fostering economic empowerment at the household level. Nonetheless, there are still deficiencies in comprehending the precise processes via which financial literacy influences economic empowerment in rural Uganda, especially concerning its effects on financial decision-making and risk management behaviors essential for sustainable rural development. This study aims to investigate the link between financial literacy training and economic empowerment in rural communities of Uganda.

Alongside financial literacy, proficient management techniques within SACCOs are crucial for addressing operational difficulties and guaranteeing sustainability. Effective management procedures, including transparent asset use and operational efficiency, are crucial for SACCOs to attain financial stability, broaden outreach, and foster rural economic development (Sebhatu, 2011). Exemplary instances, like the Kilimanjaro Co-operative Bank-SACCOS model in Tanzania, underscore the capacity of effectively managed SACCOs to evolve into sustainable rural financial institutions that can address community requirements in the long term (Temu, 1999). Notwithstanding these insights, SACCOs in Uganda encounter obstacles, including insufficient management acumen, poor regulatory assistance, and infrastructural limitations, which impede their efficacy and restrict their ability to meet the financial requirements of rural enterprises. This study seeks to uncover techniques that enable SACCOs to surmount operational problems, thereby enhancing their financial management capacities and fostering sustainable rural economic development.

Cultural and structural obstacles exacerbate the execution of financial literacy and management programs in rural Uganda. Numerous rural communities function within defined social norms that shape perspectives on savings, debt, and investment, affecting their propensity to engage in SACCOs or embrace novel financial practices (Acharya et al., 2007). Moreover, structural impediments such as restricted access to technology, inadequate infrastructure, and erratic financial regulation hinder financial inclusion initiatives and constrain SACCOs’ capacity to foster sustainable development effectively (Feleke, 2018). Overcoming these obstacles necessitates focused financial literacy and management programs tailored to the cultural and structural contexts of rural communities, promoting sustained financial inclusion and development. This paper analyzes the optimization of these activities to surmount impediments, thereby guaranteeing SACCOs’ contributions to economic empowerment and sustainable development in rural Uganda.

This study investigates three principal research inquiries: What is the connection between financial literacy training on economic empowerment in rural communities in Uganda? How can SACCOs address operational problems to improve the financial management skills of rural businesses and promote sustainable rural economic development? How can targeted financial literacy and management programs be enhanced to address cultural and structural obstacles in rural communities, thereby guaranteeing sustained financial inclusion and development? This research seeks to enhance the understanding of SACCOs’ involvement in Uganda’s rural economy by examining how financial literacy and good management practices can be utilized to foster sustainable development. These findings will guide policymakers, SACCO administrators, and community leaders in formulating evidence-based initiatives to improve SACCO performance, bolster rural financial inclusion, and promote the economic empowerment of underprivileged groups in Uganda.

Literature review

The financial empowerment of rural populations is widely acknowledged as essential for sustainable economic development, particularly in areas with restricted access to financial services and formal education. In rural Ugandan communities, Savings and Credit Cooperatives (SACCOs) and financial literacy training are essential tools for economic empowerment, fostering financial inclusion, entrepreneurship, and economic stability (Moyo and Gasva, 2022; Uganda Ministry of Finance, Planning and Economic Development, 2012). Financial literacy equips rural individuals, especially women, with essential knowledge and skills for personal finance management, thereby enhancing informed decision-making, bolstering financial stability, and promoting local economic development (Adera and Abdisa, 2023). SACCOs provide rural entrepreneurs with accessible financial services, such as savings, credit, and fundamental financial education, hence addressing the disparity in financial services and augmenting entrepreneurial potential (Feleke, 2018; Sebhatu, 2011). Nonetheless, SACCOs encounter structural and operational obstacles that may hinder their efficacy, particularly in accessing vulnerable populations and maintaining financial services over time. Confronting these obstacles is essential for optimizing the influence of SACCOs on rural economic empowerment and sustainable development. This literature review analyzes the impact of financial literacy and SACCOs on empowering rural communities, investigating how specialized training and enhanced financial management strategies might address cultural and operational obstacles to improve rural development results in Uganda.

Financial literacy training and economic empowerment among rural populations

Advancing economic empowerment in rural communities is essential for combating poverty and inequality, especially in developing areas where access to financial services and economic resources is frequently restricted. Financial literacy training has emerged as a crucial instrument in achieving this objective, equipping individuals—particularly women—with the knowledge, skills, and mindset required for effective personal financial management. The transforming effect of financial literacy on rural communities lies in its capacity to enhance financial inclusion, savings behavior, borrowing proficiency, and investment choices, which are essential for poverty reduction and sustained economic development (Adera and Abdisa, 2023).

The influence of financial literacy on economic empowerment is grounded on Human Capital Theory, which perceives knowledge and skills as investments that augment individual productivity and economic potential. Financial literacy constitutes a type of human capital that enables individuals to maneuver through financial institutions, comprehend investment prospects, and adopt practices that promote financial stability. Enhancing financial literacy enables rural communities to make educated choices, resulting in improved economic resilience and less susceptibility to poverty (Garu and Dash, 2023). Moreover, Social Learning Theory emphasizes the social aspect of financial literacy education, since individuals frequently acquire financial behaviors through observation and engagement within their communities. Informal training programs, especially in rural regions, utilize social networks to foster situations conducive to the sharing and reinforcement of information and skills, resulting in enhanced community benefits (Ntakyo et al., 2021).

Enhancing women’s financial literacy is especially transformative in rural areas, as it improves individual financial competence and reinforces their influence in household financial decisions. Financial literacy training enhances women’s economic liberty, hence improving household welfare and fostering gender equity in decision-making processes. Research indicates that women possessing financial acumen substantially enhance sustainable development in their communities (Garu and Dash, 2023). The empowerment paradigm asserts that women’s control over resources, including income and assets, allows them to positively impact home and community results. This corresponds with Empowerment Theory, which highlights that enhanced knowledge, resource control, and elevated self-efficacy foster empowerment and agency within societal frameworks. Financial literacy empowers women to participate confidently in financial endeavors, so augmenting their roles as economic contributors and decision-makers.

In rural areas with little access to formal financial education, informal financial literacy programs can have spillover effects via social networks. Ntakyo et al. (2021) illustrate that informal literacy instruction for smallholder farmers promotes knowledge dissemination within community networks, enhancing financial practices beyond the direct recipients. This phenomena can be elucidated through the Diffusion of Innovations Theory, which asserts that ideas and practices disseminate among social systems when individuals adopt and modify new behaviors observed within their networks. Social networks function as channels for the dissemination of financial knowledge, allowing trained individuals to impact others in their communities. Network effects are especially advantageous in rural areas, where financial inclusion is frequently obstructed by physical and institutional hurdles.

Financial literacy training disseminated through social networks generates a ripple effect, enhancing its influence throughout rural communities and fostering collective financial resilience. Proscovia et al. (2021) discovered that financial knowledge and behaviors were enhanced not just among direct participants of training programs but also among the broader community, as individuals disseminated insights and practices within their social networks.

The correlation between financial literacy and economic empowerment in rural communities exemplifies the significant impact of financial education on sustainable development. Theory of Sustainable Development posits that imparting financial skills to individuals fosters enduring economic growth and resilience. Financial literacy enhances savings and investment behaviors, enabling individuals and households to establish financial security, diminish reliance on informal loans, and promote entrepreneurship. This alteration in financial conduct fosters community development by diminishing poverty rates and bolstering local economic expansion. As more individuals in rural communities gain financial literacy, their enhanced economic engagement promotes sustainable development by stabilizing household income and encouraging local business ventures. We therefore pose the following research question: What is the connection between financial literacy training on economic empowerment in rural communities in Uganda?

Enhancing financial management capabilities of rural entrepreneurs through savings and credit cooperatives (SACCOs)

Savings and Credit Cooperatives (SACCOs) play a crucial role in enhancing financial inclusion and improving financial management competencies among rural entrepreneurs in developing nations. SACCOs facilitate rural entrepreneurs’ financial skills by offering accessible financial services, including savings, credit, and fundamental financial education, which are essential for the sustainability of small-scale enterprises in underserved regions. Despite their contributions, SACCOs encounter significant problems, such as inadequate managerial skills, deficient organizational governance, and difficulties in loan repayment management (Johnson et al., 2014; Sebhatu, 2011; Ndiege et al., 2014). Confronting these obstacles is essential for SACCOs to optimize their influence on rural economic development.

SACCOs frequently encounter challenges related to managerial proficiency, which impairs their capacity to provide efficient financial services to rural entrepreneurs. Johnson et al. (2014) assert that insufficient professional management in SACCOs hinders their operational efficiency, leading to inadequate financial supervision and service delivery. Moreover, deficiencies in accountability and transparency within corporate governance intensify these concerns. Sebhatu (2011) emphasizes that deficiencies in governance within SACCOs can erode confidence among members, which is essential for member-based organizations dependent on collective support.

Loan repayment management poses a significant challenge for SACCOs, especially in rural regions where entrepreneurs experience erratic income streams due to seasonal agricultural cycles. Ndiege et al. (2014) discovered that elevated default rates among borrowers jeopardize the financial viability of SACCOs, constraining their capacity to provide additional loans. These issues necessitate specific methods, including improved managerial training, government reforms, and adaptable repayment choices designed for the distinct situations of rural entrepreneurs.

Notwithstanding these operational challenges, SACCOs exert a beneficial socioeconomic influence on rural communities. Feleke (2018) contends that SACCOs enhance rural farmers’ access to money for acquiring agricultural inputs, resulting in augmented production and, subsequently, elevated incomes. SACCOs also promote the integration of rural economies with urban markets by providing financial services to regions sometimes overlooked by commercial banks, thus fostering regional economic development (Sebhatu, 2011).

The Dynamic Capabilities Theory is essential for comprehending how SACCOs may adjust to difficulties and effectively serve their members. This idea asserts that companies must perpetually enhance capacities in learning, coordination, and responsiveness to maintain competitiveness in evolving settings. For SACCOs, dynamic skills entail adjusting to the changing financial requirements of rural businesses, enhancing service delivery, and flexibly addressing economic difficulties (Omeke et al., 2020). By augmenting their dynamic capacities, SACCOs can improve their efficacy in facilitating the financial management practices of rural entrepreneurs.

Another pertinent theory is Social Capital Theory, which emphasizes the significance of social networks and trust in SACCO activities. SACCOs depend on social capital, established via communal ideals and trust, to promote engagement in financial activities. Eboh (2000) posits that social capital is crucial in mitigating credit risks, since individuals are more inclined to fulfill their obligations inside trusted networks. SACCOs can leverage this strategy to cultivate robust community connections, hence enhancing loan payback rates and general financial discipline among members.

To improve SACCO efficacy, prioritizing sustainability over profits is imperative. Ndiege et al. (2014) contend that SACCOs must prioritize long-term sustainability to guarantee ongoing service delivery to rural SMEs. Theory of Sustainable Development endorses this methodology by promoting robust financial institutions that facilitate equitable economic advancement. Sustainability for SACCOs can be attained via regulatory reforms, financial education, and an emphasis on generating enduring socioeconomic advantages for rural communities.

The financial management capabilities of rural entrepreneurs are directly affected by their financial literacy and resource accessibility. Research indicates that rural businesses possessing robust financial acumen are more adept at making informed decisions, mitigating risks, and attaining sustainable growth (Yi et al., 2023). Consequently, SACCOs ought to invest in financial literacy initiatives that provide members with critical financial acumen, so improving their entrepreneurial efficacy. From the aforementioned we develop the following research question: How can SACCOs address operational problems to improve the financial management skills of rural businesses and promote sustainable rural economic development?

Financial management and literacy gaps for sustainable Progress in rural communities

Financial literacy programs are crucial for empowering rural communities and promoting sustainable development. Research indicates that specialized financial management training can markedly improve financial literacy, especially among persons possessing a minimum of a secondary education (Peiris, 2021). Financial literacy enhances decision-making, promotes savings, and stimulates entrepreneurial activities among rural communities (Hamzah et al., 2023). Improved financial literacy fosters the viability of rural microfinance institutions by encouraging sound governance and prudent financial decision-making procedures (Atahau et al., 2023). Nonetheless, numerous obstacles, including linguistic variety and gender inequalities in financial inclusion, persist in obstructing the efficacy of these programs, especially in smallholder agricultural contexts (Peiris, 2021).

Targeted financial literacy initiatives have shown favorable results in enhancing financial management practices in rural areas. Financial literacy includes the skills and knowledge necessary for budgeting, resource management, and efficient saving strategies. Hamzah et al. (2023) discovered that financial training for rural populations in Indonesia markedly enhanced savings and improved financial resource management. These results correspond with the Theory of Planned Behavior, which posits that financial literacy improves an individual’s command over financial decisions, facilitating better informed and sustainable choices.

Furthermore, specialized financial management education fosters entrepreneurship in rural regions by providing individuals with expertise in risk evaluation and investing tactics. Atahau et al. (2023) indicate that financial literacy is associated with enhanced governance in rural financial institutions, implying that literate community members are more inclined to engage in governance positions and make prudent financial choices. These observations underscore the transformative potential of financial literacy in fostering sustainable rural development.

Notwithstanding the advantages, financial literacy initiatives encounter obstacles that hinder their efficacy. Language diversity in rural areas frequently restricts access to financial education, particularly in linguistically diverse groups (Adegbite and Machethe, 2020). Moreover, disparities in financial inclusion based on gender continue to be a substantial concern, especially in rural economies reliant on agriculture. Women in smallholder agricultural contexts frequently encounter institutional and cultural obstacles that hinder their involvement in financial education programs, hence diminishing the overall efficacy of these initiatives (Adegbite and Machethe, 2020).

Adegbite and Machethe (2020) advocate for digital financial inclusion initiatives utilizing mobile platforms to expand outreach and gender-responsive agricultural finance innovations tailored to the distinct requirements of rural women. These techniques, underpinned by Diffusion of Innovations Theory, assert that the adoption of digital financial instruments and gender-responsive initiatives can enhance financial literacy and inclusion in rural areas.

Alongside official financial literacy programs, community-driven projects and self-help efforts have demonstrated efficacy in mitigating money management deficiencies in rural regions. Ebong et al. (2018) emphasize that community-based savings and credit clubs establish a basis for financial education and management in several rural areas. These clubs utilize social capital to promote financial discipline among members and foster collective savings, offering a framework for sustainable financial practices.

Dwivedi et al. (2015) underscore that self-help groups enhance financial empowerment through the facilitation of reciprocal learning and peer support. These groups correspond with Social Capital Theory, which asserts that social networks and trust within a society are essential for efficient resource sharing and information dissemination. In rural areas, community-driven projects utilize established social connections to enhance financial education, serving as an effective means to improve financial literacy among communities with restricted access to formal educational programs. The discussion results in the following research question: How can targeted financial literacy and management programs be enhanced to address cultural and structural obstacles in rural communities?

Methodology

This research utilized a qualitative approach to examine the empowerment of rural communities in Uganda’s Busoga region, with particular emphasis on the significance of financial literacy and management in sustainable development. The Busoga region, noted for its elevated poverty levels in Uganda’s National Development Plan (NDP 111 2021-2025: National Planning Authority, 2020), and comprising 40% of Eastern Uganda’s population (UBOS 2014: Uganda Bureau of Statistics, 2014), provided a significant setting for this research.

Sample size determination and data saturation

A purposive sampling method was utilized to select key informants directly involved in government-led poverty alleviation activities, ensuring an adequate sample size for comprehensive qualitative analysis. The initial sample size was estimated according to criteria for qualitative investigations in analogous circumstances, with the objective of achieving theoretical saturation as advised by Guest et al. (2006). Data saturation was consistently evaluated throughout data collection by determining if further interviews produced novel insights or themes. Data saturation was considered attained when no new themes arose, hence supporting the dependability of the study’s conclusions.

The final sample comprised five districts from the eleven in Busoga (Jinja, Luuka, Bugweri, Kamuli, and Iganga), chosen using systematic probability sampling utilizing Excel’s random selection tool. This methodology guaranteed equitable representation across districts and obtained a thorough sample from the 113 parishes that implemented poverty alleviation initiatives (Uganda Budget 2022-2023: Ministry of Finance Planning and Economic Development, 2022; UBOS 2014: Uganda Bureau of Statistics, 2014). The sampling technique was to include 10 individuals from each parish, encompassing homes, Savings and Credit Cooperative Organizations (SACCOs), businesses, Parish Chiefs, and members of the Parish Development Committee, to obtain a variety of viewpoints on financial literacy and empowerment.

Data collection and content analysis

Data was collected via semi-structured individual and group interviews utilizing an interview guide aimed at examining participants’ experiences and viewpoints regarding financial literacy. All interviews were recorded with consent, transcribed verbatim, and subsequently examined for precision. To promote diversity, interviews were conducted in local languages and subsequently translated into English, ensuring the preservation of all voices for analysis.

The content analysis employed a meticulous coding procedure to discern, categorize, and explain themes within the dataset. An open-coding methodology was initially employed to identify repeating concepts, which were subsequently classified into preliminary codes. The codes were enhanced by axial coding, which consolidated analogous codes into overarching themes. Intercoder reliability was attained via a two-phase procedure: (1) several coders independently examined a selection of transcripts, and (2) inconsistencies in coding were deliberated and reconciled to guarantee uniform interpretation of themes. This procedure reduced potential biases and enhanced the replicability of the analysis.

To further decrease bias, reflexivity was used throughout the data analysis process, as recommended by Braun and Clarke (2006). Researchers conducted regular self-reflection and recorded their analytical decisions and interpretations, so improving the transparency and validity of the results.

Methodological justification and limitations

This qualitative methodology was chosen for its ability to yield comprehensive, contextual insights into intricate social processes such as empowerment, which quantitative methodologies may inadequately address (Cresswell, 2013). This study prioritized an in-depth assessment of participants’ lived experiences, essential for understanding the varied empowerment processes in the Busoga region, despite the potential for larger statistical analysis through quantitative methods. However, the inherent constraints of qualitative research, including possible researcher bias and restricted generalizability, were recognized and addressed by intercoder reliability assessments, validation of data saturation, and reflexivity procedures, thereby strengthening the study’s rigor.

The next section outlines the key themes discovered during this process, offering insights into how financial literacy contributes to sustainable development in rural Uganda. This analysis emphasizes the influence of financial literacy on alleviating poverty while also examining its wider implications for sustainable development in the Busoga region.

Findings

This research encompasses a diverse group of entrepreneurs from the rural expanses of Busoga, engaged in the Parish Development Model (PDM), spanning a broad spectrum of ages, genders, and operational backgrounds. To ensure the confidentiality of participants while enabling detailed analysis, specific anonymization codes were assigned to each respondent. Below, we delve into the demographic characteristics and operational contexts of these entrepreneurs, offering insights into their experiences and perspectives.

Demographic insights

Our analysis reveals that the age range of participants stretches from 36 to 65 years, showcasing a rich tapestry of entrepreneurial journeys across different life stages. This age diversity sheds light on the distinct challenges and opportunities encountered by entrepreneurs at varying points in their careers, offering a layered understanding of the entrepreneurial landscape within rural settings. Equally, the study boasts a gender-balanced participant pool, with an equitable representation of both male and female entrepreneurs. This balance is instrumental in uncovering gender-specific barriers and enablers in rural entrepreneurship, thereby enriching our comprehension of the dynamics at play.

Geographic and operational dynamics

The geographic footprint of this study covers several locales within the Busoga districts, including but not limited to Bukose, Namavundu, Nakamini, Kitukiro, Kibuutu, Ikumbya, and Bukyangwa. This geographical diversity ensures that the findings are reflective of a broad spectrum of rural environments, each with its unique agricultural practices, market conditions, and community dynamics.

A notable consensus among participants pertains to the convergence of their living and business environments, underscoring a pivotal characteristic of rural entrepreneurship—the deep entwinement of business ventures with their immediate community and natural surroundings. This synergy between entrepreneurs’ operations and their local ecosystem not only shapes their business strategies but also highlights the potential of their enterprises to contribute positively to sustainable development and the prosperity of their communities.

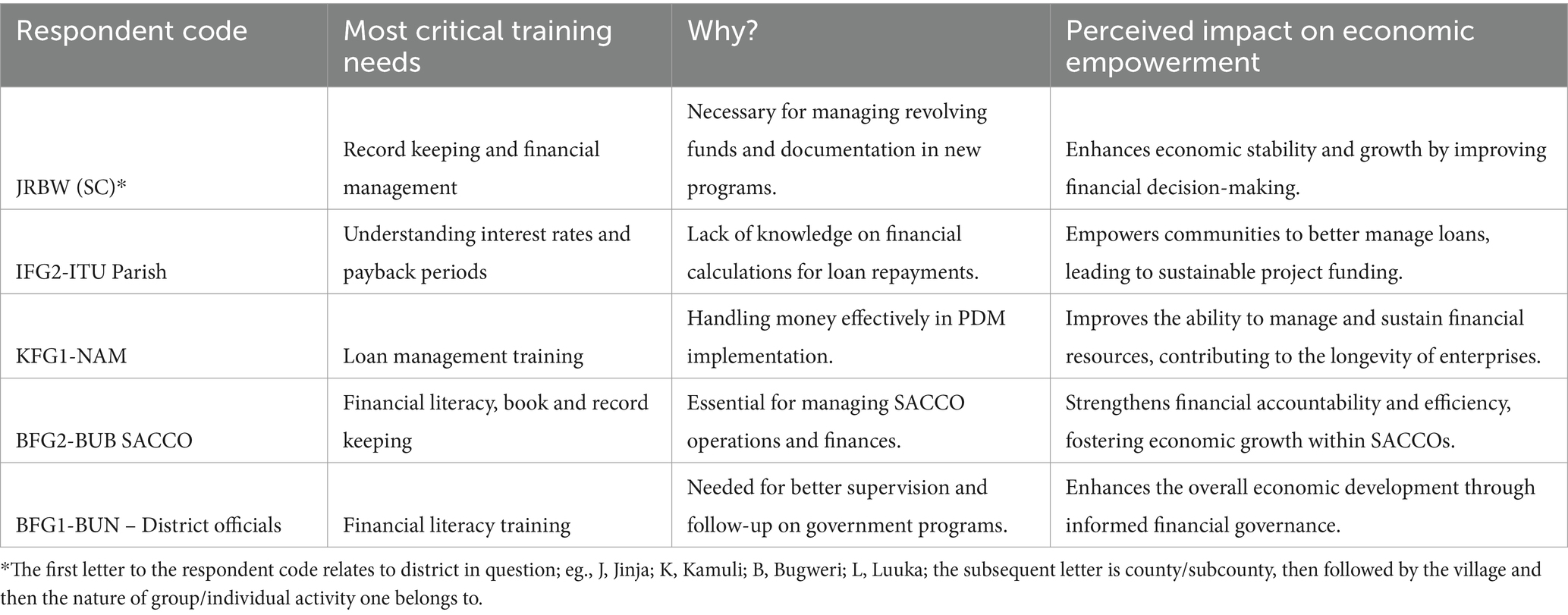

Financial literacy education and economic decisions

Our first research question (RQ 1) is “how does financial literacy education affect Ugandan rural communities’ ability to make economic decisions for themselves”? This study delves into the impact of financial literacy education on the economic decision-making capabilities of communities in Uganda’s rural Busoga region, synthesizing insights from a series of interviews with a broad spectrum of stakeholders. These interviews illuminate the prevailing state of financial literacy and its influence on economic self-sufficiency within these communities. Narratives from the inhabitants of Buwera, a locale primarily engaged in agriculture and livestock rearing, notably maize cultivation and pig farming, initially sketch a community deeply rooted in traditional farming practices. However, the discourse swiftly pivots to a fervent interest in acquiring skills in record-keeping and financial management, underscoring a collective recognition of the importance of such competencies for economic self-reliance. This reflects a proactive stance toward achieving financial stability, a critical aspect in the context of managing cyclical finances within agricultural enterprises.

A pronounced demand for financial literacy education emerged uniformly across participant groups engaged in the Parish Development Model (PDM) spanning various parishes and districts. Essential financial management principles, understanding interest rates, loan administration, and fostering transparency in financial dealings constituted the core themes echoed by participants. These needs were articulated by a diverse array of stakeholders, including SACCO members, local government officials at the parish and sub-county levels, and district representatives, indicating a widespread consensus on financial literacy as a foundational pillar for economic empowerment.

The emphasis placed on practical financial skills, such as loan management, interest computation, and bookkeeping, underscores the demand for actionable knowledge that can be directly applied. Specific logistical challenges, such as the need for stationery for record-keeping and adequate facilities for SACCO meetings, spotlight the tangible barriers to enhancing financial literacy within these communities. Additionally, the broader context suggests that enhancing financial literacy could also contribute to improved governance, amidst concerns over corruption and the overarching need for fairness, transparency, and accountability in financial practices.

Responses further unveiled a deeply ingrained aspiration for self-sufficiency and success, characterized by financial independence and the capability to manage one’s affairs autonomously. This aspiration is juxtaposed against a critical perspective on government-led initiatives perceived as ineffectual for the intended beneficiaries and a discerning evaluation of existing financial support mechanisms, where the exorbitant interest rates charged by informal lenders were particularly criticized (Table 1).

Rural PDM entrepreneurs and sustainable development

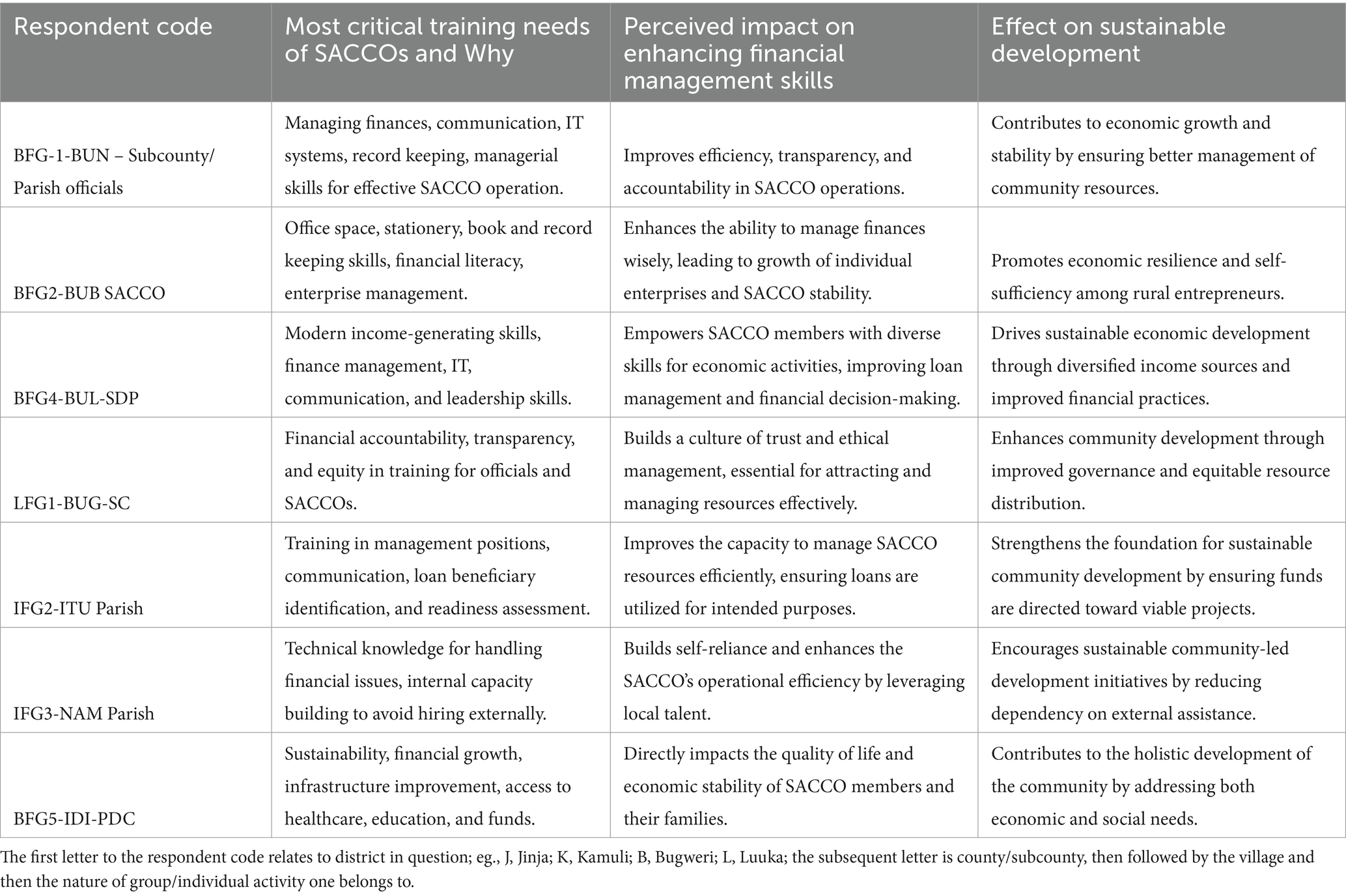

Our second research question (RQ2) is “how do SACCOs help rural PDM entrepreneurs become better financial managers, and what impact does this have on sustainable development?” Exploring the second research question sheds light on the transformative role that Savings and Credit Cooperative Organizations (SACCOs) play in equipping rural Parish Development Model (PDM) entrepreneurs with enhanced financial management capabilities, which has a profound impact on sustainable development within these communities. The analysis of interview data reveals that SACCOs are instrumental in providing their members with comprehensive training that encompasses financial planning, accurate record-keeping, and efficient administrative operations. This educational support is pivotal in empowering rural entrepreneurs with the knowledge and skills necessary for judicious financial management, thereby laying the groundwork for sustainability and economic growth in the region (Table 2).

SACCOs serve as a cornerstone for promoting sound financial management practices among rural businesses, significantly contributing to the broader agenda of sustainable development. They achieve this by broadening the access to financial services, fostering financial inclusion, and instilling responsible financial behaviors. The training offered by SACCOs is not just about managing finances; it’s about transforming the economic landscape of rural communities by driving economic stability, reducing poverty levels, and improving the quality of life through enhanced access to healthcare, education, and vital infrastructure. This holistic approach to economic empowerment facilitated by SACCOs ensures that the benefits of improved financial management permeate through various aspects of community life, contributing to the overarching goals of sustainable development.

The insights gathered from respondents, as summarized in Table 3, underscore the specific training needs identified for SACCO members, the impact of such training on the financial management competencies of rural entrepreneurs, and the extended implications for sustainable development. The emphasis placed on operational management, financial literacy, and the importance of transparency highlights the critical role SACCOs occupy in promoting sustainable community development and economic empowerment. This not only fosters an environment conducive to economic stability and growth but also champions the principles of sustainability through the empowerment of individuals and communities to manage their financial resources more effectively. By aligning the financial education and management practices with the principles of sustainability, SACCOs contribute significantly to the sustainable development goals, ensuring that rural entrepreneurs are not just financially savvy but also champions of sustainable economic practices.

Financial management and literacy and the long-term growth of rural communities

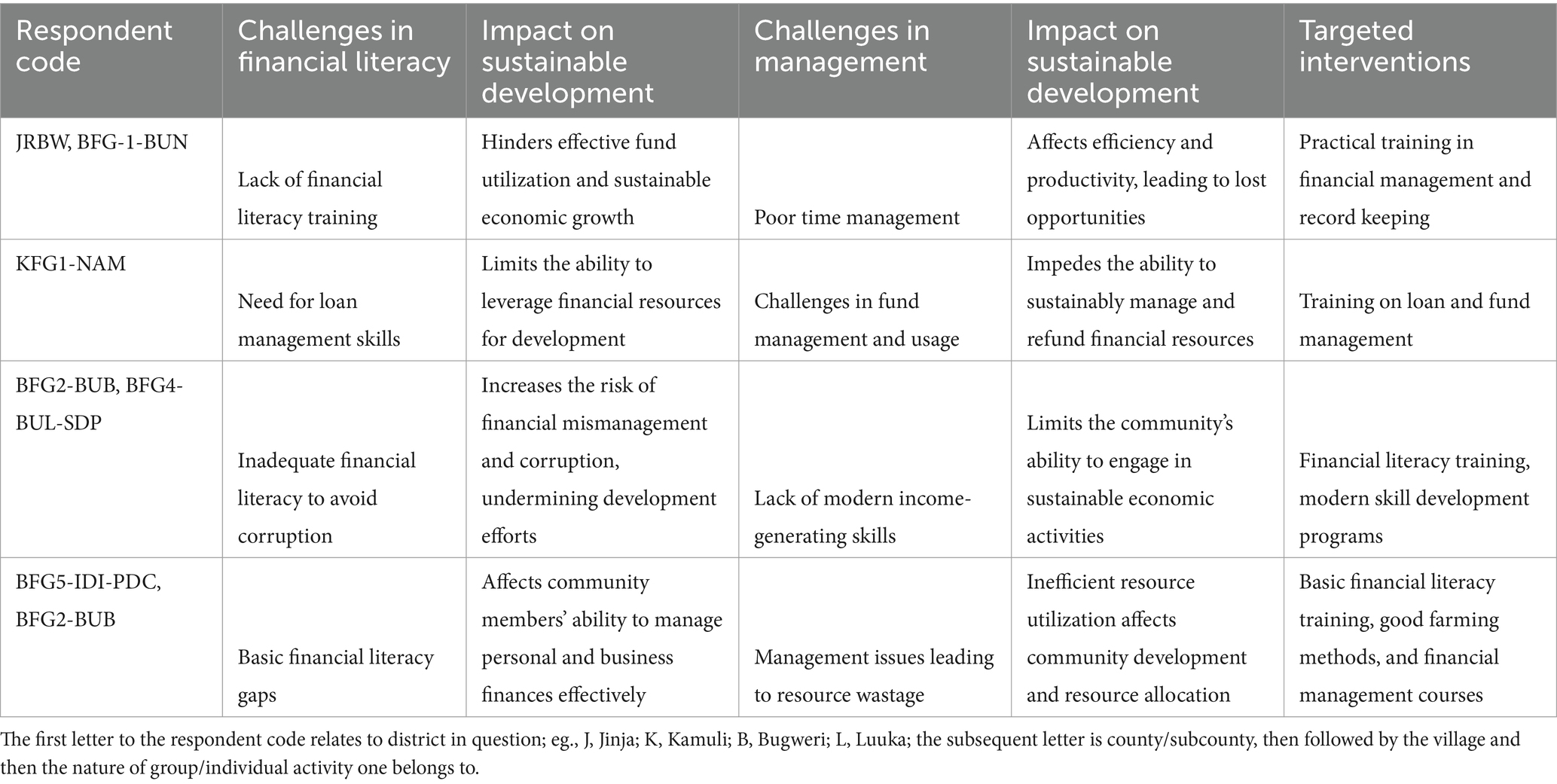

Our third research question (RQ3) is “how might deficiencies in financial management and literacy impede the long-term growth of rural communities, and what kind of focused interventions can bridge these gaps”? The qualitative analysis of interview data from the rural areas of Busoga, Uganda, underscores a significant barrier to sustainable development rooted in financial management and literacy deficiencies. These gaps not only hinder the potential for economic growth but also pose challenges to the effective utilization of financial resources for community development. A vivid illustration of this issue was provided by a chairperson from Buwera Parish, who emphasized the critical need for enhancing skills in financial management and understanding of loan repayment terms.

The data suggests that the lack of financial literacy extends across several key areas, including loan management, record-keeping, and the strategic use of funds, thereby affecting the overall efficiency and productivity of financial resources in driving development. The shortfall in such competencies leads to challenges in implementing programs effectively and achieving desired outcomes in community development. These challenges are compounded by additional issues such as inadequate support for administrative functions and suboptimal time management practices among the respondents.

In response to these identified gaps, the participants have articulated a need for targeted intervention strategies aimed at fortifying financial management and literacy. Among the recommended approaches is the provision of practical training focused on debt management, financial stewardship, and the cultivation of modern income-generating skills. To address the multifaceted nature of these challenges, participants also advocate for guidance in agricultural practices, including field preparation and planting techniques. This reflects a holistic view of financial literacy that encompasses not just the management of money but also the application of these resources in productive and sustainable ways. For instance, one respondent from KFG1-NAM highlighted the importance of optimizing the allocation of limited funds available to each parish, underscoring the necessity for comprehensive financial literacy programs that empower communities to maximize their resources for collective benefit.

The findings from this study underscore the pressing need for focused interventions that enhance financial management and literacy in rural communities. Such initiatives are essential for fostering sustainable development, improving fund management, ensuring accountability, and providing effective administrative support. As outlined in Table 4, the study synthesizes the primary concerns regarding financial literacy and management raised by the respondents, the implications of these issues on sustainable development, and the specific interventions recommended to mitigate these challenges. The inclusion of respondent codes offers additional context, illustrating the diverse perspectives and experiences that inform these findings.

Through these insights, it becomes evident that bridging the gaps in financial management and literacy requires a comprehensive approach that addresses the interconnected aspects of financial education, practical skill development, and support for administrative and agricultural practices. By adopting such focused interventions, rural communities in Busoga can enhance their capacity for sustainable growth and development, leveraging financial literacy as a cornerstone for economic empowerment and community well-being.

Financial literacy challenges and sustainable development

Lack of Financial Literacy Training: The absence of financial literacy training in rural settings curtails the community’s ability to engage in sustainable economic practices, making it challenging to manage funds efficiently and invest in eco-friendly activities.

Insufficient Financial Knowledge and Corruption Risks: A limited understanding of financial management principles increases the susceptibility to financial mismanagement and corruption, which in turn compromises development initiatives and erodes the foundation of community trust.

Basic Financial Literacy Gaps: Fundamental gaps in financial literacy impair the community’s capacity to manage finances effectively. This limitation restricts their ability to make sound financial decisions for both personal and business purposes, leading to suboptimal financial outcomes.

Management challenges within the PDM framework

Time and Finance Management Issues: Inadequacies in time and financial management can severely restrict efficiency, productivity, and the sustainable management of resources, resulting in missed opportunities for economic development.

Lack of Modern Income-Generating Skills: The absence of skills necessary for engaging in contemporary income-generating activities limits the community’s ability to adapt to market demands and participate in sustainable economic practices.

Discussions of findings

RQ1: The Role of Financial Literacy in Economic Empowerment.

This study’s findings underscore financial literacy as a pivotal element affecting economic empowerment in the rural communities of Uganda’s Busoga area. This outcome can be examined through the theoretical frameworks of Becker (1964) Human Capital Theory and Sen’s (1999) Capability Approach, both of which provide complimentary insights into how financial literacy training might enhance economic resilience and empowerment in resource-constrained environments. This debate integrates these theories with empirical evidence to elucidate the significance of financial literacy in Uganda’s rural economy.

Becker (1964) Human Capital Theory emphasizes the significance of education and skill acquisition as investments that augment individual productivity and, therefore, economic potential. In rural Uganda, financial literacy training constitutes a strategic investment in human capital by providing participants with vital skills in budgeting, debt management, and comprehension of financial products, which are crucial for economic engagement. The Parish Development Model (PDM) in Uganda, designed to alleviate poverty, underscores the necessity of financial literacy as members engage with intricate financial services and hazards. Financial literacy training cultivates skills like loan management and savings, empowering individuals to make informed decisions, avoid high-risk debt, and optimize their economic resources, in accordance with Becker (1964) claim that education in practical skills directly impacts economic empowerment.

Empirical research corroborates these conclusions. Research indicates that financial education enhances household financial management, elevates savings rates, and diminishes dependence on expensive credit alternatives (Lusardi and Mitchell, 2014). Dupas and Robinson (2013) similarly discovered that financial literacy in low-income settings, such as Kenya, facilitated individuals in maintaining regular savings habits and attaining enhanced financial stability. In rural Uganda, where access to transparent financial services is often restricted, financial literacy training acts as a safeguard, empowering individuals to withstand predatory lending and make informed financial decisions. This corresponds with the concept of Human Capital Theory that targeted talent investments propel economic growth for both individuals and communities (Becker, 1964).

Human Capital Theory prioritizes skills as an economic investment, whereas Sen’s (1999) Capability Approach offers a more comprehensive perspective by viewing financial literacy as a tool for enhancing individual freedoms and capabilities. Sen contends that economic empowerment transcends mere cash, focusing instead on augmenting individuals’ capacities to pursue their valued lives. Financial literacy is essential for enhancing individual autonomy and economic involvement by equipping individuals with the knowledge required to make informed financial decisions and confidently engage with market opportunities.

Financial literacy empowers rural Ugandans to maneuver through economic institutions that are frequently obscure and prone to corruption. When individuals comprehend financial transactions, interest rates, and loan conditions, they are more equipped to advocate for equitable treatment, negotiate advantageous terms, and withstand abuse. This corresponds with Sen (1999) perspective that authentic empowerment stems from the capacity to make informed decisions and exert agency. Empirical studies corroborate this viewpoint, demonstrating that financial literacy enhances financial management and empowers individuals to engage meaningfully in economic and social institutions. Research by Bruhn et al. (2018) indicates that financial literacy training enhances entrepreneurial decision-making, essential for economic agency and resilience in rural areas.

Moreover, financial literacy education promotes transparency and accountability, which are crucial to Sen’s (1999) concept of a conducive institutional environment. Research demonstrates that anti-corruption initiatives and financial education collectively foster an environment that enhances individuals’ economic liberties by ensuring equal resource access (Demirgüç-Kunt and Klapper, 2012). In Uganda, where financial systems frequently suffer from transparency deficiencies, financial literacy training can enable individuals to contest inequitable practices, fostering a culture of responsibility that improves both individual and group economic welfare.

The convergence of Human Capital Theory and the Capability Approach indicates that financial literacy training functions as an investment in human capital while simultaneously enhancing individual capabilities, hence promoting greater economic empowerment in rural Uganda. Empirical research indicates that financial literacy enables individuals to make informed financial decisions, participate in market transactions, and manage the intricacies of financial services (Lusardi and Mitchell, 2014; Dupas and Robinson, 2013). These abilities enhance individual economic stability and empower communities to collaboratively enhance economic outcomes, so cultivating a more resilient rural economy.

This discovery corroborates data that financial literacy is essential for economic resilience, particularly in resource-limited environments. Karlan et al. (2014) propose that financial literacy, especially when combined with savings initiatives, improves financial resilience and enables individuals to endure economic disruptions. For rural Ugandans experiencing financial vulnerabilities, proficiency in financial management is essential for economic stability and self-sufficiency, diminishing reliance on exploitative financial institutions and enabling individuals to make informed economic decisions.

Although financial literacy training is essential for economic empowerment, achieving its full potential necessitates the mitigation of institutional impediments, like corruption and insufficient transparency within financial institutions. Sen’s (1999) Capability Approach highlights the significance of institutional contexts in facilitating individual liberties. Transparent and responsible financial systems enable individuals to utilize their financial literacy more effectively to attain economic objectives. The Global Findex Database indicates that nations with transparent financial institutions and strong literacy initiatives achieve greater financial inclusion and economic stability (Demirgüç-Kunt and Klapper, 2012). Consequently, in Uganda, attempts to eliminate corruption and enhance transparency should be integrated with financial literacy programs to foster a climate conducive to economic empowerment.

RQ2: Enhancing Financial Management Skills through SACCOs for Sustainable Rural Development

This study examines how Savings and Credit Cooperative Organizations (SACCOs) in rural Uganda tackle operational problems to enhance financial management competencies among Parish Development Model (PDM) entrepreneurs. By contextualizing these findings within Amartya Sen’s Capability Approach and Becker (1964) Human Capital Theory, a refined comprehension arises concerning SACCOs’ roles in economic growth, sustainable development, and individual empowerment. SACCOs offer financial management training that enhances rural business skills, promoting individual economic resilience and overall community development.

Becker (1964) Human Capital Theory emphasizes that economic development is intrinsically linked to investments in human capital, encompassing education and skill training. From this theoretical standpoint, SACCOs’ training programs are essential investments that improve the financial management competencies of rural entrepreneurs. SACCOs enhance the productivity and efficacy of PDM entrepreneurs in operating small enterprises by imparting knowledge on budgeting, record-keeping, loan administration, and financial planning. This program empowers rural entrepreneurs to make informed financial decisions, optimize cash flow management, and ultimately improve the sustainability of their businesses.

Empirical research substantiates the transformative effects of investing in financial education. Karlan and Valdivia (2011) discovered that microfinance clients who underwent financial literacy training exhibited notable enhancements in business performance and income. Moreover, Bruhn and Zia (2011) noted that financial training for micro-entrepreneurs improved business survival rates and operational efficiency. In rural Uganda, SACCOs offer vital training that enables entrepreneurs to make prudent financial decisions, thereby diminishing reliance on informal lending sources and fostering long-term economic stability.

Moreover, SACCOs enhance local economies by directing financial resources toward productive enterprises. SACCOs bolster individual business performance and community economic resilience by providing entrepreneurs with the skills necessary for effective resource management. The improvement of financial competencies among rural entrepreneurs corresponds with Becker (1964) claim that qualified persons significantly enhance economic progress, generating a multiplier effect that advantages entire rural economies.

Human Capital Theory highlights the economic advantages of skill enhancement, but Sen’s (1999) Capability Approach provides a more comprehensive perspective on empowerment, concentrating on the augmentation of individual freedoms and agency. Sen contends that genuine empowerment allows individuals to pursue lives they deem valuable, asserting that economic resources are inadequate unless individuals can make educated decisions. From this viewpoint, SACCOs’ function beyond financial education to promote individual autonomy and resilience. Enhancing financial literacy enables SACCOs to empower rural businesses to manage their financial situations, thus broadening their economic and social potential.

Financial literacy and managerial skills, analyzed through the Capability Approach, constitute essential qualities enabling entrepreneurs to attain overarching life objectives. SACCOs educate individuals in financial management, empowering entrepreneurs to establish economic stability, circumvent predatory lending practices, and engage in strategic investments in sectors like education and healthcare. This comprehensive approach corresponds with the findings of Banerjee and Duflo (2011), who noted that persons with superior financial literacy are more inclined to invest in human development resources, hence enhancing overall well-being and life satisfaction. In Uganda, SACCOs empower entrepreneurs to enhance their families’ living standards, fostering sustainable and inclusive rural development that beyond simple revenue generation.

Studies indicate that financial literacy can facilitate financial inclusion, which is crucial for enhancing individual liberties. Demirgüç-Kunt and Klapper (2012) discovered that financial inclusion promotes increased engagement in economic activities and strengthens individual autonomy. Access to SACCOs and associated financial literacy programs enhances financial inclusion for rural Ugandans by providing financial services to historically neglected regions. This not only expands personal economic prospects but also accords with Sen’s perspective that empowered individuals may contribute more effectively to their communities. Consequently, SACCOs facilitate sustainable development by enhancing the capacities that enable rural entrepreneurs to interact with and get advantages from the formal financial system.

The interaction between Human Capital Theory and the Capability Approach demonstrates that SACCOs are essential for enhancing economic productivity and individual empowerment, therefore promoting sustainable rural development. By tackling operational issues, like insufficient training resources and logistical limitations, SACCOs can more efficiently advance the dual goals of economic empowerment and capacity development. Financial management training enhances corporate outcomes and cultivates an environment where individuals may exercise economic agency and establish meaningful careers.

The contributions of SACCOs embody a hybrid development approach that emphasizes investment in human capital and the building of capacity. SACCOs that integrate financial literacy with actual entrepreneurial tools, like credit availability and business support, exemplify this dual approach. Bruhn et al. (2018) assert that the amalgamation of financial education with accessible financial products promotes both immediate business expansion and enduring economic resilience. Likewise, SACCOs in Uganda foster a sustainable development framework that tackles the skills deficit and the necessity for financial inclusion, guaranteeing that rural entrepreneurs possess the requisite skills and resources for sustainable economic empowerment.

To optimize their influence on financial literacy and sustainable development, SACCOs must tackle structural challenges, including transparency and accessibility. In numerous rural regions, entrepreneurs encounter obstacles in obtaining dependable financial information and reasonable finance, hence constraining the efficacy of training programs. Research conducted by Beck et al. (2009) emphasizes that the proliferation of transparent financial services is crucial for inclusive growth and poverty alleviation. Enhancing openness in loan terms, service fees, and financial processes for SACCOs in Uganda can substantially bolster the trust and engagement of rural entrepreneurs, empowering them to make educated decisions and evade abuse.

Furthermore, enhancing access to SACCO services, especially in rural regions, is essential for attaining equitable development results. Demirgüç-Kunt and Klapper (2012) observed that financial inclusion efforts achieve optimal effectiveness when they mitigate logistical and informational obstacles hindering individuals from participating in formal financial systems. In Uganda, SACCOs may utilize mobile banking platforms and community outreach initiatives to broaden their accessibility, guaranteeing that financial literacy and credit services are available to everyone. By mitigating institutional impediments, SACCOs can fully actualize their potential as vehicles of sustainable development, promoting the financial empowerment and independence of rural entrepreneurs.

RQ3: Enhancing Financial Literacy Programs to Overcome Cultural and Structural Obstacles in Rural Communities.

This study examines how to enhance targeted financial literacy and management programs to overcome cultural and structural obstacles that hinder the sustainable development of rural communities. This discussion, informed by Human Capital Theory and Amartya Sen’s Capability Approach, examines how inadequacies in financial literacy and management hinder economic advancement and personal empowerment in rural regions, while also identifying interventions that can address these deficiencies to promote sustainable development.

Human Capital Theory asserts that expenditures in education, skills, and health improve individual economic production, therefore fostering communal and societal development (Becker, 1964). In this context, financial literacy is a crucial element of human capital, equipping individuals with the knowledge and skills necessary for making informed financial decisions, managing credit, and attaining economic resilience. Rural communities frequently encounter obstacles to financial literacy and proficient money management owing to restricted educational resources, insufficient access to formal financial institutions, and dependence on informal, subsistence-oriented economies.

Empirical research substantiates the essential function of financial literacy as an element of human capital investment. Bruhn et al. (2016) discovered that financial literacy programs in underdeveloped nations enhanced financial decision-making and increased business sustainability among participants. In rural areas, such knowledge is crucial for both individual financial stability and the overall economic vitality of communities, as individuals’ financial choices directly influence collective resources and development. In Uganda, financial literacy initiatives aimed at rural businesses and farmers could enable individuals to invest in agricultural inputs more judiciously, diminish dependence on informal and high-interest loans, and enhance economic resilience within communities.

To improve the efficacy of financial literacy programs in rural regions, it is crucial to tailor training to align with local conditions and address particular financial habits prevalent in agriculture-centric environments. Dupas and Robinson (2013) suggest that rural households with access to financial training are more inclined to enhance their savings and engage in productive investments, hence corroborating Human Capital Theory’s claim that skill development promotes economic growth. Consequently, tailored interventions that provide rural inhabitants with practical financial skills—such as cash flow management, savings methods, and debt management—function as investments in human capital and catalysts for sustainable development.

Human Capital Theory emphasizes the economic advantages of financial literacy, but Sen’s (1999) Capability Approach enriches this perspective by highlighting financial literacy as a tool for augmenting individual freedoms and agency. From this viewpoint, financial literacy transcends economic utility, enabling individuals to make decisions that result in fulfilling lives. In rural communities, financial literacy empowers residents to effectively navigate financial institutions, make educated decisions, and obtain the resources required for an enhanced quality of life. This comprehensive perspective on empowerment is essential for tackling the structural and cultural obstacles that restrict the financial liberty of rural inhabitants.

Cultural norms in certain rural areas may inhibit individuals, especially women, from utilizing formal financial services, thereby constraining their economic autonomy. Research indicates that financial literacy programs customized to confront socio-cultural barriers are more effective in enabling participants to independently engage in financial activities. A study by Sanyal (2009) indicated that women who underwent financial training in microfinance environments had enhanced economic agency and decision-making authority within their households. In rural Uganda, financial literacy initiatives that involve both genders and consider local cultural variables might enhance financial inclusion and participation, along with Sen’s concept of empowerment through competence enhancement.

Furthermore, financial literacy promotes accountability and openness, which are vital elements of Sen’s (1999) Capability Approach. When individuals comprehend financial principles and possess the skills to manage resources, they may more effectively fight for equitable treatment in financial dealings and counteract predatory lending practices. Targeted literacy programs enhance financial capabilities, enabling rural populations to hold local financial institutions accountable, so fostering a more equal financial climate. This corresponds with the findings of Demirgüç-Kunt and Klapper (2012), who observed that financial inclusion and literacy are positively correlated with increased agency and financial stability, especially in marginalized areas.

Addressing cultural and structural barriers to financial literacy in rural communities necessitates customized interventions that consider both practical and socio-cultural dimensions of financial education. Structural barriers, such as restricted access to financial institutions, can be mitigated by utilizing mobile banking and digital finance platforms, which enhance the availability of financial services in remote regions. A study by Jack and Suri (2014) on mobile money in Kenya illustrated how mobile financial services might improve economic resilience and financial independence, especially in regions with inadequate physical banking infrastructure. In rural Uganda, the incorporation of digital platforms into financial literacy programs would facilitate greater access to financial services and the practical application of acquired skills, thereby alleviating logistical barriers that restrict participation.

Culturally pertinent financial education is essential. Programs ought to integrate local economic activities, such as agriculture, and deliver context-specific training that aligns with rural livelihoods. Training in financial literacy that focuses on agricultural financing, seasonal budgeting, and loan management for agricultural inputs would be especially pertinent. A study conducted by Karlan et al. (2014) revealed that customized financial literacy training enhanced agricultural output and income stability among rural farmers, enabling participants to more effectively manage revenue variability and strategize for future investments. These initiatives assist rural communities in enhancing financial resilience and broadening individual liberties, in accordance with Human Capital Theory and the Capability Approach.

Moreover, tackling gender-specific obstacles via inclusive financial literacy initiatives can enhance the effectiveness of these interventions. Women in rural areas frequently encounter significant financial exclusion stemming from cultural norms and restricted access to resources. Swain and Wallentin’s (2009) research shown that microfinance initiatives targeting women markedly enhanced their economic autonomy and social status. In Uganda, financial literacy programs should establish environments conducive to women’s engagement and address their specific financial issues to promote enhanced economic inclusion and empowerment for all genders.

The integrated viewpoints of Human Capital Theory and the Capability Approach indicate that specialized financial literacy programs must not only provide technical financial competencies but also foster social and economic inclusion. Such initiatives enhance human capital investment by providing individuals with the financial skills necessary for economic engagement. By embracing the Capability Approach, these programs can simultaneously enhance individual freedoms, enabling participants to fully engage in financial and economic decision-making processes.

Sustainable development in rural areas relies on two key elements: skill enhancement and increased agency. By tackling structural and cultural obstacles to financial literacy, these initiatives can enable individuals to manage resources judiciously, enhance resilience against economic disruptions, and elevate their quality of life. Consistent with Sen’s (1999) concept of development as freedom, financial literacy serves as a mechanism for enhancing skills and fostering a more inclusive and fair rural economy.

Conclusion, recommendations and areas for further research

Conclusion

This study highlights the essential importance of financial literacy, SACCOs, and specialized financial management programs in fostering sustainable economic development and empowerment in rural Uganda. Each research topic unveiled distinct findings that jointly inspire initiatives for economic resilience, agency, and inclusive growth among these communities. The findings, grounded in Human Capital Theory (Becker, 1964) and Sen’s (1999) Capability Approach, emphasize financial literacy as an investment in human capital and a means to enhance individual skills, thereby connecting personal economic stability with overall community resilience. The importance of SACCOs in mitigating operational issues and improving financial management skills is demonstrated to be crucial in assisting rural enterprises. Overcoming cultural and structural barriers using customized, context-specific interventions enhances the effectiveness of these programs, facilitating a more sustainable and inclusive development path for rural Uganda.

To fully realize the transformative potential of these interventions, it is crucial to tackle persistent structural difficulties, such as corruption, transparency deficiencies, and accessibility obstacles in rural financial services. Combining financial literacy with increased access to reliable financial services and customizing programs to local contexts can enable individuals to make educated choices, enhance personal and community resilience, and sustainably alleviate poverty. These initiatives embody a comprehensive strategy aimed at fostering an empowered and economically resilient rural Uganda, highlighting both economic empowerment and the enhancement of individual liberties.

Recommendations

To enhance the efficacy of financial literacy programs, SACCOs, and specialized financial management initiatives in rural Uganda, the following measures are suggested:

1) Enhance Accessibility to Customized Financial Literacy Initiatives

Financial literacy initiatives must be customized to address the distinct requirements of rural Uganda, emphasizing essential competencies such as budgeting, savings, debt management, and agricultural financing. Training must take into account local economic activity and be administered in culturally pertinent methods that effectively engage community people.

2) Enhance the Capacity and Transparency of SACCOs

SACCOs must adopt strategies to improve transparency, especially on loan conditions and fee arrangements, to foster trust and engagement among rural entrepreneurs. Enhancing openness helps mitigate corruption and exploitation, enabling SACCOs to more effectively serve their communities as reliable financial institutions.

3) Incorporate Digital Solutions for Accessibility

Digital financial instruments, like mobile banking, can substantially enhance the accessibility of financial literacy initiatives and SACCO services in isolated rural regions. Utilizing digital platforms can surmount physical access obstacles and promote financial inclusion, especially for populations with restricted access to formal banking services.

4) Formulate Gender-Inclusive Financial Initiatives

Programs specifically designed to tackle gender-related financial obstacles can greatly enhance women’s economic autonomy. Enhancing financial literacy and management abilities for women, while tackling socio-cultural obstacles, will foster increased economic inclusion and community-wide advantages.

5) Establish Collaborations with Community Leaders and Organizations

Engaging with community leaders, local organizations, and other stakeholders can improve the efficacy of financial literacy initiatives by cultivating a conducive atmosphere for financial education and management training. Local leaders can significantly influence program engagement and uphold financial best practices.

Areas for further research

While this study offers important insights, further research is needed to deepen understanding and enhance the efficacy of financial literacy and management initiatives in rural Uganda. The following areas are recommended for future exploration:

1) Evaluating Long-Term Impacts of Financial Literacy Programs on Economic Outcomes

Longitudinal studies assessing the long-term impacts of financial literacy programs on economic stability, business growth, and community resilience would offer valuable insights. Research could investigate how sustained financial education influences generational financial behaviors and outcomes in rural settings.

2) Exploring the Intersection of Cultural Norms and Financial Empowerment

Additional research into the cultural factors that influence financial empowerment—particularly gender dynamics and community values—could inform the design of more culturally sensitive financial literacy programs. Understanding these dynamics could improve program participation and enhance economic empowerment outcomes, especially among marginalized groups.

3) Assessing the Role of Digital Financial Literacy in Expanding Access

As digital solutions become more prevalent, research should focus on how digital financial literacy can bridge accessibility gaps in rural areas. Studies could explore the effectiveness of mobile banking and other digital tools in promoting financial inclusion, particularly among populations with limited formal education or financial experience.

4) Investigating the Impact of Transparency and Anti-Corruption Measures in Rural SACCOs

Future studies could examine the specific role of transparency and anti-corruption efforts within SACCOs and other rural financial institutions. Research could assess how these factors influence trust, participation, and economic outcomes among rural entrepreneurs, providing insights into best practices for strengthening rural financial institutions.

5) Analyzing the Influence of Financial Literacy on Sustainable Agricultural Practices

Given the prominence of agriculture in rural Uganda, research on how financial literacy impacts agricultural investment decisions, resource management, and sustainable practices would be valuable. Understanding the link between financial knowledge and sustainable agriculture could support programs aimed at environmental resilience and long-term economic stability.

Data availability statement

The original contributions presented in the study are included in the article, further inquiries can be directed to the corresponding authors.

Author contributions

GK: Conceptualization, Data curation, Formal analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review & editing. JN: Conceptualization, Data curation, Formal analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review & editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. The research was funded by Makerere University - MakRIF Round 4 Track 1 Financial Year 2022/2023.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Acharya, M., Yoshino, Y., Jimba, M., and Wakai, S. (2007). Empowering rural women through a community development approach in Nepal. Community Dev. J. 42, 34–46. doi: 10.1093/cdj/bsi064

Adegbite, O. O., and Machethe, C. L. (2020). Bridging the financial inclusion gender gap in smallholder agriculture in Nigeria: An untapped potential for sustainable development. World Dev. 127:104755. doi: 10.1016/j.worlddev.2019.104755

Adera, A., and Abdisa, L. (2023). Financial inclusion and women’s economic empowerment: Evidence from Ethiopia, vol. 11: Cogent Economics & Finance. doi: 10.1080/23322039.2023.2244864

Atahau, A., Sakti, I. M., Hutar, A. N. R., Huruta, A. D., and Kim, M. S. (2023). Financial literacy and sustainability of rural microfinance: The mediating effect of governance. Cogent Econ. 11:2230725. doi: 10.1080/23322039.2023.2230725

Banerjee, A. V., and Duflo, E. (2011). Poor economics: A radical rethinking of the way to fight global poverty : PublicAffairs.

Becker, G. S. (1964). Human capital: A theoretical and empirical analysis, with special reference to education : University of Chicago Press.

Beck, T., Demirgüç-Kunt, A., and Honohan, P. (2009). Access to financial services: measurement, impact, and policies. World Bank Res. Obs. 24, 119–145. doi: 10.1093/wbro/lkn008

Braun, V., and Clarke, V. (2006). Using thematic analysis in psychology. Qual. Res. Psychol. 3, 77–101. doi: 10.1191/1478088706qp063oa

Bruhn, M., Karlan, D., and Schoar, A. (2018). The impact of consulting services on small and medium enterprises: evidence from a randomized trial in Mexico. J. Polit. Econ. 126, 635–687. doi: 10.1086/696154

Bruhn, M., Leão, L. S., Legovini, A., Marchetti, R., and Zia, B. (2016). The Impact of High School Financial Education: Evidence from a Large-Scale Evaluation in Brazil. Am. Econ. J. Appl. Econ. 8, 256–295. doi: 10.1257/app.20150149

Bruhn, M., and Zia, B. (2011). Stimulating managerial capital in emerging markets: the impact of business and financial literacy for young entrepreneurs. World Bank Policy Research Working Paper 1–32. Washington, D.C: World Bank. Available at: http://documents.worldbank.org/curated/en/737211468139183866/Stimulating-managerial-capital-in-emerging-markets-the-impact-of-business-and-financial-literacy-for-young-entrepreneurs.

Demirgüç-Kunt, A., and Klapper, L. (2012). Measuring financial inclusion: the global Findex database. World Bank Policy Research Working Paper 6025,1–61. doi: 10.1596/1813-9450-6025

Dupas, P., and Robinson, J. (2013). Savings constraints and microenterprise development: evidence from a field experiment in Kenya. Am. Econ. J. Appl. Econ. 5, 163–192. doi: 10.1257/app.5.1.163

Dwivedi, M., Purohit, H., Mehta, D., and Gurjar, S. (2015). Empowering rural households through financial literacy: Case study of spectacular initiatives by PRADAN. Asian J. Multidiscip. Stud. 3.

Eboh, E. C. (2000). Rural informal savings and credit associations as risk managers and the lessons for the design and execution of rural credit schemes in Nigeria. Afr. Dev. Rev. 12, 233–262. doi: 10.1111/1467-8268.00025

Ebong, C. D., Mwosi, F., Mutesigensi, D., Eton, M., and Ogwel, B. P. (2018). Human resource capabilities, financial support and enterprise development in Nebbi District, West Nile Region Uganda. International Journal of Emerging Research in Management and Technology 7, 14–24.

Feleke, A. (2018). Review on the role of rural saving and credit cooperatives in improving rural farmers’ socio-economic activities in Ethiopia. Pac. Med. J. 1, 116–128. doi: 10.55014/pij.v1i3.59

Garu, S., and Dash, S. (2023). An in-depth analysis of the relationship between financial inclusion, women empowerment, and self-help groups in the context of Odisha. India. MUDRA. J. Account. Manag. 10, 55–74. doi: 10.17492/jpi.mudra.v10i2.1022304

Guest, G., Bunce, A., and Johnson, L. (2006). How many interviews are enough, An experiment with data saturation and variability. Field methods, 18, 59–82. doi: 10.1177/1525822X05279903

Hamzah, A., Martika, L. D., Puspasari, O. R., and Nurfatimah, S. (2023). Economic Empowerment of Households through Financial Management Training in Ciputih Village. MOVE: Journal of Community Service and Engagement 3, 46–51. doi: 10.54408/move.v3i2.275

Jack, W., and Suri, T. (2014). Risk sharing and transactions costs: evidence from Kenya’s mobile money revolution. Am. Econ. Rev. 104, 183–223. doi: 10.1257/aer.104.1.183

Johnson, S., Ndiwalana, G., and Lwanga, F. (2014). Managerial competency in SACCOs: challenges and solutions. Afr. J. Bus. Manag.

Karlan, D., Osei, R., Osei-Akoto, I., and Udry, C. (2014). Agricultural decisions after relaxing credit and risk constraints. Q. J. Econ. 129, 597–652. doi: 10.1093/qje/qju002

Karlan, D., Ratan, A. L., and Zinman, J. (2014). Savings by and for the poor: a research review and agenda. Rev. Income Wealth 60, 36–78. doi: 10.1111/roiw.12101

Karlan, D., and Valdivia, M. (2011). Teaching entrepreneurship: impact of business training on microfinance clients and institutions. Rev. Econ. Stat. 93, 510–527. doi: 10.1162/REST_a_00074